Exhibit 99.1

Clearfield FieldReport: Fiscal Q1 2023 Earnings Call February 2, 2023 1 1

Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related Earnings Release are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, anticipated shipping on backlog and future lead times, future availability of components and materials from the Company’s supply chain, future availability of labor impacting our customers’ network builds, the impact of the Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or timing of customer orders, the Company’s ability to add capacity to meet expected future demand, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: adverse global economic conditions and geopolitical issues could have a negative effect on our business, and results of operations and financial condition; our planned growth may strain our business infrastructure, which could adversely affect our operations and financial condition; the acquisition of Nestor Cables and integration activities could adversely affect our operating results; the COVID - 19 pandemic has significantly impacted worldwide economic conditions and could have a material adverse effect on our business, financial condition and operating results; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders; fluctuations in product and labor costs which may not be able to be passed on to customers that could decrease margins; we depend on the availability of sufficient supply of certain materials, such as fiber optic cable and resins for plastics, and global disruptions in the supply chain for these materials could prevent us from meeting customer demand for our products; we rely on our manufacturing operations to produce product to ship to customers and manufacturing constraints and disruptions could result in decreased future revenue; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent on key personnel; cyber - security incidents on our information technology systems, including ransomware, data breaches or computer viruses, could disrupt our business operations, damage our reputation, and potentially lead to litigation; our business is dependent on interdependent management information systems; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; changes in government funding programs may cause our customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate protection of our patent and intellectual property rights; if the telecommunications market does not expand as we expect, our business may not grow as fast as we expect; we face risks associated with expanding our sales outside of the United States; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2022 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. NASDAQ:CLFD 2 © Copyright 2023 Clearfield, Inc. All Rights Reserved. Please note that during this call, management will be making forward - looking statements regarding future events and the future financial performance of the Company. These forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward - looking statements. It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward - looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10 - K filing with the Securities and Exchange Commission and its subsequent filings on Form 10 - Q provides descriptions of those risks. As a reminder, the slides in this presentation are controlled by you, the listener. Please advance forward through the presentation as the speakers present their remarks. With that, I would like to turn the call over to Clearfield’s President and CEO, Cheri Beranek. Cheri? 2

NASDAQ:CLFD 3 Introduction & Highlights Good afternoon, everyone, and thank you for joining us today. It is a pleasure to speak with our new and returning investors and analysts this afternoon to share Clearfield’s results for the first quarter of fiscal 2023, as well as provide an update on our business and current market trends. Our strong financial performance in the first quarter of fiscal 2023 reflects our ongoing execution on our strategic growth plan, as well as the robust and sustained demand for high - speed broadband. Total net sales for the first quarter were $86 million, which includes an $8 million contribution from Nestor Cables. Our organic net sales growth continues to be driven by our leadership in community broadband and expansion across each of our core end markets. As we continue to execute on our LEAP strategic plan, we aim to strengthen our existing competitive advantages as we build the scale necessary to serve the long - term demand runway for high - speed broadband in unserved and underserved communities nationwide. Based upon consideration of the expected investments and impact of our progress on our LEAP strategic plan as well as our ability to manage countervailing headwinds that could develop in customer ordering patterns and component sourcing, we are reiterating our previously stated revenue guidance for fiscal year 2023. In addition, we are introducing 2023 net income guidance of $4.30 to $4.50 a share. 3

OUR MISSION: Enabling the lifestyle better broadband provides WHAT WE DO: Clearfield provides fiber protection, fiber management and fiber delivery solutions that enable rapid and cost - effective fiber - fed deployment throughout the broadband service provider space NASDAQ:CLFD 4 Before I review our performance and current market dynamics in greater detail, I’d like to briefly introduce you to who we are and what we do, for those of you who may be new to Clearfield and our industry. Clearfield is a leader in the expanding fiber broadband industry. Our goal and underlying value proposition is to enable the lifestyle that better broadband provides. We provide craft - friendly fiber protection, fiber management, and fiber delivery solutions that enable rapid, cost - effective fiber - fed deployment throughout the broadband service provider space. Our primary end market is Community Broadband, which is predominantly comprised of Tier 2 and Tier 3 incumbent local exchange carriers and an increasing number of municipalities, utilities, co - ops, and wireless carriers. We also serve service providers in the Tier 1 National Carrier market and Multiple System/Cable TV Operators, or ‘MSO’s,’ as well as some international service providers. Pictured on slide four is the Clearview Cassette, which has changed the rules of fiber management. This integrated fiber management system is based on multiples of 12 fibers and can be utilized whenever and wherever it is required in the network. Our FieldShield platform offers protected pathways and fiber options that suit the needs of any network deployment. Our entire product line was thoughtfully designed to be craft - friendly in the field, reducing both the amount of necessary skilled labor needed for installation and the level of skill required to install. This enables our customers to complete their deployments faster and more efficiently, accelerating their time to revenue. 4

Providing Optimized Price Performance and Deep Technical Expertise Why We Win x Singularly Focused on Serving the Fiber Market x Attractive Total Cost of Ownership through Reduced Installation Cost and Maintenance Time x Our Testing Shows FastPass TM Approach Cuts Install Time Required for Homes Passed by 50% x Ease, Speed, and Cost of Deployment x Delivery of a Comprehensive Solution x Commitment to Quality and Customers x Recent Acquisition of Nestor Cables Highlights Investment to Integrate and Optimize Solutions and Mitigate Supply Chain Risk NASDAQ:CLFD 5 5 With these capabilities and the competitive advantages we’ve summarized on slide five, we’ve expanded our market leadership in underserved rural broadband. To further enhance our positioning, we have worked to improve our product delivery lead times, which represented another key area of industry leadership for Clearfield before the COVID - 19 pandemic. Across our industry, pandemic - fueled supply constraints held fiber lead times to a range of 10 to 12 months. By contrast, Clearfield is now targeting lead times within the range of eight to ten weeks. I am proud to say that we have already achieved these lead times within the range for all product lines with the exception of active cabinets which have been negatively impacted by the longer lead times associated with power conditioning subcomponents used in their manufacturing process. This work to improve our lead times comes as our customer ordering cycles return to pre - COVID patterns, but at post - COVID volumes. Over the past three years, our customers ordered products early in their deployment schedules to stay ahead of any supply chain challenges as they planned their fiber builds. These advance orders led to growth in our backlog, which reached record levels by the end of fiscal year 2022. Our customers have moved to staging less equipment in their yards and have now begun ordering according to more normalized, seasonally driven deployment schedules. We believe this trend will continue in 2023 as customers re - adjust their ordering planning to our improved product lead times and try to match their order timing to their deployment schedules. Consistent with the return to this traditional ordering and delivery patterns, we anticipate approximately 40% of our expected revenue in the first six months of our fiscal year and 60% in the second half. We believe long - term demand remains exceptionally strong. Nearly all of our customers are indicating an increase in the number of homes they are passing and connecting in comparison to the previous year. In addition, the increase in the number of service providers we serve is exciting.

Fiber deployment is projected to be strong for the next decade 11.3M Ten Year Annual Average Run Rate Assumes 12.3 New Housing Units Homes With Fiber Availability: 92% Homes with 2+ Fiber Availability: 34% Next 10 - Years Source: Fiber Broadband Association / RVA, December 2022 Assumes 12.3M New Housing Units Homes with Fiber Availability: 92% Homes with 2+ Fiber Availability: 34% For some additional insights on what we’re seeing in the market and the significant long - term growth runway for fiber deployments, I’d like to welcome our Chief Marketing Officer, Kevin Morgan, to the call. Kevin? Thank you, Cheri. It’s great to be joining all of you this afternoon. The appetite for high - speed broadband communications has never been greater and shows no sign of letting up. This continues to drive fiber deployments deeper into every corner of society and across all market segments. As Cheri mentioned, we believe our work to maintain our world - class lead times and further progress our LEAP strategic plan enhances our position for the robust near - term demand environment. On slide 6, we have also included the Fiber Broadband Association’s strong forecast for fiber deployments over the next decade. In its 2022 Fiber Provider Survey, published in December, the Fiber Broadband Association estimated a 10 - year annual average run rate of 11.3 million fiber deployments. In 2022 alone, fiber providers passed 7.9 million additional homes, representing a new record for annual deployment. This momentum gives us a powerful foundation for 2023 and the years ahead. As you’ll see in the accompanying chart, we’re positioned within an accelerating investment cycle that has yet to reach its peak. We continue to view the gradual disbursement of ARPA and RDOF funds — and the upcoming distribution of BEAD funding – as meaningful, but gradual industry tailwinds that further expand our market opportunity. The data indicated on this slide, assumes that 12.3 million new housing units will come online over the next 10 years. Further, 92% of homes are expected to have fiber availability, with an additional 34% of homes having two or more available fiber connections. As this market continues to expand, we believe our craft - friendly products will continue to play a vital role in translating Homes Passed numbers into Homes Connected revenue for our service providers as they deepen their fiber deployments. Turning back to Clearfield’s fiscal first quarter performance, I’d now like to pass the call over to our CFO, Dan Herzog, who will walk us through our financial results for the fiscal first quarter of 2023. 6

NASDAQ:CLFD 7 Financial Performance Thank you, Kevin, and good afternoon, everyone. It’s a pleasure to be speaking with you today about our fiscal first quarter 2023 results. So, looking at our fiscal first quarter 2023 results in more detail… 7

$39 $45 $51 $54 $71 $88 $78 $10 $ - $20 $30 $40 $70 $60 $50 $80 $90 $100 FINANCIAL PERFORMANCE Quarterly Revenue 68% * Q1 2023 Growth Rate $86M * Q1 2023 Revenue NASDAQ:CLFD 8 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Clearfield Organic Nestor Cables *Includes $8 million contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022 $95 $86 Consolidated net sales in the first quarter of fiscal 2023 were $86 million, a 68% increase from $51 million in the same year - ago period, and down 10% from $95 million in our fourth quarter of 2022. This figure includes $78 million from organic Clearfield and an $8 million contribution from Nestor Cables, representing Nestor’s first full quarter of contribution since we acquired the business on July 26, 2022. The increase in net sales was due to higher sales across our core end markets, particularly in our Community Broadband, Multiple System Operator and National Carrier Markets, consistent with our performance throughout fiscal year 2022. We recorded a 34% year - over - year increase in our sales order backlog. Order backlog was $136 million on December 31, 2022 up from $101 million on December 31, 2021 and down from $165 million on September 30, 2022. We believe our lead time progress will remain a more meaningful measure of our operational performance going forward. Accordingly, we will focus on this metric in lieu of reporting on backlog in future quarters. 8

Q1 FY23 Net Sales Comparison by Market All dollar figures in millions 1 ) Based on net sales of $ 86 million for Clearfield (including a $ 8 M contribution from Nestor Cables within our international market) and Point of Sales (POS) reporting from distributors who resell our product line into these markets . Q1 FY23 Net Sales Composition Ended 12/31/22 1 Legacy (Legacy contract manufacturing and misc. sales) 55% 7% 25% 12% 1% $114 $192 Community Broadband FQ1 22 FQ1 23 Quarterly Net Sales TTM Net Sales Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Europe, Canada, Mexico, and Caribbean Markets) NASDAQ:CLFD 9 $36 $48 Community Broadband FQ1 22 FQ1 23 I’ll now review net sales by our key markets. Sales to our primary market, Community Broadband, comprised 55% of our net sales in the first quarter of fiscal 2023. In Q1, we generated net sales of approximately $48 million in Community Broadband, up 33% from the same period last year. In addition, for the trailing twelve months ended on December 31, 2022, our Community Broadband market net sales totaled approximately $192 million, which was up 69% from the comparable period last year. 9

$13 $25 $10 $3 $26 $62 $24 $3 National Carrier FQ1 22 FQ1 23 NASDAQ:CLFD 10 MSO International Legacy All dollar figures in millions 1) Based on net sales of $86 million for Clearfield (including a $8M contribution from Nestor Cables within our international market) and Point of Sales (POS) reporting from distributors who resell our product line into these markets. Q1 FY23 Net Sales Composition Ended 12/31/22 1 Legacy (Legacy contract manufacturing and misc. sales) Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) International (Europe, Canada, Mexico, and Caribbean Markets) MSO (Cable TV) National Carrier (Tier 1 Wireline and all Wireless Markets) $4 $9 $2 $6 $22 $10 $1 $1 National Carrier MSO International Legacy FQ1 22 FQ1 23 Q1 FY23 Net Sales Comparison by Market Quarterly Net Sales TTM Net Sales 55% 7% 25% 12% 1% Our MSO business comprised 25 % of our net sales in the first quarter of fiscal 2023 . Momentum in the MSO market continues to be strong, with net sales growing 137 % year - over - year and up 152 % for the trailing twelve - month period . Net sales in our National Carrier market for the first quarter of fiscal 2023 increased 67% year - over - year; on a trailing twelve - month basis, net sales in our National Carrier market was up 102% from the comparable year - ago period. Net sales in our International market increased 412% year - over - year in the first quarter compared to the same period last year and were up 126% year - over - year on a trailing twelve - month basis due to the acquisition of Nestor Cables, which are included in our international sales. 10

$17 $20 $23 $23 $29 $38 $31 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $ - $5 $10 $15 $20 $25 $30 $35 $40 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Gross Profit ($) Gross Profit (%) FINANCIAL PERFORMANCE Quarterly Gross Profit 33% Gross Profit Increase YOY NASDAQ:CLFD 11 *Q1 23 gross profit includes contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022 Gross profit in the first quarter of fiscal 2023 increased 33% to $31 million, or 35.7% of net sales, from $23 million, or 44.9% of net sales, in the same year - ago quarter. Our gross profit was affected by our investments to increase capacity for additional growth in the coming quarters and years. These investments include the increased facility costs associated with the addition of the Company’s new Minnesota and Mexico facilities that came on board late in the second quarter of fiscal 2022, and the continued expansion to outfit these facilities. The Company continues its investment in cable manufacturing at its Mexico facility in conjunction with the Nestor Cables acquisition, which is expected to be operational in our second fiscal quarter. Gross profit was also affected by a full quarter of lower gross profit realized in our Nestor Cables cable manufacturing business. The Company expects to operate at these gross profit percentage levels for several quarters with improving margins as revenue levels increase later this calendar year. 11

$9 $10 $10 $13 $15 $13 0% 5% 10% 15% 20% 25% 30% $2.0 $0.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Expenses in $Millions OP as a % of Net Sales $ 11 5% YOY Decrease in Operating Expense as a percent of Net Sales NASDAQ:CLFD 12 FINANCIAL PERFORMANCE Quarterly Operating Expenses Operating expenses for the first quarter of fiscal 2023 were $13 million, which were up from $10 million in the same year - ago quarter. In addition to the increase from the first full quarter of Nestor Cables operating expenses in general, increased areas reflect higher compensation costs, travel and entertainment, stock compensation and professional fees. As a percentage of net sales, operating expenses for the first quarter of fiscal 2023 was 15%, down from 19% in the same year - ago period. Our current OpEx, at less than 15% of sales, reflects our continued strong operating leverage. 12

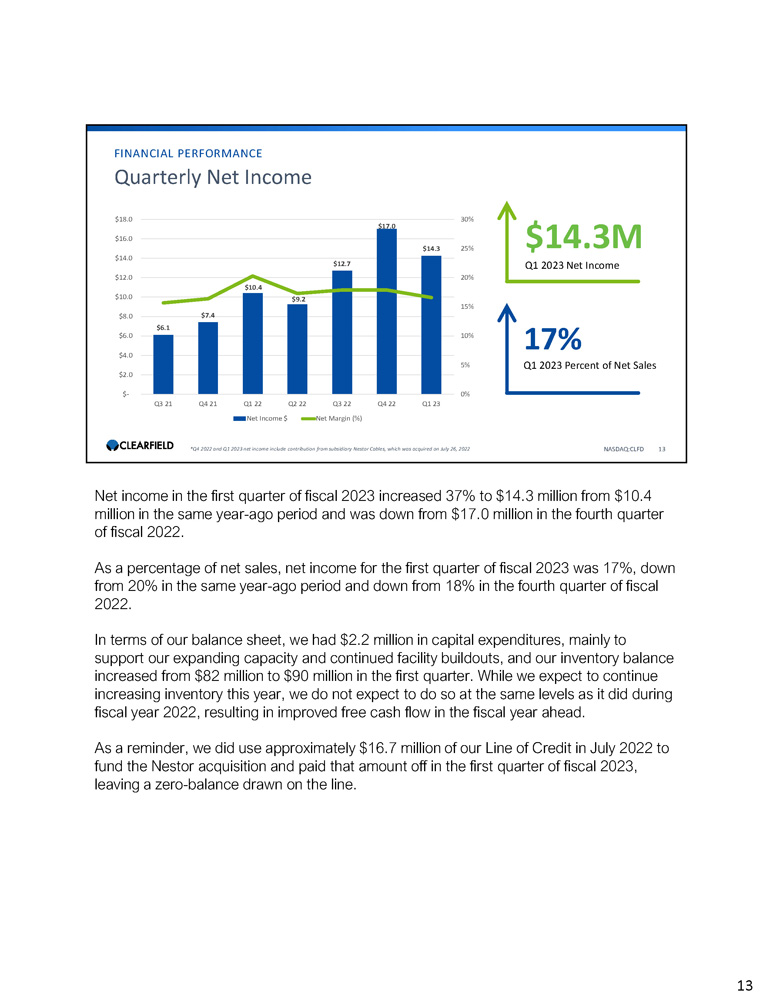

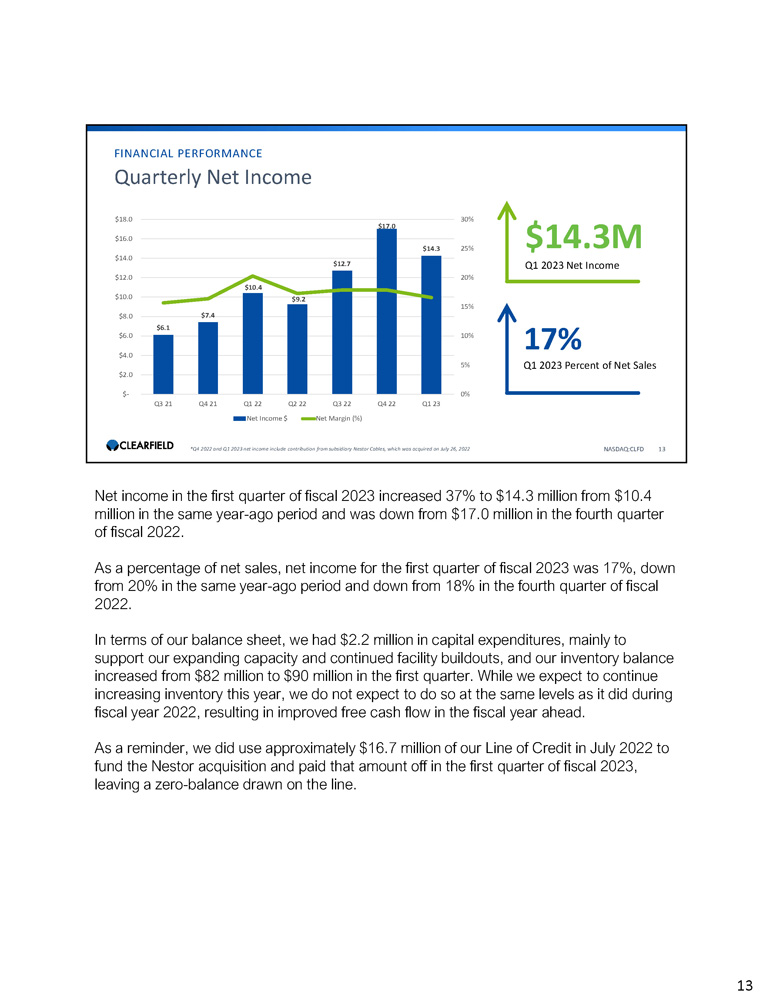

$10.4 $9.2 $12.7 $17.0 5% 10% 15% 20% $14.3 25% 30% $4.0 $8.0 $7.4 $6.1 $6.0 $10.0 $12.0 $14.0 $16.0 $18.0 $14.3M Q1 2023 Net Income 17% Q1 2023 Percent of Net Sales NASDAQ:CLFD 13 FINANCIAL PERFORMANCE Quarterly Net Income $2.0 $ - 0% Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Net Income $ Net Margin (%) *Q4 2022 and Q1 2023 net income include contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022 Net income in the first quarter of fiscal 2023 increased 37% to $14.3 million from $10.4 million in the same year - ago period and was down from $17.0 million in the fourth quarter of fiscal 2022. As a percentage of net sales, net income for the first quarter of fiscal 2023 was 17%, down from 20% in the same year - ago period and down from 18% in the fourth quarter of fiscal 2022. In terms of our balance sheet, we had $2.2 million in capital expenditures, mainly to support our expanding capacity and continued facility buildouts, and our inventory balance increased from $82 million to $90 million in the first quarter. While we expect to continue increasing inventory this year, we do not expect to do so at the same levels as it did during fiscal year 2022, resulting in improved free cash flow in the fiscal year ahead. As a reminder, we did use approximately $16.7 million of our Line of Credit in July 2022 to fund the Nestor acquisition and paid that amount off in the first quarter of fiscal 2023, leaving a zero - balance drawn on the line. 13

NASDAQ:CLFD 14 Business Update & Outlook In addition, we further enhanced our liquidity position through closing an upsized $120 million public offering of our common stock on December 9, 2022. Under the terms of the offering, we sold 1.2 million shares at a public price of $100 per share. Including the underwriters’ full exercise of the option to purchase up to 180,000 additional shares, we sold a total of 1.38 million shares of common stock at closing for net proceeds of $130.3 million, after expenses paid in connection with the offering. The additional capital grants us greater flexibility to pursue our longer - term growth objectives and be opportunistic as further growth opportunities arise. We can continue investing in our inventory, capex, infrastructure, and other necessary strategic areas at a larger scale, as well as ensure that we have the working capital position to effectively compete for larger customer opportunities. We appreciate the support of our new and existing shareholders as we continue to advance our strategic progress. That concludes my prepared remarks for our first quarter of fiscal 2023. I will now turn the call back over to Cheri. Cheri? Thanks for the financial update, Dan. 14

Leverage our decade - long excellence in Community Broadband Execute capacity growth in advance of market opportunity Accelerate infrastructure investment Position innovation at the forefront of our value proposition NASDAQ:CLFD 15 15 As I mentioned earlier in the call, we have continued to make progress on our new multi - year strategic plan, LEAP, which is the successor to our previous “Now of Age” plan. The LEAP plan is our roadmap to how we will scale as a company in order to seize the opportunity Clearfield was build to achieve – how we expect to jump higher, farther, and with greater force. With that said, I’d like to review our progress on each of our LEAP plan’s four tenets, one for each letter.

Leverage our decade - long excellence in Community Broadband NASDAQ:CLFD 16 16 The “L” is to Leverage our decade - long excellence in Community Broadband, the market on which we have focused since our founding in 2008. Through our deep understanding of this market and our customer base of regional operators, we’ve proven to be an agile partner that can evolve with the broader market and grow alongside our customers. Earlier this month, we announced that we had reached the milestone of shipping 50 million fiber ports of our craft - friendly, Labor Lite family of Clearview ® Cassettes, FieldShield ® Assemblies, and YOURx ® Terminals. The vast majority of these fiber ports have been deployed throughout the networks of our community broadband customers. Reaching this milestone underscores that success in the fiber broadband market is as much about execution as it is innovation . Through further improving our scale, we are deepening our commitment to providing our customers the products and support they need, when they need it, to take their fiber broadband networks as far as they can go .

Execute capacity growth in advance of market opportunity NASDAQ:CLFD 17 Our “E” is to Execute capacity growth in advance of the market opportunity. Building upon our previous strategic work to augment capacity for ongoing growth, we will continue making progress on these enhancements and developing our supply chain partnerships to maintain our market leadership. Having expanded our manufacturing footprint in both Minnesota and Mexico last year, we are leveraging the in - house cable manufacturing capabilities brought by our acquisition of Nestor Cables. Most recently, we are adding another microduct line in Finland to generate additional revenue and to improve margins from our current facility. This new line will enhance Nestor’s capacity and will allow us to run our manufacturing at a higher and more efficient level.

Accelerate infrastructure investment NASDAQ:CLFD 18 The “A” in our LEAP plan is to Accelerate infrastructure investments. This tenet represents our underlying investments in our organizational infrastructure as we continue to grow the business and manage our expanding capacity. To support the significant growth we have generated over the past two years, we’ve focused on investing in our quality teams and systems. This includes adding supply chain and quality personnel, as well as placing quality engineers earlier in the overall process. As I’ve said in the past, we can grow as fast as our quality systems will allow. Our investments in this area have played a meaningful role in our top line growth expansion, and we expect them to help facilitate additional progress. More broadly, we may add personnel to our sales, product management, and manufacturing teams as we work to improve lead times. We will also continue to expand Clearfield College to provide online and in - field training support as our industry navigates the ongoing shortage of trained labor in the market.

Position innovation at the forefront of our value proposition NASDAQ:CLFD 19 Finally, the “P” in LEAP stands to Position innovation at the forefront of our value proposition. Through increasing the cadence of our product expansions and emphasizing innovation in our product designs, we aim to build upon the craft - friendly nature of our products. We will soon be announcing an additional new product in the coming weeks that we believe further enhances our promise on innovation. More to come on that front! We intend to introduce additional fiber management and fiber connectivity solutions that align with federal and state funding program requirements . These will help facilitate swift and streamlined installations for our customers as they extend the depth and breadth of the fiber broadband access in their networks .

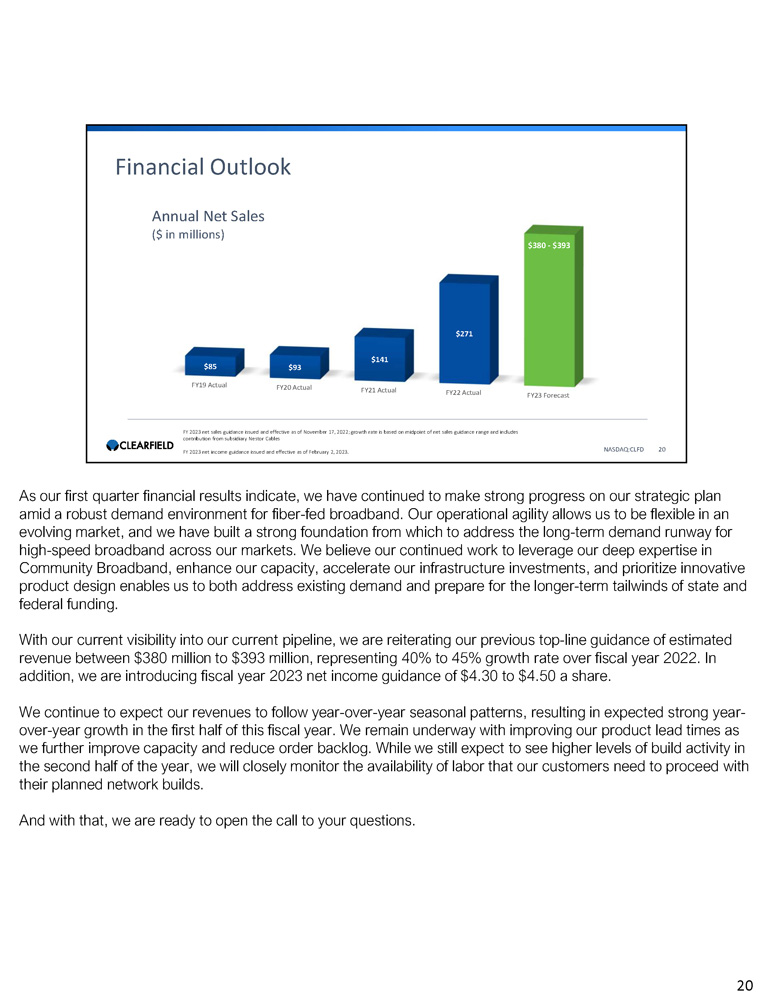

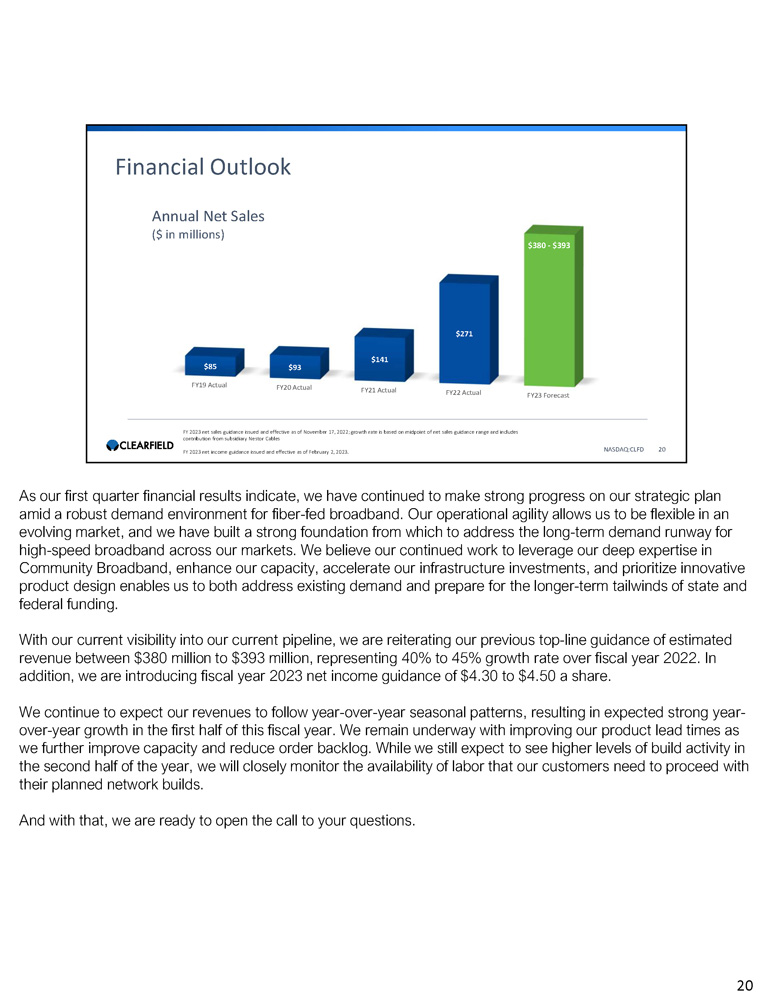

FY19 Actual FY20 Actual FY21 Actual FY22 Actual FY23 Forecast $85 $93 $141 $271 FY 2023 net sales guidance issued and effective as of November 17, 2022; growth rate is based on midpoint of net sales guidance range and includes contribution from subsidiary Nestor Cables FY 2023 net income guidance issued and effective as of February 2, 2023. Annual Net Sales ($ in millions) NASDAQ:CLFD 20 Financial Outlook $380 - $393 As our first quarter financial results indicate, we have continued to make strong progress on our strategic plan amid a robust demand environment for fiber - fed broadband. Our operational agility allows us to be flexible in an evolving market, and we have built a strong foundation from which to address the long - term demand runway for high - speed broadband across our markets. We believe our continued work to leverage our deep expertise in Community Broadband, enhance our capacity, accelerate our infrastructure investments, and prioritize innovative product design enables us to both address existing demand and prepare for the longer - term tailwinds of state and federal funding. With our current visibility into our current pipeline, we are reiterating our previous top - line guidance of estimated revenue between $380 million to $393 million, representing 40% to 45% growth rate over fiscal year 2022. In addition, we are introducing fiscal year 2023 net income guidance of $4.30 to $4.50 a share. We continue to expect our revenues to follow year - over - year seasonal patterns, resulting in expected strong year - over - year growth in the first half of this fiscal year. We remain underway with improving our product lead times as we further improve capacity and reduce order backlog. While we still expect to see higher levels of build activity in the second half of the year, we will closely monitor the availability of labor that our customers need to proceed with their planned network builds. And with that, we are ready to open the call to your questions. 20

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 21 Kevin Morgan CHIEF MARKETING OFFICER Operator Thank you. We will now be conducting a question - and - answer session. Our first question is from Paul Silverstein with Cowen and Company. Please proceed with your question. Paul Silverstein Cowen & Co LLC Thanks. Cheri, Dan, what do y’all expect, what contribution are you expecting from Nestor, in the March quarter? Is it consistent with the eight million it is in December or is it something meaningfully different than that? Cheri Beranek President & CEO Yeah, it is going to go up, in the next quarter. I mean, it is important to remember that Nestor is very much affected by the seasonal nature of our business and probably even more so than we are, and so you are going to see the their numbers about 8 million this quarter, it will probably be double that by the summer and you know, growing second quarter to probably 10, 11, up to as much as 15 in the summer months, and their gross margins are going to be affected significantly by that. So we are going to see gross margins now at about 11%, 12% by the summer months, we will be up in the high teens, kind of averaging in that middle about 15%. We said, when we acquired the company, that they are a commodity - based business, so the gross margin percentage would go down. But the gross margin dollar contribution would be accretive. This quarter, that wasn’t the case, because of the downness of the winter months, but we still continue to expect that accretive nature throughout the year. 21

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 22 Kevin Morgan CHIEF MARKETING OFFICER Paul Silverstein Cowen & Co LLC Alright you’re anticipating, let me get to the real question. So if I take 10 to 11 million in Nestor, I assume 10 million for March, that would imply organic if I did the math right, based upon your 40/60 split, your reiteration $380M, $393M, and what you did the first quarter that would imply organic, somewhere in the neighborhood if I did the math correctly, 56 million to 61 million, which in turn would translate to 23% decline to 17% decline sequentially? On a year - over - year basis, if I did the math right, that would imply 5% to as much as 15% growth if you hit those numbers, or Nestor, and for the larger company. That would be deceleration down from over 50% year - over - year, in the December quarter. And I appreciate the return of a more seasonal business pattern, but I guess I’m trying to understand the dramatic decline in growth, what would drive such a dramatic - well, I appreciate that everyone’s going to go back to more normal order patterns, the backlog wasn’t sustainable, but the numbers suggest a significant collapse in backlog in a very, we can see the numbers, but in a very compressed way. And I’m trying to understand the, if we look at linearity, including through the 30 - days of the current quarter, is business continuing to soften as you go forward in time, or is it more of a stabilization? Let me let you respond. 22

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 23 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO Thank you, Paul. I think I would call it an alignment, in that we talked about 90 - days ago, at the end of the fiscal year that we were going to see for the first time in two years, bookings were going to be less than shipments and that was a result of, the world coming back to pre - COVID world, the way of doing things and ordering patterns. We were going to start into that process. As people are, as our customers align their inventory positions and their forecast positions in regard to product alongside the labor conditions, we are seeing a bit of a bubble or perhaps even an inventory swell at this point in the market. So we think it is very much a - , it is not a softening of the market, and that demand is very high, it is an alignment of what is actually available with labor. Paul Silverstein Cowen & Co LLC Alright . And I can do the math, I guess, after the call, but help me out, the 10 % to 11 % gross margin set up for Nestor . How much of a hit was it to overall gross margin, If we look at the 35 . 7 % whatever the number was? 23

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 24 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO Yes. It is probably about 2.5% this quarter. I mean, they would affect that. It is important to, when we look at the fourth quarter of last year, that is really not a comparative number because we didn’t have any of the new facilities up and we were at complete capacity. Over the course of the last year, we have been adding a considerable level of the capacity to buildings themselves in March of last year and now adding continual building enhancements, and probably one of the biggest investments that we have made is about a 25% increase in our labor force since summer of last year. And so even though we knew that the winter was going to be more seasonal, we made a conscious investment in people to ensure cross training of resources and labor capacity availability. So while it might be a little unsettling for this first quarter, it is absolutely to our plan, as to where we are at from a gross margin standpoint, so that we can prepare for the summer and into next year on the capacities that are going to be necessary. Paul Silverstein Cowen & Co LLC Alright . I appreciate the responses . Before I pass it on, I would just respectfully submit, I think you are making a mistake with respect to your plan to stop disclosing backlog, even assuming lead times are better for gauging your business . As you maintain, again, I would urge you to continue providing that . But, let me pass it on . I appreciate the responses . 24

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 25 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO Very good. Thanks. Operator Thank you. Our next question is from Jason Schmidt with Lake Street Capital Markets. Please proceed with your question. Jason Schmidt Lake Street Capital Markets, LLC Hey guys, thanks for taking my questions. Just following up on that line of questioning, and just what gives you the confidence that that second half snapback will come and that this inventory correction or issue or digestion, whatever you want to call it, is just sort of a one quarter issue. 25

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 26 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO What we are seeing is an absolute continued demand from every customer that they want to increase the number of homes that they are connecting and passing and aggressively working with the contractor community and the labor community to find additional resources and to train additional resources. So we are actively involved in that process and helping them gain the knowledge and the training tools by which to enhance the labor availability that is out there. I think there is really a, I would call it, almost like a review of household conditions when you come back in at the end of the year and you kind of working through your calendar and you are looking to see what is out there versus what you have. And so all of our customers, I think, are just kind of making that refresh. I think it is the continual demand push that they all continue to wanted to be the first fiber out, and that commitment across the board that there was still growth in every part of our marketplace. The other thing I want to make sure I think I reiterate, is the fact that, when we walked into this year, as we identified the 40% to 45% growth rate for the year, we said we would come out extremely strong in first quarter, at up 70% growth rate over last year and that growth rate would deescalate over the course of the year, so the end of the year at a 20% to 25% increase over last year and then working for us to continue at that position. So I think it is important for us as a community to identify that the industry is going through a complete readjustment to this once in a weird lifetime situation that we call the pandemic. And so, there isn’t really a model by which to judge this by or to really even compare it to from a trend statement. 26

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 27 Kevin Morgan CHIEF MARKETING OFFICER Jason Schmidt Lake Street Capital Markets, LLC Okay, that is helpful and I understand there is a lot of dynamics out there. Just curious, when you did provide that original fiscal 2023 guidance, what had you been thinking the split would be? I mean, now you think it is going to be 40/60, but what were the initial expectations? Cheri Beranek President & CEO I was thinking a little closer to 45/55, so just a little bit of a readjustment, the answer that we would be pushing out second quarter and seeing that more at the tail end of the year. So it is important to look again, that next quarter, we are probably looking at 30%, 35% increase over last year, which again is an amazing level of increase, on an organization from a marketplace is growing, at about 12% to 15%. So, we are just trying to normalize our patterns and put everything together. Jason Schmidt Lake Street Capital Markets, LLC Okay, and then just last one, for me, just looking at gross margin, obviously going to kind of remain at these levels for the next several quarters. So does that mean we shouldn’t expect a step up until sort of that December quarter timeframe or could you start to see an improvement in September? 27

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 28 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO I think we are anticipating an improvement in September and as we get back up to levels similar and beyond last year in that fourth quarter, where everything was clicking, and people were taking their inventory positions for the winter. So yes, absolutely fourth quarter is where we should be shining. Jason Schmidt Lake Street Capital Markets, LLC Okay. Thanks a lot guys. Cheri Beranek President & CEO You’re welcome. 28

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 29 Kevin Morgan CHIEF MARKETING OFFICER Operator Thank you. Our next question is from Ryan Koontz with Needham & Company. Please proceed with your question. Ryan Koontz Needham & Company, LLC Hi, good afternoon, thanks for the questions. I want to ask about your assumptions in the March quarter and this new customer order pattern and booking behavior. What are your assumptions going into March, do you feel like March can still be a period where you would expect your backlog to soften a bit and then pick up during the peak construction season or what is your kind of general mindset there? I know you don’t plan to give backlog out but any kind of insights be helpful there. Thanks. Cheri Beranek President & CEO Of course, the backlog went down about 30 million over the course of the last 90 - days. As we talked about, that was anticipated and planned for that we had hit a very high $160 million and I think we are just a little under $130 million at this point. I said at that point that we were aiming to get to a backlog that was consistent with about one times revenue for the quarter and so March backlog will go down a little bit as well as we get to more of this cadence in which we are ordering product, or our customers are ordering product, in the period in which they are deploying. While in a normalized world, I see that this reduction in backlog is a bad thing, but in a post COVID world, I really believe this is return to normal necessity that kind of walks through this bubble during this period of time. 29

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 30 Kevin Morgan CHIEF MARKETING OFFICER Ryan Koontz Needham & Company, LLC Got you, that is helpful. And if you could reflect on the strength in the quarter from the cable segment look like it was real strong is that coming from your active cabinets into the DAA or more your fiber to home customers and maybe give us a color on the strike? Cheri Beranek President & CEO Yes, it is coming from both areas, in that there was different types of cable companies. Both the regional, as well as the national have different philosophies and how they can best provide high speed broadband to their customers, and due to the architecture of our product line that allows us to support whether it is a PON based deployment or a non - PON based deployment, active cabinets versus the your X terminal, we are actively involved in both and both have similar high gross profit margins. We are excited about all of that opportunity moving forward. Like everything else in our space, I think we will probably see some bubbles with that over the course of the next couple of quarters, but the demand is absolute and really exciting to see the cable community come and play. Ryan Koontz Needham & Company, LLC Alright terrific and in terms of your latest quarter end and bookings, any mix shifts there between passings and connected home in the product lines? 30

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 31 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO We are starting to see a more initial increase in the connectings, and that people are looking at their sampler that they made the investment in, the passing of the homes, and now by connecting the homes, they can turn that into a revenue producing customer that is at a higher rate of revenue for them. So it is still - passing of the home is still a higher percentage of our revenue, but definitely seeing connecting homes increasing and seeing it is exciting to see the success of those deployments take place. Ryan Koontz Needham & Company, LLC Got you and one last one, any new commentary around the RDOF and ARPA contributions to your recent business? Is it still gaining momentum, and kind of where do you feel like we are relative to those programs contributing? Cheri Beranek President & CEO Still gaining momentum but still very early. This is almost entirely privately funded. So, that is why we are comfortable making the capacity enhancements that we are. One of the things that is very frustrating as an industry, right, is how long it takes for government money to fund through the programs you can get into the market. We have seen it time and time again in regard to 2012, 2008. I mean, all of those times were, we were excited about the money and then we had to wait two years. So we know it is coming, we just haven’t seen a lot of it yet. 31

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 32 Kevin Morgan CHIEF MARKETING OFFICER Ryan Koontz Needham & Company, LLC Okay, great, I will pass it on. Thanks so much. Cheri Beranek President & CEO Thanks Ryan. 32

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 33 Kevin Morgan CHIEF MARKETING OFFICER Operator Thank you. Our next question is from Tim Savageaux with Northland Capital Markets. Please proceed with your question. Tim Savageaux Northland Capital Markets Actually, my question was on capacity, so that is a good place to pick it up. And you have obviously been on this capacity addition plan for a couple of quarters now, but you have made some additional kind of increases, so I wonder if you can give a sense of where you stand from a kind of quarterly revenue capacity standpoint. Currently, you are looking for some record quarters in the second half of the fiscal year, but if you want to take it from what you just reported or what you expect here in the current quarter, where are we from a capacity utilization standpoint? And where do you expect that capacity to be by, call it, fiscal year end? Cheri Beranek President & CEO Right. I would say, what we try to do from an operational standpoint is set metrics as to where we want to be by the end of each quarter, and so that we can make incremental investments along the way, and so I think we are probably at about $105 million today. By the year end, we expect to be closer to $130 million, maybe $135 million quarterly, which puts us at about a $500 million run rate by the end of the year. 33

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 34 Kevin Morgan CHIEF MARKETING OFFICER Tim Savageaux Northland Capital Markets Great. And in terms of getting there, I mean, is that more kind of adding people, are you pretty well set from a facility standpoint, as you continue throughout the year, how you kind of address the facility effectiveness a bit if at all? Cheri Beranek President & CEO Right. The facilities are in place, but we need to continue to augment the facilities and the infrastructure surrounding it, for example, bringing in the ability to produce optical cable inside of the facility means, bringing in higher power capabilities. You’ve got to bring in the new lines and we are bringing in water onto the floor, so that we can actually produce the cable and the flushing lines that are necessary for cooling the cable as it comes out of the extruder. So those are the incremental costs that you perhaps that we don’t think about, but those are what are in place right now. We are also looking at a standpoint of just kind of the infrastructure around it, and you wouldn’t think of this as affecting the capacity, but it is the procurement teams and it is the software systems around it, and it is the process development to ensure that, we do this in a systematic, process - based way. We have been very successful over the course of the last two - years growing at the rate that we have, but we have to take a step back and look and say, how are we going to make this sustainable and how can we scale this. I think that is an important element for us to look at from a gross profit standpoint is, this company was designed to scale, but there is still a standpoint of infrastructure that needs to be put in, within it, so it has that strong foundation to ensure quality. So there will be people, there will be systems, there will be some software within it, and that is so that we can grow long - term. So we have got a little bit of catch - up to do from what we perhaps should have done a year - ago. Just didn’t have the wherewithal because of how quickly we were growing to take that step back. 34

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 35 Kevin Morgan CHIEF MARKETING OFFICER Tim Savageaux Northland Capital Markets Okay . In terms of the - you seem to be going back, I guess, to maybe your more traditional seasonality, going back several years now where you had, I guess, a quarter in there somewhere that was up 20 % , 30 % sequential, something like that on a seasonal basis, is that the way we should kind of look at this in context just at a much higher revenue level, obviously . Cheri Beranek President & CEO Exactly, yes. I mean, I think that is how I’m trying to describe it as being pre - COVID conditions at post - COVID levels. There has always been seasonality to our business, it’s just that it was hidden the last two - years. So I think, I want to go back to a statement that Jason asked, how do I have the confidence that the back half of the year is going to follow through? And, it is really doing this the last 15 - years, in that that’s the traditional normalized pattern and so the only caveat to that is in a post - COVID world, how quickly will we get back to that normalized pattern? Tim Savageaux Northland Capital Markets Got it, thanks very much. Cheri Beranek President & CEO You’re welcome. 35

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 36 Kevin Morgan CHIEF MARKETING OFFICER Operator Our next question is from Scott Searle with Roth Capital Partners. Please proceed with your question. Scott Searle ROTH Capital Partners, LLC Good afternoon, thanks for taking the question. Just to dive in on the gross margins again. It sounds like most of the, beyond the mix issue, that there is a labor content issue here until you get capacity up at the facilities that is kind of weighing on the near - term results. Is that the way to think about it until we get into the second fiscal half of this year? Cheri Beranek President & CEO Absolutely. In that, we are making the addition of those people in advance of needing them so our efficiencies and utilization on the floor is not at the level that you target, but what it does allow us to do is to move those people around, so that they are not trained on a single line, which is what we did when we brought everyone on board. Last year in the second quarter, we hired people and we put them on one line. We made sure that they could optimize that one line. But it doesn’t allow you to scale, what you need to do is you need to train all those people on all the different functions, and process steps in the fiber termination process, in order to really have the flexibility to ensure these lead times that are so crucial to our long - term success. It is that investment in people and the training that will allow us to hit those six to eight week lead times this summer. That is still far more than what we were doing pre - COVID, we were working on lead times three to four weeks. I don’t think that is in our future. That is a whole - , that is not necessary, but six to eight weeks should be our goal. We will have the labor force by which to do that based upon the investments we are making right now. 36

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 37 Kevin Morgan CHIEF MARKETING OFFICER Scott Searle ROTH Capital Partners, LLC And just a follow up, I guess in catalogs a couple of the earlier comments. You are looking for 30% to 35% growth in the second fiscal quarter, which kind of implies like you said normal seasonality is sequentially down December to March, before we see that recovery into the second half of which you are expecting a 60% plus split, being skewed towards the back half of the years. Is that correct? Cheri Beranek President & CEO Absolutely. Completely. Scott Searle ROTH Capital Partners, LLC Okay, and then to just to dig in on the back half. I know, it was asked earlier, but the comfort level there. What you are seeing in terms of the engagement from a customer standpoint requesting of shipments and it doesn’t sound like RDOF is really built into those expectations. I’m kind of curious where that fits either into the backlog or your thought process around a ramp up in the second half of the fiscal year? 37

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 38 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO Right. I never count on government money in my projections, because it is just it is too much variability and lack of accountability to meeting of a date. And so that has definitely been - , that is still not in those numbers. The other thing that is affecting these numbers is, one of the things that I mentioned in regard to our backlog, our lead time is coming down with the exception of active cabinets and our availability of sourcing rectifiers. You don’t think of Clearfield as being a chipset affected company, but the components that are in the rectifiers for power conditioning are in extremely long lead time positions and it is been frustrating for our revenue models, and for our customers to not be able to get those products as they would like to see them. That is one of the other reasons for the back half of the year coming back on board, is as the chipsets and the rectifiers become more readily available that, the amount of our active cabinet business will be a much more significant part of our total revenue plan. Scott Searle ROTH Capital Partners, LLC And just the follow - up on that Cheri, active cabinets carry a higher gross margin as well? 38

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 39 Kevin Morgan CHIEF MARKETING OFFICER Cheri Beranek President & CEO They are pretty similar, to the rest of the cabinet, rest of the line. So no, I wouldn’t call them higher, but they will be pretty close. They are in the same, you know, 42%, 43% margin. Scott Searle ROTH Capital Partners, LLC Got you, but in terms of the revenue guidance and extrapolating that into the back half, you are starting to get back into that $110 million to $120 million range. Okay. Cheri Beranek President & CEO Yes. Look, I would make - , look at it from a standpoint I think of it seeming that significant, because I’m just not sure where those rectifiers are going to come in and the amount of backlog that we have for powered cabinets, that definitely the fourth quarter is going to be that step up in that the availability of some of those materials, is going to allow fourth quarter to be a higher number than what you would normally expect. Scott Searle ROTH Capital Partners, LLC Okay, great thanks. I will get back in the queue. 39

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 40 Kevin Morgan CHIEF MARKETING OFFICER Operator At this time, this concludes the Company’s question - and - answer session. If your question was not taken, you may contact Clearfield Investor Relations team at clfd@gatewayir.com. I would now want to turn the call over to Ms. Beranek for closing remarks. Cheri Beranek President & CEO Thank you all for the opportunity to speak with you and for the questions from our analyst community. Definitely a year of transition and a year of being able to come back into these normalized patterns. And so I invite shareholders to contact Gateway, our IR firm. We welcome the opportunity to speak with you, because I could not be more excited about the revenue plan in front of us and the opportunity by which to become a significant player in high speed broadband. Until next quarter. Operator Thank you for joining us today for Clearfield’s fiscal first quarter 2023 conference call. You may now disconnect. 40

NASDAQ:CLFD 41 Contact Us COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@seeclearfield.com INVESTOR RELATIONS: Matt Glover and Jackie Keshner Gateway Group, Inc. (949) 574 - 3860 CLFD@gatewayir.com 41