| Item 8 | Financial Statements and Supplementary Data |

Management's Annual Assessment of and Report on Internal Control Over Financial Reporting

The management of Occidental Petroleum Corporation and subsidiaries (Occidental) is responsible for establishing and maintaining adequate internal control over financial reporting. Occidental’s system of internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles. Occidental’s internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of Occidental’s assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that Occidental’s receipts and expenditures are being made only in accordance with authorizations of Occidental’s management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of Occidental’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management has assessed the effectiveness of Occidental’s internal control system as of December 31, 2009 based on the criteria for effective internal control over financial reporting described in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on this assessment, management believes that, as of December 31, 2009, Occidental’s system of internal control over financial reporting is effective.

Occidental’s independent auditors, KPMG LLP, have issued an audit report on Occidental’s internal control over financial reporting.

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements

To the Board of Directors and Stockholders

Occidental Petroleum Corporation:

We have audited the accompanying consolidated balance sheets of Occidental Petroleum Corporation and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of income, stockholders’ equity, comprehensive income and cash flows for each of the years in the three-year period ended December 31, 2009. In connection with our audits of the consolidated financial statements, we also have audited the accompanying financial statement schedule. These consolidated financial statements and financial statement schedule are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Occidental Petroleum Corporation and subsidiaries as of December 31, 2009 and 2008, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2009, in conformity with U.S. generally accepted accounting principles. Also in our opinion, the related financial statement schedule, when considered in relation to the basic consolidated financial statements taken as a whole, presents fairly, in all material respects, the information set forth therein.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2009, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 25, 2010 expressed an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting.

/s/ KPMG LLP

Los Angeles, California

February 25, 2010

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting

To the Board of Directors and Stockholders

Occidental Petroleum Corporation:

We have audited Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2009, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Annual Assessment of and Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, Occidental Petroleum Corporation and its subsidiaries maintained, in all material respects, effective internal control over financial reporting as of December 31, 2009, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Occidental Petroleum Corporation and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of income, stockholders’ equity, comprehensive income and cash flows for each of the years in the three-year period ended December 31, 2009, and our report dated February 25, 2010 expressed an unqualified opinion on those consolidated financial statements.

/s/ KPMG LLP

Los Angeles, CaliforniaFebruary 25, 2010

| Consolidated Statements of Income | Occidental Petroleum Corporation | |

| In millions, except per-share amounts | and Subsidiaries | |

| For the years ended December 31, | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | |

| revenues and other income | | | | | | | | | | |

| Net sales | | $ | 15,403 | | $ | 24,217 | | $ | 18,784 | |

| Interest, dividends and other income | | | 118 | | | 236 | | | 355 | |

| Gains on disposition of assets, net | | | 10 | | | 27 | | | 874 | |

| | | | | | | | | | | |

| | | | 15,531 | | | 24,480 | | | 20,013 | |

| | | | | | | | | | | |

| costs and other deductions | | | | | | | | | | |

| Cost of sales (excludes depreciation, depletion and amortization of | | | | | | | | | | |

| $3,067 in 2009, $2,664 in 2008 and $2,338 in 2007) | | | 5,360 | | | 7,423 | | | 6,454 | |

| Selling, general and administrative and other operating expenses | | | 1,350 | | | 1,257 | | | 1,320 | |

| Depreciation, depletion and amortization | | | 3,117 | | | 2,710 | | | 2,379 | |

| Taxes other than on income | | | 433 | | | 588 | | | 414 | |

| Environmental remediation | | | 25 | | | 28 | | | 107 | |

| Exploration expense | | | 267 | | | 327 | | | 364 | |

| Charges for impairments | | | 170 | | | 647 | | | 58 | |

| Interest and debt expense, net | | | 140 | | | 129 | | | 339 | |

| | | | | | | | | | | |

| | | | 10,862 | | | 13,109 | | | 11,435 | |

| | | | | | | | | | | |

| income before income taxes and other items | | | 4,669 | | | 11,371 | | | 8,578 | |

| Provision for domestic and foreign income taxes | | | 1,918 | | | 4,629 | | | 3,507 | |

| Income from equity investments | | | (227 | ) | | (213 | ) | | (82 | ) |

| | | | | | | | | | | |

| income from continuing operations | | | 2,978 | | | 6,955 | | | 5,153 | |

| Discontinued operations, net | | | (12 | ) | | 18 | | | 322 | |

| | | | | | | | | | | |

| net income | | | 2,966 | | | 6,973 | | | 5,475 | |

| Less: Net income attributable to noncontrolling interest | | | (51 | ) | | (116 | ) | | (75 | ) |

| | | | | | | | | | | |

| net income attributable to common stock | | $ | 2,915 | | $ | 6,857 | | $ | 5,400 | |

| | | | | | | | | | | |

basic earnings per common share (attributable to common stock) | | | | | | | | | | |

| Income from continuing operations | | $ | 3.60 | | $ | 8.35 | | $ | 6.06 | |

| Discontinued operations, net | | | (0.01 | ) | | 0.02 | | | 0.39 | |

| | | | | | | | | | | |

| basic earnings per common share | | $ | 3.59 | | $ | 8.37 | | $ | 6.45 | |

| | | | | | | | | | | |

diluted earnings per common share (attributable to common stock) | | | | | | | | | | |

| Income from continuing operations | | $ | 3.59 | | $ | 8.32 | | $ | 6.03 | |

| Discontinued operations, net | | | (0.01 | ) | | 0.02 | | | 0.39 | |

| | | | | | | | | | | |

| diluted earnings per common share | | $ | 3.58 | | $ | 8.34 | | $ | 6.42 | |

| | | | | | | | | | | |

| dividends per common share | | $ | 1.31 | | $ | 1.21 | | $ | 0.94 | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

| Consolidated Balance Sheets | Occidental Petroleum Corporation | |

| In millions | and Subsidiaries | |

| Assets at December 31, | | 2009 | | 2008 | |

| | | | | | | | |

| current assets | | | | | | | |

| | | | | | | | |

| Cash and cash equivalents | | $ | 1,230 | | $ | 1,777 | |

| | | | | | | | |

| Trade receivables, net of reserves of $30 in 2009 and $45 in 2008 | | | 4,142 | | | 3,117 | |

| | | | | | | | |

| Marketing and trading assets and other | | | 1,203 | | | 1,012 | |

| | | | | | | | |

| Inventories | | | 1,081 | | | 958 | |

| | | | | | | | |

| Prepaid expenses and other | | | 430 | | | 308 | |

| | | | | | | | |

| Total current assets | | | 8,086 | | | 7,172 | |

| | | | | | | | |

| investments in unconsolidated entities | | | 1,732 | | | 1,263 | |

| | | | | | | | |

| property, plant and equipment | | | | | | | |

| | | | | | | | |

| Oil and gas segment | | | 43,692 | | | 40,091 | |

| | | | | | | | |

| Chemical segment | | | 5,298 | | | 5,090 | |

| | | | | | | | |

| Midstream, marketing and other segment | | | 3,056 | | | 2,445 | |

| | | | | | | | |

| Corporate | | | 1,085 | | | 1,102 | |

| | | | | | | | |

| | | | 53,131 | | | 48,728 | |

| | | | | | | | |

| Accumulated depreciation, depletion and amortization | | | (19,486 | ) | | (16,462 | ) |

| | | | | | | | |

| | | | 33,645 | | | 32,266 | |

| | | | | | | | |

| long-term receivables and other assets, net | | | 766 | | | 836 | |

| | | | | | | | |

| TOTAL ASSETS | | $ | 44,229 | | $ | 41,537 | |

The accompanying notes are an integral part of these consolidated financial statements.

| Consolidated Balance Sheets | Occidental Petroleum Corporation | |

| In millions, except share and per-share amounts | and Subsidiaries | |

| Liabilities and Stockholders’ Equity at December 31, | | 2009 | | 2008 | |

| | | | | | | | |

| current liabilities | | | | | | | |

| | | | | | | | |

| Current maturities of long-term debt | | $ | 239 | | $ | 698 | |

| | | | | | | | |

| Accounts payable | | | 3,379 | | | 3,306 | |

| | | | | | | | |

| Accrued liabilities | | | 2,341 | | | 1,861 | |

| | | | | | | | |

| Domestic and foreign income taxes | | | 28 | | | 158 | |

| | | | | | | | |

| Liabilities of discontinued operations | | | 105 | | | 111 | |

| | | | | | | | |

| Total current liabilities | | | 6,092 | | | 6,134 | |

| | | | | | | | |

| long-term debt, net | | | 2,557 | | | 2,049 | |

| | | | | | | | |

| deferred credits and other liabilities | | | | | | | |

| | | | | | | | |

| Deferred and other domestic and foreign income taxes | | | 3,125 | | | 2,660 | |

| | | | | | | | |

| Long-term liabilities of discontinued operations | | | 136 | | | 152 | |

| | | | | | | | |

| Other | | | 3,160 | | | 3,217 | |

| | | | | | | | |

| | | | 6,421 | | | 6,029 | |

| | | | | | | | |

| contingent liabilities and commitments | | | | | | | |

| | | | | | | | |

| stockholders’ equity | | | | | | | |

| | | | | | | | |

| Common stock, $0.20 par value, authorized 1.1 billion shares, outstanding shares: | | | 177 | | | 176 | |

| | | | | | | | |

| 2009 — 883,642,957 and 2008 — 881,423,225 | | | | | | | |

| | | | | | | | |

| Treasury stock: 2009 — 71,721,221 shares and 2008 — 71,176,487 shares | | | (4,161 | ) | | (4,121 | ) |

| | | | | | | | |

| Additional paid-in capital | | | 7,127 | | | 7,113 | |

| | | | | | | | |

| Retained earnings | | | 26,534 | | | 24,684 | |

| | | | | | | | |

| Accumulated other comprehensive loss | | | (596 | ) | �� | (552 | ) |

| | | | | | | | |

| Noncontrolling interest | | | 78 | | | 25 | |

| | | | | | | | |

| | | | 29,159 | | | 27,325 | |

| | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 44,229 | | $ | 41,537 | |

The accompanying notes are an integral part of these consolidated financial statements.

Consolidated Statements of Stockholders' Equity | Occidental Petroleum Corporation | |

| In millions | and Subsidiaries | |

| | | | | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | | Additional | | | | | | Other | | | | |

| | | | Common | | | Treasury | | | Paid-in | | | Retained | | | Comprehensive | | | Noncontrolling | |

| | | | Stock | | | Stock | | | Capital | | | Earnings | | | Income (Loss) | | | Interest | |

| Balance, December 31, 2006 | | $ | 174 | | $ | (1,481 | ) | $ | 6,905 | | $ | 13,987 | | $ | (333 | ) | $ | 352 | |

| Net income | | | — | | | — | | | — | | | 5,400 | (a) | | — | | | 75 | |

| Uncertain tax positions adjustment | | | — | | | — | | | — | | | 219 | | | — | | | — | |

| Other comprehensive loss, net of tax | | | — | | | — | | | — | | | — | | | (299 | ) | | — | |

| Dividends on common stock | | | — | | | — | | | — | | | (787 | ) | | — | | | (59 | ) |

| Issuance of common stock and other, net | | | 1 | | | — | | | 166 | | | — | | | — | | | — | |

| Purchases of noncontrolling interest | | | — | | | — | | | — | | | — | | | — | | | (333 | ) |

| Purchases of treasury stock | | | — | | | (1,129 | ) | | — | | | — | | | — | | | — | |

| Balance, December 31, 2007 | | $ | 175 | | $ | (2,610 | ) | $ | 7,071 | | $ | 18,819 | | $ | (632 | ) | $ | 35 | |

| Net income | | | — | | | — | | | — | | | 6,857 | (a) | | — | | | 116 | |

| Other comprehensive income, net of tax | | | — | | | — | | | — | | | — | | | 80 | | | — | |

| Dividends on common stock | | | — | | | — | | | — | | | (992 | ) | | — | | | (126 | ) |

| Issuance of common stock and other, net | | | 1 | | | — | | | 42 | | | — | | | — | | | — | |

| Purchases of treasury stock | | | — | | | (1,511 | ) | | — | | | — | | | — | | | — | |

| Balance, December 31, 2008 | | $ | 176 | | $ | (4,121 | ) | $ | 7,113 | | $ | 24,684 | | $ | (552 | ) | $ | 25 | |

| Net income | | | — | | | — | | | — | | | 2,915 | (a) | | — | | | 51 | |

| Other comprehensive loss, net of tax | | | — | | | — | | | — | | | — | | | (44 | ) | | — | |

| Dividends on common stock | | | — | | | — | | | — | | | (1,065 | ) | | — | | | (16 | ) |

| Issuance of common stock and other, net | | | 1 | | | — | | | 14 | | | — | | | — | | | 18 | |

| Purchases of treasury stock | | | — | | | (40 | ) | | — | | | — | | | — | | | — | |

| Balance, December 31, 2009 | | $ | 177 | | $ | (4,161 | ) | $ | 7,127 | | $ | 26,534 | | $ | (596 | ) | $ | 78 | |

| (a) | Represent amounts attributable to common stock after deducting noncontrolling interest amounts. | |

| Consolidated Statements of Comprehensive Income | |

| In millions | |

| For the years ended December 31, | | 2009 | | 2008 | | 2007 | |

| Net income attributable to common stock | | $ | 2,915 | | $ | 6,857 | | $ | 5,400 | |

| Other comprehensive income (loss) items: | | | | | | | | | | |

Foreign currency translation adjustments (a) | | | 32 | | | (24 | ) | | 14 | |

Unrealized gains (losses) on derivatives (b) | | | (93 | ) | | 207 | | | (243 | ) |

Pension and postretirement adjustments (c) | | | 1 | | | (184 | ) | | (13 | ) |

Reclassification of realized losses (gains) on derivatives and securities (d) | | | 13 | | | 68 | | | (156 | ) |

Unrealized gains on securities (e) | | | 3 | | | 13 | | | 99 | |

Other comprehensive income (loss), net of tax (f) | | | (44 | ) | | 80 | | | (299 | ) |

| Comprehensive income attributable to common stock | | $ | 2,871 | | $ | 6,937 | | $ | 5,101 | |

| (a) | Net of tax of $0 in all three years. | |

| (b) | Net of tax of $53, ($118) and $139 in 2009, 2008 and 2007, respectively. | |

| (c) | Net of tax of $0, $110 and $8 in 2009, 2008 and 2007, respectively. | |

| (d) | Net of tax of ($7), ($39) and $89 in 2009, 2008 and 2007, respectively. 2007 amount represents the recognition of the gain on the sale of the remaining Lyondell Chemical Company (Lyondell) shares. | |

| (e) | Net of tax of ($1), ($7) and ($56) in 2009, 2008 and 2007, respectively. | |

| (f) | There were no other comprehensive income (loss) items related to noncontrolling interests in 2009, 2008 and 2007. | |

| | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

| Consolidated Statements of Cash Flows | Occidental Petroleum Corporation | |

| In millions | and Subsidiaries | |

| For the years ended December 31, | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | |

| cash flow from operating activities | | | | | | | | | | |

| Net income | | $ | 2,966 | | $ | 6,973 | | $ | 5,475 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

| Discontinued operations, net | | | 12 | | | (18 | ) | | (322 | ) |

| Depreciation, depletion and amortization of assets | | | 3,117 | | | 2,710 | | | 2,379 | |

| Deferred income tax provision | | | 507 | | | 268 | | | 35 | |

| Other noncash charges to income | | | 638 | | | 1,071 | | | 870 | |

| Gains on disposition of assets, net | | | (10 | ) | | (27 | ) | | (874 | ) |

| Income from equity investments | | | (227 | ) | | (213 | ) | | (82 | ) |

| Dry hole and impairment expense | | | 212 | | | 244 | | | 189 | |

| Changes in operating assets and liabilities: | | | | | | | | | | |

| Decrease (increase) in receivables | | | (602 | ) | | 1,518 | | | (2,219 | ) |

| Increase in inventories | | | (107 | ) | | (64 | ) | | (71 | ) |

| Decrease (increase) in prepaid expenses and other assets | | | (77 | ) | | 6 | | | (96 | ) |

| (Decrease) increase in accounts payable and accrued liabilities | | | (403 | ) | | (1,342 | ) | | 1,807 | |

| Increase (decrease) in current domestic and foreign income taxes | | | 12 | | | (222 | ) | | (73 | ) |

| Other operating, net | | | (182 | ) | | (275 | ) | | (358 | ) |

| Operating cash flow from continuing operations | | | 5,856 | | | 10,629 | | | 6,660 | |

| Operating cash flow from discontinued operations, net of taxes | | | (43 | ) | | 23 | | | 138 | |

| | | | | | | | | | | |

| Net cash provided by operating activities | | | 5,813 | | | 10,652 | | | 6,798 | |

| | | | | | | | | | | |

| cash flow from investing activities | | | | | | | | | | |

| Capital expenditures | | | (3,581 | ) | | (4,664 | ) | | (3,360 | ) |

| Sales of assets, net | | | 51 | | | 27 | | | 509 | |

| Purchases of assets, net | | | (1,782 | ) | | (4,701 | ) | | (1,522 | ) |

| Purchases of short-term investments | | | — | | | — | | | (10 | ) |

| Sales of short-term investments | | | — | | | — | | | 250 | |

| Sales of equity investments and available-for-sale investments | | | — | | | 51 | | | 1,157 | |

| Equity investments and other, net | | | (15 | ) | | (42 | ) | | (88 | ) |

| Investing cash flow from continuing operations | | | (5,327 | ) | | (9,329 | ) | | (3,064 | ) |

| Investing cash flow from discontinued operations | | | — | | | — | | | (11 | ) |

| | | | | | | | | | | |

| Net cash used by investing activities | | | (5,327 | ) | | (9,329 | ) | | (3,075 | ) |

| | | | | | | | | | | |

| cash flow from financing activities | | | | | | | | | | |

| Proceeds from long-term debt | | | 740 | | | 1,043 | | | 127 | |

| Payments of long-term debt | | | (699 | ) | | (96 | ) | | (1,291 | ) |

| Proceeds from issuance of common stock | | | 18 | | | 32 | | | 17 | |

| Purchases of treasury stock | | | (40 | ) | | (1,511 | ) | | (1,129 | ) |

| Redemption of preferred stock | | | — | | | — | | | (75 | ) |

| Cash dividends paid | | | (1,063 | ) | | (940 | ) | | (765 | ) |

| Excess share-based tax benefits and other | | | 27 | | | 90 | | | 71 | |

| Distributions to noncontrolling interest | | | (16 | ) | | (128 | ) | | (53 | ) |

| | | | | | | | | | | |

| Net cash used by financing activities | | | (1,033 | ) | | (1,510 | ) | | (3,098 | ) |

| | | | | | | | | | | |

| (Decrease) increase in cash and cash equivalents | | | (547 | ) | | (187 | ) | | 625 | |

| Cash and cash equivalents — beginning of year | | | 1,777 | | | 1,964 | | | 1,339 | |

| | | | | | | | | | | |

| Cash and cash equivalents — end of year | | $ | 1,230 | | $ | 1,777 | | $ | 1,964 | |

The accompanying notes are an integral part of these consolidated financial statements.

| Notes to Consolidated Financial Statements | Occidental Petroleum Corporation |

| | and Subsidiaries |

| Note 1 | Summary of Significant Accounting Policies |

Nature of Operations

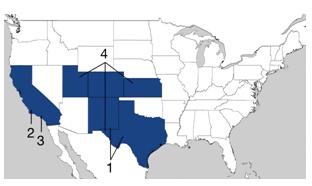

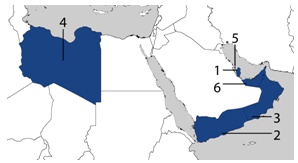

In this report, "Occidental" or "the Company" refers to Occidental Petroleum Corporation, a Delaware corporation, (OPC), and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental is a multinational organization whose subsidiaries and affiliates operate in the oil and gas, chemical and midstream, marketing and other segments. The oil and gas segment explores for, develops, produces and markets crude oil, including natural gas liquids (NGLs) and condensate, as well as natural gas. The chemical segment (OxyChem) manufactures and markets basic chemicals, vinyls and other chemicals. The midstream, marketing and other segment (midstream and marketing) gathers, treats, processes, transports, stores, purchases and markets crude oil (including NGLs and condensate), natural gas, carbon dioxide (CO2) and power. It also trades around its assets, including pipelines and storage capacity, and trades commodities and securities. Unless otherwise indicated hereafter, discussion of oil or oil and liquids refers to crude oil, NGLs and condensate. In addition, discussions of oil and gas production or volumes, in general, refer to sales volumes unless context requires or it is indicated otherwise.

Principles of Consolidation

The consolidated financial statements have been prepared in conformity with United States generally accepted accounting principles (GAAP) and include the accounts of OPC, its subsidiaries and its undivided interests in oil and gas exploration and production ventures. Occidental's proportionate share of oil and gas exploration and production ventures, in which it has a direct working interest, is accounted for by reporting its proportionate share of assets, liabilities, revenues, costs and cash flows within the relevant lines on the balance sheets, income statements and cash flow statements.

Certain financial statements, notes and supplementary data for prior years have been reclassified to conform to the 2009 presentation.

Investments in Unconsolidated Entities

Investments in unconsolidated entities include equity-method investments. Amounts representing Occidental’s percentage interest in the underlying net assets of affiliates (excluding undivided interests in oil and gas exploration and production ventures) in which it does not have a majority voting interest but as to which it exercises significant influence, are accounted for under the equity method. Occidental reviews equity-method investments for impairment whenever events or changes in circumstances indicate that an other-than-temporary decline in value may have occurred. The amount of impairment, if any, is based on quoted market prices, where available, or other valuation techniques, including discounted cash flows.

Revenue Recognition

Revenue is recognized from oil and gas production when title has passed to the customer, which occurs when the product is shipped. In international locations where oil is shipped by tanker, title passes when the tanker is loaded or product is received by the customer, depending on the shipping terms. This process occasionally causes a difference between actual production in a reporting period and sales volumes that have been recognized as revenue. Revenue from marketing and trading activities is recognized on net settled transactions upon completion of contract terms, and for physical deliveries upon title transfer. For unsettled transactions, contracts that meet specified accounting criteria are recorded at fair value. Revenue from all marketing and trading activities is reported on a net basis.

Revenue from chemical product sales is recognized when the product is shipped and title has passed to the customer. Prices are fixed at the time of shipment. Certain incentive programs may provide for payments or credits to be made to customers based on the volume of product purchased over a defined period. Total customer incentive payments over a given period are estimated and recorded as a reduction to revenue ratably over the contract period. Such estimates are evaluated and revised as warranted.

Occidental records revenue net of taxes that are assessed by governmental authorities on Occidental's customers.

Risks and Uncertainties

The process of preparing consolidated financial statements in conformity with GAAP requires Occidental's management to make informed estimates and judgments regarding certain types of financial statement balances. Such estimates primarily relate to unsettled transactions and events as of the date of the consolidated financial statements. Changes in facts and circumstances or discovery of new information relating to such transactions and events may result in revised estimates and judgments, and upon settlement actual results may differ from these estimates, but generally not by material amounts. Management believes that these estimates and assumptions provide a reasonable basis for the fair presentation of Occidental’s financial position and results of operations.

Realization of deferred tax assets, including any net operating loss carry forwards, is dependent upon Occidental generating sufficient future taxable income in jurisdictions where such assets originate. Occidental expects to realize the recorded deferred tax assets, net of any allowances, through future operating income and reversal of temporary differences.

The accompanying consolidated financial statements include assets of approximately $11.7 billion as of December 31, 2009, and net sales of approximately $5.9 billion for the year ended December 31, 2009, relating to Occidental’s operations in countries outside North America. Occidental operates some of its oil and gas business in countries that occasionally have experienced political instability, armed conflict, terrorism, insurgency, civil unrest, security problems, labor unrest, OPEC production restrictions, equipment import restrictions and sanctions that prevent continued operations, all of which increase Occidental's risk of loss or delayed or restricted production or may result in other adverse consequences. Occidental attempts to conduct its financial affairs so as to mitigate its exposure against such risks and would seek compensation in the event of nationalization.

Since Occidental’s major products are commodities, significant changes in the prices of oil and gas and chemical products may have a significant impact on Occidental’s results of operations for any particular year.

Also, see "Property, Plant and Equipment" below.

Cash and Cash Equivalents

Cash equivalents are short-term, highly liquid investments that are readily convertible to cash. Cash equivalents totaled approximately $1.2 billion and $1.8 billion at December 31, 2009 and 2008, respectively.

Short-Term Investments

Short-term investments are recorded at fair value with any unrealized gains or losses included in accumulated other comprehensive income/loss (AOCI).

Inventories

Materials and supplies are valued at the lower of weighted-average cost or market and are reviewed periodically for obsolescence. Oil and natural gas inventories are valued at the lower of cost or market.

For the chemical segment, Occidental's inventories are valued at the lower of cost or market. For most of its domestic inventories, other than materials and supplies, the chemical segment uses the last-in, first-out (LIFO) method as it better matches current costs and current revenue. For other countries, Occidental uses the first-in, first-out method (if the costs of goods are specifically identifiable) or the average-cost method (if the costs of goods are not specifically identifiable).

Property, Plant and Equipment

Oil and Gas

The carrying value of Occidental’s property, plant and equipment (PP&E) is based on the cost incurred to acquire the PP&E, including any capitalized interest, net of accumulated depreciation, depletion and amortization (DD&A) and net of any impairment charges. For acquisitions of a business, PP&E cost is determined by an allocation of total purchase price to the components of PP&E based on their estimated fair values at the date of acquisition. Interest costs incurred in connection with qualifying capital expenditures are capitalized and amortized over the lives of the related assets.

Occidental uses the successful efforts method to account for its oil and gas properties. Under this method, costs of acquiring properties, costs of drilling successful exploration wells and development costs are capitalized. The costs of exploratory wells are initially capitalized pending a determination of whether proved reserves have been found. At the completion of drilling activities, the costs of exploratory wells remain capitalized if a determination is made that proved reserves have been found. If no proved reserves have been found, the costs of the related exploratory wells are charged to expense. In some cases, a determination of proved reserves cannot be made at the completion of drilling, requiring additional testing and evaluation of the wells. Occidental's practice is to expense the costs of such exploratory wells if a determination of proved reserves has not been made within a 12-month period after drilling is complete. Annual lease rentals and geological, geophysical and seismic costs are expensed as incurred.

The following table summarizes the activity of capitalized exploratory well costs for the years ended December 31:

| In millions | | 2009 | | 2008 | | 2007 | |

Balance — Beginning of Year | | $ | 68 | | $ | 17 | | $ | 46 | |

| Additions to capitalized exploratory well costs pending the determination of proved reserves | | | 42 | | | 69 | | | 18 | |

| Reclassifications to property, plant and equipment based on the determination of proved reserves | | | (11 | ) | | (3 | ) | | (5 | ) |

| Capitalized exploratory well costs charged to expense | | | (57 | ) | | (15 | ) | | (42 | ) |

| Balance — End of Year | | $ | 42 | | $ | 68 | | $ | 17 | |

Proved oil and gas reserves (as defined in the Securities and Exchange Commission's Regulation S-X, Rule 4-10(a)) are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. Occidental has no proved oil and gas reserves for which the determination of commercial viability is subject to the completion of major additional capital expenditures. Depreciation and depletion of oil and gas producing properties is determined by the unit-of-production method.

A portion of the carrying value of Occidental’s oil and gas properties is attributable to unproved properties. At December 31, 2009, the net capitalized costs attributable to unproved properties were $1.9 billion. The unproved amounts are not subject to DD&A or impairment until a determination is made as to the existence of proved reserves. As exploration and development work progresses, if reserves on these properties are proved, capitalized costs attributable to the properties will be subject to depreciation and depletion. If the exploration and development work were to be unsuccessful, or management's plans changed with respect to these properties, as a result of economic, operating or contractual conditions, the capitalized costs of the related properties would be expensed in the period in which the determination was made. The timing of any writedowns of these unproved properties, if warranted, depends upon management's plans, the nature, timing and extent of future exploration and development activities and their results. Occidental believes its current plans and exploration and development efforts will allow it to realize its unproved property balance.

Additionally, Occidental performs impairment tests with respect to its proved properties generally when prices decline other than temporarily, reserve estimates change significantly or other significant events occur that may impact the ability to realize the recorded asset amounts. Impairment tests incorporate a number of assumptions involving expectations of future cash flows, which can change significantly over time. These assumptions include estimates of future product prices, which Occidental bases on forward price curves, estimates of oil and gas reserves and estimates of future expected operations and development costs. Fluctuations in commodities prices and production and development costs could cause management's plans to change with respect to unproved properties and could cause the carrying values of proved properties to be unrealizable. Such circumstances could result in impairments in the carrying values of proved or unproved properties or both. Any impairment loss would be calculated as the excess of the asset’s net book value over its estimated fair value.

Chemical

The most critical accounting policy affecting Occidental's chemical assets is the determination of the estimated useful lives of the PP&E. Occidental’s chemical plants are depreciated using either the unit-of-production or straight-line method, based upon the estimated useful lives of the facilities. The estimated useful lives of Occidental’s chemical assets, which range from three years to 50 years, are also used for impairment tests. The estimated useful lives used for the chemical facilities are based on the assumption that Occidental will provide an appropriate level of annual expenditures to ensure productive capacity is sustained. Without these continued expenditures, the useful lives of these plants could decrease significantly. Other factors that could change the estimated useful lives of Occidental’s chemical plants include sustained higher or lower product prices, which are particularly affected by both domestic and foreign competition, demand, feedstock costs, energy prices, environmental regulations and technological changes.

Occidental performs impairment tests on its chemical assets whenever events or changes in circumstances lead to a reduction in the estimated useful lives or estimated future cash flows that would indicate that the carrying amount may not be recoverable, or when management’s plans change with respect to those assets. Any impairment loss would be calculated as the excess of the asset’s net book value over its estimated fair value.

Midstream and Marketing

Occidental’s midstream and marketing PP&E is depreciated over the estimated useful lives of the assets, using either the unit-of-production or straight-line method.

Occidental performs impairment tests on its midstream and marketing assets whenever events or changes in circumstances lead to a reduction in the estimated useful lives or estimated future cash flows that would indicate that the carrying amount may not be recoverable, or when management’s plans change with respect to those assets. Any impairment loss would be calculated as the excess of the asset’s net book value over its estimated fair value.

Fair Value Measurements

Occidental has categorized its assets and liabilities that are measured at fair value, based on the priority of the inputs to the valuation techniques, in a three-level fair value hierarchy: Level 1 – using quoted prices in active markets for identical assets or liabilities; Level 2 – using observable inputs other than quoted prices; and Level 3 – using unobservable inputs. Occidental primarily applies the market approach for recurring fair value measurements, maximizes its use of observable inputs and minimizes its use of unobservable inputs. Occidental utilizes the mid-point price between bid and ask prices for valuing the majority of its assets and liabilities measured and reported at fair value. In addition to using market data, Occidental makes assumptions in valuing its assets and liabilities, including assumptions about risk and the risks inherent in the inputs to the valuation technique.

Certain of Occidental's derivative instruments are valued using industry-standard models that consider various inputs, including quoted forward prices for commodities, time value, volatility factors, and current market and contractual prices for the underlying instruments, as well as other relevant economic measures. Substantially all of these inputs are observable in the marketplace throughout the full term of the instrument, can be derived from observable data or are supported by observable prices at which transactions are executed in the marketplace.

Occidental generally uses an income approach to measure fair value when there is not a market observable price for an identical or similar asset or liability. This approach utilizes management's best assumptions regarding expectations of projected cash flows, and discounts the expected cash flows using a commensurate risk-adjusted discount rate. The portion of derivatives valued using Level 3 inputs is de minimis.

Accrued Liabilities—Current

Accrued liabilities include accrued payroll, commissions and related expenses of $644 million and $352 million at December 31, 2009 and 2008, respectively.

Environmental Liabilities and Expenditures Environmental expenditures that relate to current operations are expensed or capitalized as appropriate. Occidental records environmental reserves for estimated remediation costs that relate to existing conditions from past operations when environmental remediation efforts are probable and the costs can be reasonably estimated. In determining the reserves and the range of reasonably possible additional loss, Occidental refers to currently available information, including relevant past experience, remedial objectives, available technologies, applicable laws and regulations and cost-sharing arrangements. Occidental bases environmental reserves on management’s estimate of the most likely cost to be incurred, using the most cost-effective technology reasonably expected to achieve the remedial objective. Occidental periodically reviews reserves and adjusts them as new information becomes available. Occidental records environmental reserves on a discounted basis only when the aggregate amount and the timing of cash payments are reliably determinable at the time the reserves are established. The reserve methodology with respect to discounting for a specific site is not modified once it has been established. Occidental generally records reimbursements or recoveries of environmental remediation costs in income when received, unless receipt of recovery is highly probable, in which case an accrual may be recorded. As of December 31, 2009, 2008 and 2007, Occidental has not accrued any reimbursements or recoveries.

Many factors could affect Occidental’s future remediation costs and result in adjustments to its environmental reserves and range of reasonably possible additional loss. The most significant are: (1) cost estimates for remedial activities may be inaccurate; (2) the length of time, type or amount of remediation necessary to achieve the remedial objective may change due to factors such as site conditions, the ability to identify and control contaminant sources or the discovery of additional contamination; (3) the regulatory agency may ultimately reject or modify Occidental’s proposed remedial plan; (4) improved or alternative remediation technologies may change remediation costs; and (5) laws and regulations may impose more or less stringent remediation requirements or affect cost sharing or allocation of liability.

Certain sites involve multiple parties with various cost-sharing arrangements, which fall into the following three categories: (1) environmental proceedings that result in a negotiated or prescribed allocation of remediation costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, typically relating to purchases and sales of properties, in which the parties to the transaction agree to methods of allocating remediation costs. In these circumstances, Occidental evaluates the financial viability of other parties with whom it is alleged to be jointly liable, the degree of their commitment to participate and the consequences to Occidental of their failure to participate when estimating Occidental's ultimate share of liability. Occidental records reserves at its expected net cost of remedial activities and, based on these factors, believes that it will not be required to assume a share of liability of such other potentially responsible parties in an amount materially above amounts reserved.

In addition to the costs of investigations and cleanup measures, which often take in excess of ten years at Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) National Priorities List (NPL) sites, Occidental’s reserves include management’s estimates of the costs to operate and maintain remedial systems. If remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies or engineering estimates, Occidental reviews and adjusts its reserves accordingly.

Asset Retirement Obligations

In the period in which an asset retirement obligation is incurred and becomes reasonably estimable, Occidental recognizes the fair value of the liability if there is a legal obligation to dismantle the asset and reclaim or remediate the property at the end of its useful life. The liability amounts are based on future retirement cost estimates and incorporate many assumptions such as time to abandonment, technological changes, future inflation rates and the adjusted risk-free rate of interest. When the liability is initially recorded, Occidental capitalizes the cost by increasing the related PP&E balances. If the estimated future cost of the asset retirement obligation changes, an adjustment is recorded to both the asset retirement obligation and PP&E. Over time, the liability is increased and expense is recognized for changes in its present value, and the initial capitalized cost is depreciated over the useful life of the asset. No market risk premium has been included in Occidental’s liability since no reliable estimate can be made at this time.

Occidental has identified conditional asset retirement obligations at a certain number of its facilities that are related mainly to plant decommissioning. Occidental believes that there is an indeterminate settlement date for these asset retirement obligations because the range of time over which Occidental may settle these obligations is unknown or cannot be estimated. Therefore, Occidental cannot reasonably estimate the fair value of these liabilities. Occidental will recognize these conditional asset retirement obligations in the periods in which sufficient information becomes available to reasonably estimate their fair values.

The following table summarizes the activity of the asset retirement obligation, of which $677 million and $480 million is included in deferred credits and other liabilities - other, with the remaining current portion in accrued liabilities at December 31, 2009 and 2008, respectively.

| For the years ended December 31, (in millions) | | 2009 | | 2008 | |

| Beginning balance | | $ | 521 | | $ | 471 | |

| Liabilities incurred | | | 84 | | | 38 | |

| Liabilities settled | | | (28 | ) | | (30 | ) |

| Accretion expense | | | 36 | | | 30 | |

| Acquisitions and other | | | 8 | | | 45 | |

| Revisions to estimated cash flows | | | 101 | | | (33 | ) |

| Ending balance | | $ | 722 | | $ | 521 | |

Derivative Instruments

Derivatives are carried at fair value and on a net basis when a legal right of offset exists with the same counterparty. Occidental applies hedge accounting when transactions meet specified criteria for such treatment. If a derivative does not qualify or is not designated and documented as a hedge, any fair value gains or losses are recognized in earnings in the current period. For cash-flow hedges, the effective portion of the gain or loss on the derivative is reported as a component of other comprehensive income (OCI) with an offsetting adjustment to the basis of the item being hedged. Realized gains or losses from cash-flow hedges, and any ineffectiveness, are recorded as a component of net sales in the consolidated statements of income. Ineffectiveness is primarily created by a basis difference between the hedged item and the hedging instrument due to location, quality or grade of the physical commodity transactions. Gains and losses from derivative instruments are reported net in the consolidated statements of income. There were no fair value hedges as of and for the years ended December 31, 2009, 2008 and 2007.

A hedge is regarded as highly effective and qualifies for hedge accounting if, at inception and throughout its life, it is expected that changes in the fair value or cash flows of the hedged item are almost fully offset by the changes in the fair value or changes in cash flows of the hedging instrument and actual effectiveness is within a range of 80 to 125 percent. In the case of hedging a forecasted transaction, the transaction must be probable and must present an exposure to variations in cash flows that could ultimately affect reported net income or loss. Occidental discontinues hedge accounting when it determines that a derivative has ceased to be highly effective as a hedge; when the derivative expires, or is sold, terminated, or exercised; when the hedged item matures or is sold or repaid; or when a forecasted transaction is no longer deemed probable.

Stock-Based Incentive Plans

Occidental has established several shareholder-approved stock-based incentive plans for certain employees (Plans) that are more fully described in Note 12. A summary of Occidental’s accounting policy under each type of award issued under the Plans follows below.

For cash- and stock-settled restricted stock units (RSUs), compensation expense is initially measured on the grant date using the quoted market price of Occidental’s common stock. For stock options (Options), stock-settled stock appreciation rights (SARs), performance stock awards (PSAs) and total shareholder return incentives (TSRIs), compensation expense is initially measured on the grant date using potential exercise values or estimated payout level using valuation models. Compensation expense for all awards is recognized on a straight-line basis over the requisite service periods, which is generally over the awards’ respective vesting or performance periods. The compensation expense for PSAs and TSRIs are adjusted quarterly for any changes in the number of shares expected to be issued based on the performance criteria using valuation models. In addition, every quarter the cash-settled portion of RSUs, SARs, PSAs and TSRIs is further revalued for changes in the values of the underlying stock. All such performance or stock-price-related changes are recognized in periodic compensation expense.

Supplemental Cash Flow Information

Occidental paid U.S. federal, state and foreign income taxes of approximately $1.4 billion, $4.5 billion and $3.5 billion during the years ended December 31, 2009, 2008 and 2007, respectively. Occidental also paid production, property and other taxes, mostly in the U.S., of approximately $584 million, $590 million and $463 million during the years ended December 31, 2009, 2008 and 2007, respectively. Cash payments for federal, state and foreign income paid by discontinued operations were $8 million, $7 million and $17 million for the years 2009, 2008 and 2007, respectively. Interest paid totaled approximately $164 million, $84 million and $307 million for the years 2009, 2008 and 2007, respectively.

Foreign Currency Transactions

The functional currency applicable to all of Occidental’s foreign oil and gas operations is the U.S. dollar since cash flows are denominated principally in U.S. dollars. Occidental’s chemical operations in Brazil use the Real as the functional currency. Exchange-rate changes on transactions denominated in non-U.S. dollar functional currencies generated gains of $36 million and $91 million in 2009 and 2008, respectively, and losses of $18 million in 2007.

| Note 2 | Acquisitions and Dispositions |

Subsequent Event

In January 2010, Occidental and its partners signed a technical service contract with the government of Iraq to develop the Zubair Field in Iraq.

Occidental's management has evaluated events from January 1, 2010 through February 25, 2010 and has made the appropriate disclosures.

2009

On December 31, 2009, Occidental completed the acquisition of interests in Phibro LLC (Phibro) from Citigroup Inc. for approximately $370 million. Phibro, primarily an investor in commodities and securities, is included as a part of Occidental's midstream and marketing segment. The assets acquired and liabilities assumed were recorded at their estimated fair values at the acquisition date. The majority of Phibro's assets and liabilities are derivatives and trading securities, which are carried at fair value and, consequently, the allocated purchase prices are included in Note 7, Derivative Activities and Note 15, Fair Value Measurements. No goodwill was recorded on this transaction.

In December 2009, Occidental purchased additional interests in the General Partner of the Plains All-American Pipeline, L.P. for approximately $330 million. Occidental now owns approximately 22 percent of this entity.

Occidental and its partners signed a Development and Production Sharing Agreement (DPSA) in April 2009 with the National Oil and Gas Authority of Bahrain for further development of the Bahrain Field, which became effective in December 2009. Under this agreement, a joint operating company formed by Occidental and its partners will serve as operator for the project.

In 2009, Occidental acquired various additional oil and gas properties in California and the Permian Basin for approximately $610 million.

2008

In August 2008, Occidental purchased noncontrolling interests in the General Partner of Plains All-American Pipeline, L.P. for approximately $330 million in cash.

In July 2008, Occidental purchased a 15-percent interest in the Joslyn Oil Sands Project (Joslyn) in northern Alberta, Canada, for approximately $500 million in cash.

In June 2008, Occidental signed an agreement for a third party to construct a west Texas gas processing plant that will provide carbon dioxide (CO2) for Occidental’s enhanced oil recovery projects in the Permian Basin. Occidental will own and operate the new facility.

In June 2008, Occidental and its partner signed 30-year agreements (including a potential 5-year extension) with the Libyan National Oil Company (NOC) to upgrade its existing petroleum contracts in Libya. The new agreements increased Occidental's after-tax economic returns while allowing NOC and Occidental to design and implement major field redevelopment and exploration programs in the Sirte Basin. Occidental will contribute 37.5 percent of the development capital. Under these contracts, Occidental will pay $750 million as its share of a signature bonus. Occidental made its first payment in the amount of $450 million in June 2008 and its second payment of $150 million in June 2009. Occidental's remaining payment of $150 million is due in June 2010.

In February 2008, Occidental purchased from Plains Exploration & Production Company (Plains) a 50-percent interest in oil and gas properties in the Permian Basin and western Colorado for approximately $1.5 billion in cash. In December 2008, Occidental purchased the remainder of Plains’ interests in the same assets for $1.2 billion in cash.

2007

In September 2007, Occidental sold exploration properties in West Africa and recorded a pre-tax gain of $103 million.

In June 2007, Occidental completed a fair value exchange under which BP p.l.c. (BP) acquired Occidental's oil and gas interests in Horn Mountain and received cash. Occidental acquired oil and gas interests in the Permian Basin and a gas processing plant in Texas from BP. Occidental also purchased for cash BP's west Texas pipeline system and, in a separate transaction, Occidental sold its oil and gas interests in Pakistan to BP. As a result of these transactions, both the Horn Mountain and Pakistan operations were classified as discontinued operations for all periods presented. Net revenues and pre-tax income for discontinued operations related to Pakistan and Horn Mountain were $193 million and $469 million (including after-tax disposal gains of $230 million) in 2007. The assets and liabilities of Horn Mountain and Pakistan are classified as assets of discontinued operations and liabilities of discontinued operations on the consolidated balance sheet.

In January 2007, Occidental sold its 50-percent joint venture interest in Russia for an after-tax gain of approximately $412 million.

| Note 3 | Accounting and Disclosure Changes |

Future Accounting and Disclosure Changes

Effective for the first quarter of 2010, Occidental will modify its method of assessing the consolidation of variable interest entities as a result of adopting new accounting requirements issued by the Financial Accounting Standards Board (FASB) in June 2009. Occidental is currently assessing the effect of this new guidance on its financial statements but does not expect it to be material.

Recently Adopted Accounting and Disclosure Changes

Effective for the year ended December 31, 2009, the Securities and Exchange Commission (SEC) and the FASB modified certain accounting and disclosure requirements for oil and gas properties, which Occidental adopted. The new guidance includes changes to pricing methodology and the use of allowable technologies in the recognition and measurement of reserves, as well as oil and gas disclosure requirements. As of December 31, 2009, Occidental conformed its disclosures to the new guidelines, which did not have a material impact on Occidental's financial statements.

As of December 31, 2009, Occidental enhanced its disclosures related to the assets held in defined benefit plans and other post-retirement benefits in accordance with disclosure requirements issued by the FASB in December 2008 and in April 2009.

In the quarter ended June 30, 2009, Occidental adopted new disclosure requirements for its evaluation of subsequent events as a result of new accounting guidance issued by the FASB in May 2009.

In the quarter ended June 30, 2009, Occidental adopted new disclosure requirements for the fair value of financial instruments in interim periods when it is practicable to estimate such values as a result of new accounting guidance issued by the FASB in April 2009.

Beginning January 1, 2009, Occidental modified its calculation of basic earnings per share (EPS) in accordance with new accounting guidance issued by the FASB in June 2008. Under this new accounting guidance, instruments containing rights to nonforfeitable dividends granted in share-based payment transactions are considered participating securities prior to vesting and, therefore, have been included in the earnings allocations in computing EPS under the two-class method. While prior period EPS data has been adjusted retrospectively, this change had no material impact on Occidental’s financial statements.

Beginning January 1, 2009, Occidental adopted new disclosure requirements for its derivative and hedging activities as a result of new accounting guidance issued by the FASB in March 2008.

Beginning January 1, 2009, Occidental prospectively adopted the deferred portion of new accounting guidance related to the application of the measurement and disclosure framework of non-financial assets and liabilities that are recorded at fair value on a non-recurring basis. This new guidance was issued by the FASB in February 2008.

Beginning January 1, 2009, Occidental adopted new accounting guidance related to the accounting and disclosure requirements for business combinations. The new guidance was issued by the FASB in December 2007 and April 2009 and had no material impact on Occidental’s financial statements upon adoption.

On January 1, 2009, Occidental adopted new accounting guidance affecting the presentation and disclosure requirements related to noncontrolling interests in subsidiaries. Occidental adopted this new guidance prospectively, except for the presentation and disclosure requirements which were applied retrospectively to all periods presented. These new requirements were issued in December 2007 and had no material impact on Occidental’s financial statements upon adoption.

Net carrying values of inventories valued under the LIFO method were approximately $175 million and $166 million at December 31, 2009 and 2008, respectively. Inventories consisted of the following:

| Balance at December 31, (in millions) | | 2009 | | 2008 | |

| Raw materials | | $ | 63 | | $ | 123 | |

| Materials and supplies | | | 515 | | | 412 | |

| Finished goods | | | 584 | | | 494 | |

| | | | 1,162 | | | 1,029 | |

| LIFO reserve | | | (81 | ) | | (71 | ) |

| Total | | $ | 1,081 | | $ | 958 | |

Long-term debt consisted of the following:

| Balance at December 31, (in millions) | | 2009 | | 2008 | |

| Occidental Petroleum Corporation | | | | | | | |

| 7.0% senior notes due 2013 | | $ | 1,000 | | $ | 1,000 | |

| 4.125% senior notes due 2016 | | | 750 | | | — | |

| 6.75% senior notes due 2012 | | | 368 | | | 368 | |

| 4.25% medium-term senior notes due 2010 | | | 227 | | | 227 | |

| 8.45% senior notes due 2029 | | | 116 | | | 116 | |

| 9.25% senior debentures due 2019 | | | 116 | | | 116 | |

| 10.125% senior debentures due 2009 | | | ― | | | 91 | |

| 7.2% senior debentures due 2028 | | | 82 | | | 82 | |

| 8.75% medium-term notes due 2023 | | | 22 | | | 22 | |

| 11.125% senior notes due 2010 | | | 12 | | | 12 | |

| | | | 2,693 | | | 2,034 | |

| Subsidiary Debt | | | | | | | |

Dolphin Energy Limited (Dolphin Energy) loans due 2009 (3.915% as of December 31, 2008) | | | ― | | | 600 | |

| 0.19% to 0.35% unsecured notes due 2011 through 2018 | | | 115 | | | 115 | |

| | | | 2,808 | | | 2,749 | |

| Less: | | | | | | | |

| Unamortized discount, net | | | (12 | ) | | (9 | ) |

| Current maturities | | | (239 | ) | | (691 | ) |

| Total | | $ | 2,557 | | $ | 2,049 | |

In July 2009, Occidental repaid its $600 million debt associated with Dolphin Energy's debt. Also, in July 2009, Dolphin Energy refinanced its debt on a limited-recourse basis. Occidental provided guarantees limited to certain political and other events. The fair value of these guarantees was immaterial. At December 31, 2009, the notional amount was approximately $300 million, which represented a substantial majority of Occidental's total guarantees.

In May 2009, Occidental issued $750 million of 4.125-percent senior unsecured notes due 2016, receiving $740 million of net proceeds. Interest on the notes will be payable semi-annually in arrears on June 1 and December 1 of each year.

In October 2008, Occidental issued $1 billion of 7-percent senior unsecured notes due 2013, receiving $985 million of net proceeds. Interest on the notes will be payable semi-annually in arrears on May 1 and November 1 of each year.

Occidental has a $1.5 billion bank credit facility (Credit Facility) through September 2012, which adjusts to $1.4 billion in September 2011. The Credit Facility provides for the termination of the loan commitments and requires immediate repayment of any outstanding amounts if certain events of default occur or if Occidental files for bankruptcy. Up to $350 million of the Credit Facility is available in the form of letters of credit. Occidental did not draw down any amounts under the Credit Facility during 2009. Available but unused lines of committed bank credit totaled approximately $1.5 billion at December 31, 2009.

None of Occidental's committed bank credits contain material adverse change clauses or debt ratings triggers that could restrict Occidental's ability to borrow under these lines. Occidental's credit facilities and debt agreements do not contain ratings triggers that could terminate bank commitments or accelerate debt in the event of a ratings downgrade. Borrowings under the Credit Facility bear interest at various benchmark rates, including LIBOR, plus a margin based on Occidental's senior debt ratings. Additionally, Occidental paid an annual facility fee of 0.05 percent in 2009 on the total commitment amount, which was based on Occidental's senior debt ratings.

In May 2007, Occidental redeemed all $276 million of the outstanding principal amount of its 8.25-percent Vintage senior notes due 2012. In January 2007, Occidental completed cash tender offers for portions of various debt instruments totaling $659 million in principal amount. The redemption and repurchases resulted in a pre-tax interest expense of $167 million.

At December 31, 2009, minimum principal payments on long-term debt subsequent to December 31, 2009 aggregated $2.8 billion, of which $239 million is due in 2010, $68 million in 2011, $368 million in 2012, $1.0 billion in 2013, zero in 2014, zero in 2015 and $1.1 billion thereafter.

As of December 31, 2009, under the most restrictive covenants of its financing agreements, Occidental had substantial capacity for additional unsecured borrowings, the payment of cash dividends and other distributions on, or acquisitions of, Occidental stock.

Occidental estimates the fair value of fixed-rate debt based on the quoted market prices for those instruments or on quoted market yields for similarly rated debt instruments, taking into account their maturities. The estimated fair values of Occidental’s debt, at December 31, 2009 and 2008, were approximately $3.1 billion and $2.9 billion, respectively, compared to carrying values of approximately $2.8 billion and $2.7 billion, respectively. Occidental's exposure to changes in interest rates relates primarily to its variable-rate, long-term debt obligations, and is not expected to be material. As of December 31, 2009, variable-rate debt constituted approximately four percent of Occidental's total debt.

The present value of minimum capital lease payments, net of the current portion, totaled $25 million at both December 31, 2009 and 2008. These amounts are included in other liabilities.

Operating and capital lease agreements, which include leases for manufacturing facilities, office space, railcars and tanks, frequently include renewal or purchase options and require Occidental to pay for utilities, taxes, insurance and maintenance expense.

At December 31, 2009, future net minimum lease payments for capital and noncancelable operating leases (excluding oil and gas and other mineral leases, utilities, taxes, insurance and maintenance expense) were the following:

| In millions | | Capital | | Operating | (a) |

| 2010 | | $ | — | | $ | 153 | |

| 2011 | | | — | | | 118 | |

| 2012 | | | — | | | 87 | |

| 2013 | | | — | | | 70 | |

| 2014 | | | — | | | 59 | |

| Thereafter | | | 26 | | | 630 | |

| Total minimum lease payments | | | 26 | | $ | 1,117 | |

| Less: | | | | | | | |

| Imputed interest | | | 1 | | | | |

| Present value of minimum capital lease payments | | $ | 25 | | | | |

| (a) | At December 31, 2009, these operating lease payments are net of sublease rental amounts of $15 million, which are to be received as follows (in millions): 2010—$4, 2011—$4, 2012—$4, 2013—$2 and 2014—$1. | |

Rental expense for operating leases, net of sublease rental income, was $172 million in 2009, $178 million in 2008 and $196 million in 2007. Rental expense was net of sublease income of $4 million, $7 million and $7 million in 2009, 2008 and 2007, respectively.

| Note 7 | Derivative Activities |

Objective & Strategy

Occidental has used derivatives to reduce its long-term exposure to price volatility on a small portion of its oil and gas production. Through its low-risk marketing and trading activities and within its established policy controls and procedures, Occidental has also used derivative instruments, including a combination of short-term futures, forwards, options and swaps to improve realized prices for its oil and gas.

Additionally, Occidental, through its Phibro subsidiary, will also engage in trading activities using derivatives for the purpose of generating profits mainly from market price changes of commodities.

Refer to Note 1 for Occidental’s accounting policy on derivatives.

Cash-Flow Hedges

Occidental holds a series of collar agreements that qualify as cash-flow hedges for the sale of approximately 2 percent of its crude oil production. These agreements continue to the end of 2011. The following table presents the daily quantities and weighted-average strike prices of Occidental's collar positions as of December 31, 2009:

| | | Crude Oil Collars |

| | | Daily Volume (barrels) | | Average Floor | | Average Cap |

| 2010 | | 12,000 | | $33.00 | | $46.35 |

| 2011 | | 12,000 | | $32.92 | | $46.27 |

In 2009, Occidental entered into financial swap agreements related to the sale of a portion of its natural gas production from the Rockies that qualify as cash-flow hedges. The following table presents the daily quantities and weighted-average hedged prices that will be received by Occidental as of December 31, 2009:

| | | Natural Gas Swaps |

| | | Daily Volume | | Average Strike Price |

| January 2010 - December 2010 | | 40 million cubic feet | | $5.03 |

| December 2010 - March 2012 | | 50 million cubic feet | | $6.07 |

Occidental’s marketing and trading operations store natural gas purchased from third parties at Occidental’s leased storage facilities. Derivative instruments are used to fix margins on the future sales of the stored volumes. These agreements continue through 2010. As of December 31, 2009, Occidental had approximately 28 billion cubic feet of natural gas held in storage. Occidental has designated the forecasted sale of approximately 24 billion cubic feet of natural gas from storage as cash-flow hedges.

The following table presents the pre-tax gains (losses) recognized in and reclassified from Accumulated Other Comprehensive Income (AOCI) and recognized in income (net sales), including any hedge ineffectiveness, for derivative instruments classified as cash-flow hedges for the year ended December 31, 2009:

Cash-Flow Hedges (in millions) | | Gains (Losses) Recognized in AOCI – Effective Portion | | Amount of (Gains) Losses Reclassified from AOCI into Income – Effective Portion | | Gains Recognized in Income – Ineffective Portion | |

Commodity contracts | | | | | | | | | | | | | |

| Occidental’s crude oil production | | $ | (162 | ) | | $ | 74 | | | $ | 10 | | |

| Occidental’s natural gas production | | | (2 | ) | | | — | | | | — | | |

Commodity contracts | | | | | | | | | | | | | |

| Natural gas storage | | | 19 | | | | (50 | ) | | | — | | |

| Total | | $ | (145 | ) | | $ | 24 | | | $ | 10 | | |

The following table summarizes net after-tax derivative activity recorded in AOCI for the years ended December 31, 2009 and 2008:

| In millions | | 2009 | | 2008 | |

| Beginning Balance | | $ | (150 | ) | $ | (441 | ) |

| Gains (losses) from changes in cash-flow hedges | | | (93 | ) | | 207 | |

| Losses reclassified to income | | | 16 | | | 84 | |

| Ending Balance | | $ | (227 | ) | $ | (150 | ) |

During the next twelve months, Occidental expects that approximately $106 million of net after-tax derivative losses included in AOCI, based on their valuation as of December 31, 2009, will be reclassified into income.

Derivatives Not Designated as Hedging Instruments

Occidental’s third-party marketing and trading activities have been focused on purchasing crude oil and natural gas for resale from partners, producers and third parties whose oil and gas supply is located near the midstream and marketing assets; such as pipelines, processing plants and storage facilities, that are owned or leased by Occidental. These purchases allow Occidental to aggregate volumes to maximize prices received for Occidental’s production. The aggregate volumes and durations of these third-party marketing and trading purchase and sales contracts generally approximate each other. In addition, Occidental’s trading unit, Phibro, uses derivative instruments to profit from market price changes.

The following table presents gross volumes of Occidental’s commodity derivatives not designated as hedging instruments as of December 31, 2009:

| Commodity | | Volumes | |

| Occidental’s production sales contracts | | | |

| Crude oil | | 9 million barrels | |

| | | | |

| Third-party marketing and trading activities | | | |

| Purchase contracts | | | |

| Crude oil | | 161 million barrels | |

| Natural gas | | 1,386 billion cubic feet | |

| Electricity | | 408,000 megawatt hours | |

| | | | |

| Sales contracts | | | |

| Crude oil | | 182 million barrels | |

| Natural gas | | 1,556 billion cubic feet | |

| Electricity | | 408,000 megawatt hours | |

In addition, Occidental has certain other commodity trading contracts, including agricultural products, metals, precious metals and foreign exchange contracts, which were not material to Occidental as of December 31, 2009.

Approximately $61 million of gains from derivatives not designated as hedging instruments were recognized in net sales for the year ended December 31, 2009.

The following table presents the gross fair value of Occidental’s outstanding derivatives as of December 31, 2009:

| | | Asset Derivatives | | Fair | | Liability Derivatives | | Fair | |

| (in millions) | | Balance Sheet Location | | Value | | Balance Sheet Location | | Value | |

Cash-flow hedges (a) | | | | | | | | | | | |

| | | Marketing and trading assets and other | | $ | 2 | | Accrued liabilities | | $ | (168 | ) |

| Commodity contracts | | Long-term receivables and other assets, net | | | 5 | | Deferred credits and other liabilities | | | (174 | ) |

| | | | | $ | 7 | | | | $ | (342 | ) |

| | | | | | | | | | | | |

Derivatives not designated as hedging instruments (a) | | | | | | | | | | | |

| | | Marketing and trading assets and other | | $ | 776 | | Accrued liabilities | | $ | (789 | ) |

| Commodity contracts | | Long-term receivables and other assets, net | | | 72 | | Deferred credits and other liabilities | | | (69 | ) |

| | | | | | 848 | | | | | (858 | ) |

| Total gross fair value of derivatives | | | | | 855 | | | | | (1,200 | ) |

| Less: counterparty netting and cash collateral | | | | | (642 | ) | | | | 648 | |

| Total net fair value of derivatives | | | | $ | 213 | | | | $ | (552 | ) |

| (a) | The above fair values are presented at gross amounts, including when the derivatives are subject to master netting arrangements and qualify for net presentation in the consolidated balance sheet. | |

See Note 15 for fair value measurement disclosures on derivatives.

Credit Risk

A majority of Occidental’s derivative transactions are exchange-traded contracts, which are subject to nominal credit risk as a significant portion of these transactions are executed on a daily margin basis. Cash collateral of $222 million deposited by Occidental with clearing houses, which has not been reflected in the derivative fair value tables, is included in the marketing and trading assets and other balance as of December 31, 2009.

In addition, Occidental executes a portion of its derivative transactions in the over-the-counter (OTC) market with various high-credit-quality counterparties. Occidental is subject to counterparty credit risk to the extent the counterparty to the derivatives is unable to meet its settlement commitments. Occidental manages this credit risk by selecting