Third Quarter 2007 Earnings - 4Q07 Outlook

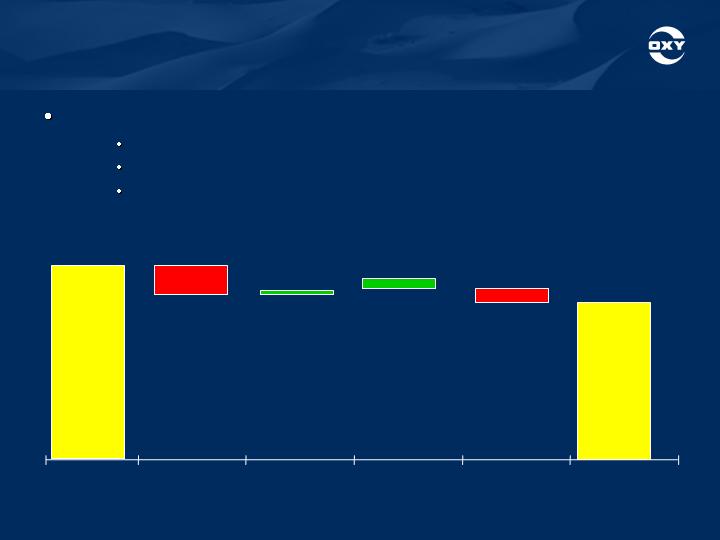

Difficulty of predicting interim period tax rates is due to:

Interim period rates are based on projected total year income and taxes;

Oxy’s tax rate is sensitive to changes in oil and gas prices and foreign

expensed exploration;

Changes in oil prices have an inverse effect on income tax rates;

Rising oil prices increases the proportion of US income which has lower

income tax rates than our international operations;

Oxy generally records no tax benefit on foreign expensed exploration

until the project is completely abandoned.

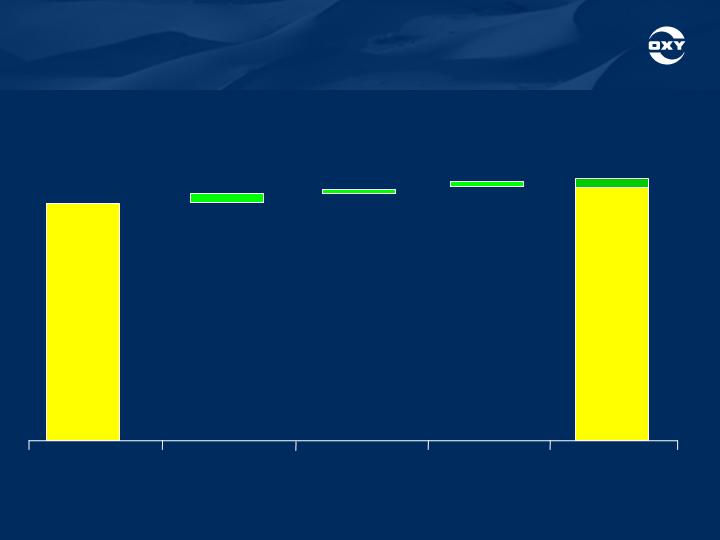

We expect 4Q07 foreign exploration expense, which is

not currently tax deductible, to be ~ $70 mm.

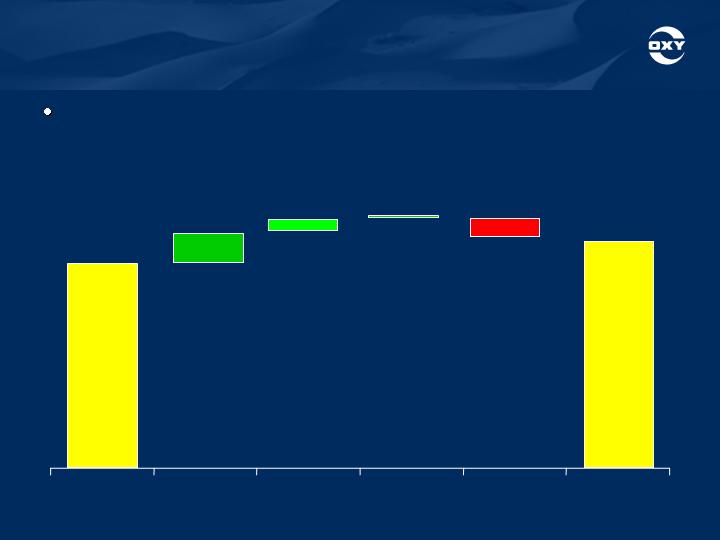

The 4Q07 worldwide tax rate before this exploration

expense is expected to be ~ 45%.

We expect our combined worldwide 4Q07 tax rate,

including exploration expense, to be ~ 46%.

Third Quarter 2007 Earnings

See the investor relations supplemental schedules for the reconciliation of non-

GAAP items. Statements in this presentation that contain words such as "will",

"expect" or "estimate", or otherwise relate to the future, are forward-looking and

involve risks and uncertainties that could materially affect expected

results. Factors that could cause results to differ materially include, but are not

limited to: exploration risks, such as drilling of unsuccessful wells; global

commodity pricing fluctuations and supply/demand considerations for oil, gas

and chemicals; higher-than-expected costs; political risk; and not successfully

completing (or any material delay in) any expansion, capital expenditure,

acquisition, or disposition. You should not place undue reliance on these

forward-looking statements which speak only as of the date of this presentation.

Unless legally required, Occidental disclaims any obligation to update any

forward-looking statements as a result of new information, future events or

otherwise. U.S. investors are urged to consider carefully the disclosure in our

Form 10-K, available through the following toll-free telephone number, 1-888-

OXYPETE (1-888-699-7383) or on the Internet at http://www.oxy.com. You also

can obtain a copy from the SEC by calling 1-800-SEC-0330.

18

Occidental Petroleum Corporation | | | | | |

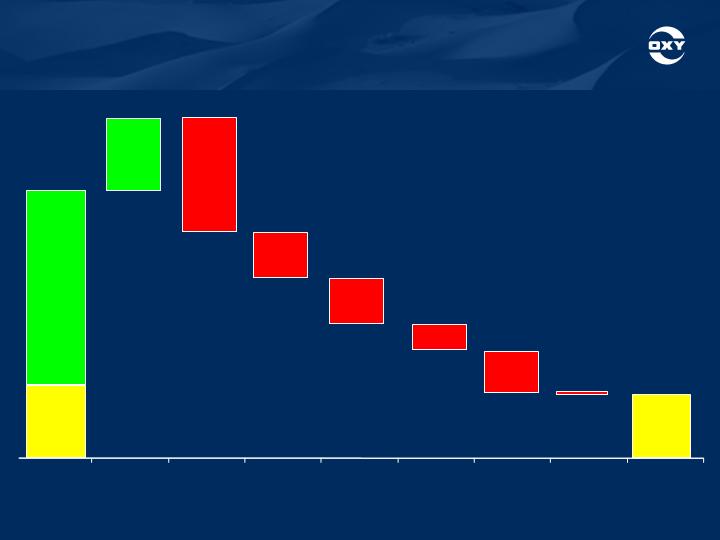

Return on Capital Employed (% ) | | | | | |

($ Millions) | | | Nine | | |

| | | Months | | Annualized |

Reconciliation to Generally Accepted Accounting Principles (GAAP) | | 2006 | 2007 | | 2007 |

GAAP measure - earnings applicable to common shareholders | | 4,191 | 3,948 | | |

Interest expense | | 131 | 186 | | |

Tax effect of interest expense | | (46) | (65) | | |

Earnings before tax-effected interest expense | | 4,276 | 4,069 | | |

GAAP stockholders' equity | | 19,252 | 21,901 | | |

DEBT | | | | | |

GAAP debt | | | | | |

Debt, including current maturities | | 2,790 | 1,904 | | |

Non-GAAP debt | | | | | |

Capital lease obligation | | 25 | 25 | | |

Subsidiary preferred stock | | 75 | 75 | | |

Total debt | | 2,890 | 2,004 | | |

Total capital employed | | 22,142 | 23,905 | | |

Return on Capital Employed (%) | | 21.2 | 17.7 | | 23.6 |