CORPORATE

Profile

The South Financial Group, headquartered in Greenville, South Carolina, is a financial holding company focused on fast-growing banking markets in the Southeast. Founded in 1986, it now has approximately $ 10.7 billion in total assets and 134 branch offices in South Carolina, North Carolina and Florida. The South Financial Group operates through two subsidiary banks:

| • | | Carolina First Bank, the largest South Carolina-headquartered commercial bank, operates in South Carolina, North Carolina and on the Internet under the brand name, Bank Caroline, and |

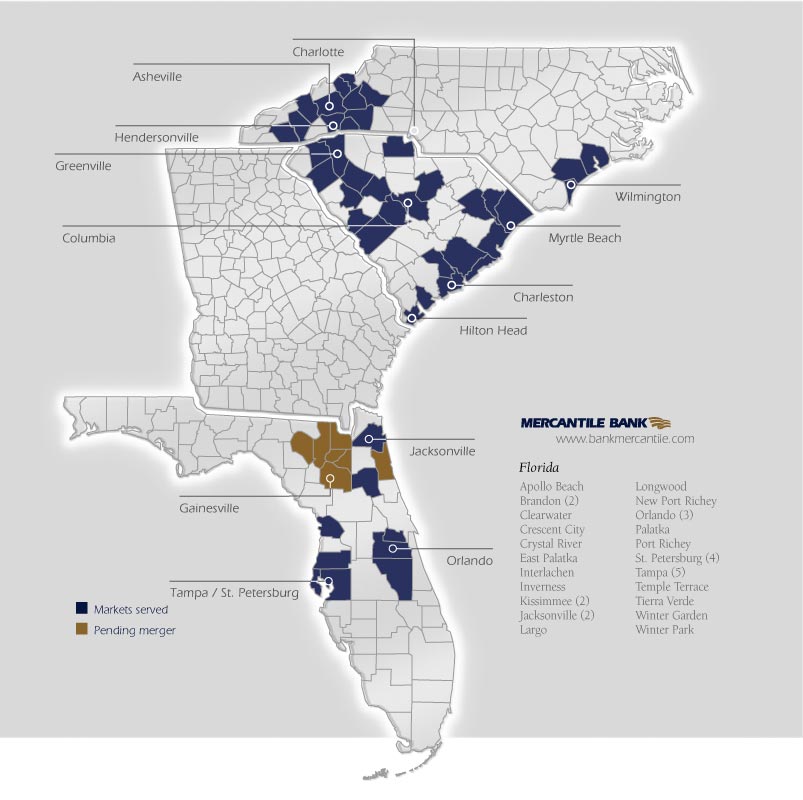

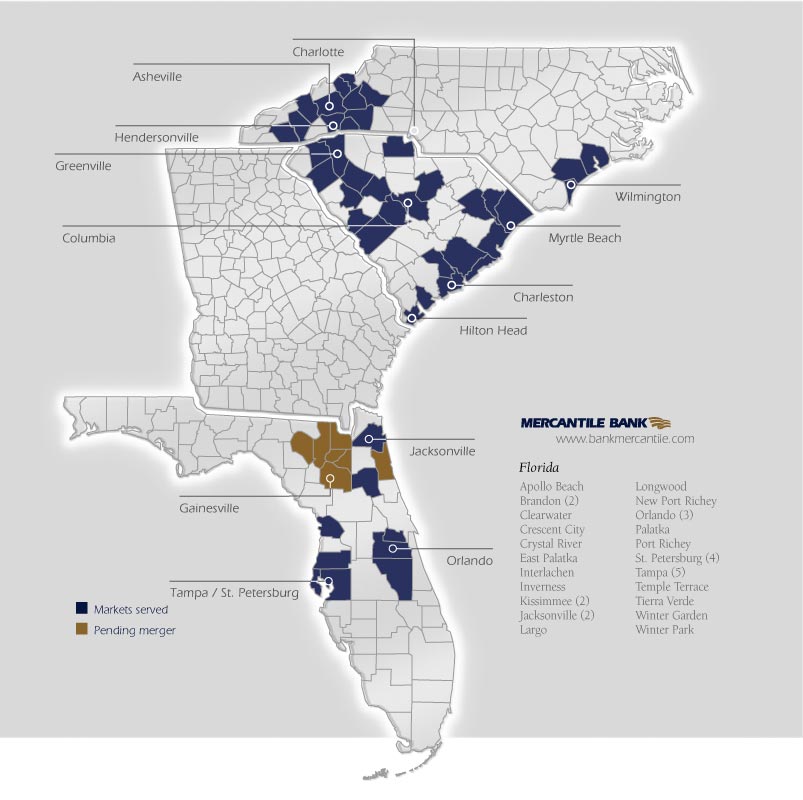

| • | | Mercantile Bank, principally serving Jacksonville, Orlando and Tampa Bay, Florida. |

The South Financial Group uses a super-community bank strategy serving small and middle market businesses and retail consumers by offering a full range of financial services, including cash management, investments, insurance and trust services. Its common stock trades on The Nasdaq Stock Market under the symbol TSFG.

TABLE

of Contents

| | | | | |

| | Inside front cover |

| | | 1 | |

| | | 2 | |

| | | 6 | |

| | | 8 | |

| | | 14 | |

| | | 15 | |

| | | 16 | |

| | | 20 | |

| | | 22 | |

| | | 24 | |

| | | 26 | |

| | Inside back cover |

SUMMARY

Annual Report

The 2003 Annual Report is presented in a summary format intended to provide information in a concise, summarized manner that will be meaningful and useful to the widest range of readers. The audited financial statements and detailed analytical schedules are contained in The South Financial Group’s Annual Report on Form 10-K for the year ended December 31, 2003 filed with the Securities and Exchange Commission.

FINANCIAL

Highlights

($ in thousands, except per share data)

| | | | | | | | | | | | | |

| | | 2003

| | 2002

| | % Change

|

EARNINGS AND DIVIDENDS | | | | | | | | | | | | |

| Net interest income | | $ | 272,591 | | | $ | 218,252 | | | | 25 | % |

| Noninterest income | | | 95,490 | | | | 59,640 | | | | 60 | |

| Total revenue | | | 368,081 | | | | 277,892 | | | | 32 | |

| Provision for loan losses | | | 20,581 | | | | 22,266 | | | | (8 | ) |

| Noninterest expenses, excluding merger-related costs | | | 202,043 | | | | 156,176 | | | | 29 | |

| Merger-related costs | | | 5,127 | | | | 6,664 | | | | n/m | |

| Net income | | | 95,058 | | | | 59,158 | | | | 61 | |

| Operating earnings (a) | | | 89,232 | | | | 63,500 | | | | 41 | |

| Per share — diluted: | | | | | | | | | | | | |

| Net income | | $ | 1.89 | | | $ | 1.38 | | | | 37 | |

| Operating earnings (a) | | | 1.77 | | | | 1.49 | | | | 19 | |

| Cash dividends declared per share | | | 0.57 | | | | 0.50 | | | | 14 | |

RATIOS | | | | | | | | | | | | |

| Return on average assets | | | 1.03 | % | | | 0.91 | % | | | | |

| Return on average equity | | | 13.40 | | | | 11.89 | | | | | |

| Average balances: | | | | | | | | | | | | |

| Assets | | $ | 9,260,767 | | | $ | 6,497,607 | | | | 43 | % |

| Shareholders’ equity | | | 709,139 | | | | 497,341 | | | | 43 | |

AT YEAR END | | | | | | | | | | | | |

| Total assets | | $ | 10,719,401 | | | $ | 7,941,010 | | | | 35 | % |

| Loans held for investment | | | 5,732,205 | | | | 4,434,011 | | | | 29 | |

| Securities | | | 4,007,571 | | | | 2,572,186 | | | | 56 | |

| Shareholders’ equity | | | 979,869 | | | | 646,799 | | | | 51 | |

| Book value per share | | $ | 16.59 | | | $ | 13.66 | | | | 21 | |

| Market price per share (Nasdaq) | | | 27.75 | | | | 20.66 | | | | 34 | |

ASSET QUALITY RATIOS | | | | | | | | | | | | |

| Nonperforming assets | | | 1.06 | % | | | 1.67 | % | | | | |

Nonperforming assets, excluding

Rock Hill Bank & Trust Workout Loans (b) | | | 0.72 | | | | 1.03 | | | | | |

| Net loan charge-offs | | | 0.62 | | | | 0.49 | | | | | |

Net loan charge-offs, excluding

Rock Hill Bank & Trust Workout Loans (b) | | | 0.41 | | | | 0.50 | | | | | |

OPERATIONS DATA | | | | | | | | | | | | |

| Branch offices (c) | | | 134 | | | | 117 | | | | 15 | % |

| ATMs | | | 122 | | | | 105 | | | | 16 | |

| Employees (full-time equivalent) | | | 1,918 | | | | 1,700 | | | | 13 | |

Notes:

| (a) | | See page 19 for a reconciliation of GAAP net income and operating earnings. |

| |

| (b) | | At December 31, 2003, Rock Hill Bank & Trust Workout Loans totaled $28.6 million with nonperforming assets of $19.6 million. At December 31, 2002, Rock Hill Bank & Trust Workout Loans totaled $72.4 million with nonperforming assets of $29.2 million. Net loan charge-offs for Rock Hill Bank & Trust Workout Loans totaled $10.3 million and a recovery of $(367,000) for 2003 and 2002, respectively. |

| |

| (c) | | Excludes one branch office for Community National Bank of Pulaski, Virginia, which TSFG acquired as part of its MountainBank Financial Corporation acquisition. On February 3, 2004, TSFG entered into a definitive asset sale agreement to sell substantially all of Community National Bank’s assets and liabilities. |

1

1

Focus. Discipline. Execution.

At The South Financial Group, we’ve put our

strategic plan into motion. Going forward, we’re focused

on executing that plan, increasing profitability and

bringing the highest possible value

to our Shareholders...

The year 2003 was the best year in the history of The South Financial Group. We delivered another year of record earnings. As promised, we achieved double-digit growth in revenues, loans and deposits. We increased our returns to shareholders. However, as proud as I am ofwhatThe South Financial Group achieved in 2003, I’m even more proud ofhowwe did it. We focused on what we needed to accomplish. We maintained our discipline. And we put the right team of professionals in place to execute our strategic plans.

For our first fourteen years, The South Financial Group emphasized strategicgrowth and expansion,focusing on the most attractive banking markets in the Southeast. We have created an impressive geographic footprint in the region. Three years ago, we shifted that focus toprofitability.Consequently, we developed a strategic plan that balanced profitability and growth, and concentrated on creating value for our shareholders. With a disciplined management team in place to execute this plan, we are witnessing the results of that focus and discipline.

For 2003, net income increased 61% over 2002 to $95.1 million. For eleven consecutive quarters, operating EPS has increased. Over this eleven quarter period, our operating earnings per share have increased at an annualized rate of 37%.

In 2003, TSFG’s total return to shareholders was 37%, making 2003 a rewarding year for our shareholders. Over the past three years, TSFG’s annualized total return to shareholders has exceeded 30%, outperforming most bank and stock market indexes.

Focus, discipline and execution produced results throughout 2003. Here are some of the highlights:

Loans and transaction deposits grew at double-digit rates.While we operate in thriving markets, The South Financial Group is actually growingfasterthan the markets themselves. More importantly, Carolina First and Mercantile Bank are taking market share from competitors.

Key credit quality measures continued to show improvement.Both our nonperforming asset ratio and charge-off ratio declined in 2003. We are very close to resolving the Rock Hill Bank & Trust workout loans; only $29 million remains in the portfolio, representing less than one half of 1% of our total loans.

Elevate sales process made impressive inroads. Our Elevate sales process did what it was designed to do: increase the number of products per household. By year’s end, we met our goal of 3.5 products per household (excluding the recently acquired MountainBank operations), and we significantly increased our overall number of households, up 25% for the year. This represents a solid foundation for future improvement.

We expanded and strengthened our geographic franchise.While our focus remains on profitability, we expanded our footprint in Western North Carolina with our acquisition of MountainBank. And in January, we announced an agreement to acquire CNB Florida Bancshares. Upon completion of this merger, we will have 50 branches and over $3 billion in assets in Florida.

2

2

Corporate Headquarters, Greenville, SC 7:43 a.m.

“The year 2003 was one of dramatic progress for The south Financial Group. The successes of the past year have given us a great deal of confidence in our long-term growth potential. We have talented, experienced professionals in place. We operate in superior banking markets. We are focused on our goals. We have the discipline to stick to our plans and execute them successfully. In short, we are prepared for the future right now.”

Mack I. Whittle, Jr.

President and Chief Executive Officer

Mack I. Whittle, Jr., a founder of the company in 1986, has led The South Financial Group since its inception. In the past seventeen years, The South Financial Group has grown from a local, start-up bank to a regional super-community bank with $10.7 billion in assets. Under his guidance, The South Financial Group has remained true to its mission to “take banking personally.”

Focus. Discipline. Execution.

Successful equity offering raised $161 million in new capital.The infusion of new capital in 2003 created a tangible equity to tangible asset ratio exceeding 6%. This laid the foundation for profitable expansion with solid capital levels. Additionally, Carolina First Bank received an “investment grade” rating from Moody’s, enhancing our ability to borrow at reasonable rates.

Setting three-year goals focused our team.In 2001, we set strategic, three-year goals. During this three-year period, we completed four strategic acquisitions and a very successful equity offering. The last acquisition, MountainBank, and our equity offering occurred in the final quarter of our plan and added approximately $300 million in new equity. However, excluding MountainBank and the equity offering, we exceeded our ROE goal and came close to our ROA goal. This is a tribute to our management team and our people.

Focus for 2004

Moving forward, we remain focused on increased earnings growth, higher performance and enhanced value for shareholders. What can you expect in 2004... and the next three years?

Continued focus on our geographic footprint.The South Financial Group operates in superior geographic markets having superior market demographics. In fact, growth rates in our markets exceed the Southeastern and U.S. medians for number of households and per capita income. This market strength enhances our opportunities to provide noninterest income products and services, as well as organic growth of loans and deposits. In short, we have the opportunity to gain more share and revenue.

4

4

“Three years ago, we shifted our focus toprofitability.Consequently, we developed a strategic plan that balanced profitability and growth, and concentrated on creating value for our shareholders. With a disciplined management team in place to execute this plan, we are witnessing the results of that focus and discipline.”

An efficiency ratio below 55%.During the past sixteen months, we acquired four banks with nearly $2 billion in assets. These new customers represent significant opportunities for future growth and increased market share. And while the recent acquisitions were smoothly and successfully integrated, we’ve yet to realize the full potential from these new customers. Enhanced efficiency from revenue growth and expense control in all of our operations will keep our operating efficiency ratio (noninterest expenses divided by total revenue) below 55%, a level we attained in the final quarter of 2003.

Increased noninterest income.We are still below our high performance peer group’s 30% average for noninterest income as a percentage of total revenue. (For 2003, we averaged 26% using GAAP results, or 22% on an operating basis.) It is important to note that our solid performance over the past three years occurred without us achieving our potential in noninterest income. Consequently, this area represents one of the best opportunities for growth and improvement in our operations. Our Elevate sales process is designed to help bring us to that peer average. In addition, we enhanced our efforts to generate additional fee income by diversifying our noninterest income sources. We added two insurance agencies to our product portfolio, developed a successful Sales and Service Center, and expanded our cash management services. Our management team is committed to showing improvements in the coming quarters.

Reduced credit costs.Our early warning credit system is developing into a more mature credit culture for The South Financial Group. And this culture helps us maintain the discipline that ultimately results in lower credit costs.

New three-year goals based on high performing peer banks.We are raising the bar and setting new three-year goals of double-digit EPS growth (targeting the mid-teens) and by the end of 4th quarter 2006, a 1.30% ROA, a 15 to 17% ROE and a 20% cash return on equity. The results for 2003 proved that multiple-year goals effectively focus our team. We plan to continue that strategy in 2004 and beyond. These ambitious three-year goals clearly underscore a tremendous opportunity for The South Financial Group and its shareholders.

The year 2003 was one of dramatic progress for The South Financial Group. The successes of the past year have given us a great deal of confidence in our long-term growth potential. We have talented, experienced professionals in place. We operate in superior banking markets. We are focused on our goals. We have the discipline to stick to our plans and execute them successfully. In short, we are prepared for the future right now.

And finally, this letter would not be complete without expressing our appreciation to our employees for their dedicated performance. We are grateful to our shareholders and our customers for continuing to support our efforts. Ultimately, it is your confidence as investors and your loyalty as customers that make the success of The South Financial Group possible.

Sincerely,

Mack I. Whittle, Jr.

President and Chief Executive Officer

5

5

Focus. Discipline. Execution.

Communication is crucial to successful relationships with our

shareholders and customers. That’s why we always keep the lines

of communication open ... and always make time for

Questions & Answers.

Q:How do acquisitions coincide with your three-year goals?

A:We will pursue acquisitions that build our franchise and our earnings. However, acquisitions will not distract us from achieving our three-year goals. Furthermore, any acquisitions will be in our targeted footprint and in markets growing faster than the U.S. and Southeast medians for household growth and per capita income growth. We will not get into a pricing war on acquisitions. We will be disciplined. In short, we will do acquisitions if they meet these strict criteria.

Q:Why divide your franchise into banking markets, each run by a Market President?

A:We divide our franchise into market areas because it allows us to operate like a community bank from a customer perspective. The Market President knows the customers and can make the banking decisions locally. However, because of the size of our overall organization, we can offer a full range of sophisticated products and services that community banks cannot. Our model is very similar to one used by the former Barnett Bank. Because each market is different, our pricing, mix of loans and deposits, and demand for particular products vary from place to place. Having a Market President who is a member of the community also ensures that we provide the right types of products and services.

Q:Could you provide an update on the progress of Elevate, the Cohen-Brown sales process?

A:Our Elevate sales process provides the foundation for making our bank a “sales and service” organization. In 2003, the Elevate process allowed us to increase our number of total households 25%, which is excellent progress. We’ve also increased the number of products per household. At the end of 2003, we increased to 3.3 products per household or, if you exclude MountainBank, 3.5 products per household, which was our year-end 2003 goal.

Q:How have you been able to meet your goal of double-digit loan growth during challenging economic times?

A:First, we operate in some of the best markets in the Southeast. Plus, we are gaining business in all of our markets. Our Florida markets are especially strong, with 2003 growth ranging from 8% in Tampa Bay to 29% in North Florida. Also, we continue to refine and develop our Elevate sales process, which helps us increase market share and increase the number of products we provide to these customers.

6

6

Q:How do you manage your securities portfolio?

A:The composition and risk profile of our balance sheet dictate the size and composition of our securities portfolio. We use our securities portfolio for four primary purposes: (1) to provide liquidity to fund loan growth, (2) to manage interest rate risk for the entire balance sheet, (3) to provide collateral for pledges on public deposits and securities sold under repurchase agreements and (4) to provide additional income. We have taken steps to reduce the portfolio risk and have shortened the duration to approximately three and a half years. The short weighted average life and duration provide us with cash flow to proactively manage as market conditions change. During 2004, we expect to reduce the level of our securities portfolio as a percentage of total assets, as loan growth replaces a portion of the securities with new loans.

Q:Congress, as well as investors, is focused on “corporate governance.” How does The South Financial Group measure up in this area?

A:The short answer is that an independent industry group rated our corporate governance as being in the top 15% of all public companies. This rating is, in part, reflective of our increased attention to this area over the past two years. For example, in 2002, our Board of Directors established a Nominating and Corporate Governance Committee, consisting entirely of independent directors. We fully implemented the CEO and CFO certification requirements of the Sarbanes-Oxley Act of 2002 and created a Disclosure Committee to ensure compliance with the disclosure obligations of that Act. The Board of Directors has also designated two members of its Audit Committee as “financial experts,” as defined in the Act. We intend to continue to run our company within a good corporate governance framework.

7

7

Our Market Presidents will have the authority

to make decisions locally for their local customers.

We want to feel like a community bank

every time a customer walks in the door

or runs down the sidewalk.

Sandberg Drive, Flat Rock, NC 6:34 a.m.

“True Story. Really. I was out jogging early one morning, and on the other side of the street, coming at me, is my banker, J.W. Davis. We must have both been on about mile five, because we’re huffing and puffing. I gotta say, he looked worse off than I did. Anyway, we’re about to pass each other and I have just enough breath to yell at him, “I think I might need a loan for a new oven!” And he yells back, “Come on by today and we’ll talk!” By the end of business that afternoon, I had the loan to buy a large capacity oven for our cookies. You see, J.W. can make decisions on the spot. He doesn’t have to run things by some corporate office a thousand miles away. He doesn’t have to sell my story upstream. He lives in this community. He knows folks in this area, so he can be responsive to our needs. I never get the feeling that some strangers are making decisions looking at a spread sheet and a computer screen. Who I am counts for something. I mean, how many banks will let you ask for a loan on your morning jog? This one will.”

Scott Blackwell

President and CEO, Immaculate Baking Company

We will continue to truly know each of our customers,

living up to our promise to “take banking personally.”

We’ll be able to recommend the products and services

to meet their needs, from a business loan

to a new pew.

First Nazareth Baptist Church, Columbia, SC Sunday Afternoon

“From our first interview with them,we were very impressed with Carolina First. And they have maintained the same image. After becoming our lending agent, they made sure to reiterate that they desired to establish a relationship with our members, and they have done just that. We have referred others to them, and the response was positive and prompt. We are grateful to God that Carolina First has worked to make that first impression a lasting one.”

Blakely N. Scott

Pastor, First Nazareth Baptist Church

Focus. Discipline. Execution.

In each of our markets, we will give our employees the tools they

need to achieve our strategic goals — the training and products and

services that allow them to cultivate lasting customer relationships.

And when employees of The South Financial Group shine, we will

recognize their efforts.

12

12

1200 Riverplace Boulevard, Jacksonville, FL Tuesday Morning

“Winning the President’s Award means we were a successful team. It means we have people who truly care about our customers and the experience they have when they come through our door. We listen. We consult. We advise. The basis for our success is customer service. I learned that lesson years ago. My dad owned an appliance business and if one of his customers had a problem with a television set, he’d let them borrow the one in our living room... just to make them happy. Seriously, whatever it took, that’s what he’d do. I saw the value of customer service. Dad’s customers knew he would always go the extra mile. That’s the same attitude we have here. We work hard as a team to know our customers better and to find the right solutions to help them be successful. When our customers are successful, we’re successful.”

Cindy Stover

Market President, North Florida

Winner of the President’s Award, 2003

The President’s Award, the most prestigious recognition given by The South Financial Group, is presented to the top performing Market President for each bank. The award is based on performance in multiple categories including profitability, efficiency, credit quality, loan, deposit and noninterest income growth.

CONDENSED CONSOLIDATED

Balance Sheets

The South Financial Group and Subsidiaries

($ in thousands, except per share data)

| | | | | | | | | |

| | | December 31,

|

| | | 2003

| | 2002

|

ASSETS | | | | | | | | |

| Cash and due from banks | | $ | 184,057 | | | $ | 201,333 | |

| Interest-bearing bank balances | | | 2,048 | | | | 58,703 | |

| Federal funds sold | | | 137 | | | | 31,293 | |

| Securities | | | | | | | | |

| Trading | | | 480 | | | | 350 | |

| Available for sale | | | 3,915,994 | | | | 2,488,944 | |

| Held for maturity (market value $93,188 in 2003 and $85,371 in 2002) | | | 91,097 | | | | 82,892 | |

| | | |

| | | |

| |

| Total securities | | | 4,007,571 | | | | 2,572,186 | |

| | | |

| | | |

| |

| Loans | | | | | | | | |

| Loans held for sale | | | 29,619 | | | | 67,218 | |

| Loans held for investment | | | 5,732,205 | | | | 4,434,011 | |

| Allowance for loan losses | | | (73,287 | ) | | | (70,275 | ) |

| | | |

| | | |

| |

| Net loans | | | 5,688,537 | | | | 4,430,954 | |

| | | |

| | | |

| |

| Premises and equipment, net | | | 142,705 | | | | 137,501 | |

| Accrued interest receivable | | | 48,365 | | | | 37,080 | |

| Intangible assets | | | 353,079 | | | | 242,182 | |

| Other assets | | | 292,902 | | | | 229,778 | |

| | | |

| | | |

| |

| | | $ | 10,719,401 | | | $ | 7,941,010 | |

| | | |

| | | |

| |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| Liabilities | | | | | | | | |

| Deposits | | | | | | | | |

| Noninterest-bearing | | $ | 882,129 | | | $ | 743,174 | |

| Interest-bearing | | | 5,146,520 | | | | 3,849,336 | |

| | | |

| | | |

| |

| Total deposits | | | 6,028,649 | | | | 4,592,510 | |

| Federal funds purchased and repurchase agreements | | | 834,866 | | | | 1,110,840 | |

| Other short-term borrowings | | | 56,079 | | | | 81,653 | |

| Long-term debt | | | 2,702,879 | | | | 1,221,511 | |

| Debt associated with trust preferred securities | | | — | | | | 95,500 | |

| Accrued interest payable | | | 24,520 | | | | 20,945 | |

| Other liabilities | | | 92,539 | | | | 84,840 | |

| | | |

| | | |

| |

| Total liabilities | | | 9,739,532 | | | | 7,207,799 | |

| | | |

| | | |

| |

| Minority interest in consolidated subsidiary | | | — | | | | 86,412 | |

| | | |

| | | |

| |

| Shareholders’ Equity: | | | | | | | | |

| Preferred stock — no par value; authorized 10,000,000 shares; issued and outstanding none | | | — | | | | — | |

| Common stock — par value $1 per share; authorized 100,000,000 shares; issued and outstanding 59,064,375 shares in 2003 and 47,347,375 shares in 2002 | | | 59,064 | | | | 47,347 | |

| Surplus | | | 712,788 | | | | 427,448 | |

| Retained earnings | | | 216,678 | | | | 150,948 | |

| Guarantee of employee stock ownership plan debt and nonvested restricted stock | | | (2,494 | ) | | | (3,094 | ) |

| Common stock held in trust for deferred compensation | | | (151 | ) | | | — | |

| Deferred compensation payable in common stock | | | 151 | | | | — | |

| Accumulated other comprehensive income (loss), net of tax | | | (6,167 | ) | | | 24,150 | |

| | | |

| | | |

| |

| Total shareholders’ equity | | | 979,869 | | | | 646,799 | |

| | | |

| | | |

| |

| | | $ | 10,719,401 | | | $ | 7,941,010 | |

| | | |

| | | |

| |

14

14

CONDENSED CONSOLIDATED

Statements of Income

The South Financial Group and Subsidiaries

($ in thousands, except per share data)

| | | | | | | | | | | | | |

| | | Years Ended December 31,

|

| | | 2003

| | 2002

| | 2001

|

| INTEREST INCOME | | | | | | | | | | | | |

| Interest and fees on loans | | $ | 280,609 | | | $ | 260,718 | | | $ | 301,312 | |

| Interest and dividends on securities | | | | | | | | | | | | |

| Taxable | | | 128,060 | | | | 87,554 | | | | 65,381 | |

| Exempt from Federal income taxes | | | 4,980 | | | | 4,367 | | | | 4,025 | |

| | | |

| | | |

| | | |

| |

| Total interest and dividends on securities | | | 133,040 | | | | 91,921 | | | | 69,406 | |

| Interest on short-term investments | | | 479 | | | | 1,100 | | | | 1,383 | |

| | | |

| | | |

| | | |

| |

| Total interest income | | | 414,128 | | | | 353,739 | | | | 372,101 | |

| | | |

| | | |

| | | |

| |

| INTEREST EXPENSE | | | | | | | | | | | | |

| Interest on deposits | | | 76,344 | | | | 82,858 | | | | 144,858 | |

| Interest on short-term borrowings | | | 11,419 | | | | 21,975 | | | | 25,342 | |

| Interest on long-term debt | | | 53,774 | | | | 30,654 | | | | 27,124 | |

| | | |

| | | |

| | | |

| |

| Total interest expense | | | 141,537 | | | | 135,487 | | | | 197,324 | |

| | | |

| | | |

| | | |

| |

| NET INTEREST INCOME | | | 272,591 | | | | 218,252 | | | | 174,777 | |

| PROVISION FOR LOAN LOSSES | | | 20,581 | | | | 22,266 | | | | 22,045 | |

| | | |

| | | |

| | | |

| |

| Net interest income after provision for loan losses | | | 252,010 | | | | 195,986 | | | | 152,732 | |

| NONINTEREST INCOME | | | 95,490 | | | | 59,640 | | | | 53,484 | |

| NONINTEREST EXPENSES | | | 207,170 | | | | 162,840 | | | | 140,820 | |

| | | |

| | | |

| | | |

| |

| Income before income taxes, minority interest, and cumulative effect of change in accounting principle | | | 140,330 | | | | 92,786 | | | | 65,396 | |

| Income taxes | | | 43,260 | | | | 28,972 | | | | 22,422 | |

| | | |

| | | |

| | | |

| |

| Income before minority interest and cumulative effect of change in accounting principle | | | 97,070 | | | | 63,814 | | | | 42,974 | |

| Minority interest in consolidated subsidiary, net of tax | | | (2,012 | ) | | | (3,250 | ) | | | (1,364 | ) |

| | | |

| | | |

| | | |

| |

| Income before cumulative effect of change in accounting principle | | | 95,058 | | | | 60,564 | | | | 41,610 | |

| Cumulative effect of change in accounting principle, net of tax | | | — | | | | (1,406 | ) | | | 282 | |

| | | |

| | | |

| | | |

| |

| NET INCOME | | $ | 95,058 | | | $ | 59,158 | | | $ | 41,892 | |

| | | |

| | | |

| | | |

| |

| AVERAGE COMMON SHARES OUTSTANDING, BASIC | | | 49,204,173 | | | | 41,714,994 | | | | 42,098,395 | |

| AVERAGE COMMON SHARES OUTSTANDING, DILUTED | | | 50,328,353 | | | | 42,714,938 | | | | 42,823,513 | |

| PER COMMON SHARE, BASIC: | | | | | | | | | | | | |

| Net income before cumulative effect of change in accounting principle | | $ | 1.93 | | | $ | 1.45 | | | $ | 0.99 | |

| Cumulative effect of change in accounting principle | | | — | | | | (0.03 | ) | | | 0.01 | |

| | | |

| | | |

| | | |

| |

| Net income | | $ | 1.93 | | | $ | 1.42 | | | $ | 1.00 | |

| | | |

| | | |

| | | |

| |

| PER COMMON SHARE, DILUTED: | | | | | | | | | | | | |

| Net income before cumulative effect of change in accounting principle | | $ | 1.89 | | | $ | 1.42 | | | $ | 0.97 | |

| Cumulative effect of change in accounting principle | | | — | | | | (0.04 | ) | | | 0.01 | |

| | | |

| | | |

| | | |

| |

| Net income | | $ | 1.89 | | | $ | 1.38 | | | $ | 0.98 | |

| | | |

| | | |

| | | |

| |

15

15

SIX-YEAR SUMMARY

of Selected Financial Data

The South Financial Group and Subsidiaries

($ in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| | Five-Year

Compound |

| | | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

| | Growth Rate

|

| INCOME STATEMENT DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 272,591 | | | $ | 218,252 | | | $ | 174,777 | | | $ | 167,111 | | | $ | 174,614 | | | $ | 149,341 | | | | 12.8 | % |

| Provision for loan losses | | | 20,581 | | | | 22,266 | | | | 22,045 | | | | 23,378 | | | | 18,273 | | | | 15,646 | | | | 5.6 | |

| Noninterest income | | | 95,490 | | | | 59,640 | | | | 53,484 | | | | 48,545 | | | | 59,649 | | | | 34,924 | | | | 22.3 | |

| Noninterest expenses(a) | | | 202,043 | | | | 156,176 | | | | 141,321 | | | | 152,340 | | | | 147,674 | | | | 109,857 | | | | 13.0 | |

| Merger-related costs (recoveries) | | | 5,127 | | | | 6,664 | | | | (501 | ) | | | 29,198 | | | | 7,155 | | | | 3,526 | | | | n/m | |

| Net income | | | 95,058 | | | | 59,158 | | | | 41,892 | | | | 6,989 | | | | 40,450 | | | | 34,656 | | | | 22.4 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| PER COMMON SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income — basic | | $ | 1.93 | | | $ | 1.42 | | | $ | 1.00 | | | $ | 0.16 | | | $ | 0.95 | | | $ | 0.90 | | | | 16.5 | % |

| Net income — diluted | | | 1.89 | | | | 1.38 | | | | 0.98 | | | | 0.16 | | | | 0.93 | | | | 0.87 | | | | 16.8 | |

| Book value (December 31) | | | 16.59 | | | | 13.66 | | | | 11.11 | | | | 11.04 | | | | 11.55 | | | | 10.64 | | | | 9.3 | |

| Market price (December 31) | | | 27.75 | | | | 20.66 | | | | 17.75 | | | | 13.25 | | | | 18.25 | | | | 25.31 | | | | 1.9 | |

| Cash dividends declared | | | 0.57 | | | | 0.50 | | | | 0.45 | | | | 0.41 | | | | 0.37 | | | | 0.33 | | | | 11.6 | |

| Dividend payout ratio | | | 30.16 | % | | | 36.23 | % | | | 45.92 | % | | | 256.25 | % | | | 39.78 | % | | | 37.93 | % | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| BALANCE SHEET DATA (YEAR END) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 10,719,401 | | | $ | 7,941,010 | | | $ | 6,029,442 | | | $ | 5,220,554 | | | $ | 4,768,656 | | | $ | 4,136,647 | | | | 21.0 | % |

| Securities | | | 4,007,571 | | | | 2,572,186 | | | | 1,643,395 | | | | 899,544 | | | | 964,146 | | | | 729,993 | | | | 40.6 | |

| Loans(b) | | | 5,761,824 | | | | 4,501,229 | | | | 3,736,763 | | | | 3,735,182 | | | | 3,291,720 | | | | 2,841,077 | | | | 15.2 | |

| Allowance for loan losses(b) | | | 73,287 | | | | 70,275 | | | | 44,587 | | | | 43,024 | | | | 33,756 | | | | 29,812 | | | | 19.7 | |

| Total earning assets | | | 9,783,087 | | | | 7,127,160 | | | | 5,479,252 | | | | 4,651,807 | | | | 4,262,837 | | | | 3,664,392 | | | | 21.7 | |

| Deposits | | | 6,028,649 | | | | 4,592,510 | | | | 3,605,255 | | | | 3,894,662 | | | | 3,481,651 | | | | 3,302,523 | | | | 12.8 | |

| Long-term debt | | | 2,702,879 | | | | 1,221,511 | | | | 411,294 | | | | 318,326 | | | | 314,279 | | | | 116,125 | | | | 87.7 | |

| Shareholders’ equity | | | 979,869 | | | | 646,799 | | | | 458,174 | | | | 468,653 | | | | 500,590 | | | | 450,989 | | | | 16.8 | |

| Nonperforming assets(b) | | | 60,774 | | | | 74,186 | | | | 43,857 | | | | 21,514 | | | | 13,972 | | | | 9,119 | | | | 46.1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| BALANCE SHEET DATA (AVERAGE) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 9,260,767 | | | $ | 6,497,607 | | | $ | 5,459,515 | | | $ | 5,032,700 | | | $ | 4,282,274 | | | $ | 3,726,204 | | | | 20.0 | % |

| Securities | | | 3,471,324 | | | | 1,850,798 | | | | 1,125,602 | | | | 875,876 | | | | 711,276 | | | | 637,089 | | | | 40.4 | |

| Loans | | | 4,915,437 | | | | 4,008,094 | | | | 3,769,358 | | | | 3,545,336 | | | | 3,045,913 | | | | 2,577,018 | | | | 13.8 | |

| Total earning assets | | | 8,425,590 | | | | 5,924,077 | | | | 4,928,970 | | | | 4,450,016 | | | | 3,820,904 | | | | 3,384,157 | | | | 20.0 | |

| Deposits | | | 5,147,627 | | | | 3,855,929 | | | | 3,688,250 | | | | 3,699,553 | | | | 3,373,282 | | | | 3,050,268 | | | | 11.0 | |

| Shareholders’ equity | | | 709,139 | | | | 497,341 | | | | 483,634 | | | | 479,800 | | | | 483,214 | | | | 371,707 | | | | 13.8 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| FINANCIAL RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest margin (tax-equivalent) | | | 3.27 | % | | | 3.72 | % | | | 3.59 | % | | | 3.81 | % | | | 4.62 | % | | | 4.46 | % | | | | |

| Return on average assets | | | 1.03 | | | | 0.91 | | | | 0.77 | | | | 0.14 | | | | 0.94 | | | | 0.93 | | | | | |

| Return on average equity | | | 13.40 | | | | 11.89 | | | | 8.66 | | | | 1.46 | | | | 8.37 | | | | 9.32 | | | | | |

| Average equity as a % of average assets | | | 7.66 | | | | 7.65 | | | | 8.86 | | | | 9.53 | | | | 11.28 | | | | 9.98 | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | |

| ASSET QUALITY RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nonperforming assets as a % of loans held for investment and other real estate owned(b) | | | 1.06 | % | | | 1.67 | % | | | 1.17 | % | | | 0.58 | % | | | 0.43 | % | | | 0.33 | % | | | | |

| Net charge-offs to average loans held for investment | | | 0.62 | | | | 0.49 | | | | 0.54 | | | | 0.39 | | | | 0.39 | | | | 0.52 | | | | | |

| Allowance for loan losses as a % of loans held for investment(b) | | | 1.28 | | | | 1.58 | | | | 1.20 | | | | 1.16 | | | | 1.04 | | | | 1.09 | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | |

| OPERATIONS DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Branch offices(c) | | | 134 | | | | 117 | | | | 90 | | | | 94 | | | | 108 | | | | 104 | | | | | |

| Employees (full-time equivalent) | | | 1,918 | | | | 1,700 | | | | 1,346 | | | | 1,374 | | | | 1,514 | | | | 1,345 | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | |

Notes:

| (a) | | Excluding merger-related costs (recoveries). |

| |

| (b) | | At December 31, 2003, Rock Hill Bank & Trust Workout Loans totaled $28.6 million with nonperforming assets of $19.6 million and an allowance for loan losses of $3.2 million. At December 31, 2002, Rock Hill Bank & Trust Workout Loans totaled $72.4 million with nonperforming assets of $29.2 million and an allowance for loan losses of $16.3 million. Excluding these balances, nonperforming assets as a % of loans held for investment and other real estate owned totaled 0.72% and 1.03% at December 31, 2003 and 2002, respectively, and net charge-offs to average loans held for investment were 0.41% and 0.50% for 2003 and 2002, respectively. |

| |

| (c) | | Excludes one branch office for Community National Bank of Pulaski, Virginia, which TSFG acquired as part of its MountainBank Financial Corporation acquisition. On February 3, 2004, TSFG entered into a definitive asset sale agreement to sell substantially all of Community National Bank’s assets and liabilities. |

16

STATEMENT OF

Financial Responsibility

Management of The South Financial Group, Inc. and subsidiaries is committed to quality customer service, enhanced shareholder value, financial stability, and integrity in all dealings. Management has prepared the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America. The statements include amounts that are based on management’s best estimates and judgments. Other financial information in this report is consistent with the consolidated financial statements.

In meeting its responsibility, management relies on its internal control structure that is supplemented by a program of internal audits. The internal control structure is designed to provide reasonable assurance that financial records are reliable for preparing financial statements and maintaining accountability for assets, and that assets are safeguarded against unauthorized use or disposition.

KPMG LLP, independent auditors, audited TSFG’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America. These standards include a study and evaluation of internal control for the purpose of establishing a basis for reliance thereon relative to the determination of the scope of their audits. KPMG LLP reviews the results of its audit with both management and the Audit Committee of the Board of Directors of TSFG. The consolidated financial statements have not been reviewed, or confirmed for accuracy or relevance, by the Federal Deposit Insurance Corporation.

The Audit Committee, composed entirely of independent directors, meets periodically with management, TSFG’s internal auditors and KPMG LLP (separately and jointly) to discuss audit, financial reporting and related matters. KPMG LLP and the internal auditors have direct access to the Audit Committee.

| | | |

| |  |

| Mack I. Whittle, Jr. | | William S. Hummers III |

President and

Chief Executive Officer | | Executive Vice President and

Chief Financial Officer |

INDEPENDENT AUDITORS’ REPORT

The Board of Directors

The South Financial Group, Inc.:

We have audited, in accordance with auditing standards generally accepted in the United States of America, the consolidated balance sheets of The South Financial Group, Inc. and subsidiaries as of December 31, 2003 and 2002, and the related consolidated statements of income, changes in shareholders’ equity and comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2003 (not presented herein); and in our report dated March 5, 2004, we expressed an unqualified opinion on those consolidated financial statements. Our report refers to the fact that on January 1, 2002 The South Financial Group, Inc. adopted Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets.”

In our opinion, the information set forth in the accompanying condensed consolidated balance sheets and statements of income is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived.

KPMG LLP

Greenville, South Carolina

March 5, 2004

17

17

COMPONENTS OF NONINTEREST

Income and Expenses

($ in thousands)

| | | | | | | | | | | | | |

| | | Years Ended December 31,

|

| | | 2003

| | 2002

| | 2001

|

| NONINTEREST INCOME | | | | | | | | | | | | |

| Service charges on deposit accounts | | $ | 30,856 | | | $ | 23,410 | | | $ | 18,689 | |

| Mortgage banking income | | | 10,481 | | | | 5,144 | | | | 6,370 | |

| Fees for investment services | | | 8,464 | | | | 6,423 | | | | 5,633 | |

| Bank-owned life insurance | | | 8,320 | | | | 7,429 | | | | 7,209 | |

| Merchant processing income | | | 7,214 | | | | 5,908 | | | | 5,799 | |

| Insurance income | | | 3,565 | | | | 1,698 | | | | 1,085 | |

| Gain (loss) on trading and derivative securities | | | 1,843 | | | | (934 | ) | | | 176 | |

| Other | | | 7,690 | | | | 4,442 | | | | 3,751 | |

| | | |

| | | |

| | | |

| |

| Noninterest income, excluding non-operating gains on asset sales | | | 78,433 | | | | 53,520 | | | | 48,712 | |

| Gains on non-operating asset sales, net | | | 17,057 | | | | 6,120 | | | | 4,772 | |

| | | |

| | | |

| | | |

| |

| Total noninterest income | | $ | 95,490 | | | $ | 59,640 | | | $ | 53,484 | |

| | | |

| | | |

| | | |

| |

| NONINTEREST EXPENSES | | | | | | | | | | | | |

| Personnel expense | | $ | 100,778 | | | $ | 75,118 | | | $ | 62,321 | |

| Occupancy | | | 18,925 | | | | 15,238 | | | | 14,269 | |

| Furniture and equipment | | | 17,922 | | | | 15,341 | | | | 13,526 | |

| Amortization of intangibles | | | 3,433 | | | | 1,519 | | | | 5,765 | |

| Other | | | 57,506 | | | | 45,311 | | | | 41,426 | |

| | | |

| | | |

| | | |

| |

| Noninterest expenses, excluding non-operating items | | | 198,564 | | | | 152,527 | | | | 137,307 | |

| | | |

| | | |

| | | |

| |

| Merger-related costs (recoveries) | | | 5,127 | | | | 6,664 | | | | (501 | ) |

| Loss on early extinguishment of debt | | | 2,699 | | | | 354 | | | | 3,106 | |

| Other, non-operating items | | | 780 | | | | 3,295 | | | | 908 | |

| | | |

| | | |

| | | |

| |

| Non-operating noninterest expenses | | | 8,606 | | | | 10,313 | | | | 3,513 | |

| | | |

| | | |

| | | |

| |

| Total noninterest expenses | | $ | 207,170 | | | $ | 162,840 | | | $ | 140,820 | |

| | | |

| | | |

| | | |

| |

FORWARD-LOOKING STATEMENTS

and Non-GAAP Financial Information

This Summary Annual Report contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. These statements include, but are not limited to, factors which may affect earnings, return goals, expected financial results for mergers, market growth and credit quality assessment. However, such performance involves risks and uncertainties, such as market deterioration, that may cause actual results to differ materially from those in such statements. For a discussion of certain factors that may cause such forward-looking statements to differ materially from TSFG’s actual results, see TSFG’s Annual Report on Form 10-K for the year ended December 31, 2003. The South Financial Group undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this report.

This Summary Annual Report also contains financial information determined by methods other than in accordance with Generally Accepted Accounting Principles (“GAAP”). The table provided on page 19 provides reconciliations between GAAP net income and operating earnings. As has been TSFG’s practice, operating earnings adjust GAAP information to exclude the after-tax effect of non-operating items (such as merger-related costs, gain or losses on asset sales, loss on early extinguishment of debt, and other non-operating expenses).

TSFG’s management uses these non-GAAP measures in their analysis of TSFG’s performance and believes presentations of financial measures excluding these non-operating items provide useful supplemental information, a clearer understanding of TSFG’s financial performance, and better reflect its core operating activities. Management uses operating earnings, in particular, to analyze on a consistent basis and over a longer period of time the performance of which it considers to be its core operating activities. TSFG believes the non-GAAP measures enhance investors’ understanding of the company’s business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of others in the financial services industry.

The limitations associated with utilizing operating earnings and cash basis information are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. Management compensates for these limitations by providing detailed reconciliations between GAAP information and operating earnings. These disclosures should not be considered an alternative to GAAP.

18

18

RECONCILIATION OF REPORTED NET INCOME (GAAP)

To Operating Earnings (Non-GAAP)

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended,

| | Year Ended

December 31, |

| | | 3/31/03

| | 6/30/03

| | 9/30/03

| | 12/31/03

| | 2003

|

Net income, as reported (GAAP) | | $ | 20,045 | | | $ | 22,699 | | | $ | 23,893 | | | $ | 28,421 | | | $ | 95,058 | |

Adjustments for non-operating items: | | | | | | | | | | | | | | | | | | | | |

| Gain on available for sale securities | | | (2,861 | ) | | | (3,197 | ) | | | (5,953 | ) | | | (4,445 | ) | | | (16,456 | ) |

| Gain on disposition of assets and liabilities | | | — | | | | (601 | ) | | | — | | | | — | | | | (601 | ) |

| Merger-related costs | | | 1,497 | | | | 382 | | | | 345 | | | | 2,903 | | | | 5,127 | |

| Employment contract payments | | | — | | | | — | | | | — | | | | 512 | | | | 512 | |

| Loss on early extinguishment of debt | | | — | | | | — | | | | 2,699 | | | | — | | | | 2,699 | |

| Impairment loss from write-down of assets | | | — | | | | 268 | | | | — | | | | — | | | | 268 | |

| Related income taxes | | | 437 | | | | 1,007 | | | | 872 | | | | 309 | | | | 2,625 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Operating earnings (non-GAAP) | | $ | 19,118 | | | $ | 20,558 | | | $ | 21,856 | | | $ | 27,700 | | | $ | 89,232 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Average common shares outstanding, diluted | | | 48,257,498 | | | | 47,760,781 | | | | 47,992,601 | | | | 57,229,604 | | | | 50,328,353 | |

Per common share data, diluted: | | | | | | | | | | | | | | | | | | | | |

| Net income, as reported (GAAP) | | $ | 0.42 | | | $ | 0.48 | | | $ | 0.50 | | | $ | 0.50 | | | $ | 1.89 | |

| Operating earnings (non-GAAP) | | | 0.40 | | | | 0.43 | | | | 0.46 | | | | 0.48 | | | | 1.77 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended,

| | Year Ended

December 31, |

| | | 3/31/02

| | 6/30/02

| | 9/30/02

| | 12/31/02

| | 2002

|

Net income, as reported (GAAP) | | $ | 13,107 | | | $ | 15,339 | | | $ | 14,776 | | | $ | 15,936 | | | $ | 59,158 | |

Adjustments for non-operating items: | | | | | | | | | | | | | | | | | | | | |

| Gain on available for sale securities | | | (40 | ) | | | (36 | ) | | | (4,317 | ) | | | (1,727 | ) | | | (6,120 | ) |

| Merger-related costs | | | — | | | | — | | | | 4,465 | | | | 2,199 | | | | 6,664 | |

| Employment contract payments | | | — | | | | — | | | | 1,583 | | | | 263 | | | | 1,846 | |

| Loss on early extinguishment of debt | | | — | | | | — | | | | 354 | | | | — | | | | 354 | |

| Impairment loss from write-down of assets | | | — | | | | — | | | | — | | | | 1,449 | | | | 1,449 | |

| Related income taxes | | | 13 | | | | 12 | | | | (636 | ) | | | (646 | ) | | | (1,257 | ) |

| Cumulative effect of change in acctg. principle, net of tax | | | 1,406 | | | | — | | | | — | | | | — | | | | 1,406 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Operating earnings (non-GAAP) | | $ | 14,486 | | | $ | 15,315 | | | $ | 16,225 | | | $ | 17,474 | | | $ | 63,500 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Average common shares outstanding, diluted | | | 42,059,462 | | | | 41,232,890 | | | | 42,504,741 | | | | 45,032,301 | | | | 42,714,938 | |

Per common share data, diluted: | | | | | | | | | | | | | | | | | | | | |

| Net income, as reported (GAAP) | | $ | 0.31 | | | $ | 0.37 | | | $ | 0.35 | | | $ | 0.35 | | | $ | 1.38 | |

| Operating earnings (non-GAAP) | | | 0.34 | | | | 0.37 | | | | 0.38 | | | | 0.39 | | | | 1.49 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended,

| | Year Ended

December 31, |

| | | 3/31/01

| | 6/30/01

| | 9/30/01

| | 12/31/01

| | 2001

|

Net income, as reported (GAAP) | | $ | 8,632 | | | $ | 9,644 | | | $ | 11,000 | | | $ | 12,616 | | | $ | 41,892 | |

Adjustments for non-operating items: | | | | | | | | | | | | | | | | | | | | |

| Gain on available for sale securities | | | (1,224 | ) | | | (183 | ) | | | (1,151 | ) | | | (1,860 | ) | | | (4,418 | ) |

| Gain (loss) on disposition of assets and liabilities | | | 262 | | | | 970 | | | | 19 | | | | (1,605 | ) | | | (354 | ) |

| Merger-related costs (recoveries) | | | (413 | ) | | | — | | | | (89 | ) | | | 1 | | | | (501 | ) |

| Charitable contribution of premises | | | — | | | | — | | | | — | | | | 665 | | | | 665 | |

| Loss on early extinguishment of debt | | | — | | | | — | | | | 1,093 | | | | 2,013 | | | | 3,106 | |

| Impairment loss (recovery) from write-down of assets | | | 215 | | | | — | | | | 176 | | | | (148 | ) | | | 243 | |

| Related income taxes | | | 400 | | | | (272 | ) | | | (43 | ) | | | 272 | | | | 357 | |

| Cumulative effect of change in acctg. principle, net of tax | | | (282 | ) | | | — | | | | — | | | | — | | | | (282 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Operating earnings (non-GAAP) | | $ | 7,590 | | | $ | 10,159 | | | $ | 11,005 | | | $ | 11,954 | | | $ | 40,708 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Average common shares outstanding, diluted | | | 43,117,270 | | | | 43,179,212 | | | | 43,091,562 | | | | 41,906,297 | | | | 42,823,513 | |

Per common share data, diluted: | | | | | | | | | | | | | | | | | | | | |

| Net income, as reported (GAAP) | | $ | 0.20 | | | $ | 0.22 | | | $ | 0.26 | | | $ | 0.30 | | | $ | 0.98 | |

| Operating earnings (non-GAAP) | | | 0.18 | | | | 0.24 | | | | 0.26 | | | | 0.29 | | | | 0.95 | |

19

19

Focus. Discipline. Execution.

LEADERSHIP

Executive Management

Mack I. Whittle, Jr.

President and Chief Executive Officer

Age: 55 With TSFG since: 1986

Mack I. Whittle, Jr. has served as President/CEO and a Director of The South Financial Group since its inception in 1986. He began his banking career with Bankers Trust of South Carolina where he served in several capacities from 1969 to 1986. Whittle is Chairman of the Board of Trustees for the University of South Carolina and a past President of the South Carolina Bankers Association. He received his undergraduate degree and MBA from the University of South Carolina.

William S. Hummers III

Vice Chairman, Executive Vice President and Chief Financial Officer

Age: 58 With TSFG since: 1988

William S. Hummers III is also a Director of The South Financial Group. His responsibilities include finance, treasury, mergers and acquisitions, regulatory relations and risk management. Hummers held various positions with Southern Bank & Trust, including Controller, from 1972 to 1986 and with First Union (following its acquisition of Southern Bank) from 1986 to 1988. A graduate of the University of South Carolina, Hummers also serves as a Director of World Acceptance Corporation, a consumer finance company.

Andrew B. Cheney

President, Mercantile Bank

Age: 54 With TSFG since: 2000

Andrew B. Cheney is responsible for the Market Presidents (North Florida, Central Florida and Tampa Bay) and Florida operations. During his 27 years with Barnett Bank and Bank of America, he served as President of Barnett affiliate banks, including Jacksonville Market President, and as commercial growth executive for North Florida. A graduate of the University of Florida and the Stonier Graduate School of Banking, Cheney currently serves on the board of the Gator Bowl and is a former Chairman of the Jacksonville Chamber of Commerce.

William P. Crawford, Jr.

Executive Vice President, General Counsel

Age: 41 With TSFG since: 2002

William P. Crawford, Jr. is primarily responsible for SEC-related matters, the legal aspects of M&A and financing activities and supervision of the company’s day-to-day legal activities. From 1989 until 2001, Crawford was a member of Wyche, Burgess, Freeman & Parham, P.A., where he served as the primary counsel for The South Financial Group with responsibility for all of its corporate transactions. From 2001 to 2002, he served as Assistant General Counsel at Bowater Incorporated. Crawford received his law degree from Harvard and graduated from Indiana University with a bachelor’s and a master’s degree in piano performance.

M. Alex Crotzer

Executive Vice President, Director of Corporate Banking

Age: 50 With TSFG since: 2003

M. Alex Crotzer has functional responsibility for the banks’ business relationships and direct responsibility for treasury services, mortgage, international and merchant services. He spent 20 years with Barnett Bank in positions throughout Florida, including Chief Business Banking Executive and President of two Barnett affiliate banks. Crotzer received his undergraduate degree from the University of Florida and MBA from the University of North Florida.

J. W. Davis

President, Carolina First Bank / North Carolina

Age: 57 With TSFG since: 2003

J.W. Davis, also a Director of The South Financial Group, is responsible for the Market President (Mountain) and Western North Carolina operations. In 1997, he founded MountainBank (acquired by TSFG in 2003) and served as its President and Chief Executive Officer. He previously served over 20 years in senior management positions with NationsBank in North Carolina and South Carolina. A graduate of the University of South Carolina and the Graduate School of Banking at LSU, J.W. Davis also serves as a member of the North Carolina Banking Commission.

John C. DuBose

President, CF Technology Services Company

Age: 52 With TSFG since: 1998

John C. DuBose’s responsibilities include developing and delivering superior technology and financial-based products and services for The South Financial Group and its subsidiaries. He is also responsible for financial services (including trust, brokerage and insurance), branch administration and the Sales and Service Center. DuBose was Director of Technology Services at Barnett Bank from 1992 to 1997 and in charge of nationwide service delivery at NationsBank (following its acquisition of Barnett). He graduated from the University of South Carolina.

Mary A. Jeffrey

Executive Vice President, Corporate Director of Human Resources

Age: 53 With TSFG since: 2002

Mary A. Jeffrey’s responsibilities include compensation, benefits, employee relations, talent development, payroll and coordination of all human resources activities for the company. She began her banking career in 1979 with Barnett Bank and NationsBank (following its acquisition of Barnett). A graduate of the University of Central Florida, Jeffrey was Regional Human Resources Manager for Huntington National Bank prior to joining The South Financial Group.

20

20

J. Stanley Ross

Executive Vice President, Finance

Age: 52 With TSFG since: 2001

J. Stanley Ross is responsible for finance, accounting and budgets. Prior to joining The South Financial Group, Ross was a partner with Tatum CFO, where he served as CFO for clients in manufacturing, banking and other service-related industries. His prior executive financial experience also includes the chemical and pharmaceutical industries. Ross holds an undergraduate degree from the University of Georgia and MBA from the University of Southern Mississippi.

Kendall L. Spencer

Executive Vice President, Director of Retail Banking

Age: 51 With TSFG since: 2000

Kendall L. Spencer is responsible for marketing, strategic planning, company-wide sales management and product development. With 24 years in the financial services industry, he served as President of two Barnett Bank affiliate banks and director of professional/executive banking with NationsBank (following its acquisition of Barnett). A graduate of the Stonier Graduate School of Banking, Spencer holds an undergraduate degree from the University of Florida and master’s degree of divinity from Trinity Evangelical Divinity School.

Michael W. Sperry

Executive Vice President, Chief Credit Officer

Age: 58 With TSFG since: 1998

Michael W. Sperry is responsible for the quality of credit risk-taking activities, loan administration, credit administration, special assets and loan operations. Sperry was Chief Credit Officer at Southern National Corporation from 1990 to 1995 and Senior Executive Vice President over commercial lending/corporate banking at BB&T from 1995 to 1997 (following its acquisition of Southern National). In banking since 1965, Sperry also held credit and commercial lending positions at three other financial institutions. A graduate of the Stonier Graduate School of Banking, Sperry earned his undergraduate and MBA degrees from Georgia State University.

James W. Terry, Jr.

President, Carolina First Bank

Age: 56 With TSFG since: 1991

James W. Terry, Jr. is responsible for the Market Presidents (Upstate, Piedmont, Midlands and Coast) and operations in South Carolina and Coastal North Carolina. Terry began his banking career in 1970 and held numerous senior management positions with First Union until joining Carolina First. Terry is Chairman of the Greater Greenville Chamber of Commerce and is a former Chairman for the Greenville United Way. Terry graduated from the University of North Carolina.

MARKET

Presidents

South Carolina

Robert E. Brown

Executive Vice President / Piedmont

Offices: 4 Assets: $157 million

Robert R. DuRant

Executive Vice President / Coastal

Offices: 28 Assets: $1,159 million

F. Justin Strickland

Executive Vice President / Midlands

Offices: 24 Assets: $945 million

C. Fredrick West

Executive Vice President / Upstate

Offices: 25 Assets: $1,086 million

North Carolina

Scott M. Frierson

Executive Vice President / Mountain

Offices: 19 Assets: $646 million

Florida

Bruce W. May

Executive Vice President / Central Florida

Offices: 10 Assets: $459 million

Cynthia S. Stover

Executive Vice President / North Florida

Offices: 6 Assets: $219 million

Douglas Winton

Executive Vice President / Tampa Bay

Offices: 18 Assets: $630 million

21

21

Focus. Discipline. Execution.

LEADERSHIP

Board of Directors

THE SOUTH FINANCIAL GROUP

William P. Brant

Attorney

Brant, Abraham, Reiter

& McCormick, PA.

Chief Executive Officer

Thayendanegea Timber, LLC

Gordon W. Campbell

Vice Chairman

Mercantile Bank

J.W. Davis

President

Carolina First Bank/North Carolina

Judd B. Farr

President

Greenco Beverage Co., Inc.

C. Claymon Grimes, Jr.

Attorney

M. Dexter Hagy

Principal

Vaxa Capital Management, LLC

William S. Hummers III

Vice Chairman and

Executive Vice President

The South Financial Group

Thomas J. Rogers

Secretary — Treasurer

Strand Media, Inc.

H. Earle Russell, Jr., M.D.

Surgeon

Greenville Surgical Associates

Charles B. Schooler, O.D.

Optometrist

Edward J. Sebastian

Retired — Founder, Chairman & CEO Resource Bancshares Mortgage Group,

Inc.

Resource Bancshares Corporation

John C.B. Smith, Jr.

Owner

John C.B. Smith Real Estate

Attorney/Of Counsel

Nexsen Pruet Jacobs & Pollard, LLC

Eugene E. Stone IV

Chief Executive Officer

Stone International, LLC

William R. Timmons, Jr.

Chairman

The South Financial Group

Chairman

Canal Insurance Company

William R. Timmons III

Secretary and Treasurer

Canal Insurance Company

Samuel H. Vickers

Chairman and

Chief Executive Officer

Design Containers, Inc.

David C. Wakefield III

President

Wakefield Enterprises, LLC

Mack I. Whittle, Jr.

President and

Chief Executive Officer

The South Financial Group

CAROLINA FIRST BANK

Mary Rainey Belser

Community Volunteer

Converse College

Board of Trustees

Robin H. Dial

Partner

Dial, Dunlap & Edwards, LLC

Claude M. Epps, Jr.

Attorney

Bellamy, Rutenberg, Copeland,

Epps, Gravely & Bowers, PA.

Judd B. Farr

President

Greenco Beverage Co., Inc.

J. Bryan Floyd*

President

Caro-Strand Corporation

M. Dexter Hagy

Principal

Vaxa Capital Management, LLC

Michael R. Hogan

President

Puckett, Scheetz & Hogan Insurance

Charles B. McElveen

Co-Owner

Swamp Fox Timber Co.

W. Gairy Nichols III

Partner

Dunes Realty, Inc.

Thomas J. Rogers

Secretary — Treasurer

Strand Media, Inc.

H. Earle Russell, Jr., M.D.

Surgeon

Greenville Surgical Associates

John C.B. Smith, Jr.

Owner

John C.B. Smith Real Estate

Attorney/Of Counsel

Nexsen Pruet Jacobs & Pollard, LLC

Andrew Sorensen

President

University of South Carolina

David H. Swinton, Ph.D.

President

Benedict College

James W. Terry, Jr.

President

Carolina First Bank

William R. Timmons, Jr.

Chairman

The South Financial Group

Chairman

Canal Insurance Company

William R. Timmons III

Secretary and Treasurer

Canal Insurance Company

David C. Wakefield III

President

Wakefield Enterprises, LLC

Mack I. Whittle, Jr.

President and

Chief Executive Officer

The South Financial Group

MERCANTILE BANK

William P. Brant

Attorney

Brant, Abraham, Reiter

& McCormick, PA.

Chief Executive Officer

Thayendanegea Timber, LLC

Gordon W. Campbell

Vice Chairman

Mercantile Bank

Michael L. Carrere

Executive Vice President

Lykes Bros., Inc.

Paul D. Causey

President

Causey Fern, Inc.

U.S. Exports, Inc.

Andrew B. Cheney

President

Mercantile Bank

William F. Crider

Retired

Thomas B. Drage, Jr.

Attorney

William S. Hummers III

Vice Chairman and

Executive Vice President

The South Financial Group

Algis Koncius

President

Koncius Enterprises, Ltd.

M. Rodney Metz

Retired/Real Estate Investor

Cecil D. Moore

Moore Foundry & Machine

Louis P Ortiz

Senior Partner

Garcia & Ortiz, P.A.

Joe H. Pickens

Member

Florida House of Representatives

Attorney

Joe H. Pickens, P.A.

Ross E. Roeder

Chairman and

Chief Executive Officer

Smart & Final, Inc.

Michael W. Sperry

Executive Vice President

and Chief Credit Officer

The South Financial Group

William R. Timmons III

Secretary and Treasurer

Canal Insurance Company

Samuel H. Vickers

Chairman and

Chief Executive Officer

Design Containers, Inc.

Mack I. Whittle, Jr.

President and

Chief Executive Officer

The South Financial Group

* Deceased

22

22

LEADERSHIP

Advisory Board Members

ANDERSON, SC

Robert G. Austin, D.M.D.

Philip C. Cahaly

David Eugene Clary

Todd R. Davidson

Daniel J. Fleming, M.D.

Virginia Hinnant

Greg L. Shore

CHARLESTON, SC

Lodema R. Adams

Samuel H. Altman

Martha Ballenger

Henry Berlin

W. Carlyle Blakeney, Jr.

Brian M. Carmody

Joseph P. Griffith, Jr.

Warren F. Lasch

Thomas M. Leland, M.D.

Ernest L. Masters

Dennis E. O’Neill

Thomas J. Parsell

LaVonne N. Phillips

Harold R. Pratt-Thomas, Jr.

Michael C. Robinson

John I. Saalfield

William S. Stuhr, Sr.

Arthur M. Swanson

O. L. Thompson III

CLINTON, SC

Lumus Byrd, Jr.

Robert L. Cason

Joy Gault

Joe J. Gresham

John V. Griffith, Ph.D.

Lykes Henderson, Jr.

Jay J. Peay

COLUMBIA, SC

Donald H. Burkett

T. Moffatt Burriss

William C. Cantey, Jr.

Craig G. Dawson

Charlie W. Devlin, M.D.

Robin H. Dial

D. Christian Goodall

Charles R. Jackson

S. Stanley Juk, Jr., M.D., FACC

Jerry C. Kline

Robert E. Kneece, Jr.

Robert C. Pulliam

John C. B. Smith, Jr.

John P. Sutton, M.D.

James T. Tharp

Susie H. VanHuss, Ph.D.

James H. Walker

CONWAY SC

Larry L. Biddle

Jonathan L. Dieter, Jr., M.D.

J. Charley Ray

Bobby J. Smith

Kenneth Ward

William D. Witherspoon

GEORGETOWN

COUNTY, SC

T. M. Andrews

William S. Duncan

John P. Grimes

William N. Miller III

Charles A. Moore

Mark A. Nash

Louis P. Parsons

Robert B. Plowden, Jr.

Julian A. Reynolds, Jr.

Wright S. Skinner III, M.D.

R. Frank Swinnie, Jr.

John B. Trotter

GREENVILLE, SC

Judith P. Alexander

Glenn E. Batson

Alfred N. Bell, Jr.

Susan J. Bichel

Steven R. Brandt

R. Jack Dill, Sr.

Nathan A. Einstein

C. Douglass Harper

A. Foster McKissick III

Mary Louise Mims

Ruben Montalvo

E. Hays Reynolds III

Porter B. Rose

Morris E. Williams, M.D.

HAYWOOD

COUNTY, NC

Robert Steve Davis

Edward E. Jones

Robert H. Morris

HENDERSON/

BUNCOMBE COUNTY, NC

William A. Banks

Thomas L. Cooper

Ken Feagin

Danny Ford

Boyd L. Hyder

Robert P. Ingle II

J. Edward Jones

Ronald R. Lamb

James F. Miller III

Hiawatha Nicely

W. Leonard Overstreet III

Maurice O. Scott

HILLSBOROUGH

COUNTY, FL

Susan V. Cody

Thomas E. Doozan

P. H. Doyle

David J. Epstein

Jeffrey Greenacre

Theodore Jay Hamilton

Walter D. Harmon

Stephen B. Horton

Perry Jacobsen

Nancy M. Kirk, M.D.

Jefferson C. Knott

Kenneth E. Lane, Jr.

Nicholas Lanese

John Lynch

Van L. McNeel

Patrick Morelli

William R. Potter

John Prahl

Neil J. Rauenhorst

P. N. Risser III

Linda Shattles

Bruce Silverman

John E. Sullivan

James G. Summerall

Leonard Vandermast III

Susan Welsh, D.C.

Jody J. Whitmyer

Millie Woolf

JACKSONVILLE, FL

John G. Harrison III

Ken Kuester

William A. McArthur

A. C. Skinner III

Harvey E. Stringer

Edgar B. Vickers

Mark S. Wood

LAKE CITY, SC

Marlene Askins

Joe F. Boswell

Rev. Matthew C. Brown

William C. Garner, Jr.

Roger K. Kirby

James C. Lynch, Sr.

E. Leroy Nettles, Jr.

William J. Sebnick

MCDOWELL

COUNTY, NC

Lanetta Byrd

James T. Cook

E. L. Cunningham

W. Hill Evans

David Ricketts, Ph.D.

MYRTLE BEACH, SC

Dorothy K. Anderson

James Arakas

J. Carson Benton, Jr.

Cecil Brandon, Jr.

David L. Brittain

D. Richard Crumpler

Calhoun Cunningham, M.D.

A. Shaw Dargan III

William W. DesChamps

John S. Divine IV

Miles M. Herring

Douglas R. Martin

Stephen L. McMillan

Leroy Rainbow

NORTH CAROLINA

COAST

W. James Brandon

Walter R. Conlogue

J. Wright Holman

Ruppert L. Piver

Charles G. Smith IV

Harry W. Stovall III

NORTH STRAND, SC

Jay O. Baldwin III

Martin H. Barrier

John L. Martini, Jr.

Raymond L. Sessions, Jr.

C. Gene Sheppard

Lattie M. Upchurch, Jr.

Terry W. White, Sr.

PASCO COUNTY, FL

Steve Athanassie

Allen S. Crumbley

Gary L. Davis

Patrick I. Epting

David Greene

Roger E. Michels

Lori A. Mowry

G. Michael Stone

Steven M. Strobbe, D.O.

Betty Thorp

PEE DEE, SC

Donald C. Ball

Mark W. Buyck III

N. Bryant Cooper, Jr.

Reaves H. Gasque

Jean C. Leatherman

Robert E. Mottern

James K. O’Kelley

Roy E. Roberts, Jr.

PICKENS COUNTY, SC

Roddey E. Gettys

C. E. Lawton

Joel D. Ledbetter

Thomas O’Hanlan

Phil Owens

Christopher P. Robinson

Mendel Stewart

PIEDMONT, SC (CITY)

Larry Ayers

M. J. Cooper

Norma J. Hedstrom

Max Kennedy

Dawn H. Nappi

Elizabeth G. Pack

T. D. Thomason, D.C.

Jerry M. Yeargin

PIEDMONT

REGION. SC

David G. Anderson

Edwin L. Barnes

William C. Beaty, Jr.

Claude W. Burns III

Fred W. Faircloth III

Jean M. Gaillard

Hugh L. Harrelson, Sr.

Jerry H. Padgett, Ph.D.

Richard S. Powell

Betty Jo Rhea

Elvin F. Walker

PINELLAS

COUNTY, FL

Brian Bunbury

Barbara Capalbo

Frank Carr

Robert J. Carter

Joseph Connell

Kenneth C. Deacon, Jr.

Larry Garuti

C. L. Glasbrenner

John K. Handel

Thomas M. Harris

Raymond P. Hempstead

Theodore C. Henter, Jr.

Harold R. Hildebrandt

Terry Hunt

Kevin M. Hussey

Al Kamavicius

Vincent Lawrence

Doug Linder

James J. LoBianco

John F. Michel, Jr.

William C. Moore

William Newton

Farhod Nikjeh

Madeleine B. Olster

Dennis A. Palso

Emil Pratesi

Jamilou T. Rosenkrans

Keith Rowland

Michael A. Shaluly

Marga Shefman

Randy L. Stowell

Joel R. Tew

John G. Thomas

Michael Wetzel, D.Min.

Richard D. Wilkes, D.V.M.

Jerry Witts

Michael R. Zoller

POLK COUNTY, NC

Stephen H. Brady

Norman D. Brannon

Daryl Kim Talbot

Laurence M. Wassong

RUTHERFORD

COUNTY, NC

John Mark Bennett, M.D.

Terry M. Campbell

H. Lee Harrill

Todd B. Morse

Peter O’Leary

Timothy J. Ridenhour

SOUTH STRAND, SC

Michael J. Arakas

William J. Epperson, M.D.

Albert W. Hitchcock

W. Winston Hoy, Jr.

R. Kirkland McQuiddy

W. Gairy Nichols

Jerry W. Oakley

Dennis G. Permenter

E. J. Servant III

Willie C. Shelley, Jr.

John S. Springs

J. Roddy Swaim

23

23

Focus. Discipline. Execution.

High Performance

MARKETS

The South Financial Group operates in outstanding geographic markets with superior market demographics. The growth rates in our markets exceed the U.S. and Southeast medians for household growth and per capita income growth.

Currently, we rank fourth in total deposit share in South Carolina (a $45 billion deposit market) with a top four position in the three largest markets. In Florida’s significantly larger markets (Tampa Bay approximately $36 billion, Orlando $23 billion and Jacksonville $16 billion), we currently rank tenth or lower in deposit market share. Given our accomplishments in the Carolinas, we see tremendous opportunities in Florida.

Fast Growing

COMMUNITIES

CAROLINA FIRST

www.carolinafirst.com

Carolina First/South Carolina

| | | |

Aiken (2)

Anderson (4)

Andrews

Camden

Chapin

Charleston (4)

Clemson

Clinton (2)

Columbia (8)

Conway

Easley (2)

Edgefield

Florence (2)

Fort Mill

Garden City

Georgetown (2)

Greenville (6)

Greenwood

Greer (2)

Hampstead, NC

Hilton Head (2)

Irmo

Jacksonville, NC (2)

Lake City | | Laurens

Lexington (2)

Litchfield

Little River

Marion

Mauldin

Moncks Corner

Mount Pleasant

Mullins

Murrells Inlet

Myrtle Beach (3)

N. Myrtle Beach (2)

Newberry

Pendleton

Pickens

Piedmont

Rock Hill (3)

Summerville

Surfside Beach

Swansea

Taylors

Travelers Rest

West Columbia

Wilmington, NC (3) |

Carolina First/North Carolina

| | | |

Asheville (2)

Bakersville

Burnsville

Columbus

Fletcher

Forest City

Franklin

Hendersonville (2)

Lake Lure | | Marion

Morganton

Rutherfordton

Spruce Pine

Sylva

Tyron

Waynesville

Weaverville |

Bank CaroLine

www.bankcaroline.com

*Deposit weighted by county based on TSFG deposits in each market

** Includes AL, FL, GA, MS, NC, SC, TN, VA

Note: The regions highlighted are MSAs except for Greater South Charlotte, which is York County (“Rock Hill”), and Hendersonville, which is Henderson County

Source: SNL Financial, Claritas

24

24

MERCANTILE BANK www.bankmercantile.com

| | | |

Florida

Apollo Beach

Brandon (2)

Clearwater

Crescent City

Crystal River

East Palatka

Interlachen

Inverness

Kissimmee (2)

Jacksonville (2)

Largo | | Longwood

New Port Richey

Orlando (3)

Palatka

Port Richey

St. Petersburg (4)

Tampa (5)

Temple Terrace

Tierra Verde

Winter Garden

Winter Park

|

25

25

Focus. Discipline. Execution.

Shareholder

SUMMARY

Dividend Information

Calendar

Dividends have been customarily paid as follows:

Record Dates: January 15, April 15, July 15, and October 15

Payment Dates: February 1, May 1, August 1, and November 1

Quarterly Dividend Rate

Our current quarterly dividend is $.15 per share. The South Financial Group has paid dividends in each quarter since the first quarter of 1994. Cash dividends have increased every year at an average rate of 15%.

Direct Deposit

The South Financial Group offers shareholders the convenience of automatic deposit of dividends into personal bank accounts on the same day dividends are paid. For more information, please contact the Transfer Agent by phone at (800) 368-5948 or by e-mail at info@rtco.com.

Dividend Reinvestment Plan

Shareholders may purchase additional shares of common stock at a 5% discount by reinvesting cash dividends. Participants in the plan may also invest additional cash, up to a maximum of $10,000 per month, for purchase of common stock at market value. For more information, please contact Investor Relations by phone at (800) 951-2699 ext. 54919 or by e-mail at investor@thesouthgroup.com.

Annual Meeting

The Annual Meeting of Shareholders will be held at 10:30 a.m., April 27, 2004 at the Gunter Theatre, Peace Center for the Performing Arts, Greenville, South Carolina.

Stock Listing

The Nasdaq Stock Market

Ticker Symbol: TSFG

Stock Information