UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04719

The TETON Westwood Funds

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: September 30

Date of reporting period: September 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

TETON WESTWOOD FUNDS

|

| |

|

Mighty MitesSM Fund |

| |

|

SmallCap Equity Fund |

| |

|

Mid-Cap Equity Fund |

| |

|

Income Fund |

| |

|

Equity Fund |

| |

|

Balanced Fund |

| |

|

Intermediate Bond Fund |

|

| Annual Report |

|

| September 30, 2014 |

TETON WESTWOOD FUNDS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class AAA Shares | | | | Class A Shares |

| | | Average Annual Returns – September 30, 2014 (a) | | | | Average Annual Returns – September 30, 2014 (a)(b)(d) |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Gross

Expense

Ratio | | Expense

Ratio after

Adviser

Reimburse-

ments | | Maximum

Sales

Charge | | | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Gross

Expense

Ratio | | Expense

Ratio after

Adviser

Reimburse-

ments | | Maximum

Sales

Charge |

Mighty Mites | | | | 2.23 | % | | | | 14.28 | % | | | | 11.03 | % | | | | 11.82 | % | | | | 1.44 | % | | | | 1.44 | % | | | | None | | | | | | | (2.12 | )% | | | | 13.07 | % | | | | 10.32 | % | | | | 11.34 | % | | | | 1.69 | % | | | | 1.69 | % | | | | 4.00 | % |

SmallCap Equity | | | | 3.48 | | | | | 12.69 | | | | | 8.91 | | | | | 7.17 | | | | | 1.63 | | | | | 1.50 | | | | | None | | | | | | | (0.83 | ) | | | | 11.51 | | | | | 8.22 | | | | | 6.78 | | | | | 1.88 | | | | | 1.75 | | | | | 4.00 | |

Mid-Cap Equity Fund | | | | 10.15 | | | | | — | | | | | — | | | | | 11.36 | | | | | 3.88 | | | | | 1.50 | | | | | None | | | | | | | 5.57 | | | | | — | | | | | — | | | | | 7.77 | | | | | 4.13 | | | | | 1.75 | | | | | 4.00 | |

Income | | | | 15.46 | | | | | 12.55 | | | | | 6.79 | | | | | 7.94 | | | | | 2.57 | | | | | 2.00 | | | | | None | | | | | | | 10.54 | | | | | 11.35 | | | | | 6.09 | | | | | 7.47 | | | | | 2.82 | | | | | 2.25 | | | | | 4.00 | |

Equity | | | | 15.28 | | | | | 12.91 | | | | | 7.85 | | | | | 10.17 | | | | | 1.60 | | | | | 1.60 | | | | | None | | | | | | | 10.43 | | | | | 11.72 | | | | | 7.14 | | | | | 9.78 | | | | | 1.85 | | | | | 1.85 | | | | | 4.00 | |

Balanced | | | | 9.85 | | | | | 9.03 | | | | | 6.49 | | | | | 8.65 | | | | | 1.28 | | | | | 1.28 | | | | | None | | | | | | | 5.17 | | | | | 7.88 | | | | | 5.79 | | | | | 8.20 | | | | | 1.53 | | | | | 1.53 | | | | | 4.00 | |

Intermediate Bond | | | | 0.54 | | | | | 2.23 | | | | | 3.17 | | | | | 4.94 | | | | | 1.36 | | | | | 1.00 | | | | | None | | | | | | | (3.53 | ) | | | | 1.30 | | | | | 2.63 | | | | | 4.69 | | | | | 1.46 | | | | | 1.10 | | | | | 4.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class C Shares | | | | Class I Shares |

| | | Average Annual Returns – September 30, 2014 (a)(c)(d) | | | | Average Annual Returns – September 30, 2014 (a)(d) |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Gross

Expense

Ratio | | Expense

Ratio after

Adviser

Reimburse-

ments | | Maximum

Sales

Charge | | | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Gross

Expense

Ratio | | Expense

Ratio after

Adviser

Reimburse-

ments | | Maximum

Sales

Charge |

Mighty Mites | | | | 0.41 | % | | | | 13.43 | % | | | | 10.21 | % | | | | 11.16 | % | | | | 2.19 | % | | | | 2.19 | % | | | | 1.00 | % | | | | | | 2.43 | % | | | | 14.56 | % | | | | 11.21 | % | | | | 11.94 | % | | | | 1.19 | % | | | | 1.19 | % | | None |

SmallCap Equity | | | | 1.77 | | | | | 11.86 | | | | | 7.90 | | | | | 6.54 | | | | | 2.38 | | | | | 2.25 | | | | | 1.00 | | | | | | | 3.78 | | | | | 12.98 | | | | | 9.10 | | | | | 7.28 | | | | | 1.38 | | | | | 1.25 | | | None |

Mid-Cap Equity | | | | 8.41 | | | | | — | | | | | — | | | | | 10.57 | | | | | 4.63 | | | | | 2.25 | | | | | 1.00 | | | | | | | 10.50 | | | | | — | | | | | — | | | | | 11.64 | | | | | 3.63 | | | | | 1.25 | | | None |

Income | | | | 13.57 | | | | | 11.70 | | | | | 5.99 | | | | | 7.41 | | | | | 3.32 | | | | | 2.75 | | | | | 1.00 | | | | | | | 15.77 | | | | | 12.81 | | | | | 6.97 | | | | | 8.04 | | | | | 2.32 | | | | | 1.75 | | | None |

Equity | | | | 13.51 | | | | | 12.08 | | | | | 7.05 | | | | | 9.70 | | | | | 2.35 | | | | | 2.35 | | | | | 1.00 | | | | | | | 15.38 | | | | | 13.16 | | | | | 8.02 | | | | | 10.23 | | | | | 1.35 | | | | | 1.35 | | | None |

Balanced | | | | 8.04 | | | | | 8.23 | | | | | 5.70 | | | | | 8.11 | | | | | 2.03 | | | | | 2.03 | | | | | 1.00 | | | | | | | 10.04 | | | | | 9.32 | | | | | 6.67 | | | | | 8.73 | | | | | 1.03 | | | | | 1.03 | | | None |

Intermediate Bond | | | | (1.16 | ) | | | | 1.45 | | | | | 2.40 | | | | | 4.50 | | | | | 2.11 | | | | | 1.75 | | | | | 1.00 | | | | | | | 0.88 | | | | | 2.49 | | | | | 3.34 | | | | | 5.01 | | | | | 1.11 | | | | | 0.75 | | | None |

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. For the SmallCap Equity, Mid-Cap Equity, Income, and Intermediate Bond Funds (and for the Mighty Mites Fund through September 30, 2005), TETON Advisors, Inc., (the “Adviser”) reimbursed expenses to limit the expense ratio. Had such limitations not been in place, returns would have been lower. The contractual expense limitations are in effect through January 31, 2015 and are renewable annually by the Adviser. The Funds, except for the Equity, Balanced, and Intermediate Bond Funds, impose a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of a Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. |

| (b) | Includes the effect of the maximum 4.00% sales charge at the beginning of the period. |

| (c) | Assuming payment of the 1% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. |

| (d) | The performance of the Class AAA Shares is used to calculate performance for the periods prior to the issuance of Class A Shares, Class C Shares, and Class I Shares, except for the Mid-Cap Equity Fund. The performance for the Class I Shares of the Mid-Cap Equity Fund is based on the Fund’s inception date for this Share class. The performance for the Class A Shares and Class C Shares would have been lower due to the additional fees and expenses associated with these classes of shares. The performance for the Class I Shares would have been higher due to the lower expenses associated with this class of shares. The inception dates for the Class AAA Shares and the initial issuance dates for the Class A Shares, Class C Shares, and Class I Shares after which shares remained continuously outstanding are listed below. |

| | | | | | | | |

| | | Class AAA Shares | | Class A Shares | | Class C Shares | | Class I Shares |

Mighty Mites | | 05/11/98 | | 11/26/01 | | 08/03/01 | | 01/11/08 |

SmallCap Equity | | 04/15/97 | | 11/26/01 | | 11/26/01 | | 01/11/08 |

Mid-Cap Equity | | 05/31/13 | | 05/31/13 | | 05/31/13 | | 05/31/13 |

Income | | 09/30/97 | | 05/09/01 | | 11/26/01 | | 01/11/08 |

Equity | | 01/02/87 | | 01/28/94 | | 02/13/01 | | 01/11/08 |

Balanced | | 10/01/91 | | 04/06/93 | | 09/25/01 | | 01/11/08 |

Intermediate Bond | | 10/01/91 | | 07/26/01 | | 10/22/01 | | 01/11/08 |

The TETON Westwood Funds file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain this information at www.gabelli.com or by calling the Funds at 800-WESTWOOD (800-937-8966). The Funds’ Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

Each Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Funds’ proxy voting policies, procedures, and how the Funds voted proxies relating to portfolio securities are available without charge, upon request, by (i) calling 800-WESTWOOD (800-937-8966); (ii) writing to The TETON Westwood Funds at One Corporate Center, Rye, NY 10580-1422; and (iii) visiting the SEC’s website at www.sec.gov.

2

Performance Discussion (Unaudited)

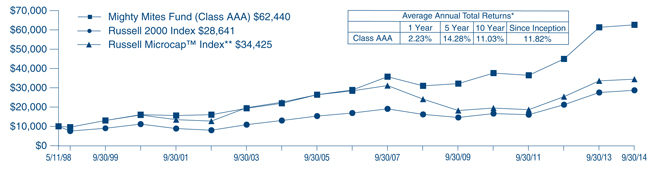

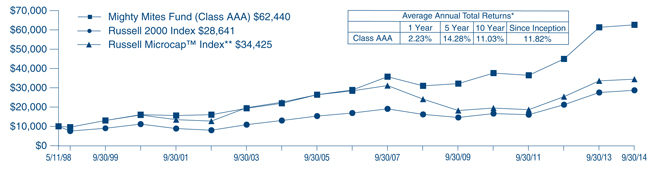

Mighty Mites Fund

For the year ended September 30, 2014, the TETON Westwood Mighty Mites Fund net asset value (“NAV”) per Class AAA Share appreciated 2.2% versus gains of 3.9% for the Russell 2000 and 2.8% for the Russell Microcap Indices. See next page for additional performance information.

The Fund invests in small and micro-cap equity securities that have a market capitalization of $500 million or less at time of purchase. The portfolio management team focuses on bottom up stock selection, seeking bite sized companies with excellent management teams, strong balance sheets, and superior long term fundamentals. As bottom up, fundamental, research driven investors, the team seeks to purchase the inefficiently priced stocks of excellent companies selling at a discount to their private market value (PMV). In many cases, they look for a catalyst that can unlock hidden value within the enterprise. As such, (y)our portfolio is diversified across a broad cross section of companies sharing these valuation characteristics.

The first calendar quarter saw equity markets continue in a slow growth pattern. Tensions across the globe continued to build, with the U.S. and the European Union imposing sanctions on Russia. The greater geopolitical risk, along with slowing growth in China, indicated possible headwinds for the market.

During the quarter ended June 30, the performance of the equity markets continued to reflect the improving economic landscape in the U.S. Despite geopolitical concerns over civil war in Iraq, Russian posturing in Eastern Europe, and the rise of ISIS, the market continued its upward trajectory. The labor market continued to gain momentum, with an accelerating pace of job gains and a downtrend in the unemployment rate.

Despite a period of global uncertainty, the U.S. economy continued to grow in the third quarter. Small and microcap stocks have lagged the S&P 500 Index through September. Although small caps have been correcting since March, much of the slide has occurred in the third quarter. Also, economic data this year has been very uneven, with Gross Domestic Product contracting 2.9% in the March quarter followed by second quarter growth at a very strong 4.6%, the fastest rate of growth since the fourth quarter of 2011.

Deal activity was strong, with 19 announced transactions during the Fund’s fiscal year. Some notable deals during the fiscal year include: Costa Inc. was purchased by Essilor International for $21.50 in cash; Coastal Contacts Inc. was acquired by Essilor International for $12.45 in cash; LIN Media was acquired by Media General Inc. for $27.82 in cash and stock; Owens & Minor acquired Medical Action Industries Inc. for $13.80 in cash; Journal Communications Inc. (0.9% of net assets as of September 30, 2014) is being acquired by The E.W. Scripps Co. (0.2%) in an all stock deal. Private equity firm, Court Square Capital Partners, is buying Pike Corp. (0.2%) for $12.00 in cash. Skilled Healthcare Group, Inc. (less than 0.05%) is merging with Genesis Healthcare in an all stock deal. Multimedia Games Holding Co. Inc. (0.3%) is being acquired by Global Cash Access Holdings for $36.50 in cash.

Among the better performing stocks for the fiscal year were The Greenbrier Companies Inc. (0.2%), a transportation manufacturing corporation, specializing in rail transportation and leasing/management services; InfuSystems Holdings Inc. (0.2%), a provider of infusion pumps and related services; and Lawson Products Inc. (0.4%), a distributor of products and services to the industrial, commercial, institutional, and governmental maintenance, repair and operations marketplace. Some of our weaker performing stocks during the year were Coldwater Creek (sold), a specialty retailer of women’s apparel; Sevcon Inc. (0.3%), a producer and distributor in the electronic controls business; and the Dolan Co. (sold), a provider of professional services and business information to the legal, financial, and real estate sectors in the U.S.

We appreciate your confidence and trust.

3

Average Annual Returns Through September 30, 2014 (a) (Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(5/11/98) | | | |

Mighty Mites Fund Class AAA | | | 2.23% | | | | 14.28% | | | | 11.03% | | | | 11.82% | | | |

Russell MicrocapTM Index | | | 2.78 | | | | 13.60 | | | | 6.36 | | | | N/A(b) | | | |

Russell 2000 Index | | | 3.93 | | | | 14.29 | | | | 8.19 | | | | 6.63 | | | |

Lipper Small Cap Value Fund Average | | | 6.71 | | | | 13.65 | | | | 8.20 | | | | 8.16(c) | | | |

In the current prospectus dated January 28, 2014, the expense ratio for Class AAA Shares is 1.44%. See page 42 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. TETON Advisors, Inc., the Adviser, reimbursed expenses through September 30, 2005 to limit the expense ratios. Had such limitations not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Russell Microcap™ Index is an unmanaged indicator which measures the performance of the microcap segment of the U.S. equity market. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. The Lipper Small Cap Value Fund Average reflects the average performance of mutual funds classified in this particular category. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | The inception date of the Russell Microcap™ Index is June 30, 2000. | |

| | (c) | Lipper Small Cap Value Fund Average since inception performance is as of April 30, 1998. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE MIGHTY MITES FUND CLASS AAA, THE RUSSELL 2000 INDEX,

AND THE RUSSELL MICROCAP™ INDEX (Unaudited)

*Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

**The Russell Microcap™ Index inception date is June 30, 2000 and the value of the Index prior to July 1, 2000 is that of the Mighty Mites Fund (Class AAA).

4

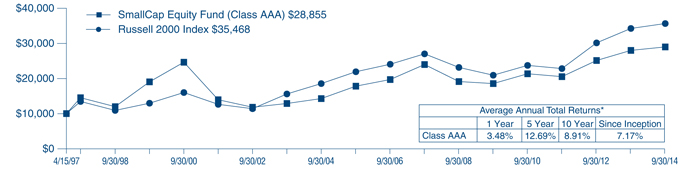

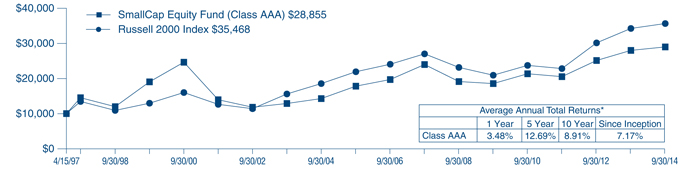

SmallCap Equity Fund (Unaudited)

For the year ended September 30, 2014, the TETON Westwood SmallCap Equity Fund net asset value (“NAV”) per Class AAA Share appreciated 3.5% compared with a gain of 3.9% for the Russell 2000 Index. See below for additional performance information.

The last calendar quarter of 2013 saw equity price/earnings (P/E) multiples expand along with strong market gains. At its December meeting, the Federal Reserve announced that it would reduce the monthly pace of bond purchases by $10 billion per month.

The U.S. economic recovery gathered momentum in the first quarter of 2014, as evidenced by robust consumer spending and an improving job picture: nonfarm payrolls rose a seasonally adjusted 192,000 in March and figures for the prior two months were revised upward by a combined 37,000 with the unemployment rate holding steady at 6.7%. Moreover, the economy witnessed the early stages of a wave in merger and acquisition activity among smaller capitalization companies being acquired by both financial and strategic buyers.

Though the market was up significantly in the second quarter of 2014, the small cap index experienced an early stumble. The small cap pullback, attributable to concerns over a slowing economy, afforded the opportunity to refresh the portfolio through pruning and capital redeployment. Following the correction in the first quarter of 2014, nearly 40% of small caps were down 10% or more, causing the P/E premium of small caps vs. large caps to narrow to 1.16x from 1.35x in September 2013.

The quarter ended September 30 saw increasing geopolitical instability in the Middle East and Ukraine, decelerating growth in China, and fears of a less accommodative monetary policy by the Federal Reserve. Markets have historically corrected in anticipation of tightening credit and higher interest rates. Some positive domestic trends included strong new home sales, retail sales up 5% from the same month a year ago, and an improving job market and manufacturing activity.

Among the better performing stocks for the fiscal year were: Trinity Industries Inc. (1.7% of net assets as of September 30, 2014), a provider of products and services to the energy, transportation, chemical, and construction sectors in the U.S., Canada, Mexico, United Kingdom, Singapore, and Sweden; Patterson-UTI Energy Inc. (1.9%), a provider of onshore contract drilling services to major and independent oil and natural gas operators in the U.S. and Canada; and Hanesbrands Inc. (0.9%), a consumer goods company that designs, manufactures, sources, and sells basic apparels primarily in the U.S. Our weaker performing stocks during the year were Energy XXI Bermuda Ltd. (0.6%), which engages in the acquisition, exploration, development, production, and operation of oil and natural gas properties; General Cable Corp., a company offering fiber optic wire and cable products for the energy, industrial, construction, specialty, and communications markets worldwide which was sold prior to the fiscal year end; and Approach Resources Inc. (0.8%), an independent energy company engaged in the acquisition, development, exploration, and production of oil and gas properties in the U.S.

We thank you for your continued confidence and trust.

| | | | | | | | | | | | | | | | |

| Average Annual Returns through September 30, 2014 (a) (Unaudited) | | | Since | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Inception

(4/15/97) | | |

SmallCap Equity Fund Class AAA | | | 3.48% | | | | 12.69% | | | | 8.91% | | | 7.17% | | |

Russell 2000 Index | | | 3.93 | | | | 14.29 | | | | 8.19 | | | 8.36 | | |

In the current prospectus dated January 28, 2014, the gross expense ratio for Class AAA Shares is 1.63%, and the net expense ratio is 1.50%, after contractual reimbursements by TETON Advisors, Inc. (the “Adviser”) in place through January 31, 2015. See page 43 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE SMALLCAP EQUITY FUND

CLASS AAA AND THE RUSSELL 2000 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

5

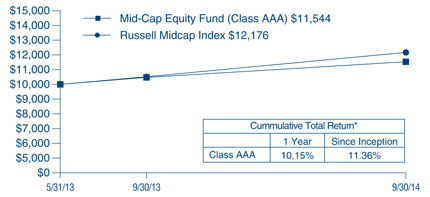

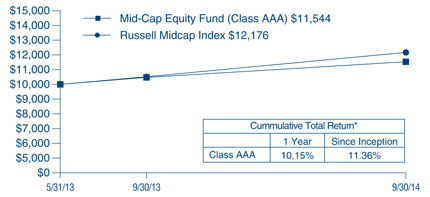

Mid-Cap Equity Fund (Unaudited)

For the year ended September 30, 2014, the TETON Westwood Mid-Cap Equity Fund’s net asset value (“NAV”) per Class AAA Share appreciated 10.2% compared with 15.8% for the Russell Midcap Index. See next page for additional performance information.

The Fund invests primarily in mid-cap companies that the portfolio managers believe are undervalued by the market and have above average growth potential. The Fund defines mid-cap companies as those whose market capitalization (number of shares multiplied by share price) falls within a range of $1 billion to $20 billion. The portfolio managers seek to identify companies with attractive products or services, financial strength, strong competitive positions, high quality management, and reasonable valuation. As bottom up, fundamental, research driven investors, they seek to invest in attractively valued companies with strong balance sheets, secular growth, experienced management teams, solid earnings prospects, leading market shares, and superior long term fundamentals.

The fourth quarter of 2013, the opening of the Fund’s fiscal year, capped an exceptional year for the U.S. equity market fueled by accommodative monetary policy and solid improvement in the economy. Mid-cap stocks appreciated 8.4% in the fourth quarter ending the year at an all time high for the Russell Midcap Index.

The financial markets were very erratic during the first three months of the calendar year as investors focused on weaker macroeconomic statistics in the U.S. and the reversal of the Federal Reserve’s stimulative monetary policy. The Russell Midcap Index swooned more than 5.0% before ending the quarter up 3.5%. Economic activity suddenly reversed course, slowing markedly from the upward momentum seen at year end. Mid-cap stocks outperformed both large and small cap stocks during the first quarter. Growth stocks underperformed throughout the quarter, but were particularly hard hit in March when the market favored lower quality, value companies.

In the second calendar quarter, economic statistics from manufacturing to employment displayed gradual improvement, reaching levels similar to or better than those reported at the end of 2013. Equity markets celebrated the recovery by resuming their ascent, reaching record levels at mid year with mid-cap stocks up 5.0% for the quarter and 8.7% year to date as measured by the Russell Midcap Index. Mid-cap companies continued to outperform both large and small cap.

The U.S. equity markets’ performance during the third calendar quarter was closely aligned with the direction of U.S. economic growth, but turned a blind eye to weakening economies and geopolitical unrest in regions outside our borders. After a second quarter rebound in GDP to 4.6%, U.S. economic activity continued to advance through August with both manufacturing and service sectors matching or exceeding post recession highs as measured by the Institute for Supply Management. The economy appeared to be on solid footing. However, the economic recovery proved somewhat temperamental. The robust growth seen in spring and summer partly reflected some catchup after a weather worn winter, as most macroeconomic statistics from manufacturing to auto sales softened in September while consumer confidence took a hit.

Two conflicting trends remained consistent throughout the third quarter. Labor market statistics remained strong, while the housing market continued to languish. Despite the Federal Reserve’s reversal of easy monetary policy, and much to everyone’s surprise, interest rates in general continued to decline with the 10 year Treasury note ending the quarter at a low 2.5%. Outside of the U.S., political conflicts escalated in the Middle East and Ukraine, while the Ebola outbreak in West Africa intensified. The Chinese economy continued to weaken and the Eurozone slipped closer to recession. The quarter ended with the recovery intact, but concerns were building about its pace going forward.

Among the better performing stocks from for the year were Illumina Inc. (1.3% of net assets as of September 30, 2014), a developer and manufacturer of life science tools and integrated systems for the analysis of genetic variation and function; Synaptics Inc. (1.8%), a developer and supplier of custom designed human interface solutions that enable people to interact with a range of mobile computing, communications, entertainment, and other electronic devices; and Vertex Pharmaceuticals Inc. (2.4%), a company dedicated to discovering, developing, manufacturing, and commercializing small molecule drugs for the treatment of serious diseases. Some of our weaker performing holdings were Ariad Pharmaceuticals (sold), a global oncology company focused on the discovery, development, and commercialization of medicines for cancer patients; Covisint Corp. (0.4%), an American information technology company established in 2000 by a consortium of General Motors, Ford, and DaimlerChrysler; and Noble Corp. plc (0.6%), an offshore drilling contractor for the oil and gas industry.

We appreciate your confidence and trust.

6

Average Annual Returns through September 30, 2014 (a) (Unaudited)

| | | | | | | | | | |

| | | 1 Year | | | Since

Inception

(5/31/13) | | | |

Mid-Cap Equity Fund Class AAA | | | 10.15% | | | | 11.36% | | | |

Russell Midcap Index | | | 15.83 | | | | 15.88(b) | | | |

In the current prospectus dated January 28, 2014, the gross expense ratio for Class AAA Shares is 3.88%, and net expense ratio is 1.50% after contractual reimbursements by TETON Advisors, Inc. (the “Adviser”) in place through January 31, 2015. See page 44 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Russell Midcap Index is an unmanaged indicator which measures the performance of the mid-cap segment of the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | Russell Midcap Index since inception performance is from May 30, 2013. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE MID-CAP EQUITY FUND

CLASS AAA AND THE RUSSELL MIDCAP INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

7

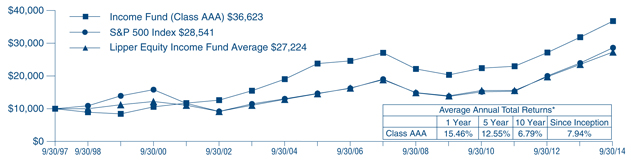

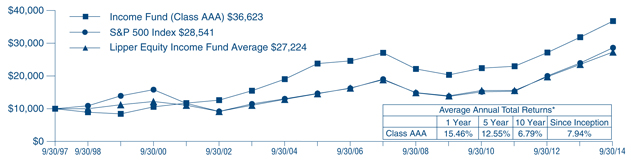

Income Fund (Unaudited)

For the year ended September 30, 2014, the TETON Westwood Income Fund net asset value (“NAV”) per Class AAA Share appreciated 15.5% compared with gains of 19.7% and 16.1% for the Standard & Poor’s (“S&P”) 500 Index and the Lipper Equity Income Fund Average, respectively. See next page for additional performance information.

The Fund invests in companies to participate in the growth of their earnings and cash flow. We look for companies that we believe will continue to return cash flow to shareholders through reinvestment in their business resulting in greater cash flow and earnings, and higher share price valuation. The Fund looks to build a steady component of not only current return from dividend yields, but also rising dividend payout.

Investors ended 2013 on an optimistic note, sending the equity markets higher to a strong finish. In the fourth quarter of 2013, the U.S. equity markets gained over 10% to top off a 30% year, the best annual return since 1997. All ten industry sectors of the S&P 500 had positive returns in the quarter.

In the Fund’s second fiscal quarter, the ten industry sectors which comprise the stocks of the S&P 500 had more widely divergent returns than we have seen over the past year. As the underlying strength of the economy began to be questioned in the quarter, the strongest performing sectors were those considered defensive, or not dependent on economic growth. The utility sector had the highest total return, just under 10%, and the healthcare sector was also strong with a return of 5.9%. The weakest two sectors were those that would be most affected by a lack of strength and spending: consumer discretionary and industrials, with returns of 0.5% and 0.1%, respectively.

In the Fund’s third quarter, all ten industry sectors had positive returns, for the second quarter in a row. The energy sector posted the highest total return, of 12.1%, followed by the utilities and technology sectors. Through the third fiscal quarter the utilities sector has gained a tremendously strong 18.4%, followed by year to date gains in the energy sector of 12.8% and healthcare of 10.6%. The weakest sector in the third quarter was the consumer discretionary sector, which gained 0.6%, reflecting the growing realization the economy would post a much weaker first half than had been thought at the end of the first quarter.

The fourth quarter saw a return of volatility to financial markets, starting with a decline in July, as macroeconomic factors, including conflict in Ukraine and the Middle East, a slowdown in emerging markets growth, and Argentinian debt default on the last day of the month all weighed on the market. Markets rebounded sharply in August, as mostly positive second quarter earnings reports were coupled with dovish comments from Federal Reserve Chair Janet Yellen, who at the annual Federal Reserve meeting in Jackson Hole reiterated, “that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after our current asset purchase program ends.”

Toward the end of August, however, markets began factoring in the possibility of a recession in Europe, a worse than expected emerging markets slowdown, the negative impact of foreign currencies on overseas earnings (especially in the Eurozone), concerns about the impact of communicable diseases on travel and leisure industries, and continued conflict around the globe, whether in Ukraine, Iraq, Syria, or elsewhere.

Among the better performing stocks for the fiscal year were Intel Corp. (3.2% of net assets as of September 30, 2014), a leader in semiconductor chip and computer hardware producers; Apple Inc. (4.9%), an American multinational that designs, develops, and sells consumer electronics, computer software, online services, and PC’s; and Gilead Sciences Inc. (1.2%), a biotechnology company that discovers, develops, and commercializes therapeutics. Some of our weaker performing stocks during the year were Noble Corp. plc (0.4%), (formerly the Noble Drilling Company) a leading offshore drilling contractor; Barrick Gold Corp (0.9%), the largest gold mining company in the world with operations in over ten countries; and Newmont Mining Corp. (0.8%), one of the world’s largest producers of gold, with active mines in Nevada, Indonesia, Australia, New Zealand, Ghana, and Peru.

We appreciate your confidence and trust.

8

| | | | | | | | | | | | | | | | | | |

| Average Annual Returns Through September 30, 2014 (a) (Unaudited) | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(9/30/97) | | | |

Income Fund Class AAA | | | 15.46% | | | | 12.55% | | | | 6.79% | | | | 7.94% | | | |

S&P 500 Index | | | 19.73 | | | | 15.70 | | | | 8.11 | | | | 6.34 | | | |

Lipper Equity Income Fund Average | | | 16.10 | | | | 14.02 | | | | 7.44 | | | | 6.07 | | | |

In the current prospectus dated January 28, 2014, the gross expense ratio for Class AAA Shares is 2.57%. The net expense ratio is 2.00% after contractual reimbursements by TETON Advisors, Inc. (the “Adviser”) in place through January 31, 2015. See page 45 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. The Lipper Equity Income Fund Average includes the 30 largest equity funds tracked by Lipper, Inc. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE INCOME FUND CLASS AAA,

THE S&P 500 INDEX, AND THE LIPPER EQUITY INCOME FUND AVERAGE (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

9

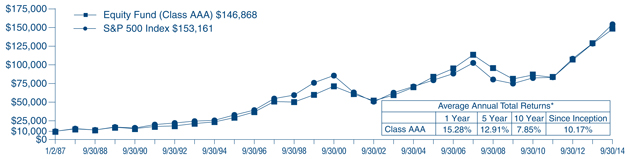

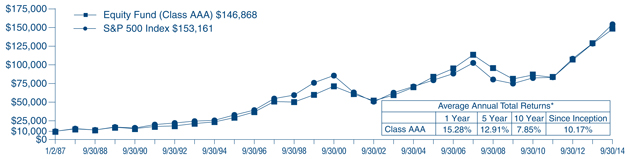

Equity Fund (Unaudited)

The Teton Westwood Equity Fund underperformed the benchmark S&P 500 Index over the fiscal year. For the twelve months ended September 30, 2014, the Equity Fund Class AAA shares posted a return of 15.3%, net of expenses, versus the S&P 500 Index return of 19.7%.

During the fiscal year ended September 30, 2014, Technology and Health Care were the best performing index sectors, while Consumer Discretionary and Energy performed the worst but still produced returns greater than 10%. Driving the Fund’s positive performance during the fiscal year was stock selection in Consumer Discretionary, followed by Utilities. The top contributors were Advance Auto Parts Inc. (1.0% of net assets as of September 30, 2014), which rallied after announcing a very accretive acquisition in the fourth quarter of 2013. Union Pacific Corp. (2.2%) was also additive to results as it continued to post strong earnings based on good execution and continued demand for rail transportation, while Wells Fargo & Co. (3.1%) was bid up on optimism over the housing market and a belief that the interest rate environment will favor banks going forward. Health care company Covidien Plc. (sold) rose after competitor Medtronic announced it was acquiring the firm, and technology company Skyworks Solutions Inc. (1.9%) continued its strong performance.

Detracting from the relative performance for the year was stock selection in Health Care, followed by Energy, Consumer Staples, and Technology. Detractors included technology companies Cisco Systems Inc. (sold), which lowered forward guidance as a result of increased competition in its core businesses, and ARRIS Group Inc. (1.9% of net assets as of September 30, 2014), after management made cautious comments about the effect on sales from consolidation in the cable/telecom provider industry. Financial services company CIT Group Inc. (1.7%) fell after reporting worse than expected net interest margins, while both consumer discretionary companies Viacom Inc (1.8%) and AMC Networks Inc. (1.7%) have experienced at points during the period weaker than expected advertising rates and a relative decline in sentiment for media companies following very strong performance in 2013.

We appreciate your confidence and trust.

| | | | | | | | | | | | | | | | | | |

| Average Annual Returns through September 30, 2014 (a) (Unaudited) | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(1/2/87) | | | |

Equity Fund Class AAA | | | 15.28% | | | | 12.91% | | | | 7.85% | | | | 10.17% | | | |

S&P 500 Index | | | 19.73 | | | | 15.70 | | | | 8.11 | | | | 10.33(b) | | | |

In the current prospectus dated January 28, 2014, the expense ratio for Class AAA Shares is 1.60%. See page 46 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | S&P 500 Index since inception performance are as of December 31, 1986. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE EQUITY FUND CLASS AAA AND THE S&P 500 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

10

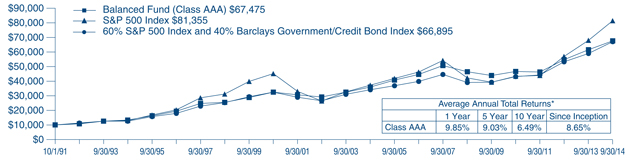

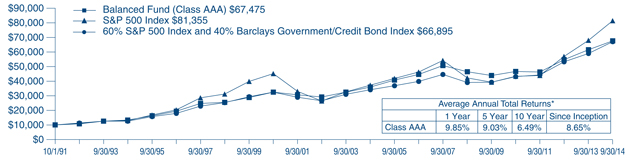

Balanced Fund (Unaudited)

For twelve months ended September 30, 2014, the Teton Westwood Balanced Fund Class AAA Shares posted a return of 9.9%, net of expenses, versus the Barclays Government/Credit Bond Index return of 4.1%. The Fund’s return was less than a common balanced benchmark comprised of 60% S&P 500 Index and 40% of the Barclays Capital Government/Credit Bond Index which returned 13.5%. See next page for additional information.

The Fund is designed to provide exposure to equities while reducing overall risk through investment in investment grade fixed income securities. The bond portion typically invests in high quality notes with lower interest rate sensitivity and generally a shorter maturity than the typical bond index, with the objective of dampening the volatility of equity holdings. Unlike the prior fiscal year, this lower interest rate sensitivity detracted over the last twelve months from relative performance of the bond portion of the Fund versus the Barclays Capital Government/Credit Bond Index.

For the twelve months ended September 30, 2014, the Treasury yield curve twisted more markedly than during the quarter end September: within the Barclays Capital Government/Credit Bond Index, bonds longer than 10 years returned 12.9% while bonds 1-10 years in maturity returned 2.2%. The spread narrowing trend for Corporates, resulted in Corporates outperforming U.S. Governments 6.8% to 2.3%. In general, fixed income investors were better compensated over the fiscal year for taking interest rate risk over credit risk. Within the Corporate sector, the 8.4% return of Baa-rated credits more than tripled the performance of Aaa-rated credits. The Utility sector led Corporates with an 8.6% return. Treasury Inflation-Indexed securities earned 1.6%.

Factors driving the performance of the Fund relative to the Barclays Capital Government/Credit Bond Index were: (1) underweighting U.S. Treasurys – particularly long maturity bonds – while overweighting the (lowest performing) U.S. Agency sector, and (2) favoring in the Industrial and Financial Services sectors’ maturities less than 10 years relative to stronger performing long maturity credits. Considerable overweight positions in these two corporate sectors were beneficial, however.

The top five contributors to fiscal year Fund performance were four Corporates and one U.S. Agency: Intel Corp. 3.3% due 01-Oct-2021 (1.2% of net assets as of September 30, 2014), Occidental Petroleum Corp. 2.7% (0.9%) due 15-Feb-2023, JPMorgan Chase & Co 6.3% due 23-Apr-2019 (1.0%), Freddie Mac note 3.75% due 27-Mar-2019 (1.9%), and Burlington Northern Santa Fe LLC 5.65% due 01-May-2017 (1.3%).

Detracting the performance the most were three Treasury Inflation-Index Protected Securities: 1.375% due 15-Jan-2020 (1.4%), 2.125% due 15-Jan-2019 (1.3%), and 2.5% due 15-Jul-2016 (1.8%); and two corporate notes: Costco Wholesale Corporation 1.7% due 15-Dec-2019 (0.9%) and The Goldman Sachs Group Inc. 3.85% due 08-Jul-2024 (0.7%).

We appreciate your confidence and trust.

11

| | | | | | | | | | | | | | | | | | |

| Average Annual Returns through September 30, 2014 (a) (Unaudited) | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(10/1/91) | | | |

Balanced Fund Class AAA | | | 9.85% | | | | 9.03% | | | | 6.49% | | | | 8.65% | | | |

Barclays Government/Credit Bond Index | | | 4.08 | | | | 4.27 | | | | 4.59 | | | | 6.21(c) | | | |

S&P 500 Index | | | 19.73 | | | | 15.70 | | | | 8.11 | | | | 9.53(c) | | | |

60% S&P 500 Index and 40% Barclays Government/Credit Bond Index (b) | | | 13.47 | | | | 11.13 | | | | 6.70 | | | | 8.20 | | | |

In the current prospectus dated January 28, 2014, the expense ratio for Class AAA Shares is 1.28%. See page 47 for the expense ratios for the year September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. TETON Advisors, LLC, the Adviser reimbursed expenses in years prior to 1998 to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Barclays Government/Credit Bond Index is a market value weighted index that tracks the performance of fixed rate, publicly placed, dollar denominated obligations. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | The Blended Index consists of a 60% blend of each of the S&P 500 Index and 40% Barclays Government/Credit Bond Index. | |

| | (c) | S&P 500 Index and Barclays Government/Credit Bond Index since inception performance are as of September 30, 1991. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE BALANCED FUND CLASS AAA,

THE S&P 500 INDEX, AND A COMPOSITE OF 60% OF THE S&P 500 INDEX AND 40% OF

THE BARCLAYS GOVERNMENT/CREDIT BOND INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

12

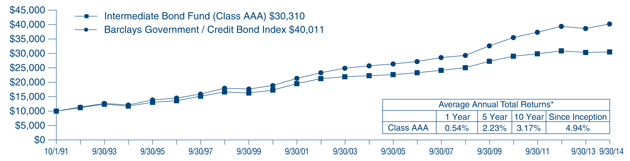

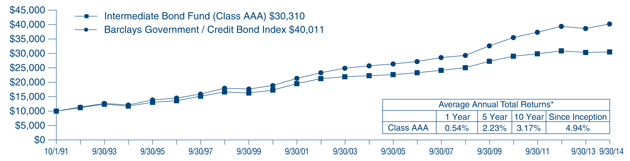

Intermediate Bond Fund (Unaudited)

For the year ended September 30, 2014, the TETON Westwood Intermediate Bond Fund net asset value (“NAV”) per Class AAA Share increased 0.5% compared with the Barclays Government/Credit Bond Index which was up 4.1%. See next page for additional performance information.

Volatility for fixed income prices increased in the fourth calendar quarter of 2013 – the opening quarter of the Fund’s fiscal year – after the Federal Reserve announced plans on December 18 to reduce the quantitative easing purchases of Treasury and mortgage securities.

Fixed income continued to appreciate during a choppy first calendar quarter of 2014. Treasuries and Investment Grade corporates benefited from the “flight-to-quality” buying associated with geopolitical and military tension in Ukraine, several pieces of underwhelming U.S. economic data, and an emerging market sell-off in January. The Federal Reserve announced plans to wind down Quantitative Easing purchases by the end of the year.

The second calendar quarter of 2014 saw fixed income investments continue to appreciate as the 10 year Treasury yield rallied from 2.72% to finish the quarter at 2.53%, while other Treasury yields declined for maturities of 5 years and longer. During the third calendar quarter of 2014, the U.S. Treasury yield curve slightly twisted, as short/intermediate yields rose and longer bond yields declined, resulting in a rally for longer versus shorter maturities. The 10 year Treasury yield moved from 2.56% to 2.49%. The rally in long Treasurys reflected expectations for a delay in Fed interest rate hikes, based on inflation and labor readings below the Federal Reserve’s targets. U.S. Treasurys also benefited from historically low sovereign bond yields in Europe.

Credit spreads (the excess yield of a corporate bond above the comparable maturity Treasury) widened during the third quarter. The rise in risk premia was driven by concern over valuations and additional supply coming to market, particularly in September. This quarter’s credit spread widening interrupted the consistent spread narrowing trend which had been in place since 2012. Corresponding to the yield curve twist and corporate spread widening: Treasurys outperformed Corporates 0.34% to -0.08% and 10+ year bonds outperformed 1-10 year maturities 1.04% to -0.03%. Within investment grade corporates: Utilities led with a gain of 0.45%, while industrials lagged with a return of -0.16% and stronger credit quality outperformed lower credit quality –AAA credits returned 0.25% versus -0.20% for BBB credits.

The top five contributors to the Fund’s annual performance all were Corporates: Intel Corp. 3.3% due 01-Oct-2021 (1.7% of net assets as of September 30, 2014), Arrow Electronics Inc. 6.0% due 01-Apr-2020 (1.1%), Oracle Corp. 3.625% due 15-Jul-2023 (1.9%), Teva Pharmaceutical Finance 3.65% due 10-Nov-2021 (1.6%), and Murphy Oil Corp. 2.5% due 01-Dec-2017 (1.9%). Detracting the most to performance were Costco Wholesale Corp. 1.7% due 15-Dec-2019 (1.8%), and the following four Treasury Inflation-Index Protected Securities: 1.375% due 15-Jul-2018 (1.7%), 1.375% due 15-Jan-2020 (1.7%), 2.125% due 15-Jan-2019 (1.6%), and 2.5% due 15-Jul-2016 (1.6%).

We thank you for your continued confidence and trust.

13

| | | | | | | | | | | | | | | | | | |

| Average Annual Returns through September 30, 2014 (a) (Unaudited) | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(10/1/91) | | | |

Intermediate Bond Fund Class AAA | | | 0.54% | | | | 2.23% | | | | 3.17% | | | | 4.94% | | | |

Barclays Government/Credit Bond Index | | | 4.08 | | | | 4.27 | | | | 4.59 | | | | 6.21(b) | | | |

In the current prospectus dated January 28, 2014, the gross expense ratio for AAA Shares is 1.36%. The net expense ratio is 1.00%, after contractual reimbursements by TETON Advisors Inc. (the “Adviser”) in place through January 31, 2015. See page 48 for the expense ratios for the year ended September 30, 2014. Class AAA Shares do not have a sales charge.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Barclays Government/Credit Bond Index is a market value weighted index that tracks the performance of fixed rate, publicly placed, dollar denominated obligations. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | The Barclays Government/Credit Bond Index since inception performance is as of September 30, 1991. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE

INTERMEDIATE BOND FUND CLASS AAA AND

THE BARCLAYS GOVERNMENT/CREDIT BOND INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

14

Morningstar® Ratings Based on Risk Adjusted Returns as of September 30, 2014 (Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Overall Rating | | 3 Year Rating | | 5 Year Rating | | 10 Year Rating |

FUND | | Morningstar

Category | | Stars | | # of

Funds | | Stars | | # of

Funds | | Stars | | # of

Funds | | Stars | | # of

Funds |

| | | | | | | | | |

TETON Westwood Mighty Mites AAA | | Small Blend | | «««« | | 616 | | ««« | | 616 | | «««« | | 563 | | ««««« | | 351 |

TETON Westwood Mighty Mites A | | Small Blend | | «««« | | 616 | | «« | | 616 | | ««« | | 563 | | ««««« | | 351 |

TETON Westwood Mighty Mites C | | Small Blend | | «««« | | 616 | | «« | | 616 | | ««« | | 563 | | ««««« | | 351 |

TETON Westwood Mighty Mites I | | Small Blend | | «««« | | 616 | | ««« | | 616 | | «««« | | 563 | | ««««« | | 351 |

| | | | | | | | | |

TETON Westwood SmallCap Equity AAA | | Small Blend | | «« | | 616 | | «« | | 616 | | «« | | 563 | | ««« | | 351 |

TETON Westwood SmallCap Equity A | | Small Blend | | « | | 616 | | « | | 616 | | « | | 563 | | «« | | 351 |

TETON Westwood SmallCap Equity C | | Small Blend | | « | | 616 | | « | | 616 | | « | | 563 | | «« | | 351 |

TETON Westwood SmallCap Equity I | | Small Blend | | «« | | 616 | | «« | | 616 | | ¶¶ | | 563 | | ¶¶¶ | | 351 |

| | | | | | | | | |

TETON Westwood Mid-Cap Equity AAA | | Mid-Cap Growth | | — | | — | | — | | — | | — | | — | | — | | — |

TETON Westwood Mid-Cap Equity A | | Mid-Cap Growth | | — | | — | | — | | — | | — | | — | | — | | — |

TETON Westwood Mid-Cap Equity C | | Mid-Cap Growth | | — | | — | | — | | — | | — | | — | | — | | — |

TETON Westwood Mid-Cap Equity I | | Mid-Cap Growth | | — | | — | | — | | — | | — | | — | | — | | — |

| | | | | | | | | |

TETON Westwood Income AAA | | Large Value | | ««« | | 1092 | | «« | | 1092 | | ««« | | 966 | | ««« | | 635 |

TETON Westwood Income A | | Large Value | | «« | | 1092 | | « | | 1092 | | «« | | 966 | | ««« | | 635 |

TETON Westwood Income C | | Large Value | | «« | | 1092 | | « | | 1092 | | «« | | 966 | | ««« | | 635 |

TETON Westwood Income I | | Large Value | | ««« | | 1092 | | «« | | 1092 | | ««« | | 966 | | ««« | | 635 |

| | | | | | | | | |

TETON Westwood Equity AAA | | Large Value | | ««« | | 1092 | | ««« | | 1092 | | «« | | 966 | | «««« | | 635 |

TETON Westwood Equity A | | Large Value | | ««« | | 1092 | | «« | | 1092 | | «« | | 966 | | ««« | | 635 |

TETON Westwood Equity C | | Large Value | | ««« | | 1092 | | «« | | 1092 | | «« | | 966 | | ««« | | 635 |

TETON Westwood Equity I | | Large Value | | «« | | 1092 | | ««« | | 1092 | | «« | | 966 | | «««« | | 635 |

| | | | | | | | | |

TETON Westwood Balanced AAA | | Moderate Allocation | | «««« | | 737 | | ««« | | 737 | | ««« | | 652 | | «««« | | 430 |

TETON Westwood Balanced A | | Moderate Allocation | | ««« | | 737 | | «« | | 737 | | «« | | 652 | | ««« | | 430 |

TETON Westwood Balanced C | | Moderate Allocation | | ««« | | 737 | | ««« | | 737 | | «« | | 652 | | ««« | | 430 |

TETON Westwood Balanced I | | Moderate Allocation | | ««« | | 737 | | ««« | | 737 | | ««« | | 652 | | «««« | | 430 |

| | | | | | | | | |

TETON Westwood Intermediate Bond AAA | | Intermediate Term Bond | | « | | 929 | | « | | 929 | | « | | 808 | | « | | 574 |

TETON Westwood Intermediate Bond A | | Intermediate Term Bond | | « | | 929 | | « | | 929 | | « | | 808 | | « | | 574 |

TETON Westwood Intermediate Bond C | | Intermediate Term Bond | | « | | 929 | | « | | 929 | | « | | 808 | | « | | 574 |

TETON Westwood Intermediate Bond I | | Intermediate Term Bond | | « | | 929 | | « | | 929 | | « | | 808 | | ¶¶ | | 574 |

The Overall Morningstar Rating™ is derived from a weighted average of the performance figures associated with its three, five, and ten year (if applicable) Morningstar Rating metrics. Data presented reflects past performance, which is no guarantee of future results. Ratings are for Class AAA, A, C, or I Shares. Unrated classes of fund shares are not listed. For each fund with at least a three year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure (including the effects of sales charges, loads, and redemption fees) that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) Strong relative performance is not indicative of positive fund returns. © 2014 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Teton Advisors, Inc. is the investment manager for all TETON Westwood Funds. Investors should carefully consider the investment objectives, risks, sales charges, and expenses of a fund carefully before investing. Each Fund’s prospectuses contain this and other information about the Funds and are available by calling 800-WESTWOOD, online at www.tetonadv.com, or from your financial adviser. The prospectuses should be read carefully before investing.

Distributed by G.distributors, LLC, One Corporate Center, Rye, NY 10580. Call 800-WESTWOOD for a prospectus.

15

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from April 1, 2014 through September 30, 2014

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended September 30, 2014.

16

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited) (Continued)

For the Six Month Period from April 1, 2014 through September 30, 2014

Expense Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Fund Return | | Hypothetical 5% Return |

| | | Beginning

Account Value

04/01/14 | | Ending

Account Value

09/30/14 | | Annualized

Expense

Ratio | | Expenses

Paid During

Period* | | Beginning

Account Value

04/01/14 | | Ending

Account Value

09/30/14 | | Annualized

Expense

Ratio | | Expenses

Paid During

Period* |

TETON Westwood Mighty Mites Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 937.70 | | | | | 1.44 | % | | | $ | 6.99 | | | | | $1,000.00 | | | | | $1,017.85 | | | | | 1.44 | % | | | $ | 7.28 | | | |

Class A | | | | $1,000.00 | | | | $ | 936.20 | | | | | 1.69 | % | | | $ | 8.20 | | | | | $1,000.00 | | | | | $1,016.60 | | | | | 1.69 | % | | | $ | 8.54 | | | |

Class C | | | | $1,000.00 | | | | $ | 933.80 | | | | | 2.19 | % | | | $ | 10.62 | | | | | $1,000.00 | | | | | $1,014.09 | | | | | 2.19 | % | | | $ | 11.06 | | | |

Class I | | | | $1,000.00 | | | | $ | 938.70 | | | | | 1.18 | % | | | $ | 5.73 | | | | | $1,000.00 | | | | | $1,019.15 | | | | | 1.18 | % | | | $ | 5.97 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood SmallCap Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 944.80 | | | | | 1.50 | % | | | $ | 7.31 | | | | | $1,000.00 | | | | | $1,017.55 | | | | | 1.50 | % | | | $ | 7.59 | | | |

Class A | | | | $1,000.00 | | | | $ | 944.00 | | | | | 1.75 | % | | | $ | 8.53 | | | | | $1,000.00 | | | | | $1,016.29 | | | | | 1.75 | % | | | $ | 8.85 | | | |

Class C | | | | $1,000.00 | | | | $ | 941.20 | | | | | 2.25 | % | | | $ | 10.95 | | | | | $1,000.00 | | | | | $1,013.79 | | | | | 2.25 | % | | | $ | 11.36 | | | |

Class I | | | | $1,000.00 | | | | $ | 946.00 | | | | | 1.25 | % | | | $ | 6.10 | | | | | $1,000.00 | | | | | $1,018.80 | | | | | 1.25 | % | | | $ | 6.33 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood Mid-Cap Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 1,014.10 | | | | | 1.50 | % | | | $ | 7.57 | | | | | $1,000.00 | | | | | $1,017.55 | | | | | 1.50 | % | | | $ | 7.59 | | | |

Class A | | | | $1,000.00 | | | | $ | 1,013.20 | | | | | 1.75 | % | | | $ | 8.83 | | | | | $1,000.00 | | | | | $1,016.29 | | | | | 1.75 | % | | | $ | 8.85 | | | |

Class C | | | | $1,000.00 | | | | $ | 1,009.70 | | | | | 2.25 | % | | | $ | 11.34 | | | | | $1,000.00 | | | | | $1,013.79 | | | | | 2.25 | % | | | $ | 11.36 | | | |

Class I | | | | $1,000.00 | | | | $ | 1,014.90 | | | | | 1.25 | % | | | $ | 6.31 | | | | | $1,000.00 | | | | | $1,018.80 | | | | | 1.25 | % | | | $ | 6.33 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood Income Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 1,064.90 | | | | | 2.00 | % | | | $ | 10.35 | | | | | $1,000.00 | | | | | $1,015.04 | | | | | 2.00 | % | | | $ | 10.10 | | | |

Class A | | | | $1,000.00 | | | | $ | 1,062.80 | | | | | 2.25 | % | | | $ | 11.64 | | | | | $1,000.00 | | | | | $1,013.79 | | | | | 2.25 | % | | | $ | 11.36 | | | |

Class C | | | | $1,000.00 | | | | $ | 1,061.00 | | | | | 2.75 | % | | | $ | 14.21 | | | | | $1,000.00 | | | | | $1,011.28 | | | | | 2.75 | % | | | $ | 13.87 | | | |

Class I | | | | $1,000.00 | | | | $ | 1,066.10 | | | | | 1.75 | % | | | $ | 9.06 | | | | | $1,000.00 | | | | | $1,016.29 | | | | | 1.75 | % | | | $ | 8.85 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 1,034.90 | | | | | 1.58 | % | | | $ | 8.06 | | | | | $1,000.00 | | | | | $1,017.15 | | | | | 1.58 | % | | | $ | 7.99 | | | |

Class A | | | | $1,000.00 | | | | $ | 1,032.60 | | | | | 1.83 | % | | | $ | 9.32 | | | | | $1,000.00 | | | | | $1,015.89 | | | | | 1.83 | % | | | $ | 9.25 | | | |

Class C | | | | $1,000.00 | | | | $ | 1,030.50 | | | | | 2.33 | % | | | $ | 11.86 | | | | | $1,000.00 | | | | | $1,013.39 | | | | | 2.33 | % | | | $ | 11.76 | | | |

Class I | | | | $1,000.00 | | | | $ | 1,035.70 | | | | | 1.33 | % | | | $ | 6.79 | | | | | $1,000.00 | | | | | $1,018.40 | | | | | 1.33 | % | | | $ | 6.73 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood Balanced Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 1,023.00 | | | | | 1.26 | % | | | $ | 6.39 | | | | | $1,000.00 | | | | | $1,018.75 | | | | | 1.26 | % | | | $ | 6.38 | | | |

Class A | | | | $1,000.00 | | | | $ | 1,021.50 | | | | | 1.51 | % | | | $ | 7.65 | | | | | $1,000.00 | | | | | $1,017.50 | | | | | 1.51 | % | | | $ | 7.64 | | | |

Class C | | | | $1,000.00 | | | | $ | 1,019.60 | | | | | 2.01 | % | | | $ | 10.18 | | | | | $1,000.00 | | | | | $1,014.99 | | | | | 2.01 | % | | | $ | 10.15 | | | |

Class I | | | | $1,000.00 | | | | $ | 1,024.30 | | | | | 1.01 | % | | | $ | 5.13 | | | | | $1,000.00 | | | | | $1,020.00 | | | | | 1.01 | % | | | $ | 5.11 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TETON Westwood Intermediate Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class AAA | | | | $1,000.00 | | | | $ | 1,002.80 | | | | | 1.00 | % | | | $ | 5.02 | | | | | $1,000.00 | | | | | $1,020.05 | | | | | 1.00 | % | | | $ | 5.06 | | | |

Class A | | | | $1,000.00 | | | | $ | 1,002.30 | | | | | 1.10 | % | | | $ | 5.52 | | | | | $1,000.00 | | | | | $1,019.55 | | | | | 1.10 | % | | | $ | 5.57 | | | |

Class C | | | | $1,000.00 | | | | $ | 998.90 | | | | | 1.75 | % | | | $ | 8.77 | | | | | $1,000.00 | | | | | $1,016.29 | | | | | 1.75 | % | | | $ | 8.85 | | | |

Class I | | | | $1,000.00 | | | | $ | 1,005.00 | | | | | 0.75 | % | | | $ | 3.77 | | | | | $1,000.00 | | | | | $1,021.31 | | | | | 0.75 | % | | | $ | 3.80 | | | |

| * | Expenses are equal to the Funds’ annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183 days), then divided by 365. |

17

Summary of Portfolio Holdings (Unaudited)

The following tables present portfolio holdings as a percent of net assets as of September 30, 2014:

TETON Westwood Mighty Mites Fund

| | | | |

U.S. Government Obligations | | | 26.4 | % |

Health Care | | | 7.4 | % |

Diversified Industrial | | | 7.4 | % |

Equipment and Supplies | | | 5.6 | % |

Automotive: Parts and Accessories | | | 4.8 | % |

Financial Services | | | 4.7 | % |

Food and Beverage | | | 3.7 | % |

Business Services | | | 3.4 | % |

Computer Software and Services | | | 3.1 | % |

Electronics | | | 2.8 | % |

Aviation: Parts and Services | | | 2.5 | % |

Broadcasting | | | 2.4 | % |

Specialty Chemicals | | | 2.4 | % |

Restaurants | | | 2.3 | % |

Retail | | | 2.1 | % |

Hotels and Gaming | | | 2.1 | % |

Telecommunications | | | 1.8 | % |

Machinery | | | 1.8 | % |

Consumer Products | | | 1.5 | % |

Real Estate | | | 1.3 | % |

Metals and Mining | | | 1.3 | % |

Publishing | | | 1.1 | % |

Entertainment | | | 0.8 | % |

| | | | |

Building and Construction | | | 0.7 | % |

Energy and Utilities: Natural Gas | | | 0.7 | % |

Energy and Utilities: Services | | | 0.7 | % |

Consumer Services | | | 0.6 | % |

Energy and Utilities: Water | | | 0.6 | % |

Manufactured Housing and Recreational Vehicles | | | 0.5 | % |

Energy and Utilities: Oil | | | 0.4 | % |

Semiconductors | | | 0.4 | % |

Airlines | | | 0.4 | % |

Agriculture | | | 0.4 | % |

Energy and Utilities: Integrated | | | 0.4 | % |

Automotive | | | 0.4 | % |

Paper and Forest Products | | | 0.3 | % |

Environmental Control | | | 0.2 | % |

Educational Services | | | 0.2 | % |

Communications Equipment | | | 0.2 | % |

Transportation | | | 0.2 | % |

Aerospace and Defense | | | 0.1 | % |

Energy and Utilities: Alternative Energy | | | 0.1 | % |

Closed-End Business Development Company | | | 0.0 | % |

Other Assets and Liabilities (Net) | | | (0.2 | )% |

| | | | |

| | | 100.0 | % |

| | | | |

TETON Westwood SmallCap Equity Fund

| | | | |

Financial Services | | | 19.0 | % |

Computer Software and Services | | | 8.1 | % |

Business Services | | | 7.9 | % |

Energy and Utilities | | | 7.9 | % |

Semiconductors | | | 7.6 | % |

Health Care | | | 7.1 | % |

Diversified Industrial | | | 6.1 | % |

Retail | | | 5.9 | % |

Electronics | | | 5.3 | % |

Building and Construction | | | 4.3 | % |

Aerospace | | | 3.6 | % |

Equipment and Supplies | | | 3.2 | % |

| | | | |

Telecommunications | | | 3.1 | % |

Machinery | | | 2.8 | % |

U.S. Government Obligations | | | 2.6 | % |

Specialty Chemicals | | | 1.4 | % |

Metals and Mining | | | 1.0 | % |

Consumer Products | | | 1.0 | % |

Entertainment | | | 1.0 | % |

Computer Hardware | | | 1.0 | % |

Publishing | | | 0.2 | % |

Other Assets and Liabilities (Net) | | | (0.1 | )% |

| | | | |

| | | 100.0 | % |

| | | | |

TETON Westwood Mid-Cap Equity Fund

| | | | |

Financials | | | 18.3 | % |

Industrials | | | 16.7 | % |

Health Care | | | 16.4 | % |

Consumer Discretionary | | | 14.0 | % |

Information Technology | | | 12.0 | % |

Energy | | | 7.7 | % |

| | | | |

U.S. Government Obligations | | | 7.0 | % |

Consumer Staples | | | 4.0 | % |

Materials | | | 2.9 | % |

Utilities | | | 2.4 | % |

Other Assets and Liabilities (Net) | | | (1.4 | )% |

| | | | |

| | | 100.0 | % |

| | | | |

18

Summary of Portfolio Holdings (Unaudited) (Continued)

TETON Westwood Income Fund

| | | | |

Financial Services | | | 18.2 | % |

Health Care | | | 14.5 | % |

Energy and Utilities: Oil | | | 8.3 | % |

Retail | | | 6.8 | % |

Computer Hardware | | | 4.9 | % |

Diversified Industrial | | | 4.3 | % |

Metals and Mining | | | 3.6 | % |

Energy and Utilities: Services | | | 3.4 | % |

Electronics | | | 3.2 | % |

Energy and Utilities: Water | | | 3.1 | % |

Specialty Chemicals | | | 2.8 | % |

Automotive | | | 2.7 | % |

Paper and Forest Products | | | 2.6 | % |

Cable and Satellite | | | 2.5 | % |

Food and Beverage | | | 2.3 | % |

| | | | |

Energy and Utilities: Natural Gas | | | 2.1 | % |

Communications Equipment | | | 2.1 | % |

Machinery | | | 2.1 | % |

Telecommunications | | | 1.9 | % |

Real Estate Investment Trusts | | | 1.3 | % |

Pharmaceuticals | | | 1.2 | % |

Consumer Staples | | | 1.2 | % |

Environmental Services | | | 1.1 | % |

Services | | | 1.0 | % |

Computer Software and Services | | | 0.7 | % |

Agriculture | | | 0.6 | % |

Energy and Utilities: Integrated | | | 0.5 | % |

Other Assets and Liabilities (Net) | | | 1.0 | % |

| | | | |

| | | 100.0 | % |

| | | | |

TETON Westwood Equity Fund

| | | | |

Banking | | | 14.5 | % |

Health Care | | | 10.2 | % |

Financial Services | | | 6.9 | % |

Food and Beverage | | | 6.5 | % |

Retail | | | 6.3 | % |

Aerospace | | | 6.3 | % |

Energy: Oil | | | 5.8 | % |

Telecommunications | | | 5.1 | % |

Entertainment | | | 4.8 | % |

Communications Equipment | | | 3.8 | % |

Cable and Satellite | | | 3.7 | % |

Business Services | | | 3.5 | % |

Diversified Industrial | | | 3.1 | % |

Transportation | | | 2.2 | % |

| | | | |

Mutual Funds | | | 2.2 | % |

Computer Hardware | | | 2.1 | % |

Computer Software and Services | | | 2.0 | % |

Consumer Products | | | 2.0 | % |

Energy: Integrated | | | 1.9 | % |

Semiconductors | | | 1.9 | % |

Electronics | | | 1.8 | % |

Energy and Energy Services | | | 1.8 | % |

Consumer Services | | | 1.0 | % |

Energy: Natural Gas | | | 0.8 | % |

Other Assets and Liabilities (Net) | | | (0.2 | )% |

| | | | |

| | | 100.0 | % |

| | | | |

TETON Westwood Balanced Fund

| | | | |