As filed with the Securities and Exchange Commission on October 14, 2011

1933 Act File No. 033-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [ X ] |

| | Pre-Effective Amendment No. ____ | [ ] |

| | Post-Effective Amendment No. ____ | [ ] |

EAGLE GROWTH & INCOME FUND

880 Carillon Parkway

St. Petersburg, FL 33716

Registrant’s Telephone Number, including Area Code: (727) 567-8143

SUSAN L. WALZER, PRINCIPAL EXECUTIVE OFFICER

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates LLP

1601 K Street, NW

Washington, D.C. 20006

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing will become effective on the 30th day after filing pursuant to Rule 488.

Title of Securities Being Offered: Class A, Class C, Class I, Class R-3 and Class R-5 shares of the Eagle Growth & Income Fund.

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of securities.

EAGLE GROWTH & INCOME FUND

CONTENTS OF REGISTRATION STATEMENT

This registration document is comprised of the following:

Cover Sheet

Contents of Registration Statement

Part A – Information Statement and Prospectus

Part B – Statement of Additional Information

Part C – Other Information

Signature Page

Exhibit Index

Exhibits

Eagle Series Trust – Large Cap Core Fund

880 Carillon Parkway

St. Petersburg, FL 33716

[ ], 2011

Dear Valued Shareholder:

On August 16, 2011, a joint meeting of the Board of Trustees of the Eagle Series Trust (“Trust”) (“Series Trust Board”) and the Board of Trustees of the Eagle Growth & Income Fund (“Growth & Income” or “Acquiring Fund”) was held to approve the reorganization of the Eagle Large Cap Core Fund, a series of the Trust (“Large Cap Core” or “Acquired Fund”) into Growth & Income (the “Reorganization”):

Acquired Fund will be reorganized into Acquiring Fund |

| Large Cap Core | Growth & Income |

The Reorganization will take effect on or about January 20, 2012. You do not need to take any action regarding your account. At that time, shareholders of Large Cap Core will automatically become shareholders of Growth & Income, receiving shares of Growth & Income having an aggregate net asset value equal to the shareholder’s investment in Large Cap Core.

Both Funds are managed by Eagle Investment Management, Inc. and have substantially similar investment objectives, although different investment strategies and risks. The attached Combined Prospectus and Information Statement contains further information regarding the Reorganization and Growth & Income. Please read it carefully.

The Series Trust Board believes that the Reorganization will benefit Large Cap Core and its shareholders as a result of the lower fees and expenses, strong performance record, and stable asset base of Growth & Income. Further, the Reorganization is not expected to result directly in any adverse tax consequences or changes in account values for shareholders. No sales load, commission or other fee will be imposed on shareholders in connection with the tax-free exchange of their shares. Detailed information regarding the Reorganization is contained in the enclosed materials.

If you have any questions regarding the Reorganization, please call Eagle Family of Funds toll-free at 800.421.4184.

Sincerely,

______________

Susan L. Walzer

Vice President,

Principal Executive Officer

Questions and Answers

Q. What is happening? Why did I get this document?

A. The Board of Trustees of Eagle Series Trust (“Board”), of which the Eagle Large Cap Core Fund (“Large Cap Core”) is a series, has approved the reorganization of Large Cap Core into the Eagle Growth & Income Fund (“Growth & Income”) (the “Reorganization”). Please see below for more information comparing the investment objectives, strategies and policies of the Funds.

You are receiving this document because, as of [ ], 2011, you were a shareholder of Large Cap Core. Pursuant to the Agreement and Plan of Reorganization and Termination (“Plan”), upon closing of the transaction, your shares of Large Cap Core will convert to shares of Growth & Income with an aggregate net asset value (“NAV”) equal to your Large Cap Core shares as of the close of business on the day of the closing of the Reorganization, which currently is scheduled to take place on or about January 20, 2012 (“Effective Date”).

Q. What is this document?

A. This document is a Combined Prospectus and Information Statement (“Information Statement”) for Large Cap Core and Growth & Income. This Information Statement contains information the shareholders of Large Cap Core should know prior to the Reorganization. You should retain this document for future reference.

Q. What is the Reorganization?

A. The Reorganization discussed in this Information Statement will reorganize Large Cap Core into Growth & Income on or about the Effective Date. Both Funds have substantially similar investment objectives, although they employ different investment policies and strategies to reach those objectives. Please see below for more information comparing the investment objectives, strategies and policies of the Funds.

Q. How will this affect me as a shareholder?

A. Shareholders of Large Cap Core will become shareholders of Growth & Income on the Effective Date. No sales charges or other fees, other than those described below, will be imposed in connection with the Reorganization. In addition, the Funds’ procedures for purchasing, redeeming and exchanging shares are identical.

If you own Class A shares of Large Cap Core, you will receive Class A shares of Growth & Income. The initial sales charge will not apply to Class A shares you receive in connection with the Reorganization. Purchases you make of Class A shares of Growth & Income after consummation of the Reorganization will be subject to an initial sales charge. If your Class A shares of Large Cap Core are subject to a contingent deferred sales charge (“CDSC”), the CDSC will apply to your redemption of the Class A shares of Growth & Income you receive in the Reorganization. For purposes of determining the CDSC, if any, applicable to a redemption of the Class A shares of Growth & Income you acquire in the Reorganization, those Class A shares of Growth & Income will continue to age from the date you purchased the Large Cap Core Class A shares that were converted in the Reorganization.

If you own Class C shares of Large Cap Core, you will receive Class C shares of Growth & Income. The CDSC applicable to the Large Cap Core Class C shares will apply to your redemption of the Class C shares of Growth & Income you receive in the Reorganization. For purposes of determining the CDSC, if any, applicable to any redemption of the Class C shares of Growth & Income you acquire in the Reorganization, those Class C shares of Growth & Income will continue to age from the date you purchased the Large Cap Core Class C shares that were converted in the Reorganization.

If you own Class I shares of Large Cap Core, you will receive Class I shares of Growth & Income in the Reorganization. If you own Class R-3 shares of Large Cap Core, you will receive Class R-3 shares of Growth & Income in the Reorganization. If you own Class R-5 shares of Large Cap Core, you will receive Class R-5 shares of Growth & Income in the Reorganization. Class I, Class R-3, and Class R-5 shares of both Large Cap Core and Growth & Income have neither a front-end sales charge nor a CDSC.

Q. After the Reorganization, will I own the same number of shares?

A. The aggregate value of your investment will not change as a result of the Reorganization. It is likely, however, that the number of shares you own will change because your shares will be exchanged at the NAV per share of Growth & Income, which will probably be different from the NAV per share of Large Cap Core.

Q. What if I already own shares of Growth & Income?

A. If you already own shares of both Large Cap Core and Growth & Income, the shares exchanged in this Reorganization will be added to your existing account so long as your account in each Fund has the same account number.

Q. Will my expenses increase pursuant to the Reorganization?

A. No. One of the benefits of the Reorganization is that Growth & Income has lower total annual operating expenses than Large Cap Core.

Q. What are the tax consequences of the Reorganization?

A. The Reorganization is expected to be a tax-free transaction for federal income tax purposes. However, some, or a substantial portion of, the assets transferred to Growth & Income from Large Cap Core may be sold, which may result in Large Cap Core’s recognition of net capital gain that would be taxable to shareholders when distributed to them before the Reorganization.

Q. Can I still purchase shares of Large Cap Core until the Reorganization?

A. You may continue to purchase shares of Large Cap Core through December 15, 2011. As a result of the Reorganization, effective December 16, 2011, Large Cap Core will no longer accept purchases or exchanges of shares.

Q. Will I need to open an account in Growth & Income prior to the Reorganization?

A. No. An account will be set up in your name and your shares of Large Cap Core automatically will be converted to corresponding shares of Growth & Income. You will receive confirmation of this transaction following the Reorganization.

Q. What if I want to exchange my shares into another Eagle Fund prior to the Reorganization?

A. You may exchange your shares into another Fund in the Eagle Family of Funds before the Effective Date in accordance with your pre-existing exchange privileges. If you choose to exchange your shares of Large Cap Core for another Fund in the Eagle Family of Funds, your request will be treated as a normal exchange of shares and will be a taxable transaction unless your shares are held in a tax-deferred account, such as an individual retirement account. Exchanges may be subject to minimum investment requirements, sales loads, and redemption fees.

Q. Who is paying the costs of the Reorganization?

A. Eagle Asset Management, Inc. (“Eagle”), the Funds’ investment adviser, has agreed to pay all costs associated with the Reorganization (other than brokerage or similar expenses incurred by, or for the benefit of, Large Cap Core in connection with the Reorganization). Large Cap Core will not bear any of the Reorganization costs (but will pay those expenses previously noted).

If you have any questions, please call the Eagle Family of Funds toll-free at 800.421.4184.

Combined Prospectus and Information Statement

[ ], 2011

Reorganization of the Assets and Liabilities of the

EAGLE LARGE CAP CORE FUND,

a series of Eagle Series Trust

By and in Exchange for Shares of and Assumption of Liabilities by the

EAGLE GROWTH & INCOME FUND

880 Carillon Parkway

St. Petersburg, FL 33716

(800) 421-4184

This Combined Prospectus and Information Statement (“Information Statement”) contains information you should know about the Agreement and Plan of Reorganization and Termination (“Plan”) relating to the reorganization of the Eagle Large Cap Core Fund (“Large Cap Core”) into the Eagle Growth & Income Fund (“Growth & Income”) (the “Reorganization”). Each of Large Cap Core and Growth & Income is referred to as a “Fund” and collectively, the “Funds.”

Large Cap Core is a series of Eagle Series Trust (“Series Trust”). Series Trust and Growth & Income are Massachusetts business trusts and are registered, open-end management investment companies. The investment objective of Large Cap Core is to seek long-term growth through capital appreciation, and the investment objective of Growth & Income is to seek long-term capital appreciation and, secondarily, to seek current income. You should carefully read this Information Statement, which contains important information you should know, and keep it for future reference.

Upon completion of the Reorganization you will become a shareholder of Growth & Income. You will receive shares of the corresponding class of Growth & Income with an aggregate net asset value (“NAV”) equal to the aggregate NAV of the class of Large Cap Core shares that you hold as of the close of business on the day of the closing of the Reorganization, which is expected to be January 20, 2012 (“Closing Date”). When the Reorganization is completed, Large Cap Core will be dissolved.

This Information Statement sets forth important information that you should know regarding the Reorganization. You should read and retain this Information Statement for future reference. The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated by reference into this Information Statement:

| | 1. | The combined prospectus for Series Trust, which includes Large Cap Core (File Nos. 811-07470 and 033-57986), and Growth & Income (File Nos. 811-04767 and 033-07559) dated March 1, 2011 (as supplemented April 26, 2011 and June 30, 2011). You should review this prospectus. |

| | 2. | The combined Statement of Additional Information for the Funds dated March 1, 2011 (as supplemented April 26, 2011, May 19, 2011 and June 30, 2011). |

| | 3. | The financial statements included in the Annual Report to shareholders of the Funds for the fiscal year ended October 31, 2010, and the unaudited financial statements and Fund highlights included in the Semi-Annual Report to shareholders of the Funds for the six-month period ended April 30, 2011. |

Large Cap Core previously sent its Annual Report and Semi-Annual Report to its shareholders. For a free copy of these reports or any of the documents listed above, you may call 1.800.421.4184, send an email to EagleFundServices@eagleasset.com, or write to Large Cap Core at:

Eagle Large Cap Core Fund

c/o/ Eagle Family of Funds

P.O. Box 33022

St. Petersburg, FL 33733

You also may obtain many of these documents by accessing the Internet site for the Funds at eagleasset.com. Text-only versions of all the Funds’ documents can be viewed online or downloaded from the EDGAR database on the SEC’s Internet site at www.sec.gov. You can review and copy information regarding the Funds by visiting the SEC’s Public Reference Room, Room 1580, 100 F Street NE, Washington, D.C. 20549. You can obtain copies, upon payment of a duplicating fee, by sending an e-mail request to publicinfo@sec.gov or by writing the Public Reference Room at the address above. Information on the operations of the Public Reference Room may be obtained by calling 1.800.SEC.0330.

The SEC has not approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

Shares of each Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal.

No person has been authorized to give any information or to make any representation other than those in this Information Statement, and, if given or made, such other information or representation must not be relied upon as having been authorized by either Fund or Series Trust.

TABLE OF CONTENTS

| ABOUT THE REORGANIZATION | 6 |

| | Summary | 6 |

| | Considerations Regarding the Reorganization | 7 |

| | Comparison of Investment Objectives, Strategies and Policies | 8 |

| | Comparison of Investment Restrictions and Limitations | 10 |

| | Comparison of Principal Risks | 12 |

| | Comparison of Fees and Expenses | 15 |

| | Example of Fund Expenses | 17 |

| | Comparative Performance Information | 17 |

| | Capitalization | 20 |

| | Information Regarding the Reorganization | 21 |

| | Agreement and Plan of Reorganization and Termination | 21 |

| | Reasons for the Reorganization | 21 |

| | Description of the Securities to be issued | 23 |

| | Federal Income Tax Considerations | 23 |

| | | |

| ADDITIONAL INFORMATION REGARDING GROWTH & INCOME | 24 |

| | Investment Adviser | 24 |

| | Valuation of Shares | 25 |

| | Market Timing Policy | 25 |

| | Disclosure of Portfolio Holdings | 26 |

| | | |

| OTHER INFORMATION | 26 |

| | Legal Matters | 26 |

| | Additional Information | 26 |

| | | |

| FINANCIAL HIGHLIGHTS | 27 |

| APPENDIX A – AGREEMENT AND PLAN OF REORGANIZATION AND TERMINATION | A-1 |

| APPENDIX B – FINANCIAL HIGLIGHTS | B-1 |

ABOUT THE REORGANIZATION

Summary

The following is a summary of certain information relating to the Reorganization and is qualified in its entirety by reference to the more complete information contained elsewhere in the Information Statement. Due primarily to concerns over asset levels and marketability, Eagle Asset Management, Inc., the investment manager of Large Cap Core (“Eagle”), recommended to Series Trust’s Board of Trustees (“Board”) to reorganize Large Cap Core into Growth & Income.

After careful consideration of a number of factors, the Board has voted to reorganize Large Cap Core into Growth & Income, which would acquire all of the assets of Large Cap Core in exchange solely for the assumption of all the liabilities of Large Cap Core and the issuance of shares of Growth & Income to be distributed pro rata by Large Cap Core to its shareholders in complete liquidation and termination of Large Cap Core. As a result of the Reorganization, each shareholder of Large Cap Core would become the owner of Growth & Income’s shares having a total aggregate value equal to the total aggregate value of his or her holdings in Large Cap Core on the Closing Date.

Large Cap Core and Growth & Income both offer Class A, Class C, Class I, Class R-3 and Class R-5 shares. Each class of shares of Large Cap Core has the same purchase, exchange and redemption procedures as the corresponding class of shares of Growth & Income. Each Large Cap Core shareholder would receive shares of the same class of Growth & Income having the same aggregate value as such shareholder currently owns.

You will not incur any sales loads or similar transaction charges as a result of the Reorganization. Further, for purposes of calculating any holding period used to determine a contingent deferred sales charge, your original purchase will apply.

The Board, including the Trustees who are not “interested persons” (within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”)) of Series Trust or Growth & Income (“Independent Trustees”), has concluded that the Reorganization would be in the best interests of Large Cap Core and its existing shareholders and that the interests of existing shareholders would not be diluted as a result of the transactions contemplated by the Reorganization. Among other things, the Reorganization would give Large Cap Core’s shareholders the opportunity to participate in a larger fund with a substantially similar investment objective (although with differing investment policies and strategies). In addition, shareholders of Large Cap Core are expected to experience a reduction in the overall operating expenses paid in connection with their investment in Growth & Income. See “Reasons for the Proposed Reorganization” below for further information.

As a condition to the Reorganization, Large Cap Core will receive an opinion of counsel that the Reorganization will be considered a tax-free reorganization under applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), so that neither Large Cap Core nor Growth & Income or their shareholders will recognize any gain or loss as a result of the Reorganization. See “Federal Income Tax Considerations” below for further information. However, sales of any of Large Cap Core’s assets could result in its realization of net gains that would have to be distributed before the Reorganization and, thus, taxed to its shareholders. Large Cap Core has capital loss carryovers that it does not expect to be able to fully use before the Reorganization, and Growth & Income’s utilization of Large Cap Core’s remaining capital loss carryovers after the Reorganization will be subject to certain limitations under the Code.

Considerations Regarding the Reorganization

Please note the following information regarding the Reorganization:

| | ● | Growth & Income pursues a substantially similar investment objective as Large Cap Core, although via different investment policies and strategies. The investment objective of Large Cap Core is to seek long-term growth through capital appreciation, and the investment objective of Growth & Income is to seek long-term capital appreciation and, secondarily, to seek current income. Each Fund invests primarily in common stocks of U.S. companies. Among other differences, however, Growth & Income invests in securities that its portfolio managers believe are undervalued and demonstrate the potential for intermediate- and long-term growth, while Large Cap Core invests in securities that its portfolio managers believe are high-quality, financially strong companies that pay above–market dividends, have cash resources and a history of raising dividends. Nevertheless, Eagle, each Fund’s investment adviser, has reviewed their current portfolio holdings and determined that Large Cap Core’s holdings generally are compatible with Growth & Income’s investment objective and policies. As a result, Eagle believes that all or substantially all of Large Cap Core’s assets could be transferred to and held by Growth & Income. See “Comparison of Investment Objectives, Strategies and Policies” below for further information. |

| | ● | Eagle is the investment adviser of each Fund. |

| | ● | Growth & Income has outperformed its benchmark index, the S&P 500 Index, for the five- and ten-year time periods, while Large Cap Core has underperformed its benchmark index, also the S&P 500 Index, for all time periods. |

| | ● | The Reorganization is expected to result in lower overall fees and expenses for shareholders of Large Cap Core, even though Growth & Income has identical contractual expense caps as Large Cap Core. Similar to its agreement with Large Cap Core, Eagle contractually has agreed to limit Growth & Income’s total annual operating expenses through February 29, 2012. In addition, Eagle will benefit to the extent that it will no longer continue to waive and/or reimburse the operating expenses for Large Cap Core. |

| | ● | For each class of shares other than Class R-5, Growth & Income’s total annual operating expense ratio is lower than that of the corresponding class of shares of Large Cap Core. In this regard, the total annual operating expense for both Funds is higher than the expense cap for the Funds, which results in identical net operating expenses for Class R-5 shares of both Funds. |

| | ● | The interests of the Funds’ shareholders would not be diluted by the Reorganization, because the Reorganization would be effected on the basis of each Fund’s NAV. |

| | ● | Eagle has agreed to pay all costs associated with the Reorganization (other than brokerage or similar expenses incurred by or for the benefit of Large Cap Core in connection with the Reorganization). Large Cap Core will not bear any of the Reorganization costs (but will pay those expenses previously noted). |

| | ● | The Reorganization is expected to be a tax-free transaction. However, to the extent that Large Cap Core has any assets that cannot be held by Growth & Income, those assets will be sold before the Reorganization. The proceeds of those sales will be held in temporary investments or reinvested in assets that qualify to be held by Growth & Income. The possible need for Large Cap Core to dispose of assets before the Reorganization could result in its selling securities at a disadvantageous time and realizing losses that otherwise would not have been realized. Alternatively, these sales could result in Large Cap Core realizing gains that otherwise would not have been realized, the net proceeds of which would be included in a taxable distribution to its shareholders before the Reorganization. |

Comparison of Investment Objectives, Strategies and Policies

Large Cap Core and Growth & Income have substantially similar investment objectives but pursue these objectives via varying investment policies and strategies. The Funds’ investment objectives, strategies and policies are described below.

Eagle, the investment adviser of Large Cap Core, has reviewed Large Cap Core’s current portfolio holdings and determined that those holdings generally are compatible with Growth & Income’s investment objective and policies. As a result, Eagle believes that all or substantially all of Large Cap Core’s assets could be transferred to and held by Growth & Income. However, the portfolio manager of Growth & Income may determine to sell some or a substantial portion of the assets of Large Cap Core after the completion of the Reorganization, which may result in Growth & Income’s recognition of net gain that would be taxable to its shareholders, including former Large Cap Core shareholders, when distributed to them.

| | Large Cap Core | Growth & Income |

Investment Objective | Seeks long-term growth through capital apprecation. | Primarily seeks long-term capital appreciation and, secondarily, seeks current income. |

| Investment | During normal market conditions, Large | During normal market conditions, Growth |

| | Large Cap Core | Growth & Income |

| Strategies | Cap Core seeks to achieve its objective by investing at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in the equity securities of large U.S. companies (i.e., typically having a market capitalization over $3 billion at the time of investment). The Fund will invest in securities that the portfolio managers believe are undervalued relative to their earnings growth prospects and have the potential for growth over the intermediate- and long-term. The Fund also may invest in preferred stocks and convertible securities that the portfolio managers believe may permit the Fund to achieve its investment objective. | & Income seeks to achieve its objective by investing primarily in domestic equity securities (predominantly common stocks) that the portfolio managers believe are high-quality, financially strong companies that pay above-market dividends, have cash resources (i.e., free cash flow) and a history of raising dividends. |

| | In general, Large Cap Core’s portfolio managers seek to select securities that, at the time of purchase, typically have at least one of the following characteristics: (1) projected earnings growth rate at or above that of the Standard & Poor’s Composite Stock Index (“S&P 500 Index”), (2) above-average earnings quality and stability, or (3) a price-to-earnings ratio comparable to that of the S&P 500 Index. | Growth & Income’s portfolio managers select securities based in part upon their belief that those companies have the following characteristics: (1) yield or dividend growth at or above that of the S&P 500 Index, (2) potential for growth, and (3) stock price below its intrinsic value. |

| | Large Cap Core invests in the equities of large U.S. companies (as referenced above), preferred stocks and convertible securities. | Growth & Income invests primarily in domestic equity securities, including common stocks, convertible securities, preferred stocks and real estate investment trusts. |

| | Large Cap Core generally invests in the securities of domestic large-capitalization companies. | Growth & Income generally invests in the securities of mid- and large-capitalization companies. |

| | Large Cap Core normally holds a focused portfolio of stocks of fewer companies than many other diversified mutual funds. | Growth & Income normally holds a broader range of stocks than Large Cap Core. |

| | Large Cap Core’s portfolio manager uses a “bottom-up” method of analysis based on fundamental research to determine which common stocks to purchase. | Same. |

| | Large Cap Core | Growth & Income |

| Strategies |

| | Large Cap Core generally sells securities when they no longer meet the portfolio management team’s investment criteria. | Growth & Income generally sells a security when its price appreciation reaches or exceeds sustainable levels, the issuer’s fundamentals deteriorate, or a more attractive investment opportunity develops. |

| | As a temporary defensive measure because of market, economic or other conditions, Large Cap Core may invest up to 100% of its assets in high-quality, short-term debt instruments or may take positions that are inconsistent with its principal investment strategies. To the extent that the Fund invokes this strategy, its ability to achieve its investment objective may be affected adversely. | Same. |

Investment Manager | Eagle Asset Management, Inc. | Same. |

Portfolio Managers | The large cap core team of Eagle has been responsible for the day-to-day management of Large Cap Core since its inception in 2010. The team is comprised of four Co-Portfolio Managers, each of whom is responsible for all aspects of the management of the Fund: Richard H. Skeppstrom II, E. Craig Dauer, CFA®, John G. Jordan, III, CFA®, and Robert Marshall. Mr. Skeppstrom leads the team and has been a Managing Director of Eagle since 2001. Messrs. Dauer and Jordan have been Co-Portfolio Managers on the large cap core team since 2001. Mr. Marshall has been a Co-Portfolio Manager on the large cap core team since 2002. | Edmund Cowart, David Blount and John Pandtle are Co-Portfolio Managers of Growth & Income and responsible for the day-to-day management of the Fund. They have been managing the Fund since June 2011. Mr. Cowart joined Eagle in 1993 and has been a Senior Vice President, Managing Director and portfolio manager at Eagle since 1999. Mr. Blount joined Eagle in 1993, was a Senior Research Analyst at Eagle from 1999 through 2008 and has been a Portfolio Manager at Eagle since 2008. Mr. Pandtle worked at Eagle from 1999-2002, was a Senior Vice President in the equity research department of Raymond James & Associates, Inc. from 2002 through 2008 and has been a portfolio manager at Eagle since 2009. |

Comparison of Investment Restrictions and Limitations

As described in the table below, the investment restrictions and limitations for each Fund are identical. The fundamental investment policies of each Fund may not be changed without a vote of the majority of the outstanding securities of the Fund. Each investment restriction and limitation for Large Cap Core and Growth & Income may be found in their combined Statement of Additional Information (“SAI”).

| Investment Restriction | Large Cap Core | Growth & Income |

| Fundamental Investment Policies |

| Diversification | Except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief, Large Cap Core may not, with respect to 75% of its total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, and securities of other investment companies) if, as a result, (a) more than 5% of the Fund’s total assets would be invested in the securities of that issuer, or (b) the Fund would hold more than 10% of the outstanding voting securities of that issuer. | Same. |

| Industry Concentration | Large Cap Core may not invest more than 25% in any one industry. | Same. |

| Borrowing Money | Large Cap Core may not borrow money, except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. | Same. |

| Issuing Senior Securities | Large Cap Core may not issue senior securities, except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. | Same. |

| Underwriting | Large Cap Core may not underwrite securities issued by others, except to the extent that the Fund may be considered an underwriter within the meaning of the Securities Act of 1933, as amended, in the disposition of restricted securities or in connection with investments in other investment companies. | Same. |

| Investment Restriction | Large Cap Core | Growth & Income |

| Investing in Real Estate | Large Cap Core may not purchase or sell real estate, except that, to the extent permitted by applicable law, it may (1) invest in securities or other instruments directly or indirectly secured by real estate and (2) invest in securities or other instruments issued by issuers that invest in real estate. | Same. |

| Loans | Large Cap Core may make loans only as permitted under the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. | Same. |

| Non-Fundamental Investment Policies |

Investing in Illiquid

Securities | Large Cap Core may not invest more than 15% of its net assets in repurchase agreements maturing in more than seven days or in other illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions as to resale. | Same. The 15% limitation also includes privately placed securities. |

Investing in Investment

Companies | Large Cap Core may invest in securities issued by other investment companies as permitted by the 1940 Act. | Same. |

| Option Writing | No limitation. | Same. |

| Pledging | No limitation. | Same. |

Comparison of Principal Risks

The principal risks of investing in Growth & Income and Large Cap Core are discussed below. The Funds’ risks vary between them. The greatest risk of investing in a mutual fund is that its returns will fluctuate and you could lose money. Turbulence in financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect many issuers worldwide, which could have an adverse effect on the Funds. Additionally, while the portfolio managers of each Fund seek to take advantage of investment opportunities that will maximize the Fund’s investment returns, there is no guarantee that such opportunities will ultimately benefit the Fund. There is no assurance that the portfolio managers’ investment strategy will enable a Fund to achieve its investment objective. Each Fund may be subject to different principal risks. Some of the principal risks of investing in the Funds are discussed below. However, other factors may also affect each Fund’s NAV.

| Risk | Large Cap Core | Growth & Income |

| Covered call options | | X |

| Credit | | X |

| Focused holdings | X | |

| Government sponsored enterprise | | X |

| Growth stocks | X | X |

| High yield securities | | X |

| Interest rates | | X |

| Market timing activities | | X |

| Mid cap companies | | X |

| Sectors | X | |

| Stock Market | X | X |

| Value Stocks | X | X |

The Funds are both subject to the following primary risks:

Growth stocks | Growth companies are expected to increase their earnings at a certain rate. When these expectations are not met, investors may punish the prices of stocks excessively, even if earnings showed an absolute increase. Growth company stocks also typically lack the dividend yield that can cushion stock prices in market downturns.

Stock market | The value of a Fund’s stock holdings may decline in price because of changes in prices of its holdings or a broad stock market decline. These fluctuations could be a sustained trend or a drastic movement. The stock markets generally move in cycles, with periods of rising prices followed by periods of declining prices. The value of your investment may reflect these fluctuations.

Value stocks | Investments in value stocks are subject to the risk that their true worth may not be fully realized by the market. This may result in the value stocks’ prices remaining undervalued for extended periods of time. A Fund’s performance also may be affected adversely if value stocks remain unpopular with or lose favor among investors.

Growth & Income is subject to the following primary risks that are not primary risks of Large Cap Core:

Covered Call Options | Because Growth & Income may write covered call options, it may be exposed to risk stemming from changes in the value of the stock that the option is written on. While call option premiums may generate incremental portfolio income, they also can limit gains from market movements.

Credit | Growth & Income could lose money if the issuer of a fixed-income security is unable to meet its financial obligations or goes bankrupt. Credit risk usually applies to most fixed-income securities, but generally is not a factor for U.S. government obligations.

Government sponsored enterprises | Investments in government sponsored enterprises are debt obligations issued by agencies and instrumentalities of the U.S. Government. These obligations vary in the level of support they receive from the U.S. Government. They may be: (1) supported by the full faith

and credit of the U.S. Treasury, such as those of the Government National Mortgage Association; (2) supported by the right of the issuer to borrow from the U.S. Treasury, such as those of the Federal National Mortgage Association; (3) supported by the discretionary authority of the U.S. Government to purchase the issuer’s obligations, such as those of the Student Loan Marketing Association; or (4) supported only by the credit of the issuer, such as those of the Federal Farm Credit Bureau. The U.S. Government may choose not to provide financial support to U.S. Government sponsored agencies or instrumentalities if it is not legally obligated to do so, in which case, if the issuer defaulted, Growth & Income might not be able to recover its investment from the U.S. Government.

High-yield securities | Investments in securities rated below investment grade, or “junk bonds,” generally involve significantly greater risks of loss of your money than an investment in investment grade bonds. Compared with issuers of investment grade bonds, junk bonds are more likely to encounter financial difficulties and to be materially affected by these difficulties. Rising interest rates may compound these difficulties and reduce an issuer’s ability to repay principal and interest obligations. Issuers of lower-rated securities also have a greater risk of default or bankruptcy. Additionally, due to the greater number of considerations involved in the selection of Growth & Income’s securities, the achievement of its objective depends more on the skills of the portfolio managers than investing only in higher-rated securities. Therefore, your investment may experience greater volatility in price and yield. High-yield securities may be less liquid than higher quality investments. A security whose credit rating has been lowered may be particularly difficult to sell.

Interest rates | Investments in investment-grade and non-investment grade fixed-income securities are subject to interest rate risk. The value of Growth & Income’s fixed income investments typically will fall when interest rates rise. Growth & Income is particularly sensitive to changes in interest rates because it may invest in debt securities with intermediate and long terms to maturity. Debt securities with longer durations tend to be more sensitive to changes in interest rates, usually making them more volatile than debt securities with shorter durations. Yields of debt securities will fluctuate over time.

Market timing activities | Because of specific securities that Growth & Income may invest in, it could be subject to the risk of market timing activities by Fund shareholders. Some examples of these types of securities are high-yield, small-cap and foreign securities. Typically, foreign securities offer the most opportunity for these market timing activities. Growth & Income generally prices these foreign securities using their closing prices from the foreign markets in which they trade, typically prior to Growth & Income’s calculation of its NAV per share. These prices may be affected by events that occur after the close of a foreign market but before Growth & Income prices its shares. In such instances, Growth & Income may fair value foreign securities. However, some investors may engage in frequent short-term trading in Growth & Income to take advantage of any price differentials that may be reflected in the NAV of its shares. There is no assurance that fair valuation of securities can reduce or eliminate market timing. While Eagle and the transfer agent of Growth & Income monitor trading in the Fund, there is no guarantee that they can detect all market timing activities.

Mid-cap companies | Investments in mid-capitalization companies generally involve greater risks than investing in large-capitalization companies. Mid-capitalization companies often have narrower commercial markets and more limited managerial and financial resources than larger, more established companies. As a result, their performance can be more volatile and they face greater risk of business failure, which could increase the volatility of Growth & Income’s portfolio. Generally, the smaller the company size, the greater these risks. Additionally, mid-capitalization companies may have less market liquidity than large-capitalization companies.

Large Cap Core is subject to the following primary risks that are not primary risks of Growth & Income:

Focused holdings | Large Cap Core normally holds a core portfolio of stocks of fewer companies than other more diversified funds, which means that the increase or decrease in the value of a single stock may have a greater impact on Large Cap Core’s NAV and total return.

Sectors | Companies that are in similar businesses may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in a particular sector of the market to change. To the extent Large Cap Core has substantial holdings within a particular sector, the risks associated with that sector increase.

Comparison of Fees and Expenses

The following tables show the fees and expenses of each class of shares of Large Cap Core and Growth & Income and the pro forma fees and expenses of each class of shares of Growth & Income after giving effect to the proposed Reorganization. Expenses for each Fund are based on the operating expenses incurred by each class of their shares for the twelve-month period ended April 30, 2011. The pro forma of each class of shares of Growth & Income assumes that the Reorganization had been in effect for the same period.

Shareholder Fees (fees paid directly from your investment)

| | Large Cap Core | Growth & Income | Pro Forma Fund |

| | Class A | Class C | Class I,

R-3 and

R-5 | Class A | Class C | Class I,

R-3 and

R-5 | Class A | Class C | Class I,

R-3 and

R-5 |

Maximum sales

charge imposed on

purchases (as a

percentage of

offering price) | 4.75% | None | None | 4.75% | None | None | 4.75% | None | None |

Maximum deferred

sales charge (as

a percentage of

original purchase

price or redemption

proceeds,

whichever is

lower) | None* | 1%▲ | | None* | 1%▲ | | None* | 1%▲ | |

Redemption fee (as

a percentage of

amount redeemed,

if applicable) | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

* If you purchased $1,000,000 or more of Class A shares of an Eagle mutual fund that were subject to a front-end sales charge and sell those shares within 18 months from the date of purchase, you may pay a 1% contingent deferred sales charge at the time of sale.

▲ Declining to 0% at the first year.

Annual fund operating expenses (expenses deducted from fund assets) | Class A | Class C | Class I | Class R-3 | Class R-5 |

| Investment Advisory Fees | |

| Large Cap Core | 0.60% | 0.60% | 0.60% | 0.60% | 0.60% |

| Growth & Income | 0.51% | 0.51% | 0.51% | 0.51% | 0.51% |

| Pro Forma Fund | 0.49% | 0.49% | 0.49% | 0.49% | 0.49% |

Distribution and Service (12b-1)

Fees(a) | | | | | |

| Large Cap Core | 0.25% | 1.00% | 0.00% | 0.50% | 0.00% |

| Growth & Income | 0.25% | 1.00% | 0.00% | 0.50% | 0.00% |

| Pro Forma Fund | 0.25% | 1.00% | 0.00% | 0.50% | 0.00% |

| Other Expenses | | | | | |

| Large Cap Core | 0.53% | 0.53% | 0.48% | 0.51% | 0.48% |

| Growth & Income | 0.41% | 0.41% | 0.36% | 0.41% | 0.38% |

| Pro Forma Fund | 0.41% | 0.41% | 0.37% | 0.41% | 0.39% |

Acquired Fund Fees and Expenses

(b) | | | | | |

| Large Cap Core | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Growth & Income | 0.03% | 0.03% | 0.03% | 0.03% | 0.03% |

| Pro Forma Fund | 0.03% | 0.03% | 0.03% | 0.03% | 0.03% |

Total Annual Fund Operating

Expenses (c) | | | | | |

| Large Cap Core | 1.39% | 2.14% | 1.09% | 1.62% | 1.09% |

| Growth & Income | 1.20% | 1.95% | 0.90% | 1.45% | 0.92% |

| Pro Forma Fund | 1.18% | 1.93% | 0.89% | 1.43% | 0.91% |

Fee Waivers and Expense

Reimbursements | | | | | |

| Large Cap Core | 0.00% | 0.02% | (0.13)% | 0.04% | (0.13%) |

| Growth & Income | 0.00% | 0.00% | 0.02% | 0.00% | 0.06% |

| Pro Forma Fund | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Net Expenses | | | | | |

| Large Cap Core | 1.39% | 2.16% | 0.96% | 1.66% | 0.96% |

| Growth & Income | 1.20% | 1.95% | 0.92% | 1.45% | 0.98% |

| Pro Forma Fund | 1.18% | 1.93% | 0.89% | 1.43% | 0.91% |

| (a) | Each Fund has adopted a distribution plan for each share class under Rule 12b-1 under the 1940 Act that allows it to pay distribution and service fees for the sale of its A shares, C shares and R-3 shares and for services provided to shareholders. Because these fees are paid out of a Fund’s assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. Under the Funds’ distribution plans, Large Cap Core is authorized to pay a maximum distribution and service fee of up to 0.35% of average daily assets on Class A shares and Growth & Income is authorized to pay a maximum distribution and service fee of up to 0.50% of average daily assets on Class A shares. Each Fund’s Board of Trustees has approved a current fee of 0.25% on Class A shares. Also, each Fund is authorized under its distribution plan to pay a maximum distribution and service fee of up to 0.50% of average daily net assets on Class R-3 shares. Class C shares of each Fund are subject to ongoing Rule 12b-1 fees of up to 1.00% of their average daily net assets. |

| (b) | Acquired fund fees and expenses are fees incurred indirectly by the Fund as a result of investment in certain pooled investment vehicles, such as mutual funds. |

| (c) | As the Funds’ asset levels change, the Funds’ fees and expenses may differ from those reflected in the preceding table. For example, as asset levels decline, expense ratios may increase. Eagle has contractually agreed to cap its investment advisory fee and/or reimburse certain expenses of the Funds to the extent that annual operating expenses of each class exceed a percentage of that class’ average daily net assets through February 29, 2012 as follows: Class A – 1.40%, Class C – 2.20%, Class I – 0.95%, Class R-3 – 1.65%, and |

| | Class R-5 – 0.95%. This expense limitation excludes interest, taxes, brokerage commissions, costs relating to investments in other investment companies, dividends, extraordinary expenses and includes offset expense arrangements with the Funds’ custodian. Each Fund’s Board of Trustees may agree to change fee limitations or reimbursements without the approval of Fund shareholders. Any reimbursement of Fund expenses or reduction in Eagle’s investment advisory fees is subject to reimbursement by the Funds within the following two fiscal years, if overall expenses fall below the lesser of its then current expense cap or the expense cap in effect at the time of the Fund reimbursement. |

Example of Fund Expenses

This example can help you compare costs between Large Cap Core and Growth & Income and the pro forma costs for Growth & Income after giving effect to the Reorganization. The example assumes that you invested $10,000 for the periods shown, that you earned a hypothetical 5% total return each year, and that the Funds’ expenses were those in the table above. Your costs would be the same whether you sold your shares or continued to hold them at the end of each period. Actual performance and expenses may be higher or lower.

| | Large Cap Core | Growth & Income | Pro Forma Fund |

| | Year

1 | Year

3 | Year

5 | Year

10 | Year

1 | Year

3 | Year

5 | Year

10 | Year

1 | Year

3 | Year

5 | Year

10 |

| Class A | $610 | $894 | $1,199 | $2,064 | $591 | $838 | $1,103 | $1,860 | $590 | $832 | $1,093 | $1,839 |

| Class C | $219 | $672 | $1,151 | $2,474 | $198 | $612 | $1,052 | $2,275 | $196 | $606 | $1,042 | $2,254 |

| Class I | $98 | $334 | $588 | $1,317 | $94 | $289 | $500 | $1,110 | $91 | $284 | $493 | $1,096 |

| Class R-3 | $169 | $515 | $885 | $1,925 | $148 | $459 | $792 | $1,735 | $146 | $452 | $782 | $1,713 |

| Class R-5 | $98 | $334 | $588 | $1,317 | $100 | $299 | $515 | $1,137 | $93 | $290 | $504 | $1,120 |

Comparative Performance Information

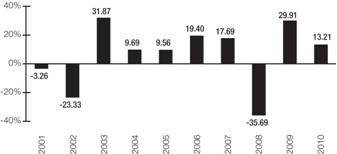

The bar charts below give some indication of the risks of an investment in Large Cap Core and Growth & Income by showing yearly changes in each Fund’s performance and by comparing each Fund’s performance with a broad measure of market performance. Both the bar chart and the table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Past performance (before and after taxes) is not an indication of future performance.

Calendar Year Annual Total Returns (Class A). The following bar charts illustrate the annual total returns for each Fund’s Class A shares for the calendar years shown. The inception date for Large Cap Core is May 2, 2005 and for Growth & Income is December 15, 1986. The returns for other share classes of the Fund may be higher or lower than the Class A returns shown in the bar chart depending on whether or not those other classes have higher total expenses.

Large Cap Core

For the ten-year period through December 31, 2010, Large Cap Core’s Class A shares’ highest quarterly return was 20.74% for the quarter ended June 30, 2009 and the lowest quarterly return was -24.28% for the quarter ended December 31, 2008. For the period from January 1, 2011 through September 30, 2011, Large Cap Core’s Class A shares’ total return (not annualized) was [__]%. These returns do not reflect sales charges. If the sales charges were reflected, the returns would be lower than those shown.

Growth & Income

For the ten-year period through December 31, 2010, Growth & Income’s Class A shares’ highest quarterly return was 23.28% for the quarter ended June 30, 2009 and the lowest quarterly return was -14.03% for the quarter ended December 31, 2008. For the period from January 1, 2011 through September 30, 2011, Growth & Income’s Class A shares’ total return (not annualized) was [__]%. These returns do not reflect sales charges. If the sales charges were reflected, the returns would be lower than those shown.

Average Annual Total Returns for the period ended December 31, 2010. The tables below show how the average annual total returns (adjusted to reflect applicable sales charges) for each class of shares of Large Cap Core and Growth & Income (before and after taxes) for the periods shown compare to those of a broad-based index. The table also shows total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of Fund shares.

| Large Cap Core* |

| Share Class | 1-Year | 5-Years | Lifetime |

| Class A Shares (Inception Date 5/2/05) |

| Return Before Taxes | 5.54% | -0.15% | 0.29% |

| Return After Taxes on Distributions | 5.51% | -0.58% | -0.09% |

Return After Taxes on Distributions and Sale of

Fund Shares | 3.64% | -0.29% | 0.10% |

| Class C Shares (Inception Date 5/2/05) |

| Return Before Taxes | 9.98% | 0.01% | 0.34% |

| Class I Shares (Inception Date 3/3/06) |

| Return Before Taxes | 11.33% | n/a | 0.52% |

| Class R-3 Shares (Inception date 12/28/09) |

| Return Before Taxes | 10.54% | n/a | 9.51% |

| Large Cap Core* |

| Class R-5 Shares (Inception date 4/2/07) |

| Return Before Taxes | 11.32% | n/a | -1.91% |

| Index |

S&P 500 Index** (reflects no deduction for fees,

expenses or taxes) | 15.06% | 2.29% | 3.55% |

* Large Cap Core’s returns in this table are after deduction of sales charges and expenses.

** The S&P 500 Index is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

| Growth & Income* |

| Share Class | 1-Year | 5-Years | 10-Years | Lifetime |

| Class A Shares (Inception Date 5/7/93) |

| Return Before Taxes | 7.84% | 4.83% | 4.05% | n/a |

| Return After Taxes on Distributions | 7.56% | 3.47% | 2.72% | n/a |

Return After Taxes on Distributions and Sale of

Fund Shares | 5.43% | 3.58% | 2.88% | n/a |

| Class C Shares (Inception Date 4/3/95) |

| Return Before Taxes | 12.45% | 5.06% | 3.77% | n/a |

| Class I Shares (Inception Date 6/27/06) |

| Return Before Taxes | 13.67% | n/a | n/a | 33.37% |

| Class R-3 Shares (Inception date 9/19/06) |

| Return Before Taxes | 12.99% | n/a | n/a | 12.61% |

| Class R-5 Shares (Inception date 10/2/06) |

| Return Before Taxes | 13.74% | n/a | n/a | 12.97% |

| Index |

S&P 500 Index** (reflects no deduction for fees,

expenses or taxes) | 15.06% | 2.29% | 1.41% | 32.08% |

* Growth & Income’s returns in this table are after deduction of sales charges and expenses.

** The S&P 500 Index is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

Capitalization

The following table sets forth the capitalization of Large Cap Core and Growth & Income as of June 30, 2011 and of Growth & Income on a pro forma combined basis as of that date, giving effect to the Reorganization.

| |

Net Assets | Net Asset Value Per Share | Shares

Outstanding |

| Large Cap Core – Class A | $11,198,747 | $14.70 | 761,584 |

| Growth & Income – Class A | $147,958,307 | $13.84 | 10,691,060 |

| Pro Forma Fund – Class A | $159,157,054 | $13.84 | 11,500,218 |

| | | | |

| Large Cap Core – Class C | $9,466,128 | $14.42 | 656,488 |

| Growth & Income – Class C | $80,213,298 | $13.41 | 5,980,414 |

| Pro Forma Fund – Class C | $89,679,426 | $13.41 | 6,686,315 |

| | | | |

| Large Cap Core – Class I | $5,910,118 | $14.65 | 403,514 |

| Growth & Income – Class I | $25,149,149 | $13.83 | 1,818,267 |

| Pro Forma Fund – Class I | $31,059,267 | $13.83 | 2,245,607 |

| | | | |

| Large Cap Core – Class R3 | $2,873 | $14.67 | 196 |

| Growth & Income – Class R3 | $846,413 | $13.81 | 61,295 |

| Pro Forma Fund – Class R3 | $846,286 | $13.81 | 61,503 |

| | | | |

| Large Cap Core – Class R5 | $26,428 | $15.02 | 1,759 |

| Growth & Income – Class R5 | $2,930 | $13.83 | 212 |

| Pro Forma Fund – Class R5 | $29,358 | $13.83 | 2,123 |

Information Regarding the Reorganization

Agreement and Plan of Reorganization and Termination

The terms and conditions under which the Reorganization will be consummated are set forth in the Plan, a copy of the form of which is attached as Appendix A to this Information Statement. Significant provisions of the Plan are summarized below; however, this summary is qualified in its entirety by reference to the Plan itself.

The Plan provides for the Reorganization to occur on or about January 20, 2012. The Plan provides that all of the assets of Large Cap Core will be transferred to Growth & Income at the close of business (or other time agreed time) on the Closing Date of the Reorganization (the “Effective Time”). In exchange for the transfer of those assets, Growth & Income will simultaneously (a) issue to Large Cap Core a number of full and fractional Growth & Income shares equal in value to the aggregate NAV of Large Cap Core at the Effective Time and (b) assume all of the liabilities of Large Cap Core.

Following that exchange, Large Cap Core will distribute all of those shares of Growth & Income pro rata to its shareholders of record in complete liquidation of Large Cap Core. Shareholders of Large Cap Core owning shares at the Effective Time will receive a number of shares of Growth & Income with the same aggregate value as the shareholder had in Large Cap Core immediately before the Reorganization. Such distribution will be accomplished by the establishment of accounts in the names of each Large Cap Core’s shareholder on the share records of Growth & Income’s transfer agent. Each such account (and each existing account for a Growth & Income shareholder who is a Large Cap Core shareholder) will be credited with the respective pro rata number of full and fractional shares of Growth & Income, by class, due to the shareholders of Large Cap Core. Large Cap Core will then be terminated.

The Plan may be terminated, and the Reorganization may be abandoned, at any time prior to consummation of the Reorganization, whether before or after approval by Large Cap Core’s shareholders, by mutual agreement of Series Trust, on behalf of Large Cap Core, and Growth & Income and under certain other circumstances. The completion of the Reorganization also is subject to various conditions, including approval of the proposal by Large Cap Core’s shareholders, completion of all filings with, and receipt of all necessary approvals from, the SEC, delivery of a legal opinion regarding the federal tax consequences of the Reorganization and other customary corporate and securities matters. Subject to the satisfaction of those conditions, the Reorganization will take place at the Effective Time.

No sales charges will be imposed in connection with the receipt of Growth & Income shares by shareholders of Large Cap Core. Each Large Cap Core shareholder will receive shares of the same class of Growth & Income as he or she currently owns of Large Cap Core.

To the extent described in the Plan, expenses solely and directly related to the Reorganization (as determined in accordance with guidelines set by the Internal Revenue Service), other than brokerage or similar expenses incurred by or for the benefit of Large Cap Core in connection with the Reorganization, will be paid by Eagle, the investment manager of each Fund.

Reasons for the Reorganization

The Board met on August 16, 2011 to consider information in connection with the Reorganization. In determining whether to approve the Reorganization and Plan, the Board, including the Independent Trustees, with the advice and assistance of independent legal counsel, inquired into and considered a number of matters, including: (1) the terms and conditions of the Reorganization; (2) the compatibility of the investment programs of Large Cap Core and Growth & Income; (3) the expense ratios of each Fund on a comparative basis and projected pro forma estimated expense ratios, as well as the sales load of each Fund’s share classes; (4) the relative historical performance record of the Funds; (5) the historical asset levels of Large Cap Core and its prospects for future growth; (6) the continuity of advisory and portfolio management, distribution and shareholder services provided by the Reorganization; (7) that Eagle would bear the costs of the Reorganization (other than brokerage or similar expenses incurred by or for the benefit of Large Cap Core in connection with the Reorganization); (8) the benefits to Eagle as a result of the Reorganization; and (9) the non-recognition of any gain or loss for federal income tax purposes to Large Cap Core or its shareholders as a result of the Reorganization. The Board did not assign specific weights to any or all of these factors, but it did consider all of them in determining, in its business judgment, to approve the Reorganization and Plan.

At the meetings, representatives of Eagle discussed the rationale for the Reorganization. Eagle’s representatives explained that Large Cap Core has a small and declining asset base and that its investment performance has trailed its peers, making it difficult to attract new assets to Large Cap Core. In addition, Eagle has waived and/or reimbursed a substantial amount of Large Cap Core’s operating expenses and expects that, due to current and declining asset levels, it would be required to do so for Large Cap Core for the foreseeable future. If Eagle discontinued these waivers and/or reimbursements, the costs to Large Cap Core shareholders would increase substantially. As a result, Eagle’s representatives recommended reorganizing Large Cap Core into Growth & Income. Eagle’s representatives explained that merging the Funds would benefit Large Cap Core’s shareholders by moving them into a Fund that has a larger and stable asset base and that is more marketable with potential for long-term growth. Eagle’s representatives also noted that Large Cap Core and Growth & Income have substantially similar investment objectives although employ differing investment strategies to meet those objectives.

Eagle’s representatives also noted that the Reorganization is expected to result in lower overall fees and expenses for shareholders of Large Cap Core, even though Large Cap Core has similar contractual advisory fees as Growth & Income. In addition, Eagle has contractually agreed to cap Growth & Income’s total operating expenses through February 29, 2012. Eagle’s representatives acknowledged that the Reorganization would benefit Eagle to the extent that Eagle would no longer continue to waive and/or reimburse the operating expenses for Large Cap Core and would lower the amounts to be waived and/or reimbursed for Growth & Income.

Eagle’s representatives also noted that merging the Funds is expected to result in economies of scale as fixed expenses would be dispersed over a larger asset and shareholder base, thereby allowing the shareholders of both Funds to realize a reduction in expenses when the Reorganization is effected.

Eagle’s representatives discussed the historical performance records of the Funds. They noted that Large Cap Core has continually underperformed its peers and benchmark index, while Growth & Income has consistently outperformed its peers and benchmark index.

Eagle’s representatives explained that alternatives to the Reorganization were considered, including liquidating and terminating Large Cap Core, but that it was determined that the more beneficial course of action for shareholders would be to merge the Funds due to the tax-free nature of the Reorganization.

Eagle’s representatives then reviewed with the Board the terms and conditions of the Plan, noting that the Reorganization was expected to be tax-free to Large Cap Core and its shareholders. Eagle’s representatives noted that the interests of the shareholders would not be diluted by the Reorganization because it would be effected on the basis of the Fund’s NAV. Eagle’s representatives further noted that the Plan provides that Eagle will pay all costs associated with the Reorganization (other than brokerage or similar expenses incurred by or for the benefit of Large Cap Core in connection with the Reorganization) and that, accordingly, Large Cap Core would not bear any of those costs (but would pay those expenses). They then recommended that the Board approve the Reorganization.

In reaching the decision to approve the Reorganization and Plan, the Board, including the Independent Trustees, concluded that the participation of Large Cap Core in the Reorganization would be in the best interests of Large Cap Core and that the interests of the shareholders of Large Cap Core would not be diluted as a result of the Reorganization. The Board’s conclusion was based on a number of factors, including those discussed above under the section of this Information Statement entitled “Considerations Regarding the Reorganization.”

On the basis of the information provided to it and its evaluation of that information, the Board, including the Independent Trustees, voted unanimously to approve the Reorganization and Plan.

Description of the Securities to be issued

The shareholders of Large Cap Core will receive Class A, Class C, Class I, Class R-3 or Class R-5 shares of Growth & Income in accordance with the procedures provided for in the Plan. All such shares will be fully paid and non-assessable by Growth & Income when issued and will have no preemptive or conversion rights.

Growth & Income is registered with the SEC as an open-end management investment company, and its Trustees are authorized to issue an unlimited number of shares of beneficial interest. Shares of Growth & Income represent equal proportionate interests in its assets and have identical voting, dividend, redemption, liquidation, and other rights.

The Board of Trustees of Growth & Income does not intend to hold annual meetings of shareholders of Growth & Income. It will call special meetings of the shareholders of the Fund only if required under the 1940 Act or in their discretion or upon the written request of holders of 10% or more of the outstanding shares of the Fund entitled to vote.

Under Massachusetts law, the shareholders of Growth & Income will not be personally liable for its obligations; a shareholder is entitled to the same limitation of personal liability extended to shareholders of a corporation. To guard against the risk that Massachusetts law might not be applied in other states, Growth & Income’s Amended and Restated Declaration of Trust requires that every written obligation of the Fund contain a statement that such obligation may be enforced only against its assets and provides for indemnification out of Fund property of any shareholder nevertheless held personally liable for Fund obligations.

Federal Income Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under section 368(a) (1) (C) of the Code.

As a condition to consummation of the Reorganization, each of Growth & Income and Series Trust will receive an opinion of K&L Gates LLP, their counsel (“Opinion”), substantially to the effect that, based on the facts and assumptions stated therein and conditioned on certain representations of each of them being true and complete at the Effective Time and the Reorganization’s being completed in accordance with the Plan (without the waiver or modification of any terms or conditions of the Plan and without taking into account any amendment thereof that such counsel has not approved), for federal income tax purposes:

| | (1) | Growth & Income’s acquisition of the assets of Large Cap Core in exchange solely for shares of Growth & Income and Growth & Income’s assumption of the liabilities of Large Cap Core, followed by Large Cap Core’s distribution of those shares pro rata to its shareholders actually or constructively in exchange for their Large Cap Core Shares and in complete liquidation of Large Cap Core, will qualify as a “reorganization” (as defined in section 368(a)(1)(C) of the Code), and each Fund will be “a party to a reorganization” within the meaning of section 368(b) of the Code; |

| | (2) | Large Cap Core will recognize no gain or loss on the transfer of its assets to Growth & Income in exchange solely for shares of Growth & Income and Growth & Income’s assumption of the liabilities of Large Cap Core or on the subsequent distribution of those shares to the Large Cap Core shareholders in exchange for their shares of Large Cap Core; |

| | (3) | Growth & Income will recognize no gain or loss on its receipt of the assets of Large Cap Core in exchange solely for shares of Growth & Income and its assumption of the liabilities of Large Cap Core; |

| | (4) | Growth & Income’s basis in each asset of Large Cap Core will be the same as Large Cap Core’s basis therein immediately before the Reorganization, and Growth & Income’s holding period for each such asset will include Large Cap Core’s holding period therefor (except where Growth & Income’s investment activities have the effect of reducing or eliminating an asset’s holding period); |

| | (5) | A shareholder will recognize no gain or loss on the exchange of all its Large Cap Core shares solely for shares of Growth & Income pursuant to the Reorganization; and |

| | (6) | A shareholder’s aggregate basis in the shares of Growth & Income it receives in the Reorganization will be the same as the aggregate basis in its shares of Large Cap Core it actually or constructively surrenders in exchange for those shares of Growth & Income, and its holding period for those shares of Growth & Income will include, in each instance, its holding period for those shares of Large Cap Core, provided the shareholder holds them as capital assets at the Effective Time. |

Notwithstanding clauses (2) and (4), the Opinion may state that no opinion is expressed as to the effect of the Reorganization on either Fund or any shareholder with respect to any transferred asset as to which any unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on the termination or transfer thereof) under a mark-to-market system of accounting.

Growth & Income’s utilization after the Reorganization of Large Cap Core’s pre-Reorganization capital losses to offset Growth & Income’s gains will be subject to limitation in future years.

On or before the Closing Date, Large Cap Core will distribute substantially all of its undistributed net investment income, net capital gain, net short-term capital gain and net gains from foreign currency transactions, if any, in order to continue to maintain its tax status as a regulated investment company. That distribution will be taxable to Large Cap Core’s shareholders that receive it.

Shareholders of Large Cap Core should consult their tax advisers regarding the effect, if any, of the Reorganization in light of their individual circumstances. The foregoing description of the federal income tax consequences of the Reorganization does not take into account the particular circumstances of any shareholder. Shareholders are therefore urged to consult their tax advisers as to the specific consequences to them of the Reorganization, including the applicability and effect of state, local, foreign and other tax consequences, if any, of the Reorganization.

ADDITIONAL INFORMATION REGARDING GROWTH & INCOME

Investment Adviser

Eagle serves as investment adviser and administrator for Growth & Income. Eagle manages, supervises and conducts the business and administrative affairs of the Fund and other Eagle mutual funds with net assets totaling approximately $[ ] billion as of [ ], 2011. Pursuant to an Investment Advisory Agreement, Growth & Income pays Eagle an advisory fee as described below.

The contractual advisory fee rate for Growth & Income is 0.60% of its average daily net assets up to $100 million, 0.45% for average daily net assets between $100 million and $500 million, and 0.40% for average daily net assets over $500 million.

With respect to Growth & Income, Eagle has contractually agreed to waive its investment advisory fees and, if necessary, reimburse Growth & Income to the extent that annual operating expenses of each class exceed a percentage of that class’ average daily net assets as follows: Class A – 1.40%, Class C – 2.20%, Class I – 0.95%, Class R-3 – 1.65% and Class R-5 – 0.95%. Further information regarding waivers and expenses is available in the Funds’ Prospectus.

Any waivers or reimbursements will have the effect of lowering the overall expense ratio for Growth & Income and increasing its overall return to investors at the time any such amounts were waived and/or reimbursed. A discussion regarding the basis for Growth & Income’s Board’s approval of the Investment Advisory Agreement is available in the Annual Report to Shareholders for the period ended October 31, 2010.

Valuation of Shares

Price of Shares. Growth & Income’s regular business days are the same as those of the New York Stock Exchange (“NYSE”), normally Monday through Friday. The NAV per share for each class of the Fund is determined each business day as of the close of regular trading on the NYSE (typically 4:00 p.m. Eastern time). The share price is calculated by dividing a class’s net assets by the number of its outstanding shares. Because the value of the Fund’s investment portfolio changes every business day, the NAV per share usually changes as well.

In calculating its NAV per share, Growth & Income typically prices its securities by using pricing services or market quotations. However, if (1) price quotations or valuations are not readily available, (2) readily available price quotations or valuations are not reflective of market value (prices deemed unreliable), or (3) a significant event has been recognized in relation to a security or class of securities, fair valuation may be applied to such security (or class of securities) in accordance with the Fund’s Valuation Procedures.

Growth & Income has retained a third party pricing service to assist in fair valuing any foreign securities held in its portfolio. Fair valuation has the effect of updating security prices to reflect market value based on, among other things, the recognition of a significant event -- thus alleviating arbitraging opportunities. Attempts to determine the fair value of securities introduce an element of subjectivity to the pricing of securities. As a result, the price of a security determined through the fair valuation techniques may differ from the prices quoted or published by other sources.

In addition, Growth & Income may invest in securities that are primarily listed on foreign exchanges that trade on weekends and other days when the Fund does not price its shares. As a result, the NAV of its shares may change on days when shareholders will not be able to purchase or redeem its shares.

Timing of Orders. All orders to purchase or sell shares are executed as of the next NAV per share calculated after the order has been received in “good order” by Growth & Income, the distributor or a participating dealer. Orders are accepted until the close of regular trading on the NYSE every business day -- typically 4:00 p.m. Eastern time -- and are executed the same day at that day’s NAV per share. To ensure this occurs, dealers are responsible for transmitting all orders to Eagle to comply with the deadline imposed by applicable regulations.

Market Timing Policy

Growth & Income has a market timing policy (which is identical to Large Cap Core’s). “Market Timing” typically refers to the practice of frequent trading in the shares of a mutual fund in order to exploit inefficiencies in fund pricing. Such transactions include trades that occur when Growth & Income’s NAV per share does not fully reflect the value of its holdings -- for example, when it owns holdings, such as foreign or thinly traded securities, that are valued in a manner that may not reflect the most updated information possible. Market timing can be disruptive to the Fund’s efficient management and have a dilutive effect on the value of the investments of long-term Fund shareholders, increase the transaction and other costs of the Fund and increase taxes, all of which could reduce the return to Fund shareholders.

Growth & Income will not enter into agreements to accommodate frequent purchases or exchanges. Growth & Income and Eagle have adopted the following guidelines (which are identical to Series Trust’s), which have been approved by Growth & Income’s Board of Trustees:

| | ● | Eagle reviews transaction activity, using established criteria, to identify transactions that may signal excessive trading. |

| | ● | Eagle may reject any purchase or exchange orders, in whole or in part, that in its opinion, appear excessive in frequency and/or amount or otherwise potentially disruptive to the Fund. Eagle may consider the trading history of accounts under common ownership or control in this determination. |