First Quarter 2008 Earnings –

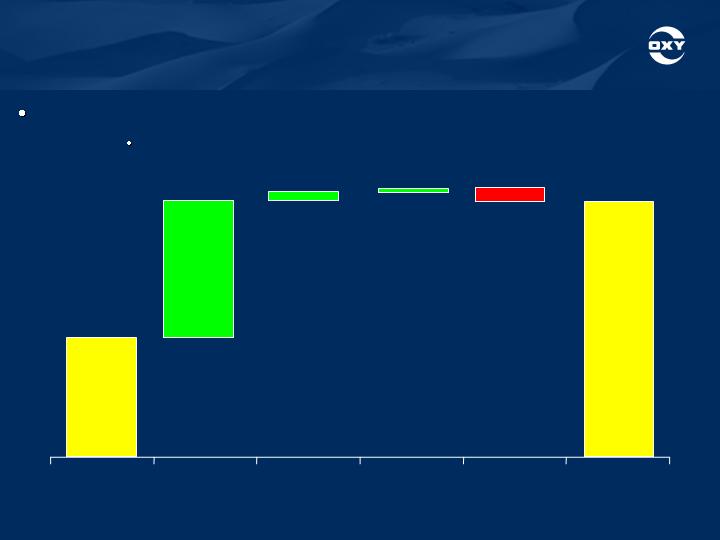

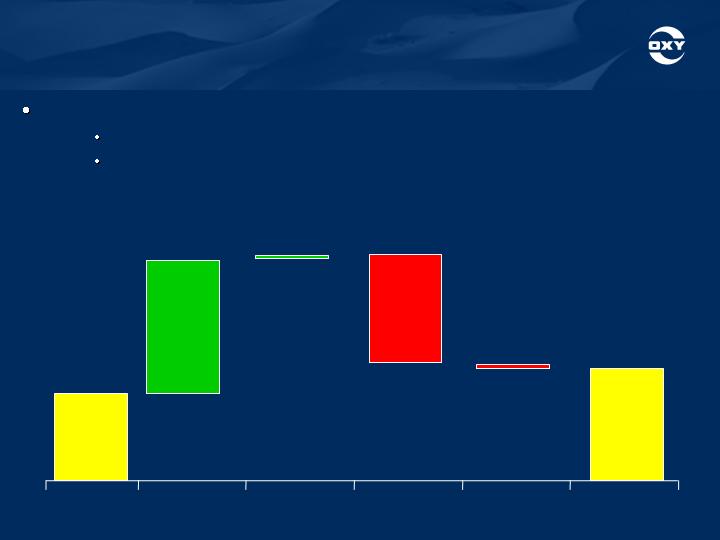

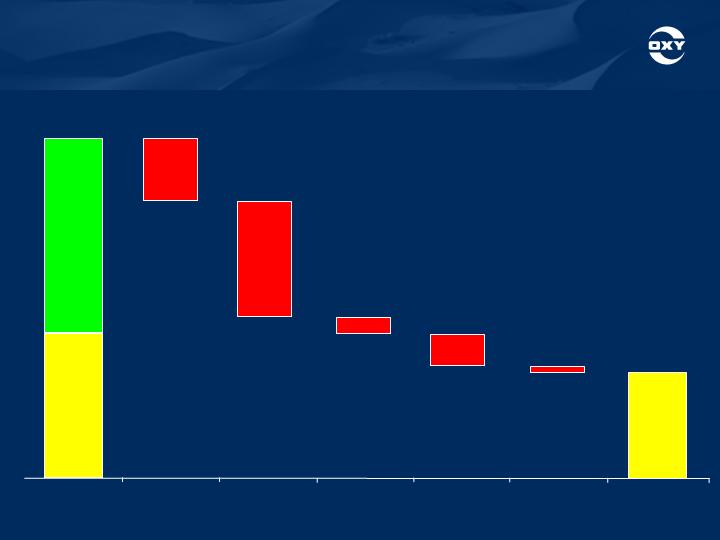

Midstream, Marketing and Other

Midstream assets reclassified out of the Oil and Gas segment

The assets are comprised of the following businesses:

•

Marketing – Oxy’s marketing group markets our equity production and manages third party transactions. The primary drivers of these earnings are marketing and trading margins in oil and gas, transportation and storage programs.

•

Gas processing plants – Oxy’s domestic wet gas production and third party production is processed through 13 Permian and 2 other gas plants to extract NGLs and deliver dry gas to the pipelines. The primary driver for margins and cash flows is the difference between inlet costs of natural gas and market prices for NGLs and inlet volumes processed.

•

Pipelines – In the Permian basin, Oxy owns an oil-gathering, common carrier pipeline company with approximately 2,750 miles of pipeline, and a storage system with 5 mm barrels of active storage. The main margin and cash flow drivers are volumes shipped. Oxy also owns a 24.5% equity interest in the Dolphin Pipeline, which carries gas to markets in the UAE.

•

Power generation – Oxy owns 2 cogen plants, one in TX and one in LA, and an equity investment in a gas-fired power plant at Elk Hills. The three plants have combined electricity capacity to produce 1,768 megawatts per hour.

•

CO2 source fields and facilities – CO2 is processed and transported from the Permian Basin for use in Oxy’s EOR program, and the earnings represent the small volume sold to 3rd parties.