UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

|

| PREMIER EXHIBITIONS, INC. |

| (Name of Registrant as Specified in its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

PREMIER EXHIBITIONS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD AUGUST 23, 2012

The annual meeting of shareholders of Premier Exhibitions, Inc. will be held at The Westin New York at Times Square, 270 West 43rd Street, New York, NY 10036 on August 23, 2012 at 8:00 a.m., local time, for the following purposes, which are more fully described in the accompanying proxy statement:

| | 1. | to elect as directors the eight nominees named in the proxy statement and recommended by our Board of Directors to serve until the 2013 annual meeting of shareholders and until the subsequent election and qualification of their respective successors; |

| | 2. | to ratify the selection of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm for the fiscal year ending February 28, 2013; |

| | 3. | to approve the Premier Exhibitions 2009 Equity Incentive Plan, as amended, as more fully set forth in the accompanying proxy statement; and |

| | 4. | to transact such other business as may properly come before the annual meeting or at any adjournments thereof. |

The Board of Directors has fixed the close of business on June 19, 2012, as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any adjournments thereof.

|

By Order of the Board of Directors, |

|

/s/ Samuel S. Weiser |

Samuel S. Weiser |

Interim President and Chief Executive Officer |

Atlanta, Georgia

June 28, 2012

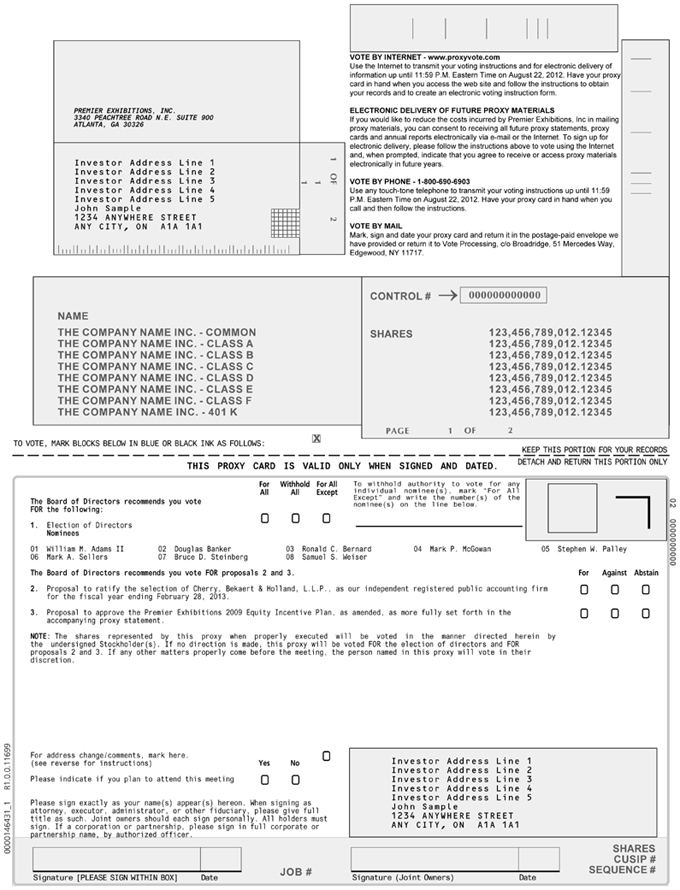

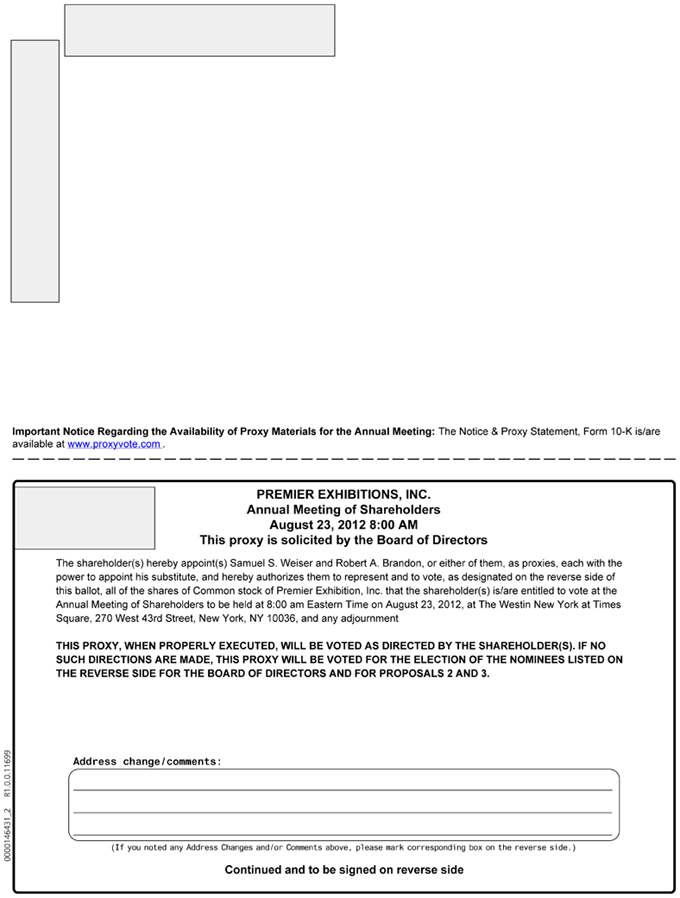

Important Notice Regarding the Availability of Proxy Materials for the 2012 Annual Meeting of Shareholders to Be Held on August 23, 2012: This proxy statement, the accompanying form of proxy card and our annual report for the fiscal year ended February 29, 2012 (the “Annual Report”) are available atwww.proxyvote.com, which does not have “cookies” that identify visitors to that site. In addition, this proxy statement and our annual report are available on our website atwww.prxi.com. Under rules issued by the Securities and Exchange Commission, we are providing access to our proxy materials both by sending you this full set of proxy materials and by notifying you of the availability of our proxy materials on the Internet.

PREMIER EXHIBITIONS, INC.

PROXY STATEMENT

2012 ANNUAL MEETING OF SHAREHOLDERS

The enclosed proxy is solicited on behalf of the Board of Directors of Premier Exhibitions, Inc. (“we”, “us”, the “Company” or “Premier”), a Florida corporation, for use at the 2012 Annual Meeting of Shareholders to be held on August 23, 2012 at 8:00 a.m., local time, or at any adjournments or postponements thereof, for the purposes set forth in this proxy statement and in the accompanying notice of annual meeting of shareholders.

Location of Annual Meeting

The Annual Meeting will be held at The Westin New York at Times Square, 270 West 43rd Street, New York, NY 10036 on August 23, 2012 at 8:00 a.m., local time.

Principal Executive Offices

Our principal executive offices are located at 3340 Peachtree Road, N.E., Suite 900, Atlanta, Georgia 30326, and our telephone number is (404) 842-2600.

Mailing Date

The definitive proxy solicitation materials are first being mailed by us on or about June 28, 2012 to all shareholders entitled to vote at the annual meeting.

Availability of Proxy Materials on the Internet

Under rules issued by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials both by sending you this full set of proxy materials, including the proxy card, and by notifying you of the availability of our proxy materials on the Internet. This proxy statement, the accompanying form of proxy card and our Annual Report are available on our website at www.prxi.com.

Record Date and Our Common Stock

Shareholders of record at the close of business on June 19, 2012, the record date for the annual meeting, are entitled to notice of, and to vote, at the annual meeting. We have one class of shares outstanding, designated common stock, $0.0001 par value per share. Shares of our common stock are traded on the NASDAQ Global Market under the symbol “PRXI.” As of the record date, 47,955,918 shares of our common stock were issued and outstanding.

Of these shares, 16,328,976 shares were issued to Sellers Capital, LLC, and SAF Capital Fund, LLC, pursuant to a financing transaction approved by shareholders at the 2009 annual meeting and have limited voting rights. Pursuant to a Convertible Note Purchase Agreement entered into between the Company and the holders of this common stock, such shares may not be voted unless another party acquires 10% of the common stock of the Company, the Company proposes a business combination transaction with a party other than Sellers Capital, LLC or SAF Capital Fund, LLC, or a matter is submitted for the vote of the Company’s shareholders that requires the affirmative vote of more than 50% of the common stock outstanding.

1

Solicitation of Proxies

We are making this solicitation of proxies, and we will bear the expense of preparing, printing, mailing and otherwise distributing this proxy statement. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited on our behalf, in person or by mail, telephone, facsimile, or other electronic means, by our directors, officers and regular employees, without additional compensation. We also expect to use the services of Alliance Advisors, LLC, to assist in the solicitation of proxies, at an estimated cost of $5,500 plus reasonable out-of-pocket expenses.

Revocability of Proxies

You may revoke any proxy given pursuant to this solicitation, at any time before it is voted, by either:

| | • | delivering a written notice of revocation or a duly executed proxy bearing a later date; or |

| | • | attending the annual meeting and voting in person. |

Please note, however, that if the record holder of your shares is a broker, bank or other nominee and you wish to vote at the annual meeting, you must bring to the annual meeting a letter from the broker, bank or other nominee confirming both (i) your beneficial ownership of the shares; and (ii) that the broker, bank or other nominee is not voting the shares at the meeting.

Proxy Cards and Voting

Each shareholder is entitled to one vote for each share of common stock held as of the record date.

If we receive the enclosed proxy, properly executed, in time to be voted at the annual meeting, the Board of Directors will vote the shares represented by it in accordance with the instructions marked on the proxy. An executed proxy without instructions marked on it will be voted:

| | 1. | “FOR” each of the eight nominees for election as director; |

| | 2. | “FOR” the ratification of the selection of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm for our fiscal year ending February 28, 2013, referred to as “fiscal year 2013”; and |

| | 3. | “FOR” the approval of the Premier Exhibitions, Inc. 2009 Equity Incentive Plan, as amended. |

The shares represented by the enclosed proxy may also be voted by the named proxies for such other business as may properly come before the annual meeting or at any adjournments or postponements of the annual meeting.

Election of Directors

Our Board of Directors, upon recommendation of its Corporate Governance and Nominating Committee, has nominated William M. Adams II, Douglas Banker, Ronald C. Bernard, Mark P. McGowan, Stephen W. Palley, Mark A. Sellers, Bruce D. Steinberg and Samuel S. Weiser for election at the annual meeting. If elected, each will serve a one-year term expiring at our 2013 annual meeting of shareholders and until their respective successors are elected and have been qualified or until their earlier resignation, removal or death. Background information about the nominees is provided in Proposal No. 1.

Each of the nominees has consented to serve if elected. If any of them becomes unable or unwilling to serve as a director before the annual meeting, our Board of Directors may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee. Our Board of Directors alternatively could decide to reduce the size of our board to the extent permitted by our articles of incorporation, by-laws and applicable laws. We presently do not know of any reason why any nominee will be unable or unwilling to serve.

Our Board of Directors recommends that you vote “FOR” the election of these nominees.

2

Ratification of Our Independent Registered Public Accounting Firm

The Audit Committee of our Board of Directors has selected Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm for our fiscal year 2013. The selection will be presented to our shareholders for approval at the annual meeting. Selection of our independent registered accounting firm is not required to be submitted to a vote of our shareholders for ratification. However, we are submitting this matter to our shareholders as a matter of good corporate governance. If our shareholders do not approve on an advisory basis our selection of Cherry, Bekaert & Holland, L.L.P., then the Audit Committee will consider the outcome of this vote in its future discussions regarding the selection of our independent registered public accounting firm. Even if our shareholders ratify the selection, the Audit Committee may, in its discretion, direct the selection of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests and the best interests of our shareholders.

Our Board of Directors recommends that you vote “FOR” the ratification of the selection of Cherry, Bekaert & Holland, L.L.P. to serve as our independent registered public accounting firm.

Approval of the Premier Exhibitions, Inc. 2009 Equity Incentive Plan, as amended

Subject to shareholder approval at the annual meeting, on June 6, 2012 our Board of Directors approved our proposed 2009 Equity Incentive Plan, as amended, which is the subject of Proposal No. 3. Our board adopted the plan in order to increase the number of shares of our common stock available for equity awards to our key employees, directors and consultants in the form of stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance shares, dividend equivalents and other awards relating to our common stock. We expect that the amended 2009 Equity Incentive Plan, if adopted, will provide us the flexibility to use equity based awards to attract, retain and reward the high caliber individuals essential to our success and in aligning the interests of these individuals with those of our shareholders.

Our Board of Directors recommends that you vote “FOR” the approval of the Premier Exhibitions 2009 Equity Incentive Plan, as amended.

Quorum

A quorum is required for shareholders to conduct business at the annual meeting. The presence, in person or by proxy, of shareholders holding a majority of the shares entitled to vote at the meeting will constitute a quorum.

Vote Required

Directors will be elected by a plurality of the votes cast by the shares of our common stock entitled to vote in the election. The affirmative vote of the holders of a majority of the shares of our common stock present at the annual meeting and cast on the proposal will be required for approval of the other proposals covered by this proxy statement (without regard to broker non-votes).

The selection of Cherry, Bekaert & Holland, L.L.P. is being presented to our shareholders for ratification. Our Audit Committee will consider the outcome of this vote in its future discussions regarding the selection of our independent registered public accounting firm.

Effect of Abstentions

Abstentions (including instructions to withhold authority to vote for one or more director nominees) are counted for purposes of determining a quorum, but will have no effect on the outcome of any matter voted upon at the annual meeting.

Effect of “Broker Non-Votes”

For shares held in “street name” through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. The ratification of the selection of our independent registered public accounting firm (Proposal 2) is considered a routine matter for which brokers and other nominees may vote shares they hold in street name, even in the absence of voting instructions from the beneficial holder. The election of directors (Proposal1) and the approval of the equity compensation plan (Proposal 3) are not considered routine matters, and the broker cannot vote the shares on these proposals if it has not received voting instructions from the beneficial owner of the shares.

3

Cumulative Voting

Our shareholders have no cumulative voting rights in the election of directors.

Dissenters’ Rights

Under Florida law, our shareholders do not have dissenters’ rights with respect to any proposal to be considered at the annual meeting.

Annual Report

We have enclosed with this proxy statement our Annual Report on Form 10-K, excluding exhibits attached to our Form 10-K, for our fiscal year ended February 29, 2012, referred to as “fiscal year 2012.” The report includes our audited financial statements, along with other information about us, which we encourage you to read.

You can obtain, free of charge, an additional copy of our Annual Report by:

| | • | | accessing our website located at www.prxi.com; |

| | • | | writing to us at: Premier Exhibitions, Inc., 3340 Peachtree Road, N.E., Suite 900, Atlanta, Georgia 30326, Attention: Secretary; or |

| | • | | telephoning us at (404) 842-2600. |

You can also obtain a copy of our Annual Report on Form 10-K for our fiscal year 2012 and the other periodic filings that we make with the SEC from the SEC’s EDGAR database located at www.sec.gov.

PROPOSAL NO. 1

Election of Directors

Nominees Proposed for Election as Directors at the Annual Meeting

At this annual meeting, the terms of all eight members of our Board of Directors will expire. At its meeting held on September 16, 2011, the Board of Directors amended our Bylaws to increase the number of directors from eight to nine, and elected Mark P. McGowan to fill the resulting vacancy. On May 3, 2012, the Board of Directors amended our Bylaws to decrease the number of directors from nine to eight following the resignation of Christopher Davino from the Board of Directors.

One nominee for election at this annual meeting, Mark P. McGowan, previously has not been elected by our shareholders. Mr. McGowan is the managing member of one of our largest shareholders, and the Corporate Governance and Nominating Committee considered his nomination at the suggestion of one of the Company’s shareholders.

Eight directors are proposed to be elected at the annual meeting to serve until our 2013 annual meeting of shareholders and until their respective successors are elected and have been qualified or until their earlier resignation, removal or death.

Upon the recommendation of our Corporate Governance and Nominating Committee, the Board of Directors has nominated each of William M. Adams II, Douglas Banker, Ronald C. Bernard, Mark P. McGowan, Stephen W. Palley, Mark A. Sellers, Bruce D. Steinberg, and Samuel S.Weiser to serve as our directors. Each nominee is a current director standing for re-election.

4

Any vacancy existing between shareholders’ meetings, including vacancies resulting from an increase in the number of directors or the resignation or removal of a director, may be filled by the Board of Directors. A director elected to fill a vacancy shall hold office until our next annual meeting of shareholders.

The Board of Directors does not contemplate that any of the director nominees will be unable to serve as a director, but if that contingency should occur before the proxies are voted, the persons named in the enclosed proxy reserve the right to vote for such substitute director nominees as they, in their discretion, determine.

Unless authority to vote for one or more of the director nominees is specifically withheld, proxies will be voted “FOR” the election of all eight director nominees.

So that you have information concerning the independence of the process by which our Board of Directors selected the nominees, we confirm, as required by the SEC, that (1) there are no family relationships among any of the nominees or among any of the nominees and any officer and (2) there is no arrangement or understanding between any nominee and any other person pursuant to which the nominee was selected.

The directors of Premier have diverse backgrounds that provide experience and expertise in a number of areas particularly relevant to the Company. The Corporate Governance and Nominating Committee considers the particular qualifications and experience of directors standing for re-election and potential nominees for election and strives to nominate a Board that has expertise in a number of areas critical to the Company. The particular qualifications of the directors nominated for election in this proxy statement are noted below their biographies.

| | | | |

Name and Background | | Director

Since | |

| William M. Adams, age 41, has served as one of our directors since January 2009. Mr. Adams has been a Partner with Alpine Investors, LP since September 2001. Alpine Investors, LP is a private equity investor in micro-cap companies, focused on firms with less than $100 million of revenue. The firm currently manages $250 million. Mr. Adams focuses primarily on managing the operational performance of portfolio companies and developing and implementing growth strategies. Leveraging early career roles that included marketing and sales positions at The Clorox Company and strategic work as a management consultant at The Mitchell Madison Group, a global strategic consulting practice, he works most closely with Alpine’s consumer, retail and direct marketing oriented businesses. Mr. Adams serves on the Boards of Directors of Direct Marketing Solutions, Inc., CarHop, McKissock and YLighting, all of which are private companies. He received a Master of Business Administration from the Kellogg Graduate School of Management at Northwestern University and a Bachelor of Arts from Colgate University. | | | 2009 | |

| |

| The Board believes that Mr. Adams’ experience with smaller cap companies, particularly with regard to growth strategies, qualifies him to serve as a member of the Board of Directors. | | | | |

| |

| Douglas Banker, age 60, has served as one of our directors since August 2000. Mr. Banker’s more than 35 years of experience in the entertainment industry includes major market concert production and promotions; providing management services to musicians and recording artists; marketing, merchandising, licensing, and sales of music media products; as well as the development and management of international concert tours and similar events. Mr. Banker is currently Vice President of McGhee Entertainment, a successful artist management company with offices in Los Angeles and Nashville. Mr. Banker also served as President of the Board of the Motor City Music Foundation in Detroit, Michigan from 1996 to 2000. | | | 2000 | |

| |

| The Board believes that Mr. Banker’s entertainment and marketing experience and his experience in international markets makes him well suited to service on the Board of Directors of the Company. | | | | |

5

| | | | |

| Ronald C. Bernard, age 69, has served as one of our directors since September 2009. Mr. Bernard has been an Advisory Director in the media sector group of M.M. Dillon & Co., and investment and merchant banking firm, since May 2012. Mr. Bernard has also been President of LWB Media Consulting, a company that provides consulting to private equity firms investing in media-related companies, since 2004, and a Managing Director and Senior Advisor of Alvarez and Marsal, a professional services firm specializing in turnarounds, since September 2009. Prior to that time Mr. Bernard served as Chief Executive Officer of Sekani, Inc., a privately held media licensing and digital media asset management company from 2000 to 2003, and as President of NFL Enterprises from 1994 to 2000, where he focused on the National Football League’s media businesses and international operations. From 1987 to 1993 Mr. Bernard served as President of Viacom Network Enterprises. He also previously served as a director of Atari, Inc. Mr. Bernard received a Master of Business Administration from Columbia University and a Bachelor of Arts from Syracuse University. Mr. Bernard is also a Certified Public Accountant. | | | 2009 | |

| |

| The Board believes that Mr. Bernard’s international media experience and his experience as a Certified Public Accountant make him qualified to serve as a director of the Company. | | | | |

| |

| Mark. P. McGowan, age 33, has served as one of our directors since September 2011. Mr. McGowan has been the managing member of SAF Capital Management LLC, an investment fund and shareholder of the Company, since 2006. Mr. McGowan is also the Chairman of the Board of CombiMatrix Corporation, a molecular diagnostics laboratory offering comprehensive profiling of chromosomes and genes for both oncology and pre- and postnatal developmental disorders. Prior to forming SAF Capital Management LLC, Mr. McGowan was Co-founder and Managing Partner of MPG Capital Management LLC, an equity market research firm which derived and licensed statistically validated algorithmic trading models and investment strategies for wealthy individuals and institutional investors. Mr. McGowan previously worked within the Consumer and Market Knowledge function of Procter & Gamble, a consumer products and healthcare company, where he was instrumental in shaping marketing strategies for multiple brands. Mr. McGowan received his Bachelor of Science in Microbiology, with a focus in Genomics and Molecular Genetics, from Michigan State University. | | | 2011 | |

| |

| The Board believes Mr. McGowan is qualified to serve as a director of the Company due to his extensive management and investment experience. In addition, Mr. McGowan provides an additional shareholder perspective to the Board. | | | | |

| |

| Stephen W. Palley, age 67, has served as one of our directors since September 2009. Mr. Palley is a consultant to Consensus Securities, LLC, a broker dealer, where he engages in investment banking services. From 2005 to March 2010, he served as an Executive Director of Pali Capital, an investment bank in New York. Prior to that time, Mr. Palley served as a consultant to LLJ Capital, L.L.C., providing financial advisory services, principally to distressed companies in the telecom and media industries. From 1999 to 2002 Mr. Palley served as President and Chief Executive Officer of Source Media, Inc., and from 1997 to 1999 as a consultant to media companies through PSW Enterprises. From 1986 through 1996 Mr. Palley served as Executive Vice President and Chief Operating Officer of King World Productions, Inc., where he negotiated the syndication of successful entertainment properties, including the Oprah Winfrey Show. Mr. Palley also served as General Counsel of King World, and prior thereto practiced media and entertainment law with Berger & Steingut and Hardee Barovick Konecky & Braun. Mr. Palley received a Juris Doctor from Columbia University School of Law and a Bachelor of Arts from American University’s School of Government and Public Administration. Mr. Palley previously served as a director of The Roo Group. | | | 2009 | |

| |

| The Board believes that Mr. Palley is qualified to serve as a director due to his experience leading and advising media companies. | | | | |

| |

| Mark A. Sellers, age 44, has served as Chairman of the Board since January 2009 and as one of our directors since July 2008. Mr. Sellers has been the founder and managing member of Sellers Capital LLC, an investment management firm, since 2003. Sellers Capital LLC manages Sellers Capital Master Fund, Ltd., a hedge fund that is our largest shareholder. Prior to founding Sellers Capital LLC, Mr. Sellers was the Lead Equity Strategist for Morningstar, Inc., a provider of investment research. | | | 2008 | |

| |

| The Board believes Mr. Sellers is qualified to serve as a director of the Company due to his extensive financial and investment experience. In addition, Mr. Sellers’ role as managing member of the Company’s largest shareholder provides a valuable shareholder perspective to the Board. | | | | |

6

| | | | |

| Bruce Steinberg, age 55, has served as one of our directors since January 2009. Mr. Steinberg has over 25 years of media industry experience. Since 2011 Mr. Steinberg has been the founding Principal of Dendy Partners Limited, a company which invests in early stage digital media companies. Mr. Steinberg was previously Executive Chairman of the Wananchi Programming division of the Wananchi Group, a media company with emphasis on residential and corporate broadband, pay-tv and VoIP telephony in East Africa. Prior thereto, he was the Chief Executive Officer of HIT Entertainment Limited, which creates internationally renowned children’s properties; Chief Executive Officer of Fox Kids Europe N.V.; General Manager of Broadcasting at BSkyB and Chief Executive Officer of UK Gold and UK Living TV. He began his career at MTV Networks, where he held various positions in New York and Europe. He is currently a director of Arts Alliance Media, Europe’s leading provider of digital cinema technology, and a Board member of JDRF UK, a charitable organization dedicated to Type 1 diabetes. Mr. Steinberg received a MBA from Harvard Business School, a BA (Cantab) from Cambridge University and a BA from Columbia University. | | | 2009 | |

| |

| The Board believes that Mr. Steinberg is qualified to serve as a director of the Company due to his executive level experience with entertainment and media companies and his international experience with media companies. | | | | |

| |

Samuel S. Weiser, age 52, is currently the Interim President and Chief Executive Officer of Premier Exhibitions, Inc. Mr. Weiser is also the owner of Foxdale Management, LLC, a consulting firm founded by Mr. Weiser that provides operational consulting to asset management firms and litigation support services in securities related disputes. Mr. Weiser served as Interim Chief Financial of the Company from May 2011 until June 27, 2011, and has served as Interim President and Chief Executive Officer since November 28, 2011. From February through October 2009 and again since July 2010, Mr. Weiser provided consulting services to us through a consulting agreement. He was the Chief Operating Officer of Sellers Capital LLC, an investment management firm, where he was responsible for all non-investment activities, from 2007 to 2010. Mr. Weiser remains a member of Sellers Capital LLC. Mr. Weiser is also an indirect investor in Sellers Capital Master Fund, Ltd., an investment fund managed by Sellers Capital LLC and Premier’s largest shareholder. From April 2005 to 2007, he was a Managing Director responsible for the Hedge Fund Consulting Group within Citigroup Inc.’s Global Prime Brokerage division. Mr. Weiser also served as Chairman of the Managed Funds Association, a lobbying organization for the hedge fund industry, from 2001 to 2003. Mr. Weiser is also a former partner in Ernst & Young. Mr. Weiser also serves as a director of Paragon Technologies, Inc. He received a Bachelor of Arts in Economics from Colby College and a Master of Science in Accounting from George Washington University. The Board believes that Mr. Weiser’s extensive financial and operational consulting experience makes him qualified to serve as a member of the Board of Directors. | | | 2009 | |

In addition to the specific qualifications noted above, the Corporate Governance and Nominating Committee considers a number of other factors in choosing director nominees, including Board dynamics, reputation of potential nominees, recommendations of other directors and of shareholders, and how the nominee will contribute to the diversity of the Board. The Corporate Governance and Nominating Committee views diversity broadly, seeking to nominate individuals from varied backgrounds, perspectives and experiences. The Corporate Governance and Nominating Committee does not have a specific written policy on the diversity of the Board of Directors at this time.

Required Vote for Approval

Directors will be elected by a plurality of the votes cast by the shares entitled to vote in the election.

Recommendation of Our Board of Directors

Our Board of Directors recommends that shareholders vote “for” the election to the Board of each of the above nominees.

7

PROPOSAL NO. 2

Ratification of Selection of

Our Independent Registered Public Accounting Firm

The Audit Committee of our Board of Directors has selected Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm for our fiscal year 2013. We will present this selection to our shareholders for approval at the annual meeting. Selection of our independent registered accounting firm is not required to be submitted to a vote of our shareholders for ratification. However, we are submitting this matter to our shareholders as a matter of good corporate governance. If our shareholders do not approve on an advisory basis our selection of Cherry, Bekaert & Holland, L.L.P., then the Audit Committee will consider the outcome of this vote in its future discussions regarding the selection of our independent registered public accounting firm. Even if our shareholders ratify the selection, the Audit Committee may, in its discretion, direct the selection of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests and the best interests of our shareholders.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the selection of Cherry, Bekaert & Holland, L.L.P. to serve as our independent registered public accounting firm. Unless otherwise instructed in the proxy, the persons named in the enclosed proxy will vote the proxies “FOR” this proposal.

Fees Paid to Cherry, Bekaert & Holland, L.L.P.

We incurred the following fees to Cherry, Bekaert & Holland, L.L.P. for fiscal year 2011 and 2012:

| | | | | | | | |

| | | Fiscal Year 2011 | | | Fiscal Year 2012 | |

Audit fees | | $ | 247,565 | | | $ | 257,628 | |

Audit-related fee | | | — | | | | 24,539 | |

Tax fees | | | — | | | | — | |

All other fees | | | — | | | | — | |

| | | | | | | | |

Total | | $ | 247,565 | | | $ | 282,167 | |

| | | | | | | | |

Audit fees for fiscal year 2011 and 2012 included fees associated with audits of our financial statements and reviews of our financial statements included in our quarterly reports on Form 10-Q. Audit related fees for fiscal year 2012 include fees associated with a registration statement on Form S-3 and audit related purchase accounting assistance. We did not pay any other fees to our independent registered public accounting firm for fiscal year 2011 or fiscal year 2012.

Policy on Pre-Approval of Services Provided by Independent Registered Public Accounting Firm

The engagement of our independent registered public accounting firm for any non-audit accounting and tax services to be performed for us is limited to those circumstances where these services are considered integral to the audit services that it provides or in which there is another compelling rationale for using its services. Cherry, Bekaert & Holland, L.L.P. was engaged to perform only audit and audit-related services in fiscal year 2012. Pursuant to the Sarbanes-Oxley Act of 2002 and the Audit Committee’s charter, the Audit Committee is responsible for the engagement of our independent registered public accounting firm and for pre-approving all audit and non-audit services provided by our independent registered public accounting firm that are not prohibited by law.

The Audit Committee has adopted procedures for pre-approving all audit and permitted non-audit services provided by our independent registered public accounting firm. The Audit Committee annually pre-approves a list of specific services and categories of services, subject to a specified cost level. Part of this approval process includes making a determination as to whether non-audit services are consistent with the SEC’s rules on auditor independence. The Audit Committee has delegated pre-approval authority to the chairman of the Audit Committee, subject to reporting any such approvals at the next Audit Committee meeting. The Audit Committee monitors the services rendered and actual fees paid to our independent registered public accounting firm quarterly to ensure such services are within the scope of approval.

8

Our Audit Committee has pre-approved all services performed by our independent registered public accounting firm in fiscal year 2012. The pre-approval requirements are not applicable with respect to the provision ofde minimis non-audit services that are approved in accordance with the Securities Exchange Act of 1934, as amended, and our Audit Committee’s charter.

Representatives of Cherry, Bekaert & Holland, L.L.P. are expected to be present at the 2012 Annual Meeting of Shareholders, with the opportunity to make a statement if they so desire, and available to respond to appropriate questions.

Required Vote for Approval

Approval of Proposal No. 2 requires the affirmative vote of a majority of the shares of our common stock present at the annual meeting and cast on the proposal. Selection of our independent registered accounting firm is not required to be submitted to a vote of our shareholders for ratification. However, we are submitting this matter to our shareholders as a matter of good corporate governance. If our shareholders do not approve on an advisory basis our selection of Cherry, Bekaert & Holland, L.L.P., then the Audit Committee will consider the outcome of this vote in its future discussions regarding the selection of our independent registered public accounting firm.

Recommendation of Our Board of Directors

Our Board of Directors recommends that you vote in favor of the ratification of the selection of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is currently comprised of Mr. Bernard (chairman), Mr. Adams and Mr. Palley, each of whom is independent in accordance with the listing standards of the NASDAQ Global Market. The Audit Committee met five times in fiscal year 2012. The duties and responsibilities of the Audit Committee are set forth in the Audit Committee’s charter, as adopted by the Board of Directors in April 2006.

The Audit Committee oversees the financial reporting process for the Company on behalf of the Board of Directors, and has other duties and functions as described in its charter.

Company management has the primary responsibility for the Company’s financial statements and the reporting process. The Company’s independent registered public accounting firm is responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

The Audit Committee has:

| | • | reviewed and discussed the Company’s audited financial statements for fiscal year 2012 with management and the independent registered public accounting firm; |

| | • | discussed with the Company’s independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as adopted, amended, modified or supplemented by the Public Company Accounting Oversight Board; and |

| | • | received the written disclosures and the letter from the Company’s independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the Company’s independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the Company’s independent registered public accounting firm such firm’s independence. |

When evaluating Cherry, Bekaert & Holland’s independence, the Audit Committee discussed with Cherry, Bekaert & Holland any relationships that may impact such firm’s objectivity and independence. The Audit Committee has also considered whether the provision of non-audit services by Cherry, Bekaert & Holland is compatible with maintaining such firm’s independence, and has satisfied itself with respect to Cherry, Bekaert & Holland’s independence from the Company and its management. Cherry, Bekaert & Holland provided only audit and audit-related services to the Company in fiscal year 2012.

9

The Audit Committee discussed with the Company’s accounting personnel performing internal audit functions and independent registered public accounting firm the overall scope and plans for their respective audits. The Audit Committee meets with the accounting personnel performing internal audit functions and independent registered public accounting firm, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 29, 2012 for filing with the Securities and Exchange Commission. The Audit Committee has also selected the Company’s independent registered public accounting firm for the fiscal year ending February 28, 2013, and has submitted such selection for ratification by the Company’s shareholders at the annual meeting.

Audit Committee:

Ronald C. Bernard,Chairman

William M. Adams

Stephen W. Palley

PROPOSAL NO. 3

Amendments to the 2009 Equity Incentive Plan

On August 6, 2009, our shareholders approved the Premier Exhibitions, Inc. 2009 Equity Incentive Plan. The Board of Directors amended the 2009 Equity Incentive Plan on June 6, 2012, subject to shareholder approval to:

| | • | | increase the number of shares available for grant under the 2009 Equity Incentive Plan from 3,000,000 to 5,000,000; and |

| | • | | provide that Dividend Equivalents with respect to Awards that vest based on the achievement of Performance Objectives shall be accumulated until such Award is earned, and the Dividend Equivalents shall not be paid if the Performance Objectives are not satisfied. |

The 2009 Equity Incentive Plan, as amended (the “2009 Plan”) will become effective as of June 6, 2012, subject to approval by the affirmative vote of the holders of a majority of the shares of our common stock represented in person or by proxy at the annual meeting and cast on Proposal No. 3.

Introduction

Our Board of Directors believes that we must offer a competitive equity incentive program if we are to continue to successfully attract and retain the best possible candidates for positions of responsibility within our company. We believe the 2009 Plan will be an important factor in attracting, retaining and rewarding the high caliber employees, consultants and directors essential to our success, and in motivating these individuals to strive to enhance our growth and profitability.

Our Board amended the 2009 Plan in order to increase the number of shares of our common stock available for equity awards to our key employees, consultants and directors. The 2009 Plan provides the ability to make these grants using a full range of equity and cash-based awards, including incentive stock options (or “ISOs”), nonqualified stock options, stock appreciation rights (or “SARs”), restricted stock, restricted stock units, performance units, performance shares, dividend equivalents and other awards relating to our shares of common stock.

10

Your approval of the 2009 Plan not only will allow us to grant these awards, it will also permit us to structure incentive compensation that is intended to preserve our tax deductions under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). We refer to these awards as qualified performance-based awards. Section 162(m) denies a corporation’s federal income tax deduction for compensation it pays to certain executive officers in excess of $1 million per year for each such officer. Section 162(m) provides an exception to this limitation for performance-based compensation, the material terms of which have been approved by a corporation’s shareholders. To that end, in connection with approval of the 2009 Plan, you are also being asked to approve the performance objectives upon which qualified performance-based awards may be based, the annual maximum limits per individual, and the eligible employees, as further described below.

The principal features of the 2009 Plan are summarized below. The full text of the 2009 Plan is attached as Appendix A to this proxy statement, and the following summary is qualified in its entirety by reference to the 2009 Plan itself.

Of the 3,000,000 shares approved for grant by our shareholders in 2009, 1,170,000 were granted as options to Chris Davino, our former President and Chief Executive Officer; 300,000 were granted as options to Mike Little, our Chief Financial Officer and Chief Operating Officer; 381,087 were granted as restricted stock units (counted on a 2-for-1 ratio) to our directors, pursuant to their elections to receive annual director fees in a split of cash and restricted stock units, 13,506 of which were forfeited; 135,000 were granted to other executive officers in the form of restricted shares (counted on a 2-for-1 ratio), 50,000 of which were forfeited; and 190,155 were granted to certain non-executive employees and consultants in fiscal 2011 in the form of restricted shares (counted on a 2-for-1 ratio) as employee retention grants, 74,870 of which were forfeited. As of February 29, 2012, we had 394,268 shares available for future grants under the Plan.

If shareholders approve the amendments to the 2009 Plan, we anticipate that we will continue to use shares each year to provide an equity component to annual director compensation, to closely align the interests of our directors with those of our shareholders and to preserve cash. In addition, the Compensation Committee will use grants under the 2009 Plan to achieve its goals of providing a large portion of executive officer compensation in the form of at-risk compensation, as more fully described under “Executive Compensation” on page 24. The Compensation Committee may also make grants to non-executive employees from time to time, particularly to encourage the retention of key employees.

Plan Highlights

| | • | | For purposes of counting the number of shares available to be issued under the 2009 Plan, “full value awards” (awards settled in shares other than stock options and stock appreciation rights) will be counted against the share reserve on a 2-for-1 basis. |

| | • | | The 2009 Plan does not permit what has been labeled by some shareholder groups as “liberal share counting” when determining the number of shares that have been granted. Only awards that are cancelled, forfeited, or which are paid in cash can be added back to the share reserve. |

| | • | | The 2009 Plan is designed to allow the compensation committee, if it chooses, to grant awards that are intended to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code. |

| | • | | Dividends or dividend equivalents paid with respect to awards that vest based on the achievement of performance objectives shall be accumulated until such award is earned, and the dividends or dividend equivalents shall not be paid if the performance goals are not satisfied. |

| | • | | The 2009 Plan prohibits the use of “discounted” stock options or stock appreciation rights. |

| | • | | The 2009 Plan prohibits the re-pricing of stock options and stock appreciation rights without shareholder approval. |

| | • | | The 2009 Plan contains a “double trigger” vesting provision for equity awards. This means that any awards assumed in a change in control transaction would vest in connection with the transaction only if the award holder’s employment is terminated without “cause,” or the award holder leaves for “good reason”, within a specified period of time after the transaction. |

11

Plan Limits

The maximum number of shares of our common stock that may be issued or transferred with respect to awards under the 2009 Plan is 5,000,000, which may include authorized but unissued shares, treasury shares, or a combination of the foregoing. The 2009 Plan provides that “full-value awards,” meaning all awards other than stock options and SARs, will be counted against the 2009 Plan maximum in a 2-to-1 ratio. For example, if we grant 100 restricted stock units, we would reduce the 2009 Plan limit by 200 shares. Stock options and SARs will be counted against the 2009 Plan limit in a 1-to-1 ratio.

Shares covering awards that terminate or are forfeited will again be available for issuance under the 2009 Plan, and upon payment in cash of the benefit provided by any award granted under the 2009 Plan, any shares that were covered by that award will be available for issue or transfer under the 2009 Plan. Shares surrendered for the payment of the exercise price under stock options, repurchased by us with option proceeds, or withheld for taxes upon exercise or vesting of an award, will not again be available for issuance under the 2009 Plan. In addition, when a SAR is exercised and settled in shares, all of the shares underlying the SAR will be counted against the 2009 Plan limit regardless of the number of shares used to settle the SAR.

The 2009 Plan imposes various sub-limits on the number of shares of our common stock that may be issued or transferred under the 2009 Plan. In order to comply with the rules applicable to ISOs, the 2009 Plan provides that the aggregate number of shares actually issued or transferred upon the exercise of ISOs may not exceed 3,000,000 shares. In order to comply with the exemption from Section 162(m) of the Internal Revenue Code relating to performance-based compensation, the 2009 Plan imposes the following additional individual sub-limits on awards intended to satisfy that exemption:

| | • | | the maximum aggregate number of shares that may be subject to stock options or SARs granted in any calendar year to any one participant will be 1,200,000 shares; |

| | • | | the maximum aggregate number of shares of restricted stock and shares subject to restricted stock units and other stock-based awards granted in any calendar year to any one participant will be 600,000 shares; |

| | • | | the maximum aggregate number of shares deliverable under performance shares granted in any calendar year to any one participant will be 750,000 shares; |

| | • | | the maximum aggregate compensation that can be paid pursuant to performance units or other cash-based awards granted in any calendar year to any one participant will be $1,200,000 or a number of shares having an aggregate fair market value not in excess of such amount; and |

| | • | | the maximum dividend equivalents that may be paid in any calendar year to any one participant will be $300,000. |

Administration

The 2009 Plan will be administered by our Compensation Committee or such other committee as our Board selects consisting of two or more directors, each of whom is intended to be a “non-employee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended, an “outside director” under regulations promulgated under Section 162(m) of the Internal Revenue Code, and an “independent director” under the NASDAQ Global Market rules. The Compensation Committee will have full and final authority in its discretion to take all actions determined by the Committee to be necessary in the administration of the 2009 Plan.

Our board may reserve to itself any or all of the authority and responsibility of the Compensation Committee under the 2009 Plan or may act as administrator of the 2009 Plan for any and all purposes. In addition, our Board or Compensation Committee may expressly delegate to a special committee, consisting of one or more directors who are also our officers, some or all of the Compensation Committee’s authority, within specified parameters, to grant awards to eligible participants who, at the time of grant, are not officers.

12

Eligibility

The 2009 Plan provides that awards may be granted to our employees, consultants and non-employee directors, except that ISOs may be granted only to employees. Approximately seven non-employee directors and approximately 232 employees and consultants would currently be eligible to participate in the 2009 Plan.

Duration and Modification

The 2009 Plan will terminate on June 6, 2022, or such earlier date as our Board of Directors may determine. The 2009 Plan will remain in effect for outstanding awards until no awards remain outstanding. The Board may amend, suspend or terminate the 2009 Plan at any time but shareholder approval is required for any amendment to the extent necessary to comply with the NASDAQ Global Market rules or applicable laws. Currently, the NASDAQ Global Market rules would require shareholder approval for a material amendment of the 2009 Plan, which would include any material increase in the number of shares to be issued under the 2009 Plan (other than to reflect a reorganization, stock split, merger, spinoff or similar transaction), any material increase in benefits to participants, any material change to extend the duration of the 2009 Plan, any material expansion of the class of participants eligible to participate in the 2009 Plan, and any expansion of the types of options or awards provided under the 2009 Plan.

Stock Options

Our Compensation Committee may, at any time and from time to time, grant stock options to participants in such number as the committee determines in its discretion. Stock options may consist of ISOs, non-qualified stock options or any combinations of the foregoing awards.

Stock options provide the right to purchase shares at a price not less than their fair market value on the date of grant (which date may not be earlier than the date that the compensation committee takes action with respect to such grants). The fair market value of our common stock as reported on the NASDAQ Global Market on June 6, 2012 was $2.37 per share. No stock options may be exercised more than 10 years from the date of grant.

Each grant must specify (i) the period of continuous employment that is necessary (or the performance objectives that must be achieved) before the stock options become exercisable and (ii) the extent to which the option holder will have the right to exercise the stock options following termination. Our compensation committee will determine the terms in its discretion, which terms need not be uniform among all option holders.

The option price is payable at the time of exercise (i) in cash, (ii) by tendering unrestricted shares of our common stock that are already owned by the option holder and have a value at the time of exercise equal to the option price, (iii) with any other legal consideration that our compensation committee may deem appropriate, or (iv) by any combination of the foregoing methods of payment. Any grant of stock options may provide for deferred payment of the option price from the proceeds of sale through a broker on the date of exercise of some or all of the shares (although, in the case of executive officers and directors, this payment method may be affected by the restrictions on personal loans to executive officers provided by the Sarbanes-Oxley Act of 2002).

SARs

Our compensation committee may, at any time and from time to time, grant SARs to participants in such number as the committee determines in its discretion. SARs can be tandem (granted with stock options to provide an alternative to exercise of the option) or free-standing.

The grant price for each freestanding SAR will be determined by the committee, in its discretion, and will be at least equal to the fair market value of a share on the date of grant. The grant price of tandem SARs will be equal to the exercise price of the related stock option. No SAR may be exercised more than 10 years from the date of grant.

Upon the exercise of a SAR, the holder is entitled to receive payment in an amount determined by multiplying: (i) the excess of the fair market value of a share on the date of exercise over the grant price; by (ii) the number of shares with respect to which the SAR is exercised. Each grant will specify whether the payment will be in cash, shares of equivalent value, or in some combination thereof.

13

Tandem SARs may only be exercised at a time when the related stock option is exercisable and the spread is positive. Upon exercise of a tandem SAR, the related stock option will be surrendered for cancellation.

Each grant of a free-standing SAR must specify (i) the period of continuous employment that is necessary (or the performance objectives that must be achieved) before the SAR becomes exercisable and (ii) the extent to which the holder will have the right to exercise the SAR following termination. Our compensation committee will determine these terms in its discretion, and these terms need not be uniform among all participants.

Restricted Stock

Our compensation committee may, at any time and from time to time, grant or sell shares of restricted stock to participants in such number as the committee determines in its discretion.

An award of restricted stock constitutes an immediate transfer of ownership of a specified number of shares to the recipient in consideration of the performance of services. Unless otherwise provided by the compensation committee, the participant is entitled immediately to voting, dividend and other ownership rights in the shares. The transfer may be made without additional consideration or in consideration of a payment by the recipient that is less than the fair market value per share on the date of grant.

Restricted shares must be subject to a “substantial risk of forfeiture,” within the meaning of Section 83 of the Internal Revenue Code, based on the passage of time, the achievement of performance objectives, or upon the occurrence of other events as determined by our compensation committee, at its discretion. In order to enforce these forfeiture provisions, the transferability of restricted shares will be prohibited or restricted in the manner prescribed by the compensation committee on the date of grant for the period during which such forfeiture provisions are to continue.

Restricted Stock Units

Our compensation committee may, at any time and from time to time, grant or sell restricted stock units to participants in such number as the committee determines in its discretion.

Restricted stock units constitute an agreement to deliver shares to the recipient in the future at the end of a restriction period and subject to the fulfillment of such conditions as the compensation committee may specify. The transfer may be made without additional consideration or in consideration of a payment by the recipient that is less than the fair market value per share on the date of grant.

During the restriction period the participant has no right to transfer any rights under his or her award and no right to vote or receive dividends on the shares covered by the restricted stock units, but the compensation committee may authorize the payment of dividend equivalents with respect to the restricted stock units.

Performance Shares and Performance Units

Our compensation committee may, at any time and from time to time, grant performance shares or performance units to participants in such number as the committee determines in its discretion. A performance share is the equivalent of one share of our common stock and a performance unit is the equivalent of $1.00.

The participant will be required to meet one or more performance objectives (as described below) within a specified period. Payment of the performance shares or performance units depends on the extent to which the performance objectives have been achieved. To the extent earned, the participant will receive the performance shares or performance units at the time and in the manner determined by our compensation committee, in cash, shares or any combination thereof.

The participant has no right to transfer any rights under his or her award and no right to vote or receive dividends on the shares covered by the performance shares, but the compensation committee may authorize the payment of dividend equivalents with respect to the performance shares.

14

Other Awards

Our compensation committee may, at any time and from time to time, grant or sell other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to, shares of our common stock or factors that may influence the value of such shares. For example, the awards may include convertible or exchangeable debt securities or other securities, purchase rights for shares, or awards with value and payment contingent upon performance of our company or our subsidiaries or other factors determined by the compensation committee.

The compensation committee will determine the terms and conditions of these awards. Shares delivered pursuant to these types of awards will be purchased for such consideration, by such methods and in such forms as the compensation committee determines. We may also grant cash awards, as an element of or supplement to any other award granted under the 2009 Plan.

The compensation committee may also grant shares as a bonus, or may grant other awards in lieu of obligations of our company or a subsidiary to pay cash or deliver other property under the 2009 Plan or under other plans or compensatory arrangements, subject to such terms as are determined by the compensation committee.

Performance Objectives

Our compensation committee may designate any award as a qualified performance-based award in order to make the award fully deductible for federal income tax purposes without regard to the $1.0 million limit imposed by Section 162(m) of the Internal Revenue Code. If an award is so designated, the compensation committee must establish objectively determinable performance objectives for the award within certain time limits. Performance objectives for such awards will be based on one or more of the following criteria: revenues, weighted average revenue per unit, earnings from operations, operating income, earnings before or after interest and taxes, operating income before or after interest and taxes, net income, cash flow, earnings per share, debt to capital ratio, economic value added, return on total capital, return on invested capital, return on equity, return on assets, total return to shareholders, earnings before or after interest, taxes, depreciation, amortization or extraordinary or special items, operating income before or after interest, taxes, depreciation, amortization or extraordinary or special items, return on investment, free cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, cash flow in excess of cost of capital, operating margin, profit margin, contribution margin, stock price and/or strategic business criteria consisting of one or more objectives based on meeting specified product development, strategic partnering, research and development, market penetration, geographic business expansion goals, cost targets, customer satisfaction, gross or net additional customers, employee satisfaction, management of employment practices and employee benefits, supervision of litigation and information technology, and goals relating to acquisitions or divestitures of subsidiaries, affiliates and joint ventures.

Performance objectives may be described in terms of either company-wide objectives or objectives that are related to the performance of the individual participant or subsidiary, division, department, region or function within our company or a subsidiary in which the participant is employed. The performance objectives may be relative to the performance of a group of comparable companies, or published or special index that our compensation committee, in its discretion, deems appropriate, or we may also select performance objectives as compared to various stock market indices.

Acceleration of Awards

Our compensation committee may in its discretion determine at any time that: (i) all or a portion of a participant’s stock options, SARs and other awards in the nature of rights that may be exercised will become fully or partially exercisable; (ii) all or a part of the time-based vesting restrictions on all or a portion of the outstanding awards will lapse; (iii) any performance-based criteria with respect to any awards will be deemed to be wholly or partially satisfied; and/or (iv) any other limitation or requirement under any such award will be waived, in each case, as of such date as the compensation committee, in its discretion, declares. Any such decisions by the compensation committee need not be uniform among all participants or awards. Unless our compensation committee otherwise determines, any such adjustment that is made with respect to an award that is intended to qualify for the performance-based exception of Section 162(m) of the Internal Revenue Code will be specified at such times and in such manner as will not cause such awards to fail to qualify under the performance-based exception. Additionally, the compensation committee will not make any adjustment that would cause an award that is otherwise exempt from Section 409A of the Internal Revenue Code to become subject to Section 409A or that would cause an award that is subject to Section 409A of the Internal Revenue Code to fail to satisfy the requirements of Section 409A.

15

Change in Control

If we experience a change in control and the resulting entity assumes, converts or replaces the outstanding awards under the 2009 Plan, the awards will continue to vest in accordance with their terms, except that vesting will accelerate upon a participant’s earlier involuntary termination of employment without cause, or resignation with good reason, within two years after the transaction. On the other hand, if the resulting entity does not assume, convert or replace awards outstanding under the 2009 Plan in connection with the change in control, the awards will become fully vested and no longer subject to any restrictions, and any performance objectives will be deemed to have been satisfied at target.

A change-in-control generally means any of the following: (i) an acquisition of 50% or more of our common stock; (ii) a change in the membership of our board of directors, so that the current incumbents and their approved successors no longer constitute a majority; (iii) a reorganization, merger, consolidation or other sale of substantially all of our assets, unless the company’s shareholders own more than 50% of the common stock or voting stock of the successor corporation, no person owns 50% or more of the common stock or voting stock of the successor corporation, and a majority of the directors are incumbent directors; or (iv) our shareholders approve a complete liquidation of the company.

Transferability

Except as our board or compensation committee otherwise determines, awards granted under the 2009 Plan will not be transferable by a participant other than by will or the laws of descent and distribution. Except as otherwise determined by our compensation committee, stock options and SARs will be exercisable during a participant’s lifetime only by him or her or, in the event of the participant’s legal incapacity to do so, by his or her guardian or legal representative. Any award made under the 2009 Plan may provide that any shares issued or transferred as a result of the award will be subject to further restrictions upon transfer.

Adjustments

In the event of any equity restructuring, such as a stock dividend, stock split, spinoff, rights offering or recapitalization through a large, nonrecurring cash dividend, our compensation committee will adjust the number and kind of shares that may be delivered under the 2009 Plan, the individual award limits, and, with respect to outstanding awards, the number and kind of shares subject to outstanding awards, the exercise price, and the grant price or other price of shares subject to outstanding awards, to prevent dilution or enlargement of rights. In the event of any other change in corporate capitalization, such as a merger, consolidation or liquidation, the compensation committee may, in its discretion, cause there to be such equitable adjustment as described in the foregoing sentence, to prevent dilution or enlargement of rights. However, unless otherwise determined by the compensation committee, we will always round down to a whole number of shares subject to any award. Any such adjustment will be made by our compensation committee, whose determination will be conclusive.

Prohibition on Re-Pricing

Subject to adjustment as described under “Adjustments” immediately above, the 2009 Plan does not permit, without the approval of our shareholders, what is commonly known as the “re-pricing” of stock options or SARs, including:

| | • | | an amendment to reduce the exercise price of any outstanding stock option or base price of any outstanding SAR; |

16

| | • | | the cancellation of an outstanding stock option or SAR and replacement with a stock option having a lower exercise price or with a SAR having a lower base price; and |

| | • | | the cancellation of an outstanding stock option or SAR and replacement with another award under the 2009 Plan. |

Federal Income Tax Consequences

The following discussion is limited to a summary of the U.S. federal income tax provisions relating to the grant, exercise and vesting of awards under the 2009 Plan. The tax consequences of awards may vary according to country of participation. Also, the tax consequences of the grant, exercise or vesting of awards vary depending upon the particular circumstances, and it should be noted that income tax laws, regulations and interpretations change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

Tax Consequences to Participants

Nonqualified Stock Options. In general, (i) a participant will not recognize income at the time a nonqualified option is granted; (ii) a participant will recognize ordinary income at the time of exercise in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option price paid for the shares; and (iii) at the time of sale of shares acquired pursuant to the exercise of the nonqualified option, appreciation (or depreciation) in value of the shares after the date of exercise will be treated as either short-term or long-term capital gain (or loss) depending on how long the shares have been held.

Incentive Stock Options. A participant will not recognize income at the time an ISO is granted or exercised. However, the excess of the fair market value of the shares on the date of exercise over the option price paid may constitute a preference item for the alternative minimum tax. If shares are issued to the optionee pursuant to the exercise of an ISO, and if no disqualifying disposition of such shares is made by such optionee within two years after the date of the grant or within one year after the issuance of such shares to the optionee, then upon sale of such shares, any amount realized in excess of the option price will be taxed to the optionee as a long-term capital gain and any loss sustained will be a long-term capital loss. If shares acquired upon the exercise of an ISO are disposed of prior to the expiration of either holding period described above, the optionee generally will recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares as of the time of exercise (or, if less, the amount realized on the disposition of such shares if a sale or exchange) over the option price paid for such shares. Any further gain (or loss) realized by the participant generally will be taxed as short-term or long-term capital gain (or loss) depending on the holding period.

SARs. A participant will not recognize income upon the grant of a tandem SAR or a free-standing SAR. The participant generally will recognize ordinary income when the SAR is exercised in an amount equal to the cash and the fair market value of any unrestricted shares received on the exercise.

Restricted Stock.A participant will not be subject to tax until the shares of restricted stock are no longer subject to forfeiture or restrictions on transfer for purposes of Section 83 of the Internal Revenue Code (“restrictions”). At that time, the participant will be subject to tax at ordinary income rates on the fair market value of the restricted shares (reduced by any amount paid by the participant for such restricted shares). However, a participant who so elects under Section 83(b) of the Internal Revenue Code within 30 days of the date of transfer of the shares will have taxable ordinary income on the date of transfer of the shares equal to the excess of the fair market value of such shares (determined without regard to the restrictions) over the purchase price, if any, of such restricted shares. Any appreciation (or depreciation) realized upon a later disposition of such shares will be treated as long-term or short-term capital gain depending upon how long the shares have been held. If a Section 83(b) election has not been made, any dividends received with respect to restricted shares that are subject to the restrictions generally will be treated as compensation that is taxable as ordinary income to the participant.

Restricted Stock Units, Performance Shares, Performance Units. A participant will not recognize income upon the grant of restricted stock units, performance shares or performance units. Upon payment of the awards, the participant generally will recognize ordinary income in an amount equal to the cash and the fair market value of any unrestricted shares received.

17

Dividend Equivalents. Any dividend equivalents awarded with respect to awards granted under the 2009 Plan and paid in cash or unrestricted shares will be taxed to the participant at ordinary income rates when received by the participant.

Section 409A. The 2009 Plan permits the grant of various types of awards that may or may not be exempt from Section 409A of the Internal Revenue Code. If an award is subject to Section 409A, and if the requirements of Section 409A are not met, the taxable events as described above could apply earlier than described, and could result in the imposition of additional taxes and penalties. Restricted stock awards, stock options and stock appreciation rights that comply with the terms of the 2009 Plan are designed to be exempt from the application of Section 409A. Restricted stock units, performance shares, performance units and dividend equivalents granted under the 2009 Plan would be subject to Section 409A unless they are designed to satisfy the short-term deferral exemption (or other applicable exception). If not exempt, those awards will be designed to meet the requirements of Section 409A in order to avoid early taxation and penalties.

Tax Consequences to Us

To the extent that a participant recognizes ordinary income in the circumstances described above, our company or our subsidiary for which the participant performs services will be entitled to a corresponding deduction provided that, among other things, the income (i) meets the test of reasonableness, is an ordinary and necessary business expense, and is not an “excess parachute payment” within the meaning of Section 280G of the Internal Revenue Code; and (ii) is not disallowed by the $1.0 million limitation on executive compensation under Section 162(m) of the Internal Revenue Code.

New Plan Benefits

Our compensation committee will determine all awards for our fiscal year 2013, but no new awards to our officers, employees, consultants or non-employee directors are currently determinable.

Current Equity Compensation Plan Information

The following table provides information as of February 29, 2012 about our equity compensation plans under which awards are currently outstanding.

| | | | | | | | | | | | |

Plan Category | | Number of Shares

Issuable

Upon Exercise

of Outstanding Options,

Warrants and Rights(1)

(a) | | | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b) | | | Number of Shares

Remaining Available for

Issuance Under

Equity Compensation

Plans

(Excluding Shares

Reflected in Column (a))

(c)(2) | |

Equity compensation plans approved by security holders | | | 3,211,919 | | | $ | 2.13 | | | | 394,268 | |

Equity compensation plans not approved by security holders(3) | | | 115,000 | | | | 2.65 | | | | N/A | |

| | | | | | | | | | | | |

Total | | | 3,326,919 | | | $ | 2.15 | | | | 394,268 | |

| | | | | | | | | | | | |

18

| (1) | Column (a) represents the number of shares of our common stock that may be issued in connection with the exercise or conversion of 1,434,741 outstanding stock options granted under our Amended and Restated 2004 Stock Options Plan (the “2004 Plan”) and 1,777,178 outstanding stock options and restricted stock units granted under our 2009 Plan. |

| (2) | Column (c) includes shares that may be issued under our 2009 Plan. |

| (3) | Represents 55,000 outstanding stock option awards made to employees outside of our plans pursuant to individual employment agreements and 60,000 warrants to promoters and licensors outside of our plans. |

Required Vote for Approval

Approval of Proposal No. 3 requires the affirmative vote of a majority of the shares of our common stock present at the annual meeting and cast on the proposal.

Recommendation of Our Board of Directors

Our Board of Directors has approved the 2009 Plan and recommends that you vote in favor of Proposal No. 3.

CORPORATE GOVERNANCE

Board and Committee Meetings

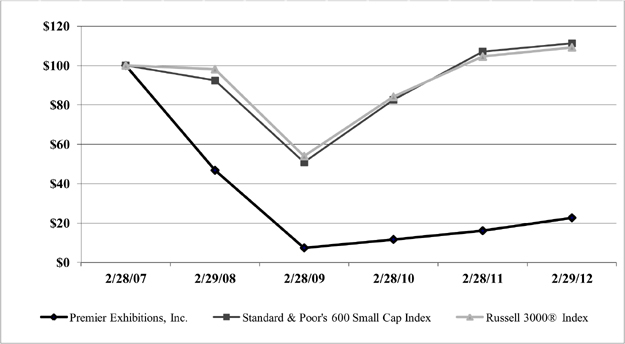

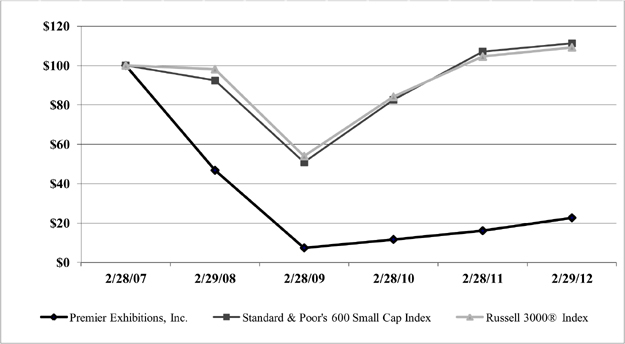

As of February 29, 2012, the Board of Directors consisted of nine members. During fiscal year 2012, the Board of Directors met twenty-three times. Each director attended not less than 75% of the aggregate number of meetings of the Board and meetings of all committees on which such director served.