EXHIBIT 99.1

Occidental Petroleum Corporation

September 7, 2005

STEVE CHAZEN

Senior Executive Vice President &

Chief Financial Officer

Lehman Brothers

Nineteenth Annual CEO Energy/Power Conference

1

Occidental Petroleum Corporation

Equity Market Capitalization $33 billion as of 8/31/05

4th largest U.S. oil & gas company

Proven Reserves of 2.5 billion barrels oil equivalent

2004 Results:WTI = $41.40 per bbl

Net Income $2.6 billion

Cash From Operations $3.9 billion

Return on Equity 27.8%

Return on Capital Employed 20.2%

Total Shareholder Return 41.1%

2

Six Month 2005 Results

Net Income – Core/Reported

Earnings per Share – Core/Reported

Cash from Operations

Stockholders’ Equity

*ROCE (%)

*ROE (%)

Total Shareholder Return

$1.717/$2.382 Billion

$4.28/$5.94

$2.4 Billion

$12.7 Billion

32

41

32.9%

Consolidated Results

*Annualized through first half of 2005

WTI = $51.51

See Appendix for GAAP reconciliation.

3

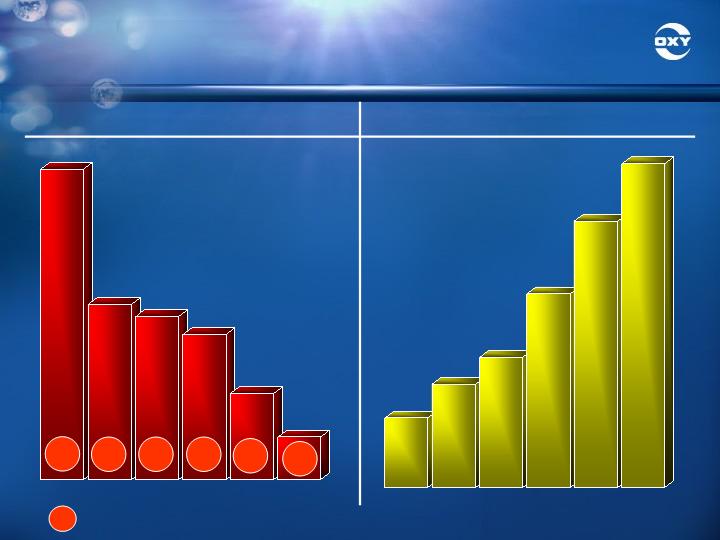

Financial Performance Criteria

Return on Capital Employed

Measures Efficient Use of Capital

Return on Equity

Total Return to Stockholders

Stock Price Change Plus Dividend

4

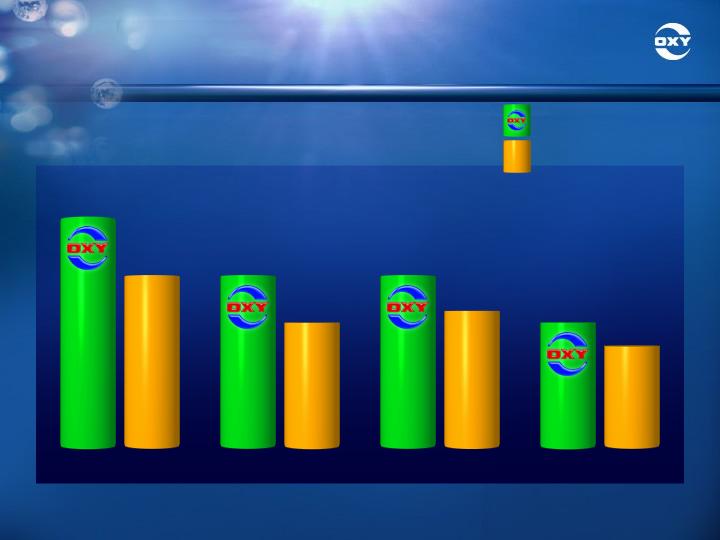

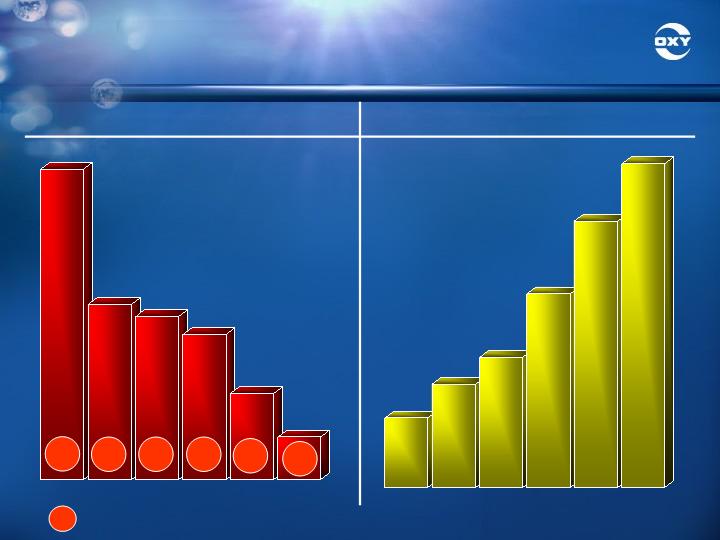

20

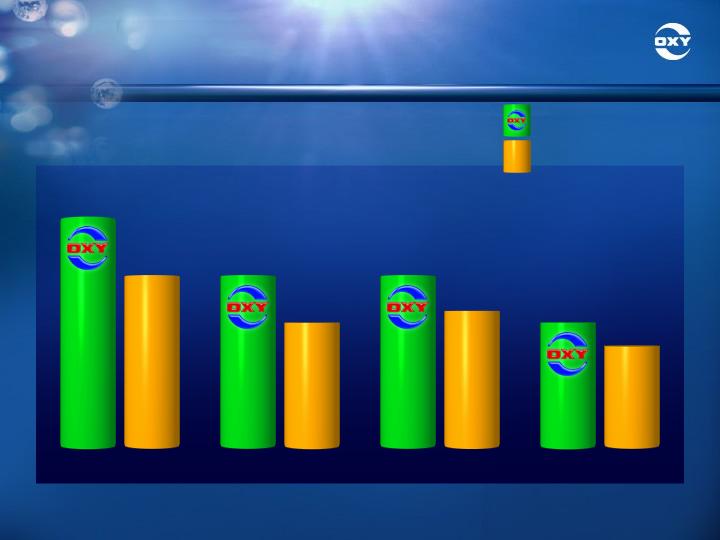

Return On Capital Employed

Percent

15

15

11

15

12

11

9

2004

2002 - 2004

2000 - 2004

1995 - 2004

S&P 500

Oil & Gas Index

Oxy

Data Source: Bloomberg

5

Return On Common Equity

Percent

28

22

22

15

25

17

17

12

2004

2002 - 2004

2000 - 2004

1995 - 2004

S&P 500

Oil & Gas Index

Oxy

Data Source: Bloomberg

6

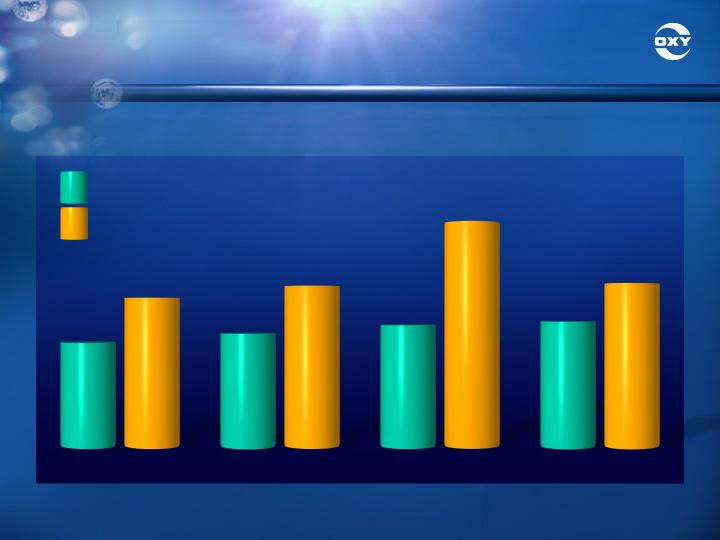

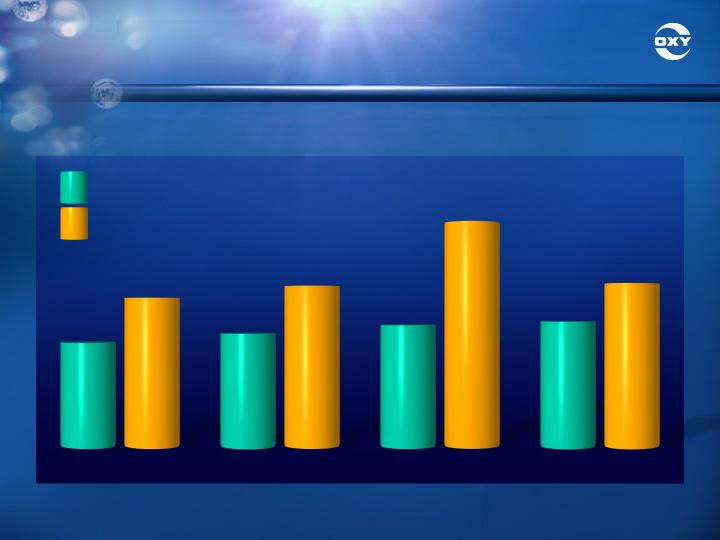

Total Returns

2000-2004

1995-2004

% Without Dividend

% With Dividend

350

203

286

192

212

164

242

181

Six Months 2005

170

38

(1)

(4)

220

56

(11)

4

33

20

(18)

(6)

Data Source: Bloomberg

7

What’s Been Oxy Strategy:

Focused Operations

Focused Value Creation

Disciplined Financial Philosophy

8

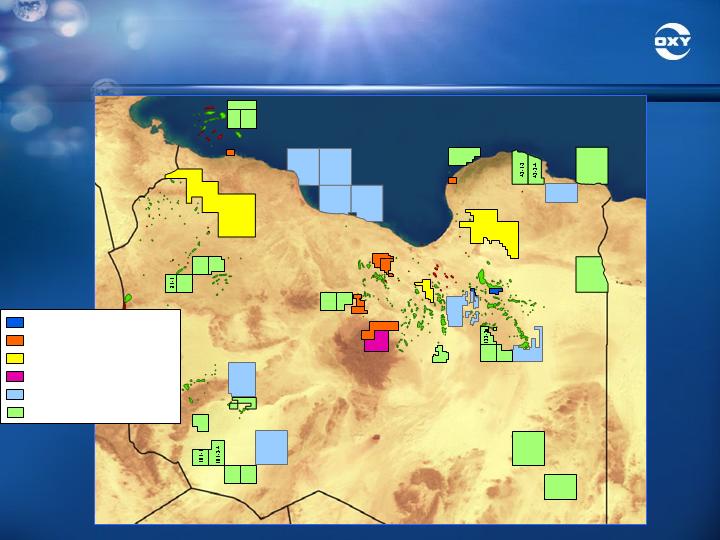

Worldwide Operations

Long Beach

Permian Basin

Horn Mountain

Hugoton

Elk Hills

Colombia

Ecuador

Libya

Russia

Pakistan

Oman

U.A.E.

Yemen

Qatar

.

.

.

9

2004 Proven Reserves by Country

Million BOE

1,844

348

58

63

49

42

24

US

Qatar

Yemen

Russia

Pakistan

Oman

Colombia

104

Ecuador

See Appendix for GAAP reconciliation.

10

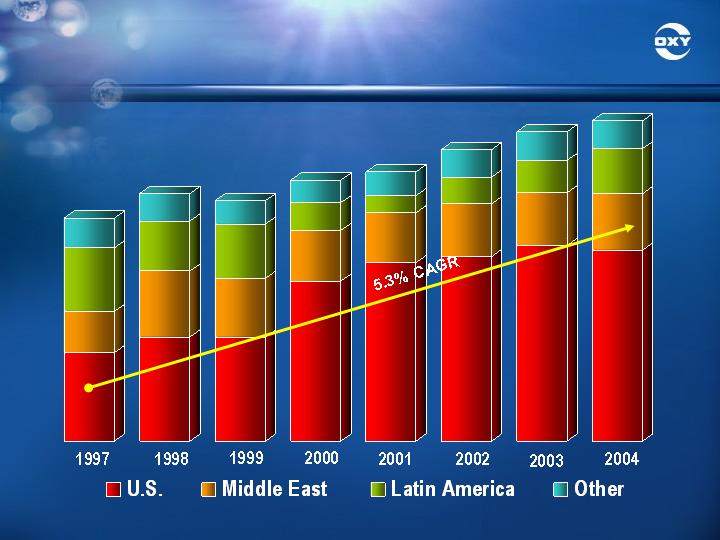

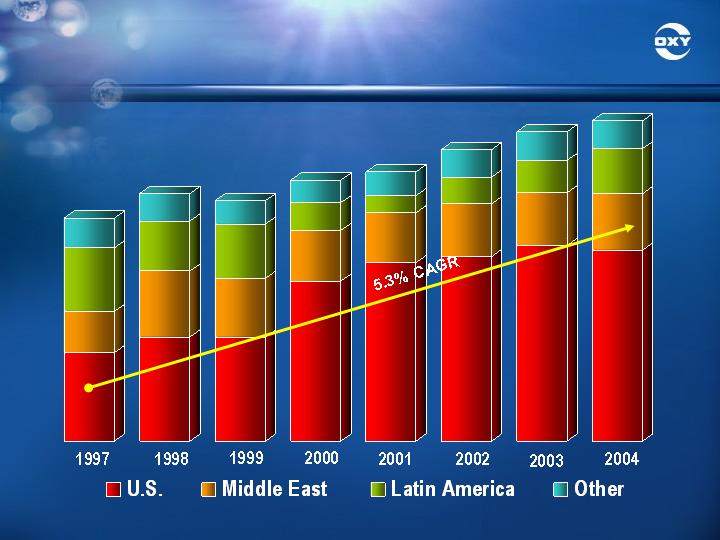

Thousand BOE/Day

515

476

566

547

461

425

438

395

Worldwide Production

11

Production & Reserve Additions

173

244

188

263

200

368

207

268

Million BOE

2004

2003

2002

2001

Production

Additions

See Appendix for GAAP reconciliation.

12

Million BOE

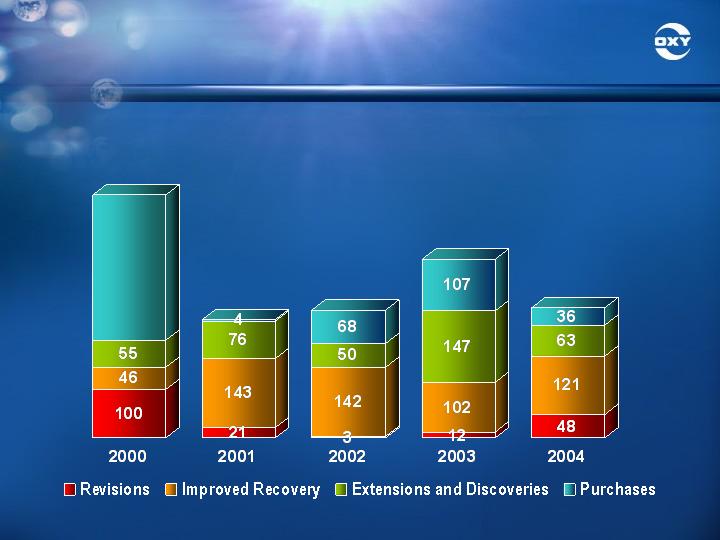

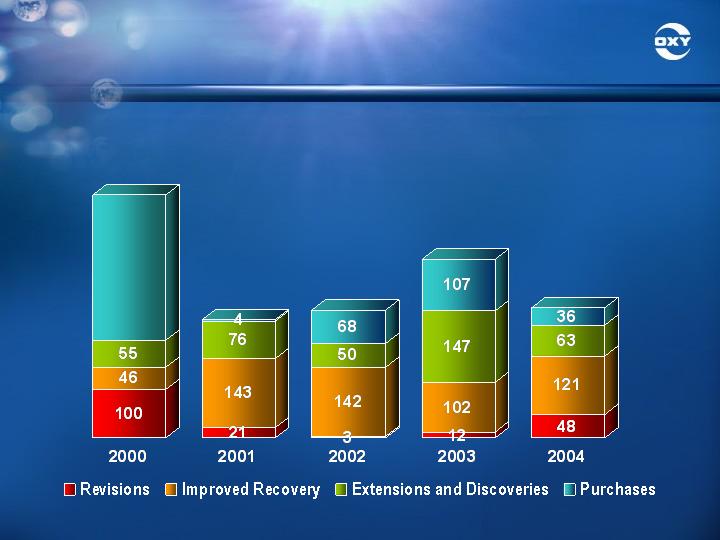

Sources of Worldwide Reserve Additions

1,170

244

263

368

268

969

See Appendix for GAAP reconciliation.

13

2001

2002

2,241

2,311

Worldwide Proven Reserves

Million BOE

2003

1,698

543

1,755

556

US

International

1,804

667

2,471

- Horn Mountain -

2004

1,844

688

2,532

R/P = 12.2

See Appendix for GAAP reconciliation.

14

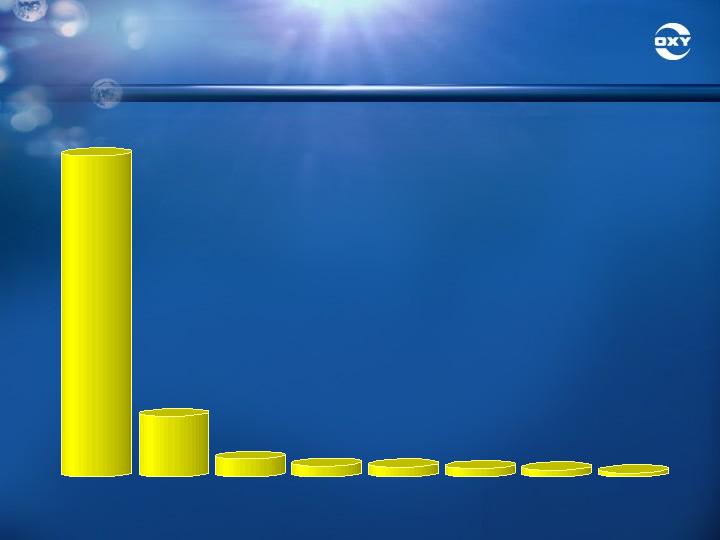

Finding & Development Costs

3-year Average (2002-2004)

BP plc

Marathon Oil

ExxonMobil

Chevron Corporation

Apache Corporation

Burlington Resources

ConocoPhillips

Anadarko Petroleum

Unocal Corporation

Devon Energy

Amerada Hess

Kerr-McGee Corporation

5.42

5.71

6.05

6.77

6.95

7.00

8.20

8.58

9.35

9.72

15.99

17.18

$/BOE

Oxy

5.00

Source: Merrill Lynch Equity Research

15

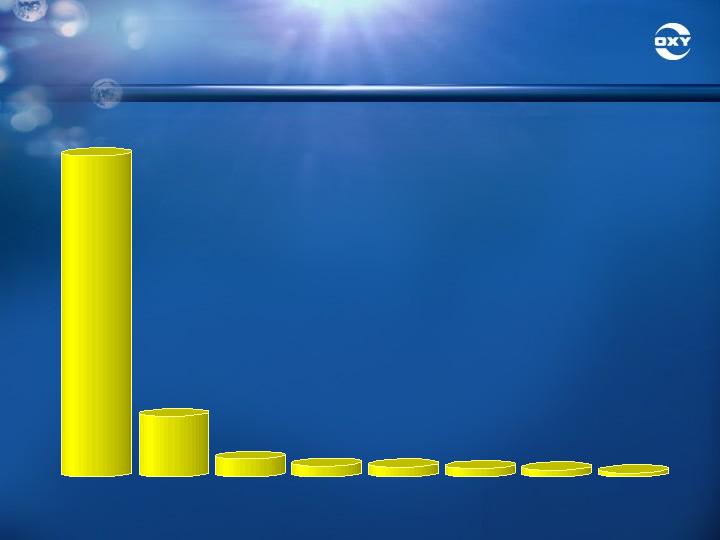

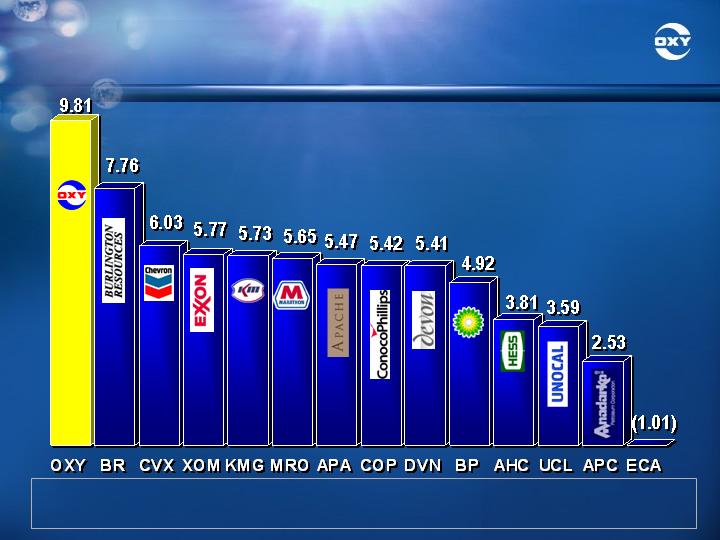

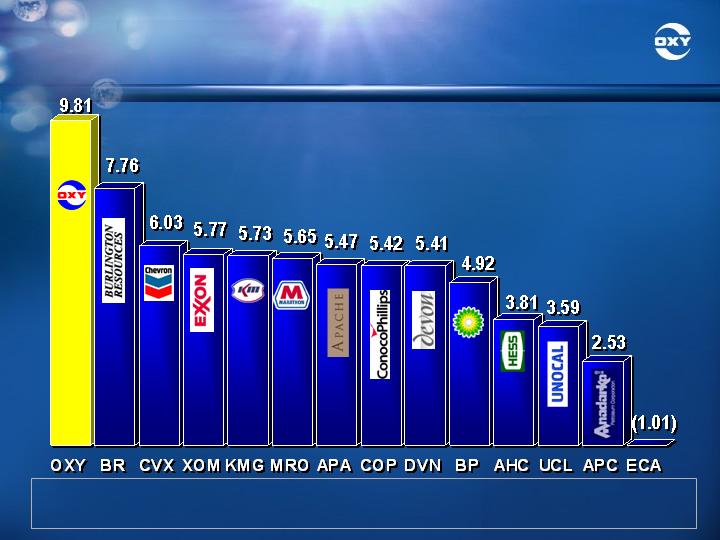

2002-2004 Free Cash Flow*

$/BOE

OXY: 2004 $12.04/BOE

* Combined (consolidated and other interests) exploration & production income after taxes and before interest,

plus DD&A and exploration expense, less capital (excluding acquisitions and ARO costs) – divided by BOE

sales.

See Appendix for GAAP reconciliation

16

Focused Value Creation Strategy

Maintain Strong Balance Sheet

Disciplined Capital Expenditure Program

Selective Acquisitions

Moderate Predictable Reserve/Production Growth

Chemicals Provides Excess Cash Flow

Review Non-Core Investments

Review Dividend Policy Annually

17

Balance Sheet

6,354

4,890

2000

2001

2002

4,759

4,774

5,634

6,318

Total Debt - $ Millions

Total Equity - $Millions

2000

2001

2002

4,570

2003

2003

7,929

2004

3,905

2004

10,550

57

46

43

37

27

Debt/Cap - Percentage

3,461

2Q 2005

2Q 2005

12,706

21

18

2005 Capital Expenditures ($MM)

Oil & Gas US $ 775

Middle East 560

Latin America 160

Other International 10

Exploration 280

Chemicals 165

1,950

Dolphin 360

$ 2,310

Net Acquisition Capital $ 1,200

19

Selective Acquisitions

Natural Consolidator

Permian Basin

California

Vulcan Chlor-Alkali Plants

20

Permian Basin Acquisitions

Spent $1.2 Billion on Three Asset Acquisitions

(Net of Asset Sales)

Projected Production Impact

Estimated Year-End 2005 Exit Rate of 26,000 BOE/Day

Total Proved Reserves for All Three Permian

Acquisitions (Net of Asset Sales)

At Least 130 Million BOE

First Half 2005

21

Oxy’s Permian Basin Production

Thousand BOE/Day

172

1Q-05

172

198

with 1H-05 acquisitions

26

22

198

56

22

18

19

OXY*

CVX

COP

PDX

UCL

AHC

APA

29

Additional Permian Opportunities Still Exist

Top 10 Permian Oil Producers

(Thousand Barrels/Day)

Data Source: IHS Energy

KMI

XTO

48

29

18

*production adjusted for recent acquisitions/divestitures

XOM*

50

23

Chemical Highlights

Generate Cash Flow In Excess of

Capital Expenditures Through the

Business Cycle

Primary Mission of

Oxy’s Chemicals Business

Generated Nearly $3 Billion of Cash Flow After Capital

During the Last 10 Years

Generated Over $500 Million of Cash Flow After Capital

in 2004

24

Ingleside, Texas LNG Terminal*

*Conceptual Illustration

25

FERC Approval Granted in Late July

$450 Million LNG Receiving Terminal and Related

26-Mile Pipeline

1 BCF/Day Send-Out Capacity

To Be Integrated with Oxy’s Existing Ingleside

Chemical and Power Facilities

Includes NGL Recovery Unit & Vaporization Facility

Expected Start-up late 2008

Ingleside, Texas LNG Terminal

26

Dividends

2002-2004 Dividend Payments

Totaled Nearly $1.2 Billion

Annual Payout Rates Per Common Share

2002 = $1.00

2003 = $1.04

2004 = $1.10

2005 = $1.24

Dividend Policy Evaluated Annually

Cash Dividends

Paid Continuously Since 1975

27

What’s ahead?

Success Riding on Two Factors

Add New Projects in Core Areas to Provide Growth

Maintain Strong Asset Base to Generate Cash to

Support Growth

Stay Focused on the Fundamentals

Maintain Financial Discipline and Focus

Execute Our Strategy

Create Long-Term Value

28

Production Growth Projects

Oman: Mukhaizna Oil Field

Qatar:

ISND / ISSD

Dolphin

Libya

Permian Basin / California

Exploration

Current Plans to Drill 30-40 Wells in 2005

Awarded 9 Exploration Blocks in Libya in January

29

Oman - Mukhaizna Oil Field

Oxy Active in Oman

Since 1979

2nd Quarter 2005

Production

29,000 BOE/Day

Oxy Signs 30-Year

Production Sharing

Contract for Oman’s

Mukhaizna Oil Field

30

Oman - Mukhaizna Oil Field

Current Production

10,000 Barrels of Oil/Day (Gross)

Future Investment

$2 Billion (Gross)

Future Production Target

150,000 Barrels of Oil/Day (Gross)

Ultimate Recovery

1 Billion Barrels Over Project Life

Project Overview

31

Dolphin Gas Project

Projected Start – late 2006

Invest Gross Capital

of $4 Billion

(2004-2006)

Oxy’s Share is 24.5%

Estimated Net Reserves:

300 Million BOE

(assumes 2 BCF/Day Gas

Production)

32

Dolphin Gas Project

Oxy’s Peak Net Production

Oxy’s Production

275 Million Cubic Ft./Day

20,000 Barrels Liquids/Day

Equals 65,000 BOE/Day

Contracts in Place for 2 Billion Cubic Ft./Day

Phase 2

Working on Contracts for an Additional Billion Cubic

Feet/Day

Scheduled Start-Up 2009– 2010

33

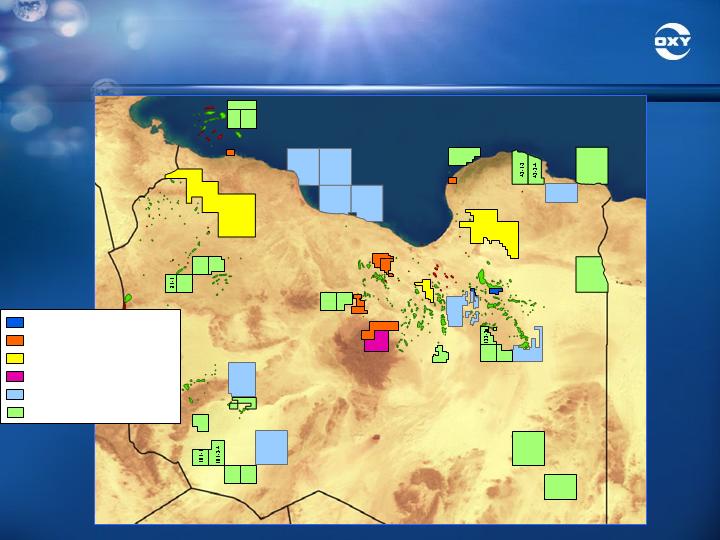

Return to Libya

We Have Returned to our Historical Assets

Immediate impact will be to add 12,000 to 15,000

BOE/day of production to 2005 exit rate

Oxy’s net working interest in Libya covers

approximately 130,000 square kilometers

Exploration

Work program proceeding on nine blocks awarded

earlier this year

Significant Potential for Future Production

Growth Through Investment in EOR Projects

34

Return to Libya

EPSA II

NC143

EPSA II

NC145

EPSA II

NC144

EPSA 85

NC150

EPSA I

NC74

EPSA I

NC29

Concessions

102, 103

B

C

A

B

F

36

53

35

52

163

131

59

124

106

Concession Blocks

EPSA I (Zueitina)

EPSA II Exploration (Oxy)

EPSA 85 Exploration (Oxy)

EPSA IV #1 Exploration (Oxy)

EPSA IV #2 Bid Round

Libya

Tunisia

Algeria

Niger

Chad

Egypt

Tripoli

Benghazi

44

94

171

186

40-3-4

17-4

82-3

81-2

17-3

82-4

2-1-2

102-3

123-1

176-3

176-4

146-1

102-4

123-2

121-2

147-3-4

123-3b

35

Conclusion

Strong, Flexible Balance Sheet

Continued Oil & Gas Production Growth

Long-Lived Domestic Oil & Gas Reserve Base

New, High Potential Exploration Opportunities

Solid Base for Future Growth

And Profitability

36

Occidental Petroleum Corporation

Statements in this presentation that contain words such as "will", "expect" or "estimate",

or otherwise relate to the future, are forward-looking and involve risks and uncertainties

that could significantly affect expected results. Factors that could cause results to differ

materially include, but are not limited to: changes in tax rate, exploration risks such as

drilling of unsuccessful wells, global commodity pricing fluctuations and supply/demand

considerations for oil, gas and chemicals; higher-than-expected costs; political risk; and

not successfully completing (or any material delay in) any expansion, capital expenditure,

acquisition, or disposition. Occidental disclaims any obligation to update any forward-

looking statements. The United States Securities and Exchange Commission (SEC)

permits oil and natural gas companies, in their filings with the SEC, to disclose only

proved reserves demonstrated by actual production or conclusive formation tests to be

economically producible under existing economic and operating conditions. We use

certain terms in this presentation, such as probable, possible and recoverable reserves,

that the SEC's guidelines strictly prohibit us from using in filings with the SEC.

Additionally, the SEC requires oil and natural gas companies, in their filings, to disclose

non-financial statistical information about their consolidated entities separately from

such information about their equity holdings and not to show combined totals. Certain

information in this presentation is shown on a combined basis; however, the information

is disclosed separately in the Appendix. U.S. investors are urged to consider carefully

the disclosure in our Form 10-K, available through the following toll-free telephone

number,1-888-OXYPETE (1-888-699-7383)or on the Internet athttp://www.oxy.com.

You also can obtain a copy from the SEC by calling1-800-SEC-0330.

37

38

Appendix

39

US International Worldwide

2004 OIL GAS BOE OIL GAS BOE OIL GAS BOE

Consolidated Subsidiaries 1,494 2,101 1,844 499 874 645 1,993 2,975 2,489

Other Interests - - - 43 - 43 43 - 43

Worldwide 1,494 2,101 1,844 542 874 688 2,036 2,975 2,532

2003

Consolidated Subsidiaries 1,500 1,826 1,804 490 759 617 1,990 2,585 2,421

Other Interests - - - 48 9 50 48 9 �� 50

Worldwide 1,500 1,826 1,804 538 768 667 2,038 2,594 2,471

2002

Consolidated Subsidiaries 1,452 1,821 1,755 476 228 514 1,928 2,049 2,269

Other Interests - - - 42 - 42 42 - 42

Worldwide 1,452 1,821 1,755 518 228 556 1,970 2,049 2,311

2001

Consolidated Subsidiaries 1,371 1,962 1,698 482 106 499 1,853 2,068 2,197

Other Interests - - - 44 - 44 44 - 44

Worldwide 1,371 1,962 1,698 526 106 543 1,897 2,068 2,241

Worldwide Proven Reserves

(Million BOE)

GAAP RECONCILIATION

40

Consolidated Subsidiaries Other Interests Worldwide

OIL GAS BOE OIL GAS BOE OIL GAS BOE

United States 1,494 2,101 1,844 - - - 1,494 2,101 1,844

Qatar 237 668 348 - - - 237 668 348

Ecuador 104 - 104 - - - 104 - 104

Oman 46 100 63 - - - 46 100 63

Colombia 67 - 67 (9) - (9) 58 - 58

Russia - - - 49 - 49 49 - 49

Yemen 39 - 39 3 - 3 42 - 42

Pakistan 6 106 24 - - - 6 106 24

1,993 2,975 2,489 43 - 43 2,036 2,975 2,532

2004 Proven Reserves by Country

(Million BOE)

GAAP RECONCILIATION

41

(Million BOE) Consolidated Subsidiaries Other Interests Worldwide

OIL GAS BOE OIL GAS BOE OIL GAS BOE

PRODUCTION

2000 117 259 160 8 - 8 125 259 168

2001 124 241 164 9 - 9 133 241 173

2002 �� 142 229 180 8 - 8 150 229 188

2003 153 221 190 10 - 10 163 221 200

2004 159 233 198 9 - 9 168 233 207

Proved Reserve Additions

2000 1,041 777 1,170 - - - 1,041 777 1,170

2001 219 100 236 8 - 8 227 100 244

2002 221 216 257 6 - 6 227 216 263

2003 223 766 351 16 9 18 23 775 368

2004 162 624 266 4 (9) 2 166 615 268

Worldwide Production and Proved

Reserve Additions

GAAP RECONCILIATION

42

(Million BOE) Consolidated Subsidiaries Other Interests Worldwide

OIL GAS BOE OIL GAS BOE OIL GAS BOE

2004

Revisions 5 241 45 5 (9) 3 10 232 48

Improved Recovery 88 185 120 1 - 1 89 185 121

Extensions and Discoveries 30 191 61 2 - - 2 32 191 63

Purchases 39 7 40 (4) - (4 ) 35 7 36

162 624 266 4 (9) 2 166 615 268

2003

Revisions (1) 44 6 6 - 6 5 44 12

Improved Recovery 85 70 97 4 9 6 89 79 102

Extensions and Discoveries 41 597 141 6 - 6 47 597 147

Purchases 98 55 107 - - - - 98 55 107

223 766 351 16 9 18 239 775 368

2002

Revisions 13 (54) 4 (1 ) - (1) 12 (54) 3

Improved Recovery 112 151 137 5 - - 5 117 151 142

Extensions and Discoveries 40 50 - - - - - 40 60 50

Purchases 56 59 66 2 - 2 58 9 68

221 216 257 �� 6 - 6 227 216 263

2001

Revisions 21 (49) 13 8 - 8 29 (49) 21

Improved Recovery 139 23 143 - - - - 139 23 143

Extensions and Discoveries 56 122 76 - - - - 56 122 76

Purchases 3 4 4 - - - 3 4 4

219 100 236 8 - 8 227 100 244

2000

Revisions 62 223 99 1 - 1 63 223 100

Improved Recovery 42 25 46 - - - - 42 25 46

Extensions and Discoveries 37 112 56 (1) - (1 ) 36 112 55

Purchases 900 417 969 - - - - 900 417 969

1,041 777 1,170 - - - 1,041 777 1,170

Sources of Worldwide Proved

Reserve Additions

GAAP RECONCILIATION

43

2004

Occidental Petroleum Consolidated Statement of Cash Flows

Cash flow from operating activities $ 3,878

Cash flow from investing activities (2,288)

Cash flow from financing activities (824)

Consolidated Other

Subsidiaries Interests Worldwide

FAS 69 GAAP Oil & Gas results of operations $ 2,781 $ 50 $ 2,831

Depreciation, depletion & amortization 1,040 12 1,052

Exploration expense 214 1 215

Capital expenditures (excluding acquisitions) (1,596) (11) (1,607)

Cash flow from operations $ 2,439 $ 52 $ 2,491

Sales volumes (million BOE) 206.83

Cash flow per BOE $ 12.04

Oil & Gas: Cash Flow

($ Millions, except $/BOE)

44

Annual Average

2002 - 2004

Occidental Petroleum Consolidated Statement of Cash Flows

Cash flow from operating activities $ 3,017

Cash flow from investing activities (2,002)

Cash flow from financing activities (599)

Change in cash $ 416

Annual Average 2002 - 2004

Consolidated Other

Subsidiaries Interests Worldwide

FAS 69 GAAP Oil & Gas results of operations $ 2,095 $ 26 $ 2,121

Depreciation, depletion & amortization 933 14 947

Exploration expense 176 0 176

Capital expenditures (excluding acquisitions) (1,272) (9) (1,281)

Cash flow from operations $ 1,932 $ 31 $ 1,963

Sales volumes (million BOE) 200.15

Cash flow per BOE $ 9.81

Oil & Gas: Cash Flow

($ Millions, except $/BOE)

GAAP RECONCILIATION

45

December 31 June 30 2005

2004 2005 Annualized

GAAP measure – earnings applicable $ 2,568 $ 2,382

to common shareholders

Interest expense 239 108

Tax effect of interest expense (84) (38)

Earnings before tax-effected interest expense $ 2,723 2,452

GAAP stockholders’ equity $10,550 $ 12,706

Debt

GAAP debt

Debt, including current maturities $ 3,804 $ 3,360

Non-GAAP debt

Capital lease obligation 26 26

Subsidiary preferred stock 75 75

Total debt $ 3,905 $ 3,461

Total capital employed $ 14,455 $ 16,167

RETURN ON CAPITAL EMPLOYED (ROCE) (%) 20.2 16.0 32.0

Return on Capital Employed (ROCE)

($ Millions)

GAAP RECONCILIATION

46