Second Quarter 2009

Financial Review

July 22, 2009

Forward-Looking Statements

and Non-GAAP Financial Information

We caution you that this presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including certain plans, expectations, goals, projections, and

statements, which are subject to numerous assumptions, risks, and uncertainties. The use of words such as "anticipates", "estimates", "expects",

“illustrates”, "intends", "plans", and "believes", among others, generally identify forward-looking statements. However, these words are not the

exclusive means of identifying such statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical

or current facts.

Actual results could differ materially from those contained or implied by such statements for a variety of factors including: loan deterioration could be

worse than expected due to a number of factors such as the underlying value of the collateral could prove less valuable than otherwise assumed and

assumed cash flows may be worse than expected; changes in economic conditions; movements in interest rates; competitive pressures on product

pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms, including

existing and potential future restrictions and limitations imposed in connection with the Troubled Asset Relief Program’s voluntary Capital Purchase

Plan or otherwise under the Emergency Economic Stabilization Act of 2008; and the relative success of anticipated capital actions.

Additional factors that could cause results to differ materially from those described above can be found in TSFG’s 2008 Annual Report on Form 10-K,

including in the discussion under "Risk Factors", and documents subsequently filed by TSFG with the Securities and Exchange Commission.

Reference is made to TSFG’s reports filed with the Securities and Exchange Commission for a discussion of factors that may cause such differences to

occur. TSFG undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after today’s

presentation.

This presentation contains certain non-GAAP measures, such as results excluding the impact of certain nonoperating items. TSFG management uses

these non-GAAP, or operating measures, in its analysis of TSFG’s performance. TSFG believes presentations of financial measures excluding the impact

of certain items provide useful supplemental information and better reflect its core operating activities. Management uses operating measures, in

particular, to analyze on a consistent basis and over a longer period of time, the performance of which it considers to be its core operations.

Operating measures adjust GAAP information to exclude the effects of nonoperating items, such as gains or losses on certain asset sales, early

extinguishment of debt, employment contract buyouts, impairment charges, and other nonoperating expenses.

The limitations associated with utilizing operating measures are the risk that persons might disagree as to the appropriateness of items comprising

these measures and different companies might calculate these measures differently. Management compensates for these limitations by providing

detailed reconciliations between GAAP and operating measures. These disclosures should not be considered an alternative to GAAP results. A

reconciliation of GAAP results and non-GAAP measures is provided in the Quarterly Financial Data Supplement on our web site,

www.thesouthgroup.com, in the Investor Relations section under Quarterly Earnings.

2Q09 Financial Overview

Net loss available to common shareholders of $(111.5) million, or $(101.9) million

operating loss

Smaller, more focused balance sheet from sales and reductions of non-core loans

and securities (total assets down $697 million linked-quarter to $12.6 billion)

Period-end core deposit growth of 2.4% linked-quarter (representing growth in each

of the last 3 quarters)

Net interest margin improved by 13 bps linked quarter to 2.96%

Operating noninterest income increased 3.7% linked-quarter, driven primarily by

increases in mortgage banking income

Continued reductions in controllable operating noninterest expenses, although

credit-related costs and FDIC insurance increased

Loan loss reserve increased to 3.11% of total loans

Successful execution of the first phase of our capital plan with a 6/30/09 Tier 1

capital ratio of 12.36% and tangible common equity ratio of 6.07%, or 7.60%

reflecting conversion of the convertible preferred

Period-end common shares increased to 160.2 million due to the issuance of 75

million common shares in June offering (additional 10 million in July from

underwriters’ over-allotment)

Capital Plan: Update

API completed 7/1/09 ($3.1

million); other sales in process

Expect $15 million

Sale of Ancillary Businesses

Completed in June; automatically

converts to common upon

shareholder approval (expected in

3Q09)

$94.5 million

Privately negotiated Mandatory Convertible

Exchange1

Requires shareholder approval

referenced above

Expect $95.5 million

Public Tender for Mandatory Convertible

Exchange2

Requires shareholder approval

referenced above

Expect $20 - $30

million

Exchange Common for Hybrid Securities2

$75 million completed in June and

$10 million in July (underwriters’

over-allotment)

$85 million gross

proceeds

Common Equity Issuance

Tier 1 Common

Impact

Status/Timing

Description

1

2

3

1 Participants received contingent mandatorily convertible preferred shares that automatically convert, subject to certain limitations, into 24 million shares of common stock upon shareholder approval of common shares issued upon conversion and an increase in authorized shares (shareholder meeting expected to be held 3Q09)

² Subject to shareholder approval to increase authorized shares

4

5

Additional Capital Actions

Moved $150 million to Carolina First Bank to bolster bank-level capital ratios

Preferred dividend savings of approximately $35 million on mandatory convertible exchanges

Reduction in non-core loans and securities of approximately $700 million during 2Q09; estimated

Tier 1 Common benefit (using SCAP 4% requirement) of more than $20 million

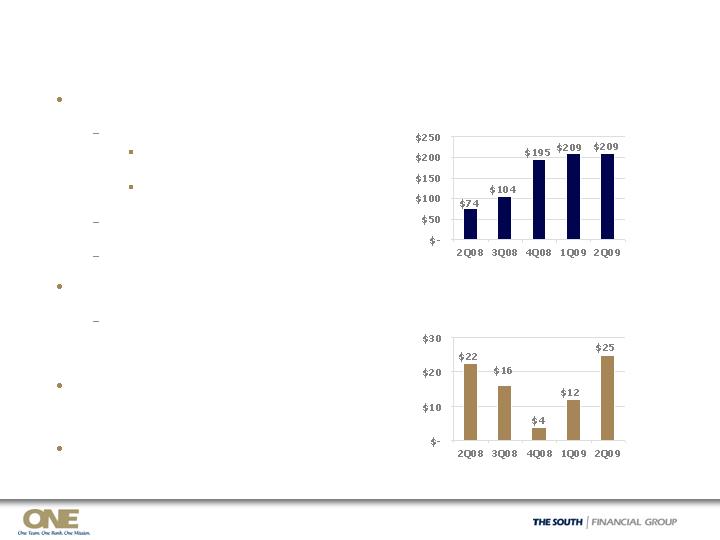

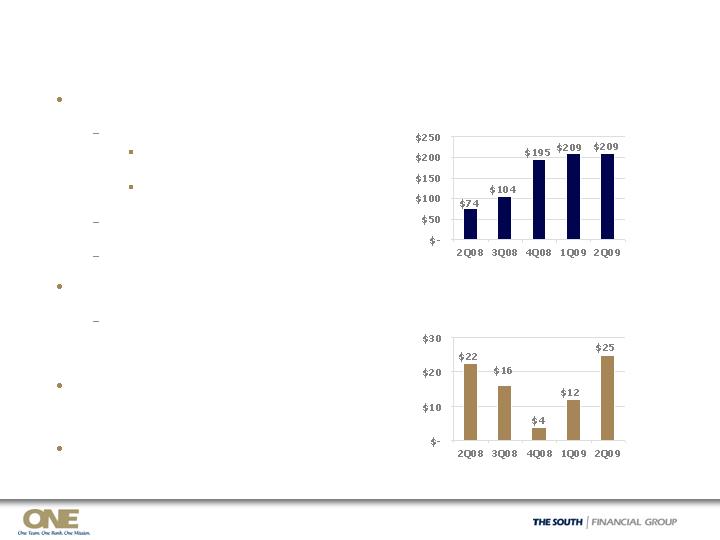

Asset Quality Overview

6/30/09 NPAs of $560.7 million, a $47.8

million increase linked-quarter

Commercial NALs:

Declined approximately $50

million in FL

Increased by $98 million in SC

and NC as expected

Lot loans and consumer NALs

declined for the 2nd quarter in a row

OREO up by $20 million

2Q09 NCOs $120.6 million, or 4.91% of

average loans annualized

2Q09 proceeds from problem loan

sales of $25 million (vs. $12 million

for 1Q09)

2Q09 provision of $131.3 million; loan

loss reserve increased to 3.11% at

6/30/09

Proactive revaluation of OREO carrying

values to reflect market declines

Gross Nonaccrual Loan Inflows

$ in millions

Proceeds from Problem Loan Sales

$ in millions

Loan and Credit Quality Composition

2.22%

$76.1

3.43%

$349

$10,192

12/31/08

1.16%

1.99%

1.86%

1.28%

4.64%

2.01%

3.54%

2.71%

4.68%

0.88%

0.91%

1.37%

30-Day

Past

Due %

$229.7

2.2

37.5

7.7

8.0

85.1

16.4

28.6

5.2

$39.0

YTD Net

Charge-

Offs

$109.1

4.24%

$423

$9,987

3/31/09

$75.4

$120.6

0.9

11.2

4.5

3.1

52.5

14.4

15.2

1.8

$17.0

QTD Net

Charge-

Offs

2.31%

$238

$10,300

9/30/08

4.99%

$465

100%

$9,306

Total Loans HFI

9.68%

49

6%

505

Mortgage1

0.23%

1

3%

286

Indirect – sales finance

0.61%

5

9%

811

Home equity

0.09%

16.55%

6.95%

3.64%

1.84%

3.15%

NAL %

of O/S

Balance

78

23%

2,135

Completed income

property

40

6%

585

Commercial

development

87

1,153

1,315

$ 2,429

O/S

Balance

1%

12%

14%

26%

% of

O/S

Balance

--

Other1

24

Owner-occupied CRE

$77

C&I

191

Residential construction

Nonaccrual

Loans HFI

As of June 30, 2009, $ in millions

HFI = Held for Investment; 30-day past due % of outstanding balance excludes nonaccrual loans. Commercial Development includes Commercial A&D

and Commercial Construction. Residential Construction includes Residential A&D, Residential Construction, Residential Condo, and Undeveloped Land.

1 Mortgage includes Consumer Lot Loans of $178 million. Other includes Direct Retail and Unsecured Lines.

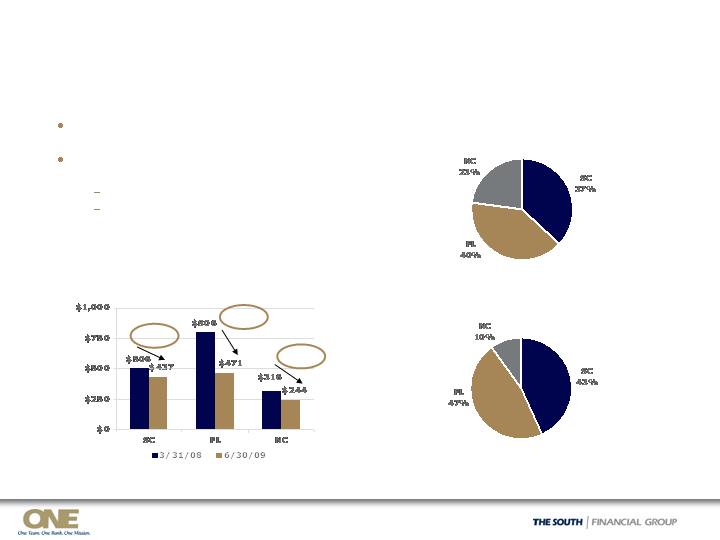

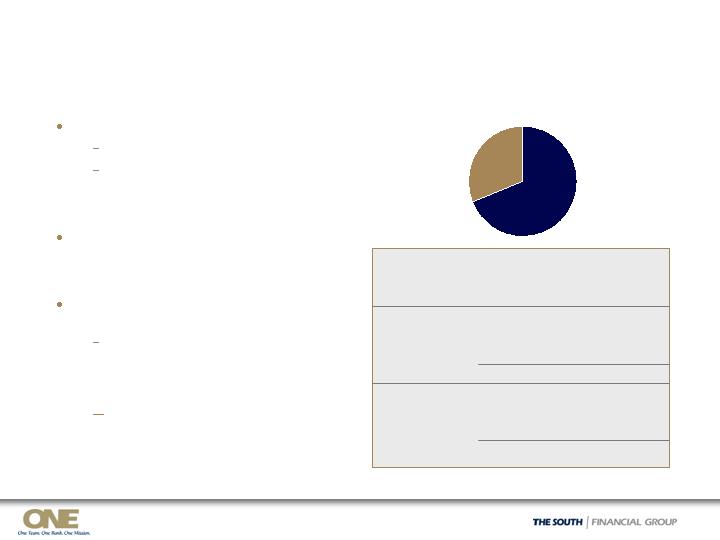

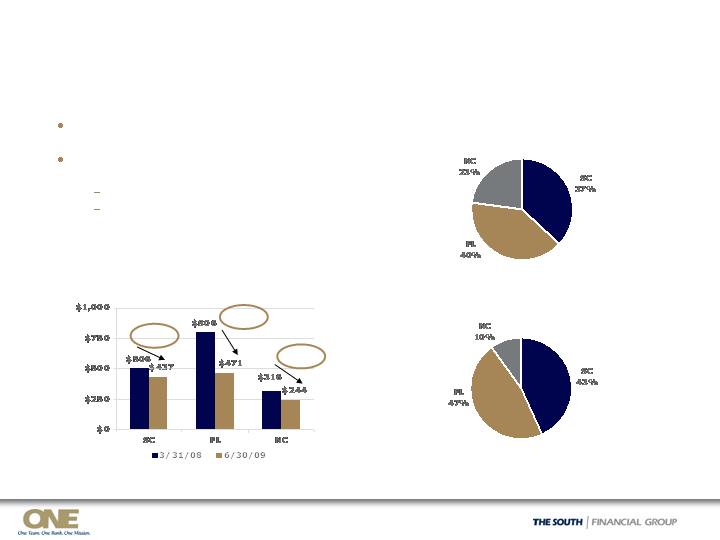

Residential Construction

BY GEOGRAPHY:

Outstanding

Performing Loans1

Nonaccrual Loans

Decline in Outstanding Balance

$ in millions

1 Reflects outstanding loan balances net of nonaccrual loans

Reduced $476 million, or 29%, since 3/31/08

Nonaccrual loans increased 5% linked-quarter

($10 million)

FL down $42 million

Coastal SC up $44 million

As of June 30, 2009

- 14%

- 42%

- 23%

$962 million

$191 million

Mortgage Banking Portfolio

NALs decrease of $4 million

linked-quarter; second

consecutive qtr of declines

Decline in Lot Loan charge-

offs as nearing end of

“cleanup” in 4 developments

where originations departed

from product model

Reduced balances in Lot Loans

and Construction Perm by

$209 million (49%) since Y/E

2007

Mortgage restructured loans

of $10.6 million (excluded

from NALs) from working with

borrowers to do loan

modifications

$ in millions

1 SIVA = Stated Income Verified Assets

$ 3.5

$ 10.2

21.90%

0.00%

2.60%

$ 47.4

$ 17.1

$ 21.8

11.00%

0.16%

5.95%

$198.0

$ 5.6

$ 20.9

7.25%

0.51%

8.67%

$289.3

1Q09

$ 12.6

$ 12.8

$ 10.0

NAL $

$ 15.2

$ 29.9

$ 20.8

NAL $

$ 8.3

$ 16.3

$ 18.0

NAL $

$ 1.0

20.02%

0.00%

5.22%

$ 64.0

$ 8.9

13.20%

1.84%

6.34%

$225.5

$ 1.8

5.59%

3.41%

7.90%

$290.7

4Q08

Construction Perm:

$ 78.8

$ 38.2

Balance

1.70%

4.07%

30-89 DPD

0.00%

0.00%

90+ DPD

15.98%

26.17%

NAL %

$ 2.2

$ 1.7

NCO $

Lot Loans:

$249.1

$178.2

Balance

3.84%

4.86%

30-89 DPD

2.34%

0.27%

90+ DPD

6.12%

11.68%

NAL %

$ 0.9

$ 6.5

NCO $

SIVA1Alt-A:

$ 2.0

$ 3.1

NCO $

2.94%

6.26%

NAL %

2.21%

2.73%

90+ DPD

1.89%

1.68%

30-89 DPD

$282.3

$288.4

Balance

3Q08

2Q09

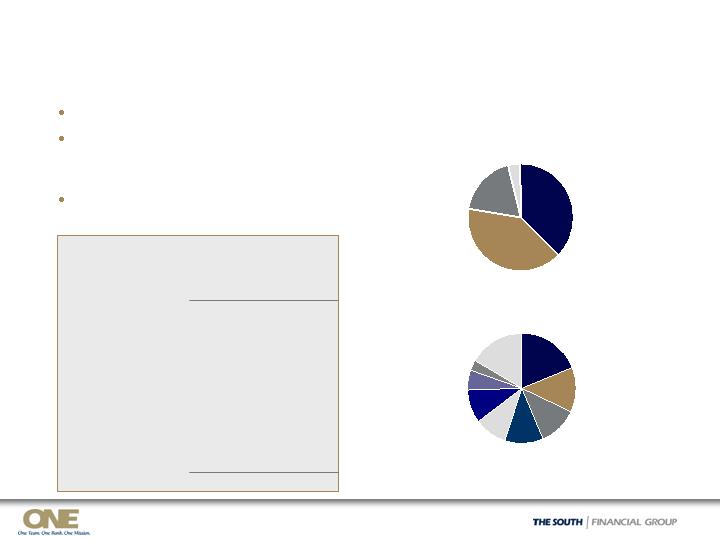

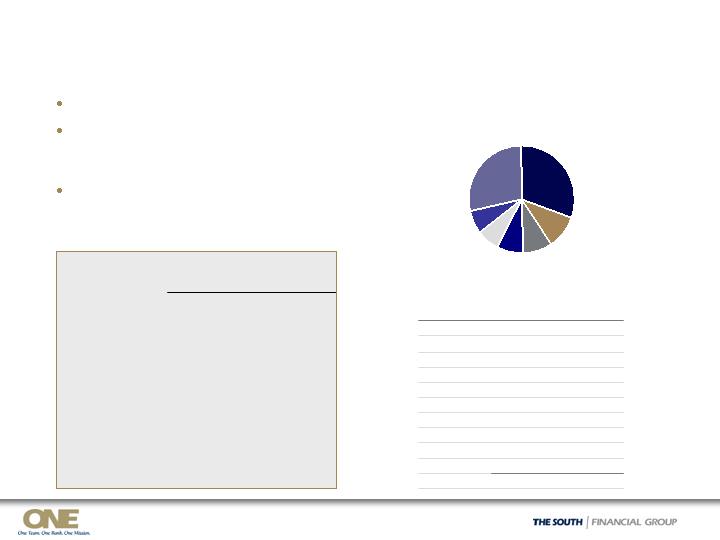

Completed Income Property Portfolio

SC, $795

37%

FL, $862

40%

NC, $395

19%

As of June 30, 2009

Well-diversified by property type

Granular exposures, with average loan

size of $0.5 million; weighted average

time to maturity of 37.8 months

Some performance weakening due to

economic conditions

Other, $83

4%

0.3%

0.4

Office

3.1%

11.2

Other

2.1%

1.4

Medical

1.3%

5.1

Retail

3.6%

2.9%

4.1%

4.6%

6.3%

7.4%

NAL %

of O/S

Balance

$77.7

Total

8.0

Mixed Use

8.8

Industrial

11.2

Hotel

12.9

Residential 1-4 fam.

$18.7

Multi-Family

NALs

Residential

$204, 9%

Retail

$398, 19%

Mixed Use

$275, 13%

By Property Type

Total $2,135 million, or 23% of loans

By Geography

Multi-Family

$251, 12%

Hotel

$243, 11%

Industrial

$213, 10%

Office

$127, 6%

Other

$357, 17%

Medical

$67, 3%

Nonaccrual Loans

By Property Type

$ in millions

Shared National Credits

Plan to reduce non-core SNCs

Exiting deals when restructured

Amendments to reduce

commitments and improve

credit dynamics

In 2Q09, liquidated or entered into

contracts to sell approximately $90

million for a loss of $4.4 million

Lead agent banks based on # of

commitments

Top 3:

Bank of America, 37%

Wachovia, 28%

JPMorgan, 5%

TSFG is not lead agent on any

SNCs

1 Excludes approximately $25 million in loans held for sale at June 30, 2009, subsequently liquidated in July

Committed:

Outstanding:1

SNCs, Period-End

$1,233

982

$251

$722

601

$121

1Q09

$(128)

$1,105

Total

(128)

854

Non-core

$ --

$251

Core

$(123)

$599

Total

(121)

480

Non-core

$ (2)

$119

Core

$

Change

2Q09

SNCs Outstanding, $599 million1

By Category

As of June 30, 2009, $ in millions

C&I, $412

69%

CRE, $187

31%

Other Real Estate Owned

OREO, $93.9 million1

By Geography

As of June 30, 2009

2Q09 losses on OREO of $12.9 million

In 2Q09, sold $12.4 million with losses

on sale of $2.7 million

$1.8 million of the losses were on

one residential subdivision valued

and foreclosed 12 months ago

In view of market changes, proactively

revalued OREO older than 12 months

and also changed policy to 70% of

appraised value vs. previous 80%

Resulted in $10.2 million loss in

OREO write-downs during 2Q09

(12)

(3)

(8)

- OREO sales

OREO Flows

44

32

27

+ Additions

(10)

--

--

- Write downs

$94

$74

$45

Ending balance

$26

4Q08

$74

$45

Beginning balance

2Q09

1Q09

# of Months in OREO

FL, 50%

NC, 30%

SC, 18%

Other, 2%

0-3 mos,

41%

Note: Numbers may not add due to rounding 1 Based on $ balances in OREO; geography reflects property zip code

3-6 mos,

27%

6-9 mos, 18%

9-12 mos, 6%

>12 mos,

8%

$ in millions

2Q09 Operating Results

$(1.08)

$(1.12)

Per diluted share1

OREO reappraisals/policy change to write properties

down to 70% of appraised value; loss on sale of loans

2.0

22.4

OREO/LHFS losses

Exceeded NCOs by $10.7 million; allowance at 3.11%

142.6

131.3

Provision for credit losses

$14 million for the value of common shares issued as

inducement for early conversion (vs. $6.5 million 1Q09)

16.4

21.8

Preferred stock dividends and

other

40%

39%

Effective tax rate

91.0

$(101.9)

(130.5)

0.8

23.2

90.4

27.7

$85.9

2Q09

22.1

Pre-tax, pre-provision operating

income1

24.1

Pre-tax, pre-credit operating

income1

Issuance of 75 million shares on June 24, 2009

82.2

Weighted avg. shares

(120.5)

Pre-tax operating loss1

$(88.6)

Operating loss available to

common shareholders1

$4.2 million increase from loan collection and foreclosed

asset/FDIC insurance; all other down $1.4 million

87.6

Operating noninterest expenses,

excluding OREO/LHFS losses1

Higher mortgage banking income

26.7

Operating noninterest income1

$85.0

1Q09

2Q09 NIM increased 13 bp to 2.96%

Net interest income

Comments

1 Excludes non-operating items. Net loss available to common shareholders totaled $(111.5) million for 2Q09 and $(90.8) million for 1Q09. Net loss per

diluted share totaled $(1.23) for 2Q09 and $(1.10) for 1Q09. See slide 23 for non-operating items. Reconciliations of GAAP to non-GAAP measures

are provided on page 15 of the Quarterly Financial Data Supplement for 2Q09 available in the Investor Relations section of TSFG’s web site,

www.thesouthgroup.com.

In millions, except per share data

2Q09 – Unusual Items

X

(9.5)

Loss on nonmortgage loans HFS ($4.4 for SNC sales, $0.5 gain for

indirect loan sale, and $5.5 on write down and transfer of 1 loan to

OREO)

X

(2.5)

Goodwill impairment related to non-banking subsidiaries

X

(0.8)

Severance charges, including amounts for 72 FTEs to be eliminated

effective 3Q09 (notified in June)

X

(5.7)

FDIC special assessment

X

(17.4)

Impairment of long-lived assets (corporate campus $15.9,

branch/office closings $0.9, airplane $0.6)

X

3.0

Net gain on extinguishment of debt ($8.3 gain on repurchase of

REIT preferred stock; $5.4 loss on early repo termination)

Included in:

(14.0)

$(12.9)

$ 4.6

Pre-Tax

Amount

Inducement for early conversion of preferred stock, compared to

$6.5 million in 1Q09 (EPS purposes only; no capital impact)

Non-Operating Items:

Operating Items:

X

Loss on OREO, including policy change to write down all OREO to

70% of appraised value

X

Noninterest

Income

Noninterest

Expenses

Gain on securities, net of other than temporary impairment of $0.8

$ in millions

OREO = Other Real Estate Owned; HFS = Held for Sale; SNC = Shared National Credits

Capital Position

7.43%

5.31%

5.64%

Tier 1 common to risk-weighted

assets

11.93%

9.81%

9.30%

TCE plus reserves to risk-

weighted assets

8.79%

11.75%

10.10%

10.55%

13.53%

12.10%

6.05%

3/31/09

Actual

10.37%

13.74%

12.45%

7.88%

6/30/09

Pro Forma2

5%

10%

6%

5%

10%

6%

Well

Capitalized

Minimum

9.17%

12.55%

11.01%

10.30%

13.65%

12.36%

6.07%

6/30/09

Actual1

Total risk-based

Leverage

CAROLINA FIRST BANK

Tier 1 risk-based

Total risk-based

Leverage

Tier 1 risk-based

Tangible common equity (TCE) to

tangible assets

THE SOUTH FINANCIAL GROUP

$ in millions

1 Estimated

2 Reflects the issuance of 10 million common shares from underwriters’ over-allotment (net proceeds of $9.45 million), conversion of

Series 2009 preferred into 24 million common shares ($94.5 million), conversion of remaining $95.5 million of Series 2008 Preferred

into common, and exchange of $25 million of hybrid capital instruments into common

Smaller, More Focused Balance Sheet

$1,014

$13,602

$13,285

$12,588

Total assets

$3,750

1,280

2,130

2,685

$7,507

4Q08

(765)

2,455

1,920

Total non-core loans HFI

(180)

2,124

1,950

Securities

$(555)

$3,730

$3,195

Wholesale borrowings

52

1,174

1,332

Other

$(121)

Change

vs. YE ‘08

$7,532

1Q09

$7,386

Total core loans HFI

2Q09

$ in millions

Period-End Assets

2Q09 Reductions of Non-Core Assets

Approximately $25 million in HFS at 6/30/09

for transactions that closed in July

$(4.4) million

$90 million

Non-core loans – Liquidation of

Shared National Credits

Closed in June

$0.5 million

$230 million

Non-core loans – Sale of indirect

auto loans

$5.4 million

Gain/(loss)

Terminated $75 million in long-term

repurchase agreements (4.3% rate) for a

loss of $5.4 million

$120 million

Securities – Government agencies

(3.6% yield)

Approx.

Amount

Comments

Description

Net Interest Income and Margin

Repricing Opportunity – Customer CDs

2.28%

236

1Q10

3.54%

904

Beyond 1Q10

3.15%

660

4Q09

3.37%

1,171

3Q09

Avg.

Yield

%

Balance

$

Maturing in

Continued Growth in Core Deposits1

$ in billions

+2.4

+2.8

+1.8

-10.5

-1.3

% LQ

Growth

0.02

--

Sale of securities

0.06

2.0

Change in wholesale

funding rate and volume;

other

0.08

2.5

Change in customer

funding rate and volume

0.02

0.6

Decrease in nonaccrual

loan interest reversals

--

0.7

1 add’l day in quarter

--

(3.6)

Lower earning assets

(0.05)

(1.4)

Increase in nonperforming

assets and charge-offs

2.96%

$87.0

2ndQUARTER 2009

Estimated impact from:

$86.2

Net

Interest

Income

(FTE)

2.83%

1stQUARTER 2009

Net

Interest

Margin

$ in millions

NIM Roll forward

1 Core deposits equal total deposits less both brokered deposits and time deposits

Wholesale Borrowings

By Maturity

$4,033

$3,195

$2,015

$1,180

Total wholesale

borrowings

--

2,057

948

1,109

Brokered CDs

293

762

703

59

FHLB advances

239

125

--

$ --

> 1 year

239

125

12

$ --

Total

--

1,011

2,729

$ --*

Unused

Secured

capacity

--

Repurchase

agreements

12

$ --

1 year or

less

Other

Fed Reserve and

T,T&L

Fed funds purchased

As of June 30, 2009, $ in millions

$3.9 billion

at 3/31/09

Strong parent company

liquidity position

Parent company cash of

$105 million at 6/30/09

No debt maturities until

2033

Cash sufficient to satisfy

dividend requirements

through early 2012

subject to further

subsidiary bank capital

support as needed

Parent Company Liquidity

*Excludes $150 million in excess cash at Federal Reserve at June 30, 2009

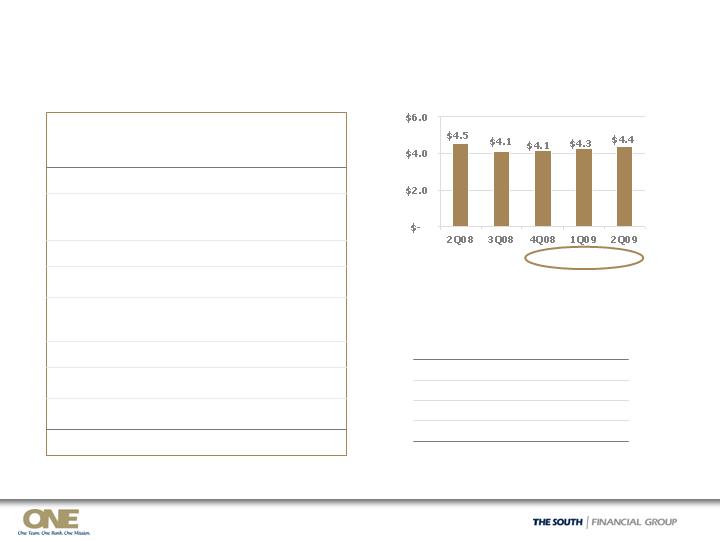

Operating Noninterest Income

0.2

0.8

1.8

1.2

2.0

Mortgage banking income

$ Change

$1.0

0.4

--

0.1

0.2

(1.1)

$0.6

2Q09 vs.

1Q09

(0.1)

0.8

0.6

0.8

Merchant processing income, net

$27.7

2.7

1.1

2.6

5.5

$13.0

2Q09

0.9

0.2

1.1

Gain/(loss) on certain derivative

activities

(0.3)

2.9

2.5

Bank-owned life insurance

(1.6)

7.1

6.6

Wealth management income

(0.3)

3.0

2.3

Other

$(2.6)

$30.3

$26.7

Operating noninterest income1

$(1.4)

2Q09 vs.

2Q08

$14.4

2Q08

$12.4

1Q09

Customer fee income

$ in millions

Mortgage banking income drove the increase for 2Q09; benefited from recent mortgage

leadership changes and higher mortgage loan originations (up 68% linked-quarter)

Customer fee, wealth management, and mortgage banking income comprise approximately 75%

of operating noninterest income

1 Excludes non-operating items. Total noninterest income was $32.3 million for 2Q09, $23.7 million for 1Q09, and $32.2 million for 2Q08. See slide 23

for non-operating items. Reconciliations of GAAP to non-GAAP measures are provided on page 15 of the Quarterly Financial Data Supplement for 2Q09

available in the Investor Relations section of TSFG’s web site, www.thesouthgroup.com.

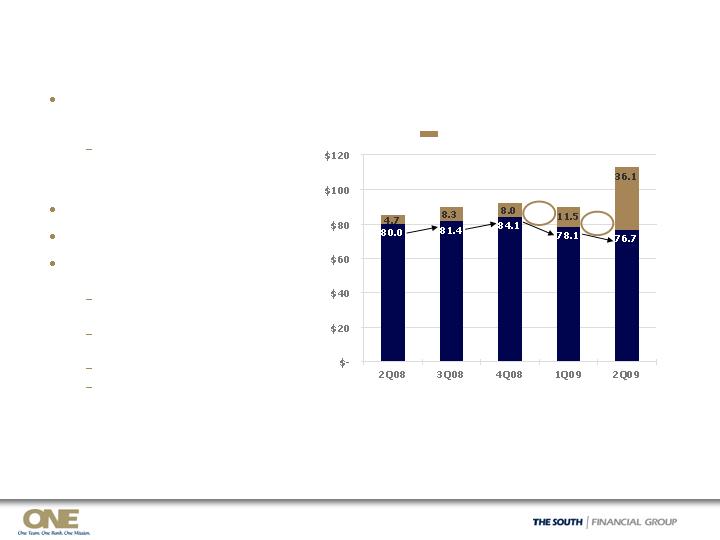

- $6.0

Staff reductions; 95 FTE

reductions in 3Q09, including 23

FTEs associated with API

With 3Q09 reductions,

down 10% since Y/E 2008

and below Y/E 2004 level

No merit pay increases

Project NOW efficiencies

Took additional actions to

reduce cost base:

Market corporate campus for

sale

Closed 3 branch/2 other

office locations 2Q09

Sale of corporate airplane

Sale of retirement plan

administration business (API)

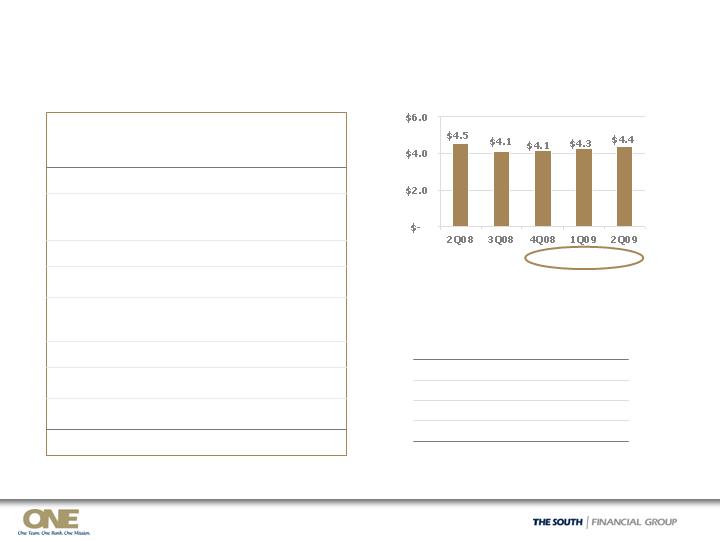

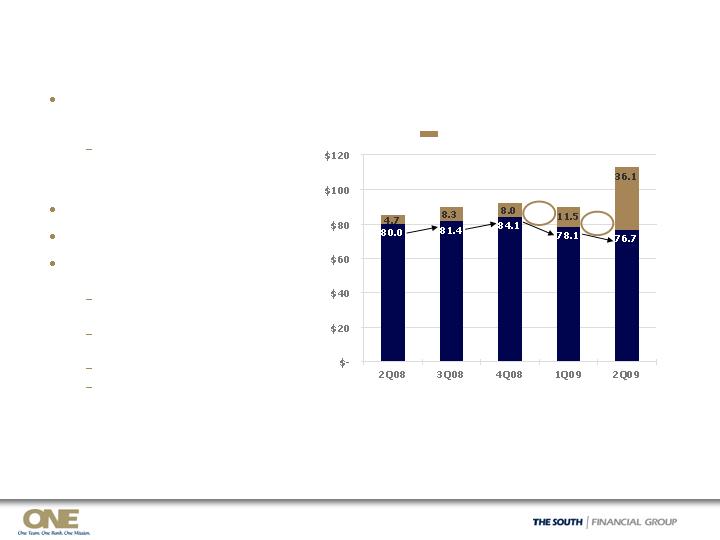

Credit-related costs2 and FDIC insurance

Noninterest Expense Control

1 Excludes non-operating items. Total noninterest expenses were $87.6 million for 2Q08, $94.2 million for 3Q08, $342.1 million for 4Q08, $90.2 million

for 1Q09, and $136.2 million for 2Q09. See slide 24 in the Appendix for reconciliations of GAAP to non-GAAP measures.

2 Credit–related costs include loan and foreclosed asset expense, loss on nonmortgage loans held for sale, and gain/loss on OREO.

$112.8

$84.7

$89.7

$92.1

$ in millions

Operating Noninterest Expenses1

$89.6

+$1.4

2,250

Pro Forma with Eliminations Effective 3Q09

2,572

2,535

2,505

2,430

2,345

# Employees (FTEs):

+$2.7

- $1.4

Expectations for 2009

Operating environment and results will remain challenging for remainder of 2009

Credit losses remain elevated in third quarter and begin to decline slowly; provisioning

depends on continuing economic developments

Potential expansion of margin due to pricing initiatives on both the loan and deposit side,

partially offset by lower indirect loans and overall credit impact

Net interest income will be impacted by non-core loan reductions

Continued expense headwinds from loan collection costs and FDIC insurance

Positive impact from Project NOW and other expense initiatives

Increase in weighted average shares outstanding to reflect Capital Plan actions

Continue to evaluate the realizability of the net deferred tax asset throughout 2009 for both

book and regulatory purposes

Run-off of non-core loan portfolio, partially offset by growth in lending to core customers;

similar to 1Q09 non-core run-off levels per quarter over remainder of 2009

Potential for FDIC transactions with appropriate loss-sharing arrangements if market overlap;

promotes efficiency and improves customer funding

Focus on cross sell, customer satisfaction, and other measures that support our strategic

positioning

2Q09 Execution of Strategic Actions

Strengthened capital position; raised $85 million in new common equity

Capital Plan well underway to fortify balance sheet with Tier 1 common

Capital

Reduced residential construction, lot loan, SNC, and indirect auto exposures

Increased loan loss reserve to 3.11% at 6/30/09

Continued recognition of loan and OREO losses (cycle-to-date NCOs $453 million)

Reduced controllable operating expenses

Reduced FTEs to 2,345 at 6/30/09; with add’l 95 3Q09, down 10% since Y/E ‘08

Closed 5 branches/offices, corporate campus for sale, airplane sale, API sale

Defined “who we are,” “how we compete,” and “how we measure success”

Strong management team in place; aligned management goals to strategy

Improved net interest margin to 2.96%, up 13 bps linked-quarter

Period-end core deposit growth, up 5% ($217 million) since Y/E ‘08

Credit

Vision

Balance Sheet

Management

Net Interest

Margin

Noninterest

Expense

Noninterest

Income

Reduced exposure to non-core loan categories by $534 million ($1.9 billion)

Reduced total assets by $697 million ($12.6 billion)

Strengthened liquidity – no overnight borrowings at 6/30/09

New leadership in mortgage drove 4% linked-quarter noninterest income

increase; mortgage originations up 68% linked-quarter

2Q09 Non-Operating Items

0.1

0.1

3.0

(Gain) loss on early extinguishment of debt

(2.3)

--

(0.8)

Employment contracts and severance

--

--

(2.5)

Goodwill impairment

--

--

(5.7)

FDIC special assessment

--

--

(17.4)

Impairment of long-lived assets

Non-operating noninterest expenses:

Non-operating noninterest income:

$(1.10)

$(90.8)

$(124.1)

--

(0.7)

(3.0)

$(120.5)

1Q09

--

--

Loss on repurchase of auction rate securities

$(0.23)

$(16.8)

$(19.0)

(0.7)

1.9

$(17.9)

2Q08

$(111.5)

Net loss (GAAP) available to common shareholders

$(149.3)

Pre-tax loss (GAAP)

$(130.5)

Pre-tax operating loss

--

Branch acquisition and conversion costs

$(1.23)

Per diluted share

4.6

2Q09

Gain (loss) on securities

Reconciliations of GAAP to non-GAAP measures are provided on page 15 of the Quarterly Financial Data Supplement for 1Q09

available in the Investor Relations section of TSFG’s web site, www.thesouthgroup.com.

$ in millions, except per share data

Reconciliations of GAAP to Non-GAAP Measures

$90.2

0.7

--

--

(0.1)

--

--

--

--

$89.6

1Q09

$87.6

--

--

0.7

(0.1)

2.3

--

--

--

$84.7

2Q08

$94.2

--

--

--

(0.1)

4.6

--

--

--

$89.7

3Q08

$342.1

--

1.1

--

1.7

9.6

237.6

--

--

$92.1

4Q08

$136.2

--

--

--

(3.0)

0.8

2.5

5.7

17.4

$112.8

2Q09

(Gain) loss on early extinguishment of debt

FDIC special assessment

Impairment of long-lived assets

Branch acquisition and conversion cost

Loss on derivative collateral

Employment contracts and severance

Goodwill impairment

Loss on repurchase of auction rate securities

Noninterest Expense:

Total noninterest expense

Operating noninterest expense

$ in millions

Credit Quality Trends - Commercial

4.99%

$32.6

14.65%

$181

$1,235

1Q09

4.93%

$24.5

11.24%

$142

$1,263

4Q08

1.50%

$1.9

8.17%

$49

$606

1Q09

1.45%

$2.6

4.85%

$29

$608

4Q08

1.32%

$13.4

3.24%

$72

$2,202

1Q09

1.32%

$10.3

2.67%

$59

$2,203

4Q08

0.69%

$3.4

1.50%

$19

$1,285

1Q09

1.19%

$1.8

1.17%

$15

$1,271

4Q08

1.23%

$22.1

1.58%

$42

$2,646

1Q09

1.01%

$17.6

1.32%

$36

$2,723

4Q08

2Q09

2Q09

2Q09

2Q09

2Q09

16.55%

6.95%

3.64%

1.84%

3.15%

NAL % of

O/S

Balance

$52.5

$14.4

$15.2

$1.8

$17.0

QTD Net

Charge-offs

2.71%

4.68%

0.88%

0.91%

1.37%

30-day past

due %

$78

$2,135

Completed income

$40

$585

Commercial development

$1,153

$1,315

$ 2,429

Outstanding

Balance

$24

Owner-occupied CRE

$77

C&I

$191

Residential construction

Nonaccrual

Loans HFI

$ in millions

HFI = Held for Investment; 30-day past due % of outstanding balance excludes nonaccrual loans.

Credit Quality Trends - Consumer

1.28%

$0.9

0.09%

$ --

$87

2Q09

Other2

1.50%

$1.4

0.16%

$ --

$91

1Q09

7.44%

$26.3

9.90%

$53

$535

1Q09

9.46%

$11.7

10.17%

$59

$580

4Q08

0.90%

$3.2

0.77%

$6

$813

1Q09

1.42%

$2.4

1.01%

$8

$813

4Q08

1.62%

$4.8

0.09%

$1

$574

1Q09

2.21%

$5.0

0.11%

$1

$636

4Q08

4Q08

2Q09

2Q09

2Q09

4.64%

$11.2

9.68%

$49

$505

Mortgage2

3.54%

$3.1

0.23%

$1

$286

Indirect–sales finance1

2.01%

$4.5

0.61%

$5

$811

Home equity

0.26%

NAL % of

O/S

Balance

$0.4

QTD Net

Charge-offs

3.04%

30-day

past due %

$95

Outstanding

Balance

$ --

Nonaccrual

Loans HFI

$ in millions

HFI = Held for Investment; 30-day past due % of outstanding balance excludes nonaccrual loans.

1 Sold approximately $230 million in June 2009

2 Mortgage includes Consumer Lot Loans. Other includes Direct Retail and Unsecured Lines.

Residential Construction by Geography

$85.1

$13.0

$10.4

$61.7

4.1

7.6

17.3

$32.7

YTD Net

Charge-

Offs

4.99%

$32.6

14.65%

$181

$1,235

3/31/09

4.93%

$24.5

11.24%

$142

$1,263

12/31/08

1.33%

$9.6

18.76%

$82

38%

$437

Total SC, 6/30/09

4.19%

$3.4

6.20%

$28

37%

$450

3/31/09

3.09%

$6.7

8.20%

$21

21%

$264

3/31/09

3.49%

$39.2

19.17%

$90

41%

$472

Total FL, 6/30/09

6.63%

$22.5

25.20%

$132

42%

$521

3/31/09

2.71%

$52.5

16.55%

$191

100%

$1,153

Overall Total,

6/30/09

1.76%

$44.6

9.03%

$127

$1,410

9/30/08

3.67%

$3.7

7.57%

$19

21%

$244

Total NC, 6/30/09

22.87%

30.71%

9.92%

22.24%

NAL %

of O/S

Balance

4.1

4.3

9.4

$21.4

QTD Net

Charge-

offs

1.22%

5.38%

3.31%

4.09%

30-day

past due

%

15

13%

153

FL residential A&D

14

4%

44

FL residential

construction

78

$197

O/S

Balance

7%

17%

% of

Resid.

Constr.

18

FL residential condo

$44

FL undeveloped land

FL Residential Construction:

Nonaccrual

Loans HFI

As of June 30, 2009, $ in millions

30-day past due % of outstanding balance excludes nonaccrual loans; see slide 28 for detail for NC and SC

Residential Construction by Geography

$3.4

$9.6

4.4

1.0

4.2

$ --

$6.7

$3.7

--

1.1

2.0

$0.6

QTD Net

Charge-

offs

SC Residential Construction:

0.08%

5.9

48.27%

42

7%

87

SC residential condo

0.83%

1.2

11.26%

8

7%

76

SC residential

construction

1.00%

5.9

18.75%

30

14%

157

SC residential A&D

3.02%

$ --

1.60%

$ 2

10%

$117

SC undeveloped land

1.33%

$13.0

18.76%

$82

38%

$437

Total SC, 6/30/09

4.19%

6.20%

$28

37%

$450

3/31/09

3.67%

$10.4

7.57%

$19

21%

$244

Total NC, 6/30/09

3.09%

8.20%

$21

21%

$264

3/31/09

1.87%

16.16%

8.83%

1.88%

NAL %

of O/S

Balance

--

3.7

6.0

$0.7

YTD Net

Charge-

offs

2.78%

-- %

5.12%

1.43%

30-day

past due

%

14

13%

153

NC residential A&D

4

2%

23

NC residential

construction

11

$57

O/S

Balance

1%

5%

% of

Resid.

Constr.

--

NC residential condo

$ 1

NC undeveloped land

NC Residential Construction:

Nonaccrual

Loans HFI

As of June 30, 2009, $ in millions

30-day past due % of outstanding balance excludes nonaccrual loans.

Commercial Nonaccruals – Net Balance

$410

191

40

78

24

$77

6/30/09

Nonaccrual

Loan

Balance

$340

164

36

66

21

$53

Net

Balance

Less

Specific

Reserve

62%

$70

$139

$549

Total Commercial

63%

63%

64%

68%

54%

Net

Balance

as % of

Unpaid

Principal

12

25

102

Completed income

property

5

16

57

Commercial

development

261

30

$98

Unpaid

Principal1

70

6

$22

Cumulative

Net

Charge-

offs2

27

Residential

construction

3

Owner-occupied

CRE

$23

C&I

6/30/09

Specific

Reserve3

$ in millions

-

=

-

=

Note: Numbers may not add due to rounding.

1 Outstanding balance at default

2 Typically charge-down at nonaccrual to approximately 80% of most recent appraised value

3 Additional specific reserves are established as necessary based on estimated disposal costs, estimated holding period and current market

and economic conditions; recognized as charge-offs when realized. However, these amounts do not include the qualitative components

within the overall allowance for credit loans.

63% at

3/31/09

Indirect – Sales Finance Portfolio

As of June 30, 2009, $ in millions

In 5/08, ceased production in Florida

Effective 1/09, offered only through

full relationship dealerships in NC and

SC

In 6/09, sold $230 million of indirect

loans to a third party financial

institution for a small gain

Toyota

31%

Summary Statistics

69%

71%

66%

New %

31%

29%

34%

Used %

$728

$484

$244

6/08 Balance

68%

32%

659

711

$286

Total

71%

62%

Foreign %

29%

38%

Domestic %

658

661

Current FICO

708

718

Orig FICO

$180

$106

6/09 Balance

FL

NC/SC

30-day Past Dues, By Auto Make (Top 10)

Total $286 million, or 3% of loans

By Auto Make

3.70%

8

Hyundai

4.97%

7

Scion

3.77%

$239

Top 10

4.12%

8

Jeep

3.96%

12

Nissan

4.46%

19

Dodge

4.34%

19

Ford

3.06%

24

Kia

5.18%

25

Chevrolet

2.98%

29

Honda

3.40%

$88

Toyota

30-day %

O/S$

Honda

10%

Ford

7%

Other

28%

Chevrolet

9%

Dodge

7%

Kia

8%

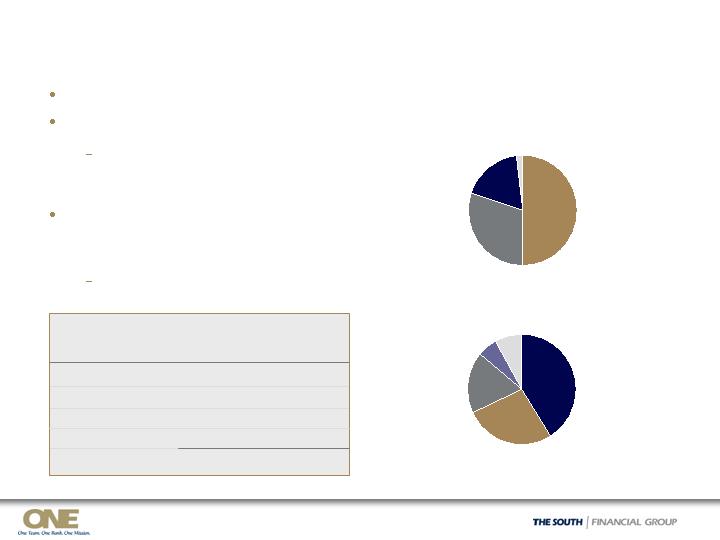

Home Equity Lines/Loans Portfolio

SC, $340

42%

FL, $276

34%

NC, $129

16%

As of June 30, 2009, $ in millions

Originated by TSFG sales force in-

market; no broker loans

Strong FICO scores

Conservative LTV position and usage

amounts

Not pushed as a growth product

Home Equity Portfolio = HE Line and HE Loan portfolios

Geography based on customer address

Other, $66

8%

Summary Statistics

NA

NA

71%

WAvg Util %1

69%

56%

44%

720

729

$811

Total

66%

70%

Orig WAvg LTV %

17%

65%

2ndLien %

83%

35%

1stLien %

703

724

Current FICO

709

732

Orig FICO

$161

$650

Balance $

Loans

Lines

2008, $117

14%

2007, $151

19%

2006, $123

15%

2004 or before

$277, 34%

2005, $120

15%

By Vintage

Total $811 million, or 9% of loans

By Geography

2009, $23

3%

1 Includes HE lines with balances greater than zero

Current as of 7/21/09