EXHIBIT 99.1

Occidental Petroleum Corporation

Dr. Ray R. Irani

Chairman and Chief Executive Officer

May 19, 2010

1

2

Top quartile total shareholder

return as compared to peers

return as compared to peers

Oxy Goal

2

3

• Grow production 5-8% compounded over a multi-year

period

period

• Maintain return-based focus

– 15+% after tax for U.S. assets

– 20+% after tax for foreign assets

• Increase dividend payout annually

• Low level of financial risk

Key Elements to Achieve Goal

3

4

• Strong Health, Environment and Safety performance

• Bulk of the assets in the United States

• Maintain oil focus with significant natural gas exposure

• Capture new projects in the Middle East

• Make property acquisitions in the U.S. for growth

Additional Elements to Achieve Goal

4

5

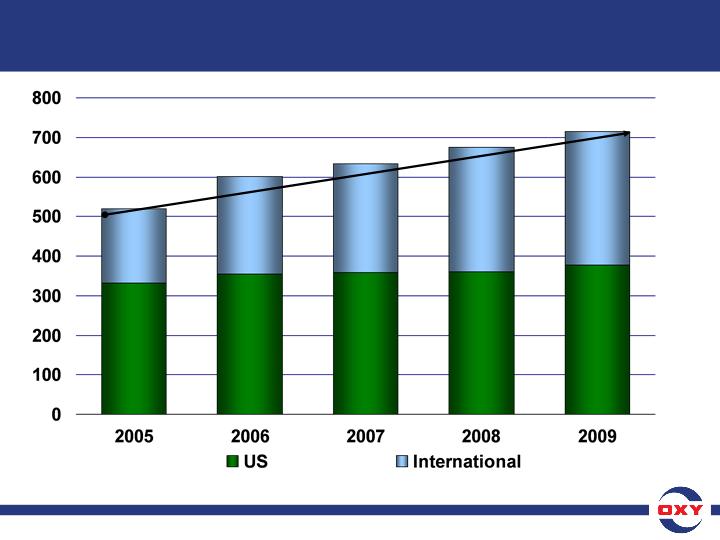

Thousand BOE/Day

519

601

633

675

Notes: 1) From continuing operations; 2) This schedule reflects what production volumes

would have been for the past 5 years if all production had been represented on a pre-tax basis.

would have been for the past 5 years if all production had been represented on a pre-tax basis.

714

7.9%

CAGR

CAGR

Actual Worldwide Production

5

6

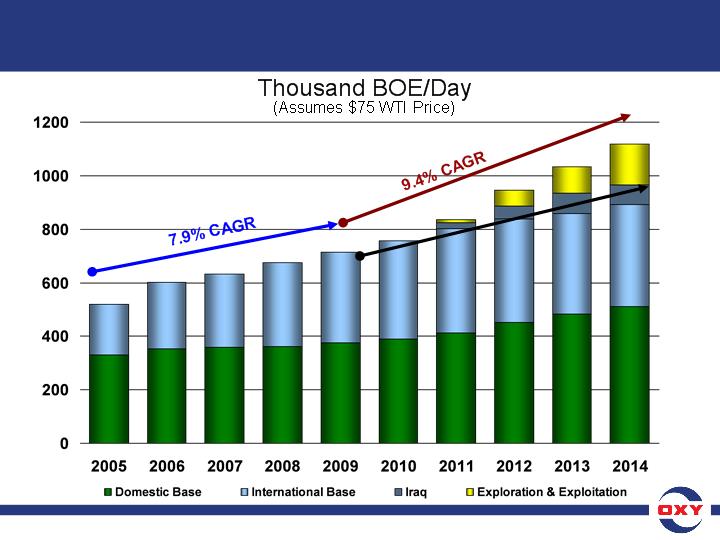

519

601

633

675

714

756

837

946

1,033

1,118

6.2%

Base

CAGR

Base

CAGR

Worldwide Production Outlook

6

7

• Abu Dhabi

• Oman

• Iraq

Additional Middle East Opportunities

7

8

• Sandy Lowe, President, Oxy Oil & Gas -

International Production

International Production

– Latin America

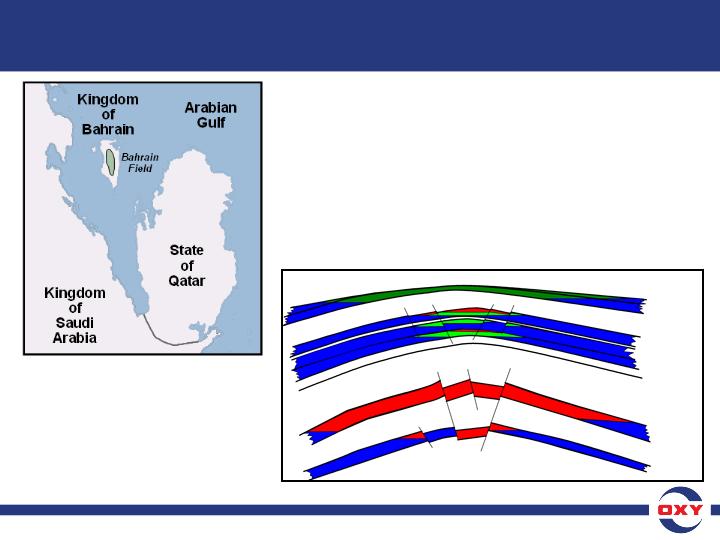

– Bahrain

– Oman

– Iraq

• Bill Albrecht, President, Oxy Oil & Gas - USA

– Permian CO2 Growth

– Deep Inventory of Drilling Projects

Today’s Focus

8

9

• Anita Powers, EVP Worldwide Exploration

– California Conventional Exploration

• Todd Stevens, VP - California Operations

– California Unconventional Plays

Today’s Focus

9

10

• Steve Chazen, President & Chief Financial Officer

– Midstream & Chemicals

– Production Forecast

– Capital Forecast

– Acquisition Strategy

– Cash Flow Priorities

– Investment Attributes

• Questions & Answers

Today’s Focus

10

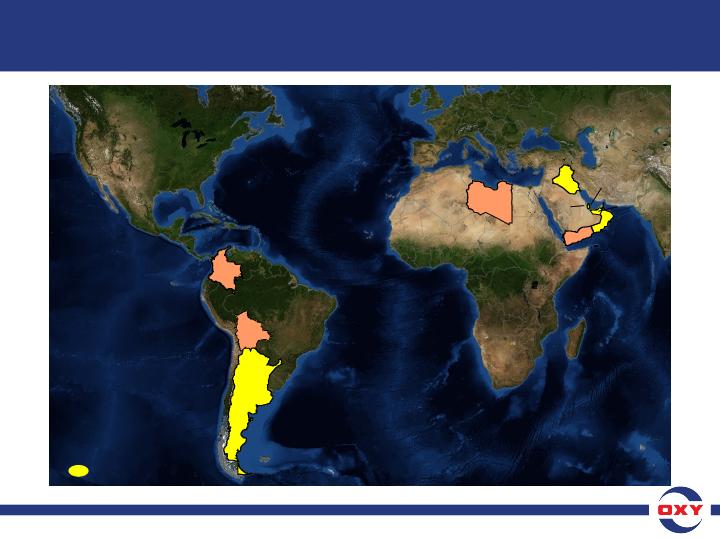

International Oil & Gas

Sandy Lowe

President, Oxy Oil & Gas - International Production

May 19, 2010

2

Colombia

Libya

Oman

UAE

Yemen

Argentina

Bolivia

Qatar

Iraq

Bahrain

Focus Areas

International Producing Areas

3

• 2010 Outlook 79

• 2014 Outlook 95 - 105

$75 WTI

Latin America Net Production

Mboepd

4

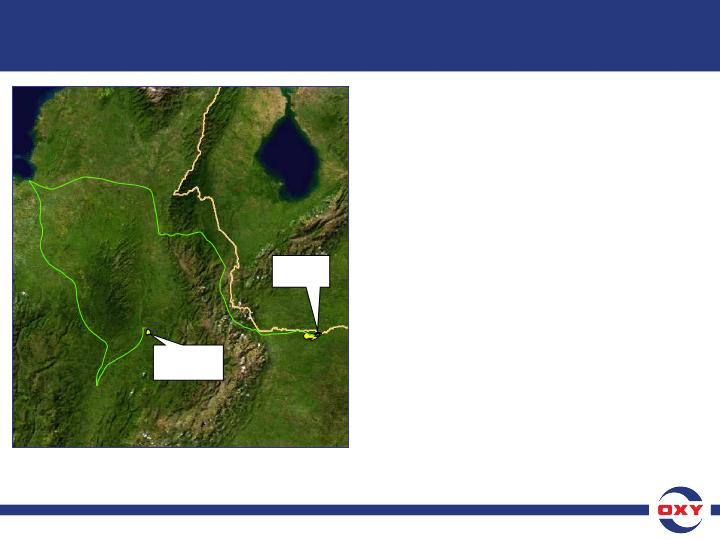

Llanos Basin - 3 B boe Remaining Oil In

Place (ROIP)

Place (ROIP)

• Cano Limon - 15 infill wells in 2010

• New Fields on trend with Cano Limon

– Some stratigraphic reserves upside

– 2 exploration wells this year

• 2010 Gross 80 Mbopd, Net 23 Mbopd

• 2014 expected gross 33 Mbopd,

Net 10 Mbopd

Net 10 Mbopd

La Cira Infantas - 800 MM boe ROIP

• Gross raised from 4 Mbopd to 26

Mbopd in 4 years

Mbopd in 4 years

– 150 new wells per year

– Increasing water injection facilities

• 2010 Gross 28 Mbopd, Net 9 Mbopd

• 2014 expected Gross 50 Mbopd,

Net 18 Mbopd

Net 18 Mbopd

• Total Colombia 2014 Net expected to

be 28 Mbopd

be 28 Mbopd

!

(

!

!

Covenas

Ayacucho

La Cira

Infantas

Infantas

Cano

Limon

Limon

Venezuela

Colombia

LLN-COV pipeline

Vasconia

Oleoducto de

Colombia

Pipeline Source: Ecopetrol

Colombia BU Highlights

5

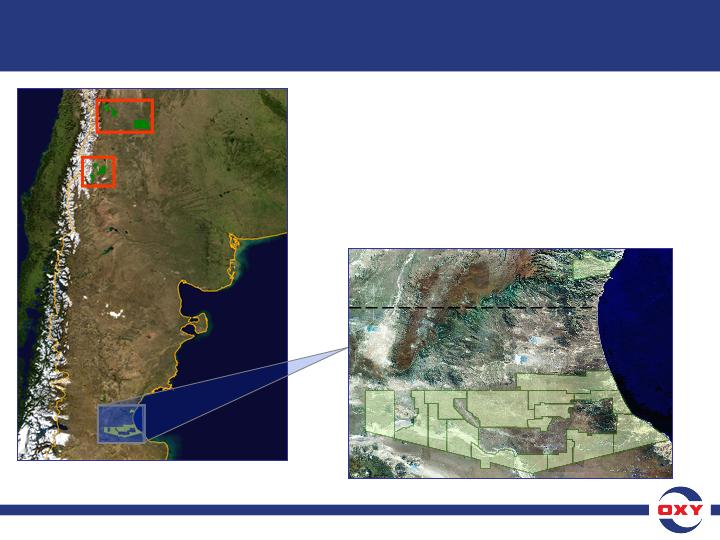

Oxy Argentina Concessions | |||

Province | Concessions | Proved Reserves (MMboe) | Current Net Production (Mboepd) |

Santa Cruz | 15 | 118 | 39 |

Chubut | 1 | 3 | 2 |

Mendoza | 7 | 9 | 4 |

TOTAL | 23 | 130 | 45 |

Argentina

Cuyo Basin

Cuyo Basin

Neuquen Basin

Neuquen Basin

San Jorge Basin

San Jorge Basin

Atlantic

Ocean

Ocean

Chubut

Santa Cruz

Argentina Asset - Overview

6

• 6 B boe ROIP

• Oxy Argentina currently operates

– 2,200 active wells

– 85% oil

– 26 waterflood projects, 13 gas plants

• 2010 plan

– Sign 10 year contract extension, adding over 72

MMboe of proven reserves

MMboe of proven reserves

– Production growth of 8% over 2009

– Drill 140 wells and perform 100 workovers

– Continue to add waterflood facilities

• 2010 Gross production 50 Mboepd, Net 45 Mbopd

Argentina - 2010

7

• Contract extension increases the term to 2025

• Opportunity to fully develop and exploit these prolific

reservoirs

reservoirs

• Continue production growth at 9% per year through 2014

• Perform near field, low risk exploration - 10 wells per year

• Drill 140 development wells per year

• Focus on waterflood development

• 2014 Gross production expected to be 74 to 85 Mboepd,

Net production expected to be 65 to 75 Mboepd

Net production expected to be 65 to 75 Mboepd

Argentina - Future Plans

8

• 2010 Outlook 286

• 2014 Outlook 358 - 381

$75 WTI

Middle East/North Africa Net Production

Mboepd

9

• 7 B boe ROIP

• Nafoora Augila Field

– 255 new wells and 32 workovers

– Install 1 MMBD processing & water

injection facilities and 100 MW

power

injection facilities and 100 MW

power

• Blocks 103 and 74/29 Fields

– 96 new wells

– Install 500 MBD processing & water

injection facilities and 50 MW power

injection facilities and 50 MW power

• 22 Exploration wells 2011 to 2013

• 2010 Gross production 98 Mbopd,

Net 15 Mbopd

Net 15 Mbopd

• 2014 expected Gross production 160

to 172 Mbopd, Net 28 to 33 Mbopd

to 172 Mbopd, Net 28 to 33 Mbopd

Libya Re-Development Plan

Gulf of Sidra

Mediterranean Sea

Benghazi

Sirte

74A

29B

74F

103

102

51A

NAU-NNU

74B

29C

NC145

NC144

NC150

Tripoli

NC143

Area 103

Zueitina EPSA

NAU - NNU

-

Exploration Blocks

Bid Round 4

10

• 2 B bo ROIP

• Block S-1 producing 9 Mbopd

gross

gross

• East Shabwa producing 60 Mbopd

gross

gross

• Masila producing 71 Mbopd gross

– Contract expires 12/2011

– Extension being negotiated

• 2010 program

– 31 development wells

– 3 exploration wells

• 2010 Net production 30 Mbopd

• 2014 Expected Gross production

75 to 110 Mbopd, Net 16 to 24

Mbopd

75 to 110 Mbopd, Net 16 to 24

Mbopd

!

(

!

(

!

(

Aden

Shibam

OXY Exploration

OXY Non Operated Production

OXY Operated Production

Oil Fields / Gas Fields

Pipeline

Red

Sea

Red

Sea

!

San’a

As Salif

Block 14

Masila

Block 10

East Shabwa

Saudi Arabia

Yemen

Gulf of Aden

Block S-1

Damis

Oil Fields / Gas Fields

Pipeline

Yemen

10

11

Qatar - Oil & Gas Fields

• Idd El Shargi North Dome

(ISND) - 4 B bo ROIP

(ISND) - 4 B bo ROIP

• Idd El Shargi South Dome

(ISSD) - 800 MM bo ROIP

(ISSD) - 800 MM bo ROIP

• Al Rayyan - 300 MM bo ROIP

• 2010 Gross Production 118

Mbopd, Net 76 Mbopd

Mbopd, Net 76 Mbopd

• Priorities:

– Maintain production from

existing fields

existing fields

– Additional activity to

increase production later

in the 2010 - 2014 period

increase production later

in the 2010 - 2014 period

Qatar

Qatar

Al Rayyan

Gas Project

Idd El Shargi

North Dome (ISND)

North Dome (ISND)

Idd El Shargi

South Dome (ISSD)

Saudi Arabia

Saudi Arabia

Bahrain

Doha

Umm Sa’id

12

• ISND - applying modern

technology

technology

– Gross Production -

105 Mbopd

105 Mbopd

– Extensive Horizontal Drilling

– Tight matrix waterflood

– Multi-lateral production

– Early use of multi-lateral

source water to injection

completions

source water to injection

completions

Qatar - ISND - Enhancing Production

Qatar

Qatar

Idd El Shargi

North Dome (ISND)

North Dome (ISND)

Saudi Arabia

Saudi Arabia

Bahrain

Bahrain

Doha

Umm Sa’id

13

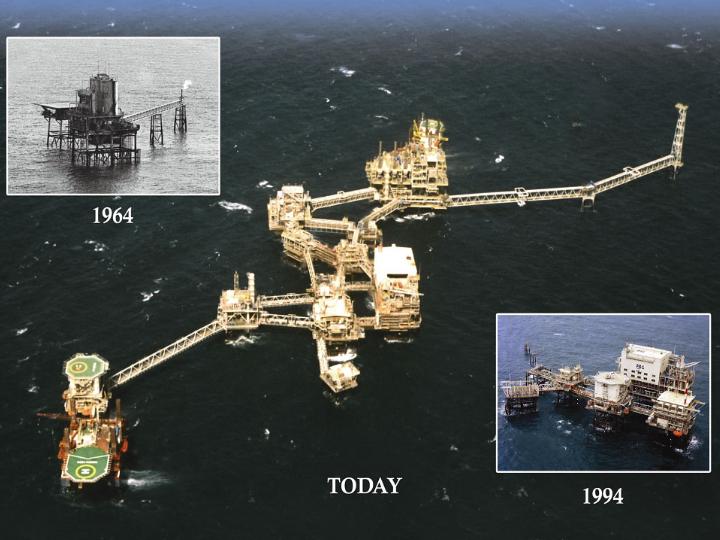

• Phase 1 1994 - 2001

– Drilled 77 Wells

– Added gas lift and water injection facilities

– Multi-lateral production and injection

• Phase 2 2002 - 2005

– Drilled 50 Wells

– Added power, gas compression and water injection facilities

• Phase 3 2007 - 2010

– Drilled 70 wells

– Minor facilities additions

• 2010-2012 Projects for all three assets

– Drill 55 additional development wells

– Install additional facilities

§ 2 new platforms

§ Power generator

§ Additional processing equipment

– Develop 70 MMBO of gross reserves

• 2014 Gross production expected to be 100 to 110 Mboepd,

Net 65 to 70 Mbopd

Net 65 to 70 Mbopd

Qatar Projects

14

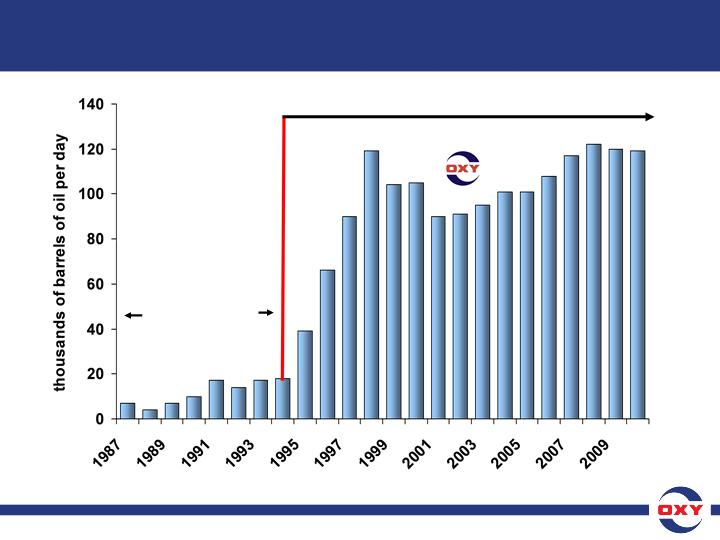

15

Oxy operated since 1994

previous operators

Oxy Qatar Gross Oil Production

15

16

• Delivering 2.0 Bcfd to UAE

and 200 MMcfd to Oman

markets

and 200 MMcfd to Oman

markets

• Gross Production over

530 Mboepd

530 Mboepd

• Consistently above

anticipated gas / liquids

production

anticipated gas / liquids

production

• Additional third party gas

volumes being shipped

volumes being shipped

• On time and budget during

period of rapidly increasing

costs

period of rapidly increasing

costs

• Exceptional returns

Dubai

Taweelah

Jebel Ali

Abu Dhabi

Al Ain

Fujayrah

Umm Sa’id

Doha

Al Hawailah

Dolphin

ISND

ISSD

Block 12

Al Rayyan

Qatar

Saudi Arabia

United Arab Emirates

Oman

Iran

48” Export Pipeline

Jarn

Yaphour

Dolphin Project

17

• Oxy share 24.5%

• 2010 Gross production

537 Mboepd, Net

production 64 Mboepd

537 Mboepd, Net

production 64 Mboepd

• Fee income for UAE

distribution and 3rd party

sales increasing

distribution and 3rd party

sales increasing

• 2014 expected Gross

production 535 Mboepd,

Net 39 Mboepd

production 535 Mboepd,

Net 39 Mboepd

Ras Laffan Plant

Dolphin Gas Project - Oxy Metrics

17

18

Dolphin Fee Income

18

19

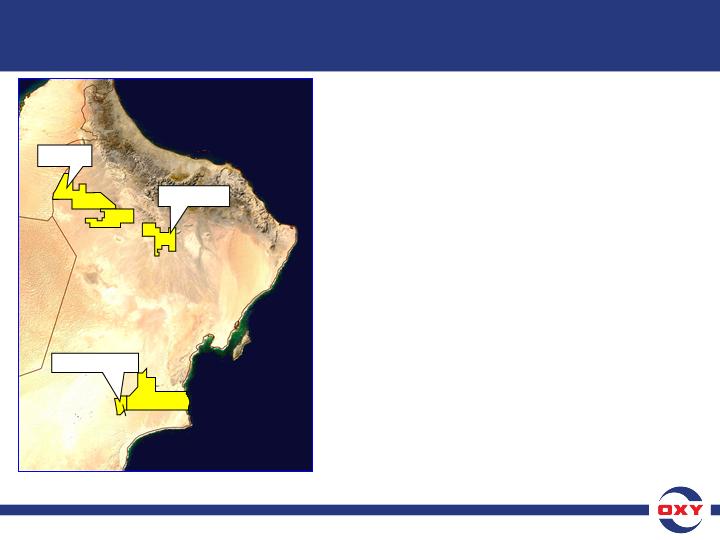

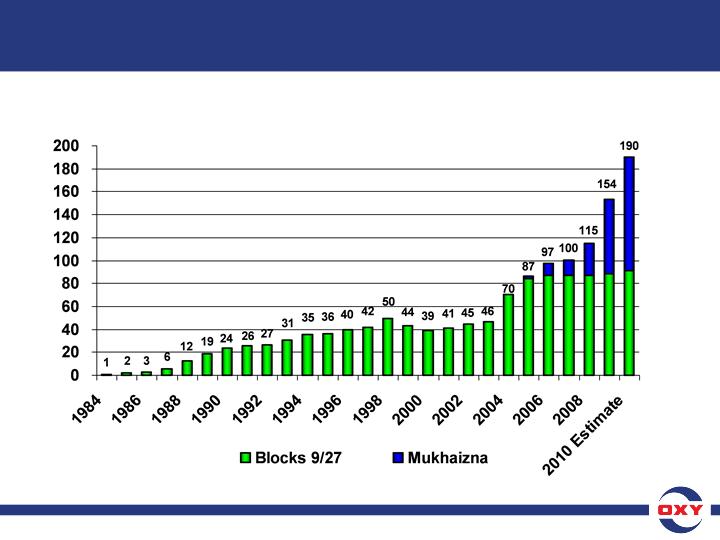

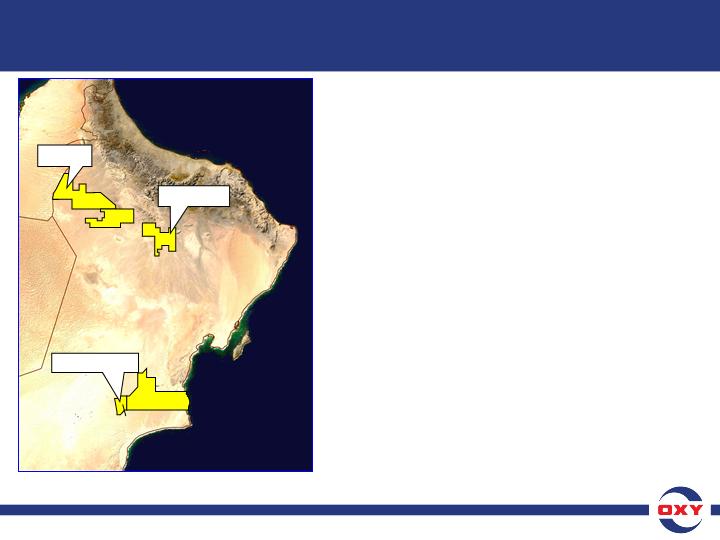

Oxy Oman History

• Oxy commenced operation of the

Safah field in 1984

Safah field in 1984

• Over 500 wells drilled and 30 fields

discovered in Blocks 9 and 27

discovered in Blocks 9 and 27

• Mukhaizna acquired in 2005

• Block 62 acquired in 2008

�� 1,300 total wells drilled in Oman

• 2010 Gross production 190

Mboepd, Net production 70

Mboepd

Mboepd, Net production 70

Mboepd

• 2014 expected Gross production

220 to 240 Mboepd, Net production

70 to 80 Mboepd

220 to 240 Mboepd, Net production

70 to 80 Mboepd

9

27

62

54

53

Safah

Mukhaizna

Block 62

!

Muscat

Gulf of Oman

Arabian Sea

Oman

Oman

Saudi

Saudi

Arabia

Arabia

UAE

UAE

19

20

Mboepd

Oman Gross Production Growth

1984 - 2010

1984 - 2010

21

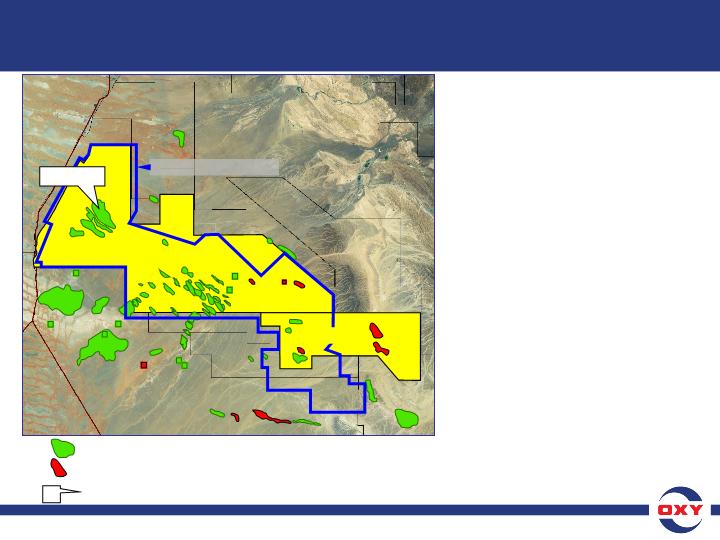

Block 9

Block 27

Safah Field

3D Seismic Coverage

• 2.1 B boe ROIP

• Gross Production

currently at record 91

Mboepd

currently at record 91

Mboepd

• Exploration

– Near field, low risk

– Added ~50Mmboe

over last five years

over last five years

– Multi-year inventory

– Expect to discover

~10 Mmboe gross

per year

~10 Mmboe gross

per year

Oil Discovery or Producing Field

Gas Discovery or Producing Field

Example Oxy Discovery

Oman Blocks 9 & 27

22

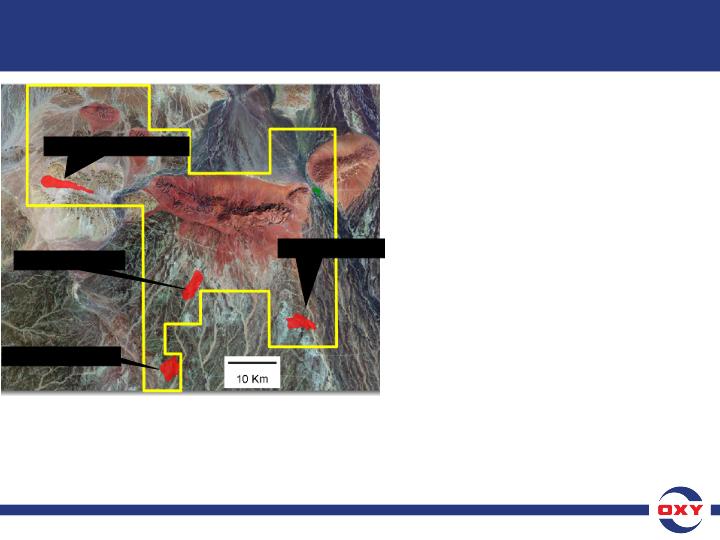

• Oxy is partnered with Oman

Oil Company and Mubadala

Oil Company and Mubadala

• Develop Maradi Huraymah

Field

Field

• Appraise 3 gas discoveries

– 5 wells

– 2 drilled at Habiba

– Encouraging logs and

cores, testing in June

cores, testing in June

• 2011+ Exploration Program

– 2 shallow wells

– 3 to 4 deep wells, 15,000 to

20,000 ft

20,000 ft

– Deep potential of 1 to 2 TCF

Oman Block 62

KM

-

1H1

Oman Block 62

Maradi Huraymah Field

Rasafah Discovery

Habiba Discovery

Fushaigah Discovery

23

• World Class Steam flood

• 2 B bo ROIP

• Discovered in 1975 in South

Central Oman

Central Oman

• Cold production commenced 1992

• Oxy assumed operation

September 1, 2005 at 8,500 Bopd

September 1, 2005 at 8,500 Bopd

• Steam flood commenced May 2007

• Current Gross Production: 100,000

Bopd

Bopd

• Target Gross Production: 150,000

Bopd

Bopd

9

27

62

54

53

Safah

Mukhaizna

Block 62

!

Muscat

Gulf of Oman

Arabian Sea

Oman

Oman

Saudi

Saudi

Arabia

Arabia

UAE

UAE

Oman - Mukhaizna

24

MECHANICAL VAPOR COMPRESSORS

• 7 TRAINS - LARGEST EVER BUILT

• CONDITION WATER FOR BOILER FEED

• 43 MBWPD PER TRAIN

Water Treatment Plant - 2010

24

25

• Increase long term gross oil production from 30,000

to over 100,000 Bopd

to over 100,000 Bopd

• Increase total sales gas rate from 1.1 Bcfd to

over 2 Bcfd

over 2 Bcfd

• Gross oil production expected to be 70,000 to 75,000 Bopd

by 2014

by 2014

• Gross gas production expected to be 1.6 Bcfd by 2014

Bahrain Field Development Plan

25

26

• 7 B bo ROIP

• 17 TCF remaining gas in place (RGIP)

• JV with OXY, Mubadala & Nogaholding

• 19 Reservoirs

• Development includes several new

reservoirs including steam flood of heavy

oil

reservoirs including steam flood of heavy

oil

1.5 B bbl heavy oil

28 TCF gas

6.8 B bbl light oil

Bahrain Field Development

26

27

• Drilling over 2,500 wells

– Increase the rig fleet - building up to 6 drilling rigs and 6

workover rigs

workover rigs

• Implement new recovery processes

– Waterfloods

– Steam injection

• Increase fluid and gas handling capacity

– Expanding and adding new tank batteries and manifolds

– Add new steam and water injection facilities

– Expand gas processing capacity

Bahrain Work Activities

27

28

• Agreement Signed January 2010 allows Oxy

to:

to:

– Produce oil

– Take payment in kind

– Book reserves

• Over 20 B bo ROIP

• Gross production of 200 Mbopd by year end,

1.2 MMbopd in 7 years

1.2 MMbopd in 7 years

• Base Rate - 182 Mbopd

• Rehabilitation Plan of activities submitted

April 16, 2010

(period 2011 - 2013)

April 16, 2010

(period 2011 - 2013)

Iran

Iran

Kuwait

Kuwait

Basra

Iraq

Iraq

OXY Production

Oil & Gas Fields

Majnoon

(Shell, Petronas)

Rumaila

(BP & CNPC)

West Qurna-2

(Lukoil & Statoil)

West Qurna-1

(ExxonMobil & Shell)

Halfaya

(CNPC, Total, & Petronas)

Zubair Field

(OXY, ENI, KoGas)

Iraq - Zubair Field

29

Iraq - Contract Features

• Contract allows for quick cost recovery

• At current prices, payback occurs in 4

years, sooner if prices rise

years, sooner if prices rise

• Maximum cash outlay at risk is $800 million

• Ultimate recovery net to Oxy is 210 MMBO

at current prices

at current prices

30

• Consortium presence of 40 personnel currently

in Zubair increasing to 150 by year end

in Zubair increasing to 150 by year end

• Consortium working with the Iraqi South Operating

Company (SOC) to form the Zubair Field Operating

Division (ZFOD)

Company (SOC) to form the Zubair Field Operating

Division (ZFOD)

• Anticipate Zubair 10% gross production increase and

Rehabilitation Plan approval by the end of the year

Rehabilitation Plan approval by the end of the year

• 2014 Gross production expected to be 840 to 880

Mbopd, Net production expected to be 65 to 75

Mbopd

Mbopd, Net production expected to be 65 to 75

Mbopd

Iraq - Current Activities

31

Middle East / Africa 286 358-381

Latin America 79 95-105

TOTAL 365 453-486

2010 2014

Outlook Estimate

Outlook Estimate

MBOEPD

International Net Production

32

Grow:

• Oman gross production from 190 to 240 Mboepd

• Bahrain gross oil production from 30 to 75 Mbopd

• Bahrain gross gas production from 1.1 to 1.6 Bcfd

• Argentina gross production from 50 to 85 Mboepd

• Iraq gross production from 182 to 880 Mbopd

Continue generating substantial free cash flow

from:

from:

• Qatar

• Dolphin

• Colombia

• Yemen

International Summary - 5 years

United States Production Operations

Bill Albrecht

President, Oxy Oil & Gas - USA

May 19, 2010

1

2

Overview

• Permian

– Primary Development

– CO2 Growth Opportunities

• California

– Elk Hills Development

– Other California

• Mid-Continent

– Piceance Overview

– Hugoton Overview

• Domestic Summary

2

3

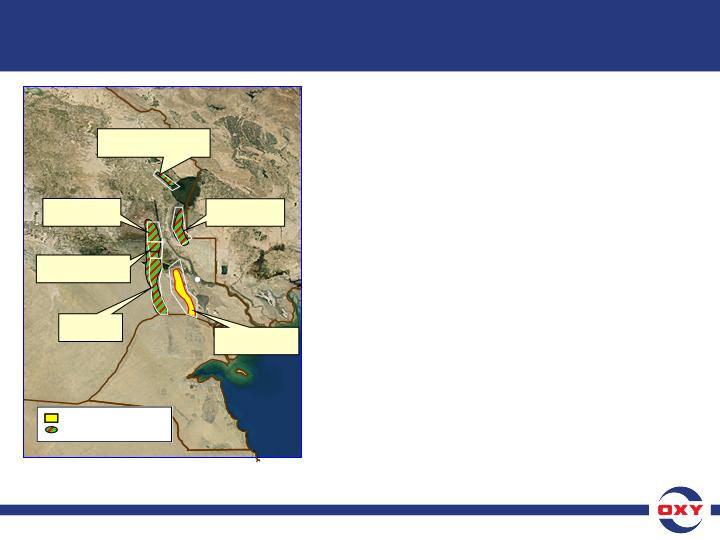

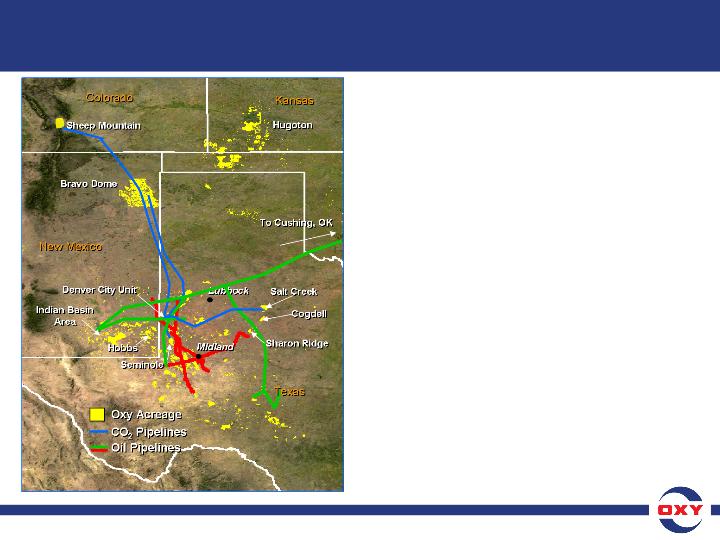

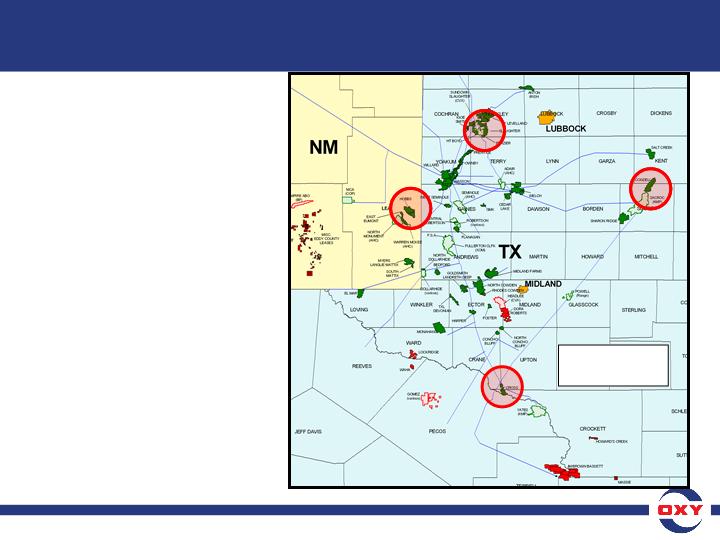

PERMIAN

3

4

• Oxy’s largest business unit

• 180,000 BOEPD

• Largest oil producer in Texas

• Largest oil producer in Permian

(20% of total)

(20% of total)

• Largest operator in Permian

(of 1,500+ operators)

(of 1,500+ operators)

• 10,000+ interest owners

• 100,000 square mile area

• Acreage

– 3,600,000 gross

– 2,200,000 net

• 1.1 BBOE of net proved

reserves (34% of Oxy total)

reserves (34% of Oxy total)

• 1.7 BCFPD (0.5 TCF/YR) of CO2

Permian Overview

4

5

Permian Basin

Permian Basin

• Primary Development (1,000+

locations)

locations)

– Plan a 6-7 rig program

– Dora Roberts Wolfberry

– Continued southeast New

Mexico exploitation

Mexico exploitation

– Deeper added plays

• CO2 Growth

– Existing flood expansions

(including residual oil zone

deepenings)

(including residual oil zone

deepenings)

– New CO2 projects

– Infill drilling/pattern flooding

– New Century plant online 4Q

2010 for additional CO2

supply

2010 for additional CO2

supply

Lubbock

Texas

New Mexico

Oklahoma

Bravo Dome CO2

Source

Source

Midland

Wolfberry

Delaware Sands

Permian Growth Opportunities

5

6

Shallow (4,000-10,000 feet)

• Non-traditional pays, e.g.,

“Wolfberry” play at Dora

Roberts (250 well program)

“Wolfberry” play at Dora

Roberts (250 well program)

• Historically uneconomic

pays with horizontal drilling

applications, e.g., Delaware

and Bone Springs sands

pays with horizontal drilling

applications, e.g., Delaware

and Bone Springs sands

Delaware Sands

“Wolfberry”

Permian Primary Development

Delaware Sands (Oil)

200+ locations; 20+ mmboe

“Wolfberry” (Oil)

550+ locations; 70+ mmboe

6

7

Deep (10,000-15,000 feet)

• Horizontal Devonian

opportunities

opportunities

• Ellenburger oil and deeper

Ellenburger gas

Ellenburger gas

• Morrow sand opportunities

on southeast New Mexico

acreage

on southeast New Mexico

acreage

• These deeper plays are on

acreage Oxy already owns

acreage Oxy already owns

Delaware Sands

Fusselman

Ellenburger

“Wolfberry”

Devonian

Potential Added Plays

Devonian (Oil)

375+ locations; 30+ mmboe

Fusselman (Oil)

75+ locations; 15+ mmboe

Ellenburger (Oil)

125+ locations; 25+ mmboe

7

8

Permian Added Plays

• Added plays inventory

– ~1,000 locations and 90-100 MMBOE net risked reserves

• Infill drilling inventory

– ~1,100+ locations, greater than a 10-year inventory at

existing drilling pace

existing drilling pace

• Higher oil prices bringing new opportunities (1,100

additional locations, 25-40 MMBOE) which are

economic at current oil prices

additional locations, 25-40 MMBOE) which are

economic at current oil prices

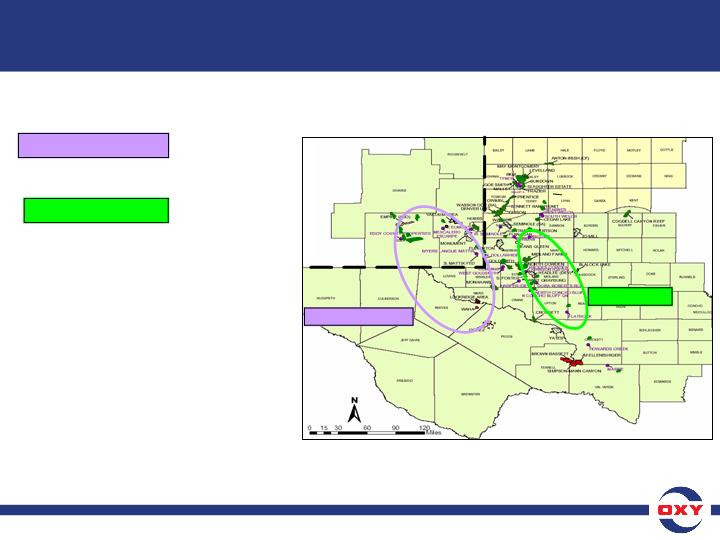

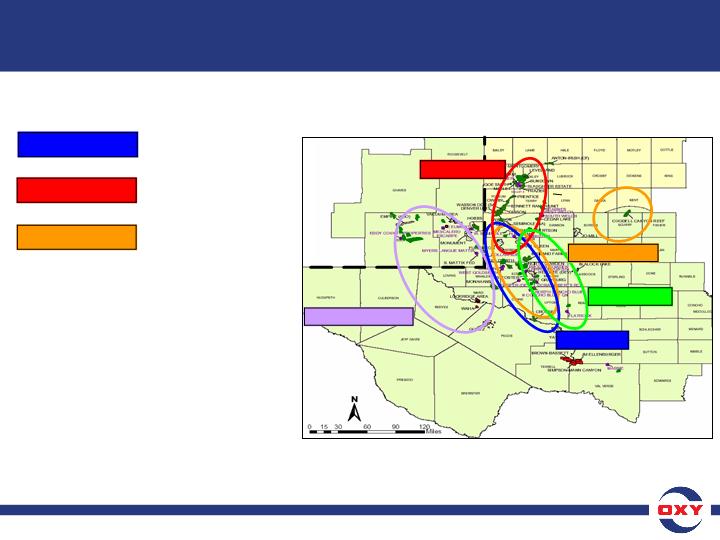

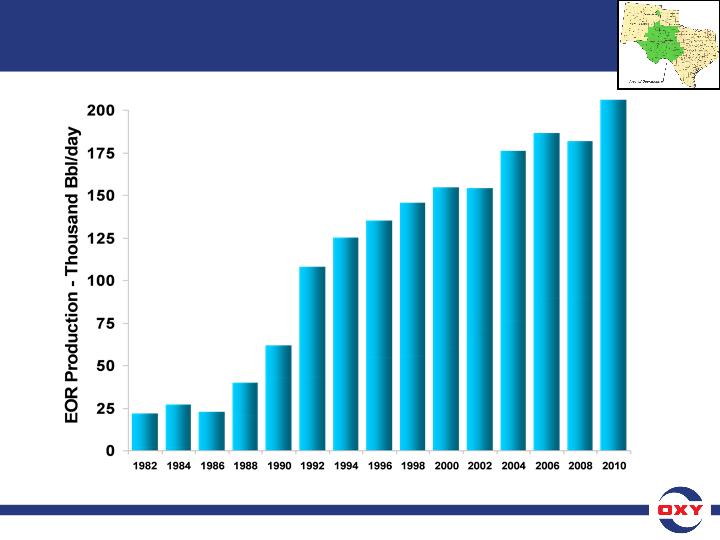

8

9

Note: Based on data obtained from the O&GJ 2010 Biannual EOR Survey

22% of Permian Basin’s Oil Production

Permian Basin CO2 Floods

EOR Production is Growing

EOR Production is Growing

9

10

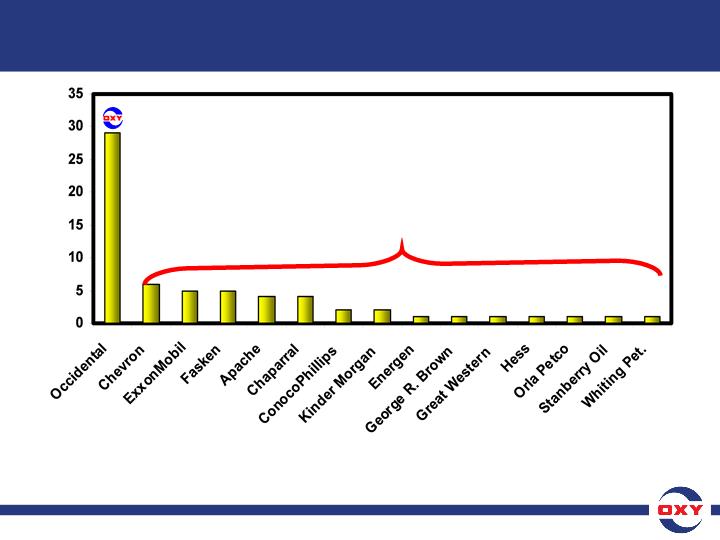

14 other companies

• Permian Basin CO2 Floods

• First floods initiated 35 years ago

• Over 50 CO2 floods in Permian Basin

Note: Based on data obtained from the O&GJ 2010 Biannual EOR Survey

Permian Basin CO2 Floods

Number of Active Operated CO2 Projects

Number of Active Operated CO2 Projects

10

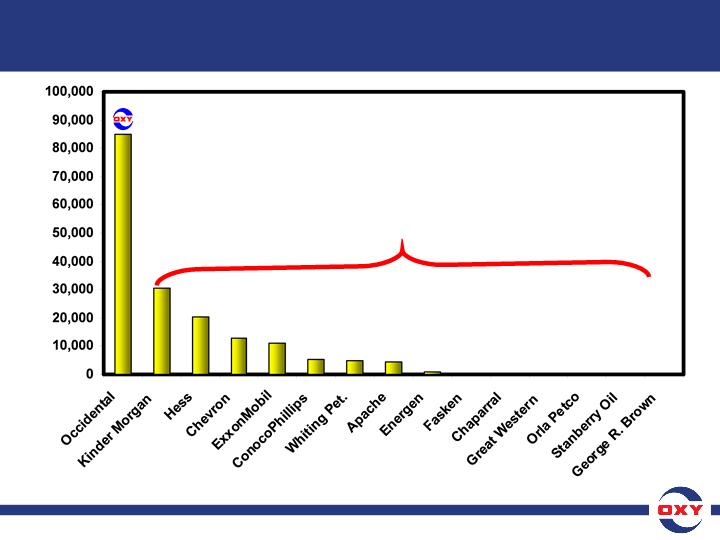

11

14 other companies

• Permian Basin CO2 Floods

• First floods initiated 35 years ago

• Over 50 CO2 floods in Permian Basin

Note: Based on data obtained from the O&GJ 2010 Biannual EOR Survey

Permian Basin CO2 Floods

Operated CO2 Projects EOR Production, BOPD

Operated CO2 Projects EOR Production, BOPD

11

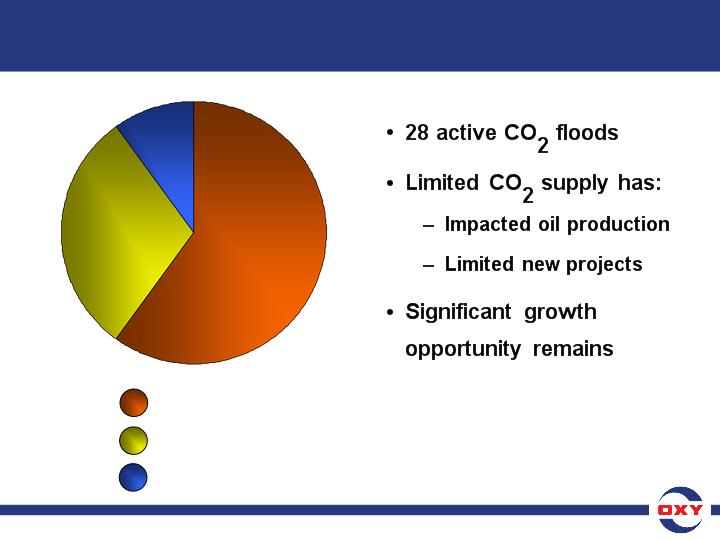

12

CO2 Flood

Waterflood

Primary

60%

30%

10%

Permian Oil Production

12

13

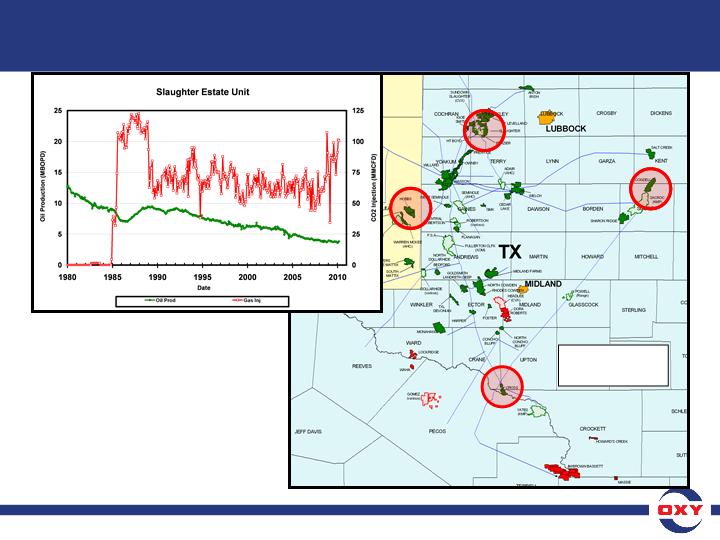

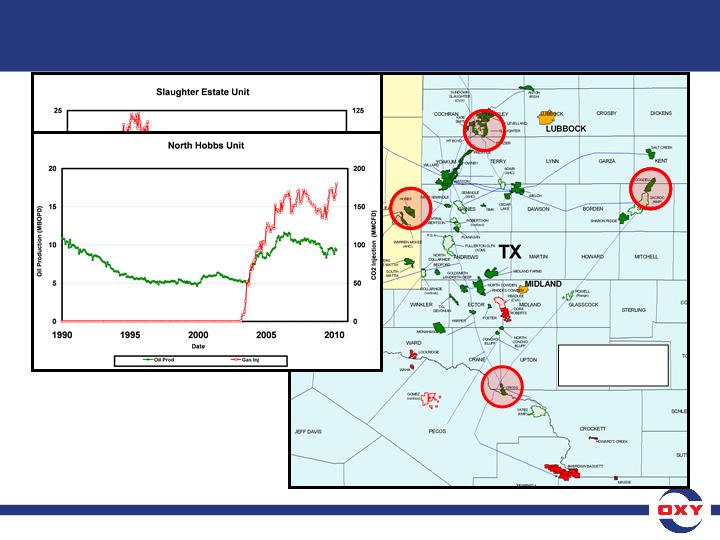

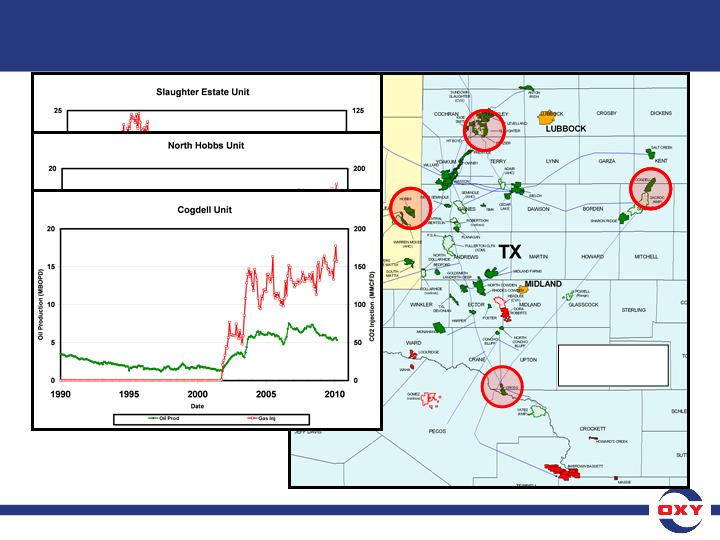

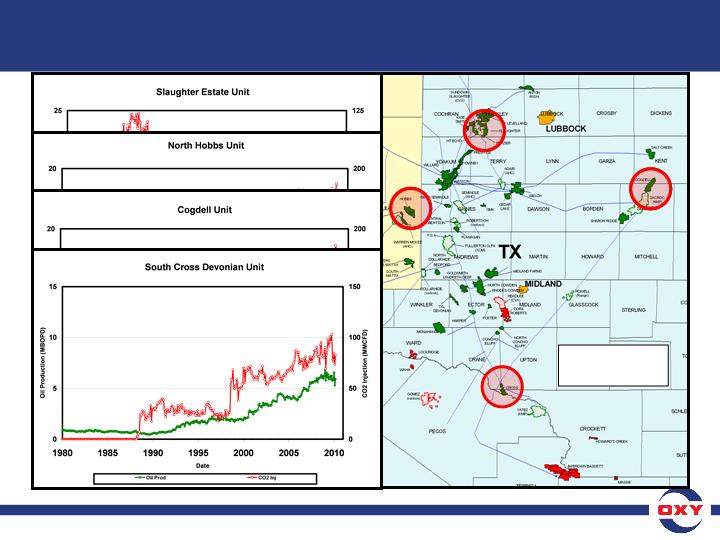

1-2 yrs. avg.

response time

response time

Examples of CO2 Flood Response

13

14

1-2 yrs. avg.

response time

response time

Examples of CO2 Flood Response

14

15

1-2 yrs. avg.

response time

response time

Examples of CO2 Flood Response

15

16

1-2 yrs. avg.

response time

response time

Examples of CO2 Flood Response

16

17

1-2 yrs. avg.

response time

response time

Examples of CO2 Flood Response

17

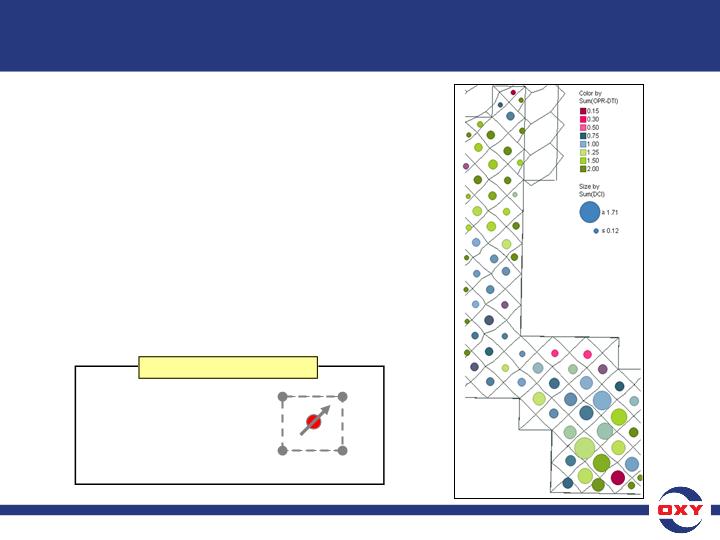

18

Pattern Layout

Evaluated more

than 50 parameters

for each pattern

than 50 parameters

for each pattern

Facilitated by new

generation of tools

generation of tools

Traditional Process

New Process

Typical pattern =

One injector and

four producers

four producers

1800 CO2 Patterns

Applied at Pattern Level

CO2 Surveillance - Step Change

• Flood specific tools

• Only applied to largest

projects

projects

• Limited to senior

engineers

engineers

• Manual process

• Annual frequency

• Standardized approach

• Applied to all CO2 floods

• Visualization software

• Monthly updates

• Readily taught

• Improved accuracy

• Frequent flood

improvements

improvements

18

19

Permian CO2 Surveillance

Results of Surveillance Effort

• Constructed new tools to enable review of 1,600

patterns in two months

patterns in two months

• Re-allocated CO2 to better performing patterns

• Defined 3,000+ BOPD improvement with equal volume

of CO2 injected

of CO2 injected

• Developed skills to maintain efficiency

19

20

4.6 BBO

3P Reserves

EOR Likely

EOR Potential

0.8 BBO

1.4 BBO

1.0 BBO

Residual

7.8 BBO Net Remaining

EOR Opportunities

• 4.1 BBO have been

produced,

produced,

• leaving 7.8 BBO net

remaining

remaining

20

21

Net Reserves* (MMBOE) | Net CO2 Required (TCF) | |

Developed | 570 | 2.8 |

Undeveloped TOTAL | 430 1,000 | 2.2 5.0 |

“The next billion barrels”

Reserves and CO2 Requirements

* 3P Reserves

21

22

CO2 Growth Opportunities

• Currently produce 1.7 BCF/day (0.5 TCF/year)

• Short term CO2 purchase opportunities (1.1TCF)

– More opportunity to purchase additional CO2 volumes

– Recently contracted for additional 100 MMCFD

• Oxy produced CO2 (1.6 TCF)

– Can add CO2 by drilling more wells

• Additional CO2 supply (3.5 TCF)

– From methane/CO2 fields (e.g., Piñon field)

• Enables Occidental to accelerate development of

projects that are in hand

projects that are in hand

22

23

Additional CO2 Supply vs. Demand

• Should Piñon development cease, currently developed

CO2 would continue to be available to Oxy at similar

rates

CO2 would continue to be available to Oxy at similar

rates

• If Century Plant CO2 delivery schedule not met,

adequate CO2 supply exists today on the market to

cover the shortfall

adequate CO2 supply exists today on the market to

cover the shortfall

• Penalties paid for non-delivery of CO2 would

effectively reduce the cost of make-up CO2

effectively reduce the cost of make-up CO2

• Oxy expects to be able to secure such supply if

necessary

necessary

23

24

• Plant design

– Inlet = 675 MMCFD

– Train I = 260 MMCFD CO2

– Train II = 180 MMCFD CO2

• Expected start up:

– Train I - 4th Quarter 2010

– Train II - Early 2012

Permian - Century CO2 Plant Project

24

25

• Flood Expansions:

Slaughter (in 6 Units)

Levelland (3 Units)

Wasson (ROZ, 3 Units)

Seminole (ROZ, Hess)

South Hobbs

North Cowden

ROZ Expansions (numerous

projects)

projects)

• New CO2 Floods:

West Seminole

Sharon Ridge

Clearfork Reservoirs

• Slug Size Increases

Nearly all existing projects

Permian CO2 Floods (with additional CO2)

25

26

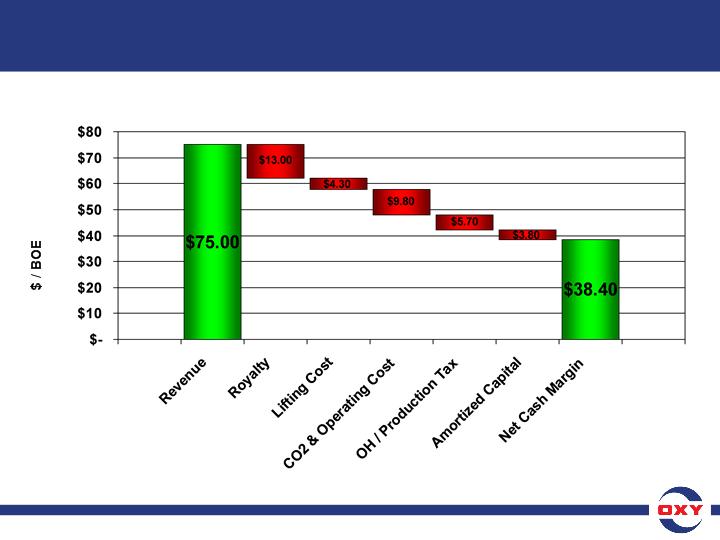

* $75 / Bbl Marker Price

Typical CO2 Project Cost Structure

26

27

Permian - Summary

• Primary development

– Deep inventory of 2,000+ drilling locations, mostly oil,

with 150+ MMBOE risked reserve exposure

with 150+ MMBOE risked reserve exposure

– Locations on acreage Oxy already owns

• CO2 growth

– 1-3 billion BBLS net of enhanced recovery reserves

expected from Oxy Operated CO2 floods

expected from Oxy Operated CO2 floods

– Significant inventory of CO2 flood opportunities

§ Expansions, new floods, residual oil zone

development, slug size increases

development, slug size increases

– Ample CO2 supply accelerates implementation

• Production

– Expect to grow production from 180 MBOEPD in 2010 to

220-230 MBOEPD in 2014

220-230 MBOEPD in 2014

– Assumes no additional acquisitions

27

28

CALIFORNIA

28

29

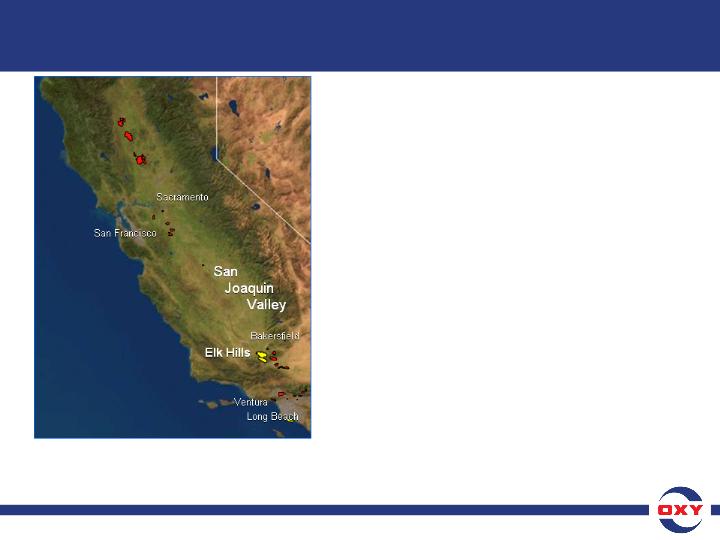

• 143,000 BOEPD

• 780 MMBOE net proved reserves

(24% of Oxy total)

(24% of Oxy total)

• Main producing assets are Elk Hills,

Wilmington, and other assets in the

San Joaquin, Ventura, Sacramento

and LA basins

Wilmington, and other assets in the

San Joaquin, Ventura, Sacramento

and LA basins

• #1 natural gas producer and #2 oil

producer in the state

producer in the state

• Largest fee mineral owner in the

state with more than one million

net acres

state with more than one million

net acres

• 90 producing fields, spanning

more than 600 miles

more than 600 miles

• 7,500 active wells

California Overview

29

30

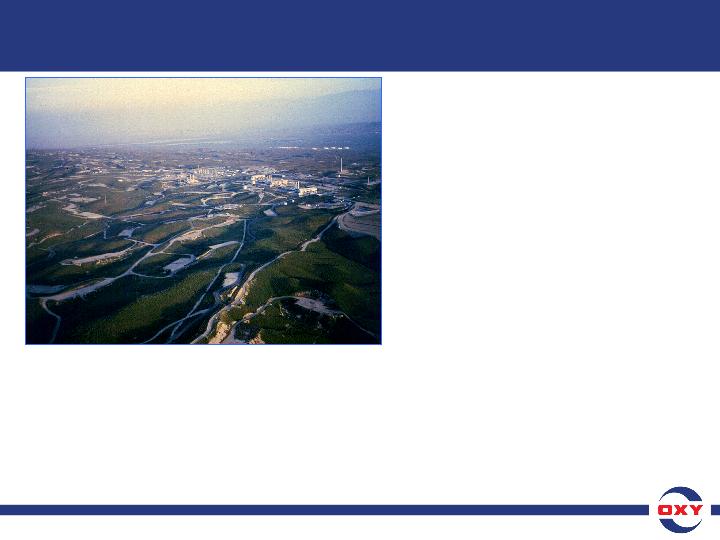

• Took over operations in February 1998

• Approximately 78% ownership

• 538 million BOE proved reserves (70% of CA total)

• Produced 400 million BOE (1998-2009)

• ~125% production replacement

• Largest CA gas & NGL producer

• 5th largest CA oil producer

• Largest gas plant in CA

Elk Hills Key Facts

30

31

Elk Hills

• Development Drilling

– Continued focus on

Stevens sands and shales

(60+ wells in 2010)

Stevens sands and shales

(60+ wells in 2010)

– Re-focused effort on

eastern shallow oil zone

development (129 wells and

57 workovers)

eastern shallow oil zone

development (129 wells and

57 workovers)

– Maintain a 7-rig program

California Development

31

32

Drilling

Inventory

Shallow Oil 1,060

Stevens Sands & Shales 700

Total 1,760

Elk Hills Drilling Location Inventory

32

33

Gas Plant

Capacity MMCFD

Current 420

Late 2Q 2010 Skid Plant 90

Q1 2012 Cryo Plant 200

Total 710

• 200 MMCFD plant-largest that could be built in 20-24 months

• Awarded contract for the plant, and work has begun

• Deeper NGL recovery, high sales gas quality

• Largest, most efficient plant in the area (regional gas hub)

• By year-end 2010, additional capacity will be ordered

(at capacity)

(will be at capacity)

Elk Hills Gas Plant Expansions

33

34

California Development -

Kern County Discovery

Kern County Discovery

• Currently have 24 wells capable

of producing ~45 MBOEPD

of producing ~45 MBOEPD

– Currently gas plant

constrained

constrained

– When 90 MMCFPD skid

mounted facility is brought

online, it will be filled

mounted facility is brought

online, it will be filled

• Planning to drill an additional

20 wells in 2010 (oil focused)

20 wells in 2010 (oil focused)

• Extension opportunities to the

North, South, and West

North, South, and West

• At least 30 additional locations

beyond 2010

beyond 2010

34

35

California Development -

North Shafter

North Shafter

• North Shafter Field

– Acquired 58% in 2004, and

the remainder in 2009

the remainder in 2009

– Now 100% Oxy

– 140+ MMBOEIP

– 7.3% current Recovery Factor

– 44 active wells

– Potential to reduce 80 acre

well spacing to 40 acres

well spacing to 40 acres

• New Concept

– California’s first cemented

liner, plug & perf, fracture

stimulation

liner, plug & perf, fracture

stimulation

– Completed March, 2010

– IP 350 BOPD

– Up to 40 additional locations

using this new completion

method and 40 acre spacing

using this new completion

method and 40 acre spacing

35

36

• Producing:

– 580 Wells, 22 MMbo Net

• Undeveloped:

– 720 Wells, 42 MMbo Net

Historical Steam

Development

Development

Proved

Undeveloped

Undeveloped

Probable

Undeveloped

Undeveloped

California Development - Heavy Oil

36

37

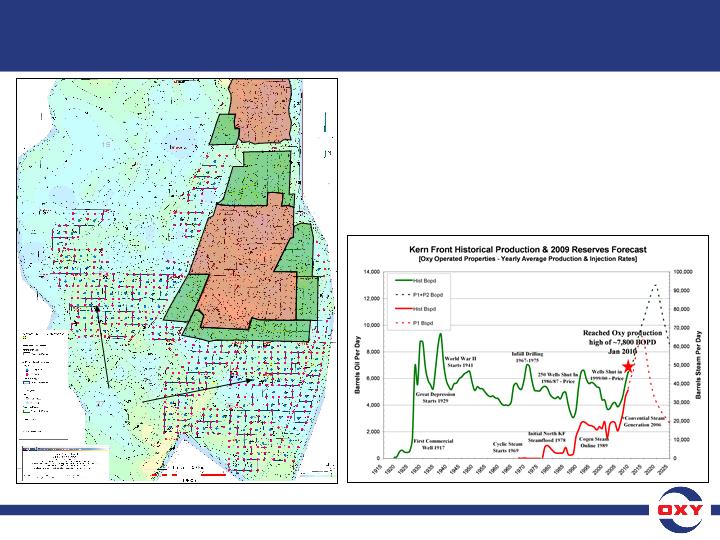

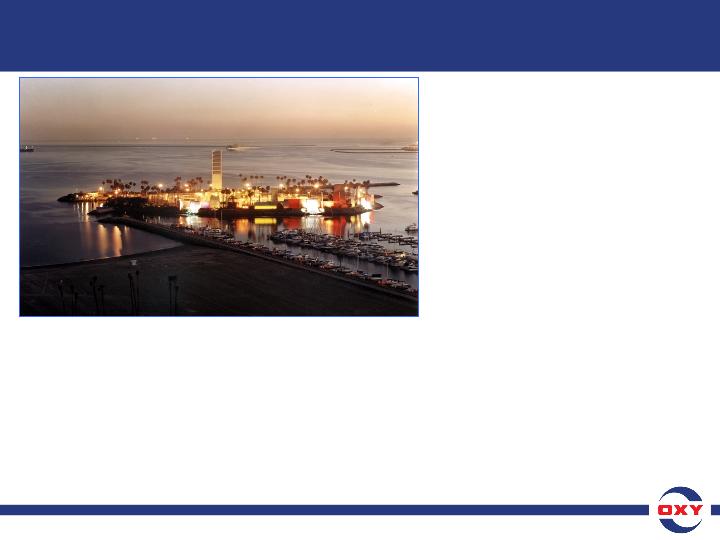

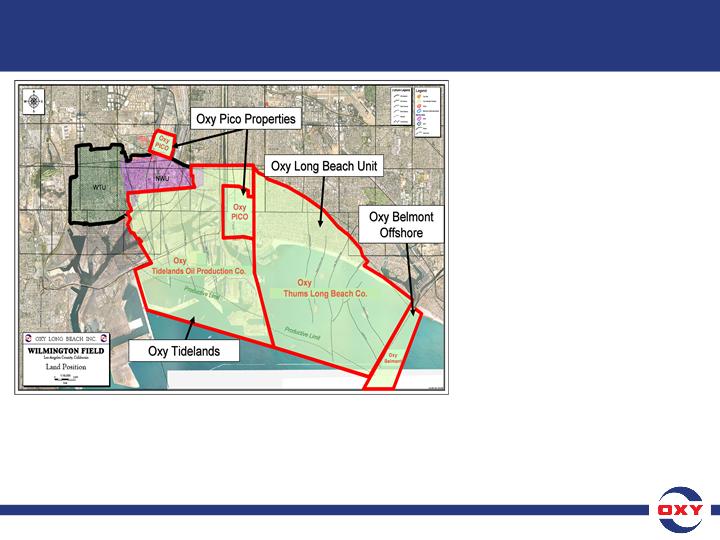

Oxy Long Beach Overview

Wilmington Field

• Among Top 10 largest

oilfields in North America

oilfields in North America

– 6-8 Billion barrels in place

– 2+ Billion recovered

to date

to date

• Significant redevelopment

upside

upside

• Oxy partnering with State,

City of Long Beach, and

the Port of Long Beach

City of Long Beach, and

the Port of Long Beach

37

38

Oxy Long Beach Development

• Steadily growing field

ownership

ownership

– Current stake in over

80% of properties

80% of properties

• Tidelands is a service

contract; THUMS Long

Beach is a PSC

contract; THUMS Long

Beach is a PSC

• Converted a portion of

Tidelands contract to a

PSC through deal with

Port of Long Beach

Tidelands contract to a

PSC through deal with

Port of Long Beach

• Currently negotiating with

the State to do the same

the State to do the same

• Opportunity to grow

production over a 5 year

period with additional

investment

production over a 5 year

period with additional

investment

38

39

California - Summary

• Primary development

– Current inventory of 3,700+ drilling locations

– Locations on HBP or Oxy owned fee minerals

– Recent Kern county discovery does not materially change

gas/oil production mix

gas/oil production mix

– Long Beach is a growth opportunity with recent increases

in equity ownership

in equity ownership

• Infrastructure

– Aging gas plant infrastructure constraining production

– 200 MMCFPD gas plant to be built in 20-24 months

– Additional gas plant capacity will be necessary

• Production

– Expect to grow production from 151 MBOEPD in 2010 to

212-222 MBOEPD in 2014

212-222 MBOEPD in 2014

– Assumes no exploration success or acquisitions

39

40

MID-CONTINENT

40

41

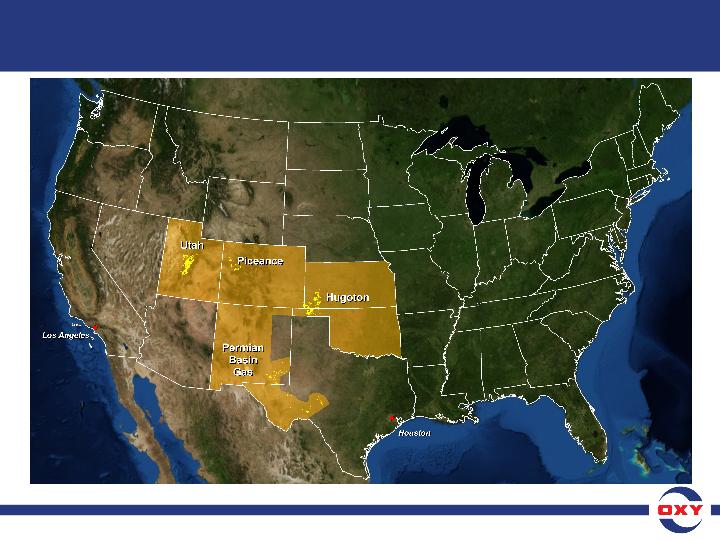

Mid-Continent Gas Business Unit

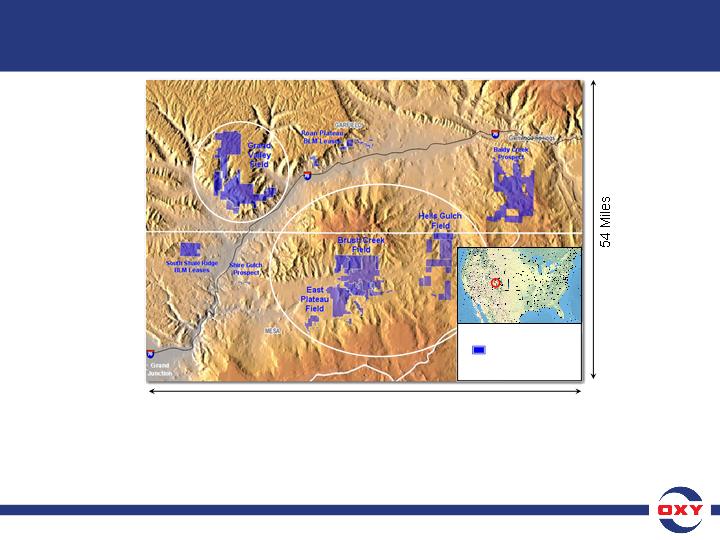

42

42

Cascade Creek

Collbran Valley

Oxy Acreage

Legend

65 Miles

Piceance Position Overview

• ~120,000 net acres

• ~ 640 mmboe total resource base (> 3.8 TCFE)

• ~ 6,000 undrilled locations

42

43

Piceance Development

• Prudent development approach short term, because of

low current gas prices

low current gas prices

– One rig program currently

• Excellent acreage

– Own legacy fee acreage with low royalty (15,000 acres

<1% royalty)

<1% royalty)

• Focused operations

– Reduced unit operating costs by 40+% in 2009

– Specialized Piceance fit-for-purpose drilling rigs in

inventory

inventory

– Reduced drilling time to < 10 days/well from 15+ days/well

in 2008

in 2008

– Improved time to market through simultaneous drilling &

completions operations

completions operations

• Growth

– Resource play where we can readily add production

43

44

NYMEX Price | Realized Price ($/MMBTU) | Capital ($MM) | Reserves/Well (BCFE) | ROR |

$4.00/MMBTU | $3.62 | $2.1 | 1.6 | 19% |

$6.00/MMBTU | $5.36 | $2.1 | 1.6 | 40% |

Piceance Development Economics

44

45

Legacy Acreage

Recently Acquired Acreage

Chase

Council Grove

Wabaunsee

Shawnee

Lansing

Kansas City

Marmaton

Cherokee

Atoka

Morrow

Chester

St. Genevieve

Summer

Heebner

Shallow

Formations

Formations

Gas

Lower

Formations

Formations

Oil + Gas

2500’

4000’

6000’

Hugoton - Oil Drilling Opportunities

• 185 miles long by 45 miles wide

• 2,500 active Oxy wells & 500 miles of pipeline

• ~25,000 boepd (100 mmcfpd, 5,500 bopd, 3,000 bcpd)

• Oxy operated since 1940’s

• Recently doubled acreage from 700,000 to 1,400,000 acres

• 2010 capital program targeting high ROR oil opportunities

– Primary & secondary recovery opportunities

(waterfloods)

(waterfloods)

– 35+ wells planned (90+% oil)

45

46

Mid-Continent Gas - Summary

• Primary development

– Prudent approach to gas drilling

– 3.8 TCFE Resource

– 6,000+ drilling locations

– Low royalty burden enhances economics

– Recent Hugoton acquisition doubles acreage position

and adds significant oil location inventory

and adds significant oil location inventory

• Production

– Expect to grow production from 60 MBOEPD in 2010 to

80-100 MBOEPD in 2014

80-100 MBOEPD in 2014

– Assumes no additional acquisitions

46

47

DOMESTIC SUMMARY

47

48

Drilling Inventory | |

Mid-Continent | 6,500 |

Other California | 1,870 |

Permian Primary | 1,350 |

Elk Hills Shallow Oil | 1,060 |

Permian ROZ deepenings | 800 |

Elk Hills Stevens | 700 |

Kern County discovery | 50 |

TOTAL | 12,330 |

Domestic Drilling Location Inventory

48

49

Domestic Net Production

Permian 184 185 180 220-230

California 128 134 151 212-222

Mid-Continent 49 57 60 80-100

TOTAL 361 376 391 512-552

CAGR, % 6.4 - 8.0

2010 2014

2008 2009 Outlook Estimate

2008 2009 Outlook Estimate

MBOEPD

49

50

Domestic Summary

• Stable, low decline base production

• Deep inventory of drilling projects, mostly oil, across

all domestic business units (12,000+ locations)

all domestic business units (12,000+ locations)

• Large inventory of existing and new CO2 floods

with adequate CO2 supplies secured

with adequate CO2 supplies secured

• California continues to be a major production growth

driver in the U.S.

driver in the U.S.

• Expect to generate 6-8% growth per year over the next

five years (excludes exploration success and

acquisitions)

five years (excludes exploration success and

acquisitions)

• U.S. business is 70% liquids, and we expect this

percentage to stay the same, or grow in the future

percentage to stay the same, or grow in the future

50

California Conventional Exploration

Anita Powers

EVP Worldwide Exploration

May 19, 2010

1

2

Source: Modified from Schlumberger

Conventional Reservoirs

These are the reservoirs that are capable of

natural flow and will produce economic

volumes of oil and gas without special recovery

techniques.

natural flow and will produce economic

volumes of oil and gas without special recovery

techniques.

2

3

Occidental Petroleum

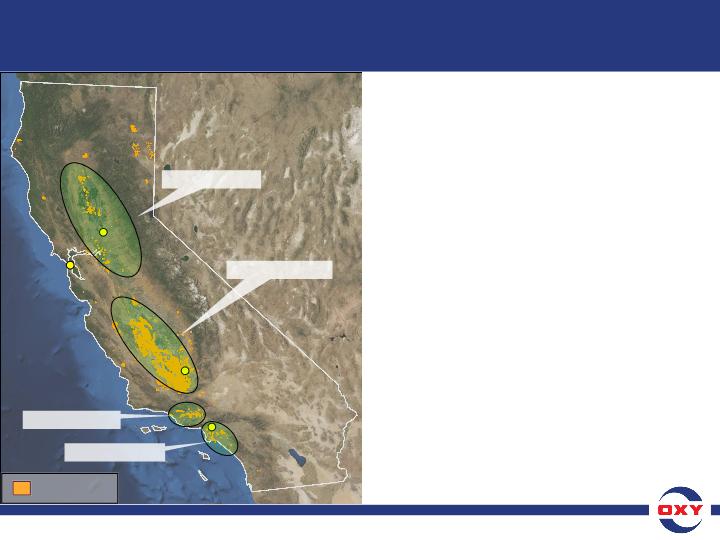

• Why California

– High potential, underexplored

– Dominant position

– Favorable geology, many plays

– Kern County Discovery

– Just started, multi year inventory

3

4

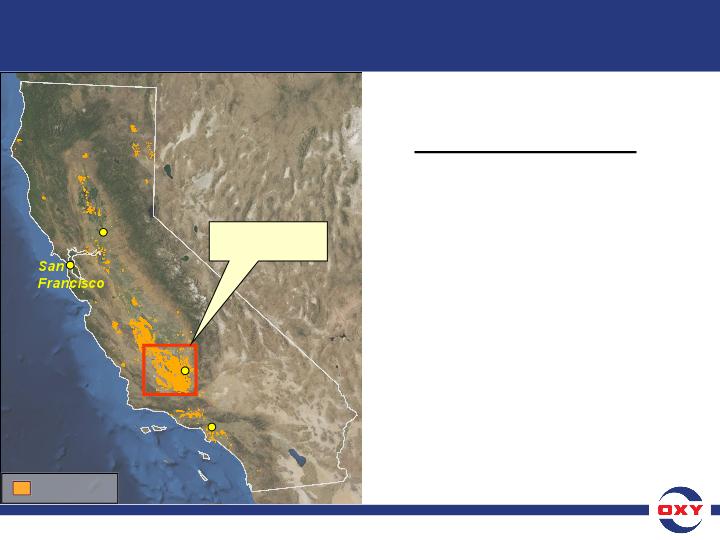

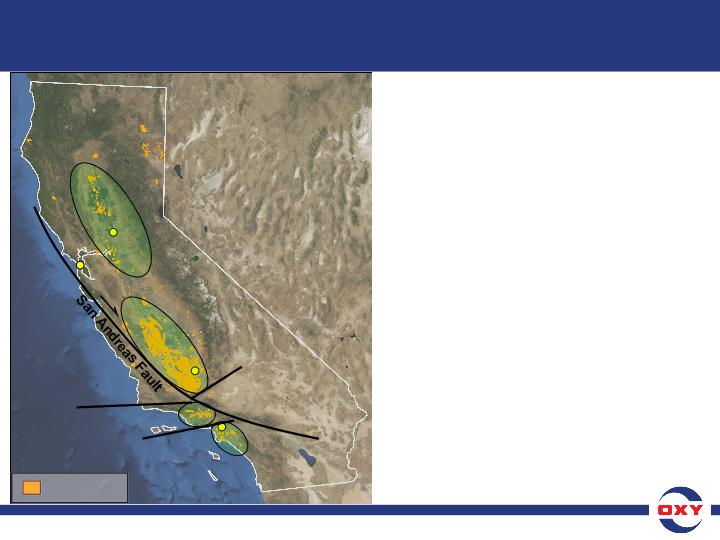

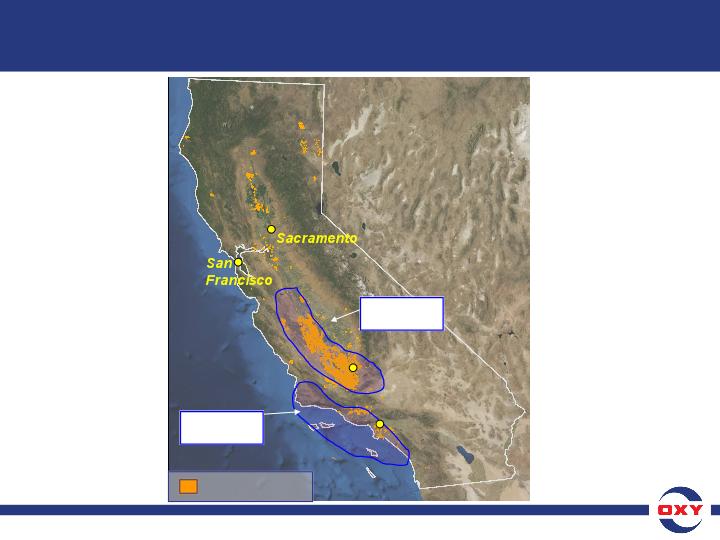

Sources:

California Division of Oil, Gas & Geothermal Resources

Gibson Consulting

Oxy Fee/Lease

2 Billion BOE

20 Billion BOE

3 Billion BOE

10 Billion BOE

Major Producing

Basins

Sacramento

Sacramento

San

Francisco

Francisco

San

Francisco

Francisco

Los Angeles

Los Angeles

Bakersfield

Bakersfield

California Oil and Gas Overview

• World Class Province

– 35+ Billion BOE discovered

– 5 of top 12 U.S. oil fields

• Significant Remaining Potential

– Large undiscovered resources

– Multiple play and trap types

• Underexplored

• Oxy

– Major producer

– Largest land holder

– Successful explorer

– Multi-year prospect inventory

4

5

Discovery Year

Drill Oil and

Gas Seeps

Gas Seeps

Drill Surface

Features

Features

2D

Seismic

Seismic

Small

Discoveries

Discoveries

Since mid 1970’s

• Little exploration activity

• Few discoveries

Why?

• Super major focus?

• Shift to EOR?

• Limited potential?

• Too little exploration?

Sources:

California Division of Oil, Gas & Geothermal Resources

2008-2009 Occidental Upside Estimates

California Exploration History

5

6

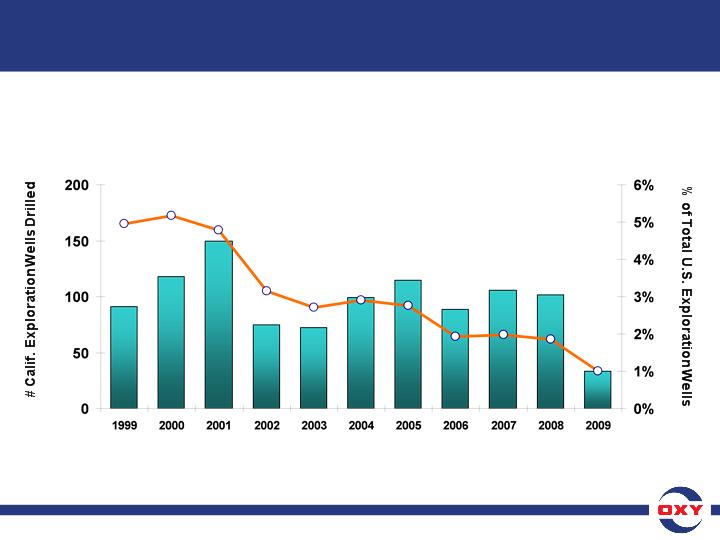

USGS National Assessment of Oil and Gas Update (2008)

* Excludes Federal Waters

* Excludes Federal Waters

Total US Onshore 90 BBOE

California Only 11 BBOE (12%)

Conventional Oil and Gas - L/48

USGS Undiscovered Upside Resources

6

7

Sources:

EIA, IHS wells with recorded spud dates and Oxy estimated spud

EIA, IHS wells with recorded spud dates and Oxy estimated spud

California Exploration Drilling

As a percentage of the Total U.S. Exploration

7

8

Occidental Petroleum

• Why California

– High potential, underexplored

– Dominant position

– Favorable geology, many plays

– Kern County Discovery

– Just started, multi year inventory

8

9

Competitor data estimated by Oxy

4Q 2009 Oxy 1.3

Competitor A 0.4

Competitor B 0.3

Competitor C 0.3

Competitor D 0.1

California Net Acreage

Million Acres

Sacramento

Sacramento

Los Angeles

Los Angeles

Bakersfield

Bakersfield

South San

Joaquin Valley

Joaquin Valley

Oxy Fee/Lease

Oxy Land Position Today

9

10

1998 Fee Holdings

• Elk Hills Acquisition in 1998

Elk Hills Field

Kern Front Field

Bakersfield

Taft

1998

10

11

1998 Fee Holdings

1999-2005 Lease/Fee Additions

1998-2005 3D Seismic

1998-2005 Exploration Wells

• Elk Hills Acquisition in 1998

• Learn, build, explore close-in

Elk Hills Field

Kern Front Field

Bakersfield

Taft

1998 - 2005

11

12

Bakersfield

Taft

Elk Hills Field

Kern Front Field

1998 Fee Holdings

1999-2005 Lease/Fee Additions

2005-2010 Lease/Fee Additions

1998-2005 3D Seismic

2005-2010 3D Seismic

1998-2005 Exploration Wells

2005-2010 Exploration Wells*

• Elk Hills Acquisition in 1998

• Learn, build, explore close-in

• Dominant player, expand

*Excludes certain wells currently in confidentiality period

1998 - 2010

12

13

Occidental Petroleum

• Why California

– High potential, underexplored

– Dominant position

– Favorable geology, many plays

– Kern County Discovery

– Just started, multi year inventory

13

14

Oxy Fee/Lease

San

Francisco

Francisco

San

Francisco

Francisco

Los Angeles

Los Angeles

Major Producing

Basins

Sacramento

Sacramento

Bakersfield

Bakersfield

Favorable Geology

Multiple Reservoirs

Rich Marine Oil and Gas

Source Rocks

Source Rocks

Tectonics Form Variety of

Trap Types

Trap Types

14

15

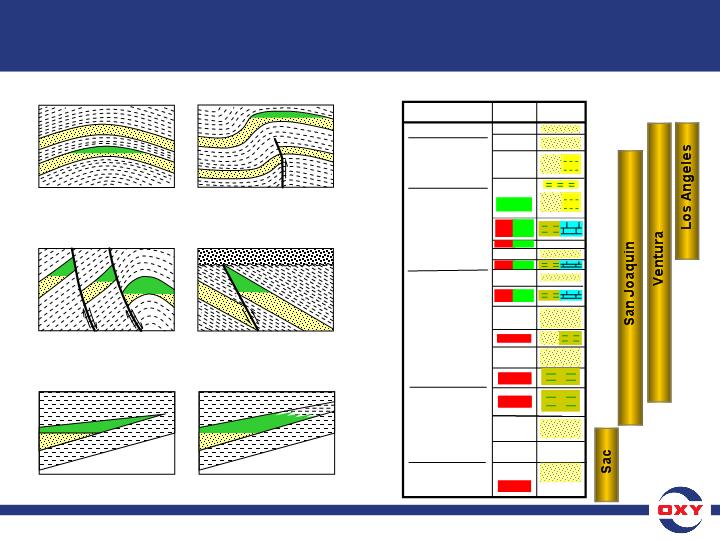

Producing Intervals

AGE

PLEISTOCENE

PLIOCENE

MIOCENE

OLIGOCENE

EOCENE

CRETACEOUS

UPPER

25

35

60

MyBP

Reservoir

Source

2

5

Anticlines

Simple

Complex

Normal

Faulted Closures

Stratigraphic

Reverse

Pinch-out

Facies Change

Conventional Exploration Plays

15

16

• Targeting Oil Prone Plays and Areas

• Integrate Well, Seismic, Outcrop and Analog Data

• Forensic geology - not all information resides on a workstation

• Challenge what is known

• No magic bullets - Just good solid geoscience

47 Plays Identified

San

Joaquin

Ventura

L.A.

Sac.

Valley

Valley

10 Plays Selected

Focus

Plays

Emerging

All Others

Oxy California Play Focus

16

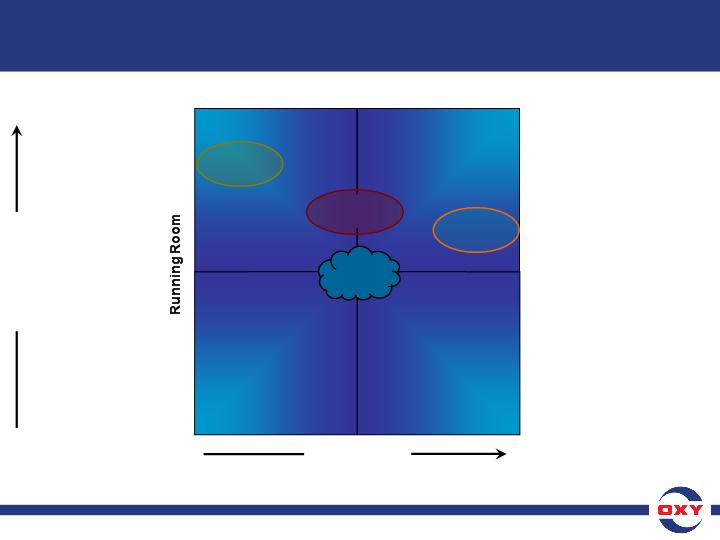

17

Prospect Size

Limited Potential

Limited Potential

One-Offs

One-Offs

Ideal

Ideal

Traditional

Traditional

Bread &

Butter

Butter

Bread &

Butter

Butter

High

Potential

Potential

High

Potential

Potential

?

Emerging

Emerging

?

Emerging

Emerging

Discovery

Discovery

Play

Play

Oxy Play Grouping

17

18

Field Size (MMBOE)

Oxy Play Type and Prospect Exposure

Sources:

California Division of Oil, Gas & Geothermal Resources

Occidental Estimates

California Division of Oil, Gas & Geothermal Resources

Occidental Estimates

California Field Sizes

18

19

Occidental Petroleum

• Why California

– High potential, underexplored

– Dominant position

– Favorable geology, many plays

– Kern County Discovery

– Just started, multi year inventory

19

20

Mix of Sand and Silts

Gross: 1,500 ft.

Net Pay: 600-1000 ft.

Upper Reservoirs

IP ~ 10-30 MMCF/d

36 bc/MMcf, 1,100 BTU

Lower Reservoirs

IP ~ 100-2000 BO/d

1-3 MMCF/d

Clastic Zone

SP Log

Rock

Fluid

Gross: 2,300 ft.

Net Pay: 1,000 ft.

IP ~ 100-500 BO/d

0.3 - 2 MMCF/d

SP Log

Rock

Fluid

“Shale” Zone

Discovery Play

2008: 1st discovery: Proved play concept

2009: 2nd discovery: Major Kern County find

20

21

Gas

Condensate

Zone

Condensate

Zone

Oil Zone

Kern County Discovery

• 24 wells drilled to date

• Observed tighter intervals on edges

of field

of field

– Modified completions of 6 wells

• Increased flow rates

• Ex: Low flow to >1,000+ BOEPD

– 2 horizontal wells planned 2010

• Exploit thick laminated pay intervals

• Field limits not yet defined

– Continue step-out drilling along strike

– Appraise down-dip limits for fluid contacts

21

22

Gross Production

Actual

Forecast

Discovery Volumes

(Net MMBOE)

Results after 24 Wells:

Produced + Proved 88

Probable 47

Possible 40 - 115

End 1Q ‘10 175 - 250

2010 Step-Out Plan 100 - 150

Total Net Potential 275 - 400

Gross Potential 350 - 500

Kern County Discovery

22

23

Occidental Petroleum

• Why California

– High potential, underexplored

– Dominant position

– Favorable geology, many plays

– Kern County Discovery

– Just started, multi year inventory

23

24

* Includes recompletions and deepenings

California Exploration Program

24

25

* includes Deepenings and Recompletions

14-20 Wells

3-5 Wells

3-5 Wells

San

Francisco

Francisco

San

Francisco

Francisco

Los Angeles

Los Angeles

Sacramento

Sacramento

Bakersfield

Bakersfield

Major Producing

Basins

Oxy Fee/Lease

2011 - 14 Annual Program

# Wells*

3D Seismic - 200-400 km2 per year

- San Joaquin - Infill and Expand

- Ventura/LA - Combined exploration

and development

Exploration Going Forward

Discovery Play 7-10

High Potential 5-10

Bread & Butter 5-6

Emerging 3-4

Total per year 20 - 30

25

26

California Conventional Exploration

• Tremendous potential

– Attractive risk profile (Oxy 1 in 3 success rate)

• Dominant land position

• Kern County Discovery

– 175 - 250 MMBOE net discovered with significant upside

• Discovery Play

– 7-10 prospects/year

– Each prospect

• 100 - 125 MMBOE, average

• 500 MMBOE, high-side

• Program will evolve

– Targeting areas more oil prone than Kern County Discovery

– Multi-year inventory: 50 prospects and leads (and growing)

– Learn as we go, prioritize and drill

26

California Unconventional

Todd Stevens

VP - California Operations

May 19, 2010

1

2

“These are the reservoirs that cannot be produced at

economic flow rates or that do not produce economic

volumes of oil and gas without assistance from

massive stimulation treatments or special recovery

processes and technologies.”

economic flow rates or that do not produce economic

volumes of oil and gas without assistance from

massive stimulation treatments or special recovery

processes and technologies.”

Source: Schlumberger Presentation

Unconventional Reservoirs

2

3

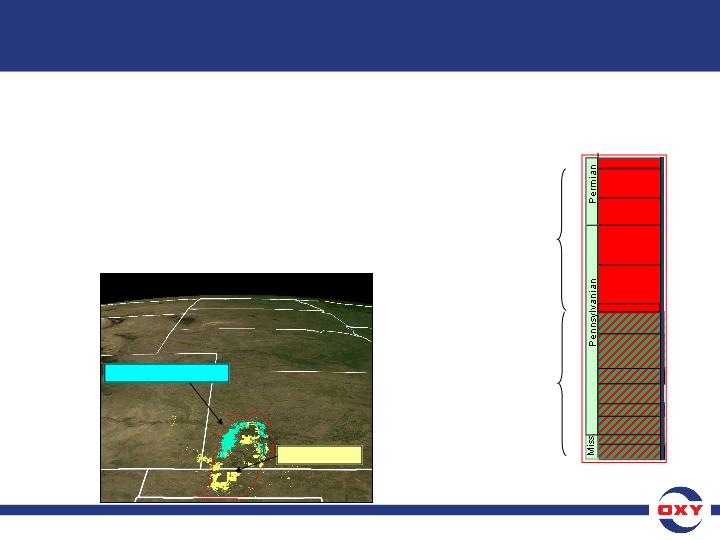

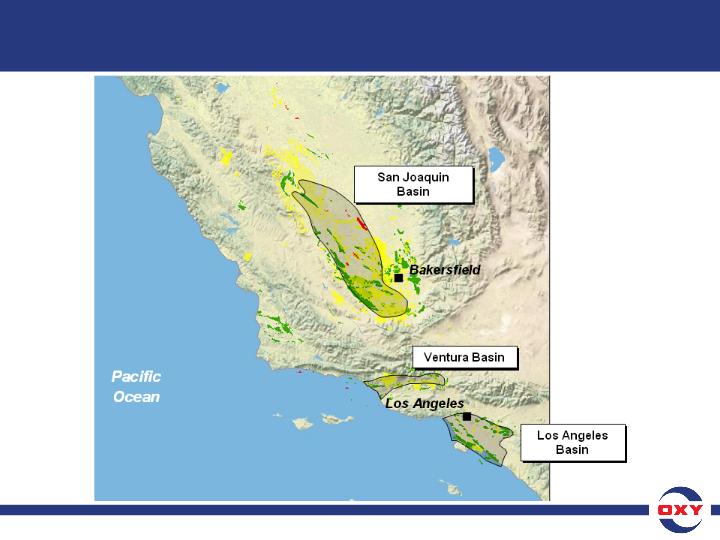

• California “Shale” Background

• Oxy’s “Shale” Program

• California “Shale” Technical Attributes

• California “Shale” Analogs

• Summary

Agenda

3

4

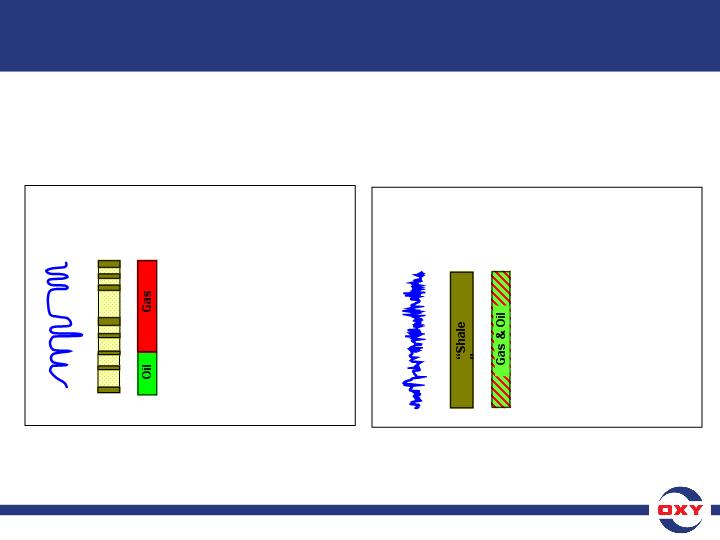

“Shale”

Production

Production

“Shale”

Production

Production

Los Angeles

Los Angeles

Bakersfield

Bakersfield

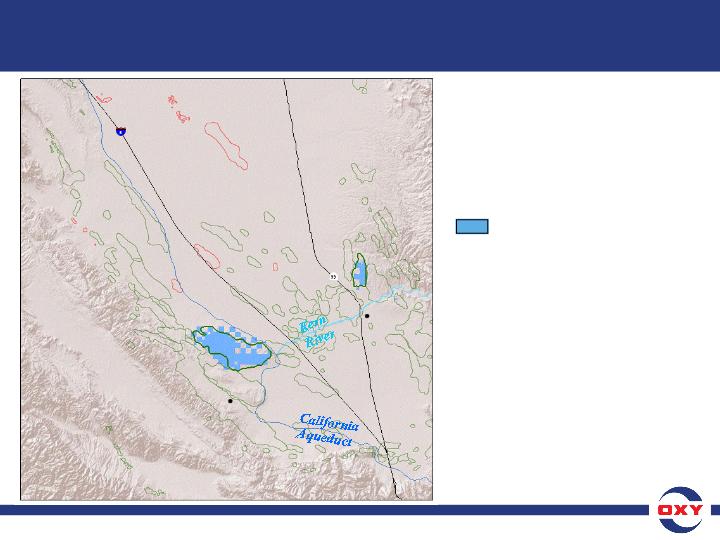

Oxy Acreage

Locator Map

4

5

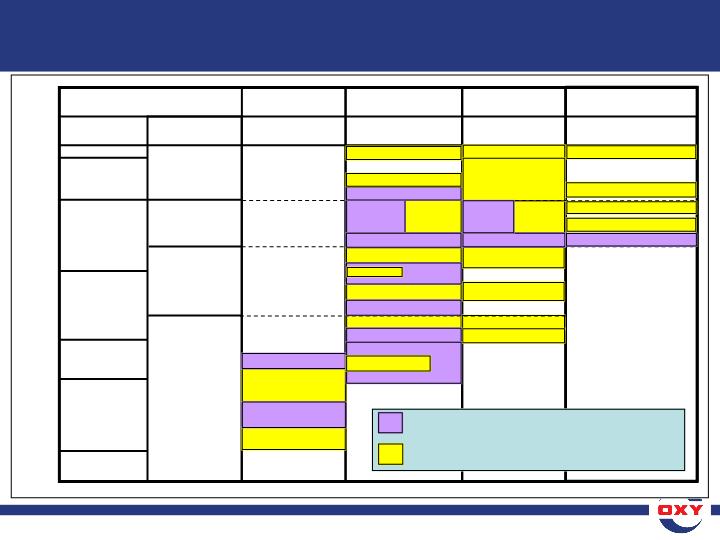

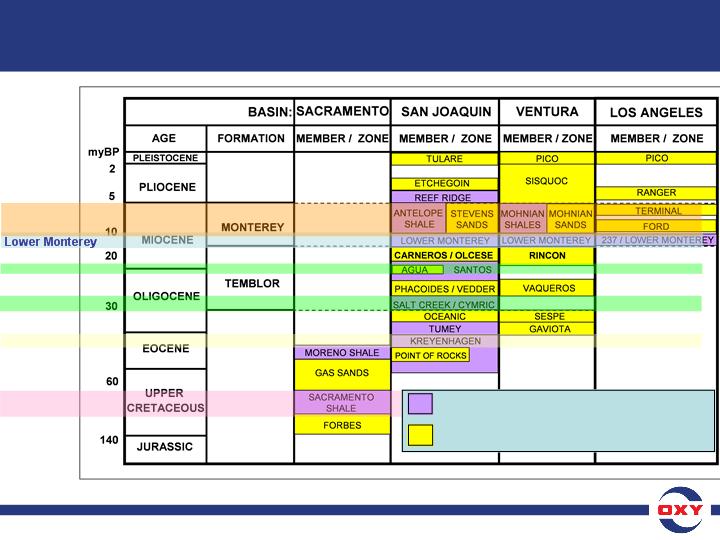

BASIN:

SACRAMENTO

LOS ANGELES

AGE

FORMATION

MEMBER / ZONE

MEMBER / ZONE

MEMBER / ZONE

PLEISTOCENE

PLIOCENE

MIOCENE

OLIGOCENE

EOCENE

CRETACEOUS

UPPER

TEMBLOR

MONTEREY

2

5

60

myBP

JURASSIC

30

20

10

140

GAS SANDS

FORBES

PHACOIDES / VEDDER

CARNEROS / OLCESE

SAN JOAQUIN

MEMBER / ZONE

STEVENS

SANDS

OCEANIC

VAQUEROS

SISQUOC

GAVIOTA

RINCON

SESPE

VENTURA

PICO

PICO

MOHNIAN

SANDS

TERMINAL

FORD

RANGER

SACRAMENTO

SHALE

LOWER MONTEREY

ANTELOPE

SHALE

SANTOS

MORENO SHALE

SALT CREEK / CYMRIC

TUMEY

REEF RIDGE

LOWER MONTEREY

MOHNIAN

SHALES

237 / LOWER MONTEREY

Sandstone Reservoirs / Conventional Plays

Source Rocks and “Shales” / Unconventional Plays

KREYENHAGEN

POINT OF ROCKS

AGUA

ETCHEGOIN

TULARE

Stratigraphic Column - Major Producing Basins

5

6

Antelope

Santos/Salt Creek

Kreyenhagen

Sacramento

Santos

Sandstone Reservoirs / Conventional Plays

Source Rocks and “Shales” / Unconventional Plays

California “Shales” - Target Zones

6

7

• Oil and gas companies in California, in particular Oxy,

have been producing from unconventional plays for a

number of years

have been producing from unconventional plays for a

number of years

• California “shales” compare very favorably with some

of the higher profile plays in other states

of the higher profile plays in other states

• Since acquiring Elk Hills, Oxy has been building its

shale expertise

shale expertise

• Oxy has maintained a low profile to acquire the

California acreage and assets it covets at reasonable

prices

California acreage and assets it covets at reasonable

prices

California “Shales” - “Under the Radar”

Unconventional Play

Unconventional Play

7

8

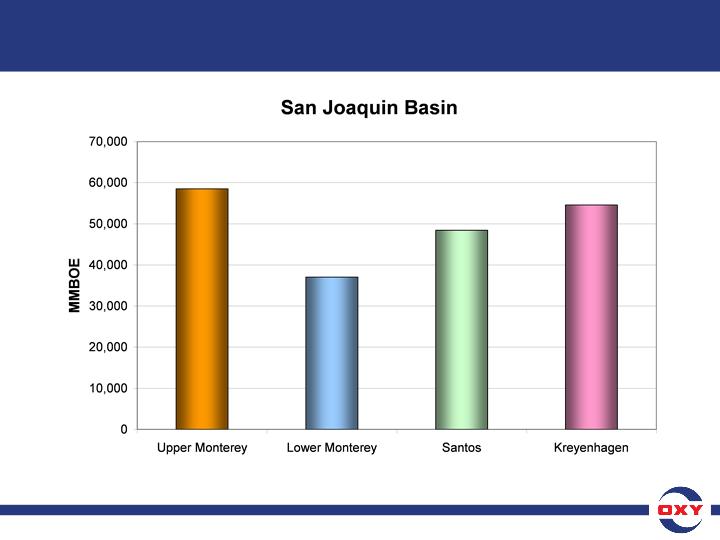

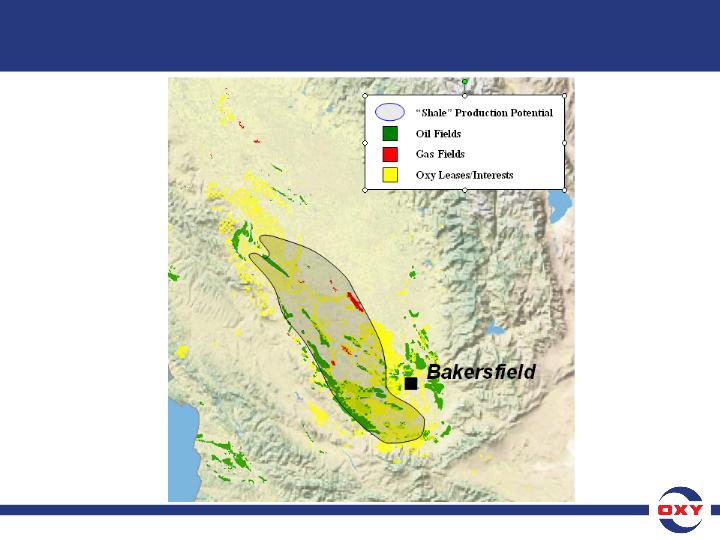

San Joaquin Basin: Breaking the Paradigm

• Unlock the potential:

– Tight Sands (w/shows)

– Oxy’s “Shale” Successes

– Carbonates (lower Monterey /

Santos?)

Santos?)

– Encouraging results

– Kern County discovery

• Historical view of California

reservoirs:

reservoirs:

– Permeable Sands

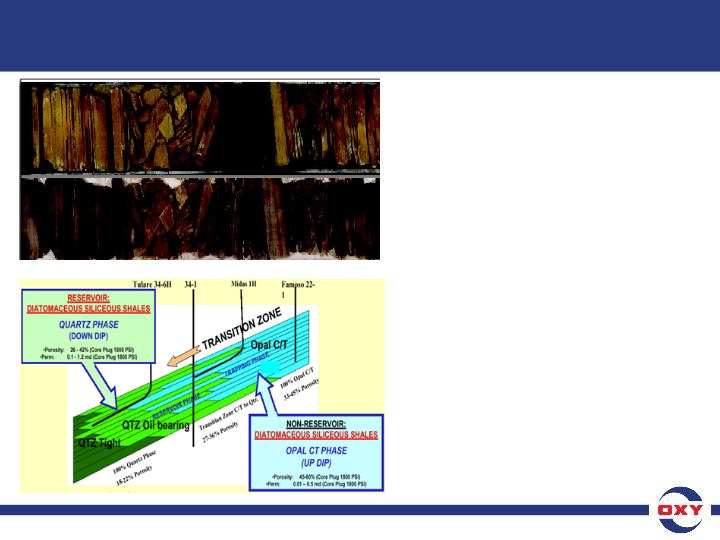

– Shales (biosiliceous rocks -

diatomite, porcelanite and cherts)

diatomite, porcelanite and cherts)

– No carbonates (except sporadic

dolomites)

dolomites)

– “The Lower Monterey is a source

rock with good shows but no

production potential.”

rock with good shows but no

production potential.”

– Very small new discoveries - not

material to large operators

material to large operators

8

9

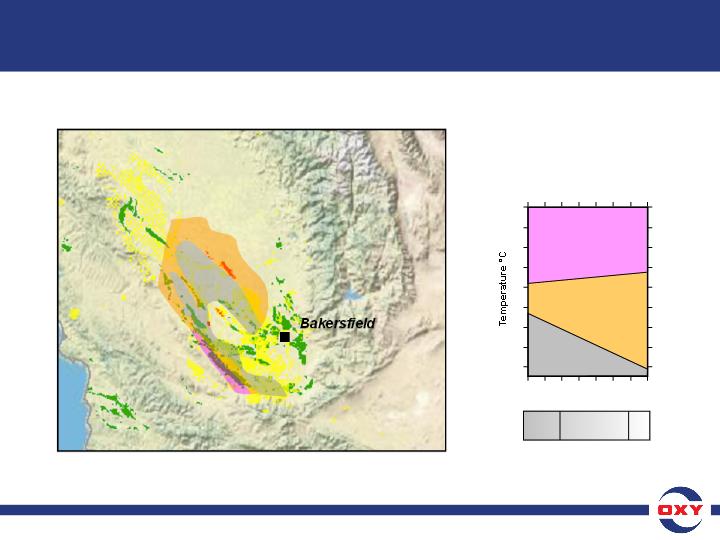

After : Brown (2001)

Petroleum Resource Generation by Zone

9

10

Thermal Regime - Source Rock Kitchens

10

11

Thermal Regime - San Joaquin Basin

11

12

Thermal Regime - Los Angeles and Ventura Basins

12

13

60º

70º

80º

90º

50º

40º

30º

20º

10º

Opal A

Opal CT

Quartz

30

70

40

60

50

50

60

40

70

30

80

20

90

10

100

0

Biogenic Silica in wt %

Detritus in wt %

Siliceous

Mudstone

Porcelanite

Chert

Silica Phase Diagram

Modified after Behl & Garrison, 1994

Antelope Shale Facies

Thermal Regime - Silica Phases

13

14

• California “Shale” Background

• Oxy’s “Shale” Program

• California “Shale” Technical Attributes

• California “Shale” Analogs

• Summary

Agenda

14

15

• “Shale” drilling program really started in 1998 at Elk Hills

• Currently, over 1/4th of Oxy’s production in California

comes from “shales”

comes from “shales”

– Have successfully tested concept in eight more fields

• Undertaking 4 year development program

– Appraising 20+ BBOE in place from “most likely” areas

– 10 to 15 test wells/ year in different areas

– Largest 3D seismic program in the history of the state

– Identify “sweet” spots

– Determine pay thickness, fracture distribution,

fault zones, etc.

fault zones, etc.

Occidental “Shale” Production

15

16

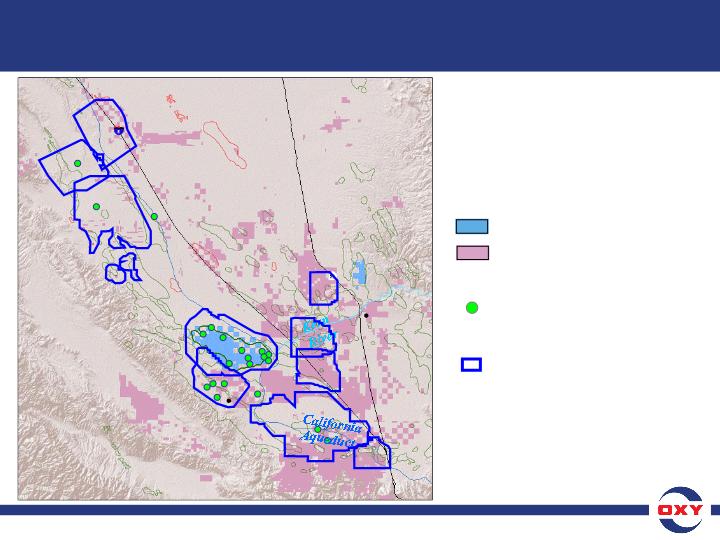

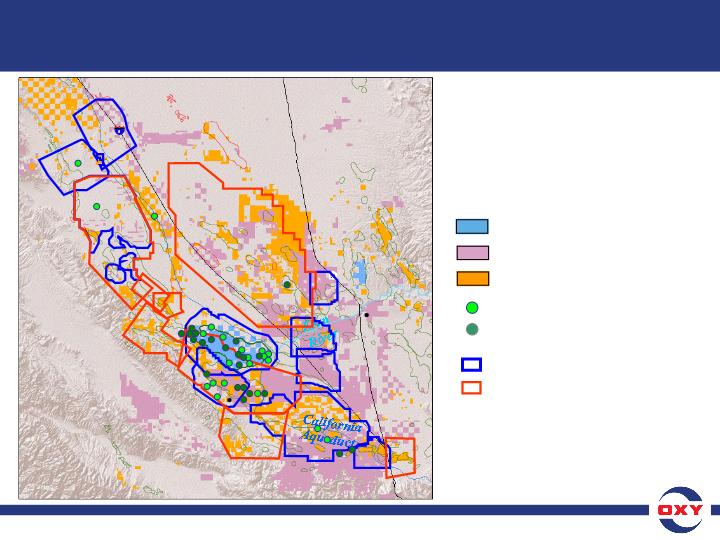

• Oxy has over

1.3 MM net acres

in California

1.3 MM net acres

in California

• Largest acreage

position in the

state

position in the

state

• Oxy “shale”

production spans

multiple basins

production spans

multiple basins

Occidental Acreage - Southern California

16

17

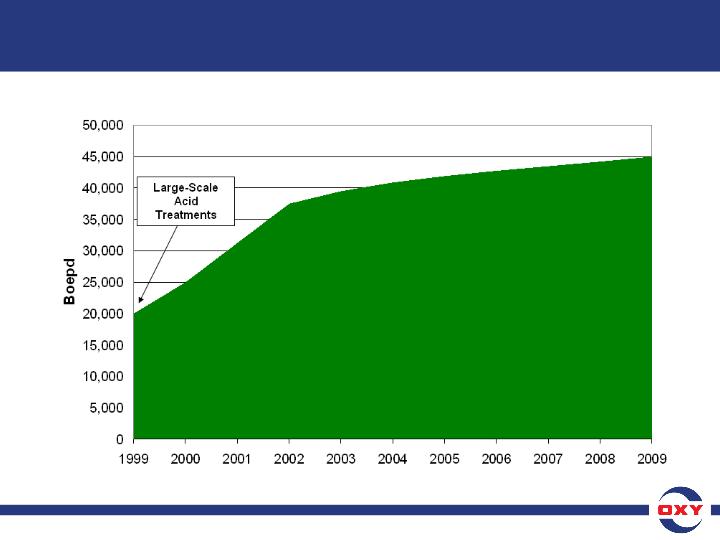

Occidental “Shale” Production

17

18

Sample of “Shale” Producing Fields

18

19

• Stimulation recipe innovation

– Large acid treatments key to unlocking potential in

some areas

some areas

• Interval production testing

– Distinguish between oil-producing, wet and other zones

– Determine hydrocarbon properties and quality

• Reservoir characterization

– Better understanding of hydrocarbons in place and their

distribution

distribution

– Fracture reservoir modeling

• Reservoir Management

– Individual zone completions

– Optimizing lateral length and frac stages leads to better

economics

economics

Drivers for Success - California “Shales”

19

20

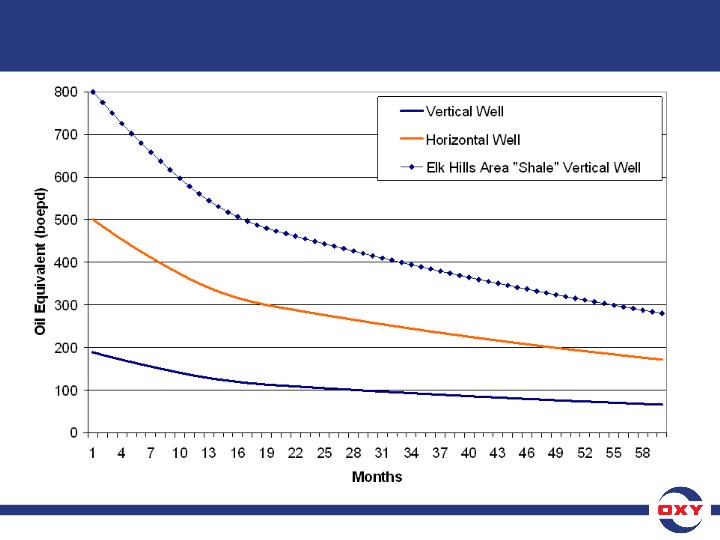

Representative “Shale” Type Curves

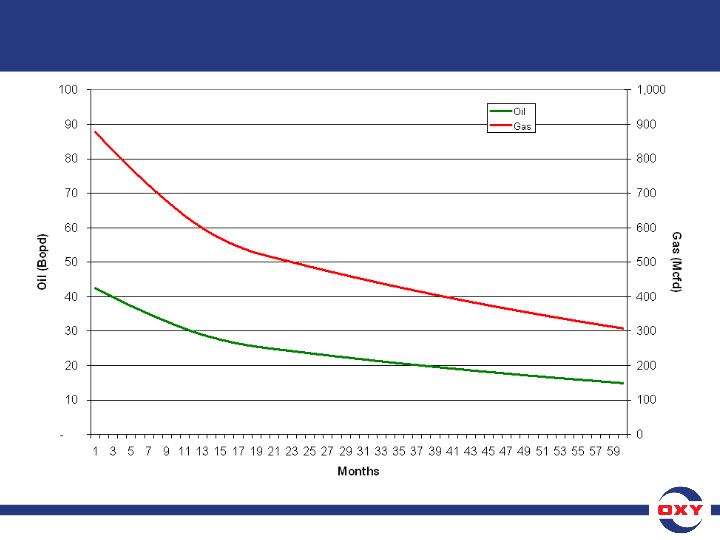

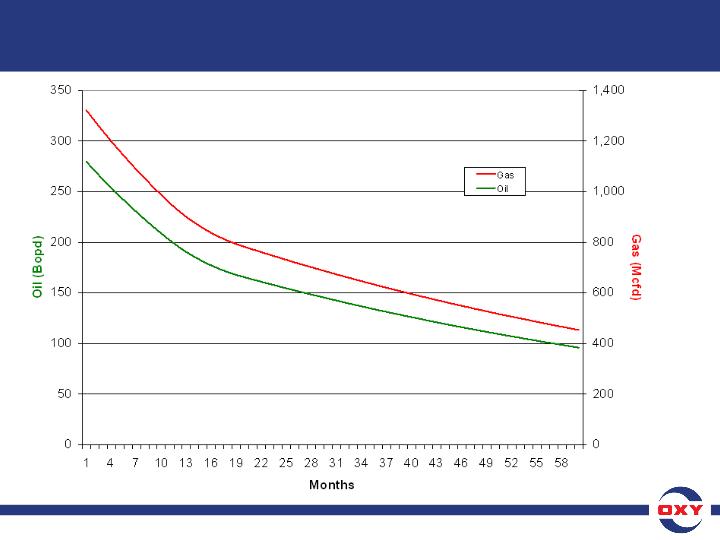

20

21

Vertical “Shale” Type Curve

21

22

Horizontal “Shale” Type Curve

22

23

• California “Shale” Background

• Oxy’s “Shale” Program

• California “Shale” Technical Attributes

• California “Shale” Analogs

• Summary

Agenda

23

24

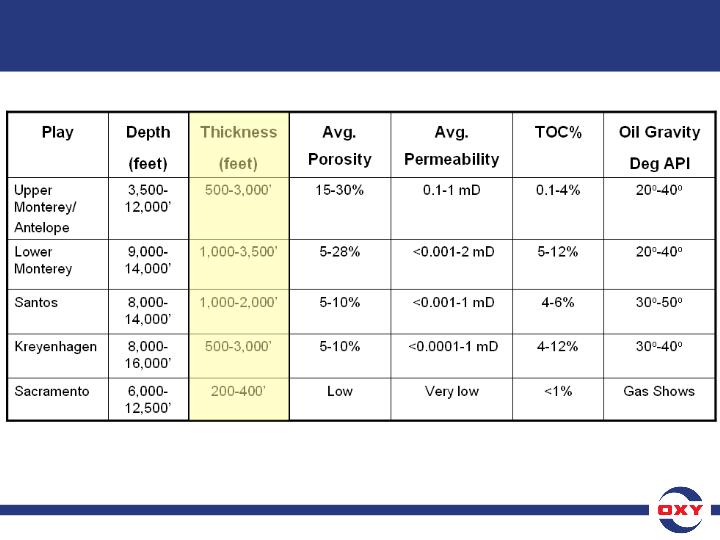

Comparison of Major California “Shales”

24

25

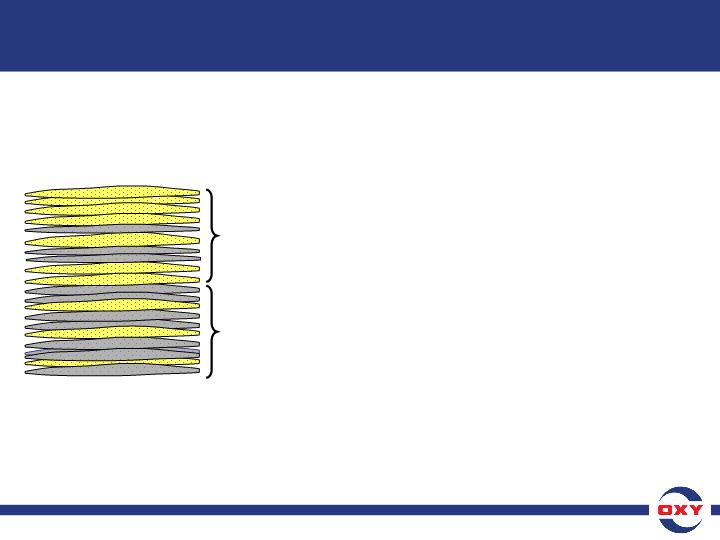

• Organic Rich “Shales”

– Good TOC

– Thermal Maturity

– Source and Reservoir Rock

• Gross Thickness

– Active Margin Basins

• Unique Depositional Environment

– Deep vs. Shallow water

– Diatom & Foram Rich

CA “Shales” - Critical Technical Aspects

25

26

• California “Shale” Background

• Oxy’s “Shale” Program

• California “Shale” Technical Attributes

• California “Shale” Analogs

• Summary

Agenda

26

27

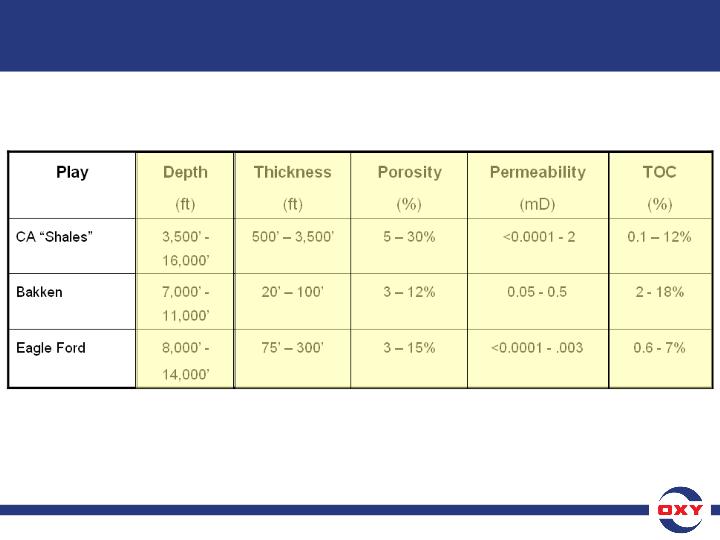

• California oil “shales” compare very favorably to

developed unconventional oil plays

developed unconventional oil plays

• Bakken and Eagle Ford are best analogs

– Large amounts of hydrocarbons generated and in place

– Reservoir parameters are similar

– Predominantly oil/liquids plays

– Significant learning curves with pay-off - the more these

plays are understood the more prospective they become

plays are understood the more prospective they become

California “Shale” Analogs

27

28

Side by Side Play Comparison

28

29

• California “Shale” Background

• Oxy’s “Shale” Program

• California “Shale” Technical Attributes

• California “Shale” Analogs

• Summary

Agenda

29

30

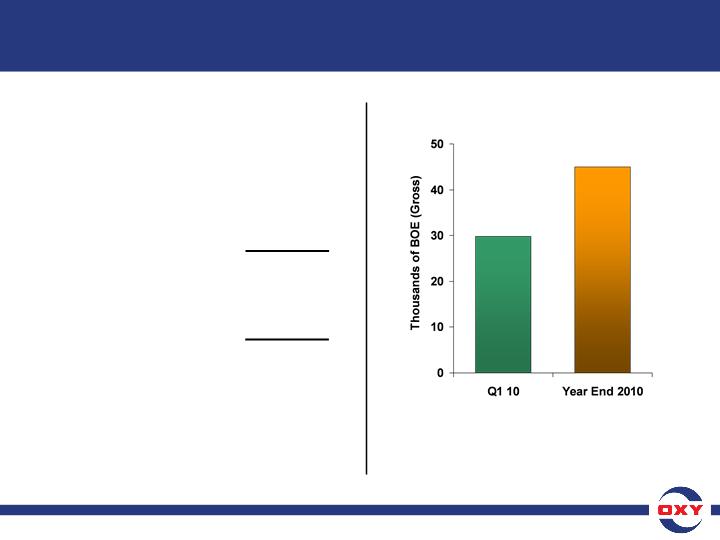

• ~870,000 acres are within most prospective “shale” plays

• Oxy’s average NRI ~95%

• Multiple potentially productive “shale” zones in each well

• Oxy’s acreage encompasses favorable thermal regime

• Identified 15 areas to appraise over the next 4 years

(5-10% of total acreage)

(5-10% of total acreage)

– Initially target 1-2 areas including Kern County discovery

– Average IP 400-800 boepd

– Production range from 100 to 1,000 boepd

– Average EUR 400-700 Mboe

– 10-acre spacing

• 10 years from now California “shale” could become Oxy’s

largest business unit

largest business unit

Summary

30

Occidental Petroleum Corporation

Stephen I. Chazen

President and Chief Financial Officer

May 19, 2010

1

2

• Midstream & Chemicals

• Production Forecast

• Capital Forecast

• Acquisition Strategy

• Asset Return Results

• Cash Flow Priorities

• Investment Attributes

Agenda

2

3

Midstream Overview

• 3-Year Average EBIT

was $374 Million

was $374 Million

• 2009 EBIT was $235

Million

Million

• $3.8 Billion net PP&E

and investments

and investments

• Significant and growing

fee income

fee income

Midstream 3-Year Average EBIT

3

4

Gas Processing

• Located near our domestic producing operations

• Processes both Oxy and third-party gas

• Spread between natural gas and NGL prices drives

business

business

Marketing & Trading

• Maximizes value of company’s production

– Spread in pricing between various grades of crude

oil drives business

oil drives business

• Gas storage arbitrage

• Gas storage capacity of 30.5 BCF

• Phibro is long a basket of commodities

Midstream Lines of Business

4

5

Pipelines

• Oxy owns 2,760 miles of oil pipeline in Permian Basin

and Oklahoma

and Oklahoma

• 22% ownership of Plains All American Pipeline, G.P.

• 24.5% ownership of Dolphin Pipeline

• Fee-based business

Power Generation

• Oxy power and steam generation facilities at our

Louisiana and Texas chemical sites

Louisiana and Texas chemical sites

• 50% ownership in a power generation facility at Elk Hills

• Spread between natural gas price and electricity price

drives business

drives business

Midstream Lines of Business

5

6

EBIT Growth to $1 Billion Annually by 2014

• Increased pipeline fees

• Addition of Phibro

• Increased gas and CO2 plant capacity

• Bolt-on acquisitions likely

Midstream 5-Year Outlook

6

7

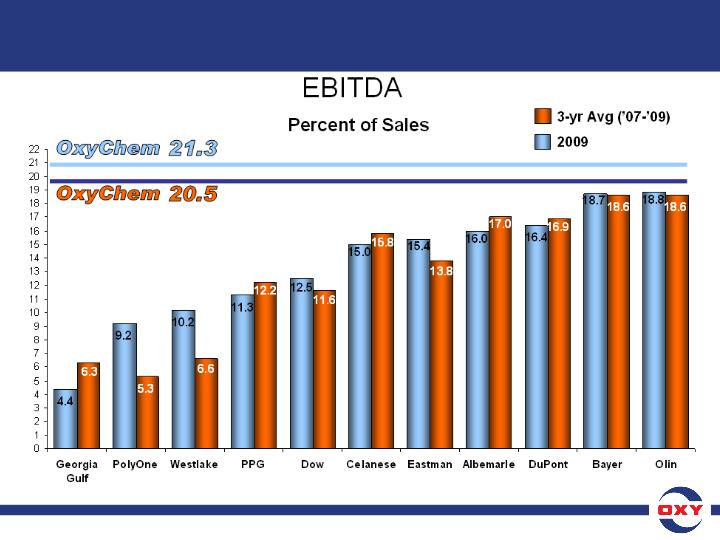

• 5-Year Average EBIT was $688 Million

• $ 389 Million EBIT in 2009

• $ 2.6 Billion Net PP&E

• Focus on Chlorovinyls

• Major Factor in its Industry

• Earnings are Volatile

Chemicals Overview

See attached for GAAP reconciliation

7

8

* Other Products Accounted for 12% of Sales & 16% of Earnings in 2009

Major Market End Uses for OxyChem Products

Chlorovinyls

• Building Materials / Automotive Products

• Pulp & Paper / Aluminum Production

• Water Treatment / Disinfection

• Medical Products

• Fertilizers / Ag Feed

Other Products *

• Soaps / Detergents / Paint Pigments

• Ice Melting / Dust Control / Oil Field Services

8

9

Chemical Companies Comparison

See attached for GAAP reconciliation

9

10

• Expect average annual EBIT of $700 Million

over next five years

over next five years

• Opportunity for small bolt-on acquisitions

Chemicals 5-Year Outlook

10

11

• Volume Growth

• Capital Expenditures

• Acquisitions

• Return Targets

E&P Business Drivers

11

12

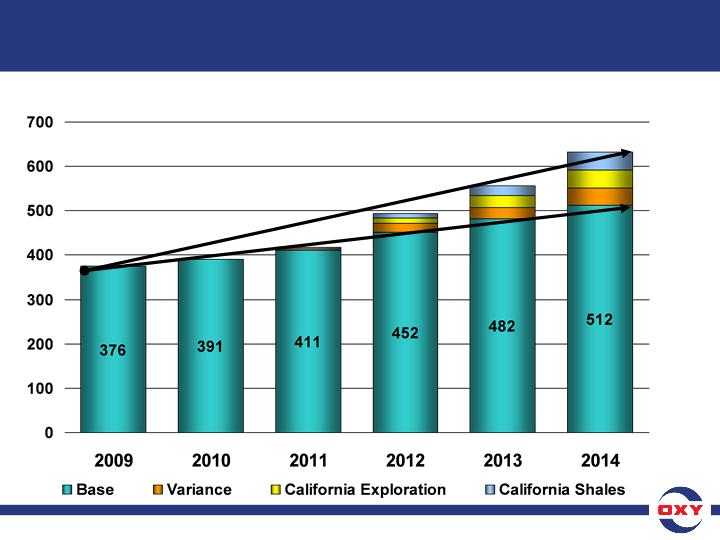

• Base 5 - 8% Growth

– CO2 in Permian

– Current California risked prospects

– Rockies gas

– Bahrain

– Oman

– Iraq

• Upside from Existing Holdings

– New California conventional and unconventional prospects

– Permian exploration

– Rockies gas

– Argentina

• Additional opportunities from balance sheet and cash

generation

generation

– Domestic properties acquisitions

– New Middle East projects

Volume Growth Drivers

12

13

Major Potential Drivers

of Production and Profitability

of Production and Profitability

• California Non-conventional

– 870,000 potential acres with virtually no royalties

– EUR of 400 - 700 MBOE per well

– Modest F&D

– Modest success built into production wedge

• California Conventional

– 50 prospect inventory and growing

– Low F&D

– Considerable success so far

– Only two or three moderate exploration successes built

into production wedge

into production wedge

13

14

Major Potential Drivers

of Production and Profitability

of Production and Profitability

• Rockies Gas

– 3.8 TCFE potential

– Base uses $6.00 gas in 2014

– Upside case is $7.00 gas in 2014

• Permian CO2

– 3 billion net barrels in resource from Oxy operated only

– Possibly more CO2 available over the 5-year period

– Probable better response by 2013-14

14

15

Thousand BOE/Day

U.S. Production Outlook

376

391

417

494

557

632

6.4% Base

CAGR

CAGR

10.9% Total

CAGR

CAGR

15

16

Major Potential Drivers

of Production and Profitability

of Production and Profitability

• Bahrain

– Base case shows steady but not aggressive progress

– Possible better oil results by 2014

• Oman

– Base shows only modest growth of Oman gas markets

– Likely better growth by 2014

• Libya

– Little progress assumed

– Possible need by the government for better production

growth by end of the period

growth by end of the period

16

17

Major Potential Drivers

of Production and Profitability

of Production and Profitability

• Argentina

– Modest base case shown

– Potential is very high

• Iraq

– Field is capable of outperforming our estimates

17

18

Thousand BOE/Day

(Assumes $75 WTI Price)

International Production Outlook

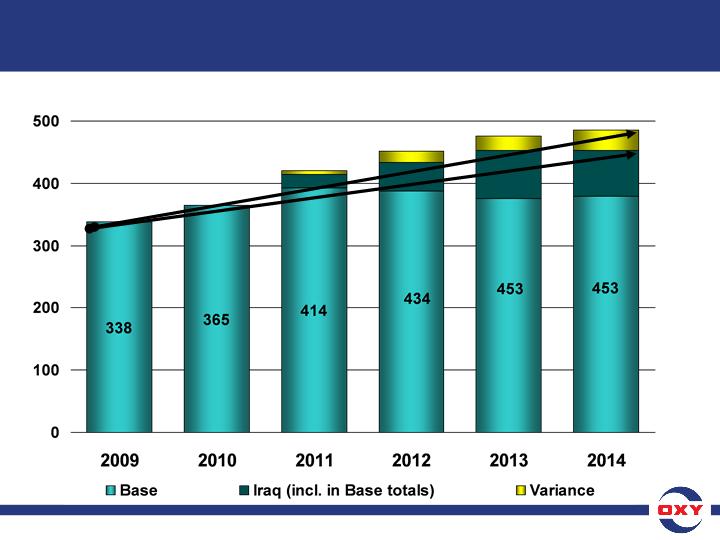

338

365

420

452

476

486

6.0% Base

CAGR

CAGR

7.5% Total

CAGR

CAGR

18

19

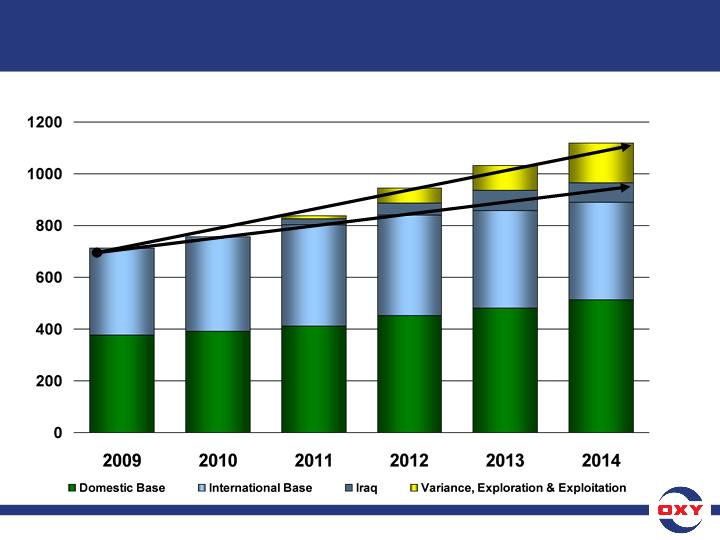

Worldwide Production Outlook

Thousand BOE/Day

(Assumes $75 WTI Price)

714

756

837

946

1,033

1,118

6.2% Base

CAGR

CAGR

9.4% Total

CAGR

CAGR

19

20

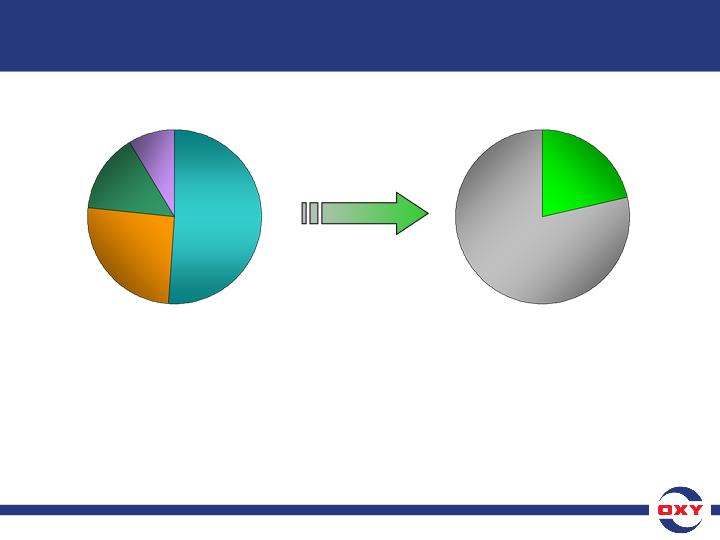

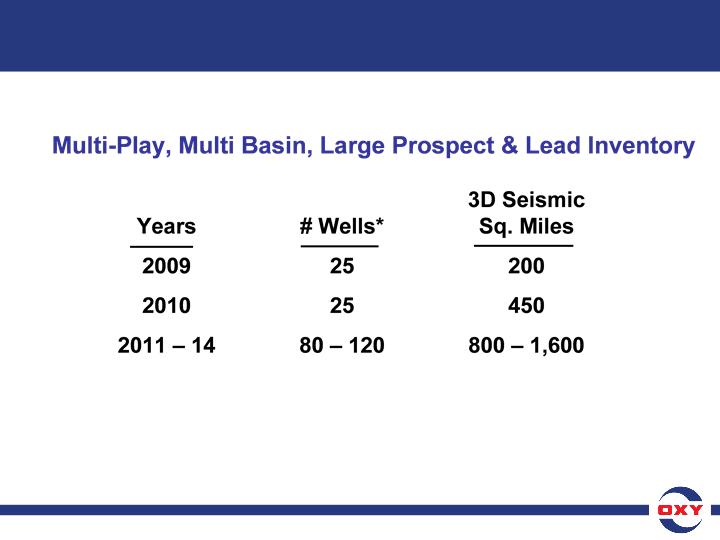

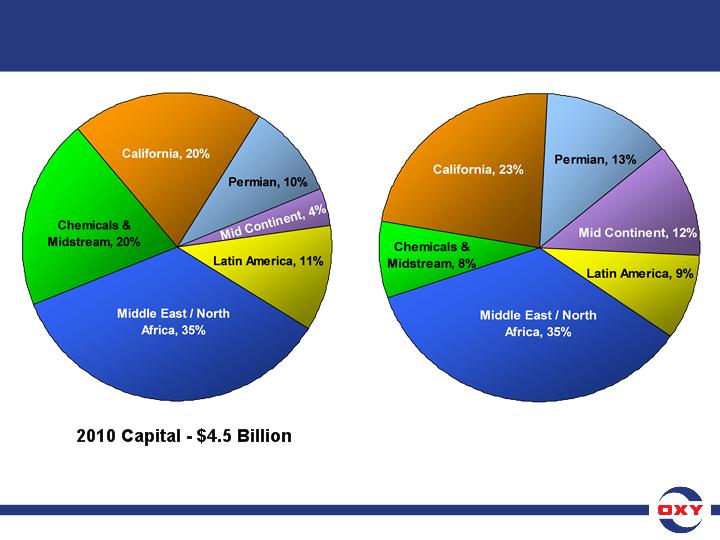

2010 - 2014 Capital - $27.5 Billion

International share will remain at 45% of Capital Program

Capital

20

21

• Company’s core business is acquiring assets that can

provide future growth through improved recovery

provide future growth through improved recovery

– Foreign contracts

– Domestic add-ons

– Small incremental additions to production in

short term

short term

• Generate returns of at least 15% in the U.S. and

20% internationally

20% internationally

• Overall average finding & development costs of

less than 25% of selling price

less than 25% of selling price

• Even with the additional capital shown, program will

generate a significant amount of free cash flow

generate a significant amount of free cash flow

• Large number of opportunities over 5-year period

Acquisition Strategy

21

22

• Permian

– 1,500+ Operators; 75,000+ Royalty owners

• California

– Large acreage holders

• Other U.S.

– Small investments in emerging plays

• Foreign

– Additional foreign contracts

Sources of Acquisitions

22

23

2005 128 139 104 371 220% 169

2006 137 325 51 513 259% 198

2007 254 60 (72) 242 116% 208

2008 247 210 (121) 336 153% 220

2009 173 160 150 483 206% 235

3-Year Avg. 225 143 (14) 354 160% 221

5-Year Avg. 188 179 22 389 189% 206

Improved Reserve Worldwide

Recovery Acquisitions Others Total Replace % Production

Recovery Acquisitions Others Total Replace % Production

Million BOE

Reserves Replacement

23

24

2005 $ 1,807 139 128

2006 $ 4,463 325 137

2007 $ 1,103 60 254

2008 $ 3,202 210 247

2009 $ 703 160 173

Investment in Reserves Immediately Improved

Acquisitions Added from Acquisition Recovery

($ Million) (MMBOE) (MMBOE)

Acquisitions Added from Acquisition Recovery

($ Million) (MMBOE) (MMBOE)

Acquisitions

See attached for GAAP reconciliation

24

25

Net Income Return on Assets

U.S. 19%

International 24%

Total E&P 21%

Cash Flow* Return on Assets

U.S. 27%

International 41%

Total E&P 31%

* Net Income + DD&A

5 Year Average

5 Year Average

Return on Assets

See attached for GAAP reconciliation

25

26

F&D Costs

Actual as a % of

6:1 * Prices ** WTI Price

Actual as a % of

6:1 * Prices ** WTI Price

* Oil / Gas Energy Content (Industry convention)

** Gas converted to BOE @ WTI Oil Price / NYMEX Gas Price

** Gas converted to BOE @ WTI Oil Price / NYMEX Gas Price

Finding & Development Costs per Barrel

See attached for GAAP reconciliation

2009 $ 7.90 $ 9.64 16%

3-Year Average $15.04 $18.40 24%

(2007 - 2009)

(2007 - 2009)

5-Year Average $14.77 $16.84 24%

(2005 - 2009)

(2005 - 2009)

10-Year Average $ 9.15 $ 9.82 19%

(2000 - 2009)

(2000 - 2009)

26

27

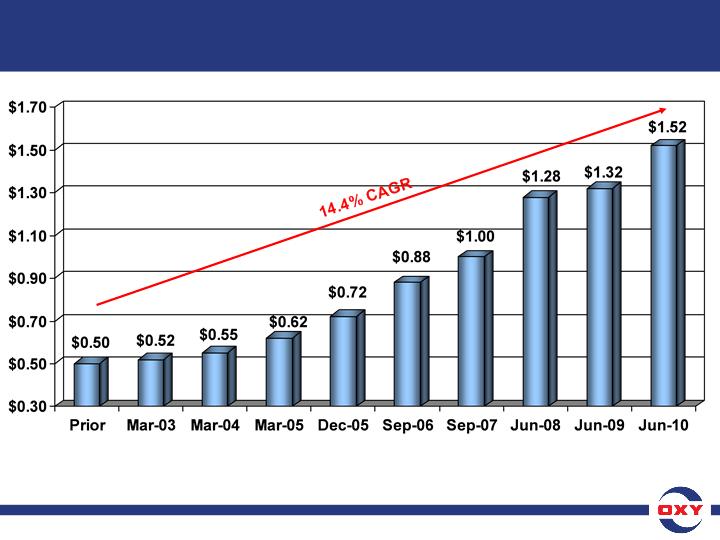

1. Base/Maintenance Capital

2. Dividends

3. Growth Capital

4. Acquisitions

5. Share Repurchase

Cash Flow Priorities

27

28

Growth Capital $ 1.8 $ 11.2

Base Capital 2.5 15.0

Total Oil & Gas

and Midstream Capital $ 4.3 $ 26.2

and Midstream Capital $ 4.3 $ 26.2

($ in Billions)

2010-2014

Oil & Gas and Midstream Capital 2010 Cumulative

Oil & Gas and Midstream Capital 2010 Cumulative

• Base Oil & Gas capital historically running at $2.5 billion

• As production increases, the base capital will grow

Capital Spending Program

28

29

Dividends

29

30

Proved Unproved Properties

Developed plus Goodwill /

Developed plus Goodwill /

Reserves / Total Net Capitalized Costs

Company Proved Reserves plus Goodwill

Company Proved Reserves plus Goodwill

OXY 77.3% 6.7%

A 54.4% 10.0%

B 59.2% 21.6%

C 69.1% 8.2%

D 70.5% 39.3%

E 70.3% 40.5%

F 61.4% 13.6%

G 70.7% 21.9%

H 70.1% 22.6%

I 67.3% 3.4%

J 56.6% 21.0%

Conservative Accounting

30

31

Five years Ten Years

Company ended 12/31/09 ended 12/31/09

Company ended 12/31/09 ended 12/31/09

OXY $2.67 $2.57

A $2.28 $2.53

B $1.67 $1.31

C $1.38 $1.63

D $1.38 $1.29

E $1.06 $1.13

F $0.75 $1.28

G $0.60 $0.83

H $0.25 $0.66

I ($0.60) $0.87

J ($1.15) ($0.24 )

* Impairments greater than 5% of Shareholders’ Equity have been added back to Shareholders’ Equity.

(Equity Market Value Created per $1 Change in Shareholders’ Equity*)

Capital Program Effectiveness

31

32

• 5 - 8% base annual production growth

• Opportunity for additional volume growth

• Annual increases in dividends

• Significant financial flexibility for opportunities in

distressed periods

distressed periods

• Conservative financial statements

• Returns on invested capital significantly in excess of

Company’s cost of capital

Company’s cost of capital

• Committed to generating stock market value which is

greater than earnings retained

greater than earnings retained

• We believe this will generate top quartile returns for

our shareholders

our shareholders

Investment Attributes

32

Statements in this release that contain words such as “will,” “expect” or “estimate,” or otherwise relate to

the future, are forward-looking and involve risks and uncertainties that could significantly affect expected

results. Factors that could cause actual results to differ materially include, but are not limited to: global

commodity price fluctuations and supply/demand considerations for oil, gas and chemicals; not

successfully completing (or any material delay in) any expansions, field development, capital projects,

acquisitions, or dispositions; higher-than-expected costs; political risk; operational interruptions; changes

in tax rates; exploration risks, such as drilling of unsuccessful wells; and commodity trading risks. You

should not place undue reliance on these forward-looking statements which speak only as of the date of

this release. Unless legally required, Occidental does not undertake any obligation to update any forward-

looking statements as a result of new information, future events or otherwise. The United States Securities

and Exchange Commission (SEC) permits oil and natural gas companies, in their filings with the SEC, to

disclose only reserves anticipated to be economically producible, as of a given date, by application of

development projects to known accumulations. We use certain terms in this presentation, such as

reported reserves, EUR, expected ultimate recovery, potential reserves, volumes in resource, net risked

reserves, enhanced recovery reserves, expected recovery, discovery volumes, recoverable reserves and

oil in place, that the SEC’s guidelines strictly prohibit us from using in filings with the SEC. See our 2010

Form 10-K and February 3, 2010 8-K for information on calculation methodology for our reserves

replacement ratio and F&D costs. U.S. investors are urged to consider carefully the disclosures in our

2010 Form 10-K, available through the following toll-free telephone number, 1-888-OXYPETE (1-888-699-

7383) or on the Internet at http://www.oxy.com. You also can obtain a copy from the SEC by calling 1-800

- -SEC-0330. We post or provide links to important information on its website including investor and analyst

presentations, certain board committee charters and information the SEC requires companies and certain

of its officers and directors to file or furnish. Such information may be found in the “Investor Relations”

and “Social Responsibility” portions of the website.

the future, are forward-looking and involve risks and uncertainties that could significantly affect expected

results. Factors that could cause actual results to differ materially include, but are not limited to: global

commodity price fluctuations and supply/demand considerations for oil, gas and chemicals; not

successfully completing (or any material delay in) any expansions, field development, capital projects,

acquisitions, or dispositions; higher-than-expected costs; political risk; operational interruptions; changes

in tax rates; exploration risks, such as drilling of unsuccessful wells; and commodity trading risks. You

should not place undue reliance on these forward-looking statements which speak only as of the date of

this release. Unless legally required, Occidental does not undertake any obligation to update any forward-

looking statements as a result of new information, future events or otherwise. The United States Securities

and Exchange Commission (SEC) permits oil and natural gas companies, in their filings with the SEC, to

disclose only reserves anticipated to be economically producible, as of a given date, by application of

development projects to known accumulations. We use certain terms in this presentation, such as

reported reserves, EUR, expected ultimate recovery, potential reserves, volumes in resource, net risked

reserves, enhanced recovery reserves, expected recovery, discovery volumes, recoverable reserves and

oil in place, that the SEC’s guidelines strictly prohibit us from using in filings with the SEC. See our 2010

Form 10-K and February 3, 2010 8-K for information on calculation methodology for our reserves

replacement ratio and F&D costs. U.S. investors are urged to consider carefully the disclosures in our

2010 Form 10-K, available through the following toll-free telephone number, 1-888-OXYPETE (1-888-699-

7383) or on the Internet at http://www.oxy.com. You also can obtain a copy from the SEC by calling 1-800

- -SEC-0330. We post or provide links to important information on its website including investor and analyst

presentations, certain board committee charters and information the SEC requires companies and certain

of its officers and directors to file or furnish. Such information may be found in the “Investor Relations”

and “Social Responsibility” portions of the website.

Forward-Looking Statements

1

Anadarko

Apache

BP

Chevron

ConocoPhillips

Devon

EOG

ExxonMobil

Hess

Marathon

Companies Included

in Equity Market Comparison

in Equity Market Comparison

2

| Occidental Petroleum Corporation | |||||||||||||

| Chemicals | |||||||||||||

| EBIT | |||||||||||||

| Reconciliation to Generally Accepted Accounting Principles (GAAP) | |||||||||||||

| ($ Millions) | |||||||||||||

| 5-Year | |||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | Average | ||||||||

| Segment income | 614 | 906 | 601 | 669 | 389 | 636 | |||||||

| Add: significant items affecting earnings | |||||||||||||

| Plant closure and impairments | - | - | - | 90 | - | 18 | |||||||

| Hurricane insurance charges | 11 | - | - | - | - | 2 | |||||||

| Write-off of plants | 159 | - | - | - | - | 32 | |||||||

| Core results - EBIT | 784 | 906 | 601 | 759 | 389 | 688 | |||||||

| Occidental Petroleum Corporation | |||||||||

| Chemicals | |||||||||

| EBITDA as a Percentage of Sales | |||||||||

| Reconciliation to Generally Accepted Accounting Principles (GAAP) | |||||||||

| ($ Millions) | |||||||||

| 3-Year | |||||||||

| 2007 | 2008 | 2009 | Average | ||||||

| Net Sales | 4,664 | 5,112 | 3,225 | 4,334 | |||||

| Segment income | 601 | 669 | 389 | 553 | |||||

| Add: significant items affecting earnings | |||||||||

| Plant closure and impairments | - | 90 | - | 30 | |||||

| Core results - EBIT | 601 | 759 | 389 | 583 | |||||

| DD&A Expense | 304 | 311 | 298 | 304 | |||||

| EBITDA | 905 | 1,070 | 687 | 887 | |||||

| EBITDA as a % of Sales | 19.4% | 20.9% | 21.3% | 20.5% | |||||

| Occidental Petroleum Corporation | |||||||||||

| Oil & Gas | |||||||||||