EXHIBIT 99.3

Investor Relations Supplemental Schedules

| Investor Relations Supplemental Schedules |

| Summary |

| | | | |

| | | | |

| | | | |

| | | | |

| | 3Q 2013 | | 3Q 2012 |

| | | | |

| Core Results (millions) | $1,588 | | $1,379 |

| EPS - Diluted | $1.97 | | $1.70 |

| | | | |

| Reported Net Income (millions) | $1,583 | | $1,375 |

| EPS - Diluted | $1.96 | | $1.69 |

| | | | |

| Total Worldwide Sales Volumes (mboe/day) | 765 | | 765 |

| Total Worldwide Production Volumes (mboe/day) | 767 | | 766 |

| | | | |

| Total Worldwide Crude Oil Realizations ($/BBL) | $103.95 | | $96.62 |

| Total Worldwide NGL Realizations ($/BBL) | $40.53 | | $40.65 |

| Domestic Natural Gas Realizations ($/MCF) | $3.27 | | $2.48 |

| | | | |

| Wtd. Average Basic Shares O/S (millions) | 805.1 | | 809.7 |

| Wtd. Average Diluted Shares O/S (millions) | 805.7 | | 810.4 |

| | | | |

| | | | |

| | YTD 2013 | | YTD 2012 |

| | | | |

| Core Results (millions) | $4,223 | | $4,271 |

| EPS - Diluted | $5.23 | | $5.26 |

| | | | |

| Reported Net Income (millions) | $4,260 | | $4,262 |

| EPS - Diluted | $5.28 | | $5.25 |

| | | | |

| Total Worldwide Sales Volumes (mboe/day) | 758 | | 757 |

| Total Worldwide Production Volumes (mboe/day) | 767 | | 762 |

| | | | |

| Total Worldwide Crude Oil Realizations ($/BBL) | $100.04 | | $101.20 |

| Total Worldwide NGL Realizations ($/BBL) | $39.87 | | $45.21 |

| Domestic Natural Gas Realizations ($/MCF) | $3.39 | | $2.47 |

| | | | |

| Wtd. Average Basic Shares O/S (millions) | 804.8 | | 810.1 |

| Wtd. Average Diluted Shares O/S (millions) | 805.4 | | 810.8 |

| | | | |

| Shares Outstanding (millions) | 806.1 | | 810.2 |

| | | | |

| Cash Flow from Operations (millions) | $9,800 | | $8,500 |

1

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2013 Third Quarter |

| Net Income (Loss) |

| ($ millions, except per share amounts) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Reported | | | | | | | | Core |

| | Income | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 2,363 | | | | | | | | | $ | 2,363 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Chemical | | 181 | | | | | | | | | | 181 | |

| | | | | | | | | | | | | | |

| Midstream, marketing and other | | 212 | | | | | | | | | | 212 | |

| | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | |

| Interest expense, net | | (28 | ) | | | | | | | | | (28 | ) |

| | | | | | | | | | | | | | |

| Other | | (103 | ) | | | | | | | | | (103 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Taxes | | (1,037 | ) | | | | | | | | | (1,037 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from continuing operations | | 1,588 | | | | - | | | | | | 1,588 | |

| Discontinued operations, net of tax | | (5 | ) | | | 5 | | | Discontinued operations, net | | | - | |

| Net Income | $ | 1,583 | | | $ | 5 | | | | | $ | 1,588 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.97 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 1.96 | | | | | | | | | $ | 1.97 | |

| | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.97 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 1.96 | | | | | | | | | $ | 1.97 | |

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2012 Third Quarter |

| Net Income (Loss) |

| ($ millions, except per share amounts) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Reported | | | | | | | | Core |

| | Income | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 2,026 | | | | | | | | | $ | 2,026 | |

| | | | | | | | | | | | | | |

| Chemical | | 162 | | | | | | | | | | 162 | |

| | | | | | | | | | | | | | |

| Midstream, marketing and other | | 156 | | | | | | | | | | 156 | |

| | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | |

| Interest expense, net | | (34 | ) | | | | | | | | | (34 | ) |

| | | | | | | | | | | | | | |

| Other | | (76 | ) | | | | | | | | | (76 | ) |

| | | | | | | | | | | | | | |

| Taxes | | (855 | ) | | | | | | | | | (855 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from continuing operations | | 1,379 | | | | - | | | | | | 1,379 | |

| Discontinued operations, net of tax | | (4 | ) | | | 4 | | | Discontinued operations, net | | | - | |

| Net Income | $ | 1,375 | | | $ | 4 | | | | | $ | 1,379 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.70 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 1.69 | | | | | | | | | $ | 1.70 | |

| | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.70 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 1.69 | | | | | | | | | $ | 1.70 | |

3

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2013 Nine Months |

| Net Income (Loss) |

| ($ millions, except per share amounts) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Reported | | | | | | | | Core |

| | Income | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 6,383 | | | | | | | | | $ | 6,383 | |

| | | | | | | | | | | | | | |

| Chemical | | 615 | | | | (131 | ) | | Carbocloro sale gain | | | 484 | |

| | | | | | | | | | | | | | |

| Midstream, marketing and other | | 475 | | | | | | | | | | 475 | |

| | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | |

| Interest expense, net | | (87 | ) | | | | | | | | | (87 | ) |

| | | | | | | | | | | | | | |

| Other | | (330 | ) | | | 55 | | | Charge for former executives and consultants (a) | | | (275 | ) |

| | | | | | | | | | | | | | |

| Taxes | | (2,782 | ) | | | 25 | | | Tax effect of pre-tax adjustments | | | (2,757 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from continuing operations | | 4,274 | | | | (51 | ) | | | | | 4,223 | |

| Discontinued operations, net of tax | | (14 | ) | | | 14 | | | Discontinued operations, net | | | - | |

| Net Income | $ | 4,260 | | | $ | (37 | ) | | | | $ | 4,223 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 5.30 | | | | | | | | | | | |

| Discontinued operations, net | | (0.02 | ) | | | | | | | | | | |

| Net Income | $ | 5.28 | | | | | | | | | $ | 5.24 | |

| | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 5.30 | | | | | | | | | | | |

| Discontinued operations, net | | (0.02 | ) | | | | | | | | | | |

| Net Income | $ | 5.28 | | | | | | | | | $ | 5.23 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (a) Reflects pre-tax charge for the estimated cost related to the employment and post-employment benefits for the | | | | |

| Company's former Executive Chairman and termination of certain other employees and consulting arrangements. | | | | |

4

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2012 Nine Months |

| Net Income (Loss) |

| ($ millions, except per share amounts) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Reported | | | | | | | | Core |

| | Income | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 6,573 | | | | | | | | | $ | 6,573 | |

| | | | | | | | | | | | | | |

| Chemical | | 540 | | | | | | | | | | 540 | |

| | | | | | | | | | | | | | |

| Midstream, marketing and other | | 364 | | | | | | | | | | 364 | |

| | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | |

| Interest expense, net | | (87 | ) | | | | | | | | | (87 | ) |

| | | | | | | | | | | | | | |

| Other | | (250 | ) | | | | | | | | | (250 | ) |

| | | | | | | | | | | | | | |

| Taxes | | (2,869 | ) | | | | | | | | | (2,869 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from continuing operations | | 4,271 | | | | - | | | | | | 4,271 | |

| Discontinued operations, net of tax | | (9 | ) | | | 9 | | | Discontinued operations, net | | | - | |

| Net Income | $ | 4,262 | | | $ | 9 | | | | | $ | 4,271 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 5.26 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 5.25 | | | | | | | | | $ | 5.26 | |

| | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | |

| Income from continuing operations | $ | 5.26 | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | |

| Net Income | $ | 5.25 | | | | | | | | | $ | 5.26 | |

5

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| Worldwide Effective Tax Rate |

| | | | | | | | | | | | | | | |

| | QUARTERLY | | YEAR-TO-DATE |

| | 2013 | | 2013 | | 2012 | | 2013 | | 2012 |

| REPORTED INCOME | QTR 3 | | QTR 2 | | QTR 3 | | 9 Months | | 9 Months |

| Oil & Gas | 2,363 | | | 2,100 | | | 2,026 | | | 6,383 | | | 6,573 | |

| Chemical | 181 | | | 275 | | | 162 | | | 615 | | | 540 | |

| Midstream, marketing and other | 212 | | | 48 | | | 156 | | | 475 | | | 364 | |

| Corporate & other | (131 | ) | | (195 | ) | | (110 | ) | | (417 | ) | | (337 | ) |

| Pre-tax income | 2,625 | | | 2,228 | | | 2,234 | | | 7,056 | | | 7,140 | |

| | | | | | | | | | | | | | | |

| Income tax expense | | | | | | | | | | | | | | |

| Federal and state | 461 | | | 332 | | | 286 | | | 1,085 | | | 986 | |

| Foreign | 576 | | | 569 | | | 569 | | | 1,697 | | | 1,883 | |

| Total | 1,037 | | | 901 | | | 855 | | | 2,782 | | | 2,869 | |

| | | | | | | | | | | | | | | |

| Income from continuing operations | 1,588 | | | 1,327 | | | 1,379 | | | 4,274 | | | 4,271 | |

| | | | | | | | | | | | | | | |

| Worldwide effective tax rate | 40% | | 40% | | 38% | | 39% | | 40% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 2013 | | 2013 | | 2012 | | 2013 | | 2012 |

| CORE RESULTS | QTR 3 | | QTR 2 | | QTR 3 | | 9 Months | | 9 Months |

| Oil & Gas | 2,363 | | | 2,100 | | | 2,026 | | | 6,383 | | | 6,573 | |

| Chemical | 181 | | | 144 | | | 162 | | | 484 | | | 540 | |

| Midstream, marketing and other | 212 | | | 48 | | | 156 | | | 475 | | | 364 | |

| Corporate & other | (131 | ) | | (140 | ) | | (110 | ) | | (362 | ) | | (337 | ) |

| Pre-tax income | 2,625 | | | 2,152 | | | 2,234 | | | 6,980 | | | 7,140 | |

| | | | | | | | | | | | | | | |

| Income tax expense | | | | | | | | | | | | | | |

| Federal and state | 461 | | | 331 | | | 286 | | | 1,084 | | | 986 | |

| Foreign | 576 | | | 545 | | | 569 | | | 1,673 | | | 1,883 | |

| Total | 1,037 | | | 876 | | | 855 | | | 2,757 | | | 2,869 | |

| | | | | | | | | | | | | | | |

| Core results | 1,588 | | | 1,276 | | | 1,379 | | | 4,223 | | | 4,271 | |

| | | | | | | | | | | | | | | |

| Worldwide effective tax rate | 40% | | 41% | | 38% | | 39% | | 40% |

6

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2013 Third Quarter Net Income (Loss) |

| Reported Income Comparison |

| | | | | | | | | | | | | |

| | | Third | | Second | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2013 | | 2013 | | B / (W) |

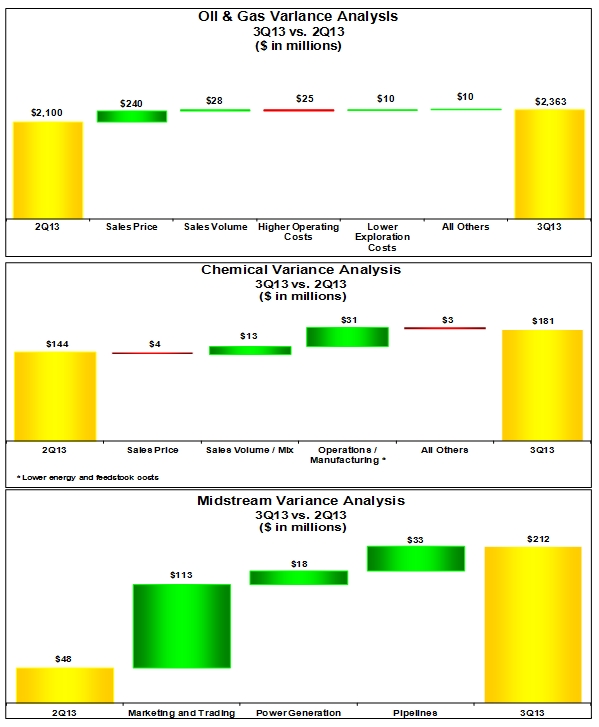

| Oil & Gas | | $ | 2,363 | | | $ | 2,100 | | | $ | 263 | |

| Chemical | | | 181 | | | | 275 | | | | (94 | ) |

| Midstream, marketing and other | | | 212 | | | | 48 | | | | 164 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (28 | ) | | | (29 | ) | | | 1 | |

| Other | | | (103 | ) | | | (166 | ) | | | 63 | |

| Taxes | | | (1,037 | ) | | | (901 | ) | | | (136 | ) |

| Income from continuing operations | | | 1,588 | | | | 1,327 | | | | 261 | |

| Discontinued operations, net | | | (5 | ) | | | (5 | ) | | | - | |

| Net Income | | $ | 1,583 | | | $ | 1,322 | | | $ | 261 | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.96 | | | $ | 1.64 | | | $ | 0.32 | |

| Diluted | | $ | 1.96 | | | $ | 1.64 | | | $ | 0.32 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 40% | | | 40% | | | 0% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| OCCIDENTAL PETROLEUM |

| 2013 Third Quarter Net Income (Loss) |

| Core Results Comparison |

| | | | | | | | | | | | | |

| | | Third | | Second | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2013 | | 2013 | | B / (W) |

| Oil & Gas | | $ | 2,363 | | | $ | 2,100 | | | $ | 263 | |

| Chemical | | | 181 | | | | 144 | | | | 37 | |

| Midstream, marketing and other | | | 212 | | | | 48 | | | | 164 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (28 | ) | | | (29 | ) | | | 1 | |

| Other | | | (103 | ) | | | (111 | ) | | | 8 | |

| Taxes | | | (1,037 | ) | | | (876 | ) | | | (161 | ) |

| Core Results | | $ | 1,588 | | | $ | 1,276 | | | $ | 312 | |

| | | | | | | | | | | | | |

| Core Results Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.97 | | | $ | 1.58 | | | $ | 0.39 | |

| Diluted | | $ | 1.97 | | | $ | 1.58 | | | $ | 0.39 | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 40% | | | 41% | | | 1% | |

7

Investor Relations Supplemental Schedules

8

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| 2013 Third Quarter Net Income (Loss) |

| Reported Income Comparison |

| | | | | | | | | | | | | |

| | | Third | | Third | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2013 | | 2012 | | B / (W) |

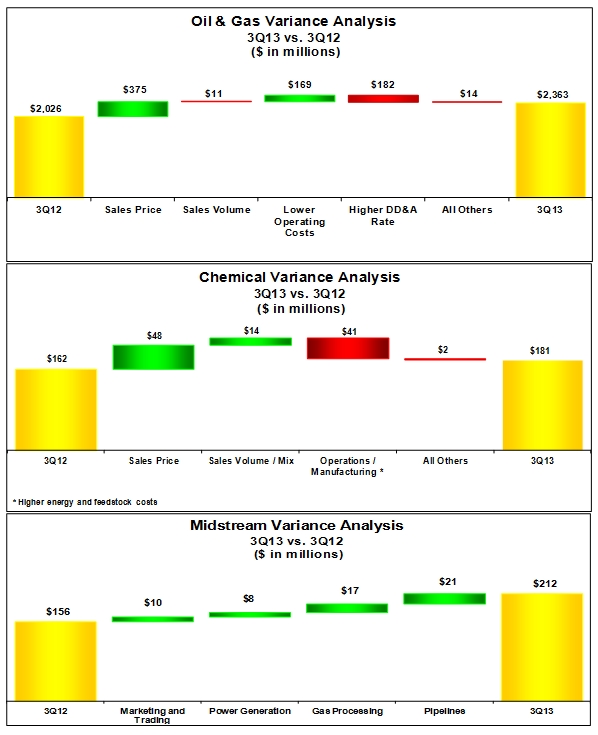

| Oil & Gas | | $ | 2,363 | | | $ | 2,026 | | | $ | 337 | |

| Chemical | | | 181 | | | | 162 | | | | 19 | |

| Midstream, marketing and other | | | 212 | | | | 156 | | | | 56 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (28 | ) | | | (34 | ) | | | 6 | |

| Other | | | (103 | ) | | | (76 | ) | | | (27 | ) |

| Taxes | | | (1,037 | ) | | | (855 | ) | | | (182 | ) |

| Income from continuing operations | | | 1,588 | | | | 1,379 | | | | 209 | |

| Discontinued operations, net | | | (5 | ) | | | (4 | ) | | | (1 | ) |

| Net Income | | $ | 1,583 | | | $ | 1,375 | | | $ | 208 | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.96 | | | $ | 1.69 | | | $ | 0.27 | |

| Diluted | | $ | 1.96 | | | $ | 1.69 | | | $ | 0.27 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 40% | | | 38% | | | -2% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| OCCIDENTAL PETROLEUM |

| 2013 Third Quarter Net Income (Loss) |

| Core Results Comparison |

| | | | | | | | | | | | | |

| | | Third | | Third | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2013 | | 2012 | | B / (W) |

| Oil & Gas | | $ | 2,363 | | | $ | 2,026 | | | $ | 337 | |

| Chemical | | | 181 | | | | 162 | | | | 19 | |

| Midstream, marketing and other | | | 212 | | | | 156 | | | | 56 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (28 | ) | | | (34 | ) | | | 6 | |

| Other | | | (103 | ) | | | (76 | ) | | | (27 | ) |

| Taxes | | | (1,037 | ) | | | (855 | ) | | | (182 | ) |

| Core Results | | $ | 1,588 | | | $ | 1,379 | | | $ | 209 | |

| | | | | | | | | | | | | |

| Core Results Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.97 | | | $ | 1.70 | | | $ | 0.27 | |

| Diluted | | $ | 1.97 | | | $ | 1.70 | | | $ | 0.27 | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 40% | | | 38% | | | -2% |

9

Investor Relations Supplemental Schedules

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| SUMMARY OF OPERATING STATISTICS |

| | | | | | | | | | | | | | | |

| | | | Third Quarter | | | Nine Months |

| | | | 2013 | | 2012 | | | 2013 | | 2012 |

| NET PRODUCTION PER DAY: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | |

| Oil (MBBL) | | | | | | | | | | | | | | |

| | California | | 89 | | | 88 | | | | 88 | | | 87 | |

| | Permian | | 146 | | | 144 | | | | 146 | | | 140 | |

| Midcontinent and other | | 32 | | | 28 | | | | 30 | | | 24 | |

| | Total | | 267 | | | 260 | | | | 264 | | | 251 | |

| NGLs (MBBL) | | | | | | | | | | | | | | |

| | California | | 21 | | | 18 | | | | 21 | | | 16 | |

| | Permian | | 41 | | | 40 | | | | 40 | | | 39 | |

| Midcontinent and other | | 17 | | | 16 | | | | 17 | | | 18 | |

| | Total | | 79 | | | 74 | | | | 78 | | | 73 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | |

| | California | | 260 | | | 247 | | | | 261 | | | 261 | |

| | Permian | | 148 | | | 151 | | | | 161 | | | 153 | |

| Midcontinent and other | | 373 | | | 414 | | | | 377 | | | 414 | |

| | Total | | 781 | | | 812 | | | | 799 | | | 828 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Latin America | | | | | | | | | | | | | | |

| Oil (MBBL) | Colombia | | 30 | | | 30 | | | | 29 | | | 28 | |

| | | | | | | | | | | | | | | |

| Natural Gas (MMCF) | Bolivia | | 12 | | | 12 | | | | 13 | | | 13 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Middle East / North Africa | | | | | | | | | | | | | | |

| Oil (MBBL) | | | | | | | | | | | | | | |

| | Dolphin | | 7 | | | 7 | | | | 7 | | | 8 | |

| | Oman | | 69 | | | 69 | | | | 67 | | | 65 | |

| | Qatar | | 69 | | | 69 | | | | 68 | | | 71 | |

| | Other | | 35 | | | 38 | | | | 40 | | | 41 | |

| | Total | | 180 | | | 183 | | | | 182 | | | 185 | |

| | | | | | | | | | | | | | | |

| NGLs (MBBL) | Dolphin | | 7 | | | 7 | | | | 7 | | | 9 | |

| | Other | | - | | | 1 | | | | - | | | - | |

| | Total | | 7 | | | 8 | | | | 7 | | | 9 | |

| | | | | | | | | | | | | | | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | |

| | Dolphin | | 145 | | | 147 | | | | 141 | | | 171 | |

| | Oman | | 53 | | | 57 | | | | 55 | | | 57 | |

| | Other | | 233 | | | 237 | | | | 236 | | | 229 | |

| | Total | | 431 | | | 441 | | | | 432 | | | 457 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | | 767 | | | 766 | | | | 767 | | | 762 | |

11

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM | | | | | |

| SUMMARY OF OPERATING STATISTICS | | | | | |

| | | | | | | | | | | | | | | |

| | | | Third Quarter | | | Nine Months |

| | | | 2013 | | 2012 | | | 2013 | | 2012 |

| NET SALES VOLUMES PER DAY: | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | |

| Oil (MBBL) | | | 267 | | | 259 | | | | 264 | | | 251 | |

| NGLs (MBBL) | | | 79 | | | 74 | | | | 78 | | | 73 | |

| Natural Gas (MMCF) | | | 781 | | | 807 | | | | 800 | | | 825 | |

| | | | | | | | | | | | | | | |

| Latin America | | | | | | | | | | | | | | |

| Oil (MBBL) | | | 30 | | | 30 | | | | 29 | | | 28 | |

| Natural Gas (MMCF) | | | 12 | | | 12 | | | | 13 | | | 13 | |

| | | | | | | | | | | | | | | |

| Middle East / North Africa | | | | | | | | | | | | | | |

| Oil (MBBL) | | | | | | | | | | | | | | |

| | Dolphin | | 7 | | | 7 | | | | 6 | | | 8 | |

| | Oman | | 72 | | | 67 | | | | 69 | | | 64 | |

| | Qatar | | 70 | | | 68 | | | | 67 | | | 70 | |

| | Other | | 29 | | | 42 | | | | 30 | | | 38 | |

| | Total | | 178 | | | 184 | | | | 172 | | | 180 | |

| | | | | | | | | | | | | | | |

| NGLs (MBBL) | Dolphin | | 7 | | | 8 | | | | 7 | | | 9 | |

| | | | | | | | | | | | | | | |

| Natural Gas (MMCF) | | | 431 | | | 441 | | | | 432 | | | 457 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | | 765 | | | 765 | | | | 758 | | | 757 | |

12

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| SUMMARY OF OPERATING STATISTICS |

| | | | | | | | | | | | | | | | | |

| | | Third Quarter | | Nine Months |

| | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | | | | | | | | | | | | | | |

| OIL & GAS: | | | | | | | | | | | | | | | | |

| REALIZED PRICES | | | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | | | |

| Oil ($/BBL) | | | 104.30 | | | | 91.97 | | | | 97.07 | | | | 95.83 | |

| NGLs ($/BBL) | | | 41.36 | | | | 41.66 | | | | 40.56 | | | | 46.60 | |

| Natural gas ($/MCF) | | | 3.27 | | | | 2.48 | | | | 3.39 | | | | 2.47 | |

| | | | | | | | | | | | | | | | | |

| Latin America | | | | | | | | | | | | | | | | |

| Oil ($/BBL) | | | 105.64 | | | | 95.04 | | | | 104.13 | | | | 98.50 | |

| Natural gas ($/MCF) | | | 11.17 | | | | 12.13 | | | | 11.36 | | | | 11.93 | |

| | | | | | | | | | | | | | | | | |

| Middle East / North Africa | | | | | | | | | | | | | | | | |

| Oil ($/BBL) | | | 103.12 | | | | 103.46 | | | | 103.96 | | | | 109.22 | |

| NGLs ($/BBL) | | | 31.67 | | | | 30.89 | | | | 32.31 | | | | 33.61 | |

| | | | | | | | | | | | | | | | | |

| Total Worldwide | | | | | | | | | | | | | | | | |

| Oil ($/BBL) | | | 103.95 | | | | 96.62 | | | | 100.04 | | | | 101.20 | |

| NGLs ($/BBL) | | | 40.53 | | | | 40.65 | | | | 39.87 | | | | 45.21 | |

| Natural gas ($/MCF) | | | 2.48 | | | | 1.97 | | | | 2.56 | | | | 1.97 | |

| | | | | | | | | | | | | | | | | |

| INDEX PRICES | | | | | | | | | | | | | | | | |

| WTI oil ($/BBL) | | | 105.83 | | | | 92.22 | | | | 98.14 | | | | 96.21 | |

| Brent oil ($/BBL) | | | 109.71 | | | | 109.48 | | | | 108.57 | | | | 112.24 | |

| NYMEX gas ($/MCF) | | | 3.62 | | | | 2.76 | | | | 3.66 | | | | 2.62 | |

| | | | | | | | | | | | | | | | | |

| REALIZED PRICES AS PERCENTAGE OF INDEX PRICES | | | | | | | | | | | | | | | | |

| Worldwide oil as a percentage of WTI | | | 98% | | | 105% | | | 102% | | | 105% |

| Worldwide oil as a percentage of Brent | | | 95% | | | 88% | | | 92% | | | 90% |

| Worldwide NGLs as a percentage of WTI | | | 38% | | | 44% | | | 41% | | | 47% |

| Domestic natural gas as a percentage of NYMEX | | | 90% | | | 90% | | | 92% | | | 94% |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Third Quarter | | Nine Months |

| | | 2013 | | 2012 | | 2013 | | 2012 |

| Exploration Expense | | | | | | | | | | | | | | | | |

| United States | | $ | 52 | | | $ | 45 | | | $ | 137 | | | $ | 186 | |

| Latin America | | | 5 | | | | 1 | | | | 5 | | | | 1 | |

| Middle East / North Africa | | | 11 | | | | 23 | | | | 54 | | | | 76 | |

| | | $ | 68 | | | $ | 69 | | | $ | 196 | | | $ | 263 | |

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM |

| SUMMARY OF OPERATING STATISTICS |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Third Quarter | | Nine Months |

| Capital Expenditures ($MM) | | 2013 | | 2012 | | 2013 | | 2012 |

| Oil & Gas | | | | | | | | | | | | | | | | |

| California | | $ | 397 | | | $ | 544 | | | $ | 1,076 | | | $ | 1,647 | |

| Permian | | | 416 | | | | 559 | | | | 1,287 | | | | 1,496 | |

| Midcontinent and other | | | 215 | | | | 278 | | | | 641 | | | | 1,120 | |

| Latin America | | | 91 | | | | 76 | | | | 236 | | | | 185 | |

| Middle East / North Africa | | | 505 | | | | 520 | | | | 1,601 | | | | 1,378 | |

| Exploration | | | 106 | | | | 160 | | | | 287 | | | | 514 | |

| Chemical | | | 131 | | | | 75 | | | | 299 | | | | 192 | |

| Midstream, marketing and other | | 323 | | | | 364 | | | | 979 | | | | 1,118 | |

| Corporate | | | 87 | | | | 15 | | | | 145 | | | | 66 | |

| | TOTAL | | 2,271 | | | | 2,591 | | | | 6,551 | | | | 7,716 | |

| Non-controlling interest contributions | | (80 | ) | | | - | | | | (145 | ) | | | - | |

| | | $ | 2,191 | | | $ | 2,591 | | | $ | 6,406 | | | $ | 7,716 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Depreciation, Depletion & | | Third Quarter | | Nine Months |

| Amortization of Assets ($MM) | 2013 | | 2012 | | 2013 | | 2012 |

| Oil & Gas | | | | | | | | | | | | | | | | |

| Domestic | | $ | 750 | | | $ | 614 | | | $ | 2,222 | | | $ | 1,784 | |

| Latin America | | | 30 | | | | 30 | | | | 87 | | | | 86 | |

| Middle East / North Africa | | | 405 | | | | 356 | | | | 1,145 | | | | 1,019 | |

| Chemical | | | 88 | | | | 86 | | | | 260 | | | | 257 | |

| Midstream, marketing and other | | 52 | | | | 54 | | | | 154 | | | | 154 | |

| Corporate | | | 9 | | | | 8 | | | | 28 | | | | 20 | |

| | TOTAL | $ | 1,334 | | | $ | 1,148 | | | $ | 3,896 | | | $ | 3,320 | |

14

Investor Relations Supplemental Schedules

| OCCIDENTAL PETROLEUM | |

| CORPORATE | |

| ($ millions) | |

| | | | | | | | | | | | | |

| | | 30-Sep-13 | | 31-Dec-12 |

| | | | | | | | | | | | | |

| CAPITALIZATION | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Long-Term Debt (including current maturities) | | | $ | 7,561 | | | | | $ | 7,623 | | |

| | | | | | | | | | | | | |

| EQUITY | | | $ | 42,968 | | | | | $ | 40,048 | | |

| | | | | | | | | | | | | |

| Total Debt To Total Capitalization | | | | 15% | | | | | 16% | |

15