VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2018 and 2017

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2018 and 2017

CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Viewbix Ltd.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Viewbix Ltd. and its subsidiary (the “Company”) as of December 31, 2018 and 2017 and the related consolidated statements of comprehensive loss, shareholders' deficit and cash flows for each of the two years in the period ended December 31, 2018, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company's substantial operating losses, shareholder's deficit, working capital deficit and negative cash flows from operations raise substantial doubt about its ability to continue as a going concern. Management's plans concerning these matters are also described in Note 1 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of' these uncertainties

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

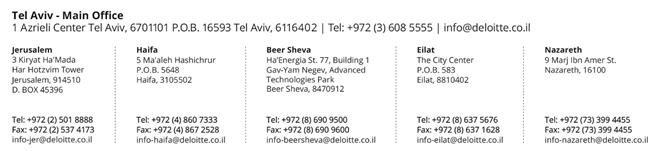

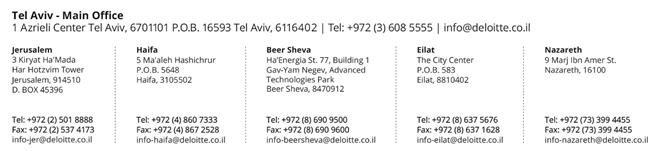

/s/Brightman Almagor Zohar & Co.

Brightman Almagor Zohar & Co.

Certified Public Accountants

A Firm in the Deloitte Global Network

Tel Aviv, Israel

September 23, 2019

We have served as the Company's auditor since 2019.

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share data)

| | | | | | As of December 31, | |

| | | Note | | | 2018 | | | 2017 | |

| | | | | | | | | | |

| ASSETS | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | |

| Cash and cash equivalents | | | | | | $ | 51 | | | $ | 22 | |

| Restricted cash | | | | | | | 2 | | | | 2 | |

| Trade receivables | | | | | | | 15 | | | | 43 | |

| Prepaid expenses | | | | | | | 7 | | | | 1 | |

| Other accounts receivable | | | 3 | | | | 78 | | | | 15 | |

| | | | | | | | | | | | | |

| Total current assets | | | | | | | 153 | | | | 83 | |

| | | | | | | | | | | | | |

| NON CURRENT ASSETS | | | | | | | | | | | | |

| Property and equipment, net | | | 4 | | | | 5 | | | | 7 | |

| | | | | | | | | | | | | |

| Total non-current assets | | | | | | $ | 5 | | | $ | 7 | |

| | | | | | | | | | | | | |

| Total assets | | | | | | | 158 | | | | 90 | |

The accompanying notes are an integral part of the consolidated financial statements.

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED BALANCE SHEETS (Cont.)

U.S. dollars in thousands (except share data)

| | | | | | As of December 31, | |

| | | Note | | | 2018 | | | 2017 | |

| | | | | | | | | | |

| LIABILITIES, TEMPORARY EQUITY AND SHAREHOLDERS' DEFICIT | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | |

| Trade payables | | | | | | $ | 19 | | | $ | 48 | |

| Payable to parent company | | | 16 | | | | 789 | | | | - | |

| Other accounts payable | | | 5 | | | | 25 | | | | 142 | |

| Convertible loans | | | 6 | | | | - | | | | 250 | |

| Total current liabilities | | | | | | | 833 | | | | 440 | |

| | | | | | | | | | | | | |

| Commitments and contingencies | | | 7 | | | | | | | | | |

| | | | | | | | | | | | | |

| TEMPORARY EQUITY | | | | | | | | | | | | |

| Preferred A-1 shares of NIS 0.01 par value - Authorized: 154,000 shares as of December 31, 2018 and 2017; Issued and outstanding: 153,955 shares as of December 31, 2018 and 2017 | | | 8 | | | | (* | ) | | | (* | ) |

| Preferred A-2 shares of NIS 0.01 par value - Authorized: 3,760,300 shares as of December 31, 2018 and 2017; Issued and outstanding: 3,760,217 shares as of December 31, 2018 and 2017 | | | | | | | 10 | | | | 10 | |

| Preferred B shares of NIS 0.01 par value - Authorized: 3,509,500 shares as of December 31, 2018 and 2017; Issued and outstanding: 3,509,446 shares as of December 31, 2018 and 2017 | | | | | | | 9 | | | | 9 | |

| Preferred C shares of NIS 0.01 par value: Authorized: 9,352,000 shares as of December 31, 2018 and 2017; Issued and outstanding 5,563,162 shares as of December 2018 and 2017. | | | | | | | 15 | | | | 15 | |

| Preferred C-1 shares of NIS 0.01 par value: Authorized: 2,123,000 shares as of December 31, 2018 and 2017; Issued and outstanding 2, 122, 652 shares as of December 2018, and 2017. | | | | | | | 11 | | | | 11 | |

| Preferred C-2 shares of NIS 0.01 par value: Authorized: 350,000 shares as of December 31, 2018 and 2017; Issued and outstanding 302,261 shares and 0 shares as of December 2018 and December 2017 respectively | | | | | | | 1 | | | | - | |

| Total temporary equity | | | 8 | | | | 46 | | | | 45 | |

| | | | | | | | | | | | | |

| SHAREHOLDERS' DEFICIT | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Share Capital | | | | | | | | | | | | |

| Ordinary shares of NIS 0.01 par value - Authorized: 23,872,000 shares as of December 31, 2018 and 2017; Issued and outstanding: 210,323 shares as of December 31, 2018 and 2017 | | | | | | | 1 | | | | 1 | |

| Additional paid-in capital | | | | | | | 12,872 | | | | 12,623 | |

| Accumulated deficit | | | | | | | (13,594 | ) | | | (13,019 | ) |

| Total shareholders' deficit | | | | | | | (721 | ) | | | (395 | ) |

| | | | | | | | | | | | | |

| Total liabilities, temporary equity and shareholders' deficit | | | | | | $ | 158 | | | $ | 90 | |

(*) Represents an amount less than $1.

The accompanying notes are an integral part of the consolidated financial statements.

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

U.S. dollars in thousands (except share data)

| | | | | | Year ended | |

| | | | | | December 31, | |

| | | Note | | | 2018 | | | 2017 | |

| | | | | | | | | | |

| Revenues | | | 9 | | | $ | 252 | | | $ | 317 | |

| Cost of revenues | | | | | | | 75 | | | | 100 | |

| | | | | | | | | | | | | |

| Gross profit | | | | | | | 177 | | | | 217 | |

| | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | |

| Research and development | | | 10 | | | | 258 | | | | 328 | |

| Selling and marketing | | | 11 | | | | 373 | | | | 195 | |

| General and administrative | | | 12 | | | | 124 | | | | 90 | |

| | | | | | | | | | | | | |

| Operating loss | | | | | | | 578 | | | | 396 | |

| | | | | | | | | | | | | |

| Financial expenses (income), net | | | 13 | | | | (18 | ) | | | 7 | |

| | | | | | | | | | | | | |

| Loss before tax | | | | | | | 560 | | | | 403 | |

| | | | | | | | | | | | | |

| Taxes on income | | | 14 | | | | 15 | | | | 3 | |

| | | | | | | | | | | | | |

| Net loss | | | | | | $ | 575 | | | $ | 406 | |

| | | | | | | | | | | | | |

| Loss per share - basic and diluted | | | 15 | | | $ | 2.73 | | | $ | 1.93 | |

| | | | | | | | | | | | | |

| Weighted average number of ordinary shares outstanding used in the computation of loss per share (in thousands) | | | | | | | 210,323 | | | | 210,323 | |

The accompanying notes are an integral part of the consolidated financial statements.

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN TEMPORARY EQUITY AND SHAREHOLDERS' DEFICIT

U.S. dollars in thousands (except share data)

| | | Preferred A-1 | | | Preferred A-2 | | | Preferred B | | | Preferred C | | | Preferred C-1 | | Preferred C-2 | | | Total temporary | | | Ordinary shares | | | Additional paid-in | | | Accumulated | | | Total shareholders | |

| | | Number | | | Amount | | | Number | | | Amount | | | Number | | | Amount | | | Number | | | Amount | | | Number | | | Amount | | | Number | | | Amount | | | equity | | | Number | | | Amount | | | Capital | | | deficit | | | deficit | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of January 1, 2017 | | | 153,955 | | | $ | * | | | | 3,760,217 | | | $ | 10 | | | | 3,509,446 | | | $ | 9 | | | | 5,563,162 | | | $ | 15 | | | | 2,122,652 | | | $ | 11 | | | | - | | | $ | - | | | $ | 45 | | | | 210,323 | | | $ | 1 | | | $ | 12,620 | | | $ | (12,613 | ) | | | 8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 3 | | | | - | | | | 3 | |

| Net loss for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (406 | ) | | | (406 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2017 | | | 153,955 | | | | * | | | | 3,760,217 | | | | 10 | | | | 3,509,446 | | | | 9 | | | | 5,563,162 | | | | 15 | | | | 2,122,652 | | | | 11 | | | | - | | | | - | | | | 45 | | | | 210,323 | | | | 1 | | | | 12,623 | | | | (13,019 | ) | | | (395 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conversion of convertible loans into Preferred C-2 shares | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 302,261 | | | | 1 | | | | 1 | | | | - | | | | - | | | | 249 | | | | - | | | | 249 | |

| Net loss for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (575 | ) | | | (575 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2018 | | | 153,955 | | | $ | * | | | | 3,760,217 | | | $ | 10 | | | | 3,509,446 | | | $ | 9 | | | | 5,563,162 | | | $ | 15 | | | | 2,122,652 | | | $ | 11 | | | | 302,261 | | | $ | 1 | | | $ | 46 | | | | 210,323 | | | $ | 1 | | | $ | 12,872 | | | $ | (13,594 | ) | | | (721 | ) |

(*) Represents an amount less than $1.

The accompanying notes are an integral part of the consolidated financial statements.

VIEWBIX LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands (except share data)

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Cash flows from operating activities | | | | | | | | |

| | | | | | | | | |

| Net loss | | $ | (575 | ) | | $ | (406 | ) |

| | | | | | | | | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation | | | 2 | | | | 4 | |

| Share-based compensation expense | | | * | | | | 3 | |

| | | | | | | | | |

| Changes in assets and liabilities: | | | | | | | | |

| | | | | | | | | |

| Decrease in trade receivables | | | 28 | | | | 45 | |

| Decrease (increase) in other accounts receivable and prepaid expenses | | | (68 | ) | | | 12 | |

| Increase (decrease) in trade payables | | | (29 | ) | | | 12 | |

| Increase (decrease) in other accounts payable | | | (67 | ) | | | 6 | |

| Increase in payable to parent company | | | 739 | | | | - | |

| | | | | | | | | |

| Net cash provided by (used in) operating activities | | | 30 | | | | (324 | ) |

| | | | | | | | | |

| Cash flows used in investing activities | | | | | | | | |

| | | | | | | | | |

| Purchase of property and equipment | | | (1 | ) | | | (1 | ) |

| | | | | | | | | |

| Net cash flow generated used in investing activities | | | (1 | ) | | | (1 | ) |

| | | | | | | | | |

| Cash flows provided by financing activities | | | | | | | | |

| | | | | | | | | |

| Issuance of convertible loan | | | - | | | | 75 | |

| | | | | | | | | |

| Net cash provided by financing activities | | | - | | | | 75 | |

| | | | | | | | | |

| Increase (decrease) in cash and cash equivalents and restricted cash | | | 29 | | | | (250 | ) |

| | | | | | | | | |

| Cash and cash equivalents and restricted cash at the beginning of the year | | | 24 | | | | 274 | |

| | | | | | | | | |

| Cash and cash equivalents and restricted cash at the end of the year | | $ | 53 | | | $ | 24 | |

| | | | | | | | | |

| Supplementary information | | | | | | | | |

| Conversion of convertible loans into Preferred C-2 shares | | $ | (250 | ) | | $ | - | |

(*) Represents an amount less than $1

The accompanying notes are an integral part of the consolidated financial statements.

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 1: | GENERAL |

| | | |

| | A. | Company description: |

| | | |

| | | Viewbix Ltd (the "Company”) was incorporated on February 2006 in Israel. The Company has developed an interactive video platform based on Software as a Service ("SaaS") business model with interactive elements, and the ability to collect and analyze information about each interactive action performed during the viewing of the video clip. The interactive elements and information gathered, allowing the advertiser to analyze user viewing habits and optimize real-time throughout the campaign while increasing the effectiveness of online and live video advertising. |

| | | |

| | | The Company has a wholly-owned US subsidiary, Viewbix Inc. (the "Subsidiary"), which was formed in 2008. The Subsidiary is engaged in marketing of the Company's products. The Company generates substantially all of its revenues from US based clients. |

| | | |

| | | On November 20, 2018 (the "Closing Date"), the Company's shareholders signed an agreement with Algomizer Ltd. (“Algomizer” or the “Parent company”). Pursuant to the agreement, Algomizer acquired 99.83% of Company’s share capital. |

| | | |

| | B. | Going Concern: |

| | | |

| | | The Company has incurred $ 578 in operating losses for the year ended December 31, 2018, and $ 396 in operating losses for the year ended December 31, 2017, had $ 721 in total shareholders' deficit as of December 31, 2018 and $ 395 in total shareholders' deficit as of December 31, 2017, had $ 30 in negative cash flows from operations for the year ended December 31, 2018 and $324 in negative cash flows from operations for the year ended December 31, 2017. Management expects the Company to continue to generate substantial operating losses and to continue to fund its operations primarily through utilization of its current financial resources and through additional raises of capital. |

| | | |

| | | Such conditions raise substantial doubts about the Company's ability to continue as a going concern. Management’s plan includes raising funds from outside potential investors. However, there is no assurance such funding will be available to the Company or that it will be obtained on terms favorable to the Company or will provide the Company with sufficient funds to meet its objectives. These financial statements do not include any adjustments relating to the recoverability and classification of assets, carrying amounts or the amount and classification of liabilities that may be required should the Company be unable to continue as a going concern. |

| | | |

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES |

| | | |

| | A. | Basis of Presentation: |

| | | |

| | | These consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). |

| | | |

| | B. | Use of estimates in the preparation of financial statements: |

| | | |

| | | The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Management believes that the estimates, judgments and assumptions used are reasonable based upon |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.) |

| | | |

| | B. | Use of estimates in the preparation of financial statements (Cont.): |

| | | |

| | | Information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. |

| | | |

| | C. | Functional currency and foreign currency translation: |

| | | |

| | | The functional currency of the Company and its subsidiaries is the U.S dollar ("USD" or "$") since the USD is the currency of the primary economic environment in which the Company has operated and expects to continue to operate in the foreseeable future. |

| | | |

| | | Transactions and balances denominated in USD are presented at their original amounts. Transactions and balances denominated in foreign currencies have been re-measured to USD in accordance with the provisions of ASC 830-10, "Foreign Currency Translation". |

| | | All transaction gains and losses from re-measurement of monetary balance sheet items denominated in non-USD currencies are reflected in the statement of comprehensive loss as financial income or expenses, as appropriate. |

| | | |

| | D. | Principles of consolidation: |

| | | |

| | | The financial statements include the accounts of the Company and its wholly-owned subsidiary. Intercompany balances and transactions have been eliminated in the consolidation. |

| | | |

| | E. | Cash and cash equivalents: |

| | | |

| | | Cash equivalents are short-term highly liquid investments that are readily convertible into cash with original maturities of three months or less, at the date acquired. |

| | | |

| | F. | Restricted Cash: |

| | | |

| | | Restricted cash is a non-interest-bearing savings account, which is used as security for the Company’s lease agreements. |

| | | |

| | G. | Property and equipment, net: |

| | | |

| | | Property and equipment are presented at cost less accumulated depreciation. Depreciation is calculated based on the straight-line method over the estimated useful lives of the related assets, as follows: |

| | | | % | |

| | | | | |

| Computers and peripheral equipment | | | 33 | |

| Office furniture and equipment | | | 7 - 15 | |

| | | In accordance with ASC 360, "Property, plant and equipment", management reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For the years ended December 31, 2018 and 2017 no impairment expenses were recorded. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.) |

| | | |

| | H. | Revenue recognition: |

| | | |

| | | The Company applies the provisions of Accounting Standards Codification (or "ASC") 606, Revenue from Contracts with Customers ("ASC 606"). The Company adopted the provisions of ASC 606 effective January 1, 2018 using the modified retrospective application method for all uncompleted contracts as of that date. The adoption of ASC 606 did not have a material impact on the Company’s consolidated financial statements. In addition, the adoption of ASC 606 had no impact on the Company's trade receivables, deferred revenues and accumulated deficit balances balance as of December 31, 2018 or on the Company's revenues, cost of revenues or its operating expenses during 2018, compared to ASC 605. |

| | | |

| | | The Company generates revenues primarily by granting customers the right to access software products through the Company's cloud-based SaaS subscription offerings. Under a SaaS subscription agreement, the customer receives a right to access the software for a specified period of time in an environment hosted, supported, and maintained by the Company. SaaS subscription services are a single performance obligation satisfied over time, and associated revenue is generally recognized ratably over the contract term once the software is made available to the customer. The SaaS subscription offerings are typically sold with one year subscription terms, generally invoiced in advance of each annual subscription period, and are non-cancelable during the committed subscription term. |

| | | |

| | I. | Research and development costs: |

| | | |

| | | Research and development costs are charged to operations as incurred. |

| | | |

| | J. | Stock-based compensation: |

| | | |

| | | The Company applies ASC 718, "Share-Based Payment," which requires the measurement and recognition of compensation expense for all share-based payment awards made to employees and directors including employee stock options under the Company's stock plans based on estimated fair values. |

| | | |

| | | ASC 718-10 requires companies to estimate the fair value of equity-based payment awards on the date of grant; which the Company determines using the Black-Scholes option-pricing model. The value of the portion of the award that is ultimately expected to vest is recognized as an expense over the service periods, based on the Company's estimate of equity instruments that will eventually vest. |

| | | |

| | K. | Concentrations of credit risk: |

| | | |

| | | Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents, bank deposits and trade receivables |

| | | |

| | | The majority of the Company’s cash and cash equivalents and bank deposits are invested in dollar-denominated instruments with major banks in Israel and the United States. Management believes that the financial institutions that hold the Company’s investments are corporations with high credit standing. Accordingly, management believes that low credit risk exists with respect to these financial investments. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.): |

| | | |

| | L. | Fair value of financial instruments: |

| | | |

| | | The financial instruments of the Company consist mainly of cash and cash equivalents, restricted cash, trade receivables, other accounts receivable, trade payables, convertible loan and other accounts payable. Due to their nature, the fair value of the financial instruments is usually identical or substantially similar to their carrying amounts. Hierarchical levels are directly related to the amount of subjectivity with the inputs to the valuation of these assets or liabilities as follows: |

| | | |

| | | Level 1—Observable inputs such as unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date; |

| | | |

| | | Level 2—Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable inputs for similar assets or liabilities. These include quoted prices for identical or similar assets or liabilities in active markets and quoted prices for identical or similar assets of liabilities in markets that are not active; |

| | | |

| | | Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

| | | |

| | M. | Income taxes: |

| | | |

| | | The Company accounts for income taxes in accordance with ASC 740, "Income Taxes", and ("ASC 740"). ASC 740 prescribes the use of the asset and liability method whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and for carry forward tax losses. Deferred taxes are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance, if necessary, to reduce deferred tax assets to their estimated realizable value if it is more-likely-than-not that some portion or all of the deferred tax asset will not be realized. |

| | | |

| | | In addition, ASC 740 prescribes a recognition threshold and measurement attribute for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The first step is to evaluate the tax position taken or expected to be taken in a tax return. This is done by determining if the weight of available evidence indicates that it is more-likely-than-not that, on an evaluation of the technical merits, the tax position will be sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.): |

| | |

| | N. | Basic and diluted net loss per share: |

| | | |

| | | Earnings or loss per share ("EPS") is the amount of earnings attributable to each share of common stock. For convenience, the term is used to refer to either earnings or loss per share. EPS is computed pursuant to ASC 260-10-45. Pursuant to ASC 260-10-45-10 through 260-10-45-16 Basic EPS is computed by dividing income available to ordinary stockholders (the numerator) by the weighted-average number of ordinary shares outstanding (the denominator) during the period. Income available to ordinary stockholders shall be computed by deducting both the dividends declared in the period on preferred stock (whether or not paid) from income from continuing operations (if that amount appears in the income statement) and also from net income. The computation of diluted EPS is similar to the computation of basic EPS except that the denominator is increased to include the number of additional ordinary shares that would have been outstanding if the dilutive potential ordinary shares had been issued during the period to reflect the potential dilution that could occur from ordinary shares issuable through contingent shares issuance arrangement, stock options or warrants. |

| | | |

| | O. | Convertible loans: |

| | | |

| | | Proceeds from the sale of debt securities with a conversion feature that include a beneficial conversion feature are allocated to equity based on the intrinsic value of such conversion feature in accordance with ASC 470-20 “Debt with Conversion and Other Options”, with a corresponding discount on the debt instrument recorded in liabilities which is amortized in finance expense over the term of the loan. The Company evaluated its convertible loan agreements and concluded that no beneficial conversion feature existed. Consequently, no financial expenses were recorded and the gross proceeds of the loans were recorded as a liability. During 2018, all the loans were converted into Preferred C-2 shares. |

| | | |

| | P. | Preferred Shares |

| | | |

| | | The Company applies the guidance enumerated in ASC 480, Distinguishing Liabilities from Equity (“ASC 480”), when determining the classification and measurement of preferred stock. Preferred shares subject to mandatory redemption (if any) are classified as liability instruments and are measured at fair value. The Company classifies conditionally redeemable preferred which includes preferred shares that feature redemption rights that are either within the control of the holder or subject to redemption upon the occurrence of uncertain events not solely within the Company’s control, as temporary equity. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.): |

| | | |

| | Q. | Recently issued accounting standards: |

| | | |

| | | In June 2016, the FASB issued a new standard, ASU 2016-13 – "Financial Instruments—Credit Losses", requiring measurement and recognition of expected credit losses on certain types of financial instruments. The standard also modifies the impairment model for available-for-sale debt securities and provides for a simplified accounting model for purchased financial assets with credit deterioration since their origination. This standard is effective for the Company after December 15, 2019. The standard does not have a material impact on the Company's financial statements. |

| | | |

| | | In February 2016, the FASB issued a new lease accounting standard, ASU 2016-02 - "Leases", requiring the recognition of lease assets and liabilities on the balance sheet. This standard is effective starting January 1, 2019. In 2018 and 2019, additional ASU’s were issued with respect to ASU 2016-02. The adoption of ASU 2016-02 and other related ASU’s is not expected to have a material impact on the Company's financial statements. |

| | | |

| | | In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09 “Revenue from Contracts with Customers,” and modified the standard thereafter. The objective of the ASU is to establish a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers that will supersede most current revenue recognition guidance. The basis of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. The Company adopted this standard as of January 1, 2018 using the modified retrospective method. See Note 2.H. to the consolidated financial statements for additional details. |

| | | |

| | | On January 5, 2016, the FASB issued ASU 2016-01, “Recognition and Measurement of Financial Assets and Financial Liabilities. The standard requiring changes to recognition and measurement of certain financial assets and liabilities. The standard primarily affects equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements for financial instruments. The Company prospectively adopted ASU 2016-01 in the first quarter of 2018 and the impact on its consolidated financial statements was not material. |

| | | |

| | | In November 2016, the FASB issued ASU 2016-18 “Restricted Cash” to provide guidance on the presentation of restricted cash in the statement of cash flows. Currently, the statement of cash flows explained the change in cash and cash equivalents for the period. The ASU requires that the statement of cash flows explain the change in cash, cash equivalents and restricted cash for the period. The Company retrospectively adopted this ASU in the first quarter of 2018. The ASU did not have a material effect on the statements of cash flows as the Company’s restricted cash is not material. |

| | | |

| | | In June 2018, the FASB issued ASU No. 2018-07 “Compensation – Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting.” These amendments expand the scope of Topic 718, Compensation – Stock Compensation (which currently only includes share-based payments to employees) to include share-based payments issued to nonemployees for goods or services. Consequently, the accounting for share-based payments to nonemployees and employees will be substantially aligned. The ASU supersedes Subtopic 505-50, Equity – Equity-Based Payments to Non-Employees. The Company plans to adopt this standard in the first quarter of 2019. ASU 2018-07 is not expected to have an impact on Company’s consolidated financial statements. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 2: | SIGNIFICANT ACCOUNTING POLICIES (Cont.): |

| | | |

| | Q. | Recently issued accounting standards (Cont.): |

| | | |

| | | In August 2018, the FASB issued ASU 2018-13, “Changes to Disclosure Requirements for Fair Value Measurements,” which will improve the effectiveness of disclosure requirements for recurring and nonrecurring fair value measurements. The standard removes, modifies, and adds certain disclosure requirements and is effective for the Company beginning on January 1, 2020. The Company does not expect that this standard will have a material effect on the Company’s consolidated financial statements. |

| NOTE 3: | OTHER ACCOUNTS RECEIVABLE |

| | |

| | Composition: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Government authorities | | $ | 78 | | | $ | 15 | |

| | | $ | 78 | | | $ | 15 | |

| NOTE 4: | PROPERTY AND EQUIPMENT |

| | |

| | Composition: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| Cost: | | | | | | |

| Computers and related equipment | | $ | 34 | | | $ | 33 | |

| Office furniture and equipment | | | 9 | | | | 9 | |

| | | | | | | | | |

| | | | 43 | | | | 42 | |

| Accumulated depreciation | | | 38 | | | | 35 | |

| | | | | | | | | |

| Net book value | | $ | 5 | | | $ | 7 | |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 5: | OTHER ACCOUNTS PAYABLE |

| | |

| | Composition: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Employees and payroll accruals | | $ | - | | | $ | 74 | |

| Other accounts payable and deferred revenues | | | 25 | | | | 68 | |

| | | $ | 25 | | | $ | 142 | |

| | A. | On December 31, 2016, the Company entered into a loan agreement with several lenders for proceeds of $175. The principal does not bear interest and is due one year after the date of funding. The principal amount could be converted into 211,583 Preferred C-2 shares of the Company at conversion rate of $0.8271 per share (See Note 6C). |

| | | |

| | B. | On February 15, 2017, the Company entered into a loan agreement with several lenders for proceeds of $75. The principal does not bear interest and is due on December 31, 2017. The principal amount could be converted into 90,678 Preferred C-2 shares of the Company at conversion rate of $0.8271 per share (See Note 6C). |

| | | |

| | | The Company considered ASC 815-15 and ASC 470-20 and concluded its convertible loans do not include an embedded derivative that will require bifurcation and measurement as a derivative instrument. |

| | | |

| | C. | On December 31, 2017, the due date for all principals was extended to December 11, 2018. On October 31, 2018, as part of the agreement with Algomizer the lenders converted the convertible loans into 302,261 Preferred C-2 shares. |

| NOTE 7: | COMMITMENTS AND CONTINGENCIES |

| | |

| | During August 2019, a motion was filed against the Company and, the parent company. Algomizer claiming that the applicants were entitled to receive shares of the Company as part of the consideration in the Company's acquisition by Algomizer. In the opinion of the Company's management, the applicants' claims are based on incorrect assumptions and deals with the distribution of the internal shares between the applicants and the other former shareholders of the Company before the acquisition transaction, resulting in a consideration coming to the applicants following the acquisition transaction. Therefore, to the understanding of the Company and its legal advisers, the claim may not create financial exposure to the Company. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 8: | TEMPORARY EQUITY AND SHAREHOLDERS' DEFICIT |

| | | |

| | A. | Composition: |

| | | As of December 31, 2018 | | | As of December 31, 2017 | |

| | | Authorized | | | Issued and outstanding | | | Authorized | | | Issued and outstanding | |

| | | Number of shares | |

| | | | | | | | | | | | | |

| Permanent Equity | | | | | | | | | | | | | | | | |

| Ordinary shares | | | 23,872,000 | | | | 210,323 | | | | 23,872,000 | | | | 210,323 | |

| | | | | | | | | | | | | | | | | |

| Temporary Equity | | | | | | | | | | | | | | | | |

| Preferred A-1 shares | | | 154,000 | | | | 153,955 | | | | 154,000 | | | | 153,955 | |

| Preferred A-2 shares | | | 3,760,300 | | | | 3,760,217 | | | | 3,760,300 | | | | 3,760,217 | |

| Preferred B shares | | | 3,509,500 | | | | 3,509,446 | | | | 3,509,500 | | | | 3,509,446 | |

| Preferred C shares | | | 9,352,000 | | | | 5,563,162 | | | | 9,352,000 | | | | 5,563,162 | |

| Preferred C-1 shares | | | 2,123,000 | | | | 2,122,652 | | | | 2,123,000 | | | | 2,122,652 | |

| Preferred C-2 shares | | | 350,000 | | | | 302,261 | | | | 350,000 | | | | - | |

| | | | 19,248,800 | | | | 15,411,693 | | | | 19,248,800 | | | | 15,109,432 | |

| | B. | Voting rights: |

| | | |

| | | Ordinary shares confer the right to participate in the general meetings, to one vote per share for any purpose, to an equal part, on share basis, in distribution of dividends and to equally participate, on share basis, in distribution of excess of assets and funds from the Company and they shall not confer other privileges unless stated hereunder or in the Companies Law otherwise. |

| | | |

| | | Some investors have standard anti-dilutive rights, registration rights, and information and representation rights. |

| | | |

| | | A preferred shareholder shall have one vote for each ordinary share that would have been received if preference shares had been converted into ordinary shares. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 8: | TEMPORARY EQUITY AND SHAREHOLDERS' DEFICIT (Cont.) |

| | | |

| | C. | Preferred shares: |

| | | | |

| | | Preferred shares may be converted into ordinary shares at any time. The preferred shares shall be automatically converted into ordinary shares if (a) the holders of at least (i) 67% (sixty seven percent) of the issued and outstanding Preferred C/C-1 shares, (ii) a majority of the issued and outstanding Preferred B shares, and (iii) a majority of the issued and outstanding Preferred A shares, so agree in writing; or (b) in the event of an IPO. |

| | | | |

| | | The conversion price for any class or series of preferred share shall be subject to adjustment, as follows: at any time, upon each issuance or deemed issuance by the Company of any new securities at a price per share less than the applicable conversion price in effect on the date of and immediately prior to the issuance of such new securities, the conversion price shall be reduced. |

| | | | |

| | | Preferred shares have priority in the distribution of dividends and upon liquidation in accordance with the Company's Articles of Association ("AOA"). These rights may be changed if a meeting of the Company's shareholders gather up and decides on a change of regulations in this context. The preference mechanism for liquidation and the distribution of dividends gives priority to the most recent preferred shareholders. |

| | | | |

| | | The preferred shares are convertible into 16,199,520 ordinary shares of the Company. For further information on preferred shares, see section D of this note. |

| | | | |

| | | Redemption |

| | | | |

| | | The Company’s AOA do not provide redemption rights to the holders of the preferred shares. In the event of liquidation, all the funds and assets of the Company available for distribution among all the shareholders shall be distributed based on a certain mechanism as described in the Company's AOA. Although the preferred shares are not redeemable, in the event of certain “deemed liquidation events” that are not solely within the Company’s control (including merger, acquisition, or sale of all or substantially all of the Company’s assets), the holders of the preferred shares would be entitled to preference amounts paid before distribution to other shareholders (as explained in the previous paragraph) and hence effectively redeeming the preference amount. In accordance with ASR 268 and ASC 480 "Distinguishing Liabilities from Equity", the Company's preferred shares are classified outside of shareholders’ deficit as a result of these in-substance contingent redemption rights. As of December 31, 2018 and 2017, the Company did not adjust the carrying values of the convertible preferred shares to the deemed liquidation values of such shares since a liquidation event was not probable of occurring. |

| | | | |

| | D. | Issuance of shares: |

| | | | |

| | | (1) | During 2016, the Company raised $ 578 (gross) through a private placement of its Preferred C-1 shares. The Company issued a total of 708,122 Preferred C-1 shares, (approximately $0.8271 per Preferred C-1 share). |

| | | | |

| | | (2) | During 2017, all the issued warrants to purchase Preferred C shares (which were issued in 2015) were forfeited. In accordance with ASC 480-10 Distinguishing Liabilities from Equity and ASC 815-40 the Company re-measured its warrants at each reporting date. The Company used inputs that are unobservable using the best information available which included the entity's own data, and taking into account all information that is reasonably available. No material effect was recorded for the year ended December 31, 2017. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 8: | TEMPORARY EQUITY AND SHAREHOLDERS' DEFICIT (Cont.) |

| | | | |

| | D. | Issuance of shares (Cont.): |

| | | | |

| | | (3) | On October 31, 2018, convertible loans taken in 2017 and 2016 (See note 6) were converted into 302,261 Preferred C-2 shares. |

| | | | |

| | | | During 2018, Preferred C-2 shares were converted into 302,261 ordinary shares. Preferred C-2 shares do not accumulate rights from previous dividends but are entitled to participate in a dividend distributed from the profits of the current year up to three (3) times from the original raising price ($ 250) of Preferred C-2 shares ($ 750). The Preferred C-2 shares have priority in the distribution of a dividend over all other classes of preferred shares. |

| | | | |

| | E. | Share-based compensation: |

| | | | |

| | | As part of the transaction at October 31, 2018 for the sale of the Company's shares to Algomizer and in accordance with the Ruling Agreement with the Tax Authorities, the Company's employees waived all the options granted to them as part of the Company's option grant plan, in return for the issuance of shares in Algomizer. In accordance with ASC 718, the Company accounted for such replacement as a modification for accounting purposes with no material effect since the issuance of shares was carried out according to the exchange ratio agreed between the parties. |

| | | | |

| | | A summary of the Company’s stock option activity and related information is as follows: |

| | | Number of options | | | Weighted average exercise price | | | Aggregate intrinsic value | |

| | | | | | | | | | |

| Outstanding at January 1, 2017 | | | 2,488,458 | | | | 0.11 | | | | 281,317 | |

| | | | | | | | | | | | | |

| Granted | | | - | | | | - | | | | - | |

| Exercised | | | - | | | | - | | | | - | |

| Forfeited | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Outstanding as of December 31, 2017 | | | 2,488,458 | | | | 0.11 | | | | 281,317 | |

| | | | | | | | | | | | | |

| Exercisable as of December 31, 2017 | | | 2,488,458 | | | | 0.11 | | | | 281,317 | |

| | | Number of options | | | Weighted average exercise price | | | Aggregate intrinsic value | |

| | | | | | | | | | |

| Outstanding at January 1, 2018 | | | 2,488,458 | | | | 0.11 | | | | 281,317 | |

| | | | | | | | | | | | | |

| Granted | | | - | | | | - | | | | - | |

| Exercised | | | - | | | | - | | | | - | |

| Forfeited | | | 2,488,458 | | | | 0.11 | | | | 281,317 | |

| | | | | | | | | | | | | |

| Outstanding as of December 31, 2018 | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Exercisable as of December 31, 2018 | | | - | | | | - | | | | - | |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 9: | REVENUES |

| | |

| | Composition: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Individual Subscriptions | | $ | 18 | | | $ | 38 | |

| Enterprise Subscriptions | | | 234 | | | | 279 | |

| | | $ | 252 | | | $ | 317 | |

| NOTE 10: | RESEARCH AND DEVELOPMENT EXPENSES |

| | |

| | Composition: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Salaries and related expense | | $ | 253 | | | $ | 275 | |

| Others | | | 5 | | | | 53 | |

| | | $ | 258 | | | $ | 328 | |

| NOTE 11: | SELLING AND MARKETING EXPENSES |

| | |

| | Composition: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Salaries and related expense | | $ | 340 | | | $ | 194 | |

| Others | | | 33 | | | | 1 | |

| | | $ | 373 | | | $ | 195 | |

| NOTE 12: | GENERAL AND ADMINISTRATIVE EXPENSES |

| | |

| | Composition: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Salaries and related expense | | $ | 30 | | | $ | 46 | |

| Depreciation | | | 2 | | | | 4 | |

| Professional services | | | 30 | | | | 24 | |

| Others | | | 62 | | | | 16 | |

| | | $ | 124 | | | $ | 90 | |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 13: | FINANCIAL EXPENSES (INCOME), NET |

| | |

| | Composition: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Bank fees | | $ | 4 | | | $ | 3 | |

| Exchange rate differences | | | (22 | ) | | | 4 | |

| | | $ | (18 | ) | | $ | 7 | |

| NOTE 14: | TAXES ON INCOME |

| | | |

| | A. | Tax rates applicable to the income of the Company: |

| | | |

| | | Viewbix Ltd. is taxed according to Israeli tax laws. |

| | | The Israeli corporate tax rate was 24% in 2017 and 23% in 2018 and onwards. Such corporate tax rate changes have no significant impact on the Company's financial statements. |

| | | |

| | | Viewbix Inc. is taxed according to U.S. tax laws. On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (the “Act”), which among other provisions, reduced the U.S. corporate tax rate from 35% to 21%, effective January 1, 2018. |

| | | |

| | | The Company evaluated the impact the Act on its financial statements and believe the Act will have a beneficial positive net impact. The Act did not have an effect on the financial condition and results of operations of the Company. |

| | | |

| | B. | Deferred income taxes: |

| | | |

| | | Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Company's deferred tax assets are as follows: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Deferred R&D expenses | | $ | 329 | | | $ | 446 | |

| Operating loss carryforward | | | 10,567 | | | | 10,878 | |

| | | | 10,896 | | | | 11,324 | |

| | | | | | | | | |

| Net deferred tax asset before valuation allowance | | | 2,506 | | | | 2,605 | |

| Valuation allowance | | | (2,506 | ) | | | (2,605 | ) |

| Net deferred tax asset | | $ | - | | | $ | - | |

| | | As of December 31, 2018, the Company has provided valuation allowances of $ 2,506 in respect of deferred tax assets resulting from tax loss carryforward and other temporary differences. Management currently believes that because the Company has a history of losses, it is more likely than not that the deferred tax regarding the loss carryforward and other temporary differences will not be realized in the foreseeable future. |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 14: | TAXES ON INCOME (Cont.): |

| | | |

| | C. | Available carryforward tax losses: |

| | | |

| | | As of December 31, 2018, the Company has an accumulated tax loss carryforward of approximately $ 10,567. Carryforward tax losses in Israel are of unlimited duration and carryforward tax losses in the U.S. generally can be carried forward and offset against taxable income in the future indefinitely. Utilization of U.S. net operating tax losses may be subject to substantial annual limitations due to the "change in ownership" provisions of the Internal Revenue Code of 1986 and similar state provisions. The annual limitation may result in the expiration of net operating tax losses before utilization. |

| | | |

| | D. | Loss (income) from continuing operations, before taxes on income, consists of the following: |

| | | Year ended | |

| | | December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| USA | | $ | (5 | ) | | $ | (11 | ) |

| Israel | | | 565 | | | | 458 | |

| | | $ | 560 | | | $ | 447 | |

| NOTE 15: | LOSS PER SHARE-BASIC AND DILUTED |

| | |

| | Composition: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | |

| Basic and diluted: | | | | | | | | |

| | | | | | | | | |

| Net loss attributable to ordinary stockholders | | $ | 575 | | | $ | 406 | |

| | | | | | | | | |

| Weighted-average ordinary shares | | | 210,323 | | | | 210,323 | |

| | | | | | | | | |

| Loss per share-basic and diluted | | $ | 2.73 | | | $ | 1.93 | |

| NOTE 16: | TRANSACTION AND BALANCES WITH PARENT COMPANY |

| | |

| | Balances: |

| | | As of December 31, | |

| | | 2018 | | | 2017 | |

| | | | | | | | | |

| Payable to parent company | | | 789 | | | | - | |

VIEWBIX LTD. AND ITS SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

| NOTE 16: | TRANSACTION AND BALANCES WITH PARENT COMPANY (Cont.): |

| | |

| | As part of the agreement with Algomizer, the parties agreed to have the Company's operations outsourced to Algomizer from the agreement date and until the acquisition is consummated. The following term were included in the agreement pursuant to the above: |

| | | |

| | (a) | From May, 2018 all of the Company's employees will become employees of Algomizer. |

| | | |

| | (b) | Between the periods of May 2018 to October 2018, Algomizer will pay the full expenses of the employees (see A above) as well as other related expenses. |

| | | |

| | (c) | From the Closing Date, the employees transferred from the Company to Algomizer will dedicate half of their time to the Company's operations and correspondingly 50% of the costs to be incurred by Algomizer in respect of these employees are to be charged to the Company. |

| | | |

| | No amounts were paid by the Company to Algomizer during 2018 in respect of the above, which resulted in a parent company payable of $789 as of December 31, 2018. |

| | | |

| NOTE 17: | SUBSEQUENT EVENTS |

| | | |

| | On February 7, 2019, Algomizer signed a share swap agreement with Virtual Crypto Technologies Inc. ("VCT"), a company whose common stock are traded on the OTC Exchange. In return for the transfer of all the shares of the Company to VCT, VCT shares and options will be allotted to Algomizer as follows: (a) share representing 65% of VCT's issued capital fully diluted after completion of the transaction to be allocated to Algomizer on the closing date of the transaction; (b) options to purchase VCT shares constituting 10% of VCT's issued capital, The options will be allocated to Algomizer after and subject VCT reach a market value of US $ 15 million. (c) additional options for the purchase of VCT shares constituting 10% of the issued capital of VCT the options will be allocated to Algomizer after and subject to VCT reach to a market value of US $ 25 million. (d) share representing 5% of the issued capital of VCT on a fully diluted basis after completion of the transaction to be allocated to Algomizer subject to completion of a business milestone related to the operations of the Company in the field of video. The transaction is subject to fulfillment of the preconditions stipulated in the agreement. On July 25, 2019, such terms that were fulfilled and the stock exchange transaction was executed. Consequently Algomizer will hold 65% of the issued and outstanding share capital of VCT and 72.8% of the share capital of VCT on a fully diluted basis. |

| | | |

| | The Company evaluated subsequent events through December 31, 2018, to the date on which the accompanying financial statements were issued. The Company concluded that no other subsequent events have occurred that would require recognition or disclosure in the accompanying consolidated financial statements. |