Exhibit 99.1

]

For immediate release

December 11, 2008 (publié également en français)

Petro-Canada Lowers Planned 2009 Capital Spending in Response to Current Market Conditions

Highlights

| · | $4.0 billion capital program planned; focus on living within financial means while maintaining access to opportunities |

| · | Long-life growth projects paced to achieve cost reductions |

| · | 2009 upstream production guidance range of 360,000 to 395,000 barrels of oil equivalent per day (boe/d) |

Calgary – Petro-Canada’s Board of Directors approved a capital and exploration expenditure program of up to $4.0 billion for 2009, down significantly compared with the program in 2008. Within this program, there is considerable flexibility to reduce and defer spending if commodity prices remain weak for an extended period of time. The Company intends to monitor commodity and financial markets closely and adjust the program accordingly.

“Petro-Canada is in an excellent position because we are financially conservative, we have diverse operations to generate cash and we can pace our growth projects,” said Ron Brenneman, president and chief executive officer.

The 2009 capital program includes $2.1 billion directed to growth projects, exploration and new venture developments and $1.3 billion to replace reserves in core areas. In addition, Petro-Canada expects to invest $360 million to enhance existing assets and to improve profitability in the base business, and $130 million to comply with new regulations. The 2009 capital expenditure program will be adjusted on an ongoing basis so that it can be funded from cash flow and, if necessary, from available credit facilities.

“We believe we’ve set a prudent level of capital spending for next year, given current market conditions,” said Brenneman. “But we’ll evaluate the business environment and financial markets as the year progresses and adjust our plans accordingly.”

Production for the full year of 2008 is expected to be at the high end of the range of 400,000 boe/d to 420,000 boe/d, in line with previous guidance. In 2009, Petro-Canada’s upstream production is expected to be in the range of 360,000 boe/d to 395,000 boe/d. The expected decrease in production is due to natural declines in Western Canada, East Coast Canada and International, as well as large facility turnarounds in East Coast Canada and International. These turnarounds are being undertaken to enhance production growth in the future and maintain reliable operations. Partially offsetting these decreases are additional volumes from Oil Sands and base business investments, which moderate the natural declines.

“Deferred production from the turnarounds will be back on-stream at year end, giving us an exit rate closer to the high end of our range,” said Brenneman. “The bottom line effect of lower production in 2009 will be offset by cash flow from the Edmonton refinery conversion project, which is just now starting up.”

The Company’s financial capacity and flexibility remain strong despite the recent turmoil in the financial markets. This is due to the Company being able to generate strong cash flow, having access to existing cash balances and significant credit facility capacity, and requiring no near-term refinancing.

“We have always managed our financing conservatively, and it’s paying off in these markets,” said Harry Roberts, executive vice-president and chief financial officer. “We have a very strong cash and liquidity position. Together with our capital flexibility, we're in very good shape to weather the downturn and come out strong on the other side.”

Petro-Canada is one of Canada’s largest oil and gas companies, operating in both the upstream and downstream sectors of the industry in Canada and internationally. The Company creates value by responsibly developing energy resources and providing world class petroleum products and services. Petro-Canada is proud to be a National Partner to the Vancouver 2010 Olympic and Paralympic Winter Games. Petro-Canada’s common shares trade on the Toronto Stock Exchange (TSX) under the symbol PCA and on the New York Stock Exchange (NYSE) under the symbol PCZ.

Petro-Canada will hold a conference call to discuss the 2009 outlook with investors on Thursday, December 11, 2008 at 9:00 a.m. eastern standard time (EST). To participate, please call 1-866-898-9626 (toll-free in North America), 00-800-8989-6323 (toll-free internationally), or 416-340-2216 at 8:55 a.m. Media are invited to listen to the call by dialing 1-866-540-8136 (toll-free in North America) or 416-340-8010. Media are invited to ask questions at the end of the call. A live audio webcast of the conference call will be available on Petro-Canada's website at http://www.petro-canada.ca/en/investors/93.aspx on December 11, 2008 at 9:00 a.m. EST. Those who are unable to listen to the call live may listen to a recording of the call approximately one hour after its completion by calling 1-800-408-3053 (toll-free in North America) or 416-695-5800 (pass code number 3275438#). Approximately one hour after the call, a recording will be available on Petro-Canada’s website.

LEGAL NOTICE – FORWARD-LOOKING INFORMATION

This release contains forward-looking information. You can usually identify this information by such words as "plan," "anticipate," "forecast," "believe," "target," "intend," "expect," "estimate," "budget," or other similar wording suggesting future outcomes or statements about an outlook. Below are examples of references to forward-looking information:

· business strategies and goals · future investment decisions · outlook (including operational updates and strategic milestones) · future capital, exploration and other expenditures · future cash flows · future resource purchases and sales · construction and repair activities · turnarounds at refineries and other facilities · anticipated refining margins · future oil and natural gas production levels and the sources of their growth · project development, and expansion schedules and results · future exploration activities and results, and dates by which certain areas may be developed or may come on-stream | · retail throughputs · pre-production and operating costs · reserves and resources estimates · royalties and taxes payable · production life-of-field estimates · natural gas export capacity · future financing and capital activities (including purchases of Petro-Canada common shares under the Company's normal course issuer bid (NCIB) program) · contingent liabilities (including potential exposure to losses related to retail licensee agreements) · environmental matters · future regulatory approvals · expected rates of return |

Such forward-looking information is subject to known and unknown risks and uncertainties. Other factors may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such factors include, but are not limited to:

· industry capacity · imprecise reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays, and other sources not currently classified as reserves · the effects of weather and climate conditions · the results of exploration and development drilling, and related activities · the ability of suppliers to meet commitments · decisions or approvals from administrative tribunals · risks attendant with domestic and international oil and gas operations · general economic, market and business conditions | · competitive action by other companies · fluctuations in oil and gas prices · refining and marketing margins · the ability to produce and transport crude oil and natural gas to markets · fluctuations in interest rates and foreign currency exchange rates · actions by governmental authorities (including changes in taxes, royalty rates and resource-use strategies) · changes in environmental and other regulations · international political events · nature and scope of actions by stakeholders and/or the general public |

Many of these and other similar factors are beyond the control of Petro-Canada. Petro-Canada discusses these factors in greater detail in filings with the Canadian provincial securities commissions and the United States (U.S.) Securities and Exchange Commission (SEC).

We caution readers that this list of important factors affecting forward-looking information is not exhaustive. Furthermore, the forward-looking information in this release is made as of December 11, 2008 and, except as required by applicable law, Petro-Canada does not update it publicly or revise it. This cautionary statement expressly qualifies the forward-looking information in this release.

Petro-Canada disclosure of reserves

Petro-Canada's qualified reserves evaluators prepare the reserves estimates the Company uses. The Canadian provincial securities commissions do not consider our reserves staff and management as independent of the Company. Petro-Canada has obtained an exemption from certain Canadian reserves disclosure requirements, which allows Petro-Canada to make disclosure in accordance with SEC standards. This exemption allows comparisons with U.S. and other international issuers.

As a result, Petro-Canada formally discloses its reserves data and other oil and gas data using U.S. requirements and practices, and these may differ from Canadian domestic standards and practices. Note that when we use the term barrel of oil equivalent (boe) in this release, it may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet (Mcf) to one barrel (bbl) is based on an energy equivalency conversion method. This method primarily applies at the burner tip and does not represent a value equivalency at the wellhead.

To disclose reserves in SEC filings, oil and gas companies must prove they are economically and legally producible under existing economic and operating conditions. Proof comes from actual production or conclusive formation tests. The use of terms such as "probable," "possible," "recoverable," or "potential reserves and resources" in this release does not meet the SEC guidelines for SEC filings.

The table below describes the industry definitions that we currently use:

| Definitions Petro-Canada uses | Reference |

| Proved oil and gas reserves (includes both proved developed and proved undeveloped) | SEC reserves definition (Accounting Rules Regulation S-X 210.4-10, U.S. Financial Accounting Standards Board (FASB) Statement No. 69) SEC Guide 7 for Oilsands Mining |

| | |

| Unproved reserves, probable and possible reserves | Canadian Securities Administrators: Canadian Oil and Gas Evaluation (COGE) Handbook, Vol. 1 Section 5 prepared by the Society of Petroleum Evaluation Engineers (SPEE) and the Canadian Institute of Mining Metallurgy and Petroleum (CIM) |

| | |

| Contingent and Prospective Resources | Petroleum Resources Management System: Society of Petroleum Engineers, SPEE, World Petroleum Congress and American Association of Petroleum Geologist definitions (approved March 2007) Canadian Securities Administrators: COGE Handbook Vol. 1 Section 5 |

Although the Society of Petroleum Engineers resource classification has categories of 1C, 2C, 3C for Contingent Resources, and low, best and high estimates for Prospective Resources, Petro-Canada will only refer to the 2C for Contingent Resources and the risked (an assessment of the probability of discovering the resources) best estimate for Prospective Resources when referencing resources in this news release. Canadian Oil Sands represents approximately 71% of Petro-Canada’s total for Contingent and Prospective Resources. The balance of Petro-Canada’s resources is spread out across the business, most notably in the North American frontier and International areas. Also, when Petro-Canada references resources for the Company, Contingent Resources are approximately 53% and risked Prospective Resources are approximately 47% of the Company’s total resources.

Cautionary statement: In the case of discovered resources or a subcategory of discovered resources other than reserves, there is no certainty that it will be commercially viable to produce any portion of the resources. In the case of undiscovered resources or a subcategory of undiscovered resources, there is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources.

For movement of resources to reserves categories, all projects must have an economic depletion plan and may require

| · | additional delineation drilling and/or new technology for oil sands mining, in situ and conventional Contingent and risked Prospective Resources prior to project sanction and regulatory approvals; and |

| · | exploration success with respect to conventional risked Prospective Resources prior to project sanction and regulatory approvals. |

Reserves and resources information contained in this news release is as at December 31, 2007.

For more information, please contact:

| INVESTOR AND ANALYST INQUIRIES | MEDIA AND GENERAL INQUIRIES |

| | |

Lisa McMahon Investor Relations 403-296-3764 email: investor@petro-canada.ca | Andrea Ranson Corporate Communications 403-296-4610 email: corpcomm@petro-canada.ca |

| | |

Ken Hall Investor Relations 403-296-7859 email: investor@petro-canada.ca | |

| | |

| www.petro-canada.ca |

OUTLOOK – CAPITAL EXPENDITURES

Long-Term Investment Profile

Petro-Canada’s capital program anticipates a number of major growth projects over the next several years, adding significantly to earnings and cash flow.

Over the past number of years, Petro-Canada has been building a suite of investment opportunities to add significantly to earnings and cash flow going forward. Most of these opportunities are long-life projects with plateau production for 10 years or more.

Currently three major projects hae been sanctioned.

| Major Sanctioned Project | Capital Cost Estimate | Target On-Stream Date | Target First Full Year Date |

| | (millions of Canadian dollars) | | |

| White Rose Extensions | 700 | 2009 | 2011 |

| Syria Ebla Gas Development | 1,000 | 2010 | 2011 |

Libya EPSAs 1 Development 2 | 4,500 | 2009 | 2013 - 2015 |

| 1 | Exploration and Production Sharing Agreements (EPSAs). |

| 2 | The Libya capital cost estimate includes the $1 billion signature bonus but excludes approximately $500 million of exploration commitments. |

In addition, there are three major projects that have not been sanctioned (Fort Hills, MacKay River expansion and the Montreal coker), allowing the Company to take advantage of the softening environment to reduce project costs and pace the projects as necessary.

Lower capital spending contemplated for 2009 is consistent with the Company’s strategy to be financially conservative, with the priority of investing in attractive projects to create shareholder value. The Company’s financial capacity and flexibility remain strong despite the recent turmoil in the financial markets. This is due to the Company being able to generate strong cash flow, having access to existing cash balances and significant credit facility capacity, and requiring no near-term refinancing. For 2009, the Company expects to cover its capital program with cash flow and, if necessary, from available credit facilities. The Company will monitor energy and financial markets through the year and take advantage of the flexibility to pace projects to adjust capital expenditures accordingly.

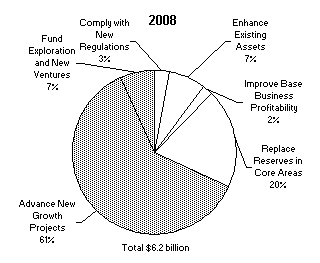

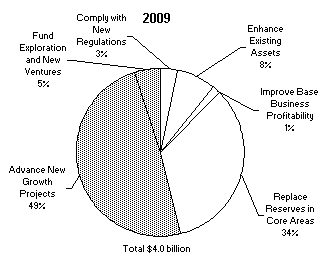

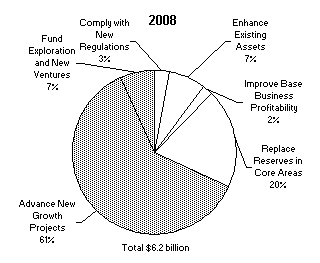

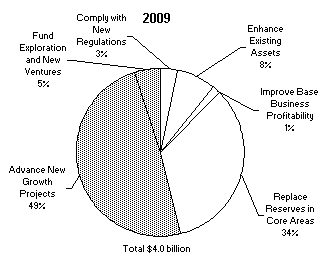

Capital Expenditures by Priorities

In 2009, spending on new growth projects is expected to decrease, while spending on replacing reserves in core areas is expected to increase. Approximately 54% of planned capital expenditures support delivering profitable new growth and funding new ventures exploration. This is down by $2.1 billion, compared with the same categories in 2008. Approximately 34% of planned capital expenditures will be directed toward replacing reserves in core areas, an increase of $130 million compared with 2008. The remaining 12% of the 2009 planned capital expenditures is directed toward enhancing existing assets, improving base business profitability and complying with new regulations.

[  ] | [  ] |

Capital Investment Priorities (millions of Canadian dollars) | 2008 Outlook As at July 24, 2008 | | 2009 Outlook As at Dec. 11, 2008 | | 2009 Highlights |

| Comply with new regulations | $ | 190 | | $ | 130 | | Spending on regulatory projects at Downstream facilities and investment at Syncrude to reduce sulphur emissions |

| Enhance existing assets | | 435 | | | 300 | | Improving reliability at Downstream, Oil Sands and North American Natural Gas facilities |

| Improve base business profitability | | 135 | | | 60 | | Developing the retail/wholesale marketing networks and increasing refinery yield |

| Replace reserves in core areas | | 1,210 | | | 1,340 | | Investing for immediate impact across the four upstream businesses |

| Advance new growth projects | | 3,770 | | | 1,935 | | Investing in medium-term growth projects, such as developing the Ebla gas project in Syria and the Libya EPSAs, and advancing the MacKay River expansion, the delayed Fort Hills project and the potential coker at the Montreal refinery |

| Fund exploration and new ventures for long-term growth | | 415 | | | 195 | | Investing in exploration activity in East Coast Canada, International and Alaska |

| Total | $ | 6,155 | | $ | 3,960 | | |

Capital Expenditures by Business

Spending reflects quality investment opportunities in the upstream and downstream sectors. In 2009, Petro-Canada plans to direct funds to Oil Sands to advance the MacKay River expansion project and the Fort Hills project, to East Coast Canada to develop the White Rose extensions, and to International to develop the Libya EPSAs, to advance the Ebla gas project in Syria and to invest in a balanced exploration program. In the Downstream, the Company plans to direct funds to advance the potential Montreal coker.

| Capital Investment by Business Unit | 2008 Outlook | | 2009 Outlook | |

| (millions of Canadian dollars) | As at July 24, 2008 | | As at December 11, 2008 | |

| Upstream | | | | |

| North American Natural Gas | | | | |

| Western Canada | $ | 390 | | $ | 320 | |

| U.S. Rockies | | 175 | | | 220 | |

| North of 60 | | 55 | | | 40 | |

| Oil Sands | | | | | | |

| Fort Hills | | 1,065 | | | 350 | |

| MacKay River | | 260 | | | 440 | |

| Syncrude | | 80 | | | 145 | |

| Other leases | | 15 | | | 50 | |

| International & Offshore | | | | | | |

| East Coast Canada | | 335 | | | 530 | |

| International | | | | | | |

| North Sea | | 315 | | | 525 | |

| Libya/Syria | | 1,380 | | | 710 | |

| Trinidad and Tobago | | 345 | | | 35 | |

| | | 4,415 | | | 3,365 | |

| Downstream | | | | | | |

| Refining and Supply | | 1,520 | | | 460 | |

| Sales and Marketing | | 160 | | | 70 | |

| Lubricants | | 25 | | | 30 | |

| | | 1,705 | | | 560 | |

| Shared Services | | 35 | | | 35 | |

| Total | $ | 6,155 | | $ | 3,960 | |

OUTLOOK – CONSOLIDATED PRODUCTION

Upstream production for 2009 is expected to be down approximately 10% from 2008, primarily due to natural declines in Western Canada, East Coast Canada and International, as well as large facility turnarounds in East Coast Canada and International. These turnarounds are being undertaken to enhance production growth in the future and maintain reliable operations. Partially offsetting these decreases are additional volumes from Oil Sands and base business investments, which moderate the natural declines. Production is expected to average in the range of 360,000 boe/d to 395,000 boe/d in 2009. With deferred production from turnarounds back on-stream at the end of 2009, the exit rate is expected to be closer to the high end of the range.

Factors that may impact production during 2009 include reservoir performance, drilling results, facility reliability and the successful execution of planned turnarounds.

| | 2008 Outlook (+/-) | | 2009 Outlook (+/-) | |

| (thousands of boe/d) | As at July 24, 2008 | | As at December 11, 2008 | |

| North American Natural Gas | | | | |

| Natural gas | | 94 | | | 84 | |

| Liquids | | 12 | | | 14 | |

| Oil Sands | | | | | | |

| Syncrude | | 35 | | | 38 | |

| MacKay River | | 25 | | | 27 | |

| International & Offshore | | | | | | |

| East Coast Canada | | 87 | | | 68 | |

| International | | | | | | |

| North Sea | | 94 | | | 85 | |

| Other International | | 58 | | | 59 | |

| Total | | 400 – 420 | | | 360 – 395 | |

North American Natural Gas

Lower capital spending is expected to result in production declines of around 8%. The business is shifting away from conventional exploration in Western Canada, with a greater focus on shale gas and U.S. Rockies in the short term and North of 60 in the long term.

The planned capital program for North American Natural Gas is approximately $580 million in 2009. Investment to replace core reserves is expected to be approximately $320 million. Investment in unconventional growth opportunities in the U.S. Rockies is estimated to be $180 million. Spending to enhance existing assets, comply with regulations and improve base business profitability is expected to be $40 million for 2009. Exploration and new venture investments of approximately $40 million are expected to be spent to develop longer term supply opportunities in the frontier area of Alaska. The Company plans to test some of its frontier exploration prospects by participating in three exploration wells in the Alaska Foothills in 2009.

North American Natural Gas production is expected to decline by approximately 8% to 98,000 boe/d in 2009, compared with estimated production of 106,000 boe/d in 2008, due to declines in conventional production in Western Canada. These declines are forecast to be partially offset by increased U.S. Rockies volumes due to a small acquisition of oil production and exploration land located in Colorado’s Denver-Julesburg (DJ) Basin.

Oil Sands

Decreased capital spending in 2009 reflects the delayed Fort Hills project, partially offset by the increased spending on the MacKay River expansion.

A capital program of about $985 million is planned for Oil Sands in 2009. Capital for new growth opportunities of approximately $745 million reflects increased spending for the MacKay River expansion and decreased spending for the delayed Fort Hills project, as compared with 2008. The time frame for making the final investment decision for the Fort Hills mine project has been extended to sometime in 2009 to pursue cost reduction opportunities. Spending to enhance existing operations and to comply with regulations at Syncrude is budgeted to be $145 million. Investments to enhance existing operations at MacKay River are expected to be approximately $65 million. An investment of $30 million is planned to replace reserves through ongoing pad development at MacKay River.

In 2009, production from Oil Sands is expected to be 65,000 barrels/day (b/d), compared with estimated production of 60,000 b/d in 2008. Higher expected production in 2009 is due to higher volumes anticipated at Syncrude and MacKay River. Syncrude’s production takes into account a planned 45-day Coker 8-3 turnaround in the spring of 2009.

International & Offshore

East Coast Canada

Lower production planned for 2009 reflects anticipated natural declines and large facility turnarounds, while capital spending increases for future developments.

The planned capital program in 2009 for East Coast Canada will be about $530 million. Capital in 2009 is forecast to be spent primarily on advancing the White Rose extensions and drilling to replace reserves at Hibernia, Terra Nova and White Rose.

East Coast Canada production is expected to be 68,000 b/d in 2009, compared with an estimate of 87,000 b/d in 2008. The 2009 production estimate reflects natural declines and turnarounds at Terra Nova, Hibernia and White Rose. In 2009, Terra Nova and Hibernia have planned maintenance turnarounds of 28 and 21 days, respectively. White Rose has a planned 28-day maintenance turnaround, which is concurrent with a 101-day shutdown of the south drill centre to tie-in the White Rose extensions. The operator continues to work at reducing the total shutdown time for the south drill centre. These maintenance turnarounds are intended to enhance production growth in the future and maintain reliable operations.

International

International is delivering a strong base of high margin production in the North Sea, while managing a portfolio of future growth opportunities from discovered resources in the North Sea, Libya, Syria and Trinidad and Tobago.

In 2009, a capital budget of approximately $1,270 million is planned for International. Investment to replace reserves in core areas is expected to be approximately $470 million, primarily for ongoing development drilling at Buzzard, Guillemot West, Saxon and on the producing fields in Trinidad and Tobago. About $670 million will be invested in new growth projects, with a focus on advancing the Ebla gas project in Syria and developing the Libya EPSAs. It is expected that approximately $130 million will be allocated to exploration and new ventures.

Production from the International business is expected to decrease to 144,000 boe/d in 2009, compared with estimated production of 152,000 boe/d in 2008. The decrease in production in 2009 reflects natural declines in several fields, as well as a planned maintenance turnaround of 28 days at Buzzard that will include tie-in of the fourth platform to treat higher than expected hydrogen sulphide content in some wells. Buzzard production will also be impacted for a 14-day period due to maintenance work on the Forties Pipeline system.

Exploration Summary

Petro-Canada’s 2009 exploration program is significant and reflects the Company’s success in building a sizable, balanced portfolio of prospects.

| (millions of Canadian dollars) | | 2009 Exploration and New Ventures Spending | | | 2009 General and Administrative, Geological and Geophysical (including seismic) Exploration Expenses | | | Total 1 | |

| International, East Coast Canada and Alaska | | $ | 195 | | | $ | 235 | | | $ | 430 | |

| 1 | The total exploration budget is comprised of capital investments for exploration and new ventures spending, plus general and administrative, and geological and geophysical (including seismic) exploration expenses. |

Petro-Canada’s exploration budget of $430 million includes exploration and new ventures spending for International, East Coast Canada and Alaska. Spending of about $195 million includes an expected program of up to 12 wells focused in the North Sea, Libya, East Coast Canada and the Alaska Foothills. The majority of the estimated exploration expense of $235 million relates to a planned seismic program and related expenses in Libya.

Downstream

Capital investment is focused on growth and improving base business profitability.

A capital program of about $560 million for the Downstream is planned in 2009. The majority of capital spending is forecast for new growth project funding of $325 million. This capital will be directed toward advancing the potential 25,000 b/d Montreal coker and additional reliability items associated with the Edmonton refinery conversion project. Approximately $105 million is forecast to be directed to the enhancement of existing operations. This includes reliability and safety improvements at Downstream facilities, as well as site enhancement within the retail and wholesale networks. A further $60 million is planned to be invested to improve the profitability of the Downstream’s base business. This includes continued development of the retail and wholesale networks and a number of refinery improvement projects. Approximately $70 million is planned for regulatory compliance and safety upgrade programs.

In 2009, turnaround and maintenance activities are planned at all three Downstream production facilities. As with all planned Downstream turnarounds, supply arrangements will be made to meet market demand during these outages.

Conference Call Details

Petro-Canada will hold a conference call to discuss the 2009 outlook with investors on Thursday, December 11, 2008 at 9:00 a.m. eastern standard time (EST). To participate, please call 1-866-898-9626 (toll-free in North America), 00-800-8989-6323 (toll-free internationally), or 416-340-2216 at 8:55 a.m. Media are invited to listen to the call by dialing 1-866-540-8136 (toll-free in North America) or 416-340-8010. Media are invited to ask questions at the end of the call. A live audio webcast of the conference call will be available on Petro-Canada's website at http://www.petro-canada.ca/en/investors/93.aspx on December 11, 2008 at 9:00 a.m. EST. Those who are unable to listen to the call live may listen to a recording of the call approximately one hour after its completion by calling 1-800-408-3053 (toll-free in North America) or 416-695-5800 (pass code number 3275438#). Approximately one hour after the call, a recording will be available on Petro-Canada’s website.

]

] ]

] ]

]