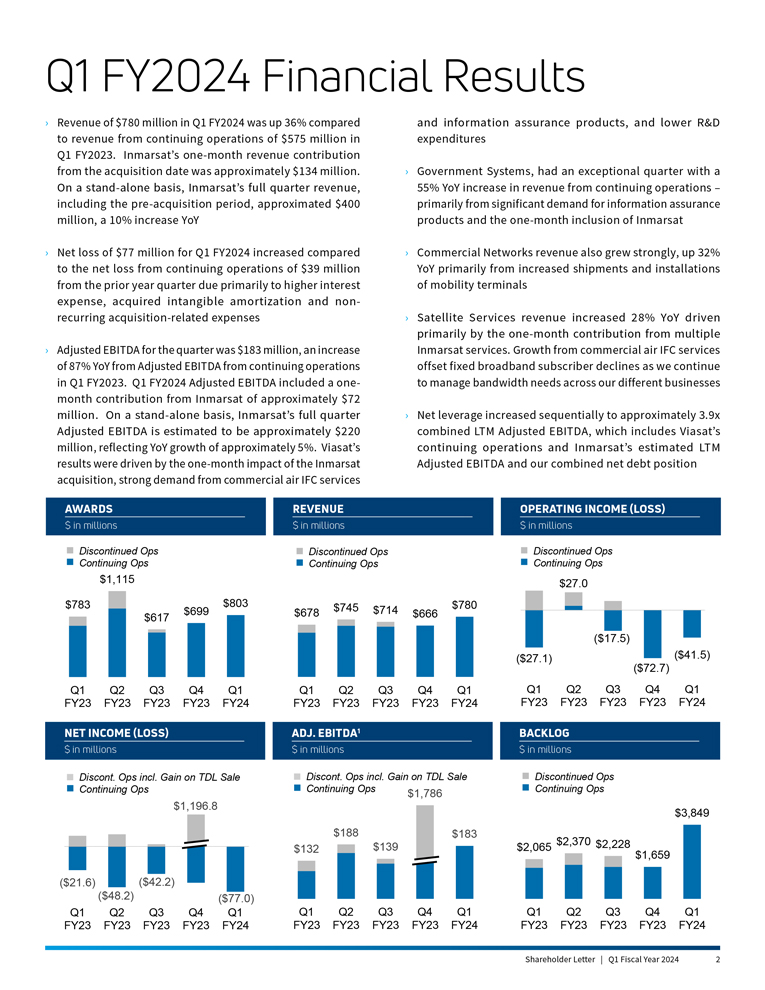

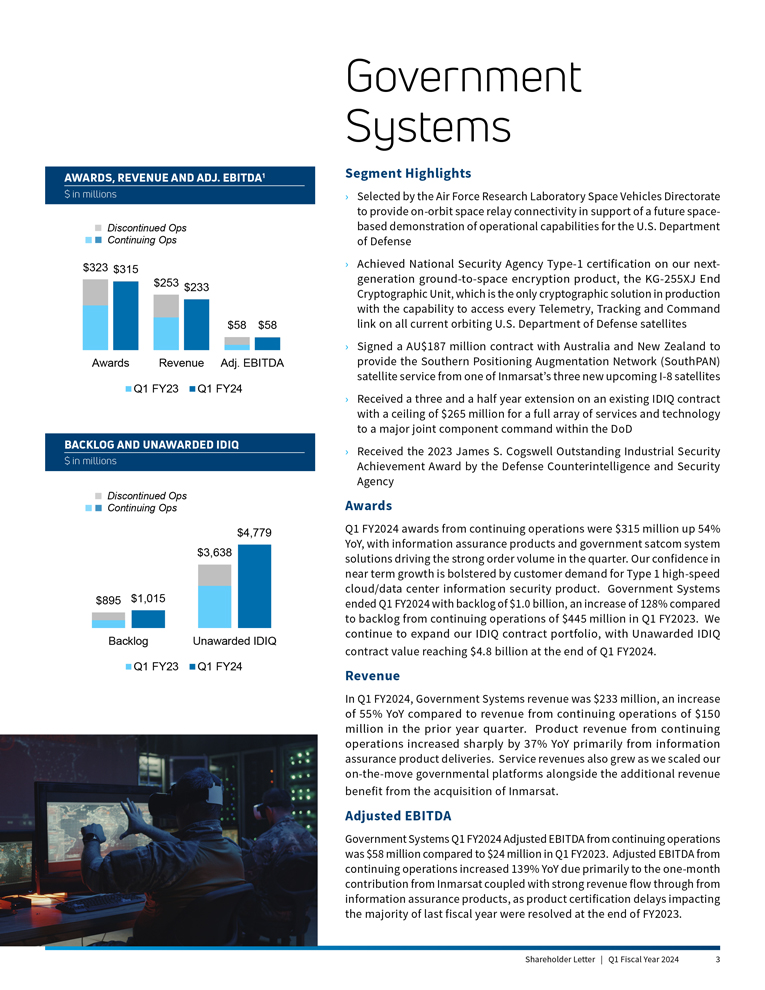

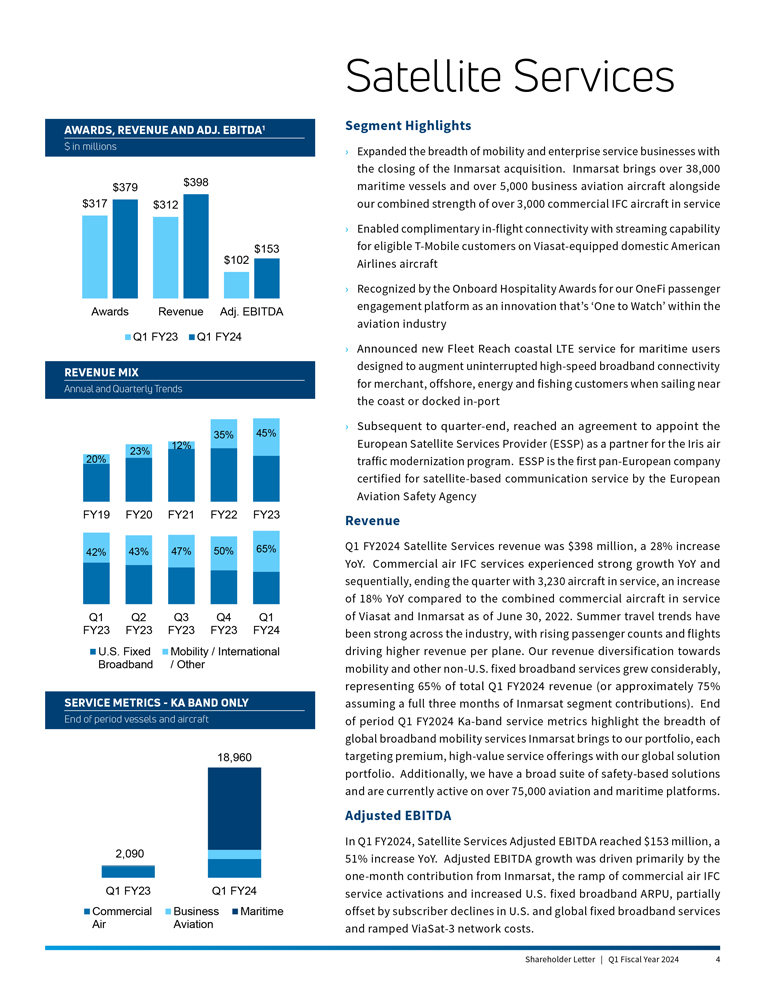

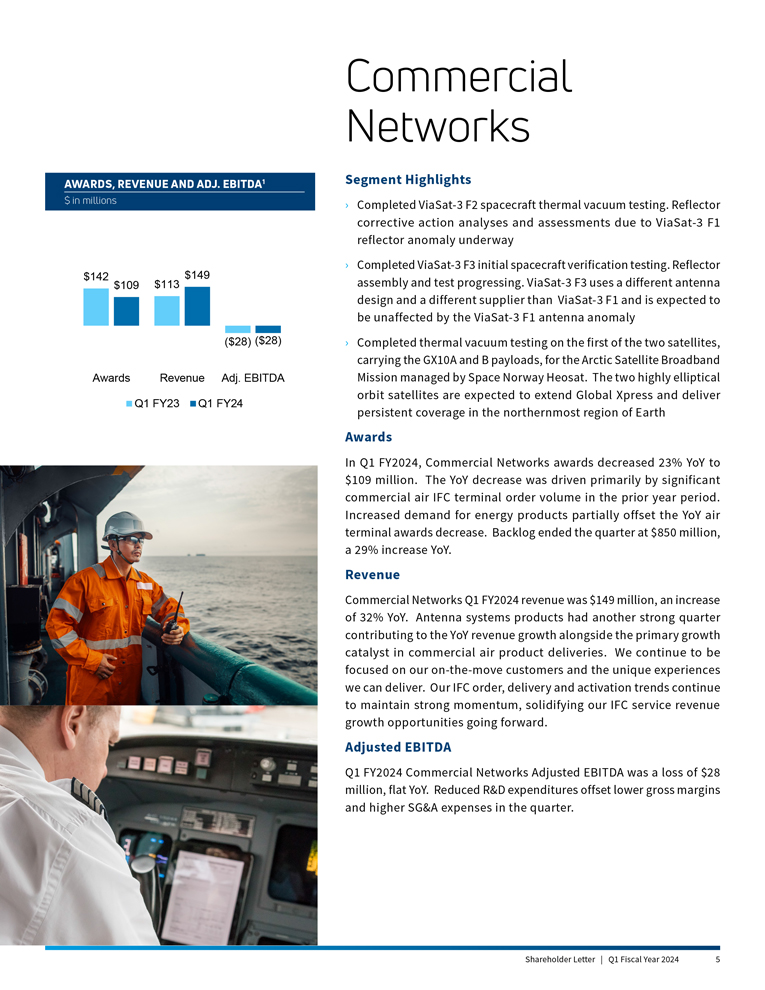

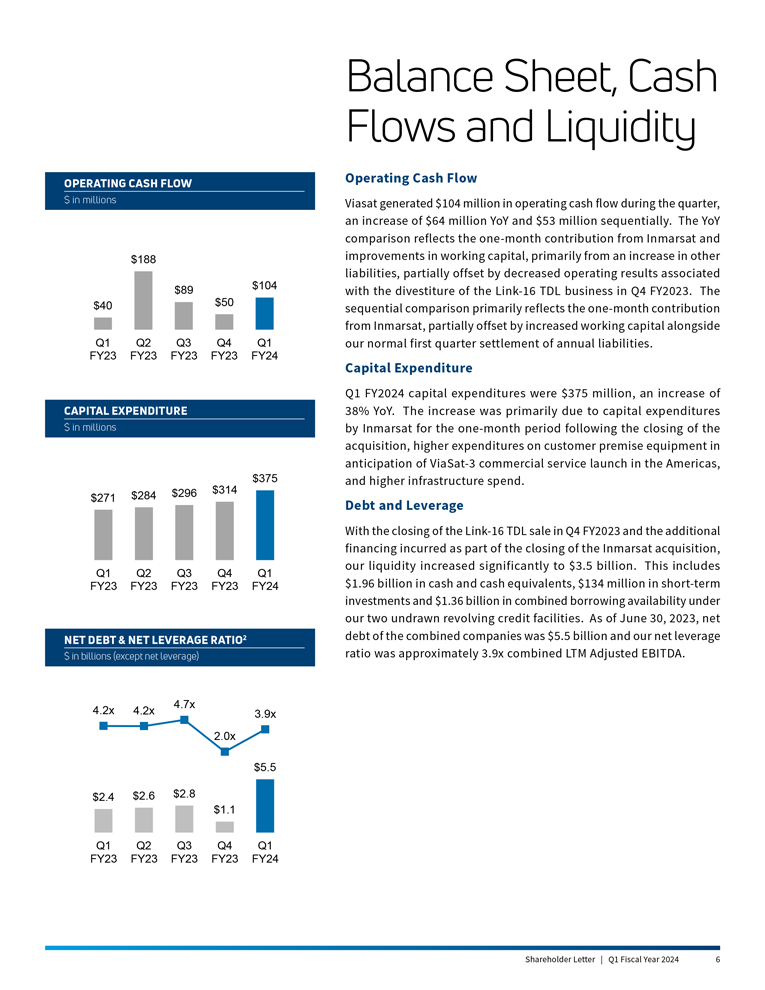

Fellow Shareholders, During our fiscal first quarter of 2024 (Q1 FY2024), we closed on the acquisition of Inmarsat and reported strong financial results that show the underlying strength of the combined companies. Recently, we experienced an anomaly with ViaSat-3 Americas (ViaSat-3 F1) during deployment of one of its antennas. With the added scale, business diversity, network resources and synergy opportunities that Inmarsat brings, we remain confident in our ability to grow. For Q1 FY2024 we earned revenue of $780 million, a 36% year-over-year (YoY) increase compared to revenue from continuing operations of $575 million in the prior year quarter. Net loss of $77 million for the quarter was driven by higher interest expense, acquired intangible amortization and non-recurring acquisition-related expenses. Adjusted EBITDA in Q1 FY2024 reached $183 million, an increase of 87% compared to Adjusted EBITDA from continuing operations in Q1 FY2023. These results include one month of contribution from Inmarsat during the quarter – including $134 million of revenue and $72 million of Adjusted EBITDA – for the period following the May 30, 2023 closing date. Inmarsat’s stand-alone performance for the full quarter ended June 30, 2023, was strong, with top line revenue growth of 10% YoY to approximately $400 million for the quarter ended June 30, 2023 and estimated Adjusted EBITDA for the quarter of approximately $220 million, an estimated increase of 5% YoY. We also are off to a strong start to the fiscal year on new contract wins, with consolidated awards of $803 million in Q1 FY2024, up 21% YoY from continuing operations, driven by the addition of Inmarsat and awards for information assurance products. Viasat’s consolidated segment level financial results described in this letter include one month of Inmarsat’s financial results, benefiting Satellite Services and Government Systems most notably. Substantially all of Inmarsat’s former aviation, maritime and enterprise business units are included in Satellite Services, while their former government business unit is included in Government Systems. Inmarsat’s revenue mix for the 12-month period ended March 31, 2023, was derived approximately 36% from government, 34% from maritime, 22% from aviation and 8% from enterprise and other. The addition of Inmarsat accelerates our global mobility and government strategy, brings Ka- and L-band coverage and network redundancy and expands our global distribution capabilities. The combination substantially enhances Viasat’s position as a leading technology and services provider across attractive markets, including in-flight connectivity (IFC), government, business aviation and maritime, plus provides incremental asset and revenue scale, business and end market diversity - alongside operating expense, capital expenditure and revenue synergy opportunities. Our synergy target, as described when we first announced the Inmarsat acquisition, was $1.5 billion of operating and capital expenditure synergies on an after-tax net present value basis, which included $80 million of annual run-rate cost synergies, with revenue synergies being an upside to that target, particularly in government and IFC. As of today, we have confidence we can achieve these original synergy targets and are working to exceed them. We are also stronger from a balance sheet perspective compared to the outlook when we announced the Inmarsat acquisition. We anticipated that the combined company would have a pro forma net leverage ratio of approximately 5.0x Adjusted EBITDA as of December 31, 2022. We substantially strengthened our balance sheet via the sale of the Link-16 Tactical Data Links (TDL) business, which closed in Q4 FY2023, and was expected to result in a net leverage ratio improvement of approximately 0.7 turn, to about 4.3x Adjusted EBITDA. As described in the section on Balance Sheet, Cash Flows, and Liquidity below we are now reporting a further improvement in net leverage, to 3.9x estimated combined LTM Adjusted EBITDA as of Q1 FY2024, just after closing of the Inmarsat acquisition. We have also secured substantial additional liquidity from the acquisition and associated financing transactions and are in a strong financial position to continue to grow the business. The ViaSat-3 F1 antenna anomaly creates unanticipated challenges that we are already addressing. The affected antenna was from a commercial product line of a leading space supplier with a decades long track record of successful space deployment. Antennas from that product line are deployed on numerous prior missions, including on several Inmarsat satellites. We understand the risks involved in space systems, and have insurance. Among the benefits of the Inmarsat acquisition is access to an existing, and forthcoming global Ka-band satellite fleet that can be a key factor in enabling sustained growth, while achieving our very high level of global mobility performance for our customers, despite the ViaSat-3 F1 antenna anomaly. In addition, we had also executed bandwidth supply contracts with other Ka-band broadband operators/partners as a precaution in the event of delays or other possible complications with ViaSat-3 F1. We are currently working closely with our antenna supplier to assess the status of the antenna. Our near-term objectives, working with the antenna manufacturer and our satellite supplier, are to perform a root cause analysis and determine corrective actions for the antenna on ViaSat-3 F2. We have also begun analyzing and assessing the performance of ViaSat-3 F1 with the affected antenna. To date, all other activated subsystems, including the innovative space payload technology and ground infrastructure designed and built by Viasat, are performing as expected, or better, in end-to-end measurements. Importantly, the ViaSat-3 F1 anomaly does not impact any of our existing customers or users. Each of the ViaSat-3 satellites is capable of performing in any of the three orbital slots for the covered regions (Americas, EMEA, and Asia Pacific), enabling options in deployment sequence. On a combined basis we have 13 Ka-band satellites in space with another eight under construction (including ViaSat-3 F2 and F3). Five of those eight are expected to launch by the end of calendar 2025. We also expect to gain additional bandwidth from the existing in-orbit fleet via ground network optimizations. We believe these augmentations will allow us to provide the high-quality experience our mobility customers have come to expect and allow us to support our near- and intermediate-term growth objectives in mobility. Post-Inmarsat acquisition, the U.S. residential business represents approximately 13% of our current revenue. We anticipate that percentage will decline and are factoring that into our overall consolidated growth outlook. Service quality for the remaining 87% of our current revenue is not anticipated to be materially affected by the antenna anomaly. We will describe our current assessment of the FY2024 and preliminary FY2025 business outlooks in the outlook portion of this letter. Importantly, we continue to anticipate growth in revenue and Adjusted EBITDA over these next two fiscal years, driven by substantial backlog and strong recent awards, with additional exciting opportunities ahead. Shareholder Letter | Q1 Fiscal Year 2024 1