EXHIBIT 99.2

Occidental Petroleum Corporation

October 14, 2005

Acquisition of

Vintage Petroleum, Inc.

1

Why Vintage?

Strategic fit

Growth opportunities

Free cash flow generation

Asset rationalization

Cost savings

2

Transaction Summary

Consideration

0.42 Oxy shares per Vintage share (~28.7 Mm Oxy shares)

$20.00 cash per Vintage share (~$1,366 Mm)

Strategic Overlap

Financially Accretive

Annual Synergies - $40-60 Mm cost savings and exploration

capital savings of ~$100 Mm

Growth Opportunities

Argentina and California are the primary drivers

Planned Repurchase of 9 Mm Oxy shares

3

Transaction Summary

Consideration $Mm

0.42 x 68.3 Mm shares x $74.98/share $2,151

$20/share x 68.3 Mm shares 1,366

Debt assumed 550

Cash at closing (225)

Total consideration $3,842

Proved Reserves – 437 Mmboe(12/31/04)

Probable and Possible Reserves – 421 Mmboe(12/31/04)

2nd Qtr 2005 Production of ~76,000 Boepd

4

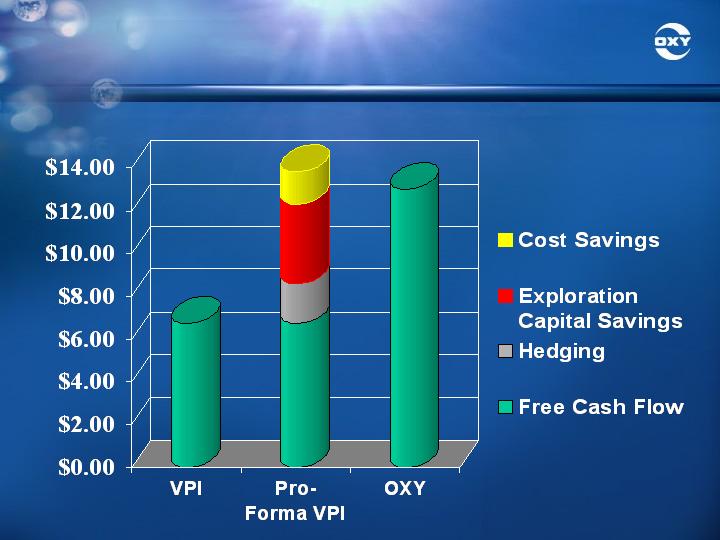

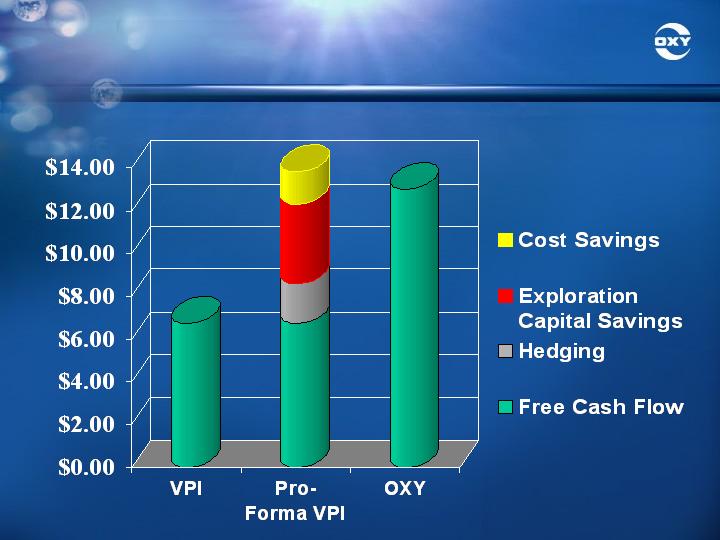

2005E Free Cash Flow

$/BOE

5

Strategic Overlap

Argentina

Significantly enhances Latin America

core area

22 concessions, mostly in the San Jorge

Basin

As of 12/31/04, ~217 Mmboe of proved

reserves, ~500 drilling locations (97%

historical drilling success rate)

Strong current production and expected

10-15% production growth over the next

few years driven by 3-D seismic

Effective export tax rate of ~27% at

$40.00 and ~31% at >$50

Multiple consolidation opportunities

10 Year average F&D costs: $2.87/Boe

Vintage Properties

Buenos Aires

6

Strategic Overlap

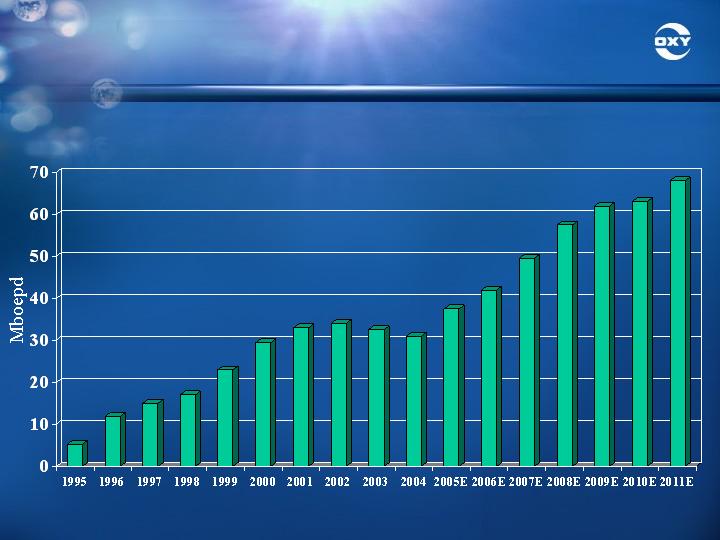

Argentina – Historical and Forecast Production Growth

7

Vintage Growth Opportunities

8

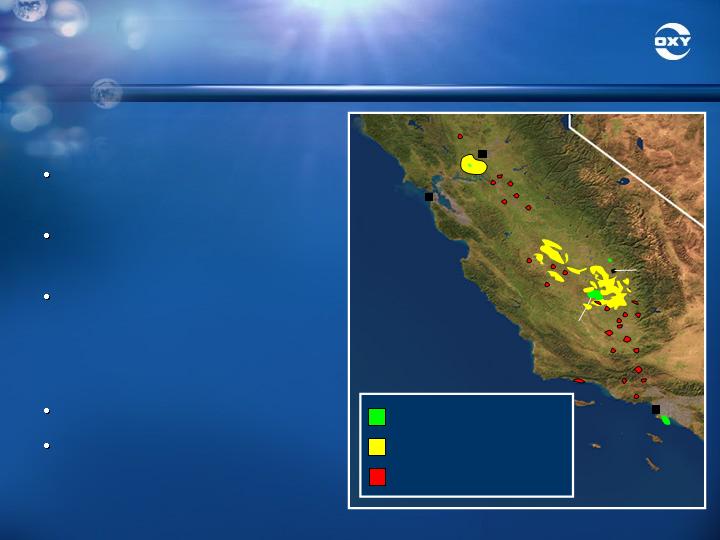

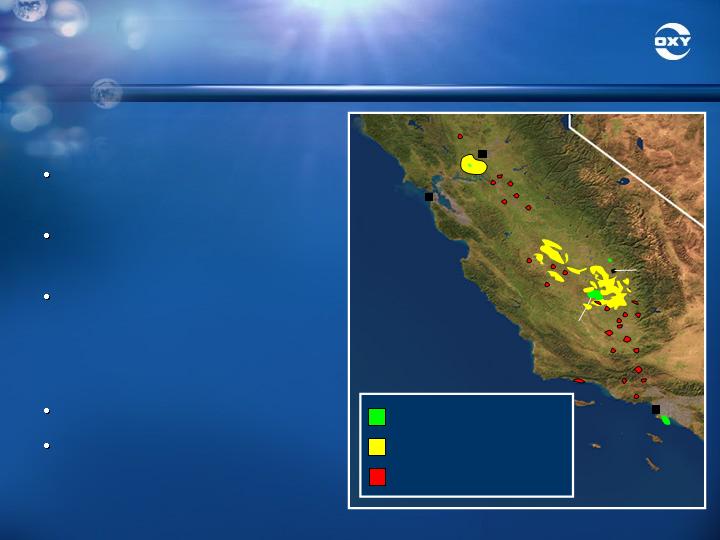

Strategic Overlap

California

Good strategic fit with existing

Oxy operations

~70 Mmboe of proved reserves

as of 12/31/04

Oxy sees significant

opportunity to increase

recovery on existing properties

(~20% over the next few years)

~11,000+ Boepd of production

Key fields are high quality

crude oil

Bakersfield

Elk Hills

Sacramento

San Francisco

Sacramento

Valley

Los Angeles

Oxy Producing Properties

Oxy Exploration Acreage

Vintage Properties

9

Strategic Overlap

Yemen

S-1 block is adjacent to

Occidental blocks

~6 Mmboe of proved

reserves as of 12/31/04

Capacity for 6,000+

Bopd of net production

Gulf of Aden

Red

Sea

Bir Ali

Sana’a

Salif

Aden

Masila

Ash Shihr

East Shabwa

Yemen

20

OXY EXPLORATION

OXY PRODUCTION

OIL FIELD

VINTAGE BLOCK

PIPELINE

10

Vintage – Other Properties

Bolivia – Intriguing potential, needs long term market

development

Candidates for portfolio rationalization

East Texas, Gulf Coast, Mid-Continent

Unconventional North American gas

~71 Mmboe of proved reserves as of 12/31/04

~19,000 Boepd of production

Divestitures expected to reduce purchase price per Boe

11

Transaction Value

Note: This slide is taken from VPI’s

analyst presentation at the UBS

conference in Las Vegas in May 2005.

$4,642

$3,849

Total

$64.10

$52.91

Net Asset Value Per Share

67.7

67.7

Fully Diluted Shares

$4,339

$3,582

Net Asset Value

(378)

(342)

Other balance sheet items

45

45

Gathering/Marketing, Sulfur assets

30

30

Unevaluated O&G Properties

198

166

Possible 20%

398

328

Probable 50%

$4,046

$3,355

Proved 100%

Reserves Pre-tax PV10%

$6.67

$5.83

NYMEX Gas Price (6 to 1 ratio)

$40

$35

NYMEX Oil Price

As of 12/31/04 ($Mm, except per share and hydrocarbon prices)

Note: The above is summarized for demonstration purposes

12

Contribution Analysis

VPI OXY

% of Enterprise Value 9% 91%

% of Market Value 5% 95%

LTM EBITDA 7% 93%

LTM Cash from Operations 6% 94%

Production (per Day)

Oil �� 11% 89%

Gas 16% 84%

Boe 12% 88%

Proved Reserves (Mmboe) 15% 85%

PDP Reserves (Mmboe) 13% 87%

Note: VPI numbers have been adjusted to take out hedging effects; without share buyback VPI’s Enterprise and

Market Value would be 11% and 7% respectively. Market and Enterprise values are at the deal value.

13

Occidental Pro-Forma Financials

2005

14.51

14.86

Cash Flow Per Share

$9.76

$9.79

Earnings per Share

Occidental

Stand-alone

Pro-Forma

Pro-forma: Consensus First Call Oxy 2005 estimate, including 9 Mm share buyback

14

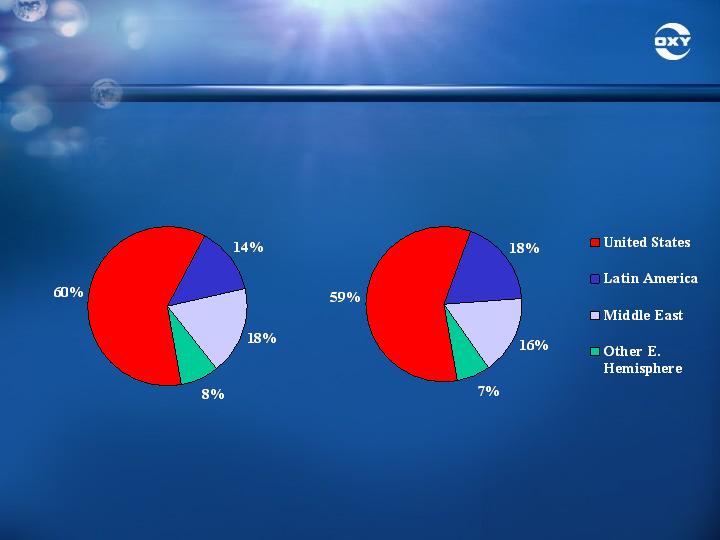

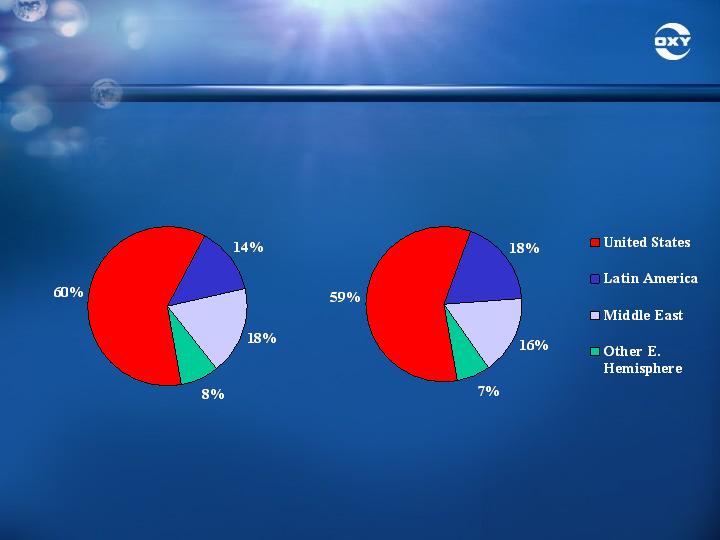

Pro-Forma Reserves by Country

Million BOE

1,982

348

58

63

49

47

24

US

Qatar

Yemen

Russia

Pakistan

Oman

Colombia

104

Ecuador

Proved reserves as of 12/31/04

217

Argentina

Bolivia

77

OXY

Vintage

Reserve Life of 12.7;

Total proved reserves

of 2,969 Mmboe

15

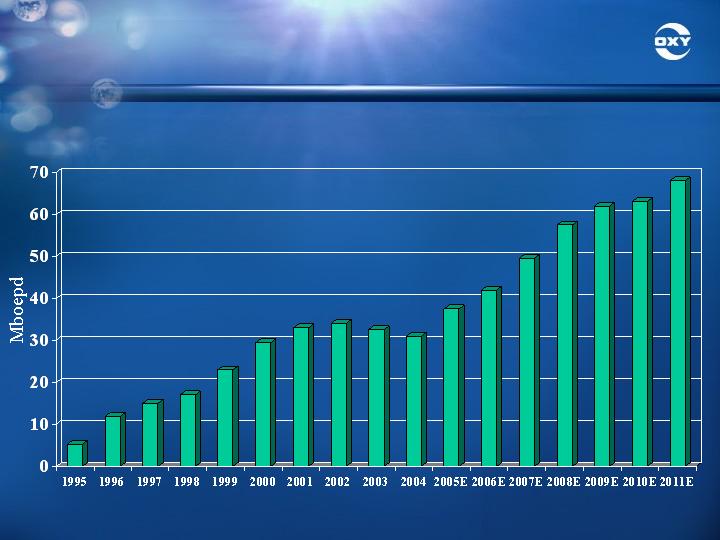

Worldwide Production

Note: Occidental + Vintage - No effects of rationalization

Occidental

Pro-Forma

16

Focused Value Creation Strategy

Maintain Strong Balance Sheet

Disciplined Capital Expenditure Program

Selective Acquisitions

Moderate Predictable Reserve/Production

Growth

Review Dividend Policy Annually

17

Occidental Petroleum Corporation

Additional Information and Where to Find It

Oxy will file a Form S-4, Vintage will file a proxy statement and both companies will file other relevant documents

concerning the proposed merger transaction with the Securities and Exchange Commission (SEC). INVESTORS ARE

URGED TO READ THE FORM S-4 AND PROXY STATEMENT WHEN THEY BECOME AVAILABLE AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

You will be able to obtain the documents free of charge at the website maintained by the SEC atwww.sec.gov. In

addition, you may obtain documents filed with the SEC by Oxy free of charge by contacting Christel Pauli, Counsel and

Assistant Secretary, Occidental Petroleum Corporation, at 10889 Wilshire Blvd., Los Angeles, California 90024. The

documents will also be available online at www.oxy.com.

Participants in Solicitation

Oxy, Vintage and their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from Vintage shareholders in connection with the merger. Information about the directors and executive officers

of Oxy and their ownership of Oxy stock is set forth in the proxy statement for Oxy 2005 Annual Meeting of Shareholders.

Information about the directors and executive officers of Vintage and their ownership of Vintage stock is set forth in the

proxy statement for Vintage’s 2005 Annual Meeting of Shareholders. Investors may obtain additional information

regarding the interests of such participants by reading the Form S-4 and proxy statement for the merger when they

become available.

Investors should read the Form S-4 and proxy statement carefully when they become available before making any voting

or investment decisions.

18

Occidental Petroleum Corporation

Forward-Looking Statements

The matters set forth in this presentation, including statements as to the expected benefits of the acquisition such as

efficiencies, cost savings, financial strength, and the competitive ability and position of the combined company, and other

statements identified by such words as “will,” “estimates,” “expects,” “hopes,” “projects,” “plans,” and similar expressions

are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could significantly affect

expected results, including a delay in or failure to obtain required approvals, the possibility that the anticipated benefits

from the acquisition cannot be fully realized, the possibility that costs or difficulties related to the integration will be

greater than expected, the ability to manage regulatory, tax and legal matters, including changes in tax rates, the impact

of competition, and other risk factors related to our industries as detailed in each of Oxy’s and Vintage’s reports filed with

the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Unless legally required, Oxy undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events or otherwise. Actual results may differ from those set

forth in the forward-looking statements.

The SEC limits the ability of oil and natural gas companies, in their filings with the SEC, to disclose reserves other than

proved reserves demonstrated by actual production or conclusive formation tests to be economically producible under

existing economic and operating conditions. We use certain terms in this press release, such as probable, possible and

recoverable reserves, that the SEC's guidelines limit in filings with the SEC.

Information contained in this presentation regarding Vintage’s production, reserves, results, assets and other information

has been taken from Vintage’s public filings with the SEC. Oxy makes no representation with respect to the accuracy of

this information.

19

20