LEASE

BY AND BETWEEN

BASS LAKE REALTY LLC,

as Landlord

AND

APA CABLES & NETWORKS. INC.,

as Tenant

DATED: MAY 31, 2006

PROPERTY : BASS LAKE BUSINESS CENTRE I, 5480 NATHAN LANE, PLYMOUTH, MN

LEASE

THIS LEASE is made this 31st day of May, 2006 between Bass Lake Realty LLC, a Delaware limited liability company ("Landlord"), and the Tenant named below.

ARTICLE I

BASIC TERMS

| TENANT: | APA Cables & Networks, Inc., a Minnesota corporation |

| | |

| TENANT'S NOTICE ADDRESS: | 5480 Nathan Lane, Suite 120 |

| | Plymouth, Minnesota 55442 |

| | Attn: Chris B Podzimek |

| | |

| LANDLORD'S NOTICE ADDRESS: | c/o Great Point Investors LLC |

| | Two Center Plaza, Suite 410 |

| | Boston, MA 02108 |

| | Attn: Joseph A. Versaggi |

| | |

| | with a copy to: |

| | |

| | United Properties LLC |

| | 3500 American Boulevard West |

| | Suite 200 |

| | Bloomington, MN 55431 |

| | Attn: Lisa Dongoske |

| | |

| | Rent payments to be sent to: |

| | United Properties |

| | MI 65 |

| | PO Box 1150 |

| | Minneapolis, MN 55480-1150 |

| | |

| PROPERTY: | Bass Lake Business Centre, 5480 Nathan Lane, Plymouth, MN (the "Building"), together with the parking areas, landscaping, walkways and other improvements related to the Building, as described on Exhibit A. |

| | |

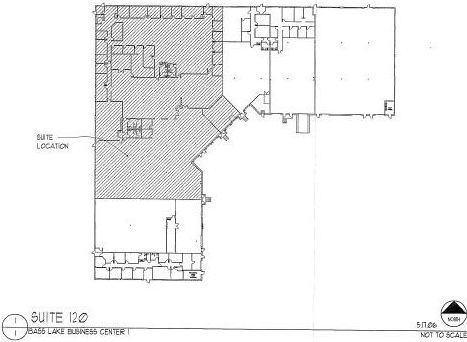

| PREMISES: | Approximately Twenty-Nine Thousand Seven Hundred Thirty-Eight (29,738) rentable square feet (9,284 square feet of which is office space, 4,499 square feet of which is warehouse space, and15,955 space) located at the Building, as shown on square feet of which is production/tech Exhibit B. |

| | |

| PROPERTY RENTABLE AREA: | Approximately Sixty-Three rentable square feet. |

| | |

| TENANT'S PRO RATA SHARE: | 47.2% |

| LEASE TERM: | Approximately eighty-nine (89) months beginning on the Lease Commencement Date and ending on November 30, 2013. |

| | |

| LEASE COMMENCEMENT DATE: | July 1, 2006. |

| | |

| RENT COMMENCEMENT DATE: | November 1, 2006. |

| | |

| BASE RENT: | (a) From the Rent Commencement Date through and including the last day of the first Lease Year, $203,110.54 per year; $16,925.88 per month; |

| | |

| | (b) For the second Lease Year, $210,247.66 per year; $17,520.64 per month; |

| | |

| | (c) For the third Lease Year, $217,384.78 per year; $18,115.40 per month; |

| | |

| | (d) For the fourth Lease Year, $225,116.66 per year; $18,759.72 per month; |

| | |

| | (e) For the fifth Lease Year, $232,551.16 per year; $19,379.26 per month; |

| | |

| | (f) For the sixth Lease Year, $239,985.66 per year; $19,998.81 per month; |

| | |

| | (g) For the seventh Lease Year, $247,122.78 per year; $20,593.56 per month; and |

| | |

| | (h) For the last five months of the Term, five monthly payments, each in the amount of $21,237.89. |

| | |

| LEASE YEAR: | Each successive twelve (12) month period comprising the Term, except that the first (1st) Lease Year of the Term may be greater than twelve (12) months and shall commence on the Lease Commencement Date and end on the last day of the month in which the first (1st) anniversary of the Lease Commencement Date occurs (unless the Lease Commencement Date occurs on the first day of a month, in which case the first Lease Year shall end on the day before the first (1st) anniversary of the Lease Commencement Date). Subsequent Lease Years shall commence on the day after the last day of the first (1st) Lease Year or an anniversary thereof, and shall end on each anniversary of the last day of the first (1st) Lease Year. |

| | |

| SECURITY DEPOSIT: | An unconditional, irrevocable letter of credit in the amount of One Hundred Thousand ($100,000) Dollars in the form attached hereto as Exhibit E, subject to reduction as set forth in Section 14.14. |

| PERMITTED USES: | Subject to applicable zoning, for general office, warehouse and production/technical use, and for no other purpose whatsoever. |

| | |

| BROKERS: | United Properties LLC |

| | 3500 American Boulevard West |

| | Suite 200 |

| | Bloomington, MN 55431 |

| | Attn: Mark Sims, Jon Yanta, and Bruce Hoberman |

| | |

| PARKING SPACES: | Eighty-Nine (89) unreserved spaces. |

ARTICLE II

LEASE TERM

| 2.1 | LEASE OF PREMISES FOR LEASE TERM. |

Landlord hereby leases the Premises to Tenant and Tenant leases the Premises from Landlord for the Lease Term, unless sooner terminated pursuant to the terms hereof. Additionally, from June 1, 2006 until the date that is two (2) weeks after substantial completion of Landlord's Work (as hereinafter defined), Landlord grants to Tenant a license to use approximately 5,000 square feet of warehouse space in a location determined by Landlord at the property known as Eagle Lake Business Centre II, 10200 73rd Avenue, Maple Grove, MN, or Parkers Lake Point III, 14305 21st Avenue. Plymouth, MN. Tenant's use and occupancy of such warehouse space shall be subject to all of the terms and conditions of this Lease, provided, however, Tenant shall not be required to pay any rent for such use and occupancy, and Landlord may immediately terminate such license in the event of any default by Tenant hereunder.

| 2.2 | DELAY IN COMMENCEMENT. |

If Landlord is unable to deliver the Premises on the Lease Commencement Date, such date will be postponed to the date possession of the Premises is delivered to Tenant (and all other dates herein shall likewise be recalculated). At Landlord's request, Landlord and Tenant will execute a Memorandum of Acceptance of Lease, in Landlord's customary form, setting forth the Lease Commencement Date, Rent Commencement Date and Expiration Date of this Lease.

| 2.3 | EARLY TERMINATION OPTION. |

Provided no default exists or would exist but for the passage of time or the giving of notice, or both, Tenant shall have the right to send to Landlord, on or before March 1, 2011, written notice (the "Termination Notice") that Tenant has elected to terminate the Term effective on November 30, 2011 (the "Early Termination Date"). If Tenant elects to terminate the Term pursuant to the immediately preceding sentence, the effectiveness of such termination will be conditioned upon Tenant's paying to Landlord, contemporaneously with Tenant's delivery of the Termination Notice to Landlord, an early termination fee (the "Early Termination Fee") equal to the sum of (a) $77,517.04, (b) four (4) months of Additional Rent due to Landlord pursuant to the terms hereof at the rate payable during such fifth (5th) Lease Year, and (c) all unamortized transaction costs, including but not limited to the four months free Base Rent provided hereunder, brokerage commissions, costs of tenant improvements made by Landlord, and legal fees; provided, however, if a replacement tenant occupies, pursuant to the terms of a lease, the entire Premises, by February 1, 2012, Landlord will refund to Tenant $38,758.52, plus two (2) months of Additional Rent due to Landlord pursuant to the terms hereof at the rate payable during the fifth (5th) Lease Year. The Early Termination Fee is consideration for Tenant's option to terminate and will not be applied to rent or any other obligation of Tenant. If Tenant exercises this early termination option, on or before the Early Termination Date, Tenant shall vacate and surrender the Premises to Landlord pursuant to the terms of the Lease, and, as of such Early Terminate Date, Tenant shall no longer be responsible for Tenant's obligations under the terms of the Lease, except for those provisions of the Lease that survive termination of the Lease, and any obligations arising prior to the Early Termination Date.

ARTICLE III

RENT

Commencing on the Rent Commencement Date, on the first day of each calendar month during the Lease Term, Tenant will pay to Landlord the Base Rent in equal monthly installments, in lawful money of the United States, in advance and without offset, deduction prior notice or demand. The Base Rent is payable at Landlord's Rent Payment Address or at such other place or to such other person as Landlord may designate in writing from time to time. Payments of Base Rent for any partial calendar month will be prorated. Base Rent for the first month of the Term shall be paid on the date hereof.

All sums payable by Tenant under this Lease other than Base Rent are "Additional Rent"; the term "Rent" includes both Base Rent and Additional Rent. Landlord will estimate in advance and charge to Tenant the following costs ("Total Operating Costs"), which Tenant will pay with the Base Rent on a monthly basis throughout the Occupancy Period: (i) all Real Property Taxes for which Tenant is liable under Article 4, (ii) all utility costs (to the extent utilities are not separately metered) for which Tenant is liable under Article 5, (iii) all insurance premiums for which Tenant is liable under Article 6 and (iv) all Operating Expenses for which Tenant is liable under Article 7 of this Lease. Landlord may adjust its estimates of Total Operating Costs at any time based upon Landlord's experience and reasonable anticipation of costs. Such adjustments will be effective as of the next Rent payment date after notice to Tenant. "Occupancy Period" means the period from the time Tenant first enters the Premises, throughout the Lease Term and thereafter as long as Tenant remains in the Premises.

After the end of each fiscal year during the Term, Landlord will deliver to Tenant a statement setting forth, in reasonable detail, the Total Operating Costs paid or incurred by Landlord during the preceding fiscal year and Tenant's Pro Rata Share of such expenses. Within 30 days after Tenant's receipt of such statement, there will be an adjustment between Landlord and Tenant, with payment to or credit given by Landlord (as the case may be).

| 3.3 | INTEREST AND LATE CHARGES. |

Any Rent or other amount due to Landlord, if not paid when due, will bear interest from the date due until paid at the rate of 10% per year, but not to exceed the highest rate legally permitted. In addition, if any installment of Rent or any other sums due from Tenant is not received by Landlord within 5 days following the due date, Tenant will pay to Landlord a late charge equal to 5% of such overdue amount. The parties hereby agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant. Notwithstanding the foregoing, no interest shall accrue and the late charge shall not be due for the first late payment in any rolling twelve (12) month period.

ARTICLE IV

PROPERTY TAXES

Tenant will pay Tenant's Pro Rata Share of Real Property Taxes allocable to the Occupancy Period. If Landlord receives a refund of any Real Property Taxes with respect to which Tenant has paid Tenant's Pro Rata Share, Landlord will refund to Tenant Tenant's Pro Rata Share of such refund after deducting therefrom all related costs and expenses. "Real Property Taxes" means taxes, assessments (special, betterment, or otherwise), levies, fees, rent taxes, excises, impositions, charges, water and sewer rents and charges, and all other government levies and charges, general and special, ordinary and extraordinary, foreseen and unforeseen, which are imposed or levied upon or assessed against the Property or any Rent. Real Property Taxes include Landlord's costs and expenses of review and contesting any Real Property Tax. If at any time during the Lease Term the present system of ad valorem taxation of real property is changed so that in lieu of the whole or any part of the ad valorem tax on real property, or in lieu of increases therein, Landlord is assessed a capital levy or other tax on the gross rents received with respect to the Property or a federal, state, county, municipal, or other local income, franchise, excise or similar tax, assessment, levy, or charge (distinct from any now in effect) measured by or based, in whole or in part, upon gross rents or any similar substitute tax or levy, then all of such taxes, assessments, levies or charges, to the extent so measured or based, will be deemed to be a Real Property Tax.

| 4.2 | PERSONAL PROPERTY TAXES. |

Tenant will pay directly all taxes charged against trade fixtures, furnishings, equipment, inventory or any other personal property belonging to Tenant. Tenant will use its best efforts to have personal property taxed separately from the Property. If any of Tenant's personal property is taxed with the Property, Tenant will pay Landlord the taxes for such personal property within 15 days after Tenant receives a written statement from Landlord for such personal property taxes.

ARTICLE V

UTILITIES

Tenant will promptly pay, directly to the appropriate supplier, the cost of all natural gas, heat, cooling, energy, light, power, sewer service, telephone, water, refuse disposal and other utilities and services supplied to the Premises, together with any related installation or connection charges or deposits (collectively, "Utility Costs") incurred during the Occupancy Period. If any services or utilities are jointly metered with other premises, Landlord will make a reasonable determination of Tenant's proportionate share of such Utility Costs and Tenant will pay such share to Landlord. Landlord reserves the right to participate in wholesale energy purchase programs and to provide energy to the Premises through such programs so long as the cost to Tenant is competitive.

ARTICLE SIX

INSURANCE

Tenant, at its expense, will maintain the following insurance coverages during the Occupancy Period:

(a) Liability Insurance. Commercial general liability insurance insuring Tenant against liability for bodily injury, property damage (including loss of use of property) and personal injury at the Premises, including contractual liability. Such insurance will name Landlord, its property manager, any mortgagee, Great Point Investors LLC, and such other parties as Landlord may designate, as additional insureds. The initial amount of such insurance will be Five Million Dollars ($5,000,000) per occurrence and will be subject to periodic increases reasonably specified by Landlord based upon inflation, increased liability awards, recommendations of Landlord's professional insurance advisers, and other relevant factors. The liability insurance obtained by Tenant under this Section 6.1 will (i) be primary and (ii) insure Tenant's obligations to Landlord under Section 6.4. The amount and coverage of such insurance will not limit Tenant's liability nor relieve Tenant of any other obligation under this Lease.

(b) Worker's Compensation Insurance. Worker's Compensation Insurance in the statutory amount (and Employers' Liability Insurance) covering all employees of Tenant employed or performing services at the Premises, in order to provide the statutory benefits required by the laws of the state in which the Premises are located.

(c) Automobile Liability Insurance. Automobile Liability Insurance, including but not limited to, passenger liability, on all owned, non-owned, and hired vehicles used in connection with the Premises, with a combined single limit per occurrence of not less than One Million Dollars ($1,000,000) for injuries or death of one or more persons or loss or damage to property.

(d) Personal Property Insurance. Personal Property Insurance covering leasehold improvements paid for by Tenant and Tenant's personal property and fixtures from time to time in, on, or at the Premises, in an amount not less than 100% of the full replacement cost, without deduction for depreciation, providing protection against events protected under "All Risk Coverage," as well as against sprinkler damage, vandalism, and malicious mischief. Any proceeds from the Personal Property Insurance will be used for the repair or replacement of the property damaged or destroyed, unless the Lease Term is terminated under an applicable provision herein. If the Premises are not repaired or restored in accordance with this Lease, Landlord will receive any proceeds from the personal property insurance allocable to Tenant's leasehold improvements.

During the Lease Term, Landlord will maintain in effect all risk insurance covering loss of or damage to the Property in the amount of its replacement value with such endorsements and deductibles as Landlord determines from time to time. Landlord will have the right to obtain flood, earthquake, and such other insurance as Landlord determines from time to time or is required by any mortgagee of the Property. Landlord will not insure Tenant's fixtures or equipment or building improvements installed or paid by Tenant. Landlord may obtain commercial general liability insurance in an amount and with coverage determined by Landlord insuring Landlord against liability with respect to the Premises and the Property. The policy obtained by Landlord will not provide primary insurance, will not be contributory and will be excess over any liability insurance maintained by Tenant. Landlord will also maintain a rental income insurance policy, with loss payable to Landlord. Tenant will pay Tenant's Pro Rata Share of premiums for the insurance policies maintained by Landlord. Any increase in the cost of Landlord's insurance due to Tenant's use or activities at the Premises will be paid by Tenant to Landlord as Additional Rent.

| 6.3 | GENERAL INSURANCE PROVISIONS. |

(a) Any insurance which Tenant is required to maintain under this Lease will include a provision which requires the insurance carrier to give Landlord not less than 30 days' written notice prior to any cancellation or modification of such coverage.

(b) Prior to the earlier of Tenant's entry into the Premises or the Lease Commencement Date, Tenant will deliver to Landlord an insurance company certificate that Tenant maintains the insurance required by Section 6.1 and not less than 20 days prior to the expiration or termination of any such insurance, Tenant will deliver to Landlord renewal certificates therefor. Tenant will provide Landlord with copies of the policies promptly upon request from time to time.

(c) All insurance policies required under this Lease will be with companies having a "General Policy Rating" of A -; X or better, as set forth in the most current issue of the Best Key Rating Guide.

(d) Without limiting the provisions of Section 6.4, Landlord and Tenant, on behalf of themselves and their insurers, each hereby waives any and all rights of recovery against the other, the agents, advisors, employees, members, officers, directors, partners, trustees, beneficiaries and shareholders of the other and the agents, advisors, employees, members, officers, directors, partners, trustees, beneficiaries and shareholders of each of the foregoing (collectively, "Representatives"), for loss of or damage to its property or the property of others under its control, to the extent that such loss or damage is covered by any insurance policy in force (whether or not described in this Lease) at the time of such loss or damage, or required to be carried under this Article 6. All property insurance carried by either party will contain a waiver of subrogation against the other party to the extent such right was waived by the insured party prior to the occurrence of loss or injury.

To the fullest extent permitted by law, Tenant hereby waives all claims against Landlord and its Representatives (collectively, the "Indemnitees") for damage to any property or injury to or death of any person in, upon or about the Premises or the Property arising at any time and from any cause. Tenant shall hold Indemnitees harmless from and defend Indemnitees from and against all claims, liabilities, judgments, demands, causes of action, losses, damages, costs and expenses, including reasonable attorney's fees, for damage to any property or injury to or death of any person arising from (i) the use or occupancy of the Premises by Tenant or persons claiming under Tenant, except such as is caused by the sole negligence or willful misconduct of Landlord, its agents, employees or contractors, (ii) the negligence or willful misconduct of Tenant in, upon or about the Properly, or (iii) any breach or default by Tenant under this Lease.

ARTICLE VII

OPERATING EXPENSES

Tenant will pay Tenant's Pro Rata Share of all Operating Expenses allocable to the Occupancy Period. "Operating Expenses" means all costs and expenses incurred by Landlord with respect to the ownership, maintenance and operation of the Property including, but not limited to: maintenance, repair and replacement of the heating, ventilation, air conditioning, plumbing, electrical, mechanical, utility and safety systems, paving and parking areas, roads and driveways; maintenance of exterior areas such as gardening and landscaping, snow removal and signage; maintenance and repair of roof membrane, flashings, gutters, downspouts, roof drains, skylights and waterproofing; painting; lighting; cleaning; refuse removal; security; utility services attributable to the Common Areas (as defined below); Building personnel costs; personal property taxes; rentals or lease payments paid by Landlord for rented or leased personal property used in the operation or maintenance of the Property; fees for required licenses and permits; a property management fee,; and contributions to reserves for any or all of the foregoing. Operating Expenses do not include: (a) expenditures for capital improvements except (i) those which Landlord anticipates will have the effect of reducing current and/or future Operating Expenses or the rate of increase in Operating Expenses, and (ii) those required by Legal Requirements or insurance requirements; (b) debt service under mortgages; (c) costs of restoration to the extent of net insurance proceeds received by Landlord; (d) leasing commissions and tenant improvement costs; and (e) litigation expenses relating to disputes with tenants.

ARTICLE VIII

USE OF PREMISES

Tenant will use the Premises only for the Permitted Uses. Tenant will not cause or permit the Premises to be used in any way which (i) constitutes a violation of any Legal Requirements (as defined below) or the rules and regulations (the "Rules and Regulations") established by Landlord, a copy of which is attached as Exhibit C, as they may be amended in writing by Landlord, (ii) annoys or interferes with the rights of tenants of the Properly, or (iii) constitutes a nuisance or waste or will invalidate any insurance carried by Landlord. Tenant will obtain and pay for all necessary permits, including a certificate of occupancy, and will promptly take all actions necessary to comply with all applicable Federal, State or local statutes, ordinances, notes, regulations, orders, recorded declarations, covenants and requirements (collectively, "Legal Requirements") regulating the use by Tenant of the Premises, including, without limitation, the Occupational Safety and Health Act and the Americans With Disabilities Act.

| 8.2 | ENVIRONMENTAL REQUIREMENTS. |

(a) Definition of "Hazardous Material". "Hazardous Material" means any flammable items, explosives, radioactive materials, oil, hazardous or toxic substances, material or waste or related materials, including any substances defined as or included in the definition of "hazardous substances", "hazardous wastes", "hazardous materials" or "toxic substances" now or hereafter regulated under any Legal Requirements, including without limitation petroleum-based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds, and including any different products and materials which are found to have adverse effects on the environment or the health and safety of persons; provided, however, "Hazardous Material" does not include any de minimis quantities of office or other cleaning supplies commonly used in accordance with Legal Requirements.

(b) Tenant's Obligations. Tenant will not cause or permit any Hazardous Material to be generated, produced, brought upon, used, stored, treated or disposed of in or about the Property by Tenant, its agents, employees, contractors, sublessees or invitees without (i) the prior written consent of Landlord, and (ii) complying with all applicable Legal Requirements pertaining to the transportation, storage, use or disposal of such Hazardous Material (collectively, "Environmental Laws"), including, but not limited to, obtaining proper permits. Landlord is entitled to take into account such other factors or facts Landlord deems reasonably relevant in granting or withholding consent to Tenant's proposed activity with respect to Hazardous Material. Landlord will not, however, be required to consent to the installation or use of any storage tanks on the Property.

If Tenant's transportation, storage, use or disposal of Hazardous Materials results in the contamination of the soil or surface or ground water, release of a Hazardous Material or loss or damage to person(s) or property or the violation of any Environmental Law, then Tenant agrees to: (x) notify Landlord immediately of any contamination, claim of contamination, release, loss or damage, (y) after consultation with Landlord, clean up the contamination in full compliance with all Environmental Laws and (z) indemnify, defend and hold Landlord harmless from and against any claims, suits, causes of action, costs and fees, including, without limitation, attorney's fees and costs, arising from or connected with any such contamination, claim of contamination, release, loss or damage. Tenant will fully cooperate with Landlord and provide such documents, affidavits and information as may be requested by Landlord (A) to comply with any Environmental Law, (B) to comply with the request of any lender, purchaser or tenant, and/or (C) as otherwise deemed reasonably necessary by Landlord in its discretion. Tenant will notify Landlord promptly in the event of any spill or other release of any Hazardous Material at, in, on, under or about the Premises which is required to be reported to a governmental authority under any Environmental Law, will promptly forward to Landlord copies of any notices received by Tenant relating to alleged violations of any Environmental Law, will promptly pay when due any fine or assessment against Landlord, Tenant or the Property and remove or bond any lien filed against the Property relating to any violation of Tenant's obligations with respect to Hazardous Material.

(c) Landlord's Rights. Landlord will have the right, but not the obligation, without in any way limiting Landlord's other rights and remedies under this Lease, to enter upon the Premises, or to take such other actions as it deems necessary or advisable, to investigate, clean up, remove or remediate any Hazardous Material or contamination by Hazardous Material present on, in, at, under or emanating from the Premises or the Property in violation of Tenant's obligations under this Lease or under any laws regulating Hazardous Material or that Tenant is liable under this Lease to clean up, remove or remediate. Landlord will have the right, at its election, in its own name or as Tenant's agent, to negotiate, defend, approve and appeal, at Tenant's expense, any action taken or order issued by any governmental agency or authority against Tenant, Landlord or the Premises or the Property relating to any Hazardous Material or under any related law or the occurrence of any event or existence of any condition that would cause a breach of any of the covenants set forth in this Section 8.2.

If Landlord determines in good faith that a release or other environmental condition may have occurred during the Occupancy Period, at Tenant's cost, Landlord may require an environmental audit of the Premises by a qualified environmental consultant. Tenant will, at it sole cost and expense, take all actions recommended in such audit to remediate any environmental conditions for which it is responsible under this Lease.

Landlord or its agents may enter the Premises, upon 24 hours notice to Tenant (except in the case of an emergency), to show the Premises to potential buyers, investors or tenants or other parties, for routine property inspections and maintenance or for any other purpose Landlord deems reasonably necessary. During the last 9 months of the Lease Term, Landlord may place customary "For Lease" signs on the Premises.

(a) Common Areas. "Common Areas" means all areas within the Property which are available for the common use of tenants of the Property and which are not leased or held for the exclusive use of Tenant or other tenants, including, but not limited to, parking areas, driveways, sidewalks, access roads, landscaping, and planted areas. Landlord, from time to time, may change the size, location, nature, and use of any of the Common Areas, convert Common Areas into leaseable areas, construct additional parking facilities in the Common Areas, and increase or decrease Common Area land or facilities so long as Tenant's use of the Premises is not materially affected.

(b) Use of Common Areas. Tenant will have the non-exclusive right (in common with other tenants and all others to whom Landlord has granted or may grant such rights) to use the Common Areas, including the Parking Spaces, for the purposes intended, subject to such reasonable rules and regulations as Landlord may establish or modify from time to time. Tenant agrees to abide by all such rules and regulations and to use its best efforts to cause others who use the Common Areas with Tenant's express or implied permission to abide by the Rules and Regulations. At any time, Landlord may close any Common Areas to perform any acts as, in Landlord's reasonable judgment, are desirable to maintain or improve the Property. Tenant will not interfere with the rights of Landlord, other tenants, or any other person entitled to use the Common Areas.

(c) Parking. Tenant shall be entitled to park in common with other tenants of Landlord, and receive three (3) nonreserved, unassigned parking spaces for every 1,000 square feet of rentable area of the Premises (i.e., eighty-nine (89) spaces as of the date hereof). Tenant agrees not to overburden the parking facilities, agrees to cooperate with Landlord and other tenants in the use of parking facilities, and to abide by all rules and regulations regarding the use of such parking facilities as may now exist, or as may hereinafter be promulgated by Landlord. Said parking spaces shall be used for parking by vehicles no larger than full-size passenger automobiles or pick-up trucks, herein called "Permitted Size Vehicles." Vehicles other than Permitted Size Vehicles shall be parked and loaded or unloaded as directed by Landlord. Landlord reserves the right, in its absolute discretion, to determine whether parking facilities are becoming overcrowded, and in such event, to allocate parking spaces among tenants or to designate areas within which Tenant must park. Landlord further reserves the right to modify, restripe, and otherwise change the location of drives and parking spaces. Tenant and Tenant's employees, visitors and customers assume all responsibility for damage and theft to vehicles. Tenant shall repair or cause to be repaired, at Tenant's sole cost and expense, any and all damage to the buildings on the Property caused by Tenant's, or Tenant's employees', visitors' or customers' use of such parking areas thereon.

ARTICLE IX

CONDITION AND MAINTENANCE OF PREMISES

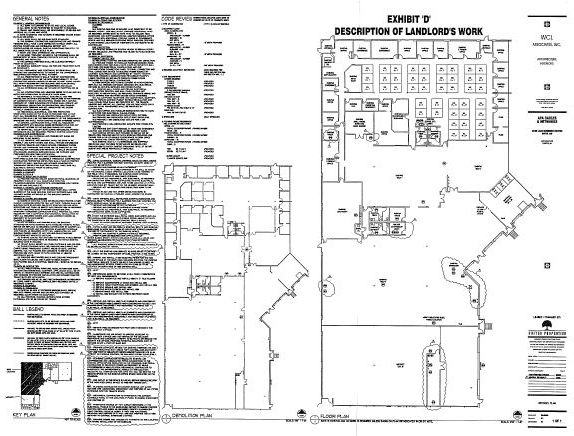

Tenant hereby accepts the Property and the Premises in their present condition, subject to all Legal Requirements. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation as to the condition of the Property or the suitability of the Property for Tenant's intended use, and except as specifically set forth herein, no agreement of Landlord to alter, remodel, decorate, clean or improve the Premises or Property (or to provide Tenant with any credit or allowance for the same), have been made by or on behalf of Landlord or relied upon by Tenant. Tenant represents and warrants that Tenant has made its own inspection of and inquiry regarding the condition of the Property and is not relying on any representations of Landlord or any broker with respect thereto. Notwithstanding the foregoing, Landlord, at Landlord's sole cost and expense, shall perform the improvements to the Premises as described on Exhibit D attached hereto and made a pail hereof using building standard materials and finishes ("Landlord's Work"). Landlord estimates that the cost of Landlord's Work is Two Hundred Five Thousand Five Hundred Fifteen and 00/100 ($205,515.00) Dollars. In the event that Tenant requests changes to Landlord's Work which will increase the cost thereof, Tenant shall pay to Landlord any such additional costs (the "Excess Costs") upon demand by Landlord. Tenant shall provide its own furniture, fixtures, equipment and appliances for the Premises.

| 9.2 | LANDLORD'S OBLIGATIONS. |

Subject to the provisions of Article 10 (Casualty and Condemnation) and Tenant's obligation to pay Additional Rent pursuant to Section 3.2, and except for damage caused by any act or omission of Tenant or Tenant's employees, agents, contractors or invitees, Landlord will maintain the Common Areas in good order, condition and repair and will keep the foundation, roof, building systems (including the heating, ventilating and air conditioning system), structural supports and exterior walls of the improvements on the Property in good order, condition and repair. Landlord will not be obligated to maintain or repair windows, doors or plate glass. Tenant will promptly report in writing to Landlord any defective condition known to it which Landlord is required to repair. Landlord will repair, at Tenant's expense, any damage to the Property caused by Tenant's acts or omissions which is Landlord's maintenance responsibility. In the event that Landlord replaces the heating, ventilating and air conditioning system serving the Premises (after its determination that such replacement is necessary), the cost thereof shall accrue interest at a rate reasonably determined by Landlord and shall be amortized over a term often (10) years, with payments of principal and interest with respect to such replacement cost to be made by Tenant to Landlord on a monthly basis from the date of an invoice from Landlord to Tenant through the expiration of the Lease and paid with Tenant's payments of Base Rent hereunder.

Subject to the provisions of Article 10 (Casualty and Condemnation), at its sole cost and expense, Tenant will keep all portions of the Premises (including without limitation, all systems and equipment, i.e., dock levelers, bumpers, doors and floors including slabs and slab repairs, crack filling and joint repairs, other than the heating, ventilating and air conditioning system, which is to be maintained, repaired and replaced by Landlord as set forth above) in good order, condition and repair (including repainting and refinishing, as needed). If any portion of the Premises or any system or equipment in the Premises which Tenant is obligated to repair can not be fully repaired or restored, Tenant will promptly replace such portion of the Premises or system or equipment. If the benefit or useful life of such replacement extends beyond the Lease Term, Tenant will only pay for a prorated portion of the useful life of such replacement. At Tenant's request, Landlord will perform Tenant's maintenance and repair obligations under this Section 9.03 and Tenant will reimburse Landlord for all costs incurred in doing so promptly upon receipt of an invoice from Landlord.

| 9.4 | ALTERATIONS, ADDITIONS, AND IMPROVEMENTS. |

(a) Tenant's Work. Tenant may not make any installations, alterations, additions, or improvements or major repairs in or to the Premises without obtaining Landlord's prior written consent. All work will be performed in accordance with plans and specifications approved by Landlord. Tenant will procure all necessary permits and licenses before undertaking any work on the Premises and will perform all work in a good and workmanlike manner employing materials of good quality and in conformity with all applicable Legal Requirements and insurance requirements. Tenant will (i) employ only contractors reasonably approved by Landlord, (ii) require all contractors employed by Tenant to carry worker's compensation insurance in accordance with statutory requirements and commercial general liability insurance covering such contractors on or about the Premises with a combined single limit not less than $1,000,000 and (iii) submit certificates evidencing such coverage to Landlord prior to the commencement of any work. Landlord may inspect Tenant's work at reasonable times. Tenant will prosecute and complete such work with reasonable diligence and will provide Landlord with "as built" plans, copies of all construction contracts and proof of payment for all labor and materials.

(b) No Liens. Tenant will pay when due all claims for labor and material furnished to the Premises and keep the Property at all times free from liens for labor and materials. Tenant will give Landlord at least 20 days' prior written notice of the commencement of any work on the Premises, regardless of whether Landlord's consent to such work is required. Landlord may record and post notices of non-responsibility on the Premises.

| 9.5 | CONDITION UPON TERMINATION. |

Upon the expiration or termination of the Lease Term, Tenant will surrender the Premises to Landlord broom clean and in the condition which Tenant is required to maintain the Premises under this Lease. Tenant will not be obligated to repair any damage which Landlord is required to repair under Article 10 (Casualty and Condemnation). Landlord may require Tenant, at its expense, to remove any alterations, additions or improvements (other than Landlord's Work), as well as any and all signage installed by or for Tenant on the Premises or the Building, prior to the expiration of the Lease and to restore the Premises and the Building to their prior condition. With respect to any alterations, additions or improvements which require Landlord's approval, Landlord will specify if Tenant will be required to remove the same at the time of such approval. Additionally, prior to the expiration or earlier termination of the Lease Term or Tenant's right to possession of the Premises, Tenant shall remove its furniture, equipment, trade fixtures, other items of personal property, and any and all wiring and cabling (including but not limited to telephone, fiber optic, computer, communications, and fire alarm wires and cables) from the Premises, as well as any and all risers, plenums and conduits installed and used exclusively by Tenant in the Building. If Tenant does not remove any such alterations, additions, improvements, or items as set forth herein, Tenant shall be conclusively presumed to have conveyed the same to Landlord free and clear of any and all liens and security interests without further payment or credit by Landlord to Tenant; or at Landlord's sole option, such items shall be deemed abandoned, in which event Landlord may cause such items to be removed and disposed of at Tenant's expense, without notice to Tenant and without obligation to compensate Tenant, and Landlord shall, prior to returning the Security Deposit to Tenant pursuant to Section 14.4 hereof, deduct the cost of such removal and disposal from the Security Deposit, with any costs thereof in excess of the Security Deposit to be paid by Tenant to Landlord upon demand.

| 9.6 | EXEMPTION OF LANDLORD FROM LIABILITY. |

Landlord will not be liable for any damage or injury to the person, business (or any loss of income therefrom), goods, wares, merchandise or other property of Tenant, Tenant's employees, invitees, customers or any other person or about the Property, whether such damage or injury is caused by or results from: (a) fire, steam, electricity, water, gas or rain; (b) the breakage, leakage, obstruction or other defects of pipes, sprinklers, wires, appliances, plumbing, air conditioning or lighting fixtures or any other cause; (c) conditions arising in or about the Property, or from other sources or places; (d) any curtailment or interruption in utility services or (e) any act or omission of any other tenant of the Property. Tenant will give Landlord prompt notice upon the occurrence of any accident or casualty at the Premises. The provisions of this Section will not exempt Landlord from liability for its gross negligence or willful misconduct; provided, however, Landlord will not be liable for any consequential damages.

ARTICLE X

CASUALTY AND CONDEMNATION

(a) If the Premises are destroyed or rendered untenantable, either wholly or in part, by fire or other casualty ("Casualty"), Tenant will immediately notify Landlord in writing upon the occurrence of such Casualty. Landlord may elect either to (i) repair the damage caused by such casualty as soon as reasonably possible, in which case this Lease will remain in full force and effect, or (ii) terminate the Lease Term as of the date the Casualty occurred. Landlord will notify Tenant within 30 days after receipt of notice of the Casualty whether Landlord elects to repair the damage or terminate the Lease Term. If Landlord elects to repair the damage, Tenant will pay Landlord Tenant's Pro Rata Share of the deductible amount (which deductible shall not exceed $25,000) under Landlord's insurance allocable to the damage to the Premises and, if the damage was due to an act or omission of Tenant or its employees, agents, contractors or invitees, the difference between the actual cost of repair and any insurance proceeds received by Landlord.

(b) If (i) based on the estimate of Landlord's architect or contractor, it will take Landlord more than 9 months to rebuild the Premises or (ii) the Casualty occurs during the last 6 months of the Lease Term and the damage is estimated by Landlord to require more than 30 days to repair, Tenant may elect to terminate the Lease Term as of the date the Casualty occurred, which must be exercised by written notification to Landlord within 10 days after the occurrence of the Casualty.

(c) If the Property is destroyed or damaged by Casualty and Landlord elects to repair or restore the Property pursuant to the provisions of this Article 10, any Rent payable during the period of such damage, repair and/or restoration will be reduced according to the degree, if any, to which Tenant's use of the Premises is impaired.

(d) The provisions of this Article 10 will govern the rights and obligations of Landlord and Tenant in the event of any damage or destruction of or to the Property. Tenant waives the protection of any statute, code or judicial decision which grants a tenant the right to terminate a lease in the event of the damage or destruction of the leased property.

If more than 20% of the floor area of the Premises or more than 25% of the parking on the Property is taken by eminent domain, either Landlord or Tenant may terminate the Lease Term as of the date the condemning authority takes title or possession, by delivering notice to the other within 10 days after receipt of written notice of such taking (or in the absence of such notice, within 10 days after the condemning authority takes title or possession). If neither party terminates the Lease Term, this Lease will remain hi effect as to the portion of the Premises not taken, except that the Base Rent will be reduced in proportion to the reduction in the floor area of the Premises. Any condemnation award or payment will be paid to Landlord. Tenant will have no claim against Landlord for the value of the unexpired lease term or otherwise; provided, however, Tenant may make a separate claim with the condemning authority for its personal property and/or moving costs so long as Landlord's award is not reduced thereby.

ARTICLE XI

ASSIGNMENT AND SUBLETTING

| 11.1 | LANDLORD'S CONSENT REQUIRED. |

Tenant will not assign or transfer this Lease or sublease the Premises or any part thereof or interest therein, or mortgage, pledge or hypothecate its leasehold interest, without Landlord's prior written consent, which will not be unreasonably withheld. Unless Tenant is a publicly traded company, a transfer of a controlling interest in Tenant will be deemed an assignment of this Lease. Any attempted transfer without consent will be void and constitute a non-curable Event of Default under this Lease (as defined below). Tenant's request for consent will include the details of the proposed sublease or assignment, including the name, business and financial condition of the prospective transferee, financial details of the proposed transaction (e.g., the term of and the rent and security deposit payable under any proposed assignment or sublease), and any other information Landlord deems relevant. Landlord will have the right to withhold consent, in its reasonable business judgment, or to grant consent, based on the following factors: (i) the business of the proposed assignee or subtenant and the proposed use of the Premises; (ii) the net worth and financial condition of the proposed assignee or subtenant; (iii) Tenant's compliance with all of its obligations under this Lease; and (iv) such other factors as Landlord may reasonably deem relevant. Tenant will promptly furnish to Landlord copies of all transaction documentation.

If Tenant desires to assign this Lease or sublease all or any part of the Premises, Tenant will notify Landlord and Landlord for a period of 30 days will have the right to terminate the Lease Term. If Tenant desires to sublease only a portion of the Premises, and such portion is subdividable (with any costs paid by Tenant), then the right to terminate may be exercised with respect to only that portion of the Premises to be subleased. If Landlord elects not to terminate the Lease Term as provided in this Section 11.2, Tenant shall pay to Landlord 50% of any net profits (i.e., profits after deducting the actual bona fide costs or expenses incurred by Tenant in connection with such assignment or sublease, amortized monthly on a straight-line basis over the term of the applicable sublease or assignment) received by Tenant from any assignment of this Lease or sublet of the Premises.

| 11.3 | NO RELEASE OF TENANT. |

Notwithstanding any assignment or subletting, Tenant will at all times remain fully responsible and primarily liable for the payment of Rent and compliance with all of Tenant's obligations under this Lease. Consent to one transfer will not be deemed a consent to any subsequent transfer or a waiver of the obligation to obtain consent on subsequent occasions. If Tenant's assignee or transferee defaults under this Lease, Landlord may proceed directly against Tenant without pursuing remedies against the assignee or transferee.

ARTICLE XII

DEFAULTS AND REMEDIES

| 12.1 | COVENANTS AND CONDITIONS. |

Tenant's performance of each of Tenant's obligations under this Lease is a condition as well as a covenant. Tenant's right to continue in possession of the Premises is conditioned upon such performance. Time is of the essence in the performance by Tenant of all covenants and conditions.

Each of the following constitutes an "Event of Default" under this Lease:

(a) Tenant fails to pay Rent or any other sum payable under this Lease within 5 days after it is due;

(b) Tenant fails to perform any of Tenant's other obligations under this Lease and such failure continues for a period of 30 days after notice from Landlord; provided that if more than 30 days are reasonably required to complete such performance, Tenant will not be in default if Tenant commences such performance within the 30 day period and thereafter diligently pursues its completion;

(c) Tenant abandons the Premises; or

(d) Tenant (or Guarantor) becomes insolvent or bankrupt, has a receiver or trustee appointed for any part of its property, makes an assignment for the benefit of its creditors, or any proceeding is commenced either by Tenant or against it under any bankruptcy or insolvency laws, which proceeding is not dismissed within 60 days; provided, however, if a court of competent jurisdiction determines that any of the acts described in this subsection (d) is not an Event of Default under this Lease, and a trustee is appointed to take possession (or if Tenant remains a debtor in possession) and such trustee or Tenant assigns, subleases, or transfers Tenant's interest hereunder, then Landlord will receive, as Additional Rent, the excess, if any, of the rent (or any other consideration) paid in connection with such assignment, transfer or sublease over the rent payable by Tenant under this Lease.

On the occurrence of an Event of Default, Landlord may, at any time thereafter, with or without notice or demand, and without limiting Landlord in the exercise of any right or remedy which Landlord may have:

(a) Terminate the Lease Term by written notice to Tenant. Tenant will then immediately quit and surrender the Premises to Landlord, but Tenant will remain liable as hereinafter provided. Following termination, without prejudice to other remedies Landlord may have by reason of Tenant's default or of such termination, Landlord may (i) peaceably reenter the Premises upon voluntary surrender by Tenant or remove Tenant therefrom and any other persons occupying the Premises, using such legal proceedings as may be available; (ii) repossess the Premises or relet the Premises or any part thereof for such term (which may be for a term extending beyond the Lease Term), at such rental and upon such other terms and conditions as Landlord in Landlord's sole discretion determines, with the right to make alterations and repairs to the Premises; and (iii) remove all personal property therefrom.

The amount of damages Tenant will pay to Landlord following termination will include all Rent unpaid up to the termination of the Lease Term, the value of any free or reduced rent provided for in this Lease, costs and expenses incurred by Landlord due to such Event of Default and, in addition, Tenant will pay to Landlord as damages, at the election of Landlord (if Landlord shall elect subsection (y) below, it may cease such election at any time), either (x) the amount, discounted to present value (at the then Federal Reserve Bank discount rate) by which, at the time of the termination of the Lease Term or of Tenant's right to possession (or at any time thereafter if Landlord initially elects damages under subsection (y) below), (i) the aggregate of the Rent and other charges projected over the period commencing with such termination and ending on the expiration date of this Lease exceeds (ii) the aggregate projected rental value of the Premises for such period; or (y) amounts equal to the Rent and other charges which would have been payable by Tenant had the Lease Term or Tenant's right to possession not been so terminated, payable upon the due dates therefor specified herein following such termination and until the expiration date of this Lease, provided, however, that if Landlord re-lets the Premises during such period, Landlord will credit Tenant with the net rents received by Landlord from such re-letting, such net rents to be determined by first deducting from the gross rents received from such re-letting the expenses incurred or paid by Landlord in terminating this Lease, and the reasonable expenses of re-letting, including, without limitation, altering and preparing the Premises for new tenants, brokers' commissions and legal fees, it being understood that any such reletting may be for a period equal to or shorter or longer than the remaining Lease Term; and provided, further, that in no event (i) will Tenant be entitled to receive any excess of such net rents over the sums payable by Tenant to Landlord hereunder or (ii) will Tenant be entitled in any suit for the collection of damages pursuant to this subsection (y) to a credit in respect of any net rents from a re-letting except to the extent that such net rents are actually received by Landlord prior to the commencement of such suit.

If the Premises or any part thereof are re-let in combination with other space, then proper apportionment on a square foot area basis will be made of the rent received from such re-letting and of the expenses of re-letting. In calculating the Rent and other charges under subsection (x) above, there will be included, in addition to the Rent, other considerations agreed to be paid or performed by Tenant, on the assumption that all such considerations would have remained constant for the balance of the full Lease Term hereby granted. Landlord may re-let the Premises or any part thereof for such rent and on such terms as it determines (including the right to re-let the Premises for a greater or lesser term than the Lease Term, the right to re-let the Premises as part of a larger area and the right to change the character or use made of the Premises). Landlord will use reasonable efforts to re-let the Premises and otherwise to mitigate Tenant's damages upon redelivery of the Premises to Landlord. Suit or suits for the recovery of damages, or any installments thereof, may be brought by Landlord from time to time at its election, and nothing contained herein will be deemed to require Landlord to postpone suit until the date when the Lease Term would have expired if it had not been terminated hereunder.

(b) Maintain Tenant's right to possession, in which case this Lease will continue in effect whether or not Tenant has abandoned the Premises. In such event, Landlord will be entitled to enforce all of Landlord's rights and remedies under this Lease, including the right to recover the Rent as it becomes due.

(c) Pursue any other remedy now or hereafter available to Landlord under the laws or judicial decisions of the state in which the Property is located.

On any termination, Landlord's damages will include all costs and fees, including reasonable attorneys' fees that Landlord incurs in connection with any bankruptcy court or other court proceeding with respect to the Lease, the obtaining of relief from any stay in bankruptcy restraining any action to evict Tenant, or the pursuing of any action with respect to Landlord's right to possession of the Premises. All such damages suffered (apart from Rent payable hereunder) will constitute pecuniary damages which will be paid to Landlord prior to assumption of the Lease by Tenant or any successor to Tenant in any bankruptcy or other proceedings.

Except as otherwise expressly provided herein, any and all rights and remedies which Landlord may have under this Lease and at law and equity are cumulative and will not be deemed inconsistent with each other, and any two or more of all such rights and remedies may be exercised at the same time to the greatest extent permitted by law.

ARTICLE XIII

PROTECTION OF LENDERS

This Lease shall be automatically subordinated to any Mortgage encumbering the Property. Landlord shall use commercially reasonable efforts to provide to Tenant an instrument in commercially reasonable form providing that the ground lessor, mortgagor or beneficiary of such Mortgage agrees that in the event of the foreclosure or termination of such Mortgage, this Lease and the rights of Tenant hereunder will continue in full force and effect so long as Tenant continues to comply with all its obligations hereunder. "Mortgage" includes any mortgage, deed of trust or ground lease, together with any amendments, additional advances, restatements, modifications or consolidations of such instrument. If any ground lessor, beneficiary or mortgagee elects to have this Lease prior to the lien of its Mortgage and gives written notice thereof to Tenant, this Lease will be deemed prior to such Mortgage whether this Lease is dated prior or subsequent to the date of said Mortgage or the date of recording thereof.

If Landlord's interest in the Property is acquired by any ground lessor, beneficiary, mortgagee, or purchaser at a foreclosure sale, Tenant will attorn to the transferee of or successor to Landlord's interest in the Property and recognize such transferee or successor as successor Landlord under this Lease. Tenant waives the protection of any statute or rule of law which gives Tenant any right to terminate this Lease or surrender possession of the Premises upon the transfer of Landlord's interest.

| 13.3 | ESTOPPEL CERTIFICATES. |

Within 10 days after Landlord's request, Tenant will execute, acknowledge and deliver to Landlord a written statement certifying: (i) that none of the terms or provisions of this Lease have been changed (or if they have been changed, stating how they have been changed); (ii) that this Lease has not been canceled or terminated; (iii) the last date of payment of the Base Rent and other charges and the time period covered by such payment; (iv) that Landlord is not in default under this Lease (or if Landlord is claimed to be in default, setting forth such default in reasonable detail); and (v) such other information with respect to Tenant or this Lease as Landlord may reasonably request or which any prospective purchaser or encumbrancer of the Property may require. Landlord may deliver any such statement by Tenant to any prospective purchaser or encumbrancer of the Property, and such purchaser or encumbrancer may rely conclusively upon such statement as true and correct. If Tenant does not deliver such statement to Landlord within such 10 day period, Landlord, and any prospective purchaser or encumbrancer, may conclusively presume and rely upon (and Tenant will be estopped from denying): (i) that the terms and provisions of this Lease have not been changed except as otherwise represented by Landlord; (ii) that this Lease has not been canceled or terminated except as otherwise represented by Landlord; (iii) that not more than one month's Base Rent or other charges have been paid in advance; and (iv) that Landlord is not in default under this Lease.

| 13.4 | TENANT'S FINANCIAL CONDITION. |

Within 10 days after request from Landlord from time to time, Tenant will deliver to Landlord Tenant's financial statements (audited, if available) for the most recent two fiscal years. Such financial statements may be delivered to Landlord's mortgagees and lenders and prospective mortgagees, lenders and purchasers. Landlord shall exercise commercially reasonable efforts to keep all non-public financial statements confidential to Landlord and such mortgagees or prospective purchasers and their respective attorneys, accountants and representatives, and Landlord will use them only in connection with the Property and this Lease.

ARTICLE XIV

MISCELLANEOUS PROVISIONS

| 14.1 | COVENANT OF QUIET ENJOYMENT. |

Tenant on paying the Rent and performing its obligations hereunder will peacefully and quietly have, hold and enjoy the Premises throughout the Lease Term without any manner of hindrance from Landlord, subject however to all the terms and provisions hereof.

| 14.2 | LANDLORD'S LIABILITY AND INDEMNITY. |

The obligations of this Lease run with the land, and this Lease will be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. No owner of the Property will be liable under this Lease except for breaches of Landlord's obligations occurring while it is owner of the Property. The obligations of Landlord will be binding upon the assets of Landlord which comprise the Property but not upon other assets of Landlord. No individual Representative will be personally liable under this Lease or any other instrument, transaction or undertaking contemplated hereby.

To the fullest extent permitted by law, Landlord will indemnify and hold harmless Tenant from any liabilities, losses, damages, costs, expenses (including reasonable attorneys' fees and expenses), causes of action, suits, claims, demands or judgments arising from any act of negligence of Landlord, except to the extent arising out of Tenant's negligence or willful misconduct or breach of this Lease. This indemnity does not cover claims arising from the presence or release of Hazardous Materials.

Tenant will give written notice of any failure by Landlord to perform any of its obligations under this Lease to Landlord and to any ground lessor, mortgagee or beneficiary under any Mortgage encumbering the Property whose name and address have been furnished to Tenant. Landlord will not be in default under this Lease unless Landlord (or such ground lessor, mortgagee or beneficiary) fails to cure such non-performance within 30 days after receipt of Tenant's notice or such longer period as may be required to diligently complete such matter. If Landlord (or such ground lessor, mortgagee or beneficiary) can not perform any of its obligations due to events beyond its reasonable control, the time provided for performing such obligations will be extended by a period of time equal to the duration of such events. Events beyond Landlord's reasonable control include, but are not limited to, acts of God, war, civil commotion, labor disputes, strikes, fire, flood or other casualty or weather conditions, shortages of labor or material, and Legal Requirements.

If Tenant does not vacate the Premises upon the expiration or earlier termination of this Lease, (i) Tenant will indemnify Landlord against all damages, costs, liabilities and expenses, including attorneys' fees, which Landlord incurs on account of Tenant's failure to vacate and (ii) the Base Rent will increase to 150% of the Base Rent then in effect, payable to Landlord in monthly installments without pro-ration for any partial month, and Tenant's obligation to pay Additional Rent will continue. Any holdover by Tenant does not constitute an extension of the Lease or recognition by Landlord of any right of Tenant to remain in the Premises.

Tenant will pay Landlord its reasonable fees and expenses incurred in connection with any act by Tenant which requires Landlord's consent or approval under this Lease.

| 14.6 | LANDLORD'S RIGHT TO CURE. |

If Tenant defaults in the performance of any obligation under this Lease, Landlord will have the right (but is not required) to perform such obligation and, if necessary, to enter upon the Premises. All costs incurred by Landlord (together with interest at the rate of 15% per year but not to exceed the highest legal rate) will be deemed to be Additional Rent under this Lease and will be payable to Landlord immediately on demand. Landlord may exercise the foregoing rights without waiving any of its other rights or releasing Tenant from any of its obligations under this Lease.

The captions of the Articles or Sections of this Lease are not a part of the terms or provisions of this Lease. Whenever required by the context of this Lease, the singular includes the plural and the plural includes the singular. The masculine, feminine and neuter genders each include the other. In any provision relating to the conduct, acts or omissions of Tenant, the term "Tenant" includes Tenant's agents, employees, contractors, invitees, successors or others using the Premises with Tenant's express or implied permission. This Lease does not, and nothing contained herein, will create a partnership or other joint venture between Landlord and Tenant. A determination by a court of competent jurisdiction that any provision of this Lease or any part thereof is illegal or unenforceable will not invalidate the remainder of such provision, which will remain in full force and effect.

| 14.8 | INCORPORATION OF PRIOR AGREEMENTS; MODIFICATIONS. |

This Lease is the only agreement between the parties pertaining to the lease of the Premises. All amendments to this Lease must be in writing and signed by all parties. Any other attempted amendment will be void.

All notices, requests and other communications required or permitted under this Lease will be in writing and personally delivered or sent by a national overnight delivery service which maintains delivery records. Notices will be delivered to Tenant's Notice Address or to Landlord's Notice Address, as appropriate. All notices will be effective upon delivery (or refusal to accept delivery). Either party may change its notice address upon written notice to the other party.

All waivers will be in writing and signed by the waiving party. Landlord's failure to enforce any provision of this Lease or its acceptance of Rent is not a waiver and will not prevent Landlord from enforcing that provision or any other provision of this Lease in the future. No statement on a payment check from Tenant or in a letter accompanying a payment check will be binding on Landlord. Landlord may, with or without notice to Tenant, negotiate such check without being bound by to the conditions of such statement.

| 14.11 | BINDING EFFECT; CHOICE OF LAW. |

This Lease will bind any party who legally acquires any rights or interest in this Lease from Landlord or Tenant, provided that Landlord will have no obligation to Tenant's successor unless the rights or interests of Tenant's successor are acquired in accordance with the terms of this Lease. The laws of the state in which the Property is located govern this Lease. The parties hereto waive trial by jury in any action, proceeding or counterclaim brought by any party(ies) against any other party(ies) on any matter arising out of or in any way connected with this Lease or the relationship of the parties hereunder.

This Lease may be executed in counterparts and, when all counterpart documents are executed, the counterparts will constitute a single binding instrument. Landlord's delivery of this Lease to Tenant is not be deemed to be an offer to lease and will not be binding upon either party until executed and delivered by both parties.

All representations and warranties of Landlord and Tenant, Tenant's indemnity under Section 6.4, the provisions of Section 8.2 and all obligations of Tenant to pay Additional Rent hereunder, shall survive the termination of this Lease.

Upon the execution of this Lease and as a condition precedent to the effectiveness of this Lease, Tenant shall deposit with Landlord the Security Deposit. Landlord may, at its option, apply all or part of the Security Deposit to any unpaid Rent or other charges due from Tenant, cure any other defaults of Tenant, or compensate Landlord for any loss or damage which Landlord may suffer due to Tenant's default. If Landlord uses any part of the Security Deposit, Tenant will restore the Security Deposit to its full amount within 10 days after Landlord's request. No interest will be paid on the Security Deposit, no trust relationship is created herein between Landlord and Tenant with respect to the Security Deposit, and the Security Deposit may be commingled with other funds of Landlord. Upon expiration or termination of this Lease not resulting from Tenant's default and after Tenant has vacated the Premises in the manner required by this Lease, Landlord will pay to Tenant any balance of the Security Deposit not applied pursuant to this Section. If the Security Deposit is in the form of an unconditional, irrevocable letter of credit, such letter of credit will be issued by a financial institution approved by Landlord and in the form of Exhibit E attached hereto and made a part hereof. Tenant acknowledges that any failure of the issuing bank to renew the letter of credit for an additional period of one (1) year (unless the letter of credit has been reduced to $0 as set forth below, or the Term has expired) shall constitute an Event of Default hereunder, entitling Landlord to immediately draw down on such letter of credit without notice to Tenant.

So long as Tenant is not in default under the terms of the Lease (and no condition exists which, but for the passage of time or the giving of notice would constitute a default hereunder), upon notice to Landlord, and Landlord's written approval thereof, the Letter of Credit may be reduced as follows (a) to $75,000 on the first day of the third (3rd) Lease Year, (b) to $50,000 on the first day of the fourth (4th) Lease Year, (c) to $25,000 on the first day of the fifth (5th) Lease Year, and (d) to $0 on the first day of the sixth (6th) Lease Year. If Tenant is not entitled to any one reduction, as set forth above, Tenant shall not be entitled to any further reductions hereunder. Upon reduction of the amount of the Letter of Credit, Tenant shall deliver to Landlord an amendment to the Letter of Credit setting forth the new amount thereof. If the Letter of Credit has not been released as set forth above, within forty-five (45) days of the Expiration Date, provided no draw is pending or has been made with the issuer of said Letter of Credit by Landlord, and Tenant is not in default (nor are there any conditions which, but for the passage of time or the giving of notice would constitute a default hereunder), Tenant shall be entitled to a full release of the Letter of Credit.

In any case where either party hereto is required to do any act, delays caused by or resulting from Acts of God, war, civil commotion, fire, floor or other casualty, labor difficulties, shortages of labor, materials or equipment, government regulations, unusually severe weather, or other causes beyond such party's reasonable control, shall not be counted in determining the time during which work shall be completed, whether such time be designated by a fixed date, a fixed time or a "reasonable time", and such time shall be deemed to be extended by the period of such delay.

| 14.16 | INTENTIONALLY DELETED. |

| 14.17 | INTENTIONALLY DELETED. |

Landlord and Tenant each represent and warrant to the other that the Brokers are the only agents, brokers, finders or other parties with whom it has dealt who may be entitled to any commission or fee with respect to this Lease or the Premises or the Property. Landlord and Tenant each agree to indemnify and hold the other party harmless from any claim, demand, cost or liability, including, without limitation, attorneys' fees and expenses, asserted by any party other than the Brokers based upon dealings with that party.

In any enforcement proceeding brought by either party with respect to this Lease, the non-prevailing party will pay to the prevailing party in such proceeding all costs, including reasonable attorneys' fees and court costs, incurred by such other party with respect to said proceeding and any appeals therefrom.

| 14.20 | ADDITIONAL PROVISIONS. |

The exhibits, if any, attached hereto, are incorporated herein by reference.

SIGNATURES FOLLOW ON NEXT PAGE

Signed on June 6, 2006

LANDLORD:

BASS LAKEJ&EALTY LLC, a Delaware limited liability company

| By: | /s/ Randolph L. Razazian III | |

| | Name: Randolph L. Razazian III |

| | Title: Manager |

Signed on May 31, 2006

TENANT:

APA CABLES & NETWORKS, INC., a Minnesota corporation

| By: | /s/ Cheri B Podzimek | |

| | Name: Cheri B Podzimek |

| | Title: President |

EXHIBIT A

THE PROPERTY

Lot 1, Block 1, NATHAN 54 CENTER, Hennepin County, Minnesota,

(Abstract property).

EXHIBIT "B"

EXHIBIT C

RULES AND REGULATIONS

1. No sign, placard, picture, advertisement, name, notice or sun screening shall be inscribed, displayed, printed or affixed on or to any part of the outside or inside of the Building without the written consent of Landlord first had and obtained and in the absence thereof, Landlord shall have the right to remove any such sign, placard, picture, advertisement, name or notice without notice to and at the expense of Tenant. All approved signs of lettering on doors shall be printed, painted, affixed or inscribed at the sole risk and expense of Tenant by a licensed contractor approved by Landlord and subject to all laws, ordinances rules, regulations and recommendations of all governmental and quasi-governmental authorities having jurisdiction thereover and all insurance companies and fire rating agencies which insure the Building. Tenant shall not place anything or allow anything to be placed near the glass of any window, door, partition or wall which may appear unsightly from outside the Premises. Landlord may specify a Building standard window covering for all exterior windows.

2. All parking shall be within the property boundaries of the Property and within marked parking spaces. There should be no on-street parking and at no time shall any Tenant obstruct any driveways or loading areas intended for the use of other tenants, their employees, agents, customers and invitees. The driveways and parking areas at the Property are for the joint and non-exclusive use of Landlord's tenants, -their employees, agents, customers and invitees, unless specifically marked to the contrary. In the event Tenant, its agents, customers and/or invitees use a disproportionate portion of the parking areas, Landlord shall have the right to restrict Tenant, its agents, customers and/or invitees to certain parking areas. Tenant shall not permit any fleet trucks to park overnight in the Property's parking areas without Landlord's prior written approval.

3. Unless specifically approved by Landlord in writing, no materials, supplies or equipment shall be stored anywhere in, on or about the Building except inside the Premises. Trash receptacles may not be placed in the service areas except by Landlord. If Landlord does not supply trash receptacles, Tenant shall furnish its own receptacles, and shall place such receptacles in a location designated by Landlord.

4. No additional locks, other than Landlord approved entry systems, shall be placed on the doors of the Premises by Tenant nor shall any existing locks be changed unless Landlord is immediately furnished with two keys thereto. Landlord will, without charge, furnish Tenant with two keys for each lock on the entrance doors to the Premises when Tenant assumes possession, with the understanding that at the termination or expiration of the Term of this Lease the keys to the Premises shall be returned to Landlord.

5. Tenant will refer all contractors, contractor's representatives and installation technicians rendering any service on or to the Premises for Tenant to Landlord for its approval and supervision before performance of any service. This provision shall apply to all work performed in the Building, including, but not limited to, installation of electrical devices and attachments and installations of any nature affecting floors, walls, woodwork, trim, windows, ceilings, equipment or any other portion of the Building.

6. No Tenant shall at any time occupy or allow any person to occupy any part of the Premises or the Property as sleeping or lodging quarters.

7. Tenant shall not place, install or operate on the Premises or in any part of the Property, any engine, stove or machinery, or conduct mechanical operations or cook thereon or therein, or place or use in or about the Premises any explosives, gasoline, kerosene, oil, acids, caustics or any other flammable, explosive or Hazardous Material without the prior written consent of Landlord. The foregoing shall not prohibit the use of microwave ovens.

8. Windows facing the Building exterior shall at all times be wholly clear and uncovered (except for such blinds or curtains or other window coverings Landlord may provide or approve) so that a full unobstructed view of the interior of the Premises may be had from outside the Building.

9. The sidewalks, parking lots and exits shall not be obstructed by Tenant, its employees, agents, contractors, subtenants or assigns or used for any purpose other than for ingress to and egress from the Premises.

10. Tenant shall not use, keep or permit to be used or kept any foul or noxious gas or substance in the Premises, or permit or suffer the Premises to be occupied or used in a manner offensive or objectionable to Landlord or other occupants of the Building by reason of noise, odors and vibrations, or interfere in any way with other Tenants or those having business in the Building, nor shall any animals or birds be brought in or kept in or about the Premises or the Building.

11. Landlord reserves the right to exclude or expel from the Property any person who, in the judgment of Landlord, is intoxicated or under the influence of liquor or drugs, or who may in any manner do any act in violation of any law or any rule or regulations of the Property.

12. Landlord shall have the right, exercisable without notice and without liability to Tenant, to change the name of the Building and street address of the Building of which the Premises are a part.

13. Tenant shall not disturb, solicit or canvass any occupant of the Building and shall cooperate to prevent same.

14. Without the prior written consent of Landlord, Tenant shall not use the name of the Building or Property in connection with or in promoting or advertising the business of Tenant except as Tenant's address.

15. Landlord shall have the right to control and operate the common areas of the Property, the public facilities thereof, as well as the facilities furnished for the common use of all Tenants, in such manner as it deems appropriate.

16. No satellite dish, radio, television or other aerial or equipment of any kind may be placed or installed on the roof or on any exterior wall of the Premises or on the grounds or common areas of the Property without the prior written consent of Landlord in each instance. Any equipment so installed without such written consent shall be at the sole risk of Tenant and shall be subject to removal without notice at any time and Tenant shall pay to Landlord, on demand, as additional rent, the cost of any damages occasioned thereby including, but not limited to, the cost to replace any warranty voided or diminished by such installation and the cost of removal and repairs.

17. Landlord shall have the right from time to time to modify, add to or delete any of these rules and regulations at Landlord's discretion, provided that any changes are uniformly applied to all Tenants.

EXHIBIT D

DESCRIPTION OF LANDLORD'S WORK

Landlord shall make the improvements to the Premises shown on the attached space plan prepared by WCL Architects dated September 21, 2005, updated on January 20, 2006, and further updated on March 3, 2006, using building standard colors, materials and finishes, mutually agreed upon by Landlord and Tenant.