EXHIBIT 99.1

June 2, 2006

Dr. Ray R. Irani

Chairman, President & Chief

Executive Officer

Sanford C. Bernstein Co., Inc.

22nd Annual Strategic Decisions

Conference 2006

Core Area Growth Projects

Large pipeline of growth projects

U.S.

California & Permian

Latin America

Argentina

Colombia

Middle East & North Africa

Libya

Oman

Qatar

United Arab Emirates

Yemen

2

Ecuador

Oxy filed arbitration claim against the Government

of Ecuador for illegally seizing assets

Claim filed with International Centre for Settlement of

Investment disputes under the U.S.-Ecuador Bilateral

Investment Treaty

Oxy requests the arbitration panel block third party

takeover of assets until claim is settled

3

Ecuador

Impact of expropriation

Net production averaged 44,000 barrels/day in

1st quarter 2006

7% of worldwide production of 636,000 BOE/day

Year-end 2005 proved reserves of 96 million

barrels

3% of proforma worldwide reserves, including

Vintage properties

Net PP&E @ 3/31/06 of about $400 million

2% of worldwide total

4

Ecuador

Since 1999

Oxy’s cash flow from the Block 15 operations

significantly exceeded its investment (net of

the Encana farmout)

Managing Risk

5

Production Growth Profile

Grow oil & gas production

Minimum volume growth of 5

percent

More likely growth of 7 – 10

percent

Maintain top quartile financial

returns

6

Oil & Gas ROCE *

WTI

($/Barrel)

Domestic

Returns

(%)

International

Returns

(%)

2005

56.56

26

40

2004

41.40

20

37

2003

31.03

16

30

2002

26.08

10

35

2001

25.97

17

23

* Net income divided by average capital employed.

7

Return Targets*

New Projects & Acquisitions

Domestic …………………...

15+%

International ……………….

20+%

* Assumes moderate product prices

8

Argentina

2005 production – 37,000

BOE/Day

2006 annualized

production – 41,000

BOE/Day

Inventory of 700 drilling

locations

2006: 145 wells

Ramp up in future years

Increase production to

70,000 BOE/Day by 2011

9

UAE / Qatar – Dolphin Project

Phase I

$4 billion gross capital

Oxy’s share 24.5%

First gas @ year-end

2006

Production ramp-up

in 2007

Estimated year-end

exit rate of 55,000

BOE/Day

10

Oman – Overview

Mukhaizna Overview

Discovered in 1975

2+ billion barrels of heavy oil

Previous peak production -

15,000 barrels/day

Transfer of operatorship

to Oxy & partners

3-4 years of technical work &

negotiation

11

Oman – Mukhaizna Project

Project Overview

Gross Capital – $3.5 Billion

1800+ wells

Central processing facility

Water treatment plant

Steam generation facilities

Pipelines

2006 Work Program

$450 – $500 MM (Gross)

Drill 65 – 85 wells

Initial steam injection

12

Oman – Additional Growth Potential

13

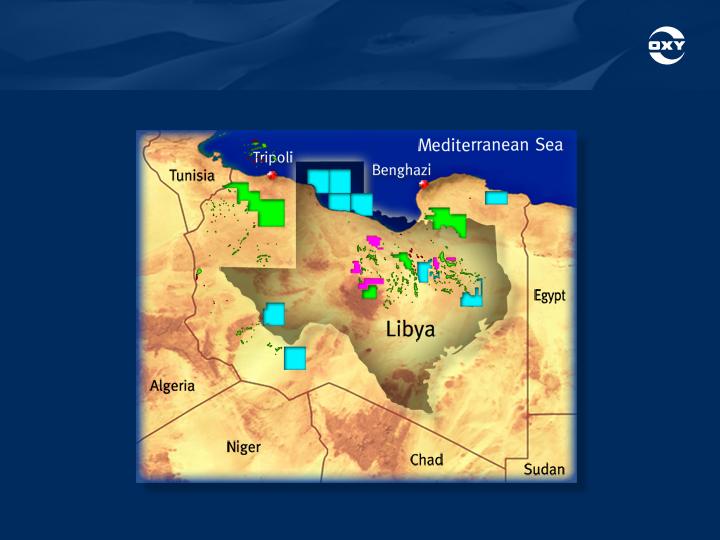

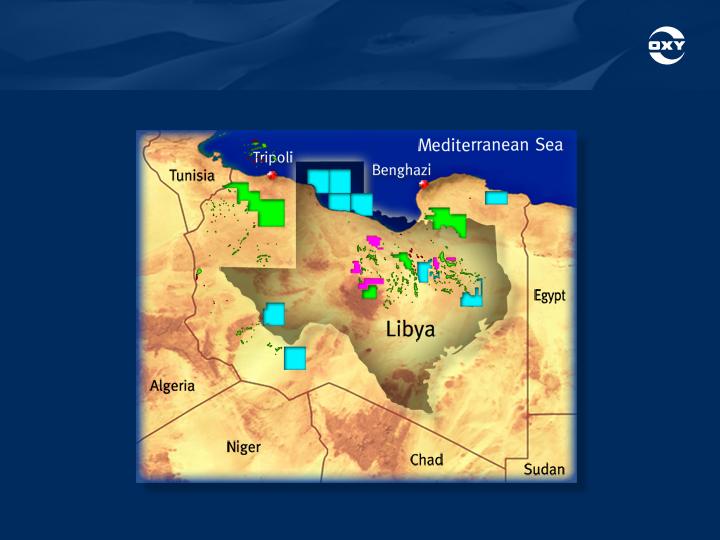

Oxy Libya Holdings

14

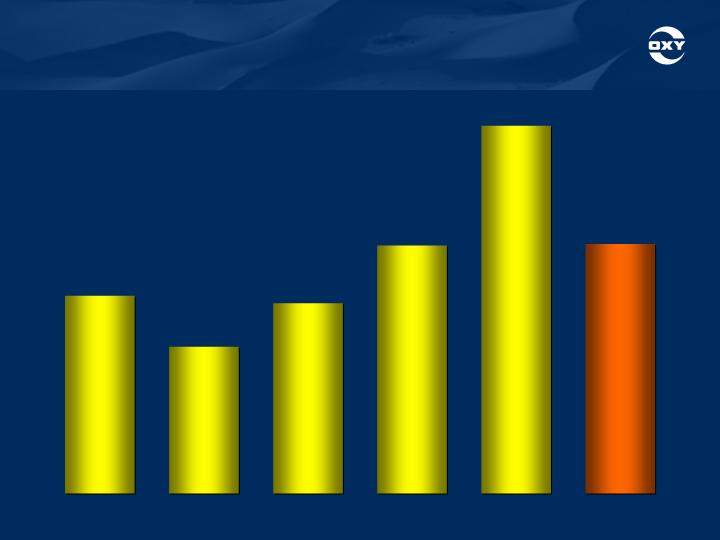

Oxy 2006 Exploration Program

35

36

52

59

59

106

124

131

163

15

Scope of Oxy Libya Projects

16

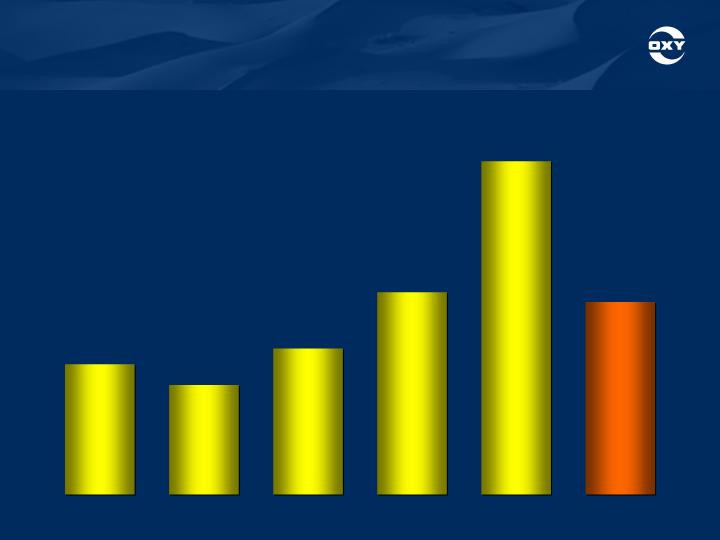

Worldwide Production Outlook

Does not depend on exploration success

Does not include future acquisitions

Does not include new EOR/development projects

Does not include swap/sale of mature non-

operated properties

Range reflects timing differences

17

Additional Growth Opportunities

Base Production ………………

New EOR/development projects

Middle East/North Africa ….

Latin America……………....

Exploration …………………….

Domestic acquisitions ………..

Mature non-operated …………

Total ……………………………

665 - 750

50 - 75

20 - 30

20 - 40

35 - 50

(20 - 30)

770 - 915

(Thousand BOE/Day)

Excludes Ecuador.

5.3%-8.5%

9.3%-14.8%

Growth Rate

Production

18

Competitive Advantages

Economies of scale

Infrastructure

Operating experience

Large technical data base

Strong regional relations

19

Top 10 Texas Oil Producers

2005 Gross Operated Production

(Thousand Barrels/Day)

174.5

OXY

56.7

CVX

56.5

KMI

30.7

APA

29.6

XOM

23.6

PXD

22.5

HES

21.9

XTO

20.4

APC

15.5

COP

20

Financial Policy

Continue to increase the dividend regularly

Reduce outstanding shares to a pre-Vintage

acquisition level of about 400 million shares

Keep debt levels low & maintain “A” credit

ratings

21

Conclusion - Focus on Key Metrics

Focus on key performance metrics that drive top

quartile financial returns

Continue to improve quality of assets

Grow reserves at a rate exceeding production

Keep finding & development costs low

Optimize profit/BOE

Optimize free cash flow/BOE

Maintain financial discipline

Maintain “A” credit rating

Achieve top quartile returns on equity & capital

employed

Generate top quartile total returns

22

Occidental Petroleum Corporation

Statements in this presentation that contain words such as "will," "expect" or "estimate," or otherwise

relate to the future, are forward-looking and involve risks and uncertainties that could significantly affect

expected results. Factors that could cause results to differ materially include, but are not limited to:

exploration risks such as drilling of unsuccessful wells, global commodity pricing fluctuations and

supply/demand considerations for oil, gas and chemicals; higher than expected costs; political risks;

changes in tax rates; unrealized acquisition benefits or higher than expected integration costs; and not

successfully completing (or any material delay in) any expansion, capital expenditure, acquisition or

disposition. You should not place undue reliance on these forward-looking statements which speak only

as of the date of this presentation. Unless legally required, Occidental does not undertake any obligation

to update any forward-looking statements as a result of new information, future events or otherwise. The

United States Securities and Exchange Commission (SEC) permits oil and natural gas companies, in their

filings with the SEC, to disclose only proved reserves demonstrated by actual production or conclusive

formation tests to be economically producible under existing economic and operating conditions. We use

certain terms in this presentation, such as probable, possible and recoverable reserves and oil in place,

that the SEC's guidelines strictly prohibit us from using in filings with the SEC. Additionally, the SEC

requires oil and natural gas companies, in their filings, to disclose non-financial statistical information

about their consolidated entities separately from such information about their equity holdings and not to

show combined totals. Certain information in this presentation is shown on a combined basis; however,

the information is disclosed separately in the Appendix. U.S investors are urged to consider carefully the

disclosure in our Form 10-K, available through 1-888-699-7383 or at www.oxy.com. You also can obtain a

copy from the SEC by calling 1-800-SEC-0330.

24

Appendix

25

Worldwide Oil & Gas Operations

Long Beach

Permian Basin

Horn Mountain

Hugoton

Elk Hills

Colombia

Libya

Russia

Pakistan

Oman

U.A.E.

Yemen

Qatar

.

.

.

Argentina

26

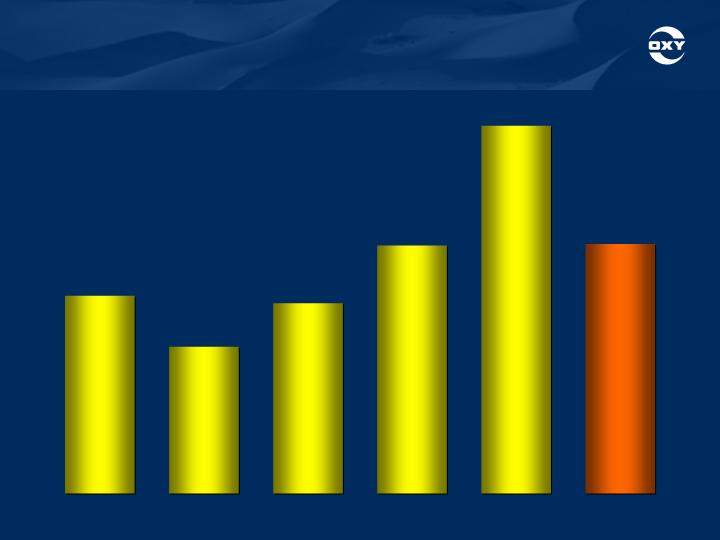

Return on Equity

Percentage

22

2001

17

2002

21

2003

28

2004

41

2005

28

5-Year

Average

See Appendix for GAAP reconciliation.

27

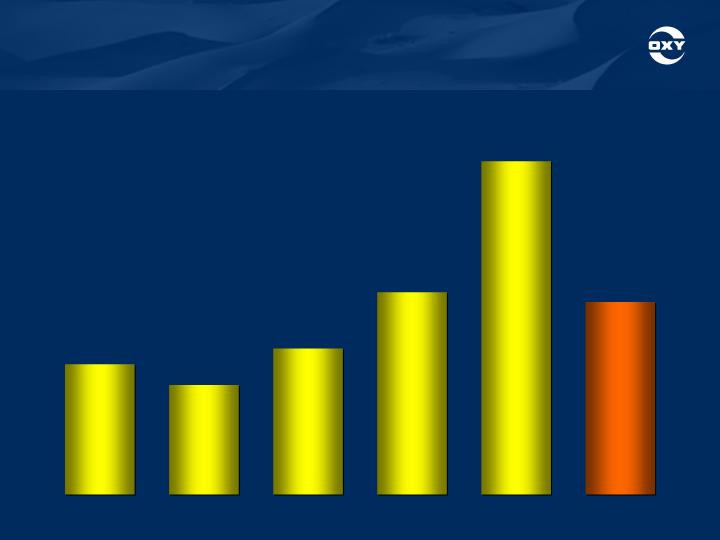

Return on Capital Employed

Percentage

2001

2002

2003

2004

5 Year

Average

13

11

15

20

33

2005

19

See Appendix for GAAP reconciliation.

28

Reserves Replacement

244

263

368

268

382

339

305

173

188

200

207

194

200

192

Worldwide

Reserve Additions

(Million BOE)

Worldwide

Production

(Million BOE)

2001

2002

2003

2004

2005

3-Year Average

5-Year Average

2005 excludes Ecuador. See Appendix for GAAP reconciliation.

29

Finding & Development Costs

1,171

1,223

1,584

1,785

4,283

2,551

2,009

244

263

368

268

382

339

305

Costs

Incurred

($ Millions)

Reserve

Additions

(Million BOE)

2001

2002

2003

2004

2005

3-Year Average

5-Year Average

2005 excludes Ecuador. See Appendix for GAAP reconciliation.

30

Finding & Development Costs

2005

2004

2003

2002

2001

3-Year Average

5-Year Average

2,103

1,631

1,216

1,031

1,089

1,650

1,414

2,180

154

368

192

82

901

595

4,283

1,785

1,584

1,223

1,171

2,551

2,009

49

91

77

84

93

65

70

Organic

Growth

Acquisitions

Total

Organic

(% Total)

Costs Incurred

($ Million)

382

268

368

263

244

339

305

Total

Reserve

Additions

(Million BOE)

2005 excludes Ecuador.

31

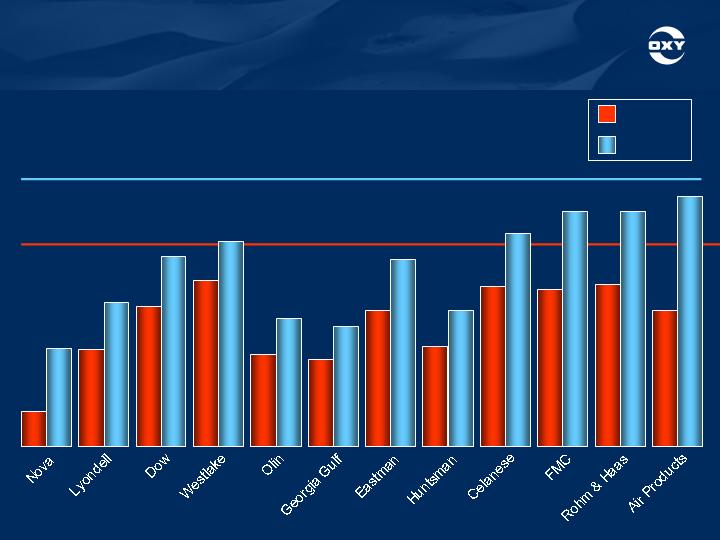

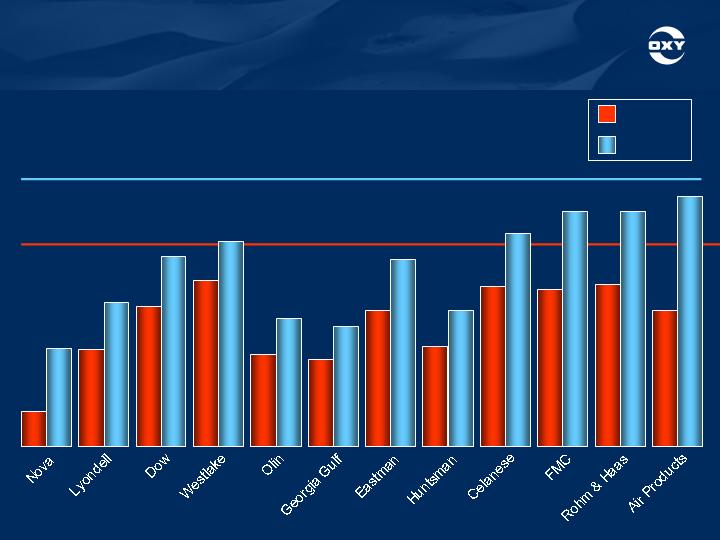

Chemical Companies Comparisons

OxyChem – 16.7

OxyChem – 22.2

8.0

11.6

2.9

14.0

7.6

7.2

8.2

13.9

11.8

13.0

13.4

11.2

EBIT

Percent of Sales

EBITDA

12.0

8.1

11.9

10.6

9.9

20.7

19.4

19.4

15.7

15.5

17.3

18.4

Excludes special items.

32

WORLDWIDE PRODUCTION

Reconciliation to Generally Accepted Accounting Principles (GAAP)

For the Quarter Ended March 31, 2006

| | Per Form 10Q | | Less: Ecuador | | Restated 2006 |

MBOE/D | OIL | GAS | BOE | | OIL | GAS | BOE | | OIL | GAS | BOE |

| | | | | | | | | | | | | | | | | | | | | |

California | 82 | | 250 | | 124 | | | - | | - | | - | | | 82 | | 250 | | 124 | |

Permian | 166 | | 133 | | 187 | | | - | | - | | - | | | 166 | | 133 | | 187 | |

Horn Mountain | 15 | | 10 | | 17 | | | - | | - | | - | | | 15 | | 10 | | 17 | |

Hugoton / Other | 3 | | 189 | | 36 | | | - | | - | | - | | | 3 | | 189 | | 36 | |

Total US | 266 | | 582 | | 363 | | | - | | - | | - | | | 266 | | 582 | | 363 | |

| | | | | | | | | | | | | | | | | | | | | |

Argentina | 24 | | 13 | | 26 | | | - | | - | | - | | | 24 | | 13 | | 26 | |

Bolivia | - | | 13 | | 2 | | | - | | - | | - | | | - | | 13 | | 2 | |

Colombia - 100% | 39 | | - | | 39 | | | - | | - | | - | | | 39 | | - | | 39 | |

Colombia - MI | (5 | ) | - | | (5 | ) | | - | | - | | - | | | (5 | ) | - | | (5 | ) |

Ecuador | 44 | | - | | 44 | | | (44 | ) | - | | (44 | ) | | - | | - | | - | |

Latin America | 102 | | 26 | | 106 | | | (44 | ) | - | | (44 | ) | | 58 | | 26 | | 62 | |

| | | | | | | | | | | | | | | | | | | | | |

Oman | 17 | | 25 | | 21 | | | - | | - | | - | | | 17 | | 25 | | 21 | |

Qatar | 44 | | - | | 44 | | | - | | - | | - | | | 44 | | - | | 44 | |

Libya | 22 | | - | | 22 | | | - | | - | | - | | | 22 | | - | | 22 | |

Yemen | 32 | | - | | 32 | | | - | | - | | - | | | 32 | | - | | 32 | |

Yemen - Comeco | 2 | | - | | 2 | | | - | | - | | - | | | 2 | | - | | 2 | |

Middle East / No Africa | 117 | | 25 | | 121 | | | - | | - | | - | | | 117 | | 25 | | 121 | |

| | | | | | | | | | | | | | | | | | | | | |

Pakistan | 4 | | 75 | | 17 | | | - | | - | | - | | | 4 | | 75 | | 17 | |

Vanyoganneft | 24 | | 28 | | 29 | | | - | | - | | - | | | 24 | | 28 | | 29 | |

Other Eastern | 28 | | 103 | | 45 | | | - | | - | | - | | | 28 | | 103 | | 45 | |

| | | | | | | | | | | | | | | | | | | | | |

Total International | | | | | 273 | | | | | | | (44 | ) | | | | | | 229 | |

| | | | | | | | | | | | | | | | | | | | | |

Worldwide | 513 | | 736 | | 636 | | | (44 | ) | - | | (44 | ) | | 469 | | 736 | | 592 | |

| | | | | | | | | | | | | | | | | | | | | |

Percentage of Total | | | | | | | | 7% | | | | | | | | | | | | |

Pro-forma Oil and Gas Net Proved Developed and Undeveloped Year-End Reserves

Reconciliation to Generally Accepted Accounting Principles (GAAP)

2005 Barrels of Oil Equivalent Basis ¹

| | OXY Annual Rpt | Less: Ecuador | OXY Restated | VPI Rounded | Total |

United States | | | | | | |

California - OXY | 659 | - | | 659 | - | 659 |

California - VPI | - | - | | - | 67 | 67 |

Permian | 1,211 | - | | 1,211 | - | 1,211 |

Other Domestic | 156 | - | | 156 | - | 156 |

Other Domestic - VPI (Keeper) | - | - | | - | 2 | 2 |

Total Domestic | 2,026 | - | | 2,026 | 69 | 2,095 |

| | | | | | | |

Latin America | | | | | | |

Argentina - VPI | - | - | | - | 219 | 219 |

Bolivia - VPI | - | - | | - | 51 | 51 |

Colombia | 43 | - | | 43 | - | 43 |

Colombia - minority interest | - | - | | - | - | - |

Ecuador | 96 | (96 | ) | - | - | - |

| | 139 | (96 | ) | 43 | 270 | 313 |

Middle East and North Africa | | | | | | |

Oman | 44 | - | | 44 | - | 44 |

Qatar | 396 | - | | 396 | - | 396 |

Yemen | 35 | - | | 35 | - | 35 |

Yemen - Oxy net interest | - | - | | - | - | - |

Yemen - VPI | - | - | | - | 5 | 5 |

United Arab Emirates | - | - | | - | - | - |

| | 475 | - | | 475 | 5 | 480 |

Other Eastern Hemisphere | | | | | | |

Pakistan | 19 | - | | 19 | - | 19 |

Russia - Oxy net interest | 48 | - | | 48 | - | 48 |

| | 67 | - | | 67 | - | 67 |

| | | | | | | |

Total International | 681 | (96 | ) | 585 | 275 | 860 |

Total Worldwide - Continuing Ops | 2,707 | (96 | ) | 2,611 | 344 | 2,955 |

VPI - Divestiture Assets | - | - | | - | 72 | - |

| | 2,707 | (96 | ) | 2,611 | 416 | 2,955 |

¹ Gas volumes converted at 6,000 cubic feet per barrel of oil.

Return on Capital Employed (ROCE)

($ Millions)

Reconciliation to Generally Accepted Accounting Principles (GAAP) | 2001 | 2002 | 2003 | 2004 | 2005 | | 5 Year Average |

GAAP measure - earnings applicable | 1,154 | | 989 | | 1,527 | | 2,568 | | 5,281 | | | 2,304 | |

to common shareholders | | | | | | | | | | | | | |

Interest expense | 392 | | 281 | | 295 | | 239 | | 201 | | | 282 | |

Tax effect of interest expense | (137 | ) | (98 | ) | (103 | ) | (84 | ) | (70 | ) | | (98 | ) |

Earnings before tax-effected interest expense | 1,409 | | 1,172 | | 1,719 | | 2,723 | | 5,412 | | | 2,487 | |

| | | | | | | | | | | | | |

GAAP average stockholders' equity | 5,634 | | 6,318 | | 7,929 | | 10,550 | | 15,032 | | | 8,373 | |

| | | | | | | | | | | | | |

Average Debt | | | | | | | | | | | | | |

GAAP debt | | | | | | | | | | | | | |

Notes payable | 54 | | - | | - | | - | | - | | | 9 | |

Non-recourse debt | - | | - | | - | | - | | - | | | 317 | |

Debt, including current maturities | 4,065 | | 4,203 | | 4,016 | | 3,804 | | 2,919 | | | 3,758 | |

Non-GAAP debt | | | | | | | | | | | | | |

Capital lease obligation | 26 | | 26 | | 26 | | 26 | | 25 | | | 26 | |

Subsidiary preferred stock | - | | 75 | | 75 | | 75 | | 75 | | | 50 | |

Gas sales agreements | 282 | | - | | - | | - | | - | | | 116 | |

Trust preferred securities | 463 | | 455 | | 453 | | - | | - | | | 307 | |

Average total debt | 4,890 | | 4,759 | | 4,570 | | 3,905 | | 3,019 | | | 4,583 | |

| | | | | | | | | | | | | |

Total average capital employed | 10,524 | | 11,077 | | 12,499 | | 14,455 | | 18,051 | | | 12,956 | |

| | | | | | | | | | | | | |

ROCE | 13.0 | | 10.9 | | 14.6 | | 20.2 | | 33.3 | | | 19.2 | |

Worldwide Production and Proved Reserve Additions

Million BOE

Reconciliation to Generally Accepted Accounting Principles (GAAP)

| Consolidated Subsidiaries | | Other Interests | | Worldwide |

| OIL | GAS | BOE | | OIL | GAS | BOE | | OIL | GAS | BOE |

PRODUCTION | | | | | | | | | | | | |

2001 | 124 | 241 | 164 | | 9 | - | | 9 | | 133 | 241 | 173 |

2002 | 142 | 229 | 180 | | 8 | - | | 8 | | 150 | 229 | 188 |

2003 | 153 | 221 | 190 | | 10 | - | | 10 | | 163 | 221 | 200 |

2004 | 159 | 233 | 198 | | 9 | - | | 9 | | 168 | 233 | 207 |

2005 (see restatement below) | 145 | 246 | 186 | | 7 | 6 | | 8 | | 152 | 252 | 194 |

Three-Year (2003 - 2005) Average | 152 | 233 | 191 | | 9 | 2 | | 9 | | 161 | 235 | 200 |

Five-Year (2001 - 2005) Average | 145 | 234 | 184 | | 9 | 1 | | 9 | | 153 | 235 | 192 |

| | | | | | | | | | | | |

Proved Reserve Additions | | | | | | | | | | | | |

2000 | 1,041 | 777 | 1,170 | | - | - | | - | | 1,041 | 777 | 1,170 |

2001 | 219 | 100 | 236 | | 8 | - | | 8 | | 227 | 100 | 244 |

2002 | 221 | 216 | 257 | | 6 | - | | 6 | | 227 | 216 | 263 |

2003 | 223 | 766 | 351 | | 16 | 9 | | 18 | | 239 | 775 | 368 |

2004 | 162 | 624 | 266 | | 4 | (9 | ) | 2 | | 166 | 615 | 268 |

2005 (see restatement below) | 247 | 752 | 372 | | 9 | 6 | | 10 | | 256 | 758 | 382 |

Three-Year (2003 - 2005) Average | 211 | 714 | 330 | | 10 | 2 | | 10 | | 220 | 716 | 339 |

Five-Year (2001 - 2005) Average | 214 | 492 | 296 | | 9 | 1 | | 9 | | 223 | 493 | 305 |

Note: 2005 has been restated to exclude Ecuador as follows:

PRODUCTION | | | | | | | | | | | | | | | |

2005 - per annual report | 158 | | 246 | 199 | | | 7 | 6 | 8 | | 165 | | 252 | 207 | |

Less: Ecuador | (13 | ) | - | (13 | ) | | - | - | - | | (13 | ) | - | (13 | ) |

2005 - restated | 145 | | 246 | 186 | | | 7 | 6 | 8 | | 152 | | 252 | 194 | |

| | | | | | | | | | | | | | | |

Proved Reserve Additions | | | | | | | | | | | | | | | |

2005 - per annual report | 255 | | 752 | 380 | | | 9 | 6 | 10 | | 264 | | 758 | 390 | |

Less: Ecuador | (8 | ) | - | (8 | ) | | - | - | - | | (8 | ) | - | (8 | ) |

2005 - restated | 247 | | 752 | 372 | | | 9 | 6 | 10 | | 256 | | 758 | 382 | |

Sources of Worldwide Proved Reserve Additions

Million BOE

Reconciliation to Generally Accepted Accounting Principles (GAAP)

| Consolidated Subsidiaries | | Other Interests | | Worldwide |

| OIL | GAS | BOE | | OIL | GAS | BOE | | OIL | GAS | BOE |

Three Year (2001-2005) Average | 211 | | 714 | | 330 | | | 10 | | 2 | | 10 | | | 220 | | 716 | | 339 | |

| | | | | | | | | | | | | | | | | | | | |

Five Year (2001-2005) Average | 214 | | 492 | | 296 | | | 9 | | 1 | | 9 | | | 223 | | 493 | | 305 | |

| | | | | | | | | | | | | | | | | | | | |

2005 | | | | | | | | | | | | | | | | | | | | |

Revisions | (18 | ) | 30 | | (13 | ) | | 8 | | 6 | | 9 | | | (10 | ) | 36 | | (4 | ) |

Improved Recovery | 107 | | 131 | | 129 | | | - | | - | | - | | | 107 | | 131 | | 129 | |

Extensions and Discoveries | 46 | | 427 | | 117 | | | 1 | | - | | 1 | | | 47 | | 427 | | 118 | |

Purchases | 112 | | 164 | | 139 | | | - | | - | | - | | | 112 | | 164 | | 139 | |

| 247 | | 752 | | 372 | | | 9 | | 6 | | 10 | | | 256 | | 758 | | 382 | |

| | | | | | | | | | | | | | | | | | | | |

2004 | | | | | | | | | | | | | | | | | | | | |

Revisions | 5 | | 241 | | 45 | | | 5 | | (9 | ) | 3 | | | 10 | | 232 | | 48 | |

Improved Recovery | 88 | | 185 | | 120 | | | 1 | | - | | 1 | | | 89 | | 185 | | 121 | |

Extensions and Discoveries | 30 | | 191 | | 61 | | | 2 | | - | | 2 | | | 32 | | 191 | | 63 | |

Purchases | 39 | | 7 | | 40 | | | (4 | ) | - | | (4 | ) | | 35 | | 7 | | 36 | |

| 162 | | 624 | | 266 | | | 4 | | (9 | ) | 2 | | | 166 | | 615 | | 268 | |

| | | | | | | | | | | | | | | | | | | | |

2003 | | | | | | | | | | | | | | | | | | | | |

Revisions | (1 | ) | 44 | | 6 | | | 6 | | - | | 6 | | | 5 | | 44 | | 12 | |

Improved Recovery | 85 | | 70 | | 97 | | | 4 | | 9 | | 6 | | | 89 | | 79 | | 102 | |

Extensions and Discoveries | 41 | | 597 | | 141 | | | 6 | | - | | 6 | | | 47 | | 597 | | 147 | |

Purchases | 98 | | 55 | | 107 | | | - | | - | | - | | | 98 | | 55 | | 107 | |

| 223 | | 766 | | 351 | | | 16 | | 9 | | 18 | | | 239 | | 775 | | 368 | |

| | | | | | | | | | | | | | | | | | | | |

2002 | | | | | | | | | | | | | | | | | | | | |

Revisions | 13 | | (54 | ) | 4 | | | (1 | ) | - | | (1 | ) | | 12 | | (54 | ) | 3 | |

Improved Recovery | 112 | | 151 | | 137 | | | 5 | | - | | 5 | | | 117 | | 151 | | 142 | |

Extensions and Discoveries | 40 | | 60 | | 50 | | | - | | - | | - | | | 40 | | 60 | | 50 | |

Purchases | 56 | | 59 | | 66 | | | 2 | | - | | 2 | | | 58 | | 59 | | 68 | |

| 221 | | 216 | | 257 | | | 6 | | - | | 6 | | | 227 | | 216 | | 263 | |

| | | | | | | | | | | | | | | | | | | | |

2001 | | | | | | | | | | | | | | | | | | | | |

Revisions | 21 | | (49 | ) | 13 | | | 8 | | - | | 8 | | | 29 | | (49 | ) | 21 | |

Improved Recovery | 139 | | 23 | | 143 | | | - | | - | | - | | | 139 | | 23 | | 143 | |

Extensions and Discoveries | 56 | | 122 | | 76 | | | - | | - | | - | | | 56 | | 122 | | 76 | |

Purchases | 3 | | 4 | | 4 | | | - | | - | | - | | | 3 | | 4 | | 4 | |

| 219 | | 100 | | 236 | | | 8 | | - | | 8 | | | 227 | | 100 | | 244 | |

Note: 2005 has been restated to exclude Ecuador as follows:

2005 - Per Annual Report | | | | | | | | | | | | | | | | | | | | |

Revisions | (26 | ) | 30 | | (21 | ) | | 8 | | 6 | | 9 | | | (18 | ) | 36 | | (12 | ) |

Improved Recovery | 117 | | 131 | | 139 | | | - | | - | | - | | | 117 | | 131 | | 139 | |

Extensions and Discoveries | 52 | | 427 | | 123 | | | 1 | | - | | 1 | | | 53 | | 427 | | 124 | |

Purchases | 112 | | 164 | | 139 | | | - | | - | | - | | | 112 | | 164 | | 139 | |

| 255 | | 752 | | 380 | | | 9 | | 6 | | 10 | | | 264 | | 758 | | 390 | |

| | | | | | | | | | | | | | | | | | | | |

Less: Ecuador | | | | | | | | | | | | | | | | | | | | |

Revisions | 8 | | - | | 8 | | | - | | - | | - | | | 8 | | - | | 8 | |

Improved Recovery | (10 | ) | - | | (10 | ) | | - | | - | | - | | | (10 | ) | - | | (10 | ) |

Extensions and Discoveries | (6 | ) | - | | (6 | ) | | - | | - | | - | | | (6 | ) | - | | (6 | ) |

Purchases | - | | - | | - | | | - | | - | | - | | | - | | - | | - | |

| (8 | ) | - | | (8 | ) | | - | | - | | - | | | (8 | ) | - | | (8 | ) |

| | | | | | | | | | | | | | | | | | | | |

2005 - Restated | | | | | | | | | | | | | | | | | | | | |

Revisions | (18 | ) | 30 | | (13 | ) | | 8 | | 6 | | 9 | | | (10 | ) | 36 | | (4 | ) |

Improved Recovery | 107 | | 131 | | 129 | | | - | | - | | - | | | 107 | | 131 | | 129 | |

Extensions and Discoveries | 46 | | 427 | | 117 | | | 1 | | - | | 1 | | | 47 | | 427 | | 118 | |

Purchases | 112 | | 164 | | 139 | | | - | | - | | - | | | 112 | | 164 | | 139 | |

| 247 | | 752 | | 372 | | | 9 | | 6 | | 10 | | | 256 | | 758 | | 382 | |

Costs Incurred

Million BOE

Reconciliation to Generally Accepted Accounting Principles (GAAP)

| Consolidated Subsidiaries | Other Interests | Worldwide | | Consolidated Subsidiaries | Other Interests | Worldwide |

Three Year (2003-2005) Average | 2,544 | 7 | | 2,551 | | | | | |

| | | | | | | | | |

Five Year (2001-2005) Average | 2,003 | 7 | | 2,009 | | | | | |

| | | | | | | | | |

Property acquisition costs | 2005 | | 2004 |

Proved properties | 1,782 | - | | 1,782 | | 158 | (12 | ) | 146 |

Unproved properties | 398 | - | | 398 | | 8 | - | | 8 |

Exploration costs | 245 | (2 | ) | 243 | | 158 | - | | 158 |

Development costs | 1,833 | 15 | | 1,848 | | 1,438 | 11 | | 1,449 |

Asset retirement costs | 12 | - | | 12 | | 25 | (1 | ) | 24 |

Costs incurred | 4,270 | 13 | | 4,283 | | 1,787 | (2 | ) | 1,785 |

| | | | | | | | | |

| | | | | | | | | |

Property acquisition costs | 2003 | | 2002 |

Proved properties | 364 | - | | 364 | | 163 | - | | 163 |

Unproved properties | 4 | - | | 4 | | 29 | - | | 29 |

Exploration costs | 98 | (1 | ) | 97 | | 134 | - | | 134 |

Development costs | 1,097 | 10 | | 1,107 | | 890 | 7 | | 897 |

Asset retirement costs | 12 | - | | 12 | | - | - | | - |

Costs incurred | 1,575 | 9 | | 1,584 | | 1,216 | 7 | | 1,223 |

| | | | | | | | | |

| | | | | | | | | |

Property acquisition costs | 2001 | | | | | |

Proved properties | 29 | - | | 29 | | | | | |

Unproved properties | 53 | - | | 53 | | | | | |

Exploration costs | 176 | (5 | ) | 171 | | | | | |

Development costs | 907 | 11 | | 918 | | | | | |

Asset retirement costs | - | - | | - | | | | | |

Costs incurred | 1,165 | 6 | | 1,171 | | | | | |

Note: 2005 has been restated to exclude Ecuador as follows:

2005 - Per Annual Report | | | | | | | | | |

Property acquisition costs | | | | | | | | | |

Proved properties | 1,782 | | - | | 1,782 | | | | |

Unproved properties | 398 | | - | | 398 | | | | |

Exploration costs | 257 | | (2 | ) | 255 | | | | |

Development costs | 1,920 | | 15 | | 1,935 | | | | |

Asset retirement costs | 12 | | - | | 12 | | | | |

Costs incurred | 4,369 | | 13 | | 4,382 | | | | |

| | | | | | | | | |

Less - Ecuador | | | | | | | | | |

Property acquisition costs | | | | | | | | | |

Proved properties | - | | - | | - | | | | |

Unproved properties | - | | - | | - | | | | |

Exploration costs | (12 | ) | - | | (12 | ) | | | |

Development costs | (87 | ) | - | | (87 | ) | | | |

Asset retirement costs | - | | - | | - | | | | |

Costs incurred | (99 | ) | - | | (99 | ) | | | |

| | | | | | | | | |

2005 - Restated | | | | | | | | | |

Property acquisition costs | | | | | | | | | |

Proved properties | 1,782 | | - | | 1,782 | | | | |

Unproved properties | 398 | | - | | 398 | | | | |

Exploration costs | 245 | | (2 | ) | 243 | | | | |

Development costs | 1,833 | | 15 | | 1,848 | | | | |

Asset retirement costs | 12 | | - | | 12 | | | | |

Costs incurred | 4,270 | | 13 | | 4,283 | | | | |

| | | | | | | | | |

Finding & Development Costs

Reconciliation to Generally Accepted Accounting Principles (GAAP)

| | | | | | Total |

| Costs Incurred ($ Millions) | | Reserve |

| Organic | | | Organic | | Additions |

| Growth | Acquisitions | Total | (% Total) | | (million boe) |

Three Year (2003-2005) Average | 1,650 | 901 | 2,551 | 65% | | 339 |

| | | | | | |

Five Year (2001-2005) Average | 1,414 | 595 | 2,009 | 70% | | 305 |

| | | | | | |

2005 | 2,103 | 2,180 | 4,283 | 49% | | 382 |

2004 | 1,631 | 154 | 1,785 | 91% | | 268 |

2003 | 1,216 | 368 | 1,584 | 77% | | 368 |

2002 | 1,031 | 192 | 1,223 | 84% | | 263 |

2001 | 1,089 | 82 | 1,171 | 93% | | 244 |

See detail of costs incurred and reserve additions by category in the GAAP reconciliations for costs incurred and source of worldwide reserve additions.

Note: 2005 has been restated to exclude Ecuador as follows:

2005 - Per Annual Report | 2,202 | | 2,180 | 4,382 | | 50% | | 390 | |

Less - Ecuador | (99 | ) | - | (99 | ) | | | (8 | ) |

2005 - Restated | 2,103 | | 2,180 | 4,283 | | 49% | | 382 | |

| | | | | | | | | |

Chemical - Percent of Sales

Reconciliation to Generally Accepted Accounting Principles (GAAP)

For the Year Ended December 31, 2005

Sales | | | |

Oil and Gas | 10,416 | | |

Chemical | 4,641 | | |

Other | 151 | | |

| 15,208 | | |

| | | |

Chemicals | $ AMT | | % of Sales |

Segment income | 607 | | |

Less: significant items affecting earnings | | | |

Hurricane insurance charges | 11 | | |

Write-off of plants | 159 | | |

Core earnings - EBIT | 777 | | 16.7% |

DD&A expense | 251 | | |

EBITDA | 1,028 | | 22.2% |