Exhibit 99.5

Premium Nickel Resources Corporation

UNAUDITED CONDENSED INTERIM Consolidated Financial Statements

For the quarter ended June 30, 2022

(Stated in Canadian dollars, unless otherwise indicated)

INDEX

Unaudited Condensed Interim Consolidated Financial Statements

| § | Condensed Interim Consolidated Statements of Financial Position |

| § | Condensed Interim Consolidated Statements of Comprehensive Loss |

| § | Condensed Interim Consolidated Statements of Changes in Shareholders’ Deficiency |

| § | Condensed Interim Consolidated Statements of Cash Flows |

| § | Notes to the Condensed Interim Consolidated Financial Statements |

1 | Premium Nickel Resources / Q2 2022

Notice to reader of the unaudited CONDENSED interim CONSOLIDATED financial statements

For the six months period ended June 30, 2022

In accordance with National Instrument 51-102, of the Canadian Securities Administrators, Premium Nickel Resources Corporation. (the “Company” or “PNR”) discloses that its auditors have not reviewed the unaudited condensed interim consolidated interim financial statements.

The unaudited condensed interim consolidated financial statements of the Company for the six months period ended June 30, 2022 (“Financial Statements”) have been prepared by management. The Financial Statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto of the Company for the fiscal year ended December 31, 2021, which are included in the Form 3D2 (Information Required in a Filing Statement for a Reverse Takeover or Change of Business) (the “Filing Statement”) prepared in accordance with the policies of the TSXV. A copy of the Filing Statement is available electronically on SEDAR (www.sedar.com) under the name, Premium Nickel Resources Ltd. The Financial Statements are stated in Canadian dollars, unless otherwise indicated, and are prepared in accordance with International Financial Reporting Standards (“IFRS”).

2 | Premium Nickel Resources / Q2 2022

Condensed Interim Consolidated Statements of Financial Position

(Expressed in Canadian dollars, unaudited)

| | | Notes | | | As at June 30,

2022 | | | As at December

31, 2021 | |

| ASSETS | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | |

| Cash | | | | | | | 2,740,881 | | | | 1,990,203 | |

| Prepaid expenses | | | | | | | 211,314 | | | | 8,664 | |

| Other receivables | | | 4 | | | | 1,060,536 | | | | 139,630 | |

| TOTAL CURRENT ASSETS | | | | | | | 4,012,731 | | | | 2,138,497 | |

| | | | | | | | | | | | | |

| NON-CURRENT ASSETS | | | | | | | | | | | | |

| Exploration and evaluation assets | | | 5 | | | | 20,382,516 | | | | 3,099,926 | |

| Property, plant and equipment | | | 6 | | | | 266,112 | | | | - | |

| TOTAL NON-CURRENT ASSETS | | | | | | | 20,648,628 | | | | 3,099,926 | |

| TOTAL ASSETS | | | | | | | 24,661,359 | | | | 5,238,423 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | |

| Trade payables and accrued liabilities | | | 7 | | | | 3,043,976 | | | | 580,486 | |

| TOTAL CURRENT LIABILITIES | | | | | | | 3,043,976 | | | | 580,486 | |

| | | | | | | | | | | | | |

| NON-CURRENT LIABILITIES | | | | | | | | | | | | |

| Vehicle financing | | | | | | | 135,289 | | | | - | |

| Financial liability – warrant | | | 8 | | | | 28,275,256 | | | | 8,974,901 | |

| TOTAL NON-CURRENT LIABILITIES | | | | | | | 28,410,545 | | | | 8,974,901 | |

| TOTAL LIABILITIES | | | | | | | 31,454,521 | | | | 9,555,387 | |

| | | | | | | | | | | | | |

| SHAREHOLDERS’ DEFICIENCY | | | | | | | | | | | | |

| Share capital | | | 8 | | | | 28,389,799 | | | | 7,952,675 | |

| Reserve | | | | | | | 3,854,986 | | | | 1,261,891 | |

| Deficit | | | | | | | (37,717,684 | ) | | | (13,482,624 | ) |

| Foreign currency translation reserve | | | | | | | (1,320,263 | ) | | | (48,906 | ) |

| TOTAL SHAREHOLDERS’ DEFICIENCY | | | | | | | (6,793,162 | ) | | | (4,316,964 | ) |

| TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIENCY | | | | | | | 24,661,359 | | | | 5,238,423 | |

Nature of Operations and Going Concern (Note 1)

Subsequent Events (Note 12)

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Approved by the Board of Directors on October 06, 2022

"signed" Keith Morrison Chief Executive Officer | "signed" John Hick Audit Committee Chair |

3 | Premium Nickel Resources / Q2 2022

Condensed Interim Consolidated Statements of Comprehensive Loss

(Expressed in Canadian dollars, unaudited)

| | | | | | Three months ended | | | Six months ended | |

| | | Notes | | | June 30,

2022 | | | June 30,

2021 | | | June 30,

2022 | | | June 30,

2021 | |

| EXPENSES | | | | | | | | | | | | | | | | | | | | |

| Corporate and administration expenses | | | | | | | (615,200 | ) | | | (97,033 | ) | | | (833,353 | ) | | | (168,311 | ) |

| Management fees | | | 9 | | | | (576,332 | ) | | | (212,728 | ) | | | (1,075,306 | ) | | | (263,451 | ) |

| Due diligence BCL | | | | | | | 762 | | | | 80,715 | | | | (4,035 | ) | | | (54,363 | ) |

| Advisory and consultancy | | | | | | | (302,259 | ) | | | (16,111 | ) | | | (494,026 | ) | | | (41,311 | ) |

| Interest and bank charges | | | | | | | (7,086 | ) | | | (1,742 | ) | | | (8,549 | ) | | | (1,742 | ) |

| Share-based payment | | | 8 | | | | - | | | | - | | | | (2,593,095 | ) | | | (761,480 | ) |

| Warrant fair value movement | | | 8 | | | | 411,943 | | | | - | | | | (19,300,354 | ) | | | - | |

| Net foreign exchange gain (loss) | | | | | | | 169,977 | | | | (2,272 | ) | | | 160,792 | | | | (3,248 | ) |

| | | | | | | | (918,195 | ) | | | (249,171 | ) | | | (24,147,926 | ) | | | (1,293,906 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER ITEMS | | | | | | | | | | | | | | | | | | | | |

| Interest income (expenses) and other income | | | | | | | (87,134 | ) | | | 251 | | | | (87,134 | ) | | | 251 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET LOSS FOR THE PERIOD | | | | | | | (1,005,329 | ) | | | (248,920 | ) | | | (24,235,060 | ) | | | (1,293,655 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE LOSS | | | | | | | | | | | | | | | | | | | | |

| Exchange differences on translation of foreign operations | | | | | | | (852,062 | ) | | | (1,538 | ) | | | (1,271,357 | ) | | | (1,538 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL COMPREHENSIVE LOSS FOR THE PERIOD | | | | | | | (1,857,391 | ) | | | (250,458 | ) | | | (25,506,417 | ) | | | (1,295,193 | ) |

| Weighted average number of common shares outstanding | | | | | | | 85,215,054 | | | | 73,522,041 | | | | 80,708,849 | | | | 64,817,597 | |

| Basic and diluted loss per share | | | | | | | (0.02 | ) | | | (0.00 | ) | | | (0.32 | ) | | | (0.02 | ) |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

4 | Premium Nickel Resources / Q2 2022

Condensed Interim Consolidated Statements of Changes in Shareholders’ Deficiency

(Expressed in Canadian dollars, unaudited)

| | | Notes | | | Number of

Shares | | | Share

Capital | | | Reserve | | | Deficit | | | Foreign

Currency

Translation

Reserve | | | Total

Shareholders’

Deficiency | |

| BALANCE AS AT DECEMBER 31, 2020 | | | 8 | | | | 64,083,487 | | | | 1,468,174 | | | | - | | | | (4,123,019 | ) | | | - | | | | (2,654,845 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Loss for the period | | | | | | | - | | | | - | | | | - | | | | (1,293,655 | ) | | | - | | | | (1,293,655 | ) |

| Share capital issued through private placement | | | | | | | 9,188,554 | | | | 3,771,172 | | | | - | | | | - | | | | | | | | 3,771,172 | |

| Share issue costs | | | | | | | | | | | (262,160 | ) | | | - | | | | - | | | | | | | | (262,160 | ) |

| Share-based payment | | | | | | | | | | | | | | | 761,480 | | | | | | | | | | | | 761,480 | |

| Exchange differences on translation of foreign operations | | | | | | | | | | | | | | | | | | | | | | | (1,538 | ) | | | (1,538 | ) |

| BALANCE AS AT JUNE 30, 2021 | | | | | | | 73,272,041 | | | | 4,977,186 | | | | 761,480 | | | | (5,416,674 | ) | | | (1,538 | ) | | | (320,454 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE AS AT DECEMBER 31, 2021 | | | 8 | | | | 76,679,908 | | | | 7,952,675 | | | | 1,261,891 | | | | (13,482,624 | ) | | | (48,906 | ) | | | (4,316,964 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Loss for the period | | | | | | | - | | | | | | | | | | | | (24,235,060 | ) | | | | | | | (24,235,060 | ) |

| Share capital issued through private placement | | | | | | | 8,936,167 | | | | 22,388,599 | | | | | | | | | | | | | | | | 22,388,599 | |

| Share issue costs | | | | | | | - | | | | (1,951,475 | ) | | | | | | | | | | | | | | | (1,951,475 | ) |

| Share-based payment | | | | | | | | | | | | | | | 2,593,095 | | | | | | | | | | | | 2,593,095 | |

| Exchange differences on translation of foreign operations | | | | | | | | | | | | | | | | | | | | | | | (1,271,357 | ) | | | (1,271,357 | ) |

| BALANCE AS AT JUNE 30, 2022 | | | 8 | | | | 85,616,075 | | | | 28,389,799 | | | | 3,854,986 | | | | (37,717,684 | ) | | | (1,320,263 | ) | | | (6,793,162 | ) |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

5 | Premium Nickel Resources / Q2 2022

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian dollars, unaudited)

| | | Period ended | | | Period ended | |

| | | June 30,

2022 | | | June 30,

2021 | |

| OPERATING ACTIVITIES | | | | | | | | |

| Net loss for the period | | | (24,235,060 | ) | | | (1,293,655 | ) |

| Items not affecting cash: | | | | | | | | |

| Share-based payment | | | 2,593,095 | | | | 761,480 | |

| Warrant fair value movement | | | 19,300,354 | | | | - | |

| Unrealized foreign exchange loss | | | (1,271,357 | ) | | | (1,538 | ) |

| Changes in working capital | | | | | | | | |

| Prepaid expenses and other receivables | | | (1,123,555 | ) | | | (113,457 | ) |

| Trade payables and accrued expenses | | | 2,463,490 | | | | 327,575 | |

| Other loan payable | | | 135,289 | | | | - | |

| Net cash used in operating activities | | | (2,137,744 | ) | | | (319,595 | ) |

| | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | |

| Property, plant and equipment | | | (266,112 | ) | | | - | |

| Expenditures on exploration and evaluation assets | | | (17,282,590 | ) | | | (1,351,100 | ) |

| Net cash used in investing activities | | | (17,548,702 | ) | | | (1,351,100 | ) |

| | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | |

| Proceeds from issuance of common shares | | | 22,388,599 | | | | 3,771,172 | |

| Direct financing costs | | | (1,951,475 | ) | | | (287,228 | ) |

| Proceeds from issuance of promissory notes and vehicle financing | | | - | | | | - | |

| Net cash provided by financing activities | | | 20,437,124 | | | | 3,483,944 | |

| | | | | | | | | |

| Change in cash for the period | | | 750,678 | | | | 1,813,249 | |

| Cash, beginning of the period | | | 1,990,203 | | | | 108,853 | |

| Cash at the end of the period | | | 2,740,881 | | | | 1,922,102 | |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

6 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

1. NATURE OF OPERATIONS AND GOING CONCERN

Premium Nickel Resources Corporation (the “Company” or “PNR”) was incorporated on November 26, 2018, under the laws of the Province of Ontario, Canada. The head office and principal address is located at 130 Spadina Avenue, Suite 40, Toronto, Ontario M5V 2L4.

PNR is a private Canadian company organized to evaluate, acquire, improve and reopen, assuming economic feasibility, a combination of certain assets of BCL Limited (“BCL”) and Tati Nickel Mining Company (“TNMC”) that are currently in liquidation. The founders of the Company include North American Nickel Inc. (“NAN”), a public Canadian nickel exploration and development company, several resource investors and local Namibian and Botswana mine operators.

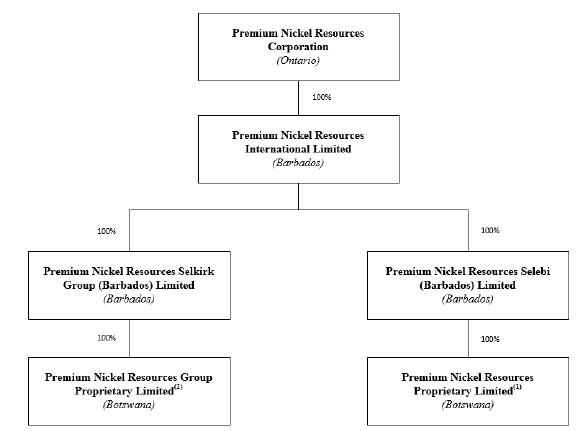

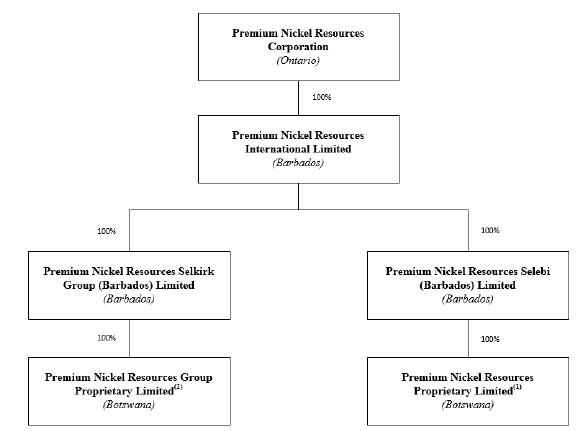

PNR has five subsidiaries, Premium Nickel Resources International Limited (Barbados), Premium Nickel Resources Selkirk Group Limited (Barbados), Premium Nickel Resources Selebi Limited (Barbados), Premium Nickel Resources Proprietary Limited (Botswana) and Premium Nickel Resources Group Proprietary Limited (Botswana). As of June 30, 2022, the corporate structure of PNR is set forth in the chart below:

(1)(2)Premium Nickel Resources Proprietary Limited and Premium Nickel Resources Group Proprietary Limited, are private companies registered in Botswana, dedicated to this asset acquisition activity.

The Company submitted its indicative offer to the BCL and TNMC Liquidators in June 2020 to acquire assets of the former-producing BCL Mining Complex and TNMC operations located in north-eastern Botswana. On February 10, 2021, PNR was selected as the preferred bidder and on March 22, 2021, PNR entered into a Memorandum of Understanding (“MOU”) providing for a six-month exclusivity period to complete additional work and negotiate the asset purchase agreements.

On September 28, 2021, the Company executed a definitive asset purchase agreement (“APA”) with the Liquidator of BCL to acquire the Selebi and Selebi North (together, the “Selebi Assets”) nickel-copper-cobalt ("Ni-Cu-Co") deposits and related infrastructure formerly operated by BCL. The due diligence process was completed within 120 days upon signing the APA. On February 10, 2022, the Company closed the transaction and ownership of the assets has been transferred to the Company. PNR is also negotiating a separate asset purchase agreement to finalize terms for any prioritized TNMC assets that may be purchased.

7 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

On February 17, 2022, the Company announced that it executed a non-binding letter of intent ("Non-Binding LOI") with North American Nickel Inc. (“NAN”) which outlined the proposed terms and conditions of a "reverse takeover" (RTO) (under the policies of the TSX Venture Exchange (the "Exchange")) of NAN by PNR, through a triangular amalgamation involving a wholly owned subsidiary of NAN, as a result of which the wholly owned subsidiary of NAN (“NAN Subco”) would amalgamate with PNR to form one corporation, all as more specifically to be provided in a definitive agreement to be entered into between NAN and PNR.

The Company continues to monitor the global COVID-19 developments and is committed to working with health and safety as a priority and in full respect of all government and local COVID-19 protocol requirements. PNR has developed COVID-19 travel, living and working protocols and is ensuring integration of those protocols with the currently applicable protocols of the Government of Botswana and surrounding communities.

Going Concern

The Company, being in the exploration stage, is subject to risks and challenges similar to companies in a comparable stage of development. These risks include the challenges of securing adequate capital for exploration, development and operational risks inherent in the mining industry, global economic and metal price volatility and there is no assurance management will be successful in its endeavours. As at June 30, 2022, the Company had no source of operating cash flows, nor any credit line currently in place. The Company incurred a net loss of $24,647,003 for the six months ended June 30, 2022 ($532,175 for the six months ended June 30, 2021). The Company’s committed cash obligations and expected level of expenses will vary depending on its operations.

These condensed interim consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning it will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations. The ability of the Company to continue operations as a going concern is ultimately dependent upon achieving profitable operations and its ability to raise additional capital. To date, the Company has not generated profitable operations from its resource activities and will need to invest additional funds in carrying out its planned exploration, development and operational activities. These uncertainties cast substantial doubt about the Company’s ability to continue as a going concern. These condensed interim consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company’s continuance as a going concern is also dependent upon its ability to obtain adequate financing. It is not possible to predict whether financing efforts will be successful or if the Company will attain a profitable level of operation. These material uncertainties cast significant doubt on the Company’s ability to continue as a going concern. These condensed interim consolidated financial statements do not include any adjustments to the carrying values of assets and liabilities and the reported expenses and condensed interim consolidated statement of comprehensive loss classification that would be necessary should the Company be unable to continue as a going concern. These adjustments could be material.

The evaluation properties in which the Company currently has an interest are in pre-revenue exploration stage. As such, the Company is dependent on external financing to fund its activities. In order to carry out the planned due diligence, exploration and cover administrative costs, the Company will use its existing working capital and raise additional amounts as needed. Although the Company has been successful in its past fundraising activities, there is no assurance as to the success of future fundraising efforts or as to the sufficiency of funds raised in the future. The Company will continue to assess new properties and seek to acquire interests in additional properties if there is sufficient geologic or economic potential and if adequate financial resources are available to do so.

8 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

The condensed interim consolidated financial statements were approved and authorized for issuance by the Board of Directors of the Company on October 6, 2022. The discussion in notes to the condensed interim consolidated financial statements is stated in Canadian dollars.

| 2. | BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Statement of Compliance |

These condensed interim consolidated financial statements were prepared in accordance with International Accounting Standards (“IAS 34”), Interim Financial Reporting, utilizing the accounting policies of the Company outlined in its December 31, 2021 annual consolidated financial statements. The accounting policies are in line with International Financial Reporting Standards (IFRS) guidelines. These condensed interim consolidated financial statements do not include all the information and disclosures required in the annual consolidated financial statements and therefore should be read in conjunction with the Company’s annual consolidated financial statements.

These condensed interim consolidated financial statements have been prepared under the historical cost convention, modified by the revaluation of any financial assets and financial liabilities where applicable. The preparation of condensed interim consolidated financial statements in conformity with IAS 34 requires the use of certain critical accounting estimates. It also requires management to exercise judgment in the process of applying the Company’s accounting policies. These areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the condensed interim consolidated financial statements, are disclosed in note 3.

| (c) | Basis of consolidation |

These consolidated financial statements include the financial statements of the Company and its wholly owned subsidiaries; Premium Nickel Resources International (Barbados), Premium Nickel Resources Selkirk Group (Barbados), Premium Nickel Resources Selebi (Barbados), which were incorporated in Barbados on November 12, 2021 as well as Premium Nickel Resources Proprietary (Botswana) and Premium Nickel Resources Group Proprietary (Botswana), which were incorporated in Botswana on September 19, 2019 and August 25, 2021, respectively

Consolidation is required when the Company is exposed or has rights to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. All intercompany transactions, balances, income and expenses are eliminated upon consolidation.

| 3. | CRITICAL ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS |

The preparation of the condensed interim consolidated financial statements in accordance with International Financial Reporting Accounting Standards (“IFRSIAS 34”) requires management to make judgments, estimates and assumptions that can affect reported amounts of assets, liabilities, revenue and expenses and the accompanying disclosures. Estimates and assumptions are continuously evaluated and are based on management's historical experience and on other assumptions believed to be reasonable under the circumstances. However, different judgments, estimates and assumptions could result in outcomes that require a material adjustment to the carrying amount of assets or liabilities affected in future periods.

The area involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the condensed interim consolidated financial statements is:

9 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

Going Concern

Condensed interim consolidated financial statements are prepared on a going concern basis unless management either intends to liquidate the Company or has no realistic alternative to do so. Assessment of the Company’s ability to continue as a going concern requires the consideration of all available information about the future, which is at least, but not limited to, twelve months from the end of the reporting period. This information includes estimates of future cash flows and other factors, the outcome of which is uncertain. When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast substantial doubt upon the Company’s ability to continue as a going concern those uncertainties are disclosed.

A summary of the receivables and other current assets as at June 30, 2022 and December 31, 2021 is detailed in the table below:

| | | June 30,

2022 | | | December 31, 2021 | |

| HST paid on purchase | | | 315,218 | | | | 84,563 | |

| VAT paid on purchases | | | 733,603 | | | | 55,067 | |

| Other receivables | | | 11,715 | | | | - | |

| | | | 1,060,536 | | | | 139,630 | |

| 5. | EXPLORATION AND EVALUATION ASSETS |

| | | Botswana | |

| | | Selebi | |

| Acquisition | | | | |

| Balance, December 31, 2021 | | | - | |

| Acquisition costs | | | 8,527,376 | |

| Balance, June 30, 2022 | | | 8,527,376 | |

| | | | | |

| Exploration | | | | |

| Balance, December 31, 2021 | | | 3,099,926 | |

| Care and maintenance cost | | | 3,257,343 | |

| Drilling and exploration | | | 5,497,871 | |

| Balance, June 30, 2022 | | | 11,855,140 | |

| | | | | |

| Total, June 30, 2022 | | | 20,382,516 | |

| | | | | |

| Total, December 31, 2021 | | | 3,099,926 | |

The following is a description of the Company’s exploration and evaluation assets and the related spending commitments:

Selebi Assets

On September 28, 2021, the Company executed an APA with the BCL Liquidator to acquire the Selebi assets and related infrastructure formerly operated by BCL. On January 31, 2022, the Company closed the transaction and ownership of the Selebi Assets transferred to the Company.

PNR also negotiated a separate asset purchase agreement with the Liquidator of TNMC to acquire the Selkirk deposit and related infrastructure formerly operated by TNMC on January 19, 2022.

As per the APA of the Selebi Assets, the aggregate purchase price payable to the seller shall be the sum of US$56,750,000 which amount shall be paid in three instalments:

| · | US$1,750,000 payable on the closing date. This payment has been made. |

| · | US$25,000,000 upon which is earlier: a) approval by the Ministry of Mineral Resources, Green Technology and Energy Security “MMRGTES” of the Company’s Section 42 and Section 43 Applications (further extension of the mining license and conversion of the mining licence into an operating license respectively), and b) on the expiry date of the study phase, January 31, 2025, which could be extend for one year with written notice. |

10 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

| · | The third instalment of $30,000,000 is payable on the completion of mine construction and production start-up by the Company on or before January 31, 2030, but not later than four (4) years after the approval by the Minister of MMRGTES of the Company’s Section 42 and Section 43 Applications. |

| · | Payment of Care and maintenance funding contribution of Selebi Assets for a total of $5,178,747 from March 22, 2021 to the closing date. |

As per the term and conditions of the Selebi APA, PNR has the option to cancel the second and third payments and give back the Selebi assets to the liquidator in the event where the exploration program determines that the Selebi assets are not economical. PNR also has an option to pay in advance the second and third payments in the event where the exploration program determines that the Selebi assets are economical. The Company’s accounting policy, as permitted by IAS 16, is to measure and record contingent consideration when the conditions associated with the contingency are met. As of June 30, 2022, none of the conditions of the second and third instalment are met. Hence, these amounts are not accrued in the condensed interim consolidated financial statements.

In addition to the Selebi APA, the purchase of the Selebi assets are also subject to a contingent compensation agreement as well as a royalty agreement with the Liquidator.

In regard to the Selkirk Assets (the Selkirk mine and related infrastructures), the purchase agreement does not provide for a purchase price or initial payment for the purchase of the assets. The Selkirk purchase agreement provides that if the Company elects to develop Selkirk first, the payment of the second Selebi instalment of US$25,000,000 would be upon the approval by the Minister of MMRGTES of the Company’s Section 42 and Section 43 Applications (further extension of the Selkirk mining license (years) and conversion of the Selkirk mining licence into an operating license respectively). For the third Selebi instalment of US$30,000,000, if Selkirk were commissioning earlier than Selebi, the payment would trigger on Selkirk’s commission date.

During the three months ended June 30, 2022, the Company incurred $11,014,139 in acquisition and exploration expenditure on the Selebi Assets (December 31, 2021 - $3,099,926).

6. PROPERTY, PLANT AND EQUIPMENT

The table below sets out costs and accumulated amortization as at June 30, 2022:

| | | Vehicles | | | Furniture | | | Leasehold

improvement | | | Total | |

| Cost | | | | | | | | | | | | | | | | |

| Balance – December 31, 2021 | | | - | | | | - | | | | - | | | | - | |

| Purchases | | | 168,438 | | | | 18,296 | | | | 79,378 | | | | 266,112 | |

| Balance – June 30, 2022 | | | 168,438 | | | | 18,296 | | | | 79,378 | | | | 266,112 | |

Property, Plant and Equipment

Equipment is stated at historical cost less accumulated amortization and accumulated impairment losses.

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably. The carrying amount of a significant replaced part is derecognized. All other repairs and maintenance are charged to the condensed interim consolidated statements of comprehensive loss during the financial period in which they are incurred. Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized in profit or loss.

Depreciation and amortization are calculated on a straight-line method to charge the cost, less residual value, of the assets to their residual values over their estimated useful lives. The depreciation and amortization rate applicable to each category of equipment is as follows:

11 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

| Equipment | | Depreciation rate | |

| Vehicles | | | 30 | % |

| Furniture | | | 20 | % |

| Leasehold improvement | | | 10 | % |

| 7. | TRADE PAYABLES AND ACCRUED LIABILITIES |

| | | June 30, 2022 | | | December 31, 2021 | |

| Amounts due to related parties (note 9) | | | 313,040 | | | | 225,904 | |

| Trade payables | | | 2,192,996 | | | | 218,456 | |

| Accrued liabilities | | | 537,940 | | | | 136,126 | |

| | | | 3,043,976 | | | | 580,486 | |

| a) | Common Shares Issued and Outstanding |

During the year 2021, the Company closed two non-broker private placement equity financings totalling 12,596,421 shares at a price of $0.40 and $0.95, respectively, and raised aggregate gross proceeds of $6,771,729. The Company incurred total share issuance costs of $287,228, including the fair value of $7,000 for 17,000 shares issued to the agent in conjunction with the first private placement.

The Company launched a private placement for up to US$20,000,000 at US$2.00/share in December 2021 and the funding received would be deposited in a trust account and escrow until the closing of the APA on the Selebi Assets. PNR closed the first tranche on February 10, 2022 for the pro-rata round of existing shareholders upon completion of APA transaction. On April 20, 2022, the Company closed the final tranche of financing and raised aggregate gross proceeds of US$17,731,238 (C$22,388,599) including the pro-rata round.

As at June 30, 2022, the Company has 85,616,075 common shares issued and outstanding (December 31, 2021 – 76,679,908).

On February 26, 2021, the Company issued NAN a non-transferable share purchase warrant (the “Warrant”), which entitles NAN to purchase common shares of the Company, for up to 15% of the capital of PNR, upon payment of US $10,000,000 prior to the fifth anniversary of the date of issue.

The Warrant is classified as a derivative financial liability that should be measured at fair value, with changes in value recorded in profit or loss. As at June 30, 2022, the Company reassessed the fair value of the warrant at $28,275,256 and recorded the amount as a long-term Financial liability.

12 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

The fair value of liability of the Warrant was estimated using the Black-Scholes Option Pricing Model with the following assumptions:

| | | June 30,

2022 | | | December 31,

2021 | |

| Expected dividend yield | | | 0% | | | | 0% | |

| Latest private placement price | | | $2.49 | | | | $0.95 | |

| Expected share price volatility | | | 141.63% | | | | 144.13% | |

| Risk free interest rate | | | 3.14% | | | | 1.02% | |

| Remaining life of warrants | | | 2.66 years | | | | 3.16 years | |

Volatility assumptions for the valuation of the Warrant were derived by reference to the volatility of NAN as the stock price of NAN has been highly correlated to the advancement of the BCL assets acquisition since its investment in PNR.

On April 25, 2022, in connection with and immediately prior to the entry into the Amalgamation Agreement, NAN and PNR entered into the Waiver and Suspension Agreement, pursuant to which NAN agreed that its exercise privileges under the 15% Warrant or any portion thereof to subscribe for additional PNR Shares are suspended until the later of (i) the 61st calendar date following the date on which the Amalgamation Agreement is executed, and (ii) the date on which the Amalgamation Agreement is terminated in accordance with its terms.

Prior to the date that the Amalgamation becomes effective, the PNR Shares and the 15% Warrant held by NAN will be contributed to NAN Subco, as part of the Securities Contribution, resulting in such securities being cancelled by operation of the triangular amalgamation.

The Company adopted a Stock Option Plan (the “Plan”), providing the authority to grant options to directors, officers, employees and consultants enabling them to acquire up to 10% of the issued and outstanding common stock of the Company. Under the Plan, the exercise price of each option equals the offer price of the most recent financing on the date of grant. The options can be granted for a maximum term of five years.

13 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

A summary of option activity under the Plan during the six months ended June 30, 2022 is as follows:

| | | June 30, 2022 | | | December 31, 2021 | |

| | | Number

Outstanding | | | Weighted

Average

Exercise Price

($) | | | Number

Outstanding | | | Weighted

Average

Exercise Price

($) | |

| Outstanding, beginning of period | | | 5,775,000 | | | | 0.52 | | | | - | | | | - | |

| Issued | | | 2,600,000 | | | | 2.49 | | | | 5,775,000 | | | | 0.52 | |

| Outstanding, end of period | | | 8,375,000 | | | | 1.13 | | | | 5,775,000 | | | | 0.52 | |

During the three months ended June 30, 2022, the Company granted an aggregate total of 2,600,000 stock options to employees, directors and consultants with a maximum term of five years. All options vest immediately and are exercisable at US$2.00 per share (C$2.49/share). The Company calculates the fair value of all stock options using the Black-Scholes Option Pricing Model. The fair value of options granted during the six months ended June 30, 2022 amounted to $2,593,095 and was recorded as a share-based payment expense. The weighted average fair value of options granted during the three months ended June 30, 2022 is $0.83 per option.

The fair value of stock options granted and vested during the three months ended June 30, 2022 was calculated using the following assumptions:

| | | June 30,

2022 | | | December 31,

2021 | |

| Expected dividend yield | | | 0% | | | | 0% | |

| Latest private placement price | | | $2.49 | | | | $0.95 | |

| Expected share price volatility | | | 125.83% | | | | 125.18%-127.03% | |

| Risk free interest rate | | | 1.68% | | | | 0.42% - 1.11% | |

| Expected life of options | | | 5 years | | | | 5 years | |

Volatility assumptions for the valuation of warrants were derived by reference to the volatility of NAN as the stock price of NAN has been highly correlated to the advancement of the BCL assets acquisition since its investment in PNR.

14 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

Details of options outstanding as at June 30, 2022 are as follows:

Options

Outstanding | | | Options

Exercisable | | | Expiry

Date | | | Exercise

Price ($) | | | Weighted average

remaining contractual life

(years) | |

| | 4,500,0001 | | | | 4,500,000 | | | | January 26, 2026 | | | | 0.40 | | | | 1.92 | |

| | 975,0002 | | | | 325,000 | | | | September 29, 2026 | | | | 0.95 | | | | 0.50 | |

| | 300,000 | | | | 300,000 | | | | September 29, 2026 | | | | 0.95 | | | | 0.15 | |

| | 2,600,0003 | | | | 866,667 | | | | January 20, 2027 | | | | 2.49 | | | | 1.42 | |

| | 8,375,000 | | | | 5,991,667 | | | | | | | | | | | | 3.99 | |

1 Vesting 1/2 on the date of grant, 1/2 on closing of the transactions contemplated by any asset purchase agreement between the Company and BCL Limited on January 31, 2022

2 Vesting 1/3 on the date of grant, 1/3 on the first anniversary of the grant and 1/3 on the second anniversary.

3 Vesting 1/3 on the date of grant, 1/3 on the first anniversary and 1/3 on the second anniversary held in escrow following the close of the US$20,000,000 private placement.

The reserve records items recognized as stock-based compensation expense and other share-based payments until such time that the stock options or warrants are exercised, at which time the corresponding amount will be transferred to share capital. Amounts recorded for forfeited or expired unexercised options and warrants are transferred to deficit. During the period ended June 30, 2022, the Company recorded $2,593,095 (December 31, 2021 - $1,261,891) of share-based payments to reserves.

| 9. | RELATED PARTY TRANSACTIONS |

The following amounts due to related parties are included in trade payables and accrued liabilities (note 6).

| | | June 30, 2022 | | | December 31,

2021 | |

| Directors and Officers of the Company | | | 43,160 | | | | 26,759 | |

| NAN | | | 269,880 | | | | 199,145 | |

| | | | 313,040 | | | | 225,904 | |

These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

| (a) | Related party transactions |

During the six months ended June 30, 2022, pursuant to the Services Agreement, the Company was charged by NAN $937,583 (2021 - $844,379) for services including $17,212 in administrative fees, paid $866,848 (2021 – $793,017) and recorded $269,880 in amount due to related parties (2021 - $199,145).

As of June 30, 2022, NAN beneficially owns 7,667,707 shares of PNR (December 31, 2021 - 7,667,707 shares), constituting approximately 8.96% (2021 – 10%) of the issued and outstanding PNR shares.

15 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

During the six months ended June 30, 2022, ThreeD Capital subscribed for a further 1,213,538 common shares of PNR, for a further investment of US$2,427,076 (2021 - $374,123). As of June 30, 2022, ThreeD Capital beneficially owns 8,218,546 shares (2021 - 7,005,008 shares), constituting approximately 9.6% (2021 – 9.14%) of the current issued and outstanding shares of the Company.

Between March 2 and March 3, 2022, PNR issued promissory notes to its officers and directors as well as its shareholders as below:

| Directors and Officers of the Company | | | 35,000 | |

| ThreeD Capital | | | 762,180 | |

| NAN | | | 1,270,000 | |

| | | | 2,067,180 | |

On April 30, 2022, all amounts owing in respect of above promissory notes have either been repaid in cash for an amount of $2,018,568, including interest and fee, as well as by issuing 310,000 PNR Shares.

| (b) | Key management personnel is defined as members of the Board of Directors and senior officers. |

Key management compensation was as follows:

| | | June 30, 2022 | | | June 30, 2021 | |

| Management fee | | | 1,075,306 | | | | 263,451 | |

| Due diligence BCL | | | - | | | | 60,000 | |

| Corporate and administration expenses | | | 145,418 | | | | 61,353 | |

| | | | 1,220,724 | | | | 384,804 | |

The Company thoroughly examines the various financial instrument risks to which it is exposed and assesses the impact and likelihood of those risks. These risks may include interest rate risk, credit risk, liquidity risk, and currency risk. The carrying value of the Company's financial instruments approximates their fair value due to their short-term nature. Fair value measurements of financial instruments are required to be classified using a fair value hierarchy that reflects the significance of inputs in making the measurements. The levels of the fair value hierarchy are defined as follows:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 – Inputs for the asset or liability that are not based on observable market data.

As at June 30, 2022, the fair value of the Company’s warrant liabilities are based on Level 3 measurements and the fair value of cash is based on Level 1 measurements. The fair values of other financial instruments approximate their carrying values due to the relatively short-term maturity of these instruments.

16 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

The Company's exposure to market risk includes, but is not limited to, the following risks:

Interest Rate Risk

Interest rate risk is the risk that the future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company is not subject to significant changes in interest rates.

Foreign Currency Exchange Rate Risk

Currency risk is the risk that the fair value or future cash flows will fluctuate because of changes in foreign currency exchange rates. In addition, the value of cash and other financial assets and liabilities denominated in foreign currencies can fluctuate with changes in currency exchange rates.

The Company operates in Canada and Botswana and undertakes transactions denominated in foreign currencies such as the United States dollar and Botswana Pula, and consequently is exposed to exchange rate risks. Exchange risks are managed by matching levels of foreign currency balances and related obligations and by maintaining operating cash accounts in non-Canadian dollar currencies.

Credit Risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge an obligation. The credit risk is primarily associated with liquid financial assets. The Company limits exposure to credit risk on liquid financial assets by holding cash at highly-rated financial institutions.

Price Risk

The Company is exposed to price risk with respect to commodity prices. Commodity price risk is defined as the potential adverse impact on income and economic value due to commodity price movements and volatilities. To mitigate price risk, the Company closely monitors commodity prices of precious metals and the stock market to determine the appropriate course of action to be taken by the Company.

Liquidity Risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting obligations associated with financial liabilities that are settled by delivering cash or another financial asset. The Company manages the liquidity risk inherent in these financial obligations by regularly monitoring actual cash flows to annual budget which forecast cash and expected cash availability to meet future obligations.

The Company will defer discretionary expenditures, as required, in order to manage and conserve cash required for current liabilities.

The following table shows the Company's contractual obligations as at June 30, 2022:

| As at June 30, 2022 | | Less than

1 year | | | 1 - 2

years | | | 2 - 5

years | | | Total | |

| Trade payables and accrued liabilities | | | 3,043,976 | | | | - | | | | - | | | | 3,043,976 | |

| Vehicle financing | | | 39,446 | | | | 39,446 | | | | 56,397 | | | | 135,289 | |

| | | | 3,083,422 | | | | 39,446 | | | | 56,397 | | | | 3,179,265 | |

Capital Risk Management

The Company manages its capital to ensure that it will be able to continue as a going concern, so that adequate funds are available or are scheduled to be raised to meet its ongoing administrative and operating costs and obligations. This is achieved by the Board of Directors' review and ultimate approval of budgets that are achievable within existing resources, and the timely matching and release of the next stage of expenditures with the resources made available from capital raisings and debt funding from related or other parties. In doing so, the Company may issue new shares, restructure or issue new debt.

17 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

The Company is not subject to any externally imposed capital requirements imposed by a regulator or a lending institution.

In the management of capital, the Company includes the components of equity deficiency, loans and borrowings, other current liabilities, net of cash.

| | | As at June 30, 2022 | | | As at December 31, 2021 | |

| Shareholder’s deficiency | | | (6,793,162 | ) | | | (4,316,964 | ) |

| Current liabilities | | | 3,043,976 | | | | 580,486 | |

| | | | (3,749,186 | ) | | | (3,736,478 | ) |

| Cash | | | (2,740,881 | ) | | | (1,990,203 | ) |

| | | | (6,490,067 | ) | | | (5,726,681 | ) |

On August 3, 2022, Premium Nickel Resources Ltd. (TSXV: PNRL) (formerly, North American Nickel Inc.) ("PNRL" or the "Resulting Issuer”") announced the closing of its previously-announced "reverse takeover" transaction (the "RTO”) whereby PNR and 1000178269 Ontario Inc., a wholly-owned subsidiary of the Company, amalgamated by way of a triangular amalgamation under the Business Corporations Act (Ontario) (the "Amalgamation").

Transaction Particulars

| (i) | NAN Subco amalgamated with PNR under Section 174 of the OBCA to form one corporation – PNRL, the “Resulting Issuer” |

| (ii) | the securityholders of PNR received securities of the Resulting Issuer in exchange for their securities of PNR at an exchange ratio of 1.054 common shares of the Resulting Issuer (after giving effect to a 5-to-1 share consolidation) for each outstanding share of PNR (the "Exchange Ratio"), and |

| (iii) | the transactions resulted in a RTO of the Company in accordance with the policies of the TSXV, all in the manner contemplated by, and pursuant to, the terms and conditions of the Amalgamation Agreement. |

upon closing of the RTO, NAN has: (i) changed its name to "Premium Nickel Resources Ltd."; (ii) changed its stock exchange ticker symbol to "PNRL"; and (iii) reconstituted the board of directors (the "Board Reconstitution") and management of the Resulting Issuer. The outstanding options of PNR immediately prior to the effective time of the RTO were exchanged and adjusted pursuant to the terms of the Amalgamation Agreement such that holders thereof are entitled to acquire, following the closing of the RTO, options of the Resulting Issuer after giving effect to the Exchange Ratio, as applicable.

18 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

In connection with the RTO, NAN issued approximately 82,157,579 common shares of PNRL (on a post-Consolidation basis) in exchange for 77,948,368 outstanding shares of PNR immediately prior to the effective time of the RTO (after giving effect to the Exchange Ratio). Immediately after giving effect to the RTO Transaction, the Resulting Issuer was owned approximately (i) 72.6% by persons who were shareholders of PNR prior to RTO, (ii) 23.7% by persons who were shareholders of NAN prior to RTO, and (iii) 3.7% by the holders of the subscription receipts of NAN. The following table sets out the share structure upon the closing of the RTO:

| Premium Nickel Resource Ltd. | | 03/08/2022 | | | | |

| | | | | | | |

| # of share outstanding | | | 113,905,949 | | | | | |

| | Shares in escrow1 | | | (32,670,896 | ) | | | | |

| | | | | | | | | |

| | | | # of options | | | | Exercise price | |

| Options: | | | | | | | | |

| 24-Feb-2025 | | | 1,160,000 | | | $ | 0.80 | |

| 19-Aug-2025 | | | 240,000 | | | $ | 0.45 | |

| 25-Feb-2026 | | | 597,000 | | | $ | 1.60 | |

| 25-Oct-2026 | | | 998,794 | | | $ | 2.00 | |

| 26-Jan-2026 | | | 4,743,000 | | | $ | 0.39 | |

| 29-Sep-2026 | | | 1,343,850 | | | $ | 0.91 | |

| 20-Jan-2027 | | | 2,740,400 | | | $ | 2.11 | |

| | | | 11,823,044 | | | | | |

| | Options in escrow1 | | | (3,847,100 | ) | | | | |

| Warrants: | | | | | | | | |

| 13-Aug-2022 2 | | | 1,088,783 | | | $ | 0.45 | |

| 31-Aug-2022 | | | 150,000 | | | $ | 0.45 | |

| 16-Apr-2023 | | | 693,905 | | | $ | 1.75 | |

| 03-Aug-2024 | | | 295,652 | | | $ | 2.40 | |

| | | | 2,228,340 | | | | | |

| | | | | | | | | | |

| Prefer shares | 118,186 | | | 13,131 | | | | | |

| (conversion ratio 9:1) | | | | | | | | |

| | | | | | | | | |

| Fully diluted # of shares | | | 127,970,464 | | | | | |

Note 1: Certain directors, officers and seed share shareholders of the Resulting Issuer are subject to escrow requirements pursuant to the Policy 5.4 - Escrow, Vendor Considerations and Resale Restrictions of the TSX Venture Exchange ("Exchange Policy 5.4").

Note 2: Subsequently, 1,076,408 of warrants were exercised and 12,375 expired.

On Aug 18, 2022, the common shares of PNRL were listed for trading on the TSXV under the symbol "PNRL".

The full particulars of the RTO, the Selebi Project (as defined herein) located in Botswana, which is currently the only material property of the Resulting Issuer, and the business of the Resulting Issuer are described in the Form 3D2 (Information Required in a Filing Statement for a Reverse Takeover or Change of Business) (the “Filing Statement”) prepared in accordance with the policies of the TSXV. A copy of the Filing Statement is available electronically on SEDAR (www.sedar.com) under the new name, Premium Nickel Resources Ltd.

Shareholder Approvals

On June 23, 2022, NAN received shareholder approval in respect of, among other things, the reconstitution of the board of directors, the continuance of the Resulting Issuer from under the laws of the province of British Columbia under the Business Corporations Act (British Columbia) to the laws of the province of Ontario under the Business Corporations Act (Ontario) and a change of its name upon completion of the RTO. Further on July 27, the disinterested shareholders of NAN approved the RTO by way of a resolution passed in writing pursuant to the policies of the TSXV.

19 | Premium Nickel Resources / Q2 2022

Notes to the unaudited Condensed Interim Consolidated Financial statements

For the three and six months ended June 30, 2022

(Expressed in Canadian dollars)

Management and Board Composition

The board of directors of the Resulting Issuer consists of Keith Morrison, Charles Riopel, Sheldon Inwentash, John Hick, Sean Whiteford and William O'Reilly with Charles Riopel as Executive Chairman. Management of the Resulting Issuer includes Keith Morrison (Chief Executive Officer), Mark Fedikow (President), Sarah Wenjia Zhu (Chief Financial Officer and Corporate Secretary). In addition, the technical team of the Resulting Issuer includes Ms. Sharon Taylor (Chief Geophysicist) and Dr. Peter Lightfoot (Consulting Chief Geologist).

Select Financial Information

The following table sets out certain preliminary pro forma financial information for the Resulting Issuer upon completion of the RTO. The following information should be read in conjunction with, and is qualified in its entirety by, the pro forma financial statements of the Resulting Issuer to be included in Filing Statement, which is available on SEDAR (www.sedar.com) under PNRL's issuer profile.

| | | Select Financial Information | |

| | | NAN

(as at March 31, 2022)

('$000) | | | PNR

(as at March 31, 2022)

('$000) | | | Pro Forma

Adjustments(1)(2)

('$000) | | | Resulting Issuer Pro

Forma

Consolidation

('$000) | |

| Current Assets | | | 2,595 | | | | 6,300 | | | | 14,566 | | | | 23,461 | |

| Total Assets | | | 41,970 | | | | 21,187 | | | | 67,722 | | | | 130,879 | |

| Current Liabilities | | | 777 | | | | 5,824 | (1) | | | (3,055 | ) | | | 3,546 | |

| Total Liabilities | | | 777 | | | | 34,662 | | | | (31,742 | ) | | | 3,697 | |

| Shareholders' Equity | | | 41,193 | | | | (13,476 | ) | | | 99,465 | | | | 127,182 | |

| Net Loss | | | 390 | | | | 23,649 | | | | (19,847 | ) | | | 4,192 | (3) |

Note:

(1) Includes US$1.35 million of success fees payable to CIBC World Markets Inc. in connection with the Selebi acquisition, of which US$1 million was paid in May 2022, with the balance of US$350,000 to be due upon the next financing by the Company.

(2) The pro forma adjustments include, among other things, the adjustments for the subscription receipt financing of NAN which was completed on April 28, 2022, an advisory fee of $420,000, which will be payable to INFOR Financial Inc. upon the closing of the RTO and certain non-recurring due diligence and transaction costs in respect of the Selebi and Selkirk acquisitions and the RTO.

The Selebi Project

Following the completion of the RTO, it is anticipated that the Selebi and Selebi North nickel-copper-cobalt (Ni-Cu-Co) mines and related infrastructure (the "Selebi Project") would be the only material property of the Resulting Issuer for purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Selebi Project is located in Botswana and consists of a single mining licence no. 2022/1L (the "Selebi Mining Licence") covering an area of 11,504 hectares located near the town of Selebi Phikwe, approximately 150 kilometres southeast of the city of Francistown, and 410 kilometres northeast of the national capital Gaborone. The Selebi Mine includes two shafts (Selebi and Selebi North deposits) and related infrastructure (rail, power and water).

In accordance with NI 43-101, a technical report for the Selebi Project was filed on SEDAR (www.sedar.com) under PNRL's issuer profile and a summary of the Selebi Project and work program were included in the Filing Statement.

On August 22, 2022, PNRL announced the completion of its acquisition of the nickel, copper, cobalt, platinum-group elements ("Ni-Cu-Co-PGE") Selkirk Mine in Botswana, together with associated infrastructure and four surrounding prospecting licences formerly operated by Tati Nickel Mining Company ("TNMC"). The acquisition was completed pursuant to the Company's previously-announced asset purchase agreement with the Liquidator of TNMC on February 14, 2022. With the acquisition now complete, ownership of the Selkirk Mine has been transferred to PNRL.

20 | Premium Nickel Resources / Q2 2022