Exhibit 99.2

Contents

| Notice of Annual Meeting of Shareholders of Petro-Canada | 1 |

| Invitation to Shareholders of Petro-Canada | 2 |

| Legal Notice - Forward-Looking Information | 3 |

| | |

Management Proxy Circular | |

| Questions and Answers on Voting | 4 |

| Business of the Meeting | 7 |

| Nominees for Election to the Board of Directors | 8 |

| Compensation of the Board of Directors | 14 |

| Report on Executive Compensation | 16 |

| Management Resources and Compensation Committee | 16 |

| Stock Performance Graph | 24 |

| Summary Compensation Table | 25 |

| Equity Compensation Plans | 26 |

| Grants of Stock Options | 27 |

| Stock Options Exercised | 28 |

| Pension Plans | 28 |

| Contracts Relating to Termination of Employment | 31 |

| Indebtedness of Directors, Executive and Senior Officers | 31 |

| Directors and Officers Insurance Program | 31 |

| Returning Cash to Shareholders | 32 |

| Report to Shareholders from the Corporate Governance and Nominating Committee | 32 |

| Governance Committee Responsibilities | 32 |

| 2006 Governance Initiatives | 33 |

| Corporate Governance Practices | 33 |

| Board Composition and Independence | 33 |

| Board Roles and Responsibilities | 33 |

| Board Committees | 34 |

| Position Descriptions | 35 |

| Director Evaluation and Compensation | 35 |

| Director Orientation and Continuing Education | 35 |

| Ethical Business Conduct | 36 |

| Other Business | 37 |

| Submission Date for 2007 Shareholder Proposals | 37 |

| Annual Disclosure Documents | 37 |

| Board of Directors Approval | 37 |

| Appendix A - Board of Directors Mandate | 38 |

Notice of Annual Meeting of Shareholders of Petro-Canada

The Board of Directors of Petro-Canada (the Company) advises our shareholders of the upcoming Annual Meeting:

Tuesday, April 24, 2007, 11:00 a.m. (MDT)

Macleod D, Telus Convention Centre

120 - 9 Avenue S.E., Calgary, Alberta

At the Annual Meeting shareholders will:

| § | receive the Consolidated Financial Statements of the Company for the year ended December 31, 2006, and the auditors' report on those statements |

| § | elect the Board of Directors of the Company for a term ending at the close of the next Annual Meeting |

| § | appoint auditors of the Company until the close of the next Annual Meeting |

| § | transact other business properly brought before the meeting |

The Management Proxy Circular provides detailed information on the business of the Annual Meeting and forms part of this Notice.

If you are registered as a shareholder at the close of business on February 27, 2007, you are entitled to vote at the Annual Meeting.

Shareholders who cannot attend the Annual Meeting in person, or are attending but prefer the convenience of voting in advance, you may vote by Proxy. Your deadline for getting the completed Proxy Form to our transfer agent and registrar, CIBC Mellon Trust Company (CIBC Mellon), is 11:00 a.m. (MDT) on Friday, April 20, 2007. If the Annual Meeting is adjourned, the deadline is at least 48 hours (excluding Saturdays, Sundays and holidays) before the adjourned meeting.

Send your completed Proxy Form to:

CIBC Mellon

600 The Dome Tower,

333 - 7 Avenue S.W.,

Calgary, Alberta T2P 2Z1

Hugh L. Hooker

Corporate Secretary

Calgary, Alberta

March 1, 2007

Invitation to Shareholders of Petro-Canada

Dear Shareholder:

Your invitation

Petro-Canada's Board of Directors, management and employees invite you to come to our 2007 Annual Meeting of Shareholders. Details of location and time are in the Notice of Meeting on page 1.

Both the Notice of Meeting and this Circular describe the Annual Meeting's business.

Come and ask questions and meet us

After the formal part of the Annual Meeting, Ron Brenneman, President and Chief Executive Officer of Petro-Canada, will describe some of the past year's Company highlights. You will have an opportunity to ask questions and meet the Board of Directors and executives.

Exercise your right to vote

As a shareholder, you may choose to vote either in person or by proxy. No matter what method you choose, we appreciate your participation in the Annual Meeting process. The Annual Meeting is an important forum for our shareholders, and we encourage you to use your voting power.

If you cannot attend

We have arranged other options for you to learn about the Annual Meeting if you cannot attend. We will:

| § | provide live audio coverage of the Annual Meeting at www.petro-canada.ca |

| § | make available online a recording of the Annual Meeting after its conclusion. |

We look forward to seeing you at the Annual Meeting.

Sincerely,

|  |

Brian F. MacNeill Chairman of the Board | Ron A. Brenneman President and Chief Executive Officer |

Legal Notice - Forward-Looking Information

This Circular contains forward-looking information. You can usually identify this information by such words as "plan," "anticipate," "forecast," "believe," "target," "intend," "expect," "estimate," "budget" or other similar wording suggesting future outcomes or statements about an outlook. We list below examples of references to forward-looking information:

· business strategies and goals · outlook (including operational updates and strategic milestones) · future capital, exploration and other expenditures · future resource purchases and sales · construction and repair activities · refinery turnarounds · anticipated refining margins · future oil and gas production levels and the sources of their growth · project development and expansion schedules and results · future results of exploration activities and dates by which certain areas may be developed or may come on-stream | · retail throughputs · pre-production and operating costs · reserves and resources estimates · royalties and taxes payable · production life-of-field estimates · natural gas export capacity · future financing and capital activities (including purchases of Petro-Canada common shares under the Company's normal course issuer bid (NCIB) program) · contingent liabilities (including potential exposure to losses related to retail licensee agreements) · environmental matters · future regulatory approvals |

Such forward-looking information is subject to known and unknown risks and uncertainties. Factors may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such factors include, but are not limited to:

· industry capacity · imprecise reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays and other sources not currently classified as reserves · the effects of weather and climate conditions · the results of exploration and development drilling and related activities · the ability of suppliers to meet commitments · decisions or approvals from administrative tribunals · risks attendant with domestic and international oil and gas operations · expected rates of return | · general economic, market and business conditions · competitive action by other companies · fluctuations in oil and gas prices · refining and marketing margins · the ability to produce and transport crude oil and natural gas to markets · fluctuations in interest rates and foreign currency exchange rates · actions by governmental authorities, including changes in taxes, royalty rates and resource-use strategies · changes in environmental and other regulations · international political events |

Many of these and other similar factors are beyond the control of Petro-Canada. Petro-Canada discusses these factors in greater detail in filings with the Canadian provincial securities commissions and the United States (U.S.) Securities and Exchange Commission (SEC).

We caution readers that this list of important factors affecting forward-looking information is not exhaustive. Furthermore, the forward-looking information in this Circular is made as of March 1, 2007 and, except as required by applicable law, Petro-Canada does not update it publicly or revise it. This cautionary statement expressly qualifies the forward-looking information in this Circular.

Petro-Canada disclosure of reserves

Petro-Canada's qualified reserves evaluators prepare the reserves estimates the Company uses. The Canadian provincial securities commissions do not consider our reserves staff and management as independent of the Company. Petro-Canada has obtained an exemption from certain Canadian reserves disclosure requirements that allows us to make disclosure in accordance with SEC standards. This exemption allows comparisons with U.S. and other international issuers.

As a result, Petro-Canada formally discloses its reserves data and other oil and gas data using U.S. requirements and practices, and these may differ from Canadian domestic standards and practices. Note that when we use the term barrel of oil equivalent (boe) in this Circular, it may be misleading, particularly if used in isolation. A boe conversion ratio of 6,000 cubic feet (Mcf) to 1 barrel (bbl) is based on an energy equivalency conversion method. This method primarily applies at the burner tip and does not represent a value equivalency at the wellhead.

To disclose reserves in SEC filings, oil and gas companies must prove they are economically and legally producible under existing economic and operating conditions. Proof comes from actual production or conclusive formation tests. The use of terms such as "probable," "possible," "recoverable," or "potential reserves and resources" in this Circular does not meet the SEC guidelines for SEC filings.

The table below describes the industry definitions that we currently use:

Definitions Petro-Canada uses | Reference |

| Proved oil and gas reserves (includes both proved developed and proved undeveloped) | U.S. SEC reserves definition (Accounting Rules Regulation S-X 210.4-10, FASB-69) |

| Unproved reserves, probable and possible reserves | CIM (Petroleum Society) definitions (Canadian Oil and Gas Evaluation Handbook, Vol. 1 Section 5) |

| Contingent and prospective resources | Society of Petroleum Engineers/World Petroleum Congress and American Association of Petroleum Geologist definitions (approved February 2000) |

There is no certainty that it will be economically viable or technically feasible to produce any portion of the resources. For use in this Circular, "total resources" means reserves plus resources.

SEC regulations do not define proved reserves from our oil sands mining operations as an oil and gas activity. These reserves are classified as a mining activity and are estimated in accordance with SEC Industry Guide 7. For internal management purposes, we view these reserves and their development as part of our total exploration and production operations.

Throughout this Circular, total Company reserves, total Company production, total Company reserves replacement and total Company reserves life index (RLI) are calculated using the sum of oil and gas activities, and oil sands mining activities. Before royalties, oil sands mining 2006 year-end proved reserves were 345 million barrels (MMbbls) and oil sands mining annual 2006 production was 11 MMbbls.

Management Proxy Circular

All information in this Circular is as of March 1, 2007, unless otherwise indicated.

Petro-Canada provides this Circular in connection with its solicitation of voting proxies for the Annual Meeting.

Questions and Answers on Voting

Your vote is very important to Petro-Canada. We encourage you to exercise your right to vote by proxy if

you cannot attend the Annual Meeting, or

you plan to attend but prefer the convenience of voting in advance.

The questions and answers below give general guidance for voting your common shares. Unless otherwise noted, all answers relate to both registered and beneficial shareholders.

Am I entitled to vote?

You are entitled to vote if you were a holder of common shares of Petro-Canada as of the close of business on February 27, 2007. Each common share entitles its holder to one vote.

Am I a registered shareholder?

You are a registered shareholder if you hold any common shares in your own name. Your common shares are represented by a share certificate.

You can inspect the Company's list of registered shareholders on request after March 16, 2007, between 8:00 a.m. and 4:00 p.m., at the Company's registered office at 150 - 6 Avenue S.W., Calgary, Alberta. This list will also be available at the Annual Meeting.

Am I a beneficial shareholder? (also commonly referred to as non-registered)

You are a beneficial shareholder if your common shares are held in an account in the name of a nominee (bank, trust company, securities broker or other). Your common shares are not represented by a share certificate but are recorded on an electronic system.

How do I vote?

The two ways you can vote your shares if you are a registered shareholder:

| | 1) | By voting in person at the Annual Meeting, or |

| | 2) | By signing and returning the enclosed Proxy Form appointing the named persons or some other person you choose, who need not be a shareholder, to represent you as proxyholder and vote your shares at the Annual Meeting. |

If you are a beneficial shareholder, you will have received voting instructions from your nominee.

Should you hold some common shares as a registered and others as a beneficial shareholder, you will have to use both voting methods described above.

If I am a beneficial shareholder, can I vote in person at the meeting?

Yes. To vote in person at the Annual Meeting, print your name in the space provided on the Voting Instruction Form and return it by following the instructions included. Your vote will be taken at the Annual Meeting. Please register with the Company's transfer agent, CIBC Mellon, when you arrive at the Annual Meeting. Petro-Canada has no access to the names of its beneficial shareholders; if you attend the Annual Meeting without following this procedure, we will have no record of your shareholding or entitlement to vote.

What am I voting on?

You are voting:

| § | to elect nominees to the Board of Directors of the Company until the close of the next Annual Meeting |

| § | to appoint auditors of the Company until close of the next Annual Meeting. |

What if amendments are made to these matters or if other business matters are brought before the meeting?

If you attend the Annual Meeting in person, you may vote on the business matters as you choose.

If you have completed and returned a Proxy Form, the person named in the Proxy Form will have discretionary authority to vote on amendments or variations to the business matters identified in the Notice of the Annual Meeting, and on other matters that may properly come before the Annual Meeting. As of the date of this Circular, the management of the Company is not aware of any amendments, variations or additional matters to come before the Annual Meeting. If any additional matters properly come before the Annual Meeting, the persons named in the Proxy Form will vote on them following their best judgment.

Who is soliciting my proxy?

The management of Petro-Canada is soliciting your proxy.

We solicit proxies primarily by mail. The Company's employees or agents might also phone or use other forms of contact, at nominal cost. The Company bears all costs from solicitation.

Who votes my shares and how will they be voted if I return a Proxy Form?

By properly completing and returning a Proxy Form, you are authorizing the person named in the Proxy Form to attend the Annual Meeting and to vote your shares. You can use the Proxy Form enclosed, or any other proper Proxy Form, to appoint your proxyholder.

The shares represented by your proxy must be voted as you instruct in the Proxy Form. If you properly complete and return your proxy but do not specify how you wish the votes cast, your proxyholder will vote your shares as they see fit.

NOTE: Unless you provide contrary instructions, shares represented by proxies that management receives will be voted:

| § | FOR the election as Directors of those nominees set out in this Management Proxy Circular |

| § | FOR the appointment of Deloitte & Touche LLP as the auditors of the Company. |

Can I appoint someone other than those named in the enclosed Proxy Form to vote my shares?

Yes, you have the right to appoint another person of your choice. They do not need to be a shareholder to attend and act on your behalf at the Annual Meeting. To appoint someone who is not named in the enclosed Proxy Form, strike out those printed names appearing on it and print in the space provided the name of the person you choose.

NOTE: | It is important for you to ensure that any other person you appoint will attend the Annual Meeting and know of your appointment of them. On arriving at the Annual Meeting, proxyholders must present themselves to a representative of CIBC Mellon. |

What if my shares are registered in more than one name or in the name of a company?

If the shares are registered in more than one name, all registered persons must sign the Proxy Form. If the shares are registered in a company's name or any name other than your own, you must provide documents proving your authorization to sign the Proxy Form for that company or name. For any questions about the proper supporting documents, contact CIBC Mellon before submitting your Proxy Form.

Can I revoke a proxy or voting instruction?

Yes. If you are a registered shareholder and have returned a Proxy Form, you may revoke it by:

| | 1) | completing and signing another Proxy Form with a later date and delivering it to CIBC Mellon before: |

| | (a) | the close of business on April 20, 2007, or |

| | (b) | if the Annual Meeting is adjourned, up to the close of business on the business day before the day the meeting is adjourned to; or |

| | 2) | delivering a written statement, signed by you or your authorized representative to: |

| | (a) | the Corporate Secretary of Petro-Canada at 150 - 6 Avenue S.W., Calgary, Alberta T2P 3E3 before |

| | (i) | the close of business on April 20, 2007, or |

| | (ii) | if the Annual Meeting is adjourned, up to the close of business on the last business day before the day the meeting is adjourned; or |

| | (b) | the Chairman of the meeting |

| | (i) | before the Annual Meeting begins, or |

| | (ii) | if the meeting is adjourned, before the adjourned Annual Meeting begins. |

If you are a beneficial shareholder, contact your nominee.

Is my vote confidential?

Yes. Petro-Canada's transfer agent, CIBC Mellon, receives, counts and tabulates proxies. CIBC Mellon does not tell Petro-Canada how any particular shareholder voted.

Are there any voting or ownership restrictions?

Yes. Under the Petro-Canada Public Participation Act, the Company's Articles must include certain restrictions on the ownership of Company shares. Below are details of the current ownership restrictions:

No person, together with associates of that person, may hold, beneficially own or control, directly or indirectly, other than by way of security only, in the aggregate, voting shares to which are attached more than 20% of the votes that may ordinarily be cast to elect Directors of the Company.

How many shares are entitled to vote?

As of the date of this Management Proxy Circular, there were 497,132,045 Petro-Canada common shares outstanding. Each shareholder has one vote for each common share of Petro-Canada held as of the close of business on February 27, 2007.

The Board of Directors and the officers of Petro-Canada know of no person who beneficially owns or exercises control or direction over shares carrying 10% or more of the voting rights for any class of the Company's voting shares.

What if ownership of Petro-Canada shares has been transferred after February 27, 2007?

The new owner must produce properly endorsed share certificates or other proof of ownership to vote the shares at the Annual Meeting. The new owner must also ask Petro-Canada to include their name on the list of shareholders. Please provide proof of share ownership to the Corporate Secretary of Petro-Canada at 150 -6 Avenue S.W., Calgary, Alberta T2P 3E3 by 5:00 p.m. (MDT) on April 20, 2007.

What if I have other questions?

If you have any questions regarding the Annual Meeting, please contact:

Transfer Agent: CIBC Mellon Trust Company

1-800-387-0825

416-643-5000 (outside North America)

www.cibcmellon.com

the Company: Petro-Canada

Hugh L. Hooker, Corporate Secretary

403-296-7778

hhooker@petro-canada.ca

Business of the Meeting

1. Consolidated Financial Statements

The Consolidated Financial Statements for the year ended December 31, 2006 are included in the 2006 Annual Report, which is available to all shareholders upon request or on the Company's website at www.petro-canada.ca.

2. Election of the Board of Directors

The following persons are the nominees proposed by the Corporate Governance and Nominating Committee and approved by the Board of Directors for election as Directors. If elected, the nominees will hold office until the close of the next Annual Meeting, or until their successors are duly elected or appointed:

Ron A. Brenneman Gail Cook-Bennett Richard J. Currie Claude Fontaine Paul Haseldonckx Thomas E. Kierans | Brian F. MacNeill Maureen McCaw Paul D. Melnuk Guylaine Saucier James W. Simpson |

You will find the nominees' biographies starting on page 8 of this Circular under the heading "Nominees for Election to the Board of Directors."

3. Appointment of Auditors

The Board of Directors proposes that Deloitte & Touche LLP be appointed as Petro-Canada's auditors until the close of the next Annual Meeting.

Deloitte & Touche LLP has served continuously as auditors of the Company since June 7, 2002. The fees paid to the auditors during the years ended December 31, 2006 and 2005 were as follows:

| | | 2006 | | 2005 |

| Audit fees | | | 4,024,750 | | | 3,217,000 |

| Audit related services for pension plan and attest services | | | 196,180 | | | 213,000 |

TOTAL | | $ | 4,220,930 | | $ | 3,430,000 |

The Audit, Finance and Risk Committee pre-approves all services that the auditors provide. These services comply with professional standards and securities regulations governing auditor independence. The Board of Directors limits the auditors from providing services not related to the audit.

Nominees for Election to the Board of Directors

Shareholders will be voting to elect 11 Directors of the Company at the Annual Meeting. Petro-Canada's Articles require the Board to have between 9 and 13 Directors. Resolutions of the Board of Directors set the number of Directors of the Company from time to time (including the nominees for election as Directors at the Annual Meeting). The Board has adopted a resolution proposing 11 nominees for election to the Board. Between Annual Meetings, the Board of Directors may appoint additional Directors, as the Corporate Governance and Nominating Committee recommends. Appointed Directors may hold office until the close of the next Annual Meeting. The number of appointed Directors may not exceed one-third of the number of Directors elected at the previous Annual Meeting.

Below are the names and biographies of the nominees for election as Directors. Those named in the enclosed Proxy Form intend to vote FOR these nominees unless authority to do so is withheld. Management does not expect that any of these nominees will be unable to serve as a Director; however, if that occurs, those named in the Proxy Form may vote for another nominee, unless the shareholder has directed that the shares be withheld from voting in the election of Directors.

The Board of Directors would like to acknowledge the contributions made by Dr. Angus A. Bruneau. Dr. Bruneau is retiring as a Director of Petro-Canada effective April 24, 2007.

GAIL COOK-BENNETT Independent1 Age: 66 Toronto, Ontario, Canada Director since 1991 | Gail Cook-Bennett is Chairperson of the Canada Pension Plan Investment Board (public pension plan investment). Dr. Cook-Bennett has earned a Doctorate in Economics and holds a Doctor of Laws (honoris causa) from Carleton University. She is a Fellow of the Institute of Corporate Directors. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| Pension Committee (Chair) | 2 of 2 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 4,098 | 20,151 | 24,249 | $ 1,157,890 | $300,000 |

| 2005 | 4,098 | 19,998 | 24,096 | $ 874,303 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

Other Public Board Directorships:6 Emera Inc. and Manulife Financial Corporation |

RICHARD J. CURRIE, O.C.8 Independent1 Age: 69 Toronto, Ontario, Canada Director since 2003 | Dick Currie is Chairman of the Board of Bell Canada Enterprises (telecommunications). From 1996 to 2002, he was President and Director of George Weston Limited (food processing) and from 1976 to 2000, President and Director of Loblaw Companies Limited (food and distribution). Mr. Currie holds a Bachelor of Engineering and a Master of Business Administration. He is the Chancellor of the University of New Brunswick and a Fellow of the Institute of Corporate Directors. |

| Board and Committee Membership | Attendance |

| Board of Directors | 7 of 9 | 78% |

| Management Resources and Compensation Committee | 3 of 4 | 75% |

| Pension Committee | 1 of 2 | 50% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 50,000 | 3,165 | 53,165 | $ 2,538,629 | $300,000 |

| 2005 | 20,000 | 3,146 | 23,146 | $ 1,040,467 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

Other Public Board Directorships:6 BCE Inc. |

CLAUDE FONTAINE, Q.C. Independent1 Age: 65 Montreal, Quebec, Canada Director since 1987 | Claude Fontaine is counsel to Ogilvy Renault LLP (barristers and solicitors) and, prior to that, he was a Partner of the firm. He serves as Lead Director for Optimum General Inc. and is a Director of the Institute of Corporate Directors (Chair of the Quebec Chapter) and the Montreal Heart Institute Foundation. Mr. Fontaine holds a Bachelor of Arts, Licence in Law (LL.L). and an Institute of Corporate Directors certification. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| Management Resources and Compensation Committee (Chair) | 4 of 4 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 15,929 | 30,221 | 46,150 | $ 2,203,663 | $300,000 |

| 2005 | 15,926 | 28,340 | 44,266 | $ 1,711,042 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| Other Public Board Directorships: Optimum General Inc. |

PAUL HASELDONCKX Independent1 Age: 58 Essen, Germany Director since 2002 | Paul Haseldonckx, Corporate Director, is the past Chairman of the Executive Board of Veba Oil & Gas GmbH (integrated oil and gas) and its predecessor companies. Mr. Haseldonckx holds a Master of Science. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 6,022 | 6,119 | 12,141 | $ 579,733 | $300,000 |

| 2005 | 3,001 | 6,076 | 9,077 | $ 347,553 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| Other Public Board Directorships: None |

THOMAS E. KIERANS, O.C.8 Independent1 Age: 66 Toronto, Ontario, Canada Director since 1991 | Tom Kierans is Chairman of the Canadian Journalism Foundation (non-profit), prior to which he was Chairman of CSI Global Markets. Mr. Kierans holds a Bachelor of Arts (Honours) and a Master of Business Administration (Finance, Dean's Honours List), and is a Fellow of the Canadian Institute of Corporate Directors. He serves as a Director of Mount Sinai Hospital, the Canadian Institute for Advanced Research and the Social Sciences and Humanities Research Council. Mr. Kierans also sits on a number of advisory boards of for-profit and not-for-profit organizations, including Lazard (Canada) and the Schulich School of Business, York University. |

| Board and Committee Membership | Attendance |

| Board of Directors | 8 of 9 | 89% |

| Corporate Governance and Nominating Committee | 4 of 4 | 100% |

| Management Resources and Compensation Committee | 3 of 4 | 75% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 50,000 | 6,707 | 56,707 | $ 2,707,759 | $300,000 |

| 2005 | 40,900 | 6,659 | 47,559 | $ 2,135,456 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

Other Public Board Directorships:6 Manulife Financial Corporation |

BRIAN F. MacNEILL, C.M. Independent1 Age: 67 Calgary, Alberta, Canada Director since 1995 | Brian MacNeill is the Chairman of the Board of Directors of Petro-Canada. Mr. MacNeill is a Certified Public Accountant and holds a Bachelor of Commerce. He is a member of the Canadian Institute of Chartered Accountants and the Financial Executives Institute. He is also a Fellow of the Alberta and Ontario Institutes of Chartered Accountants and of the Institute of Corporate Directors. He is Chair of the Board of Governors of the University of Calgary. |

| Board and Committee Membership | Attendance |

Board of Directors (Chair) As Chair of the Board, Mr. MacNeill is an ex-officio member of all Committees. | 9 of 9 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 10,200 | 42,573 | 52,773 | $ 2,519,911 | $300,000 |

| 2005 | 10,200 | 37,266 | 47,466 | $ 1,748,837 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

Other Public Board Directorships: Toronto-Dominion Bank, Telus Corp. and West-Fraser Timber Co. Ltd. |

MAUREEN McCAW Independent1 Age: 52 Edmonton, Alberta, Canada Director since 2004 | Maureen McCaw is immediate past President of Leger Marketing (Alberta) (marketing research), formerly Criterion Research Corp., a company she founded in 1986. Ms. McCaw holds a Bachelor of Arts from the University of Alberta. She is a past Chair of the Edmonton Chamber of Commerce and also serves on a number of Alberta Boards and advisory committees. |

| Board and Committee Membership | Attendance |

| Board of Directors | 8 of 9 | 89% |

| Corporate Governance and Nominating Committee | 2 of 4 | 50% |

| Pension Committee | 2 of 2 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 1,744 | 4,757 | 6,501 | $ 310,423 | $300,000 |

| 2005 | 1,360 | 3,314 | 4,674 | $ 176,650 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| Other Public Board Directorships: None |

PAUL D. MELNUK Independent1 Age: 52 St. Louis, Missouri, USA Director since 2000 | Paul Melnuk is Chairman and Chief Executive Officer of Thermadyne Holdings Corporation (industrial products) and Managing Partner of FTL Capital Partners LLC (merchant banking). He is past President and Chief Executive Officer of Bracknell Corporation and Barrick Gold Corporation. Mr. Melnuk holds a Bachelor of Commerce. He is a member of the Canadian Institute of Chartered Accountants (CICA) and of the World Presidents' Organization, St. Louis chapter. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Audit, Finance and Risk Committee (Chair) | 7 of 7 | 100% |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 4,400 | 19,624 | 24,024 | $ 1,147,146 | $300,000 |

| 2005 | 4,400 | 15,904 | 20,304 | $ 748,541 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| Other Public Board Directorships: Thermadyne Holdings Corporation |

GUYLAINE SAUCIER, F.C.A, C.M.7 Independent1 Age: 60 Montreal, Quebec, Canada Director since 1991 | Guylaine Saucier, Corporate Director, is a former Chair of the Board of Directors of the Canadian Broadcasting Corporation, a former Director of the Bank of Canada, a former Chair of the Canadian Institute of Chartered Accountants (CICA), a former Director of the International Federation of Accountants and former Chair of the Joint Committee on Corporate Governance established by the CICA, the Toronto Stock Exchange and the Canadian Venture Exchange. She was also the first woman to serve as President of the Quebec Chamber of Commerce. Mme Saucier obtained a Bachelor of Arts from Collège Marguerite-Bourgeois and a Bachelor of Commerce from the École des Hautes Études Commerciales, Université de Montréal. She is a Fellow of the Institute of Chartered Accountants and a member of the Order of Canada. In 2004, she received the Fellowship Award from the Institute of Corporate Directors. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Corporate Governance and Nominating Committee (Chair) | 4 of 4 | 100% |

| Pension Committee | 2 of 2 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 6,520 | 34,961 | 41,481 | $ 1,980,718 | $300,000 |

| 2005 | 6,520 | 31,571 | 38,091 | $ 1,382,623 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

Other Public Board Directorships: AXA Assurance Inc., Bank of Montreal, CHC Helicopter Corp. and Groupe Areva |

JAMES W. SIMPSON Independent1 Age: 63 Danville, California, USA Director since 2004 | Jim Simpson is past President of Chevron Canada Resources (oil and gas). He serves as Lead Director for Canadian Utilities Limited and is on its Audit, Governance and, Compensation Committees. Mr. Simpson holds a Bachelor of Science and Master of Science, and graduated from the Program for Senior Executives at M.I.T's Sloan School of Business. He is also past Chairman of the Canadian Association of Petroleum Producers and past Vice-Chairman of the Canadian Association of the World Petroleum Congresses. |

| Board and Committee Membership | Attendance |

| Board of Directors | 9 of 9 | 100% |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| Management Resources and Compensation Committee | 4 of 4 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 2,000 | 4,413 | 6,413 | $ 306,221 | $300,000 |

| 2005 | 0 | 2,973 | 2,973 | $ 101,558 |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| Other Public Board Directorships: Canadian Utilities Limited |

RON A. BRENNEMAN Non-independent1, Management Age: 60 Calgary, Alberta, Canada Director since 2000 | Ron Brenneman joined Petro-Canada as President and Chief Executive Officer in January 2000. He leads the Company's Executive Leadership Team. He is responsible for the overall strategic direction of the Company and its sound management and performance. Mr. Brenneman holds a Bachelor of Science and a Master of Science. He is a member of the Board of Directors of the Canadian Council of Chief Executives. |

| Board and Committee Membership | Attendance |

Board of Directors As a member of management, Mr. Brenneman is not a member of any Committee of the Board, but he is invited to attend all Committee meetings other than in camera sessions. | 9 of 9 | 100% |

| Securities Held |

| Year | Common Shares2 | DSUs3 | Total of Common Shares and DSUs | Total Market Value of Common Shares and DSUs4 | Minimum Required5 |

| 2006 | 81,534 | 217,580 | 299,114 | $ 14,282,693 | $4,860,000 |

| 2005 | 78,793 | 190,887 | 269,680 | $ 10,196,393 |

| Options Held: 1,219,000 |

Other Public Board Directorships:6 Bank of Nova Scotia and BCE Inc. |

1 Independent: refers to the standards of independence established under Section 303A.02 of the New York Stock Exchange (NYSE) Listed Company Manual, Section 301 and Rule 10A-3 of the Sarbanes-Oxley Act of 2002 and Section 1.2 of Canadian Securities Administrators' National Instrument 58-101.

2 Common Shares refers to the number of common shares beneficially owned, or over which control or direction is exercised by the Director, as of December 31, 2006 and December 31, 2005, respectively. For Messrs. Currie, Kierans and Simpson, 2006 includes 30,000, 9,100 and 2,000 shares, respectively, purchased in January and/or February 2007.

3 DSUs refers to the number of deferred stock units held by the Director as of December 31, 2006 and December 31, 2005, respectively.

4 The Total Market Value of Common Shares is determined by multiplying the number of common shares held by the closing price of the common shares on the Toronto Stock Exchange (TSX) on December 29, 2006 (the last trading day prior to December 31, 2006) of $47.75 and on December 31, 2005 of $46.65, as applicable. The Total Market Value of DSUs is based on the previous five-day average market value of Petro-Canada's common shares as of December 29, 2006 of $47.75 and December 31, 2005 of $34.16. Dividend equivalents are credited on a quarterly basis.

5 Each non-employee Director is required to hold a minimum number of Company shares or share equivalents equal in value to $300,000. Directors have five years to reach this level. Mr. Brenneman, as an employee Director, participates in the Company's Officer Share Ownership Program and is required to hold four times his annual base salary. Refer to Report on Executive Compensation on page 16.

6 Ms. Cook-Bennett and Mr. Kierans both serve on the Board of Manulife Financial Corporation and Messrs. Currie and Brenneman both serve on the Board of BCE Inc.

7 Mme. Saucier was a Director of Nortel Networks Corporation until June 2005, and was subject to a cease trade order issued on May 17, 2004 as a result of Nortel's failure to file financial statements. The cease trade order was cancelled on June 21, 2005.

8 Messrs. Currie and Kierans were Directors of Teleglobe Inc. from December 2000 until April 2002. Teleglobe Inc. filed for court protection under insolvency statutes on May 28, 2002.

Compensation of the Board of Directors

2006 Compensation

The compensation of Petro-Canada's Board of Directors is intended to ensure that highly qualified Directors are attracted to Petro-Canada to meet the demanding responsibilities that are fulfilled by the Company's Board members. The compensation package is reviewed periodically for competitiveness with the packages of similarly complex organizations.

The Company believes that the overall structure of the Directors' compensation is aligned to ensure that Directors act in the long-term interest of the Company. Only non-employee Directors are compensated for Board services; the President and Chief Executive Officer is not paid for his services as a Director.

Compensation Components for all Directors Except the Chair of the Board of Directors

Compensation Structure | Effective January 1, 2006 |

Annual Retainer For Directors1 | $105,000 |

| Board Meeting Fee | $1,500 |

| Committee Meeting Fee | $1,500 |

| Annual Committee Member Retainer (excluding Audit, Finance and Risk Committee) | $4,000 all Committees |

| Annual Committee Member Retainer for Audit, Finance and Risk Committee | $10,500 AFRC |

| Annual Committee Chair Retainer (excluding Audit, Finance and Risk Committee) | $10,000 all Committees |

| Annual Committee Chair Retainer for Audit, Finance and Risk Committee | $25,000 AFRC |

Out-of-Province Travel Fee2 (per round trip) | $1,500 |

Compensation Components for the Chair of the Board of Directors

Compensation Structure | Effective January 1, 2006 |

Annual Retainer3 | $330,000 |

No other compensation is payable to the Chair of the Board of Directors.

1 Directors may elect to take the annual retainer in cash, common shares and/or DSUs once the Director has reached the share ownership guideline level. Directors who have not reached their share ownership guideline level receive the annual retainer payable by $70,000 in DSUs and the remainder by $35,000 in cash, common shares and/or DSUs for a total of $105,000.

2 Provided to Directors who travel to a Board or Committee meeting held outside their home province of permanent residence.

3 The Chair of the Board of Directors may elect to take the annual retainer in cash, common shares and/or DSUs once the Chair has reached the share ownership guideline level. When the Chair has not met the share ownership guideline level, he will receive the annual retainer payable by $75,000 in DSUs and the remainder by $255,000 in cash, shares and/or DSUs for a total of $330,000.

Deferred Stock Unit Plan (DSUs)

| § | Annually, Directors can choose to receive their non-DSU compensation in the form of cash, Company common shares and/or DSUs. |

| § | Under the DSU Plan, dividends paid on the common shares of the Company are credited to Directors' notional DSU accounts. |

| § | A Director becomes entitled to the benefit of the Director's DSUs upon ceasing to be a Director. The Director can then choose to receive the value of the DSUs in the form of common shares of the Company purchased on the open market or to receive the value of the DSUs in the form of cash at any time up to 15 days prior to the end of the 12 months following retirement. The value of the DSUs will be based on the five-day average market price of the Company's common shares immediately before the conversion of the DSUs to cash or shares. If a Director chooses to receive common shares, the value of the Director's DSU entitlement is used to purchase common shares of the Company on the open market for the benefit of the Director. The Company is responsible for brokerage costs incurred in acquiring those shares. The value of DSUs granted prior to January 1, 2004 can only be paid out in the form of Company common shares purchased on the open market. |

Share Ownership Guidelines

| § | The Company has adopted share ownership guidelines under which each non-employee Director is required to hold Company shares or share equivalents equal in value to at least $300,000. |

| § | Directors have five years to reach this level of share ownership, including shares held notionally in the DSU Plan. |

| § | As of the date of this Circular, all Directors had attained the required level of share ownership. |

| § | Non-employee Directors are not eligible to participate in the Company's Option Plan. |

2006 Election of Payment

The following table shows the percentages of each form of payment that each Director received during the year ended December 31, 2006.

| Cash | Petro-Canada Common Shares | Deferred Stock Units (DSUs) |

Director | Annual Retainer | Committee Retainer(s)/ Meeting and Out-of-Province Travel Fees | Annual Retainer | Committee Retainer(s)/ Meeting and Out-of-Province Travel Fees | Annual Retainer | Committee Retainer(s)/ Meeting and Out-of-Province Travel Fees |

| Angus A. Bruneau | 100% | 100% | | | | |

| Gail Cook-Bennett | 100% | 100% | | | | |

| Richard J. Currie | 100% | 100% | | | | |

| Claude Fontaine | 50% | 50% | | | 50% | 50% |

| Paul Haseldonckx | 100% | 100% | | | | |

| Thomas E. Kierans | 100% | 100% | | | | |

| Brian F. MacNeill | 25% | | | | 75% | |

| Maureen McCaw | | 100% | 33.33% | | 66.67% | |

| Paul D. Melnuk | | | | | 100% | 100% |

| Guylaine Saucier | | | | | 100% | 100% |

| James W. Simpson | 33.33% | 100% | | | 66.67% | |

Directors Remuneration

The total amount paid to Directors of the Company for the year ended December 31, 2006 was $1,919,500 paid as follows:

Director | | Board Retainer | | Committee Chair Retainer | | Committee Member Retainer | | Non-Executive Chairman Retainer | | Board Attendance Fee1 | | Committee Attendance Fee1 | | Out-of-Province Travel Fee | | Total Compensation |

| Angus A. Bruneau | $ | 105,000 | $ | 10,000 | $ | 10,500 | | | $ | 15,000 | $ | 18,000 | $ | 10,500 | $ | 169,000 |

| Gail Cook-Bennett | $ | 105,000 | $ | 10,000 | $ | 10,500 | | | $ | 16,500 | $ | 16,500 | $ | 9,000 | $ | 167,500 |

| Richard J. Currie | $ | 105,000 | | | $ | 8,000 | | | $ | 13,500 | $ | 7,500 | $ | 9,000 | $ | 143,000 |

| Claude Fontaine | $ | 105,000 | $ | 10,000 | $ | 4,000 | | | $ | 16,500 | $ | 19,500 | $ | 9,000 | $ | 164,000 |

| Paul Haseldonckx | $ | 105,000 | | | $ | 14,500 | | | $ | 16,500 | $ | 18,000 | $ | 10,500 | $ | 164,500 |

| Thomas E. Kierans | $ | 105,000 | | | $ | 8,000 | | | $ | 13,500 | $ | 13,500 | $ | 7,500 | $ | 147,500 |

| Brian F. MacNeill | | | | | | | $ | 330,000 | | | | | | | $ | 330,000 |

| Maureen McCaw | $ | 105,000 | | | $ | 8,000 | | | $ | 15,000 | $ | 7,500 | $ | 1,500 | $ | 137,000 |

| Paul D. Melnuk | $ | 105,000 | $ | 25,000 | $ | 4,000 | | | $ | 16,500 | $ | 16,500 | $ | 10,500 | $ | 177,500 |

| Guylaine Saucier | $ | 105,000 | $ | 10,000 | $ | 4,000 | | | $ | 16,500 | $ | 12,000 | $ | 7,500 | $ | 155,000 |

| James W. Simpson | $ | 105,000 | | | $ | 14,500 | | | $ | 16,500 | $ | 19,500 | $ | 9,000 | $ | 164,500 |

| Total | $ | 1,050,000 | $ | 65,000 | $ | 86,000 | $ | 330,000 | $ | 156,000 | $ | 148,500 | $ | 84,000 | $ | 1,919,500 |

1 During the year, Petro-Canada puts on a number of in-house education sessions that all Directors are invited to attend. A meeting fee of $1,500 is paid to each Director attending each session that is offered. Extra meeting fees are also paid for multi-day Board meetings, telephone conferences and, from time to time, participation in a Committee meeting of which a Director is not a member.

2007 Compensation

No changes are contemplated for Director compensation for 2007.

Report on Executive Compensation

Management Resources and Compensation Committee (the Compensation Committee)

The Management Resources and Compensation Committee (the Compensation Committee) is composed entirely of independent Directors. The Compensation Committee is responsible for reviewing and making recommendations to the Board of Directors regarding compensation and benefit practices, and management development and succession. President and Chief Executive Officer and executive officer performance, succession and recruitment are key focus areas. The Charter of the Compensation Committee can be found on the Company's website at www.petro-canada.ca.

Compensation Philosophy

The success of the Company depends to a great extent on the Company's ability to attract, retain and motivate high-performing employees at all levels of the organization. The Company regularly reviews its compensation policies relative to these objectives.

The Compensation Committee reviews overall compensation policies and makes recommendations to the Board of Directors on the compensation programs for the executive officers of Petro-Canada, including the Named Executive Officers (see Executive Compensation - Summary Compensation Table). The objectives of the programs are to:

| § | attract, retain and motivate key personnel |

| § | encourage commitment to the Company and its goals, aligning executive officer interests with interests of shareholders |

| § | reward executive officers for demonstrated leadership and for performance related to predetermined and quantifiable goals |

In developing a total compensation structure for executive officers, the Compensation Committee considers the compensation paid for similar positions in comparator group companies which compete with Petro-Canada for executive talent. The comparator groups for Canadian executive officers are major Canadian oil and gas companies and other large Canadian industrial and resource companies that exercise a reasonable degree of autonomy. These groups were selected as being the most similar to Petro-Canada in terms of size, scope and complexity. The comparator groups for international executive officers are selected using similar criteria in the relevant international locations.

The programs are designed to deliver competitive base salary and incentive payments where corporate, business unit and individual performance meets specific predetermined objectives. Programs also provide the opportunity for top quartile pay relative to the Company's comparator groups for superior performance. The competitiveness of the compensation structure is determined regularly by a compensation survey conducted by the independent consulting firm, Towers Perrin.

The Compensation Committee retains Towers Perrin to provide expertise and advice, including custom survey work, in connection with the development of compensation policies and to make recommendations with respect to the design and implementation of executive compensation programs for the Compensation Committee's review and approval. In addition, Towers Perrin periodically updates the Compensation Committee on 'best practices' and trends in executive compensation. Towers Perrin also provides actuarial and other pension advice to the Company, as well as advice on its health and welfare programs.

As a result of the broad relationship, the Compensation Committee has agreed with Towers Perrin on a formal mandate that outlines Towers Perrin's role and terms of reference as an independent advisor to the Compensation Committee. Important features include a clear reporting relationship of the consultant to the Compensation Committee. There are also assurances that the executive compensation consultant has an internal reporting relationship and compensation determined separately from those activities of Towers Perrin and Petro-Canada, which is not connected to executive compensation.

The compensation structure for executive officers consists of a base salary, an annual incentive, and mid/long-term incentives that use stock options, performance stock units and DSUs. A significant portion of an executive's compensation depends on performance and is, therefore, variable.

Base Salary

Each year, the Compensation Committee reviews the base salaries of each Named Executive Officer and makes any adjustments needed to reflect the duties and responsibilities of the position, the degree of special skill and knowledge required, and the performance and contribution of the officer. The Committee uses the median base salaries for positions with similar responsibilities in comparable businesses as reference points.

Annual Incentive Program

Awards paid under the annual incentive program are based on the degree of achievement of specific predetermined corporate, business unit and individual objectives. Each executive officer is assigned a target incentive level that represents the amount that would be paid if all objectives were achieved at planned levels. If planned results are not achieved or are exceeded, actual payments could vary from zero to double the target award for corporate and business unit performance and from zero to triple the target award for individual performance. For the year ended December 31, 2006, awards under the program for the achievement of planned objectives by executive officers ranged from a target of 32.5% to 75% of base salary, depending on the level and geographic region of the executive officer. The highest percentage was applicable to the President and Chief Executive Officer.

In 2006, 30% of the target annual incentive award had a profit-sharing focus, which is based upon a key measure of corporate performance, related to earnings from operations.

The next 50% of the target annual incentive award is based on business unit operating measures connected to generally controllable objectives that drive excellent operations. Each business unit has a suite of operating and project measures related to the unit's business objectives. Examples of these measures include such items as safety, reliability, production and operating costs. Scores for each measure aggregate to a total business unit score for the senior executive responsible for that unit. The score for each of the President and Chief Executive Officer and the Executive Vice-President and Chief Financial Officer is the sum of the weighted results of all the business units.

The remaining 20% of each target award is based on the executive officer's individual performance against personal objectives assessed by the Compensation Committee.

Deferred Stock Unit (DSU) Plan

The Company has established a DSU Plan for executive officers to increase the alignment of their interests with shareholders' interests. The plan links short-term cash incentive rewards to the future value of the Company's shares. Under the DSU Plan, executive officers may elect to receive all or some of their annual incentive in DSUs.

When awards are determined, the amount elected is converted to DSUs. The DSUs' value is based on the average Toronto Stock Exchange (TSX) closing price of Company shares for the five days immediately before the award is payable. The DSUs earn dividends in the form of additional DSUs at the same rate as Company shares. Executive officers may not convert the DSUs to cash until their termination or retirement. The value of the DSUs, when converted to cash, will equal the five-day average TSX closing price of Company shares immediately before the conversion.

Mid-Long-Term Incentive Plan

Effective January 1, 2004, the Board of Directors amended the long-term incentive plan for executive officers by introducing Performance Stock Units (PSUs) as a mid-term incentive. PSUs replaced approximately 50% of the stock options which would otherwise have been granted under the Employee Stock Option Plan. They include a performance feature tied to the Company's Total Shareholder Return (TSR) as compared to the TSRs of a group of similar North American oil and gas companies. Commencing in 2006, for executive officers other than the President and Chief Executive Officer and the Executive and Senior Vice-Presidents, PSUs replace approximately 40% of the stock options.

The mid-long-term incentives are designed to:

| § | link executive compensation with the creation of shareholder value |

| § | align the interests of executive officers with those of the Company's shareholders and |

| § | reward executive officers for achievement of TSR relative to peer companies |

The Compensation Committee uses its discretion in granting these awards considering data for similar positions and companies as a reference point. In 2006, the Committee used a binomial valuation model to estimate the value of mid-long-term incentive awards. In setting awards for the year, the Committee considered the number of awards granted in the previous year, the competitiveness of the overall compensation structure, and individual performance.

At its first meeting of the year, the Compensation Committee sets the date for the grant of mid-long-term incentives. The grant date, which is later than the date of the meeting, complies with applicable securities regulatory standards and Petro-Canada's Code of Business Conduct. It also aligns with the timing of performance assessments and other compensation decisions. This timing is important because performance assessments significantly impact, not only mid-long-term incentive grants but, also, other aspects of executive officer compensation, including base salary changes and annual incentive awards.

Stock Options

Stock options have a maximum exercise period of seven years and vest at the rate of 25% per year over a four-year period that starts on the first anniversary of the grant date.

Performance Stock Units (PSUs)

PSUs reward participants for the relative performance of the Company against North American oil and gas companies with which it competes for investment dollars (the Peer Group). Three years from the grant date, if the Company's TSR equals the median of the Peer Group's TSRs, the participants will receive cash equal to the original PSUs' ending market value, plus notional dividends earned during the three-year period. If the Company's TSR is equal to or above the TSR of 75% of the Peer Group, participants will receive 150% of the ending market value. If the Company's TSR is equal to or below the TSR of 25% of the Peer Group, the original award will be forfeited. The actual amount of the award (if any) will be pro-rated between the percentile rankings, starting with zero at 25%. The Compensation Committee may adjust this schedule if applying these standards confers unintended results.

DSUs

The Compensation Committee may make special DSU awards from time to time to recognize an executive officer's achievement. The value of any special DSUs is considered in setting the value of the total mid-long-term incentive pay for the executive officer compared with competitive pay levels.

Share Ownership Guidelines

The Company supports its belief in share ownership by executive officers through guidelines requiring shareholdings, including DSUs, worth at least the following amounts:

| § | for the President and Chief Executive Officer, four times base salary |

| § | for executive and senior vice-presidents, two times base salary |

| § | for other officers, their base salary |

The President and Chief Executive Officer must maintain the required ownership level for 12 months after leaving the Company. The Compensation Committee regularly reviews officers' actual shareholdings. It also reviews these guidelines for consistency with competitive standards.

President and Chief Executive Officer Compensation

The Compensation Committee reviews the compensation paid to chief executive officers at the comparator group of companies to determine the competitiveness of the compensation of our President and Chief Executive Officer, Mr. Brenneman. The Committee also carefully assesses both the financial and non-financial components of Mr. Brenneman's performance. Petro-Canada's compensation structure for Mr. Brenneman contains significant pay-at-risk components, with a major portion of his total compensation delivered through performance-driven variable pay and equity-based programs.

In 2006, Mr. Brenneman's base salary was increased from $1,155,000 to $1,215,000 to position him at approximately the median of his peers. He also received a grant of 180,000 stock options, 45,000 PSUs and 25,000 DSUs. His annual incentive award of $1,390,000 was set under the annual incentive program described above, and included the following elements:

| § | a profit-sharing component of $358,000, reflecting strong performance on earnings from operations, with a score of 131% |

| § | an operational component of $540,000, reflecting the aggregate scores achieved by each business unit on largely controllable operating and project measures, with a score of 119% |

| § | an individual work plan component of $492,000, reflecting the Compensation Committee's assessment of Mr. Brenneman's performance against his personal work plan objectives, with a score of 270% |

This award reflects the following achievements under Mr. Brenneman's leadership:

| § | 2006 was a solid year for Petro-Canada in terms of overall financial results, with robust operating earnings and cash flow and a very strong balance sheet |

| § | The Company continued to provide cash to shareholders in the form of dividends and the share buyback program. On December 14, 2006, the Company declared a 30% increase in its quarterly dividend to $0.13/share, starting with the dividend payable April 1, 2007. In 2006, the Company purchased a total of 19.8 million common shares at a total cost of more than $1 billion, which included use of the $640 million net proceeds from the sale of the mature Syrian assets |

| § | Petro-Canada's programs for leadership development, succession planning and performance management continue to build a strong and effective organization for the future. In 2006, the Company hired 665 new employees, addressing the need to attract people to achieve business goals. In addition, substantial progress was made in raising the profile of safety throughout the Company, resulting in a further reduction in total recordable injury frequency by 25% in 2006, compared with 2005. Environmental exceedances were also reduced by 21% in 2006, compared with 2005 |

| § | In 2006, the Company made great strides to deliver near-term production growth and to position itself for future earnings and cash flow growth. Although there were a few challenges, the Company's business units had many successes, as we outline below1 |

North American Natural Gas

This business continued its shift to unconventional natural gas production in the United States (U.S.) Rockies and in the Medicine Hat area.

North American Natural Gas contributed $397 million of operating earnings adjusted for unusual items, down considerably from $636 million in 2005. Weak natural gas prices, lower Western Canada production, increased operating costs, higher exploration expenses and higher depreciation, depletion and amortization were partially offset by higher U.S. Rockies production.

In the U.S. Rockies, 2005 delays in obtaining coal bed methane (CBM) water treatment permits delayed an increase in natural gas production in 2006. In February 2006, approval was obtained of water treatment permits required for wells previously planned in 2005 and 2006, resulting in a ramp up of coal de-watering. Four projects (Wild Turkey, North Shell Draw, Cedar Draw, and Kingsbury) are scheduled to increase CBM production in 2007. The Company continues to drill in the Denver-Julesburg Basin for natural gas from tight sands. The Company expects to double U.S. Rockies production to 100 million cubic feet of natural gas equivalent/day, net by the end of 2007.

This unit also made progress on the longer term strategy of accessing new supplies, including adding acreage in Alaska and advancing the proposed Gros-Cacouna re-gasification project in Quebec.

East Coast Oil contributed $884 million of operating earnings adjusted for unusual items, up 11% from $800 million in 2005. Strong realized prices were partially offset by lower production and increased operating expense. White Rose operated reliably and Hibernia continued to sustain first quartile operations.

Terra Nova had a challenging year when its planned maintenance turnaround was advanced following the mechanical failure of the second of two main power generators. The resulting work extended the 90-day downtime expected for inspections and reliability improvements. Oil production from the Terra Nova field resumed in November. Improving Terra Nova reliability was a key objective of the turnaround. While it is still too early to tell, the Company remains optimistic that Terra Nova can reach reliability levels in the 90% range.

Development drilling in the White Rose field proved promising in 2006, with discoveries made in the west and southwest sections of the field. The Company is gathering and evaluating additional information to determine the size of any additional reserves within these formations.

In April 2006, Petro-Canada and its partners in the Hebron development decided to suspend negotiations with the Government of Newfoundland and Labrador and demobilize the Hebron project team after failing to reach a development agreement with the government. Petro-Canada continues to consider Hebron a quality asset.

Hibernia continued to have solid operations in 2006. In January 2007, the Government of Newfoundland and Labrador rejected the recommendation of the Canada-Newfoundland and Labrador Offshore Petroleum Board to approve the development of the Hibernia Southern Extension, resulting in lower production in 2007.

1 Please see the Legal Notice about Forward-Looking Information accompanying this Circular.

Oil Sands

In 2006, Oil Sands contributed $192 million of operating earnings adjusted for unusual items, up 61% from $119 million in 2005. Higher realized prices and production were partially offset by increased operating costs in 2006.

Petro-Canada advanced the Fort Hills project with a regulatory application to construct and operate the Sturgeon Upgrader, about 40 kilometres northeast of Edmonton.

MacKay River delivered reliability of more than 92% for the year and maintained production by adding a third well pad to offset natural declines. The Company also added in situ oil sands resources with the purchase of additional leases adjacent to MacKay River.

International

International contributed $269 million of operating earnings from continuing operations adjusted for unusual items, down 39% from $442 million in 2005. Lower production, tax adjustments in Northwest Europe, higher exploration, depreciation, depletion and amortization costs, and foreign exchange losses were partially offset by higher realized prices.

Early in 2006, Petro-Canada completed the sale of the Company's producing assets in Syria for net proceeds of $640 million. The sale resulted in a $134 million gain on disposal. Later in the year, the Company completed an agreement to buy a 90% interest in the Ash Shaer and Cherrife natural gas fields in central Syria for $54 million. Under this agreement, Petro-Canada will act as operator and will have the option to buy the remaining 10% interest within five years, subject only to approval by the Syrian government. The changes made in Syria in 2006 align with Petro-Canada's strategy to increase the proportion of long-life and operated assets within its asset portfolio.

In the Netherlands sector of the North Sea, the Company-operated De Ruyter project achieved first oil in September, while L5b-C achieved first natural gas in November within schedule and budget. The two projects are expected to add 13,000 barrels of oil equivalent per day net to Petro-Canada in 2007.

In the United Kingdom (U.K.) sector of the North Sea, the Buzzard project achieved first oil in early 2007, on schedule and budget. The field is expected to ramp up to full production around the middle of 2007.

In September 2006, the Company furthered its balanced exploration program by securing drilling rigs for its 2007 and 2008 well programs.

Downstream

Downstream contributed $430 million of operating earnings adjusted for unusual items, up 2% from $421 million in 2005. Strong reliability at the Edmonton and Montreal refineries allowed Petro-Canada to maximize the benefits of favourable refining margins and a wider light/heavy crude price differential. These benefits were partially offset by the impact of higher operating costs associated with the planned refinery turnarounds in the second quarter, higher energy prices, and one-time expenses incurred due to a fire at the Mississauga lubricants plant.

The Edmonton and Montreal refineries operated at a reliability index of about 95 in 2006. The Company completed its ultra-low sulphur diesel projects at these refineries, thereby providing cleaner burning fuels to consumers.

Early in 2006, a fire at the Mississauga lubricants plant reduced output to 50% of plant capacity for approximately two months. The lubricants plant repairs were completed in March and, in June, the facility began ramping up its 25% expansion.

The Downstream began conversion of the Edmonton refinery to process 100% oil sands feedstock. At year-end 2006, this work was about 18% complete. The Downstream also furthered work to evaluate the feasibility of adding a coker to the Montreal refinery.

Total compensation

In the following tables, Total Direct Compensation means the sum of base salary, cash bonus, equity incentives (PSUs, DSUs and Stock Options), perquisites and all other compensation as presented in the Summary Compensation Table. Total Compensation means Total Direct Compensation plus the annual pension service cost. Please note that the values for the various elements of long-term compensation are theoretical-expected values calculated at the date of grant. Realized values are determined when the incentives are payable to the executive officer. For example, the President and Chief Executive Officer's PSU grant made in 2004 shows a value of $1,170,500 as at grant date but as at December 31, 2006 has a value of zero. As another example, the 2006 stock options reported on these tables had a value of zero at December 31, 2006, based on the share price at that date.

President and Chief Executive Officer

The following table shows 2006, 2005 and 2004 fiscal year Total Compensation as fixed by the Compensation Committee for the President and Chief Executive Officer.

Ron A. Brenneman President and Chief Executive Officer | | 2006 | | 2005 | | 2004 |

| CASH COMPENSATION | | | | | | | | | |

| Base Salary | | $ | 1,198,862 | | $ | 1,140,458 | | $ | 1,066,035 |

| Bonus | | $ | 1,390,000 | | $ | 1,465,000 | | $ | 1,395,000 |

Total Cash Compensation | | $ | 2,588,862 | | $ | 2,605,458 | | $ | 2,461,035 |

| LONG-TERM COMPENSATION | | | | | | | | | |

Special DSUs1 | | $ | 1,314,750 | | $ | 1,708,000 | | $ | 1,183,600 |

PSUs2 | | $ | 1,743,300 | | $ | 1,573,800 | | $ | 1,170,500 |

Stock Options3 | | $ | 2,155,284 | | $ | 1,240,200 | | $ | 1,035,000 |

Total Long-Term Compensation | | $ | 5,213,334 | | $ | 4,522,000 | | $ | 3,389,100 |

Other Annual Compensation4 | | $ | 145,075 | | $ | 132,986 | | $ | 123,035 |

| Total Direct Compensation | | $ | 7,947,271 | | $ | 7,260,444 | | $ | 5,973,170 |

Annual Pension Service Cost5 | | $ | 604,000 | | $ | 505,400 | | $ | 785,000 |

TOTAL | | $ | 8,551,271 | | $ | 7,765,844 | | $ | 6,758,170 |

Other Named Executive Officers

The following table shows 2006 fiscal year Total Compensation fixed by the Compensation Committee for the other Named Executive Officers.

| | | Boris J. Jackman | Peter S. Kallos | E.F.H. Roberts | | Neil J. Camarta |

| CASH COMPENSATION | | | | | | | | | | | | |

| Base Salary | | $ | 637,895 | | £ | 290,010 | | $ | 585,203 | | $ | 425,000 |

| Bonus | | $ | 616,000 | | £ | 225,000 | | $ | 554,000 | | $ | 296,000 |

Total Cash Compensation | | $ | 1,253,895 | | £ | 515,010 | | $ | 1,139,203 | | $ | 721,000 |

| LONG-TERM COMPENSATION | | | | | | | | | | | | |

Special DSUs1 | | $ | 525,900 | | £ | - | | $ | 262,950 | | | - |

PSUs2 | | $ | 484,250 | | £ | 169,734 | | $ | 484,250 | | $ | 338,975 |

Stock Options3 | | $ | 598,700 | | £ | 209,850 | | $ | 598,700 | | $ | 419,100 |

Total Long-Term Compensation | | $ | 1,608,850 | | £ | 379,584 | | $ | 1,345,900 | | $ | 758,075 |

Other Annual Compensation4 | | $ | 35,484 | | £ | 17,617 | | $ | 30,949 | | $ | 22,474 |

| Total Direct Compensation | | $ | 2,898,229 | | £ | 912,211 | | $ | 2,516,052 | | $ | 1,501,549 |

Annual Pension Service Cost5,6 | | $ | 180,000 | | £ | 26,000 | | $ | 149,000 | | $ | 162,000 |

TOTAL | | $ | 3,078,229 | | £ | 938,211 | | $ | 2,665,052 | | $ | 1,663,549 |

1 This represents the portion of total direct compensation that was granted in DSU awards to the executive officers. To Mr. Brenneman: 25,000 units in 2006, 50,000 units in 2005 and 40,000 units in 2004. To Mr. Jackman in 2006: 10,000 units; and to Mr. Roberts in 2006: 5,000 units. The values disclosed are based on the previous five-day average market value of Petro-Canada's common shares from the award date of: $52.59 in 2006, $34.16 in 2005 and $29.59 in 2004. Dividend equivalents are credited on a quarterly basis. This table excludes DSUs acquired through the conversion of annual incentive awards into DSUs.

2 This represents the portion of total direct compensation that was granted in PSU awards to the executive officers. To Mr. Brenneman: 45,000 units in 2006, 60,000 units in 2005 and 50,000 units in 2004. To Mr. Jackman in 2006: 12,500 units; to Mr. Kallos in 2006: 10,000 units; to Mr. Roberts in 2006: 12,500 units; to Mr. Camarta in 2006: 8,750 units. The values disclosed have been calculated using a binomial pricing model based on the previous 20-day average market value of Petro-Canada's common shares from the award date of: $49.66 in 2006, $32.93 in 2005 and $29.39 in 2004. Dividend equivalents are credited on a quarterly basis.

3 This represents the portion of total direct compensation that was granted in stock options to the executive officers. To Mr. Brenneman: 180,000 options in 2006, 180,000 options in 2005 and 150,000 options in 2004. To Mr. Jackman in 2006: 50,000 options; to Mr. Kallos in 2006: 40,000 options; to Mr. Roberts in 2006: 50,000 options; to Mr. Camarta in 2006: 35,000 options. The values disclosed have been calculated using a binomial pricing model based on a grant price of $52.06 in 2006, $34.28 in 2005 and $28.70 in 2004. Awards vest at a rate of 25% per year over a four-year period, starting on the first anniversary of the grant date, and expire after seven years

4 For Messrs. Brenneman, Jackman, Roberts and Camarta, this represents the Company's contributions under the Petro-Canada Capital Accumulation Plan, Health Care Spending Account and Group Life Insurance Plan. For Mr. Brenneman, the amount also includes perquisites and, for Mr. Jackman, imputed interest on a Company loan. For Mr. Kallos, this amount represents contributions under the Petro-Canada Capital Accumulation Plan and premiums paid toward coverage under life insurance, health and dental plans.

5 Annual pension service cost is the value of the projected pension earned for the year of service credited for the specific financial year. For comparability and consistency, this value is determined using the same actuarial assumptions as for determining the year-end pension plan liabilities disclosed in the financial statements, in accordance with Canadian Generally Accepted Accounting Principles.

6 The value of the employee contributions paid by Mr. Kallos to the pension plan is included in the annual pension service cost.

2007 Executive Officer Compensation Highlights

The base salaries of the Company's executive officers will be increased effective April 1, 2007 to reflect competitive practice for similar positions within the comparator groups and the Compensation Committee's assessment of their leadership, performance and contribution to the Company's success. No major changes are expected to be made to the design of the annual incentive program or mid-long-term incentive program for 2007. However, the Company intends to provide stock appreciation rights to international executive officers instead of stock options for any long-term incentive grants made to them.

As part of its due diligence to confirm the linkage between pay and performance, in 2006, the Compensation Committee reviewed the actual amounts paid and accrued to the President and Chief Executive Officer since his appointment against the incremental market capitalization of the Company. The data collected from this review were used to inform the decision-making process for 2006 President and Chief Executive Officer compensation.

This report is submitted by the Management Resources and Compensation Committee.

Claude Fontaine (Chair)

Richard J. Currie

Thomas E. Kierans

James W. Simpson

Brian F. MacNeill (ex-officio member)

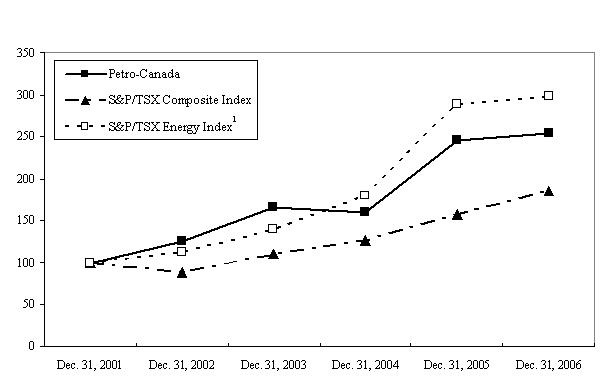

Stock Performance Graph

The following graph charts performance of an investment in the Company's common shares against each of the Standard & Poor's (S&P)/TSX Composite Index and the S&P/TSX Energy Index, assuming an investment of $100 on December 31, 2001, and accumulation and reinvestment of all dividends paid from that date through December 31, 2006.

| Petro-Canada | 100 | 126 | 165 | 160 | 246 | 254 |

| S&P/TSX Composite Index | 100 | 88 | 111 | 127 | 158 | 185 |

S&P/TSX Energy Index1 | 100 | 113 | 139 | 179 | 289 | 298 |

1 No dividends for S&P/TSX Energy Index.

Summary Compensation Table

The following table summarizes, for the periods indicated, the compensation of the Company's President and Chief Executive Officer, the Executive Vice-President and Chief Financial Officer and each of the three most highly compensated executive officers who were serving as executive officers on December 31, 2006. These executive officers are collectively referred to in this Circular as the Named Executive Officers.