UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-04767

EAGLE GROWTH & INCOME FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

RICHARD J. ROSSI, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K & L Gates LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: April 30, 2010

| Item 1. | Reports to Shareholders |

| | | | |

| Semiannual Report | | | | |

| | |

| and Investment Performance Review for the | | | | |

| six-month period ended April 30, 2010 (unaudited) | | | | |

| | |

| Eagle Capital Appreciation Fund | | | | |

| | |

| Eagle Growth & Income Fund | | | | |

| | |

| Eagle International Equity Fund | | | | |

| | |

| Eagle Investment Grade Bond Fund | | | | |

| | |

| Eagle Large Cap Core Fund | | | | |

| | |

| Eagle Mid Cap Growth Fund | | | | |

| | |

| Eagle Mid Cap Stock Fund | | | | |

| | |

| Eagle Small Cap Core Value Fund | | | | |

| | |

| Eagle Small Cap Growth Fund | | | | |

| |

| | |

| | | | | | | | |

| Go Paperless with eDelivery | | visit eagleasset.com/eDelivery | | For more information, see inside. | | | | |

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the semiannual report and investment performance review of the Eagle Family of Funds for the six months ended April 30, 2010 (the “reporting period”).

Major U.S. stock indexes posted solid gains during the reporting period, extending the rally that began in early March 2009, as investors were encouraged by low inflation, strong earnings, and low interest rates. Some positive economic indicators, along with the strength in corporate America, had led to long-term optimism, even amid near-term caution and volatility.

Internationally, most markets posted solid returns reflecting some signs of improvement in the economic environment. Emerging markets outpaced developed markets, with the notable exception of China, which barely remained in positive territory. The debt crisis in Greece and Portugal has created uncertainty in domestic and foreign markets. There is concern that the problems in Greece and Portugal may spread to other European countries with similar fiscal positions.

In the commentaries that follow, each fund’s portfolio managers discuss the specific performance in their funds. While performance during the reporting period was encouraging and positive signs of economic growth are present, it bears remembering that markets can be quite volatile. Recoveries are seldom in a straight line and investors can expect challenges along the way as the year unfolds.

Market corrections and movement can create opportunities for long-term, fundamental stock picking over time.

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this report. Carefully consider the investment objectives, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds. Our website also has timely information about the Funds, including performance and portfolio holdings.

Finally, on March 12, 2010, I was appointed president of the Funds by their Boards of Trustees. I have been with Eagle Asset Management, Inc., the Funds’ investment adviser, since 2000 and assumed the role of president and co-chief operating officer last year. I am grateful for your continued support and confidence in the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

June 15, 2010

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund | | |

Meet the managers | Steven M. Barry and David G. Shell, CFA®, are Chief Investment Officers and Senior Portfolio Managers at Goldman Sachs Asset Management L.P. and have been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Shell and Mr. Barry have been affiliated with the Fund since 1987 and 1999, respectively. Both Portfolio Managers have more than 20 years of investment experience.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

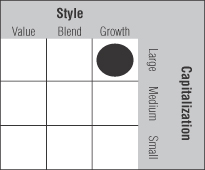

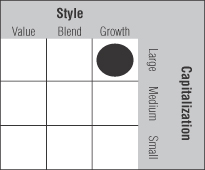

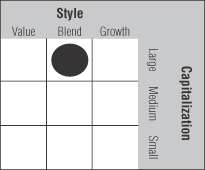

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2010 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 14.22% (excluding front-end sales charges) during the six-month period ended April 30, 2010, underperforming its benchmark index, the Russell 1000® Growth Index, which returned 15.79%. The Russell 1000® Growth Index measures

performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Fund delivered strong absolute performance during the six-month reporting period. The Fund’s top performing sectors were consumer discretionary and financials. While all market sectors posted positive returns, the Fund’s weakest returns were in the materials, consumer staples and health care sectors.

The Fund trailed its benchmark, the Russell 1000® Growth Index, during the period. The Fund had a significant underweight in the top performing industrials sector, while weakness in selected health care stocks detracted from performance. On the positive side, stock selection in the information technology sector and an overweight position in the strong telecommunications sector contributed to results.

Under performers | Pharmaceutical manufacturer Baxter International, Inc. detracted from performance. Shares of Baxter fell after the company trimmed its guidance for 2010 due to a weaker outlook for its bioscience (blood plasma) business. Competition in the blood plasma market has increased, making it more difficult for Baxter to price its products at a premium. While we expect uncertainty in the plasma business to remain an overhang in the near-term, we continue to hold the stock in the Fund as we believe the company trades at an attractive valuation due to its robust product pipeline and its market leading franchise.

Retailer Staples, Inc. traded down after the company reported fourth quarter earnings and provided full year 2010 guidance that disappointed investors. In our view, the company is making investments in new business and processes that should strengthen its brand and position it for growth over the long-term. The Fund still owns the stock.

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) | | |

Financial holding company Morgan Stanley detracted from performance during the period and we exited our position. While we continue to like the business for its diverse product offering and strong balance sheet, we have greater conviction in Northern Trust. Consequently, we decided to exit our position in Morgan Stanley to initiate a position in Northern Trust, which we believe offers greater upside potential over the next three to five years.

Suncor Energy Inc., an oil exploration firm, detracted from performance and we exited our position. Suncor has had some operational issues in the past several months and we now have lower confidence it will be able to meet its production guidance. While we continue to like Suncor longer term, we believe there are more attractive investment opportunities in the energy space.

Gilead Sciences Inc., a biopharmaceuticals company, detracted from performance as uncertainty around health care reform weighed on the stock. We continue to have conviction in the company as we believe it is well positioned within the biotechnology industry, holding dominant market share in several niche areas. Specifically, Gilead produces the most commonly used treatments for HIV/AIDS and is continually developing improved antiretroviral therapies to maintain its advantage. We continue to hold the stock in the Fund.

Top performers | Wireless tower company Crown Castle International Corporation contributed to performance after reporting positive earnings. Shares rose after one of their major customers, Clearwire, made a significant investment to further build out its new wireless network. As the wireless space continues to expand, we believe that our wireless tower businesses are well positioned given their dominant market share in an industry with high barriers to entry. The Fund continues to hold the stock.

Apple Inc. contributed to performance after posting second quarter earnings that were significantly ahead of consensus. The strong results were driven by record iPhone sales of nearly 9 million units, a 131% jump from the second quarter last year. We continue to hold the stock in the Fund as we have conviction in Apple’s expanding product lineup, including the recent introduction of the iPad, and believe the stock is attractively valued.

CB Richard Ellis Group, Inc., the world’s leading commercial real estate services firm, contributed to performance after reporting fourth quarter results that exceeded expectations. Sales and leasing revenues increased year-over-year and margins showed significant improvement driven by well executed cost cutting efforts. Furthermore, the company’s management team expressed increasing optimism that the real estate markets are nearing an inflection point. While the timing of a recovery remains uncertain, we believe CB Richard Ellis is well positioned to take market share and generate significant operating leverage. We continue to hold the stock in the Fund.

Broadcom Corporation, a global leader in semiconductors for wired and wireless communications, contributed to performance. Shares rose after the company reported better than expected fourth quarter earnings and issued positive first quarter sales guidance. We continue to maintain our long-term conviction in the name and hold the stock in the Fund as we believe that Broadcom is well positioned to gain market share from its peers due to its strong portfolio of multi integrated semiconductor chips.

Software company Oracle Corporation contributed to performance after reporting strong quarterly results and providing an encouraging outlook. The company’s software license revenues and product support revenues were above expectation as demand has improved. We believe that the acquisition of Sun Microsystems should complement Oracle’s product portfolio and strengthen its long-term industry position. The Fund continues to own the stock.

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund | | |

Meet the managers | William V. Fries, CFA®, Managing Director, and Cliff Remily, CFA®, of Thornburg Investment Management, Inc. are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Mr. Fries has more than 40 years of investment experience and has been Portfolio Manager/Co-Portfolio Manager since 2001. Mr. Remily was named Co-Portfolio Manager in January 2009 and has more than 10 years of industry experience.

Investment highlights | The Fund invests primarily in domestic equity securities (primarily common stocks). The Fund’s portfolio managers look for promising investments that can be purchased at a discount to their estimate of each investment’s intrinsic value. They seek investments that deliver a competitive total return over normal investment time horizons. Holdings are classified in three categories: basic value, consistent earners and emerging franchises as a means of structuring diversification. Dividends and dividend growth are a consideration in stock selection and may include stocks outside the traditional dividend paying areas.

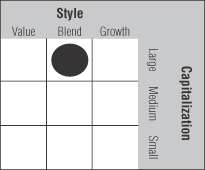

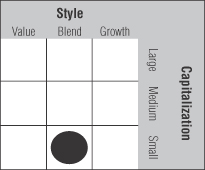

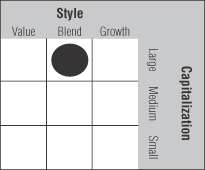

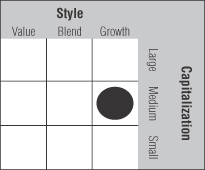

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 10.78% (excluding front-end sales charges) during the six-month period ended April 30, 2010, underperforming the Fund’s benchmark index, which returned 15.66% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | On an absolute basis, the Fund posted strong returns during the reporting period. We believe the actions taken during and since the downturn of 2008 and early 2009 solidly positioned the portfolio for the current market. All market sectors posted positive returns for the reporting period, with the financials, information technology, and consumer discretionary sectors making the greatest contributions to the Fund’s total return. The Fund’s investments in the telecommunication services, energy and utilities sectors lagged the Fund as a whole.

The Fund’s exposure to fixed-income was dramatically reduced over the reporting period from 13% to roughly 1.5% as many of the holdings approached price targets. The decision to invest in bonds was opportunistic given the market conditions in 2009. In general, we continued to see strong price appreciation in our bond portfolios and made the transition away from fixed income back into more attractive equities that are uncovered through our fundamental, bottom-up research process.

The Fund underperformed its benchmark index, the S&P 500 Index, during the reporting period. Relative to the benchmark, the Fund benefited from an overweight allocation to the financials sector, particularly with banking stocks. Detracting from relative performance were the telecommunication services, industrials, consumer discretionary and healthcare sectors. The telecommunication services sector was the weakest performing sector and the Fund had negative stock selection coupled with a significant overweight position. In industrials, the Fund’s material underweight position damped the effect of strong stock selection. In consumer discretionary, an underweight position and stock selection detracted from relative performance. Finally, in healthcare, negative stock selection hurt performance relative to the benchmark.

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund (cont’d) | | |

Because we have the flexibility to vary widely from benchmark sector weights, the relative size of our investments in a sector can often cause short-term over- or under-performance. However, we believe that, over the long-term, our bottom-up approach and basket diversification allow individual stock picking to be a more important driver of performance than sector allocation.

Under performers | Shares of Telefonica SA, a telecommunication services provider in Europe and Latin America, declined due to concerns over the European debt crisis as well as a growing perception the firm has a maturing revenue stream in an increasingly competitive market. In Europe, sovereign debt issues continue to arise as Greece looks to refinance its debt commitments and investors grow increasingly concerned about fiscal deficits in Italy, Spain, and other European countries. The Fund continues to hold the stock.

AXA SA has three main businesses, annuity and life insurance, property and casualty insurance and asset management. The annuity business, which is core to our investment thesis, is in recovery mode on the strength of newly configured products. The other segments have improved but are still not contributing to their potential, as the property & casualty business needs firmer pricing to return to its former profit levels and asset management continues to experience net outflows, albeit at a declining rate. Financial turmoil in Europe related to Greece, potential austerity measures in a number of countries and the company’s investment exposure (manageable but a meaningful percent of tangible equity capital), hangs over the stock as investors evaluate solvency and capital strength of financial institutions. We continue to hold the stock in the Fund as we believe the valuation imbeds most of the negatives and little of the potential.

Drug manufacturer Actelion Pharmaceuticals Ltd. announced disappointing results in a trial for their existing drug Tracleer in a new indication (Idiopathic Pulmonary Fibrosis). While positive results in this trial would have been great news, we continue to believe that the company looks reasonably valued on its currently approved products and has a number of very exciting new treatments in its pipeline. We continue to hold the stock in the Fund.

Weak natural gas prices have had a negative impact on energy producer ENI SpA. However, we believe the company is well

positioned to maintain its attractive dividend and grow its earnings power over the longer term. As such, the Fund continues to hold the stock.

Brazilian stock exchange BM&F Bovespa S.A. has seen its equity trading business recover from last year’s lows, but improvement in the derivatives business up until this most recent quarter has been sluggish. Additionally, general macro concerns have arisen over the Brazilian government’s attempts to restrict the inflow of foreign capital, the possibility of further interest rate increases in Brazil, and the impact to financial service stocks from recent turmoil in Europe. The Fund continues to own the stock.

Top performers | Fifth Third Bancorp, a diversified financial services holding company, increased in value as the company’s balance sheet continued to heal and fears surrounding the company’s ability to manage their leverage subsided. The Fund continues to hold the stock.

Aircraft manufacturer Boeing Company successfully tested its 787 Dreamliner aircraft during the period. The 787 represents a tremendous future revenue and earnings opportunity for Boeing, and successful progress of this program, as well as the strengthening global economy, rewarded shareholders smartly during the period. The Fund continues to hold the stock.

Telecommunication services provider Comcast Corporation performed well during the period. Recently, the Federal Communications Commission announced that the regulatory regime surrounding broadband internet access may change. While the FCC claims they will not regulate pricing in the industry under the new regime, investors are skeptical. We continue to hold the stock in the Fund.

Baidu, Inc. is the leader in Chinese language internet search. It saw its share price increase as the company’s largest competitor, Google, announced plans to exit the Chinese internet advertising business. The Fund continues to own the stock.

Software provider Amdocs Ltd. announced very strong earnings in the December quarter which helped drive price appreciation. Not only did the firm outperform expectations on the top and bottom line, but they issued very strong guidance indicating a return to growth for the company. The Fund continues to hold the stock.

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund | | |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its affiliate, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA®, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 4.76% (excluding front-end sales charges) during the six-month period ended April 30, 2010, underperforming the Fund’s benchmark index, which returned 5.76% during the same period. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex- US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | For the reporting period, the Fund lagged behind its benchmark. Stock selection in emerging markets detracted as did the Fund’s underweight to and stock selection in Japan, while UK stock selection was positive. Within Continental Europe, the decision to underweight banks in Spain and Greece was positive. Additionally, the decision to hedge a portion of the Fund’s Euro exposure back to the US dollar contributed to results.

Stock selection in China and South Korea detracted from relative performance. In particular, China Construction Bank Corp and Industrial & Commercial Bank of China Ltd underperformed. However, positions held in India outperformed the benchmark, particularly ICICI Bank Ltd, iShares MSCI India Index Fund, Tata Motors Ltd and HDFC Bank Ltd. Within Central and Eastern Europe, the Ukraine, Russia and Hungary positively contributed to performance, including positions in Ukraine Social Bank (Ukraine) and OTP Bank (Hungary).

From a sector perspective, information technology underperformed the benchmark, due primarily to two positions in Taiwan. Weakness in Gazprom ADS and Lukoil ADS (Russia) as well as OMV AG (Austria) contributed to absolute and relative underperformance in the energy sector. On a positive note, companies held within materials outperformed, including Rio Tinto Ltd (Australia), Rio Tinto PLC and Xstrata PLC (UK) as well as Norilsk Nickel (Russia). Within financials, positions held in Lloyds Banking Group PLC and HSBC Holdings PLC (UK) had a positive effect; however, the Fund’s positions in Mediobanca Banca di Credito Finanziario and Unicredito Italiano (Italy) and BNP Paribas (France) underperformed. Finally, within consumer staples, shares of Imperial Tobacco Group PLC and Reckitt Benckiser Group PLC underperformed.

The core European markets, particularly those highly leveraged to global trade, (particularly Germany, France and the Netherlands) are running lower deficits and are in better structural positions than their southern neighbors, the epicenter of the turmoil. We have taken several defensive measures within the Fund in light of the sovereign debt debacle. We find ourselves once again in an environment where macro factors are driving markets, and the solutions lie in government and

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund (cont’d) | | |

central bank policy changes. We hold no positions in the banks or insurers within Portugal, Ireland, Greece and Spain and are underweight financials globally versus the benchmark. We have reduced our exposure to materials and other cyclical companies, although we have directed some of the proceeds toward gold mining companies as well as small positions in gold exchange-traded funds (ETFs). On the currency front, we have a hedge against Euro weakness and have hedges in place against weakening emerging European currencies and those of some small developed European currencies. We are favoring globally-oriented or export-focused firms as well as defensive growth companies with strong brands, especially those that have exposure to the growth potential of emerging markets. This currently includes the consumer staples sector and pharmaceutical industry. We also are focused on European capital goods and industrial companies including airports, cement and those involved in trucking, logistics and electrical

equipment. Finally, the Fund is overweight in Central and Eastern European markets, including Russia.

The Fund is underweight to Japan because of demographic, debt and political issues. Within emerging Asia, we found several technology companies attractive, including several in Taiwan and South Korea, as the region continues to achieve global dominance in an industry that we believe would benefit from the global capital expenditure cycle. Within India, the Fund’s holdings are in companies leveraged to the long-term infrastructure build-out, with particular focus on steel, engineering and cement companies as well as private sector banks. In China, we are avoiding the banking sector, given an overheated real estate market. Instead, the Fund’s holdings are focused on the domestic consumer, amid structural changes in China toward a more consumption-driven economy.

| | |

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund |

Meet the managers | James C. Camp, CFA®, a Managing Director at Eagle Asset Management (“Eagle”) and Joseph Jackson, CFA®, have been Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) since its inception on March 1, 2010, and are jointly responsible for the day-to-day management of the Fund’s investment portfolio.

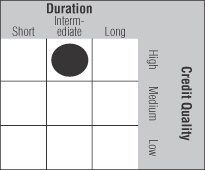

Investment highlights | The Fund invests primarily in investment grade fixed income securities. Investment grade is defined as securities rated [BBB-] or better by Standard & Poor’s Rating Services or an equivalent rating by at least one other nationally recognized statistical rating organization or, for unrated securities, those that are determined to be of equivalent quality by the Fund’s portfolio manager. The average portfolio duration of the Fund is expected to vary and may generally range anywhere from two to seven years based upon economic and market conditions. The Fund expects to invest in a variety of fixed income securities including, but not limited to corporate debt securities of U.S. and non-U.S. issuers, including corporate commercial paper; bank certificates of deposit; debt securities issued by states or local governments and their agencies; obligations of non-U.S. Governments and their subdivisions, agencies and government sponsored enterprises; obligations of international agencies or supranational entities (such as the European Union); obligations issued or guaranteed by the U.S. Government and its agencies; mortgage-backed securities and asset-backed securities; commercial real estate securities; and floating rate instruments.

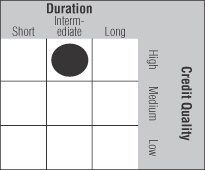

This Morningstar Style Box™ shows the credit quality and the duration of the Fund’s investments.

Performance summary | The Fund’s Class A shares returned 0.70% (excluding front-end sales charges) from March 1, 2010 (commencement of operations) to April 30, 2010, outperforming its benchmark index, which returned 0.58% during the same period. The Fund’s benchmark index, the Barclays Intermediate Government/Credit Bond Index, includes U.S. government and investment grade credit securities that

have a greater than or equal to one year and less than ten years remaining to maturity and have $250 million or more of outstanding face value. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Fund commenced operations on March 1, 2010. During the two months of operations covered by the reporting period, there was a high level of bond issuance and liquidity in the marketplace. This allowed us to invest the Fund’s assets quickly and efficiently. Further, since the Fund was in the start-up phase, there was low turnover during the period.

On an absolute basis, the Fund’s corporate bond holdings led performance during the period. In particular, holdings in the industrials sector outpaced those in the financials and utilities sectors. Due to falling interest rates, longer duration bonds outperformed those with shorter maturities.

For the reporting period, the Fund outperformed its benchmark index. The biggest contributor to relative performance was that the Fund maintained a longer average duration in its Treasury holdings than the benchmark while interest rates fell during the reporting period. In particular, the Fund’s overweight and longer duration positions in industrials and utilities contributed to performance. The Fund also benefited from its holdings in commercial mortgage backed securities (CMBS), which outperformed the benchmark. Detracting from relative performance was the Fund’s underweight and underperforming holdings in financials.

Top performers | Pharmaceutical manufacturers Pfizer, Inc. and Amgen, Inc. were both strong performers during the period. The passage of the healthcare bill was viewed by the market as a positive for the future earnings potential of these firms. The Fund continues to hold these bonds.

Barrick Gold Corporation, a mining company, performed well due to the high price of gold during the reporting period. The Fund continues to hold the bond.

| | |

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund (cont’d) |

The Fund’s U.S. Treasury Note maturing in 2017 helped Fund performance as longer duration Treasuries rallied during the period. The Fund continues to hold the bond.

The Fund’s holding in Ginnie Mae was also a top performer because we were able to buy the security at a favorable price. We continue to hold the bond in the Fund.

Under performers | The Fund’s position in software firm CA, Inc. lagged on rumors that the firm is a buyout target. The Fund continues to hold the position.

Telecommunications firm Verizon Communications, Inc. trailed the market as it is a short duration holding in a low risk firm. The broad market rally favored longer duration bonds of higher

risk. The Fund sold this bond, maturing in 2012, and purchased a longer duration Verizon issue maturing in 2019.

Investment bank Goldman Sachs Group, Inc. declined following the announcement of SEC fraud charges in connection with a 2007 synthetic sub-prime mortgage derivative deal. The Fund continues to own the bond.

A Fannie Mae 2006 series bond, maturing in 2033, hurt performance as a significant number of loans were bought back by the company at a discount. The Fund still owns the bond.

The Fund’s U.S. Treasury Note maturing in 2013 hurt performance as short duration Treasuries performed poorly in March and April. We continue to own the bond in the Fund.

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund | | |

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, CFA®, Craig Dauer, CFA®, and Robert Marshall at Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Eagle Large Cap Core Fund (the “Fund”) since its inception in 2005. Mr. Skeppstrom is a Managing Director at Eagle and has 19 years of investment experience. Mr. Jordan, Mr. Dauer and Mr. Marshall have 19,16 and 23 years of investment experience, respectively.

Investment highlights | The Fund invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In general, the portfolio managers seek to select securities, that, at the time of purchase, have above-average expected returns and at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

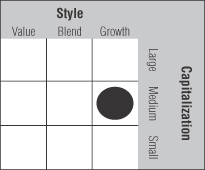

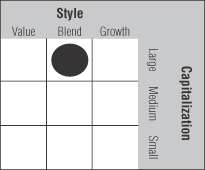

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 14.08% (excluding front-end sales charges) during the six-month period ended April 30, 2010 underperforming the Fund’s benchmark index, which returned 15.66% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and

principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Fund performed well during the reporting period, with particularly strong absolute returns from its holdings in the telecommunication services, consumer discretionary and industrials sectors. In telecommunication services, the Fund benefited from a single holding in the wireless telecommunications services industry that outperformed the Fund’s other holdings. In consumer discretionary, holdings in the multiline retail (e.g. department stores), media and specialty retail industries all performed well. In industrials, the Fund’s strong performing holdings were in the industrial conglomerates, machinery and aerospace & defense industries. Absolute performance was hindered by a single holding in the consumer staples sector, which posted a negative return.

The Fund slightly underperformed its benchmark index during the period, primarily due to stock selection in the consumer staples sector. In addition, the Fund’s holdings in the strong performing industrials sector detracted from relative performance. Finally, a few underperforming stocks in the overweighted information technology sector held back Fund performance. Relative performance was helped by strong stock selection in the telecommunication services, energy and health care sectors. The Fund also benefited from a lack of holdings in the underperforming utilities sector and an overweight position in the strong performing consumer discretionary sector.

Under performers | Pharmacy services company CVS Caremark Corporation announced additional large contract losses in its pharmacy benefits management (PBM) business. We sold the Fund’s holdings because we were not satisfied with management’s explanations for the contract losses and were unable to independently gauge how impaired the PBM business might be.

Shares of the investment bank Goldman Sachs Group, Inc. declined following the announcement of SEC fraud charges in connection with a 2007 synthetic sub-prime mortgage derivative deal. The Fund continues to hold the stock as we feel that the firm maintains a strong position in a consolidating industry and the stock is attractively valued.

BP PLC, an oil exploration firm, saw its shares fall on liability concerns associated with the recent Deepwater Horizon oil spill

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund (cont’d) | | |

in the Gulf of Mexico. The fallout from this accident offset improving fundamentals within its exploration and production business. The Fund held the stock at the end of the reporting period pending analysis of its potential liability resulting from the spill.

Exxon Mobil Corporation underperformed as its defensive characteristics, including stability and financial strength, remained out of favor in a strong equity return environment driven by exceptional earnings growth. The Fund continues to hold the stock for its solid fundamentals and attractive valuation.

The stock price of computer games developer Activision Blizzard, Inc. declined on the news that several members of its game studio (Infinity Ward) which produced the hit game Modern Warfare 2 resigned, and will likely join a recently established start-up founded by the unit’s prior managers. Personnel changes are common in the industry, and the company’s studio is well positioned going forward. The Fund continues to hold the shares on our belief that the market over reacted to the employee defections.

Top performers | Managed care provider UnitedHealth Group, Inc. performed well as the health care reform bill that ultimately

passed was relatively benign to the managed care industry. Most critically, the bill did not include a government-run option to compete with the private companies. We trimmed the Fund’s holdings in January to take profits resulting from market optimism surrounding Scott Brown’s Massachusetts Senate election, which led some to declare healthcare reform dead. While we did not share that degree of optimism, we feel that the market supports the stock’s valuation and continue to hold it in the Fund.

Sales performance improved at retailer Macy’s Inc. Accordingly, analysts increased their earnings estimates for the year. We trimmed the Fund’s position in mid-April as the stock approached fair value.

EOG Resources, Inc. is an oil and gas exploration company which benefited from rising oil prices and a strong growth profile. The Fund continues to hold the position.

Bank of America Corporation and Wells Fargo & Company both benefited from their low market valuations as the market began to anticipate the peak of provisioning and a re-normalization of earnings in an expanding economy. We believe the stocks remain attractively valued and are both still held by the Fund.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has more than 30 years of investment experience. Christopher Sassouni, DMD, with 21 years of investment experience and Eric Mintz, CFA®, with 15 years of investment experience, have been Assistant Portfolio Managers since 2006 and 2008, respectively.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s portfolio managers believe that conducting extensive research on mid cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 26.12% (excluding front-end sales charges) during the six-month period ended April 30, 2010 outperforming the Fund’s benchmark index, which returned 23.23% during the same period. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and

principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Investments in the materials and industrials sectors led the Fund’s strong returns. In materials, stocks in the chemicals and metals & mining industries performed well. In industrials, the strongest rally was found in the road & rail industry. Elsewhere, the Fund’s holdings in the electronic equipment instruments & components and biotechnology industries performed well. While all sectors posted positive returns, on an absolute basis, stocks in the financials and consumer staples sectors lagged. The construction & engineering and auto components industries had negative returns for the reporting period.

The Fund outperformed its benchmark index during the reporting period, as investments in the materials, industrials, information technology, consumer staples, and energy sectors outperformed the benchmark due to strong stock selection. In materials, the Fund outperformed the benchmark due to strong returns and an overweight position in the chemicals industry. Strong returns in the overweight road & rail industry benefited industrials. The electronic equipment instruments & components industry and overweight software industry led to outperformance in information technology. The Fund’s only consumer staples holding (in the household products industry) had very strong performance relative to the lackluster benchmark sector performance. Strong stock selection in the oil gas & consumable fuels industry led to outperformance in the lagging energy sector.

Relative to the benchmark, the Fund slightly underperformed in the financials and consumer discretionary sectors. While the Fund’s absolute performance was in line with the benchmark, an overweight position in the lagging capital markets industry led to underperformance in the financials sector. In the top performing consumer discretionary sector, the lagging returns in the internet & catalog retail industry detracted from sector returns as did a lack of exposure to some of the better performing industries, such as multiline retail, leisure equipment & products and automobiles.

Top Performers | Micron Technology, Inc. sells memory used in computers, and is benefiting from increasing demand in conjunction with vastly lower industry supply, which is pushing up prices and increasing profitability.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund (cont’d) |

Shares in Huntsman Corporation, a chemical producer, appreciated as investors are anticipating improved business fundamentals as a result of an economic recovery in this highly cyclical industry. Further, the company has successfully implemented a cost reduction program.

Transportation company Kansas City Southern, Inc., appreciated on strong pricing and volume trends.

Sound technology provider Dolby Laboratories, Inc. appreciated during the reporting period due to a pickup in demand in Blu-ray and the Windows 7 product cycle.

Fertilizer producer Terra Industries Inc’s share price increased during the period as the result of a bidding war for the company which ended with its acquisition by CF Industries Holdings.

With the exception of Terra Industries, Inc., which was acquired, the Fund still holds each of these securities.

Under performers | CF Industries Holdings, a fertilizer producer, traded down due to concerns regarding the cost of its recent acquisition of Terra Industries as well as seasonality in fertilizer sales. We continue to hold the stock as we believe the Terra acquisition is a long-term positive for the company.

KLA-Tencor Corporation provides process control and yield-management solutions to semiconductor manufacturers. We sold the stock because we no longer see the company benefiting as much as its peers from increased spending by semiconductor manufacturers.

Oil and gas explorer Denbury Resources, Inc. underperformed due to its surprising acquisition of Encore Oil and Gas. We sold the stock and replaced it with shares of another company in this industry.

Specialty electrical contracting and maintenance company Quanta Services, Inc. has seen delays in its new transmission line business. Although we believe in the long-term fundamentals of the business, we sold the stock due to its near-term outlook uncertainty.

Health insurer Cigna Corporation has declined slightly since our recent purchase, due primarily to market conditions. We remain optimistic about the company as it has little exposure to the individual and group markets, nor does it offer Medicare plans. As such, we feel it is ideally positioned to weather the storms of healthcare reform and continue to hold the stock in the Fund.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund | | |

Meet the managers | Todd L. McCallister, Ph.D., CFA®, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Mr. McCallister has more than 20 years of investment experience and has managed the Fund since its inception in 1997. Stacey Serafini Thomas, CFA®, is a Vice President at Eagle and served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager. Ms. Thomas has more than 10 years of investment experience.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

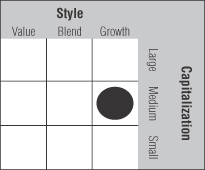

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 15.55% (excluding front-end sales charges) during the six-month period ended April 30, 2010, underperforming the Fund’s benchmark index, which returned 25.77% during the same period. The Fund’s benchmark index, the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”), is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | During the reporting period, the Fund saw the strongest absolute contribution from the information technology, consumer discretionary, and materials sectors. In information technology the electronic equipment instruments and semiconductors industries led performance, while in consumer discretionary, holdings in the media and specialty retail industries contributed the most. In materials, chemicals and containers/packaging were the top performing industries. While all sectors had positive absolute returns for the Fund, holdings in the utilities and telecommunication sectors contributed the least amount.

The Fund underperformed relative to its benchmark index during the reporting period. The better performing mid-cap companies were those with a low return-on-equity (ROE), low price and low market cap. The Fund’s holdings in the utilities sector outperformed while maintaining a large underweight to utilities. Holding in the financials and industrials sectors had the worst relative performance. In financials, the Fund had an overweight position in the insurance and diversified financial services industries. While the Fund’s holdings in these industries posted positive returns during the reporting period, they underperformed the benchmark. In industrials, holdings in the professional services and machinery industries underperformed the benchmark.

Under performers | Tax preparation firm H&R Block, Inc. announced in February that its tax preparation division was showing disappointing results for the early portion of the tax season. Consequently, the company said it’s not likely to reach its previously announced earnings guidance. The Fund sold the stock after management failed to provide updated earnings guidance or plans to address the problems.

FTI Consulting, Inc, a business advisory firm, traded lower after reporting weaker than expected corporate finance and restructuring results and issuing its 2010 earnings guidance. Investors appear to be worried about how a move from recession to recovery will affect FTI’s revenues. We sold the Fund’s position in the stock.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund (cont’d) |

Payment services firm Western Union Company underperformed after it announced earnings estimates for the coming year below analysts’ expectations. Management explained that their estimates considered that much of its business is tied to employment levels. We sold the stock from the Fund because we believe that compressed profit margins will negatively impact earnings for more than a year.

AGCO Corporation, an agricultural equipment manufacturer, has traded lower since earnings were reported in April. Some investors are concerned that business in South America is going to be weaker than expected and earnings growth will be reduced. The Fund continues to hold this stock.

State Street Corporation, a major institutional bank, traded lower after they reported lower than expected earnings and lower fee revenue. The company also reported weaker securities lending and foreign exchange revenues. The Fund continues to hold the stock.

Top performers | Whiting Petroleum Corporation is an energy company that gives us exposure to Bakken Shale, the most potent domestic crude oil region. The company’s stock was trading at a discount to its peers based on a net asset value of proven reserves and also has some of the strongest margins in the industry. Further, its operating well results keep improving and management has said it intends to double its rig count. The Fund continues to hold the stock.

Semiconductor manufacturer Marvell Technology Group, Ltd. reported strong earnings driven by improvements in its gross margin and growth in all its business units. The Fund continues to hold the stock.

Airgas, Inc., a distributor of specialty industrial gas products, was the subject of a hostile takeover bid by Air Products and Chemicals, which had been rebuffed in private negotiations before taking its offer for Airgas public on February 5th. Airgas is currently the largest U.S. industrial gases distributor and the combined company would be the third largest in the world. We expect that Air Products will likely wage a proxy battle, and we took the opportunity to sell the Fund’s position.

The Fund acquired shares in internet and television marketing firm Liberty Media Holding Corporation Interactive during the period at what we viewed as an attractive valuation in spite of its high profit margins and investments. The stock price increased after a tender offer for its Live Nation unit by its sister company Liberty Capital, which moved some cash and debt from Liberty Capital to Liberty Interactive. Liberty Interactive also beat earnings expectations, driven by revenue growth at QVC. The Fund continues to hold the stock.

Silver Wheaton Corporation utilizes silver streams, which are agreements to purchase all or part of a silver mine’s production. The company’s earnings in the fourth quarter, and 2009 as a whole, met estimates and analysts’ consensus. The Fund continues to own this stock as we believe that the company will benefit from its focus on silver production as investors diversify into precious metals.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Core Value Fund | | |

Meet the managers | David M. Adams, CFA®, Lead Portfolio Manager, and John “Jack” McPherson, CFA®, Co-Portfolio Manager, are Managing Directors at Eagle Boston Investment Management, Inc. (“EBIM”) and have been responsible for the day-to-day management of the Eagle Small Cap Core Value Fund (the “Fund”) since its inception in 2008. Both Mr. Adams and Mr. McPherson have 20 years of investment experience.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization companies. Using a value approach to investing, the Fund’s portfolio managers seek to capture capital growth by selecting securities that the portfolio managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the portfolio managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

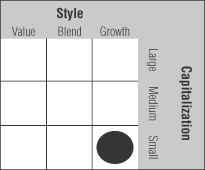

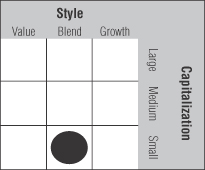

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 23.32% (excluding front-end sales charges) during six-month period ended April 30, 2010, underperforming the Fund’s benchmark index, which returned 28.17% during the same period. The Fund’s benchmark index, the Russell 2000® Index, is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Fund realized strong absolute returns during the period, benefiting from strong performance in the consumer staples, materials and energy sectors. While the utilities, telecommunications services and information technology sectors all generated positive returns for the period, they lagged the overall return for the Fund.

The performance of the Fund trailed its benchmark index during the reporting period. The primary factor contributing to the Fund’s relative underperformance was the Fund’s below average exposure to higher beta areas of the market versus the Russell 2000® Index. A higher beta stock is one that has a higher degree of volatility, and thus risk, than the average stock in a market. During the reporting period, the highest beta stocks were the strongest performers, reflecting a higher tolerance for risk among investors. The Fund’s fundamental focus on higher quality companies with below average debt combined with our value-oriented investing approach generally results in below average exposure to the riskier market segments. We believe that higher-quality stocks tend to outperform higher beta stocks over longer periods of time and we remain committed to focusing on the higher-quality segment of the market.

Relative to the benchmark, the Fund outperformed in the energy, consumer staples and telecommunication services sectors. In energy, the Fund benefited from an overweight position and strong stock selection. In consumer staples, strong stock selection led to outperformance, while in telecommunication services, outperformance was driven by an overweight position. Sectors detracting from relative performance were consumer discretionary and information technology. In consumer discretionary, the Fund was underweight and underperformed while holding an overweight position in the underperforming information technology sector.

Under performers | Electronic payment system provider Euronet Worldwide, Inc. saw its shares fall as investors reacted to a price cut for their services in the Polish market. The Fund continues to hold the position as we believe that investors overreacted to the pricing change.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Core Value Fund (cont’d) |

Gift retailer 1-800-FLOWERS.COM, Inc. again reported results that disappointed analysts’ expectations, causing its shares to drop. We believe the long-term potential for the business remains attractive and continue to hold the stock in the Fund.

Comstock Resources, Inc., an oil and gas exploration firm, declined as weak natural gas prices offset continued strong developments within their major production areas. The Fund continues to hold the position as we believe the company has attractive drilling sites in some of the more important natural gas producing regions of the country.

Shares in financial technology and brokerage firm Investment Technology Group, Inc. declined as weak equity market trading volumes contributed to slightly disappointing earnings results. We continue to hold the position in the Fund as we view the company as well positioned to benefit from an eventual rebound in activity.

Merit Medical Systems, Inc., a medical device manufacturer, declined as a result of a disappointing earnings report. The disappointing earnings report was partially driven by intentional production cuts designed to manage inventory. The Fund continues to hold the position as we believe the long-term outlook remains attractive.

Top performers | Technology firm Sonic Solutions saw its shares increase dramatically during the reporting period as the company announced several new partners for its CinemaNow product, which continues to validate the long-term earnings potential of the company. We continue to hold the position in the Fund.

FGX International designed and marketed products under brands such as Foster Grant. The company was acquired by a European competitor during the reporting period at a premium, leading to its strong performance. The Fund no longer owns the stock as the merger was completed in March.

Marketing firm Herbalife Ltd. saw its stock price benefit from strong results. We continue to own the position in the Fund.

Retailer Jo-Ann Stores, Inc. appreciated as the company’s results again exceeded investor expectations. The Fund continues to own this stock.

IAMGOLD Corporation, a mining firm, saw its shares rise as investor optimism regarding one of their development programs continued to improve. We continue to hold the position in the Fund.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), has been responsible for the management of the Eagle Small Cap Growth Fund (the “Fund”) since 1995. Mr. Boksen has more than 30 years of investment experience. Eric Mintz, CFA®, has 15 years of investment experience and has been Assistant Portfolio Manager since 2008.

Investment highlights | The Fund invests primarily in stocks of small-capitalization companies. Using a “bottom-up” approach, the Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers also look for small-cap growth companies that are reasonably priced. Since small-cap companies often have narrower markets than large-cap companies, the portfolio managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

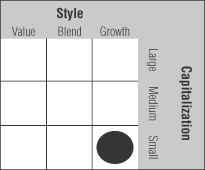

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 26.81% (excluding front-end sales charges) during the six-month period ended April 30, 2010, outperforming the Fund’s benchmark index, which returned 25.49% during the same period. The Fund’s benchmark index, the Russell 2000® Growth Index, is an unmanaged index comprised of Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | On an absolute basis, the energy and materials sectors led the Fund’s returns during the reporting period, while all sectors posted gains. In energy, the stocks in the energy equipment & services and oil, gas & consumable fuels industries posted strong gains. In materials, the Fund’s investments in the chemicals industry performed well. In addition, the Fund’s holdings in the auto components industry, which is part of the consumer discretionary sector, contributed to overall absolute performance.

On an absolute basis, the industrials and financials sectors lagged. In industrials, the Fund’s construction & engineering holdings posted negative returns, while holdings in the commercial services industry lagged. In financials, the capital markets holdings had negative returns for the reporting period.

The Fund outperformed its benchmark index for the reporting period. Relative to the benchmark, stocks in the materials, energy and healthcare sectors outperformed due to strong stock selection. In materials, the Fund outperformed the benchmark due to strong returns and an overweight position in the chemicals industry. Strong returns and an overweight position in the energy equipment & services industry led to outperformance in energy. Outperformance in healthcare is primarily due to a large position in a medical device stock that appreciated significantly during the reporting period.

Relative to the benchmark, the Fund underperformed most significantly in industrials and, to a lesser extent, in the information technology, consumer discretionary and financials sectors. The Fund’s underperformance in industrials was due to an overweight positioning and underperformance in the commercial services & supplies and construction & engineering industries. Information technology was a relative laggard due to underperformance of the Fund’s holdings in the semiconductors & semiconductor equipment and computers & peripherals industries. The Fund’s textiles apparel & luxury goods and household durables holdings underperformed relative to the benchmark in the consumer discretionary sector. In the financials sector, negative returns in the capital markets industry led to relative underperformance.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund (cont’d) | | |

Top performers | Medical device company Thoratec Corporation exhibited strong stock performance due to stronger than expected interest in left ventricular assist devices (LVADs) for the treatment of patients with end stage heart failure. The company recently received U.S. Food and Drug Administration (FDA) approval in “destination therapy” (an alternative to cardiac transplantation), which we believe is still in its infancy. The Fund still holds the stock.

Shares in Huntsman Corporation, a chemical producer, appreciated as investors were anticipating improved business fundamentals as a result an economic recovery in this highly cyclical industry. Further, the company has successfully implemented a cost reduction program. The Fund still owns the stock.

Fertilizer producer Terra Industries Inc.’s share price increased during the period as the result of a bidding war for the company which ended with its acquisition by CF Industries Holdings. The Fund sold its shares prior to the close of the acquisition.

Shares in oil equipment manufacturer Lufkin Industries, Inc. appreciated due to a sharp rise in oil prices, which helped boost prospects for a recovery in demand for Lufkin’s pump jacks. The Fund still holds its shares in Lufkin.

OYO Geospace Corporation, a provider of seismic instruments to the oil and gas industries, appreciated substantially on significant orders for its new wireless product line. The Fund still owns the stock.

Under performers | Clothing manufacturer True Religion Apparel, Inc. gave back some of its prior period gains in November when investors became concerned about its management’s muted outlook and high inventory levels. We took our profits and sold the stock.

Compellent Technologies, Inc., which provides storage solutions for commercial computer users, pulled back after margins came in below expectations due to heavy discounts used to lock in large strategic accounts. The stock was recently sold.

Shares of water pipe manufacturer Northwest Pipe Company fell after the company pre-announced disappointing third quarter results and delayed filing its financial reports due to an ongoing investigation in accounting irregularities. We continue to hold the stock due to favorable prospects for its end markets in 2010 and believe the stock’s current valuation is well below replacement cost and appears to more than adequately discount the risks associated with an accounting restatement.

Telecommunications company EMS Technologies, Inc. declined after it announced lower than expected earnings and muted guidance due to the challenging economic environment. We are optimistic that a recent change in key management will improve performance and we continue to hold the stock.

FormFactor, Inc. provides equipment used to electronically test integrated circuits. The stock has been weak due to poor earnings results and guidance. We continue to hold the stock because we believe the company continues to have a strong competitive position and demand is expected to pick up significantly in the second half of the year.

Investment Portfolios

| | | | | | |

| EAGLE CAPITAL APPRECIATION FUND | | | | | | |

| Common stocks—96.3% (a) | | | | Shares | | Value |

| Apparel—1.8% | | | | | | |

| Nike, Inc., Class B | | | | 138,800 | | $10,536,308 |

| | | |

| Banks—2.2% | | | | | | |

| Northern Trust Corporation | | | | 231,546 | | 12,730,399 |

| | | |

| Beverages—3.7% | | | | | | |

| PepsiCo, Inc. | | | | 340,409 | | 22,201,475 |

| | | |

| Biotechnology—3.6% | | | | | | |

| Biogen Idec Inc.* | | | | 210,813 | | 11,225,792 |

| Gilead Sciences, Inc.* | | | | 253,977 | | 10,075,268 |

| | | |

| Chemicals—1.5% | | | | | | |

| Praxair, Inc. | | | | 105,500 | | 8,837,735 |

| | | |

| Commercial services—2.3% | | | | | | |

| Mastercard Inc., Class A | | | | 54,700 | | 13,567,788 |

| The Western Union Company | | | | 11,210 | | 204,582 |

| | | |

| Computers—5.1% | | | | | | |

| Apple, Inc.* | | | | 115,400 | | 30,133,248 |

| | | |

| Cosmetics/personal care—3.4% | | | | | | |

| The Procter & Gamble Company | | | | 321,539 | | 19,986,864 |

| | | |

| Electronics—2.3% | | | | | | |

| Thermo Fisher Scientific Inc.* | | | | 241,376 | | 13,343,265 |

| | | |

| Financial services—4.7% | | | | | | |

| CME Group Inc. | | | | 49,917 | | 16,393,242 |

| The Charles Schwab Corporation | | | | 591,919 | | 11,418,118 |

| | | |

| Healthcare products—9.4% | | | | | | |

| Baxter International Inc. | | | | 422,439 | | 19,947,570 |

| Johnson & Johnson | | | | 321,847 | | 20,694,762 |

| St. Jude Medical, Inc.* | | | | 364,700 | | 14,887,054 |

| | | |

| Internet—3.1% | | | | | | |

| Equinix Inc.* | | | | 183,095 | | 18,428,512 |

| | | |

| Oil & gas—4.1% | | | | | | |

| Occidental Petroleum Corporation | | | | 154,400 | | 13,689,104 |

| Southwestern Energy Company* | | | | 260,329 | | 10,329,854 |

| | | |

| Oil & gas services—7.0% | | | | | | |

| Halliburton Company | | | | 473,641 | | 14,517,097 |

| Schlumberger Ltd. | | | | 374,842 | | 26,771,216 |

| | | |

| Pharmaceuticals—3.3% | | | | | | |

| Express Scripts Inc.* | | | | 115,500 | | 11,565,015 |

| Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | | 139,165 | | 8,173,160 |

| | | |

| Real estate—2.9% | | | | | | |

| CB Richard Ellis Group Inc., Class A* | | | | 997,432 | | 17,275,522 |

| | | |

| Retail—9.0% | | | | | | |

| Costco Wholesale Corporation | | | | 273,248 | | 16,143,492 |

| Lowe’s Companies, Inc. | | | | 357,137 | | 9,685,555 |

| Staples, Inc. | | | | 658,100 | | 15,485,093 |

| Target Corporation | | | | 214,100 | | 12,175,867 |

| | | |

| Semiconductors—4.3% | | | | | | |

| Altera Corporation | | | | 341,909 | | 8,670,812 |

| Broadcom Corporation, Class A | | | | 491,400 | | 16,948,386 |

| | | |

| Software—7.0% | | | | | | |

| Microsoft Corporation | | | | 667,450 | | 20,383,923 |

| Oracle Corporation | | | | 825,338 | | 21,326,734 |

| | | |

| Telecommunications—15.6% | | | | | | |

| American Tower Corporation, Class A* | | | | 741,450 | | 30,258,574 |

| | | | | | |

| | | |

| Common stocks—96.3% (a) | | | | Shares | | Value |

| Cisco Systems, Inc.* | | | | 659,800 | | $17,761,816 |

| Crown Castle International Corporation* | | | | 618,378 | | 23,405,607 |

| QUALCOMM Inc. | | | | 536,040 | | 20,766,191 |

| Total common stocks (cost $449,525,470) | | | | | | 569,945,000 |

| | | |

| Repurchase agreement—3.3% (a) | | | | | | |

| Repurchase agreement with Fixed Income Clearing Corporation dated April 30, 2010 @ 0.05% to be repurchased at $19,707,082 on May 3, 2010, collateralized by $20,515,000 United States Treasury Notes, 3.375% due November 15, 2019 (market value $20,393,352 including interest) (cost $19,707,000) | | 19,707,000 |

| |

| Total investment portfolio (cost $469,232,470) 99.6% (a) | | $589,652,000 |

| |

* Non-income producing security. (a) Percentages indicated are based on net assets of $591,703,778. | | |

| |

| ADR—American depository receipt | | |

| | |

| |

| Sector allocation | | |

| Sector | | Percent of net assets |

| Consumer, non-cyclical | | 22.2% |

| Technology | | 20.1% |

| Communications | | 18.6% |

| Energy | | 11.0% |

| Consumer, cyclical | | 10.8% |

| Financial | | 9.8% |

| Other sectors | | 3.8% |

| Cash | | 3.3% |

| | | | | | |

| | | | |

| EAGLE GROWTH & INCOME FUND | | | | | | |

| Common stocks—93.1% (a) | | | | Shares | | Value |

| Domestic—62.9% | | | | | | |

| Aerospace/defense—3.7% | | | | | | |

| Lockheed Martin Corporation | | | | 38,700 | | $3,285,243 |

| The Boeing Company | | | | 54,900 | | 3,976,407 |

| | | |

| Agriculture—1.7% | | | | | | |

| Philip Morris International Inc. | | | | 70,200 | | 3,445,416 |

| | | |

| Banks—11.1% | | | | | | |

| Bank of America Corporation | | | | 161,500 | | 2,879,545 |

| Fifth Third Bancorp | | | | 276,571 | | 4,123,674 |

| JPMorgan Chase & Company | | | | 114,752 | | 4,886,140 |

| KeyCorp | | | | 218,400 | | 1,969,968 |

| SVB Financial Group* | | | | 69,400 | | 3,416,562 |

| U.S. Bancorp | | | | 171,800 | | 4,599,086 |

| | | |

| Beverages—1.8% | | | | | | |

| The Coca-Cola Company | | | | 67,300 | | 3,597,185 |

| | | |

| Biotechnology—1.9% | | | | | | |

| Gilead Sciences, Inc.* | | | | 97,382 | | 3,863,144 |

| | | |

| Chemicals—2.0% | | | | | | |

| E.I. du Pont de Nemours & Company | | | | 97,500 | | 3,884,400 |

| | |

| 20 | | The accompanying notes are an integral part of the financial statements. |

Investment Portfolios

| | | | | | |

| EAGLE GROWTH & INCOME FUND (cont’d) | | | | | | |

| Common stocks—93.1% (a) | | | | Shares | | Value |

| Commercial services—2.3% | | | | | | |

| Paychex, Inc. | | | | 150,500 | | $4,605,300 |

| | | |

| Computers—4.1% | | | | | | |

| Apple, Inc.* | | | | 7,435 | | 1,941,427 |

| Dell Inc.* | | | | 375,500 | | 6,075,590 |

| | | |