May 4, 2023

Mr. Ameen Hamady

Division of Corporation Finance

Office of Real Estate & Construction

Securities and Exchange Commission

Washington, D.C. 20549

VIA EDGAR as CORRESPONDENCE filing

Re: Universal Health Realty Income Trust (“UHT”)

Form 10-K for the year ended December 31, 2022

As filed on February 27, 2023

File No. 001-09321

Dear Mr. Hamady:

This letter is being written in connection with the Staff’s examination of the filing referenced above. Set forth below is our response to the comment included in the Staff’s letter to us dated April 21, 2023.

Footnote 2. Relationship with UHS and Related Party Transactions, page 67

1)We note your disclosure that on December 31, 2021 you entered into an asset purchase and sale agreement whereby UHS purchased the real estate assets of Inland Valley Campus of Southwest Healthcare System for its fair market value of $79.6 million. Concurrently, UHS transferred the real estate assets for Aiken and Canyon Creek with a combined fair value of $83.7 million. Given the difference in fair market values, the Company paid $4.1 million in cash and a gain of approximately $68.4 million was recognized as a result of these transactions. We further note your disclosure on page 64 that in connection with this transaction, Aiken and Canyon Creek (as lessees), entered into a master lease and individual property leases with the Company as lessor and that as a result of UHS’ purchase option within the lease agreements of Aiken and Canyon Creek, the transaction is accounted for as a failed sale leaseback and accounted with UHS as a financing arrangement. In order to better understand the Company’s accounting treatment with these transactions, please further explain the following:

•Whether the Company is treating the sale of Inland Valley and the failed sale lease back of the Aiken and Canyon Creek properties as two separate transactions or as part of the same transaction; and

•How the Company determined it was appropriate to recognize a gain in the transaction and how it was calculated.

In providing your response, please tell us how the Company applied the guidance in ASC 842-40 in arriving at its conclusion. Please also tell us whether the Company considered other guidance in its evaluation including but not limited to ASC 845-10 and ASC 610-20 for part or all of the transactions.

Background:

On December 31, 2021, the Company (herein referenced to as "UHT", "we" or "us") entered into an asset purchase and sale agreement with Universal Health Services, Inc. (“UHS”) and certain of its affiliates. Pursuant to the terms of the purchase and sale agreement:

1

•a wholly-owned subsidiary of UHS purchased from us, the real estate assets of the Inland Valley Campus of Southwest Healthcare System (“Inland Valley”) located in Wildomar, California, at its fair market value of $79.6 million.

•two wholly-owned subsidiaries of UHS transferred to us, the real estate assets of the following properties:

oAiken Regional Medical Center (“Aiken”), located in Aiken, South Carolina (which includes an acute care hospital and a behavioral health pavilion), at its fair-market value of approximately $57.7 million, and;

oCanyon Creek Behavioral Health (“Canyon Creek”), located in Temple, Texas, at its fair-market value of approximately $26.0 million.

•in connection with this transaction, since the combined fair-market values of Aiken and Canyon Creek, which totaled approximately $83.7 million in the aggregate, exceeded the $79.6 million fair-market value of Inland Valley, we paid approximately $4.1 million in cash to UHS.

Also on December 31, 2021, Aiken and Canyon Creek (as lessees), entered into a master lease and individual property leases (with us as lessor), for initial lease terms on each property of approximately twelve years, ending on December 31, 2033. Pursuant to the Master Lease, each lessee has the option, among other things, to renew the lease at the then current fair market rent (as defined in the Master Lease), for seven, five-year optional renewal terms, by providing notice to us at least 90 days prior to the termination of the then current term. The lessees also have the right to purchase the respective leased facilities from us at their appraised fair market value upon any of the following: (i) at the end of the lease terms or any renewal terms; (ii) upon one month’s notice should a change of control of the Trust occur, or; (iii) within the time period as specified in the lease in the event that the lessee provides notice to us of their intent to offer a substitution property/properties in exchange for one of facilities leased from us, should we be unable to reach an agreement with the lessee on the properties to be substituted. Additionally, each lessee has rights of first refusal to: (i) purchase the respective leased facilities during and for 180 days after the lease terms at the same price, terms and conditions of any third-party offer, or; (ii) renew the lease on the respective leased facility at the end of, and for 180 days after, the lease term at the same terms and conditions pursuant to any third-party offer.

Accounting treatment considerations for Aiken and Canyon Creek sale and leaseback arrangement:

We considered the sale of Inland Valley to UHS, and the receipt of the Aiken and Canyon Creek properties with the leaseback to UHS, as a single transaction. When evaluating whether we obtained control of the Aiken and Canyon Creek properties, we considered the existence of the leasebacks and the fair value purchase options.

The existence of a purchase option does not always preclude recognition of a sale in a sale and leaseback arrangement and ASC 842-40-25-3 provides specific guidance on evaluating a purchase option in a sale and leaseback transaction: “an option for the seller-lessee to repurchase the asset would preclude accounting for the transfer of the asset as a sale of the asset unless both of the following criteria are met:

a.The exercise price of the option is the fair value of the asset at the time the option is exercised.

b.There are alternative assets, substantially the same as the transferred asset, readily available in the marketplace.”

Since UHS, as seller-lessee, has the option to purchase the real estate at fair market value, criterion “a.” above was met. However, as the underlying assets are real estate, the transaction fails to meet criterion “b.” noted above, because each location is unique, and therefore, alternative real estate assets that are readily available in the marketplace will not be considered “substantially the same” as the underlying real estate assets. Therefore criterion “b.” noted above was not met.

2

Since criterion “b.” as outlined above was not met, the sale and leaseback transaction does not qualify for sale accounting and the transaction must be accounted for as a financing transaction per ASC 842-40-25-5, and both of the following apply:

a.The seller-lessee (UHS) shall not derecognize the transferred asset and shall account for any amounts received as a financial liability.

b.The buyer-lessor (UHT) shall not recognize the transferred asset as property and shall account for the amounts paid as financing receivables.

As noted above, UHT did not recognize the transferred assets (Aiken and Canyon Creek) as property and accounted for the amounts received from UHS (the fair value of Aiken and Canyon Creek) as a financing receivable. Effectively, we sold Inland Valley to UHS in exchange for a finance receivable from UHS. UHS is required to pay UHT principal and interest payments (in the form of contractual lease payments) and the financing receivable is secured by the real estate properties. Our balance sheet was: (i) debited to a financing receivable asset to equal the fair value of Aiken and Canyon Creek, as noted above; (ii) credited for the gross asset value of Inland Valley ; (iii) credited for the cash paid to UHS by UHT, and; (iv) debited for the accumulated depreciation on Inland Valley. Additionally, our income statement reflected a $68.4 million gain on the divestiture of Inland Valley for the year ended December 31, 2021, as further discussed below.

Staff’s Comment:

Please explain whether the Company is treating the sale of Inland Valley and the failed sale lease back of the Aiken and Canyon Creek properties as two separate transactions or as part of the same transaction:

Response:

UHT treated the sale of Inland Valley to UHS, and the transfer of the Aiken and Canyon Creek properties from UHS to us (which was accounted for as a failed sale leaseback) as part of the same transaction.

Staff’s Comment:

Please explain how the Company determined it was appropriate to recognize a gain in the transaction and how it was calculated.

Response:

Since the consideration received by us has been determined to be a financing receivable under ASC 842-40, the transaction is not considered an exchange of nonmonetary assets under the guidance of ASC 845, Nonmonetary Transactions.

ASC 610-20 Gains and Losses from the Derecognition of Nonfinancial Assets, provides guidance on the recognition of gains and losses on transfers of non-financial assets and in substance non-financial assets with counterparties that are not customers. As noted above, consideration received was accounted for as a financing receivable under ASC 842-40. Further, UHS did not meet the definition of a customer based upon the nature of our business since our ordinary activities are to hold and lease real estate properties. Therefore, ASC 610-20 was deemed the appropriate guidance.

Since UHT no longer had a controlling financial interest in Inland Valley, we concluded that pursuant to ASC 610-20-25-4 to -7, we further evaluated the transaction in accordance with the principles of ASC 606 to determine if gain recognition was appropriate.

Under ASC 606-10-25-1, an entity shall account for a contract that is within the scope of the Topic only when specific criteria are met.

3

The asset purchase and sale agreement between UHT and UHS was recognized and accounted for as a contract since all of the specific criteria required under ASC 606-10-25-1 were met: (i) the contract was approved in writing, and both parties are committed to perform their respective obligations; (ii) the contract clearly identifies each party’s rights regarding the assets transferred; (iii) the payment terms for the assets transferred are clearly stipulated in the agreement; (iv) the contract has commercial substance since the timing and future cash flows are provided for, and; (v) as of the December 31, 2021 transaction date, the probability that UHT will collect all of the consideration to which we are entitled was clear since UHT's consideration in the transaction (i.e. financing receivable due from UHS in the form of contractual lease payments consisting of principal and interest) is secured by the real estate properties.

Since it was determined that a contract existed and that the December 31, 2021 purchase and sale transaction with UHS met all of the criteria of ASC 606-20-25-1 (as noted above), we concluded that a gain should be recognized under ASC 610-20-32-2.

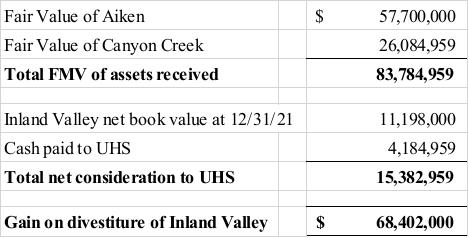

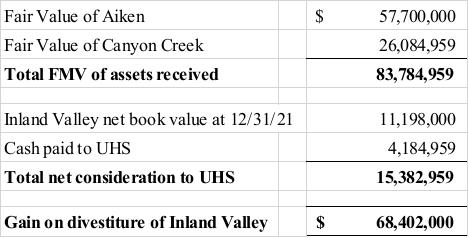

Pursuant to ASC 610-20-32-2, a gain was recognized for the difference between the amount of consideration received (the combined fair values of Aiken and Canyon Creek of $83,784,959) and the carrying amount of the Inland Valley asset (net book value of $11,198,000). Additionally, the gain was adjusted for the $4,184,959 of cash paid to UHS by UHT. The table below summarizes the calculation of the $68.4 million gain on the divestiture of Inland Valley:

Below is my contact information should the Staff have any questions or require any additional information. Thank you for your consideration and cooperation regarding this matter.

Sincerely,

/s/ Charles Boyle

Charles Boyle

Senior Vice President and Chief Financial Officer

Universal Health Realty Income Trust

367 South Gulph Road

King of Prussia, PA 19406

610-768-3354 (telephone)

chick.boyle@uhsinc.com (email)

4