UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2005 |

Item 1. Reports to Stockholders

| | Fidelity® Advisor

Mid Cap II

Fund - Class A, Class T,

Class B and Class C

|

| | Annual Report

December 31, 2005

|

| Contents | | | | |

| |

| Chairman’s Message | | 4 | | Ned Johnson’s message to shareholders. |

| Performance | | 5 | | How the fund has done over time. |

| Management’s Discussion | | 7 | | The manager’s review of fund |

| | | | | performance, strategy and outlook. |

| Shareholder Expense | | 8 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 10 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 11 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 27 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 36 | | Notes to the financial statements. |

| Report of Independent | | 45 | | |

| Registered Public | | | | |

| Accounting Firm | | | | |

| Trustees and Officers | | 46 | | |

| Distributions | | 56 | | |

| Proxy Voting Results | | 57 | | |

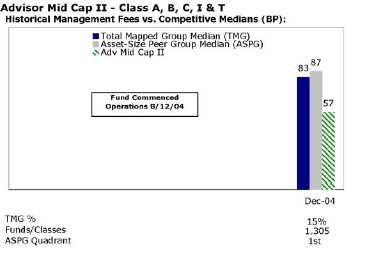

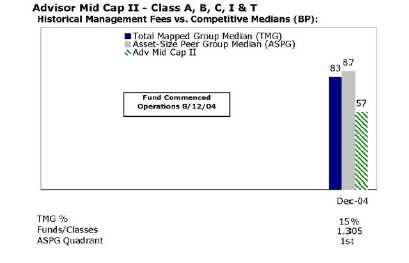

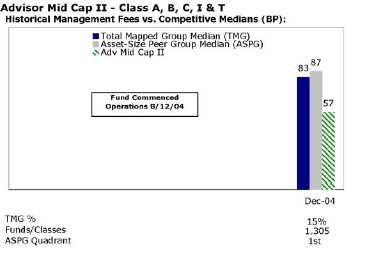

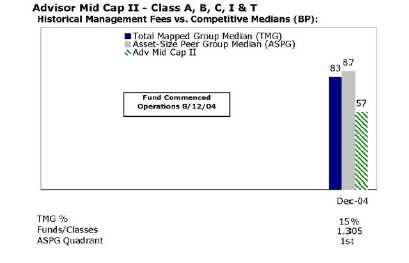

| Board Approval of | | 58 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies,

Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

This report and the financial statements contained herein are submitted for the general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors

in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference

Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio hold

ings, view the most recent quarterly holdings report, semiannual report, or annual report on

Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

3 Annual Report

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind every one where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that some one could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner and in every other. But I underscore again that Fidelity has no so called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee which is returned to the fund and, therefore, to investors to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report 4

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | |

| Periods ended December 31, 2005 | | Past 1 | | Life of |

| | | year | | fundA |

| Class A (incl. 5.75% sales charge) | | 10.47% | | 26.37% |

| Class T (incl. 3.50% sales charge) | | 12.78% | | 28.19% |

| Class B (incl. contingent deferred sales charge)B | | 11.34% | | 28.26% |

| Class C (incl. contingent deferred sales charge)C | | 15.25% | | 30.87% |

A From August 12, 2004.

B Class B shares’ contingent deferred sales charges included in the past one year and life of fund total

return figures are 5% and 4%, respectively.

C Class C shares’ contingent deferred sales charges included in the past one year and life of fund

total return figures are 1% and 0%, respectively.

|

5 Annual Report

5

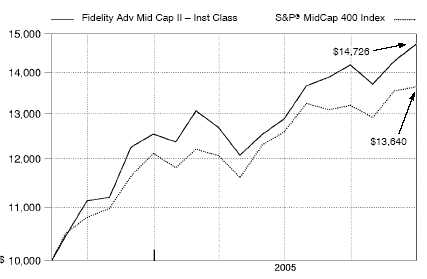

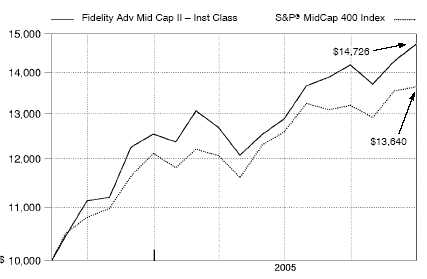

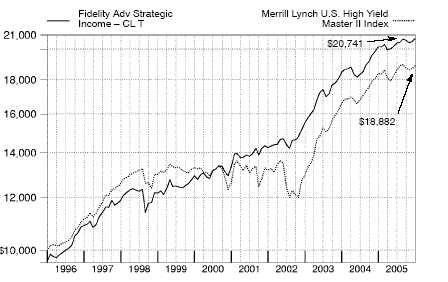

| | $10,000 Over Life of Fund

|

Let’s say hypothetically that $10,000 was invested in Fidelity® Advisor Mid Cap II Class T on August 12, 2004, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the Standard & Poor’s® MidCap 400 Index performed over the same period.

Management’s Discussion of Fund Performance

Comments from Thomas Allen, Portfolio Manager of Fidelity® Advisor Mid Cap II Fund

U.S. equity benchmarks generally had positive results for the 12 months ending Decem ber 31, 2005, the third consecutive year that stocks finished in the black. Energy and utilities were the two best performing sectors, contributing greatly to the 4.91% gain of the Standard & Poor’s 500SM Index. Elsewhere, the NASDAQ Composite® Index returned 2.13%, while the Dow Jones Industrial AverageSM rose 1.72% . The U.S. economy did not decelerate as much as many had predicted, despite eight short term interest rate hikes, record high energy prices and the devastation caused by Hurricane Katrina. Meanwhile, corporate America notched its 14th consecutive quarter of double digit earnings gains through the third quarter of the year, an unprecedented streak in market history. From a style perspec tive, large cap stocks ended the six year reign of small caps by a narrow margin, but mid caps finished well ahead of both categories. The gap between growth and value stocks also was relatively narrow, with value gaining a slight edge.

During the past year, the fund’s Class A, Class T, Class B and Class C shares returned 17.21%, 16.87%, 16.34% and 16.25%, respectively (excluding sales charges), compared with 12.56% for the Standard & Poor’s® MidCap 400 Index and 9.67% for the LipperSM Mid Cap Funds Average. Most of the outperformance relative to the index came from a significant overweighting in energy, along with effective stock picking in the sector. Also aiding the fund’s performance was timely stock selection in financials and materials. Valero Energy was the fund’s top contributor both in absolute terms and compared with the index. The crude oil refiner benefited from strong demand and limited industrywide refining capacity. Southwestern Energy, an exploration and production company, was aided by some natural gas discoveries that significantly boosted its reserves. Within technology, Apple Computer was a standout, spurred by robust sales of the iPod, the company’s personal digital media player. Conversely, Symbol Technologies, a maker of bar code scanners, was the fund’s largest detractor both in absolute terms and versus the index. Lackluster sales growth derailed the stock, and I sold it before period end. Household and personal products marketer Avon Products also had a negative impact on the fund’s results, primarily because of its disappointing sales growth in the United States and abroad. In absolute terms, currency fluctuations particularly the depreciation of the Japanese yen versus the U.S. dollar acted as a mild head wind given the fund’s significant foreign exposure.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

7 Annual Report

7

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b 1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2005 to December 31, 2005).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | Ending | | During Period* |

| | | | | Account Value | | Account Value | | July 1, 2005 to |

| | | | | July 1, 2005 | | December 31, 2005 | | December 31, 2005 |

| Class A | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | $ | | 1,142.00 | | $ | | 6.75 |

| HypotheticalA | | | $ | 1,000.00 | | $ | | 1,018.90 | | $ | | 6.36 |

| Class T | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | $ | | 1,140.90 | | $ | | 7.77 |

| HypotheticalA | | | $ | 1,000.00 | | $ | | 1,017.95 | | $ | | 7.32 |

| Class B | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | $ | | 1,137.90 | | $ | | 10.78 |

| HypotheticalA | | | $ | 1,000.00 | | $ | | 1,015.12 | | $ | | 10.16 |

| |

| |

| |

| Annual Report | | | | 8 | | | | | | | | |

| | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | Ending | | During Period* |

| | | | | Account Value | | Account Value | | July 1, 2005 to |

| | | | | July 1, 2005 | | December 31, 2005 | | December 31, 2005 |

| Class C | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | $ | | 1,137.00 | | $ | | 10.77 |

| HypotheticalA | | | $ | 1,000.00 | | $ | | 1,015.12 | | $ | | 10.16 |

| Institutional Class | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | $ | | 1,143.30 | | $ | | 5.40 |

| HypotheticalA | | | $ | 1,000.00 | | $ | | 1,020.16 | | $ | | 5.09 |

A 5% return per year before expenses

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.25% |

| Class T | | 1.44% |

| Class B | | 2.00% |

| Class C | | 2.00% |

| Institutional Class | | 1.00% |

9 Annual Report

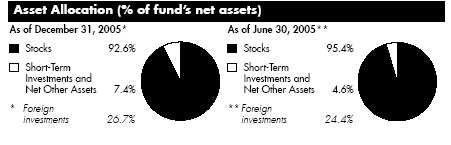

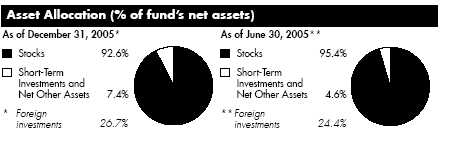

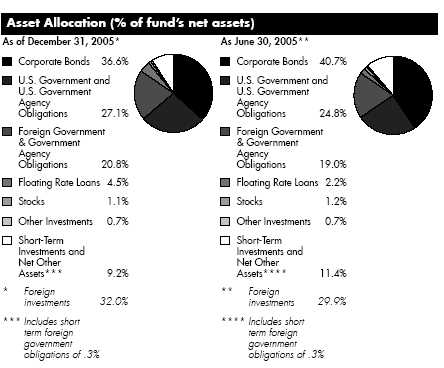

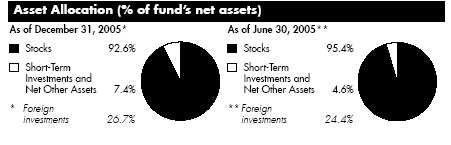

| Investment Changes | | | | |

| |

| |

| Top Ten Stocks as of December 31, 2005 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Newmont Mining Corp. | | 1.6 | | 1.7 |

| Rockwell Automation, Inc. | | 1.5 | | 1.0 |

| Assurant, Inc. | | 1.4 | | 1.8 |

| Nabors Industries Ltd. | | 1.4 | | 0.7 |

| Thermo Electron Corp. | | 1.4 | | 0.1 |

| CONSOL Energy, Inc. | | 1.3 | | 1.1 |

| Freeport McMoRan Copper & Gold, Inc. Class B | | 1.2 | | 1.1 |

| QIAGEN NV | | 1.2 | | 1.2 |

| Covance, Inc. | | 1.2 | | 0.9 |

| Harsco Corp. | | 1.1 | | 0.6 |

| | | 13.3 | | |

Top Five Market Sectors as of December 31, 2005 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Health Care | | 16.9 | | 17.3 |

| Energy | | 16.0 | | 15.3 |

| Industrials | | 13.9 | | 10.3 |

| Information Technology | | 10.7 | | 14.1 |

| Consumer Discretionary | | 10.3 | | 13.1 |

Annual Report 10

| Investments December 31, 2005 | | |

| Showing Percentage of Net Assets | | | | | | |

| |

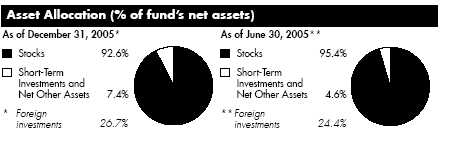

| Common Stocks 92.6% | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – 10.3% | | | | | | |

| Auto Components 0.9% | | | | | | |

| Autoliv, Inc. | | 30 | | $ | | 1,363 |

| BorgWarner, Inc. | | 41,100 | | | | 2,491,893 |

| Gentex Corp. | | 95,200 | | | | 1,856,400 |

| IMPCO Technologies, Inc. | | 242,000 | | | | 1,241,460 |

| LKQ Corp. (a) | | 49,313 | | | | 1,707,216 |

| New Focus Auto Tech Holdings Ltd. | | 1,016,000 | | | | 148,070 |

| | | | | | | 7,446,402 |

| Automobiles – 0.5% | | | | | | |

| Bajaj Auto Ltd. | | 37,059 | | | | 1,648,156 |

| Geely Automobile Holdings Ltd. | | 6,045,000 | | | | 253,381 |

| Harley Davidson, Inc. | | 7,600 | | | | 391,324 |

| Hero Honda Motors Ltd. | | 6 | | | | 115 |

| Hyundai Motor Co. | | 10,327 | | | | 997,337 |

| Mahindra & Mahindra Ltd. | | 23,218 | | | | 263,992 |

| Maruti Udyog Ltd. | | 59,705 | | | | 843,659 |

| | | | | | | 4,397,964 |

| Diversified Consumer Services – 0.1% | | | | | | |

| Bright Horizons Family Solutions, Inc. (a) | | 14,102 | | | | 522,479 |

| Education Management Corp. (a) | | 7,000 | | | | 234,570 |

| Service Corp. International (SCI) | | 38,700 | | | | 316,566 |

| | | | | | | 1,073,615 |

| Hotels, Restaurants & Leisure 0.9% | | | | | | |

| Royal Caribbean Cruises Ltd. | | 52,800 | | | | 2,379,168 |

| Sonic Corp. (a) | | 48,766 | | | | 1,438,597 |

| St. Marc Co. Ltd. | | 48,600 | | | | 3,384,131 |

| TAJ GVK Hotels & Resorts Ltd. | | 92,125 | | | | 368,234 |

| | | | | | | 7,570,130 |

| Household Durables – 0.8% | | | | | | |

| Alba PLC | | 19 | | | | 132 |

| Goldcrest Co. Ltd. (d) | | 25,810 | | | | 2,335,717 |

| LG Electronics, Inc. | | 15,800 | | | | 1,400,437 |

| Nihon Eslead Corp. | | 32,400 | | | | 931,564 |

| Rational AG | | 5,400 | | | | 717,719 |

| Sekisui House Ltd. | | 87,000 | | | | 1,095,017 |

| | | | | | | 6,480,586 |

| Internet & Catalog Retail 0.1% | | | | | | |

| Alloy, Inc. (a) | | 1,700 | | | | 4,913 |

| ASKUL Corp. | | 12,000 | | | | 372,503 |

| ASKUL Corp. New | | 12,000 | | | | 372,503 |

See accompanying notes which are an integral part of the financial statements. | | | | |

| |

| 11 | | | | Annual Report |

| Investments continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – continued | | | | | | |

| Internet & Catalog Retail continued | | | | | | |

| dELiA*s, Inc. (a) | | 850 | | $ | | 7,055 |

| dELiA*s, Inc. rights 1/27/06 (a) | | 126 | | | | 126 |

| | | | | | | 757,100 |

| Leisure Equipment & Products – 0.4% | | | | | | |

| Giant Manufacturing Co. Ltd. | | 126,000 | | | | 243,736 |

| Jumbo SA | | 93,700 | | | | 1,018,307 |

| Oakley, Inc. (d) | | 14,500 | | | | 213,005 |

| Trigano SA | | 29,800 | | | | 1,327,186 |

| | | | | | | 2,802,234 |

| Media – 2.1% | | | | | | |

| Astral Media, Inc. Class A (non-vtg.) | | 50,200 | | | | 1,323,064 |

| Clear Media Ltd. (a) | | 1,000 | | | | 813 |

| E.W. Scripps Co. Class A | | 83,800 | | | | 4,024,076 |

| Getty Images, Inc. (a) | | 500 | | | | 44,635 |

| Harris Interactive, Inc. (a) | | 217,858 | | | | 938,968 |

| Omnicom Group, Inc. | | 93,726 | | | | 7,978,894 |

| Salem Communications Corp. Class A (a) | | 23,300 | | | | 407,517 |

| Trader Classified Media NV Class A (NY Shares) | | 8,000 | | | | 122,800 |

| Univision Communications, Inc. Class A (a) | | 78,800 | | | | 2,315,932 |

| Zee Telefilms Ltd. | | 12 | | | | 42 |

| | | | | | | 17,156,741 |

| Multiline Retail – 0.4% | | | | | | |

| Lifestyle International Holdings Ltd. | | 242,500 | | | | 337,776 |

| Lojas Renner SA | | 35,500 | | | | 1,138,648 |

| Pantaloon Retail India Ltd. | | 9,698 | | | | 365,688 |

| Pantaloon Retail India Ltd. rights 2/22/06 (a) | | 1,940 | | | | 51,584 |

| PT Mitra Adiperkasa Tbk | | 238,000 | | | | 21,306 |

| Ryohin Keikaku Co. Ltd. | | 11,300 | | | | 986,192 |

| | | | | | | 2,901,194 |

| Specialty Retail – 3.6% | | | | | | |

| Abercrombie & Fitch Co. Class A | | 9,500 | | | | 619,210 |

| A.C. Moore Arts & Crafts, Inc. (a) | | 27,406 | | | | 398,757 |

| Advance Auto Parts, Inc. (a) | | 15,000 | | | | 651,900 |

| Best Buy Co., Inc. | | 28,950 | | | | 1,258,746 |

| Build-A Bear Workshop, Inc. (a)(d) | | 108,000 | | | | 3,201,120 |

| CarMax, Inc. (a) | | 68,800 | | | | 1,904,384 |

| Circuit City Stores, Inc. | | 175,100 | | | | 3,955,509 |

| Cost Plus, Inc. (a) | | 108,500 | | | | 1,860,775 |

| DSG International PLC | | 781,100 | | | | 2,201,951 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – continued | | | | |

| Specialty Retail – continued | | | | |

| Edgars Consolidated Stores Ltd. | | 265,800 | | $ 1,476,970 |

| Gamestop Corp. Class B (a) | | 70,200 | | 2,028,780 |

| Guess?, Inc. (a) | | 10,900 | | 388,040 |

| KOMERI Co. Ltd. (d) | | 98,400 | | 4,231,271 |

| Nitori Co. Ltd. | | 31,900 | | 2,976,125 |

| Pacific Sunwear of California, Inc. (a) | | 53,600 | | 1,335,712 |

| Tiffany & Co., Inc. | | 5,700 | | 218,253 |

| | | | | 28,707,503 |

| Textiles, Apparel & Luxury Goods – 0.5% | | | | |

| Columbia Sportswear Co. (a) | | 9,700 | | 462,981 |

| Ports Design Ltd. | | 393,000 | | 456,172 |

| Quiksilver, Inc. (a) | | 34,600 | | 478,864 |

| Ted Baker PLC | | 166,040 | | 1,473,537 |

| Tod’s Spa | | 6,500 | | 438,693 |

| Wacoal Holdings Corp. sponsored ADR | | 7,800 | | 528,138 |

| | | | | 3,838,385 |

| |

| TOTAL CONSUMER DISCRETIONARY | | | | 83,131,854 |

| |

| CONSUMER STAPLES 4.9% | | | | |

| Beverages – 0.1% | | | | |

| Fomento Economico Mexicano SA de CV sponsored ADR | | 4,400 | | 319,044 |

| Grupo Modelo SA de CV Series C | | 25,400 | | 91,973 |

| Hansen Natural Corp. (a) | | 5,500 | | 433,455 |

| Jones Soda Co. (a) | | 24,000 | | 129,600 |

| | | | | 974,072 |

| Food & Staples Retailing – 0.9% | | | | |

| Daikokutenbussan Co. Ltd. | | 4,600 | | 248,912 |

| Heng Tai Consumables Group Ltd. | | 1,756,000 | | 251,386 |

| Massmart Holdings Ltd. | | 152,300 | | 1,243,192 |

| Metro AG | | 10,000 | | 483,011 |

| Plant Co. Ltd. | | 9,800 | | 85,611 |

| Shinsegae Co. Ltd. | | 478 | | 210,178 |

| Sugi Pharmacy Co. Ltd. (d) | | 68,900 | | 3,289,996 |

| Valor Co. Ltd. | | 8,900 | | 345,719 |

| Whole Foods Market, Inc. | | 8,000 | | 619,120 |

| | | | | 6,777,125 |

| Food Products 2.8% | | | | |

| Archer-Daniels Midland Co. | | 32,900 | | 811,314 |

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Investments continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER STAPLES – continued | | | | | | |

| Food Products – continued | | | | | | |

| Barry Callebaut AG | | 5 | | $ | | 1,631 |

| Britannia Industries Ltd. | | 13,684 | | | | 413,683 |

| Chaoda Modern Agriculture (Holdings) Ltd. | | 140,000 | | | | 58,231 |

| China Mengniu Dairy Co. Ltd. | | 438,000 | | | | 372,831 |

| Green Mountain Coffee Roasters, Inc. (a) | | 7,739 | | | | 314,203 |

| Groupe Danone | | 52,800 | | | | 5,516,267 |

| Groupe Danone sponsored ADR | | 54,800 | | | | 1,152,992 |

| Hershey Co. | | 108,800 | | | | 6,011,200 |

| IAWS Group PLC (Ireland) | | 700 | | | | 10,069 |

| Lindt & Spruengli AG | | 165 | | | | 2,756,279 |

| Lindt & Spruengli AG (participation certificate) | | 344 | | | | 585,638 |

| McCormick & Co., Inc. (non-vtg.) | | 35,800 | | | | 1,106,936 |

| PT Indofood Sukses Makmur Tbk | | 8,040,500 | | | | 744,336 |

| Want Want Holdings Ltd. | | 216,000 | | | | 214,920 |

| Wimm Bill-Dann Foods OJSC sponsored ADR (a) | | 10,500 | | | | 252,315 |

| Wm. Wrigley Jr. Co. | | 34,000 | | | | 2,260,660 |

| | | | | | | 22,583,505 |

| Personal Products 1.1% | | | | | | |

| Avon Products, Inc. | | 70,500 | | | | 2,012,775 |

| Concern Kalina OJSC sponsored ADR | | 3,000 | | | | 118,783 |

| Dabur India Ltd. | | 97,780 | | | | 458,313 |

| Godrej Consumer Products Ltd. | | 23,838 | | | | 278,989 |

| Hengan International Group Co. Ltd. | | 4,835,000 | | | | 5,487,480 |

| Shiseido Co. Ltd. sponsored ADR | | 45,400 | | | | 842,170 |

| | | | | | | 9,198,510 |

| |

| TOTAL CONSUMER STAPLES | | | | | | 39,533,212 |

| |

| ENERGY 16.0% | | | | | | |

| Energy Equipment & Services – 11.5% | | | | | | |

| BJ Services Co. | | 10,000 | | | | 366,700 |

| Cal Dive International, Inc. (a) | | 147,400 | | | | 5,290,186 |

| Cooper Cameron Corp. (a) | | 111,600 | | | | 4,620,240 |

| Core Laboratories NV (a) | | 133,600 | | | | 4,991,296 |

| Dril-Quip, Inc. (a) | | 8,900 | | | | 420,080 |

| FMC Technologies, Inc. (a) | | 82,200 | | | | 3,528,024 |

| Global Industries Ltd. (a) | | 130,500 | | | | 1,481,175 |

| GlobalSantaFe Corp. | | 103,100 | | | | 4,964,265 |

| Grant Prideco, Inc. (a) | | 8,900 | | | | 392,668 |

| Gulf Island Fabrication, Inc. | | 55,800 | | | | 1,356,498 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| ENERGY – continued | | | | | | |

| Energy Equipment & Services – continued | | | | | | |

| Helmerich & Payne, Inc. | | 32,000 | | $ | | 1,981,120 |

| Input/Output, Inc. (a)(d) | | 108,000 | | | | 759,240 |

| Nabors Industries Ltd. (a) | | 146,900 | | | | 11,127,675 |

| National Oilwell Varco, Inc. (a) | | 41,611 | | | | 2,609,010 |

| Newpark Resources, Inc. (a) | | 117,800 | | | | 898,814 |

| Noble Corp. | | 117,100 | | | | 8,260,234 |

| Oceaneering International, Inc. (a) | | 55,000 | | | | 2,737,900 |

| Parker Drilling Co. (a) | | 789,200 | | | | 8,547,036 |

| Pason Systems, Inc. | | 179,100 | | | | 4,452,273 |

| Patterson-UTI Energy, Inc. | | 42,300 | | | | 1,393,785 |

| Pioneer Drilling Co. (a) | | 26,276 | | | | 471,129 |

| Precision Drilling Trust | | 60,800 | | | | 2,007,229 |

| Pride International, Inc. (a) | | 90,400 | | | | 2,779,800 |

| Rowan Companies, Inc. | | 109,000 | | | | 3,884,760 |

| Smith International, Inc. | | 70,200 | | | | 2,605,122 |

| Superior Energy Services, Inc. (a) | | 89,800 | | | | 1,890,290 |

| Transocean, Inc. (a) | | 67,500 | | | | 4,704,075 |

| W-H Energy Services, Inc. (a) | | 79,463 | | | | 2,628,636 |

| Weatherford International Ltd. (a) | | 65,736 | | | | 2,379,643 |

| | | | | | | 93,528,903 |

| Oil, Gas & Consumable Fuels – 4.5% | | | | | | |

| Amerada Hess Corp. | | 7,400 | | | | 938,468 |

| Arch Coal, Inc. | | 26,800 | | | | 2,130,600 |

| Cameco Corp. | | 7,700 | | | | 488,739 |

| Canadian Natural Resources Ltd. | | 53,400 | | | | 2,647,148 |

| Chesapeake Energy Corp. | | 29,600 | | | | 939,208 |

| CONSOL Energy, Inc. | | 165,700 | | | | 10,800,326 |

| Forest Oil Corp. (a) | | 61,900 | | | | 2,820,783 |

| Golar LNG Ltd. (Nasdaq) (a) | | 377 | | | | 4,995 |

| Goodrich Petroleum Corp. (a) | | 42,500 | | | | 1,068,875 |

| International Coal Group, Inc. (a) | | 80,300 | | | | 762,850 |

| Newfield Exploration Co. (a) | | 40,500 | | | | 2,027,835 |

| Oil Search Ltd. | | 119,400 | | | | 323,192 |

| Peabody Energy Corp. | | 23,700 | | | | 1,953,354 |

| Plains Exploration & Production Co. (a) | | 5,000 | | | | 198,650 |

| Ship Finance International Ltd. (NY Shares) | | 61,300 | | | | 1,035,970 |

| Southwestern Energy Co. (a) | | 57,900 | | | | 2,080,926 |

| Tesoro Corp. | | 24,100 | | | | 1,483,355 |

| TransCanada Corp. (d) | | 88,700 | | | | 2,796,314 |

| TransMontaigne, Inc. (a) | | 100 | | | | 660 |

See accompanying notes which are an integral part of the financial statements.

15 Annual Report

| Investments continued | | | | |

| |

| |

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| ENERGY – continued | | | | |

| Oil, Gas & Consumable Fuels – continued | | | | |

| Valero Energy Corp. | | 30,602 | | $ 1,579,063 |

| World Fuel Services Corp. | | 3,100 | | 104,532 |

| | | | | 36,185,843 |

| |

| TOTAL ENERGY | | | | 129,714,746 |

| |

| FINANCIALS – 8.9% | | | | |

| Capital Markets 0.3% | | | | |

| Korea Investment Holdings Co. Ltd. | | 53,870 | | 2,299,167 |

| TradeStation Group, Inc. (a) | | 1,400 | | 17,332 |

| | | | | 2,316,499 |

| Commercial Banks – 2.7% | | | | |

| Banco Itau Holding Financeira SA sponsored ADR (non-vtg.) | | 26,000 | | 624,520 |

| Banco Pastor SA (Reg.) | | 65,700 | | 3,152,381 |

| Bank of Baroda | | 188,892 | | 1,012,616 |

| Bank of Fukuoka Ltd. | | 506,400 | | 4,333,638 |

| Bank of India | | 367,394 | | 1,036,166 |

| Boston Private Financial Holdings, Inc. | | 53,145 | | 1,616,671 |

| Canara Bank | | 77,440 | | 415,211 |

| Center Financial Corp., California | | 10,700 | | 269,212 |

| Colonial Bancgroup, Inc. | | 33,100 | | 788,442 |

| Corp. Bank | | 65,656 | | 529,830 |

| HDFC Bank Ltd. sponsored ADR | | 9,900 | | 503,910 |

| Hiroshima Bank Ltd. | | 215,100 | | 1,390,155 |

| ICICI Bank Ltd. sponsored ADR | | 6,100 | | 175,680 |

| Juroku Bank Ltd. | | 159,000 | | 1,198,855 |

| Oriental Bank of Commerce | | 8,668 | | 54,125 |

| PrivateBancorp, Inc. | | 8,000 | | 284,560 |

| Punjab National Bank | | 13,630 | | 149,713 |

| State Bank of India | | 94,498 | | 2,073,223 |

| Sumitomo Trust & Banking Co. Ltd. | | 107,000 | | 1,093,550 |

| The Keiyo Bank Ltd. | | 102,000 | | 727,552 |

| Uti Bank Ltd. | | 92,200 | | 587,994 |

| | | | | 22,018,004 |

| Diversified Financial Services – 0.7% | | | | |

| Alliance Capital Management Holding LP | | 31,600 | | 1,785,084 |

| IntercontinentalExchange, Inc. | | 24,200 | | 879,670 |

| Kotak Mahindra Bank Ltd. | | 201,869 | | 1,002,276 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| FINANCIALS – continued | | | | |

| Diversified Financial Services – continued | | | | |

| Moody’s Corp. | | 18,900 | | $ 1,160,838 |

| TSX Group, Inc. | | 27,900 | | 1,123,872 |

| | | | | 5,951,740 |

| Insurance – 3.4% | | | | |

| Admiral Group PLC | | 51,900 | | 406,535 |

| AFLAC, Inc. | | 105,000 | | 4,874,100 |

| American International Group, Inc. | | 34,100 | | 2,326,643 |

| Assurant, Inc. | | 265,100 | | 11,529,199 |

| Brown & Brown, Inc. | | 25,200 | | 769,608 |

| Everest Re Group Ltd. | | 22,000 | | 2,207,700 |

| Ohio Casualty Corp. | | 14,500 | | 410,640 |

| Ping An Insurance (Group) Co. of China, Ltd. (H Shares) | | 730,000 | | 1,346,334 |

| Progressive Corp. | | 11,000 | | 1,284,580 |

| Universal American Financial Corp. (a) | | 79,225 | | 1,194,713 |

| USI Holdings Corp. (a) | | 16,900 | | 232,713 |

| W.R. Berkley Corp. | | 15,400 | | 733,348 |

| | | | | 27,316,113 |

| Real Estate 1.6% | | | | |

| Aeon Mall Co. Ltd. | | 46,000 | | 2,243,332 |

| Diamond City Co. Ltd. | | 57,300 | | 2,342,445 |

| Digital Realty Trust, Inc. | | 129,700 | | 2,935,111 |

| Equity Office Properties Trust | | 27,900 | | 846,207 |

| Equity Residential (SBI) | | 79,100 | | 3,094,391 |

| General Growth Properties, Inc. | | 21,100 | | 991,489 |

| W.P. Carey & Co. LLC | | 1,100 | | 27,896 |

| Weingarten Realty Investors (SBI) | | 19,900 | | 752,419 |

| | | | | 13,233,290 |

| Thrifts & Mortgage Finance – 0.2% | | | | |

| Housing Development Finance Corp. Ltd. | | 20,402 | | 547,288 |

| NetBank, Inc. | | 119,029 | | 854,628 |

| | | | | 1,401,916 |

| |

| TOTAL FINANCIALS | | | | 72,237,562 |

| |

| HEALTH CARE – 16.9% | | | | |

| Biotechnology – 2.3% | | | | |

| Albany Molecular Research, Inc. (a) | | 78,300 | | 951,345 |

| Genentech, Inc. (a) | | 2,200 | | 203,500 |

| Harvard Bioscience, Inc. (a) | | 334,311 | | 1,487,684 |

See accompanying notes which are an integral part of the financial statements.

17 Annual Report

| Investments continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| HEALTH CARE – continued | | | | | | |

| Biotechnology – continued | | | | | | |

| ImmunoGen, Inc. (a) | | 4,600 | | $ | | 23,598 |

| Invitrogen Corp. (a) | | 39,400 | | | | 2,625,616 |

| Myriad Genetics, Inc. (a) | | 11,500 | | | | 239,200 |

| OSI Pharmaceuticals, Inc. (a) | | 17,700 | | | | 496,308 |

| QIAGEN NV (a) | | 803,800 | | | | 9,444,650 |

| Seattle Genetics, Inc. (a) | | 500 | | | | 2,360 |

| Stratagene Corp. | | 193,041 | | | | 1,938,132 |

| ViroPharma, Inc. (a) | | 75,600 | | | | 1,402,380 |

| | | | | | | 18,814,773 |

| Health Care Equipment & Supplies – 4.1% | | | | | | |

| ArthroCare Corp. (a) | | 12,800 | | | | 539,392 |

| Beckman Coulter, Inc. | | 45,600 | | | | 2,594,640 |

| Bruker BioSciences Corp. (a) | | 2,000 | | | | 9,720 |

| DENTSPLY International, Inc. | | 24,395 | | | | 1,309,768 |

| Endocare, Inc. (a) | | 7,500 | | | | 20,550 |

| Epix Pharmaceuticals, Inc. (a) | | 17,200 | | | | 69,488 |

| Haemonetics Corp. (a) | | 136,850 | | | | 6,686,491 |

| IDEXX Laboratories, Inc. (a) | | 5,600 | | | | 403,088 |

| INAMED Corp. (a) | | 8,500 | | | | 745,280 |

| Millipore Corp. (a) | | 94,200 | | | | 6,220,968 |

| Neogen Corp. (a) | | 13,300 | | | | 279,433 |

| Strategic Diagnostics, Inc. (a) | | 181,000 | | | | 658,840 |

| Synthes, Inc. | | 10 | | | | 1,123 |

| Thermo Electron Corp. (a) | | 367,800 | | | | 11,081,814 |

| Ventana Medical Systems, Inc. (a) | | 13,820 | | | | 585,277 |

| Waters Corp. (a) | | 55,500 | | | | 2,097,900 |

| | | | | | | 33,303,772 |

| Health Care Providers & Services – 8.3% | | | | | | |

| Aetna, Inc. | | 57,300 | | | | 5,403,963 |

| American Retirement Corp. (a) | | 70,172 | | | | 1,763,422 |

| Apollo Hospitals Enterprise Ltd. | | 32,298 | | | | 357,866 |

| Caremark Rx, Inc. (a) | | 147,800 | | | | 7,654,562 |

| Cerner Corp. (a) | | 6,500 | | | | 590,915 |

| Community Health Systems, Inc. (a) | | 70,300 | | | | 2,695,302 |

| Covance, Inc. (a) | | 193,400 | | | | 9,389,570 |

| Diagnosticos da America SA (a) | | 16,000 | | | | 301,073 |

| Eclipsys Corp. (a) | | 351,900 | | | | 6,661,467 |

| Emageon, Inc. | | 58,500 | | | | 930,150 |

| Health Grades, Inc. (a) | | 43,815 | | | | 274,720 |

| Humana, Inc. (a) | | 155,300 | | | | 8,437,449 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| HEALTH CARE – continued | | | | |

| Health Care Providers & Services – continued | | | | |

| ICON PLC sponsored ADR (a) | | 25,100 | | $ 1,032,614 |

| IMS Health, Inc. | | 323,600 | | 8,064,112 |

| Merge Technologies, Inc. (a) | | 5,600 | | 140,224 |

| Omnicare, Inc. | | 68,100 | | 3,896,682 |

| Pharmaceutical Product Development, Inc. | | 300 | | 18,585 |

| ResCare, Inc. (a) | | 209,900 | | 3,645,963 |

| Sunrise Senior Living, Inc. (a) | | 106,000 | | 3,573,260 |

| TriZetto Group, Inc. (a) | | 77,400 | | 1,315,026 |

| VCA Antech, Inc. (a) | | 24,200 | | 682,440 |

| | | | | 66,829,365 |

| Pharmaceuticals – 2.2% | | | | |

| Allergan, Inc. | | 23,700 | | 2,558,652 |

| Bentley Pharmaceuticals, Inc. (a) | | 32,000 | | 525,120 |

| Dr. Reddy’s Laboratories Ltd. sponsored ADR | | 8,200 | | 177,120 |

| Kos Pharmaceuticals, Inc. (a) | | 92,200 | | 4,769,506 |

| Medicis Pharmaceutical Corp. Class A | | 21,500 | | 689,075 |

| Merck KGaA | | 53,800 | | 4,455,195 |

| Ranbaxy Laboratories Ltd. sponsored GDR | | 62,777 | | 501,588 |

| Roche Holding AG: | | | | |

| (participation certificate) | | 21,861 | | 3,282,477 |

| sponsored ADR | | 8,000 | | 600,800 |

| Valeant Pharmaceuticals International | | 25,600 | | 462,848 |

| | | | | 18,022,381 |

| |

| TOTAL HEALTH CARE | | | | 136,970,291 |

| |

| INDUSTRIALS – 13.9% | | | | |

| Aerospace & Defense – 1.0% | | | | |

| CAE, Inc. | | 147,600 | | 1,081,719 |

| Ceradyne, Inc. (a)(d) | | 50,400 | | 2,207,520 |

| Esterline Technologies Corp. (a) | | 96,109 | | 3,574,294 |

| L 3 Communications Holdings, Inc. | | 11,700 | | 869,895 |

| | | | | 7,733,428 |

| Air Freight & Logistics – 0.2% | | | | |

| Hub Group, Inc. Class A (a) | | 46,388 | | 1,639,816 |

| Airlines – 0.2% | | | | |

| ACE Aviation Holdings, Inc. Class A (a) | | 43,200 | | 1,412,068 |

| Ryanair Holdings PLC sponsored ADR (a) | | 8,600 | | 481,514 |

| | | | | 1,893,582 |

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Investments continued | | | | |

| |

| |

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| INDUSTRIALS – continued | | | | |

| Building Products 0.1% | | | | |

| Simpson Manufacturing Co. Ltd. | | 32,300 | | $ 1,174,105 |

| Commercial Services & Supplies – 3.0% | | | | |

| Bennett Environmental, Inc. (a) | | 1,600 | | 4,968 |

| CDI Corp. | | 83,055 | | 2,275,707 |

| ChoicePoint, Inc. (a) | | 154,000 | | 6,854,540 |

| Cintas Corp. | | 132,026 | | 5,436,831 |

| Fullcast Co. Ltd. (d) | | 789 | | 2,623,197 |

| Intertek Group PLC | | 61,600 | | 739,151 |

| Monster Worldwide, Inc. (a) | | 44,900 | | 1,832,818 |

| Randstad Holdings NV | | 9,600 | | 416,980 |

| Ritchie Brothers Auctioneers, Inc. | | 4,300 | | 181,675 |

| Societe Generale de Surveillance Holding SA (SGS) (Reg.) | | 2,031 | | 1,712,594 |

| Stericycle, Inc. (a) | | 31,398 | | 1,848,714 |

| Tele Atlas NV (a) | | 7,300 | | 195,398 |

| | | | | 24,122,573 |

| Construction & Engineering – 1.7% | | | | |

| Chicago Bridge & Iron Co. NV (NY Shares) | | 83,200 | | 2,097,472 |

| Daelim Industrial Co. | | 7,100 | | 507,395 |

| Fluor Corp. | | 18,500 | | 1,429,310 |

| Jacobs Engineering Group, Inc. (a) | | 61,000 | | 4,140,070 |

| Shaw Group, Inc. (a) | | 147,400 | | 4,287,866 |

| United Group Ltd. | | 176,500 | | 1,494,102 |

| | | | | 13,956,215 |

| Electrical Equipment – 1.9% | | | | |

| C&D Technologies, Inc. | | 49,200 | | 374,904 |

| Crompton Greaves Ltd. | | 16,190 | | 273,695 |

| Rockwell Automation, Inc. | | 201,700 | | 11,932,572 |

| Roper Industries, Inc. | | 39,800 | | 1,572,498 |

| SolarWorld AG | | 7,100 | | 949,803 |

| | | | | 15,103,472 |

| Industrial Conglomerates – 0.8% | | | | |

| Fu Sheng Industrial Co. Ltd. | | 416,000 | | 529,718 |

| Max India Ltd. (a) | | 50,512 | | 674,130 |

| Teleflex, Inc. | | 82,400 | | 5,354,352 |

| | | | | 6,558,200 |

| Machinery – 4.5% | | | | |

| AGCO Corp. (a) | | 523,045 | | 8,666,856 |

| Badger Meter, Inc. | | 33,300 | | 1,306,692 |

| Dover Corp. | | 36,900 | | 1,494,081 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| INDUSTRIALS – continued | | | | | | |

| Machinery – continued | | | | | | |

| Eicher Motors Ltd. | | 30,058 | | $ | | 153,279 |

| Flowserve Corp. (a) | | 64,800 | | | | 2,563,488 |

| Graco, Inc. | | 46,200 | | | | 1,685,376 |

| Harsco Corp. | | 137,500 | | | | 9,282,625 |

| Heidelberger Druckmaschinen AG | | 24,500 | | | | 937,420 |

| Krones AG | | 190 | | | | 19,144 |

| Pentair, Inc. | | 94,200 | | | | 3,251,784 |

| Tata Motors Ltd. | | 56,135 | | | | 815,171 |

| Terex Corp. (a) | | 66,800 | | | | 3,967,920 |

| Timken Co. | | 20,000 | | | | 640,400 |

| Wabtec Corp. | | 26,700 | | | | 718,230 |

| Zenon Environmental, Inc. (a) | | 41,400 | | | | 598,983 |

| | | | | | | 36,101,449 |

| Marine – 0.1% | | | | | | |

| Alexander & Baldwin, Inc. | | 11,500 | | | | 623,760 |

| Hanjin Shipping Co. Ltd. | | 10 | | | | 228 |

| Odfjell ASA: | | | | | | |

| (A Shares) | | 6,450 | | | | 131,006 |

| (B Shares) | | 50 | | | | 867 |

| | | | | | | 755,861 |

| Trading Companies & Distributors – 0.4% | | | | | | |

| Fastenal Co. | | 33,000 | | | | 1,293,270 |

| MSC Industrial Direct Co., Inc. Class A | | 40,800 | | | | 1,640,976 |

| NuCo2, Inc. (a) | | 7,200 | | | | 200,736 |

| W.W. Grainger, Inc. | | 3,700 | | | | 263,070 |

| | | | | | | 3,398,052 |

| |

| TOTAL INDUSTRIALS | | | | | | 112,436,753 |

| |

| INFORMATION TECHNOLOGY – 10.7% | | | | | | |

| Communications Equipment – 0.5% | | | | | | |

| Ixia (a) | | 118,900 | | | | 1,757,342 |

| NETGEAR, Inc. (a) | | 99,796 | | | | 1,921,073 |

| TANDBERG ASA | | 3,600 | | | | 22,043 |

| | | | | | | 3,700,458 |

| Computers & Peripherals – 1.6% | | | | | | |

| Apple Computer, Inc. (a) | | 107,951 | | | | 7,760,597 |

| Komag, Inc. (a) | | 28,800 | | | | 998,208 |

| NEC Corp. sponsored ADR | | 230,900 | | | | 1,429,271 |

See accompanying notes which are an integral part of the financial statements.

21 Annual Report

| Investments continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| INFORMATION TECHNOLOGY – continued | | | | | | |

| Computers & Peripherals – continued | | | | | | |

| Oberthur Card Systems | | 96,500 | | $ | | 837,390 |

| SanDisk Corp. (a) | | 29,399 | | | | 1,846,845 |

| | | | | | | 12,872,311 |

| Electronic Equipment & Instruments – 3.8% | | | | | | |

| CDW Corp. | | 157,520 | | | | 9,068,426 |

| FLIR Systems, Inc. (a) | | 53,491 | | | | 1,194,454 |

| Hon Hai Precision Industry Co. Ltd. (Foxconn) | | 1,473,486 | | | | 8,079,674 |

| KEMET Corp. (a) | | 151,900 | | | | 1,073,933 |

| Keyence Corp. | | 2,000 | | | | 569,102 |

| Mercury Computer Systems, Inc. (a) | | 200 | | | | 4,126 |

| Mettler-Toledo International, Inc. (a) | | 70,100 | | | | 3,869,520 |

| National Instruments Corp. | | 401 | | | | 12,852 |

| Sunpower Corp. Class A | | 500 | | | | 16,995 |

| Vishay Intertechnology, Inc. (a) | | 492,200 | | | | 6,772,672 |

| Xyratex Ltd. (a) | | 1,800 | | | | 31,824 |

| | | | | | | 30,693,578 |

| Internet Software & Services – 1.6% | | | | | | |

| aQuantive, Inc. (a) | | 17,450 | | | | 440,438 |

| eCollege.com (a) | | 86,150 | | | | 1,553,285 |

| RealNetworks, Inc. (a) | | 569,272 | | | | 4,417,551 |

| ValueClick, Inc. (a) | | 168,558 | | | | 3,052,585 |

| VeriSign, Inc. (a) | | 130,200 | | | | 2,853,984 |

| Yahoo! Japan Corp | | 466 | | | | 707,468 |

| | | | | | | 13,025,311 |

| IT Services – 0.4% | | | | | | |

| Affiliated Computer Services, Inc. Class A (a) | | 84 | | | | 4,971 |

| Lionbridge Technologies, Inc. (a) | | 156,400 | | | | 1,097,928 |

| ManTech International Corp. Class A (a) | | 21,900 | | | | 610,134 |

| Maximus, Inc. | | 46,500 | | | | 1,706,085 |

| | | | | | | 3,419,118 |

| Semiconductors & Semiconductor Equipment – 0.9% | | | | | | |

| Credence Systems Corp. (a) | | 109,300 | | | | 760,728 |

| Integrated Device Technology, Inc. (a) | | 137,900 | | | | 1,817,522 |

| Mattson Technology, Inc. (a) | | 66,300 | | | | 666,978 |

| NVIDIA Corp. (a) | | 35,210 | | | | 1,287,278 |

| Saifun Semiconductors Ltd. | | 6,200 | | | | 195,114 |

| Veeco Instruments, Inc. (a) | | 56,300 | | | | 975,679 |

| Zoran Corp. (a) | | 83,476 | | | | 1,353,146 |

| | | | | | | 7,056,445 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| INFORMATION TECHNOLOGY – continued | | | | |

| Software 1.9% | | | | |

| Activision, Inc. (a) | | 73,400 | | $ 1,008,516 |

| Advent Software, Inc. (a) | | 20,400 | | 589,764 |

| Cognos, Inc. (a) | | 135,200 | | 4,715,806 |

| Hyperion Solutions Corp. (a) | | 53,959 | | 1,932,811 |

| KOEI Co. Ltd. (d) | | 59,800 | | 1,658,505 |

| Nuance Communications, Inc. (a) | | 33,900 | | 258,657 |

| Open Solutions, Inc. (a) | | 151,400 | | 3,470,088 |

| Plato Learning, Inc. (a) | | 8,100 | | 64,314 |

| Salesforce.com, Inc. (a) | | 1,300 | | 41,665 |

| THQ, Inc. (a) | | 65,550 | | 1,563,368 |

| | | | | 15,303,494 |

| |

| TOTAL INFORMATION TECHNOLOGY | | | | 86,070,715 |

| |

| MATERIALS 8.8% | | | | |

| Chemicals – 3.1% | | | | |

| Airgas, Inc. | | 260,808 | | 8,580,583 |

| Asian Paints India Ltd. | | 113,701 | | 1,462,484 |

| Ecolab, Inc. | | 175,700 | | 6,372,639 |

| Kuraray Co. Ltd. | | 27,500 | | 285,018 |

| Monsanto Co. | | 36,500 | | 2,829,845 |

| Nitto Denko Corp. | | 14,200 | | 1,106,806 |

| Praxair, Inc. | | 29,600 | | 1,567,616 |

| Sinopec Shanghai Petrochemical Co. Ltd. sponsored ADR | | 3,800 | | 143,906 |

| Tokuyama Corp. | | 211,000 | | 2,711,208 |

| United Phosphorous Ltd. | | 45 | | 240 |

| | | | | 25,060,345 |

| Construction Materials 0.1% | | | | |

| Florida Rock Industries, Inc. | | 21,150 | | 1,037,619 |

| Containers & Packaging – 0.0% | | | | |

| Essel Propack Ltd. | | 23,235 | | 185,023 |

| Silgan Holdings, Inc. | | 188 | | 6,791 |

| | | | | 191,814 |

| Metals & Mining – 5.2% | | | | |

| Agnico-Eagle Mines Ltd. | | 157,100 | | 3,110,784 |

| Boliden AB (a) | | 76,000 | | 621,814 |

| Compania de Minas Buenaventura SA sponsored ADR | | 61,900 | | 1,751,770 |

| Fording Canadian Coal Trust | | 12,900 | | 446,293 |

| Freeport-McMoRan Copper & Gold, Inc. Class B (d) | | 185,100 | | 9,958,380 |

| Goldcorp, Inc. | | 20,200 | | 450,028 |

See accompanying notes which are an integral part of the financial statements.

23 Annual Report

| Investments continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| MATERIALS – continued | | | | | | |

| Metals & Mining – continued | | | | | | |

| Golden Star Resources Ltd. (a) | | 4,700 | | $ | | 12,492 |

| Harmony Gold Mining Co. Ltd. (a) | | 150,200 | | | | 1,960,110 |

| High River Gold Mines Ltd. (a) | | 246,900 | | | | 314,319 |

| Kinross Gold Corp. (a) | | 932,600 | | | | 8,615,650 |

| Newmont Mining Corp. | | 238,700 | | | | 12,746,577 |

| Teck Cominco Ltd. Class B (sub. vtg.) | | 38,400 | | | | 2,049,563 |

| | | | | | | 42,037,780 |

| Paper & Forest Products 0.4% | | | | | | |

| Lee & Man Paper Manufacturing Ltd. | | 1,404,000 | | | | 1,557,254 |

| Sino-Forest Corp. (a) | | 359,500 | | | | 1,527,616 |

| | | | | | | 3,084,870 |

| |

| TOTAL MATERIALS | | | | | | 71,412,428 |

| |

| TELECOMMUNICATION SERVICES – 1.2% | | | | | | |

| Wireless Telecommunication Services – 1.2% | | | | | | |

| America Movil SA de CV Series L sponsored ADR | | 50,000 | | | | 1,463,000 |

| Bharti Televentures Ltd. (a) | | 132,517 | | | | 1,037,723 |

| NII Holdings, Inc. (a) | | 135,706 | | | | 5,927,638 |

| USA Mobility, Inc. | | 39,360 | | | | 1,091,059 |

| | | | | | | 9,519,420 |

| |

| UTILITIES – 1.0% | | | | | | |

| Gas Utilities 0.3% | | | | | | |

| SEMCO Energy, Inc. (a) | | 216,200 | | | | 1,215,044 |

| Xinao Gas Holdings Ltd. | | 1,822,000 | | | | 1,445,165 |

| | | | | | | 2,660,209 |

| Independent Power Producers & Energy Traders – 0.6% | | | | | | |

| AES Corp. (a) | | 276,900 | | | | 4,383,327 |

| Multi-Utilities – 0.1% | | | | | | |

| Public Service Enterprise Group, Inc. | | 14,900 | | | | 968,053 |

| |

| TOTAL UTILITIES | | | | | | 8,011,589 |

| |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $651,777,022) | | | | 749,038,570 |

See accompanying notes which are an integral part of the financial statements.

| Money Market Funds 8.8% | | | | | | | | |

| | | | | Shares | | | | Value (Note 1) |

| Fidelity Cash Central Fund, 4.28% (b) | | | | 59,961,944 | | | $ | 59,961,944 |

| Fidelity Securities Lending Cash Central Fund, | | | | | | |

| 4.35% (b)(c) | | | | 11,756,373 | | | | 11,756,373 |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $71,718,317) | | | | | | | | 71,718,317 |

| TOTAL INVESTMENT PORTFOLIO 101.4% | | | | | | |

| (Cost $723,495,339) | | | | | | | | 820,756,887 |

| |

| NET OTHER ASSETS – (1.4)% | | | | | | | | (11,701,980) |

| NET ASSETS 100% | | | | | | | $ | 809,054,907 |

Legend

(a) Non-income producing

(b) Affiliated fund that is available only to

investment companies and other

accounts managed by Fidelity

Investments. The rate quoted is the

annualized seven-day yield of the fund

at period end. A complete unaudited

listing of the fund’s holdings as of its

most recent quarter end is available

upon request.

|

(c) Includes investment made with cash

collateral received from securities on

loan.

(d) Security or a portion of the security is on

loan at period end.

|

Affiliated Central Funds

Information regarding income received by the fund from the affiliated Central funds during the period is as follows:

| Fund | | | | Income received |

| Fidelity Cash Central Fund | | | $ | 1,257,257 |

| Fidelity Securities Lending Cash Central Fund | | | | 73,374 |

| Total | | | $ | 1,330,631 |

See accompanying notes which are an integral part of the financial statements.

25 Annual Report

Investments continued

Other Information

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | | 73.3% |

| Japan | | 5.6% |

| Canada | | 5.0% |

| India | | 2.4% |

| Netherlands | | 2.1% |

| Cayman Islands | | 1.8% |

| Taiwan | | 1.2% |

| Switzerland | | 1.1% |

| France | | 1.1% |

| Others (individually less than 1%) . | | 6.4% |

| | | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report 26

| Financial Statements | | | | | | | | |

| |

| |

| Statement of Assets and Liabilities | | | | | | | | |

| | | | | | | December 31, 2005 |

| |

| Assets | | | | | | | | |

| Investment in securities, at value (including securities | | | | | | | | |

| loaned of $11,235,836) See accompanying | | | | | | | | |

| schedule: | | | | | | | | |

| Unaffiliated issuers (cost $651,777,022) | | | $ | 749,038,570 | | | | |

| Affiliated Central Funds (cost $71,718,317) | | | | 71,718,317 | | | | |

| Total Investments (cost $723,495,339) | | | | | | | $ | 820,756,887 |

| Foreign currency held at value (cost $117,253) | | | | | | | | 113,162 |

| Receivable for investments sold | | | | | | | | 604,844 |

| Receivable for fund shares sold | | | | | | | | 5,059,706 |

| Dividends receivable | | | | | | | | 442,854 |

| Interest receivable | | | | | | | | 195,586 |

| Prepaid expenses | | | | | | | | 2,307 |

| Receivable from investment adviser for expense | | | | | | | | |

| reductions | | | | | | | | 42,307 |

| Other receivables | | | | | | | | 146,541 |

| Total assets | | | | | | | | 827,364,194 |

| |

| Liabilities | | | | | | | | |

| Payable to custodian bank | | | $ | 1,914 | | | | |

| Payable for investments purchased | | | | 4,550,575 | | | | |

| Payable for fund shares redeemed | | | | 712,454 | | | | |

| Distributions payable | | | | 1,380 | | | | |

| Accrued management fee | | | | 370,660 | | | | |

| Distribution fees payable | | | | 296,504 | | | | |

| Other affiliated payables | | | | 196,216 | | | | |

| Other payables and accrued expenses | | | | 423,211 | | | | |

| Collateral on securities loaned, at value | | | | 11,756,373 | | | | |

| Total liabilities | | | | | | | | 18,309,287 |

| |

| Net Assets | | | | | | | $ | 809,054,907 |

| Net Assets consist of: | | | | | | | | |

| Paid in capital | | | | | | | $ | 712,058,190 |

| Accumulated net investment loss | | | | | | | | (571) |

| Accumulated undistributed net realized gain (loss) on | | | | | | | | |

| investments and foreign currency transactions | | | | | | | | 47,343 |

| Net unrealized appreciation (depreciation) on | | | | | | | | |

| investments and assets and liabilities in foreign | | | | | | | | |

| currencies | | | | | | | | 96,949,945 |

| Net Assets | | | | | | | $ | 809,054,907 |

See accompanying notes which are an integral part of the financial statements.

27 Annual Report

| Financial Statements continued | | | | |

| |

| |

| Statement of Assets and Liabilities continued | | | | |

| | | December 31, 2005 |

| |

| Calculation of Maximum Offering Price | | | | |

| Class A: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($189,863,519 ÷ 12,999,277 shares) | | $ | | 14.61 |

| Maximum offering price per share (100/94.25 of | | | | |

| $14.61) | | $ | | 15.50 |

| Class T: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($318,825,582 ÷ 21,868,649 shares) | | $ | | 14.58 |

| Maximum offering price per share (100/96.50 of | | | | |

| $14.58) | | $ | | 15.11 |

| Class B: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($56,201,211 ÷ 3,879,578 shares)A | | $ | | 14.49 |

| Class C: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($107,285,615 ÷ 7,401,874 shares)A | | $ | | 14.49 |

| Institutional Class: | | | | |

| Net Asset Value, offering price and redemption price | | | | |

| per share ($136,878,980 ÷ 9,350,263 shares) | | $ | | 14.64 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | | | | |

See accompanying notes which are an integral part of the financial statements.

Annual Report 28

| Statement of Operations | | | | | | |

| | | | | Year ended December 31, 2005 |

| |

| Investment Income | | | | | | |

| Dividends | | | | $ | | 3,272,949 |

| Special dividends | | | | | | 837,545 |

| Interest | | | | | | 2,111 |

| Income from affiliated Central Funds | | | | | | 1,330,631 |

| Total income | | | | | | 5,443,236 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 2,528,233 | | |

| Transfer agent fees | | | | 1,348,073 | | |

| Distribution fees | | | | 2,080,420 | | |

| Accounting and security lending fees | | | | 176,771 | | |

| Independent trustees’ compensation | | | | 1,717 | | |

| Custodian fees and expenses | | | | 168,881 | | |

| Registration fees | | | | 261,074 | | |

| Audit | | | | 51,488 | | |

| Legal | | | | 2,151 | | |

| Miscellaneous | | | | 20,550 | | |

| Total expenses before reductions | | | | 6,639,358 | | |

| Expense reductions | | | | (489,043) | | 6,150,315 |

| |

| Net investment income (loss) | | | | | | (707,079) |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers (net of foreign taxes of | | | | | | |

| $34,552) | | | | 3,579,014 | | |

| Investment not meeting investment restrictions | | | | (447) | | |

| Foreign currency transactions | | | | (101,110) | | |

| Payment from investment advisor for loss on invest- | | | | | | |

| ment not meeting investment restrictions | | | | 447 | | |

| Total net realized gain (loss) | | | | | | 3,477,904 |

| Change in net unrealized appreciation (depreciation) | | | | | | |

| on: | | | | | | |

| Investment securities (net of increase in deferred | | | | | | |

| foreign taxes of $271,429) | | | | 84,375,042 | | |

| Assets and liabilities in foreign currencies | | | | (5,036) | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | 84,370,006 |

| Net gain (loss) | | | | | | 87,847,910 |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | $ | | 87,140,831 |

See accompanying notes which are an integral part of the financial statements.

29 Annual Report

| Financial Statements continued | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | | | For the period |

| | | | | | | August 12, 2004 |

| | | | | Year ended | | (commencement |

| | | | | December 31, | | of operations) to |

| | | | | 2005 | | December 31, 2004 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | | $ | (707,079) | | $ | | (194,575) |

| Net realized gain (loss) | | | | 3,477,904 | | | | 12,035 |

| Change in net unrealized appreciation | | | | | | | | |

| (depreciation) | | | | 84,370,006 | | | | 12,579,939 |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 87,140,831 | | | | 12,397,399 |

| Distributions to shareholders from net realized gain . | | | | (2,541,513) | | | | — |

| Share transactions - net increase (decrease) | | | | 589,804,166 | | | | 122,254,024 |

| Total increase (decrease) in net assets | | | | 674,403,484 | | | | 134,651,423 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 134,651,423 | | | | — |

| End of period (including accumulated net invest- | | | | | | | | |

| ment loss of $571 and accumulated net | | | | | | | | |

| investment loss of $2,465, respectively) | | | $ | 809,054,907 | | $ | | 134,651,423 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class A | | | | | | | | |

| Years ended December 31, | | | | 2005 | | | | 2004F |

| Selected Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | | $ | 12.52 | | | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

| Net investment income (loss)E | | | | 01H | | | | (.02) |

| Net realized and unrealized gain (loss) | | | | 2.14 | | | | 2.54 |

| Total from investment operations | | | | 2.15 | | | | 2.52 |

| Distributions from net realized gain | | | | (.06) | | | | — |

| Net asset value, end of period | | | $ | 14.61 | | | $ | 12.52 |

| Total ReturnB,C,D | | | | 17.21% | | | | 25.20% |

| Ratios to Average Net AssetsG | | | | | | | | |

| Expenses before reductions | | | | 1.32% | | | | 1.79%A |

| Expenses net of fee waivers, if any | | | | 1.25% | | | | 1.30%A |

| Expenses net of all reductions | | | | 1.18% | | | | 1.26%A |

| Net investment income (loss) | | | | 04%H | | | | (.53)%A |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $ | 189,864 | | | $ | 34,438 |

| Portfolio turnover rate | | | | 111% | | | | 40%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F For the period August 12, 2004 (commencement of operations) to December 31, 2004.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term

operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from

brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the

class.

H Investment income per share reflects a special dividend which amounted to $.03 per share. Excluding the special dividend, the ratio of net

investment income (loss) to average net assets would have been (.14)%.

|

See accompanying notes which are an integral part of the financial statements.

31 Annual Report

| Financial Highlights Class T | | | | | | | | |

| Years ended December 31, | | | | 2005 | | | | 2004F |

| Selected Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | | $ | 12.51 | | | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

| Net investment income (loss)E | | | | (.02)H | | | | (.03) |

| Net realized and unrealized gain (loss) | | | | 2.13 | | | | 2.54 |

| Total from investment operations | | | | 2.11 | | | | 2.51 |

| Distributions from net realized gain | | | | (.04) | | | | — |

| Net asset value, end of period | | | $ | 14.58 | | | $ | 12.51 |

| Total ReturnB,C,D | | | | 16.87% | | | | 25.10% |

| Ratios to Average Net AssetsG | | | | | | | | |

| Expenses before reductions | | | | 1.46% | | | | 1.96%A |

| Expenses net of fee waivers, if any | | | | 1.46% | | | | 1.55%A |

| Expenses net of all reductions | | | | 1.39% | | | | 1.51%A |

| Net investment income (loss) | | | | (.16)%H | | | | (.78)%A |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $ | 318,826 | | | $ | 60,107 |

| Portfolio turnover rate | | | | 111% | | | | 40%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F For the period August 12, 2004 (commencement of operations) to December 31, 2004.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term

operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from

brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the

class.

H Investment income per share reflects a special dividend which amounted to $.03 per share. Excluding the special dividend, the ratio of net

investment income (loss) to average net assets would have been (.35)%.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class B | | | | | | | | |

| Years ended December 31, | | | | 2005 | | | | 2004F |

| Selected Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | | $ | 12.48 | | | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

| Net investment income (loss)E | | | | (.09)H | | | | (.06) |

| Net realized and unrealized gain (loss) | | | | 2.13 | | | | 2.54 |

| Total from investment operations | | | | 2.04 | | | | 2.48 |

| Distributions from net realized gain | | | | (.03) | | | | — |

| Net asset value, end of period | | | $ | 14.49 | | | $ | 12.48 |

| Total ReturnB,C,D | | | | 16.34% | | | | 24.80% |

| Ratios to Average Net AssetsG | | | | | | | | |

| Expenses before reductions | | | | 2.08% | | | | 2.61%A |

| Expenses net of fee waivers, if any | | | | 2.00% | | | | 2.05%A |

| Expenses net of all reductions | | | | 1.92% | | | | 2.01%A |

| Net investment income (loss) | | | | (.70)%H | | | | (1.28)%A |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $ | 56,201 | | | $ | 15,527 |

| Portfolio turnover rate | | | | 111% | | | | 40%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F For the period August 12, 2004 (commencement of operations) to December 31, 2004.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term

operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from

brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the

class.

H Investment income per share reflects a special dividend which amounted to $.02 per share. Excluding the special dividend, the ratio of net

investment income (loss) to average net assets would have been (.89)%.

|

See accompanying notes which are an integral part of the financial statements.

33 Annual Report

| Financial Highlights Class C | | | | | | | | |

| Years ended December 31, | | | | 2005 | | | | 2004F |

| Selected Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | | $ | 12.49 | | | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

| ��Net investment income (loss)E | | | | (.09)H | | | | (.06) |

| Net realized and unrealized gain (loss) | | | | 2.12 | | | | 2.55 |

| Total from investment operations | | | | 2.03 | | | | 2.49 |

| Distributions from net realized gain | | | | (.03) | | | | — |

| Net asset value, end of period | | | $ | 14.49 | | | | 12.49 |

| Total ReturnB,C,D | | | | 16.25% | | | | 24.90% |

| Ratios to Average Net AssetsG | | | | | | | | |

| Expenses before reductions | | | | 2.05% | | | | 2.53%A |

| Expenses net of fee waivers, if any | | | | 2.00% | | | | 2.05%A |

| Expenses net of all reductions | | | | 1.93% | | | | 2.01%A |

| Net investment income (loss) | | | | (.70)%H | | | | (1.28)%A |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $ | 107,286 | | | $ | 17,822 |

| Portfolio turnover rate | | | | 111% | | | | 40%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F For the period August 12, 2004 (commencement of operations) to December 31, 2004.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term

operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from

brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the

class.

H Investment income per share reflects a special dividend which amounted to $.02 per share. Excluding the special dividend, the ratio of net

investment income (loss) to average net assets would have been (.89)%.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Institutional Class | | | | | | | | |

| Years ended December 31, | | | | 2005 | | | | 2004E |

| Selected Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | | $ | 12.54 | | | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

| Net investment income (loss)D | | | | 04G | | | | (.01) |

| Net realized and unrealized gain (loss) | | | | 2.15 | | | | 2.55 |

| Total from investment operations | | | | 2.19 | | | | 2.54 |

| Distributions from net realized gain | | | | (.09) | | | | — |

| Net asset value, end of period | | | $ | 14.64 | | | $ | 12.54 |

| Total ReturnB,C | | | | 17.43% | | | | 25.40% |

| Ratios to Average Net AssetsF | | | | | | | | |

| Expenses before reductions | | | | 1.04% | | | | 1.38%A |

| Expenses net of fee waivers, if any | | | | 1.00% | | | | 1.05%A |

| Expenses net of all reductions | | | | 93% | | | | 1.01%A |

| Net investment income (loss) | | | | 29%G | | | | (.28)%A |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $ | 136,879 | | | $ | 6,757 |

| Portfolio turnover rate | | | | 111% | | | | 40%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E For the period August 12, 2004 (commencement of operations) to December 31, 2004.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term

operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from

brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the

class.

G Investment income per share reflects a special dividend which amounted to $.03 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been .10%.

|

See accompanying notes which are an integral part of the financial statements.

35 Annual Report

Notes to Financial Statements

For the period ended December 31, 2005

|

1. Significant Accounting Policies.

Fidelity Advisor Mid Cap II Fund (the fund) is a fund of Fidelity Advisor Series II (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The fund may invest in affiliated money market central funds (Money Market Central Funds) which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require manage ment to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open end mutual funds, are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.