globally as both a processing solution and a licensed software solution that enables clients to process their own transactions, depending on the market. We also enable merchants and financial institutions to offer next generation payment solutions to their clients, such as Apple Pay, Android Pay, and Samsung Pay.

Revenues for outsourced issuer processing services are derived from fees payable under contracts that depend primarily on the number of cardholder accounts on file. More revenue is derived from active accounts (those accounts on file that had a balance or any monetary posting or authorization activity during a specified period) than inactive accounts. Revenues are also derived from licensing fees for our VisionPLUS application, as well as cardholder and data transactions and professional services such as custom programming and development.

Account Support Servicesalong with our outsourced processing and licensing solutions, we provide a variety of supporting services throughout the life cycle of each account. Services include processing a card application, initiating services for the cardholder to enable the cardholder to transact, accumulating the card’s transactions into a monthly billing statement, and posting cardholder payments. Other services provided include customized communications to cardholders, plastics personalization and mailing, information verification associated with granting credit, debt collection, statement printing, and customer service on behalf of financial institutions. We also provide programming and customization to enhance and tailor our solutions to clients’ needs through professional services.

Global Financial Solutions CompetitionGFS competes with card issuer processors, such as Total System Services, Worldpay, Fidelity National Information Services, Fiserv, Worldline, and SIX Payment Services, as well as the card issuer processing businesses of the global payment networks such as Visa and Mastercard. In addition, we compete with various software or custom designed solutions that some financial institutions use to perform these servicesin-house.

The primary competitive factors impacting GFS are system performance and reliability, digital solutions, data security, breadth of features and functionality, disaster recovery capabilities and business continuity preparedness, platform scalability and flexibility, price, and servicing capability. Market events that impact GFS include financial institution consolidation and portfolio transactions between financial institutions.

Global Financial Solutions Seasonality GFS experiences a modest level of seasonality, with the first quarter representing the lowest level of sales and the fourth quarter representing the highest level of sales. Over the past eight quarters, GFS’ quarterly revenue as a percentage of GFS’ total yearly revenue has ranged between 24% and 26%.

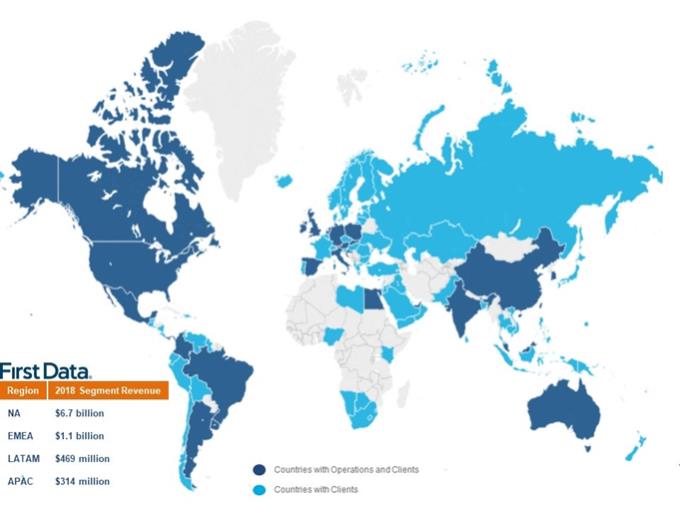

Global Financial Solutions Geographic Mix and RevenuesGFS generates 58% of its revenues from clients in our North America region, 27% from clients in our EMEA region, 8% from clients in our LATAM region, and 7% from clients in our APAC region. Globally, revenues are diversified across major financial institutions of various sizes and geographies.

Global Financial Solutions Acquisitions and DispositionsIn September 2018, we divested our card processing business in Central and Southeastern Europe for proceeds of €387 million (the U.S. dollar equivalent is $449 million). The divestiture does not represent a strategic shift that will have a major effect on our operations and financial statements. The total gain on disposition recognized was $174 million.

In August 2018, we divested 100% of our remittance processing business in the U.S. for proceeds of $100 million. The total gain on disposition recognized was $28 million.

In September 2017, we divested all of our businesses in Lithuania, Latvia and Estonia for €73 million (the U.S. dollar equivalent is $85 million). Associated with the transaction, we recognized a $4 million loss on the sale.

See note 13 “Acquisitions and Dispositions” in our consolidated financial statements in Exhibit 99.1 to this Current Report on Form 8-K for more details relating to this disposition.

Network & Security Solutions Segment

The following table presents NSS information as a percentage of total segment revenue and segment EBITDA:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | |

Segment revenue | | | 17 | % | | | 19 | % | | | 19 | % |

Segment EBITDA | | | 24 | % | | | 24 | % | | | 23 | % |

See note 8 “Segment Information” in our consolidated financial statements in Exhibit 99.1 to this Current Report on Form 8-K for a detail of segment revenue and segment EBITDA results.

Network & Security Solutions OperationsNSS provides a range of network solutions and security, risk and fraud management solutions to business and financial institution clients in our GBS and GFS segments, and independently to financial institutions, businesses, governments, processors and other clients. OurEFT Network Solutions manages U.S. debit card and account processing solutions. OurSTAR Networkenables clients to encrypt, route, and decrypt PIN debit,PIN-less debit, and ATM transactions, and provide access to

-5-