Fourth Quarter 2006 Earnings - 1Q07 Outlook

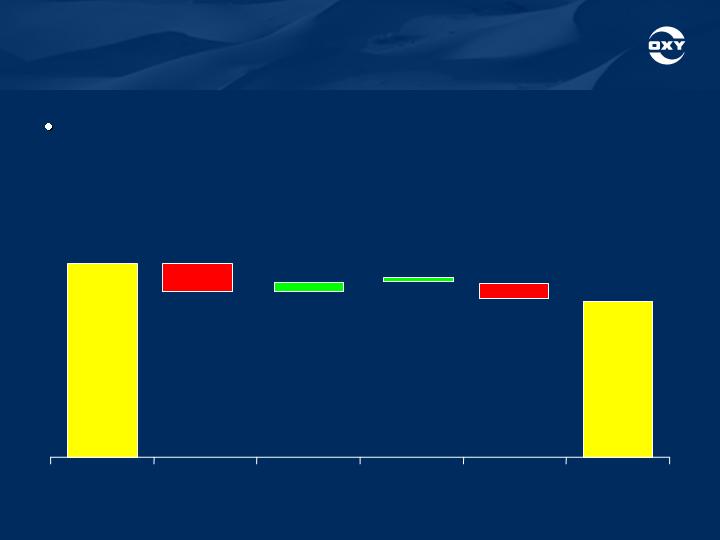

Expect Total Capex for 2007 of about $3.3 to $3.4 Billion.

Oil & Gas accounting for approximately 90 percent.

Year-to-year increase in capex is due to the Oman Mukhaizna project,

development of the Vintage acquisition properties in Argentina and

California, the exploratory activity in Libya, and a Permian gas plant and CO2 expansion.

Increases partly offset by lower expenditures for the Dolphin project which

will start-up later this year.

Expect 1Q07 Chemical Earnings to be similar to 4Q06 results.

Volume in January expected to remain weak with continuing improvement in

February and March.

We currently expect improvement from these levels in subsequent quarters.

Expect Interest Expense to be about $15 million.

Excludes charges for the recently announced debt reduction tender.

Fourth Quarter 2006 Earnings - 1Q07 Outlook

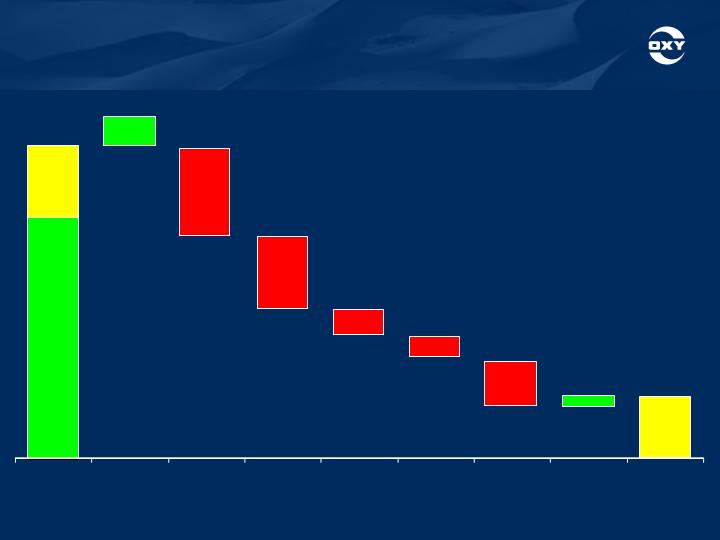

Commodity Price Sensitivity

A $1.00 per barrel change in oil prices impacts oil and gas quarterly earnings by

about $38 million (pre-tax). The WTI price in 4Q06 was $60.20 per barrel, compared

to the current price of approx. $53 per barrel. This $7 a barrel WTI price drop is

expected to reduce Oil & Gas segment income by $265 million.

A change of 25-cents per million BTUs in gas prices has a $12 million impact on

quarterly earnings (pre-tax). The NYMEX gas price for 4Q06 was $6.27 per mcf.

Our realized 4Q06 domestic gas price averaged $5.64 per mcf.

We expect DD&A to be $2.4 billion for full-year 2007.

We expect our effective worldwide tax rate in 1Q07 to be

about 49%.

Higher taxes are due to an increase in the proportion of income outside the US.

14

Fourth Quarter 2006 Earnings

See the investor relations supplemental schedules for the reconciliation of non-

GAAP items. Statements in this presentation that contain words such as "will",

"expect" or "estimate", or otherwise relate to the future, are forward-looking and

involve risks and uncertainties that could materially affect expected

results. Factors that could cause results to differ materially include, but are not

limited to: exploration risks, such as drilling of unsuccessful wells; global

commodity pricing fluctuations and supply/demand considerations for oil, gas

and chemicals; higher-than-expected costs; political risk; and not successfully

completing (or any material delay in) any expansion, capital expenditure,

acquisition, or disposition. You should not place undue reliance on these

forward-looking statements which speak only as of the date of this filing. Unless

legally required, Occidental disclaims any obligation to update any forward-

looking statements as a result of new information, future events or

otherwise. U.S. investors are urged to consider carefully the disclosure in our

Form 10-K, available through the following toll-free telephone number, 1-888-

OXYPETE (1-888-699-7383) or on the Internet at http://www.oxy.com. You also

can obtain a copy from the SEC by calling 1-800-SEC-0330.

15