As filed with the Securities and Exchange Commission on April 22, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933 ☒

Pre-Effective Amendment No. ☐

ARIEL INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

200 East Randolph Street, Suite 2900

Chicago, Illinois 60601-6505

(Address of Principal Executive Offices)

Registrant’s Area Code and Telephone Number: 312-726-0140

Agent for Service:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive, Suite 3100 Chicago, IL 60601

(312) 456-8438

Copies to:

| | |

Mareilé B. Cusack, Esq. Ariel Investments, LLC 200 E. Randolph Street, Suite 2900 Chicago, Illinois 60601-6505 (312) 726-0140 | | Marcia Y. Lucas, Esq. The Northern Trust Company 50 S. LaSalle Street Chicago, Illinois 60603 (312) 557-3361 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Shares of the Ariel Fund (Ticker Symbols: ARGFX for Investor Class and ARAIX for Institutional Class), a series of the Registrant

It is proposed that this filing will become effective 30 days after filing, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

IMPORTANT NEWS FOR ARIEL DISCOVERY FUND SHAREHOLDERS

ARIEL INVESTMENT TRUST

Ariel Discovery Fund

200 East Randolph Street, Suite 2900, Chicago, Illinois 60601

[•], 2019

Dear Valued Shareholder:

On April 12, 2019, the Ariel Investment Trust Board of Trustees voted to reorganize Ariel Discovery Fund, our small-cap, deep value offering, with and into Ariel Fund, our small and mid-cap flagship fund. The board made the decision after determining that it is in the best interests of both Funds and their shareholders and that the reorganization will not dilute the interests of Ariel Discovery Fund’s shareholders. The enclosed combined information statement and prospectus contains information about the reorganization. As a result of the reorganization, you will receive shares of Ariel Fund in the same share class and equal in value to the closing market value of your shares in Ariel Discovery Fund. On the day the reorganization is completed, you will become a shareholder of Ariel Fund. Lastly, this transaction is expected to be a tax-free transaction for federal income tax purposes.

As you may recall, we launched Ariel Discovery Fund in 2011 to offer shareholders a way to invest in small- and micro-capitalization companies selling at deep discounts to their intrinsic value. Like Ariel Fund, the investment objective is long-term capital appreciation. Prior to launching this mutual fund, this deep value strategy managed by veteran investor David Maley was only available through separately managed accounts with higher investment minimums than our mutual funds. While there have been considerable investments in this strategy by institutional investors, the mutual fund has not garnered the same level of interest.

Ariel Fund was launched in 1986 and has been managed since inception by our Founder and Chief Investment Officer, John W. Rogers, Jr. The fund invests in small- and mid-capitalization undervalued companies that show strong potential for growth. Ariel Fund has a strong long-term track record and has significantly lower expenses than Ariel Discovery Fund. The Trust Board’s determination that the reorganization would be in the best interests of shareholders was based upon consideration of, among other things, the Ariel Fund’s strong long-term performance history, lower contractual management fees and total expenses along with an identical investment objective and similar investment strategies. Lastly, it is important to note that any reorganization-related expenses (except for brokerage expenses incurred by the Target Fund prior to the Reorganization) will be absorbed by the adviser.

We expect the reorganization will be completed on or after [•], 2019. If you intend to participate in the reorganization, no action is required on your part. We will automatically exchange your Ariel Discovery Fund shares for shares in the same share class and of equal value in Ariel Fund.

If you have any questions on the reorganization, or wish to redeem or exchange your Ariel Discovery Fund shares before the reorganization is completed, please contact one of our Investment Specialists at 1-800-292-7435 or visit our award-winning website at www.arielinvestments.com. Our site offers additional information about Ariel Fund, its investment approach, schedule of holdings, quarterly market commentary, as well as an introduction to our domestic research team, led by John W. Rogers, Jr.

Thank you for your investment. We will continue to work hard on your behalf.

Sincerely,

Mellody L. Hobson

Chairman, Ariel Investment Trust Board of Trustees

The information in this combined information statement and prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This combined information statement and prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

COMBINED INFORMATION STATEMENT AND PROSPECTUS

[•], 2019

ARIEL INVESTMENT TRUST

200 E. Randolph Street, Suite 2900, Chicago, Illinois 60601 | (800) 292-7435

| | | | |

Ariel Discovery Fund Investor Class ARDFX, Institutional Class ADYIX | | Ariel Fund Investor Class ARGFX, Institutional Class ARAIX | | |

The SEC has not approved or disapproved these securities, or passed upon the accuracy or adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

This combined information statement and prospectus (the “Information Statement/Prospectus”) is being furnished to you because you are a shareholder of the Ariel Discovery Fund (the “Target Fund”), a series of the Ariel Investment Trust (the “Trust”). As provided in an Agreement and Plan of Reorganization (the “Agreement”), the Target Fund will be reorganized into and with the Ariel Fund (the “Acquiring Fund”), another series of the Trust. In exchange for your shares of the Target Fund, you will receive a number of shares of beneficial interest of the Acquiring Fund in the same share class as and equal in value to the current net asset value (“NAV”) of your Target Fund shares, as of the closing date of the reorganization (the “Reorganization”). As a result, at the conclusion of the Reorganization, you will become a shareholder of the Acquiring Fund.

The Trust’s Board of Trustees (the “Board” or the “Trustees”) determined that the Reorganization is in the best interests of the Target Fund, the Acquiring Fund and their respective shareholders, and that the interests of the Target Fund’s shareholders will not be diluted as a result of the Reorganization. For federal income tax purposes, the Reorganization is not expected to result in income, gain or loss being recognized by the Target Fund or its shareholders.

The Target Fund and the Acquiring Fund (together, the “Funds”) are each a series of the Trust, a Massachusetts statutory trust registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company. Ariel Investments, LLC (the “Adviser”) serves as investment adviser to both Funds under the same investment management agreement. The Funds have the same Trustees and officers and the same distributor, auditor, transfer agent and other service providers.

This Information Statement/Prospectus sets forth the information about the Funds that you should know before investing and should be retained for future reference. It is both an information statement for the Target Fund and a prospectus for the Acquiring Fund. This Information Statement/Prospectus is being mailed to shareholders on or about [•], 2019.

A Statement of Additional Information dated February 1, 2019 contains additional information about the Funds and has been filed with the SEC and is incorporated herein by reference and, therefore, legally forms a part of this Information Statement/Prospectus. In addition, the Prospectus for the Trust and its six series (including the Funds) dated February 1, 2019 (the “Prospectus”) and [To be inserted.] are incorporated herein by reference. The Funds’ Prospectus dated February 1, 2019 is incorporated into this Information Statement/Prospectus.

You may obtain a copy of each of the documents described above, without charge, by writing to the Trust at: Ariel Investment Trust, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701, calling us at (800) 292-7435 or visiting the Ariel Investments website at https://www.arielinvestments.com/prospectus-and-reports/.

Information about the Trust (including each document incorporated by reference) can also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-8090. Reports and other information about the Funds are available on the EDGAR Database on the SEC’s website at www.sec.gov, and copies of this information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing to the SEC’s Public Reference Section, Washington, D.C. 20549-1520.

In accordance with the Trust’s Agreement and Declaration of Trust, the laws of the Commonwealth of Massachusetts, and U.S. federal securities laws (including Rule 17a-8 under the Investment Company Act of 1940), the Reorganization does not require the approval of shareholders of either Fund. Prior to the Reorganization, you may redeem and exchange shares of the Target Fund as usual in accordance with the procedures described in the Prospectus dated February 1, 2019. Effective on April 16, 2019, the Target Fund stopped accepting any new purchases except for purchases that were part of

the Fund’s Automatic Investment Program or are as a result of dividend reinvestment arrangements. All purchases, including those that are part of the Fund’s Automatic Investment Program or as a result of dividend reinvestments, may cease at some time prior to the Reorganization. At the close of business on or after [•], 2019 the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund, and your shares in the Target Fund will be automatically exchanged for shares in the same share class and of equal value of the Acquiring Fund. The Reorganization is not expected to be a taxable transaction for federal income tax purposes, and you are not expected to recognize gain or loss upon the exchange of your shares in connection with this transaction. The cost basis of your shares in the Acquiring Fund will be the same as the basis of your shares in the Target Fund.

No shareholder vote will be taken with respect to the matters described in this Information Statement/Prospectus. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

2

U.S. SECURITIES AND EXCHANGE COMMISSION

FORM N-14

ARIEL INVESTMENT TRUST

TABLE OF CONTENTS

SUMMARY

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus, or incorporated by reference into this Information Statement/Prospectus. A form of the Agreement pursuant to which the Reorganization will be conducted is attached to this Information Statement/Prospectus as Appendix A.

The Reorganization and Agreement and Plan of Reorganization. The Board, including a majority of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Trust (the “Independent Trustees”), has approved the Reorganization of the Target Fund with and into the Acquiring Fund (each a “Fund” and, together, the “Funds”). Under the Agreement and Plan of Reorganization (the “Agreement”), on the date of the Reorganization (the “Closing Date”), the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for (i) the Acquiring Fund’s assumption of all of the liabilities of the Target Fund and (ii) shares of beneficial interest of the Acquiring Fund of equal value to the net assets of the Target Fund. Immediately thereafter, the Target Fund will distribute the Acquiring Fund shares to the Target Fund shareholders of record at the Closing Date in connection with the liquidation and termination of the Target Fund. The aggregate value of the Acquiring Fund shares received in the Reorganization will equal the aggregate value of the Target Fund shares held by the Target Fund’s shareholders immediately prior to the Reorganization.

Prior to the Reorganization, the Target Fund may dispose of securities to meet redemptions. Any such disposition of securities will be consistent with the tax-free nature of the Reorganization. The Target Fund may incur expenses associated with such transactions. Effective on April 16, 2019, the Target Fund stopped accepting any new purchases except for purchases that are part of the Fund’s Automatic Investment Program or are as a result of dividend reinvestment arrangements. At some time prior to the Closing Date, the Target Fund may stop accepting any new investments in order to facilitate the transfer of its portfolio securities to the Acquiring Fund as part of the Reorganization. As soon as practicable after the transfer of the assets and liabilities of the Target Fund described above, the Target Fund will take steps to wind up its affairs.

The implementation of the Reorganization is subject to a number of conditions set forth in the Agreement, including the receipt of a tax opinion from Greenberg Traurig, LLP described in greater detail below. All expenses that are solely and directly related to the Reorganization will be paid by Ariel Investments, LLC (the “Adviser”) and will not be borne by the Target Fund’s or the Acquiring Fund’s shareholders. The Adviser estimates that these costs will be approximately [$75,000-$100,000]. The Target Fund, however, will bear the brokerage expenses incurred prior to the Reorganization.

Small/micro cap stocks held by the Target Fund may trade less frequently and in smaller volumes, and as a result, may be less liquid than securities of large cap stocks. Therefore, when selling such securities, the Target Fund may experience higher transactional costs. Additionally, in selling securities to meet redemption requests, the Target Fund may be forced to dispose of those securities under disadvantageous circumstances and at a loss. In preparation for the Reorganization and anticipated redemption requests, the Target Fund may hold excess cash which is generally inconsistent with Fund’s principal investment strategy and, upon doing so, the Fund may fail to achieve its fundamental investment objective.

The Target Fund and the Acquiring Fund have many similarities. Both Funds have an identical investment objective of long-term capital appreciation, both are diversified funds that generally hold between 25 to 45 securities in their portfolio, both Funds have value strategies, and both Funds have substantially similar risks. Additionally, the Funds are managed by the same investment adviser under the same investment management agreement.

1

The Board of Trustees has concluded that the Reorganization is in the best interests of each Fund and its shareholders, and that the interests of the Target Fund’s shareholders will not be diluted as a result of the Reorganization. Additionally, the Acquiring Fund has a lower contractual management fee, a lower ratio of expenses to average net assets (the “Expense Ratio”), and an ability to invest in a larger market capitalization range of companies. The Reorganization may increase the size of the Acquiring Fund. The size of the combined fund will provide current shareholders of the Target Fund with significant economies of scale that they do not have today without diluting the benefits of scale enjoyed by the shareholders of Acquiring Fund today.

In accordance with the Trust’s Agreement and Declaration of Trust, the laws of the Commonwealth of Massachusetts, and U.S. federal securities laws (including Rule 17a-8 under the Investment Company Act of 1940), the Reorganization does not require the approval of shareholders of either Fund. At the close of business on or after [•], 2019 the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund, and your shares in the Target Fund will be automatically exchanged for shares in the same share class and of equal value of the Acquiring Fund. The Reorganization is not expected to be a taxable transaction for federal income tax purposes, and you are not expected to recognize gain or loss upon the exchange of your shares in connection with this transaction. The cost basis of your shares in the Acquiring Fund will be the same as the basis of your shares in the Target Fund.

Federal Income Tax Consequences. The Reorganization is expected to be a tax-free reorganization for federal income tax purposes. As a condition to the closing of the Reorganization, the Target Fund and the Acquiring Fund will receive a tax opinion from Greenberg Traurig, LLP to the effect that, for federal income tax purposes, the Reorganization will qualify as a tax-free reorganization for federal income tax purposes and, thus, no gain or loss will be recognized by the Target Fund or the Acquiring Fund as a direct result of the Reorganization and that no gain or loss will be recognized by the shareholders of the Target Fund upon the exchange of their shares of the Target Fund for Acquiring Fund shares. The tax basis of the shares of the Acquiring Fund received by the Target Fund shareholders will be the same as the tax basis of their shares in the Target Fund. Prior to the Reorganization, the Target Fund will distribute any previously undistributed net investment income and net realized capital gains (after reduction for any capital loss carryforwards), which distribution will be taxable to shareholders. Certain tax attributes of the Target Fund may not carry over to the Acquiring Fund, including the ability of the Acquiring Fund to fully utilize the Target Fund’s capital loss carryforwards, if any. See the section entitled “Information about the Reorganization—Federal Income Tax Consequences.”

Comparison of the Target Fund and the Acquiring Fund. This section is intended to help you compare the investment objectives, policies, limitations, and risks of the Funds. Information contained in this Information Statement/Prospectus is qualified by the more complete information set forth in the Prospectus dated February 1, 2019.

Investment Policies. The Funds have identical fundamental investment policies. The Funds also have identical non-fundamental policies.

Investment Objectives and Strategies. The Target Fund and the Acquiring Fund have the identical investment objective of long-term capital appreciation. Both Funds are diversified funds that generally hold between 25 and 45 securities. Both Funds do not invest in companies whose primary source of revenue is derived from the production or sale of tobacco products or the manufacture of handguns. Both Funds invest primarily in equity securities of U.S. companies.

2

A comparison of each Fund’s principal investment strategy components is described below:

| | | | |

Principal Investment Strategy Components | | Target Fund | | Acquiring Fund |

| Market Capitalization | | small- and micro-capitalization: companies with market capitalizations under $2 billion, measured at the time of initial purchase | | small- and mid-capitalization: companies that have market capitalizations within the range of the companies in the Russell 2500TM Index, measured at the time of initial purchase. As of December 31, 2018, the market capitalizations of the companies in the Russell 2500 Index ranged from $7.90 million to $18.44 billion. |

| Value Strategy | | companies that are selling at deep discounts to their intrinsic value | | undervalued companies that show strong potential for growth |

| Valuation Metrics | | Individual company valuations are based on assets and/or earnings power. The Fund is managed on a dynamic basis as companies that approach fair value are likely to be sold and replaced by those with deeper discounts to intrinsic value. | | The Fund seeks to invest in quality companies in industries in which the Adviser has expertise. This often results in the Fund investing a significant portion of its assets among fewer sectors than its benchmarks. The Fund only buys companies when the Adviser believes that they are selling at excellent values. Quality companies typically share several attributes that the Adviser believes will result in capital appreciation over time: high barriers to entry, sustainable competitive advantages, predictable fundamentals that allow for double-digit earnings growth, skilled management teams, and solid financials. A high barrier to entry may exist where, for example, significant capital is required for new companies to enter a particular marketplace, thus giving companies already within the marketplace a perceived competitive advantage. As disciplined value investors, the Fund generally seeks to invest in companies that are trading at a low valuation relative to potential earnings and/or a low valuation relative to intrinsic worth. |

3

Principal Risks. Below is a comparison of each Fund’s principal risks.

| | | | |

| Components from which Risks Arise | | Target Fund | | Acquiring Fund |

| Market Capitalization | | Small/micro cap stocks held by the Fund could fall out of favor and returns would subsequently trail returns of the overall stock market. The performance of such stocks could also be more volatile. Small/micro cap stocks often have less predictable earnings, more limited product lines and markets, and more limited financial and management resources than large cap stocks. Small/micro cap stocks held by the Fund may trade less frequently and in smaller volumes, and as a result, may be less liquid than securities of large cap stocks. Therefore, when purchasing and selling such securities, the Fund may experience higher transactional costs. Additionally, if the Fund is forced to sell securities to meet redemption requests or other cash needs, it may be forced to dispose of those securities under disadvantageous circumstances and at a loss. | | Small/mid cap stocks held by the Fund could fall out of favor and returns would subsequently trail returns of the overall stock market. The performance of such stocks could also be more volatile. Small/mid cap stocks often have less predictable earnings, more limited product lines and markets, and more limited financial and management resources than large cap stocks. |

| Equity | | Investing in equity securities is risky and subject to the volatility of the markets. Equity securities represent an ownership position in a company. The prices of equity securities fluctuate based on changes in the financial condition of their issuers and on market and economic conditions. Furthermore, when the stock market declines, most equity securities, even those issued by strong companies, often will decline in value. | | Same |

| Value Strategy | | The intrinsic value of the stocks in which the Fund invests may never be recognized by the broader market. Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces. | | The intrinsic value of the stocks in which the Fund invests may never be recognized by the broader market. |

| Sectors | | Not applicable | | The Fund is often concentrated in fewer sectors than its benchmarks, and its performance may suffer if these sectors underperform the overall stock market. |

4

Fees and Expenses. Both Funds are parties to the same investment management agreement with the Trust. As part of that agreement with the Trust, the Adviser has contractually agreed to pay for certain administrative services that are necessary to the Trust’s affairs. Such services include maintaining the Trust’s organizational existence; providing office space; preparing reports to regulatory bodies and shareholders; determining the net asset value of each Funds’ shares; determining the amount of each Fund’s dividends per share; maintaining portfolio and general accounting records and such other incidental administrative services as are necessary to conduct the Trust’s affairs. In addition, the Adviser has contractually agreed to pay the salaries and fees of all Trustees, executive officers and staff of the Trust who are affiliated persons of the Adviser.

Pursuant to the investment management agreement, the Target Fund pays the Adviser an annual rate of .80% of the first $500 million of average daily net assets, 0.75% for the next $500 million, and 0.70% of the average daily net assets over $1 billion. For the fiscal year ended September 30, 2018, after waivers, the fee amounted to 0.46% of average daily net assets for the Investor Class and 0.65% of daily net assets for the Institutional Class. The Acquiring Fund pays a management fee at the annual rate of 0.65% for the first $500 million of average daily net assets, 0.60% for the next $500 million, 0.55% of average daily net assets over $1 billion. For the fiscal year ended September 30, 2018, the fee amounted to 0.58% of the daily net assets for the Investor Class and 0.58% of average daily net assets for the Institutional Class.

The Trustees have adopted for both Funds a distribution plan pursuant to Rule 12b-1 under the 1940 Act pursuant to a distribution and service fee of 0.25% of the average daily net assets of each Fund’s Investor Class of shares is paid to the Fund’s distributor, Ariel Distributors, LLC (wholly-owned subsidiary of the Adviser).

The Adviser is contractually obligated to waive fees or reimburse expenses (excluding acquired fund fees and expenses, brokerage, interest, taxes, distributions plan expenses, and extraordinary items) in order to limit the ratio of expenses to average net assets (the “Expense Ratio”) of the Target Fund to 1.25% of net assets for the Investor Class and 1.00% of net assets for the Institutional Class through the end of the fiscal year ending September 30, 2020. Thus, the Target Fund’s Expense Ratio for the year ended September 30, 2018 was 1.25% and 1.00% for the Investor Class and Institutional Class, respectively. The Acquiring Fund’s Expense Ratio for the year ended September 30, 2018 was 1.01% and 0.72% for the Investor Class and Institutional Class, respectively. Because of the relatively large size of the Acquiring Fund, no waivers were employed to limit the Expense Ratio.

5

FEES AND EXPENSES OF THE FUND

The tables below show the fees and expenses of the Target Fund and the Acquiring Fund for the fiscal year ending September 30, 2018 and the pro-forma fees and expenses of the Acquiring Fund on a combined basis after giving effect to the Reorganization. The pro-forma fees and expenses of the Acquiring Fund on a combined basis after giving effect to the Reorganization will not differ from the Acquiring Fund’s current fees and expenses.

| | | | | | |

| Investor Class | | Target Fund | | Acquiring Fund | | Pro-Forma

Combined |

Shareholder Fees (fees paid directly from your investment) | | None | | None | | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.80% | | 0.58% | | 0.58% |

Distribution and/or Service (12b-1) Fees | | 0.25% | | 0.25% | | 0.25% |

Other Expenses | | 0.54% | | 0.18% | | 0.18% |

Acquired Fund Fees Expenses | | 0.11% | | * | | * |

Total Annual Fund Operating Expenses | | 1.70% | | 1.01% | | 1.01% |

Expense Waivers | | -0.34% | | None | | None |

Total Annual Fund Operating Expenses | | 1.36% | | 1.01% | | 1.01% |

| | | | | | |

| Institutional Class | | Target Fund | | Acquiring Fund | | Pro-Forma

Combined |

Shareholder Fees (fees paid directly from your investment) | | None | | None | | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.80% | | 0.58% | | 0.59% |

Distribution and/or Service (12b-1) Fees | | None | | None | | None |

Other Expenses | | 0.35% | | 0.14% | | 0.14% |

Acquired Fund Fees Expenses | | 0.11% | | * | | * |

Total Annual Fund Operating Expenses | | 1.26% | | 0.72% | | 0.73% |

Expense Waivers | | -0.15% | | None | | None |

Total Annual Fund Operating Expenses | | 1.11% | | 0.72% | | 0.73% |

*Less than 0.01%

EXAMPLE

This Example is intended to help you compare the cost of investing in the relevant fund with the cost of investing in other funds.

The Example assumes that you invest $10,000 in the listed Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and that you redeem your shares at the end of each time period. The Example does not take into account brokerage commissions that you pay when purchasing or selling shares of the Fund. If the commissions were included in the

6

Example, your costs would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | | | | |

| Investor Class | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Target Fund | | $138 | | $468 | | $857 | | $1,950 |

Acquiring Fund | | $103 | | $322 | | $558 | | $1,236 |

Pro-Forma Combined | | $103 | | $322 | | $558 | | $1,236 |

| | | | | | | | |

| | | | | |

| Institutional Class | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Target Fund | | $113 | | $369 | | $662 | | $1,495 |

Acquiring Fund | | $74 | | $230 | | $401 | | $894 |

Pro-Forma Combined | | $75 | | $233 | | $406 | | $906 |

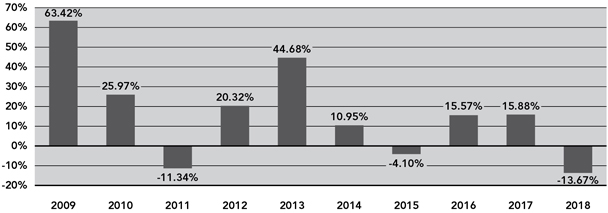

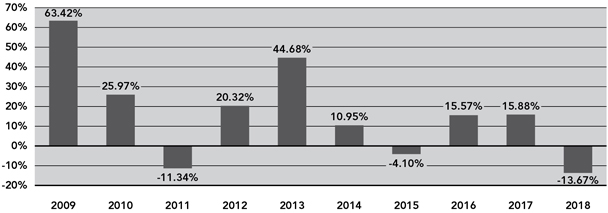

Performance. The performance information shown below will help you analyze each Fund’s investment risks in light of their historical returns. The bar charts show the changes in the performance of each Fund’s shares from year to year. The table for each Fund shows the average annual total returns of the Fund’s shares over time. Past performance (before and after taxes) is not necessarily an indication of how the Acquiring Fund or the Target Fund will perform in the future. Updated performance information is available on the Fund’s website at www.arielinvestments.com or by calling 800.292.7435.

PERFORMANCE INFORMATION

Acquiring Fund

The performance information shown below is based on a calendar year.

Highest Quarter Return: Q2 2009 +34.75%

Lowest Quarter Return: Q3 2011 -28.62%

AVERAGE ANNUAL TOTAL RETURN

(for period ended December 31, 2018)

The after-tax returns presented in the table below are calculated using highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) retirement savings plans or individual retirement accounts (“IRAs”).

| | | | | | |

| | | | |

| Acquiring Fund | | Past

1 Year | | Past

5 Years | | Past

10 Years |

Investor Class Return Before Taxes | | -13.67% | | 4.23% | | 14.60% |

Investor Class Return After Taxes on Distributions | | -15.42% | | 1.89% | | 13.28% |

Investor Class Return After Taxes on Distributions and Sale of Fund Shares | | -6.57% | | 3.26% | | 12.35% |

Institutional Class Return Before Taxes | | -13.42% | | 4.54% | | 10.70% |

Russell 2500 Value Index (reflects no deduction for fees, expenses or taxes) | | -12.36% | | 4.16% | | 11.62% |

7

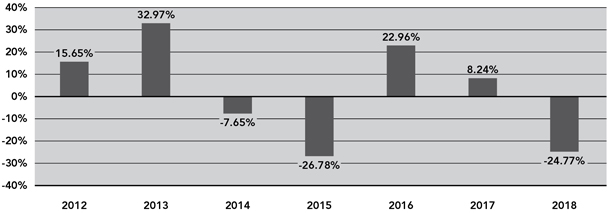

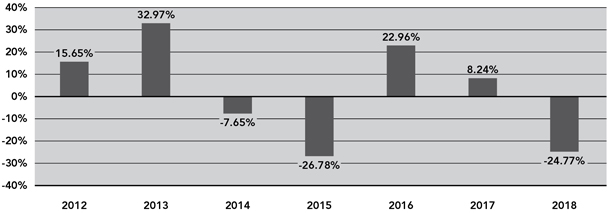

Target Fund

The performance information shown below is based on a calendar year.

Highest Quarter Return: Q1 2013 +13.53%

Lowest Quarter Return: Q4 2018 -23.15%

AVERAGE ANNUAL TOTAL RETURN

(for period ended December 31, 2018)

The after-tax returns presented in the table below are calculated using highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) retirement savings plans or individual retirement accounts (“IRAs”).

| | | | | | |

| Target Fund | | Past

1 Year | | Past

5 Years | | Since

Inception

(1/31/2011) |

Investor Class Return Before Taxes | | -24.77% | | -7.50% | | -0.81% |

Investor Class Return After Taxes on Distributions | | -24.77% | | -8.13% | | -1.27% |

Investor Class Return After Taxes on Distributions and Sale of Fund Shares | | -14.66% | | -5.53% | | -0.63% |

Institutional Class Return Before Taxes | | -24.53% | | -7.26% | | -0.56% |

Russell 2000 Value Index (reflects no deduction for fees, expenses or taxes) | | -12.86% | | 3.61% | | 7.64% |

Adviser. The Target Fund and the Acquiring Fund have been managed by the same investment adviser, Ariel Investments, LLC since each Fund’s inception. The Adviser maintains its headquarters at 200 East Randolph Street, Suite 2900, Chicago, Illinois 60601. The Adviser makes investment decisions for the assets of the Funds and continuously reviews, supervises, and administers each Fund’s investment program.

Portfolio Managers. The Target Fund is managed by David M. Maley who serves as lead portfolio manager and Kenneth E. Kuhrt who serves as portfolio manager. The Acquiring Fund is managed by John W. Rogers, Jr. who serves as lead portfolio manager and John P. Miller and Kenneth E. Kuhrt who serve as portfolio managers.

Board Members. The Target Fund and the Acquiring Fund are subject to the oversight of the same Board of Trustees. Seven of the ten Trustees are Independent Trustees.

Independent Public Accounting Firm. [_____________] is the independent registered public accounting firm for the Target Fund and the Acquiring Fund.

Capitalization. The following table sets forth the capitalization of the Target Fund and the Acquiring Fund as of September 30, 2018, the fiscal year end of the Funds, and the capitalization on a pro-forma combined basis after giving effect to the Reorganization as of that date. The capitalizations are likely to be different at the time that the Reorganization is scheduled to be completed as a result of daily share purchase and sale activity.

8

| | | | | | | | |

| Fund | | Ariel Discovery

Fund (Target Fund) | | Ariel Fund (Acquiring Fund) | | Share

Adjustments | | Pro-Forma

Combined |

| Net Assets – Investor Class | | $7,570,264 | | $1,587,935,835 | | N/A | | $1,595,506,099 |

| NAV Per Share – Investor Class | | $10.67 | | $74.58 | | N/A | | $74.58 |

| Shares Outstanding – Investor Class | | 709,774 | | 21,291,034 | | 102,183 | | 21,393,217 |

| | | | | | | | | |

| Net Assets – Institutional Class | | $25,424,570 | | $673,273,437 | | N/A | | $698,698,007 |

| NAV Per Share – Institutional Class | | $10.88 | | $74.78 | | N/A | | $74.78 |

| Shares Outstanding – Institutional Class | | 2,337,354 | | 9,003,318 | | 340,063 | | 9,343,381 |

Calculating NAV. The Funds’ procedures for calculating NAV are identical. Each Fund calculates its NAV by taking the current market value of its total assets, subtracting any liabilities, and dividing that amount by the total number of shares owned by the Fund’s shareholders. Each Fund calculates its NAV as of the regularly scheduled close of normal trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern Time) on each day NYSE is open for business. When calculating NAV, each Fund will value the portfolio securities and assets of the Fund for which market quotations are readily available at the current market price of those securities and assets. If market prices for certain securities or instruments are unavailable (whether due to a significant event or for any other reason) on any day upon which a Fund’s NAV is to be computed, the Adviser prices those securities and instruments at fair value as determined in good faith using methods approved by the Board of Trustees.

Purchase and Sale of Fund Shares. The Funds’ procedures for the purchase and sale of Fund shares are identical. Investors may purchase, redeem or exchange Fund shares on any business day by written request, via online, by telephone, by wire transfer, or through a financial intermediary.

Dividends and Distributions. The Funds have identical dividend and income distribution policies. Each Fund pays out dividends to shareholders at least annually. In addition, each Fund distributes its net capital gains, if any, to shareholders annually.

Tax Information. With respect to both Funds, Fund distributions are generally taxable as ordinary income, qualified dividend income or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged retirement account. Investments through a tax-advantaged retirement account may be subject to taxation upon withdrawal.

Payments to Broker-Dealers and Other Financial Intermediaries. Each Fund and its related companies may pay a financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

9

INFORMATION ABOUTTHE REORGANIZATION

The following summary of the Agreement and Plan of Reorganization does not purport to be complete and is qualified in its entirety by reference to the form of Agreement, a copy of which is attached as Appendix A and is incorporated herein by reference.

Terms of the Agreement and Plan of Reorganization. The Agreement provides for the Reorganization to occur on the Closing Date, which is expected to be on or after [•], 2019 but may occur on such other date as the parties may agree to in writing. On the Closing Date, the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for (i) the Acquiring Fund’s assumption of all of the liabilities of the Target Fund and (ii) shares of beneficial interest of the Acquiring Fund of equal value to the net assets of the Target Fund. Immediately thereafter, the Target Fund will distribute these Acquiring Fund shares to the Target Fund shareholders of record at the Closing Date in connection with the liquidation and termination of the Target Fund. The aggregate value of the Acquiring Fund shares received in the Reorganization will equal the aggregate value of the Target Fund shares held by the Target Fund’s shareholders immediately prior to the Reorganization.

The number of Acquiring Fund shares to be issued in exchange for the Target Fund’s assets will be determined by multiplying the outstanding shares of the Target Fund by the ratio computed by dividing the NAV per share of the Target Fund by the NAV per share of the Acquiring Fund, as of a valuation time set forth in the Agreement. In determining the value of the securities transferred by the Target Fund to the Acquiring Fund, each security will be priced in accordance with the Trust’s Board-approved valuation policies and procedures.

The transfer of shareholder accounts from the Target Fund to the Acquiring Fund will occur automatically. It is not necessary for Target Fund shareholders to take any action to effect the transfer. Please do not attempt to make the transfer yourself. If you do so, you may disrupt the management of the Funds’ portfolios. No sales charge or fee of any kind will be assessed to Target Fund shareholders in connection with their receipt of shares of the Acquiring Fund in the Reorganization.

All expenses that are solely and directly related to the Reorganization, largely those for legal, accounting and printing expenses, will be paid by the Adviser, and will not be borne by either Fund’s shareholders. The Target Fund, however, will bear the brokerage expenses incurred prior to the Reorganization.

The Agreement contains customary representations, warranties and conditions. The Agreement provides that the consummation of the Reorganization is conditioned upon, among other things, the receipt by the Target Fund and the Acquiring Fund of an opinion of Greenberg Traurig, LLP that the Reorganization will be treated as a tax-free reorganization and will not result in income, gain, or loss being recognized for federal income tax purposes by the Target Fund, the Target Fund’s shareholders, or the Acquiring Fund.

The Agreement may be terminated the mutual agreement of the Acquiring Fund and the Target Fund. In addition, either the Acquiring Fund or the Target Fund may at its option terminate the Agreement at or prior to the Closing Date: (i) because of a material breach of any representation, warranty, covenant or agreement contained in the Agreement to be performed at or prior to the Closing Date; (ii) because of a condition of the terminating party not being met; or (iii) by resolution of the Board if circumstances should develop that make proceeding with the Agreement not in the best interests of either of the Target Fund’s or Acquiring Fund’s shareholders.

Following the Reorganization, the Adviser will continue to act as investment adviser to the Acquiring Fund.

Reasons for the Reorganization. The Adviser believes that shareholders of the Target Fund and the Acquiring Fund would benefit from the Reorganization and that the interests of the Target Fund’s

10

shareholders will not be diluted as a result of the Reorganization. The Acquiring Fund has a lower contractual management fee and a lower Expense Ratio than the Target Fund. While both Funds invest in companies that fall within the smaller market capitalization range of the of the investable U.S. equity market, the Acquiring Fund has the ability to invest in more companies that are within a broader range of market capitalizations than the Target Fund. With the exception of the portfolio managers and market capitalization ranges, the Funds have an identical fundamental investment objective and similar risks.

Over time, the Acquiring Fund has substantially outperformed the Target Fund. For example, for the one-year, five-year and since January 31, 2011 (the inception date of the Target Fund) periods ended March 31, 2019, the Acquiring Fund (Investor Class) had average annual total returns (before taxes) of +0.70%, +7.88%, and +10.20%, respectively. Comparatively, for the one-year, five-year and since inception (January 31, 2011) periods ended March 31, 2019, the Acquiring Fund (Investor Class) had average annual total returns (before taxes), of -8.47%, -4.82%, and +0.89%, respectively.

The Funds are managed by the same investment adviser. The Acquiring Fund is the flagship fund offered by the Adviser and is managed by its founder and chief investment officer, John W. Rogers, Jr., as lead portfolio manager (with John P. Miller and Kenneth E. Kuhrt as portfolio managers). The Acquiring Fund has an inception date of November 6, 1986 and has a strong long-term track record. The Target Fund’s inception date is January 31, 2011. The Target Fund is managed by veteran investor David M. Maley as lead portfolio manager (with Kenneth E. Kuhrt as portfolio manager). Prior to the Target Fund’s launch, the strategy was only available through the Adviser’s separately managed account products with higher investment minimums than the Trust’s mutual funds. While there have been considerable investments in this strategy by institutional investors, the mutual fund has not garnered the same level of interest.

Additionally, the Acquiring Fund has significantly lower expenses (i.e., a lower contractual management fee and lower Expense Ratio) than the Target Fund. The Reorganization may increase the size of the Acquiring Fund. The size of the combined fund will provide current shareholders of the Target Fund with significant economies of scale that they do not have today without diluting the benefits of scale enjoyed by the shareholders of Acquiring Fund today.

The Adviser recommended the Reorganization to the Trust’s Board at a regular board meeting held on March 5, 2019. After receiving and considering further information, the Board and its Independent Trustees approved the Reorganization at a special board meeting on April 12, 2019. The factors considered by the Board in determining that the Reorganization is in the best interests of the Target Fund and the Acquiring Fund and their respective shareholders include, but are not limited to, those listed below.

| | • | | Both Funds have the identical investment objective, which is to seek long-term capital appreciation. Both Funds have identical fundamental investment policies and non-fundamental policies and have similar investment strategies and risks. |

| | • | | Both Funds are parties to the same investment management agreement with the Adviser. Both Funds also utilize the same other service providers (e.g., administrator, accountant, custodian, and transfer agent), who provide the same services to both Funds. |

| | • | | The composition of the Board of Trustees overseeing each Fund is identical. |

| | • | | For the fiscal year ended September 30, 2018, the Acquiring Fund’s Expense Ratio was lower than the Target Fund’s Expense Ratio. Immediately prior to the Reorganization, the Acquiring Fund is expected to have total annual operating expenses that are lower than the Target Fund’s total annual operating expenses, after waivers. Both Funds have the same distribution and service (Rule 12b-1) fees and plan for the Investor Class shares. Both Funds have an Institutional Class of shares with the same portfolio of securities as the Investor Class of shares, but with different expenses, which are primarily differences in distribution and service fees. Both Funds have no sales charges, and neither Fund imposes any fee upon redemptions. |

11

| | • | | The Reorganization may increase the size of the Acquiring Fund. The size of the combined fund will provide current shareholders of the Target Fund with significant economies of scale that they do not have today without diluting the benefits of scale enjoyed by the shareholders of Acquiring Fund today. |

| | • | | The Acquiring Fund is significantly larger than the Target Fund and invests in companies that are typically more liquid than the Target Fund’s investments. The Acquiring Fund also has a longer performance track record and a better performance history, as compared to the Target Fund. |

| | • | | There is expected to be no gain or loss recognized by shareholders for U.S. federal income tax purposes as a result of the Reorganization. |

| | • | | The aggregate value of the Acquiring Fund shares that shareholders of the Target Fund will receive in the Reorganization will equal the aggregate value of the shares that shareholders of the Target Fund own immediately prior to the Reorganization, and that the interests of shareholders of the Target Fund will not be diluted as a result of the Reorganization. |

| | • | | All expenses that are solely and directly related to the Reorganization will be paid by the Adviser or its affiliates and will not be borne by the Target Fund’s or the Acquiring Fund’s shareholders. The Target Fund, however, will bear the brokerage expenses incurred prior to the Reorganization. |

| | • | | Alternatives to the proposed transaction were considered, including continuation of the Target Fund, liquidation of the Target Fund, reorganizing the Target Fund with and into another series of the Ariel Investment Trust, or a similar reorganization with another trust series or public fund. |

The Board, including a majority of the Independent Trustees, concluded that based upon the factors and determinations summarized above, completion of the Reorganization is advisable and in the best interests of the Target Fund and its shareholders, and that the interests of the Target Fund’s shareholders will not be diluted as a result of the Reorganization. The Board also concluded that completion of the Reorganization is advisable and in the best interests of the Acquiring Fund and its shareholders. The determinations were made on the basis of the business judgment of each Trustee after consideration of all of the factors taken as a whole, though individual members may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

Federal Income Tax Consequences. The Reorganization is conditioned upon the receipt by the Target Fund and the Acquiring Fund of an opinion from Greenberg Traurig, LLP, substantially to the effect that, for federal income tax purposes:

| | (i) | The Reorganization will constitute a reorganization within the meaning of Section 368(a) of the Code, and the Target Fund and the Acquiring Fund will each be a “party to the reorganization” within the meaning of Section 368(b) of the Code. |

| | (ii) | No gain or loss will be recognized by the Target Fund upon the transfer of all of its assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund or upon the distribution of Acquiring Fund shares to shareholders of the Target Fund. |

| | (iii) | No gain or loss will be recognized by the Acquiring Fund upon the receipt of the assets of the Target Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of the liabilities of the Target Fund. |

| | (iv) | The tax basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the tax basis of such assets to the Target Fund immediately prior to the exchange. |

| | (v) | The holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund. |

12

| | (vi) | No gain or loss will be recognized by the shareholders of the Target Fund upon the exchange of their shares of the Target Fund for Acquiring Fund shares. |

| | (vii) | The aggregate tax basis of Acquiring Fund shares received by each shareholder of the Target Fund will be the same as the aggregate tax basis of the Target Fund shares exchanged immediately prior to the Reorganization. |

| | (viii) | The holding period of the Acquiring Fund shares received by the shareholders of the Target Fund will include the holding period of the Target Fund shares surrendered in exchange therefor, provided that the Target Fund shares were held as a capital asset as of the Closing Date of the Reorganization. |

| | (ix) | The Acquiring Fund will succeed to and take into account, as of the date of the transfer (as defined in Section 1.381(b)-1(b) of the Treasury Regulations), the items of the Target Fund described in Section 381(c) of the Code, subject to the conditions and limitations specified in Sections 381(b) and (c), 382, 383 and 384 of the Code. |

No opinion will be expressed as to the effect of the Reorganization on the Target Fund or the Acquiring Fund with respect to (A) any asset as to which any gain or loss may be recognized with respect to contracts subject to Section 1256 of the Code, (B) any gain that may be recognized on the transfer of stock in a “passive foreign investment company” as defined in Section 1297(a) of the Code and (C) any other gain or loss that may be required to be recognized (i) as a result of the closing of the Target Fund’ taxable year or (ii) upon the transfer of an asset regardless of whether such transfer would otherwise be a non-recognition transaction under the Code. In addition, no opinion will be expressed as to the effect of the Reorganization on any Target Fund shareholder that is required to recognize unrealized gains and losses for U.S. federal income tax purposes under a mark-to-market system of accounting.

Such opinion shall be based on customary assumptions, limitations and such representations as Greenberg Traurig LLP may reasonably request, and the Target Fund and Acquiring Fund will cooperate to make and certify the accuracy of such representations. Such opinion may contain such assumptions and limitations as shall be in the opinion of such counsel appropriate to render the opinions expressed therein. Notwithstanding anything herein to the contrary, neither the Acquiring Fund nor the Target Fund may waive the conditions set forth herein.

No tax ruling has been or will be received from the Internal Revenue Service in connection with the Reorganization. The tax opinion is not binding on the Internal Revenue Service or a court, and no assurance can be given that the Internal Revenue Service would not assert, or a court would not sustain, a contrary position. Shareholders of the Target Fund should consult their tax advisors regarding the federal, state and local tax treatment and implications of the Reorganization in light of their individual circumstances.

If the Target Fund has earned investment company taxable income or realized net capital gain immediately prior to the Reorganization, the Target Fund will declare and pay a dividend, which, together with all previous dividends, is intended to have the effect of distributing to the Target Fund shareholders all of the Target Fund’s investment company taxable income (computed without regard to any deduction for dividends paid) for taxable years ending on or prior to the Closing Date and all of its net capital gain, if any, realized in taxable years ending on or prior to the Closing Date (after reduction for any available capital loss carryover).

ADDITIONAL INFORMATION ABOUTTHE TARGET FUNDANDTHE ACQUIRING FUND

Additional information about the Acquiring Fund and the Target Fund, including each Fund’s Financial Highlights, is incorporated by reference into this Information Statement/Prospectus from the Trust’s

13

Prospectus, dated February 1, 2019, forming a part of the Trust’s Registration Statement on Form N-1A (1933 Act Registration File No. 33-7699; 1940 Act File No. 811-4786). A copy of the Prospectus accompanies this Information Statement/Prospectus.

The Funds are subject to the requirements of the 1940 Act and the Securities Act of 1933, and the Trust, on behalf of the Funds, files shareholder reports, proxy statements and other information with the SEC. Shareholder reports, proxy statements and other information filed by the Funds may be inspected and copied at the Public Reference Facilities of the Commission at 100 F Street, N.E., Washington, D.C. 20549. Text-only versions of Fund documents can be viewed on-line or downloaded from www.sec.gov or https://www.arielinvestments.com/prospectus-and-reports/. Copies of such material also can be obtained from the Public Reference Branch, Office of Consumer Affairs and Information Services, U.S. Securities and Exchange Commission, Washington, D.C. 20549, at prescribed rates.

If you have any questions on the Reorganization, or wish to redeem or exchange your Ariel Discovery Fund shares before the Reorganization is completed, please contact one of our Investment Specialists at 1-800-292-7435 or visit our award-winning website at www.arielinvestments.com. Our site offers additional information about Ariel Fund, its investment approach, schedule of holdings, quarterly market commentary, as well as an introduction to our domestic research team, led by John W. Rogers, Jr.

Ownership of Shares. As of December 31, 2018, the following persons were the only persons who were record owners (or to the knowledge of the Fund, beneficial owners) of 5% or more of each class of the shares of the Target Fund or the Acquiring Fund. A party holding in excess of 25% of the outstanding voting securities of a Fund is presumed to be a “control person” (as defined in the 1940 Act) of such Fund, based on the substantial ownership interest held and the party’s resultant ability to influence voting on certain matters submitted for shareholder consideration.

| | | | |

Fund | | Name and Address | | Percentage of Shares |

| Target Fund – Investor Class | | Bernard J. Tyson ** 4203 W. Ruby Hill Drive Pleasanton, CA 94566 | | 18.28% |

| | National Financial Services LLC * 499 Washington Blvd., Floor 5 Jersey City, NJ 07310 | | 11.07% |

| | JP Morgan Securities, Inc. * FBO our Customers 4 Chase Metrotech Center Brooklyn, NY 11245 | | 8.72% |

| | Charles Schwab & Co., Inc. * Reinvest Acct. 211 Main Street San Francisco, CA 94105 | | 5.13% |

| Target Fund – Institutional Class | | Charles Schwab & Co., Inc. * Reinvest Acct. 211 Main Street San Francisco, CA 94105 | | 53.73% |

| | National Financial Services LLC * 499 Washington Blvd., Floor 5 Jersey City, NJ 07310 | | 12.09% |

| | David M. Maley ** 57 E. Delaware Place Apt 2905 Chicago, IL 60611 | | 7.17% |

14

| | | | |

Fund | | Name and Address | | Percentage of Shares |

| | | Peter M. Schwab ** 1117 Goldview Lane Glenview, IL 60025 | | 6.04% |

| | | | |

Fund | | Name and Address | | Percentage of Shares |

Acquiring Fund – Investor Class | | Valic Separate Account * 2929 Allen Parkway, Suite A6-20 Houston, TX 77019 | | 28.16% |

| | National Financial Services LLC * 499 Washington Blvd., Floor 5 Jersey City, NJ 07310 | | 13.74% |

| | Charles Schwab & Co., Inc. * Reinvest Acct. 211 Main Street San Francisco, CA 94105 | | 9.43% |

Acquiring Fund – Institutional Class | | National Financial Services LLC * 499 Washington Blvd., Floor 5 Jersey City, NJ 07310 | | 61.65% |

| | ICMA Retirement * 777 North Capital Street NE Washington D.C. 20002 | | 10.71% |

* Record owners (holding for beneficial owners, most of whom are not known to the Trust)

** Beneficial owners

As of December 31, 2018, Trustees and officers of the Trust, as a group, owned less than 1% of the Investor Class shares and 2.68% of the Institutional Class shares of Acquiring Fund; and 13.43% of the Investor Class shares and 59.19% of the Institutional Class shares of Target Fund.

15

APPENDIX A

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”) is made as of this ___ day of ___________, 2019, by and between Ariel Investment Trust, a Massachusetts Business Trust (the “Trust”), on behalf of the Ariel Discovery Fund (Ticker Symbols ARDFX and ADYIX) (the “Target Fund”), and the Trust, on behalf of the Ariel Fund (Ticker Symbols ARGFX and ARAIX) (the “Acquiring Fund” and, together with the Target Fund, the “Funds”). Ariel Investments, LLC (the “Adviser”) joins this Agreement solely for purposes of Sections 14(b) and 18(b). Except for the Funds, no other series of the Trust are parties to this Agreement. The Trust has its principal place of business at 200 E. Randolph Street, Suite 2900, Chicago, Illinois 60601.

WHEREAS, the Trust was organized as a statutory trust under the laws of the Commonwealth of Massachusetts on August 1, 1986 and is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”);

WHEREAS, each of the Target Fund and the Acquiring Fund is a separate series of the Trust and the Target Fund owns securities that generally are assets of the character in which the Acquiring Fund is permitted to invest;

WHEREAS, each of the Target Fund and the Acquiring Fund is authorized to issue shares of beneficial interest;

WHEREAS, the Funds intend this Agreement to be, and adopt it as, a plan of reorganization within the meaning of the regulations under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); and

WHEREAS, the Board of Trustees of the Trust (the “Board” or “Trustees”), including a majority of Trustees that are not “interested persons,” as such term is defined in section 2(a)(19) of the 1940 Act, have determined that the transactions contemplated herein are in the best interests of each Fund and that the interests of the Target Fund’s existing shareholders will not be diluted as a result;

NOW, THEREFORE, in consideration of the mutual promises herein contained and intending to be legally bound hereby, the parties hereto hereby agree to enter into a transaction pursuant to which: (i) the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for (a) the Acquiring Fund’s assumption of all of the liabilities of the Target Fund, (b) shares of beneficial interest of the Acquiring Fund (“Acquiring Fund Shares”) in the same share class and of equal value (taking into account cash in lieu of fractional Acquiring Fund Shares, if any) to the net assets of the Target Fund, and (c) cash in lieu of fractional Acquiring Fund Shares, if necessary, and (ii) the Target Fund will distribute, at the Closing Date (as defined in Section 13 of this Agreement), the Acquiring Fund Shares and cash in lieu of fractional Acquiring Fund Shares, if any, to holders of shares of the Target Fund (“Target Fund Shares”), in connection with the liquidation and termination of the Target Fund, all upon the terms and conditions hereinafter set forth in this Agreement. The parties hereto hereby covenant and agree as follows:

1. Plan of Reorganization. At the Closing Date, the Target Fund shall assign, deliver and otherwise transfer all of its assets and good and marketable title thereto, and assign all of the liabilities as are set forth in a statement of assets and liabilities, to be prepared as of the Valuation Time (as defined in Section 5 of this Agreement) (the “Statement of Assets and Liabilities”), to the Acquiring Fund, free and clear of all liens, encumbrances and adverse claims except as provided in this Agreement, and the Acquiring Fund

A-1

shall acquire all assets, and shall assume all liabilities of the Target Fund, and the Acquiring Fund shall deliver to the Target Fund a number of Acquiring Fund Shares and cash in lieu of fractional Acquiring Fund Shares, if any, that in the aggregate are equivalent in value to the Target Fund Shares outstanding immediately prior to the Closing Date. Shareholders of record of the Target Fund at the Closing Date shall be credited with Acquiring Fund Shares and, as necessary, cash in lieu of any outstanding fractional Acquiring Fund Shares, owned immediately prior to the Closing Date. The assets and liabilities of the Target Fund shall be exclusively assigned to and assumed by the Acquiring Fund. All debts, liabilities, obligations and duties of the Target Fund, to the extent that they exist at or after the Closing Date, shall after the Closing Date attach to the Acquiring Fund and may be enforced against the Acquiring Fund to the same extent as if the same had been incurred by the Acquiring Fund. The events outlined in this Section 1 are referred to herein collectively as the “Reorganization.”

2. Transfer of Assets.

(a) The assets of the Target Fund to be targeted by the Acquiring Fund and allocated thereto shall include, without limitation, all cash, cash equivalents, securities, receivables (including interest and dividends receivable) as set forth in the Statement of Assets and Liabilities, as well as any claims or rights of action or rights to register shares under applicable securities laws, any books or records of the Target Fund and other property owned by the Target Fund at the Closing Date.

(b) The Acquiring Fund will, within a reasonable time prior to the Closing Date, furnish the Target Fund with a list of the securities and investments, if any, on the Target Fund’s list referred to in the second sentence of this paragraph that do not conform to the Acquiring Fund’s investment objectives, policies, and restrictions. The Target Fund will, within a reasonable period of time (not less than 30 days) prior to the Closing Date, furnish the Acquiring Fund with a list of its portfolio securities and other investments. In the event that the Target Fund holds any investments that the Acquiring Fund may not hold, the Target Fund, if requested by the Acquiring Fund, will dispose of such investments prior to the Closing Date. In addition, if it is determined that the Target Fund and the Acquiring Fund portfolios, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing herein will require the Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Target Fund, such disposition would either violate the Target Fund’s fiduciary duty to its shareholders or adversely affect the tax-free nature of the Reorganization (including the customary representations to be made by the Target Fund with respect to the opinion described below).

(c) The Target Fund shall direct The Northern Trust Corporation, as custodian for the Target Fund (the “Custodian”), to deliver, at or prior to the Closing Date, a certificate of an authorized officer stating that: (i) assets have been delivered in proper form to the Acquiring Fund at the Closing Date, and (ii) all necessary taxes in connection with the delivery of the assets, including all applicable foreign, federal and state stock transfer stamps, if any, have been paid or provision for payment has been made. The Target Fund’s portfolio investments represented by a certificate or other written instrument shall be transferred and delivered by the Target Fund as of the Closing Date for the account of the Acquiring Fund duly endorsed in proper form for transfer in such condition as to constitute good delivery thereof. The Custodian shall deliver prior to or as of the Closing Date by book entry, in accordance with the customary practices of any securities depository, as defined in Rule 17f-4 under the 1940 Act, in which the Target Fund’s assets are deposited, the Target Fund’s assets deposited with such depositories. The cash to be transferred by the Target Fund shall be delivered by wire transfer of federal funds prior to or as of the Closing Date.

A-2

(d) The Target Fund shall direct U.S. Bank Global Fund Services, in its capacity as the Trust’s transfer agent (the “Transfer Agent”), on behalf of the Target Fund, to deliver prior to or as of the Closing Date a certificate of an authorized officer stating that its records contain the names and addresses of the holders of the Target Fund Shares and the number and percentage ownership of outstanding shares of each class owned by each shareholder immediately prior to the Closing Date. The Acquiring Fund shall issue and deliver a confirmation evidencing the Acquiring Fund Shares and, if any, cash in lieu of fractional Acquiring Fund Shares to be credited at the Closing Date to the Secretary of the Target Fund, or provide evidence that the Acquiring Fund Shares and, if any, cash in lieu of fractional Acquiring Fund Shares have been credited to the Target Fund’s account on the books of the Acquiring Fund. No later than the Closing Date, each party shall deliver to the other such bill of sale, checks, assignments, share certificates, if any, receipts or other documents as such other party or its counsel may reasonably request.

(e) Notwithstanding anything to the contrary herein fractional Acquiring Fund Shares will be issued to the holders of Target Fund Shares. If the calculation of the pro rata distribution amount of Acquiring Fund Shares to any holder of Target Fund Shares results in fractional Acquiring Fund Shares, such holder of Target Fund Shares will receive fractional Acquiring Fund Shares and, if necessary, any additional amount in cash equal to the net asset value any remaining amount due at the Closing Date. All issued and outstanding Target Fund Shares, and certificates representing such Target Fund Shares, if any, will simultaneously be cancelled on the books of the Target Fund. The Acquiring Fund will not issue certificates representing Acquiring Fund Shares.

3. Calculations.

(a) The number of Acquiring Fund Shares to be issued and amount of cash in lieu of fractional Acquiring Fund Shares, if any, to be distributed in exchange for the Target Fund’s assets pursuant to Section 1 hereof shall be determined by multiplying the outstanding shares of the Target Fund by the ratio computed by dividing the net asset value per share of the Target Fund by the net asset value per share of the Acquiring Fund on the Valuation Date, determined in accordance with Section 3(b). Shareholders of record of the Target Fund at the Closing Date shall be credited with Acquiring Fund Shares and, if any, cash in lieu of any fractional Acquiring Fund Shares held.

(b) The net asset value per share of the Acquiring Fund shall be the net asset value per share computed as of the time at which the Acquiring Fund’s net asset value is calculated at the Valuation Time, in accordance with the pricing policies and procedures adopted by the Trust as described in the then current prospectus and statement of additional information of the Funds under the Securities Act of 1933 (the “1933 Act”).

4. Valuation of Assets. The value of the assets of the Target Fund shall be the value of such assets computed as of the time at which the Target Fund’s net asset value is calculated at the Valuation Time. The net asset value of the assets of the Target Fund to be transferred to the Acquiring Fund shall be computed by the Target Fund. In determining the value of the securities transferred by the Target Fund to the Acquiring Fund, each security shall be priced in accordance with the valuation policies and procedures adopted by the Board. For such purposes, price quotations and the security characteristics relating to establishing such quotations shall be determined by the Target Fund, provided that such determination shall be subject to the approval of the Acquiring Fund. The Target Fund and the Acquiring Fund agree to use all commercially reasonable efforts to resolve, prior to the Valuation Time, any material pricing differences.

5. Valuation Time. The valuation time shall be [___] p.m., Eastern Time, on [______________], 2019, or such earlier or later date and time as may be mutually agreed in writing by an authorized officer of the Funds (the “Valuation Time”). Notwithstanding anything herein to the

A-3

contrary, in the event that at the Valuation Time, (a) the New York Stock Exchange shall be closed to trading or trading thereon shall be restricted, or (b) trading or the reporting of trading on such exchange or elsewhere shall be disrupted so that, in the judgment of the Trust, accurate appraisal of the value of the net assets of the Target Fund is impracticable, the Valuation Time shall be postponed until the second business day after the day when trading shall have been fully resumed without restriction or disruption, reporting shall have been restored and accurate appraisal of the value of the net assets of the Target Fund is practicable.

6. Liquidation of the Target Fund and Cancellation of Shares. At the Closing Date, the Target Fund will liquidate and the Acquiring Fund Shares and cash in lieu of any fractional Acquiring Fund Shares, if any, received by the Target Fund will be distributed to the shareholders of record of the Target Fund as of the Closing Date in exchange for their Target Fund Shares and in complete liquidation of the Target Fund. Such liquidation and distribution will be accompanied by the establishment of an open account on the share records of the Acquiring Fund in the name of each shareholder of the Target Fund that represents the respective number of Acquiring Fund Shares and amount of cash in lieu of any fractional Acquiring Fund Shares, if any, due such shareholder. All of the issued and outstanding shares of the Target Fund shall be cancelled on the books of the Trust at the Closing Date and shall thereafter represent only the right to receive Acquiring Fund Shares and cash in lieu of any fractional Acquiring Fund Shares, if any. The Target Fund’s transfer books shall be closed permanently. The Trust also shall take any and all other steps as shall be necessary and proper to effect a complete termination of the Target Fund.

7. Representations and Warranties of the Acquiring Fund. The Acquiring Fund represents and warrants to the Target Fund as follows:

(a) The Acquiring Fund has been duly established as a separate investment series of the Trust, which is a statutory trust duly organized and validly existing under the laws of the Commonwealth of Massachusetts.

(b) The Trust is registered as an investment company classified as a management company of the open-end type, and its registration with the Securities and Exchange Commission (the “Commission”) as an investment company under the 1940 Act is in full force and effect.

(c) The shares of the Acquiring Fund have been duly established and represent a fractional undivided interest in the Acquiring Fund. The issued and outstanding shares of the Acquiring Fund are duly authorized, validly issued, fully paid and non-assessable. There are no outstanding options, warrants or other rights of any kind to acquire from the Trust any shares or equity interests of the Acquiring Fund or securities convertible into or exchangeable for, or which otherwise confer on the holder thereof any right to acquire, any such additional shares, nor is the Trust committed to issue any share appreciation or similar rights or options, warrants, rights or securities in connection with the Acquiring Fund. The Acquiring Fund Shares to be issued and delivered to the Target Fund, for the account of the Target Fund’s shareholders, pursuant to the terms of this Agreement will, at the Closing Date, have been duly authorized and, when so issued and delivered, will be duly and validly issued Acquiring Fund Shares, and will be fully paid and non-assessable.

(d) The execution, delivery and performance of this Agreement by the Trust, on behalf of the Acquiring Fund, and the consummation of the transactions contemplated herein have been duly and validly authorized by the Board and no other proceedings by the Acquiring Fund are necessary to authorize this Agreement and the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by the Trust, on behalf of the Acquiring Fund, and assuming due authorization, execution and delivery by the Trust, on behalf of the Target Fund, is a legal, valid and

A-4

binding obligation of the Trust, as it relates to the Acquiring Fund, enforceable in accordance with its terms subject as to enforcement, to bankruptcy, insolvency, reorganization, moratorium, and other laws relating to or affecting creditors’ rights and to general equity principles. The Acquiring Fund is not a party to or obligated under any charter, by-law, indenture or contract provision or any other commitment or obligation, or subject to any order or decree, which would be violated by its executing and carrying out this Agreement.

(e) The financial statements of the Acquiring Fund as of September 30, 2018 are in accordance with generally accepted accounting principles consistently applied, and such statements (copies of which have been furnished to the Target Fund) fairly reflect the financial condition of the Acquiring Fund as of such date, and there are no known contingent liabilities of the Acquiring Fund as of such date not disclosed therein.

(f) Since September 30, 2018, there has not been any material adverse change in the Acquiring Fund’s financial condition, assets, liabilities, or business other than changes occurring in the ordinary course of business, or any incurrence by the Acquiring Fund of indebtedness maturing more than one year from the date such indebtedness was incurred, except as otherwise disclosed to and accepted by the Target Fund. For purposes of this paragraph (f), a decline in the net asset value of the Acquiring Fund shall not constitute a material adverse change.

(g) The current prospectus and statement of additional information of the Acquiring Fund conform in all material respects to the applicable requirements of the 1933 Act and the 1940 Act and the rules and regulations of the Commission thereunder and do not include any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading.