MFS® INVESTMENT MANAGEMENT

111 Huntington Avenue, Boston, Massachusetts 02199

Phone 617-954-5000

December 28, 2016

VIA EDGAR (as Correspondence)

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| RE: | Post-Effective Amendment No. 76 to Registration Statement on Form N-1A for MFS Series Trust I ("Trust I") on behalf of MFS Low Volatility Equity Fund, MFS Low Volatility Global Equity Fund, and MFS U.S. Government Cash Reserve Fund (File Nos. 33-7638 and 811-4777) and Post-Effective Amendment No. 70 to Registration Statement on Form N-1A for MFS Series Trust IV ("Trust IV") on behalf of MFS Blended Research® Emerging Markets Equity Fund, MFS Blended Research® Global Equity Fund, MFS Blended Research® International Equity Fund (the "Blended Research Funds"), and MFS U.S. Government Money Market Fund (File Nos. 002-54607 and 811-02594) (each a "Fund" and together, the "Funds") |

Ladies and Gentlemen:

On behalf of the above-mentioned Trusts, this letter sets forth our responses to your comments of December 12, 2016, on the above-referenced Post-Effective Amendments to the Registration Statements ("PEAs"), filed with the U.S. Securities and Exchange Commission (the "SEC") on October 27, 2016. The PEAs for the Funds were filed for the purpose of incorporating certain changes to each Fund's "Principal Investment Strategies" disclosure. Comments and responses apply to each Fund unless otherwise indicated.

General Comments

| 1. | Comment: | Please include with your response letter a completed fee table, expense example, and performance table (including the performance for similarly managed accounts, as applicable) for each Fund prior to the effective date of the PEAs. Please also confirm that the impact of any expense reimbursement or fee waiver arrangement will be in effect for at least one year and is reflected only for the period(s) for which the expense reimbursement or fee waiver arrangement is expected to continue. |

Securities and Exchange Commission

December 28, 2016

Page 2

| Response: | A completed fee table and expense example for each Fund, which will be included in the Fund's final prospectus, was provided in an email to the staff on December 13, 2016, and is attached to this letter as Exhibit I. Any expense reimbursement or fee waiver arrangement will be in effect for at least one year and is reflected only for the period(s) for which the expense reimbursement or fee waiver arrangement is expected to continue. In addition, completed performance information, including performance information of similarly managed separate accounts (if any), which will be included in the Funds' final prospectus, was also provided in the email dated December 13, 2016 and included in Exhibit I. |

| 2. | Comment: | MFS Low Volatility Global Equity Fund and the Blended Research Funds state that "MFS may invest a large percentage of the fund's assets in issuers in a single country, a small number of countries, or a particular geographic region." In addition the foregoing funds as well as MFS Low Volatility Equity Fund state that ". . . MFS may invest a significant percentage of the fund's assets in issuers in a single or small number of industries or sectors." |

The most recent Form N-CSR for MFS Low Volatility Equity Fund indicates that as of August 31, 2016, 20.7% and 17.7% of the fund's net assets were invested in the financial services and health care sectors, respectively, and the most recent Form N-CSR for MFS Blended Research Emerging Markets Equity Fund indicates that as of August 31, 2016, 25.6% of the fund's net assets were invested in financial services, 21.4% of the fund's net assets were invested in technology and 24.5% of the fund's net assets were invested in China.

If any fund is currently focused on specific countries, regions, industries or sectors, please consider adding specific principal investment strategy and principal risk disclosure in this regard.

| Response: | None of the Funds have a principal investment strategy to focus their investments on issuers in a specific country, region, industry or sector, nor does MFS have a policy of concentrating in any particular country, region, sector or industry in managing the Funds. We believe that our current disclosure in each Fund's "Principal Investment Strategies" and "Principal Risks" sections appropriately discloses the principal investment strategies and principal risks of the Funds. Country and sector allocation are a result of the then-current investment opportunities identified by each Fund's portfolio manager pursuant to the identified principal investment strategies, as opposed to a principal investment strategy of each Fund to focus its investments on companies in any particular country or sector. Based on the foregoing, we do not believe any changes to the Funds' disclosure are necessary. |

Securities and Exchange Commission

December 28, 2016

Page 3

| 3. | Comment: | With respect to the MFS Low Volatility Equity Fund, "Foreign Risk" is disclosed as a principal risk of the Fund. Please include associated principal investment strategy disclosure and the anticipated level of investment in foreign securities. |

| Response: | We have added the following disclosure in the "Principal Investment Strategies" sections of the summary and statutory prospectus: |

"MFS may invest the fund's assets in foreign securities."

Additionally, there is no maximum percentage that the Fund may invest in foreign securities, and we are not aware of any legal requirement to disclose the Fund's anticipated level of investment in foreign securities. We believe that the Fund's "Principal Investment Strategies" and "Principal Risks" sections appropriately describe the Fund's principal strategies and risks; therefore, we respectfully decline to amend this disclosure to include the anticipated level of investment in foreign securities.

| 4. | Comment: | With respect to the MFS Low Volatility Equity Fund, the "Foreign Risk" disclosure included in the "Principal Risks" section of the Fund's prospectus includes a reference to emerging markets. Please consider including emerging markets investment strategy disclosure in the "Principal Investment Strategies" section, including a definition of emerging markets, if investing in emerging markets is a principal investment strategy of the Fund. |

Securities and Exchange Commission

December 28, 2016

Page 4

| Response: | We do not believe investing in emerging markets is a principal investment strategy of the Fund. Because "foreign risk" encompasses the risk of emerging markets, we believe it is important to include some emerging markets risk disclosure even though the level of investment anticipated in emerging markets is not a principal investment strategy of the Fund. |

| 5. | Comment: | With respect to the MFS Low Volatility Global Equity Fund, MFS Blended Research Global Equity Fund, and MFS Blended Research International Equity Fund, the "Principal Investment Strategies" section of the prospectus includes disclosure regarding emerging markets. Please define emerging markets and disclose how the Fund determines if a country is an emerging market country. |

| Response: | For funds that do not use the term "emerging markets" in their name, we are not aware of any legal requirement to define "emerging markets" in a fund's prospectus or to identify which countries MFS considers to be "emerging markets." We note that that the Fund is not subject to any percentage investment restrictions on emerging market investments, and therefore believe a technical definition of "emerging markets" or which countries MFS considers to be "emerging markets" is not necessary or helpful to an investor's understanding of the Fund's principal investment strategies and risks. |

Please note that we do include disclosure in each Fund's Statement of Additional Information in "Appendix K-Investment Strategies and Risks-Country Location" that generally describes how MFS determines whether the issuer of a security or other investment is generally deemed to be economically tied to a particular country, including emerging market countries.

| 6. | Comment: | Given that MFS Low Volatility Global Equity Fund and MFS Blended Research Global Equity Fund use the term "global" in their names, please expressly describe how each fund will invest its assets in investments that are tied economically to a number of countries throughout the world. For example, investing at least 40% of the Fund's assets outside the United States and investing in at least three countries outside the United States would support the use of the term "global" in each Fund's name. |

Securities and Exchange Commission

December 28, 2016

Page 5

| Response: | Rule 35d-1 under the 1940 Act requires that a fund with a name that suggests that it focuses its investments on a particular type of investment adopt a policy of investing, under normal circumstances, at least 80% of its net assets in the particular type of investments suggested by its name. The SEC made clear in the release adopting Rule 35d-1 (Release No. IC-24828) ("Name Test Adopting Release"), as well as in the "Frequently Asked Questions" published after Rule 35d-1 was adopted, that the rule does not apply where the name includes the term "global." According to the Name Test Adopting Release, the terms "international" and "global," "connote diversification among investments in a number of different countries throughout the world," and the SEC would expect "that investment companies using these terms in their names will invest their assets in investments that are tied economically to a number of countries throughout the world." Investment Company Names, Investment Company Act Release No. 24828 at footnote 42. If Rule 35d-1 does not apply, the general test of whether a particular fund is misleading under Section 35(d) is "whether the name would lead a reasonable investor to conclude that the company invests in a manner that is inconsistent with the company's intended investments or the risks of those investments." Investment Company Names, Investment Company Act Release No. 24848 at footnote 11. We believe the following disclosure in bold for the MFS Blended Research Global Equity Fund supports the use of the term "global" in the Fund's name and appropriately discloses that the fund will invest its assets in investments that are tied economically to a number of countries throughout the world. We believe that the use of the term "global" in the Fund's name is not materially misleading or deceptive under Section 35(d) of the 1940 Act given the Fund's anticipated investment practices: |

"MFS normally allocates the fund's investments across different countries and regions, but MFS may invest a large percentage of the fund's assets in issuers in a single country, a small number of countries, or a particular geographic region. [Emphasis added]"

We will revise the disclosure for the MFS Low Volatility Global Equity Fund as follows (additions bolded):

"MFS normally allocates the fund's investments across different countries and regions, but MFS may invest a large percentage of the fund's assets in issuers in a single country, a small number of countries, or a particular geographic region."

Securities and Exchange Commission

December 28, 2016

Page 6

| 7. | Comment: | With respect to the MFS U.S. Government Cash Reserve Fund and the MFS U.S. Government Money Market Fund, "Issuer Focus Risk" disclosure included in the "Principal Risks" section of the Fund's summary prospectus does not seem to correlate to the name of such risk. Please revise. |

| Response: | We have revised the disclosure in the "Principal Risks" section of each Fund's summary prospectus as follows: |

Issuer Focus Risk: The If MFS invests a significant percentage of the fund's assets in a single issuer or small number of issuers, the fund's performance could be more volatile than the performance of more diversified funds.

| 8. | Comment: | With respect to each Fund's industry concentration policy investment restriction (fundamental investment restriction #6) included under "Appendix L – Investment Restrictions" in each Fund's SAI, please confirm that MFS is aware of the SEC Staff's position that a fund should consider any concentration policy of an underlying fund when monitoring the fund's industry concentration limit. |

| Response: | Although we are aware of the SEC Staff's position that a fund should consider any concentration policy of an underlying fund when monitoring the fund's industry concentration limit, MFS is not aware of any formal SEC guidance or legal requirement to do so. Please note that investing in underlying investment companies is not a principal investment strategy of the Funds. |

| 9. | Comment: | With respect to each of the MFS U.S. Government Cash Reserve Fund and the MFS U.S. Government Money Market Fund's industry concentration policy investment restriction (fundamental investment restriction #6) included under "Appendix L – Investment Restrictions" in the Funds' SAI, please confirm whether the Fund intends to focus on investments within the utility industry? If so, please add appropriate principal strategy and risk disclosure. |

Securities and Exchange Commission

December 28, 2016

Page 7

| Response: | Each such Fund does not intend to focus on investments within the utilities industry; therefore, we respectfully decline to revise this disclosure. |

| 10. | Comment: | With respect to MFS Blended Research Emerging Markets Equity Fund, please disclose how the Fund determines if an issuer is from an emerging market country. |

| Response: | Please refer to the following disclosure in the Fund's Statement of Additional Information under "Appendix K-Investment Strategies and Risks-Country Location" which generally discloses how country location of an issuer is determined: |

Country Location. The issuer of a security or other investment is generally deemed to be economically tied to a particular country if: (a) the security or other investment is issued or guaranteed by the government of that country or any of its agencies, authorities or instrumentalities; (b) the issuer is organized under the laws of, and maintains a principal office in, that country; (c) the issuer has its principal securities trading market in that country; (d) the issuer derives 50% or more of its total revenues from goods sold or services performed in that country; (e) the issuer has 50% or more of its assets in that country; or (f) the issuer is included in an index which is representative of that country. For purposes of determining if a security or other investment is considered a foreign security, revenues from goods sold or services performed in all countries other than the United States and assets in all countries other than the United States may be aggregated. For purposes of determining if a security or other investment is considered an emerging market security, revenues from goods sold or services performed in all emerging market countries and assets in all emerging market countries may be aggregated.

| 11. | Comment: | With Respect to the Blended Research Funds, the second paragraph in each Blended Research Fund's summary "Principal Investment Strategies" section states "Equity securities include common stocks and other securities that represent an ownership interest (or right to acquire an ownership interest) in a company or other issuer." Please provide an example of "other securities that represent an ownership interest in a company." |

Securities and Exchange Commission

December 28, 2016

Page 8

| Response: | We believe that "Equity Securities," as described in the "Principal Investment Types" section of each Blended Research Fund's statutory prospectus and set forth below, provides examples of "other securities that represent an ownership interest in a company." We believe that the principal investment types section is the appropriate section in which to provide such examples. |

Equity Securities: Equity securities represent an ownership interest, or the right to acquire an ownership interest, in a company or other issuer. Different types of equity securities provide different voting and dividend rights and priorities in the event of bankruptcy of the issuer. Equity securities include common stocks, preferred stocks, securities convertible into stocks, equity interests in real estate investment trusts, and depositary receipts for such securities.

| 12. | Comment: | With respect to the Blended Research Funds, the "Investment Strategy Risk" disclosure included in the "Principal Risks" section of the Fund's summary and statutory prospectus states "MFS fundamental research is not available for all issuers." Please describe how a portfolio manager determines investment selections with only a quantitative rating. |

| Response: | Please refer to the principal investment strategies section of each fund's statutory prospectus which states that "When MFS quantitative research is available but MFS fundamental research is not available, MFS considers the issuer to have a neutral fundamental rating." The same disclosure will be added in the second to last paragraph of the summary prospectus "Principal Investment Strategies" section for each of the Blended Research Funds. |

| 13. | Comment: | With Respect to the Blended Research Funds, please confirm that MFS has the necessary records to support the calculation of the performance of Similarly-Managed Accounts, as required by Rule 204-2(a)(16) under the Investment Advisers Act of 1940. |

Securities and Exchange Commission

December 28, 2016

Page 9

| Response: | MFS maintains the required records for the performance of Similarly-Managed Accounts presented in the section titled "Performance Information of Similarly-Managed Accounts" in each of the Blended Research Fund's prospectuses. |

| 14. | Comment: | With respect to the Blended Research Funds, in the section titled "Performance Information of Similarly-Managed Accounts," please disclose that GIPS methodology for calculating performance differs from that of the SEC. |

| Response: | We will revise the disclosure as follows: |

"Performance was calculated using a methodology which compliescomplying with the calculation requirements of the Global Investment Performance Standards® (GIPS).), which differs from the standard methodology required by the SEC for mutual funds.

| 15. | Comment: | With Respect to the Blended Research Funds, please confirm that net composite returns are more prominent than gross composite returns. |

| Response: | As shown in Exhibit I, net composite returns are presented in the first line of the chart. |

| 16. | Comment: | With respect to the Blended Research Funds, the net returns for the composite as noted in the section "Performance Information of Similarly-Managed Accounts" should be net of all expenses, including sales loads, not just net of investment management fees. Please revise your disclosure. |

| Response: | We have reviewed the Staff's guidance in the Nicholas-Applegate no action letter (pub. avail. August 6, 1996; Ref. No. 95-506-CC) with respect to presentation of composite performance in a fund's prospectus and believe that our presentation and disclosure of composite performance is consistent with that guidance. The composite included in this section may contain separately managed and other institutional accounts that do not involve the same types of fees and expenses (e.g., custody expenses, sales loads and distribution fees, among others) that apply to the Fund, and, instead, involve only an advisory fee paid to MFS. In addition, the composite performance adjusted to reflect each class' expenses are adjusted to reflect all of the class expenses, including sales charges. Therefore, we believe the current presentation is consistent with the SEC guidance and respectfully decline to make any changes. |

Securities and Exchange Commission

December 28, 2016

Page 10

| 17. | Comment: | The "Principal Investment Strategies" sections of the prospectuses of MFS Blended Research Global Equity Fund and MFS Blended Research International Equity Fund include the following: "…MFS primarily invests in companies with large capitalizations." Please consider including corresponding risk disclosure specific to large capitalization companies in the "Principal Risks" sections of these Funds' prospectuses. |

| Response: | We believe that the "Equity Market Risk" disclosure included in each Fund's "Principal Risks" section, and as included below, appropriately discloses the principal risk of investing primarily in companies with large capitalizations: |

Equity Market Risk: Equity markets can be volatile and can decline significantly in response to, or investor perceptions of, issuer, market, economic, industry, political, regulatory, geopolitical, and other conditions. These conditions can affect a single issuer or type of security, issuers within a broad market sector, industry or geographic region, or the equity markets in general. Different parts of the market and different types of securities can react differently to these conditions. For example, the stocks of growth companies can react differently from the stocks of value companies, and the stocks of large cap companies can react differently from the stocks of small cap companies. Certain events, such as political, social, or economic developments; government or regulatory action, including the imposition of tariffs or other protectionist actions; natural disasters; terrorist attacks; war; and other geopolitical events, can have a dramatic adverse effect on equity markets and may lead to periods of high volatility in an equity market or a segment of an equity market. [Emphasis added]

Securities and Exchange Commission

December 28, 2016

Page 11

If you have any questions concerning the foregoing, please call the undersigned at 617-954-5000.

Sincerely,

AMANDA S. MOORADIAN

Amanda S. Mooradian

Assistant Vice President and Counsel

MFS Investment Management

Securities and Exchange Commission

December 28, 2016

Page 12

Exhibit I

MFS Series Trust I

MFS Low Volatility Global Equity Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund. Expenses have been adjusted to reflect the current management fee set forth in the fund's Investment Advisory Agreement.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 9 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.65% | | 0.65% | | 0.65% | | 0.65% | | 0.65% | | 0.65% | | 0.65% | | 0.65% | | 0.65% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 0.54% | | 0.54% | | 0.54% | | 0.54% | | 0.54% | | 0.54% | | 0.54% | | 0.54% | | 0.48% |

| | Total Annual Fund Operating Expenses | | 1.44% | | 2.19% | | 2.19% | | 1.19% | | 2.19% | | 1.69% | | 1.44% | | 1.19% | | 1.13% |

| | Fee Reductions and/or Expense Reimbursements1 | | (0.20)% | | (0.20)% | | (0.20)% | | (0.20)% | | (0.20)% | | (0.20)% | | (0.20)% | | (0.20)% | | (0.18)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 1.24% | | 1.99% | | 1.99% | | 0.99% | | 1.99% | | 1.49% | | 1.24% | | 0.99% | | 0.95% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that "Total Annual Fund Operating Expenses" do not exceed 1.24% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.99% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.99% of the class' average daily net assets annually for each of Class I and Class R4 shares, 1.49% of the class' average daily net assets annually for Class R2 shares, and 0.95% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least December 31, 2017. |

Securities and Exchange Commission

December 28, 2016

Page 13

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $694 | | $986 | | $1,299 | | $2,184 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $602 | | $966 | | $1,356 | | $2,318 | |

| | no redemption at end of period | | $202 | | $666 | | $1,156 | | $2,318 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $302 | | $666 | | $1,156 | | $2,508 | |

| | no redemption at end of period | | $202 | | $666 | | $1,156 | | $2,508 | |

| | Class I Shares | | $101 | | $358 | | $635 | | $1,425 | |

| | Class R1 Shares | | $202 | | $666 | | $1,156 | | $2,508 | |

| | Class R2 Shares | | $152 | | $513 | | $899 | | $1,981 | |

| | Class R3 Shares | | $126 | | $436 | | $768 | | $1,707 | |

| | Class R4 Shares | | $101 | | $358 | | $635 | | $1,425 | |

| | Class R6 Shares | | $97 | | $341 | | $605 | | $1,359 | |

Securities and Exchange Commission

December 28, 2016

Page 14

Performance Information

The bar chart and performance table below are intended to provide some indication of the risks of investing in the fund by showing changes in the fund's performance over time and how the fund's performance over time compares with that of a broad measure of market performance.

The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future. Updated performance is available online at mfs.com or by calling 1-800-225-2606.

Class A Bar Chart. The bar chart does not take into account any sales charges (loads) that you may be required to pay upon purchase or redemption of the fund's shares. If these sales charges were included, they would reduce the returns shown.

The total return for the nine-month period ended September 30, 2016, was 8.47%. During the period(s) shown in the bar chart, the highest quarterly return was 5.27% (for the calendar quarter ended December 31, 2015) and the lowest quarterly return was (5.79)% (for the calendar quarter ended September 30, 2015).

Securities and Exchange Commission

December 28, 2016

Page 15

Performance Table.

| Average Annual Total Returns | | | | | | |

| (For the Periods Ended December 31, 2015) | | | | | | |

| | Share Class | | 1 YEAR | | LIFE

(INCEPTION 12-5-2013) |

| | Returns Before Taxes |

| | B Shares | | (3.71)% | | 3.48% |

| | C Shares | | (0.70)% | | 5.34% |

| | I Shares | | 1.22% | | 6.37% |

| | R1 Shares | | 0.28% | | 5.33% |

| | R2 Shares | | 0.75% | | 5.85% |

| | R3 Shares | | 1.16% | | 6.16% |

| | R4 Shares | | 1.39% | | 6.41% |

| | R6 Shares | | 1.41% | | 6.43% |

| | A Shares | | (4.71)% | | 3.21% |

| | Returns After Taxes on Distributions | | | |

| | A Shares | | (5.08)% | | 2.87% |

| | Returns After Taxes on Distributions and Sale of Fund Shares | | | |

| | A Shares | | (2.36)% | | 2.44% |

| | Index Comparison (Reflects no deduction for fees, expenses, or taxes) | | | |

| | MSCI All Country World Index | | (1.84)% | | 2.94% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your own tax situation, and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. The after-tax returns are shown for only one of the fund's classes of shares, and after-tax returns for the fund's other classes of shares will vary from the returns shown.

Securities and Exchange Commission

December 28, 2016

Page 16

MFS Low Volatility Global Equity Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund. Expenses have been adjusted to reflect the current management fee set forth in the fund's Investment Advisory Agreement.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 8 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.60% | | 0.60% | | 0.60% | | 0.60% | | 0.60% | | 0.60% | | 0.60% | | 0.60% | | 0.60% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 0.72% | | 0.72% | | 0.72% | | 0.72% | | 0.72% | | 0.72% | | 0.72% | | 0.72% | | 0.65% |

| | Total Annual Fund Operating Expenses | | 1.57% | | 2.32% | | 2.32% | | 1.32% | | 2.32% | | 1.82% | | 1.57% | | 1.32% | | 1.25% |

| | Fee Reductions and/or Expense Reimbursements1 | | (0.37)% | | (0.37)% | | (0.37)% | | (0.37)% | | (0.37)% | | (0.37)% | | (0.37)% | | (0.37)% | | (0.34)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 1.20% | | 1.95% | | 1.95% | | 0.95% | | 1.95% | | 1.45% | | 1.20% | | 0.95% | | 0.91% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that ''Total Annual Fund Operating Expenses" do not exceed 1.20% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.95% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.95% of the class' average daily net assets annually for each of Class I and Class R4 shares, 1.45% of the class' average daily net assets annually for Class R2 shares, and 0.91% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least December 31, 2017. |

Securities and Exchange Commission

December 28, 2016

Page 17

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $690 | | $1,008 | | $1,348 | | $2,305 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $598 | | $989 | | $1,407 | | $2,439 | |

| | no redemption at end of period | | $198 | | $689 | | $1,207 | | $2,439 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $298 | | $689 | | $1,207 | | $2,627 | |

| | no redemption at end of period | | $198 | | $689 | | $1,207 | | $2,627 | |

| | Class I Shares | | $97 | | $382 | | $688 | | $1,558 | |

| | Class R1 Shares | | $198 | | $689 | | $1,207 | | $2,627 | |

| | Class R2 Shares | | $148 | | $537 | | $951 | | $2,107 | |

| | Class R3 Shares | | $122 | | $459 | | $820 | | $1,836 | |

| | Class R4 Shares | | $97 | | $382 | | $688 | | $1,558 | |

| | Class R6 Shares | | $93 | | $364 | | $656 | | $1,485 | |

Securities and Exchange Commission

December 28, 2016

Page 18

Performance Information

The bar chart and performance table below are intended to provide some indication of the risks of investing in the fund by showing changes in the fund's performance over time and how the fund's performance over time compares with that of a broad measure of market performance.

The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future. Updated performance is available online at mfs.com or by calling 1-800-225-2606.

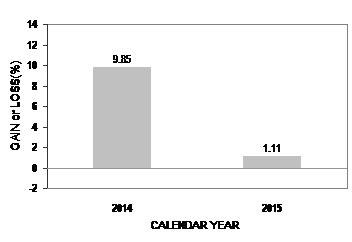

Class A Bar Chart. The bar chart does not take into account any sales charges (loads) that you may be required to pay upon purchase or redemption of the fund's shares. If these sales charges were included, they would reduce the returns shown.

The total return for the nine-month period ended September 30, 2016, was 7.71%. During the period(s) shown in the bar chart, the highest quarterly return was 6.56% (for the calendar quarter ended December 31, 2014) and the lowest quarterly return was (2.42)% (for the calendar quarter ended September 30, 2015).

1027047

Securities and Exchange Commission

December 28, 2016

Page 19

Performance Table.

| Average Annual Total Returns | | | | | | |

| (For the Periods Ended December 31, 2015) | | | | | | |

| | Share Class | | 1 YEAR | | LIFE

(INCEPTION 12-5-2013) |

| | Returns Before Taxes |

| | B Shares | | (0.34)% | | 6.50% |

| | C Shares | | 2.69% | | 8.31% |

| | I Shares | | 4.65% | | 9.33% |

| | R1 Shares | | 3.72% | | 8.30% |

| | R2 Shares | | 4.25% | | 8.85% |

| | R3 Shares | | 4.48% | | 9.10% |

| | R4 Shares | | 4.71% | | 9.36% |

| | R6 Shares | | 4.78% | | 9.41% |

| | A Shares | | (1.55)% | | 6.03% |

| | Returns After Taxes on Distributions | | | |

| | A Shares | | (1.96)% | | 5.67% |

| | Returns After Taxes on Distributions and Sale of Fund Shares | | | |

| | A Shares | | (0.56)% | | 4.61% |

| | Index Comparison (Reflects no deduction for fees, expenses, or taxes) | | | |

| | Standard & Poor's 500 Stock Index | | 1.38% | | 8.75% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your own tax situation, and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. The after-tax returns are shown for only one of the fund's classes of shares, and after-tax returns for the fund's other classes of shares will vary from the returns shown.

1027047

Securities and Exchange Commission

December 28, 2016

Page 20

MFS U.S. Government Cash Reserve Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund.

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A AND 529A | | B AND

529B | | C AND

529C | | R1 | | R2 | | R3 | | R4 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | None | | 4.00% | | 1.00% | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | 529A | | 529B | | 529C | | R1 | | R2 | | R3 | | R4 |

| | Management Fee | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | 0.25% | | 1.00% | | 1.00% | | 1.00% | | 0.50% | | 0.25% | | None |

| | Other Expenses | | 0.26% | | 0.26% | | 0.26% | | 0.36% | | 0.36% | | 0.36% | | 0.26% | | 0.26% | | 0.26% | | 0.26% |

| | Total Annual Fund Operating Expenses | | 0.91% | | 1.66% | | 1.66% | | 1.01% | | 1.76% | | 1.76% | | 1.66% | | 1.16% | | 0.91% | | 0.66% |

| | Fee Reductions and/or Expense Reimbursements1 | | (0.25)% | | 0.00% | | 0.00% | | (0.30)% | | (0.05)% | | (0.05)% | | 0.00% | | 0.00% | | 0.00% | | 0.00% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 0.66% | | 1.66% | | 1.66% | | 0.71% | | 1.71% | | 1.71% | | 1.66% | | 1.16% | | 0.91% | | 0.66% |

| 1 | MFS Fund Distributors, Inc., has agreed to in writing to waive the Class A service fee and the Class 529A service fee to 0.00% of the class' average daily net assets annually until modified by the fund's Board of Trustees, but such agreements will continue until at least December 31, 2017. MFS Fund Distributors, Inc., has agreed in writing to waive the program management fee for each of the fund's Class 529A, Class 529B, and Class 529C shares to 0.05% of the class' average daily net assets attributable to each share class annually. This written agreement will expire on December 31, 2017, unless MFS Fund Distributors, Inc., elects to extend the waiver. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 21

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $67 | | $265 | | $479 | | $1,097 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $569 | | $823 | | $1,102 | | $1,766 | |

| | no redemption at end of period | | $169 | | $523 | | $902 | | $1,766 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $269 | | $523 | | $902 | | $1,965 | |

| | no redemption at end of period | | $169 | | $523 | | $902 | | $1,965 | |

| | Class 529A Shares | | $73 | | $292 | | $529 | | $1,209 | |

| | Class 529B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $574 | | $849 | | $1,149 | | $1,871 | |

| | no redemption at end of period | | $174 | | $549 | | $949 | | $1,871 | |

| | Class 529C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $274 | | $549 | | $949 | | $2,069 | |

| | no redemption at end of period | | $174 | | $549 | | $949 | | $2,069 | |

| | Class R1 Shares | | $169 | | $523 | | $902 | | $1,965 | |

| | Class R2 Shares | | $118 | | $368 | | $638 | | $1,409 | |

| | Class R3 Shares | | $93 | | $290 | | $504 | | $1,120 | |

| | Class R4 Shares | | $67 | | $211 | | $368 | | $822 | |

1027047

Securities and Exchange Commission

December 28, 2016

Page 22

Performance Information

The bar chart and performance table below are intended to provide some indication of the risks of investing in the fund by showing changes in the fund's performance over time.

Performance information prior to July 1, 2014, reflects time periods when the fund was not considered a U.S. Government money market fund and had different investment policies and strategies. The fund's investment policies and strategies changed effective July 1, 2014. The fund's past performance does not necessarily indicate how the fund will perform in the future. Updated performance is available online at mfs.com or by calling 1-800-225-2606.

Class A Bar Chart.

The total return for the nine-month period ended September 30, 2016, was 0.00%. During the period(s) shown in the bar chart, the highest quarterly return was 1.26% (for the calendar quarter ended September 30, 2007) and the lowest quarterly return was 0.00% (for the calendar quarter ended December 31, 2015).

Performance Table.

| Average Annual Total Returns | | | | | | |

| (For the Periods Ended December 31, 2015) | | | | | | |

| | Share Class | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| | A Shares | | 0.00% | | 0.00% | | 1.16% | |

| | B Shares | | (4.00)% | | (0.40)% | | 0.87% | |

| | C Shares | | (1.00)% | | 0.00% | | 0.87% | |

| | 529A Shares | | 0.00% | | 0.00% | | 1.10% | |

| | 529B Shares | | (4.00)% | | (0.40)% | | 0.81% | |

| | 529C Shares | | (1.00)% | | 0.00% | | 0.81% | |

| | R1 Shares | | 0.00% | | 0.00% | | 0.85% | |

| | R2 Shares | | 0.00% | | 0.00% | | 0.98% | |

| | R3 Shares | | 0.00% | | 0.00% | | 1.06% | |

| | R4 Shares | | 0.00% | | 0.00% | | 1.14% | |

Securities and Exchange Commission

December 28, 2016

Page 23

MFS Series Trust IV

MFS Blended Research Emerging Markets Equity Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 8 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.75% | | 0.75% | | 0.75% | | 0.75% | | 0.75% | | 0.75% | | 0.75% | | 0.75% | | 0.75% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 6.03% | | 6.03% | | 6.03% | | 6.03% | | 6.03% | | 6.03% | | 6.03% | | 6.03% | | 5.98% |

| | Total Annual Fund Operating Expenses | | 7.03% | | 7.78% | | 7.78% | | 6.78% | | 7.78% | | 7.28% | | 7.03% | | 6.78% | | 6.73% |

| | Fee Reductions and/or Expense Reimbursements1 | | (5.79)% | | (5.79)% | | (5.79)% | | (5.79)% | | (5.79)% | | (5.79)% | | (5.79)% | | (5.79)% | | (5.78)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 1.24% | | 1.99% | | 1.99% | | 0.99% | | 1.99% | | 1.49% | | 1.24% | | 0.99% | | 0.95% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that ''Total Annual Fund Operating Expenses" do not exceed 1.24% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.99% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.99% of the class' average daily net assets annually for each of Class I and Class R4 shares, 1.49% of the class' average daily net assets annually for Class R2 shares, and 0.95% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least December 31, 2017. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 24

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $694 | | $2,041 | | $3,334 | | $6,344 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $602 | | $2,053 | | $3,418 | | $6,458 | |

| | no redemption at end of period | | $202 | | $1,761 | | $3,234 | | $6,458 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $302 | | $1,761 | | $3,234 | | $6,573 | |

| | no redemption at end of period | | $202 | | $1,761 | | $3,234 | | $6,573 | |

| | Class I Shares | | $101 | | $1,486 | | $2,823 | | $5,961 | |

| | Class R1 Shares | | $202 | | $1,761 | | $3,234 | | $6,573 | |

| | Class R2 Shares | | $152 | | $1,625 | | $3,031 | | $6,276 | |

| | Class R3 Shares | | $126 | | $1,556 | | $2,928 | | $6,121 | |

| | Class R4 Shares | | $101 | | $1,486 | | $2,823 | | $5,961 | |

| | Class R6 Shares | | $97 | | $1,473 | | $2,802 | | $5,929 | |

Performance Information

The bar chart and performance table are not included because the fund has not had a full calendar year of operations. Once the fund has commenced operations, updated performance information will be available online at mfs.com or by calling 1-800-225-2606. The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future.

1027047

Securities and Exchange Commission

December 28, 2016

Page 25

Additional Information on Fees and Expenses and Performance

Fees and Expenses

The annual fund operating expenses shown in "Fees and Expenses" are based on annualized expenses reported during the fund's most recently completed fiscal year expressed as a percentage of a class' average net assets during the period. Annual fund operating expenses have not been adjusted to reflect the fund's current asset size. In general, annual fund operating expenses, expressed as a percentage of a class' average net assets, increase as the fund's assets decrease. Annual fund operating expenses will likely vary from year to year.

Performance Information of Similarly-Managed Accounts

The following table presents the past performance of the MFS Blended Research - Emerging Markets Equity Composite (the "Composite"), which consists of accounts advised or sub-advised by MFS. Performance was calculated using a methodology which complies with the calculation requirements of the Global Investment Performance Standards® (GIPS). The table also shows the average annual total return for the MSCI Emerging Markets Index, a broad-based securities market index ("Index"). The Composite is composed of all fee paying accounts under discretionary management by MFS that have investment objectives, policies, and strategies substantially similar to those of the fund. Likewise, the accounts that make up the Composite have the same portfolio management team as the fund. The gross performance data shown for the Composite does not reflect the deduction of investment advisory fees paid by the accounts composing the Composite and certain other expenses which would be applicable to mutual funds. The net performance data may be more relevant to potential investors in the fund in their analysis of the historical experience of MFS in managing portfolios with investment objectives, policies, and strategies substantially similar to those of the fund. The Composite returns and the Index returns are calculated net of withholding taxes on dividends, interest, and capital gains. Net returns for the Composite are net of the maximum applicable investment management fees charged by MFS for accounts managed in this strategy. The table also includes the performance of the Composite as adjusted for the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of the fund, net of any fee reduction and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. Fees and expenses of the fund differ from those used to calculate the net performance of the Composite.

The historical performance of the Composite is not, and is not a substitute for, the performance of the fund and is not necessarily indicative of the fund's future results. You should not assume that the fund will have the same future performance as the Composite. Future performance of the fund may be greater or less than the performance of the Composite due to, among other things, differences in fees, expenses, asset size, and cash flows. The fund's actual performance may vary significantly from the past performance of the Composite. Also, the accounts composing the Composite are not subject to the investment limitations, diversification requirements, and other restrictions imposed by the Investment Company Act of 1940 and the Internal Revenue Code or the fund's fundamental investment restrictions. If these limitations, requirements, and restrictions were applicable to the accounts in the Composite, they may have had an adverse effect on the performance results of the Composite.

1027047

Securities and Exchange Commission

December 28, 2016

Page 26

Average Annual Total Returns

(for the Periods Ended December 31, 2015)

| | 1 YEAR | 3 YEARS | Since 10-1-20111 |

| Composite (net) | (14.59)% | (6.96)% | 0.56% |

Adjusted for Class A Expenses with initial Sales charge of 5.75% 2 | (20.02)% | (9.32)% | (1.41)% |

Adjusted for Class B Expenses2 | (15.79)% | (8.21)% | (0.78)% |

Adjusted for Class B Expenses with CDSC (Declining over seven years from 4% to 0%)2 | (19.79)% | (9.41)% | (1.51)% |

Adjusted for Class C Expenses2 | (15.79)% | (8.21)% | (0.78)% |

Adjusted for Class C Expenses with CDSC (1% for 12 months) 2 | (16.79)% | (8.21)% | (0.78)% |

Adjusted for Class I Expenses2 | (14.93)% | (7.28)% | 0.22% |

Adjusted for Class R1 Expenses2 | (15.79)% | (8.21)% | (0.78)% |

Adjusted for Class R2 Expenses2 | (15.36)% | (7.74)% | (0.28)% |

Adjusted for Class R3 Expenses2 | (15.14)% | (7.51)% | (0.03)% |

Adjusted for Class R4 Expenses2 | (14.93)% | (7.28)% | 0.22% |

Adjusted for Class R6 Expenses2 | (14.89)% | (7.24)% | 0.26% |

| Composite (gross) | (14.07)% | (6.35)% | 1.22% |

| MSCI Emerging Markets Index (gross div) | (14.60)% | (6.42)% | (0.36)% |

| 1 | Inception date of the Composite. |

| 2 | Gross returns of the Composite have been adjusted to reflect the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of shares of the fund, net of any waiver and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. The returns reflect the impact of maximum sales charges you may be required to pay upon the purchase or redemption of the fund's shares. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 27

MFS Blended Research Global Equity Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 7 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 5.52% | | 5.52% | | 5.52% | | 5.52% | | 5.52% | | 5.52% | | 5.52% | | 5.52% | | 5.51% |

| | Total Annual Fund Operating Expenses | | 6.27% | | 7.02% | | 7.02% | | 6.02% | | 7.02% | | 6.52% | | 6.27% | | 6.02% | | 6.01% |

| | Fee Reductions and/or Expense Reimbursements1 | | (5.38)% | | (5.38)% | | (5.38)% | | (5.38)% | | (5.38)% | | (5.38)% | | (5.38)% | | (5.38)% | | (5.41)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 0.89% | | 1.64% | | 1.64% | | 0.64% | | 1.64% | | 1.14% | | 0.89% | | 0.64% | | 0.60% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that "Total Annual Fund Operating Expenses" do not exceed 0.89% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.64% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.64% of the class' average daily net assets annually for each of Class I and Class R4 shares, 1.14% of the class' average daily net assets annually for Class R2 shares, and 0.60% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least December 31, 2017. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 28

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $661 | | $1,876 | | $3,060 | | $5,891 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $567 | | $1,886 | | $3,144 | | $6,009 | |

| | no redemption at end of period | | $167 | | $1,589 | | $2,954 | | $6,009 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $267 | | $1,589 | | $2,954 | | $6,133 | |

| | no redemption at end of period | | $167 | | $1,589 | | $2,954 | | $6,133 | |

| | Class I Shares | | $65 | | $1,309 | | $2,528 | | $5,467 | |

| | Class R1 Shares | | $167 | | $1,589 | | $2,954 | | $6,133 | |

| | Class R2 Shares | | $116 | | $1,450 | | $2,744 | | $5,809 | |

| | Class R3 Shares | | $91 | | $1,380 | | $2,636 | | $5,641 | |

| | Class R4 Shares | | $65 | | $1,309 | | $2,528 | | $5,467 | |

| | Class R6 Shares | | $61 | | $1,304 | | $2,521 | | $5,458 | |

Performance Information

The bar chart and performance table are not included because the fund has not had a full calendar year of operations. Once the fund has commenced operations, updated performance information will be available online at mfs.com or by calling 1-800-225-2606. The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future.

1027047

Securities and Exchange Commission

December 28, 2016

Page 29

Additional Information on Fees and Expenses and Performance

Fees and Expenses

The annual fund operating expenses shown in "Fees and Expenses" are based on annualized expenses reported during the fund's most recently completed fiscal year expressed as a percentage of a class' average net assets during the period. Annual fund operating expenses have not been adjusted to reflect the fund's current asset size. In general, annual fund operating expenses, expressed as a percentage of a class' average net assets, increase as the fund's assets decrease. Annual fund operating expenses will likely vary from year to year.

Performance Information of Similarly-Managed Accounts

The following table presents the past performance of the MFS Blended Research Global Equity Composite (the "Composite"), which consists of accounts advised or sub-advised by MFS. Performance was calculated using a methodology which complies with the calculation requirements of the Global Investment Performance Standards® (GIPS). The table also shows the average annual total return for MSCI All Country World Index, a broad-based securities market index ("Index"). The Composite is composed of all fee paying accounts under discretionary management by MFS that have investment objectives, policies, and strategies substantially similar to those of the fund. Likewise, the accounts that make up the Composite have the same portfolio management team as the fund. The gross performance data shown for the Composite does not reflect the deduction of investment advisory fees paid by the accounts composing the Composite and certain other expenses which would be applicable to mutual funds. The net performance data may be more relevant to potential investors in the fund in their analysis of the historical experience of MFS in managing portfolios with investment objectives, policies, and strategies substantially similar to those of the fund. The Composite returns and the Index returns are calculated net of withholding taxes on dividends, interest, and capital gains. Net returns for the Composite are net of the maximum applicable investment management fees charged by MFS for accounts managed in this strategy. The table also includes the performance of the Composite as adjusted for the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of the fund, net of any fee reduction and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. Fees and expenses of the fund differ from those used to calculate the net performance of the Composite.

The historical performance of the Composite is not, and is not a substitute for, the performance of the fund and is not necessarily indicative of the fund's future results. You should not assume that the fund will have the same future performance as the Composite. Future performance of the fund may be greater or less than the performance of the Composite due to, among other things, differences in fees, expenses, asset size, and cash flows. The fund's actual performance may vary significantly from the past performance of the Composite. Also, the accounts composing the Composite are not subject to the investment limitations, diversification requirements, and other restrictions imposed by the Investment Company Act of 1940 and the Internal Revenue Code or the fund's fundamental investment restrictions. If these limitations, requirements, and restrictions were applicable to the accounts in the Composite, they may have had an adverse effect on the performance results of the Composite.

027047

Securities and Exchange Commission

December 28, 2016

Page 30

Average Annual Total Returns

(for the Periods Ended December 31, 2015)

| | 1 YEAR | 3 YEARS | Since 5-1-20111 |

| Composite (net) | (1.08)% | 10.07% | 6.99% |

Adjusted for Class A Expenses with initial Sales charge of 5.75%2 | (7.27)% | 7.49% | 5.23% |

Adjusted for Class B Expenses2 | (2.35)% | 8.81% | 5.79% |

Adjusted for Class B Expenses with CDSC (Declining over seven years from 4% to 0%)2 | (6.35)% | 7.96% | 5.26% |

Adjusted for Class C Expenses2 | (2.35)% | 8.81% | 5.79% |

Adjusted for Class C Expenses with CDSC (1% for 12 months) 2 | (3.35)% | 8.81% | 5.79% |

Adjusted for Class I Expenses2 | (1.36)% | 9.90% | 6.84% |

Adjusted for Class R1 Expenses2 | (2.35)% | 8.81% | 5.79% |

Adjusted for Class R2 Expenses2 | (1.86)% | 9.36% | 6.31% |

Adjusted for Class R3 Expenses2 | (1.61)% | 9.63% | 6.58% |

Adjusted for Class R4 Expenses2 | (1.36)% | 9.90% | 6.84% |

Adjusted for Class R6 Expenses2 | (1.32)% | 9.94% | 6.89% |

| Composite (gross) | (0.73)% | 10.60% | 7.53% |

| MSCI All Country World Index (net div) | (2.36)% | 7.69% | 4.65% |

| 1 | Inception date of the Composite. |

| 2 | Gross returns of the Composite have been adjusted to reflect the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of shares of the fund, net of any waiver and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. The returns reflect the impact of maximum sales charges you may be required to pay upon the purchase or redemption of the fund's shares. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 31

MFS Blended Research International Equity Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 7 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% | | 0.50% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 2.87% | | 2.87% | | 2.87% | | 2.87% | | 2.87% | | 2.87% | | 2.87% | | 2.87% | | 2.84% |

| | Total Annual Fund Operating Expenses | | 3.62% | | 4.37% | | 4.37% | | 3.37% | | 4.37% | | 3.87% | | 3.62% | | 3.37% | | 3.34% |

| | Fee Reductions and/or Expense Reimbursements1 | | (2.73)% | | (2.73)% | | (2.73)% | | (2.73)% | | (2.73)% | | (2.73)% | | (2.73)% | | (2.73)% | | (2.74)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 0.89% | | 1.64% | | 1.64% | | 0.64% | | 1.64% | | 1.14% | | 0.89% | | 0.64% | | 0.60% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that "Total Annual Fund Operating Expenses" do not exceed 0.89% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.64% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.64% of the class' average daily net assets annually for each of Class I and Class R4 shares, 1.14% of the class' average daily net assets annually for Class R2 shares, and 0.60% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least December 31, 2017. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 32

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $661 | | $1,381 | | $2,121 | | $4,063 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $567 | | $1,376 | | $2,196 | | $4,192 | |

| | no redemption at end of period | | $167 | | $1,076 | | $1,996 | | $4,192 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $267 | | $1,076 | | $1,996 | | $4,349 | |

| | no redemption at end of period | | $167 | | $1,076 | | $1,996 | | $4,349 | |

| | Class I Shares | | $65 | | $780 | | $1,519 | | $3,473 | |

| | Class R1 Shares | | $167 | | $1,076 | | $1,996 | | $4,349 | |

| | Class R2 Shares | | $116 | | $929 | | $1,761 | | $3,923 | |

| | Class R3 Shares | | $91 | | $855 | | $1,640 | | $3,701 | |

| | Class R4 Shares | | $65 | | $780 | | $1,519 | | $3,473 | |

| | Class R6 Shares | | $61 | | $770 | | $1,503 | | $3,444 | |

Performance Information

The bar chart and performance table are not included because the fund has not had a full calendar year of operations. Once the fund has commenced operations, updated performance information will be available online at mfs.com or by calling 1-800-225-2606. The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future.

1027047

Securities and Exchange Commission

December 28, 2016

Page 33

Additional Information on Fees and Expenses and Performance

Fees and Expenses

The annual fund operating expenses shown in "Fees and Expenses" are based on annualized expenses reported during the fund's most recently completed fiscal year expressed as a percentage of a class' average net assets during the period. Annual fund operating expenses have not been adjusted to reflect the fund's current asset size. In general, annual fund operating expenses, expressed as a percentage of a class' average net assets, increase as the fund's assets decrease. Annual fund operating expenses will likely vary from year to year.

Performance Information of Similarly-Managed Accounts

The following table presents the past performance of the MFS Blended Research International Equity Composite (the "Composite"), which consists of accounts advised or sub-advised by MFS. Performance was calculated using a methodology which complies with the calculation requirements of the Global Investment Performance Standards® (GIPS). The table also shows the average annual total return for MSCI All Country World ex U.S. Index, a broad-based securities market index ("Index"). The Composite is composed of all fee paying accounts under discretionary management by MFS that have investment objectives, policies, and strategies substantially similar to those of the fund. Likewise, the accounts that make up the Composite have the same portfolio management team as the fund. The gross performance data shown for the Composite does not reflect the deduction of investment advisory fees paid by the accounts composing the Composite and certain other expenses which would be applicable to mutual funds. The net performance data may be more relevant to potential investors in the fund in their analysis of the historical experience of MFS in managing portfolios with investment objectives, policies, and strategies substantially similar to those of the fund. The Composite returns and the Index returns are calculated net of withholding taxes on dividends, interest, and capital gains. Net returns for the Composite are net of the maximum applicable investment management fees charged by MFS for accounts managed in this strategy. The table also includes the performance of the Composite as adjusted for the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of the fund, net of any fee reduction and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. Fees and expenses of the fund differ from those used to calculate the net performance of the Composite.

The historical performance of the Composite is not, and is not a substitute for, the performance of the fund and is not necessarily indicative of the fund's future results. You should not assume that the fund will have the same future performance as the Composite. Future performance of the fund may be greater or less than the performance of the Composite due to, among other things, differences in fees, expenses, asset size, and cash flows. The fund's actual performance may vary significantly from the past performance of the Composite. Also, the accounts composing the Composite are not subject to the investment limitations, diversification requirements, and other restrictions imposed by the Investment Company Act of 1940 and the Internal Revenue Code or the fund's fundamental investment restrictions. If these limitations, requirements, and restrictions were applicable to the accounts in the Composite, they may have had an adverse effect on the performance results of the Composite.

1027047

Securities and Exchange Commission

December 28, 2016

Page 34

Average Annual Total Returns

(for the Periods Ended December 31, 2015)

| | 1 YEAR | 3 YEARS | Since 5-1-20111 |

| Composite (net) | (4.80)% | 3.86% | 0.93% |

Adjusted for Class A Expenses with initial Sales charge of 5.75%2 | (10.71)% | 1.43% | (0.72)% |

Adjusted for Class B Expenses2 | (5.97)% | 2.68% | (0.20)% |

Adjusted for Class B Expenses with CDSC (Declining over seven years from 4% to 0%)2 | (9.97)% | 1.73% | (0.85)% |

Adjusted for Class C Expenses2 | (5.97)% | 2.68% | (0.20)% |

Adjusted for Class C Expenses with CDSC (1% for 12 months) 2 | (6.97)% | 2.68% | (0.20)% |

Adjusted for Class I Expenses2 | (5.02)% | 3.71% | 0.80% |

Adjusted for Class R1 Expenses2 | (5.97)% | 2.68% | (0.20)% |

Adjusted for Class R2 Expenses2 | (5.50)% | 3.20% | 0.30% |

Adjusted for Class R3 Expenses2 | (5.26)% | 3.45% | 0.55% |

Adjusted for Class R4 Expenses2 | (5.02)% | 3.71% | 0.80% |

Adjusted for Class R6 Expenses2 | (4.99)% | 3.75% | 0.84% |

| Composite (gross) | (4.41)% | 4.38% | 1.45% |

| MSCI All Country World ex U.S. Index (net div) | (5.66)% | 1.50% | (0.61)% |

| 1 | Inception date of the Composite. |

| 2 | Gross returns of the Composite have been adjusted to reflect the expenses (on a percentage basis) that are expected to be borne by shareholders of each class of shares of the fund, net of any waiver and/or reimbursement, as reflected in the "Annual Fund Operating Expenses" table. The returns reflect the impact of maximum sales charges you may be required to pay upon the purchase or redemption of the fund's shares. |

1027047

Securities and Exchange Commission

December 28, 2016

Page 35

MFS U.S. Government Money Market Fund

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund.

| Shareholder Fees (fees paid directly from your investment): |

| | | | | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | | | |

| | Management Fee | | 0.40% |

| | Other Expenses | | 0.21% |

| | Total Annual Fund Operating Expenses | | 0.61% |

1027047

Securities and Exchange Commission

December 28, 2016

Page 36

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods; your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |