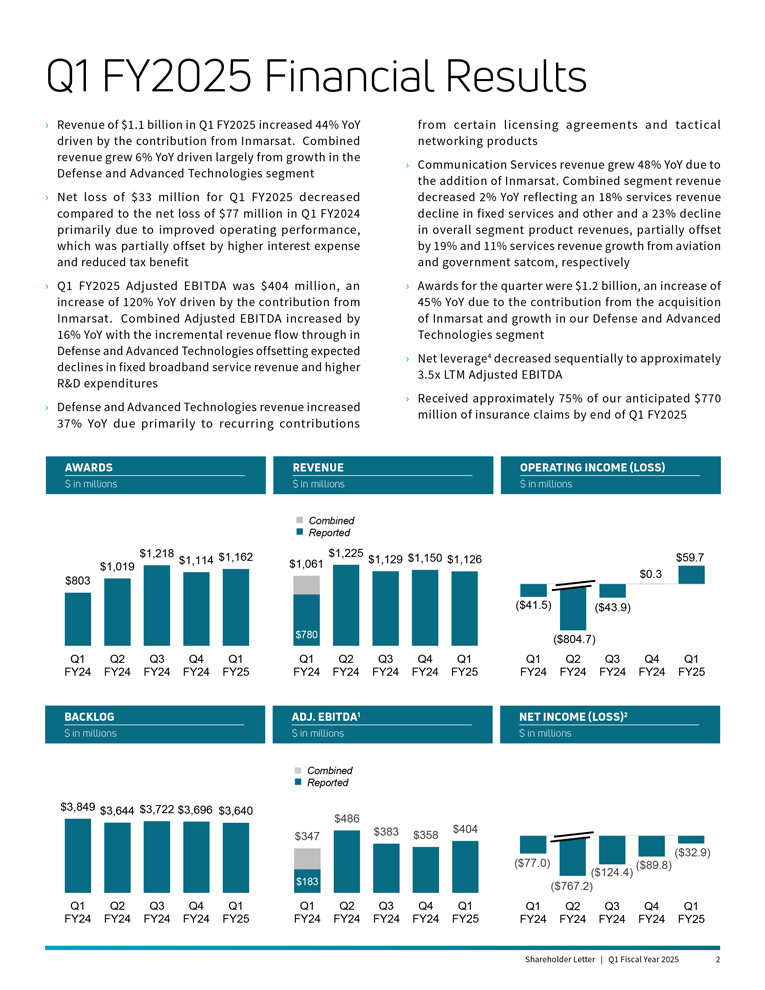

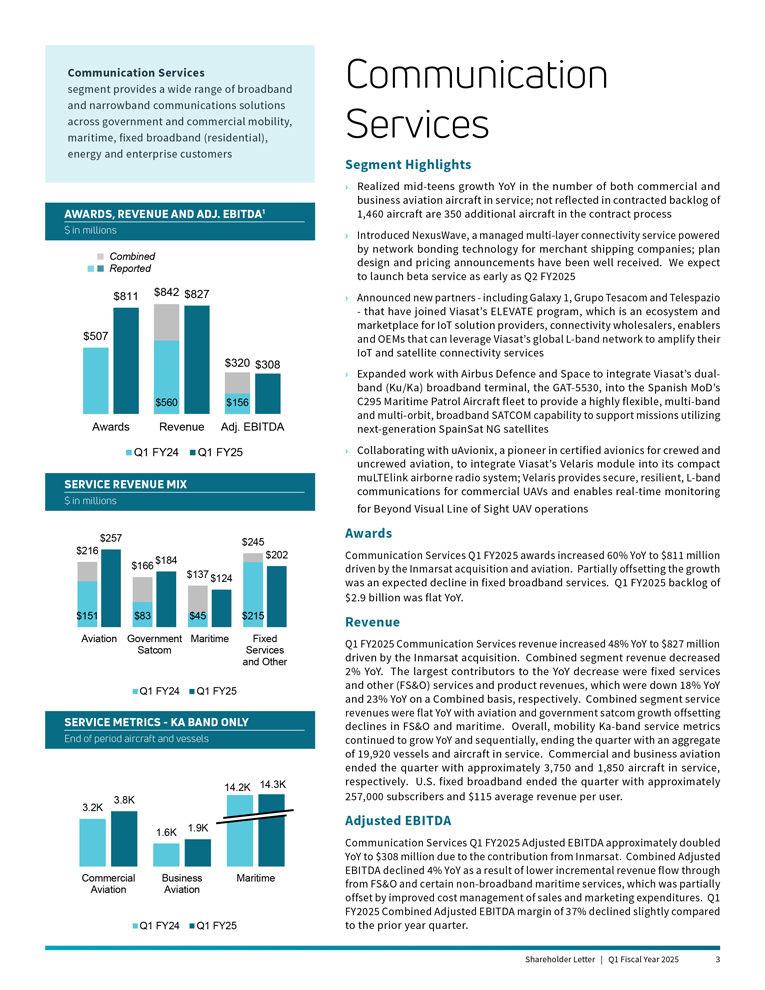

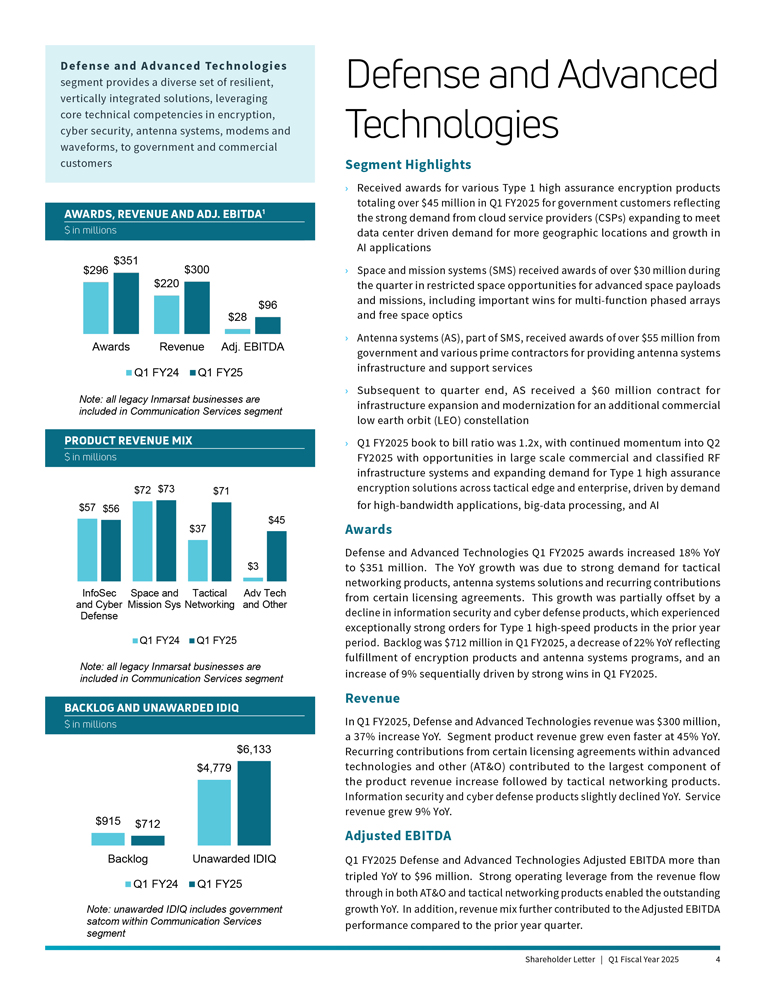

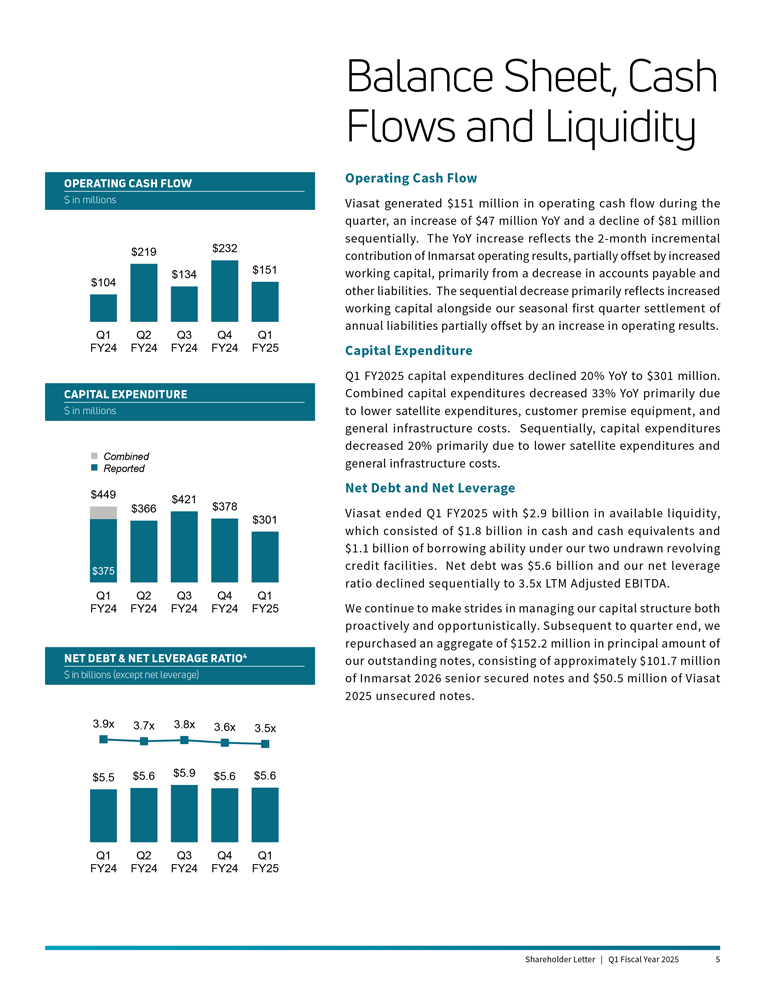

Fellow Shareholders, Our Q1 Fiscal Year 2025 results yielded stronger than expected year-over-year (YoY) revenue and Adjusted EBITDA1 growth. Our Q1 results, ongoing services revenue, expected activations in aviation (despite OEM delays), solid defense orders, existing and new backlog, and order pipeline enable us to increase our outlook for FY2025. Further to delivering the overperformance, we also continued to take actions to strengthen our capital structure while thoughtfully investing and positioning for a promising future. For Q1 FY2025 net loss2 of $33 million decreased compared to net loss of $77 million in Q1 FY2024 primarily due to improved operating performance, partially offset by higher interest expense and reduced tax benefit. Supplemental adjusted combined (“Combined”)3 revenue grew 6% YoY driven largely from growth in the Defense and Advanced Technologies segment reflecting the value of the technology portfolio. Combined Adjusted EBITDA increased by 16% YoY primarily from incremental revenue flow-through in Defense and Advanced Technologies and double-digit Adjusted EBITDA growth in both aviation and government satcom business lines within the Communication Services segment. Growth in those areas more than offset expected declines in fixed broadband service revenue and higher R&D investments in growth businesses. Strong secular growth in satellite mobility; the diversity of our businesses; and domain-specific platform integration, business models and value-added services; all contribute to a durable competitive posture and favorable operating leverage. Our updated Communication Services and Defense and Advanced Technologies segment reporting is intended to give greater insight into our business, our opportunities, and our challenges. We intend to show the opportunities can support growth – while we take affirmative actions to overcome the challenges. Continued capital synergies and productivity gains reduced YoY Combined capex by 33% to $301 million while we approach deployment of five new state-of-the-art broadband satellites, two polar coverage satellites, and three replenishment L-band satellites. Capital budgets reflect the synergies enabled by the Inmarsat integration and the associated operating and revenue synergy potential. We are managing to invest for growth in target markets while working to opportunistically strengthen our capital structure via organic cash flow improvements, debt maturity extensions, and/or non-core portfolio monetizations. We are making steady progress and consistent with prior guidance, we continue to expect an inflection to positive free cash flow by the end of Q1 FY2026. We are determined to enter FY2026 with a solid foundation for accelerated and sustained growth. We’re excited to have ViaSat-3 F1 (VS3-F1) entering service—proving its very unique dynamic beam forming can aim bandwidth just where it’s needed most. That capability, and our growing organic and international operator/partner satellite fleet, multiplies the value of unique Machine Learning (ML) tools optimizing bandwidth generation and economic utility. Those tools can predict and fulfill real time dynamic bandwidth demand across all vertical markets, especially in the highest demand times and places. That supports state-of-the-art service confidence and performance, while simultaneously offering enhanced and more predictable returns on capital. AI/ML tools change the game from optimizing individual satellites to jointly optimizing the value of an entire fleet in serving a constantly shifting, dynamic mobility demand profile. Our broad portfolio of vertical markets, applications, and service level agreements create opportunities for greater economic yields for us and our partners, and greater confidence for our customers. All that within a regulatory framework protecting the sovereign rights of global space-faring nations – and all while broadband mobility demand is soaring due to greater penetration and inexorable increases in per user/per platform bandwidth consumption. We’re pleased with the financial results this quarter, but remain focused on our agenda of strategic imperatives including overcoming the VS3-F1 anomaly. We are delivering financial and operational results with a sense of urgency. We are making steady progress on these items and that progress is supporting the improvements in our growth outlook. The headway we’re making on multiple fronts creates optionality in the means and sequences in which we address our challenges and opportunities: › Bring our satellites under construction into service › Holistically address our capital structure, while improving underlying leverage ratios › Continue to groom our business portfolio to the highest leverage satellite & network technologies that attract customers and partners, and ultimately yield attractive recurring service revenues › Continue Inmarsat integration, drive economic productivity, and continue service-offering innovation › Cultivate an enduring and economically accretive satellite operator partnership eco-system leveraging AI/ML technologies to augment coverage and capacity and integrate multi-orbit capabilities › Achieve our free cash flow inflection objective as planned, as part of a comprehensive plan to enhance, achieve, and illustrate our Return on Invested Capital objectives › Continue to win and execute new defense and advanced technology programs with attractive growth potential and durable competitive advantages in key technologies such as ground networks, unique free space optical applications, mission-specific phased array terminals, space-based cyber security, and others. Leverage technology to provide recurring service revenues for commercial and government customers › Capture a leadership position in the emerging Direct-to-Device (D2D) services market by leveraging our substantial installed base of aviation, maritime, and mobile users, emerging 3GPP standards, open architecture, and existing resources › Foster innovative business models, serving an extremely large base of satellite enabled mobile devices and platforms, further optimizing use of our MSS spectrum licenses and evolving our L-band services to create value for the millions of people that depend on them for safety and connectivity in the air, at sea, and on land Viasat has always managed for the long term. Yet we know we have to perform today to have the opportunity to compete tomorrow. That’s enabled us to sustain growth for decades, build key franchise businesses, and evolve our technology, business models and market segments to sustain competitive advantages even in the presence of generational technology evolutions and consistently shifting playing fields and competitive environments.