August 13, 2019

SUBMITTED VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| Attention: | Scott Anderegg, Staff Attorney |

| | Lilyanna Peyser, Special Counsel |

| Re: | Virtual Crypto Technologies, Inc. |

| | Form 8-K |

| | Filed July 25, 2019 |

| | File No. 000-15746-19975121 |

Dear Mr. Anderegg:

This letter sets forth the response of Viewbix Inc. (f/k/a Virtual Crypto Technologies, Inc.) (the “Company” or the “Registrant”) to the comment of the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “SEC”) contained in its letter, dated July 31, 2019 (the “Comment Letter”), relating to the above referenced Form 8-K filed by the Registrant on July 25, 2019 (the “8-K”).

For ease of reference, set forth below is the Company’s response to the comment preceded by the comment, which is included in bold italics. Capitalized terms used in this letter but not otherwise defined herein shall have the meaning set forth in the 8-K.

1. Based on your Form 10-Q for the fiscal quarter ended March 31, 2019, it appears that you were a shell company, as defined in Exchange Act Rule 12b-2, prior to the transactions described in the Form 8-K. In this regard, we note that, as of March 31, 2019, you had no assets other than cash and cash equivalents and no or nominal operations. Please provide us with your analysis of whether the transactions described in the Form 8-K resulted in a change in your shell company status. If they did, please amend the Form 8-K to include the disclosure required by Items 2.01(f) and 5.06 of Form 8-K, including the financial statements required by Items 9.01(a) and (b) of Form 8-K.

In response to the Staff’s comment, the Company respectfully submits that the Company is not and was not a “shell company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Act”). Rule 12b-2 of the Act defines a shell company as “a registrant, other than an asset-backed issuer as defined in Item 1101(b) of Regulation AB, that has: (1) no or nominal operations; and (2) either: (i) no or nominal assets; (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets.”

In adopting the definition of a shell company in SEC Release No. 33-8587 (the “Release”), the Commission stated that it intentionally did not define the term “nominal” and it did not set a quantitative threshold of what constitutes a shell company. In the Release, the Commission states:

“We are not defining the term “nominal,” as we believe that this term embodies the principle that we seek to apply and is not inappropriately vague or ambiguous. We have considered the comment that a quantitative threshold would improve the definition of a shell company; however, we believe that quantitative thresholds would, in this context, present a serious potential problem, as they would be more easily circumvented. We believe further specification of the meaning of “nominal” in the definition of a “shell company” is unnecessary and would make circumventing the intent of our regulations and the fraudulent misuse of shell companies easier.”

As such, under the Rule, the threshold for what is considered “nominal” is, to a large degree, based upon facts and circumstances of each individual case.

As more fully set forth below, the Company is of the position that its current business operations and assets exceed any classification as “nominal” and therefore, the Company was not, is not, and should not be, classified as a “shell company”.

1. On January 17, 2018, the Company formed a wholly-owned subsidiary Virtual Crypto Technologies Ltd. (the “Subsidiary”), a company organized under the laws of Israel, through which all active technology, product development and marketing activities have been carried out by the Company.

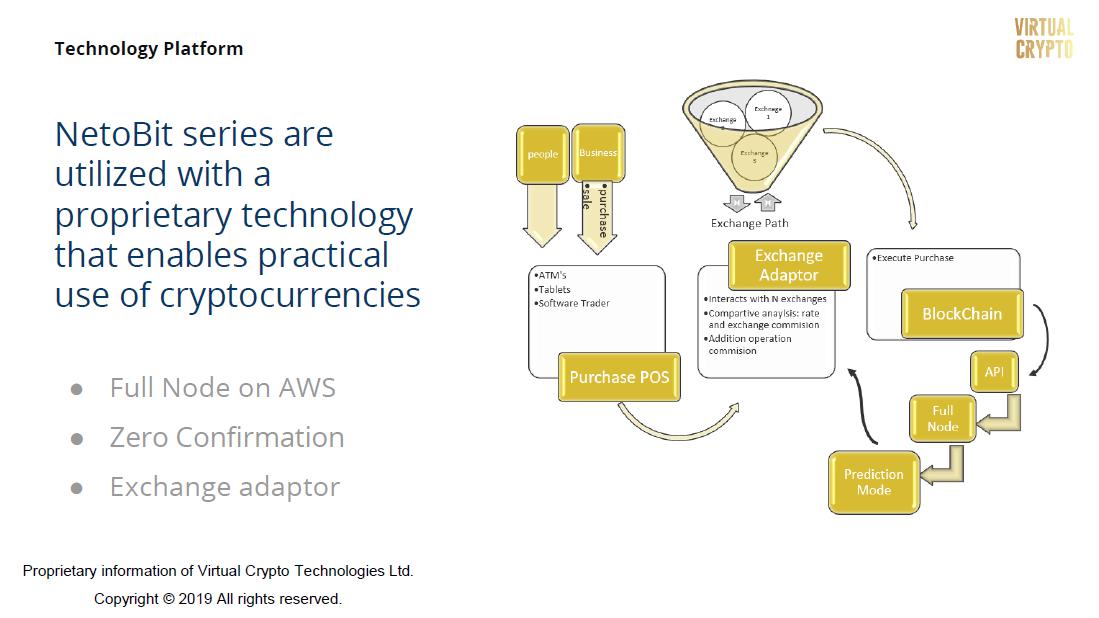

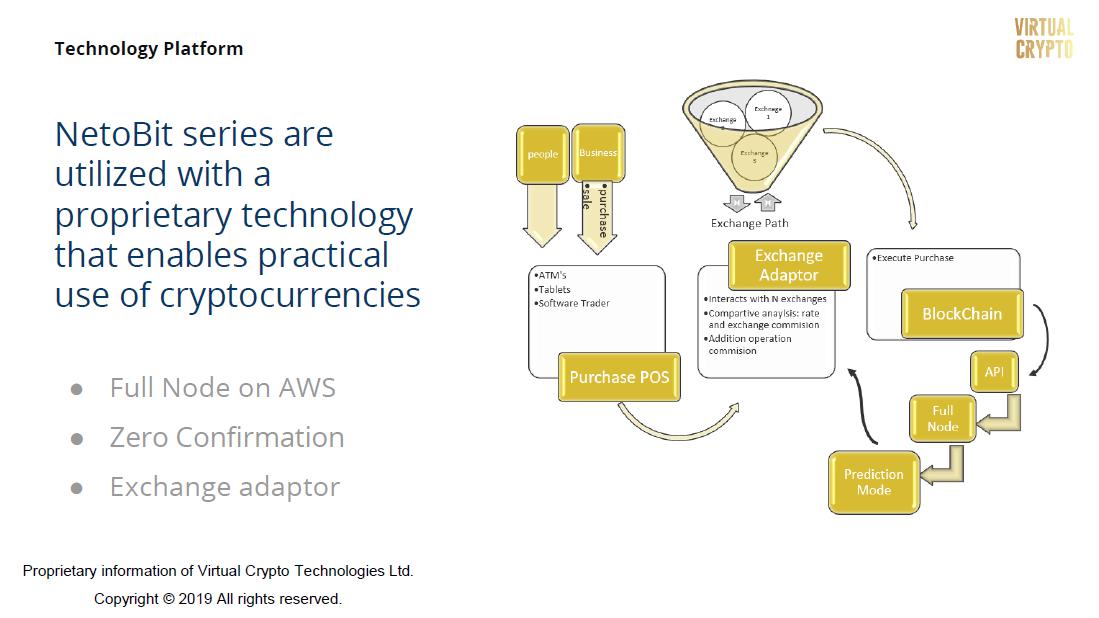

2. The Company, through the Subsidiary, completed the development of an algorithm that predicts the likelihood of clearing a virtual currency in a BlockChain transaction, which was intended to serve as an efficient conversion tool of virtual currencies into fiat coins and vice versa (the “Algorithm”). The Company’s business plan was based on marketing and selling certain products based on the Algorithm, and the Company has believed that the Algorithm would make virtual currencies further accessible to the traders.

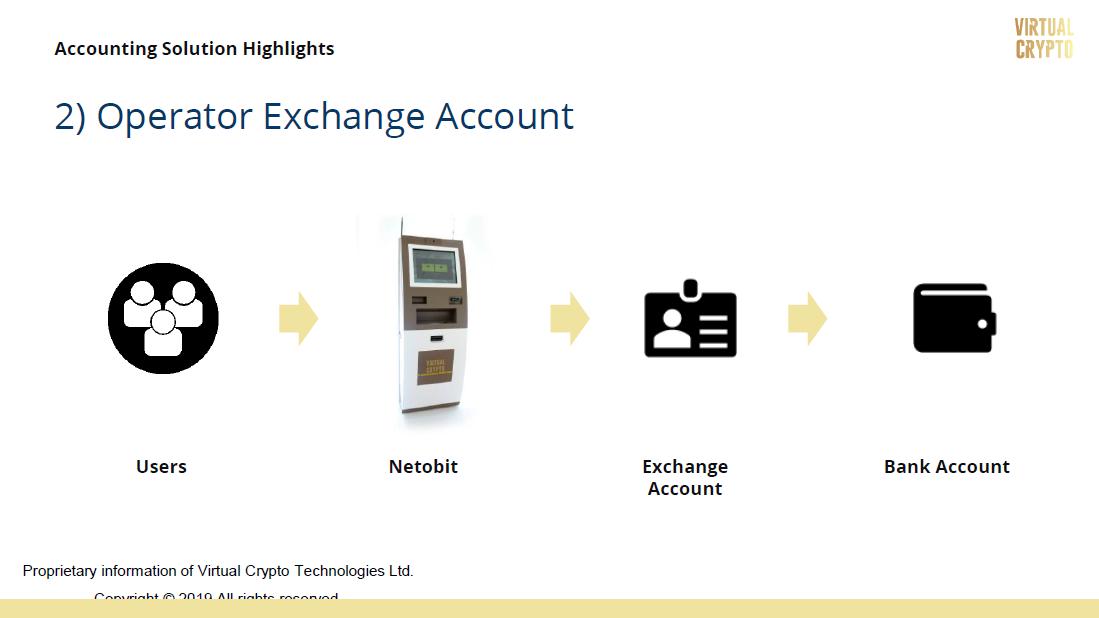

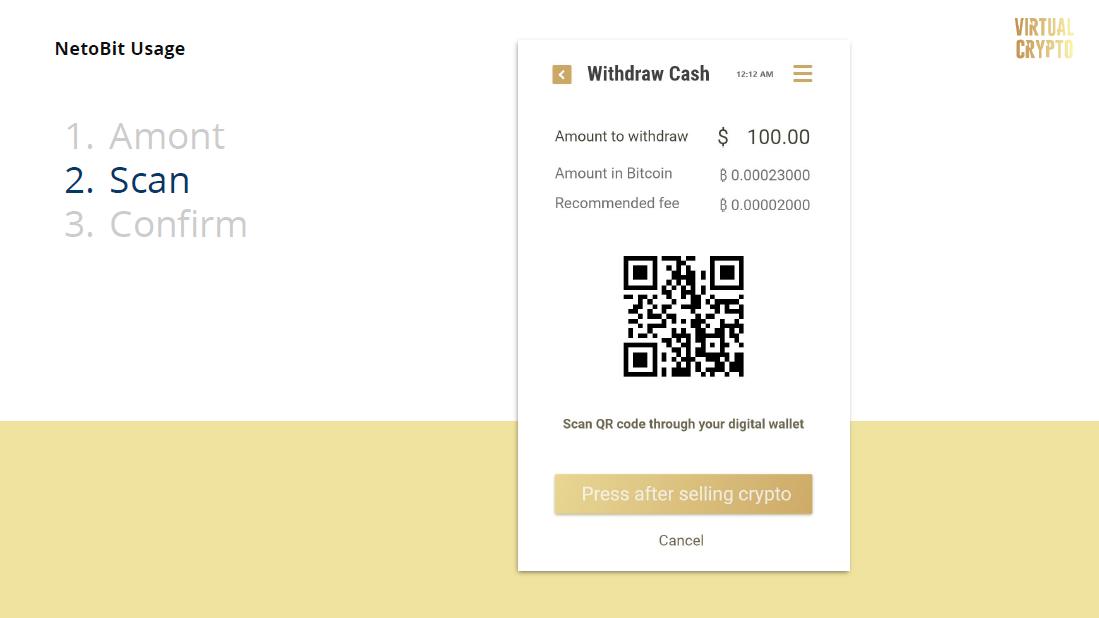

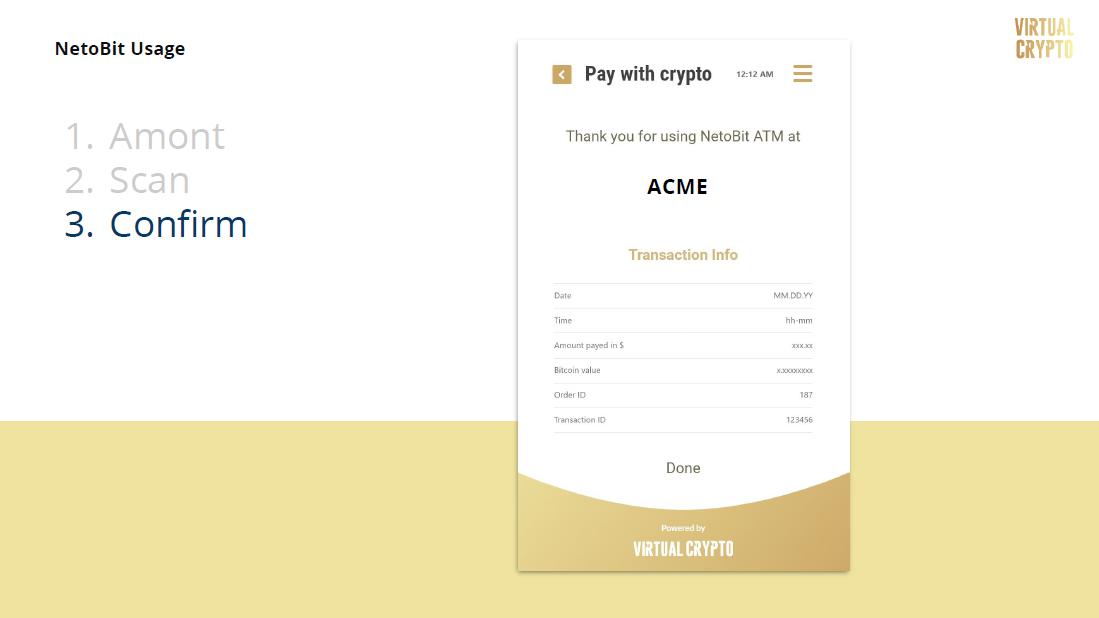

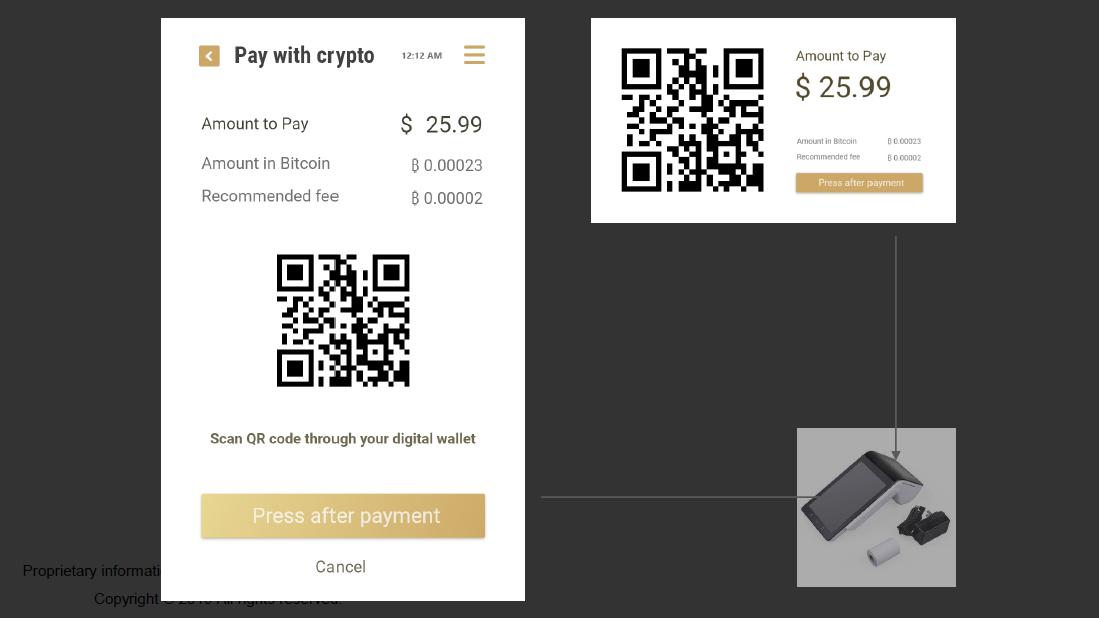

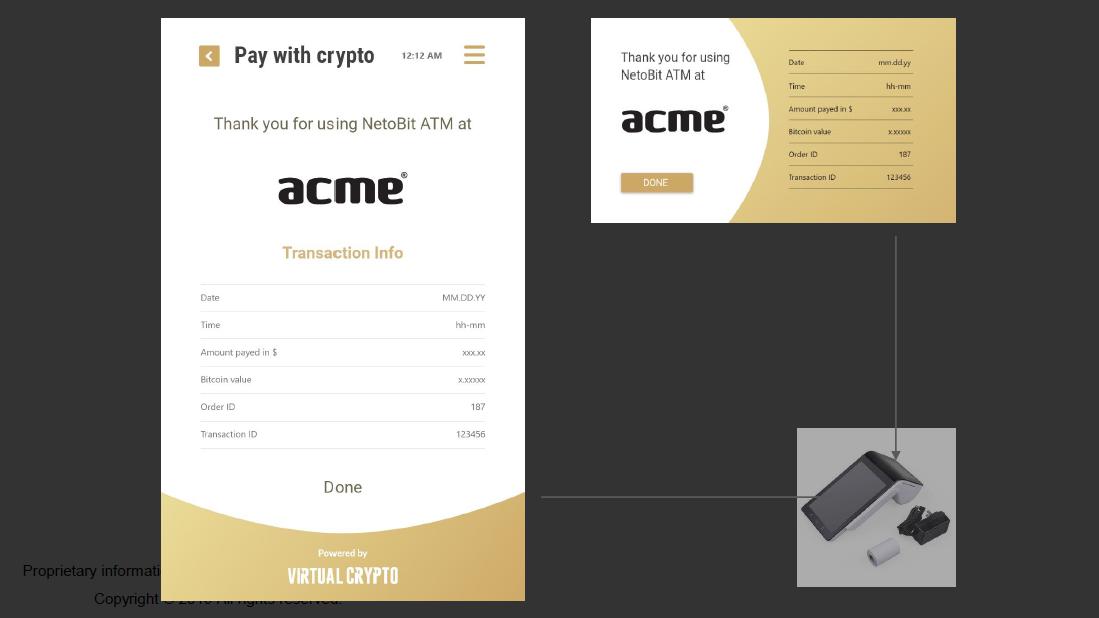

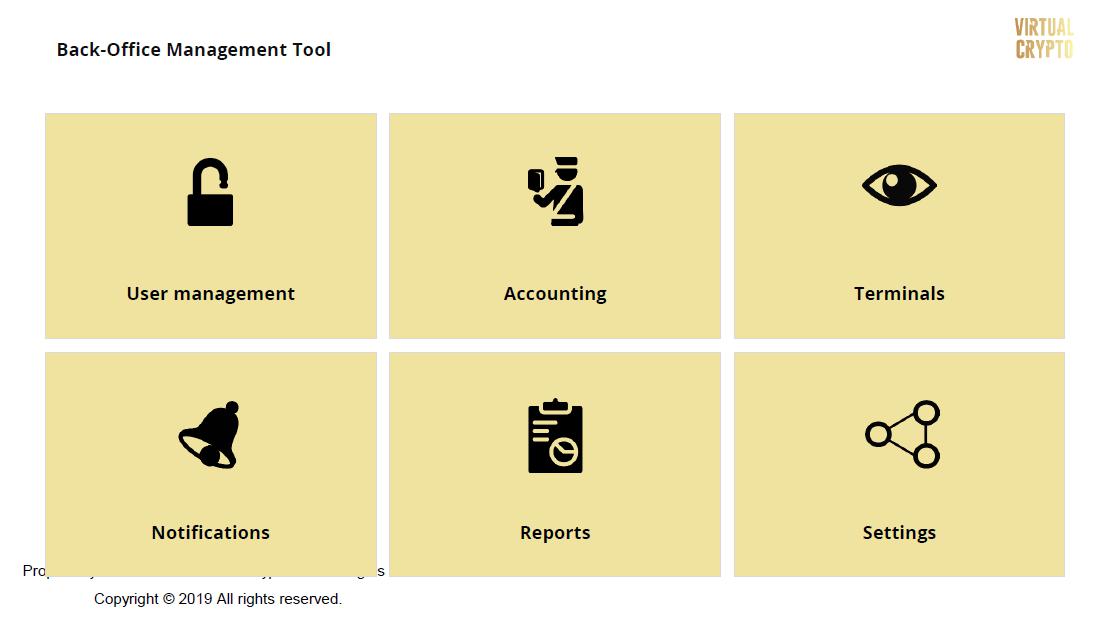

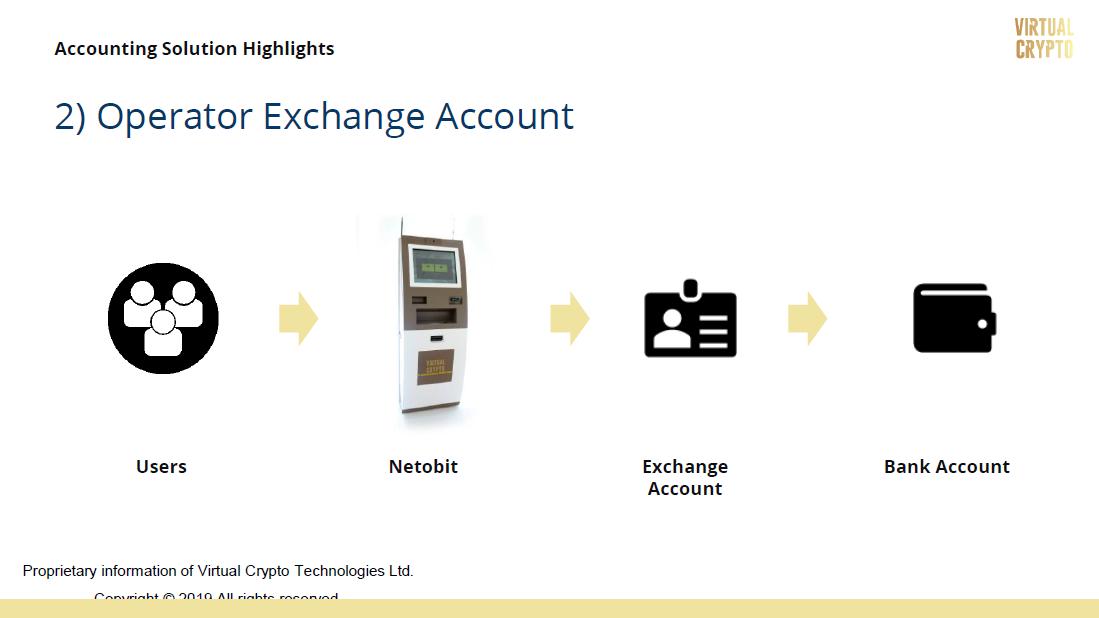

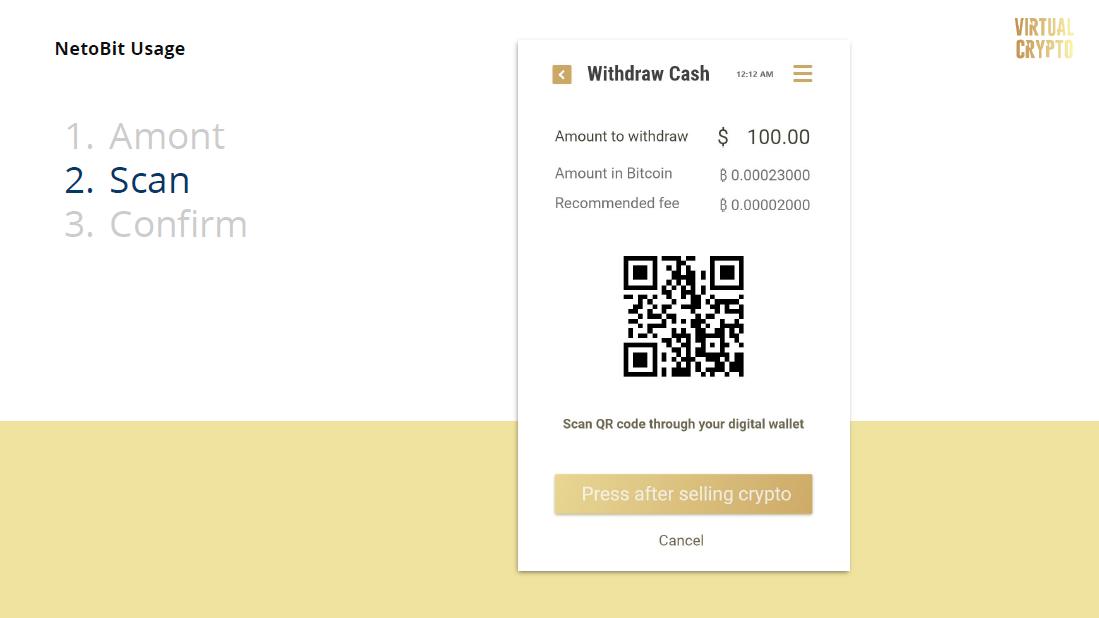

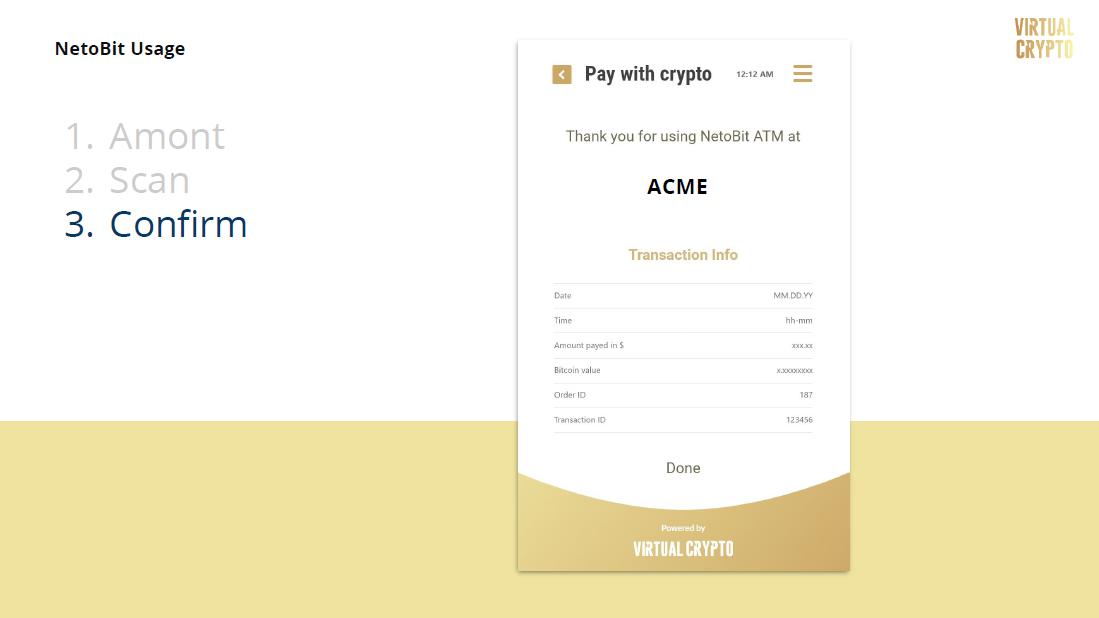

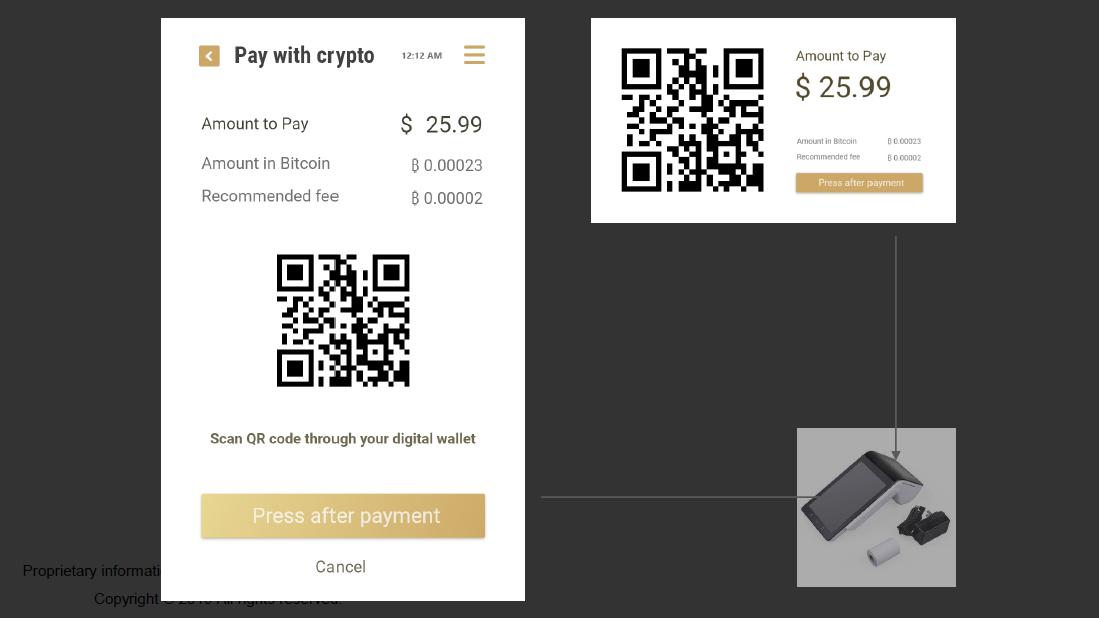

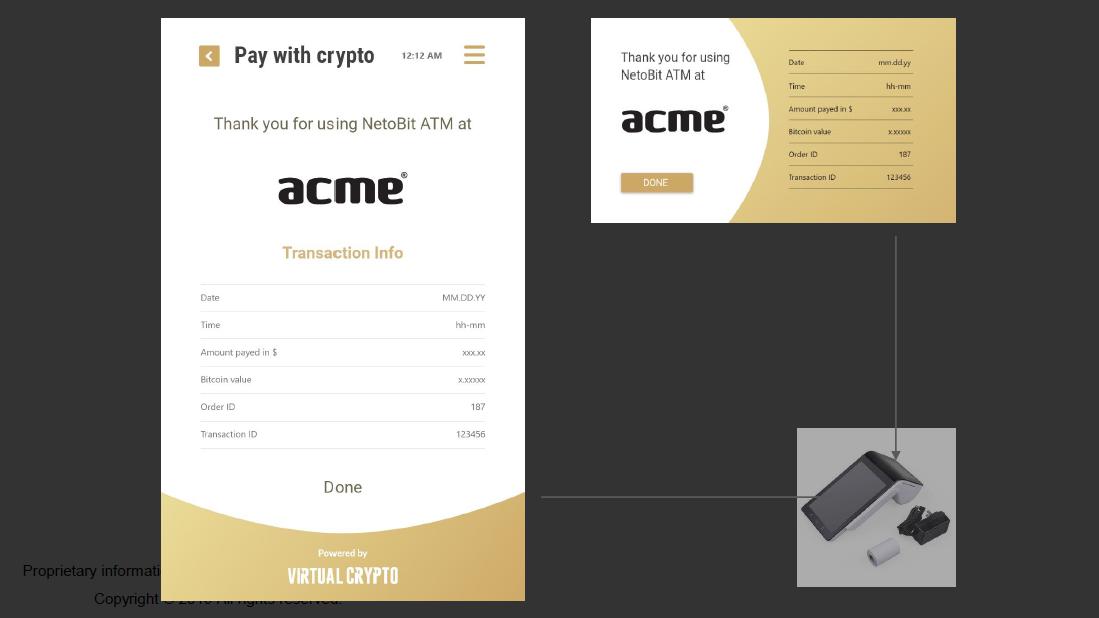

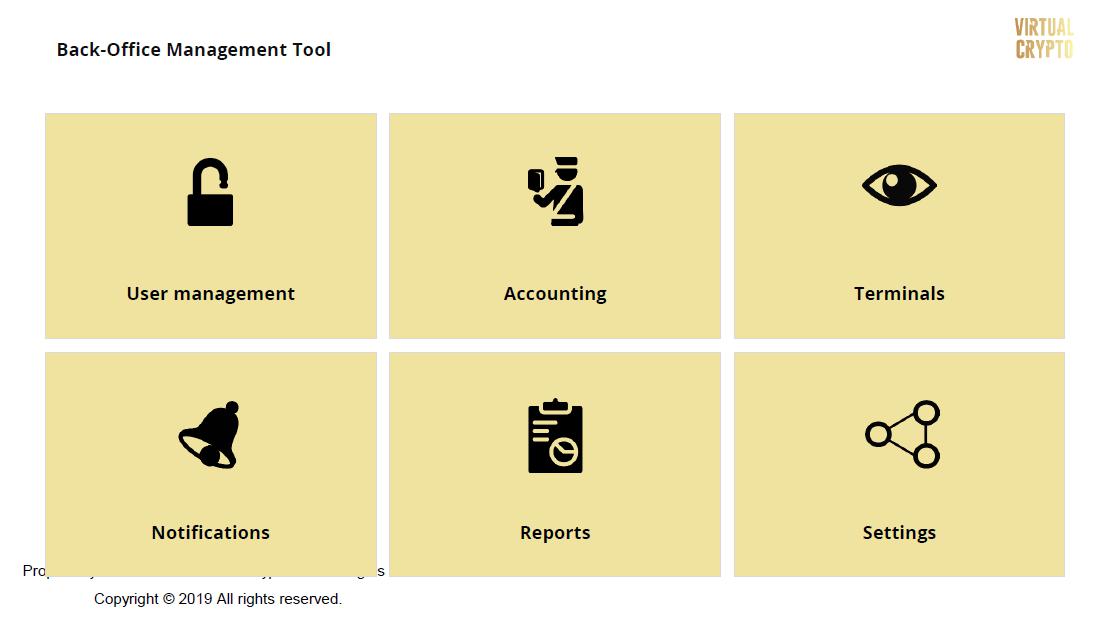

3. The Company, through the Subsidiary, has developed products for public use as well as for small businesses, including ATMs and clearance terminals, and since the second half of 2018, the Company was engaged in certain ongoing efforts to market its products concurrent with its continued focus on improving the Algorithm. Given the downturn of the Cryptocurrencies markets, the Company sustained difficulties in generating sales from such marketing efforts. The Company has attached to this Letter, as Exhibit A, a presentation prepared and delivered by the Subsidiary to promote “NetoBit”, a line of products developed by the Subsidiary during the calendar year of 2018 and which was marketed to potential customers as recently as the first half of 2019.

4. The Subsidiary employed an active management team up until the closing of the Share Exchange Agreement on July 25, 2019 (the “Share Exchange Closing”), as further described in the 8-K. The Subsidiary’s executive employees included, among others, Mr. Ronen Fattal, an experienced marketing executive, who was promoted in late 2018 to the position of full-time Chief Executive Officer, and Mr. Or Elkin, a software engineer, who had been employed by the Subsidiary since approximately the Subsidiary’s inception and served as its full-time Chief Technology Officer until the Share Exchange Closing, in which capacity he focused on improving and maintaining the Subsidiary’s primary algorithm and intellectual property.

5. Mr. Alon Dayan, the Company’s outgoing Chief Executive Officer, as well as other consultants and marketing firms, have been actively supporting the Company’s marketing activities. Particularly in the Subsidiary’s situation, management has been working at implementing the Subsidiary’s core business strategy, including, but not limited to, by engaging a marketing professional as recently as December of 2018, in an effort to assist the Subsidiary with identifying additional sales opportunities and revenue targets.

6. In December of 2018, the Company, through its Subsidiary, attempted to receive a financing grant from the Israel Innovation Authority (formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry, or the OCS) (the “IIA”) for certain research and development programs of the Subsidiary that met the IIA’s specified criteria.

7. Simultaneous with the Company’s aforementioned efforts to stimulate interest in the Company’s product portfolio, including products developed and marketed by the Subsidiary, the Company met with and engaged certain strategic business partners and considered alternative business strategies in order to maximize shareholder value. In February of 2019, the Company’s management determined that, subject to a positive tax-ruling from the Israeli Tax Authority (the “ITA”) and other approvals necessary for the consummation of the Share Exchange Agreement, it was the appropriate business decision to invest the Company’s time and assets in the acquired products and intellectual property of Viewbix Ltd. given the uncertainties associated with the BlockChain industry and irrespective of the Company’s recent marketing and sales campaigns. As was reported in the Registrant’s Report on Form 8-K as filed with the SEC on February 7, 2019, obtaining a positive tax-ruling from the ITA was a condition to closing the Share Exchange Agreement, and since the Company was not afforded any tangible assurance that such a determination by the ITA would be given, the Company resolved to maintain its marketing, research and development, and sales efforts up through the Share Exchange Closing.

The foregoing demonstrates the Company has engaged in definitive business operations since its inception through its recent strategic business transaction, as described in the 8-K, primarily as evidenced through, inter alia the research and development of certain products, and the engagement of various executive employees and external consultants and advisors to assist the Company and the Subsidiary in exploring and identifying lucrative business opportunities. Accordingly, the Company’s current business operations exceed the threshold of “nominal”, as defined in Rule 12b-2 of the Act, and, therefore, the Company should not be classified, either currently or previously, as a “shell company”.

The Company acknowledges that the Company and its management are responsible for the accuracy and adequacy of their disclosures, notwithstanding any review, comments, action or absence of action by the Staff.

The Company respectfully requests the Staff’s assistance in completing the review of this response letter. Thank you in advance for your attention to the above.

| | Sincerely, |

| | |

| | Viewbix Inc. |

| | |

| | /s/ Alon Dayan |

| | Alon Dayan Director |

cc: Shachar Hadar, Meitar Liquornik Geva Leshem Tal