| | | UNITED STATES |

| | | SECURITIES AND EXCHANGE COMMISSION |

| | | Washington, D.C. 20549 |

| |

| |

| | | FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| | | INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-4765 |

| |

| | | Dreyfus Premier New York Municipal Bond Fund |

| | | (Exact name of Registrant as specified in charter) |

| |

| |

| | | c/o The Dreyfus Corporation |

| | | 200 Park Avenue |

| | | New York, New York 10166 |

| | | (Address of principal executive offices) (Zip code) |

| |

| | | Mark N. Jacobs, Esq. |

| | | 200 Park Avenue |

| | | New York, New York 10166 |

| | | (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| |

| Date of fiscal year end: | | 11/30 |

| |

| Date of reporting period: | | 11/30/2004 |

FORM N-CSR

Item 1. Reports to Stockholders.

| Dreyfus Premier |

| New York Municipal |

| Bond Fund |

ANNUAL REPORT November 30, 2004

Save time. Save paper. View your next shareholder report online as soon as it's available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It's simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund's Expenses |

| 8 | | Comparing Your Fund's Expenses |

| With Those of Other Funds |

| 9 | | Statement of Investments |

| 15 | | Statement of Assets and Liabilities |

| 16 | | Statement of Operations |

| 17 | | Statement of Changes in Net Assets |

| 19 | | Financial Highlights |

| 22 | | Notes to Financial Statements |

| 28 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 29 | | Important Tax Information |

| 30 | | Board Members Information |

| 32 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

| Dreyfus Premier |

| New York Municipal Bond Fund |

The Fund

LETTER FROM THE CHAIRMAN

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Premier New York Municipal Bond Fund, covering the 12-month period from December 1, 2003, through November 30, 2004. Inside, you'll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund's portfolio manager, Monica S.Wieboldt.

The Federal Reserve Board has raised short-term interest rates four times since June 2004, the U.S. labor market is strengthening, and lower federal tax rates have made tax-advantaged investments somewhat less beneficial for many investors. Nonetheless, the municipal bond market is poised to have another consecutive calendar year of positive returns. In our view, investor demand for municipal bonds has remained strong due to concerns that record energy prices and persistent geopolitical tensions may be eroding the rate of U.S. economic growth.

In uncertain markets such as these, the tax-exempt investments that are right for you depend on your current needs, future goals, tolerance for risk and the composition of your current portfolio. As always, your financial advisor may be in the best position to recommend the specific market sectors and most suitable investments that will satisfy most effectively your tax-exempt income and capital preservation needs.

Thank you for your continued confidence and support.

Sincerely,

| Stephen E. Canter |

| Chairman and Chief Executive Officer |

| The Dreyfus Corporation |

| December 15, 2004 |

2

DISCUSSION OF FUND PERFORMANCE

Monica S. Wieboldt, Senior Portfolio Manager

How did Dreyfus Premier New York Municipal Bond Fund perform relative to its benchmark?

For the 12-month period ended November 30, 2004, the fund achieved total returns of 2.71% for Class A shares, 2.18% for Class B shares and 1.94% for Class C shares.1 The Lehman Brothers Municipal Bond Index, the fund's benchmark, achieved a total return of 4.07% for the same period.2 In addition, the average total return for all funds reported in the Lipper New York Municipal Debt Funds category was 2.97% over the reporting period.3

The municipal bond market's returns were driven by investors' changing expectations of economic growth and inflation. The fund's returns were lower than its benchmark, primarily because the fund's relatively defensive positioning prevented it from participating fully in market rallies later in the reporting period. In addition, the fund's benchmark contains bonds from many states, not just New York, and does not reflect fees and other expenses.

What is the fund's investment approach?

The fund seeks to maximize current income exempt from federal, New York state and New York city income taxes to the extent consistent with the preservation of capital.To pursue this goal, the fund normally invests substantially all of its assets in municipal bonds that provide income exempt from federal, New York state and New York city personal income taxes.

The fund will invest at least 70% of its assets in investment-grade municipal bonds or the unrated equivalent as determined by Dreyfus. For additional yield, the fund may invest up to 30% of its assets in municipal bonds rated below investment grade ("high yield" or "junk" bonds) or the unrated equivalent as determined by Dreyfus. Under normal market conditions, the dollar-weighted average maturity of the fund's portfolio is expected to exceed 10 years.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

The portfolio manager may buy and sell bonds based on credit quality, market outlook and yield potential. In selecting municipal bonds for investment, the portfolio manager may assess the current interest-rate environment and the municipal bond's potential volatility in different rate environments.The portfolio manager focuses on bonds with the potential to offer attractive current income, typically looking for bonds that can provide consistently attractive current yields or that are trading at competitive market prices. A portion of the fund's assets may be allocated to "discount" bonds, which are bonds that sell at a price below their face value, or to "premium" bonds, which are bonds that sell at a price above their face value. The fund's allocation to either discount bonds or to premium bonds will change along with our changing views of the current interest-rate and market environment.The portfolio manager may also look to select bonds that are most likely to obtain attractive prices when sold.

What other factors influenced the fund's performance?

As it became increasingly apparent during the first four months of the reporting period that the U.S. economy was recovering slowly and inflation remained low, municipal bonds generally gained value. In April 2004, however, reports of an unexpectedly strong U.S. labor market and higher energy prices rekindled investors' inflation concerns. In response, the Federal Reserve Board raised short-term interest rates four times between June and November, driving the overnight federal funds rate to 2%. Nonetheless, municipal bond prices generally rallied during the summer when the U.S. economy appeared to hit a "soft patch," offsetting earlier declines.

As the economy improved, New York issuers had less need to borrow, and the supply of newly issued tax-exempt bonds dropped compared to the same period one year earlier. In November, one of the major bond rating agencies rewarded the state's improved fiscal condition by upgrading its credit rating.These factors further supported bond prices.

4

When the market became more volatile in April 2004, we attempted to adopt a more defensive investment posture by intensifying the fund's focus on the short- to intermediate-term portion of the maturity spectrum. However, this sector of the yield curve lagged when trading activity by non-traditional investors, including hedge funds, created heightened volatility among intermediate-term bonds. During the summer of 2004, we increased the fund's holdings of longer-term bonds, which had been less severely affected by market volatility.

What is the fund's current strategy?

As of the end of the reporting period, we have set the fund's average duration in a range we consider slightly longer than industry averages. This strategy is designed to increase the fund's exposure to a part of the maturity spectrum that we expect to be supported by robust investor demand and relatively little new issuance. In addition, we are looking for opportunities to capture attractive yields among lower-rated bonds that, in our judgment, complement the fund's higher-quality core holdings.

December 15, 2004

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charge in the case of Class A shares, or the applicable |

| | | contingent deferred sales charges imposed on redemptions in the case of Class B and Class C |

| | | shares. Had these charges been reflected, returns would have been lower. Past performance is no |

| | | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. Income may be subject |

| | | to state and local taxes for non-New York residents, and some income may be subject to the federal |

| | | alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Lehman Brothers Municipal Bond Index is a widely accepted, unmanaged |

| | | total return performance benchmark for the long-term, investment-grade, tax-exempt bond market. |

| | | Index returns do not reflect the fees and expenses associated with operating a mutual fund. |

| 3 | | Source: Lipper Inc. |

The Fund 5

FUND PERFORMANCE

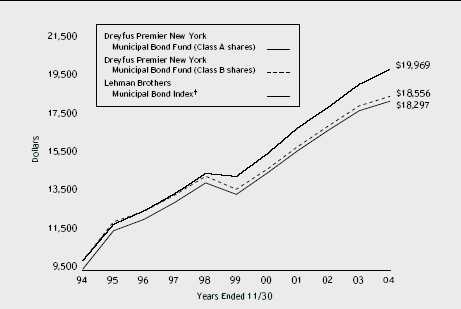

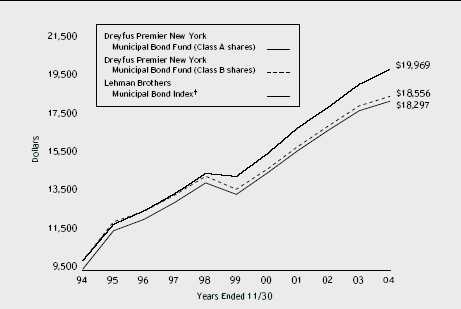

Comparison of change in value of $10,000 investment in Dreyfus Premier New York Municipal Bond Fund Class A shares and Class B shares and the Lehman Brothers Municipal Bond Index

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class A shares and Class B shares of Dreyfus Premier New York Municipal Bond Fund on 11/30/94 to a $10,000 investment made in the Lehman Brothers Municipal Bond Index (the "Index") on that date. All dividends and capital gain distributions are reinvested. Performance for Class C shares will vary from the performance of both Class A and Class B shares shown above due to differences in charges and expenses.

The fund invests primarily in New York municipal securities and the fund's performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses.The Index is not limited to investments principally in New York municipal obligations and does not take into account charges, fees and other expenses.The Index, unlike the fund, is an unmanaged total return performance benchmark for the long-term, investment-grade, geographically unrestricted tax-exempt bond market, calculated by using municipal bonds selected to be representative of the municipal market overall.These factors can contribute to the Index potentially outperforming or underperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| Average Annual Total Returns as of 11/30/04 | | | | | | |

| |

| | | Inception | | | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (4.5%) | | | | (1.91)% | | 5.37% | | 6.23% | | |

| without sales charge | | | | 2.71% | | 6.34% | | 6.72% | | |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | | | (1.73)% | | 5.48% | | 6.38% | | |

| without redemption | | | | 2.18% | | 5.80% | | 6.38% | | |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge †† | | 9/11/95 | | 0.96% | | 5.54% | | — | | 4.70% |

| without redemption | | 9/11/95 | | 1.94% | | 5.54% | | — | | 4.70% |

Past performance is not predictive of future performance.The fund's performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class B shares assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date of purchase.

| † | | The maximum contingent deferred sales charge for Class B shares is 4%.After six years Class B shares convert to |

| | | Class A shares. |

| †† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. |

The Fund 7

U N D E R S TA N D I N G YO U R F U N D ' S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund's prospectus or talk to your financial adviser.

Review your fund's expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier New York Municipal Bond Fund from June 1, 2004 to November 30, 2004. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | | | |

| assuming actual returns for the six months ended November 30, 2004 | | |

| | | Class A | | Class B | | Class C |

| |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.83 | | $ 7.47 | | $ 8.64 |

| Ending value (after expenses) | | $1,035.70 | | $1,033.10 | | $1,031.90 |

COMPARING YOUR FUND'S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC's method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund's expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended November 30, 2004

| | | Class A | | Class B | | Class C |

| |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.80 | | $ 7.41 | | $ 8.57 |

| Ending value (after expenses) | | $1,020.25 | | $1,017.65 | | $1,016.50 |

| † Expenses are equal to the fund's annualized expense ratio of .95% for Class A, 1.47% for Class B and 1.70% |

| for Class C; multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half |

| year period). |

STATEMENT OF INVESTMENTS

November 30, 2004

|

| | | Principal | | | | |

| Long-Term Municipal Investments—96.1% | | Amount ($) | | Value ($) |

| |

| |

|

| New York—88.9% | | | | | | |

| Huntington Housing Authority, Senior Housing | | | | | | |

| Facility Revenue (Gurwin Jewish | | | | | | |

| Senior Residences) 6%, 5/1/2029 | | 1,370,000 | | | | 1,312,940 |

| Jefferson County Industrial Development Agency, | | | | | | |

| SWDR (International Paper Co.) | | | | | | |

| 5.20%, 12/1/2020 | | 1,465,000 | | | | 1,473,893 |

| Long Island Power Authority, | | | | | | |

| Electric System Revenue | | | | | | |

| 5.25%, 12/1/2014 | | 3,000,000 | | | | 3,282,840 |

| Metropolitan Transportation Authority, Revenue: | | | | | | |

| 5%, 11/15/2009 (Insured; MBIA) | | 3,000,000 | | | | 3,286,800 |

| 5.50%, 11/15/2018 (Insured; AMBAC) | | 4,000,000 | | | | 4,447,760 |

| Dedicated Tax Fund: | | | | | | |

| 6.125%, 4/1/2015 | | | | | | |

| (Insured; FGIC) (Prerefunded; 4/1/2010) | | 2,145,000 | | a | | 2,469,152 |

| 5.25%, 11/15/2025 (Insured; FSA) | | 2,000,000 | | | | 2,115,400 |

| Transit Facilities: | | | | | | |

| 5.125%, 7/1/2014 | | | | | | |

| (Insured; FSA) (Prerefunded 1/1/2012) | | 1,225,000 | | a | | 1,363,156 |

| 5.125%, 7/1/2014 | | | | | | |

| (Insured; FSA) (Prerefunded 7/1/2012) | | 2,775,000 | | a | | 3,097,566 |

| Nassau County Industrial Development Agency, IDR | | | | | | |

| (Keyspan—Glenwood) 5.25%, 6/1/2027 | | 4,000,000 | | | | 4,049,520 |

| Newburg Industrial Development Agency, IDR | | | | | | |

| (Bourne and Kenney Redevelopment Co.) | | | | | | |

| 5.75%, 8/1/2032 (Guaranteed; SONYMA) | | 1,000,000 | | | | 1,041,790 |

| New York City: | | | | | | |

| 6.75%, 2/1/2009 | | 2,000,000 | | | | 2,286,800 |

| 5.25%, 8/1/2016 (Insured; MBIA) | | 3,500,000 | | | | 3,763,130 |

| 6%, 8/1/2017 | | 2,210,000 | | | | 2,384,303 |

| 6%, 8/1/2017 (Prerefunded 8/1/2007) | | 790,000 | | a | | 872,405 |

| 5.25%, 10/15/2019 | | 2,000,000 | | | | 2,130,500 |

| 5%, 8/1/2021 | | 2,000,000 | | | | 2,070,440 |

| 5.50%, 8/1/2021 | | 2,000,000 | | | | 2,166,760 |

| 5.25%, 8/15/2024 | | 2,420,000 | | | | 2,538,991 |

| 5%, 11/1/2034 | | 2,000,000 | | | | 2,002,860 |

| New York City Housing Development Corp., MFHR | | | | | | |

| 5.625%, 5/1/2012 | | 320,000 | | | | 322,134 |

| New York City Industrial Development Agency, | | | | | | |

| Civic Facility Revenue, Lease | | | | | | |

| (College of Aeronautics Project) | | | | | | |

| 5.45%, 5/1/2018 | | 1,000,000 | | | | 1,025,330 |

The Fund 9

S T A T E M E N T O F I N V E S T M E N T S (continued)

| | | Principal | | | | |

| Long-Term Municipal Investments (continued) | | Amount ($) | | | | Value ($) |

| |

| |

| |

|

| New York (continued) | | | | | | |

| New York City Municipal Water Finance Authority, | | | | | | |

| Water and Sewer Systems Revenue: | | | | | | |

| 8.841%, 6/15/2015 | | 2,000,000 | | b,c | | 2,398,900 |

| 5.25%, 6/15/2034 | | 2,000,000 | | | | 2,056,220 |

| 5%, 6/15/2035 | | 2,000,000 | | | | 2,006,280 |

| New York City Transitional Finance Authority, Revenue: | | | | | | |

| 8.768%, 5/1/2012 | | 2,000,000 | | b,c | | 2,394,760 |

| 6%, 11/15/2013 | | 450,000 | | | | 511,650 |

| 5.50%, 11/1/2026 | | 2,000,000 | | | | 2,243,960 |

| 5.25%, 2/1/2029 | | 2,450,000 | | | | 2,686,572 |

| Zero Coupon, 11/1/2011 | | 2,000,000 | | | | 1,540,100 |

| New York State Dormitory Authority, Revenues: | | | | | | |

| (Consolidated City University System): | | | | | | |

| 5.75%, 7/1/2009 (Insured; AMBAC) | | 3,000,000 | | | | 3,361,170 |

| 5.75%, 7/1/2013 (Insured; AMBAC) | | 1,000,000 | | | | 1,149,980 |

| 5.625%, 7/1/2016 | | 4,000,000 | | | | 4,540,160 |

| 5.75%, 7/1/2016 (Insured; FGIC) | | 1,000,000 | | | | 1,123,750 |

| 5.75%, 7/1/2018 (Insured; FSA) | | 1,000,000 | | | | 1,167,120 |

| (Court Facilities) 5.25%, 5/15/2015 | | 3,000,000 | | | | 3,293,430 |

| Health Hospital and Nursing Home: | | | | | | |

| (Catholic Health of Long Island) | | | | | | |

| 5%, 7/1/2021 | | 2,000,000 | | | | 2,020,400 |

| (Department of Health): | | | | | | |

| 5%, 7/1/2014 | | 2,000,000 | | | | 2,166,160 |

| 5.75%, 7/1/2017 (Prerefunded 7/1/2016) | | 390,000 | | a | | 419,086 |

| (Ideal Senior Living Center Housing Corp.) | | | | | | |

| 5.90%, 8/1/2026 (Insured: MBIA and FHA) | | 1,000,000 | | | | 1,060,450 |

| (Lutheran Medical Center) | | | | | | |

| 5%, 8/1/2014 (Insured; MBIA) | | 1,000,000 | | | | 1,077,580 |

| Mental Health Facilities Improvement | | | | | | |

| 5%, 2/15/2028 | | 1,000,000 | | | | 1,007,050 |

| (Miriam Osborn Memorial Home) | | | | | | |

| 6.875%, 7/1/2019 (Insured; ACA) | | 1,000,000 | | | | 1,127,730 |

| (Municipal Health Facilities Improvement | | | | | | |

| Program) 5.50%, 5/15/2024 (Insured; FSA) | | 1,000,000 | | | | 1,058,270 |

| (New York Methodist Hospital) 5.25%, 7/1/2024 | | 1,250,000 | | | | 1,297,138 |

| (North General Hospital): | | | | | | |

| 5.20%, 2/15/2015 (Insured; AMBAC) | | | | | | |

| (Prerefunded 2/15/2015) | | 2,000,000 | | a | | 2,179,600 |

| 5.75%, 2/15/2016 | | 3,000,000 | | | | 3,320,910 |

| (Winthrop South Nassau University Hospital) | | | | | | |

| 5.50%, 7/1/2023 | | 1,650,000 | | | | 1,722,155 |

10

| | | Principal | | |

| Long-Term Municipal Investments (continued) | | Amount ($) | | Value ($) |

| |

| |

|

| New York (continued) | | | | |

| New York State Dormitory Authority, Revenues (continued): | | |

| (Long Island University) 5.50%, 9/1/2020 | | 1,585,000 | | 1,692,590 |

| (Manhattan College) 5.50%, 7/1/2016 | | 975,000 | | 1,060,810 |

| (New York University) 5.50%, 7/1/2040 | | | | |

| (Insured; AMBAC) | | 2,500,000 | | 2,825,050 |

| (Rochester University) 5%, 7/1/2034 | | 2,870,000 | | 2,871,177 |

| (State Personal Income Tax) | | | | |

| 5.375%, 3/15/2022 | | 1,000,000 | | 1,076,050 |

| (State University Educational Facilities): | | | | |

| 5.875%, 5/15/2017 | | 2,000,000 | | 2,326,140 |

| 5.50%, 5/15/2026 (Insured; FSA) | | | | |

| (Prerefunded 5/15/2006) | | 5,000,000 a | | 5,336,450 |

| 5.50%, 7/1/2026 (Insured; FGIC) | | 1,000,000 | | 1,134,630 |

| New York State Housing Finance Agency, Revenue, | | | | |

| Service Contract Obligation: | | | | |

| 6.25%, 9/15/2010 | | 1,080,000 | | 1,133,125 |

| 6.25%, 9/15/2010 | | | | |

| (Prerefunded 9/15/2007) | | 1,920,000 a | | 2,095,718 |

| 5.50%, 9/15/2018 | | 1,650,000 | | 1,773,057 |

| New York State Mortgage Agency, | | | | |

| Homeownership Mortgage Revenue | | | | |

| 6%, 4/1/2017 | | 1,560,000 | | 1,635,254 |

| New York State Power Authority, Revenue: | | | | |

| 8.26%, 11/15/2015 (Insured; MBIA) | | 2,000,000 b,c | | 2,308,420 |

| 5%, 11/15/2020 | | 2,000,000 | | 2,105,180 |

| New York State Thruway Authority, | | | | |

| Service Contract Revenue | | | | |

| (Local Highway and Bridge): | | | | |

| 6%, 4/1/2011 | | 1,955,000 | | 2,140,275 |

| 5.75%, 4/1/2019 | | 2,000,000 | | 2,259,160 |

| 5.25%, 4/1/2020 | | 2,500,000 | | 2,792,475 |

| New York State Urban Development Corp. | | | | |

| Revenue: | | | | |

| Correctional Capital Facilities | | | | |

| 5.70%, 1/1/2016 | | 5,350,000 | | 5,824,385 |

| Correctional & Youth Facilities: | | | | |

| 5.25%, 1/1/2010 | | 2,000,000 | | 2,190,500 |

| 5%, 1/1/2027 | | 2,000,000 | | 2,145,140 |

| Personal Income Tax | | | | |

| 5.50%, 3/15/2017 (Insured; FGIC) | | 2,450,000 | | 2,719,598 |

The Fund 11

S T A T E M E N T O F I N V E S T M E N T S (continued)

| | | Principal | | |

| Long-Term Municipal Investments (continued) | | Amount ($) | | Value ($) |

| |

| |

|

| New York (continued) | | | | |

| Niagara County Industrial | | | | |

| Development Agency, SWDR: | | | | |

| 5.55%, 11/15/2024 | | 1,000,000 | | 1,065,780 |

| 5.625%, 11/15/2024 | | 2,000,000 | | 2,134,600 |

| Niagara Frontier Transportation | | | | |

| Authority, Airport Revenue | | | | |

| (Buffalo Niagara International Airport) | | | | |

| 5.625%, 4/1/2029 (Insured; MBIA) | | 2,000,000 | | 2,070,660 |

| Orange County Industrial Development Agency, | | | | |

| Life Care Community Revenue | | | | |

| (Glen Arden Inc. Project) 5.625%, 1/1/2018 | | 1,000,000 | | 891,360 |

| Port Authority of New York and New Jersey | | | | |

| (Consolidated Thirty Seventh Series) | | | | |

| 5.50%, 7/15/2018 (Insured; FSA) | | 3,000,000 | | 3,302,310 |

| Rensselaer County Industrial Development | | | | |

| Agency, IDR (Albany International Corp.) | | | | |

| 7.55%, 6/1/2007 (LOC; Norstar Bank) | | 1,500,000 | | 1,662,540 |

| Sales Tax Asset Receivable Corporation | | | | |

| 5%, 10/15/2032 (Insured; AMBAC) | | 2,000,000 | | 2,031,840 |

| Tobacco Settlement Financing Corporation: | | | | |

| 5.50%, 6/1/2018 | | 1,000,000 | | 1,097,420 |

| 5.50%, 6/1/2021 | | 3,000,000 | | 3,246,360 |

| Triborough Bridge and Tunnel Authority, Revenue: | | | | |

| Highway and Toll | | | | |

| 6%, 1/1/2012 | | 2,000,000 | | 2,277,420 |

| Lease (Convention Center Project) | | | | |

| 7.125%, 1/1/2010 | | 905,000 | | 1,013,790 |

| Ulster County Industrial Development | | | | |

| Agency, Civic Facility Revenue | | | | |

| (Benedictine Hospital Project) | | | | |

| 6.40%, 6/1/2014 | | 730,000 | | 733,460 |

| Watervliet Housing Authority, | | | | |

| Residential Housing Revenue | | | | |

| (Beltrone Living Center Project) | | | | |

| 6%, 6/1/2028 | | 1,000,000 | | 933,920 |

| Yonkers Industrial Development | | | | |

| Agency, Civic Facility Revenue | | | | |

| (Saint Joseph's Hospital) | | | | |

| 5.90%, 3/1/2008 | | 1,400,000 | | 1,371,916 |

| | | Principal | | | | |

| Long-Term Municipal Investments (continued) | | Amount ($) | | Value ($) |

| |

| |

|

| U.S. Related—7.2% | | | | | | |

| Children's Trust Fund of Puerto Rico, | | | | | | |

| Tobacco Settlement Asset Backed | | | | | | |

| 6%, 7/1/2026 (Prerefunded 7/1/2010) | | 2,000,000 | | a | | 2,287,060 |

| Commonwealth of Puerto Rico, Public Improvement: | | | | | | |

| 5.50%, 7/1/2016 (Insured; FSA) | | 40,000 | | | | 45,939 |

| 9.15%, 7/1/2016 (Insured; FSA) | | 2,800,000 | | b,c | | 3,631,488 |

| Puerto Rico Electric Power Authority, Power Revenue | | | | | | |

| 5.625%, 7/1/2019 (Insured; FSA) | | 2,000,000 | | | | 2,250,420 |

| Puerto Rico Highway and Transportation Authority, | | | | | | |

| Transportation Revenue | | | | | | |

| 5.75%, 7/1/2019 (Insured; MBIA) | | 1,500,000 | | | | 1,697,295 |

| Puerto Rico Industrial Medical, Educational | | | | | | |

| and Environmental Pollution Control | | | | | | |

| Facilities Financing Authority, HR | | | | | | |

| (Saint Luke's Hospital Project) | | | | | | |

| 6.25%, 6/1/2010 (Prerefunded 6/1/2006) | | 880,000 | | a | | 922,908 |

| Virgin Islands Public Finance Authority, Revenue | | | | | | |

| 5.50%, 10/1/2014 | | 3,000,000 | | | | 3,158,220 |

| Total Long-Term Municipal Investments | | | | | | |

| (cost $176,181,230) | | | | | | 185,706,941 |

| |

| |

| |

|

| |

| Short-Term Municipal Investment—2.1% | | | | | | |

| |

| |

| |

|

| New York City Transitional Finance Authority, Revenue, | | | | | | |

| VRDN 1.65% (SBPA; Bayerische Landesbank) | | | | | | |

| (cost $4,000,000) | | 4,000,000 | | d | | 4,000,000 |

| |

| |

| |

|

| |

| Total Investments (cost $180,181,230) | | 98.2% | | | | 189,706,941 |

| Cash and Receivables (Net) | | 1.8% | | | | 3,499,031 |

| Net Assets | | 100.0% | | | | 193,205,972 |

The Fund 13

S T A T E M E N T O F I N V E S T M E N T S (continued)

| Summary of Abbreviations | | | | |

| |

| ACA | | American Capital Access | | LOC | | Letter of Credit |

| AMBAC | | American Municipal Bond | | MBIA | | Municipal Bond Investors Assurance |

| | | Assurance Corporation | | | | Insurance Corporation |

| FGIC | | Financial Guaranty Insurance | | MFHR | | Multi-Family Housing Revenue |

| | | Company | | SBPA | | Standby Bond Purchase Agreement |

| FHA | | Federal Housing Administration | | SONYMA | | State of New York Mortgage Agency |

| FSA | | Financial Security Assurance | | SWDR | | Solid Waste Disposal Revenue |

| HR | | Hospital Revenue | | VRDN | | Variable Rate Demand Notes |

| IDR | | Industrial Development Revenue | | | | |

| Summary of Combined Ratings (Unaudited) | | |

| |

| Fitch | | or | | Moody's | | or | | Standard & Poor's | | Value (%) † |

| |

| |

| |

| |

| |

|

| AAA | | | | Aaa | | | | AAA | | 38.3 |

| AA | | | | Aa | | | | AA | | 34.7 |

| A | | | | A | | | | A | | 18.7 |

| BBB | | | | Baa | | | | BBB | | 5.0 |

| Not Rated e | | | | Not Rated e | | | | Not Rated e | | 3.3 |

| | | | | | | | | | | 100.0 |

| † | | Based on total investments. |

| a | | Bonds which are prerefunded are collateralized by U.S. Government securities which are held in escrow and are used |

| | | to pay principal and interest on the municipal issue and to retire the bonds in full at the earliest refunding date. |

| b | | Inverse floater security—the interest rate is subject to change periodically. |

| c | | Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in |

| | | transactions exempt from registration, normally to qualified institutional buyers.These securities have been determined |

| | | to be liquid by the Board of Trustees.At November 30, 2004, these securities amounted to $10,733,568 or 5.6% |

| | | of net assets. |

| d | | Securities payable on demand.Variable interest rate—subject to periodic change. |

| e | | Securities which, while not rated by Fitch, Moody's and Standard & Poor's, have been determined by the Manager to |

| | | be of comparable quality to those rated securities in which the fund may invest. |

| See notes to financial statements. |

14

| | STATEMENT OF ASSETS AND LIABILITIES

November 30, 2004

|

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments | | 180,181,230 | | 189,706,941 |

| Cash | | | | 53,806 |

| Interest receivable | | | | 2,734,270 |

| Receivable for investment securities sold | | | | 1,122,713 |

| Receivable for shares of Beneficial Interest subscribed | | | | 35,728 |

| Prepaid expenses | | | | 17,021 |

| | | | | 193,670,479 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 146,184 |

| Payable for shares of Beneficial Interest redeemed | | | | 303,181 |

| Accrued expenses | | | | 15,142 |

| | | | | 464,507 |

| |

| |

|

| Net Assets ($) | | | | 193,205,972 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 183,318,585 |

| Accumulated net realized gain (loss) on investments | | | | 361,676 |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | 9,525,711 |

| |

| |

|

| Net Assets ($) | | | | 193,205,972 |

| Net Asset Value Per Share | | | | | | |

| | | Class A | | Class B | | Class C |

| |

| |

| |

|

| Net Assets ($) | | 153,173,424 | | 30,960,407 | | 9,072,141 |

| Shares Outstanding | | 10,212,041 | | 2,064,442 | | 604,845 |

| |

| |

| |

|

| Net Asset Value Per Share ($) | | 15.00 | | 15.00 | | 15.00 |

See notes to financial statements.

The Fund 15

| | STATEMENT OF OPERATIONS

Year Ended November 30, 2004

|

| Investment Income ($): | | |

| Interest Income | | 9,575,947 |

| Expenses: | | |

| Management fee—Note 3(a) | | 1,109,365 |

| Shareholder servicing costs—Note 3(c) | | 633,354 |

| Distribution fees—Note 3(b) | | 250,299 |

| Professional fees | | 56,831 |

| Registration fees | | 33,920 |

| Custodian fees | | 24,933 |

| Prospectus and shareholders' reports | | 15,423 |

| Trustees' fees and expenses—Note 3(d) | | 7,150 |

| Loan commitment fees—Note 2 | | 1,384 |

| Miscellaneous | | 21,170 |

| Total Expenses | | 2,153,829 |

| Less—reduction in custody fees due to | | |

| earnings credits—Note 1(b) | | (2,272) |

| Net Expenses | | 2,151,557 |

| Investment Income—Net | | 7,424,390 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 363,192 |

| Net unrealized appreciation (depreciation) on investments | | (2,836,666) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (2,473,474) |

| Net Increase In Net Assets Resulting from Operations | | 4,950,916 |

See notes to financial statements.

16

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended November 30, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 7,424,390 | | 7,997,540 |

| Net realized gain (loss) on investments | | 363,192 | | 2,135,792 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (2,836,666) | | 1,534,494 |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 4,950,916 | | 11,667,826 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (5,956,362) | | (6,259,123) |

| Class B shares | | (1,153,860) | | (1,399,217) |

| Class C shares | | (305,989) | | (324,966) |

| Net realized gain on investments: | | | | |

| Class A shares | | (1,636,350) | | (860,744) |

| Class B shares | | (388,816) | | (221,850) |

| Class C shares | | (117,987) | | (46,702) |

| Total Dividends | | (9,559,364) | | (9,112,602) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 15,193,366 | | 34,678,218 |

| Class B shares | | 1,516,036 | | 10,737,192 |

| Class C shares | | 2,253,245 | | 9,800,763 |

| Dividends reinvested: | | | | |

| Class A shares | | 5,445,832 | | 4,544,518 |

| Class B shares | | 934,847 | | 943,227 |

| Class C shares | | 263,165 | | 226,593 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (24,228,395) | | (32,505,161) |

| Class B shares | | (9,836,828) | | (12,787,895) |

| Class C shares | | (5,469,081) | | (5,766,273) |

| Increase (Decrease) in Net Assets from | | | | |

| Beneficial Interest Transactions | | (13,927,813) | | 9,871,182 |

| Total Increase (Decrease) in Net Assets | | (18,536,261) | | 12,426,406 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 211,742,233 | | 199,315,827 |

| End of Period | | 193,205,972 | | 211,742,233 |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended November 30, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A a | | | | |

| Shares sold | | 1,000,567 | | 2,258,130 |

| Shares issued for dividends reinvested | | 360,440 | | 297,517 |

| Shares redeemed | | (1,611,266) | | (2,129,961) |

| Net Increase (Decrease) in Shares Outstanding | | (250,259) | | 425,686 |

| |

| |

|

| Class B a | | | | |

| Shares sold | | 99,739 | | 698,935 |

| Shares issued for dividends reinvested | | 61,860 | | 61,767 |

| Shares redeemed | | (651,879) | | (837,786) |

| Net Increase (Decrease) in Shares Outstanding | | (490,280) | | (77,084) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 147,671 | | 638,262 |

| Shares issued for dividends reinvested | | 17,405 | | 14,840 |

| Shares redeemed | | (357,182) | | (378,667) |

| Net Increase (Decrease) in Shares Outstanding | | (192,106) | | 274,435 |

| a | | During the period ended November 30, 2004, 226,556 Class B shares representing $3,429,242 were |

| | | automatically converted to 226,542 Class A shares and during the period ended November 30, 2003, 184,849 |

| | | Class B shares representing $2,827,145 were automatically converted to 184,846 Class A shares. |

| See notes to financial statements. |

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased or (decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund's financial statements.

| | | | | Year Ended November 30, | | |

| |

| |

| |

|

| Class A Shares | | 2004 | | 2003 | | 2002 a | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 15.33 | | 15.11 | | 14.80 | | 14.34 | | 14.01 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .58b | | .60b | | .67b | | .68 | | .69 |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | (.17) | | .30 | | .31 | | .46 | | .42 |

| Total from Investment Operations | | .41 | | .90 | | .98 | | 1.14 | | 1.11 |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.58) | | (.60) | | (.67) | | (.68) | | (.69) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.16) | | (.08) | | — | | — | | (.09) |

| Total Distributions | | (.74) | | (.68) | | (.67) | | (.68) | | (.78) |

| Net asset value, end of period | | 15.00 | | 15.33 | | 15.11 | | 14.80 | | 14.34 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 2.71 | | 6.11 | | 6.76 | | 8.05 | | 8.17 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .94 | | .94 | | .96 | | .92 | | .97 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 3.81 | | 3.94 | | 4.49 | | 4.58 | | 4.92 |

| Portfolio Turnover Rate | | 21.53 | | 44.33 | | 24.22 | | 23.65 | | 19.02 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | | 153,173 | | 160,371 | | 151,658 | | 149,772 | | 131,482 |

| a | | As required, effective December 1, 2001, the fund has adopted the provisions of the AICPA Audit and Accounting |

| | | Guide for Investment Companies and began accreting discount or amortizing premium on a scientific basis for debt |

| | | securities.The effect of this change for the period ended November 30, 2002 was to increase net investment income per |

| | | share and decrease net realized and unrealized gain (loss) on investments per share by less than $.01 and increase the |

| | | ratio of net investment income to average net assets from 4.48% to 4.49%. Per share data and ratios/supplemental |

| | | data for periods prior to December 1, 2001 have not been restated to reflect this change in presentation. |

| b | | Based on average shares outstanding at each month end. |

| c | | Exclusive of sales charge. |

| See notes to financial statements. |

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

| | | | | Year Ended November 30, | | |

| |

| |

| |

|

| Class B Shares | | 2004 | | 2003 | | 2002 a | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 15.33 | | 15.11 | | 14.80 | | 14.34 | | 14.01 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .50b | | .53b | | .59b | | .60 | | .62 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (.17) | | .29 | | .32 | | .46 | | .42 |

| Total from Investment Operations | | .33 | | .82 | | .91 | | 1.06 | | 1.04 |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.50) | | (.52) | | (.60) | | (.60) | | (.62) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.16) | | (.08) | | — | | — | | (.09) |

| Total Distributions | | (.66) | | (.60) | | (.60) | | (.60) | | (.71) |

| Net asset value, end of period | | 15.00 | | 15.33 | | 15.11 | | 14.80 | | 14.34 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 2.18 | | 5.57 | | 6.23 | | 7.50 | | 7.62 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.45 | | 1.44 | | 1.46 | | 1.42 | | 1.48 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 3.30 | | 3.43 | | 3.97 | | 4.07 | | 4.42 |

| Portfolio Turnover Rate | | 21.53 | | 44.33 | | 24.22 | | 23.65 | | 19.02 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | | 30,960 | | 39,155 | | 39,763 | | 32,484 | | 36,669 |

| a | | As required, effective December 1, 2001, the fund has adopted the provisions of the AICPA Audit and Accounting |

| | | Guide for Investment Companies and began accreting discount or amortizing premium on a scientific basis for debt |

| | | securities.The effect of this change for the period ended November 30, 2002 was to increase net investment income per |

| | | share and decrease net realized and unrealized gain (loss) on investments per share by less than $.01 and increase the |

| | | ratio of net investment income to average net assets from 3.96% to 3.97%. Per share data and ratios/supplemental |

| | | data for periods prior to December 1, 2001 have not been restated to reflect this change in presentation. |

| b | | Based on average shares outstanding at each month end. |

| c | | Exclusive of sales charge. |

| See notes to financial statements. |

| | | | | Year Ended November 30, | | |

| |

| |

| |

|

| Class C Shares | | 2004 | | 2003 | | 2002 a | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 15.33 | | 15.11 | | 14.81 | | 14.35 | | 14.02 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .46b | | .48b | | .55b | | .57 | | .58 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (.17) | | .31 | | .31 | | .46 | | .42 |

| Total from Investment Operations | | .29 | | .79 | | .86 | | 1.03 | | 1.00 |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.46) | | (.49) | | (.56) | | (.57) | | (.58) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.16) | | (.08) | | — | | — | | (.09) |

| Total Distributions | | (.62) | | (.57) | | (.56) | | (.57) | | (.67) |

| Net asset value, end of period | | 15.00 | | 15.33 | | 15.11 | | 14.81 | | 14.35 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 1.94 | | 5.32 | | 5.93 | | 7.23 | | 7.36 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.69 | | 1.68 | | 1.69 | | 1.67 | | 1.74 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 3.06 | | 3.16 | | 3.71 | | 3.77 | | 4.18 |

| Portfolio Turnover Rate | | 21.53 | | 44.33 | | 24.22 | | 23.65 | | 19.02 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | | 9,072 | | 12,216 | | 7,895 | | 4,879 | | 1,787 |

| a | | As required, effective December 1, 2001, the fund has adopted the provisions of the AICPA Audit and Accounting |

| | | Guide for Investment Companies and began accreting discount or amortizing premium on a scientific basis for debt |

| | | securities.The effect of this change for the period ended November 30, 2002 was to increase net investment income per |

| | | share and decrease net realized and unrealized gain (loss) on investments per share by less than $.01 and increase the |

| | | ratio of net investment income to average net assets from 3.70% to 3.71%. Per share data and ratios/supplemental |

| | | data for periods prior to December 1, 2001 have not been restated to reflect this change in presentation. |

| b | | Based on average shares outstanding at each month end. |

| c | | Exclusive of sales charge. |

| See notes to financial statements. |

The Fund 21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier New York Municipal Bond Fund (the "fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a non-diversified open-end management investment com-pany.The fund's investment objective is to maximize current income exempt from federal, New York state and New York city personal income taxes to the extent consistent with the preservation of capital. The Dreyfus Corporation (the "Manager" or "Dreyfus") serves as the fund's investment adviser.The Manager is a wholly-owned subsidiary of Mellon Financial Corporation ("Mellon Financial").

Dreyfus Service Corporation (the "Distributor"), a wholly-owned subsidiary of the Manager, is the distributor of the fund's shares.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in the following classes of shares: Class A, Class B and Class C. Class A shares are subject to a sales charge imposed at the time of purchase. Class B shares are subject to a contingent deferred sales charge ("CDSC") imposed on Class B share redemptions made within six years of purchase and automatically convert to Class A shares after six years. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Other differences between the classes include the services offered to and the expenses borne by each class and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative assets.

The fund's financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from these estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund's maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

22

(a) Portfolio valuation: Investments in securities are valued each business day by an independent pricing service (the "Service") approved by the Board of Trustees. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. Options and financial futures on municipal and U.S.Treasury securities are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund follows an investment policy of investing primarily in municipal obligations of one state. Economic changes affecting the state and certain of its public bodies and municipalities may affect the ability of issuers within the state to pay interest on, or repay principal of, municipal obligations held by the fund.

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Dividends to shareholders: It is the policy of the fund to declare dividends daily from investment income-net. Such dividends are paid monthly. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the "Code").To the extent that net realized capital gain can be offset by capital loss carryovers, if any, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(d) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

At November 30, 2004, the components of accumulated earnings on a tax basis were as follows: undistributed capital gains $366,266 and unrealized appreciation $9,558,134.

The tax character of distributions paid to shareholders during the fiscal periods ended November 30, 2004 and November 30, 2003, were as follows: tax exempt income $7,416,210 and $7,983,306, ordinary income $325,673 and $1,430 and long-term capital gains $1,817,481 and $1,127,866, respectively.

During the period ended November 30, 2004, as a result of permanent book to tax differences primarily due to the tax treatment for amortization adjustments, the fund decreased accumulated undistributed investment income-net by $8,179 and increased paid-in capital by the same amount. Net assets were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the "Facility") to be utilized for temporary or emergency purposes, including the financing of redemptions.

24

In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings. During the period ended November 30, 2004, the fund did not borrow under the Facility.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .55 of 1% of the value of the fund's average daily net assets and is payable monthly.

During the period ended November 30, 2004, the Distributor retained $11,958 from commissions earned on sales of the fund's Class A shares and $94,426 and $3,613 from contingent deferred sales charges on redemptions of the fund's Class B and Class C shares, respectively.

(b) Under the Distribution Plan (the "Plan") adopted pursuant to Rule 12b-1 under the Act, Class B and Class C shares pay the Distributor for distributing their shares at an annual rate of .50 of 1% of the value of the average daily net assets of Class B shares and .75 of 1% of the value of the average daily net assets of Class C shares. During the period ended November 30, 2004, Class B and Class C shares were charged $175,256 and $75,043, respectively, pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A, Class B and Class C shares pay the Distributor at an annual rate of .25 of 1% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended November 30, 2004, Class A, Class B and

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

Class C shares were charged $391,615, $87,628 and $25,014, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended November 30, 2004, the fund was charged $69,111 pursuant to the transfer agency agreement.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $87,768, Rule 12b-1 distribution plan fees $18,522 and shareholder services plan fees $39,894.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended November 30, 2004, amounted to $42,397,655 and $66,561,124, respectively.

At November 30, 2004, the cost of investments for federal income tax purposes was $180,148,807; accordingly, accumulated net unrealized appreciation on investments was $9,558,134, consisting of $10,204,278 gross unrealized appreciation and $646,144 gross unrealized depreciation.

NOTE 5—Legal Matters:

Two class actions have been filed against Mellon Financial, Mellon Bank, N.A., Dreyfus, Founders Asset Management LLC and the directors of all or substantially all of the Dreyfus Funds, on behalf of a purported class and derivatively on behalf of said funds, alleging violations of the Investment Company Act of 1940, the Investment Advisers Act of 1940, and the common law. The complaints alleged, among other things, (i) that 12b-1 fees and directed brokerage were improperly used

26

to pay brokers to recommend Dreyfus funds over other funds, (ii) that such payments were not disclosed to investors, (iii) that economies of scale and soft-dollar benefits were not passed on to investors, and (iv) that 12b-1 fees charged to certain funds that were closed to new investors were also improper. The complaints sought compensatory and punitive damages, rescission of the advisory contracts and an accounting and restitution of any unlawful fees, as well as an award of attorneys' fees and litigation expenses. On April 22, 2004, the actions were consolidated under the caption In re Dreyfus Mutual Funds Fee Litigation, and a consolidated amended complaint was filed on September 13, 2004.While adding new parties and claims under state and federal law, the allegations in the consolidated amended complaint essentially track the allegations in the prior complaints pertaining to 12b-1 fees, directed brokerage, soft dollars and revenue sharing. Dreyfus and the funds believe the allegations to be totally without merit and intend to defend the action vigorously.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Dreyfus funds believe that any of the pending actions will have a material adverse effect on the Dreyfus funds or Dreyfus' ability to perform its contracts with the Dreyfus funds.

The Fund 27

| | REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

|

Shareholders and Board of Trustees

Dreyfus Premier New York Municipal Bond Fund

We have audited the accompanying statement of assets and liabilities of Dreyfus Premier New York Municipal Bond Fund, including the statement of investments, as of November 30, 2004, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended and financial highlights for each of the years indicated therein.These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November 30, 2004 by correspondence with the custodian.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier New York Municipal Bond Fund at November 30, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

New York, New York

January 5, 2005

|

28

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund hereby makes the following designations regarding its fiscal year ended November 30, 2004:

—all the dividends paid from investment income-net are "exempt-interest dividends" (not subject to regular federal income tax and, for individuals who are New York residents, New York State and New York City personal income taxes).

—the fund hereby designates $.0943 per share as a long-term capital gain distribution of the $.1178 per share paid on December 5, 2003, and also designates $.0401 per share as a long-term capital gain distribution of the $.0401 per share paid on July 28, 2004.

As required by federal tax law rules, shareholders will receive notification of their portion of the fund's taxable ordinary dividends and capital gain distributions paid for the 2004 calendar year on Form 1099-DIV which will be mailed by January 31, 2005.

The Fund 29

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (61) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Levcor International, Inc., an apparel fabric processor, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Azimuth Trust, an institutional asset management firm, Member of Board of Managers and |

| Advisory Board |

| No. of Portfolios for which Board Member Serves: 186 |

| ——————— |

| Clifford L. Alexander, Jr. (71) |

| Board Member (1986) |

| Principal Occupation During Past 5 Years: |

| • President of Alexander & Associates, Inc., a management consulting firm ( January 1981-present) |

| • Chairman of the Board of Moody's Corporation (October 2000-October 2003) |

| • Chairman of the Board and Chief Executive Officer of The Dun and Bradstreet Corporation |

| (October 1999-September 2000) |

| Other Board Memberships and Affiliations: |

| • Wyeth (formerly, American Home Products Corporation), a global leader in pharmaceuticals, |

| consumer healthcare products and animal health products, Director |

| • Mutual of America Life Insurance Company, Director |

| No. of Portfolios for which Board Member Serves: 65 |

| ——————— |

| Peggy C. Davis (61) |

| Board Member (1990) |

| Principal Occupation During Past 5 Years: |

| • Shad Professor of Law, New York University School of Law (1983-present) |

| • Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences |

| and the law, legal process and professional methodology and training |

| No. of Portfolios for which Board Member Serves: 26 |

30

| Ernest Kafka (72) |

| Board Member (1986) |

| Principal Occupation During Past 5 Years: |

| • Physician engaged in private practice specializing in the psychoanalysis of adults and |

| adolescents (1962-present) |

| • Instructor,The New York Psychoanalytic Institute (1981-present) |

| • Associate Clinical Professor of Psychiatry at Cornell Medical School (1987-2002) |

| No. of Portfolios for which Board Member Serves: 26 |

| ——————— |

| Nathan Leventhal (61) |

| Board Member (1989) |

| Principal Occupation During Past 5 Years: |

| • A management consultant for various non-profit organizations (May 2004-present) |

| • Chairman of the Avery-Fisher Artist Program (November 1997-present) |

| • President of Lincoln Center for the Performing Arts, Inc. (March 1984-December 2000) |

| Other Board Memberships and Affiliations: |

| • Movado Group, Inc., Director |

| No. of Portfolios for which Board Member Serves: 26 |

| ——————— |

Once elected all Board Members serve for an indefinite term.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund's Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

Saul B. Klaman, Emeritus Board Member

The Fund 31

OFFICERS OF THE FUND (Unaudited)

STEPHEN E. CANTER, President since March 2000.

Chairman of the Board, Chief Executive Officer and Chief Operating Officer of the Manager, and an officer of 93 investment companies (comprised of 186 portfolios) managed by the Manager. Mr. Canter also is a Board member and, where applicable, an Executive Committee Member of the other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 59 years old and has been an employee of the Manager since May 1995.

STEPHEN R. BYERS, Executive Vice President since November 2002.

Chief Investment Officer,Vice Chairman and a director of the Manager, and an officer of 93 investment companies (comprised of 186 portfolios) managed by the Manager. Mr. Byers also is an officer, director or an Executive Committee Member of certain other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 51 years old and has been an employee of the Manager since January 2000. Prior to joining the Manager, he served as an Executive Vice President-Capital Markets, Chief Financial Officer and Treasurer at Gruntal & Co., L.L.C.

MARK N. JACOBS, Vice President since March 2000.

Executive Vice President, Secretary and General Counsel of the Manager, and an officer of 94 investment companies (comprised of 202 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since June 1977.

STEVEN F. NEWMAN, Secretary since March 2000.

Associate General Counsel and Assistant Secretary of the Manager, and an officer of 94 investment companies (comprised of 202 portfolios) managed by the Manager. He is 55 years old and has been an employee of the Manager since July 1980.

JANETTE E. FARRAGHER, Assistant Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 12 investment companies (comprised of 23 portfolios) managed by the Manager. She is 42 years old and has been an employee of the Manager since February 1984.

MICHAEL A. ROSENBERG, Assistant Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 91 investment companies (comprised of 195 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since October 1991.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 94 investment companies (comprised of 202 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since April 1985.

GREGORY S. GRUBER, Assistant Treasurer since March 2000.

Senior Accounting Manager – Municipal Bond Funds of the Manager, and an officer of 26 investment companies (comprised of 55 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since August 1981.

32

KENNETH J. SANDGREN, Assistant Treasurer since November 2001.

Mutual Funds Tax Director of the Manager, and an officer of 94 investment companies (comprised of 202 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since June 1993.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (94 investment companies, comprising 202 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon's Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 47 years old and has served in various capacities with the Manager since 1980, including manager of the firm's Fund Accounting Department from 1997 through October 2001.

WILLIAM GERMENIS, Anti-Money Laundering Compliance Officer since September 2002.

Vice President and Anti-Money Laundering Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 89 investment companies (comprised of 197 portfolios) managed by the Manager. He is 34 years old and has been an employee of the Distributor since October 1998.

The Fund 33

| For More | | Information |

| |

|

| |

| Dreyfus Premier | | Transfer Agent & |

| New York Municipal | | Dividend Disbursing Agent |

| Bond Fund | | |

| | | Dreyfus Transfer, Inc. |

| 200 Park Avenue | | |

| | | 200 Park Avenue |

| New York, NY 10166 | | |

| | | New York, NY 10166 |

| |

| Manager | | Distributor |

| The Dreyfus Corporation | | |

| | | Dreyfus Service Corporation |

| 200 Park Avenue | | |

| | | 200 Park Avenue |

| New York, NY 10166 | | |

| | | New York, NY 10166 |

| Custodian | | |

| The Bank of New York | | |

| One Wall Street | | |

| New York, NY 10286 | | |

Telephone Call your financial representative or 1-800-554-4611

| Mail | | The Dreyfus Premier Family of Funds |

| | | 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 |

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The fund's Forms N-Q are available on the SEC's website at http://www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Information regarding how the fund voted proxies relating to portfolio securities for the 12-month period ended June 30, 2004, is available on the SEC's website at http://www.sec.gov and without charge, upon request, by calling 1-800-645-6561.

© 2005 Dreyfus Service Corporation 0021AR1104

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There have been no amendments to, or waivers in connection with, the Code of Ethics during the period covered by this Report.

Item 3. Audit Committee Financial Expert.

The Registrant's Board has determined that Joseph S. DiMartino, a member of the Audit Committee of the Board, is an audit committee financial expert as defined by the Securities and Exchange Commission (the "SEC"). Mr. DiMartino is "independent" as defined by the SEC for purposes of audit committee financial expert determinations.

Item 4. Principal Accountant Fees and Services

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements, or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $25,900 in 2003 and $27,195 in 2004.

(b) Audit-Related Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2003 and $0 in 2004.

The aggregate fees billed in the Reporting Periods for non-audit assurance and related services by the Auditor to the Registrant's investment adviser (not including any sub-investment adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant ("Service Affiliates"), that were reasonably related to the performance of the annual audit of the Service Affiliate, which required pre-approval by the Audit Committee were $125,000 in 2003 and $178,500 in 2004.

Note: For the second paragraph in each of (b) through (d) of this Item 4, certain of such services were not pre-approved prior to May 6, 2003, when such services were required to be pre-approved. On and after May 6, 2003, 100% of all services provided by the Auditor were pre-approved as required. For comparative purposes, the fees shown assume that all such services were pre-approved, including services that were not pre-approved prior to the compliance date of the pre-approval requirement.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice and tax planning ("Tax Services") were $2,523 in 2003 and $2,674 in 2004. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments, (iii) tax advice regarding tax qualification matters and/or treatment of various

financial instruments held or proposed to be acquired or held, and (iv) determination of Passive Foreign Investment Companies.

The aggregate fees billed in the Reporting Periods for Tax Services by the Auditor to Service Affiliates which required pre-approval by the Audit Committee were $0 in 2003 and $0 in 2004.

(d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2003 and $197 in 2004. These services consisted of a review of the Registrant's anti-money laundering program.

The aggregate fees billed in the Reporting Periods for Non-Audit Services by the Auditor to Service Affiliates, other than the services reported in paragraphs (b) through (c) of this Item, which required pre-approval by the Audit Committee were $0 in 2003 and $0 in 2004.

Audit Committee Pre-Approval Policies and Procedures. The Registrant's Audit Committee has established policies and procedures (the "Policy") for pre-approval (within specified fee limits) of the Auditor's engagements for non-audit services to the Registrant and Service Affiliates without specific case-by-case consideration. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. Pre-approvals pursuant to the Policy are considered annually.

Non-Audit Fees. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant, and rendered to Service Affiliates, for the Reporting Periods were $292,712 in 2003 and $653,655 in 2004.

Auditor Independence. The Registrant's Audit Committee has considered whether the provision of non-audit services that were rendered to Service Affiliates which were not pre-approved (not requiring pre-approval) is compatible with maintaining the Auditor's independence.

| Item 5. | | Audit Committee of Listed Registrants. |

| | | Not applicable. | | [CLOSED-END FUNDS ONLY] |

| Item 6. | | Schedule of Investments. |

| | | Not applicable. | | |

| Item 7. | | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management |

| | | Investment Companies. |

| | | Not applicable. | | [CLOSED-END FUNDS ONLY] |

| Item 8. | | Purchases of Equity Securities by Closed-End Management Investment Companies and |

| | | Affiliated Purchasers. |

| | | Not applicable. | | [CLOSED-END FUNDS ONLY] |

| Item 9. | | Submission of Matters to a Vote of Security Holders. |