UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2010 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

Strategic Income

Fund - Class A, Class T, Class B

and Class C

Annual Report

December 31, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | The Chairman's message to shareholders. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion of Fund Performance | <Click Here> | The Portfolio Managers' review of fundperformance and strategy. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

The investment environment in 2010 was volatile but generally supportive of most major asset classes. Equities experienced the biggest gains, rallying in the second half of the period on incremental economic growth, supportive monetary policies, strong corporate profits and very little inflation. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Annual Report

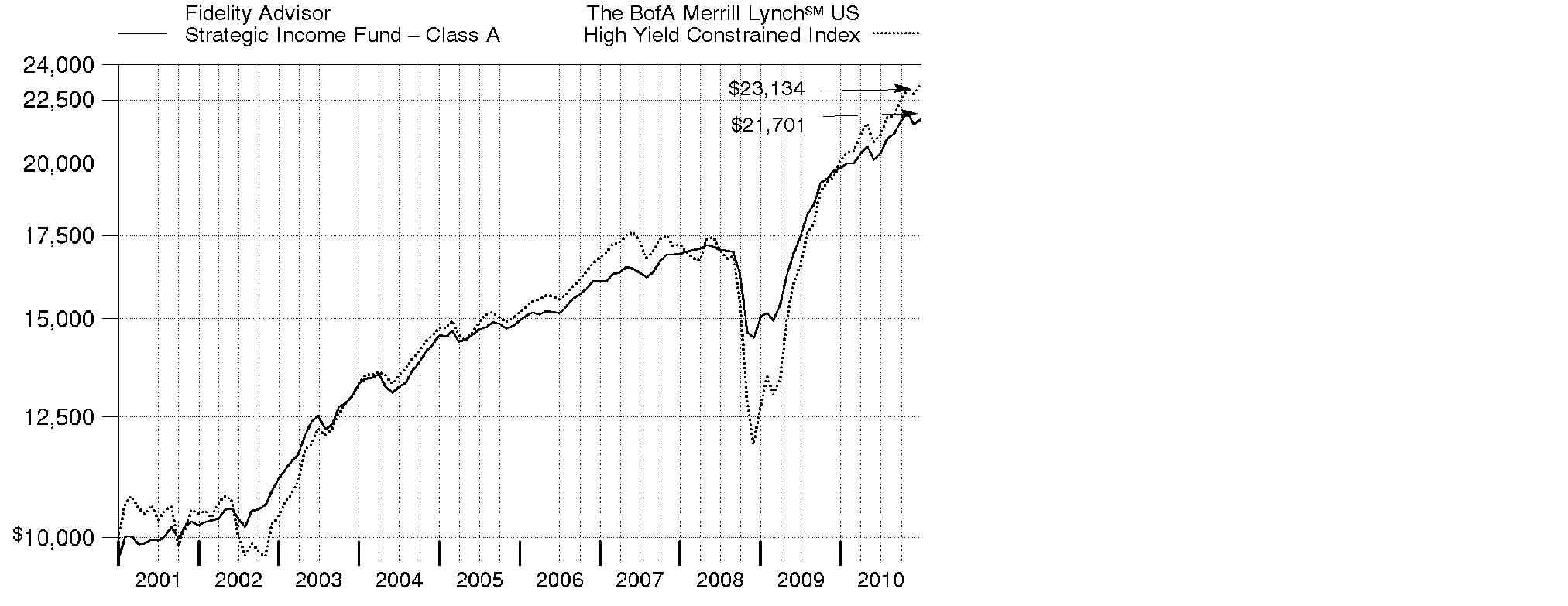

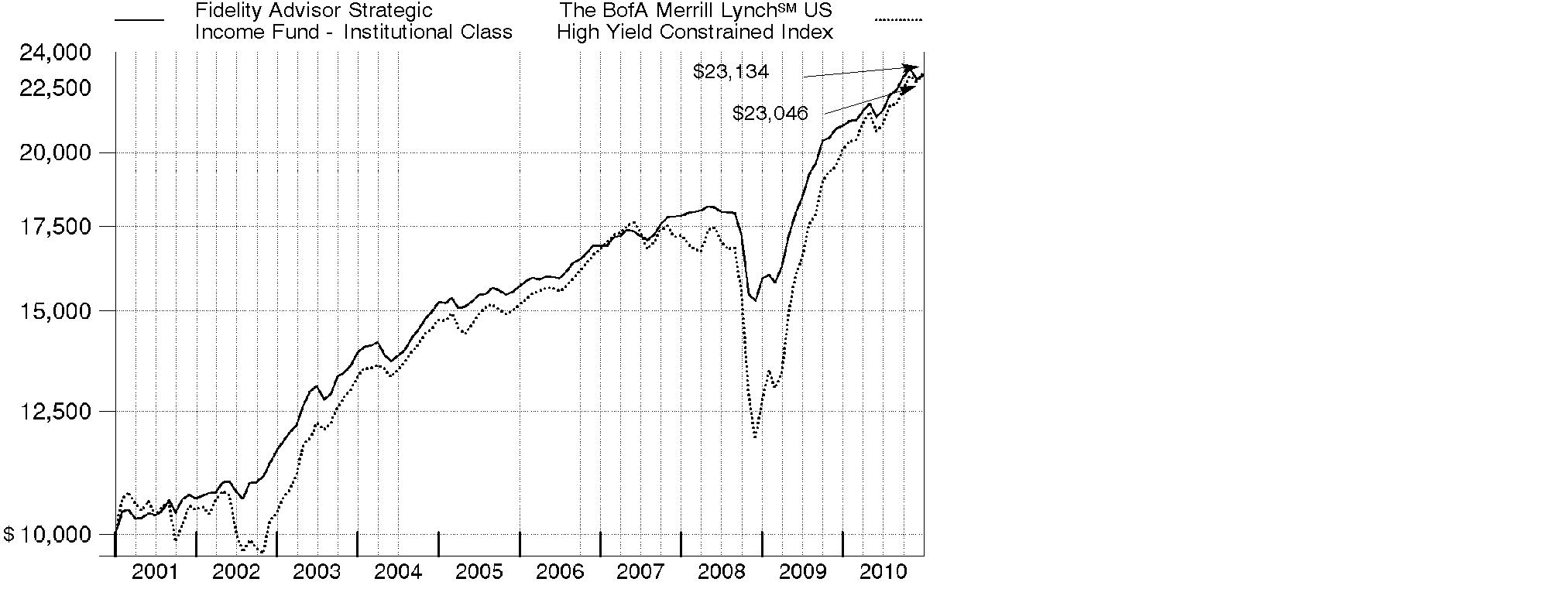

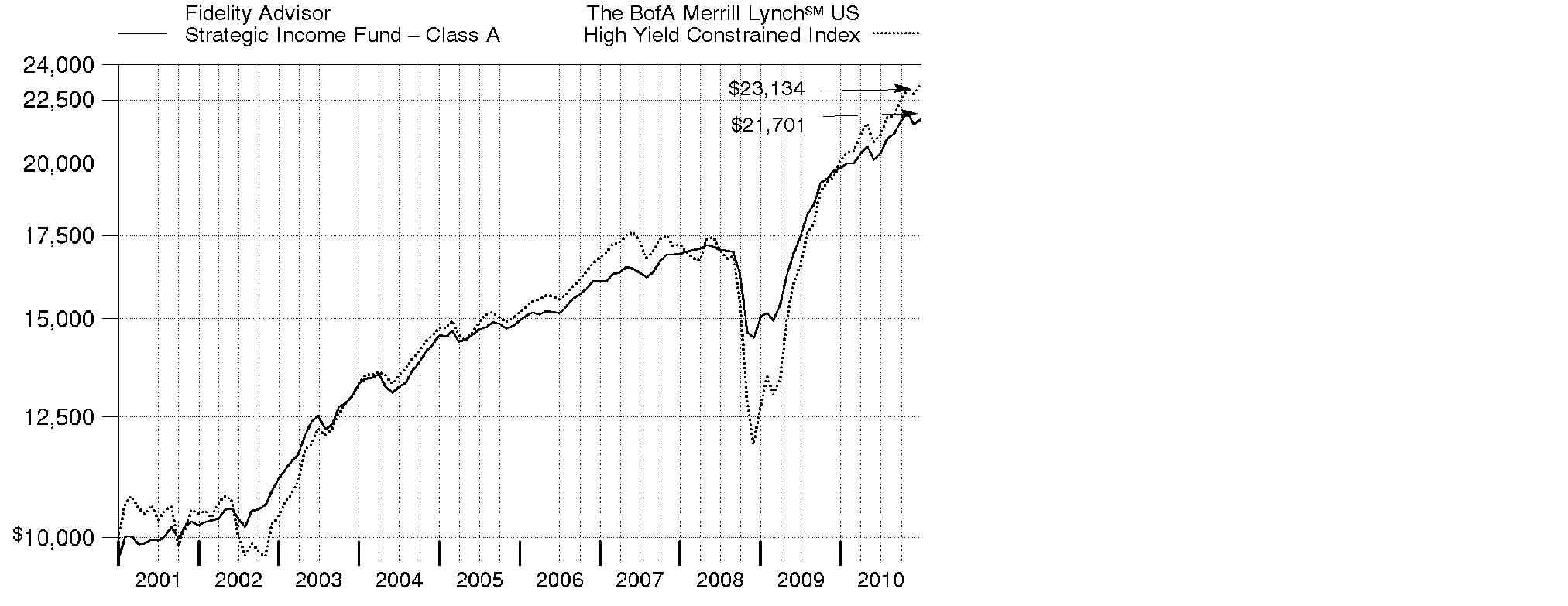

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

Periods ended December 31, 2010 | Past 1

year | Past 5

years | Past 10

years |

Class A (incl. 4.00% sales charge) | 5.10% | 6.88% | 8.06% |

Class T (incl. 4.00% sales charge) | 5.19% | 6.88% | 8.02% |

Class B (incl. contingent deferred sales charge) A | 3.77% | 6.66% | 7.94% |

Class C (incl. contingent deferred sales charge) B | 7.77% | 6.92% | 7.64% |

A Class B shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 5%, 2% and 0%, respectively.

B Class C shares' contingent deferred sales charge included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

Annual Report

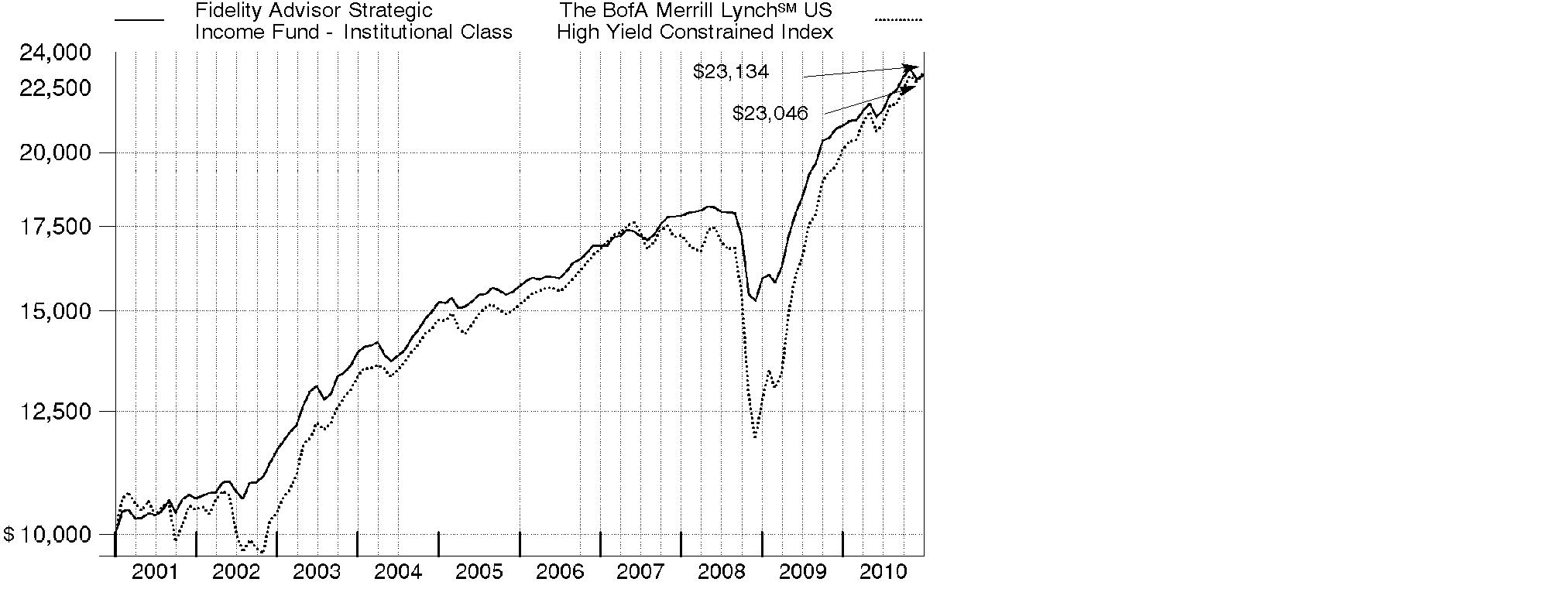

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Strategic Income Fund - Class A on December 31, 2000, and the current 4.00% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how The BofA Merrill LynchSM US High Yield Constrained Index performed over the same period.

Annual Report

Market Recap: Fixed-income markets achieved solid gains for the year ending December 31, 2010, despite bouts of volatility in the world's still-fragile credit markets due to concern about European debt woes. With ultra-low interest rates bolstering nearly all fixed-income securities for most of the year, asset classes with higher yields and more credit risk generally fared better than high-quality bonds backed by the federal government. Accordingly, The BofA Merrill LynchSM US High Yield Constrained Index gained 15.07%, while the Barclays Capital® U.S. Government Bond Index rose 5.52%. Foreign bonds showed mixed results during the period, with a sizable disparity between the gains of major developed markets and emerging-markets fixed-income securities. Concerns about sovereign debt hampered not only European equities, but also fixed-income securities in that region, and the Citigroup® Non-U.S. Group of 7 Index - which measures the performance of sovereign debt of the major global economies outside the U.S. - returned only 3.97% for the year. Conversely, the rising overall credit quality of emerging-markets debt issuers provided support for this asset class, helping the JPMorgan Emerging Markets Bond Index Global (EMBI Global) advance 12.04%. Returns across the nearly 40 individual country components of the EMBI Global index were predominantly positive for the period.

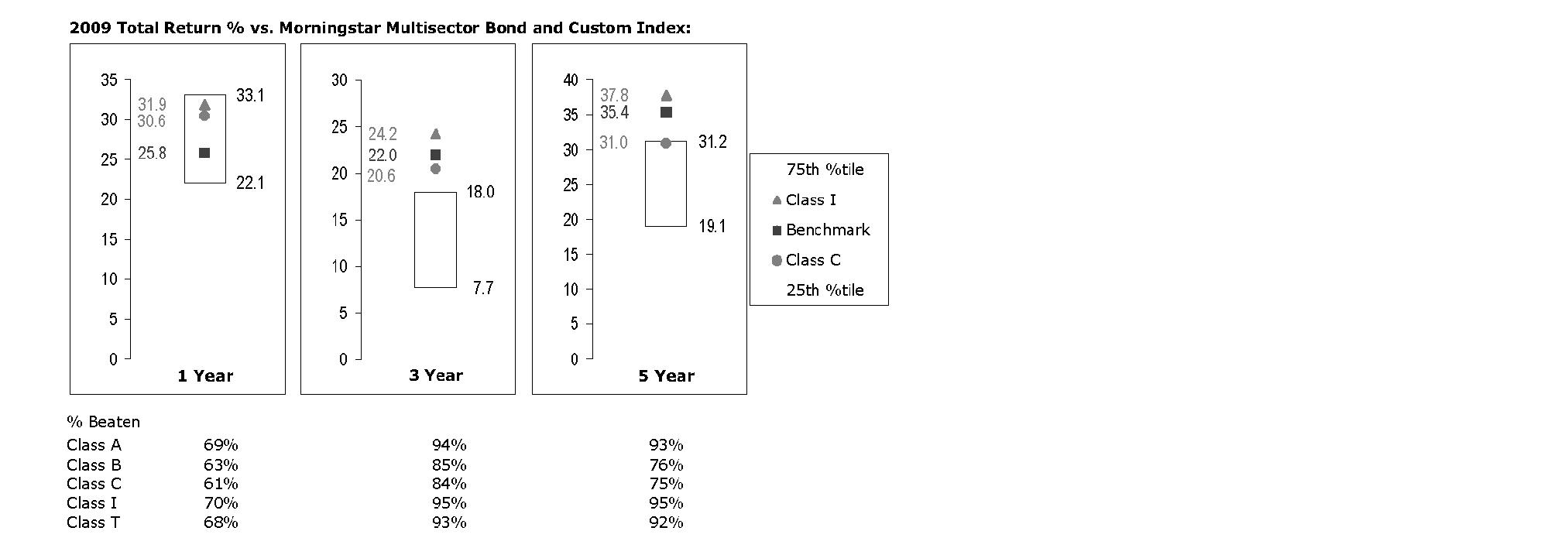

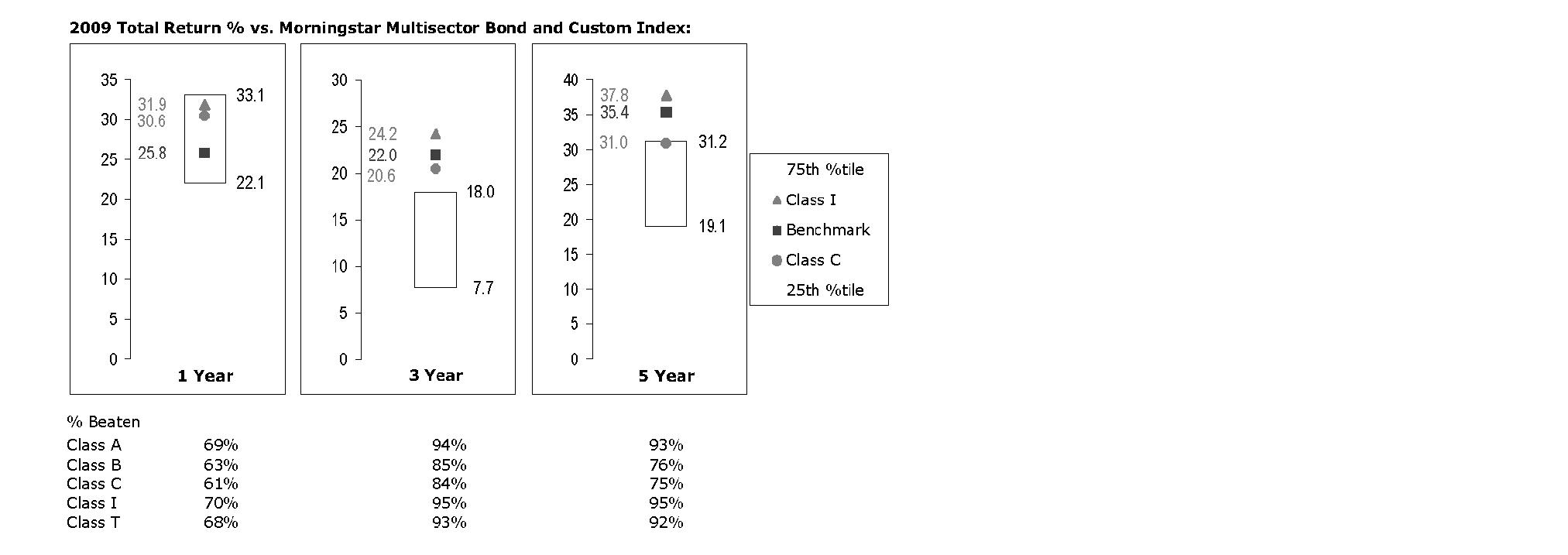

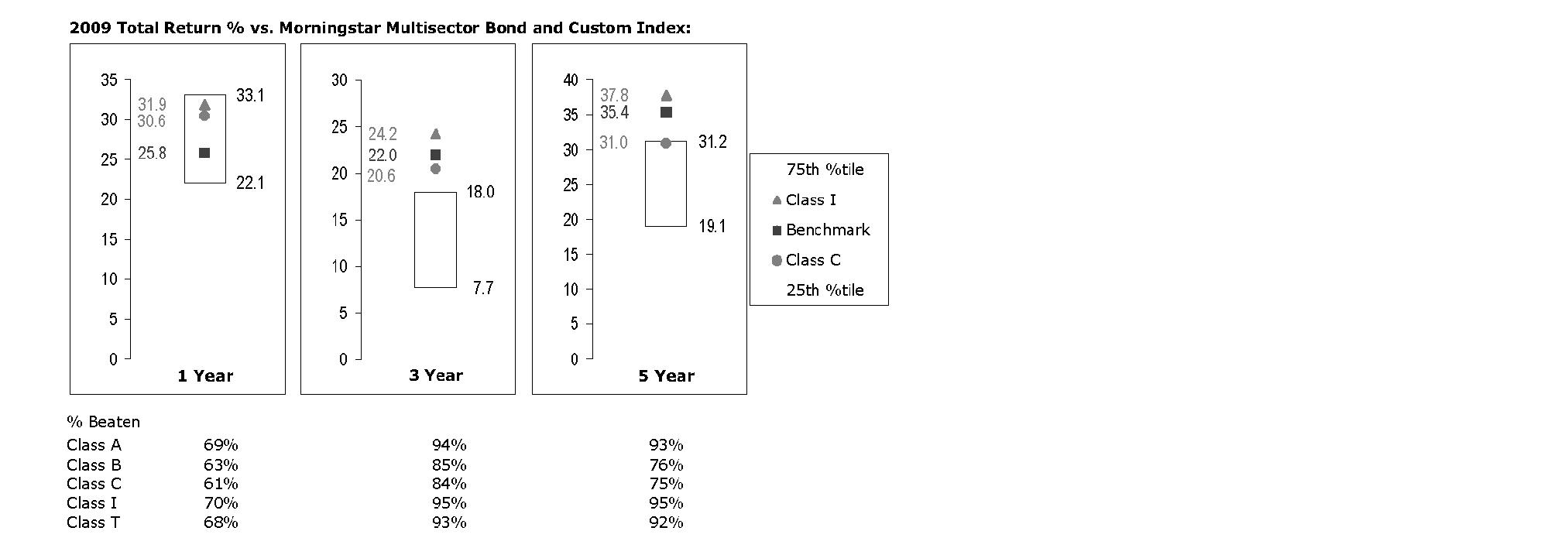

Comments from Joanna Bewick and Christopher Sharpe, Lead Co-Managers of Fidelity Advisor® Strategic Income Fund: During the year, the fund's Class A, Class T, Class B and Class C shares rose 9.48%, 9.57%, 8.77% and 8.77%, respectively (excluding sales charges), falling short of the 10.10% return of the Fidelity Strategic Income Composite Index. Asset allocation and security selection each provided a meaningful contribution to overall results. From a subportfolio standpoint, the high-yield debt sleeve produced the largest absolute return, but fell just short of its index, nicking overall results. Adverse security selection in publishing/printing and holding some uninvested cash played a big role in the sleeve's marginal underperformance. Elsewhere, the U.S. government bond sub posted a mid-single-digit return, benefiting mostly from superior security selection among Treasuries. The fund's emerging-markets debt category produced a double-digit gain and was the biggest contributor to relative performance. A significant overweighting in Argentina proved rewarding here, as did larger-than-benchmark positions in Ukraine and Venezuela. The developed-markets debt sleeve delivered the smallest absolute result, but still outpaced its benchmark due to successful yield-curve positioning and credit exposure. Unfortunately, currency fluctuations slightly dampened returns in this category. Lastly, excess return from the floating-rate central fund further aided performance.

Comments from Joanna Bewick and Christopher Sharpe, Lead Co-Managers of Fidelity Advisor® Strategic Income Fund: During the year, the fund's Institutional Class shares rose 9.80%, roughly in line with the 10.10% return of the Fidelity Strategic Income Composite Index. Asset allocation and security selection each provided a meaningful contribution to overall results. From a subportfolio standpoint, the high-yield debt sleeve produced the largest absolute return, but fell just short of its index, nicking overall results. Adverse security selection in publishing/printing and holding some uninvested cash played a big role in the sleeve's marginal underperformance. Elsewhere, the U.S. government bond sub posted a mid-single-digit return, benefiting mostly from superior security selection among Treasuries. The fund's emerging-markets debt category produced a double-digit gain and was the biggest contributor to relative performance. A significant overweighting in Argentina proved rewarding here, as did larger-than-benchmark positions in Ukraine and Venezuela. The developed-markets debt sleeve delivered the smallest absolute result, but still outpaced its benchmark due to successful yield-curve positioning and credit exposure. Unfortunately, currency fluctuations slightly dampened returns in this category. Lastly, excess return from the floating-rate central fund further aided performance.

Annual Report

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2010 to December 31, 2010).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Annualized Expense Ratio | Beginning

Account Value

July 1, 2010 | Ending

Account Value

December 31, 2010 | Expenses Paid

During Period*

July 1, 2010

to December 31, 2010 |

Class A | .98% | | | |

Actual | | $ 1,000.00 | $ 1,065.60 | $ 5.10 |

HypotheticalA | | $ 1,000.00 | $ 1,020.27 | $ 4.99 |

Class T | .98% | | | |

Actual | | $ 1,000.00 | $ 1,066.40 | $ 5.10 |

HypotheticalA | | $ 1,000.00 | $ 1,020.27 | $ 4.99 |

Class B | 1.68% | | | |

Actual | | $ 1,000.00 | $ 1,062.50 | $ 8.73 |

HypotheticalA | | $ 1,000.00 | $ 1,016.74 | $ 8.54 |

Class C | 1.72% | | | |

Actual | | $ 1,000.00 | $ 1,062.60 | $ 8.94 |

HypotheticalA | | $ 1,000.00 | $ 1,016.53 | $ 8.74 |

Institutional Class | .76% | | | |

Actual | | $ 1,000.00 | $ 1,067.80 | $ 3.96 |

HypotheticalA | | $ 1,000.00 | $ 1,021.37 | $ 3.87 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of its investments in each non-money market Fidelity Central Fund.

Top Five Holdings as of December 31, 2010 |

(by issuer, excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

U.S. Treasury Obligations | 17.0 | 17.8 |

German Federal Republic | 3.6 | 2.0 |

Japan Government | 2.4 | 2.4 |

Canadian Government | 2.3 | 2.2 |

UK Treasury GILT | 2.1 | 1.9 |

| 27.4 | |

Top Five Market Sectors as of December 31, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 8.9 | 8.3 |

Telecommunication Services | 8.0 | 7.7 |

Financials | 7.6 | 7.2 |

Energy | 6.0 | 5.5 |

Industrials | 4.7 | 4.0 |

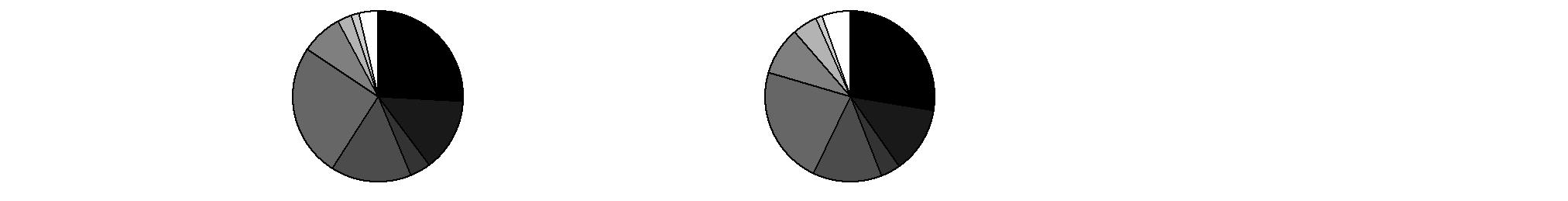

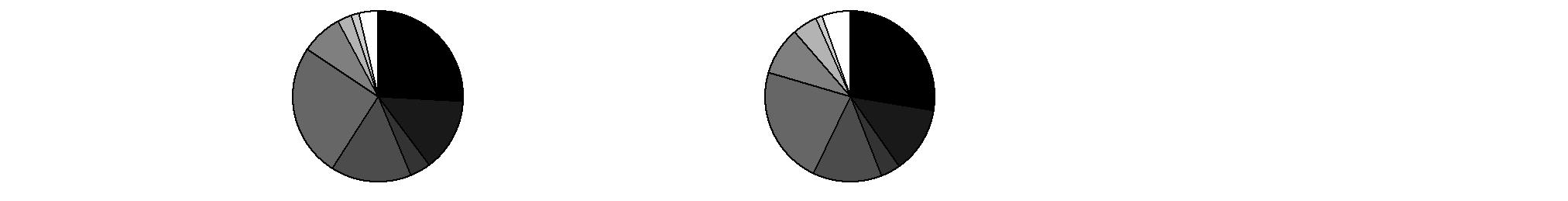

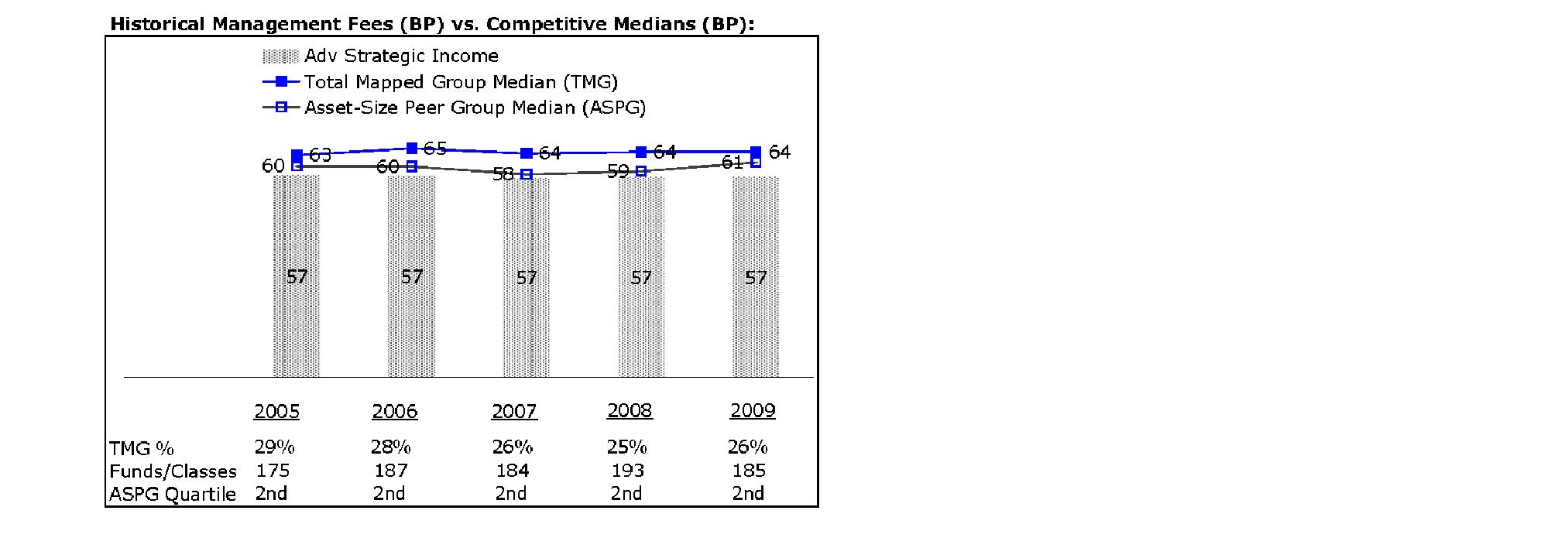

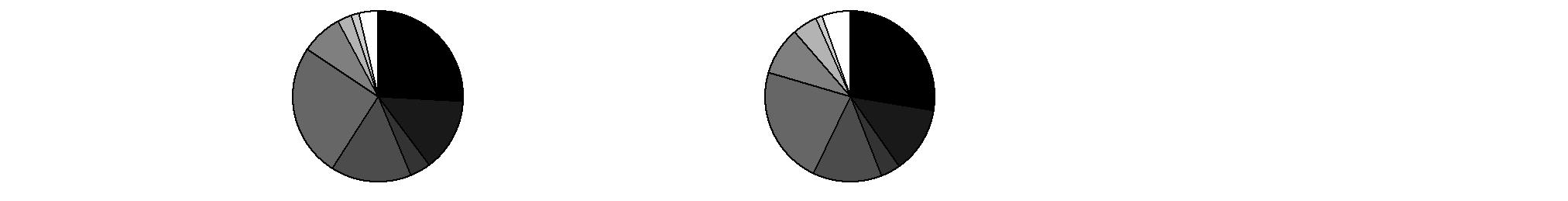

Quality Diversification (% of fund's net assets) |

As of December 31, 2010 | As of June 30, 2010 |

| U.S. Government

and U.S. Government

Agency Obligations † 26.0% | |  | U.S. Government

and U.S. Government

Agency Obligations † 27.6% | |

| AAA,AA,A 13.9% | |  | AAA,AA,A 12.6% | |

| BBB 4.0% | |  | BBB 3.8% | |

| BB 15.2% | |  | BB 13.1% | |

| B 25.2% | |  | B 22.4% | |

| CCC,CC,C 7.9% | |  | CCC,CC,C 9.1% | |

| Not Rated 2.6% | |  | Not Rated 4.8% | |

| Equities 1.5% | |  | Equities 1.2% | |

| Short-Term

Investments and

Net Other Assets 3.7% | |  | Short-Term

Investments and

Net Other Assets 5.4% | |

† Includes FDIC Guaranteed Corporate Securities and NCUA Guaranteed Notes.

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the report date and do not reflect subsequent changes. |

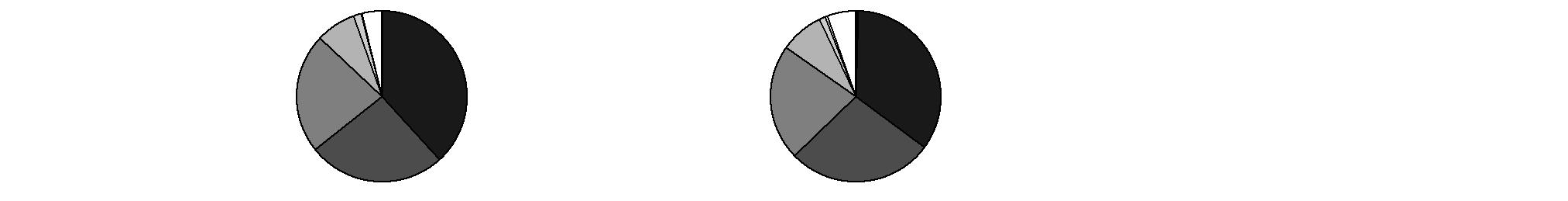

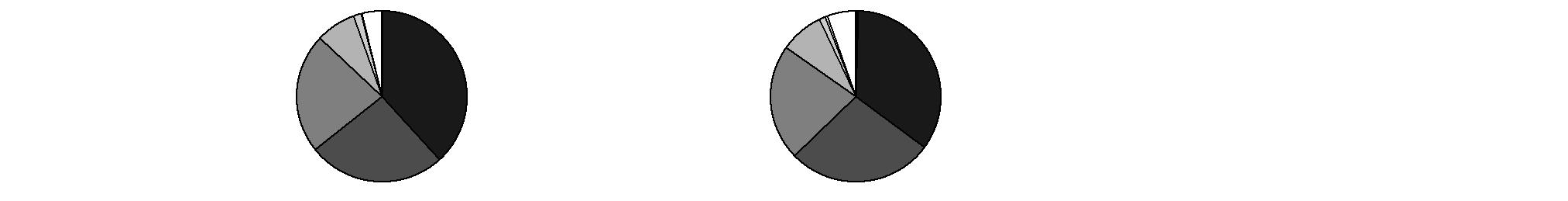

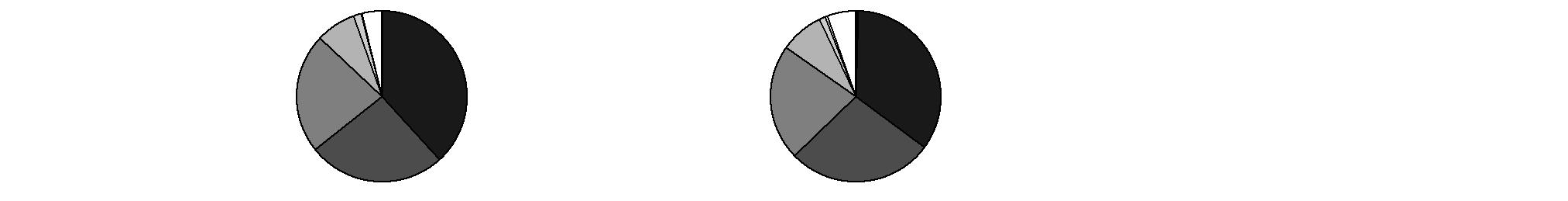

Asset Allocation (% of fund's net assets) |

As of December 31, 2010 * | As of June 30, 2010 ** |

| Preferred Securities 0.2% | |  | Preferred Securities 0.6% | |

| Corporate Bonds 38.1% | |  | Corporate Bonds 34.5% | |

| U.S. Government

and U.S. Government Agency Obligations † 26.0% | |  | U.S. Government

and U.S. Government

Agency Obligations† 27.6% | |

| Foreign Government & Government Agency Obligations 22.7% | |  | Foreign Government & Government Agency Obligations 22.0% | |

| Floating Rate Loans 7.6% | |  | Floating Rate Loans 8.3% | |

| Stocks 1.5% | |  | Stocks 1.2% | |

| Other Investments 0.2% | |  | Other Investments 0.4% | |

| Short-Term

Investments and

Net Other Assets 3.7% | |  | Short-Term

Investments and

Net Other Assets 5.4% | |

* Foreign investments | 34.1% | | ** Foreign investments | 33.4% | |

* Swaps | (0.3%) | | ** Swaps | (0.1%) | |

† Includes FDIC Guaranteed Corporate Securities and NCUA Guaranteed Notes.

An unaudited holdings list for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds is available at advisor.fidelity.com. |

Annual Report

Investments December 31, 2010

Showing Percentage of Net Assets

Corporate Bonds - 37.9% |

| Principal Amount (000s) (d) | | Value (000s) |

Convertible Bonds - 1.6% |

CONSUMER DISCRETIONARY - 0.3% |

Auto Components - 0.2% |

TRW Automotive, Inc. 3.5% 12/1/15 (f) | | $ 11,836 | | $ 22,810 |

Hotels, Restaurants & Leisure - 0.1% |

MGM Mirage, Inc. 4.25% 4/15/15 (f) | | 4,610 | | 5,019 |

TOTAL CONSUMER DISCRETIONARY | | 27,829 |

ENERGY - 0.8% |

Energy Equipment & Services - 0.1% |

Cal Dive International, Inc. 3.25% 12/15/25 | | 2,640 | | 2,543 |

Oil, Gas & Consumable Fuels - 0.7% |

Alpha Natural Resources, Inc. 2.375% 4/15/15 | | 16,660 | | 22,146 |

Chesapeake Energy Corp. 2.5% 5/15/37 | | 16,670 | | 14,871 |

Massey Energy Co. 3.25% 8/1/15 | | 30,040 | | 29,379 |

| | 66,396 |

TOTAL ENERGY | | 68,939 |

HEALTH CARE - 0.2% |

Health Care Equipment & Supplies - 0.2% |

Kinetic Concepts, Inc. 3.25% 4/15/15 (f) | | 14,400 | | 15,191 |

TELECOMMUNICATION SERVICES - 0.3% |

Wireless Telecommunication Services - 0.3% |

NII Holdings, Inc. 3.125% 6/15/12 | | 29,220 | | 28,672 |

TOTAL CONVERTIBLE BONDS | | 140,631 |

Nonconvertible Bonds - 36.3% |

CONSUMER DISCRETIONARY - 5.6% |

Auto Components - 0.5% |

Affinia Group, Inc.: | | | | |

9% 11/30/14 | | 2,950 | | 2,994 |

9% 11/30/14 (f) | | 2,190 | | 2,234 |

10.75% 8/15/16 (f) | | 1,813 | | 2,012 |

Cooper-Standard Automotive, Inc. 8.5% 5/1/18 (f) | | 1,775 | | 1,870 |

Lear Corp.: | | | | |

7.875% 3/15/18 | | 1,380 | | 1,470 |

8.125% 3/15/20 | | 1,530 | | 1,660 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Auto Components - continued |

RSC Equipment Rental, Inc. 10% 7/15/17 (f) | | $ 2,610 | | $ 2,969 |

Stoneridge, Inc. 9.5% 10/15/17 (f) | | 2,330 | | 2,505 |

Tenneco, Inc.: | | | | |

6.875% 12/15/20 (f) | | 6,205 | | 6,267 |

7.75% 8/15/18 (f) | | 1,545 | | 1,634 |

8.125% 11/15/15 | | 1,185 | | 1,256 |

The Goodyear Tire & Rubber Co. 10.5% 5/15/16 | | 4,795 | | 5,466 |

Tower Automotive Holdings USA LLC / TA Holdings Finance, Inc. 10.625% 9/1/17 (f) | | 5,143 | | 5,483 |

TRW Automotive, Inc.: | | | | |

7% 3/15/14 (f) | | 335 | | 358 |

7.25% 3/15/17 (f) | | 240 | | 259 |

8.875% 12/1/17 (f) | | 1,550 | | 1,732 |

| | 40,169 |

Automobiles - 0.1% |

General Motors Corp.: | | | | |

6.75% 5/1/28 (c) | | 10,670 | | 3,628 |

7.125% 7/15/13 (c) | | 1,605 | | 542 |

7.2% 1/15/11 (c) | | 4,015 | | 1,285 |

7.4% 9/1/25 (c) | | 500 | | 168 |

7.7% 4/15/16 (c) | | 7,804 | | 2,575 |

8.25% 7/15/23 (c) | | 4,845 | | 1,684 |

8.375% 7/15/33 (c) | | 7,015 | | 2,508 |

| | 12,390 |

Distributors - 0.1% |

Ferrellgas LP/Ferrellgas Finance Corp. 6.5% 5/1/21 (f) | | 4,470 | | 4,358 |

Diversified Consumer Services - 0.0% |

Mac-Gray Corp. 7.625% 8/15/15 | | 680 | | 668 |

Hotels, Restaurants & Leisure - 1.6% |

Blue Acquisition Sub, Inc. 9.875% 10/15/18 (f) | | 6,600 | | 6,963 |

DineEquity, Inc. 9.5% 10/30/18 (f) | | 2,410 | | 2,549 |

Dunkin Finance Corp. 9.625% 12/1/18 (f) | | 2,390 | | 2,414 |

GWR Operating Partnership LLP/Great Wolf Finance Corp. 10.875% 4/1/17 | | 4,365 | | 4,605 |

Harrah's Escrow Corp. 12.75% 4/15/18 (f) | | 7,620 | | 7,811 |

Harrah's Operating Co., Inc. 11.25% 6/1/17 | | 5,650 | | 6,356 |

Landry's Restaurants, Inc.: | | | | |

11.625% 12/1/15 | | 1,385 | | 1,461 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Hotels, Restaurants & Leisure - continued |

Landry's Restaurants, Inc.: - continued | | | | |

11.625% 12/1/15 (f) | | $ 1,000 | | $ 1,055 |

MCE Finance Ltd. 10.25% 5/15/18 | | 7,675 | | 8,769 |

MGM Mirage, Inc.: | | | | |

5.875% 2/27/14 | | 3,890 | | 3,579 |

6.625% 7/15/15 | | 8,014 | | 7,253 |

6.75% 4/1/13 | | 3,430 | | 3,327 |

6.875% 4/1/16 | | 4,440 | | 3,974 |

7.5% 6/1/16 | | 3,955 | | 3,629 |

7.625% 1/15/17 | | 5,785 | | 5,293 |

9% 3/15/20 (f) | | 3,485 | | 3,834 |

10.375% 5/15/14 | | 1,535 | | 1,723 |

11.125% 11/15/17 | | 17,530 | | 20,072 |

MGM Resorts International 10% 11/1/16 (f) | | 9,210 | | 9,302 |

Mohegan Tribal Gaming Authority 6.875% 2/15/15 | | 2,333 | | 1,441 |

NAI Entertainment Holdings LLC/NAI Entertainment Finance Corp. 8.25% 12/15/17 (f) | | 2,745 | | 2,882 |

NCL Corp. Ltd. 9.5% 11/15/18 (f) | | 1,450 | | 1,504 |

Roadhouse Financing, Inc. 10.75% 10/15/17 (f) | | 5,275 | | 5,684 |

Shingle Springs Tribal Gaming Authority 9.375% 6/15/15 (f) | | 1,540 | | 1,078 |

Speedway Motorsports, Inc. 6.75% 6/1/13 | | 3,495 | | 3,512 |

Station Casinos, Inc.: | | | | |

6% 4/1/12 (c) | | 9,620 | | 1 |

6.5% 2/1/14 (c) | | 11,643 | | 29 |

6.625% 3/15/18 (c) | | 11,970 | | 30 |

6.875% 3/1/16 (c) | | 12,803 | | 32 |

7.75% 8/15/16 (c) | | 14,415 | | 1 |

Town Sports International Holdings, Inc. 11% 2/1/14 | | 3,328 | | 3,295 |

Universal City Development Partners Ltd./UCDP Finance, Inc. 8.875% 11/15/15 | | 3,030 | | 3,219 |

Virgin River Casino Corp./RBG LLC/B&BB, Inc.: | | | | |

9% 1/15/12 (c) | | 575 | | 271 |

12.75% 1/15/13 (c) | | 1,070 | | 1 |

Waterford Gaming LLC/Waterford Gaming Finance Corp. 8.625% 9/15/14 (f) | | 996 | | 543 |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. 7.75% 8/15/20 | | 18,025 | | 19,197 |

| | 146,689 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Household Durables - 0.3% |

Controladora Mabe SA CV 7.875% 10/28/19 (f) | | $ 3,020 | | $ 3,413 |

Jarden Corp. 6.125% 11/15/22 | | 3,220 | | 3,075 |

K. Hovnanian Enterprises, Inc. 10.625% 10/15/16 | | 6,165 | | 6,350 |

Reliance Intermediate Holdings LP 9.5% 12/15/19 (f) | | 6,915 | | 7,261 |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer SA: | | | | |

7.125% 4/15/19 (f) | | 2,845 | | 2,902 |

9% 4/15/19 (f) | | 3,260 | | 3,342 |

Sealy Mattress Co. 10.875% 4/15/16 (f) | | 1,508 | | 1,704 |

| | 28,047 |

Leisure Equipment & Products - 0.1% |

Cedar Fair LP/Magnum Management Corp. 9.125% 8/1/18 (f) | | 7,710 | | 8,250 |

Easton-Bell Sports, Inc. 9.75% 12/1/16 | | 1,505 | | 1,644 |

| | 9,894 |

Media - 2.3% |

AMC Entertainment, Inc. 11% 2/1/16 | | 8,060 | | 8,584 |

Bresnan Broadband Holdings LLC 8% 12/15/18 (f) | | 2,255 | | 2,317 |

Cequel Communications Holdings I LLC/Cequel Capital Corp. 8.625% 11/15/17 (f) | | 6,485 | | 6,842 |

Charter Communications Holdings II LLC/Charter Communications Holdings II Capital Corp. 13.5% 11/30/16 | | 6,489 | | 7,738 |

Checkout Holding Corp. 0% 11/15/15 (f) | | 3,310 | | 2,031 |

Clear Channel Communications, Inc.: | | | | |

4.9% 5/15/15 | | 2,600 | | 2,002 |

5.5% 9/15/14 | | 2,000 | | 1,660 |

5.5% 12/15/16 | | 1,890 | | 1,229 |

6.25% 3/15/11 | | 175 | | 175 |

6.875% 6/15/18 | | 1,275 | | 794 |

10.75% 8/1/16 | | 21,845 | | 19,442 |

11% 8/1/16 pay-in-kind (j) | | 4,736 | | 4,120 |

Clear Channel Worldwide Holdings, Inc.: | | | | |

Series A, 9.25% 12/15/17 | | 1,490 | | 1,620 |

Series B, 9.25% 12/15/17 | | 13,145 | | 14,394 |

EchoStar Communications Corp. 7.125% 2/1/16 | | 33,535 | | 34,541 |

Globo Comunicacoes e Participacoes SA 6.25% (e)(f) | | 12,615 | | 13,246 |

Gray Television, Inc. 10.5% 6/29/15 | | 1,985 | | 2,000 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Media - continued |

Interpublic Group of Companies, Inc. 10% 7/15/17 | | $ 2,530 | | $ 2,941 |

Liberty Media Corp. 8.5% 7/15/29 | | 6,535 | | 6,372 |

Livent, Inc. yankee 9.375% 10/15/04 (c) | | 300 | | 0 |

MDC Partners, Inc. 11% 11/1/16 | | 845 | | 932 |

MediMedia USA, Inc. 11.375% 11/15/14 (f) | | 850 | | 731 |

Net Servicos de Comunicacao SA 7.5% 1/27/20 | | 2,830 | | 3,219 |

Nielsen Finance LLC/Nielsen Finance Co.: | | | | |

7.75% 10/15/18 (f) | | 7,365 | | 7,604 |

11.5% 5/1/16 | | 4,920 | | 5,646 |

11.625% 2/1/14 | | 2,535 | | 2,909 |

Rainbow National Services LLC: | | | | |

8.75% 9/1/12 (f) | | 3,280 | | 3,280 |

10.375% 9/1/14 (f) | | 9,075 | | 9,370 |

Sinclair Television Group, Inc. 8.375% 10/15/18 (f) | | 3,550 | | 3,657 |

Sun Media Corp. Canada 7.625% 2/15/13 | | 635 | | 635 |

The Reader's Digest Association, Inc. 9.5% 2/15/17 (f)(j) | | 6,000 | | 5,955 |

TL Acquisitions, Inc. 10.5% 1/15/15 (f) | | 11,490 | | 11,835 |

Univision Communications, Inc. 12% 7/1/14 (f) | | 16,875 | | 18,478 |

Videotron Ltd. 6.875% 1/15/14 | | 550 | | 557 |

| | 206,856 |

Multiline Retail - 0.1% |

Sears Holdings Corp. 6.625% 10/15/18 (f) | | 9,800 | | 9,188 |

Specialty Retail - 0.3% |

Asbury Automotive Group, Inc. 8.375% 11/15/20 (f) | | 1,455 | | 1,499 |

Claire's Stores, Inc.: | | | | |

9.25% 6/1/15 | | 1,235 | | 1,192 |

10.375% 6/1/15 pay-in-kind (j) | | 2,170 | | 2,118 |

Michaels Stores, Inc. 7.75% 11/1/18 (f) | | 14,235 | | 14,164 |

Sonic Automotive, Inc. 9% 3/15/18 | | 9,150 | | 9,585 |

| | 28,558 |

Textiles, Apparel & Luxury Goods - 0.2% |

American Achievement Corp. 10.875% 4/15/16 (f) | | 2,985 | | 3,075 |

Hanesbrands, Inc. 6.375% 12/15/20 (f) | | 7,350 | | 6,964 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Textiles, Apparel & Luxury Goods - continued |

Levi Strauss & Co.: | | | | |

7.625% 5/15/20 | | $ 9,350 | | $ 9,631 |

8.875% 4/1/16 | | 1,650 | | 1,731 |

| | 21,401 |

TOTAL CONSUMER DISCRETIONARY | | 508,218 |

CONSUMER STAPLES - 0.8% |

Beverages - 0.1% |

Anheuser-Busch InBev SA NV 4% 4/26/18 | EUR | 2,500 | | 3,372 |

Carlsberg Breweries A/S 3.375% 10/13/17 | EUR | 2,000 | | 2,573 |

Cerveceria Nacional Dominicana C por A: | | | | |

8% 3/27/14 (Reg. S) | | 780 | | 803 |

16% 3/27/12 | | 150 | | 133 |

16% 3/27/12 (f) | | 5,372 | | 4,768 |

| | 11,649 |

Food & Staples Retailing - 0.2% |

Rite Aid Corp.: | | | | |

8% 8/15/20 | | 7,350 | | 7,644 |

9.5% 6/15/17 | | 1,085 | | 914 |

9.75% 6/12/16 | | 3,670 | | 4,046 |

10.25% 10/15/19 | | 1,835 | | 1,904 |

Simmons Foods, Inc. 10.5% 11/1/17 (f) | | 2,845 | | 3,009 |

| | 17,517 |

Food Products - 0.4% |

Bumble Bee Acquisition Corp. 9% 12/15/17 (f) | | 3,750 | | 3,891 |

Darling International, Inc. 8.5% 12/15/18 (f) | | 1,130 | | 1,177 |

Dean Foods Co. 9.75% 12/15/18 (f) | | 7,250 | | 7,304 |

Harbinger Group, Inc. 10.625% 11/15/15 (f) | | 2,645 | | 2,638 |

Hines Nurseries, Inc. 10.25% 10/1/11 (c) | | 370 | | 4 |

JBS USA LLC/JBS USA Finance, Inc. 11.625% 5/1/14 | | 5,200 | | 5,999 |

Michael Foods Group, Inc. 9.75% 7/15/18 (f) | | 1,885 | | 2,045 |

Pilgrims Pride Corp. 7.875% 12/15/18 (f) | | 6,345 | | 6,305 |

Smithfield Foods, Inc. 10% 7/15/14 (f) | | 5,540 | | 6,371 |

| | 35,734 |

Personal Products - 0.1% |

Elizabeth Arden, Inc. 7.75% 1/15/14 | | 470 | | 475 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

CONSUMER STAPLES - continued |

Personal Products - continued |

NBTY, Inc. 9% 10/1/18 (f) | | $ 5,005 | | $ 5,305 |

Revlon Consumer Products Corp. 9.75% 11/15/15 | | 3,875 | | 4,117 |

| | 9,897 |

TOTAL CONSUMER STAPLES | | 74,797 |

ENERGY - 5.2% |

Energy Equipment & Services - 0.2% |

Complete Production Services, Inc. 8% 12/15/16 | | 2,530 | | 2,619 |

Frac Tech Services LLLC/Frac Tech Finance, Inc. 7.125% 11/15/18 (f) | | 2,210 | | 2,243 |

Helix Energy Solutions Group, Inc. 9.5% 1/15/16 (f) | | 3,970 | | 4,109 |

Pioneer Drilling Co. 9.875% 3/15/18 | | 3,410 | | 3,581 |

Pride International, Inc. 6.875% 8/15/20 | | 3,150 | | 3,245 |

Trinidad Drilling Ltd. 7.875% 1/15/19 (f) | | 1,615 | | 1,635 |

| | 17,432 |

Oil, Gas & Consumable Fuels - 5.0% |

Adaro Indonesia PT 7.625% 10/22/19 (f) | | 4,515 | | 4,950 |

Arch Coal, Inc. 7.25% 10/1/20 | | 1,670 | | 1,741 |

Atlas Energy Operating Co. LLC/Financing Corp. 10.75% 2/1/18 | | 4,090 | | 4,995 |

Atlas Pipeline Partners LP 8.125% 12/15/15 | | 9,415 | | 9,697 |

ATP Oil & Gas Corp. 11.875% 5/1/15 (f) | | 32,370 | | 30,671 |

Berry Petroleum Co.: | | | | |

8.25% 11/1/16 | | 2,930 | | 3,047 |

10.25% 6/1/14 | | 2,220 | | 2,547 |

Carrizo Oil & Gas, Inc. 8.625% 10/15/18 (f) | | 2,340 | | 2,410 |

Chaparral Energy, Inc.: | | | | |

8.5% 12/1/15 | | 4,498 | | 4,577 |

9.875% 10/1/20 (f) | | 1,845 | | 1,946 |

Chesapeake Energy Corp.: | | | | |

6.5% 8/15/17 | | 13,550 | | 13,516 |

6.875% 11/15/20 | | 12,030 | | 12,180 |

7.25% 12/15/18 | | 1,970 | | 2,024 |

9.5% 2/15/15 | | 5,630 | | 6,348 |

Concho Resources, Inc. 7% 1/15/21 | | 2,855 | | 2,926 |

Connacher Oil and Gas Ltd. 10.25% 12/15/15 (f) | | 4,560 | | 4,583 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

CONSOL Energy, Inc.: | | | | |

8% 4/1/17 (f) | | $ 6,470 | | $ 6,858 |

8.25% 4/1/20 (f) | | 6,645 | | 7,110 |

Continental Resources, Inc.: | | | | |

7.125% 4/1/21 (f) | | 2,540 | | 2,642 |

8.25% 10/1/19 | | 885 | | 982 |

Crosstex Energy/Crosstex Energy Finance Corp. 8.875% 2/15/18 | | 4,920 | | 5,166 |

Denbury Resources, Inc.: | | | | |

8.25% 2/15/20 | | 3,877 | | 4,226 |

9.75% 3/1/16 | | 1,660 | | 1,849 |

Drummond Co., Inc.: | | | | |

7.375% 2/15/16 | | 7,335 | | 7,555 |

9% 10/15/14 (f) | | 8,730 | | 9,276 |

DTEK Finance BV 9.5% 4/28/15 (f) | | 3,235 | | 3,340 |

Energy Transfer Equity LP 7.5% 10/15/20 | | 10,210 | | 10,567 |

Energy XXI Gulf Coast, Inc. 9.25% 12/15/17 (f) | | 12,735 | | 13,244 |

Forest Oil Corp. 8% 12/15/11 | | 480 | | 502 |

International Coal Group, Inc. 9.125% 4/1/18 | | 3,690 | | 4,004 |

InterNorth, Inc. 9.625% 3/16/06 (c) | | 935 | | 0 |

KazMunaiGaz Finance Sub BV: | | | | |

6.375% 4/9/21 (f) | | 3,335 | | 3,285 |

7% 5/5/20 (f) | | 3,100 | | 3,209 |

8.375% 7/2/13 (f) | | 3,355 | | 3,674 |

9.125% 7/2/18 (f) | | 3,975 | | 4,631 |

11.75% 1/23/15 (f) | | 4,880 | | 6,051 |

LINN Energy LLC: | | | | |

7.75% 2/1/21 (f) | | 17,760 | | 18,204 |

8.625% 4/15/20 (f) | | 14,060 | | 15,150 |

Markwest Energy Partners LP/Markwest Energy Finance Corp. 6.75% 11/1/20 | | 1,880 | | 1,880 |

Naftogaz of Ukraine NJSC 9.5% 9/30/14 | | 2,830 | | 3,088 |

Nakilat, Inc. 6.267% 12/31/33 (Reg. S) | | 1,728 | | 1,797 |

Newfield Exploration Co. 6.875% 2/1/20 | | 12,875 | | 13,454 |

Northern Tier Energy LLC/Northern Tier Finance Corp. 10.5% 12/1/17 (f) | | 4,575 | | 4,724 |

Pacific Rubiales Energy Corp. 8.75% 11/10/16 | | 3,000 | | 3,368 |

Pan American Energy LLC 7.875% 5/7/21 (f) | | 2,045 | | 2,168 |

Peabody Energy Corp. 7.875% 11/1/26 | | 5,640 | | 6,246 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

Pemex Project Funding Master Trust 6.625% 6/15/35 | | $ 4,245 | | $ 4,266 |

Petrobras International Finance Co. Ltd.: | | | | |

6.875% 1/20/40 | | 3,175 | | 3,302 |

8.375% 12/10/18 | | 1,635 | | 1,989 |

Petrohawk Energy Corp. 7.875% 6/1/15 | | 22,900 | | 23,845 |

Petroleos de Venezuela SA: | | | | |

4.9% 10/28/14 | | 6,550 | | 4,061 |

5.25% 4/12/17 | | 10,385 | | 5,868 |

5.375% 4/12/27 | | 41,035 | | 19,389 |

5.5% 4/12/37 | | 7,220 | | 3,339 |

Petroleos de Venezuela SA 144: | | | | |

8% 11/17/13 (f) | | 2,530 | | 2,078 |

8.5% 11/2/17 (f) | | 9,790 | | 6,584 |

Petroleos Mexicanos: | | | | |

5.5% 1/21/21 | | 3,200 | | 3,248 |

6% 3/5/20 | | 2,990 | | 3,177 |

6.625% (f) | | 8,755 | | 8,711 |

8% 5/3/19 | | 2,695 | | 3,234 |

Petroleum Co. of Trinidad & Tobago Ltd. (Reg. S) 6% 5/8/22 | | 3,886 | | 3,867 |

Petroleum Development Corp. 12% 2/15/18 | | 4,390 | | 4,917 |

Pioneer Natural Resources Co. 7.5% 1/15/20 | | 8,285 | | 9,093 |

Plains Exploration & Production Co. 10% 3/1/16 | | 10,150 | | 11,267 |

Quicksilver Resources, Inc. 11.75% 1/1/16 | | 5,045 | | 5,852 |

Regency Energy Partners LP/Regency Energy Finance Corp. 6.875% 12/1/18 | | 6,445 | | 6,493 |

Rosetta Resources, Inc. 9.5% 4/15/18 | | 3,565 | | 3,850 |

Southern Star Central Corp. 6.75% 3/1/16 | | 1,560 | | 1,576 |

Southwestern Energy Co. 7.5% 2/1/18 | | 2,460 | | 2,764 |

Targa Resources Partners LP/Targa Resources Partners Finance Corp. 11.25% 7/15/17 | | 4,265 | | 4,883 |

Teekay Corp. 8.5% 1/15/20 | | 3,695 | | 4,023 |

Tennessee Gas Pipeline Co.: | | | | |

7% 10/15/28 | | 550 | | 582 |

7.5% 4/1/17 | | 7,600 | | 8,737 |

7.625% 4/1/37 | | 1,035 | | 1,152 |

8.375% 6/15/32 | | 1,155 | | 1,359 |

TNK-BP Finance SA 7.5% 7/18/16 | | 3,490 | | 3,861 |

Venoco, Inc. 11.5% 10/1/17 | | 5,185 | | 5,535 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

W&T Offshore, Inc. 8.25% 6/15/14 (f) | | $ 5,300 | | $ 5,247 |

YPF SA 10% 11/2/28 | | 4,285 | | 4,928 |

| | 459,485 |

TOTAL ENERGY | | 476,917 |

FINANCIALS - 6.7% |

Capital Markets - 0.2% |

Bank Nederlandse Gemeenten NV 2.5% 11/15/17 | EUR | 5,000 | | 6,415 |

Equinox Holdings, Inc. 9.5% 2/1/16 (f) | | 5,755 | | 6,079 |

HSBC Bank PLC 5.75% 6/27/17 (e) | GBP | 1,130 | | 1,813 |

Penson Worldwide, Inc. 12.5% 5/15/17 (f) | | 3,580 | | 3,276 |

| | 17,583 |

Commercial Banks - 2.3% |

African Export-Import Bank 8.75% 11/13/14 | | 4,020 | | 4,502 |

Akbank T. A. S. 5.125% 7/22/15 (f) | | 4,605 | | 4,645 |

Ally Financial, Inc.: | | | | |

7.5% 9/15/20 (f) | | 19,185 | | 20,144 |

8% 3/15/20 | | 25,720 | | 27,649 |

Banco Bilbao Vizcaya Argentaria SA 3.5% 7/26/13 | EUR | 2,300 | | 3,033 |

Banco Bradesco SA 5.9% 1/16/21 (f) | | 2,270 | | 2,273 |

Banco de Credito del Peru 5.375% 9/16/20 (f) | | 2,055 | | 2,017 |

Banco do Nordeste do Brasil SA 3.625% 11/9/15 (f) | | 1,965 | | 1,916 |

BanColombia SA 6.125% 7/26/20 | | 2,000 | | 2,040 |

Barclays Bank PLC 14.9359% 3/18/13 (f)(j) | | 4,245 | | 4,244 |

BNP Paribas Public Sector SCF 2.25% 10/22/15 | EUR | 5,200 | | 6,748 |

CIT Group, Inc.: | | | | |

7% 5/1/13 | | 1,854 | | 1,888 |

7% 5/1/14 | | 2,780 | | 2,801 |

7% 5/1/15 | | 2,780 | | 2,787 |

7% 5/1/16 | | 13,914 | | 13,914 |

7% 5/1/17 | | 29,888 | | 29,850 |

Development Bank of Kazakhstan JSC 5.5% 12/20/15 (f) | | 1,940 | | 1,947 |

Development Bank of Philippines 8.375% (j) | | 6,440 | | 7,116 |

EXIM of Ukraine 7.65% 9/7/11 (Issued by Credit Suisse International for EXIM of Ukraine) | | 21,735 | | 22,034 |

Export-Import Bank of India 0.6825% 6/7/12 (j) | JPY | 170,000 | | 2,049 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Commercial Banks - continued |

HSBK (Europe) BV: | | | | |

7.25% 5/3/17 (f) | | $ 2,050 | | $ 2,071 |

9.25% 10/16/13 (f) | | 8,170 | | 8,885 |

Intesa Sanpaolo SpA 3.75% 11/23/16 | EUR | 1,850 | | 2,398 |

Itau Unibanco Holding SA 5.75% 1/22/21 (f) | | 2,055 | | 2,050 |

Kazkommerts International BV 8.5% 4/16/13 (f) | | 3,380 | | 3,270 |

Nordea Bank Finland PLC 2.25% 11/16/15 | EUR | 5,250 | | 6,853 |

RSHB Capital SA 9% 6/11/14 (f) | | 1,535 | | 1,729 |

SNS Bank NV 3.5% 9/28/20 | EUR | 1,600 | | 2,035 |

The State Export-Import Bank of Ukraine JSC 8.4% 2/9/16 (Issued by Credit Suisse First Boston International for The State Export-Import Bank of Ukraine JSC) (e) | | 3,725 | | 3,576 |

Trade & Development Bank of Mong LLC 8.5% 10/25/13 | | 1,965 | | 2,004 |

US Bank NA 4.375% 2/28/17 (j) | EUR | 1,600 | | 2,094 |

Vimpel Communications 8.25% 5/23/16 (Reg. S) (Issued by UBS Luxembourg SA for Vimpel Communications) | | 2,935 | | 3,210 |

Wells Fargo & Co. 7.98% (j) | | 2,035 | | 2,152 |

| | 205,924 |

Consumer Finance - 1.6% |

ACE Cash Express, Inc. 10.25% 10/1/14 (f) | | 1,420 | | 1,250 |

Ford Motor Credit Co. LLC: | | | | |

6.625% 8/15/17 | | 9,820 | | 10,286 |

7.5% 8/1/12 | | 9,230 | | 9,807 |

12% 5/15/15 | | 12,770 | | 15,899 |

General Motors Acceptance Corp.: | | | | |

6.75% 12/1/14 | | 11,870 | | 12,374 |

8% 11/1/31 | | 7,330 | | 7,841 |

GMAC LLC: | | | | |

6% 4/1/11 | | 1,435 | | 1,437 |

6.75% 12/1/14 | | 4,285 | | 4,478 |

8% 11/1/31 | | 81,013 | | 86,279 |

| | 149,651 |

Diversified Financial Services - 2.2% |

Azovstal Capital BV 9.125% 2/28/11 | | 1,705 | | 1,709 |

Bank of America Corp.: | | | | |

4% 3/28/18 (j) | EUR | 1,450 | | 1,736 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Diversified Financial Services - continued |

Bank of America Corp.: - continued | | | | |

8% (j) | | $ 5,365 | | $ 5,365 |

8.125% (j) | | 7,380 | | 7,417 |

Bank of Georgia JSC 9% 2/8/12 (Issued by BG Finance BV for Bank of Georgia JSC) | | 2,060 | | 2,060 |

BG Energy Capital PLC 5.125% 12/1/25 | GBP | 2,950 | | 4,578 |

BP Capital Markets PLC 3.83% 10/6/17 | EUR | 5,500 | | 7,354 |

Broadgate PLC 1.5348% 10/5/25 (j) | GBP | 535 | | 701 |

CCO Holdings LLC/CCO Holdings Capital Corp.: | | | | |

7.875% 4/30/18 | | 2,920 | | 3,015 |

8.125% 4/30/20 | | 6,955 | | 7,372 |

CDW LLC/CDW Finance Corp. 8% 12/15/18 (f) | | 5,405 | | 5,513 |

City of Buenos Aires 12.5% 4/6/15 (f) | | 9,815 | | 10,895 |

Dignity Finance PLC: | | | | |

6.31% 12/31/23 (Reg. S) | GBP | 231 | | 404 |

8.151% 12/31/30 | GBP | 475 | | 900 |

FireKeepers Development Authority 13.875% 5/1/15 (f) | | 1,600 | | 1,892 |

Global Cash Access LLC/Global Cash Access Finance Corp. 8.75% 3/15/12 | | 1,688 | | 1,684 |

Greene King Finance PLC Series A1, 1.1294% 6/15/31 (j) | GBP | 1,000 | | 1,217 |

Hilcorp Energy I LP/Hilcorp Finance Co. 7.625% 4/15/21 (f) | | 4,195 | | 4,321 |

Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | | |

7.75% 1/15/16 | | 17,475 | | 17,562 |

7.75% 1/15/16 (f) | | 4,570 | | 4,593 |

8% 1/15/18 | | 24,247 | | 24,368 |

8% 1/15/18 (f) | | 4,570 | | 4,593 |

Imperial Tobacco Finance 7.75% 6/24/19 | GBP | 1,200 | | 2,230 |

International Lease Finance Corp. 5.625% 9/20/13 | | 6,845 | | 6,879 |

Landrys Holdings, Inc. 11.5% 6/1/14 (f) | | 3,230 | | 3,165 |

LBI Escrow Corp. 8% 11/1/17 (f) | | 6,515 | | 7,199 |

Myriad International Holding BV 6.375% 7/28/17 (f) | | 3,345 | | 3,529 |

NCO Group, Inc. 11.875% 11/15/14 | | 2,185 | | 1,704 |

Offshore Group Investment Ltd. 11.5% 8/1/15 (f) | | 8,495 | | 9,090 |

Rearden G Holdings Eins GmbH 7.875% 3/30/20 (f) | | 3,140 | | 3,297 |

TMK Capital SA 10% 7/29/11 | | 6,300 | | 6,502 |

Trans Union LLC/Trans Union Financing Corp. 11.375% 6/15/18 (f) | | 4,285 | | 4,863 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Diversified Financial Services - continued |

UPC Germany GmbH 8.125% 12/1/17 (f) | | $ 7,210 | | $ 7,607 |

Vnesheconombank Via VEB Finance Ltd. 6.8% 11/22/25 (f) | | 2,365 | | 2,347 |

WaMu Covered Bond Program 3.875% 9/27/11 | EUR | 1,090 | | 1,476 |

Wind Acquisition Holdings Finance SA 12.25% 7/15/17 pay-in-kind (f)(j) | | 15,245 | | 16,650 |

Zhaikmunai Finance BV 10.5% 10/19/15 (f) | | 3,525 | | 3,525 |

| | 199,312 |

Insurance - 0.1% |

American International Group, Inc.: | | | | |

5.45% 5/18/17 | | 4,290 | | 4,344 |

5.85% 1/16/18 | | 1,505 | | 1,552 |

CNO Financial Group, Inc. 9% 1/15/18 (f) | | 2,935 | | 3,008 |

USI Holdings Corp. 4.1606% 11/15/14 (f)(j) | | 920 | | 805 |

| | 9,709 |

Real Estate Investment Trusts - 0.1% |

Omega Healthcare Investors, Inc.: | | | | |

6.75% 10/15/22 (f) | | 8,390 | | 8,264 |

7.5% 2/15/20 | | 4,860 | | 5,103 |

| | 13,367 |

Real Estate Management & Development - 0.2% |

CB Richard Ellis Services, Inc.: | | | | |

6.625% 10/15/20 (f) | | 5,565 | | 5,509 |

11.625% 6/15/17 | | 6,420 | | 7,447 |

Realogy Corp.: | | | | |

11.5% 4/15/17 (f) | | 2,315 | | 2,338 |

12% 4/15/17 (e)(f) | | 2,748 | | 2,803 |

Toys 'R' Us Property Co. II LLC 8.5% 12/1/17 | | 845 | | 908 |

Ventas Realty LP 6.5% 6/1/16 | | 980 | | 1,019 |

| | 20,024 |

TOTAL FINANCIALS | | 615,570 |

HEALTH CARE - 2.3% |

Health Care Providers & Services - 1.7% |

Apria Healthcare Group, Inc. 11.25% 11/1/14 | | 7,720 | | 8,396 |

Capella Healthcare, Inc. 9.25% 7/1/17 (f) | | 3,465 | | 3,682 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

HEALTH CARE - continued |

Health Care Providers & Services - continued |

CRC Health Group, Inc. 10.75% 2/1/16 | | $ 1,880 | | $ 1,885 |

DaVita, Inc.: | | | | |

6.375% 11/1/18 | | 4,475 | | 4,386 |

6.625% 11/1/20 | | 3,875 | | 3,807 |

Gentiva Health Services, Inc. 11.5% 9/1/18 | | 5,710 | | 6,224 |

HCA Holdings, Inc. 7.75% 5/15/21 (f) | | 30,445 | | 30,445 |

HCA, Inc.: | | | | |

5.75% 3/15/14 | | 3,377 | | 3,301 |

6.25% 2/15/13 | | 1,755 | | 1,790 |

6.375% 1/15/15 | | 1,125 | | 1,108 |

6.5% 2/15/16 | | 4,220 | | 4,115 |

6.75% 7/15/13 | | 1,750 | | 1,798 |

7.25% 9/15/20 | | 23,835 | | 24,610 |

9.125% 11/15/14 | | 7,020 | | 7,353 |

9.25% 11/15/16 | | 17,055 | | 18,249 |

HealthSouth Corp. 8.125% 2/15/20 | | 7,395 | | 7,913 |

InVentiv Health, Inc. 10% 8/15/18 (f) | | 905 | | 896 |

LifePoint Hospitals, Inc. 6.625% 10/1/20 (f) | | 4,045 | | 4,015 |

Quintiles Transnational Holdings, Inc. 9.5% 12/30/14 (f) | | 4,910 | | 5,033 |

ResCare, Inc. 10.75% 1/15/19 (f) | | 2,735 | | 2,800 |

Rhoen-Klinikum AG 3.875% 3/11/16 | EUR | 1,400 | | 1,874 |

Rotech Healthcare, Inc. 10.75% 10/15/15 (f) | | 4,075 | | 4,218 |

Sabra Health Care LP/Sabra Capital Corp. 8.125% 11/1/18 (f) | | 1,200 | | 1,236 |

Skilled Healthcare Group, Inc. 11% 1/15/14 | | 3,652 | | 3,752 |

UHS Escrow Corp. 7% 10/1/18 (f) | | 1,020 | | 1,048 |

United Surgical Partners International, Inc. 8.875% 5/1/17 | | 895 | | 920 |

| | 154,854 |

Health Care Technology - 0.1% |

ConvaTec Healthcare ESA 10.5% 12/15/18 (f) | | 10,355 | | 10,459 |

Life Sciences Tools & Services - 0.0% |

Bio-Rad Laboratories, Inc. 7.5% 8/15/13 | | 1,770 | | 1,794 |

Pharmaceuticals - 0.5% |

Elan Finance PLC/Elan Finance Corp. 8.75% 10/15/16 | | 5,775 | | 5,833 |

Leiner Health Products, Inc. 11% 6/1/12 (c) | | 1,885 | | 94 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

HEALTH CARE - continued |

Pharmaceuticals - continued |

Mylan, Inc.: | | | | |

6% 11/15/18 (f) | | $ 10,955 | | $ 10,723 |

7.625% 7/15/17 (f) | | 3,900 | | 4,124 |

7.875% 7/15/20 (f) | | 7,040 | | 7,568 |

Valeant Pharmaceuticals International 6.875% 12/1/18 (f) | | 15,705 | | 15,548 |

| | 43,890 |

TOTAL HEALTH CARE | | 210,997 |

INDUSTRIALS - 3.4% |

Aerospace & Defense - 0.1% |

Alion Science & Technology Corp.: | | | | |

10.25% 2/1/15 | | 800 | | 608 |

12% 11/1/14 pay-in-kind | | 1,447 | | 1,457 |

DigitalGlobe, Inc. 10.5% 5/1/14 | | 2,915 | | 3,330 |

GeoEye, Inc. 9.625% 10/1/15 | | 1,030 | | 1,164 |

Hexcel Corp. 6.75% 2/1/15 | | 2,350 | | 2,397 |

| | 8,956 |

Air Freight & Logistics - 0.0% |

Air Medical Group Holdings, Inc. 9.25% 11/1/18 (f) | | 3,295 | | 3,460 |

Airlines - 0.7% |

Air Canada 9.25% 8/1/15 (f) | | 7,170 | | 7,529 |

American Airlines, Inc. equipment trust certificate 13% 8/1/16 | | 4,470 | | 5,230 |

American Airlines, Inc. pass-thru trust certificates 10.375% 7/2/19 | | 5,873 | | 6,930 |

Continental Airlines, Inc. pass-thru trust certificates 6.903% 4/19/22 | | 805 | | 805 |

Continental Airlines, Inc. 7.25% 11/10/19 | | 4,925 | | 5,479 |

Delta Air Lines, Inc. 9.5% 9/15/14 (f) | | 1,374 | | 1,496 |

Delta Air Lines, Inc. pass-thru trust certificates: | | | | |

6.821% 8/10/22 | | 9,056 | | 9,735 |

8.021% 8/10/22 | | 4,222 | | 4,391 |

Northwest Airlines Corp. 10% 2/1/09 (a) | | 1,895 | | 0 |

Northwest Airlines, Inc.: | | | | |

7.875% 3/15/08 (a) | | 1,365 | | 0 |

8.875% 6/1/06 (a) | | 1,355 | | 0 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

INDUSTRIALS - continued |

Airlines - continued |

Northwest Airlines, Inc. pass-thru trust certificates: | | | | |

7.027% 11/1/19 | | $ 2,184 | | $ 2,293 |

8.028% 11/1/17 | | 764 | | 756 |

United Air Lines, Inc.: | | | | |

9.875% 8/1/13 (f) | | 2,140 | | 2,306 |

12% 11/1/13 (f) | | 3,415 | | 3,765 |

United Air Lines, Inc. pass-thru trust certificates 9.75% 1/15/17 | | 8,094 | | 9,329 |

| | 60,044 |

Building Products - 0.1% |

Nortek, Inc. 11% 12/1/13 | | 11,672 | | 12,314 |

Commercial Services & Supplies - 1.0% |

ACCO Brands Corp. 10.625% 3/15/15 | | 595 | | 669 |

American Reprographics Co. 10.5% 12/15/16 (f) | | 4,570 | | 4,776 |

Browning-Ferris Industries, Inc. 9.25% 5/1/21 | | 680 | | 855 |

Casella Waste Systems, Inc. 11% 7/15/14 | | 1,510 | | 1,657 |

Cenveo Corp. 10.5% 8/15/16 (f) | | 2,795 | | 2,746 |

Covanta Holding Corp. 7.25% 12/1/20 | | 4,940 | | 5,008 |

EnergySolutions, Inc. / EnergySolutions LLC 10.75% 8/15/18 (f) | | 3,525 | | 3,846 |

Garda World Security Corp. 9.75% 3/15/17 (f) | | 2,260 | | 2,424 |

International Lease Finance Corp.: | | | | |

6.75% 9/1/16 (f) | | 4,580 | | 4,798 |

7.125% 9/1/18 (f) | | 9,160 | | 9,618 |

8.25% 12/15/20 | | 8,235 | | 8,400 |

8.625% 9/15/15 (f) | | 7,985 | | 8,464 |

8.75% 3/15/17 (f) | | 11,970 | | 12,718 |

Iron Mountain, Inc.: | | | | |

6.625% 1/1/16 | | 10,955 | | 10,996 |

7.75% 1/15/15 | | 2,645 | | 2,652 |

The Geo Group, Inc. 7.75% 10/15/17 | | 2,845 | | 2,987 |

United Rentals North America, Inc. 8.375% 9/15/20 | | 6,995 | | 7,152 |

| | 89,766 |

Construction & Engineering - 0.0% |

Odebrecht Finance Ltd. 7% 4/21/20 (f) | | 1,830 | | 1,940 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

INDUSTRIALS - continued |

Electrical Equipment - 0.0% |

General Cable Corp. 7.125% 4/1/17 | | $ 680 | | $ 700 |

Sensus Metering Systems, Inc. 8.625% 12/15/13 | | 900 | | 914 |

| | 1,614 |

Industrial Conglomerates - 0.2% |

Sequa Corp.: | | | | |

11.75% 12/1/15 (f) | | 11,050 | | 11,879 |

13.5% 12/1/15 pay-in-kind (f) | | 4,393 | | 4,833 |

| | 16,712 |

Machinery - 0.3% |

Accuride Corp. 9.5% 8/1/18 (f) | | 650 | | 705 |

ArvinMeritor, Inc. 10.625% 3/15/18 | | 2,115 | | 2,374 |

Chart Industries, Inc. 9.125% 10/15/15 | | 1,160 | | 1,189 |

Cummins, Inc. 7.125% 3/1/28 | | 1,870 | | 2,040 |

Navistar International Corp. 8.25% 11/1/21 | | 9,025 | | 9,747 |

Terex Corp. 10.875% 6/1/16 | | 5,025 | | 5,829 |

| | 21,884 |

Marine - 0.3% |

Navios Maritime Acquisition Corp./Navios Acquisition Finance US, Inc. 8.625% 11/1/17 (f) | | 2,585 | | 2,617 |

Navios Maritime Holdings, Inc.: | | | | |

8.875% 11/1/17 | | 10,830 | | 11,561 |

9.5% 12/15/14 | | 5,215 | | 5,424 |

SCF Capital Ltd. 5.375% 10/27/17 (f) | | 1,885 | | 1,845 |

Ultrapetrol (Bahamas) Ltd. 9% 11/24/14 | | 2,050 | | 2,060 |

| | 23,507 |

Road & Rail - 0.4% |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc.: | | | | |

8.25% 1/15/19 (f) | | 10,035 | | 10,110 |

9.625% 3/15/18 | | 2,465 | | 2,638 |

Georgian Railway Ltd. 9.875% 7/22/15 | | 1,850 | | 1,989 |

Kansas City Southern de Mexico, SA de CV: | | | | |

6.625% 12/15/20 (f) | | 2,020 | | 2,020 |

7.375% 6/1/14 | | 1,670 | | 1,741 |

12.5% 4/1/16 | | 7,075 | | 8,667 |

Swift Services Holdings, Inc. 10% 11/15/18 (f) | | 7,890 | | 8,206 |

Western Express, Inc. 12.5% 4/15/15 (f) | | 3,185 | | 2,819 |

| | 38,190 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

INDUSTRIALS - continued |

Trading Companies & Distributors - 0.2% |

Aircastle Ltd. 9.75% 8/1/18 | | $ 9,000 | | $ 9,878 |

VWR Funding, Inc. 10.25% 7/15/15 pay-in-kind (j) | | 10,578 | | 11,107 |

| | 20,985 |

Transportation Infrastructure - 0.1% |

Aeropuertos Argentina 2000 SA 10.75% 12/1/20 (f) | | 2,140 | | 2,236 |

Trico Shipping AS 11.875% 11/1/14 (c)(f) | | 9,180 | | 7,436 |

| | 9,672 |

TOTAL INDUSTRIALS | | 309,044 |

INFORMATION TECHNOLOGY - 1.3% |

Communications Equipment - 0.4% |

Brocade Communications Systems, Inc.: | | | | |

6.625% 1/15/18 | | 1,135 | | 1,180 |

6.875% 1/15/20 | | 2,095 | | 2,231 |

Hughes Network System LLC/HNS Finance Corp. 9.5% 4/15/14 | | 6,290 | | 6,487 |

Lucent Technologies, Inc.: | | | | |

6.45% 3/15/29 | | 20,050 | | 15,840 |

6.5% 1/15/28 | | 6,570 | | 5,223 |

ViaSat, Inc. 8.875% 9/15/16 | | 1,335 | | 1,422 |

| | 32,383 |

Computers & Peripherals - 0.1% |

Seagate HDD Cayman 7.75% 12/15/18 (f) | | 9,070 | | 9,115 |

Electronic Equipment & Components - 0.1% |

Atkore International, Inc. 9.875% 1/1/18 (f) | | 2,155 | | 2,236 |

Reddy Ice Corp.: | | | | |

11.25% 3/15/15 | | 4,625 | | 4,741 |

13.25% 11/1/15 | | 3,266 | | 2,792 |

| | 9,769 |

Internet Software & Services - 0.1% |

Equinix, Inc. 8.125% 3/1/18 | | 8,180 | | 8,548 |

IT Services - 0.3% |

Ceridian Corp. 11.25% 11/15/15 | | 4,145 | | 4,041 |

Fidelity National Information Services, Inc.: | | | | |

7.625% 7/15/17 (f) | | 2,935 | | 3,089 |

7.875% 7/15/20 (f) | | 3,910 | | 4,145 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

INFORMATION TECHNOLOGY - continued |

IT Services - continued |

SunGard Data Systems, Inc. 7.375% 11/15/18 (f) | | $ 4,435 | | $ 4,391 |

Telcordia Technologies, Inc. 11% 5/1/18 (f) | | 6,855 | | 6,924 |

Unisys Corp.: | | | | |

12.5% 1/15/16 | | 3,030 | | 3,363 |

12.75% 10/15/14 (f) | | 437 | | 520 |

14.25% 9/15/15 (f) | | 350 | | 424 |

| | 26,897 |

Semiconductors & Semiconductor Equipment - 0.3% |

Advanced Micro Devices, Inc.: | | | | |

7.75% 8/1/20 (f) | | 1,640 | | 1,702 |

8.125% 12/15/17 | | 3,470 | | 3,665 |

Amkor Technology, Inc. 7.375% 5/1/18 | | 3,485 | | 3,581 |

Freescale Semiconductor, Inc. 10.75% 8/1/20 (f) | | 3,485 | | 3,729 |

NXP BV/NXP Funding LLC 9.75% 8/1/18 (f) | | 10,905 | | 12,241 |

Spansion LLC 11.25% 1/15/16 (c)(f) | | 4,255 | | 1,159 |

Viasystems, Inc. 12% 1/15/15 (f) | | 4,000 | | 4,470 |

| | 30,547 |

Software - 0.0% |

Open Solutions, Inc. 9.75% 2/1/15 (f) | | 870 | | 600 |

TOTAL INFORMATION TECHNOLOGY | | 117,859 |

MATERIALS - 2.7% |

Chemicals - 0.7% |

Air Liquide SA 2.908% 10/12/18 | EUR | 850 | | 1,086 |

Ashland, Inc. 9.125% 6/1/17 | | 2,490 | | 2,851 |

Braskem Finance Ltd. 7% 5/7/20 (f) | | 3,300 | | 3,383 |

Ferro Corp. 7.875% 8/15/18 | | 4,325 | | 4,585 |

Georgia Gulf Corp. 9% 1/15/17 (f) | | 10,825 | | 11,637 |

Hexion US Finance Corp./Hexion Nova Scotia Finance ULC 9% 11/15/20 (f) | | 220 | | 232 |

Ineos Finance PLC 9% 5/15/15 (f) | | 2,655 | | 2,821 |

MacDermid, Inc. 9.5% 4/15/17 (f) | | 500 | | 533 |

Momentive Performance Materials, Inc. 9% 1/15/21 (f) | | 835 | | 864 |

Nalco Co. 6.625% 1/15/19 (f) | | 6,310 | | 6,484 |

NOVA Chemicals Corp.: | | | | |

3.5678% 11/15/13 (j) | | 1,690 | | 1,660 |

6.5% 1/15/12 | | 5,775 | | 5,963 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

MATERIALS - continued |

Chemicals - continued |

OMNOVA Solutions, Inc. 7.875% 11/1/18 (f) | | $ 1,105 | | $ 1,113 |

OXEA Finance & Cy SCA 9.5% 7/15/17 (f) | | 3,735 | | 4,024 |

PolyOne Corp. 7.375% 9/15/20 | | 1,845 | | 1,905 |

Solutia, Inc.: | | | | |

7.875% 3/15/20 | | 2,180 | | 2,344 |

8.75% 11/1/17 | | 1,100 | | 1,194 |

Sterling Chemicals, Inc. 10.25% 4/1/15 | | 1,600 | | 1,648 |

TPC Group LLC 8.25% 10/1/17 (f) | | 2,195 | | 2,294 |

Tronox Worldwide LLC/Tronox Worldwide Finance Corp. 9.5% 12/1/12 (c) | | 3,430 | | 5,377 |

| | 61,998 |

Construction Materials - 0.0% |

Headwaters, Inc. 11.375% 11/1/14 | | 1,025 | | 1,121 |

Roofing Supply Group LLC/Roofing Supply Finance, Inc. 8.625% 12/1/17 (f) | | 1,220 | | 1,266 |

| | 2,387 |

Containers & Packaging - 0.5% |

AEP Industries, Inc. 7.875% 3/15/13 | | 640 | | 638 |

Ardagh Packaging Finance PLC: | | | | |

7.375% 10/15/17 (f) | | 1,190 | | 1,220 |

9.125% 10/15/20 (f) | | 4,205 | | 4,405 |

Berry Plastics Corp.: | | | | |

8.25% 11/15/15 | | 4,610 | | 4,806 |

9.75% 1/15/21 (f) | | 11,885 | | 11,766 |

Berry Plastics Holding Corp. 4.1766% 9/15/14 (j) | | 640 | | 586 |

BWAY Parent Co., Inc. 10.875% 11/1/15 pay-in-kind (f)(j) | | 3,680 | | 3,680 |

Crown Cork & Seal, Inc.: | | | | |

7.375% 12/15/26 | | 9,795 | | 9,722 |

7.5% 12/15/96 | | 3,685 | | 2,948 |

Jefferson Smurfit Corp. U.S. 8.25% 10/1/12 (c) | | 1,170 | | 0 |

Smurfit-Stone Container Enterprises, Inc. 8% 3/15/17 (c) | | 5,845 | | 0 |

| | 39,771 |

Metals & Mining - 1.1% |

Aleris International, Inc.: | | | | |

6% 6/1/20 (f) | | 33 | | 156 |

9% 12/15/14 pay-in-kind (c)(j) | | 2,790 | | 13 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

MATERIALS - continued |

Metals & Mining - continued |

Alrosa Finance SA 7.75% 11/3/20 (f) | | $ 2,685 | | $ 2,819 |

CSN Islands XI Corp. 6.875% 9/21/19 (f) | | 3,240 | | 3,499 |

Edgen Murray Corp. 12.25% 1/15/15 | | 8,545 | | 7,477 |

Evraz Group SA: | | | | |

8.25% 11/10/15 (f) | | 1,970 | | 2,098 |

8.875% 4/24/13 (f) | | 6,450 | | 6,950 |

FMG Resources (August 2006) Pty Ltd.: | | | | |

6.375% 2/1/16 (f) | | 7,260 | | 7,314 |

6.875% 2/1/18 (f) | | 7,260 | | 7,242 |

7% 11/1/15 (f) | | 9,155 | | 9,453 |

Freeport-McMoRan Copper & Gold, Inc. 8.375% 4/1/17 | | 17,310 | | 19,214 |

Gerdau Trade, Inc. 5.75% 1/30/21 (f) | | 2,080 | | 2,080 |

McJunkin Red Man Corp. 9.5% 12/15/16 (f) | | 8,725 | | 8,234 |

Metinvest BV 10.25% 5/20/15 (f) | | 3,270 | | 3,466 |

Rain CII Carbon LLC/CII Carbon Corp. 8% 12/1/18 (f) | | 3,435 | | 3,572 |

RathGibson, Inc. 11.25% 2/15/14 (c) | | 5,845 | | 41 |

Severstal Columbus LLC 10.25% 2/15/18 (f) | | 7,005 | | 7,390 |

Southern Copper Corp. 6.75% 4/16/40 | | 4,625 | | 4,833 |

Steel Capital SA 6.7% 10/25/17 (f) | | 2,100 | | 2,069 |

Teck Resources Ltd. 10.25% 5/15/16 | | 3,342 | | 4,136 |

| | 102,056 |

Paper & Forest Products - 0.4% |

ABI Escrow Corp. 10.25% 10/15/18 (f) | | 18,850 | | 20,475 |

Clearwater Paper Corp. 7.125% 11/1/18 (f) | | 1,225 | | 1,262 |

Georgia-Pacific LLC 5.4% 11/1/20 (f) | | 6,505 | | 6,383 |

Glatfelter 7.125% 5/1/16 | | 550 | | 567 |

NewPage Corp.: | | | | |

6.5369% 5/1/12 (j) | | 1,770 | | 1,020 |

11.375% 12/31/14 | | 4,775 | | 4,417 |

Solo Cup Co. 8.5% 2/15/14 | | 2,140 | | 1,894 |

Stone Container Corp. 8.375% 7/1/12 (c) | | 3,005 | | 0 |

| | 36,018 |

TOTAL MATERIALS | | 242,230 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

TELECOMMUNICATION SERVICES - 7.0% |

Diversified Telecommunication Services - 4.6% |

Alestra SA de RL de CV 11.75% 8/11/14 | | $ 4,520 | | $ 5,175 |

Citizens Communications Co.: | | | | |

7.125% 3/15/19 | | 2,730 | | 2,805 |

7.875% 1/15/27 | | 4,895 | | 4,748 |

9% 8/15/31 | | 3,655 | | 3,756 |

Clearwire Communications LLC/Clearwire Finance, Inc. 12% 12/1/15 (f) | | 12,857 | | 13,886 |

Frontier Communications Corp.: | | | | |

8.25% 4/15/17 | | 7,925 | | 8,777 |

8.5% 4/15/20 | | 16,285 | | 17,832 |

8.75% 4/15/22 | | 10,450 | | 11,391 |

Global Crossing Ltd. 12% 9/15/15 | | 10,305 | | 11,619 |

Indosat Palapa Co. BV 7.375% 7/29/20 (f) | | 2,010 | | 2,216 |

Intelsat Bermuda Ltd.: | | | | |

11.25% 2/4/17 | | 31,406 | | 34,154 |

12% 2/4/17 pay-in-kind (j) | | 29,105 | | 31,313 |

Intelsat Corp.: | | | | |

9.25% 8/15/14 | | 5,215 | | 5,371 |

9.25% 6/15/16 | | 8,820 | | 9,526 |

Intelsat Ltd. 11.25% 6/15/16 | | 27,785 | | 29,869 |

Qwest Communications International, Inc.: | | | | |

Series B 7.5% 2/15/14 | | 1,655 | | 1,676 |

7.125% 4/1/18 (f) | | 6,665 | | 6,882 |

7.5% 2/15/14 | | 7,555 | | 7,649 |

Sprint Capital Corp.: | | | | |

6.875% 11/15/28 | | 85,800 | | 75,075 |

6.9% 5/1/19 | | 15,450 | | 15,257 |

8.75% 3/15/32 | | 73,236 | | 73,968 |

Telemar Norte Leste SA 5.5% 10/23/20 (f) | | 1,970 | | 1,911 |

U.S. West Communications: | | | | |

6.875% 9/15/33 | | 2,535 | | 2,491 |

7.25% 9/15/25 | | 535 | | 567 |

7.25% 10/15/35 | | 1,455 | | 1,470 |

7.5% 6/15/23 | | 460 | | 458 |

Wind Acquisition Finance SA: | | | | |

7.25% 2/15/18 (f) | | 4,780 | | 4,816 |

11.75% 7/15/17 (f) | | 34,975 | | 39,085 |

| | 423,743 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

TELECOMMUNICATION SERVICES - continued |

Wireless Telecommunication Services - 2.4% |

Clearwire Escrow Corp. 12% 12/1/15 (f) | | $ 4,260 | | $ 4,601 |

Digicel Group Ltd.: | | | | |

8.25% 9/1/17 (f) | | 2,390 | | 2,462 |

8.875% 1/15/15 (f) | | 23,300 | | 23,622 |

9.125% 1/15/15 pay-in-kind (f)(j) | | 14,920 | | 15,126 |

10.5% 4/15/18 (f) | | 30,980 | | 34,078 |

12% 4/1/14 (f) | | 9,725 | | 11,378 |

Intelsat Jackson Holdings Ltd.: | | | | |

8.5% 11/1/19 (f) | | 4,220 | | 4,537 |

9.5% 6/15/16 | | 19,260 | | 20,319 |

11.5% 6/15/16 | | 8,740 | | 9,417 |

Intelsat Subsidiary Holding Co. Ltd. 8.875% 1/15/15 | | 12,125 | | 12,458 |

Mobile Telesystems Finance SA 8% 1/28/12 (f) | | 3,306 | | 3,480 |

MTS International Funding Ltd. 8.625% 6/22/20 (f) | | 4,255 | | 4,808 |

NII Capital Corp. 10% 8/15/16 | | 16,435 | | 18,202 |

Orascom Telecom Finance SCA 7.875% 2/8/14 (f) | | 10,790 | | 10,143 |

Pakistan Mobile Communications Ltd. 8.625% 11/13/13 (f) | | 12,184 | | 12,184 |

Sprint Nextel Corp. 6% 12/1/16 | | 19,623 | | 18,961 |

Telemovil Finance Co. Ltd. 8% 10/1/17 (f) | | 4,675 | | 4,792 |

Vimpel Communications 8.375% 4/30/13 (Issued by VIP Finance Ireland Ltd. for Vimpel Communications) (f) | | 6,120 | | 6,610 |

| | 217,178 |

TOTAL TELECOMMUNICATION SERVICES | | 640,921 |

UTILITIES - 1.3% |

Electric Utilities - 0.4% |

Chivor SA E.S.P. 9.75% 12/30/14 (f) | | 2,355 | | 2,744 |

Empresa Distribuidora y Comercializadora Norte SA 9.75% 10/25/22 (f) | | 1,285 | | 1,391 |

Intergen NV 9% 6/30/17 (f) | | 17,825 | | 18,895 |

Majapahit Holding BV: | | | | |

7.75% 10/17/16 (Reg. S) | | 5,885 | | 6,797 |

7.75% 1/20/20 (f) | | 3,370 | | 3,876 |

8% 8/7/19 (f) | | 2,455 | | 2,848 |

National Power Corp. 6.875% 11/2/16 (f) | | 2,265 | | 2,605 |

| | 39,156 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

UTILITIES - continued |

Gas Utilities - 0.2% |

Intergas Finance BV 6.375% 5/14/17 (Reg. S) | | $ 1,685 | | $ 1,752 |

Southern Natural Gas Co.: | | | | |

7.35% 2/15/31 | | 6,645 | | 7,079 |

8% 3/1/32 | | 3,550 | | 4,067 |

Star Gas Partners LP/Star Gas Finance Co. 8.875% 12/1/17 (f) | | 2,435 | | 2,429 |

Transportadora de Gas del Sur SA 7.875% 5/14/17 (f) | | 4,645 | | 4,668 |

| | 19,995 |

Independent Power Producers & Energy Traders - 0.7% |

Energy Future Holdings Corp.: | | | | |

10% 1/15/20 (f) | | 8,880 | | 9,102 |

10.875% 11/1/17 | | 15,253 | | 10,677 |

12% 11/1/17 pay-in-kind (j) | | 5,789 | | 3,413 |

Energy Future Intermediate Holding Co. LLC/Energy Future Intermediate Holding Finance, Inc. 10% 12/1/20 | | 29,263 | | 29,995 |

Enron Corp.: | | | | |

Series A, 8.375% 5/23/05 (c) | | 2,500 | | 0 |

6.4% 7/15/06 (c) | | 9,815 | | 0 |

6.625% 11/15/05 (c) | | 2,200 | | 0 |

6.725% 11/17/08 (c)(j) | | 684 | | 0 |

6.75% 8/1/09 (c) | | 550 | | 0 |

6.875% 10/15/07 (c) | | 1,330 | | 0 |

6.95% 7/15/28 (c) | | 1,204 | | 0 |

7.125% 5/15/07 (c) | | 235 | | 0 |

7.375% 5/15/19 (c) | | 1,400 | | 0 |

7.875% 6/15/03 (c) | | 235 | | 0 |

9.125% 4/1/03 (c) | | 50 | | 0 |

9.875% 6/5/03 (c) | | 4,720 | | 0 |

Power Sector Assets and Liabilities Management Corp.: | | | | |

7.25% 5/27/19 (f) | | 2,795 | | 3,284 |

7.39% 12/2/24 (f) | | 2,880 | | 3,391 |

Tenaska Alabama Partners LP 7% 6/30/21 (f) | | 937 | | 997 |

| | 60,859 |

Corporate Bonds - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Nonconvertible Bonds - continued |

UTILITIES - continued |

Multi-Utilities - 0.0% |

Aquila, Inc. 11.875% 7/1/12 (j) | | $ 1,615 | | $ 1,832 |

Utilicorp United, Inc. 7.95% 2/1/11 (e) | | 39 | | 39 |

| | 1,871 |

TOTAL UTILITIES | | 121,881 |

TOTAL NONCONVERTIBLE BONDS | | 3,318,434 |

TOTAL CORPORATE BONDS (Cost $3,236,803) | 3,459,065 |

U.S. Government and Government Agency Obligations - 21.4% |

|

U.S. Government Agency Obligations - 2.2% |

Fannie Mae: | | | | |

0.375% 12/28/12 | | 9,070 | | 9,012 |

0.75% 12/18/13 | | 14,084 | | 13,927 |

1% 9/23/13 | | 4,595 | | 4,588 |

1.125% 7/30/12 | | 2,151 | | 2,170 |

1.25% 8/20/13 | | 5,560 | | 5,596 |

Federal Home Loan Bank: | | | | |

0.875% 8/22/12 | | 4,890 | | 4,914 |

0.875% 12/27/13 | | 775 | | 768 |

1.5% 1/16/13 | | 15,290 | | 15,533 |

1.875% 6/21/13 | | 36,440 | | 37,289 |

Freddie Mac: | | | | |

0.375% 11/30/12 | | 1,683 | | 1,673 |

0.625% 12/28/12 | | 81,380 | | 81,232 |

4.125% 12/21/12 | | 4,080 | | 4,349 |

4.5% 1/15/14 | | 2,625 | | 2,886 |

Israeli State (guaranteed by U.S. Government through Agency for International Development) 5.5% 9/18/23 | | 11,210 | | 12,868 |

Private Export Funding Corp. secured: | | | | |

4.974% 8/15/13 | | 1,515 | | 1,670 |

5.685% 5/15/12 | | 1,285 | | 1,376 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) (d) | | Value (000s) |

U.S. Government Agency Obligations - continued |

Small Business Administration guaranteed development participation certificates Series 2003-P10B, Class 1 5.136% 8/10/13 | | $ 328 | | $ 348 |

Tennessee Valley Authority 5.25% 9/15/39 | | 5,600 | | 5,920 |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | 206,119 |

U.S. Treasury Inflation Protected Obligations - 0.7% |

U.S. Treasury Inflation-Indexed Notes 0.5% 4/15/15 | | 66,909 | | 68,471 |

U.S. Treasury Obligations - 16.3% |

U.S. Treasury Bonds: | | | | |

3.5% 2/15/39 | | 62,582 | | 53,928 |

3.875% 8/15/40 | | 95,884 | | 88,318 |

4.25% 11/15/40 | | 5,000 | | 4,919 |

5.25% 2/15/29 | | 31,710 | | 36,367 |

6.125% 8/15/29 | | 9,487 | | 12,000 |

6.25% 8/15/23 | | 36,125 | | 45,405 |

7.5% 11/15/16 | | 2,850 | | 3,663 |

7.5% 11/15/24 | | 10,690 | | 14,978 |

7.625% 2/15/25 | | 11,000 | | 15,599 |

7.875% 2/15/21 | | 6,800 | | 9,486 |

8% 11/15/21 | | 11,000 | | 15,558 |

8.125% 5/15/21 | | 9,286 | | 13,182 |

9.875% 11/15/15 | | 11,595 | | 15,903 |

U.S. Treasury Notes: | | | | |

0.375% 9/30/12 | | 61,808 | | 61,661 |

0.75% 12/15/13 | | 77,086 | | 76,538 |

1.25% 8/31/15 | | 15,400 | | 14,978 |

1.25% 10/31/15 | | 24,400 | | 23,615 |

1.375% 2/15/13 | | 30,123 | | 30,577 |

1.375% 11/30/15 | | 25,000 | | 24,295 |

1.5% 12/31/13 | | 4,313 | | 4,375 |

1.75% 4/15/13 | | 36,755 | | 37,599 |

1.875% 4/30/14 | | 28,912 | | 29,569 |

1.875% 6/30/15 | | 17,707 | | 17,778 |

1.875% 8/31/17 | | 7,700 | | 7,350 |

1.875% 9/30/17 | | 5,400 | | 5,142 |

1.875% 10/31/17 | | 41,900 | | 39,831 |

2.125% 5/31/15 | | 20,082 | | 20,402 |

2.375% 8/31/14 | | 13,000 | | 13,467 |

2.375% 9/30/14 | | 8,471 | | 8,774 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) (d) | | Value (000s) |

U.S. Treasury Obligations - continued |

U.S. Treasury Notes: - continued | | | | |

2.375% 10/31/14 | | $ 49,620 | | $ 51,361 |

2.375% 7/31/17 | | 20,000 | | 19,738 |

2.5% 3/31/15 | | 58,749 | | 60,810 |

2.5% 4/30/15 | | 50,268 | | 51,968 |

2.625% 7/31/14 | | 66,965 | | 70,036 |

2.625% 4/30/16 | | 3,137 | | 3,211 |

2.625% 8/15/20 | | 18,750 | | 17,776 |

2.625% 11/15/20 | | 41,870 | | 39,495 |

2.75% 11/30/16 | | 10,000 | | 10,207 |

2.75% 2/15/19 | | 23,501 | | 23,198 |

3% 9/30/16 | | 37,355 | | 38,741 |

3% 2/28/17 | | 66,584 | | 68,665 |

3.125% 8/31/13 | | 11,100 | | 11,776 |

3.125% 9/30/13 | | 34,572 | | 36,676 |

3.125% 10/31/16 | | 41,816 | | 43,619 |

3.125% 1/31/17 | | 30,990 | | 32,201 |

3.125% 5/15/19 | | 52,907 | | 53,465 |

3.375% 6/30/13 | | 8,470 | | 9,019 |

3.625% 8/15/19 | | 5,731 | | 5,987 |

3.75% 11/15/18 | | 34,582 | | 36,784 |

3.875% 5/15/18 | | 2,550 | | 2,744 |

4% 8/15/18 | | 5,478 | | 5,936 |

4.25% 11/15/17 | | 28,890 | | 31,849 |

4.5% 5/15/17 | | 13,745 | | 15,379 |

TOTAL U.S. TREASURY OBLIGATIONS | | 1,485,898 |

Other Government Related - 2.2% |

Bank of America Corp.: | | | | |

2.1% 4/30/12 (FDIC Guaranteed) (g) | | 3,013 | | 3,076 |

3.125% 6/15/12 (FDIC Guaranteed) (g) | | 45 | | 47 |

Citibank NA: | | | | |

1.75% 12/28/12 (FDIC Guaranteed) (g) | | 15,000 | | 15,304 |

1.875% 5/7/12 (FDIC Guaranteed) (g) | | 18,000 | | 18,307 |

Citigroup Funding, Inc.: | | | | |

1.875% 10/22/12 (FDIC Guaranteed) (g) | | 29,000 | | 29,581 |

1.875% 11/15/12 (FDIC Guaranteed) (g) | | 6,937 | | 7,077 |

2% 3/30/12 (FDIC Guaranteed) (g) | | 10,000 | | 10,163 |

2.125% 7/12/12 (FDIC Guaranteed) (g) | | 2,505 | | 2,562 |

General Electric Capital Corp.: | | | | |

2% 9/28/12 (FDIC Guaranteed) (g) | | 19,526 | | 19,945 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Other Government Related - continued |

General Electric Capital Corp.: - continued | | | | |

2.125% 12/21/12 (FDIC Guaranteed) (g) | | $ 15,000 | | $ 15,412 |

2.625% 12/28/12 (FDIC Guaranteed) (g) | | 5,402 | | 5,603 |

3% 12/9/11 (FDIC Guaranteed) (g) | | 3,120 | | 3,195 |

GMAC, Inc. 1.75% 10/30/12 (FDIC Guaranteed) (g) | | 21,000 | | 21,372 |

Goldman Sachs Group, Inc. 3.25% 6/15/12 (FDIC Guaranteed) (g) | | 45 | | 47 |

JPMorgan Chase & Co.: | | | | |

2.2% 6/15/12 (FDIC Guaranteed) (g) | | 5,230 | | 5,351 |

3.125% 12/1/11 (FDIC Guaranteed) (g) | | 520 | | 533 |

Morgan Stanley 3.25% 12/1/11 (FDIC Guaranteed) (g) | | 21,887 | | 22,456 |

National Credit Union Administration Guaranteed Notes: | | | | |

Series 2010-A1 Class A, 0.6106% 12/7/20 (NCUA Guaranteed) (j) | | 5,810 | | 5,816 |

Series 2010-R3 Class 1A, 0.8253% 12/8/20 (NCUA Guaranteed) (j) | | 11,600 | | 11,586 |

TOTAL OTHER GOVERNMENT RELATED | | 197,433 |

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,943,341) | 1,957,921 |

U.S. Government Agency - Mortgage Securities - 2.4% |

|

Fannie Mae - 1.4% |

2.073% 11/1/35 (j) | | 863 | | 892 |

2.233% 9/1/33 (j) | | 830 | | 857 |

2.474% 10/1/35 (j) | | 119 | | 124 |

2.48% 11/1/33 (j) | | 207 | | 216 |

2.589% 6/1/36 (j) | | 62 | | 65 |

2.642% 7/1/35 (j) | | 495 | | 519 |

2.652% 3/1/33 (j) | | 250 | | 262 |

2.68% 1/1/35 (j) | | 448 | | 469 |

2.731% 5/1/35 (j) | | 1,518 | | 1,599 |

2.744% 9/1/34 (j) | | 619 | | 647 |

2.773% 11/1/36 (j) | | 72 | | 76 |

2.805% 7/1/35 (j) | | 1,046 | | 1,097 |

2.829% 9/1/36 (j) | | 246 | | 259 |

2.857% 9/1/35 (j) | | 1,465 | | 1,541 |

2.884% 11/1/36 (j) | | 396 | | 417 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Fannie Mae - continued |

2.981% 7/1/35 (j) | | $ 408 | | $ 429 |

3.128% 10/1/37 (j) | | 479 | | 504 |

3.137% 8/1/35 (j) | | 1,216 | | 1,288 |

3.161% 4/1/36 (j) | | 578 | | 610 |

3.5% 1/1/26 (h) | | 67,000 | | 67,482 |

3.5% 1/1/26 (h) | | 20,400 | | 20,547 |

3.5% 11/1/40 (i) | | 13,030 | | 12,451 |

3.505% 2/1/37 (j) | | 913 | | 955 |

3.527% 6/1/47 (j) | | 234 | | 245 |

4% 9/1/13 to 12/1/40 (i) | | 10,300 | | 10,268 |

5% 2/1/16 to 5/1/22 | | 95 | | 100 |

5.046% 2/1/34 (j) | | 649 | | 676 |

5.5% 5/1/15 | | 8 | | 9 |

5.569% 2/1/36 (j) | | 168 | | 175 |

5.593% 4/1/36 (j) | | 973 | | 1,022 |

5.766% 5/1/36 (j) | | 182 | | 188 |

5.963% 3/1/37 (j) | | 131 | | 140 |

6% 6/1/16 to 10/1/16 | | 180 | | 195 |

6.5% 12/1/12 to 9/1/32 | | 2,743 | | 3,061 |

7.5% 1/1/28 | | 78 | | 88 |

TOTAL FANNIE MAE | | 129,473 |

Freddie Mac - 0.2% |

1.975% 3/1/37 (j) | | 955 | | 991 |

2.041% 3/1/35 (j) | | 324 | | 333 |

2.094% 5/1/37 (j) | | 203 | | 210 |

2.409% 6/1/33 (j) | | 511 | | 530 |

2.54% 6/1/37 (j) | | 476 | | 501 |

2.551% 5/1/37 (j) | | 1,720 | | 1,810 |

2.579% 5/1/37 (j) | | 1,080 | | 1,132 |

2.586% 12/1/33 (j) | | 1,067 | | 1,114 |

2.621% 10/1/35 (j) | | 652 | | 681 |

2.631% 7/1/35 (j) | | 574 | | 600 |

2.865% 9/1/35 (j) | | 120 | | 126 |

2.958% 1/1/35 (j) | | 1,303 | | 1,373 |

2.985% 4/1/37 (j) | | 186 | | 196 |

3.022% 7/1/35 (j) | | 375 | | 394 |

3.247% 12/1/36 (j) | | 2,004 | | 2,100 |

3.352% 10/1/35 (j) | | 86 | | 91 |

3.404% 3/1/37 (j) | | 183 | | 189 |

3.47% 10/1/36 (j) | | 679 | | 704 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) (d) | | Value (000s) |

Freddie Mac - continued |

3.508% 5/1/37 (j) | | $ 132 | | $ 138 |

4.3% 1/1/36 (j) | | 113 | | 117 |