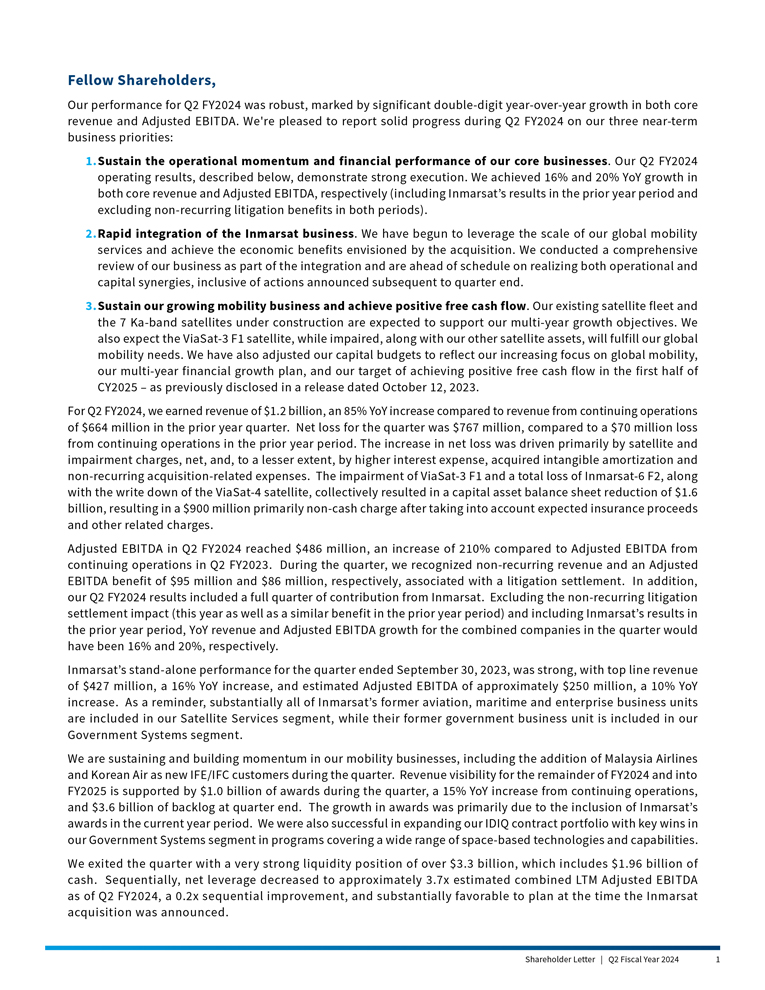

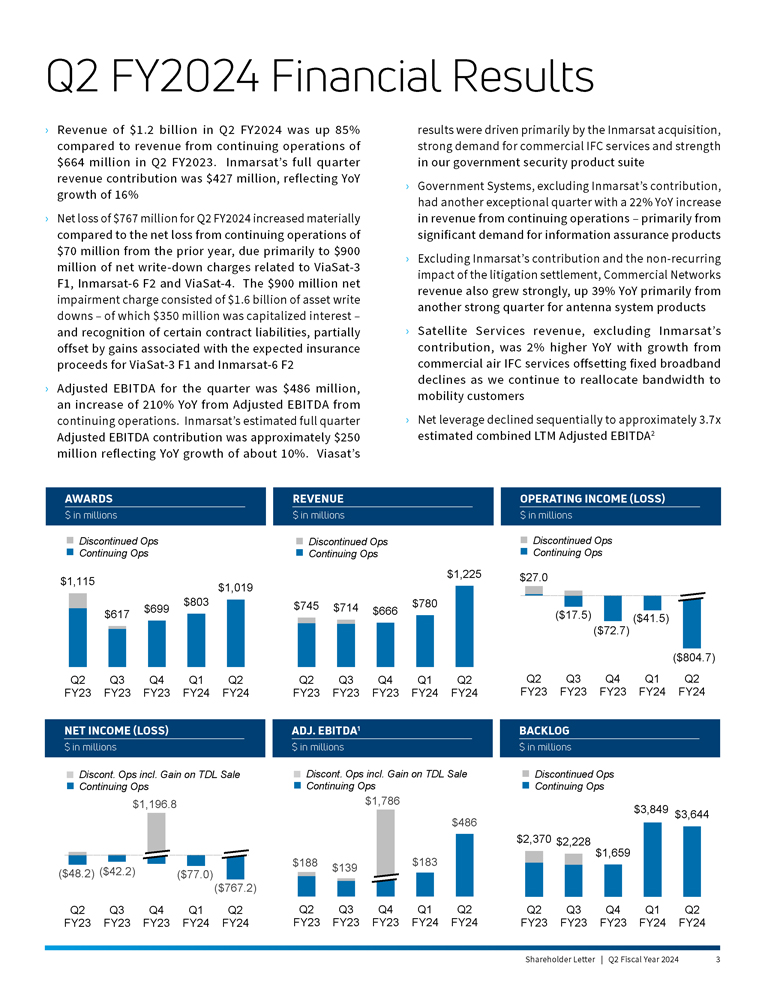

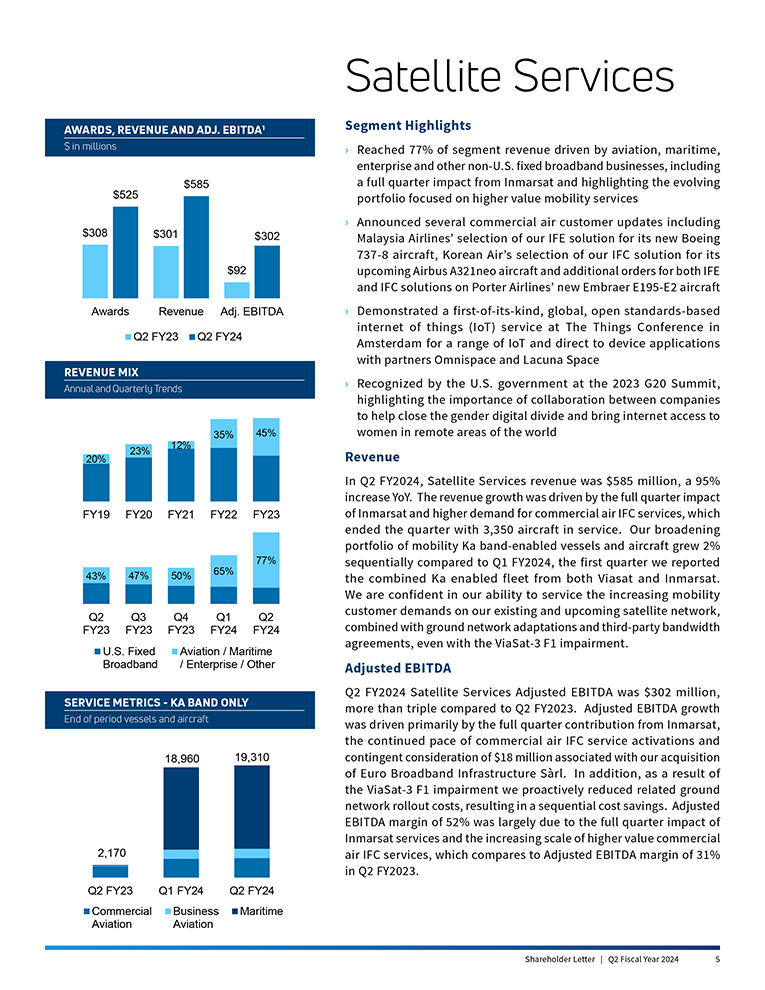

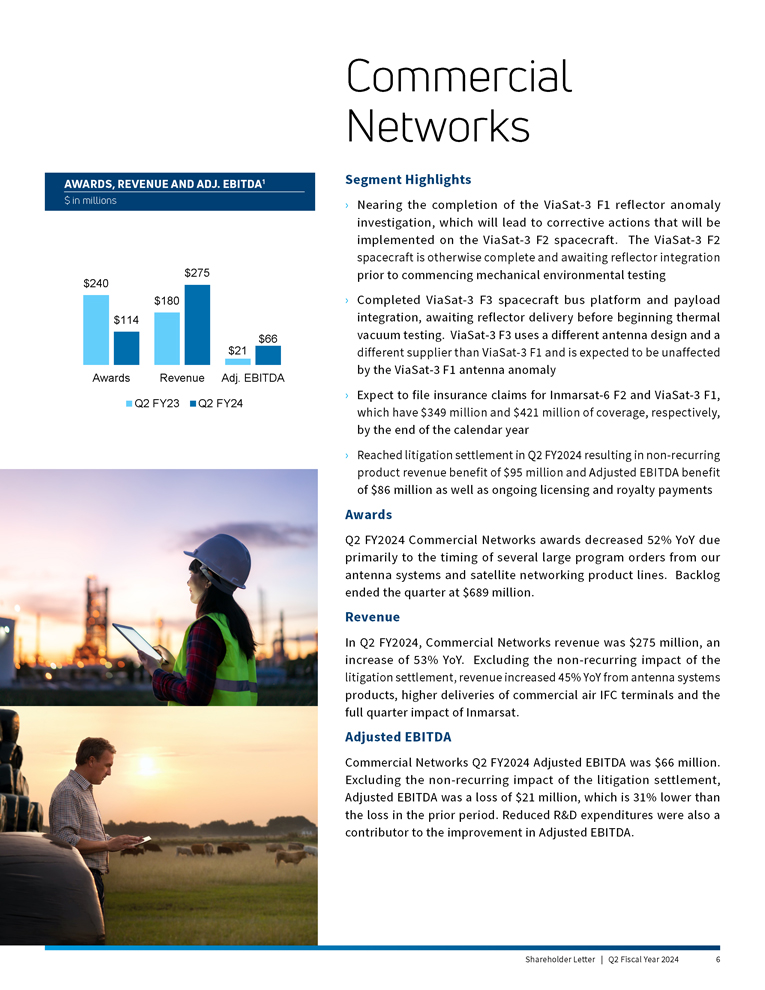

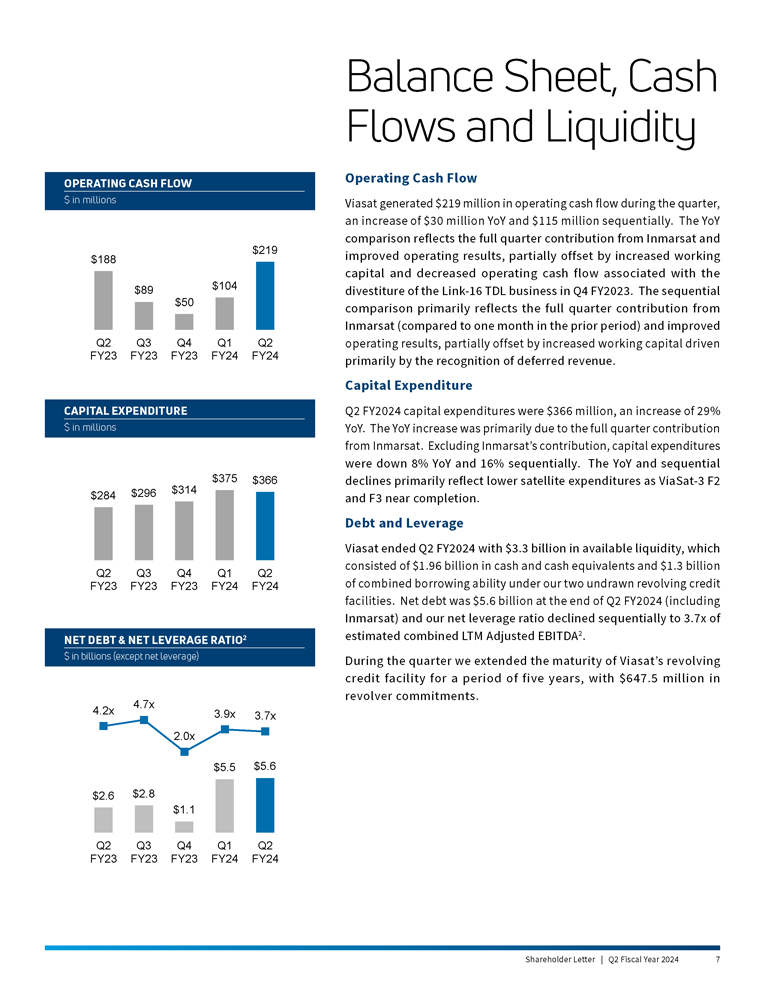

Fellow Shareholders, Our performance for Q2 FY2024 was robust, marked by significant double-digit year-over-year growth in both core revenue and Adjusted EBITDA. We’re pleased to report solid progress on our three near-term business priorities during Q2 FY2024: 1.Sustain the operational momentum and financial performance of our core businesses. Our Q2 FY2024 operating results, described below, demonstrate strong execution. We achieved 16% and 20% YoY growth in both core revenue and Adjusted EBTIDA, respectively, (including Inmarsat’s results in the prior year period and excluding non-recurring litigation benefits in both periods). 2.Rapid integration of the Inmarsat business. We have begun to leverage the scale of our global mobility services and achieve the economic benefits envisioned by the acquisition. We conducted a comprehensive review of our business as part of the integration and are ahead of schedule on realizing both operational and capital synergies, inclusive of actions announced subsequent to quarter end. 3.Sustain our growing mobility business and achieve positive free cash flow. Our existing satellite fleet and the 7 Ka-band satellites under construction are expected to support our multiyear growth objectives. We also expect the ViaSat-3 F1 satellite, while impaired, will fulfill its global mobility mission. We have also adjusted our capital budgets to reflect our increasing focus on global mobility, our multi-year financial growth plan, and our target of achieving positive free cash flow in the first half of CY2025 – as previously disclosed in a release dated October 12, 2023. Our growth outlook is described in the Outlook section – reiterating and further supporting our prior guidance. For Q2 FY2024, we earned revenue of $1.2 billion, an 85% YoY increase compared to revenue from continuing operations of $664 million in the prior year quarter. Net loss for the quarter was $767 million, compared to a $70 million loss from continuing operations in the prior year period. The increase in net loss was driven primarily by satellite and impairment charges, net, and, to a lesser extent, by higher interest expense, acquired intangible amortization and non-recurring acquisition-related expenses. The impairment of ViaSat-3 F1 and a total loss of Inmarsat-6 F2, along with work stoppage and write down of the ViaSat-4 program, collectively resulted in a capital asset balance sheet reduction of $1.6 billion, resulting in a $900 million primarily non-cash charge after taking into account expected insurance proceeds and other related charges. Adjusted EBITDA in Q2 FY2024 reached $486 million, an increase of 210% compared to Adjusted EBITDA from continuing operations in Q2 FY2023. During the quarter, we recognized non-recurring revenue and an Adjusted EBITDA benefit of $95 million and $86 million, respectively, associated with a litigation settlement. In addition, our Q2 FY2024 results included a full quarter of contribution from Inmarsat. Excluding the non-recurring litigation settlement impact (this year as well as a similar benefit in the prior year period) and including Inmarsat’s results in the prior year period, YoY revenue and Adjusted EBITDA growth for the combined companies in the quarter would have been 16% and 20%, respectively. Inmarsat’s stand-alone performance for the quarter ended September 30, 2023, was strong, with top line revenue of $427 million, a 16% YoY increase, and estimated Adjusted EBITDA of approximately $250 million, a 10% YoY increase. As a reminder, substantially all of Inmarsat’s former aviation, maritime and enterprise business units are included in our Satellite Services segment, while their former government business unit is included in Government Systems. We are sustaining and building momentum in our mobility businesses, including the addition of Malaysia Airlines and Korean Air as new IFE/IFC customers during the quarter. Revenue visibility for the remainder of FY2024 and into FY2025 is supported by $1.0 billion of awards during the quarter, a 15% YoY increase from continuing operations, and $3.6 billion of backlog at quarter end. The growth in awards was primarily due to the inclusion of Inmarsat’s awards in the current year period. We were also successful in expanding our IDIQ contract portfolio with key wins in our Government Systems segment in programs covering a wide range of space-based technologies and capabilities. We exited the quarter with a very strong liquidity position of over $3.3 billion, which includes $1.96 billion of cash. Sequentially, net leverage decreased to approximately 3.7x estimated combined LTM Adjusted EBITDA as of Q2 FY2024, a 0.2x sequential improvement, and substantially favorable to plan at the time the Inmarsat acquisition was announced.