Certain Relationships and Related Transactions

services under the Advisory Agreement, the Advisor may utilize independent professional services, including accounting, legal, tax and other services, for which the Advisor is reimbursed directly by us. The Advisory Agreement may be terminated for any reason upon sixty days written notice by us or the Advisor. The Advisory Agreement expires on December 31 of each year; however, it is renewable by us, subject to a determination by the Independent Trustees, that the Advisor’s performance has been satisfactory. The Advisory Agreement was renewed for 2022 with the same terms as the Advisory Agreement in place during 2021 and 2020.

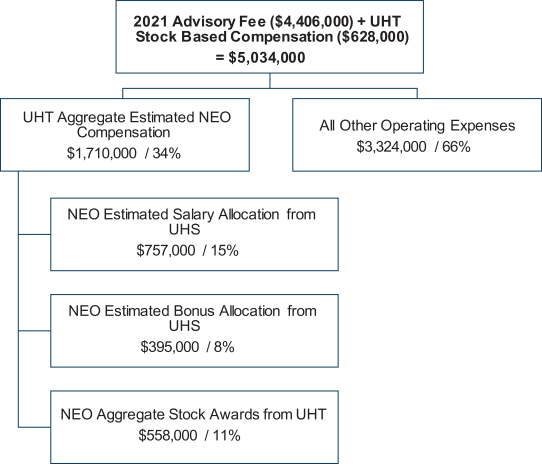

Our advisory fee for 2021, 2020 and 2019 was computed at 0.70% of our average invested real estate assets, as derived from our consolidated balance sheet. Based upon a review of our advisory fee and other general and administrative expenses, as compared to an industry peer group, the advisory fee computation remained unchanged for 2021, as compared to the last three years. The average real estate assets for advisory fee calculation purposes exclude certain items from our consolidated balance sheet such as, among other things, accumulated depreciation, cash and cash equivalents, lease receivables, deferred charges and other assets. The advisory fee is payable quarterly, subject to adjustment at year-end based upon our audited financial statements. Advisory fees incurred and paid (or payable) to UHS amounted to $4.4 million during 2021, $4.1 million during 2020 and $4.0 million during 2019 and were based upon average invested real estate assets of $629 million, $592 million and $568 million during 2021, 2020 and 2019, respectively.

Share Ownership: As of December 31, 2021 and 2020, UHS owned 5.7% of our outstanding shares of beneficial interest.

SEC reporting requirements of UHS: UHS is subject to the reporting requirements of the Securities and Exchange Commission (“SEC”) and is required to file annual reports containing audited financial information and quarterly reports containing unaudited financial information. Since the aggregate revenues generated from UHS-related tenants comprised approximately 32% of our consolidated revenue for the five years ended December 31, 2021 (approximately 37%, 33% and 31% for the years ended December 31, 2021, 2020 and 2019, respectively), and since a subsidiary of UHS is our Advisor, you are encouraged to obtain the publicly available filings for Universal Health Services, Inc. from the SEC’s website. These filings are the sole responsibility of UHS and are not incorporated by reference herein.

Review, Approval and Ratification of Related Party Transactions

Pursuant to our Code of Business Conduct and Ethics, all employees, officers and Trustees of the Trust, including family members and entities in which such persons have an interest (except any other publicly traded company in which such persons have less than a 5% interest) should avoid any relationship or financial interest which gives rise to an actual or potential conflict of interest between us and the employee, officer or Trustee. If an employee, officer or Trustee becomes aware of an actual or potential conflict of interest, he or she should promptly bring it to the attention of, and disclose all material facts to, one or more of a supervisor, a member of our legal staff, or the Chairperson of the Nominating & Governance Committee of the Board.

Pursuant to Section 4.9 of our Declaration of Trust, we may not engage in a transaction with any employee, officer, agent or Trustee of the Trust or with any employee, officer, agent or director of the Advisor, or any affiliate thereof except to the extent that such transaction has been approved or ratified by a majority of the Trustees who do not have an interest in the transaction. We may not engage in a transaction with our Advisor or any affiliate thereof (such as UHS) except to the extent that such transaction has been approved or ratified by a majority of the Independent Trustees. In approving or rejecting the proposed agreement, the Trustees will consider the relevant facts and circumstances available and deemed relevant, including but not limited to, the risks, costs, and benefits to us, the terms of the transactions, the availability of other sources for comparable services or products, and, if applicable, the impact on Trustee independence. In general, the Trustees shall only approve those agreements that, in light of known circumstances, are in our best interests and that are fair and reasonable to us and our shareholders. For certain transactions with related persons, our Declaration of Trust requires that, based on an independent real estate appraiser, the total consideration is not in excess of the appraised value of the interest in the real property being acquired or disposed of, as applicable. If a transaction involves payments by us for services rendered (other than as Advisor, officer or Trustee), our Declaration of Trust requires that the payments made by us may not be in excess of payments made by third-parties to the related person for comparable services in the same geographic area and may not be in excess of fees charged by parties unrelated to us for comparable services in the same geographic area. All of our transactions with UHS and our Advisor were approved by a majority of our Independent Trustees.

| | | | |

| | | |

| 36 | | UHT 2022 Proxy Statement | | |