Exhibit 99.1

NASDAQ:CLFD February 22, 2018 Welcome to the 2018 Clearfield Annual Meeting

NASDAQ:CLFD Leader in Fiber Optic Management & Connectivity Solutions 2018 Shareholder Meeting February 22, 2018 NASDAQ : CLFD

NASDAQ:CLFD Call to Order This meeting was called by a notice and proxy statement first mailed on January 9, 2018 to all shareholders of record on December 27, 2017 We have received proxies representing more than a majority of the outstanding shares of common stock. Therefore, this meeting has been duly called and a quorum is present. 3 2/22/2018

NASDAQ:CLFD Agenda • Elect six (6) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified; • Approve, on a non - binding advisory basis, the compensation paid to our named executive officers; and • Ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ending September 30, 2018. 4 2/22/2018 CB4

NASDAQ:CLFD Voting 5 2/22/2018

NASDAQ:CLFD Adjournment 6 2/22/2018

NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. These statements are based upon the Company's current expectations and judgments about future developments in the Company's busines s. Certain important factors could have a material impact on the Company's performance, including, without limitation: our succe ss depends upon adequate protection of our patent and intellectual property rights and our ability to successfully defend against claims of infringement; our results of operations could be adversely affected now that the stimulus funds of the American Recovery and Reinvestment Act are fully al loc ated and projections are nearing completion; National Broadband Plan’s transitioning from the USF to the CAF program may cause our cus tom ers and prospective customers to delay or reduce purchases; a significant percentage of our sales in the last three fiscal years have be en made to a small number of customers, and the loss of these major customers would adversely affect us; intense competition in our industry may re sult in price reductions, lower gross profits and loss of market share; our results of operations could be adversely affected by economic c ond itions and the effects of these conditions on our customers’ businesses; our operating results may fluctuate significantly from quarter to quarter, whi ch may make budgeting for expenses difficult and may negatively affect the market price of our common stock; to compete effectively, we m ust continually improve existing products and introduce new products that achieve market acceptance; our acquisition of the outdoor powered cabinet products may not produce the anticipated financial results within the timeframes expected; our acquisition of the outdoor powered cabinet products may not deliver the customer synergies expected; we may face circumstances in the future that will result in impairment charges, including, but not limited to, significant goodwill impairment charges; we rely on single - source suppliers, which could cause delays, increases in costs or pre vent us from completing customer orders, all of which could materially harm our business; we face risks associated with expanding our sale s o utside of the United States; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of busine ss combinations and related integration activities; we are dependent on key personnel; product defects or the failure of our pro duc ts to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; and other factors set forth in Par t I , Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2017 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events. © Copyright 2018 Clearfield, Inc. All Rights Reserved. 7 2/22/2018 CB5

NASDAQ:CLFD Deliver Patented technology forms the core building blocks for more than 550 deployments globally Clearfield at a Glance 8 We provide fiber management , protection , and delivery products that enable service providers to cost - effectively build and scale their fiber networks Protect Innovative product design ensures fiber is protected throughout the network Manage Uniform and modular platform reduces the costs of managing and deploying fiber

NASDAQ:CLFD Celebrating our 10 th Anniversary: 20 million fiber ports delivered 2008: Launched patented Clearview ® Cassette 2012: Entered Caribbean and Latin America (CALA) markets 2013: Launched FieldShield ® 2014: Expanded manufacturing capacity with Mexico facility 2015: Moved to larger U.S. facility to expand manufacturing and operations capacity Today: Included in 700+ fiber deployments 2008: Clearfield ® is born 700+ 2010: Entered the optical components packaging business Note: Figure not drawn to scale | 2008 2018 9 2016: YOURx ™ platform makes fiber your way 2017: Telcordia certifications announced 2018: Expanded TAM by 10% with acquisition of Calix powered cabinet line

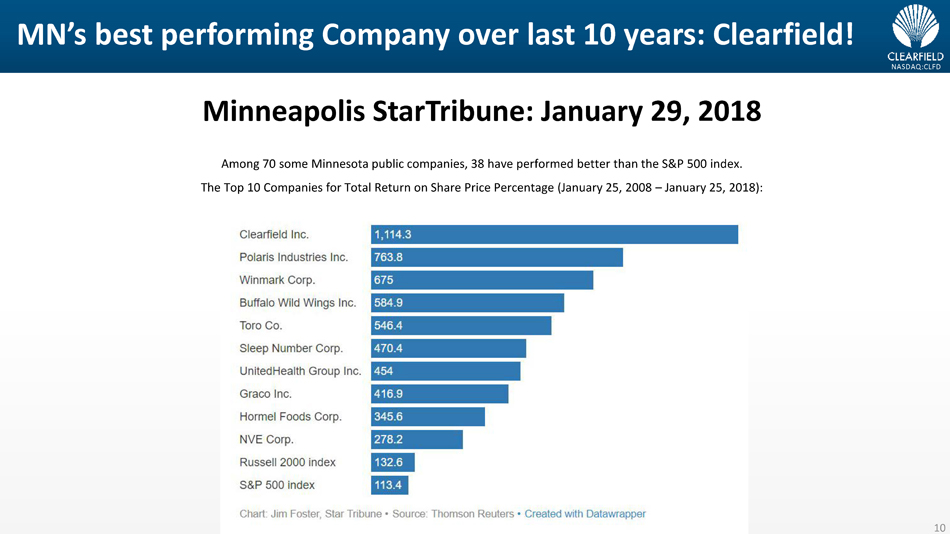

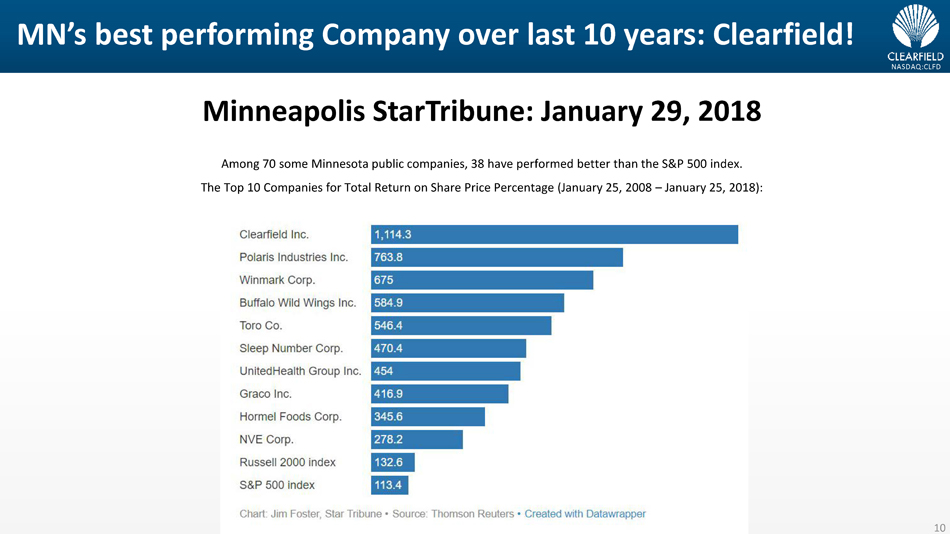

NASDAQ:CLFD MN’s best performing Company over last 10 years: Clearfield! Minneapolis StarTribune : January 29, 2018 Among 70 some Minnesota public companies, 38 have performed better than the S&P 500 index. The Top 10 Companies for Total Return on Share Price Percentage (January 25, 2008 – January 25, 2018): 10

11

NASDAQ:CLFD Fiber Management Fiber Protection & Delivery FieldSmart Clearview FieldShield and YOURx Panels, frames, cabinets, pedestals, etc., for the inside plant, outside plant and access network Patented cassettes that connect multiple fiber optic cables Fiber pathway and protection system consisting of m icroducts, cables, connectors and terminals Our Scalable, Uniform and Cost - Effective Platform 12

13

NASDAQ:CLFD Phase I (2008 - 2015) Phase II (2015+) Phase III (2018+) • Rebuild the company • Restore balance sheet and develop profitable and sustainable growth business • Build and expand the value proposition through patented and cost - minimizing solutions • Expand into national carrier market through product approvals, master purchase agreements (MPAs) and certifications: • Certifications achieved: NEBS (central office panels); GR - 326 (SC and LC connectors and cables); GR - 487 ( Makwa ) • Product approvals gained at Verizon, AT&T, CenturyLink, Frontier, Windstream, and Charter • MPA gained at Tier 1 customer, with three pending • Secure additional partnerships that will expand “feet on the street” • Dedicate sales resources to align company with industry EF&I firms, along with optical fiber and electronics vendors for referral business opportunities • Expand product suite to add more revenue to existing clients and new markets for existing product technologies The Road to Profitably Growing Revenue Faster Than 15% 14 14 FIBER MANAGEMENT FIELDSHIELD CERTIFICATIONS NATIONAL CARRIER PRODUCT APPROVALS MASTER PURCHASE AGREEMENTS CHANNEL DEVELOPMENT STRATEGIC ALLIANCES MARKET & PRODUCT LINE ENHANCEMENTS

NASDAQ:CLFD Why is the Calix Product Acquisition Strategic? 15 For Clearfield • Telcordia certified powered cabinet line complementary to existing portfolio • Incremental opportunity with limited SG&A investment • Expand sales presence through the Calix channel • Integration costs are limited • Is immediately accretive to earnings For the Industry • Accelerates entry into Tier 1 • Exposes the company us to other electronics manufacturers looking to focus on transformation to cloud platforms and software • Positions for future powered cabinet solutions of Calix deployments for 5G • Aligns Clearfield with Calix as they pursue Verizon business (Verizon has publicly stated this alignment) For Customers • No disruption to existing customers who can continue buying Clearfield powered cabinet product through Calix • Expands available Clearfield market opportunity in Tier 3 through earlier sales visibility and implied endorsement • Sellable to all of Clearfield’s telco customers

Clearfield ODC Product Line Strategic Acquisition 16

NASDAQ:CLFD ODC - 100 ODC - 200 ODC - 1000 ODC - 2000 Clearfield ODC Product Line 17

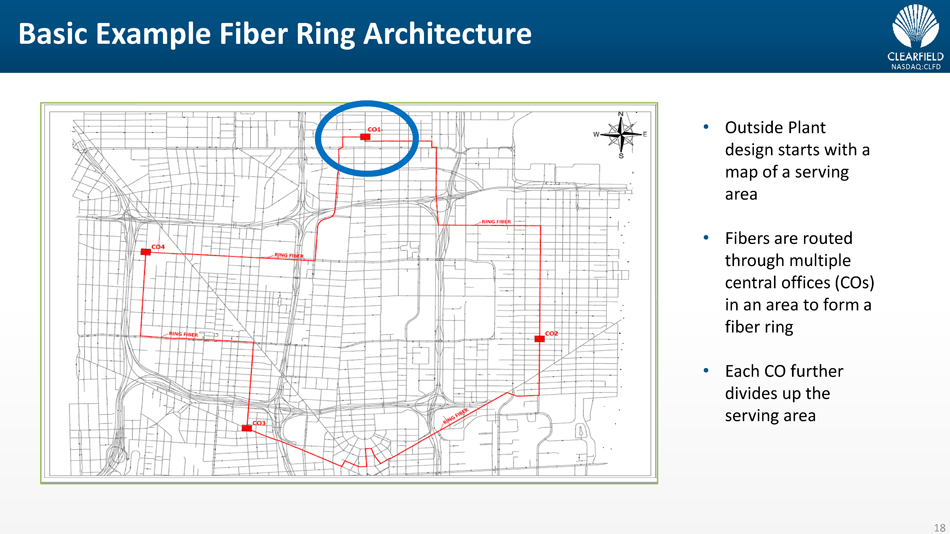

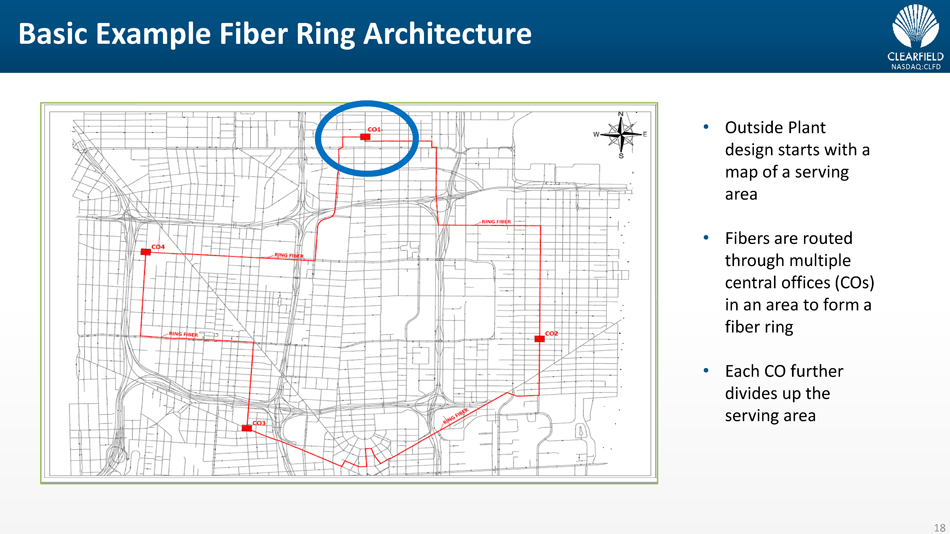

NASDAQ:CLFD • Outside Plant design starts with a map of a serving area • Fibers are routed through multiple central offices (COs) in an area to form a fiber ring • Each CO further divides up the serving area Basic Example Fiber Ring Architecture 18

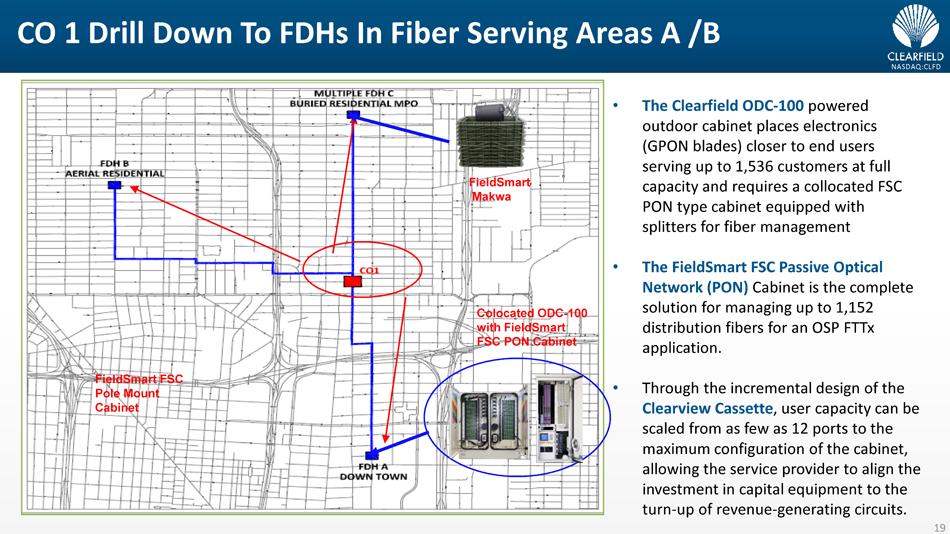

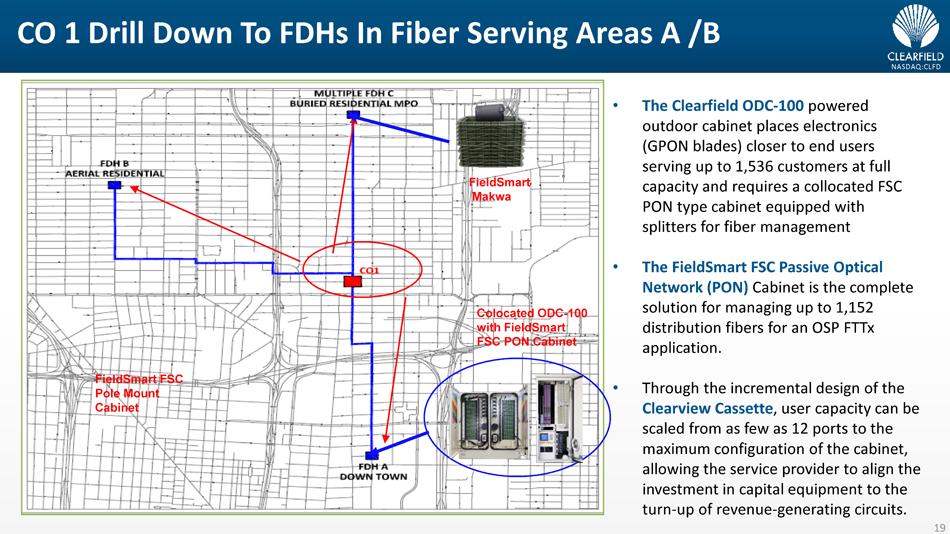

NASDAQ:CLFD • The Clearfield ODC - 100 powered outdoor cabinet places electronics (GPON blades) closer to end users serving up to 1,536 customers at full capacity and requires a collocated FSC PON type cabinet equipped with splitters for fiber management • The FieldSmart FSC Passive Optical Network (PON) Cabinet is the complete solution for managing up to 1,152 distribution fibers for an OSP FTTx application. • Through the incremental design of the Clearview Cassette , user capacity can be scaled from as few as 12 ports to the maximum configuration of the cabinet, allowing the service provider to align the investment in capital equipment to the turn - up of revenue - generating circuits. FieldSmart Makwa Colocated ODC - 100 with FieldSmart FSC PON Cabinet FieldSmart FSC Pole Mount Cabinet CO 1 Drill Down To FDHs In Fiber Serving Areas A / B 19

NASDAQ:CLFD FieldSmart FSC PON Cabinets FieldShield MPO Pushable FieldShield MPO Pushable FieldShield MPO Pushable FieldShield MPO Pushable YOURx - TAP YOURx - TAP YOURx - TAP YOURx - TAP YOURx - Terminal YOURx - Terminal YOURx - Terminal YOURx - Terminal FSA/FDH B Home - Run YOURx MPO Tails to Central Splices 20

21