UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04791

AB MUNICIPAL INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: May 31, 2024

Date of reporting period: May 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB California Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALCVX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $51 | 0.50% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within multi-family housing and private higher education contributed, while selection in the miscellaneous revenue and industry Industrial Development Revenue (“IDR”) detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

MSA Tobacco Securitization

Top detractors

Not-for-Profit Health Care

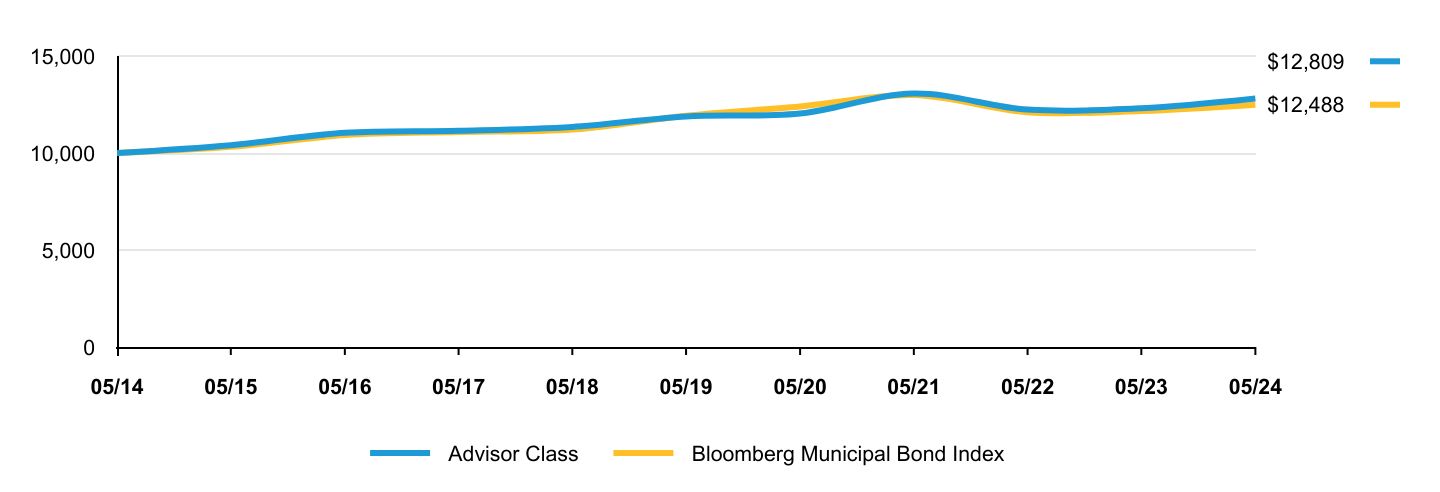

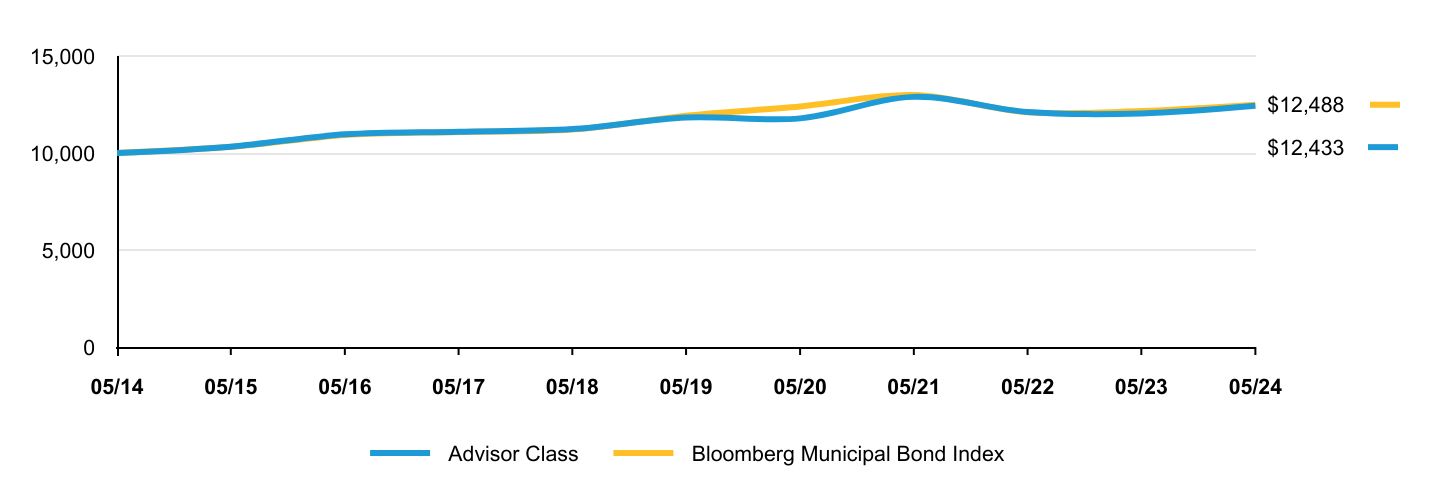

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,401 | $10,318 |

| 05/16 | $11,040 | $10,924 |

| 05/17 | $11,144 | $11,083 |

| 05/18 | $11,345 | $11,207 |

| 05/19 | $11,887 | $11,925 |

| 05/20 | $12,034 | $12,399 |

| 05/21 | $13,065 | $12,986 |

| 05/22 | $12,238 | $12,104 |

| 05/23 | $12,306 | $12,163 |

| 05/24 | $12,809 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class (without sales charge) | 4.09% | 1.44% | 2.51% |

| Advisor Class (with sales charge) | 4.09% | 1.44% | 2.51% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALCVX-A for the most recent performance information.

| Net Assets | $1,158,512,886 |

| # of Portfolio Holdings | 402 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $4,587,920 |

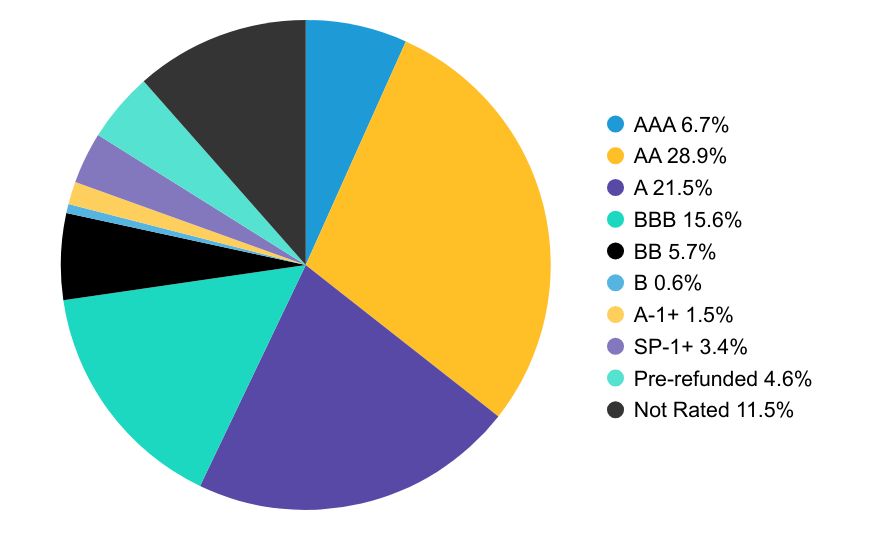

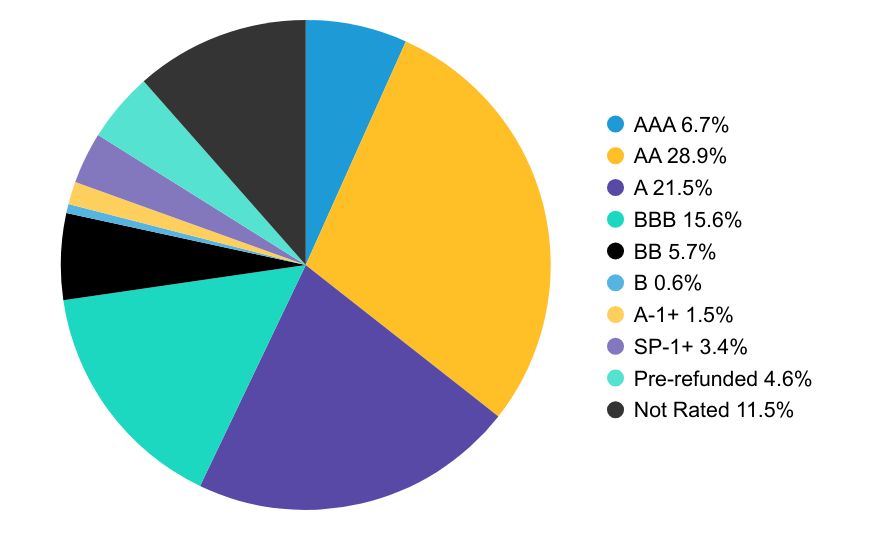

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 6.7% |

| AA | 28.9% |

| A | 21.5% |

| BBB | 15.6% |

| BB | 5.7% |

| B | 0.6% |

| A-1+ | 1.5% |

| SP-1+ | 3.4% |

| Pre-refunded | 4.6% |

| Not Rated | 11.5% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALCVX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALCVX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB California Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALCAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $76 | 0.75% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within multi-family housing and private higher education contributed, while selection in the miscellaneous revenue and industry Industrial Development Revenue (“IDR”) detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

MSA Tobacco Securitization

Top detractors

Not-for-Profit Health Care

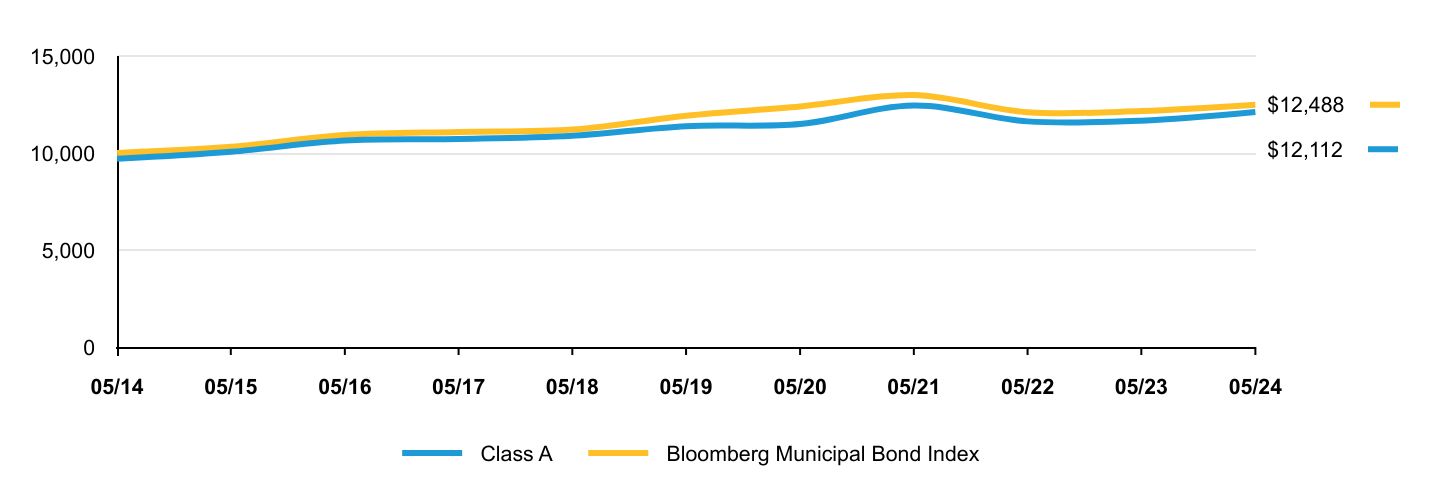

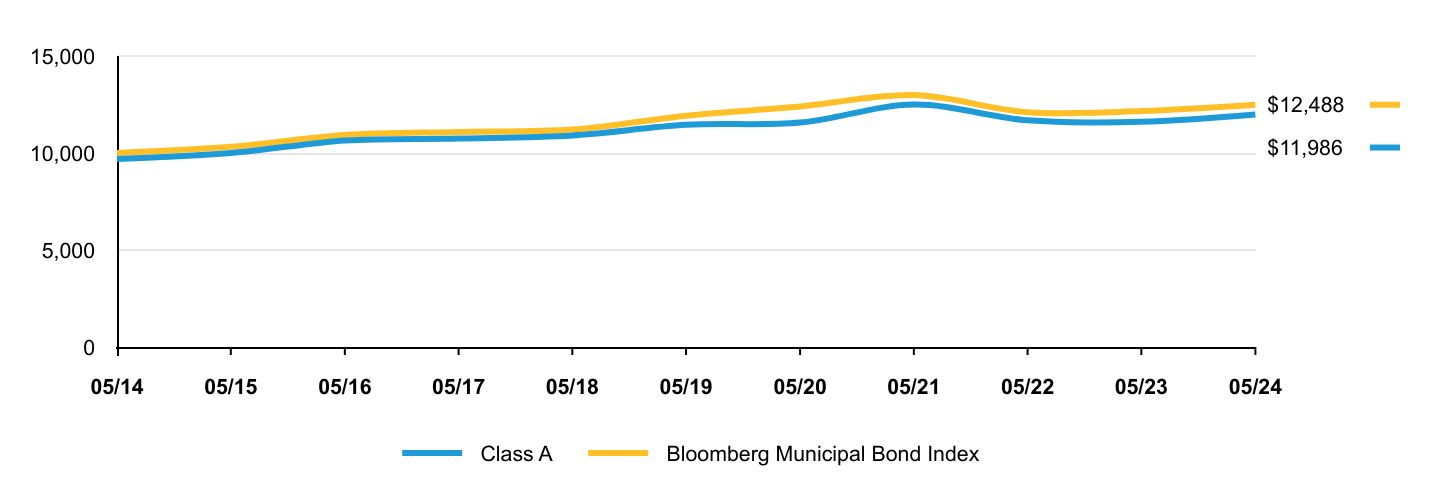

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $9,698 | $10,000 |

| 05/15 | $10,059 | $10,318 |

| 05/16 | $10,650 | $10,924 |

| 05/17 | $10,723 | $11,083 |

| 05/18 | $10,889 | $11,207 |

| 05/19 | $11,384 | $11,925 |

| 05/20 | $11,493 | $12,399 |

| 05/21 | $12,448 | $12,986 |

| 05/22 | $11,630 | $12,104 |

| 05/23 | $11,666 | $12,163 |

| 05/24 | $12,112 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charge) | 3.82% | 1.19% | 2.25% |

| Class A (with sales charge) | 0.70% | 0.57% | 1.93% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALCAX-A for the most recent performance information.

| Net Assets | $1,158,512,886 |

| # of Portfolio Holdings | 402 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $4,587,920 |

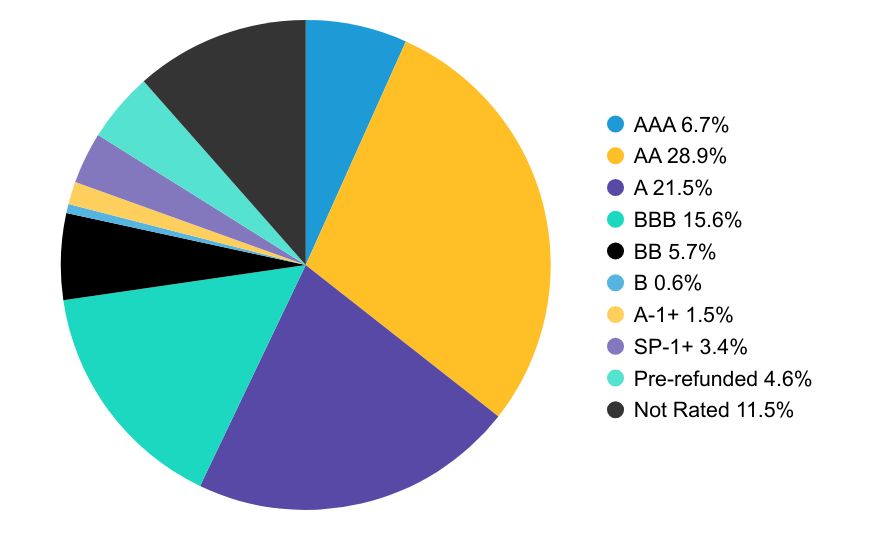

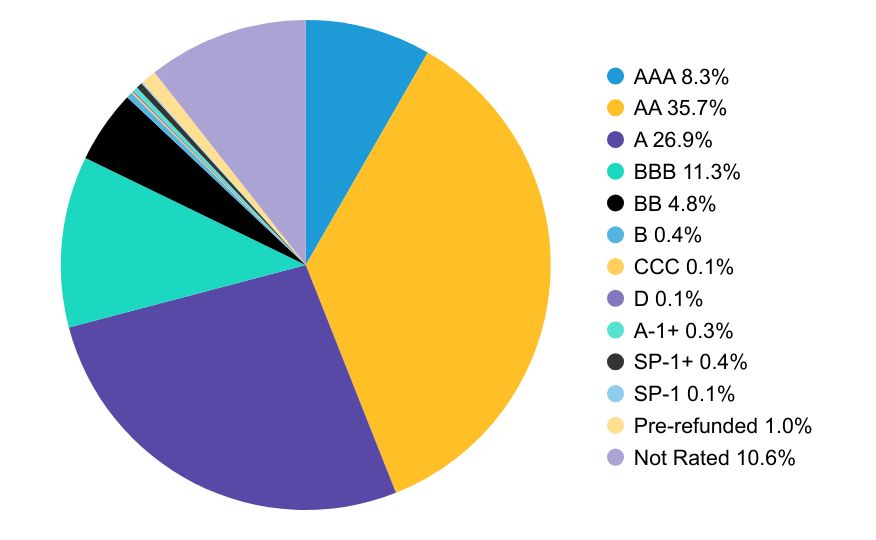

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 6.7% |

| AA | 28.9% |

| A | 21.5% |

| BBB | 15.6% |

| BB | 5.7% |

| B | 0.6% |

| A-1+ | 1.5% |

| SP-1+ | 3.4% |

| Pre-refunded | 4.6% |

| Not Rated | 11.5% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALCAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALCAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB California Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ACACX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $152 | 1.50% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Fund outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within multi-family housing and private higher education contributed, while selection in the miscellaneous revenue and industry Industrial Development Revenue (“IDR”) detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

MSA Tobacco Securitization

Top detractors

Not-for-Profit Health Care

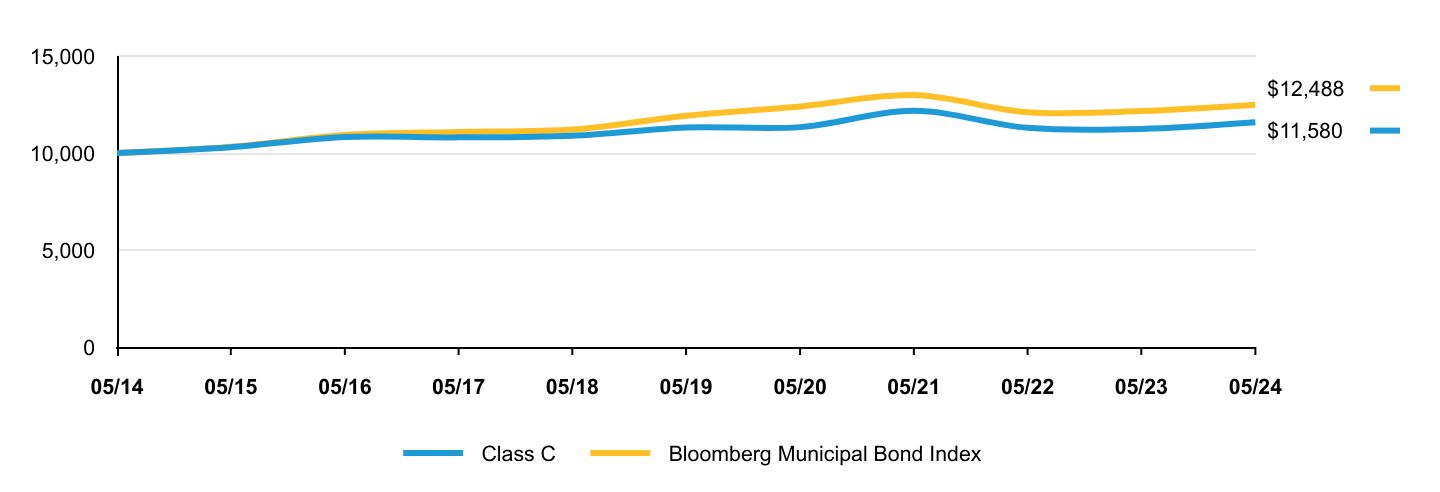

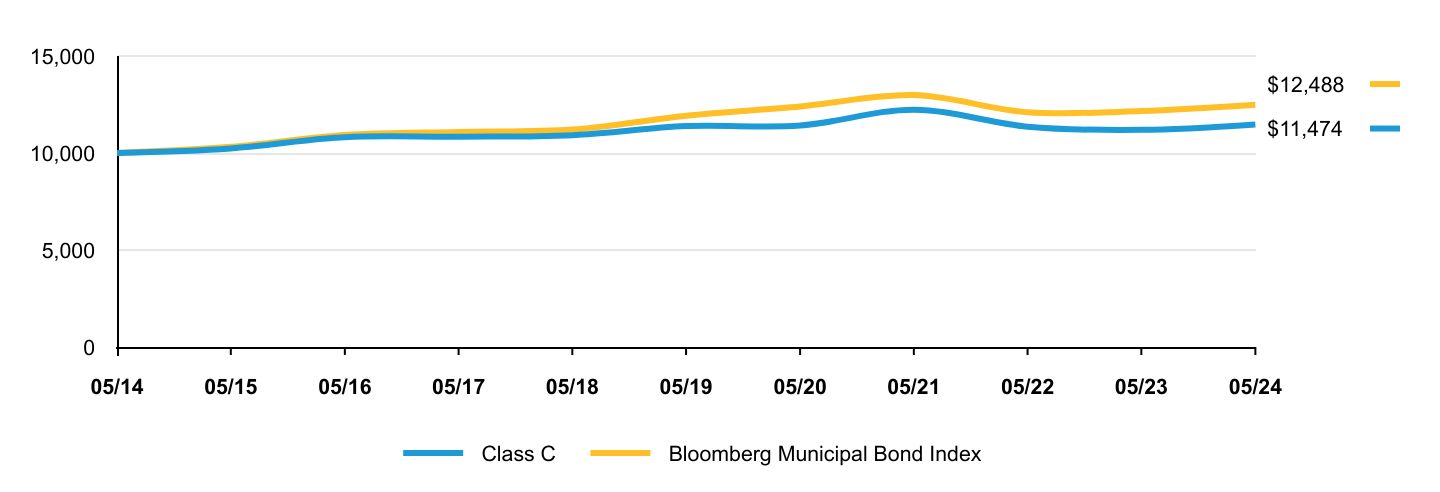

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,298 | $10,318 |

| 05/16 | $10,823 | $10,924 |

| 05/17 | $10,806 | $11,083 |

| 05/18 | $10,891 | $11,207 |

| 05/19 | $11,318 | $11,925 |

| 05/20 | $11,334 | $12,399 |

| 05/21 | $12,173 | $12,986 |

| 05/22 | $11,298 | $12,104 |

| 05/23 | $11,237 | $12,163 |

| 05/24 | $11,580 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charge) | 3.05% | 0.41% | 1.48% |

| Class C (with sales charge) | 2.05% | 0.41% | 1.48% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ACACX-A for the most recent performance information.

| Net Assets | $1,158,512,886 |

| # of Portfolio Holdings | 402 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $4,587,920 |

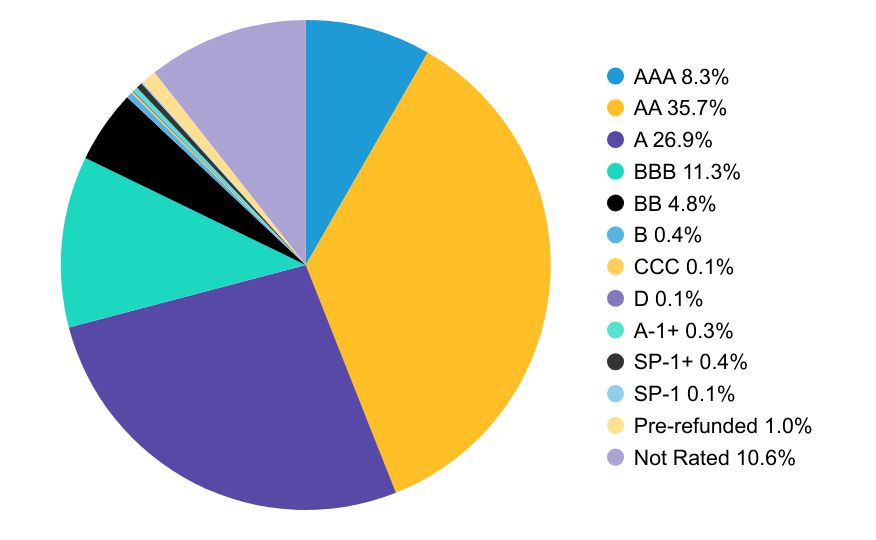

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 6.7% |

| AA | 28.9% |

| A | 21.5% |

| BBB | 15.6% |

| BB | 5.7% |

| B | 0.6% |

| A-1+ | 1.5% |

| SP-1+ | 3.4% |

| Pre-refunded | 4.6% |

| Not Rated | 11.5% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ACACX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ACACX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB High Income Municipal Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Municipal Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABTYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $97 | 0.95% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within housing and special tax contributed, while selection in the electric utility and utility Industrial Development Revenue (“IDR”) detracted.

While the benchmark is fully invested in investment-grade securities, the Fund invests in below-investment-grade securities, which added over both periods.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

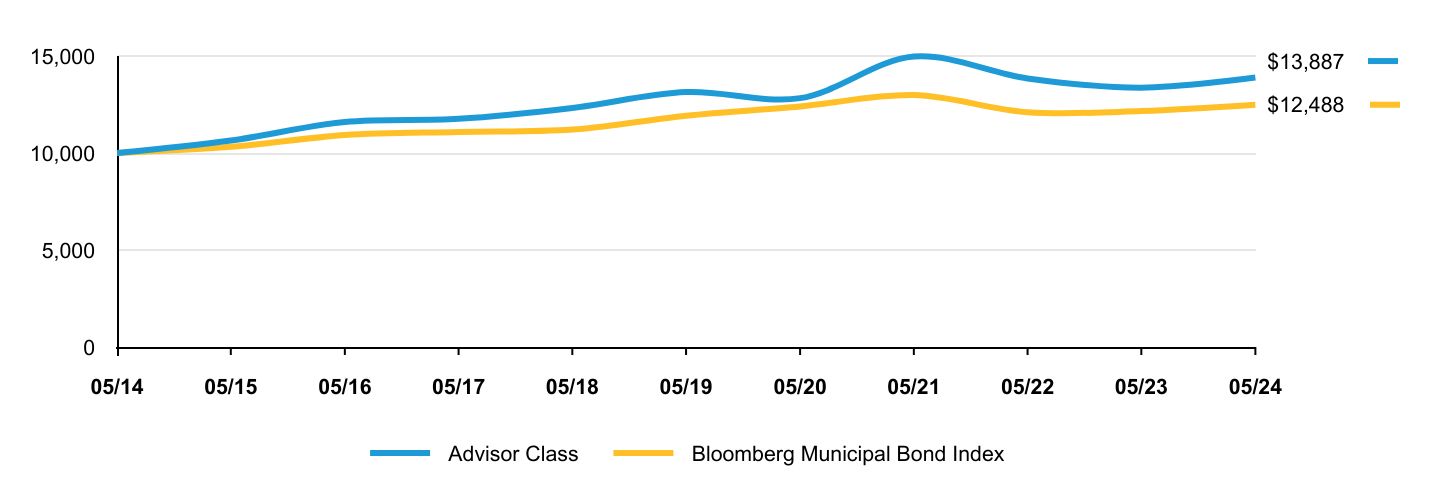

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,644 | $10,318 |

| 05/16 | $11,602 | $10,924 |

| 05/17 | $11,763 | $11,083 |

| 05/18 | $12,323 | $11,207 |

| 05/19 | $13,143 | $11,925 |

| 05/20 | $12,827 | $12,399 |

| 05/21 | $14,969 | $12,986 |

| 05/22 | $13,841 | $12,104 |

| 05/23 | $13,368 | $12,163 |

| 05/24 | $13,887 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class (without sales charge) | 3.88% | 1.04% | 3.34% |

| Advisor Class (with sales charge) | 3.88% | 1.04% | 3.34% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ABTYX-A for the most recent performance information.

| Net Assets | $2,790,140,470 |

| # of Portfolio Holdings | 812 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $13,917,267 |

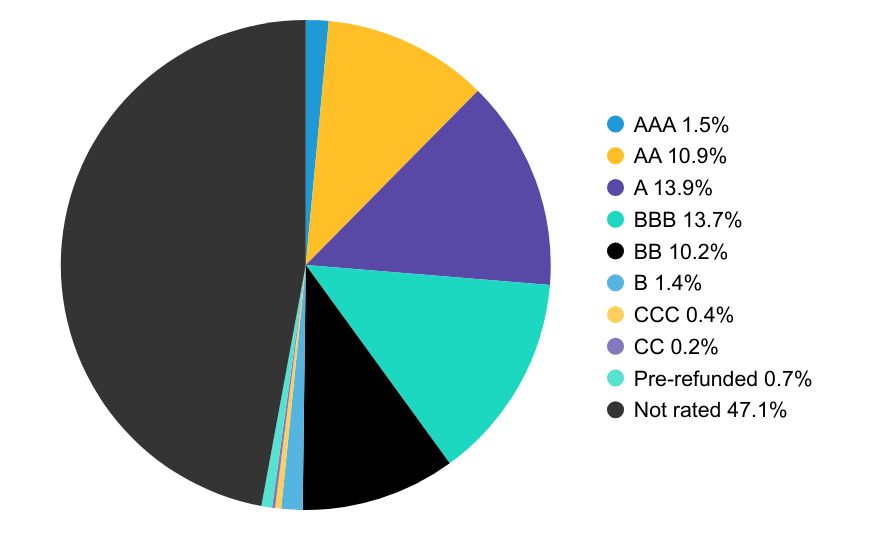

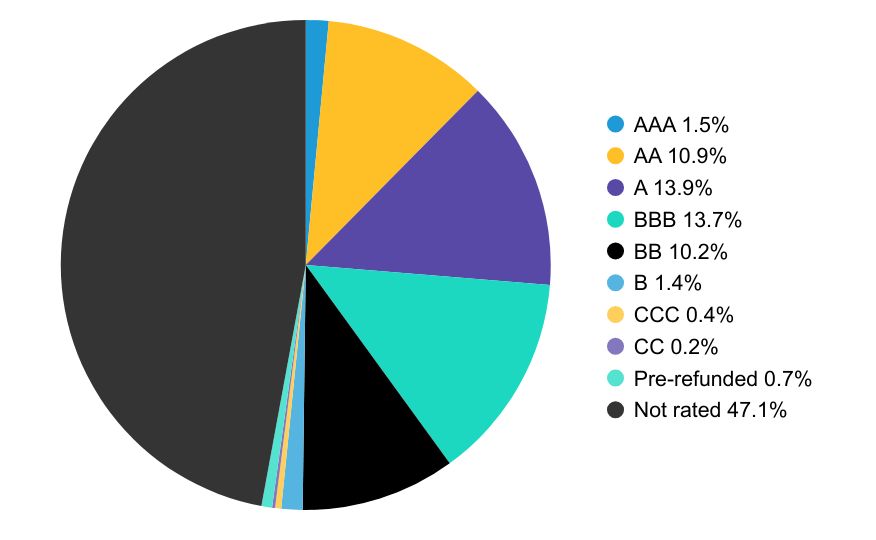

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 1.5% |

| AA | 10.9% |

| A | 13.9% |

| BBB | 13.7% |

| BB | 10.2% |

| B | 1.4% |

| CCC | 0.4% |

| CC | 0.2% |

| Pre-refunded | 0.7% |

| Not rated | 47.1% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABTYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABTYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB High Income Municipal Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Municipal Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABTHX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $122 | 1.20% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within housing and special tax contributed, while selection in the electric utility and utility Industrial Development Revenue (“IDR”) detracted.

While the benchmark is fully invested in investment-grade securities, the Fund invests in below-investment-grade securities, which added over both periods.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

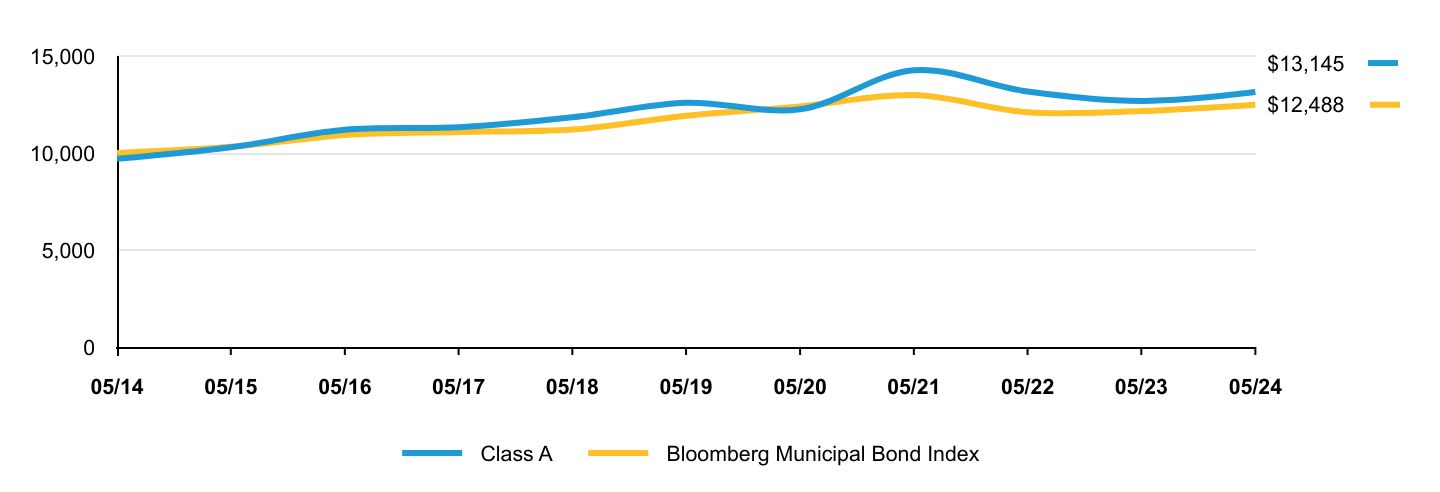

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $9,701 | $10,000 |

| 05/15 | $10,296 | $10,318 |

| 05/16 | $11,204 | $10,924 |

| 05/17 | $11,331 | $11,083 |

| 05/18 | $11,841 | $11,207 |

| 05/19 | $12,589 | $11,925 |

| 05/20 | $12,253 | $12,399 |

| 05/21 | $14,263 | $12,986 |

| 05/22 | $13,167 | $12,104 |

| 05/23 | $12,686 | $12,163 |

| 05/24 | $13,145 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charge) | 3.62% | 0.81% | 3.08% |

| Class A (with sales charge) | 0.55% | 0.19% | 2.77% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ABTHX-A for the most recent performance information.

| Net Assets | $2,790,140,470 |

| # of Portfolio Holdings | 812 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $13,917,267 |

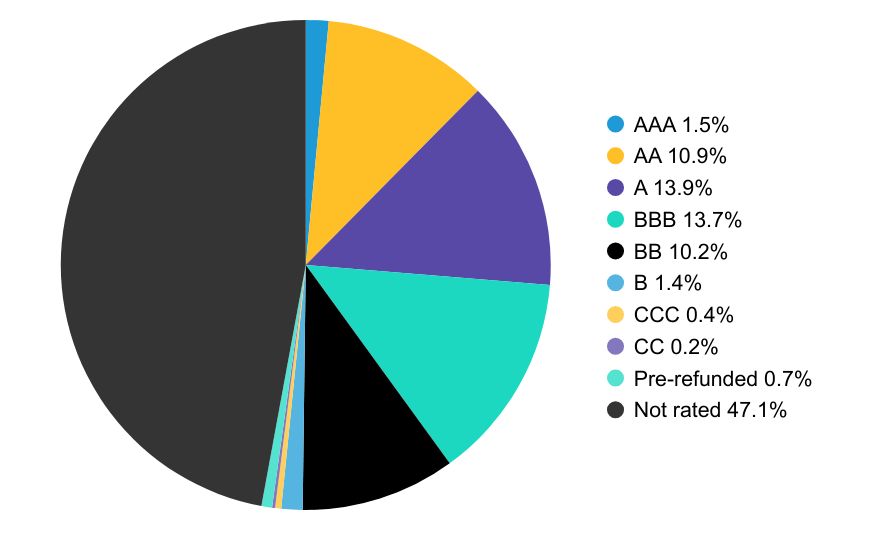

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 1.5% |

| AA | 10.9% |

| A | 13.9% |

| BBB | 13.7% |

| BB | 10.2% |

| B | 1.4% |

| CCC | 0.4% |

| CC | 0.2% |

| Pre-refunded | 0.7% |

| Not rated | 47.1% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABTHX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABTHX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB High Income Municipal Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Municipal Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABTFX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $198 | 1.95% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within housing and special tax contributed, while selection in the electric utility and utility Industrial Development Revenue (“IDR”) detracted.

While the benchmark is fully invested in investment-grade securities, the Fund invests in below-investment-grade securities, which added over both periods.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

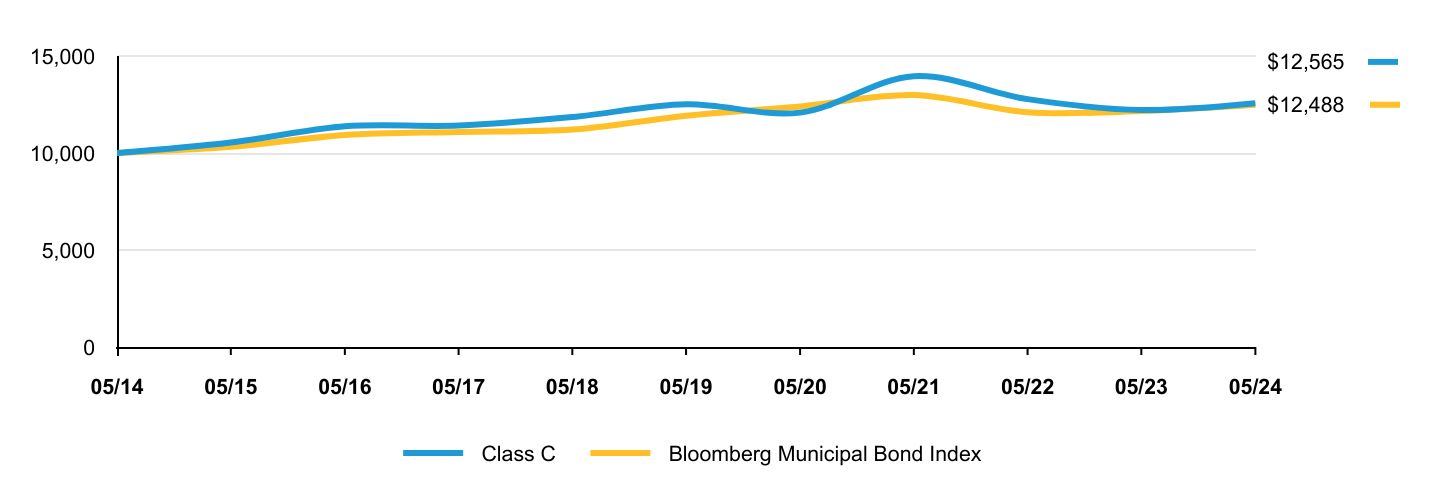

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,538 | $10,318 |

| 05/16 | $11,373 | $10,924 |

| 05/17 | $11,416 | $11,083 |

| 05/18 | $11,851 | $11,207 |

| 05/19 | $12,514 | $11,925 |

| 05/20 | $12,082 | $12,399 |

| 05/21 | $13,959 | $12,986 |

| 05/22 | $12,778 | $12,104 |

| 05/23 | $12,218 | $12,163 |

| 05/24 | $12,565 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charge) | 2.84% | 0.03% | 2.31% |

| Class C (with sales charge) | 1.84% | 0.03% | 2.31% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ABTFX-A for the most recent performance information.

| Net Assets | $2,790,140,470 |

| # of Portfolio Holdings | 812 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $13,917,267 |

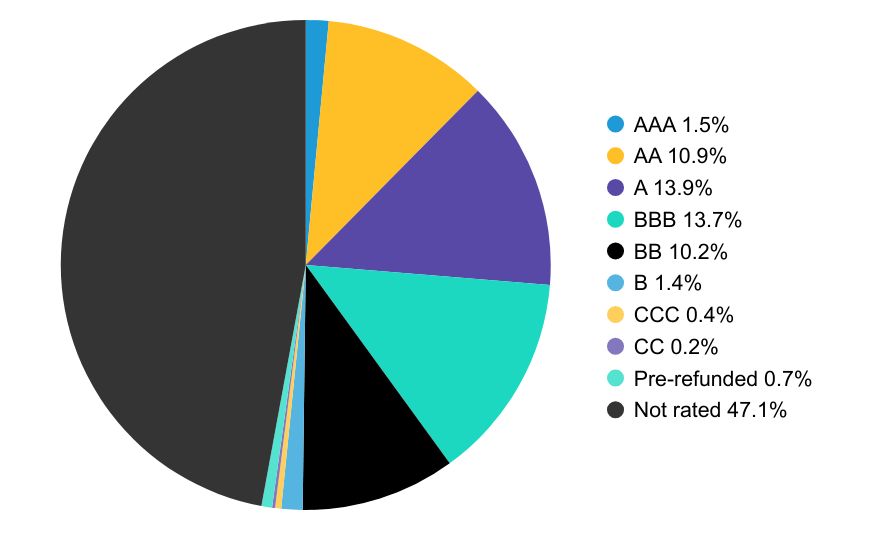

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 1.5% |

| AA | 10.9% |

| A | 13.9% |

| BBB | 13.7% |

| BB | 10.2% |

| B | 1.4% |

| CCC | 0.4% |

| CC | 0.2% |

| Pre-refunded | 0.7% |

| Not rated | 47.1% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABTFX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABTFX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB High Income Municipal Portfolio

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Municipal Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ABTZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $97 | 0.95% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within housing and special tax contributed, while selection in the electric utility and utility Industrial Development Revenue (“IDR”) detracted.

While the benchmark is fully invested in investment-grade securities, the Fund invests in below-investment-grade securities, which added over both periods.

The Fund used derivatives for hedging purposes in the form of inflation swaps, which had no material impact on performance, and interest rate swaps, which added to performance. Credit default swaps, used for hedging and investment purposes, had no material impact on performance. Municipal market data rate locks were used for investment purposes and added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

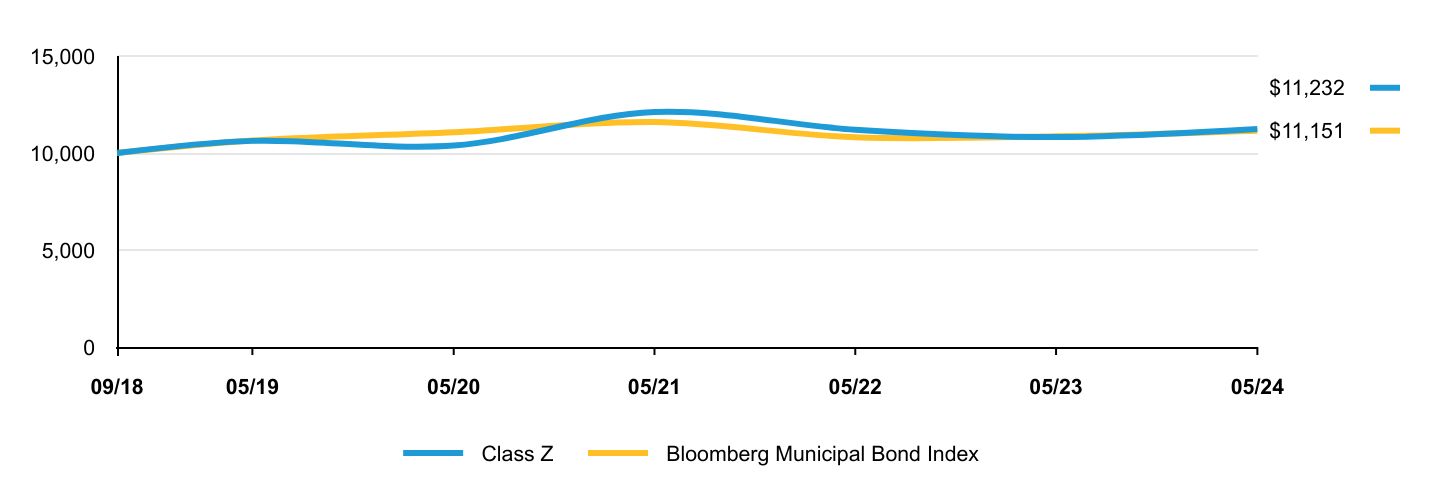

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class Z | Bloomberg Municipal Bond Index |

|---|

| 09/18 | $10,000 | $10,000 |

| 05/19 | $10,625 | $10,647 |

| 05/20 | $10,382 | $11,071 |

| 05/21 | $12,115 | $11,595 |

| 05/22 | $11,204 | $10,807 |

| 05/23 | $10,823 | $10,860 |

| 05/24 | $11,232 | $11,151 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 9/28/18 |

|---|

| Class Z (without sales charge) | 3.78% | 1.05% | 2.07% |

| Class Z (with sales charge) | 3.78% | 1.05% | 2.07% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 1.94% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ABTZX-A for the most recent performance information.

| Net Assets | $2,790,140,470 |

| # of Portfolio Holdings | 812 |

| Portfolio Turnover Rate | 23% |

| Total Advisory Fees Paid | $13,917,267 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 1.5% |

| AA | 10.9% |

| A | 13.9% |

| BBB | 13.7% |

| BB | 10.2% |

| B | 1.4% |

| CCC | 0.4% |

| CC | 0.2% |

| Pre-refunded | 0.7% |

| Not rated | 47.1% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ABTZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ABTZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB National Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALTVX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $51 | 0.50% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within special tax and multi-family housing contributed, while selection within senior living and industry Industrial Development Revenue (“IDR") detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, credit default swaps and municipal market data rate locks which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

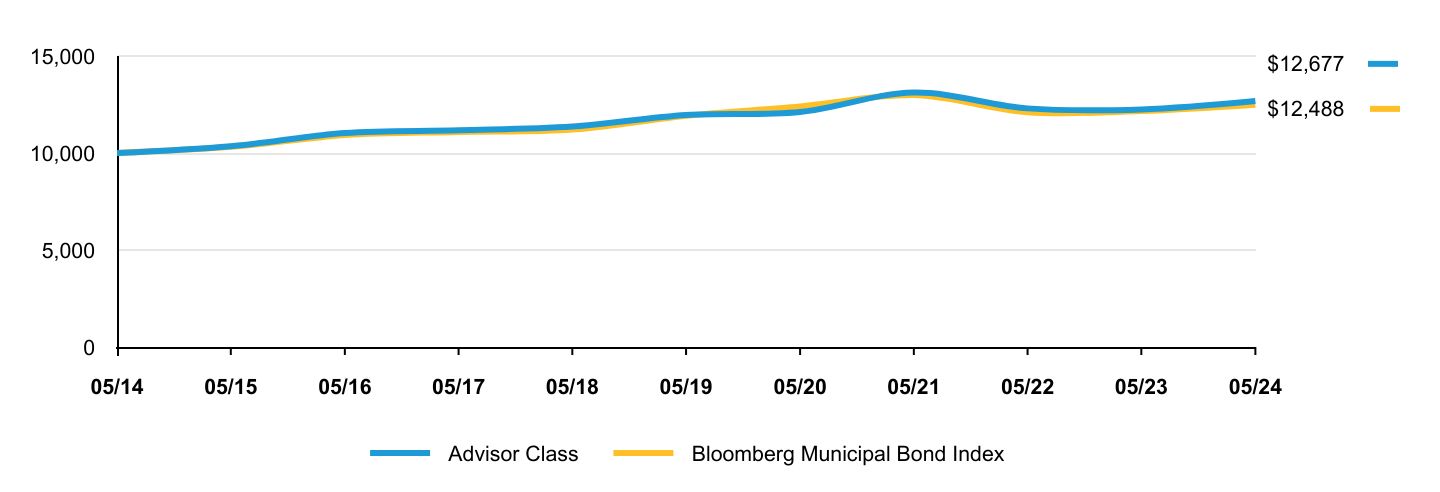

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,350 | $10,318 |

| 05/16 | $11,033 | $10,924 |

| 05/17 | $11,171 | $11,083 |

| 05/18 | $11,364 | $11,207 |

| 05/19 | $11,958 | $11,925 |

| 05/20 | $12,114 | $12,399 |

| 05/21 | $13,116 | $12,986 |

| 05/22 | $12,300 | $12,104 |

| 05/23 | $12,245 | $12,163 |

| 05/24 | $12,677 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class (without sales charge) | 3.53% | 1.12% | 2.40% |

| Advisor Class (with sales charge) | 3.53% | 1.12% | 2.40% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALTVX-A for the most recent performance information.

| Net Assets | $1,848,707,128 |

| # of Portfolio Holdings | 694 |

| Portfolio Turnover Rate | 30% |

| Total Advisory Fees Paid | $7,415,878 |

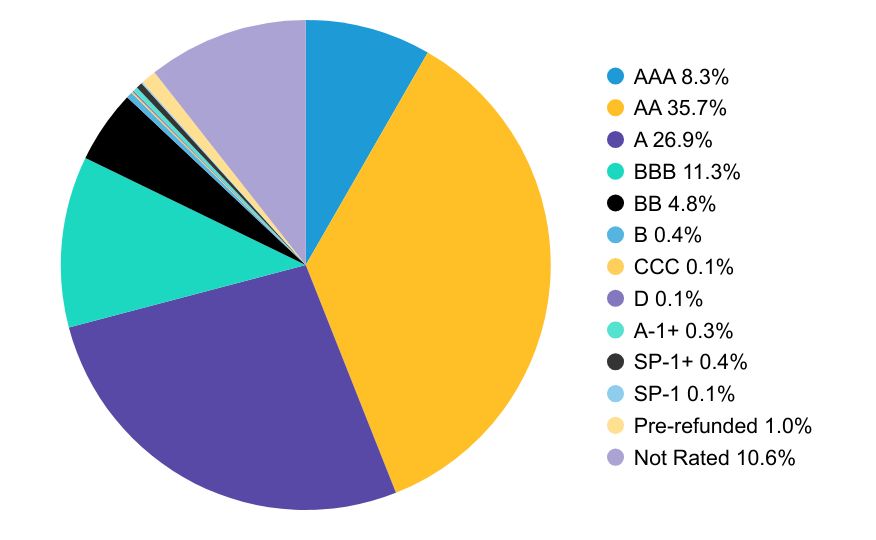

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 35.7% |

| A | 26.9% |

| BBB | 11.3% |

| BB | 4.8% |

| B | 0.4% |

| CCC | 0.1% |

| D | 0.1% |

| A-1+ | 0.3% |

| SP-1+ | 0.4% |

| SP-1 | 0.1% |

| Pre-refunded | 1.0% |

| Not Rated | 10.6% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALTVX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALTVX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB National Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALTHX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $76 | 0.75% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within special tax and multi-family housing contributed, while selection within senior living and industry Industrial Development Revenue (“IDR") detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, credit default swaps and municipal market data rate locks which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $9,697 | $10,000 |

| 05/15 | $9,998 | $10,318 |

| 05/16 | $10,642 | $10,924 |

| 05/17 | $10,748 | $11,083 |

| 05/18 | $10,907 | $11,207 |

| 05/19 | $11,451 | $11,925 |

| 05/20 | $11,569 | $12,399 |

| 05/21 | $12,495 | $12,986 |

| 05/22 | $11,688 | $12,104 |

| 05/23 | $11,607 | $12,163 |

| 05/24 | $11,986 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charge) | 3.27% | 0.87% | 2.14% |

| Class A (with sales charge) | 0.21% | 0.26% | 1.83% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALTHX-A for the most recent performance information.

| Net Assets | $1,848,707,128 |

| # of Portfolio Holdings | 694 |

| Portfolio Turnover Rate | 30% |

| Total Advisory Fees Paid | $7,415,878 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 35.7% |

| A | 26.9% |

| BBB | 11.3% |

| BB | 4.8% |

| B | 0.4% |

| CCC | 0.1% |

| D | 0.1% |

| A-1+ | 0.3% |

| SP-1+ | 0.4% |

| SP-1 | 0.1% |

| Pre-refunded | 1.0% |

| Not Rated | 10.6% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALTHX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALTHX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB National Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALNCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $152 | 1.50% |

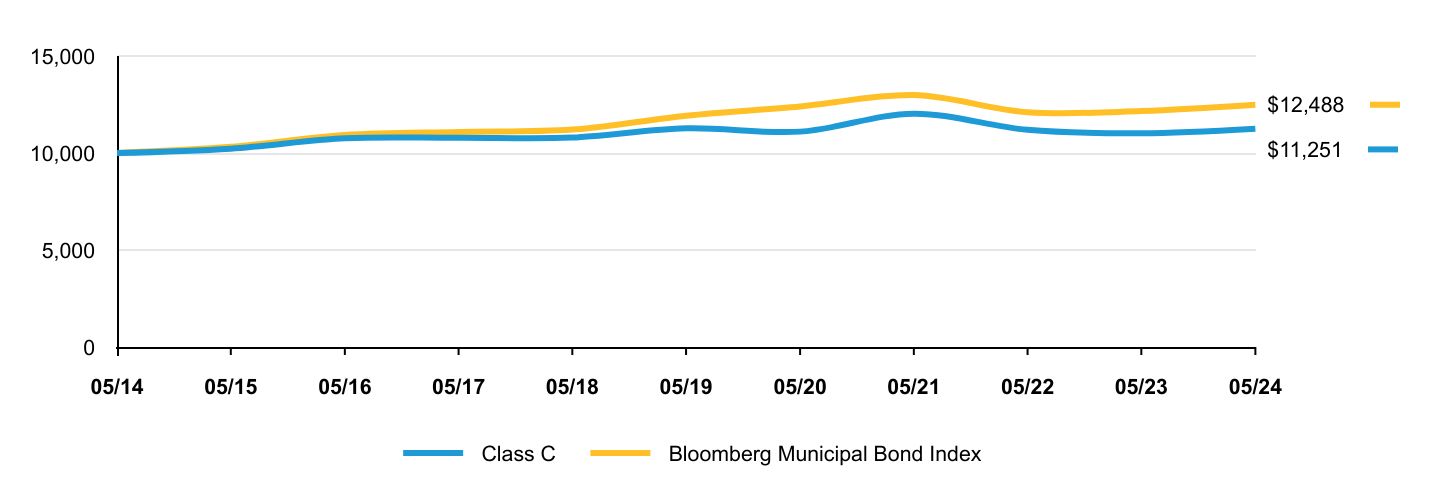

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within special tax and multi-family housing contributed, while selection within senior living and industry Industrial Development Revenue (“IDR") detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps, credit default swaps and municipal market data rate locks which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,238 | $10,318 |

| 05/16 | $10,817 | $10,924 |

| 05/17 | $10,843 | $11,083 |

| 05/18 | $10,921 | $11,207 |

| 05/19 | $11,388 | $11,925 |

| 05/20 | $11,413 | $12,399 |

| 05/21 | $12,235 | $12,986 |

| 05/22 | $11,358 | $12,104 |

| 05/23 | $11,194 | $12,163 |

| 05/24 | $11,474 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charge) | 2.50% | 0.12% | 1.38% |

| Class C (with sales charge) | 1.50% | 0.12% | 1.38% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALNCX-A for the most recent performance information.

| Net Assets | $1,848,707,128 |

| # of Portfolio Holdings | 694 |

| Portfolio Turnover Rate | 30% |

| Total Advisory Fees Paid | $7,415,878 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 8.3% |

| AA | 35.7% |

| A | 26.9% |

| BBB | 11.3% |

| BB | 4.8% |

| B | 0.4% |

| CCC | 0.1% |

| D | 0.1% |

| A-1+ | 0.3% |

| SP-1+ | 0.4% |

| SP-1 | 0.1% |

| Pre-refunded | 1.0% |

| Not Rated | 10.6% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALNCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALNCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB New York Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALNVX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $51 | 0.50% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within water and sewer and senior living contributed, while selection within toll roads and private higher education detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps and credit default swaps, which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,327 | $10,318 |

| 05/16 | $10,962 | $10,924 |

| 05/17 | $11,099 | $11,083 |

| 05/18 | $11,233 | $11,207 |

| 05/19 | $11,835 | $11,925 |

| 05/20 | $11,785 | $12,399 |

| 05/21 | $12,893 | $12,986 |

| 05/22 | $12,112 | $12,104 |

| 05/23 | $12,038 | $12,163 |

| 05/24 | $12,433 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class (without sales charge) | 3.28% | 0.94% | 2.20% |

| Advisor Class (with sales charge) | 3.28% | 0.94% | 2.20% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALNVX-A for the most recent performance information.

| Net Assets | $491,328,347 |

| # of Portfolio Holdings | 222 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $1,926,992 |

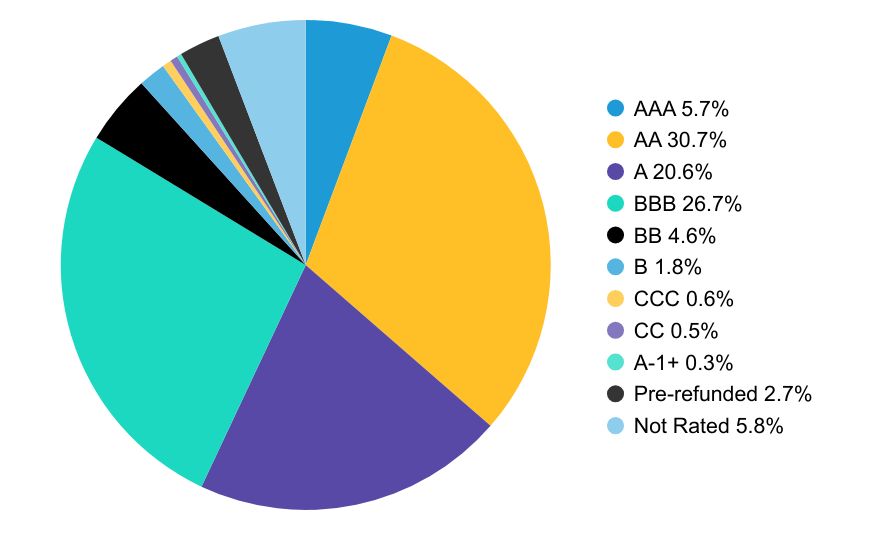

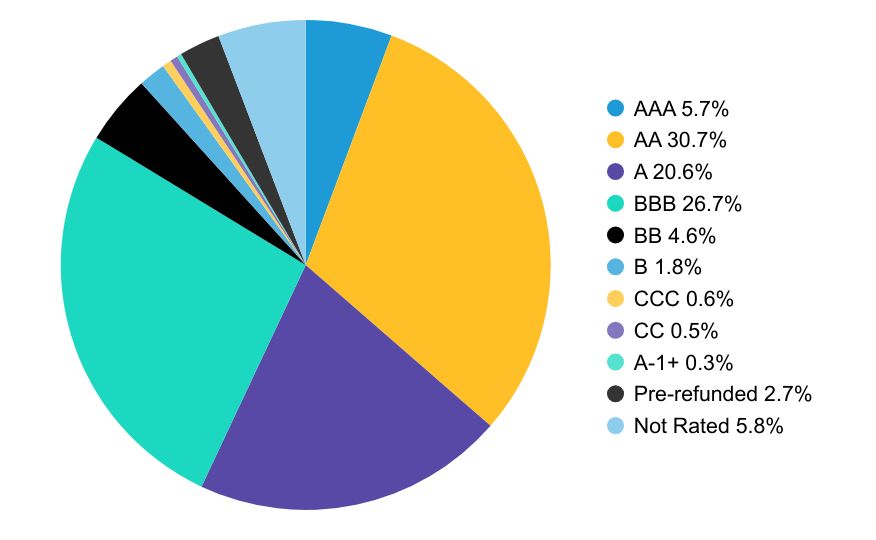

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 5.7% |

| AA | 30.7% |

| A | 20.6% |

| BBB | 26.7% |

| BB | 4.6% |

| B | 1.8% |

| CCC | 0.6% |

| CC | 0.5% |

| A-1+ | 0.3% |

| Pre-refunded | 2.7% |

| Not Rated | 5.8% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALNVX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALNVX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB New York Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ALNYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $76 | 0.75% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within water and sewer and senior living contributed, while selection within toll roads and private higher education detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps and credit default swaps, which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

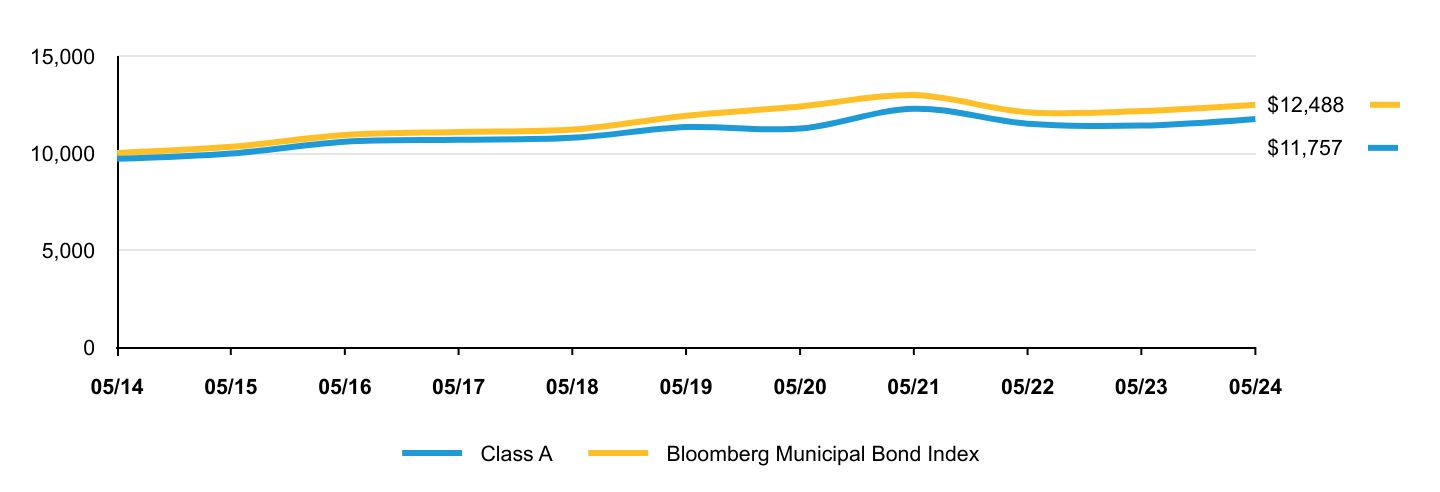

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $9,698 | $10,000 |

| 05/15 | $9,977 | $10,318 |

| 05/16 | $10,575 | $10,924 |

| 05/17 | $10,681 | $11,083 |

| 05/18 | $10,782 | $11,207 |

| 05/19 | $11,335 | $11,925 |

| 05/20 | $11,257 | $12,399 |

| 05/21 | $12,285 | $12,986 |

| 05/22 | $11,511 | $12,104 |

| 05/23 | $11,413 | $12,163 |

| 05/24 | $11,757 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charge) | 3.02% | 0.69% | 1.94% |

| Class A (with sales charge) | -0.04% | 0.08% | 1.63% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ALNYX-A for the most recent performance information.

| Net Assets | $491,328,347 |

| # of Portfolio Holdings | 222 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $1,926,992 |

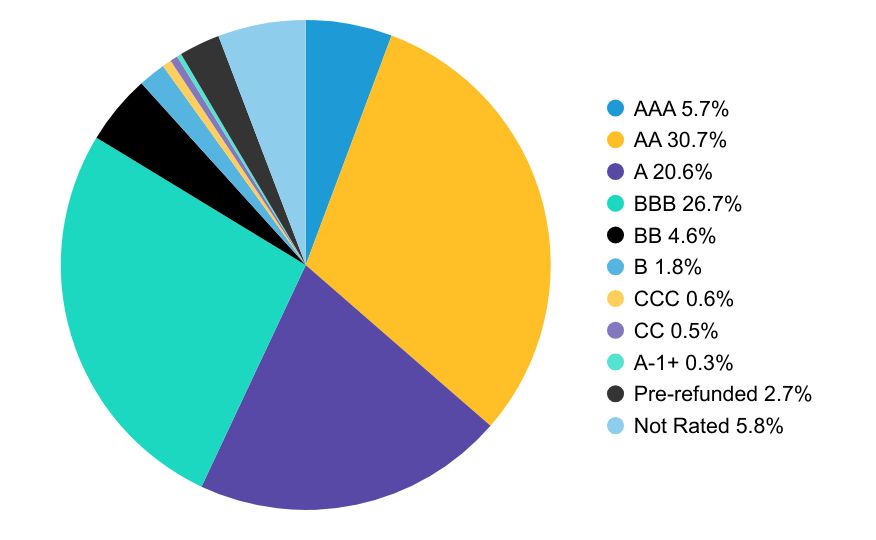

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 5.7% |

| AA | 30.7% |

| A | 20.6% |

| BBB | 26.7% |

| BB | 4.6% |

| B | 1.8% |

| CCC | 0.6% |

| CC | 0.5% |

| A-1+ | 0.3% |

| Pre-refunded | 2.7% |

| Not Rated | 5.8% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ALNYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ALNYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB New York Portfolio (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ANYCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $152 | 1.50% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes, except Class C, outperformed the Bloomberg Municipal Bond Index, before sales charges. Sector and security selection, as well as an overweight to credit, contributed to performance, relative to the benchmark. Security selection within water and sewer and senior living contributed, while selection within toll roads and private higher education detracted.

The Fund used derivatives for hedging purposes in the form of inflation swaps and credit default swaps, which had no material impact on performance. Interest rate swaps added to overall performance.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

Sector

Top contributors

Public Primary/Secondary Education

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Municipal Bond Index |

|---|

| 05/14 | $10,000 | $10,000 |

| 05/15 | $10,225 | $10,318 |

| 05/16 | $10,757 | $10,924 |

| 05/17 | $10,784 | $11,083 |

| 05/18 | $10,794 | $11,207 |

| 05/19 | $11,270 | $11,925 |

| 05/20 | $11,102 | $12,399 |

| 05/21 | $12,026 | $12,986 |

| 05/22 | $11,195 | $12,104 |

| 05/23 | $11,016 | $12,163 |

| 05/24 | $11,251 | $12,488 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charge) | 2.13% | | 1.19% |

| Class C (with sales charge) | 1.13% | -0.07% | 1.19% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ANYCX-A for the most recent performance information.

| Net Assets | $491,328,347 |

| # of Portfolio Holdings | 222 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $1,926,992 |

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 5.7% |

| AA | 30.7% |

| A | 20.6% |

| BBB | 26.7% |

| BB | 4.6% |

| B | 1.8% |

| CCC | 0.6% |

| CC | 0.5% |

| A-1+ | 0.3% |

| Pre-refunded | 2.7% |

| Not Rated | 5.8% |

*The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating used by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by Alliance Bernstein L.P. (the “Adviser”). If applicable, Not Applicable (N/A) includes non-credit worthy investments; such as, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment.

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/ANYCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/ANYCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

ITEM 2. CODE OF ETHICS.

(a) The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant’s code of ethics is filed herewith as Exhibit 19(a)(1).

(b) During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(c) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.