false --12-31 2023-09-30 Q3 0000795800 2023-09-30 P5Y P5Y P3Y 0000795800 2023-01-01 2023-09-30 0000795800 2023-09-30 0000795800 2022-12-31 0000795800 2023-07-01 2023-09-30 0000795800 2022-07-01 2022-09-30 0000795800 2022-01-01 2022-09-30 0000795800 ifrs-full:OrdinarySharesMember 2021-12-31 0000795800 ifrs-full:PreferenceSharesMember 2021-12-31 0000795800 PNRL:ReserveMember 2021-12-31 0000795800 ifrs-full:RetainedEarningsMember 2021-12-31 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2021-12-31 0000795800 2021-12-31 0000795800 ifrs-full:OrdinarySharesMember 2022-12-31 0000795800 ifrs-full:PreferenceSharesMember 2022-12-31 0000795800 PNRL:ReserveMember 2022-12-31 0000795800 ifrs-full:RetainedEarningsMember 2022-12-31 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2022-12-31 0000795800 ifrs-full:OrdinarySharesMember 2022-01-01 2022-09-30 0000795800 ifrs-full:PreferenceSharesMember 2022-01-01 2022-09-30 0000795800 PNRL:ReserveMember 2022-01-01 2022-09-30 0000795800 ifrs-full:RetainedEarningsMember 2022-01-01 2022-09-30 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2022-01-01 2022-09-30 0000795800 ifrs-full:OrdinarySharesMember 2023-01-01 2023-09-30 0000795800 ifrs-full:PreferenceSharesMember 2023-01-01 2023-09-30 0000795800 PNRL:ReserveMember 2023-01-01 2023-09-30 0000795800 ifrs-full:RetainedEarningsMember 2023-01-01 2023-09-30 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2023-01-01 2023-09-30 0000795800 ifrs-full:OrdinarySharesMember 2022-09-30 0000795800 ifrs-full:PreferenceSharesMember 2022-09-30 0000795800 PNRL:ReserveMember 2022-09-30 0000795800 ifrs-full:RetainedEarningsMember 2022-09-30 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2022-09-30 0000795800 2022-09-30 0000795800 ifrs-full:OrdinarySharesMember 2023-09-30 0000795800 ifrs-full:PreferenceSharesMember 2023-09-30 0000795800 PNRL:ReserveMember 2023-09-30 0000795800 ifrs-full:RetainedEarningsMember 2023-09-30 0000795800 PNRL:ForeignCurrencyTranslationReserveMember 2023-09-30 0000795800 PNRL:NorthAmericanNickelIncMember 2022-08-03 0000795800 PNRL:NorthAmericanNickelIncMember PNRL:AmalgamationAgreementMember 2022-04-26 0000795800 PNRL:NorthAmericanNickelIncMember PNRL:AmalgamationAgreementMember 2022-04-26 2022-04-26 0000795800 PNRL:PremiumNickelResourcesCorporationMember 2022-08-03 0000795800 PNRL:PremiumNickelResourcesCorporationMember 2022-08-03 2022-08-03 0000795800 PNRL:NorthAmericanNickelIncMember 2022-08-03 2022-08-03 0000795800 2022-08-03 2022-08-03 0000795800 PNRL:ReverseTakeoverTransactionMember 2022-08-03 2022-08-03 0000795800 ifrs-full:PreferenceSharesMember 2022-08-03 0000795800 2022-08-03 0000795800 PNRL:NorthAmericanNickelIncMember 2022-04-26 0000795800 PNRL:NorthAmericanNickelIncMember ifrs-full:OrdinarySharesMember 2022-08-03 0000795800 ifrs-full:WarrantsMember 2022-08-03 2022-08-03 0000795800 PNRL:OptionsMember 2022-08-03 2022-08-03 0000795800 ifrs-full:WarrantsMember ifrs-full:BottomOfRangeMember 2022-08-03 2022-08-03 0000795800 ifrs-full:WarrantsMember ifrs-full:TopOfRangeMember 2022-08-03 2022-08-03 0000795800 PNRL:OptionsMember ifrs-full:BottomOfRangeMember 2022-08-03 2022-08-03 0000795800 PNRL:OptionsMember ifrs-full:TopOfRangeMember 2022-08-03 2022-08-03 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelebiMember PNRL:BWMember 2022-12-31 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelkirkMember PNRL:BWMember 2022-12-31 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember 2022-12-31 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelebiMember PNRL:BWMember 2023-01-01 2023-09-30 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelkirkMember PNRL:BWMember 2023-01-01 2023-09-30 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember 2023-01-01 2023-09-30 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelebiMember PNRL:BWMember 2023-09-30 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember PNRL:SelkirkMember PNRL:BWMember 2023-09-30 0000795800 PNRL:ExplorationAndEvaluationAssetsArisingFromExplorationMember 2023-09-30 0000795800 PNRL:SelebiMember 2021-09-28 0000795800 PNRL:SelebiMember 2021-09-28 2021-09-28 0000795800 PNRL:SelebiMember 2021-03-22 2021-03-22 0000795800 PNRL:SelkirkMember 2022-08-22 0000795800 PNRL:SelebiMember 2022-08-22 2022-08-22 0000795800 2023-08-15 2023-08-16 0000795800 PNRL:SelebiMember 2023-01-01 2023-09-30 0000795800 PNRL:SelkirkMember 2022-01-01 2022-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:LandMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:BuildingsMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:FixturesAndFittingsMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ExplorationEquipmentMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:GeneratorMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:VehiclesMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ComputerEquipmentsAndSoftwareMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember 2022-12-31 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:LandMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:BuildingsMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:FixturesAndFittingsMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ExplorationEquipmentMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:GeneratorMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:VehiclesMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ComputerEquipmentsAndSoftwareMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:LandMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:BuildingsMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:FixturesAndFittingsMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ExplorationEquipmentMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:GeneratorMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:VehiclesMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ComputerEquipmentsAndSoftwareMember 2023-01-01 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember 2023-01-01 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:LandMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:BuildingsMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:FixturesAndFittingsMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ExplorationEquipmentMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:GeneratorMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember ifrs-full:VehiclesMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember PNRL:ComputerEquipmentsAndSoftwareMember 2023-09-30 0000795800 ifrs-full:GrossCarryingAmountMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:LandMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:BuildingsMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:FixturesAndFittingsMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ExplorationEquipmentMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember PNRL:GeneratorMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:VehiclesMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ComputerEquipmentsAndSoftwareMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember 2022-12-31 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:LandMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:BuildingsMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:FixturesAndFittingsMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ExplorationEquipmentMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:GeneratorMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember ifrs-full:VehiclesMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember PNRL:ComputerEquipmentsAndSoftwareMember 2023-09-30 0000795800 PNRL:AccumulatedDepreciationMember 2023-09-30 0000795800 ifrs-full:LandMember 2022-12-31 0000795800 ifrs-full:BuildingsMember 2022-12-31 0000795800 ifrs-full:FixturesAndFittingsMember 2022-12-31 0000795800 PNRL:ExplorationEquipmentMember 2022-12-31 0000795800 PNRL:GeneratorMember 2022-12-31 0000795800 ifrs-full:VehiclesMember 2022-12-31 0000795800 PNRL:ComputerEquipmentsAndSoftwareMember 2022-12-31 0000795800 ifrs-full:LandMember 2023-09-30 0000795800 ifrs-full:BuildingsMember 2023-09-30 0000795800 ifrs-full:FixturesAndFittingsMember 2023-09-30 0000795800 PNRL:ExplorationEquipmentMember 2023-09-30 0000795800 PNRL:GeneratorMember 2023-09-30 0000795800 ifrs-full:VehiclesMember 2023-09-30 0000795800 PNRL:ComputerEquipmentsAndSoftwareMember 2023-09-30 0000795800 PNRL:PinnacleIslandLPMember 2022-11-21 0000795800 PNRL:PinnacleIslandLPMember 2022-11-21 2022-11-21 0000795800 PNRL:AmendedAndRestatedPromissoryNoteMember 2023-03-16 2023-03-17 0000795800 PNRL:LenderMember 2023-03-17 0000795800 PNRL:LenderWarrantsMember PNRL:AmendedAndRestatedPromissoryNoteMember 2023-03-17 0000795800 ifrs-full:WarrantsMember PNRL:LenderMember 2023-03-16 2023-03-17 0000795800 PNRL:PinnacleIslandLPMember 2022-12-31 0000795800 PNRL:PinnacleIslandLPMember 2023-09-30 0000795800 PNRL:LenderWarrantsMember 2023-01-01 2023-09-30 0000795800 PNRL:AmendedAndRestatedPromissoryNoteMember PNRL:LenderWarrantsMember 2023-01-01 2023-09-30 0000795800 PNRL:AmendedAndRestatedPromissoryNoteMember PNRL:LenderWarrantsMember 2023-06-27 2023-06-28 0000795800 PNRL:LenderWarrantsMember 2023-01-01 2023-03-31 0000795800 PNRL:EdgePointInvestmentGroupIncMember 2023-06-27 2023-06-28 0000795800 PNRL:EdgePointInvestmentGroupIncMember 2023-06-28 0000795800 2023-06-27 2023-06-28 0000795800 PNRL:NonTransferableWarrantsMember 2023-06-28 0000795800 2023-06-28 0000795800 PNRL:NonTransferableWarrantsMember 2023-06-27 2023-06-28 0000795800 2022-01-01 2022-12-31 0000795800 PNRL:TuliTourismPtyLtdMember 2022-07-09 2022-07-09 0000795800 PNRL:TuliTourismPtyLtdMember 2022-08-17 0000795800 PNRL:TuliTourismPtyLtdMember PNRL:NonadjustingEventMember 2024-08-01 0000795800 PNRL:TuliTourismPtyLtdMember 2023-07-01 0000795800 PNRL:TuliTourismPtyLtdMember 2022-07-09 0000795800 PNRL:ForageFusionDrillingLtdMember 2023-03-14 2023-03-14 0000795800 PNRL:ForageFusionDrillingLtdMember 2023-03-14 0000795800 PNRL:PremiumNickelResourcesProprietaryLimitedMember 2023-06-28 0000795800 PNRL:PremiumNickelGroupProprietaryLimitedMember 2023-06-28 0000795800 PNRL:PremiumNickelResourcesProprietaryLimitedMember PNRL:AcquisitionAgreementMember 2023-06-28 0000795800 PNRL:PremiumNickelGroupProprietaryLimitedMember PNRL:AcquisitionAgreementMember 2023-06-28 0000795800 PNRL:PNRPAndPNGPMember 2023-06-28 0000795800 PNRL:SelebiMinesMember 2023-01-01 2023-09-30 0000795800 PNRL:SelkirkMineMember 2023-01-01 2023-09-30 0000795800 PNRL:SeriesOneConvertiblePreferredSharesMember 2023-01-01 2023-09-30 0000795800 PNRL:BrokeredPrivatePlacementMember 2023-02-24 0000795800 PNRL:BrokeredPrivatePlacementMember 2023-02-23 2023-02-24 0000795800 PNRL:BrokerWarrantsMember 2023-02-23 2023-02-24 0000795800 PNRL:BrokerWarrantsMember 2023-02-24 0000795800 PNRL:BrokerWarrantsMember 2023-02-23 2023-03-24 0000795800 PNRL:FinancingTransactionsMember 2023-06-28 0000795800 PNRL:FinancingTransactionsMember 2023-06-27 2023-06-28 0000795800 PNRL:NonBrokeredPrivatePlacementMember ifrs-full:OrdinarySharesMember 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember 2022-04-01 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember PNRL:FinderOneMember 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember PNRL:FinderOneMember 2022-04-01 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember PNRL:FinderTwoMember 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember PNRL:FinderTwoMember ifrs-full:OrdinarySharesMember 2022-04-30 0000795800 PNRL:NonBrokeredPrivatePlacementMember PNRL:FinderTwoMember ifrs-full:OrdinarySharesMember 2022-04-01 2022-04-30 0000795800 PNRL:AmalgamationAgreementMember PNRL:NorthAmericanNickelIncMember 2022-08-03 0000795800 PNRL:NorthAmericanNickelIncMember PNRL:AmalgamationAgreementMember 2022-08-03 2022-08-03 0000795800 PNRL:NorthAmericanNickelIncMember 2022-08-03 2022-08-03 0000795800 PNRL:StockOptionPlanMember 2023-01-01 2023-09-30 0000795800 PNRL:StockOptionPlanMember 2022-01-01 2022-09-30 0000795800 PNRL:ReverseTakeoverTransactionMember 2022-09-30 0000795800 PNRL:DeferredShareUnitPlanMember 2023-01-01 2023-09-30 0000795800 PNRL:DeferredShareUnitPlanMember 2022-01-01 2022-12-31 0000795800 ifrs-full:WarrantsMember 2023-02-23 2023-02-24 0000795800 ifrs-full:WarrantsMember 2023-06-27 2023-06-28 0000795800 PNRL:WarrantsExpiringOctoberSixteenTwoThousandTwentyThreeMember 2023-09-30 0000795800 PNRL:WarrantsExpiringOctoberSixteenTwoThousandTwentyThreeMember 2023-01-01 2023-09-30 0000795800 PNRL:WarrantsExpiringAugustThreeTwoThousandTwentyFourMember 2023-09-30 0000795800 PNRL:WarrantsExpiringAugustThreeTwoThousandTwentyFourMember 2023-01-01 2023-09-30 0000795800 PNRL:WarrantsExpiringFebruaryTwentyFourTwoThousandTwentyFiveMember 2023-09-30 0000795800 PNRL:WarrantsExpiringFebruaryTwentyFourTwoThousandTwentyFiveMember 2023-01-01 2023-09-30 0000795800 PNRL:WarrantsExpiringMarchTwentyTwoTwoThousandTwentyFourMember 2023-09-30 0000795800 PNRL:WarrantsExpiringMarchTwentyTwoTwoThousandTwentyFourMember 2023-01-01 2023-09-30 0000795800 PNRL:WarrantsExpiringJuneTwentyEightTwoThousandTwentySixMember 2023-09-30 0000795800 PNRL:WarrantsExpiringJuneTwentyEightTwoThousandTwentySixMember 2023-01-01 2023-09-30 0000795800 ifrs-full:BottomOfRangeMember 2022-01-01 2022-09-30 0000795800 ifrs-full:TopOfRangeMember 2022-01-01 2022-09-30 0000795800 PNRL:OptionsExpiringFebruaryTwentyFourTwoThousandTwentyFiveMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringFebruaryTwentyFourTwoThousandTwentyFiveMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringAugustNineteenTwoThousandTwentyFiveMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringAugustNineteenTwoThousandTwentyFiveMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringJanuaryTwentySixTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringJanuaryTwentySixTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringFebruaryTwentyFiveTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringFebruaryTwentyFiveTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringSeptemberTwentyNineTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringSeptemberTwentyNineTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringOctoberTwentyFiveTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringOctoberTwentyFiveTwoThousandAndTwentySixMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringJanuaryTwentyTwoThousandAndTwentySevenMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringJanuaryTwentyTwoThousandAndTwentySevenMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:OptionsExpiringAugustEightTwoThousandTwentyEightMember PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:OptionsExpiringAugustEightTwoThousandTwentyEightMember PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:PostConsolidationBasisMember 2023-09-30 0000795800 PNRL:PostConsolidationBasisMember 2023-01-01 2023-09-30 0000795800 PNRL:DeferredShareUnitPlanMember 2022-12-31 0000795800 PNRL:DeferredShareUnitPlanMember 2023-09-30 0000795800 PNRL:DirectorsAndOfficersCompanyMember 2023-09-30 0000795800 PNRL:DirectorsAndOfficersCompanyMember 2022-12-31 0000795800 PNRL:DirectorsAndOfficersCompanyMember 2023-03-03 0000795800 PNRL:ThreeDCapitalMember 2023-03-03 0000795800 PNRL:NorthAmericanNickelIncMember 2023-03-03 0000795800 2023-03-03 0000795800 PNRL:ThreeDCapitalMember 2022-12-31 0000795800 PNRL:ThreeDCapitalMember 2023-09-30 0000795800 2022-04-30 2022-04-30 0000795800 2022-04-30 0000795800 PNRL:ExchangeRateStrengthenedMember 2023-01-01 2023-09-30 0000795800 PNRL:ExchangeRateStrengthenedMember 2022-01-01 2022-12-31 0000795800 PNRL:ExchangeRateWeakenedMember 2023-01-01 2023-09-30 0000795800 PNRL:ExchangeRateWeakenedMember 2022-01-01 2022-12-31 0000795800 ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember 2023-09-30 0000795800 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember 2023-09-30 0000795800 ifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember 2023-09-30 0000795800 PNRL:CanadaCountryMember 2023-09-30 0000795800 PNRL:CanadaCountryMember 2022-12-31 0000795800 PNRL:BarbadosCountryMember 2023-09-30 0000795800 PNRL:BarbadosCountryMember 2022-12-31 0000795800 PNRL:BotswanaCountryMember 2023-09-30 0000795800 PNRL:BotswanaCountryMember 2022-12-31 iso4217:USD xbrli:shares iso4217:USD xbrli:shares xbrli:pure PNRL:Integer iso4217:DKK iso4217:CAD xbrli:shares iso4217:CAD iso4217:BWP

Exhibit 99.1

UNAUDITED CONDENSED INTERIM Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2023

In accordance with International Financial Reporting Standards and stated in Canadian dollars, unless otherwise indicated.

INDEX

Notice to Reader

Unaudited Condensed Interim Consolidated Financial Statements

| ■ | Unaudited Condensed Interim Consolidated Statements of Financial Position |

| | | |

| ■ | Unaudited Condensed Interim Consolidated Statements of Comprehensive Loss |

| | | |

| ■ | Unaudited Condensed Interim Consolidated Statements of Changes in Shareholders’ Equity |

| | | |

| ■ | Unaudited Condensed Interim Consolidated Statements of Cash Flows |

| | | |

| ■ | Notes to the Unaudited Condensed Interim Consolidated Financial Statements |

NOTICE TO READER OF THE UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS For the three AND NINE MONTHS ended September 30, 2023

In accordance with National Instrument 51-102, of the Canadian Securities Administrators, Premium Nickel Resources Ltd. (the “Company” or “PNRL”) discloses that the unaudited condensed interim consolidated financial statements have not been reviewed or audited by independent auditors.

The unaudited condensed interim consolidated financial statements of the Company for the three- and nine-month periods ended September 30, 2023 (“Financial Statements”) have been prepared by management. The Financial Statements should be read in conjunction with the audited consolidated financial statements and notes thereto of the Company for the fiscal year ended December 31, 2022, which are available electronically on SEDAR+ (www.sedarplus.ca) under the name Premium Nickel Resources Ltd. The Financial Statements are stated in Canadian dollars, unless otherwise indicated, and are prepared in accordance with International Financial Reporting Standards (“IFRS”).

“signed”

Keith Morrison

Chief Executive Officer | “signed”

Peter Rawlins

Chief Financial Officer |

November 27, 2023

Unaudited Condensed Interim Consolidated Statements of Financial Position

(Expressed in Canadian dollars)

| | | Notes | | As at

September 30,

2023 | | | As at

December 31,

2022 | |

| ASSETS | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | |

| Cash | | | | | 8,853,296 | | | | 5,162,991 | |

| Prepaid expenses | | | | | 1,885,044 | | | | 470,725 | |

| Other receivables | | 4 | | | 495,370 | | | | 804,630 | |

| TOTAL CURRENT ASSETS | | | | | 11,233,710 | | | | 6,438,346 | |

| | | | | | | | | | | |

| NON-CURRENT ASSETS | | | | | | | | | | |

| Exploration and evaluation assets | | 5 | | | 44,692,577 | | | | 31,823,982 | |

| Property, plant and equipment | | 6 | | | 5,792,943 | | | | 3,394,670 | |

| TOTAL NON-CURRENT ASSETS | | | | | 50,485,520 | | | | 35,218,652 | |

| TOTAL ASSETS | | | | | 61,719,230 | | | | 41,656,998 | |

| | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | |

| Trade payables and accrued liabilities | | 7 | | | 3,148,177 | | | | 4,025,716 | |

| Current portion of lease liability | | 10 | | | 1,892,504 | | | | 1,365,697 | |

| Promissory note | | 8 | | | - | | | | 7,070,959 | |

| TOTAL CURRENT LIABILITIES | | | | | 5,040,681 | | | | 12,462,372 | |

| | | | | | | | | | | |

| NON-CURRENT LIABILITIES | | | | | | | | | | |

| Vehicle financing | | | | | 165,019 | | | | 164,644 | |

| Provision for leave and severance | | | | | 435,045 | | | | 177,941 | |

| Term loan | | 9 | | | 12,916,710 | | | | - | |

| Lease liability | | 10 | | | - | | | | 1,365,697 | |

| NSR option liability | | 11 | | | 2,750,000 | | | | - | |

| Deferred share units liability | | 12 | | | 856,524 | | | | 298,000 | |

| TOTAL NON-CURRENT LIABILITIES | | | | | 17,123,298 | | | | 2,006,282 | |

| TOTAL LIABILITIES | | | | | 22,163,979 | | | | 14,468,654 | |

| | | | | | | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | | | | | |

| Share capital – common | | 12 | | | 111,226,156 | | | | 91,144,268 | |

| Share capital – preferred | | | | | 31,516 | | | | 31,516 | |

| Reserve | | | | | 18,987,978 | | | | 15,257,140 | |

| Deficit | | | | | (87,222,991 | ) | | | (78,092,605 | ) |

| Foreign currency translation reserve | | | | | (3,467,408 | ) | | | (1,151,975 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | | | | | 39,555,251 | | | | 27,188,344 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | 61,719,230 | | | | 41,656,998 | |

Nature of Operations and Going Concern (Note 1)

The accompanying notes are an integral part of these Unaudited Condensed Interim Consolidated Financial Statements.

Approved by the Board of Directors on November 27, 2023.

“signed”

Keith Morrison

Director | “signed”

Jason LeBlanc

Director |

Unaudited Condensed Interim Consolidated Statements of Comprehensive Loss

(Expressed in Canadian dollars)

| | | | | | | | | | | | | | | |

| | | | | Three months ended | | | Nine months ended | |

| | | Notes | | September 30, 2023 | | | September 30, 2022 | | | September 30, 2023 | | | September 30, 2022 | |

| | | | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | | | | | | | |

| Corporate and administration expenses | | | | | 1,036,363 | | | | 2,047,585 | | | | 3,278,926 | | | | 2,880,938 | |

| Management fees | | 13(b) | | | 865,446 | | | | 625,905 | | | | 2,496,109 | | | | 1,701,211 | |

| Due diligence cost of Botswana assets | | | | | - | | | | 979 | | | | - | | | | 5,014 | |

| Advisory and consultancy | | | | | 34,331 | | | | 521,075 | | | | 475,890 | | | | 1,015,101 | |

| Depreciation | | 6 | | | 184,833 | | | | 882 | | | | 274,593 | | | | 882 | |

| General exploration expenses | | | | | 62,210 | | | | - | | | | 139,782 | | | | - | |

| Interest and bank charges | | | | | 17,035 | | | | 7,302 | | | | 34,865 | | | | 15,851 | |

| Share-based payment | | | | | - | | | | 5,138,022 | | | | - | | | | 7,731,117 | |

| Deferred share units granted | | 12 | | | 252,120 | | | | - | | | | 558,524 | | | | - | |

| Warrant fair value movement | | | | | - | | | | (28,275,255 | ) | | | - | | | | (8,974,901 | ) |

| Net foreign exchange loss | | | | | 153,013 | | | | 33,343 | | | | 256,917 | | | | (127,449 | ) |

| TOTAL EXPENSES | | | | | 2,605,351 | | | | (19,900,162 | ) | | | 7,515,606 | | | | 4,247,764 | |

| | | | | | | | | | | | | | | | | | | |

| OTHER ITEMS | | | | | | | | | | | | | | | | | | |

| Interest expenses and fees | | | | | 886,292 | | | | 26,630 | | | | 1,653,639 | | | | 113,764 | |

| Acquisition loss on RTO | | | | | - | | | | 29,174,415 | | | | - | | | | 29,174,415 | |

| NET LOSS FOR THE PERIOD | | | | | 3,491,643 | | | | 9,300,883 | | | | 9,169,245 | | | | 33,535,943 | |

| | | | | | | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE LOSS | | | | | | | | | | | | | | | | | | |

| Exchange differences on translation of foreign operations | | | | | (109,273 | ) | | | 201,969 | | | | 2,315,433 | | | | 1,473,326 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL COMPREHENSIVE LOSS FOR THE PERIOD | | | | | 3,382,370 | | | | 9,502,852 | | | | 11,484,678 | | | | 35,009,269 | |

| | | | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | | | | 0.02 | | | | 0.09 | | | | 0.09 | | | | 0.37 | |

| Weighted average number of common shares outstanding – basic and diluted | | | | | 135,730,527 | | | | 105,842,672 | | | | 125,150,919 | | | | 92,836,780 | |

The accompanying notes are an integral part of these Unaudited Condensed Interim Consolidated Financial Statements.

Unaudited Condensed Interim Consolidated Statements of Changes in Shareholders’ Equity

(Expressed in Canadian dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Notes | | Number of

Shares | | | Share

Capital | | | Preferred shares | | | Reserve | | | Deficit | | | Foreign Currency Translation Reserve | | | Total

Shareholders’ Equity | |

| BALANCE AS AT DECEMBER 31, 2021 | | | | | 76,679,908 | | | | 7,952,675 | | | | - | | | | 1,261,891 | | | | (13,482,624 | ) | | | (48,906 | ) | | | (4,316,964 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the period | | | | | - | | | | - | | | | - | | | | - | | | | (33,535,943 | ) | | | - | | | | (33,535,943 | ) |

| Share capital issued through private placement | | | | | 8,936,167 | | | | 22,388,599 | | | | | | | | - | | | | - | | | | | | | | 22,388,599 | |

| Share issue costs | | | | | | | | | (1,535,727 | ) | | | | | | | - | | | | - | | | | | | | | (1,535,727 | ) |

Acquisition of NAN

Cancelled PNRC shares held by NAN | | | | | (7,667,707 | ) | | | (19,710,608 | ) | | | - | | | | - | | | | - | | | | - | | | | (19,710,608 | ) |

| Cancelled PNRC warrant held by NAN | | | | | - | | | | - | | | | - | | | | - | | | | (28,275,255 | ) | | | - | | | | (28,275,255 | ) |

| PNRC shares exchanged | | | | | (77,948,368 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| PNRC shares received in exchange | | | | | 82,157,536 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Outstanding shares of NAN acquired on RTO | | | | | 31,748,399 | | | | 77,431,152 | | | | 31,516 | | | | 9,665,577 | | | | - | | | | - | | | | 87,128,245 | |

| Exercise of warrants | | | | | 1,236,408 | | | | 569,399 | | | | - | | | | - | | | | - | | | | - | | | | 569,399 | |

| FV of warrants exercised | | | | | - | | | | 3,019,037 | | | | - | | | | (3,019,037 | ) | | | - | | | | - | | | | - | |

| Exercise of options | | | | | 300,000 | | | | 117,000 | | | | - | | | | - | | | | - | | | | - | | | | 117,000 | |

| FV of exercised options | | | | | - | | | | 101,531 | | | | - | | | | (101,531 | ) | | | - | | | | - | | | | - | |

| Share-based payment | | | | | - | | | | - | | | | - | | | | 7,731,117 | | | | | | | | | | | | 7,731,117 | |

| Exchange differences on translation of foreign operations | | | | | - | | | | - | | | | - | | | | - | | | | (48,906 | ) | | | (1,473,326 | ) | | | (1,522,232 | ) |

| BALANCE AS AT SEPTEMBER 30, 2022 | | | | | 115,442,343 | | | | 90,333,058 | | | | 31,516 | | | | 15,538,017 | | | | (75,342,728 | ) | | | (1,522,232 | ) | | | 29,037,631 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE AS AT DECEMBER 31, 2022 | | 12 | | | 116,521,343 | | | | 91,144,268 | | | | 31,516 | | | | 15,257,140 | | | | (78,092,605 | ) | | | (1,151,975 | ) | | | 27,188,344 | |

| Beginning balance | | 12 | | | 116,521,343 | | | | 91,144,268 | | | | 31,516 | | | | 15,257,140 | | | | (78,092,605 | ) | | | (1,151,975 | ) | | | 27,188,344 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the period | | - | | | - | | | | - | | | | - | | | | | | | | (9,169,245 | ) | | | | | | | (9,169,245 | ) |

| Share capital issued through private placement | | | | | 19,209,184 | | | | 24,014,273 | | | | | | | | | | | | | | | | | | | | 24,014,273 | |

| Share issue costs | | | | | | | | | (1,866,097 | ) | | | | | | | | | | | | | | | | | | | (1,866,097 | ) |

| Value allocated to warrants | | | | | | | | | (1,898,349 | ) | | | | | | | 1,898,349 | | | | | | | | | | | | | |

| FV of broker warrants | | | | | | | | | (167,939 | ) | | | | | | | 167,939 | | | | | | | | | | | | - | |

| FV of lender warrants | | | | | | | | | | | | | | | | | 1,703,409 | | | | | | | | | | | | 1,703,409 | |

| FV of expired warrants | | | | | | | | | | | | | | | | | (38,859 | ) | | | 38,859 | | | | | | | | - | |

| Exchange differences on translation of foreign operations | | | | | | | | | | | | | | | | | | | | | | | | | (2,315,433 | ) | | | (2,315,433 | ) |

| BALANCE AS AT SEPTEMBER 30, 2023 | | 12 | | | 135,730,527 | | | | 111,226,156 | | | | 31,516 | | | | 18,987,978 | | | | (87,222,991 | ) | | | (3,467,408 | ) | | | 39,555,251 | |

| Ending balance | | 12 | | | 135,730,527 | | | | 111,226,156 | | | | 31,516 | | | | 18,987,978 | | | | (87,222,991 | ) | | | (3,467,408 | ) | | | 39,555,251 | |

The accompanying notes are an integral part of these Unaudited Condensed Interim Consolidated Financial Statements.

Unaudited Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian dollars)

| | | | | | | |

| | | Nine months ended | |

| | | September 30,

2023 | | | September 30,

2022 | |

| | | | | | | |

| OPERATING ACTIVITIES | | | | | | | | |

| Total net loss for the period | | | (9,169,245 | ) | | | (33,535,943 | ) |

| Items not affecting cash: | | | | | | | | |

| Share-based payment | | | - | | | | 7,731,117 | |

| Deferred share units granted | | | 558,524 | | | | - | |

| Depreciation | | | 274,593 | | | | 882 | |

| Provision for leave and severance | | | 257,104 | | | | 114,698 | |

| Accrued interests and accretion on loans | | | 387,240 | | | | - | |

| Warrant fair value movement | | | - | | | | (8,974,901 | ) |

| Loss on acquisition | | | - | | | | 29,174,415 | |

| Changes in working capital | | | | | | | | |

| Prepaid expenses | | | (1,517,818 | ) | | | (406,752 | ) |

| Other receivables | | | 309,260 | | | | (51,912 | ) |

| Trade payables and accrued expenses | | | (1,274,776 | ) | | | 1,464,695 | |

| Net cash used in operating activities | | | (10,175,118 | ) | | | (4,483,701 | ) |

| | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | |

| Acquisition of property, plant and equipment | | | (1,852,916 | ) | | | (901,644 | ) |

| Additions to expenditures on exploration and evaluation assets | | | (13,695,245 | ) | | | (21,828,296 | ) |

| Interest received | | | 39,622 | | | | - | |

| Cash received through RTO transaction | | | - | | | | 11,051,917 | |

| Net cash used in investing activities | | | (15,508,539 | ) | | | (11,678,023 | ) |

| | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | |

| | | | | | | | | |

| Proceeds from issuance of units | | | 23,814,272 | | | | 22,032,927 | |

| Share issue costs | | | (1,818,956 | ) | | | (1,535,727 | ) |

| Loan proceeds, net of fees | | | 14,625,000 | | | | - | |

| Interest payment on the term loan | | | (390,411 | ) | | | | |

| NSR Option financing | | | 2,750,000 | | | | - | |

| Proceeds from exercise of warrants and options | | | - | | | | 686,399 | |

| Promissory note repayment | | | (7,637,329 | ) | | | - | |

| Vehicle loan financing | | | 375 | | | | 172,800 | |

| Lease payment | | | (713,100 | ) | | | - | |

| Net cash provided by financing activities | | | 30,629,851 | | | | 21,356,399 | |

| | | | | | | | | |

| Impact of currency translation for the foreign operations | | | (1,255,889 | ) | | | (1,428,236 | ) |

| Change in cash for the period | | | 3,690,305 | | | | 3,766,439 | |

| Cash at the beginning of the period | | | 5,162,991 | | | | 1,990,203 | |

| Cash at the end of the period | | | 8,853,296 | | | | 5,756,642 | |

The accompanying notes are an integral part of these Unaudited Condensed Interim Consolidated Financial Statements.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

1. NATURE OF OPERATIONS AND GOING CONCERN

Premium Nickel Resources Ltd. (TSXV: PNRL) (the “Company” or “PNRL”) was founded upon the closing of a reverse takeover transaction (the “RTO”) whereby Premium Nickel Resources Corporation (“PNRC”) and 1000178269 Ontario Inc. (“NAN Subco”), a wholly-owned subsidiary of North American Nickel Inc. (“NAN”), amalgamated by way of a triangular amalgamation (the “Amalgamation”) under the Business Corporations Act (Ontario) (the “OBCA”) on August 3, 2022 (Note 3). The common shares of PNRL are now listed and posted for trading on the TSX Venture Exchange (the “TSXV”) under the symbol “PNRL”.

Prior to the RTO, PNRC was a private company existing under the OBCA. PNRC was incorporated to evaluate, acquire, improve and reopen, assuming economic feasibility, a combination of certain assets of BCL Limited (“BCL”) and Tati Nickel Mining Company (“TNMC”) that were in liquidation in Botswana.

In connection with the RTO, the Company was continued under the OBCA and changed its name from “North American Nickel Inc.” to “Premium Nickel Resources Ltd.”

Currently, the Company’s principal business activity is the evaluation and development of mineral properties in Botswana through its wholly-owned subsidiaries.

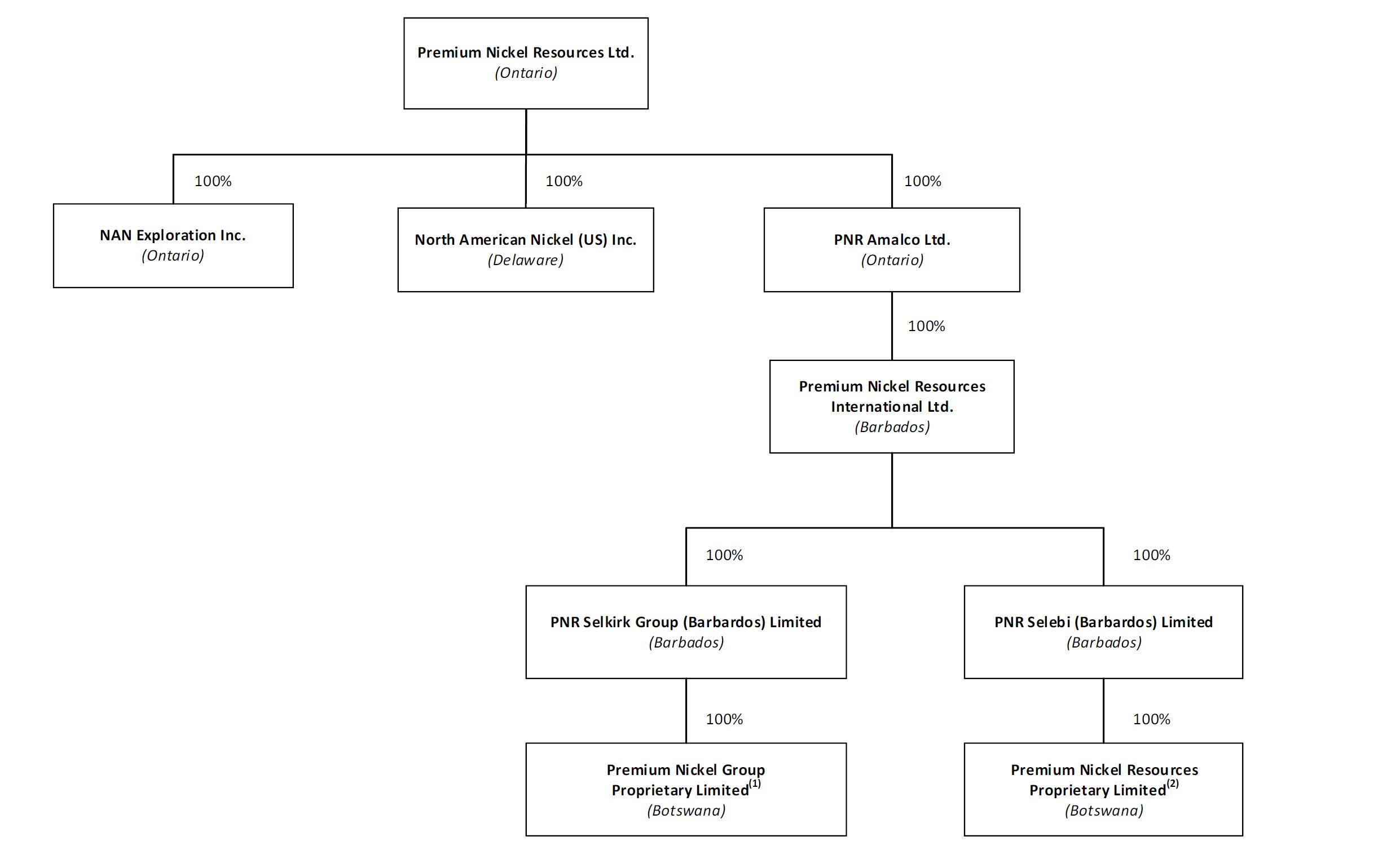

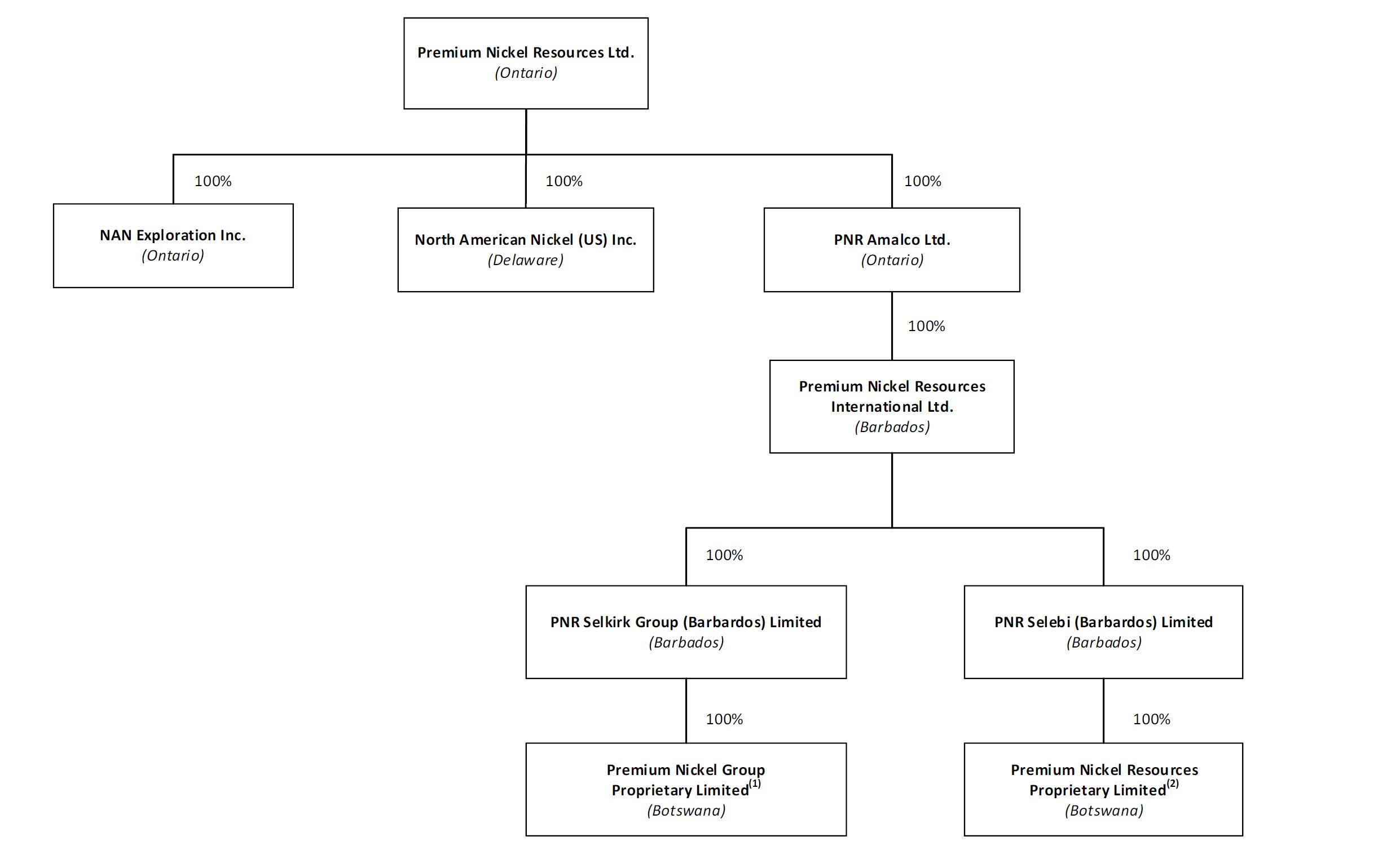

The following corporate structure chart sets out details of the direct and indirect ownership of the principal subsidiaries of the Company:

Notes:

| | (1) | Premium Nickel Group Proprietary Limited owns the Selkirk Assets (as defined below). |

| | (2) | Premium Nickel Resources Proprietary Limited owns the Selebi Assets (as defined below). |

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

The Company has its head and registered office at One First Canadian Place, 100 King Street West, Suite 3400, Toronto, Ontario, Canada M5X 1A4.

The principal assets of the Company are the Selebi and Selebi North nickel-copper-cobalt (“Ni-Cu-Co”) mines (the “Selebi Mines”) in Botswana and related infrastructure (together, the “Selebi Assets”) , as well as the nickel, copper, cobalt, platinum-group elements (“Ni-Cu-Co-PGE”) Selkirk mine (the “Selkirk Mine”) in Botswana, together with associated infrastructure and four surrounding prospecting licenses (collectively, the “Selkirk Assets”).

Going Concern

The Company, being in the exploration and redevelopment stage, is subject to risks and challenges similar to companies in a comparable stage of exploration and development. These risks include the challenges of securing adequate capital for exploration, development and operational risks inherent in the mining industry, and global economic and metal price volatility and there is no assurance management will be successful in its endeavors. As at September 30, 2023, the Company had no source of operating cash flows, nor any credit line currently in place. The Company incurred a net loss of $9,169,245 for the nine months ended September 30, 2023. The Company’s committed cash obligations and expected level of expenses will vary depending on its operations.

These unaudited condensed interim consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning it will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations. The ability of the Company to continue operations as a going concern is ultimately dependent upon achieving profitable operations and its ability to obtain adequate financing. To date the Company has not generated profitable operations from its resource activities and will need to invest additional funds in carrying out its planned evaluation, development and operational activities. It is not possible to predict whether financing efforts will be successful or if the Company will attain a profitable level of operation. These material uncertainties cast substantial doubt about the Company’s ability to continue as a going concern. These unaudited condensed interim consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities and the reported expenses and comprehensive loss that might be necessary should the Company be unable to continue as a going concern. These adjustments could be material.

The properties in which the Company currently has an interest are in pre-revenue stage. As such, the Company is dependent on external financing to fund its activities. In order to carry out the planned development and cover administrative costs, the Company will use its existing working capital and raise additional amounts as needed. Although the Company has been successful in its past fundraising activities, there is no assurance as to the success of future fundraising efforts or as to the sufficiency of funds raised in the future. The Company will continue to assess new properties and seek to acquire interests in additional properties if there is sufficient geologic or economic potential and if adequate financial resources are available to do so.

The unaudited condensed interim consolidated financial statements were approved and authorized for issuance by the Board of Directors of the Company on November 27, 2023. The discussion in the notes to the unaudited condensed interim consolidated financial statements is stated in Canadian dollars.

2. BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

(a) Statement of Compliance

These unaudited condensed interim consolidated financial statements were prepared in accordance with International Accounting Standards (“IAS 34”), Interim Financial Reporting, utilizing the accounting policies of the Company outlined in its December 31, 2022 audited annual consolidated financial statements. The accounting policies are in line with IFRS guidelines. These unaudited condensed interim consolidated financial statements do not include all the information and disclosures required in the audited annual consolidated financial statements and therefore should be read in conjunction with the Company’s audited annual consolidated financial statements.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

(b) Basis of preparation

These unaudited condensed interim consolidated financial statements have been prepared under the historical cost convention, modified by the revaluation of any financial assets and financial liabilities where applicable. The preparation of unaudited condensed interim consolidated financial statements in conformity with IAS 34 requires the use of certain critical accounting estimates. It also requires management to exercise judgment in the process of applying the Company’s accounting policies.

The significant accounting policies used in the preparation of these unaudited condensed interim consolidated financial statements are consistent with those used in the preparation of the audited annual consolidated financial statements for the year ended December 31, 2022.

(c) Basis of consolidation

These unaudited condensed interim consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries. All intercompany transactions, balances, income and expenses are eliminated upon consolidation.

Effective August 3, 2022, NAN completed the 100% acquisition of the outstanding shares of PNRC (Note 3). As the shareholders of PNRC obtained control of the Company through the exchange of their shares of PNRC for shares of NAN, the acquisition of PNRC has been accounted for in these unaudited condensed interim consolidated financial statements as a reverse takeover. Consequently, the unaudited condensed interim consolidated statements of loss and cash flows for the three and nine months ended September 30, 2023 reflect the results from the operations and cash flows of PNRL, the combined company post RTO, and the unaudited condensed interim consolidated statements of loss and cash flow for the three and nine months ended September 30, 2022 reflect the results from the operations and cash flows of PNRC, the legal subsidiary of the Company, for the quarter ended September 30, 2022, combined with NAN, the legal parent of PNRC, from the acquisition on August 3, 2022 to September 30, 2022, in accordance with the treatment of a “reverse takeover” under IFRS.

(d) New standards and amendments effective this year

IAS 1 – In February 2021, the IASB issued “Disclosure of Accounting Policies” with amendments that are intended to help preparers in deciding which accounting policies to disclose in their financial statements. The amendments are effective for year ends beginning on or after January 1, 2023. The impact of adopting this amendment on the Company’s consolidated financial statements was not significant.

IAS 8 – In February 2021, the IASB issued “Definition of Accounting Estimates” to help entities distinguish between accounting policies and accounting estimates. The amendments are effective for year ends beginning on or after January 1, 2023. The impact of adopting this amendment on the Company’s consolidated financial statements was not significant.

(e) Accounting standards and amendments issued but not yet effective

Certain pronouncements were issued by the IASB or the IFRIC that are mandatory for accounting periods commencing on or after January 1, 2023. Many are not applicable or do not have a significant impact to the Company and have been excluded. The following have not yet been adopted and are being evaluated to determine their impact on the Company.

IAS 1 – Presentation of Financial Statements (“IAS 1”) was amended in January 2020 to provide a more general approach to the classification of liabilities under IAS 1 based on the contractual arrangements in place at the reporting date. The amendments clarify that the classification of liabilities as current or non-current is based solely on a company’s right to defer settlement at the reporting date. The right needs to be unconditional and must have substance. The amendments also clarify that the transfer of a company’s own equity instruments is regarded as settlement of a liability, unless it results from the exercise of a conversion option meeting the definition of an equity instrument. The amendments are effective for annual periods beginning on January 1, 2024.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

3. AMALGAMATION

On April 26, 2022, PNRC and NAN entered into a definitive amalgamation agreement (the “Amalgamation Agreement”) in respect of their previously-announced RTO transaction, pursuant to which PNRC would “go-public” by way of a reverse takeover of NAN.

Transaction Particulars

Pursuant to the Amalgamation Agreement:

| (a) | NAN’s subsidiary, 1000178269 Ontario Inc. (“NAN Subco”), amalgamated with PNRC under Section 174 of the OBCA to form one corporation; |

| | | |

| (b) | Holders of PNRC shares exchanged their shares at a rate of 1.054 shares of NAN for each share of PNRC (the “Exchange Ratio”), after giving effect to a 5-to-1 share consolidation for each outstanding share of NAN; and |

| | | |

| (c) | the transactions resulted in an RTO of the Company in accordance with the policies of the TSXV, all in the manner contemplated by, and pursuant to, the terms and conditions of the Amalgamation Agreement. |

In connection with the RTO, NAN, among other things: (a) changed its name to “Premium Nickel Resources Ltd.”; (b) changed its stock exchange ticker symbol to “PNRL”; and (c) reconstituted the board of directors and management of the Company. The outstanding options of PNRC immediately prior to the effective time of the RTO were exchanged and adjusted pursuant to the terms of the Amalgamation Agreement such that holders thereof were entitled to acquire, following the closing of the RTO, options of the Company after giving effect to the Exchange Ratio, as applicable.

Pursuant to the Amalgamation Agreement, the Company issued 82,157,536 common shares of the Company (on a post-consolidation basis) in exchange for 77,948,368 outstanding shares of PNRC immediately prior to the effective time of the RTO. Immediately after giving effect to the RTO Transaction, the Company was owned approximately 72.1% by persons who were shareholders of PNRC prior to the RTO and 27.9% by persons who were shareholders of NAN prior to the RTO.

Prior to this exchange, NAN had 31,748,399 shares outstanding (on a post-consolidation basis). Taking into account the composition of the board and senior management and the relative ownership percentages of NAN and PNRC shareholders in the newly combined enterprise, from an accounting perspective PNRC is considered to have acquired NAN, and hence the transaction has been recorded as a reverse takeover.

The substance of the transaction was a reverse acquisition of a public company. The transaction did not constitute a business acquisition as NAN did not meet the definition of a business under IFRS 3 as it had no inputs or processes. As a result, the transaction was accounted for as a capital transaction with NAN being identified as the accounting acquiree and the equity consideration being measured at fair value (“FV”).

The purchase price was determined based on the number of shares that PNRC would have had to issue on the date of closing to give the owners of NAN the same percentage equity (27.9%) of the combined entity as they held subsequent to the reverse takeover.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

The costs of the acquisition have been allocated as follows:

SUMMARY OF COST OF ACQUISITION

| | | | | |

| FV of shares transferred | | $ | 77,431,152 | |

| FV of options, warrants and agent warrants | | | 9,665,577 | |

| FV of preferred shares | | | 31,516 | |

| Settlement of pre-existing relationship – 15% warrant and shares* | | | (47,985,863 | ) |

| | | | | |

| Total FV of consideration transferred | | $ | 39,142,383 | |

| | | | | |

| Cash | | $ | 11,051,917 | |

| Trade and other receivables | | | 450,522 | |

| Property, plant and equipment | | | 14,111 | |

| Trade payables and accrued liabilities | | | (1,548,582 | ) |

| Net assets acquired | | | 9,967,968 | |

| | | | | |

| Loss on acquisition | | | 29,174,415 | |

| Total Purchase Price | | $ | 39,142,383 | |

*Pre-existing relationship

Before the closing of the RTO, NAN owned 7,667,707 common shares of PNRC and a 15% warrant which entitled NAN to purchase common shares of PNRC for up to 15% of the then outstanding capital of PNRC upon payment of USD 10,000,000 prior to the fifth anniversary of the date of issue (the “15% Warrant”). Prior to the date that the Amalgamation became effective, the PNRC shares and the 15% Warrant held by NAN were contributed to NAN Subco, as part of the securities contribution, resulting in such securities being cancelled at law by operation of the triangular amalgamation.

Prior to the RTO, the fair value of the 15% Warrant and the shares held by NAN were $28,275,255 and $19,710,608, respectively. The fair value of the shares was calculated based on the last offer price of PNRC’s financing prior to the RTO, and the fair value of the warrants was calculated using the Black-Sholes Model with the following assumptions: expected life of 2.57 years, expected dividend yield of 0%, a risk free rate of 3.14% and an expected volatility of 141.63%. As they were the securities contributed by NAN on the closing of the RTO, the fair value of the warrants and shares were included as part of the consideration on the acquisition date.

Pursuant to the RTO, an aggregate of 8,827,250 options to purchase common shares of the Company (“Replacement Options”) were issued (on a post 5:1 consolidation basis) to the former holders of options to purchase common shares of PNRC (prior to the RTO) (“PNRC Options”) in exchange for 8,375,000 PNRC Options. The Replacement Options issued to the former holders of PNRC Options were on the same terms and conditions as those exchanged by PNRC holders except all the previously unvested options vested immediately. Immediately prior to the completion of the RTO, PNRC had 2,383,333 unvested options outstanding which re-evaluated at a fair value of $5,138,022 upon the completion of the RTO according to IFRS2.

Given that the RTO has been accounted for as a reverse takeover of NAN by PNRC, from an accounting perspective, PNRC was deemed to have issued options and warrants to the former security holders of NAN. Immediately prior to the closing of the RTO, NAN had 2,995,794 options and 2,228,340 warrants outstanding, respectively, as well as 118,186 preferred shares that could be converted to 13,131 common shares of NAN (on a post-consolidation basis). The aggregate fair value of such 2,995,794 options, 2,228,340 warrants and 118,186 preferred shares of NAN was $9,665,577, and this amount was included as a component of the purchase price. Costs related to the transaction were $2,327,125 and were expensed as incurred.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

The fair value of NAN’s options and warrants as at August 3, 2022 was calculated using the following assumptions:

SCHEDULE OF FAIR VALUE ASSUMPTIONS OF OPTIONS AND WARRANTS

| As of August 3, 2022 | | Warrants | | | Options | |

| Expected dividend yield | | | 0 | % | | | 0 | % |

| Share price of last financing | | $ | 0.48 | | | $ | 0.48 | |

| Expected share price volatility | | | 64.91% -113.22% | | | | 133.15% - 143.3% | |

| Risk free interest rate | | | 3.18 | % | | | 2.85% - 3.08% | |

| Remaining life of warrants & options | | | 0.03 - 2 years | | | | 2.56 – 4.23 years | |

For purposes of determining the fair value of the share consideration exchanged on the RTO, the shares of PNRC were valued at USD 2.00 per share, the offering price for the PNRC shares on the last PNRC equity financing prior to the RTO. The RTO resulted in a loss of $29,174,415 with respect to the fair value of the consideration transferred over the fair value of identifiable net assets, which has been recorded as a loss during the year in other income.

4. OTHER RECEIVABLES

A summary of the other receivables as at September 30, 2023 and December 31, 2022 is detailed in the table below:

SCHEDULE OF RECEIVABLES AND OTHER CURRENT ASSETS

| | | September 30, 2023 | | | December 31, 2022 | |

| | | | | | | |

| HST paid on purchases | | | 73,675 | | | | 445,128 | |

| VAT paid on purchases | | | 421,695 | | | | 359,502 | |

| Total receivables and other current assets | | | 495,370 | | | | 804,630 | |

5. EXPLORATION AND EVALUATION ASSETS

SUMMARY OF EXPLORATION AND EVALUATION ASSETS

| | | Selebi | | | Selkirk | | | Total | |

| | | Botswana | | | | |

| | | Selebi | | | Selkirk | | | Total | |

| | | | | | | | | | |

| Balance, December 31, 2022 | | | 31,146,672 | | | | 677,310 | | | | 31,823,982 | |

| Beginning balance | | | 31,146,672 | | | | 677,310 | | | | 31,823,982 | |

| Site operations & administration | | | 642,581 | | | | 41,132 | | | | 683,713 | |

| Care and maintenance | | | 2,289,013 | | | | - | | | | 2,289,013 | |

| Geology | | | 2,392,480 | | | | 318,587 | | | | 2,711,067 | |

| Drilling | | | 1,301,463 | | | | 6,584 | | | | 1,308,047 | |

| Geophysics | | | 1,460,507 | | | | 17,792 | | | | 1,478,299 | |

| Engineering | | | 5,169,574 | | | | 32,789 | | | | 5,202,363 | |

| Environmental, social and governance | | | 184,441 | | | | - | | | | 184,441 | |

| Metallurgy and processing | | | 58,517 | | | | 101,692 | | | | 160,209 | |

| Technical studies | | | 20,879 | | | | 7,650 | | | | 28,529 | |

| Health and safety | | | 314,540 | | | | - | | | | 314,540 | |

| Water treatment project | | | 45,418 | | | | - | | | | 45,418 | |

| Mine development | | | 173,885 | | | | - | | | | 173,885 | |

| Impact of foreign currency translation | | | (1,658,930 | ) | | | (51,999 | ) | | | (1,710,929 | ) |

| Balance, September 30, 2023 | | | 43,541,040 | | | | 1,151,537 | | | | 44,692,577 | |

| Ending balance | | | 43,541,040 | | | | 1,151,537 | | | | 44,692,577 | |

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

The following is a description of the Company’s exploration and evaluation assets and the related spending commitments:

Botswana Assets - Selebi and Selkirk

On September 28, 2021, the Company executed the Selebi Asset Purchase Agreement (the “Selebi APA”) with the BCL liquidator to acquire the Selebi Assets formerly operated by BCL. On January 31, 2022, the Company closed the transaction and ownership of the Selebi Assets transferred to the Company.

Pursuant to the Selebi APA, the aggregate purchase price payable to the seller for the Selebi Assets shall be the sum of $76,862,200 (USD 56,750,000) which amount shall be paid in three instalments:

| ● | $2,086,830 (USD 1,750,000) payable on the closing date. This payment has been made. |

| ● | $33,860,000 (USD 25,000,000) upon the earlier of: (a) approval by the Ministry of Mineral Resources, Green Technology and Energy Security (“MMRGTES”) of the Company’s Section 42 and Section 43 Applications (further extension of the mining licence and conversion of the mining licence into an operating licence, respectively), and (b) on the expiry date of the study phase, January 31, 2025, which can be extended for one year with written notice. |

| ● | The third instalment of $40,632,000 (USD 30,000,000) is payable on the completion of mine construction and production start-up (commissioning) by the Company on or before January 31, 2030, but not later than four years after the approval by the Minister of MMRGTES of the Company’s Section 42 and Section 43 Applications. |

| ● | Payment of care and maintenance funding contribution in respect of the Selebi Assets for a total of $6,164,688 (USD 5,178,747) from March 22, 2021 to the closing date. This payment has been made. |

The total acquisition cost of the Selebi Assets included the first instalment of $2,086,830 (USD 1,750,000) and the payment of the care and maintenance funding contribution of $6,164,688 (USD 5,178,747) for the assets. As per the terms and conditions of the Selebi APA, the Company has the option to cancel the second and third payments and give back the Selebi Assets to the liquidator in the event where the Company determines that the Selebi Assets are not economical. The Company also has an option to pay in advance the second and third payments in the event where the Company determines that the Selebi Assets are economical. The Company’s accounting policy, as permitted by IAS 16 – Property, Plant and Equipment, is to measure and record contingent consideration when the conditions associated with the contingency are met. As of September 30, 2023, none of the conditions of the second and third instalment are met, hence these amounts are not accrued in the unaudited condensed interim consolidated financial statements.

In addition to the Selebi APA, the purchase of the Selebi Assets is also subject to a contingent compensation agreement as well as a royalty agreement with the liquidator.

PNRC also negotiated a separate asset purchase agreement (the “Selkirk APA”) with the liquidator of TNMC to acquire the Selkirk deposit and related infrastructure formerly operated by TNMC on January 20, 2022. The transaction closed on August 22, 2022.

The Selkirk APA does not provide for a purchase price or initial payment for the purchase of the assets. The acquisition cost of the Selkirk Mine of $327,109 (USD 244,954) was the care and maintenance funding contribution from April 1, 2021 to the closing date of the Selkirk APA. The Selkirk APA provides that if the Company elects to develop the Selkirk Mine first, the payment of the second Selebi instalment of $33,860,000 (USD 25,000,000) would be upon the approval by the Minister of MMRGTES of the Company’s Section 42 and Section 43 Applications (further extension of the Selkirk mining licence (years) and conversion of the Selkirk mining licence into an operating licence, respectively). For the third Selebi instalment of $40,632,000 (USD 30,000,000), if the Selkirk Mine were to be commissioned earlier than the Selebi Mines, the payment would trigger on the Selkirk Mine’s commission date.

On August 16, 2023, the Company entered into a binding commitment letter with the Liquidator of BCL Limited, which is subject to customary final documentation, to acquire a 100% interest in two additional deposits (“Phikwe South” and the “Southeast Extension”) located adjacent to and immediately north of the Selebi North mine. The impact is to extend the northern boundary of the Selebi Mining Licence by 3.7 kilometres and increase the Selebi Mining License area from 115.0 square kilometres to 153.7 square kilometres. While the remaining historic resources at Phikwe South and Southeast Extension occur within the expanded Selebi Mining Licence, the amended licence intentionally does not include the historic mine workings and infrastructure at these previously-producing properties, and the Company has no liability for historic environmental issues at those sites.

The upfront cost to the Company to acquire these additional mineral properties is USD1,000,000. In addition, the Company agreed to additional work commitments of USD5,000,000 over the next four years. As a result of the extension of the Selebi Mining Licence, the remaining asset purchase obligations of the Company outlined in the original Selebi Mines asset purchase agreement with the Liquidator will each increase by 10%, $7,436,000 (USD 5,500,000) in total, while the trigger events remain unchanged. The existing 2% net smelter royalty (“NSR”) held by the Liquidator with respect to production from the Selebi Mining Licence will also apply to production from these additional deposits, subject to the Company’s existing buy-back right for 50% of the NSR. The acquisition of the Phikwe South and Southeast Extension deposits has not yet closed as at September 30, 2023.

During the nine months ended September 30, 2023, the Company incurred $12,868,595 in exploration and development expenditures on the Selebi Assets and Selkirk Assets (September 30, 2022 - $21,783,763).

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

6. PROPERTY, PLANT AND EQUIPMENT

The table below sets out costs and accumulated amortization as at September 30, 2023.

SUMMARY OF PROPERTY, PLANT AND EQUIPMENT

Cost | | Land (ROU Assets) | | | Buildings (ROU Assets) | | | Furniture and Fixtures | | | Exploration Equipment | | | Generator | | | Vehicles | | | Computer and software | | | Total | |

| Balance – December 31, 2022 | | | 220,242 | | | | 2,857,179 | | | | 126,605 | | | | 11,973 | | | | 31,381 | | | | 241,884 | | | | 1,950 | | | | 3,491,214 | |

| Additions | | | - | | | | - | | | | 67,551 | | | | 2,735,000 | | | | - | | | | 85,365 | | | | - | | | | 2,887,916 | |

| Impact of FX translation | | | (13,482 | ) | | | (171,900 | ) | | | (5,425 | ) | | | - | | | | (1,921 | ) | | | (22,322 | ) | | | - | | | | (215,050 | ) |

| Depreciation during the period | | | - | | | | 91,865 | | | | - | | | | 137,838 | | | | 441 | | | | 44,449 | | | | - | | | | 274,593 | |

| Balance – September 30, 2023 | | | 206,760 | | | | 2,685,279 | | | | 188,731 | | | | 2,746,973 | | | | 29,460 | | | | 304,927 | | | | 1,950 | | | | 6,164,080 | |

| Accumulated Depreciation | | Land (ROU Assets) | | | Buildings (ROU Assets) | | | Furniture and Fixtures | | | Exploration Equipment | | | Generator | | | Vehicles | | | Computer and software | | | Total | |

| Balance – December 31, 2022 | | | - | | | | 51,124 | | | | 1,872 | | | | 1,447 | | | | 562 | | | | 39,589 | | | | 1,950 | | | | 96,544 | |

| Depreciation during the period | | | - | | | | 91,865 | | | | - | | | | 137,838 | | | | 441 | | | | 44,449 | | | | - | | | | 274,593 | |

| Balance – September 30, 2023 | | | - | | | | 142,989 | | | | 1,872 | | | | 139,285 | | | | 1,003 | | | | 84,038 | | | | 1,950 | | | | 371,137 | |

| Carrying Value | | Land (ROU Assets) | | | Buildings (ROU Assets) | | | Furniture and Fixtures | | | Exploration Equipment | | | Generator | | | Vehicles | | | Computer and Software | | | Total | |

| Balance – December 31, 2022 | | | 220,242 | | | | 2,806,055 | | | | 124,733 | | | | 10,526 | | | | 30,819 | | | | 202,295 | | | | - | | | | 3,394,670 | |

| Beginning balance | | | 220,242 | | | | 2,806,055 | | | | 124,733 | | | | 10,526 | | | | 30,819 | | | | 202,295 | | | | - | | | | 3,394,670 | |

| Balance – September 30, 2023 | | | 206,760 | | | | 2,542,290 | | | | 186,859 | | | | 2,607,688 | | | | 28,457 | | | | 220,889 | | | | - | | | | 5,792,943 | |

| Ending balance | | | 206,760 | | | | 2,542,290 | | | | 186,859 | | | | 2,607,688 | | | | 28,457 | | | | 220,889 | | | | - | | | | 5,792,943 | |

Additions to property, plant and equipment during the period ended September 30, 2023 included the purchase of drilling equipment through a lease agreement with a drilling company (note 10) as well as vehicles financed through a local Botswana bank.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

7. TRADE PAYABLES AND ACCRUED LIABILITIES

SUMMARY OF TRADE PAYABLES AND ACCRUED LIABILITIES

| | | September 30, 2023 | | | December 31, 2022 | |

| | | | | | | |

| Amounts due to related parties (note 11) | | | 256,554 | | | | 43,235 | |

| Trade payables | | | 2,014,674 | | | | 3,660,519 | |

| Accrued liabilities | | | 876,889 | | | | 321,962 | |

| Trade payables and accrued liabilities | | | 3,148,177 | | | | 4,025,716 | |

8. PROMISSORY NOTE

On November 21, 2022, the Company announced a $7,000,000 bridge loan (the “Bridge Loan”) financing from Pinnacle Island LP (the “Lender”). The Bridge Loan financing closed on November 25, 2022 and net proceeds of $6,740,000 were received by the Company (after deducting the commitment fee of $260,000). The Bridge Loan was evidenced by the issuance of a promissory note by the Company to the Lender (the “Promissory Note”). The Promissory Note had a principal amount of $7 million and bore interest at a rate of 10% per annum, calculated monthly and initially payable on February 22, 2023, being the maturity date of the Promissory Note, with a right of the Company to extend the maturity date to March 22, 2023 by providing written notice to the Lender by February 15, 2023. The Company extended the maturity to March 22, 2023.

On March 17, 2023, the Company entered into an amended and restated promissory note (the “A&R Promissory Note”) extending the maturity of the Promissory note from March 22, 2023 to November 24, 2023 (the “Extension”). All other terms of the Promissory Note remained the same. In connection with the Extension and entry into of the A&R Promissory Note, the Company agreed to pay an amendment and restatement fee of $225,000 and issued 350,000 non-transferable common share purchase warrants to the Lender (the “Lender Warrants”). Each Lender Warrant is exercisable to acquire one common share of the Company (the “Common Shares”) at a price of $1.75 per Common Share for a period of one year from the date of the A&R Promissory Note. In connection with the Extension and issuance of the Lender Warrants, the 119,229 common share purchase warrants previously issued to the Lender in connection with the initial issuance of the Promissory Note were cancelled concurrently with the Extension.

In connection with the A&R Promissory Note, the Company accrued $70,959 of interest due to the Lender as at December 31, 2022 and a further $341,370 of interest during the nine months ended September 30, 2023.

The fair value of the liability of the Lender Warrants was estimated at $116,177 using the Black-Scholes Option Pricing Model. The fair value of the Lender Warrants and the amendment and restatement fee of $225,000 was added to the liability of the A&R Promissory Note and amortized over the remaining life of the A&R Promissory Note.

On June 28, 2023, the Company repaid the Promissory Note in full including accrued interest and restatement fee in aggregate amount of $7,637,329.

The fair value of the Lender warrants was calculated using the following assumptions:

SCHEDULE OF FAIR VALUE OF LENDER WARRANTS ASSUMPTIONS

| | | March 31,

2023 | |

| Expected dividend yield | | | 0 | % |

| Stock price | | $ | 1.40 | |

| Expected share price volatility | | | 77.2 | % |

| Risk free interest rate | | | 3.49 | % |

| Expected life of warrant | | | 1 year | |

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

9. TERM LOAN

On June 28, 2023, the Company closed a financing with Cymbria Corporation (“Cymbria”), EdgePoint Investment Group Inc. and certain other entities managed by it (“EdgePoint”) for aggregate gross proceeds to PNRL of $33,999,200. The financing included three concurrent and inter-conditional transactions (collectively the “Financing Transactions”) comprised of an equity offering of units for $16,249,200 (the “Equity Financing”), a three year term loan of $15,000,000 (the “Term Loan”) and option payments of $2,750,000 (the “Option Payment”) to acquire a 0.5% net smelter returns royalty on the Company’s Selebi Mines and Selkirk Mine in certain circumstances upon payment of further consideration (Note 11).

The Term Loan has a principal amount of $15,000,000 and bears interest at a rate of 10% per annum payable quarterly in arrears. The principal amount of the Term Loan will mature and be payable on the third anniversary of the date of issue. The obligations of the Company pursuant to the Term Loan are fully and unconditionally guaranteed by each of the Company’s existing and future subsidiaries. The Term Loan is secured by a pledge of all the shares of the Company’s subsidiaries as well as by way of a general security agreement at the parent level and debentures and hypothecations at the subsidiary level. The Term Loan is subject to certain covenants and provisions on events of default, repayments and mandatory prepayments including:

| ● | increase in the interest rate payable on the Term Loan to 15% per annum upon the occurrence of an event of default; |

| | | |

| ● | the Company may prepay all or any portion of the principal amount outstanding with a minimum repayment amount of $500,000 and in an integral multiple of $100,000, together with all accrued and unpaid interest on the principal amount being repaid; |

| | | |

| ● | if prepayment occurs within one year of the closing date, a prepayment fee in an amount equal to 10% of the principal amount of the Term Loan being prepaid less interest paid or payable on or prior to the date of prepayment attributable to the portion of the Term Loan (“Prepayment Fee”); |

| | | |

| ● | mandatory prepayment shall be made when the Company has non-ordinary course asset sales or other dispositions of property or the Company receives cash from the issuance of indebtedness for borrowed money and all of the net cash proceeds from assets sales or new loans shall be applied to repay the principal amount of the Term Loan together with all accrued and unpaid interest on the principal amount being repaid as well as the Prepayment Fee if such mandatory prepayment occurs within one year of the closing date; and |

| | | |

| ● | in the event of change of control, the Company shall repay the Term Loan in full plus a fee equal to 10% of the then-outstanding principal amount of the Term Loan. |

In connection with the Term Loan, the Company issued an aggregate of 2,000,000 non-transferable common share purchase warrants (the “Non-Transferable Warrants”) to Cymbria (the “Lender”). Each Non-Transferable Warrant is excisable by the Lender to purchase one common share upon payment of the cash purchase price of $1.4375 per common share for a period of three years from the issuance thereof.

The fair value of the Non-Transferable Warrants was estimated at $1,587,232 using the Black-Scholes Option Pricing Model and recorded in reserves.

The fair value of the Non-Transferable Warrants was calculated using the following assumptions:

SCHEDULE OF FAIR VALUE OF NON-TRANSFERABLE WARRANTS ASSUMPTIONS

| | | June 28,

2023 | |

| Expected dividend yield | | | 0 | % |

| Stock price | | $ | 1.35 | |

| Expected share price volatility | | | 92.06 | % |

| Risk free interest rate | | | 4.13 | % |

| Expected life of warrant | | | 3 years | |

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

The Company used $7,637,329 of the proceeds from the Term Loan to prepay all principal, interest and fees owing by the Company pursuant to the A&R Promissory Note dated March 17, 2023 in favour of Pinnacle Island LP (Note 8).

For the period ended September 30, 2023, The Company paid $390,411 of interest costs to the Lender.

The following is a continuity of the Term Loan

SCHEDULE OF TERM LOAN

| | | $ | |

| Principal amount of the Term Loan | | | 15,000,000 | |

| Fair value of the attached warrants | | | (1,587,232 | ) |

| Term Loan at fair value on issuance, Jun 28, 2023 | | | 13,412,768 | |

| Transaction costs | | | (695,798 | ) |

| Accrued interest | | | 390,411 | |

| Interest paid | | | (390,411 | ) |

| Amortization of warrant fair value and transaction costs | | | 199,740 | |

| | | | 12,916,710 | |

10. LEASE LIABILITY

SCHEDULE OF DETAILS OF LEASE LIABILITIES

| | | September 30,

2023 | | | December 31, 2022 | |

| | | | | | | |

| Lease liabilities, beginning of the period | | | 2,731,394 | | | | - | |

| Lease additions | | | 2,735,000 | | | | 3,213,404 | |

| Lease payments | | | (3,602,167 | ) | | | (550,295 | ) |

| Interest expense on lease liabilities | | | 233,327 | | | | 68,285 | |

| Impact of FX translation | | | (205,050 | ) | | | - | |

| IFRS 16 lease liabilities, end of the period | | | 1,892,504 | | | | 2,731,394 | |

| Current portion of lease liability (less than one year) | | | 1,892,504 | | | | 1,365,697 | |

| Long-term lease liability (one to five years) | | | - | | | | 1,365,697 | |

Syringa Lodge

On July 9, 2022, the Company executed a sales agreement (the “Lodge Agreement”) with Tuli Tourism Pty Ltd. (the “Seller”) for the Syringa Lodge (the “Lodge”) in Botswana.

As per the Lodge Agreement, the aggregate purchase price payable to the Seller shall be the sum of $3,213,404 (BWP 30,720,000). A deposit of $482,011 (BWP 4,608,000) was paid on August 17, 2022. The balance is payable in two installments of $1,365,697 (BWP 13,056,000) on July 1, 2023 and August 1, 2024. The payment due on July 1, 2023 was made to the Seller.

In addition to the above purchase price, the Company is required to pay to the Seller an agreed interest amount in twelve equal monthly instalments of $13,657 (BWP 130,560) followed by twelve equal monthly instalments of $6,828 (BWP 65,280).

Drilling Equipment

On March 14, 2023, the Company entered into a drilling equipment supply agreement (the “Equipment Agreement”) with Forage Fusion Drilling Ltd. (“Forage”) to purchase specific drilling equipment on a “rent to own” basis with the purchase price to be paid in monthly payments.

As per the Equipment Agreement, the aggregate purchase price payable to Forage is $2,942,000. A deposit of $1,700,000 was paid in March 2023. The balance is payable in twelve equal monthly instalments of $103,500. The equipment arrived at the site in July 2023. Based on the stated equipment purchase price of $2,735,000 and monthly installments, the implied interest rate for the arrangement is 35%.

Notes to the Unaudited Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2023

(Expressed in Canadian dollars)

11. NSR OPTION LIABLITY

Concurrently with the closings of the Equity Financing and the Term Loan on June 28, 2023, Cymbria paid an aggregate of $2,750,000 (“Option Payment”) to two subsidiaries of PNRL to acquire a right to participate with such subsidiaries in the exercise of certain contractual rights, as and when the same may be exercised by such subsidiaries. The Option Payment was allocated to PNRP and PNGP (defined below) for $2,500,000 and $250,000, respectively, having regard to the relative purchase prices payable in connection with the exercise of their respective contractual rights. The legal fees associated with the transaction have been expensed.

PNRL’s indirect wholly-owned subsidiary Premium Nickel Resources Proprietary Limited (“PNRP”) acquired the Selebi Mines in January 2022 out of liquidation. Pursuant to the acquisition agreement, the liquidator retained a 2% net smelter returns royalty on the Selebi Mines (the “Selebi NSR”). PNRP has a contractual right to repurchase one-half of the Selebi NSR at a future time on payment by PNRP to the liquidator of USD 20,000,000.

PNRL’s indirect wholly-owned subsidiary Premium Nickel Group Proprietary Limited (“PNGP”) acquired the Selkirk Mine in August 2022 out of liquidation. Pursuant to the acquisition agreement, the liquidator retained a 1% net smelter returns royalty on the Selkirk Mine (the “Selkirk NSR” and together with the Selebi NSR, the “NSRs”). PNGP has a contractual right to repurchase the entirety of the Selkirk NSR at a future time on payment by PNGP to the liquidator of USD 2,000,000.

Each of PNRP and PNGP has agreed to grant Cymbria, in exchange for the Option Payment, an option to participate in any such repurchase of the applicable portion of its NSR from the relevant liquidator. Cymbria will, following the exercise of its option to participate in any such repurchase, acquire a 0.5% net smelter returns royalty on the applicable property by paying an amount equal to one half of the repurchase price payable by PNRP or PNGP pursuant to the applicable NSR, less the Option Payment paid at closing pursuant to the relevant option agreement among Cymbria and PNRP or PNGP, as applicable. Cymbria has the right to put its options back to PNRP and PNGP in certain circumstances in return for the reimbursement of the applicable portion of the Option Payment.

Under the NSR option purchase agreements, Cymbria could acquire a 0.5% net smelter returns royalty on the Company’s Selebi Mines and Selkirk Mine upon payment of $10,675,231 (USD 8,102,500) and $1,067,523 (USD 810,250), respectively.

12. SHARE CAPITAL, WARRANTS AND OPTIONS

The authorized capital of the Company comprises an unlimited number of common shares without par value and 100,000,000 Series 1 convertible preferred shares without par value.

Effective August 3, 2022, in connection with the closing of the RTO, the Company completed a share consolidation of the Company’s issued and outstanding common shares and preferred shares, in each case exchanging one (1) post-consolidation share without par value for every five (5) pre-consolidation shares issued and outstanding.

All references to share capital, warrants, options and weighted average number of shares outstanding have been adjusted in these financial statements and retrospectively to reflect the Company’s RTO share exchange and 5-for-1 share consolidation as if it occurred at the beginning of the earliest period presented.

| a) | Common Shares Issued and Outstanding |

During the nine months ended September 30, 2023, the Company completed the following financing transactions: