UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-04767

HERITAGE GROWTH & INCOME TRUST

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

CLIFFORD J. ALEXANDER, ESQ.

Kirkpatrick & Lockhart Nicholson Graham LLP

1601 K Street, NW

Washington, D.C. 20006-1600

Date of fiscal year end: September 30

Date of reporting period: March 31, 2006

| Item 1. | Reports to Shareholders |

April 15, 2006

Dear Valued Shareholders:

I am pleased to present you the Heritage Growth and Income Trust (the “Fund”) semiannual report for the six-month period ended March 31, 2006. The table below shows the Fund’s Class A shares returns and the returns for the Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index” or “Index”)(a), for the various periods ended March 31, 2006.

| | | | | | | | | | | | |

| | | | | | Average Annual Returns

| |

As of March 31, 2006

| | 6-Month

| | | 1-Year

| | | 5-Years

| | | 10-Years

| |

Class A Shares | | | | | | | | | | | | |

With front-end sales charge | | +3.08 | % | | +7.99 | % | | +4.66 | % | | +6.27 | % |

Without front-end sales charge | | +8.22 | % | | +13.37 | % | | +5.68 | % | | +6.79 | % |

S&P 500 Index | | +6.38 | % | | +11.72 | % | | +3.96 | % | | +8.94 | % |

All of the returns include the effect of reinvested dividends and the deduction of Fund expenses. The 1-, 5-, and 10-year periods are annualized returns. Also, keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. The performance numbers quoted above for Class A shares are shown with and without the imposition of a front-end sales charge. The performance data quoted represents past performance and the investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Past performance does not guarantee future results and current performance information may be higher or lower than the performance data quoted. To obtain more current performance data, please visit our website at www.HeritageFunds.com. In the following pages, the performance of the Fund is discussed in detail by the Fund’s portfolio managers. Please keep in mind that these views are not meant as investment advice and although some of the described portfolio holdings were viewed favorably, there is no guarantee the Fund will continue to hold these securities in the future.

I would like to take this opportunity to remind you that your investment in the Fund is subject to certain risks. For your convenience, we have included inside the back cover a list of these risk factors and their detailed explanations from the prospectus dated January 3, 2006. In addition to risks, we ask that you carefully consider the investment objectives, charges and expenses of the Fund. Please contact Heritage at (800) 421-4184 or your financial advisor for a prospectus, which contains this and other important information about the Fund.

Thank you for your support and confidence in the Heritage Growth and Income Trust.

Sincerely,

Stephen G. Hill

President

(a) The S&P 500 Index is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market.

1

In the following Q & A, the portfolio managers of the Heritage Growth and Income Trust (the “Fund”) discuss the Fund’s performance for the six-month period ended March 31, 2006. For performance returns, please see Stephen G. Hill’s letter on the prior page and the Financial Highlights located on page 10 of this report.

Portfolio Managers’ Discussion of Fund Performance Q&A

Q: Describe the investment strategy used for the Fund during the reporting period.

A: During the reporting period, using a “bottom up”(a) method of analysis, the Fund’s portfolio was constructed from companies with at least one of the following overall characteristics:

| | (1) | A forecasted long-term growth rate that is greater than inflation; |

| | (2) | Securities priced below estimated intrinsic value, illustrated by the Fund’s portfolio overall value indicators relative to the S&P 500 Index; |

| | (3) | Investing in companies that we believe to have greater profitability and shareholder orientation than the overall market; |

| | (4) | Broadly diversified across industries and sectors, as well as diversified with holdings outside the U.S.; |

| | (5) | Weighted average market capitalization approximating that of the S&P 500 Index. |

Q: How would you describe the overall U.S. market environment and condition during the reporting period?

A: The positive performance of the S&P 500 Index was broadly diversified across sectors, but was led by companies in the financial, industrial, and information technology sectors. Consumer staples, energy, and utilities were the weakest sectors, with utilities being the only sector generating negative returns for the S&P 500 Index during the reporting period.

With U.S. employment still growing and unemployment low, the U.S. consumer sector remains healthy. Energy induced inflationary pressures were less severe than anticipated early in the period due to an unusually mild winter; this encouraged investors early in the New Year. This view shifted negatively later in the period as energy prices began rising more steeply. Energy linked inflation and its potential influence on interest rates continues to be an issue for equity valuations in the short run.

The economy seems to be progressing nicely and corporate profits reflect this. Earnings comparisons for the S&P 500 Index in the fourth quarter were strong versus levels a year ago. Further earnings progression is expected in the first quarter. At this juncture, profit growth continues to support stock prices, with assistance from restructuring initiatives and other shareholder-friendly moves such as dividend increases and share buybacks. Firm prices for commodities such as oil and copper have held at levels above general expectations but are yet to slow global economic activity. Of course, the profits of producers of these commodities are being impacted favorably.

Q: How did the Fund compare to the S&P 500 Index during the reporting period?

A: Consistent with our bottom-up approach, stock selection was the primary driver of the Fund’s outperformance relative to the S&P 500 Index (the Fund’s benchmark) during the reporting period. The Fund was underweight in the consumer discretionary sector, which was an underperforming sector for the benchmark Index during the reporting period. This created a positive allocation effect. In addition, the Fund’s holdings in this sector outperformed the overall Index for the period, creating a positive selection effect. The Fund was also underweight in the consumer staples and information technology sectors, which were also underperforming sectors for the Index during the period. The Fund’s holdings in these sectors marginally outperformed the Index holdings. Thus, the overall effect was positive, primarily due to allocation. The worst performing sector for the Fund was the telecommunications services sector, in which the Fund was slightly underweight and generated a

(a) A bottom up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole.

2

negative return. In contrast, this sector was one of the best performing sectors in the S&P 500 Index for the period. This resulted in both negative allocation and selection effects for the Fund. The Fund’s best performing sector and primary source of outperformance was the financial sector, in which the Fund’s holdings outperformed and were overweight relative to the benchmark Index. As a result, the financial sector generated positive relative performance due to both allocation and stock selection.

Investments in foreign equities also contributed to the Fund’s outperformance of the benchmark Index during the reporting period. The Fund captured positive selection and allocation effects in eight out of fifteen foreign stocks and six out of eight non-U.S. countries against the S&P 500 Index. We also demonstrated positive stock selection effect within five out of eight non-U.S. countries and five out of eight industry sectors versus the MSCI All-Country World IndexSM.

Q: Which securities positively and negatively impacted the Fund’s performance during the reporting period?

A: The following securities contributed positively to the Fund’s performance during the period:

AllianceBernstein Holdings LP is now benefiting from its brand positioning efforts in prior years. AllianceBernstein has a compelling global offering that is of particular appeal to institutional clients and healthy global markets. The stock remains a Fund holding due to the company’s sound business fundamentals and attractive valuation.

Host Marriott Corporation is benefiting from very strong fundamentals in the lodging industry and new supply falling short of new demand. We added to the position during the period due to a good yield and sustaining business fundamentals. The stock remains a Fund holding.

Level 3 Communications recently completed an acquisition which improves its bond credit profile. The bond remains a Fund holding. Bonds remain a compelling income vehicle.

Canadian Oil Sands Trust’s expected earnings and cash flows continue to increase as tar sands volumes and oil pricing remain high. As a mining operation, production volumes are sustainable for many years, whereas oil production projects have declining production as a typical characteristic. The stock remains a Fund holding.

Southern Copper Corporation has benefited from firm prices for commodities such as copper holding at levels above general expectations. This stock was initially purchased during the period. We bought Southern Copper because we believe that supply/demand fundamentals remain very favorable for the commodity’s price compared with the past. The stock remains a Fund holding.

The following securities contributed negatively to the Fund’s performance during the period:

Dominion Resource’s near-term earnings are under some pressure as industry costs are rising for oil and gas production companies. For Dominion, near-term hedges limit the company’s ability to recoup these costs. We continue to hold Dominion due to its attractive yield and sound business fundamentals.

Chevron Corporation declined during the reporting period, down from peak September levels. We continue to hold Chevron because we believe that it is positioned well to benefit from continuing high demand for oil and it is a good value.

Altria Group is the parent company of Philip Morris International which faces headwinds throughout Western Europe, including higher excise taxes and increased regulation of cigarette usage. The stock also reflects investor anxiety over pending litigation decisions in the U.S. We continue to hold Altria based on its highly profitable franchise, attractive yield and valuation.

Precision Drilling Trust was added to the Fund’s portfolio during the period. After a sharp run up in the past year, the stock has retreated with the sell off in oil prices. Precision Drilling is Canada’s largest contract drilling and oilfield services provider. The company recently reorganized into an income trust, and now pays a very high monthly dividend supported by strong cash flows and limited cash needs.

3

Alltel Corporation has shown good performance in prior periods; however, the company’s slow earnings progress and concerns over decline in access lines caused weak performance. We sold the stock to make room for more promising opportunities.

Q: What impact did balances in cash and cash equivalents have on the Fund’s performance?

A: While cash and cash equivalents may detract from relative performance, it is still a residual of the investment process and the Fund periodically ends up with higher cash balances (between 5% and 10%) during short periods of time. The Fund holds cash and cash equivalents to better redeploy certain proceeds from the sale of securities into new investment ideas.

Q: What steps do you take to manage the Fund’s portfolio investment risks?

A: We attempt to manage risk through diversification and by our stock selection. We are broadly diversified across market sectors, and we are also investing over 25% of the Fund’s assets in non-U.S. securities. In addition, we believe that the process of identifying promising companies at a discount through bottom-up fundamental research helps us to identify potential risks and incorporate them into our evaluation of each stock’s risk/reward trade-off.

The Fund is invested in forward currency contracts as a risk control measure. As of March 31, 2006, the Fund had a 12.8% exposure to companies in the United Kingdom. We evaluate currency risk on a stock-by-stock basis. We will hedge currencies utilizing forward contracts if deemed appropriate. We use currency hedging to protect the investment thesis for a given stock from being significantly undermined by dollar/foreign currency fluctuations. Presently, the Fund is approximately 50% hedged against exposure to the British pound.

While the Fund currently has very limited exposure to high yield securities, we attempt to manage the risks associated with these types of securities through comprehensive credit analysis techniques, including but not limited to cash flow analysis, balance sheet ratios, and competitive positioning. We use the results of our analysis to evaluate the risk/reward trade-off.

The answers to the Q & A are provided as of April 19, 2006 by William Fries, CFA and Brad Kinkelaar, the portfolio managers of the Fund. Both Mr. Fries and Mr. Kinkelaar serve as Managing Directors of Thornburg Investment Management, Inc., the Fund’s subadviser. We hope that you find this information useful in understanding how the Fund performed during this reporting period and thank you for your continued confidence.

4

Heritage Growth and Income Trust

Investment Portfolio

March 31, 2006

(unaudited)

| | | | | |

Shares

| | | | Value

|

Common Stocks—91.4% (a)

| | | |

Domestic—62.9%

| | | |

Agriculture—5.6%

| | | |

| 61,600 | | Altria Group, Inc. | | $ | 4,364,976 |

| 60,050 | | UST Inc. | | | 2,498,080 |

| | | | |

|

|

| | | | | | 6,863,056 |

| | | | |

|

|

Banks—3.6%

| | | |

| 34,960 | | Bank of America Corporation | | | 1,592,078 |

| 78,500 | | The Bank of New York Company, Inc. | | | 2,829,140 |

| | | | |

|

|

| | | | | | 4,421,218 |

| | | | |

|

|

Chemicals—0.2%

| | | |

| 4,700 | | The Dow Chemical Company | | | 190,820 |

| | | | |

|

|

Commercial Services—1.3%

| | | |

| 49,300 | | Macquarie Infrastructure Company Trust | | | 1,602,250 |

| | | | |

|

|

Diversified Manufacturer—4.6%

| | | |

| 129,000 | | General Electric Company | | | 4,486,620 |

| 50,000 | | Reddy Ice Holdings, Inc. | | | 1,110,500 |

| | | | |

|

|

| | | | | | 5,597,120 |

| | | | |

|

|

Electric—2.1%

| | | |

| 36,200 | | Dominion Resources, Inc. | | | 2,498,886 |

| | | | |

|

|

Electronics—2.2%

| | | |

| 38,800 | | Fisher Scientific International Inc.* | | | 2,640,340 |

| | | | |

|

|

Environmental Control—2.1%

| | | |

| 501,055 | | Synagro Technologies, Inc. | | | 2,505,275 |

| | | | |

|

|

Financial Services—8.7%

| | | |

| 50,100 | | AllianceBernstein Holding LP | | | 3,319,125 |

| 73,300 | | Citigroup Inc. | | | 3,462,692 |

| 35,600 | | Freddie Mac | | | 2,171,600 |

| 39,200 | | JPMorgan Chase & Co. | | | 1,632,288 |

| | | | |

|

|

| | | | | | 10,585,705 |

| | | | |

|

|

Healthcare Services—4.5%

| | | |

| 11,300 | | HCA Inc. | | | 517,427 |

| 107,900 | | Health Management Associates, Inc., Class “A” | | | 2,327,403 |

| 10,780 | | Quest Diagnostics Inc. | | | 553,014 |

| 26,100 | | WellPoint, Inc.* | | | 2,020,923 |

| | | | |

|

|

| | | | | | 5,418,767 |

| | | | |

|

|

Mining—2.8%

| | | |

| 40,987 | | Southern Copper Corporation | | | 3,462,582 |

| | | | |

|

|

| | | | | |

Shares

| | | | Value

|

Common Stocks (continued)

| | | |

Oil & Gas—7.9%

| | | |

| 6,800 | | Burlington Resources Inc. | | $ | 624,988 |

| 74,000 | | Chevron Corporation | | | 4,289,780 |

| 35,946 | | ConocoPhillips | | | 2,269,990 |

| 31,400 | | Exxon Mobil Corporation | | | 1,911,004 |

| 5,900 | | Occidental Petroleum Corporation | | | 546,635 |

| | | | |

|

|

| | | | | | 9,642,397 |

| | | | |

|

|

Pharmaceuticals—7.5%

| | | |

| 5,200 | | Cardinal Health, Inc. | | | 387,504 |

| 62,300 | | Caremark Rx, Inc.* | | | 3,063,914 |

| 11,863 | | Medco Health Solutions, Inc.* | | | 678,801 |

| 203,005 | | Pfizer Inc. | | | 5,058,885 |

| | | | |

|

|

| | | | | | 9,189,104 |

| | | | |

|

|

REITS—4.2%

| | | |

| 240,400 | | Host Marriott Corporation | | | 5,144,560 |

| | | | |

|

|

Retail—1.1%

| | | |

| 26,300 | | Target Corporation | | | 1,367,863 |

| | | | |

|

|

Software—3.0%

| | | |

| 135,500 | | Microsoft Corporation | | | 3,686,955 |

| | | | |

|

|

Telecommunications—1.5%

| | | |

| 80,400 | | Motorola, Inc. | | | 1,841,964 |

| | | | |

|

|

| Total Domestic Common Stocks (cost $64,381,725) | | | 76,658,862 |

| | | | |

|

|

Foreign—28.5% (b)

| | | |

Banks—5.4%

| | | |

| 271,900 | | Barclays PLC | | | 3,176,379 |

| 354,700 | | Lloyds TSB Group PLC | | | 3,386,913 |

| | | | |

|

|

| | | | | | 6,563,292 |

| | | | |

|

|

Diversified Manufacturer—1.6%

| | | |

| 73,800 | | Tyco International Ltd. | | | 1,983,744 |

| | | | |

|

|

Electric—0.6%

| | | |

| 1,163,000 | | Datang International Power Generation Company Ltd. | | | 734,383 |

| | | | |

|

|

Entertainment—2.5%

| | | |

| 80,245 | | OPAP SA | | | 3,062,814 |

| | | | |

|

|

Financial Services—2.5%

| | | |

| 440,900 | | China Merchants Holdings (International) Company Ltd. | | | 1,272,726 |

| 83,900 | | W.P. Stewart & Co., Ltd. | | | 1,768,612 |

| | | | |

|

|

| | | | | | 3,041,338 |

| | | | |

|

|

The accompanying notes are an integral part of the financial statements.

5

Heritage Growth and Income Trust

Investment Portfolio

March 31, 2006

(unaudited)

(continued)

| | | | | |

Shares

| | | | Value

|

Common Stocks (continued)

| | | |

Food—3.4%

| | | |

| 850,000 | | Fu Ji Food and Catering Services Holdings Ltd. | | $ | 1,752,611 |

| 420,800 | | Tesco PLC | | | 2,408,659 |

| | | | |

|

|

| | | | | | 4,161,270 |

| | | | |

|

|

Oil & Gas—4.4%

| | | |

| 19,500 | | Canadian Oil Sands Trust | | | 2,801,474 |

| 79,400 | | Precision Drilling Trust | | | 2,563,178 |

| | | | |

|

|

| | | | | | 5,364,652 |

| | | | |

|

|

Pharmaceuticals—5.1%

| | | |

| 58,800 | | GlaxoSmithKline PLC, Sponsored ADR | | | 3,075,828 |

| 33,400 | | Sanofi-Aventis | | | 3,172,905 |

| | | | |

|

|

| | | | | | 6,248,733 |

| | | | |

|

|

Telecommunications—3.0%

| | | |

| 1,732,700 | | Vodafone Group PLC | | | 3,621,564 |

| | | | |

|

|

| Total Foreign Common Stocks (cost $31,149,454) | | | 34,781,790 |

| | | | |

|

|

| Total Common Stocks (cost $95,531,179) | | | 111,440,652 |

| | | | |

|

|

Preferred Stocks—1.3% (a)

| | | |

Financial Services—1.3%

| | | |

| 60,000 | | Merrill Lynch & Co., Inc. 5.46% | | | 1,526,400 |

| | | | |

|

|

| Total Preferred Stocks (cost $1,500,000) | | | 1,526,400 |

| | | | |

|

|

| | |

Principal

Amount

| | | | |

Convertible Bonds—2.0% (a)

| | | |

Telecommunications—2.0%

| | | |

| $3,000,000 | | Level 3 Communications, Inc., 6.0%, 03/15/10 | | $ | 2,381,250 |

| | | | |

|

|

| Total Convertible Bonds (cost $1,954,781) | | | 2,381,250 |

| | | | |

|

|

| | | | | | |

Principal

Amount

| | | | Value

| |

Corporate Bonds—0.8% (a)

| | | | |

Pipelines—0.8%

| | | | |

| $1,000,000 | | El Paso Corporation, 7.375%, 12/15/12 | | $ | 1,017,500 | |

| | | | |

|

|

|

| Total Corporate Bonds (cost $809,021) | | | 1,017,500 | |

| | | | |

|

|

|

Total Investment Portfolio excluding repurchase

agreement (cost $99,794,981) | | | 116,365,802 | |

| | | | |

|

|

|

Repurchase Agreement—5.9% (a)

| | | | |

Repurchase Agreement with State Street Bank and

Trust Company, dated March 31, 2006 @ 4.35%

to be repurchased at $7,193,607 on April 3, 2006,

collateralized by $7,365,000 United States

Treasury Notes, 4.625% due March 31, 2008,

(market value $7,335,080 including interest)

(cost $7,191,000) | | | 7,191,000 | |

| | | | |

|

|

|

Total Investment Portfolio

(cost $106,985,981) (c), 101.4% (a) | | | 123,556,802 | |

| Other Assets and Liabilities, net, (1.40%) (a) | | | (1,709,955 | ) |

| | | | |

|

|

|

| Net Assets, 100.0% | | $ | 121,846,847 | |

| | | | |

|

|

|

| * | Non-income producing security. |

| (a) | Percentages indicated are based on net assets. |

| (b) | U.S. dollar denominated. |

| (c) | The aggregate identified cost for federal income tax purposes is the same. Market value includes net unrealized appreciation of $16,570,821 which consists of aggregate gross unrealized appreciation for all securities in which there is an excess of market value over tax cost of $17,250,384 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over market value of $679,563. |

ADR—American Depository Receipt.

Forward Foreign Currency Contracts Outstanding

| | | | | | |

Contract to Deliver

| | In Exchange For

| | Delivery Date

| | Unrealized Appreciation

|

| GBP 4,300,000 | | USD 7,501,006 | | 08/10/06 | | $29,376 |

GBP—Great Britain Pound

USD—United States Dollar

The accompanying notes are an integral part of the financial statements.

6

Heritage Growth and Income Trust

Portfolio Allocation

(unaudited)

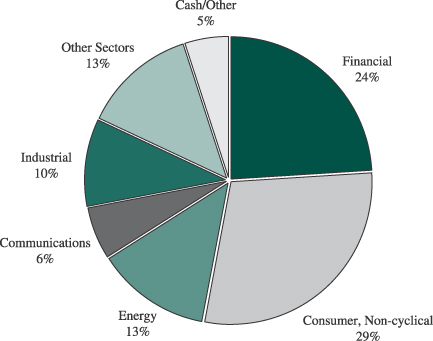

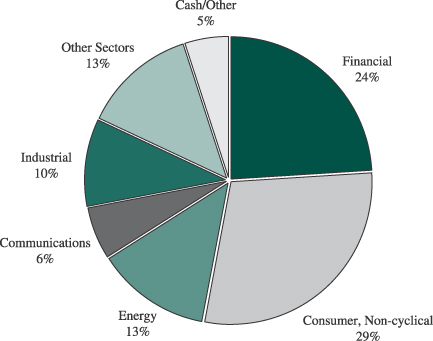

Sector Allocation as of March 31, 2006 (% of net assets)

Beginning with the Fund’s fiscal quarter ended December 31, 2004, the Fund began filing its complete schedule of portfolio holdings with the Securities Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q; the Fund’s Form N-Q filings are available on the SEC’s website at www.sec.gov; and the Fund’s Form N-Q filings may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

7

Heritage Growth and Income Trust

Statement of Assets and Liabilities

March 31, 2006

(unaudited)

| | | | | | |

Assets | | | | | | |

Investments, at value (identified cost $99,794,981) | | | | | $ | 116,365,802 |

Repurchase agreement (identified cost $7,191,000) | | | | | | 7,191,000 |

Cash | | | | | | 593 |

Receivables: | | | | | | |

Investments sold | | | | | | 2,119,283 |

Fund shares sold | | | | | | 168,005 |

Dividends and interest | | | | | | 486,230 |

Deferred state qualification expenses | | | | | | 19,470 |

Unrealized appreciation on forward currency transactions | | | | | | 29,376 |

| | | | | |

|

|

Total assets | | | | | | 126,379,759 |

Liabilities | | | | | | |

Payables: | | | | | | |

Investments purchased | | $ | 3,528,338 | | | |

Fund shares redeemed | | | 780,206 | | | |

Accrued investment advisory fee | | | 100,300 | | | |

Accrued distribution fee | | | 64,002 | | | |

Accrued shareholder servicing fee | | | 12,696 | | | |

Accrued fund accounting fee | | | 8,200 | | | |

Other accrued expenses | | | 39,170 | | | |

| | |

|

| | | |

Total liabilities | | | | | | 4,532,912 |

| | | | | |

|

|

Net assets, at market value | | | | | $ | 121,846,847 |

| | | | | |

|

|

Net Assets | | | | | | |

Net assets consist of: | | | | | | |

Paid-in capital | | | | | $ | 99,456,028 |

Undistributed net investment income | | | | | | 598,788 |

Accumulated net realized gain | | | | | | 5,193,921 |

Net unrealized appreciation on investments and other assets and liabilities

denominated in foreign currencies | | | | | | 16,598,110 |

| | | | | |

|

|

Net assets, at market value | | | | | $ | 121,846,847 |

| | | | | |

|

|

Class A shares | | | | | | |

Net asset value and redemption price per share ($62,067,481 divided by 4,463,115 shares of beneficial interest outstanding, no par value) | | | | | $ | 13.91 |

| | | | | |

|

|

Maximum offering price per share (100/95.25 of $13.91) | | | | | $ | 14.60 |

| | | | | |

|

|

Class B shares | | | | | | |

Net asset value, offering price and redemption price per share ($10,541,739 divided by 775,069 shares of beneficial interest outstanding, no par value) | | | | | $ | 13.60 |

| | | | | |

|

|

Class C shares | | | | | | |

Net asset value, offering price and redemption price per share ($49,237,627 divided by 3,619,039 shares of beneficial interest outstanding, no par value) | | | | | $ | 13.61 |

| | | | | |

|

|

The accompanying notes are an integral part of the financial statements.

8

Heritage Growth and Income Trust

Statement of Operations

For the Six-Month Period Ended March 31, 2006

(unaudited)

| | | | | | | |

Investment Income | | | | | | | |

Income: | | | | | | | |

Gross dividends | | | | | $ | 1,547,506 | |

Foreign withholding tax | | | | | | (37,457 | ) |

| | | | | |

|

|

|

Net dividends | | | | | | 1,510,049 | |

Interest | | | | | | 330,475 | |

| | | | | |

|

|

|

Total income | | | | | | 1,840,524 | |

Expenses: | | | | | | | |

Investment advisory fee | | $ | 383,433 | | | | |

Distribution fee (Class A) | | | 68,151 | | | | |

Distribution fee (Class B) | | | 46,055 | | | | |

Distribution fee (Class C) | | | 203,420 | | | | |

Shareholder servicing fees | | | 76,000 | | | | |

Fund accounting fee | | | 45,159 | | | | |

Professional fees | | | 39,048 | | | | |

State qualification expenses | | | 24,572 | | | | |

Reports to shareholders | | | 14,286 | | | | |

Trustees’ fees and expenses | | | 12,003 | | | | |

Custodian fee | | | 6,982 | | | | |

Insurance | | | 5,312 | | | | |

Federal registration expenses | | | 556 | | | | |

Other | | | 6,442 | | | | |

| | |

|

| | | | |

Total expenses | | | | | | 931,419 | |

Fees waived by Manager | | | | | | (39,506 | ) |

| | | | | |

|

|

|

Total expenses after waiver | | | | | | 891,913 | |

| | | | | |

|

|

|

Net investment income | | | | | | 948,611 | |

| | | | | |

|

|

|

Realized and Unrealized Gain on Investments | | | | | | | |

Net realized gain from investment transactions | | | | | | 5,069,175 | |

Net realized gain from forward foreign currency transactions | | | | | | 47,355 | |

Net unrealized appreciation from forward foreign currency transactions | | | | | | 29,376 | |

Net unrealized appreciation on investments | | | | | | 1,971,103 | |

Net unrealized depreciation on the translation of assets and liabilities denominated in foreign currencies | | | | | | (2,087 | ) |

| | | | | |

|

|

|

Net gain on investments | | | | | | 7,114,922 | |

| | | | | |

|

|

|

Net increase in net assets resulting from operations | | | | | $ | 8,063,533 | |

| | | | | |

|

|

|

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Six-Month

Period Ended

March 31, 2006

(unaudited)

| | | For the Fiscal

Year Ended

September 30, 2005

| |

Increase in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 948,611 | | | $ | 1,443,432 | |

Net realized gain from investment transactions | | | 5,069,175 | | | | 8,878,676 | |

Net realized gain from forward foreign currency transactions | | | 47,355 | | | | 40,002 | |

Net unrealized appreciation from forward foreign currency transactions | | | 29,376 | | | | 19,030 | |

Net unrealized appreciation on investments | | | 1,971,103 | | | | 3,502,513 | |

Net unrealized depreciation on the translation of assets and liabilities

denominated in foreign currencies | | | (2,087 | ) | | | (12,825 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 8,063,533 | | | | 13,870,828 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income Class A shares, ($0.14 and $0.26 per share, respectively) | | | (463,359 | ) | | | (878,926 | ) |

Net investment income Class B shares, ($0.09 and $0.17 per share, respectively) | | | (49,749 | ) | | | (96,842 | ) |

Net investment income Class C shares, ($0.09 and $0.17 per share, respectively) | | | (205,535 | ) | | | (374,990 | ) |

Net realized gains Class A shares, ($0.85 per share) | | | (2,874,598 | ) | | | — | |

Net realized gains Class B shares, ($0.85 per share) | | | (468,849 | ) | | | — | |

Net realized gains Class C shares, ($0.85 per share) | | | (1,959,816 | ) | | | — | |

| | |

|

|

| |

|

|

|

Net distributions to shareholders | | | (6,021,906 | ) | | | (1,350,758 | ) |

Increase (decrease) in net assets from Fund share transactions | | | 36,470,075 | | | | (3,476,051 | ) |

| | |

|

|

| |

|

|

|

Increase in net assets | | | 38,511,702 | | | | 9,044,019 | |

Net assets, beginning of period | | | 83,335,145 | | | | 74,291,126 | |

| | |

|

|

| |

|

|

|

Net assets, end of period (including undistributed net investment income of $598,788 and $368,820, respectively) | | $ | 121,846,847 | | | $ | 83,335,145 | |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of the financial statements.

9

Heritage Growth and Income Trust

Financial Highlights

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares*

| | | Class B Shares*

| | | Class C Shares*

| |

| | | For the

Six-Month

Period Ended

March 31,

2006

(unaudited)

| | | For the Fiscal Years Ended

September 30

| | | For the

Six-Month

Period Ended

March 31,

2006

(unaudited)

| | | For the Fiscal Years Ended

September 30

| | | For the

Six-Month

Period Ended

March 31,

2006

(unaudited)

| | | For the Fiscal Years Ended

September 30

| |

| | | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| |

Net asset value, beginning of period | | $ | 13.81 | | | $ | 11.80 | | | $ | 11.10 | | | $ | 9.07 | | | $ | 11.33 | | | $ | 15.40 | | | $ | 13.54 | | | $ | 11.57 | | | $ | 10.88 | | | $ | 8.90 | | | $ | 11.15 | | | $ | 15.21 | | | $ | 13.54 | | | $ | 11.57 | | | $ | 10.88 | | | $ | 8.90 | | | $ | 11.14 | | | $ | 15.21 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.15 | | | | 0.28 | | | | 0.16 | | | | 0.12 | | | | 0.11 | | | | 0.15 | | | | 0.09 | | | | 0.18 | | | | 0.07 | | | | 0.04 | | | | 0.02 | | | | 0.04 | | | | 0.10 | | | | 0.18 | | | | 0.07 | | | | 0.04 | | | | 0.02 | | | | 0.04 | |

Net realized and unrealized gain (loss)

on investments | | | 0.94 | | | | 1.99 | | | | 0.68 | | | | 2.02 | | | | (2.28 | ) | | | (1.59 | ) | | | 0.91 | | | | 1.96 | | | | 0.66 | | | | 1.99 | | | | (2.23 | ) | | | (1.55 | ) | | | 0.91 | | | | 1.96 | | | | 0.66 | | | | 1.99 | | | | (2.22 | ) | | | (1.56 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 1.09 | | | | 2.27 | | | | 0.84 | | | | 2.14 | | | | (2.17 | ) | | | (1.44 | ) | | | 1.00 | | | | 2.14 | | | | 0.73 | | | | 2.03 | | | | (2.21 | ) | | | (1.51 | ) | | | 1.01 | | | | 2.14 | | | | 0.73 | | | | 2.03 | | | | (2.20 | ) | | | (1.52 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.14 | ) | | | (0.26 | ) | | | (0.14 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.17 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.09 | ) | | | (0.17 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.03 | ) |

Distributions from net realized gains | | | (0.85 | ) | | | — | | | | — | | | | — | | | | — | | | | (2.52 | ) | | | (0.85 | ) | | | — | | | | — | | | | — | | | | — | | | | (2.52 | ) | | | (0.85 | ) | | | — | | | | — | | | | — | | | | — | | | | (2.52 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | (0.99 | ) | | | (0.26 | ) | | | (0.14 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (2.63 | ) | | | (0.94 | ) | | | (0.17 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (2.55 | ) | | | (0.94 | ) | | | (0.17 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (2.55 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net asset value, end of period | | $ | 13.91 | | | $ | 13.81 | | | $ | 11.80 | | | $ | 11.10 | | | $ | 9.07 | | | $ | 11.33 | | | $ | 13.60 | | | $ | 13.54 | | | $ | 11.57 | | | $ | 10.88 | | | $ | 8.90 | | | $ | 11.15 | | | $ | 13.61 | | | $ | 13.54 | | | $ | 11.57 | | | $ | 10.88 | | | $ | 8.90 | | | $ | 11.14 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| �� |

|

|

| |

|

|

|

Total Return (%) (a) | | | 8.22 | (b) | | | 19.41 | | | | 7.57 | | | | 23.82 | | | | (19.29 | ) | | | (10.47 | ) | | | 7.67 | (b) | | | 18.60 | | | | 6.73 | | | | 22.82 | | | | (19.91 | ) | | | (11.04 | ) | | | 7.75 | (b) | | | 18.60 | | | | 6.73 | | | | 22.82 | | | | (19.83 | ) | | | (11.12 | ) |

| | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Expenses to average daily net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

With expenses

waived (%) | | | 1.35 | (c) | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 1.35 | | | | 2.10 | (c) | | | 2.10 | | | | 2.10 | | | | 2.10 | | | | 2.10 | | | | 2.10 | | | | 2.10 | (c) | | | 2.10 | | | | 2.10 | | | | 2.10 | | | | 2.10 | | | | 2.10 | |

Without expenses waived (%) | | | 1.43 | (c) | | | 1.51 | | | | 1.50 | | | | 1.61 | | | | 1.59 | | | | 1.48 | | | | 2.18 | (c) | | | 2.26 | | | | 2.25 | | | | 2.36 | | | | 2.34 | | | | 2.23 | | | | 2.18 | (c) | | | 2.26 | | | | 2.25 | | | | 2.36 | | | | 2.34 | | | | 2.23 | |

Net investment income to average daily net

assets (%) | | | 2.17 | (c) | | | 2.13 | | | | 1.31 | | | | 1.20 | | | | 0.98 | | | | 1.08 | | | | 1.40 | (c) | | | 1.38 | | | | 0.56 | | | | 0.44 | | | | 0.22 | | | | 0.30 | | | | 1.44 | (c) | | | 1.37 | | | | 0.57 | | | | 0.45 | | | | 0.21 | | | | 0.32 | |

Portfolio turnover

rate (%) | | | 40 | | | | 73 | | | | 80 | | | | 82 | | | | 72 | | | | 178 | | | | 40 | | | | 73 | | | | 80 | | | | 82 | | | | 72 | | | | 178 | | | | 40 | | | | 73 | | | | 80 | | | | 82 | | | | 72 | | | | 178 | |

Net assets, end of period

($ millions) | | | 62 | | | | 45 | | | | 41 | | | | 36 | | | | 29 | | | | 33 | | | | 11 | | | | 8 | | | | 7 | | | | 6 | | | | 4 | | | | 4 | | | | 49 | | | | 31 | | | | 26 | | | | 19 | | | | 14 | | | | 13 | |

| * | Per share amounts have been calculated using the monthly average share method. |

| (a) | These returns are calculated without the imposition of either front-end or contingent deferred sales charges. |

The accompanying notes are an integral part of the financial statements.

10

Heritage Growth and Income Trust

Notes to Financial Statements

(unaudited)

| Note 1: | Significant Accounting Policies. Heritage Growth and Income Trust (the “Fund”) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund’s investment objective is to primarily seek long-term capital appreciation and, secondarily, to seek current income. The Fund currently offers Class A and Class C shares to the public. Class A shares are sold subject to a maximum sales charge of 4.75% of the amount invested payable at the time of purchase. Class A share investments greater than $1 million, where a maximum sales charge is waived, may be subject to a maximum contingent deferred sales charge of 1% upon redemptions made in less than 18 months of purchase. Effective February 1, 2004, Class B shares were not available for direct purchase. Class B shares will continue to be available through exchanges and dividend reinvestments as described in the Fund’s prospectus. Class B shares are still subject to a 5% maximum contingent deferred sales charge (based on the original purchase cost or the current market value), declining over a six-year period. Class C shares are sold subject to a contingent deferred sales charge of 1% of the lower of net asset value or purchase price payable upon any redemption made in less than one year of purchase. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates and those differences could be material. The following is a summary of significant accounting policies: |

Security Valuation: The Fund values investment securities at market value based on the last quoted sales price as reported by the principal securities exchange on which the security is traded. If the security is traded on the Nasdaq Stock Market, the official NASDAQ closing price is used. If no sale is reported, market value is based on the most recent quoted bid price and in the absence of a market quote, when prices are not reflective of market value, or when a significant event has been recognized with respect to a security, securities are valued using such methods as the Board of Trustees believes would reflect fair market value. Investments in certain debt instruments not traded in an organized market are valued on the basis of valuations furnished by independent pricing services or broker/dealers that utilize information with respect to market transactions in such securities or comparable securities, quotations from broker/dealers, yields, maturities, ratings and various relationships between securities. Securities that are quoted in a foreign currency are valued daily in U.S. dollars at the foreign currency exchange rates prevailing at the time the Fund calculates its daily net asset value per share. Short-term investments having a maturity of 60 days or less are valued at amortized cost, which approximates market value.

Foreign Currency Transactions: The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, other assets and other liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains and losses from investment transactions. Net realized gain (loss) and unrealized appreciation (depreciation) from foreign currency transactions include gains and losses between trade and settlement date on securities transactions, gains and losses arising from the purchase and sale of forward foreign currency contracts and gains and losses between the ex and payment dates on dividends, interest, and foreign withholding taxes.

Forward Foreign Currency Contracts: The Fund is authorized to enter into forward foreign currency contracts for the purpose of hedging against exchange risk arising from current or anticipated investments in securities dominated in foreign currencies and to enhance total return. Forward foreign currency contracts are valued at the contractual forward rate and are marked-to-market daily, with the

11

Heritage Growth and Income Trust

Notes to Financial Statements

(unaudited)

(continued)

change in market value recorded as an unrealized gain or loss. When the contracts are closed, the gain or loss is realized. Risks may arise from unanticipated movements in the currency’s value relative to the U.S. dollar and from the possible inability of counter-parties to meet the terms of their contracts.

Repurchase Agreements: The Fund enters into repurchase agreements whereby the Fund, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount of at least 100% of the resale price. Repurchase agreements involve the risk that the seller will fail to repurchase the security, as agreed. In that case, the Fund will bear the risk of market value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Federal Income Taxes: The Fund is treated as a single corporate taxpayer as provided for in the Tax Reform Act of 1986, as amended. The Fund’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended, which are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no provision has been made for federal income and excise taxes.

Distribution of Income and Gains: Distributions of net investment income are made quarterly. Net realized gains from investment transactions during any particular year in excess of available capital loss carryforwards, which, if not distributed, would be taxable to the Fund, will be distributed to shareholders in the following fiscal year. The Fund uses the identified cost method for determining realized gain or loss on investments for both financial and federal income tax reporting purposes.

Expenses: The Fund is charged for those expenses that are directly attributable to it, while other expenses are allocated proportionately among the Heritage mutual funds based upon methods approved by the Board of Trustees. Expenses that are directly attributable to a specific class of shares, such as distribution fees, are charged directly to that class. Other expenses of the Fund are allocated to each class of shares based upon their relative percentage of net assets.

Other: Investment security transactions are accounted for on a trade date basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income is recorded on the accrual basis.

In the normal course of business the Fund enters into contracts that contain a variety of representations and warranties, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

12

Heritage Growth and Income Trust

Notes to Financial Statements

(unaudited)

(continued)

| Note 2: | Fund Shares. At March 31, 2006, there were an unlimited number of shares of beneficial interest of no par value authorized. |

Transactions in Class A, B and C shares of the Fund during the six-month period ended March 31, 2006, were as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares

| | | Class B Shares

| | | Class C Shares

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares sold/exchanged | | 448,992 | | | $ | 6,141,912 | | | 21,281 | | | $ | 286,829 | | | 280,757 | | | $ | 3,765,965 | |

Shares issued on reinvestment of distributions | | 225,020 | | | | 3,000,297 | | | 33,335 | | | | 435,785 | | | 158,266 | | | | 2,069,047 | |

Shares issued in connection with Fund reorganization (Note 6) | | 951,367 | | | | 12,700,740 | | | 263,719 | | | | 3,452,077 | | | 1,280,110 | | | | 16,756,640 | |

Shares redeemed | | (441,544 | ) | | | (6,065,773 | ) | | (98,508 | ) | | | (1,316,657 | ) | | (354,499 | ) | | | (4,753,213 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

|

Net increase | | 1,183,835 | | | $ | 12,155,544 | | | 219,827 | | | $ | 2,177,961 | | | 1,364,634 | | | $ | 14,506,530 | |

| | | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Shares outstanding: | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | 3,279,280 | | | | | | | 555,242 | | | | | | | 2,254,405 | | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

End of period | | 4,463,115 | | | | | | | 775,069 | | | | | | | 3,619,039 | | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

Transactions in Class A, B and C shares of the Fund during the fiscal year ended September 30, 2005, were as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares

| | | Class B Shares

| | | Class C Shares

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares sold/exchanged | | 743,949 | | | $ | 9,855,035 | | | 66,498 | | | $ | 860,479 | | | 421,880 | | | $ | 5,462,579 | |

Shares issued on reinvestment of distributions | | 63,010 | | | | 806,579 | | | 6,611 | | | | 82,967 | | | 27,891 | | | | 350,870 | |

Shares redeemed | | (1,020,990 | ) | | | (13,547,116 | ) | | (125,022 | ) | | | (1,596,867 | ) | | (446,901 | ) | | | (5,750,578 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

|

Net increase (decrease) | | (214,031 | ) | | $ | (2,885,502 | ) | | (51,913 | ) | | $ | (653,421 | ) | | 2,870 | | | $ | 62,871 | |

| | | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Shares outstanding: | | | | | | | | | | | | | | | | | | | | | |

Beginning of fiscal year | | 3,493,311 | | | | | | | 607,155 | | | | | | | 2,251,535 | | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

End of fiscal year | | 3,279,280 | | | | | | | 555,242 | | | | | | | 2,254,405 | | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

A redemption fee of 2% of the value of the shares sold is imposed on fund shares sold (by redemption or exchange to another Heritage mutual fund) within seven (7) calendar days of their acquisition by purchase or exchange.

| Note 3: | Purchases and Sales of Securities. For the six-month period ended March 31, 2006, purchases and sales of investment securities (excluding repurchase agreements and short-term obligations) aggregated $62,642,241 and $40,150,671, respectively. |

13

Heritage Growth and Income Trust

Notes to Financial Statements

(unaudited)

(continued)

| Note 4: | Investment Advisory, Subadvisory, Distribution, Shareholder Servicing Agent, Fund Accounting and Trustees’ Fees. Under the Fund’s Investment Advisory and Administration Agreement with Heritage Asset Management, Inc. (the “Manager” or “Heritage”), the Fund agrees to pay an investment advisory fee equal to an annualized rate of 0.75% of the first $100 million of the Fund’s average daily net assets, 0.60% on the next $400 million of such net assets, and 0.55% of any excess over $500 million of such net assets, computed daily and payable monthly. The Manager has contractually agreed to waive its fees and/or reimburse the Fund to the extent that Class A annual operating expenses exceed 1.35% of the Class A shares average daily net assets and to the extent that the Class B and Class C annual operating expenses each exceed 2.10% of those classes’ average daily net assets for the fiscal year ending September 30, 2006. Under this agreement, fees of $39,506 were waived for the six-month period ended March 31, 2006. If total Fund expenses fall below the expense limitation agreed to by the Manager before the end of the fiscal year ending September 30, 2008, the Fund may be required to pay the Manager a portion or all of the fees waived. In addition, the Fund may be required to pay the Manager a portion or all of the fees waived of $111,456 in fiscal 2004 and $130,500 in fiscal 2005, if total Fund expenses fall below the annual expense limitations before the end of the fiscal years ending September 30, 2006 and September 30, 2007, respectively. No fees were recovered for the six-month period ended March 31, 2006. |

The Manager has entered into a subadvisory agreement with Thornburg Investment Management, Inc. to provide to the Fund investment advice, portfolio management services (including the placement of brokerage orders) and certain compliance and other services for an annualized fee payable by the Manager. Eagle Asset Management, Inc. (“Eagle”) serves as an additional subadviser to the Fund. However, the Manager currently has not allocated any assets of the Fund to Eagle.

Pursuant to the Class A Distribution Plan adopted in accordance with Rule 12b-1 of the Investment Company Act of 1940, as amended, the Fund is authorized to pay Raymond James & Associates, Inc. (the “Distributor”) a fee of 0.25% of the average daily net assets. Under the Class B and Class C Distribution Plans, the Fund may pay the Distributor a fee of up to 1.00% of the average daily net assets. Such fees are accrued daily and payable monthly. Class B shares will convert to Class A shares eight years after the end of the calendar month in which the shareholder’s order to purchase was accepted.

The Distributor has advised the Fund that it generated $26,675 in front-end sales charges for Class A shares, $6,729 in contingent deferred sales charges for Class B shares and $1,506 in contingent deferred sales charges for Class C shares for the six-month period ended March 31, 2006. From these fees, the Distributor paid commissions to salespersons and incurred other distribution costs.

Heritage, Eagle, and the Distributor are all wholly owned subsidiaries of Raymond James Financial, Inc. (“RJF”).

The Manager is also the Shareholder Servicing Agent and Fund Accountant for the Fund. For providing Shareholder Servicing, the Manager receives payment from the Fund at a fixed fee per account plus any out of pocket expenses. For providing Fund Accounting services, the Manager receives payment from the Fund at a fixed fee per fund, a fixed fee per class and any out of pocket expenses.

Trustees of the Fund also serve as Trustees for Heritage Cash Trust, Heritage Capital Appreciation Trust, Heritage Income Trust, and Heritage Series Trust, all of which are investment companies that are also advised by the Manager (collectively referred to as the “Heritage Mutual Funds”). Each Trustee of

14

Heritage Growth and Income Trust

Notes to Financial Statements

(unaudited)

(continued)

the Heritage Mutual Funds who is not an employee of the Manager or employee of an affiliate of the Manager receives an annual fee of $23,000 and an additional fee of $3,000 for each combined quarterly meeting of the Heritage Mutual Funds attended. In addition, each independent Trustee that serves on the Audit Committee or Compliance Committee will receive $1,000 for attendance at their respective meeting (in person or telephonic). In addition to meeting fees, the Lead Independent Trustee will receive an annual retainer of $2,500, the Compliance Committee Chair will receive an annual retainer of $3,000, and the Audit Committee Chair will receive an annual retainer of $3,500. Trustees’ fees and expenses are paid equally by each portfolio in the Heritage Mutual Funds.

| Note 5: | Federal Income Taxes. The timing and character of certain income and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. As a result, net investment income (loss) and net realized gain (loss) from investment transactions for a reporting period may differ from distributions during such period. These book/tax differences may be temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid in capital or accumulated net realized loss, as appropriate, in the period that the differences arise. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended September 30, 2005, to reflect reclassifications arising from permanent book/tax differences attributable to reclassifications of foreign currency gains and losses and distributions from REITs, the Fund increased (credited) undistributed net investment income and decreased (debited) accumulated net realized loss of $19,820. As of September 30, 2005, the Fund had utilized capital loss carryforwards of $3,498,022. |

For income tax purposes, distributions paid during the fiscal years ended September 30, 2005 and September 30, 2004 were as follows:

| | | | | | |

| | | 2005

| | 2004

|

Distributions paid from: | | | | | | |

Ordinary Income | | $ | 1,350,758 | | $ | 595,914 |

Long-Term Capital Gains | | $ | — | | $ | — |

As of September 30, 2005, the components of distributable earnings on a tax basis were as follows:

| | | |

Undistributed Ordinary Income | | $ | 368,820 |

Capital Loss Carryforwards | | $ | — |

Post October Losses | | $ | — |

Tax Basis Net Unrealized Appreciation | | $ | 7,053,100 |

| Note 6: | Fund Reorganization. On December 23, 2005, the Fund acquired all the assets and liabilities of the Heritage Series Trust - Value Equity Fund pursuant to a plan of reorganization approved by Value Equity Fund shareholders on December 20, 2005. The reorganization was accomplished by a tax-free exchange of 2,495,196 shares of the Fund for 1,640,841 shares of Value Equity Fund outstanding on December 23, 2005. Value Equity Fund’s net assets at that date, $32,909,457, including $7,630,040 unrealized appreciation, were combined with those of the Fund. The aggregate net assets of the Fund immediately before the acquisition were $88,010,980. The combined net assets of the Fund immediately after the acquisition were $120,920,437. |

15

Heritage Growth and Income Trust

Understanding Your Fund’s Expenses

(unaudited)

Understanding Your Fund’s Expenses

As a mutual fund investor, you pay two types of costs: (1) transaction costs, including sales charges on purchases, contingent deferred sales charges, or redemption fees; and (2) ongoing costs, such as investment advisory fees; distribution (12b-1) fees; and other expenses. Using the tables below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect one-time transaction expenses, such as sales charges and redemption fees. Therefore, if these transactional costs were included, your costs would have been higher. For more information, see your Fund’s prospectus or contact your financial advisor.

Review Your Fund’s Actual Expenses

The table below shows the actual expenses you would have paid on a $1,000 investment in Heritage Growth and Income Trust on October 1, 2005 and held through March 31, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns after ongoing expenses. This table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | |

Actual

| | Beginning

Account Value

October 1, 2005

| | Ending

Account Value

March 31, 2006

| | Expenses Paid

During Period*

|

| Class A | | $ | 1,000.00 | | $ | 1,082.16 | | $ | 7.01 |

| Class B | | $ | 1,000.00 | | $ | 1,076.73 | | $ | 10.87 |

| Class C | | $ | 1,000.00 | | $ | 1,077.52 | | $ | 10.88 |

Hypothetical Example for Comparison Purposes

All mutual funds now follow guidelines to assist shareholders in comparing expenses between different funds. Per these guidelines the table below shows your Fund’s expenses based on a $1,000 investment and assuming for the period a hypothetical 5% rate of return before ongoing expenses, which is not the Fund’s actual return. Please note that you should not use this information to estimate your actual ending account balance and expenses paid during the period. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the Fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison.

| | | | | | | | | |

Hypothetical (5% return before expenses)

| | Beginning

Account Value

October 1, 2005

| | Ending

Account Value

March 31, 2006

| | Expenses Paid

During Period*

|

| Class A | | $ | 1,000.00 | | $ | 1,018.20 | | $ | 6.79 |

| Class B | | $ | 1,000.00 | | $ | 1,014.46 | | $ | 10.55 |

| Class C | | $ | 1,000.00 | | $ | 1,014.46 | | $ | 10.55 |

| | * | Expenses are calculated using the Fund’s annualized expense ratios for Class A (1.35%), Class B (2.10%) and Class C (2.10%) shares, multiplied by the average account value for the period, then multiplying the result by the actual number of days in the period (182); and then dividing that result by the actual number of days in the fiscal year (365). |

16

Principal Risks

The greatest risk of investing in this Fund is that you could lose money. The Fund invests primarily in common stocks whose values increase and decrease in response to the activities of the companies that issued such stocks, general market conditions and/or economic conditions. As a result, the Fund’s net asset value also increases and decreases. Investments in the Fund are subject to the following primary risks:

| | • | | Stock Market Risk. The value of a fund’s stock holdings may decline in price because of changes in prices movement. The stock markets generally move in cycles, with periods of rising prices followed by periods of declining prices. The value of your investment may reflect these fluctuations. |

| | • | | Growth Stock Risk. Growth companies are expected to increase their earnings at a certain rate. When these expectations are not met, investors may punish the prices of stocks excessively, even if earnings showed an absolute increase. Growth company stocks also typically lack the dividend yield that can cushion stock prices in market downturns. |

| | • | | Value Stock Risk. Investments in value stocks are subject to the risk that their true worth may not be fully realized by the market. This may result in the value stocks’ prices remaining undervalued for extended periods of time. A fund’s performance also may be affected adversely if value stocks remain unpopular with or lose favor among investors. |

| | • | | Mid-Cap Companies Risk. Investments in medium-capitalization companies generally involve greater risks than investing in larger, more established companies. Mid-cap companies often have narrower commercial markets and more limited managerial and financial resources than larger, more established companies. As a result, their performance can be more volatile and they face greater risk of business failure, which could increase the volatility of a fund’s portfolio. Generally, the smaller the company size, the greater these risks. Additionally, mid-cap companies may have less market liquidity than large-cap companies. |

| | • | | Fixed Income Securities. A fund could lose money if the issuer of a fixed-income security is unable to meet its financial obligations or goes bankrupt. Credit risk usually applies to most fixed-income securities, but generally is not a factor for U.S. government obligations. In addition, investing in non-investment grade bonds generally involves significantly greater risk of loss than investments in investment-grade bonds. Issuers of non-investment grade bonds are more likely than issuers of investment-grade bonds to encounter financial difficulties and to be materially affected by these difficulties. |

| | • | | High-Yield Securities. Investments in securities rated below investment grade or “junk bonds” generally involves significantly greater risks of loss of your money than an investment in investment grade bonds. Compared with issuers of investment grade bonds, junk bonds are more likely to encounter financial difficulties and to be materially affected by these difficulties. Rising interest rates may compound these difficulties and reduce an issuer’s ability to repay principal and interest obligations. Issuers of lower-rated securities also have a greater risk of default or bankruptcy. Additionally, due to the greater number of considerations involved in the selection of a fund’s securities, the achievement of a fund’s objective depends more on the skills of the portfolio manager than investing only in higher rated securities. Therefore, your investment may experience greater volatility in price and yield. High yield securities may be less liquid than higher quality investments. A security whose credit rating has been lowered may be particularly difficult to sell. |

| | • | | Foreign Securities. Investments in foreign securities involve greater risks than investing in domestic securities. As a result, a fund’s returns and net asset value may be affected by fluctuations in currency exchange rates or political or economic conditions and regulatory requirements in a particular country. Foreign markets, as well as foreign economies and political systems, may be less stable than U.S. markets, and changes in the exchange rates of foreign currencies can affect the value of a fund’s foreign assets. Foreign laws and accounting standards typically are not as strict as they are in the U.S., and there may be less public information available about foreign companies. |

| | • | | Risk of Market Timing Activities. Because of specific securities a fund may invest in, it could be subject to the risk of market timing activities by fund shareholders. Some examples of these types of securities are small-cap, mid-cap and foreign securities. Typically, foreign securities offer the most opportunity for these market timing activities. A fund generally prices these foreign securities using their closing prices from the foreign markets in which they trade, typically prior to a fund’s calculation of its net asset value. These prices may be affected by events that occur after the close of a foreign market but before a fund prices its shares. In such instances, a fund may fair value foreign securities. However, some investors may engage in frequent short-term trading in a fund to take advantage of any price differentials that may be reflected in the net asset value of a fund’s shares. There is no assurance that fair valuation of securities can reduce or eliminate market timing. In order to discourage market timing activity in a fund, redemptions and exchanges of fund shares may be subject to a redemption fee. While Heritage monitors trading in the fund, there is no guarantee that it can detect all market timing activities. |

Not applicable to semi-annual reports.

| Item 3. | Audit Committee Financial Expert |

Not applicable to semi-annual reports.

| Item 4. | Principal Accountant Fees and Services |

Not applicable to semi-annual reports.

| Item 5. | Audit Committee of Listed Registrants |

Not applicable to the registrant.

| Item 6. | Schedule of Investments |

Included as part of report to shareholders under Item 1.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-end Management Investment Companies |

Not applicable to the registrant.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies |

Not applicable to the registrant.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers |

Not applicable to the registrant.

| Item 10. | Submission of Matters to a Vote of Security Holders |

There have been no material changes to the Nominating Committee Charter, which sets forth procedures by which shareholders may recommend nominees to the Trust’s Board of Trustees, since the Trust last provided disclosure in response to this item.

| Item 11. | Controls and Procedures |

| (a) | Based on an evaluation of the disclosure controls and procedures (as defined in Rule 30a-2(c) under the Act), the Principal Executive Officer and Principal Financial Officer of Heritage Growth & Income Trust have concluded that such disclosure controls and procedures are effective as of June 2, 2006. |

| (b) | There was no change in the internal controls over financial reporting (as defined in Rule 30a-3(d) of Heritage Growth & Income Trust that occurred during the second fiscal quarter that has |

| | materially affected or is reasonably likely to materially affect, its internal control over financial reporting. |

(a)(1) Not applicable to semi-annual reports.

(a)(2) The certifications required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 is filed and attached hereto as Exhibit 99.CERT.

(a)(3) Not applicable to the registrant.

(b) The certification required by Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 is filed and attached hereto as Exhibit 99.906 CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | HERITAGE GROWTH & INCOME TRUST |

| | |

Date: June 2, 2006 | | | | /s/ K.C. Clark |

| | | | K.C. Clark |

| | | | Executive Vice President and Principal Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Date: June 2, 2006

| | | | |

| | | | | /s/ K.C. Clark |

| | | | K.C. Clark |

| | | | Executive Vice President and Principal Executive Officer |

Date: June 2, 2006

| | | | |

| | | | | /s/ Andrea N. Mullins |

| | | | Andrea N. Mullins |

| | | | Principal Financial Officer and Treasurer |