First Citizens BancShares, Inc. Fourth Quarter 2024 Earnings Conference Call January 24, 2025

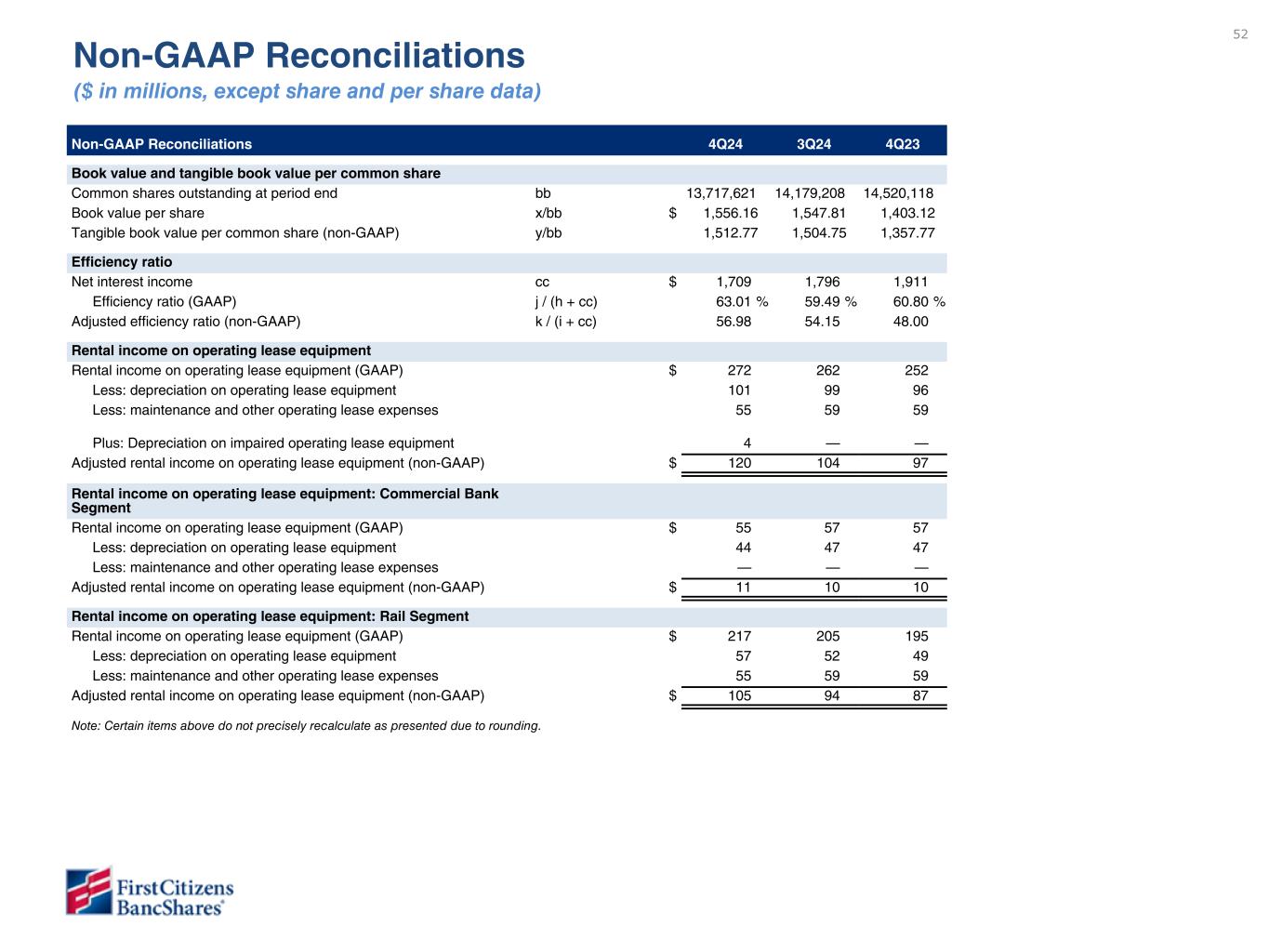

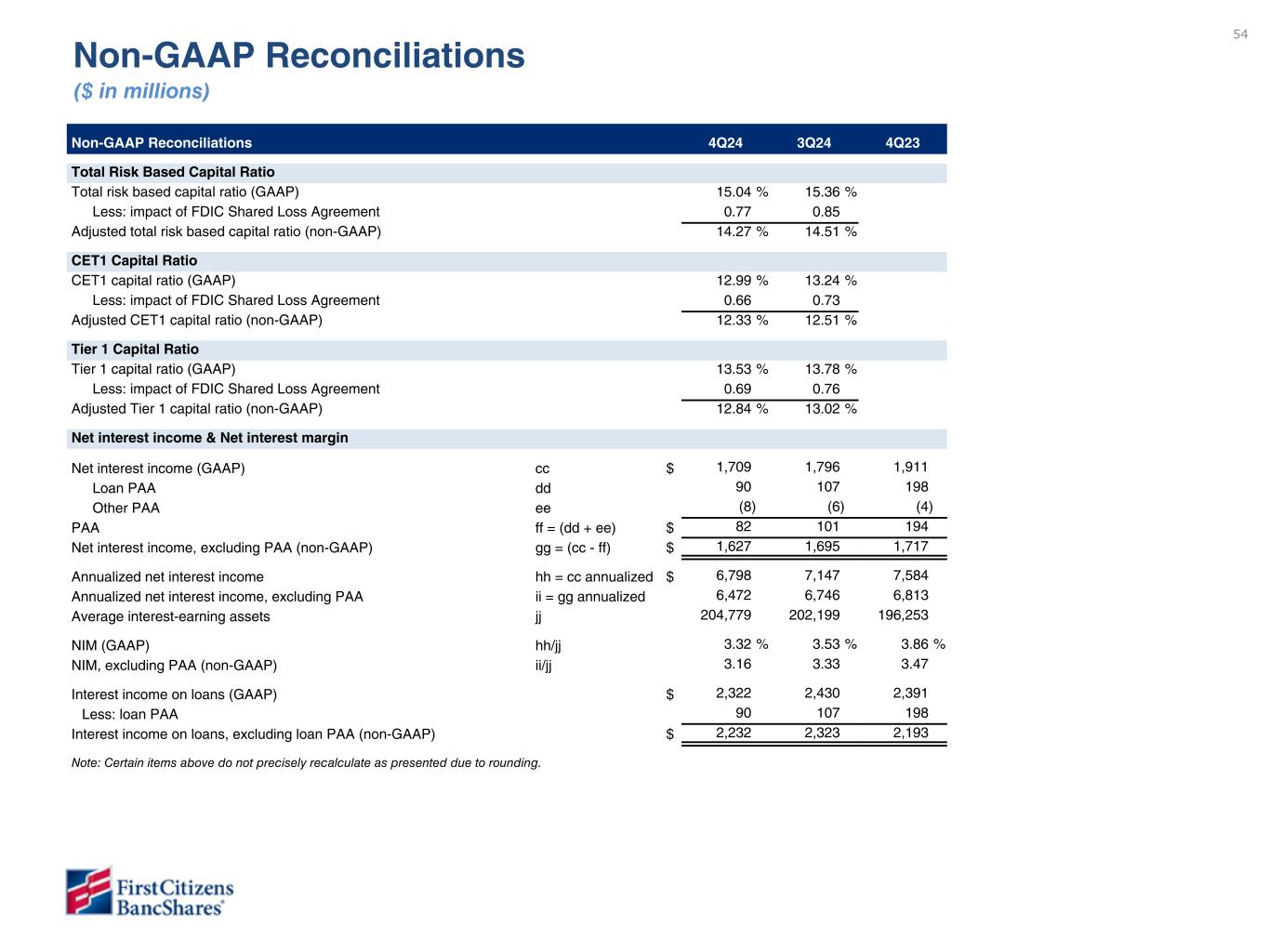

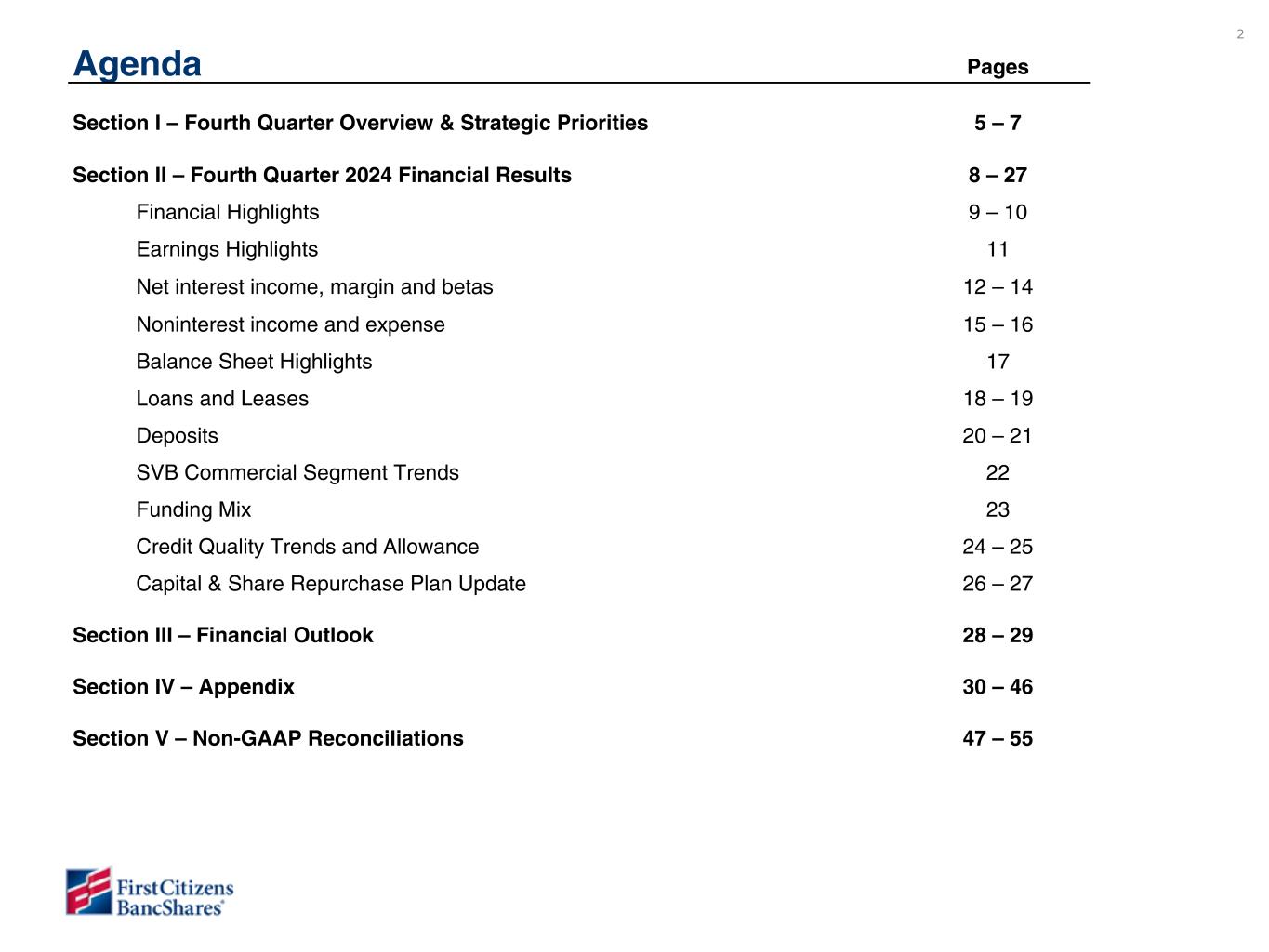

2 Agenda Pages Section I – Fourth Quarter Overview & Strategic Priorities 5 – 7 Section II – Fourth Quarter 2024 Financial Results 8 – 27 Financial Highlights 9 – 10 Earnings Highlights 11 Net interest income, margin and betas 12 – 14 Noninterest income and expense 15 – 16 Balance Sheet Highlights 17 Loans and Leases 18 – 19 Deposits 20 – 21 SVB Commercial Segment Trends 22 Funding Mix 23 Credit Quality Trends and Allowance 24 – 25 Capital & Share Repurchase Plan Update 26 – 27 Section III – Financial Outlook 28 – 29 Section IV – Appendix 30 – 46 Section V – Non-GAAP Reconciliations 47 – 55

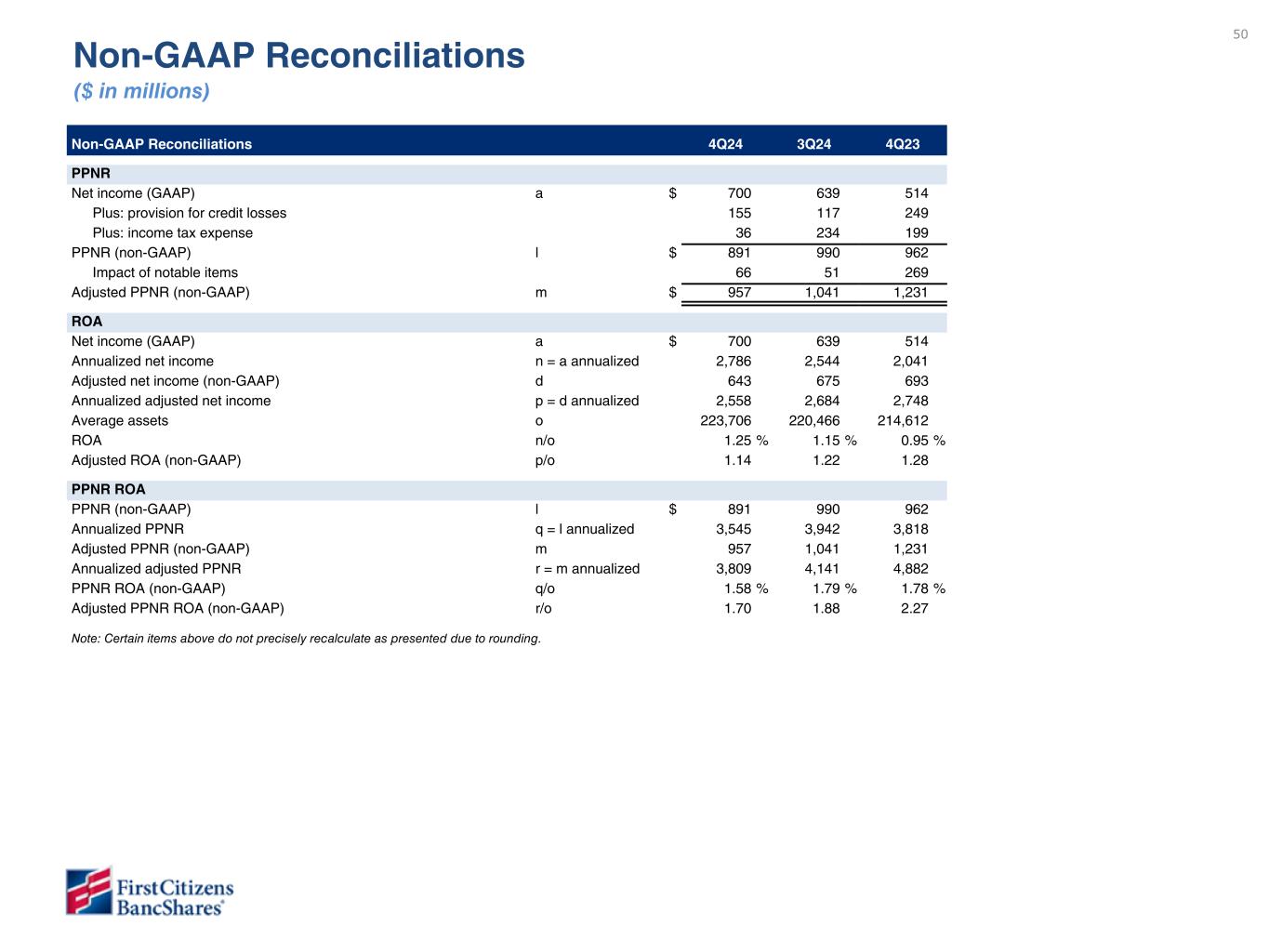

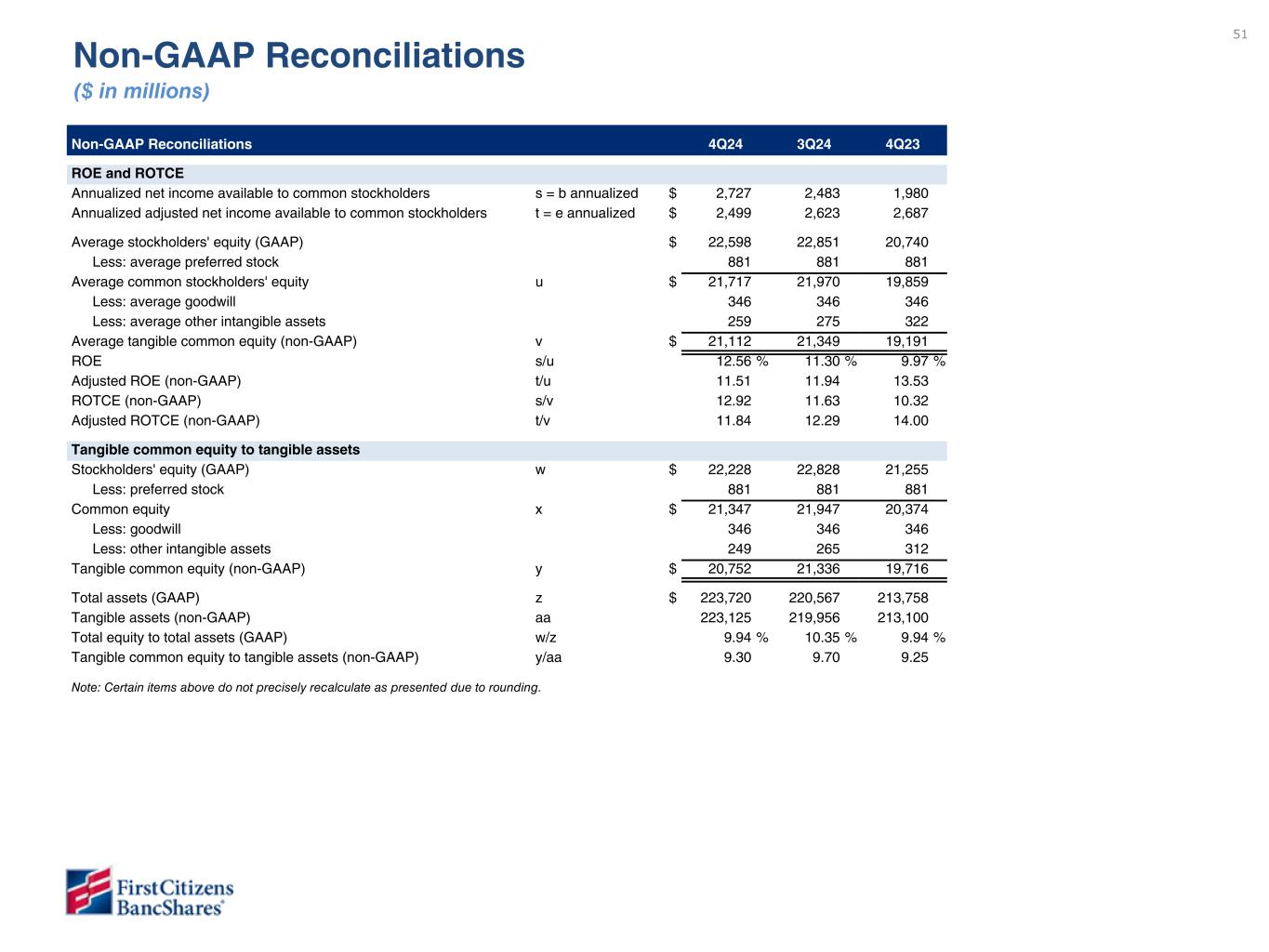

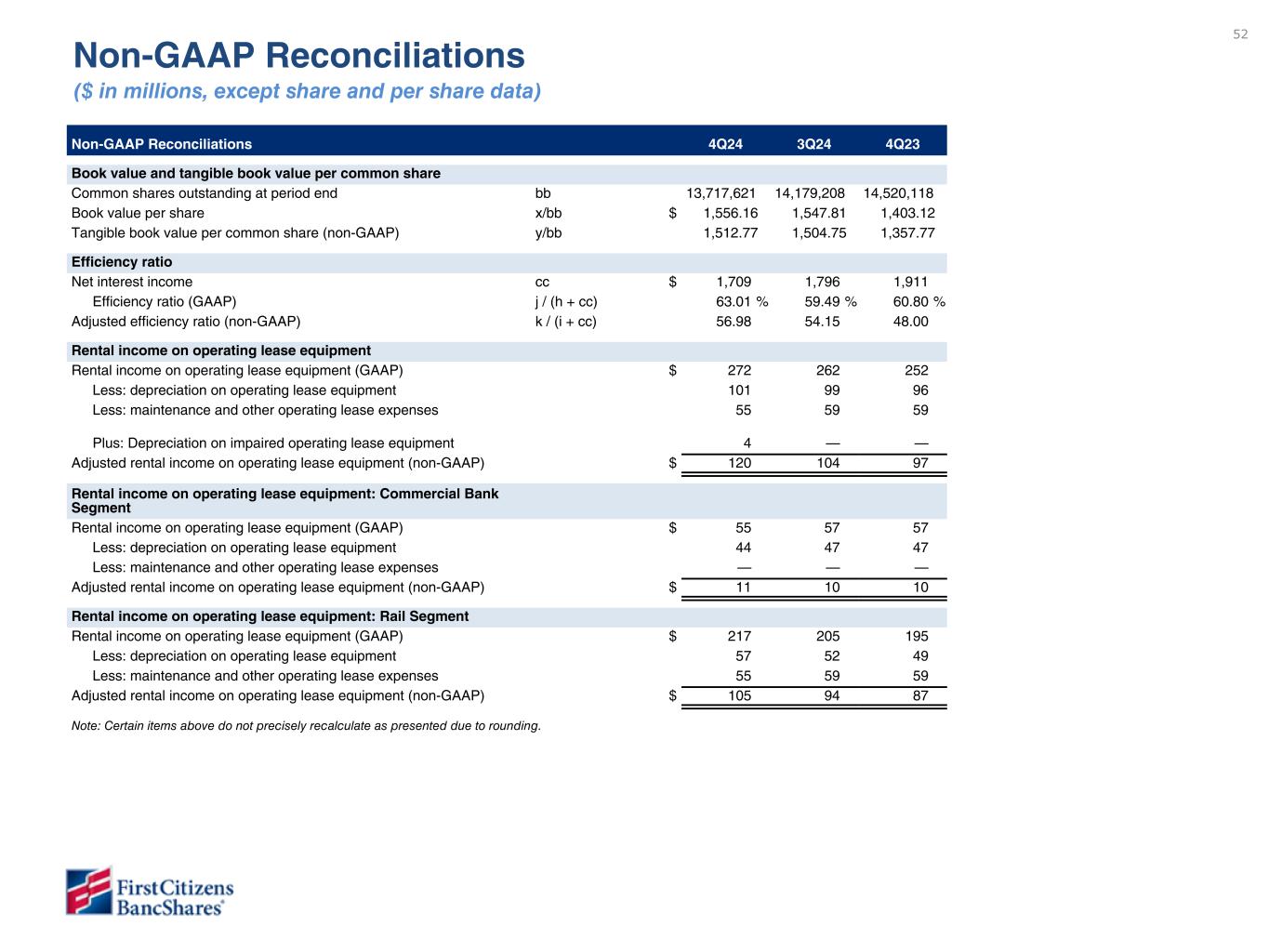

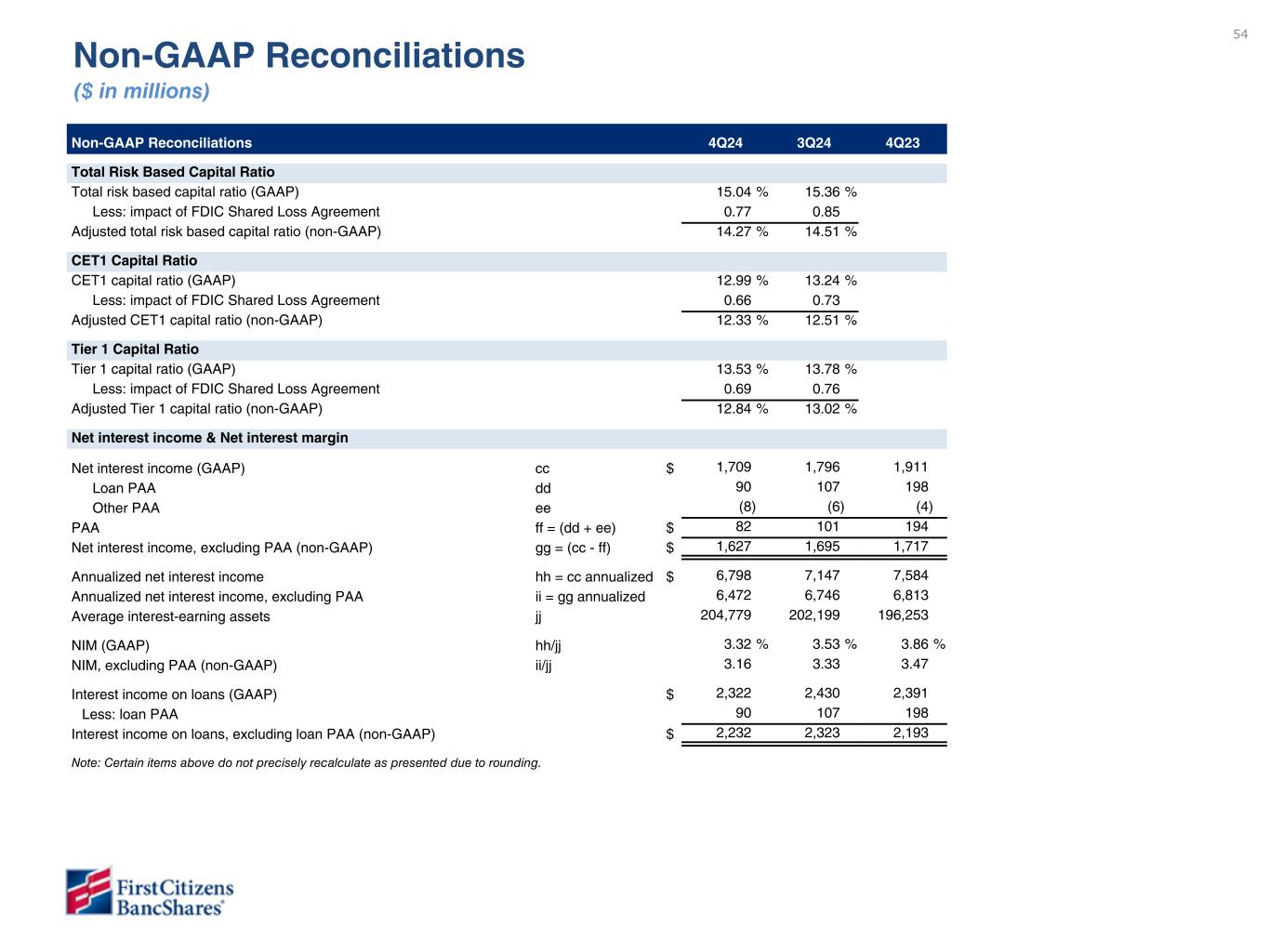

3 Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans, asset quality, future performance, and other strategic goals of BancShares. Words such as “anticipates,” “believes,” “estimates,” “expects,” “predicts,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will,” “potential,” “continue,” “aims” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BancShares’ current expectations and assumptions regarding BancShares’ business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other factors that are difficult to predict. Many possible events or factors could affect BancShares’ future financial results and performance and could cause actual results, performance or achievements of BancShares to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, general competitive, economic, political (including the new presidential administration), geopolitical events (including conflicts in Ukraine and the Middle East) and market conditions, including changes in competitive pressures among financial institutions and the impacts related to or resulting from previous bank failures, the risks and impacts of future bank failures and other volatility in the banking industry, public perceptions of our business practices, including our deposit pricing and acquisition activity, the financial success or changing conditions or strategies of BancShares’ vendors or customers, including changes in demand for deposits, loans and other financial services, fluctuations in interest rates, changes in the quality or composition of BancShares’ loan or investment portfolio, actions of government regulators, including recent interest rate cuts and any changes by the Board of Governors of the Federal Reserve Board (the “Federal Reserve”), changes to estimates of future costs and benefits of actions taken by BancShares, BancShares’ ability to maintain adequate sources of funding and liquidity, the potential impact of decisions by the Federal Reserve on BancShares’ capital plans, adverse developments with respect to U.S. or global economic conditions, including significant turbulence in the capital or financial markets, the impact of any sustained or elevated inflationary environment, the impact of any cyberattack, information or security breach, the impact of implementation and compliance with current or proposed laws, regulations and regulatory interpretations, including potential increased regulatory requirements, limitations, and costs, such as FDIC special assessments, increases to FDIC deposit insurance premiums and the proposed interagency rule on regulatory capital, along with the risk that such laws, regulations and regulatory interpretations may change, the availability of capital and personnel, and the risks associated with BancShares’ previous acquisition transactions, including the acquisition of certain assets and liabilities of Silicon Valley Bridge Bank, N.A. and the previously completed transaction with CIT Group Inc., or any future transactions. BancShares’ share repurchase program allows BancShares to repurchase shares of its Class A common stock through 2025. BancShares is not obligated under the share repurchase program to repurchase any minimum or particular number of shares, and repurchases may be suspended or discontinued at any time (subject to the terms of any Rule 10b5-1 plan in effect) without prior notice. The authorization to repurchase Class A common stock will be utilized at management’s discretion. The actual timing and amount of Class A common stock that may be repurchased will depend on a number of factors, including the terms of any Rule 10b5-1 plan then in effect, price, general business and market conditions, regulatory requirements, and alternative investment opportunities or capital needs. Except to the extent required by applicable laws or regulations, BancShares disclaims any obligation to update forward-looking statements or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Additional factors which could affect the forward-looking statements can be found in BancShares’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and its other filings with the SEC. Non-GAAP Measures Certain measures in this presentation, including those referenced as “adjusted” or “excluding PAA,” are “non-GAAP,” meaning they are numerical measures of BancShares’ financial performance, financial position or cash flows that are not presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”) because they exclude or include amounts or are adjusted in some way so as to be different than the most direct comparable measures calculated and presented in accordance with GAAP in BancShares’ statements of income, balance sheets or statements of cash flows and also are not codified in U.S. banking regulations currently applicable to BancShares. BancShares management believes that non-GAAP financial measures, when reviewed in conjunction with GAAP financial information, can provide transparency about or an alternative means of assessing its operating results, financial position or cash flows to its investors, analysts and management. These non-GAAP measures should be considered in addition to, and not superior to or a substitute for, GAAP measures. Each non-GAAP measure is reconciled to the most comparable GAAP measure in the non-GAAP reconciliation in Section V of this presentation. Certain financial results referenced as “Adjusted” in this presentation exclude notable items. The Adjusted financial measures are non-GAAP. Refer to Section V of this presentation for a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP measure. Reclassifications In certain instances, amounts reported for prior periods in this investor presentation have been reclassified to conform to the current financial statement presentation. Such reclassifications had no effect on previously reported stockholders’ equity or net income. BancShares modified its reportable segments during the first quarter of 2024. The Private Banking and Wealth Management components of the SVB segment were integrated into the General Bank segment. The SVB segment was renamed the SVB Commercial segment since it is comprised of the commercial business lines from the SVB acquisition, including Global Fund Banking and Technology and Healthcare Banking. The Direct Bank was previously allocated to the General Bank segment, but is now included in Corporate. Segment disclosures for 2023 periods included in this investor presentation were recast to reflect the segment reporting changes summarized above. Additionally, BancShares modified its loan disclosures by class in the first quarter of 2024. Loans were previously aggregated into Commercial, Consumer, and SVB portfolios, each of which consisted of several loan classes. Loans classes including the private bank, CRE, and other loan classes previously mapped to the SVB portfolio were mapped to the applicable loan classes within the Commercial and Consumer portfolios. The methodologies that we use to allocate items among our segments are dynamic and may be updated periodically to reflect enhanced expense base allocation drivers, changes in the risk profile of a segment or changes in our organizational structure. Accordingly, financial results may be revised periodically to reflect these enhancements. Important Notices

4 Glossary of Abbreviations and Acronyms The following is a list of certain abbreviations and acronyms used throughout this document. AFS – Available for Sale ALLL – Allowance for Loan and Lease Losses AOCI – Accumulated Other Comprehensive Income Bps – Basis point(s); 1 bp = 0.01% C&I – Commercial and Industrial CET1 – Common Equity Tier 1 CRE – Commercial Real Estate EOP – End of Period EPS – Earnings Per Share FDIC – Federal Deposit Insurance Corporation FFS – Fed Funds Sold FHLB – Federal Home Loan Bank FRB – Federal Reserve Bank FX – Foreign Exchange GAAP – United States Generally Accepted Accounting Principles HQLS – High-Quality Liquid Securities HTM – Held to Maturity IBD – Interest-Bearing Deposits ID – Investor Dependent LFI – Large Financial Institution MSA – Metropolitan Statistical Area NCO – Net Charge-Off NII – Net Interest Income NIM – Net Interest Margin NM – Not Meaningful NPL – Nonperforming Loans PAA – Purchase Accounting Accretion or Amortization PPNR – Pre-Provision Net Revenue QTD – Quarter-to-date ROA – Return on Average Assets ROE – Return on Average Common Stockholders’ Equity ROTCE – Return on Tangible Common Stockholders’ Equity SLA – Shared Loss Agreement with the FDIC TBV – Tangible Book Value VC – Venture Capital YTD – Year-to-date 4Q24 Additions 4Q24 Removals Archive ACL – Allowance for Credit Losses CAB - Community Association Banking NIB - Noninterest-bearing RBC - Risk-Based Capital TA - Tangible Assets TCE - Tangible Common Equity AUM – Assets Under Management AWA – Affluent Wealth Advisors LIBOR – London Inter-Bank Offered Rate LOC – Line of Credit MSA – Metropolitan Statistical Area PE – Private Equity RIA – Registered Investment Advisor SOFR – Secured Overnight Financing Rate LTD – Long Term Debt RWA – Risk Weighted Assets ACH – Automated clearing house CECL – Current Expected Credit Losses ETF – Exchange-Traded Fund FFR – Federal Funds Rate IPO – Initial Public Offering LP – Limited Partner VC – Venture Capital AI – Artificial Intelligence FFR – Federal Funds Rate FY – Full Year GFB – Global Fund Banking OBS – Off Balance Sheet Client Funds PCD – Purchased Credit Deteriorated To be updated in a subsequent draft as information becomes more concrete To be updated in subsequent draft

Fourth Quarter Overview & Strategic Priorities Section I

6 Fourth Quarter 2024 Snapshot Key Highlights: ■ Delivered strong return metrics aligned with our forecast despite headwinds from a declining policy rate. ■ Achieved loan and deposit growth across our operating segments. ■ Maintained strong capital and liquidity positions with the CET1 ratio ending the quarter at 12.99%. ■ Repurchased $963 million in Class A common shares (3.50% of Class A common) during 4Q24, bringing total repurchases since plan inception to $1.8 billion (6.44% of Class A common). ■ Appointed new board and Audit Committee member, effective January 2025. ■ Continued to support associates and clients impacted by recent natural disasters. Financial Results: Adjusted EPS (1) $45.10 Adjusted ROE / ROA (1) 11.51% / 1.14% NIM 3.32% Adjusted Efficiency Ratio (1) 56.98% Loan / Deposit Growth (2) 1.1% / 2.4% CET1 Ratio (3) 12.99% (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Loan and deposit growth percentages are quarter over quarter actual period end balances. (3) The CET1 ratio represents a BancShares ratio and is preliminary pending completion of quarterly regulatory filings.

7 2025 Strategic Priorities • Expand and grow our capabilities and products while harnessing the scale of the enterprise and maintaining a client- first focus. Client Focus • Attract, retain and develop associates who align with our long-term direction and culture while scaling for continued growth. Talent & Culture • Enhance processes and systems to reduce organizational complexity and maximize productivity. Operational Efficiency • Manage our balance sheet prudently to optimize our funding and liquidity profile while driving core deposit growth and enhancing returns. Balance Sheet Optimization Risk Management

Fourth Quarter 2024 Financial Results Section II

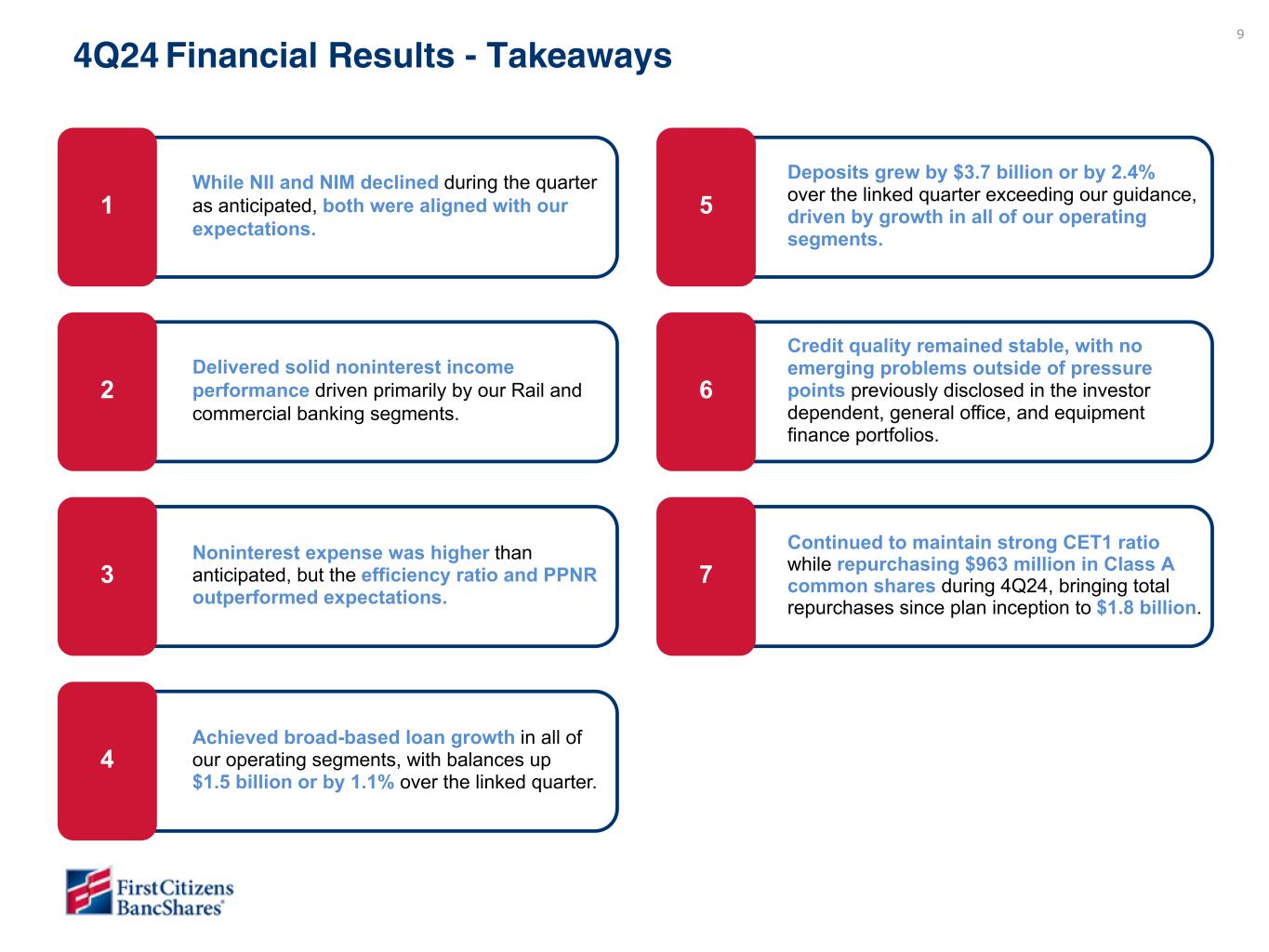

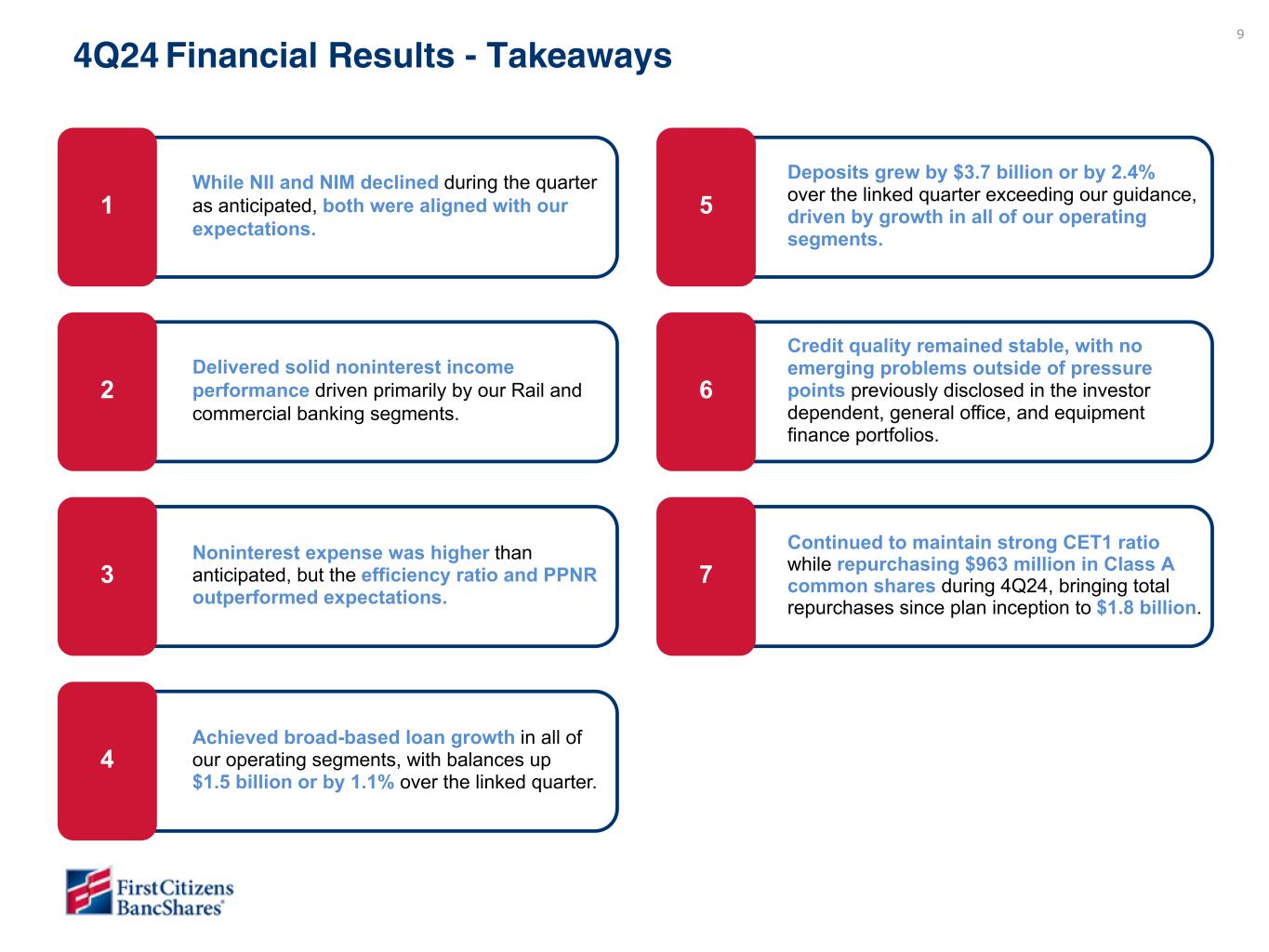

9 4Q24 Financial Results - Takeaways Quarter-to-date Year-to-date Mar 23 Dec 22 Mar 22 Mar 23 Dec 21 EPS $ 16.67 $ 20.94 $ 19.25 $ 20.77 $ 12.09 $ 12.82 $ 67.40 $ 77.24 $ 53.88 $ 51.88 ROE 11.05 % 13.89 % 12.49 % 13.47 % 10.96 % 11.63 % 11.15 % 12.78 % 12.84 % 12.36 % ROTCE 11.70 % 14.71 % 13.17 % 14.20 % 12.00 % 12.72 % 11.78 % 13.50 % 14.12 % 13.60 % ROA 0.93 % 1.15 % 1.16 % 1.24 % 1.20 % 1.09 % 1.01 % 1.15 % 1.33 % 1.10 % PPNR ROA 1.70 % 1.81 % 1.72 % 1.86 % 1.33 % 1.17 % 1.84 % 1.64 % 1.41 % 1.11 % NIM 3.36 % 3.36 % 3.40 % 3.40 % 2.56 % 2.56 % 3.14 % 3.14 % 2.55 % 2.55 % Net charge-off ratio 0.14 % 0.14 % 0.10 % 0.10 % 0.04 % 0.04 % 0.12 % 0.12 % 0.08 % 0.08 % Efficiency ratio 61.74 % 54.08 % 61.91 % 53.32 % 65.40 % 62.51 % 60.50 % 56.40 % 64.43 % 64.34 % Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) While NII and NIM declined during the quarter as anticipated, both were aligned with our expectations. 1 Continued to maintain strong CET1 ratio while repurchasing $963 million in Class A common shares during 4Q24, bringing total repurchases since plan inception to $1.8 billion. 7 Credit quality remained stable, with no emerging problems outside of pressure points previously disclosed in the investor dependent, general office, and equipment finance portfolios. 6 Delivered solid noninterest income performance driven primarily by our Rail and commercial banking segments. 2 Noninterest expense was higher than anticipated, but the efficiency ratio and PPNR outperformed expectations. 3 Deposits grew by $3.7 billion or by 2.4% over the linked quarter exceeding our guidance, driven by growth in all of our operating segments. 5 Achieved broad-based loan growth in all of our operating segments, with balances up $1.5 billion or by 1.1% over the linked quarter. 4

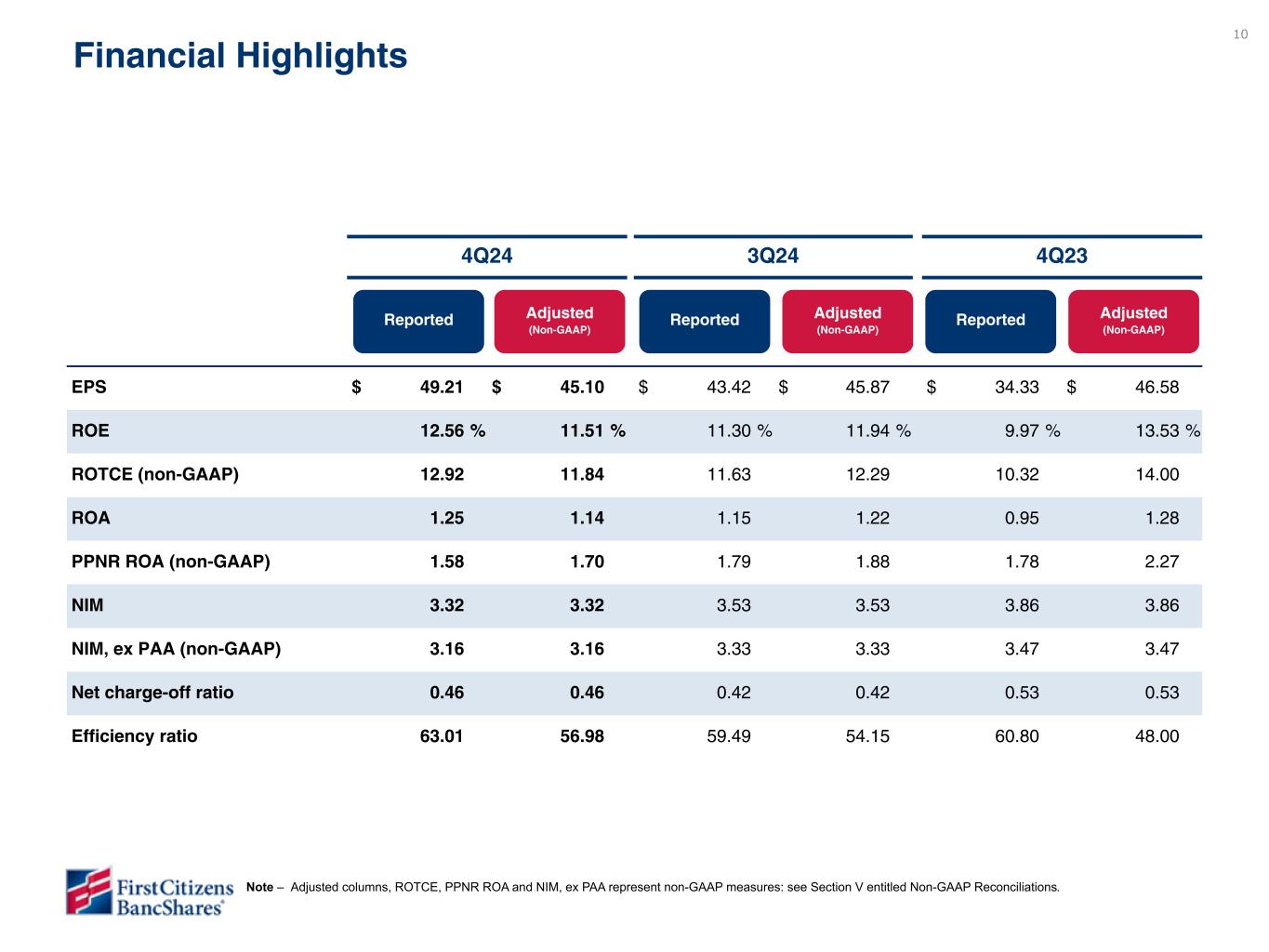

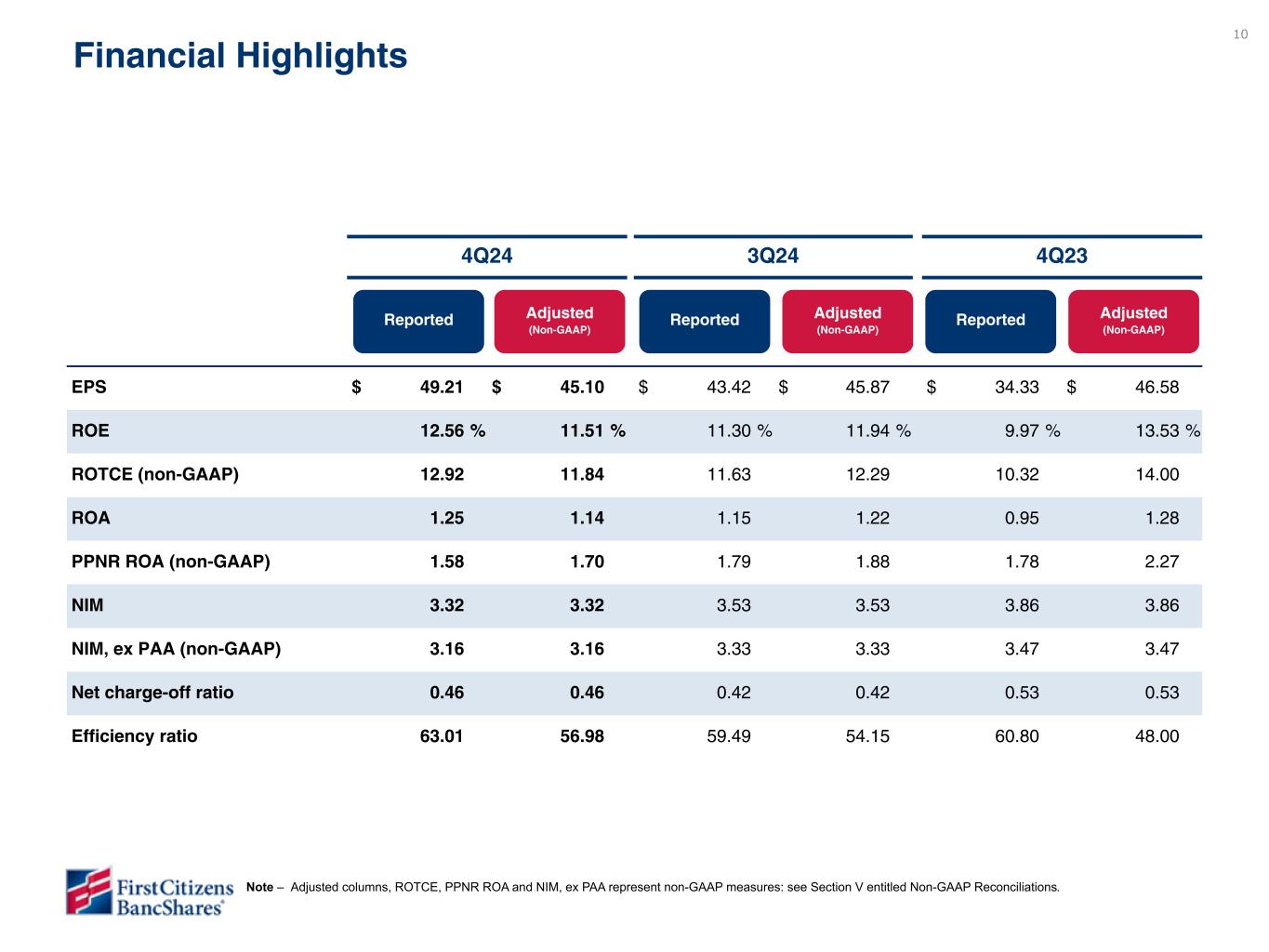

10 4Q24 3Q24 4Q23 EPS $ 49.21 $ 45.10 $ 43.42 $ 45.87 $ 34.33 $ 46.58 ROE 12.56 % 11.51 % 11.30 % 11.94 % 9.97 % 13.53 % ROTCE (non-GAAP) 12.92 11.84 11.63 12.29 10.32 14.00 ROA 1.25 1.14 1.15 1.22 0.95 1.28 PPNR ROA (non-GAAP) 1.58 1.70 1.79 1.88 1.78 2.27 NIM 3.32 3.32 3.53 3.53 3.86 3.86 NIM, ex PAA (non-GAAP) 3.16 3.16 3.33 3.33 3.47 3.47 Net charge-off ratio 0.46 0.46 0.42 0.42 0.53 0.53 Efficiency ratio 63.01 56.98 59.49 54.15 60.80 48.00 Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Financial Highlights Quarter-to-date Year-to-date Mar 23 Dec 22 Mar 22 Mar 23 Dec 21 EPS $ 16.67 $ 20.94 $ 19.25 $ 20.77 $ 12.09 $ 12.82 $ 67.40 $ 77.24 $ 53.88 $ 51.88 ROE 11.05 % 13.89 % 12.49 % 13.47 % 10.96 % 11.63 % 11.15 % 12.78 % 12.84 % 12.36 % ROTCE 11.70 % 14.71 % 13.17 % 14.20 % 12.00 % 12.72 % 11.78 % 13.50 % 14.12 % 13.60 % ROA 0.93 % 1.15 % 1.16 % 1.24 % 1.20 % 1.09 % 1.01 % 1.15 % 1.33 % 1.10 % PPNR ROA 1.70 % 1.81 % 1.72 % 1.86 % 1.33 % 1.17 % 1.84 % 1.64 % 1.41 % 1.11 % NIM 3.36 % 3.36 % 3.40 % 3.40 % 2.56 % 2.56 % 3.14 % 3.14 % 2.55 % 2.55 % Net charge-off ratio 0.14 % 0.14 % 0.10 % 0.10 % 0.04 % 0.04 % 0.12 % 0.12 % 0.08 % 0.08 % Efficiency ratio 61.74 % 54.08 % 61.91 % 53.32 % 65.40 % 62.51 % 60.50 % 56.40 % 64.43 % 64.34 % Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Note – Adjusted columns, ROTCE, PPNR ROA and NIM, ex PAA represent non-GAAP measures: see Section V entitled Non-GAAP Reconciliations.

11 Reported Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 1,709 $ 1,796 $ 1,911 $ (87) (4.9) % $ (202) (10.6) % Noninterest income 699 650 543 49 7.7 156 28.9 Net revenue 2,408 2,446 2,454 (38) (1.6) (46) (1.9) Noninterest expense 1,517 1,456 1,492 61 4.3 25 1.7 Pre-provision net revenue (1) 891 990 962 (99) (10.1) (71) (7.4) Provision for credit losses 155 117 249 38 31.4 (94) (37.8) Income before income taxes 736 873 713 (137) (15.7) 23 3.1 Income taxes 36 234 199 (198) (84.6) (163) (82.0) Net income 700 639 514 61 9.5 186 36.2 Preferred stock dividends 15 15 15 — (2.1) — (1.9) Net income available to common stockholders $ 685 $ 624 $ 499 $ 61 9.8 % $ 186 37.3 % Adjustments for notable items 4Q24 3Q24 4Q23 Noninterest income $ (183) $ (176) $ (88) Noninterest expense (249) (227) (357) Income taxes 123 15 90 Adjusted (Non-GAAP) (1) Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 1,709 $ 1,796 $ 1,911 $ (87) (4.9) % $ (202) (10.6) % Noninterest income 516 474 455 42 9.0 61 13.6 Net revenue 2,225 2,270 2,366 (45) (2.0) (141) (6.0) Noninterest expense 1,268 1,229 1,135 39 3.1 133 11.6 Pre-provision net revenue (1) 957 1,041 1,231 (84) (8.0) (274) (22.2) Provision for credit losses 155 117 249 38 31.4 (94) (37.8) Income before income taxes 802 924 982 (122) (13.1) (180) (18.3) Income taxes 159 249 289 (90) (35.8) (130) (44.8) Net income 643 675 693 (32) (4.7) (50) (7.1) Preferred stock dividends 15 15 15 — (2.1) — (1.9) Net income available to common stockholders $ 628 $ 660 $ 678 $ (32) (4.7) % $ (50) (7.3) % Quarterly Earnings Highlights ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations.

12 $1,717 $1,658 $1,681 $1,695 $1,627 3.47% 3.35% 3.36% 3.33% 3.16% NII, ex PAA (Non-GAAP) NIM, ex PAA (Non-GAAP) 4Q23 1Q24 2Q24 3Q24 4Q24 $1,911 $1,817 $1,821 $1,796 $1,709 3.86% 3.67% 3.64% 3.53% 3.32% NII NIM 4Q23 1Q24 2Q24 3Q24 4Q24 $2,441 $2,946 2.55% 3.14% YTD Dec 21 YTD Dec 22 YTD December 2022 vs YTD December 2021 Net interest income increased by $505 million due to a $483 million increase in interest income and a $22 million decrease in interest expense. The change in net interest income was primarily due to the following: ◦ $256 million increase on interest income on loans due to a higher yield and growth offset by lower SBA- PPP interest and fee income and lower accretion income, ◦ $138 million increase in interest income on investment securities due to higher yield and average balance, ◦ $118 million decline in interest expense on borrowings due to a lower rate and average balance, ◦ $89 million increase in interest income on overnight investments due to a higher yield despite a lower average balance; partially offset by a ◦ $96 million increase in interest expense on deposits due to a higher rate paid. NIM expanded from 2.55% to 3.14%. $505 million & 59 bps Highlights $(87) million & (-21 bps) Net interest income and margin ($ in millions) $(68) million & (-17 bps) 4Q24 vs 3Q24 Net interest income declined by $87 million due to a $137 million decrease in interest income, partially offset by a $50 million decrease in interest expense. The significant components of the changes follow: • $91 million decrease in interest income on loans (ex accretion income) primarily due to a lower yield, • $48 million decrease in interest income on overnight investments primarily due to a lower yield, and • $19 million decrease in accretion income; partially offset by • $19 million increase in interest income on investment securities primarily due to a higher average balance, • $47 million decrease in interest expense on deposits due to a lower rate paid, partially offset by a higher average balance, and • $3 million decrease in interest expense on borrowings. NIM contracted by 21 basis points from 3.53% to 3.32%. NIM, ex PAA contracted by 17 basis points from 3.33% to 3.16%. See the following page for a rollforward of NIM between 3Q24 and 4Q24. 4Q24 vs 4Q23 Net interest income declined by $202 million due to a $116 million decrease in interest income and a $86 million increase in interest expense. The significant components of the changes follow: • $183 million decrease in interest income on overnight investments due to a lower average balance and yield, • $113 million decrease in accretion income, and • $92 million increase in interest expense on deposits primarily due to a higher average balance; partially offset by • $136 million increase in interest income on investment securities due to a higher average balance and yield, • $39 million increase in interest income on loans (ex accretion income) due to a higher average balance, partially offset by a lower yield, and • $6 million decrease in interest expense on borrowings. NIM contracted 54 basis points from 3.86% to 3.32%. NIM, ex PAA contracted by 31 basis points from 3.47% to 3.16%. See the following page for a rollforward of NIM between 4Q23 and 4Q24. (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (1) (1)

13 3.86% 0.18% 0.04% 0.03% (0.31)% (0.22)% (0.15)% (0.11)% 3.32% 4Q23 Investment volume Debt volume Loan volume FFS volume PAA Earning asset yield Deposit volume / rate 4Q24 4Q23 to 4Q24 (-54 bps) NIM Rollforward 3.53% 0.12% (0.19)% (0.09)% (0.03)% (0.02)% 3.32% 3Q24 Deposit rate/volume Loan yield FFS yield PAA Earning asset mix 4Q24 3Q24 to 4Q24 (-21 bps) (1) (1) Includes purchase accounting impact between March 27, 2023 and March 31, 2023.

14 Historical and Forecasted Cumulative Deposit Beta Highlights • Our total cumulative deposit beta peaked in August prior to the September rate cuts. We are forecasting our cumulative down cycle beta to increase in the first quarter as the full effect of the initial rate cuts pull through. • Longer term, we expect betas to be in the 30% range for total deposits and in the 45-50% range for interest-bearing deposits. • Mid/higher beta categories: ◦ > 30% beta on Direct Bank and SVB Commercial money market, savings and time deposit accounts. ◦ 20 to 30% beta on Branch Network commercial money market accounts and Community Association Banking checking with interest and money market accounts. • Lower beta categories: ◦ 0 to 20% beta on total noninterest bearing deposits and Branch Network consumer money market accounts, checking with interest and savings accounts. 23% 30% 37% 42% 45% 46% 47% 12% 20% 29%31% 46% 53% 58% 61% 63% 64% 16% 26% 44% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 - Jul/ Aug 3Q24 - Sep 4Q24 1Q25 Up Cycle Down Cycle Terminal beta 2.61% 2.64% 2.46% Rate paid on deposits 2.53% 43% 43% 41% 43% 42% 57% 57% 59% 57% 58% Mid/higher beta categories Lower beta categories 4Q23 1Q24 2Q24 3Q24 4Q24 Total Deposits Actual cumulative beta Forecast cumulative beta Forecast cumulative beta IBDActual cumulative beta IBD

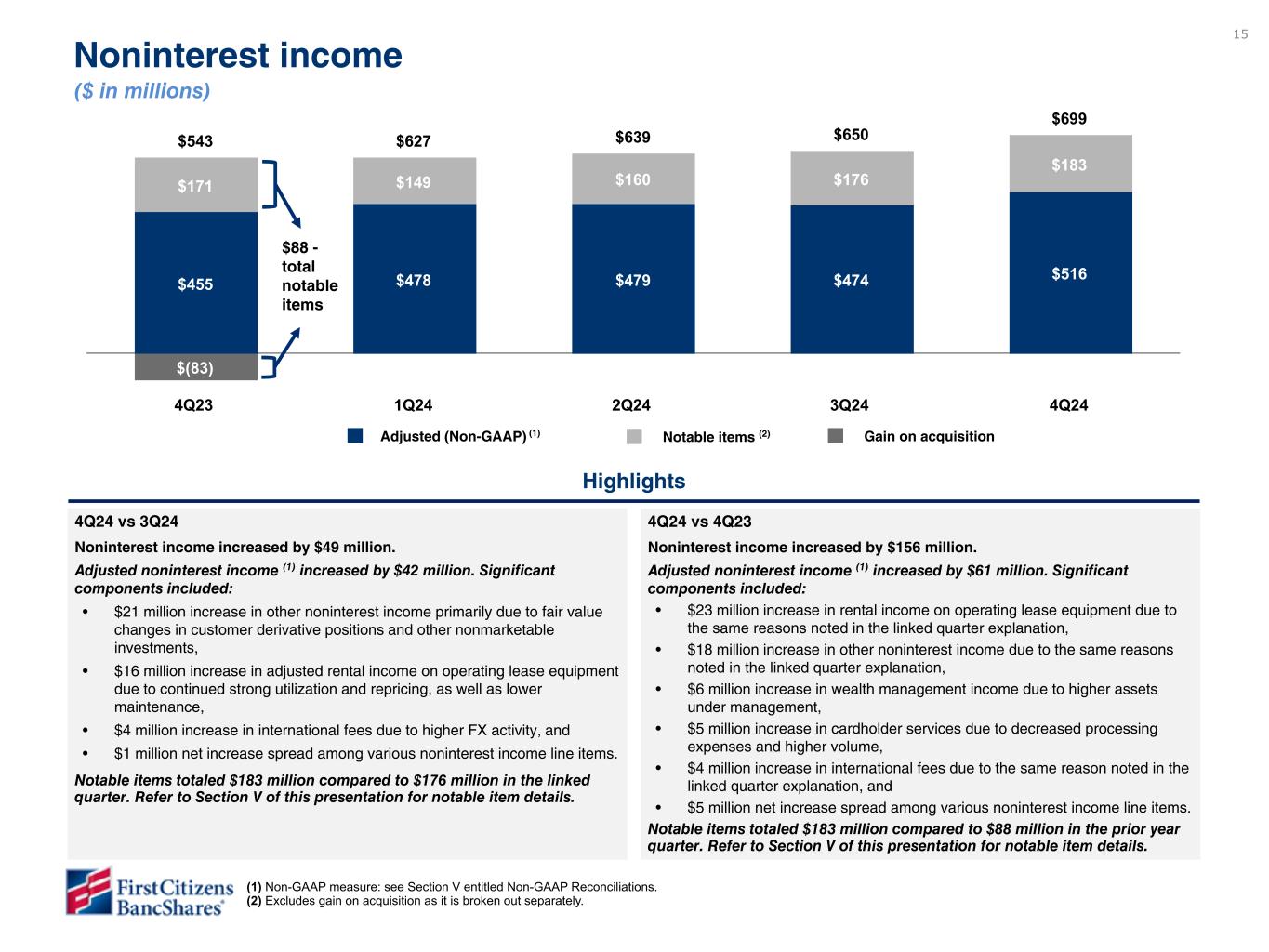

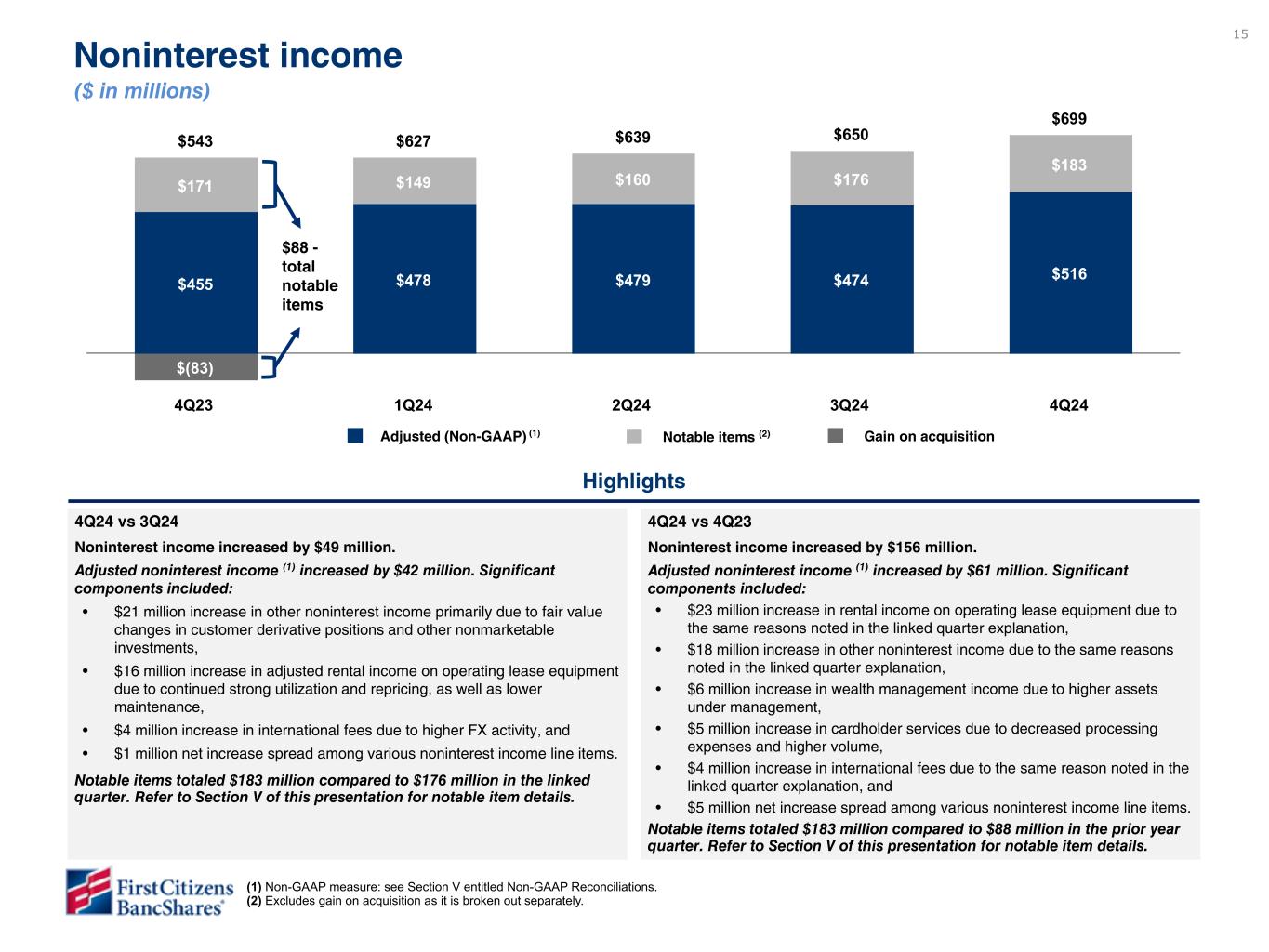

15 $543 $627 $639 $650 $699 $455 $478 $479 $474 $516 $171 $149 $160 $176 $183 $(83) 4Q23 1Q24 2Q24 3Q24 4Q24 $295 $183 1Q23 SVB contribution $1,940 $2,136 $996 $1,141 $944 $995 YTD Dec 21 YTD Dec 22 4Q24 vs 3Q24 Noninterest income increased by $49 million. Adjusted noninterest income (1) increased by $42 million. Significant components included: • $21 million increase in other noninterest income primarily due to fair value changes in customer derivative positions and other nonmarketable investments, • $16 million increase in adjusted rental income on operating lease equipment due to continued strong utilization and repricing, as well as lower maintenance, • $4 million increase in international fees due to higher FX activity, and • $1 million net increase spread among various noninterest income line items. Notable items totaled $183 million compared to $176 million in the linked quarter. Refer to Section V of this presentation for notable item details. YTD22 vs YTD21 Noninterest income increased $196 million. Significant components of the change were: ◦ Rental income on operating leases increased $91 million due to the same reasons as in the linked quarter. Expenses on operating lease equipment declined $16 million resulting in a $107 million increase in adjusted rental income. ◦ Cardholder services income, net increased $15 million due to higher volume and fee income and other service charges increased $14 million, primarily due to higher capital markets and portfolio servicing fees. ◦ Wealth management services increased $13 million due to increased brokerage transactions and higher assets under management. ◦ Other noninterest income increased $63 million spread among various line items, including a $431 million bargain purchase gain, partially offset by a $147 million decline in investment gains and a $188 million decline in gains on asset and loan sales. Highlights Noninterest income ($ in millions) Core: ### increase 4Q24 vs 4Q23 Noninterest income increased by $156 million. Adjusted noninterest income (1) increased by $61 million. Significant components included: • $23 million increase in rental income on operating lease equipment due to the same reasons noted in the linked quarter explanation, • $18 million increase in other noninterest income due to the same reasons noted in the linked quarter explanation, • $6 million increase in wealth management income due to higher assets under management, • $5 million increase in cardholder services due to decreased processing expenses and higher volume, • $4 million increase in international fees due to the same reason noted in the linked quarter explanation, and • $5 million net increase spread among various noninterest income line items. Notable items totaled $183 million compared to $88 million in the prior year quarter. Refer to Section V of this presentation for notable item details. Adjusted (Non-GAAP) (1) Notable items (2) Gain on acquisition $88 - total notable items $183 - total notable items $516 - total adjusted (Non-GAAP) (1) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Excludes gain on acquisition as it is broken out separately. $88 - total notable items

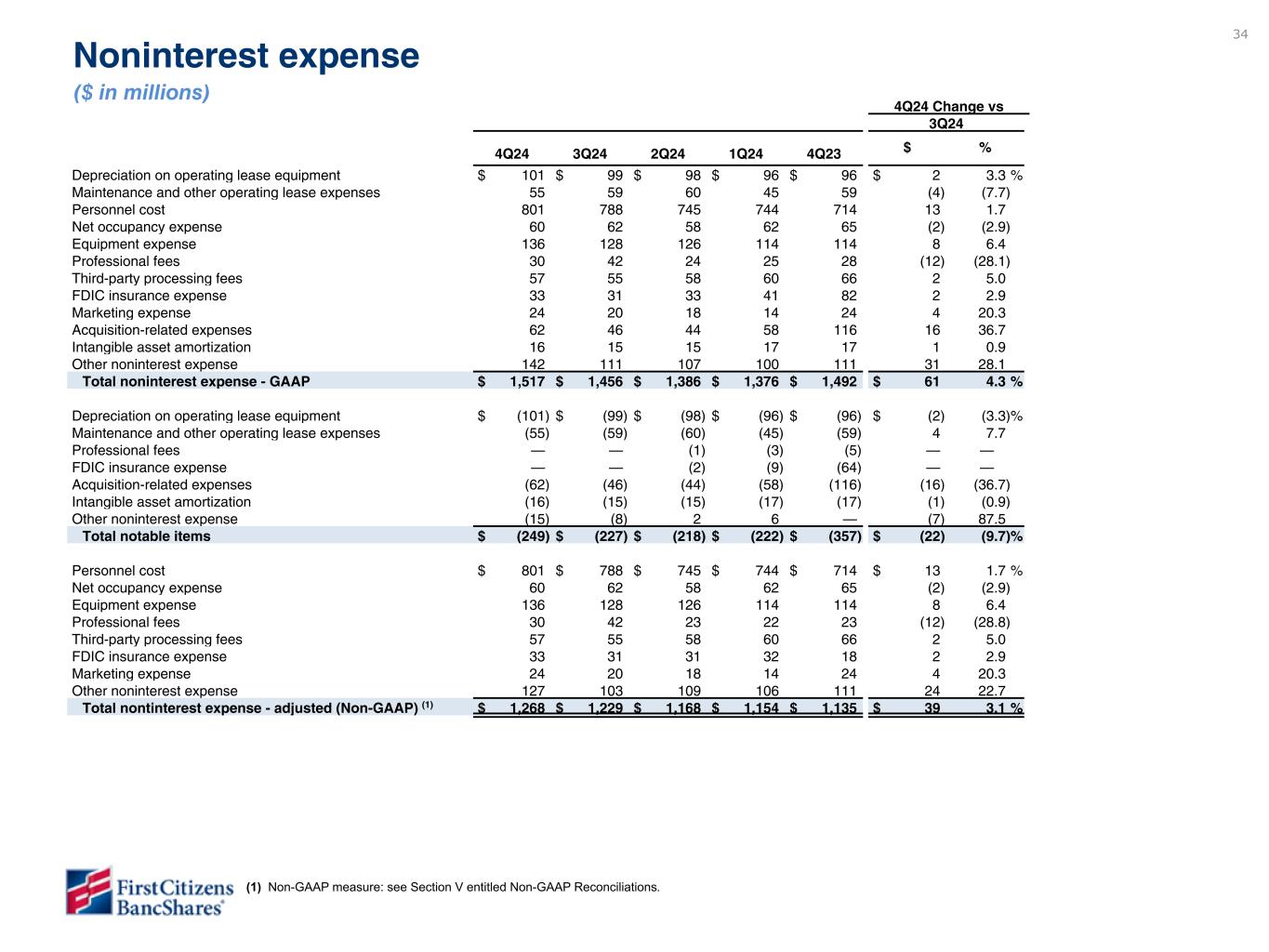

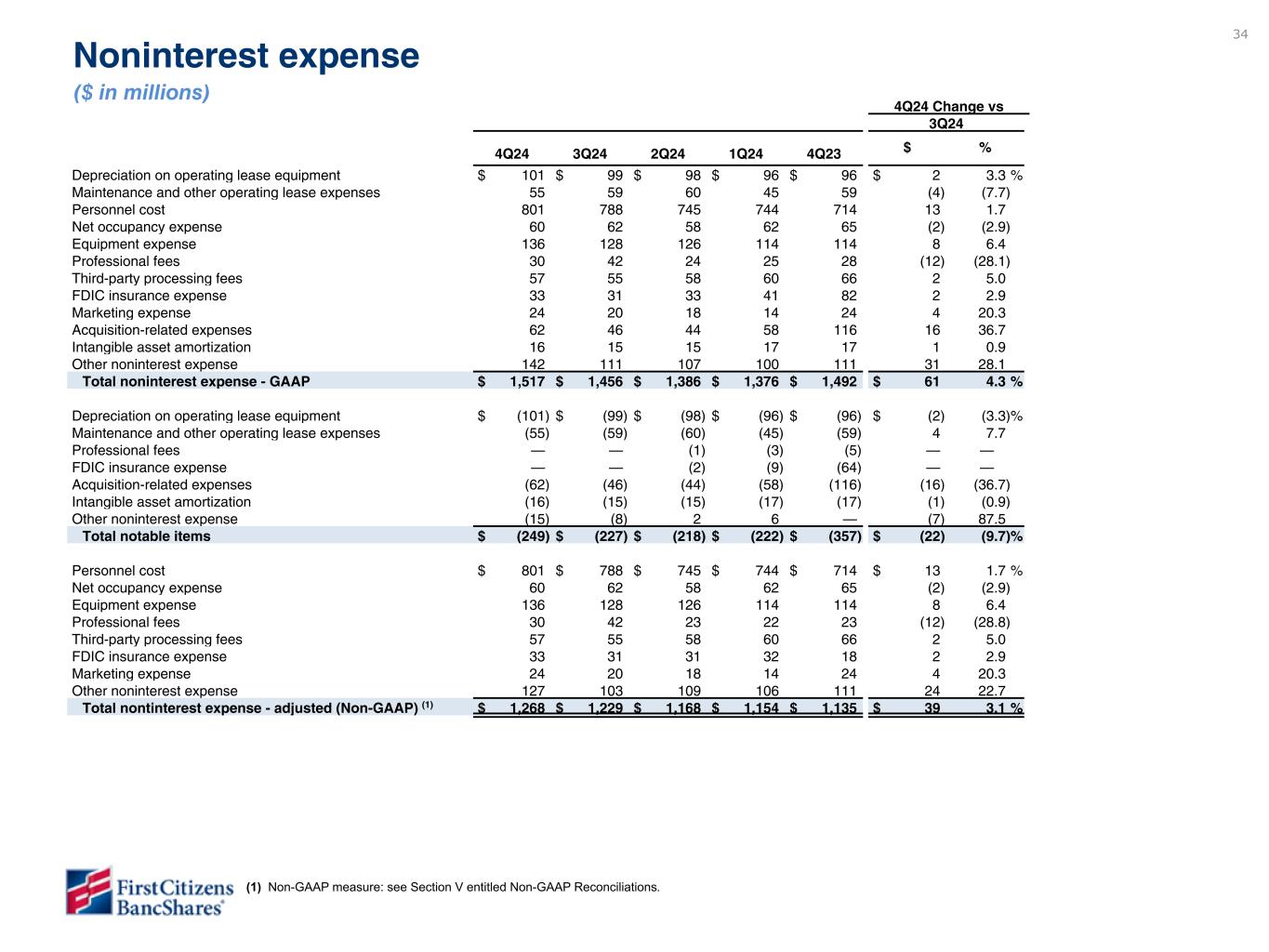

16 4Q24 vs 4Q23 Noninterest expense increased by $25 million. Adjusted noninterest expense (1) increased by $133 million. Significant components included: • $87 million increase in personnel cost primarily due to net staff additions, increased benefit expenses and higher temporary labor costs associated with technology projects, • $22 million increase in equipment expense due to the same reason noted in the linked quarter explanation, • $16 million increase in other noninterest expense spread among miscellaneous items, and • $15 million increase in FDIC insurance expense primarily due to a larger average balance; partially offset by • $9 million decrease in third-party processing fees, and • $5 million decrease in net occupancy expense. Notable items totaled $249 million compared to $357 million in the prior year quarter. Refer to Section V of this presentation for notable items details. Adjusted efficiency ratio (1) increased from 48.00% to 56.98%. 4Q24 vs 3Q24 Noninterest expense increased by $61 million. Adjusted noninterest expense (1) increased by $39 million. Significant components included: • $24 million increase in other noninterest expense driven by higher state related non-income taxes, charitable donations to support relief efforts for recent hurricanes, and other miscellaneous items, • $13 million increase in personnel cost primarily due to net staff additions, higher revenue related incentive compensation and increased benefit expenses, and • $8 million increase in equipment expense primarily due to ongoing technology investments; partially offset by • $12 million decrease in professional fees. Notable items totaled $249 million compared to $227 million in the linked quarter. Refer to Section V of this presentation for notable item details. Adjusted efficiency ratio (1) increased from 54.15% to 56.98%. Notable items $1,492 $1,376 $1,386 $1,456 $1,517 $1,135 $1,154 $1,168 $1,229 $1,268 $357 $222 $218 $227 $249 4Q23 1Q24 2Q24 3Q24 4Q24 YTD22 vs YTD21 Noninterest expense increased $252 million. Significant components of the change were: ◦ Merger-related expenses increased $194 million. ◦ Salaries and benefits expense increased $53 million as a result of merger-related costs, wage increases, revenue- based incentives and temporary personnel costs, partially offset by net staff reductions. ◦ Marketing costs increased $23 million due to the same reasons as the quarterly increases. ◦ Third-party processing expenses increased $14 million and other operating expenses increased $14 million; ◦ Partially offset by an $18 million reduction in FDIC insurance premiums, a $16 million decline in expenses on operating leases, and a $12 million reduction in professional fees. Efficiency ratio improved from 64.43% to 60.50%. Adjusted efficiency ratio improved from 64.34% to 56.40% as adjusted net revenue grew 19% and adjusted noninterest expense grew 4%. Noninterest expense ($ in millions) $2,823 $3,075 $2,212 $2,305 $611 $770 YTD Dec 21 YTD Dec 22 Adjusted (Non-GAAP) (1) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. Highlights

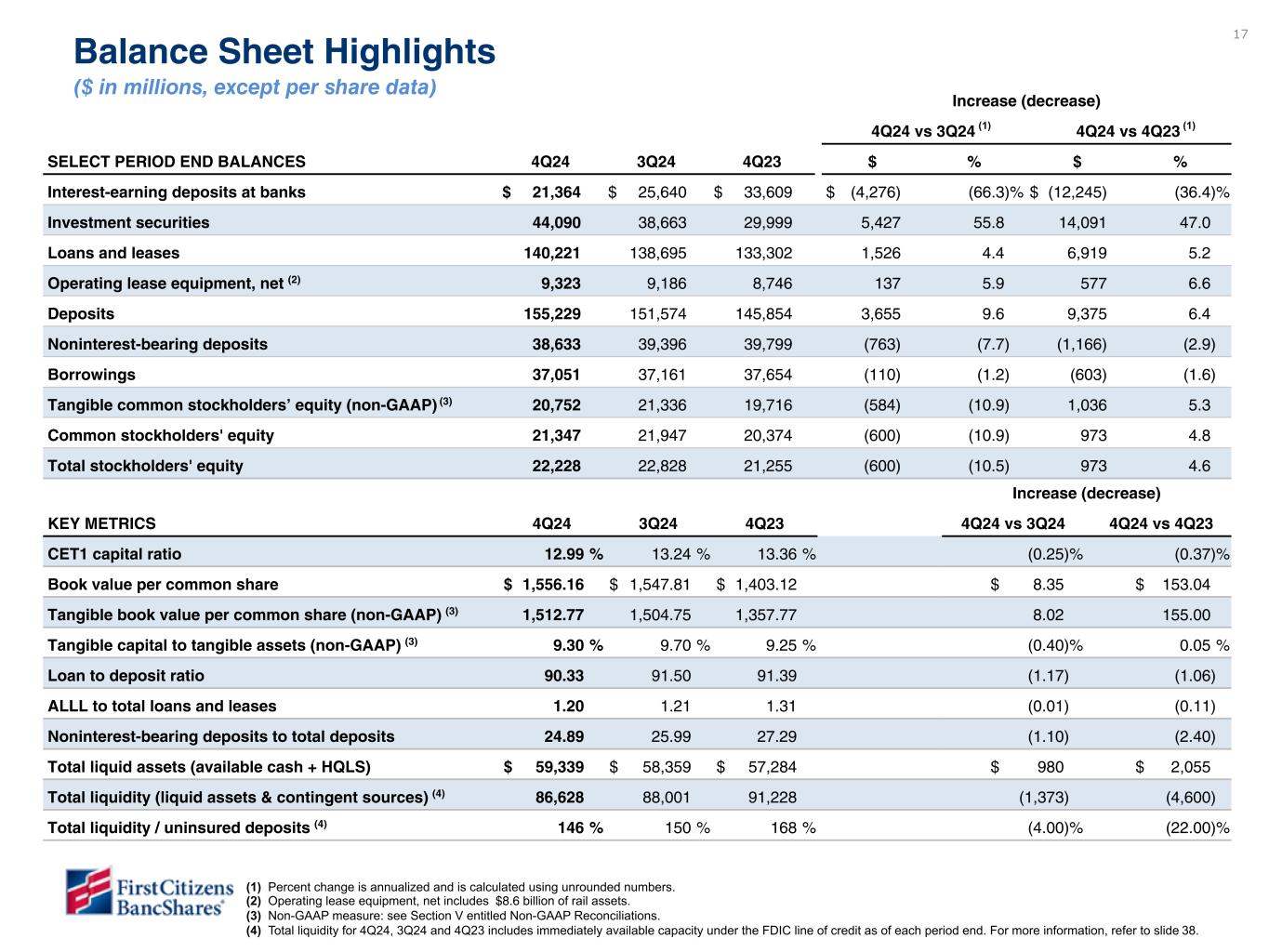

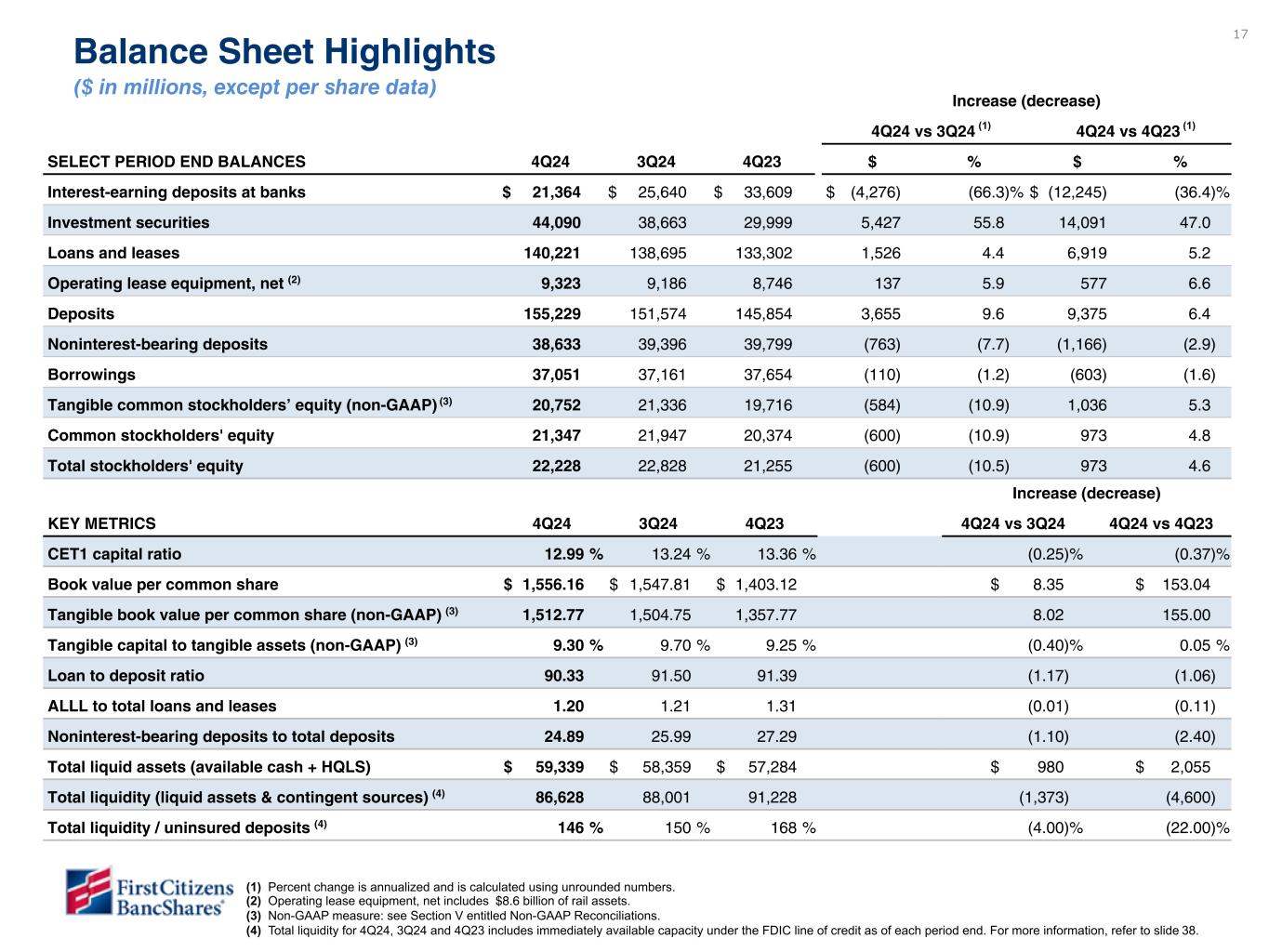

17 17 Increase (decrease) 4Q24 vs 3Q24 4Q24 vs 4Q23 SELECT PERIOD END BALANCES 4Q24 3Q24 4Q23 $ % $ % Interest-earning deposits at banks $ 21,364 $ 25,640 $ 33,609 $ (4,276) (66.3) % $ (12,245) (36.4) % Investment securities 44,090 38,663 29,999 5,427 55.8 14,091 47.0 Loans and leases 140,221 138,695 133,302 1,526 4.4 6,919 5.2 Operating lease equipment, net (2) 9,323 9,186 8,746 137 5.9 577 6.6 Deposits 155,229 151,574 145,854 3,655 9.6 9,375 6.4 Noninterest-bearing deposits 38,633 39,396 39,799 (763) (7.7) (1,166) (2.9) Borrowings 37,051 37,161 37,654 (110) (1.2) (603) (1.6) Tangible common stockholders’ equity (non-GAAP) (3) 20,752 21,336 19,716 (584) (10.9) 1,036 5.3 Common stockholders' equity 21,347 21,947 20,374 (600) (10.9) 973 4.8 Total stockholders' equity 22,228 22,828 21,255 (600) (10.5) 973 4.6 Increase (decrease) KEY METRICS 4Q24 3Q24 4Q23 4Q24 vs 3Q24 4Q24 vs 4Q23 CET1 capital ratio 12.99 % 13.24 % 13.36 % (0.25) % (0.37) % Book value per common share $ 1,556.16 $ 1,547.81 $ 1,403.12 $ 8.35 $ 153.04 Tangible book value per common share (non-GAAP) (3) 1,512.77 1,504.75 1,357.77 8.02 155.00 Tangible capital to tangible assets (non-GAAP) (3) 9.30 % 9.70 % 9.25 % (0.40) % 0.05 % Loan to deposit ratio 90.33 91.50 91.39 (1.17) (1.06) ALLL to total loans and leases 1.20 1.21 1.31 (0.01) (0.11) Noninterest-bearing deposits to total deposits 24.89 25.99 27.29 (1.10) (2.40) Total liquid assets (available cash + HQLS) $ 59,339 $ 58,359 $ 57,284 $ 980 $ 2,055 Total liquidity (liquid assets & contingent sources) (4) 86,628 88,001 91,228 (1,373) (4,600) Total liquidity / uninsured deposits (4) 146 % 150 % 168 % (4.00) % (22.00) % Balance Sheet Highlights ($ in millions, except per share data) (1) (1) (1) Percent change is annualized and is calculated using unrounded numbers. (2) Operating lease equipment, net includes $8.6 billion of rail assets. (3) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (4) Total liquidity for 4Q24, 3Q24 and 4Q23 includes immediately available capacity under the FDIC line of credit as of each period end. For more information, refer to slide 38.

18 $133,302 $135,370 $139,341 $138,695 $140,221 $62,832 $63,732 $65,195 $66,092 $66,768 $30,959 $31,792 $32,178 $32,751 $33,259 $39,511 $39,846 $41,968 $39,852 $40,194 General Bank Commercial Bank SVB Commercial Yield on loans 4Q23 1Q24 2Q24 3Q24 4Q24 Highlights 4Q24 vs 3Q24 • Total loans increased $1.5 billion or by 1.1% sequentially (4.4% annualized). The increase in loans was driven by a $676 million increase in the General Bank, a $508 million increase in the Commercial Bank, and a $342 million increase in SVB Commercial. • General Bank growth was driven by continued strong performance in business and commercial loans. Growth in the Commercial Bank was concentrated in our industry verticals. • The increase in the SVB Commercial segment was driven by growth in Global Fund Banking, partially offset by a decline in the Tech and Healthcare business as repayment levels continue to outpace new loan originations. 4Q24 vs 4Q23 • Total loans increased $6.9 billion or by 5.2%. The increase in loans was driven by a $3.9 billion (6.3%) increase in the General Bank, a $2.3 billion (7.3%) increase in the Commercial Bank, and a $683 million (1.7%) increase in the SVB Commercial segment. • Loan growth in all operating segments was due to the same reasons noted in the linked quarter explanations. Loans and Leases ($ in millions, period end balances) 7.03% 7.15%7.15%7.21% 6.69% 10.1% (1) (1) Commercial Bank includes a small amount of Rail loans (less than $100 million in all periods). Rail operating lease assets are not included in the loan totals.

19 12% 4% 4% 2% 1% 25% 8% 7% 8% 29% Commercial Finance ($16.8) Real Estate Finance ($6.4) Equipment Finance ($5.8) Commercial Services - Factoring ($2.5) Middle Market Banking ($1.8) Branch Network ($35.2) Wealth ($10.6) Mortgage ($10.2) Other ($10.7) SVB Commercial ($40.2) 27% 24%20% 18% 9% 2% Commercial mortgage ($38.1) Commercial and industrial ($33.7) Global Fund Banking ($27.9) 1-4 family residential ($25.7) Innovation lending ($12.3) Other ($2.5) Class Segment 4Q24 Loans and Leases Composition ($ in billions, period end balances) Commercial Bank: General Bank: SVB Commercial: Note – Rail operating lease assets are not included in the loan totals. Totals may not foot due to rounding.

20 $145,854 $149,609 $151,079 $151,574 $155,229 $106,055 $110,333 $111,063 $112,178 $116,596 $39,799 $39,276 $40,016 $39,396 $38,633 4Q23 1Q24 2Q24 3Q24 4Q24 2.64% 2.61% 2.53% 2.35% 2.46% Highlights Interest-bearing Noninterest-bearing Cost of deposits Deposits ($ in millions, period end balances) $140,050 $66,686 $24,105 $18,715 $30,544 1Q23 4Q24 vs. 3Q24 • Total deposits increased $3.7 billion or by 2.4% sequentially (9.6% annualized), driven by a $1.6 billion increase in the Direct Bank, a $893 million increase in the General Bank due to growth in the Branch Network, a $692 million increase in SVB Commercial driven by Tech and Healthcare business and a $529 million increase in the Commercial Bank. 4Q24 vs. 4Q23 • Total deposits grew $9.4 billion or by 6.4%, driven primarily by a $4.3 billion increase in the General Bank due to growth in the Branch Network, a $3.4 billion increase in the Direct Bank and a $1.9 billion increase in the SVB Commercial segment driven by growth in both the Global Fund Banking and Tech and Healthcare businesses.

21 42% 5%2% 24% 26% 1% Branch Network, Wealth & Other ($65.6) Community Association Banking ($7.5) Commercial Bank ($3.3) SVB Commercial ($36.6) Direct Bank ($41.0) Other ($1.2) Commercial Bank: 50% 25% 16% 9% Money market & savings ($78.0) Noninterest-bearing demand ($38.6) Checking with interest ($25.3) Time deposits ($13.3) General Bank: Corporate: Type Segment 4Q24 Deposit Composition (period end balances, $ in billions, except average account size) Insured vs Uninsured 62% 38% Insured Uninsured Average Account Size and Insured by Segment Total deposits Average size Insured % General Bank $ 73.1 $ 35,648 66 % Commercial Bank 3.3 280,886 14 % SVB Commercial 36.6 518,710 29 % Corporate 42.2 57,579 87 % Total $ 155.2 $ 54,171 62 % SVB Commercial: Note – Totals may not foot due to rounding. Insured deposit information by segment remains under review with Treasury

Internal 22 US VC investment (1)Loans Total client funds (Avg)Total client funds (EOP) SVB Commercial Segment Trends Continued pressure from market challenges remain, but underlying business activity continues to be strong. $92.8 $92.9 $95.0 $93.7 $99.0 $58.0 $58.9 $59.2 $57.8 $62.3 $34.7 $34.0 $35.9 35.9 36.6 Off balance sheet client funds Deposits 4Q23 1Q24 2Q24 3Q24 4Q24 $93.7 $92.4 $93.2 $93.8 $97.7 $58.9 $58.4 $59.0 $58.3 $61.0 $34.7 $33.9 $34.3 $35.5 $36.7 Off balance sheet client funds Deposits 4Q23 1Q24 2Q24 3Q24 4Q24 $39.5 $39.8 $42.0 $39.9 $40.2$40.8 $39.1 $40.8 $41.0 $40.0 EOP Average 4Q23 1Q24 2Q24 3Q24 4Q24 39 39 49 48 80 84 91 100 80 75 45 38 54 36 35 38 41 50 44 75 Deal Value ($B) 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 $5.3 billion or 5.6% $3.9 billion or 4.1% (1) US VC investment data is sourced using PitchBook Data, Inc. and subject to prior period revisions.

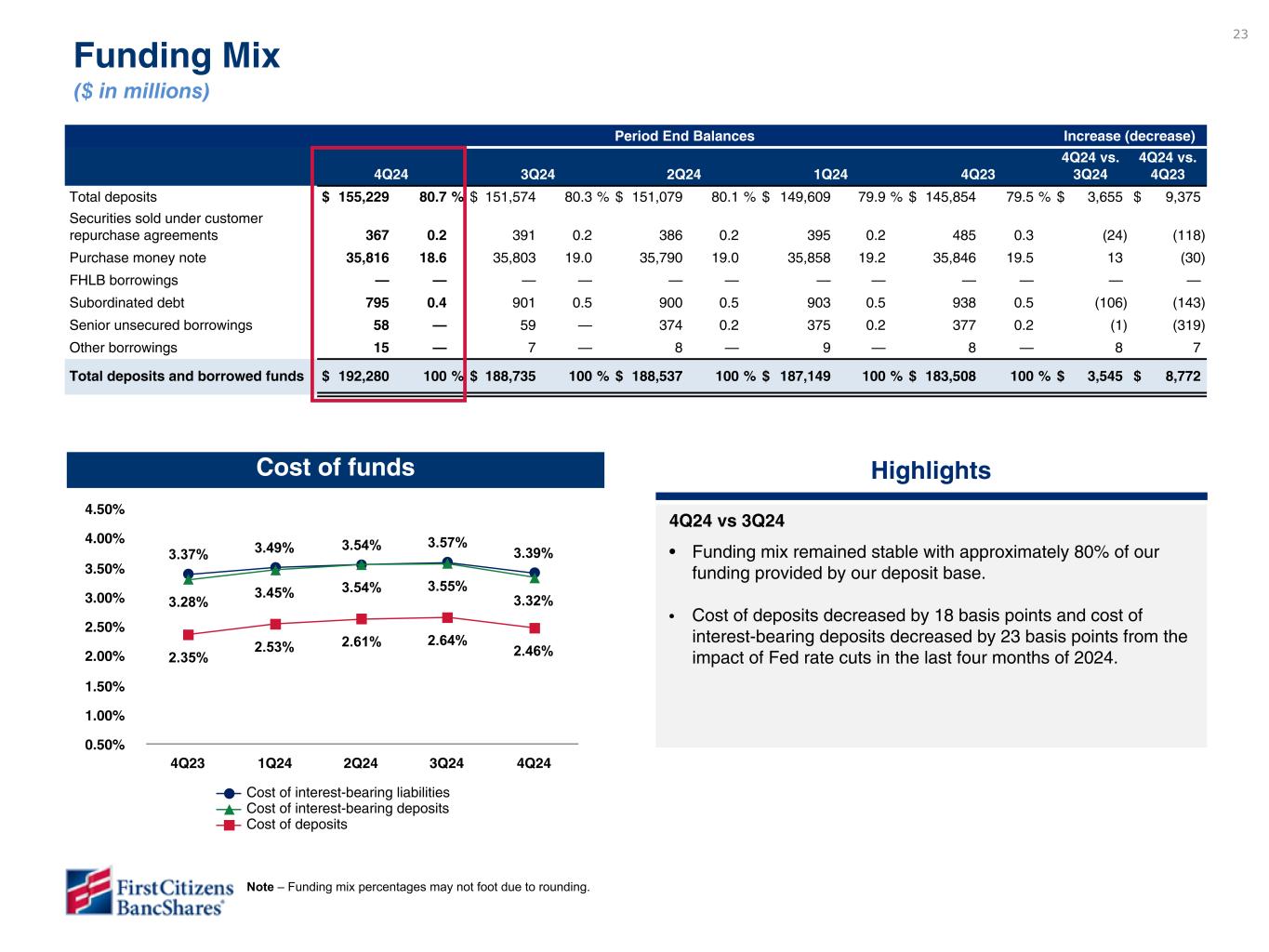

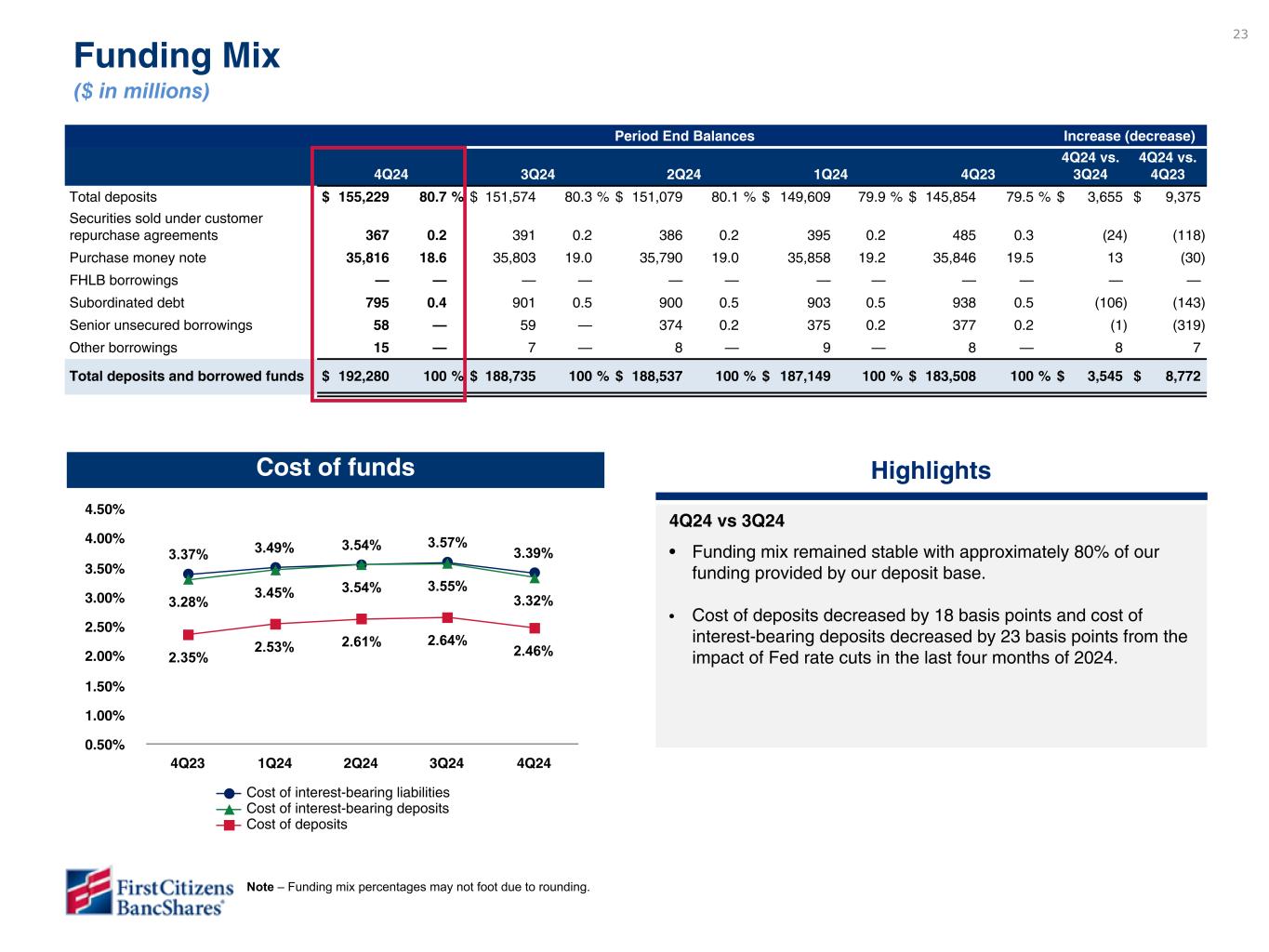

23 3.37% 3.49% 3.54% 3.57% 3.39% 3.28% 3.45% 3.54% 3.55% 3.32% 2.35% 2.53% 2.61% 2.64% 2.46% Cost of interest-bearing liabilities Cost of interest-bearing deposits Cost of deposits 4Q23 1Q24 2Q24 3Q24 4Q24 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% Cost of funds Additional sources of liquidity Categories $ in millions FHLB $ 9,218 FRB 4,203 Line of credit 100 Total $ 13,521 Period End Balances Increase (decrease) 4Q24 3Q24 2Q24 1Q24 4Q23 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Total deposits $ 155,229 80.7 % $ 151,574 80.3 % $ 151,079 80.1 % $ 149,609 79.9 % $ 145,854 79.5 % $ 3,655 $ 9,375 Securities sold under customer repurchase agreements 367 0.2 391 0.2 386 0.2 395 0.2 485 0.3 (24) (118) Purchase money note 35,816 18.6 35,803 19.0 35,790 19.0 35,858 19.2 35,846 19.5 13 (30) FHLB borrowings — — — — — — — — — — — — Subordinated debt 795 0.4 901 0.5 900 0.5 903 0.5 938 0.5 (106) (143) Senior unsecured borrowings 58 — 59 — 374 0.2 375 0.2 377 0.2 (1) (319) Other borrowings 15 — 7 — 8 — 9 — 8 — 8 7 Total deposits and borrowed funds $ 192,280 100 % $ 188,735 100 % $ 188,537 100 % $ 187,149 100 % $ 183,508 100 % $ 3,545 $ 8,772 Funding Mix ($ in millions) Highlights 4Q24 vs 3Q24 • Funding mix remained stable with approximately 80% of our funding provided by our deposit base. • Cost of deposits decreased by 18 basis points and cost of interest-bearing deposits decreased by 23 basis points from the impact of Fed rate cuts in the last four months of 2024. Note – Funding mix percentages may not foot due to rounding. To be updated in subsequent draft

24 $249 $64 $95 $117 $155 Provision for credit losses 4Q23 1Q24 2Q24 3Q24 4Q24 Credit Quality Trends and Allowance ($ in millions) Net charge-offs & NCO ratio Provision for credit losses $177 $103 $132 $145 $160 0.53% 0.31% 0.38% 0.42% 0.46% NCO $ QTD NCO ratio YTD NCO ratio 4Q23 1Q24 2Q24 3Q24 4Q24 $969 $1,074 $1,141 $1,244 $1,184 0.73% 0.79% 0.82% 0.90% 0.84% Nonaccrual loans Nonaccrual loans to total loans 4Q23 1Q24 2Q24 3Q24 4Q24 Nonaccrual loans / total loans & leases Allowance & ALLL ratio $1,747 $1,737 $1,700 $1,678 $1,676 1.31% 1.28% 1.22% 1.21% 1.20% ALLL ALLL ratio 4Q23 1Q24 2Q24 3Q24 4Q24 0.39%0.47% 0.31% 0.35% 0.37% Nonaccrual loan balance and % to total loans numbers are draft pending final SVB Commercial segment data To be updated in subsequent draft

25 $1,678 $(6) $(1) $(1) $5 $1 $1,676 3Q24 Specific reserves Portfolio change Credit quality Loan volume Economic outlook 4Q24 Highlights 4Q24 vs 3Q24 • ALLL decreased $2 million compared to the linked quarter reflecting lower specific reserves as loans that were previously reserved for were charged off in the quarter, partially offset by growth in higher credit quality loan portfolios. • The ALLL covered annualized net charge-offs 2.6 times and provided 1.4 times coverage of nonaccrual loans. ALLL Coverage 2.5x 4.2x 3.2x 2.9x 2.6x 1.8x 1.6x 1.5x 1.4x 1.4x ALLL ratio / NCO ratio ALLL / Nonaccrual loans 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 to 4Q24 Allowance for loan and lease losses ($ in millions) Please do not review - data still being finalized. To be provided in subsequent draft. To be updated in subsequent draft

26 9.83% 10.11% 10.29% 10.17% 9.90% Tier 1 Leverage ratio 4Q23 1Q24 2Q24 3Q24 4Q24 Risk-based capital ratios Capital ratio rollforward Tier 1 Leverage ratio Tangible book value per share (1) Capital Risk-Based Capital Tier 1 Leverage Total Tier 1 CET1 December 31, 2023 15.75 % 13.94 % 13.36 % 9.83 % Net income 1.70 % 1.70 % 1.70 % 1.23 % Change in risk-weighted/average assets -0.48 % -0.43 % -0.41 % -0.34 % Shared loss agreement coverage runoff -0.73 % -0.65 % -0.63 % 0.00 % Share repurchases -1.02 % -1.02 % -1.02 % -0.76 % Tier 2 Instrument Call/Phase Outs -0.12 % 0.00 % 0.00 % 0.00 % Common dividends -0.06 % -0.06 % -0.06 % -0.04 % Preferred dividends -0.04 % -0.04 % -0.04 % -0.03 % Other 0.04 % 0.09 % 0.09 % 0.01 % December 31, 2024 15.04 % 13.53 % 12.99 % 9.90 % Change since December 31, 2023 -0.71 % -0.41 % -0.37 % 0.07 % 13.36% 13.44% 13.33% 13.24% 12.99% 13.94% 14.00% 13.87% 13.78% 13.53% 15.75% 15.66% 15.45% 15.36% 15.04% CET1 Tier 1 Total 4Q23 1Q24 2Q24 3Q24 4Q24 $1,357.77 $202.28 $1.40 ($41.81) ($6.87) $1,512.77 4Q23 Retained earnings AOCI Share repurchases Common dividends 4Q24 Note – The above capital ratios represent BancShares ratios and are preliminary pending completion of quarterly regulatory filings. (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. 12.33% 12.84% 14.27% 4Q24 Adjusted Risk-based Capital Ratios (excludes impact from the SLA) (1) DRAFT Capital numbers - subject to change DRAFT - Pending updated rollforward from capital team

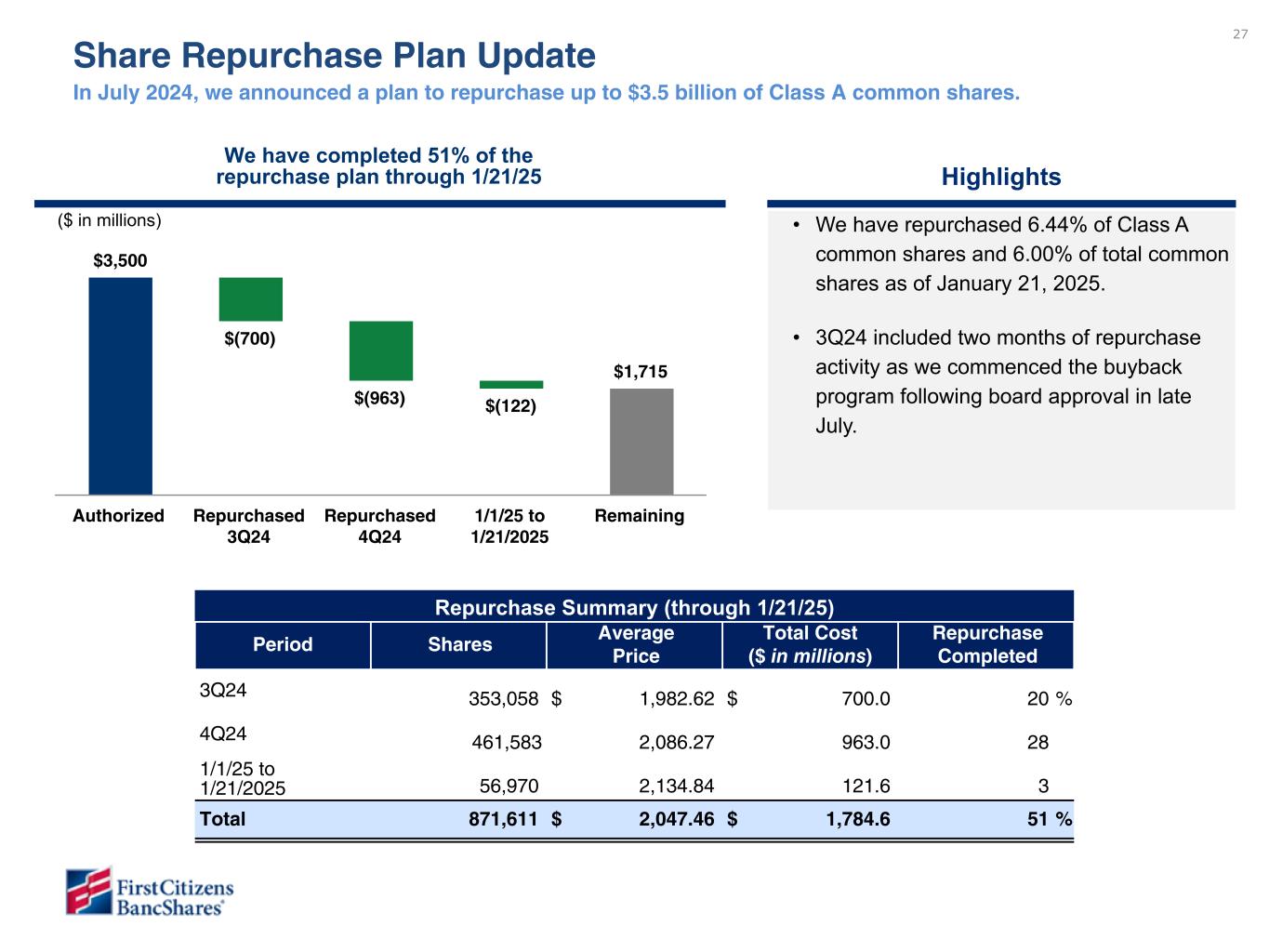

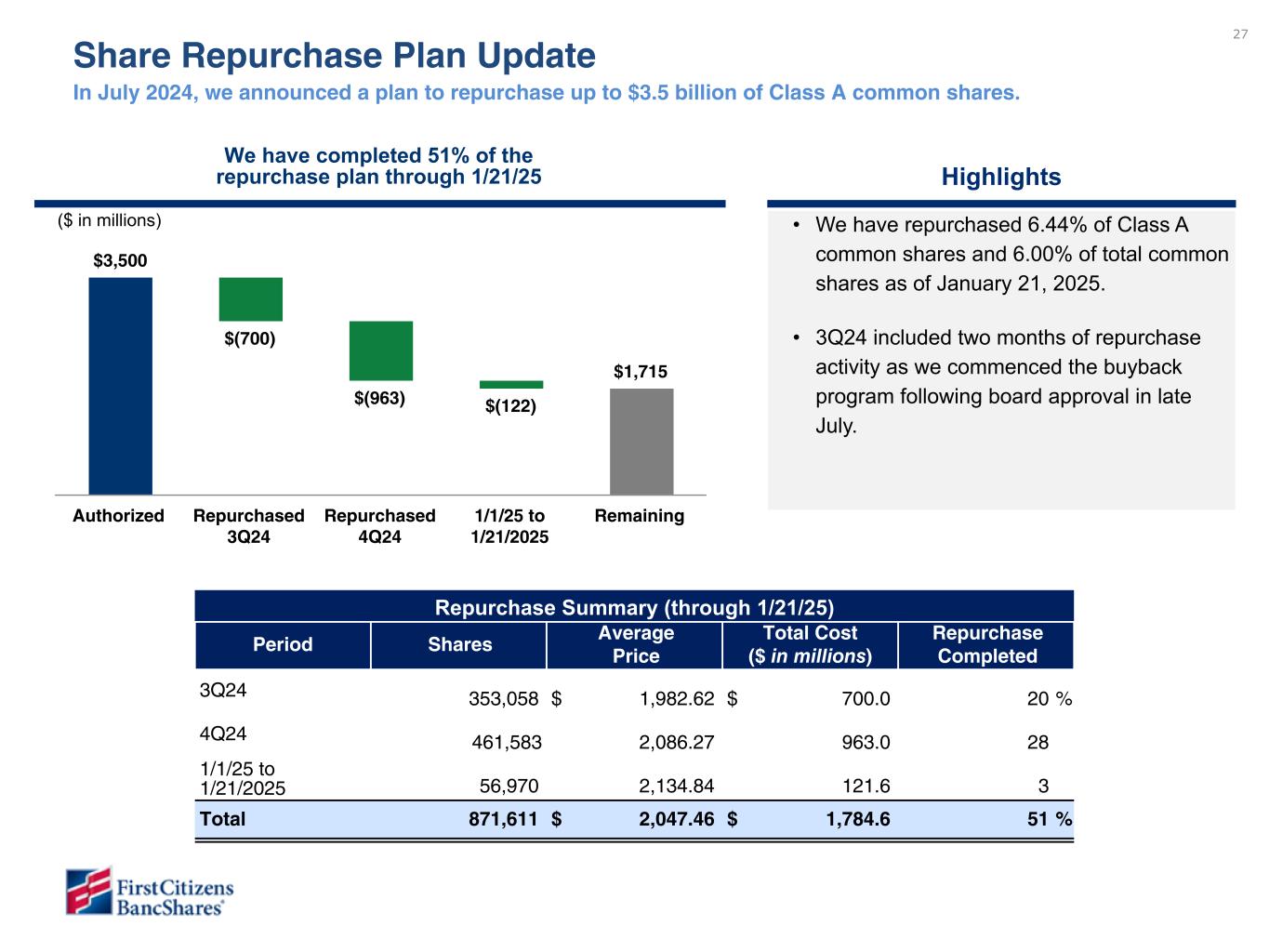

27 Share Repurchase Plan Update In July 2024, we announced a plan to repurchase up to $3.5 billion of Class A common shares. • We have repurchased 6.44% of Class A common shares and 6.00% of total common shares as of January 21, 2025. • 3Q24 included two months of repurchase activity as we commenced the buyback program following board approval in late July. Highlights We have completed 51% of the repurchase plan through 1/21/25 Repurchase Summary (through 1/21/25) Period Shares Average Price Total Cost ($ in millions) Repurchase Completed 3Q24 353,058 $ 1,982.62 $ 700.0 20 % 4Q24 461,583 2,086.27 963.0 28 1/1/25 to 1/21/2025 56,970 2,134.84 121.6 3 Total 871,611 $ 2,047.46 $ 1,784.6 51 % $3,500 $(700) $(963) $(122) $1,715 Authorized Repurchased 3Q24 Repurchased 4Q24 1/1/25 to 1/21/2025 Remaining ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. • We have repurchased 6.44% of Class A common shares and 6.00% of total common shares as of November 22, 2024. • 3Q24 included two months of repurchase activity as we commenced the buyback program following board approval in late July. • Despite share repurchase activity, our adjusted CET1 ratio (1) increased slightly from the linked quarter, as strong earnings and slower loan growth offset the impact of repurchases for the quarter. • The average repurchase price to date is $2,047.46 and the estimated TBV earn back is approximately 3 years. To be updated in subsequent draft - share repurchase plan information is as of 1/08/25 but will be updated to 1/21/25

Financial Outlook Section III

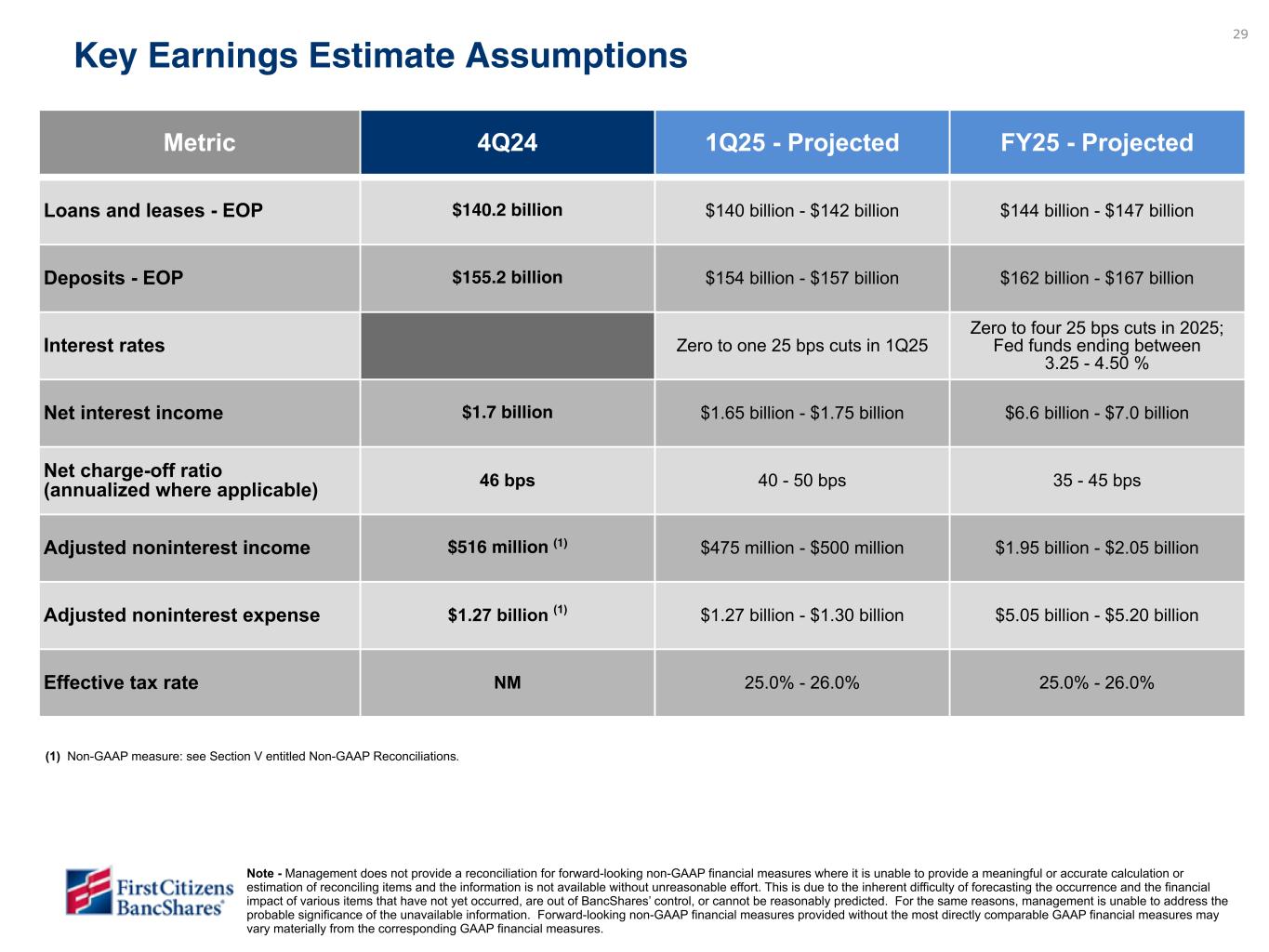

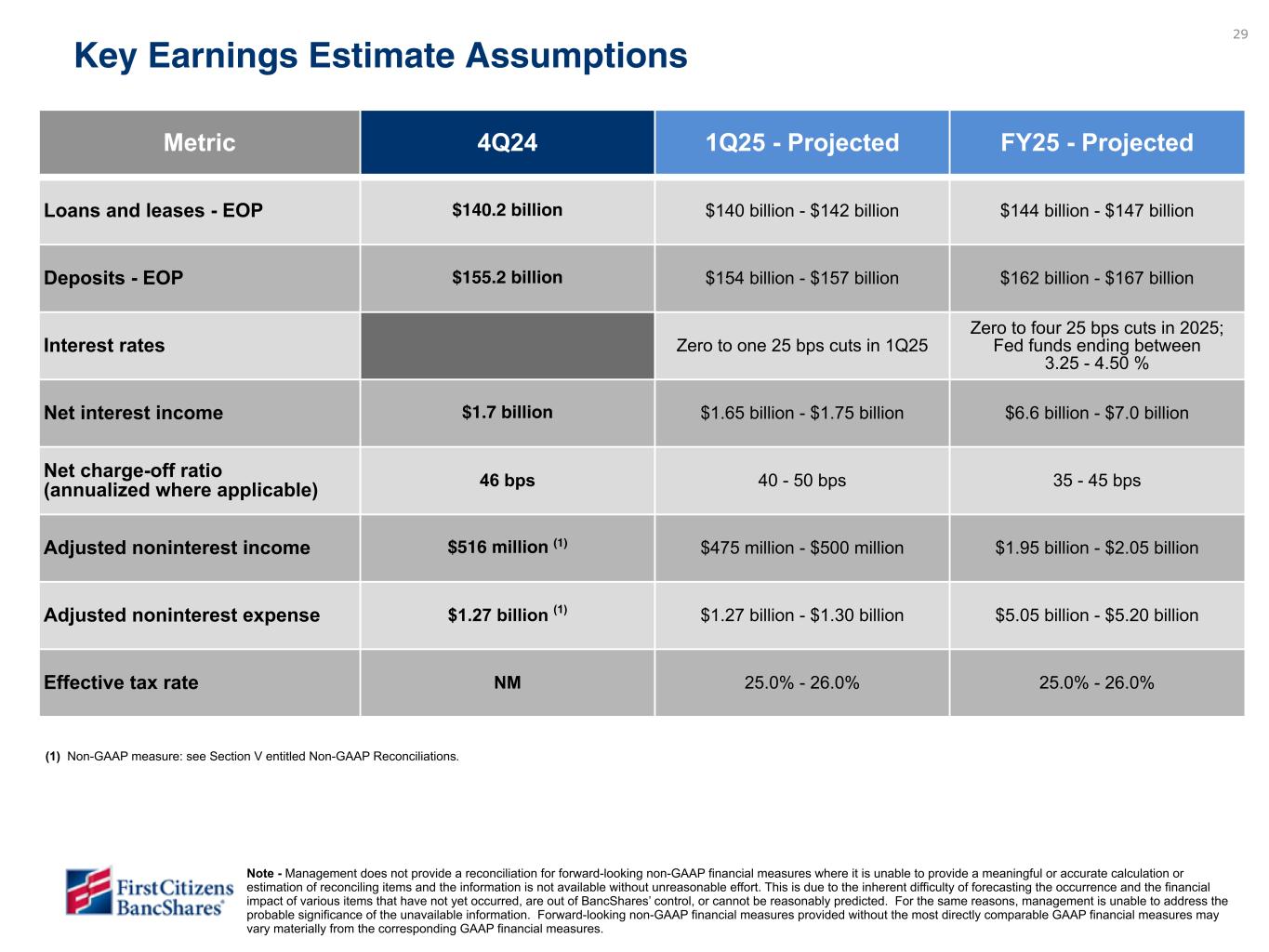

29 Metric 4Q24 1Q25 - Projected FY25 - Projected Loans and leases - EOP $140.2 billion $140 billion - $142 billion $144 billion - $147 billion Deposits - EOP $155.2 billion $154 billion - $157 billion $162 billion - $167 billion Interest rates Zero to one 25 bps cuts in 1Q25 Zero to four 25 bps cuts in 2025; Fed funds ending between 3.25 - 4.50 % Net interest income $1.7 billion $1.65 billion - $1.75 billion $6.6 billion - $7.0 billion Net charge-off ratio (annualized where applicable) 46 bps 40 - 50 bps 35 - 45 bps Adjusted noninterest income $516 million (1) $475 million - $500 million $1.95 billion - $2.05 billion Adjusted noninterest expense $1.27 billion (1) $1.27 billion - $1.30 billion $5.05 billion - $5.20 billion Effective tax rate NM 25.0% - 26.0% 25.0% - 26.0% Key Earnings Estimate Assumptions Please do not review. Data to be provided in a subsequent draft. (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. Note - Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of BancShares’ control, or cannot be reasonably predicted. For the same reasons, management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. To be updated in subsequent draft

Appendix Section IV

31 Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Dec 31, 2023 ASSETS Cash and due from banks $ 814 $ 862 $ 764 $ 698 $ 908 Interest-earning deposits at banks 21,364 25,640 25,361 30,792 33,609 Securities purchased under agreements to resell 158 455 392 394 473 Investment in marketable equity securities 101 82 78 79 84 Investment securities available for sale 33,750 28,190 27,053 24,915 19,936 Investment securities held to maturity 10,239 10,391 10,535 10,050 9,979 Assets held for sale 85 68 92 86 76 Loans and leases 140,221 138,695 139,341 135,370 133,302 Allowance for loan and lease losses (1,676) (1,678) (1,700) (1,737) (1,747) Loans and leases, net of allowance for loan and lease losses 138,545 137,017 137,641 133,633 131,555 Operating lease equipment, net 9,323 9,186 8,945 8,811 8,746 Premises and equipment, net 2,006 1,974 1,938 1,906 1,877 Goodwill 346 346 346 346 346 Other intangible assets, net 249 265 280 295 312 Other assets 6,740 6,091 6,402 5,831 5,857 Total assets $ 223,720 $ 220,567 $ 219,827 $ 217,836 $ 213,758 LIABILITIES Deposits: Noninterest-bearing $ 38,633 $ 39,396 $ 40,016 $ 39,276 $ 39,799 Interest-bearing 116,596 112,178 111,063 110,333 106,055 Total deposits 155,229 151,574 151,079 149,609 145,854 Credit balances of factoring clients 1,016 1,250 1,175 1,152 1,089 Short-term borrowings 367 391 386 395 485 Long-term borrowings 36,684 36,770 37,072 37,145 37,169 Total borrowings 37,051 37,161 37,458 37,540 37,654 Other liabilities 8,196 7,754 7,628 7,687 7,906 Total liabilities 201,492 197,739 197,340 195,988 192,503 STOCKHOLDERS’ EQUITY Preferred stock 881 881 881 881 881 Common stock 14 14 15 15 15 Additional paid in capital 2,417 3,389 4,099 4,099 4,108 Retained earnings 19,361 18,703 18,102 17,435 16,742 Accumulated other comprehensive loss (445) (159) (610) (582) (491) Total stockholders’ equity 22,228 22,828 22,487 21,848 21,255 Total liabilities and stockholders’ equity $ 223,720 $ 220,567 $ 219,827 $ 217,836 $ 213,758 BancShares Balance Sheets (unaudited) ($ in millions)

32 4Q24 3Q24 2Q24 1Q24 4Q23 INTEREST INCOME Interest and fees on loans $ 2,322 $ 2,430 $ 2,422 $ 2,354 $ 2,391 Interest on investment securities 377 358 330 282 241 Interest on deposits at banks 302 350 378 448 485 Total interest income 3,001 3,138 3,130 3,084 3,117 INTEREST EXPENSE Deposits 957 1,004 975 928 865 Borrowings 335 338 334 339 341 Total interest expense 1,292 1,342 1,309 1,267 1,206 Net interest income 1,709 1,796 1,821 1,817 1,911 Provision for credit losses 155 117 95 64 249 Net interest income after provision for credit losses 1,554 1,679 1,726 1,753 1,662 NONINTEREST INCOME Rental income on operating lease equipment 272 262 259 255 252 Lending-related fees 68 67 63 59 67 Deposit fees and service charges 58 57 57 58 55 Client investment fees 54 55 54 50 51 Wealth management services 54 54 52 51 48 International fees 33 29 29 28 29 Factoring commissions 20 19 19 17 22 Cardholder services, net 41 42 40 40 36 Merchant services, net 13 12 12 12 12 Insurance commissions 13 14 13 15 14 Realized gain on sale of investment securities, net 2 4 — — — Fair value adjustment on marketable equity securities, net 10 9 (2) (4) 9 Gain on sale of leasing equipment, net 11 5 4 10 2 Gain on acquisition — — — — (83) Loss on extinguishment of debt — — — (2) — Other noninterest income 50 21 39 38 29 Total noninterest income 699 650 639 627 543 NONINTEREST EXPENSE Depreciation on operating lease equipment 101 99 98 96 96 Maintenance and other operating lease expenses 55 59 60 45 59 Personnel cost 801 788 745 744 714 Net occupancy expense 60 62 58 62 65 Equipment expense 136 128 126 114 114 Professional fees 30 42 24 25 28 Third-party processing fees 57 55 58 60 66 FDIC insurance expense 33 31 33 41 82 Marketing expense 24 20 18 14 24 Acquisition-related expenses 62 46 44 58 116 Intangible asset amortization 16 15 15 17 17 Other noninterest expense 142 111 107 100 111 Total noninterest expense 1,517 1,456 1,386 1,376 1,492 Income before income taxes 736 873 979 1,004 713 Income tax expense 36 234 272 273 199 Net income $ 700 $ 639 $ 707 $ 731 $ 514 Preferred stock dividends $ 15 $ 15 $ 16 $ 15 $ 15 Net income available to common stockholders $ 685 $ 624 $ 691 $ 716 $ 499 BancShares Income Statements (unaudited) ($ in millions)

33 Noninterest income ($ in millions) 4Q24 Change vs 3Q24 4Q24 3Q24 2Q24 1Q24 4Q23 $ % Rental income on operating lease equipment $ 272 $ 262 $ 259 $ 255 $ 252 $ 10 4.2 % Lending-related fees 68 67 63 59 67 1 — Deposit fees and service charges 58 57 57 58 55 1 2.2 Client investment fees 54 55 54 50 51 (1) 0.1 Wealth management services 54 54 52 51 48 — (0.3) International fees 33 29 29 28 29 4 13.1 Factoring commissions 20 19 19 17 22 1 8.7 Cardholder services, net 41 42 40 40 36 (1) (3.1) Merchant services, net 13 12 12 12 12 1 14.8 Insurance commissions 13 14 13 15 14 (1) (6.0) Realized gain on sale of investment securities, net 2 4 — — — (2) (70.0) Fair value adjustment on marketable equity securities, net 10 9 (2) (4) 9 1 11.6 Gain on sale of leasing equipment, net 11 5 4 10 2 6 144.2 Gain on acquisition — — — — (83) — — Loss on extinguishment of debt — — — (2) — — — Other noninterest income 50 21 39 38 29 29 130.7 Total noninterest income - GAAP $ 699 $ 650 $ 639 $ 627 $ 543 $ 49 7.7 % Rental income on operating lease equipment (1) $ (152) $ (158) $ (158) $ (141) $ (155) $ 6 3.8 % Realized gain on sale of investment securities, net (2) (4) — — — 2 70.0 Fair value adjustment on marketable equity securities, net (10) (9) 2 4 (9) (1) (11.6) Gain on sale of leasing equipment, net (11) (5) (4) (10) (2) (6) (144.2) Gain on acquisition — — — — 83 — — Loss on extinguishment of debt — — — 2 — — — Other noninterest income (8) — — (4) (5) (8) — Total notable items $ (183) $ (176) $ (160) $ (149) $ (88) $ (7) (4.0) % Rental income on operating lease equipment $ 120 $ 104 $ 101 $ 114 $ 97 $ 16 15.7 % Lending-related fees 68 67 63 59 67 1 — Deposit fees and service charges 58 57 57 58 55 1 2.2 Client investment fees 54 55 54 50 51 (1) 0.1 Wealth management services 54 54 52 51 48 — (0.3) International fees 33 29 29 28 29 4 13.1 Factoring commissions 20 19 19 17 22 1 8.7 Cardholder services, net 41 42 40 40 36 (1) (3.1) Merchant services, net 13 12 12 12 12 1 14.8 Insurance commissions 13 14 13 15 14 (1) (6.0) Other noninterest income 42 21 39 34 24 21 95.0 Total noninterest income - adjusted (Non-GAAP) (2) $ 516 $ 474 $ 479 $ 478 $ 455 $ 42 9.0 % (1) Depreciation on operating lease equipment includes impairment of $4 million on rail assets in 4Q24. The $4 million impairment is a notable item and is excluded from adjusted rental income on operating lease equipment. See Section V entitled Non-GAAP Reconciliations. (2) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations.

34 4Q24 Change vs 3Q24 4Q24 3Q24 2Q24 1Q24 4Q23 $ % Depreciation on operating lease equipment $ 101 $ 99 $ 98 $ 96 $ 96 $ 2 3.3 % Maintenance and other operating lease expenses 55 59 60 45 59 (4) (7.7) Personnel cost 801 788 745 744 714 13 1.7 Net occupancy expense 60 62 58 62 65 (2) (2.9) Equipment expense 136 128 126 114 114 8 6.4 Professional fees 30 42 24 25 28 (12) (28.1) Third-party processing fees 57 55 58 60 66 2 5.0 FDIC insurance expense 33 31 33 41 82 2 2.9 Marketing expense 24 20 18 14 24 4 20.3 Acquisition-related expenses 62 46 44 58 116 16 36.7 Intangible asset amortization 16 15 15 17 17 1 0.9 Other noninterest expense 142 111 107 100 111 31 28.1 Total noninterest expense - GAAP $ 1,517 $ 1,456 $ 1,386 $ 1,376 $ 1,492 $ 61 4.3 % Depreciation on operating lease equipment $ (101) $ (99) $ (98) $ (96) $ (96) $ (2) (3.3) % Maintenance and other operating lease expenses (55) (59) (60) (45) (59) 4 7.7 Professional fees — — (1) (3) (5) — — FDIC insurance expense — — (2) (9) (64) — — Acquisition-related expenses (62) (46) (44) (58) (116) (16) (36.7) Intangible asset amortization (16) (15) (15) (17) (17) (1) (0.9) Other noninterest expense (15) (8) 2 6 — (7) 87.5 Total notable items $ (249) $ (227) $ (218) $ (222) $ (357) $ (22) (9.7) % Personnel cost $ 801 $ 788 $ 745 $ 744 $ 714 $ 13 1.7 % Net occupancy expense 60 62 58 62 65 (2) (2.9) Equipment expense 136 128 126 114 114 8 6.4 Professional fees 30 42 23 22 23 (12) (28.8) Third-party processing fees 57 55 58 60 66 2 5.0 FDIC insurance expense 33 31 31 32 18 2 2.9 Marketing expense 24 20 18 14 24 4 20.3 Other noninterest expense 127 103 109 106 111 24 22.7 Total nontinterest expense - adjusted (Non-GAAP) (1) $ 1,268 $ 1,229 $ 1,168 $ 1,154 $ 1,135 $ 39 3.1 % Noninterest expense ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations.

35 Loan Portfolios in Focus ($ in billions, as of December 31, 2024) Total Loans $140.2 Total Loans CRE $22.9 CRE Portfolio Composition Balance % of total loans Multi-Family $ 5.7 4.1 % Medical Office 3.7 2.6 General Office 2.5 1.8 Legacy-CIT Portfolio 0.9 0.6 Other 1.6 1.1 Industrial/Warehouse 3.6 2.6 Retail 2.0 1.4 Hotel/Motel 0.9 0.6 Other 4.5 3.2 Total $ 22.9 16.3 % Innovation Portfolio Composition Balance % of total loans Innovation C&I and cash flow dependent $ 9.1 6.5 % Investor dependent - growth stage 2.2 1.6 Investor dependent - early stage 1.0 0.7 Total $ 12.3 8.8 % Innovation $12.3 Note – The definition of CRE in these tables is aligned with supervisory guidance on commercial real estate and includes the following: construction loans (1.a.1 and 1.a.2), loans where the primary repayment is from 3rd party rental income (1.d and 1.e.2), and loans not secured by real estate but for the purpose of real estate (4.a, 8, and 9). Totals may not foot due to rounding.

36 $263 $584 $339 $1,290 Matured 2025 2026 2027 and beyond General Office CRE Portfolio (as of December 31, 2024) CA 23% NC / SC 20% FL 11% MA 8% AZ 4% TX 4% VA 4% Other 26% Total General Office $2.5 B Geographic Diversification Loan Maturity Schedule ($ in millions) 11% 24% 14% 51% (1) There are approximately $0.9 billion of general office loans in the Legacy-CIT Commercial Bank portfolio which has experienced recent portfolio stress. The ALLL ratio on this portfolio totaled 9.88%. Top 5 MSAs ($ in millions) Los Angeles $ 411 Boston $ 196 Charlotte $ 112 Phoenix $ 102 Raleigh $ 95 Percent of total loans 0.7 % General Office Portfolio Metrics % of total loans 1.8 % % of CRE loans 10.8 % Average loan amount $2 MM NCO ratio (YTD) 3.95 % Delinquencies/Loans 10.92 % NPLs/Loans 12.10 % Criticized loans/Loans 21.96 % ALLL ratio (1) 4.59 %

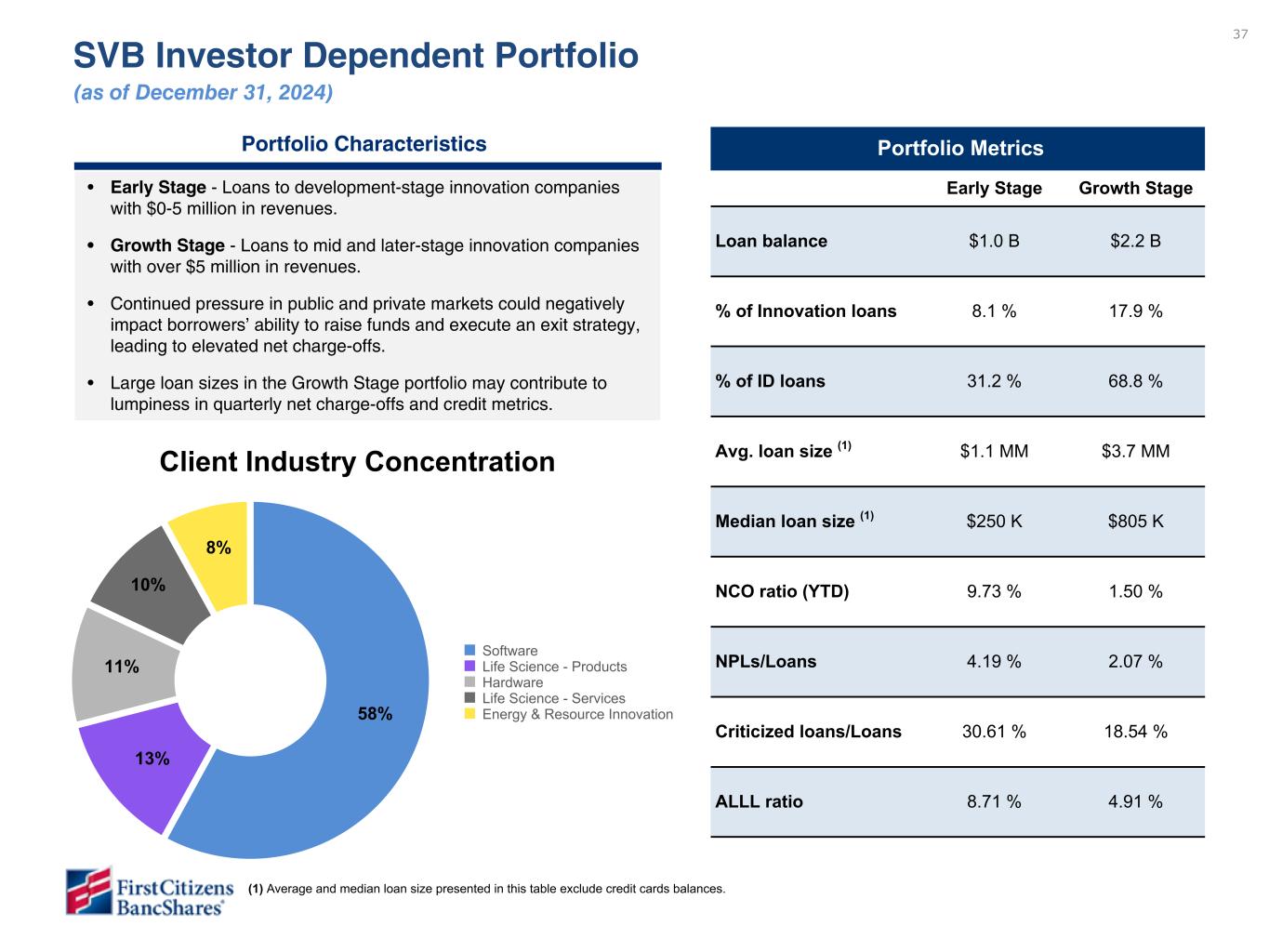

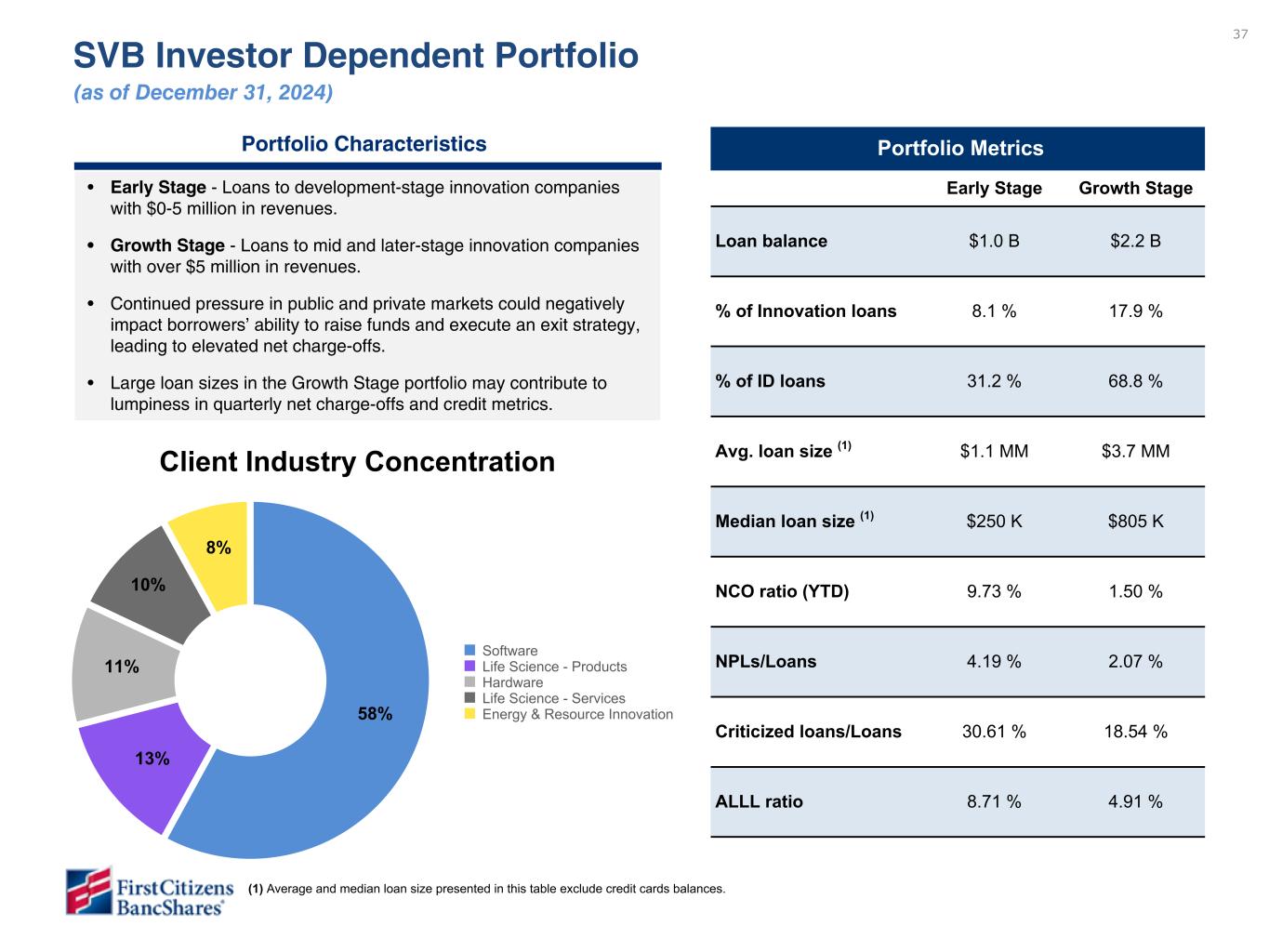

37 SVB Investor Dependent Portfolio (as of December 31, 2024) Portfolio Metrics Early Stage Growth Stage Loan balance $1.0 B $2.2 B % of Innovation loans 8.1 % 17.9 % % of ID loans 31.2 % 68.8 % Avg. loan size (1) $1.1 MM $3.7 MM Median loan size (1) $250 K $805 K NCO ratio (YTD) 9.73 % 1.50 % NPLs/Loans 4.19 % 2.07 % Criticized loans/Loans 30.61 % 18.54 % ALLL ratio 8.71 % 4.91 % Client Industry Concentration Portfolio Characteristics • Early Stage - Loans to development-stage innovation companies with $0-5 million in revenues. • Growth Stage - Loans to mid and later-stage innovation companies with over $5 million in revenues. • Continued pressure in public and private markets could negatively impact borrowers’ ability to raise funds and execute an exit strategy, leading to elevated net charge-offs. • Large loan sizes in the Growth Stage portfolio may contribute to lumpiness in quarterly net charge-offs and credit metrics. 58% 13% 11% 10% 8% Software Life Science - Products Hardware Life Science - Services Energy & Resource Innovation Please do not review - data is not available. To be provided in subsequent draft. Craig - Changed NCO ratio to YTD instead of QTD similar to previous slide per feedback from Robert Hawley and Andy Giangrave (1) Average and median loan size presented in this table exclude credit cards balances.

38 Estimated Liquidity Available for Uninsured Deposits ($ in millions) Total Deposits Less: Insured and/or collateralized deposits Total deposits - uninsured/ uncollateralized Estimated liquidity available for uninsured deposits: Immediately available cash Unpledged securities FDIC Line of Credit FHLB Fed Discount Window BTFP Program Estimated liquidity available for uninsured deposits Coverage ratio of liquidity available to uninsured and un-collateralized deposits $XX,XXX (XX,XXX) $X,XXX $X,XXX $X,XXX $X,XXX $X,XXX $XX,XXX $XX,XXX $XX,XXX December 31, 2024 September 30, 2024 December 31, 2023 Liquid assets: Available cash $ 20,545 $ 24,705 $ 32,693 High quality liquid securities 38,794 33,654 24,591 Total liquid assets (a) $ 59,339 $ 58,359 $ 57,284 Contingent liquidity: FDIC credit facility (1) $ 5,291 $ 8,126 $ 15,107 FHLB facility 16,423 15,795 13,622 FRB facility 5,475 5,621 5,115 Line of credit 100 100 100 Total contingent sources (b) $ 27,289 $ 29,642 $ 33,944 Total liquidity (a + b) $ 86,628 $ 88,001 $ 91,228 Total uninsured deposits (c) $ 59,510 $ 58,592 $ 54,155 Coverage ratio of liquidity to uninsured deposits (a + b) / c 146 % 150 % 168 % Coverage ratio of liquidity to uninsured deposits (FDIC max) (a + b) / c (2) 254 % 256 % 270 % SEC MD&A Liquidity Risk (1) The FDIC credit facility shown for 4Q24, 3Q24 and 4Q23 includes immediately available capacity and is based on the amount of collateral currently pledged at quarter end for each respective period. (2) The FDIC credit facility has a maximum capacity of $70 billion which may be used for liquidity coverage ratios. The maximum is the amount of contingent liquidity available should additional collateral be pledged to secure the facility.

39 (1) 4Q24 (1) Carrying value (2) % of Portfolio Yield (3) Duration in years AFS Portfolio U.S. Treasury $ 13,903 32 % 4.25 % 1.2 Government agency 77 — 4.55 0.3 Commercial mortgage-backed securities 3,666 8 4.13 2.3 Residential mortgage-backed securities 15,620 36 4.02 3.5 Corporate bonds 467 1 6.40 0.8 Municipal bonds 17 — 7.50 0.1 Total AFS portfolio $ 33,750 77 % 4.17 % 2.4 HTM portfolio U.S. Treasury $ 483 1 % 1.37 % 2.3 Government agency 1,489 3 1.53 2.7 Commercial mortgage-backed securities 3,407 8 2.36 3.1 Residential mortgage-backed securities 4,558 10 2.41 6.1 Other investments 302 1 1.56 4.0 Total HTM portfolio $ 10,239 23 % 2.19 % 4.4 Grand total $ 43,989 100 % 3.66 % 2.8 Debt Securities Overview ($ in millions, period end balances) (1) Includes the debt securities portfolio; excludes marketable equity securities. (2) Carrying value represents fair value for AFS and amortized cost for HTM portfolios. (3) Yield represents actual accounting yield recognized during the quarter.

40 Change vs. 4Q24 3Q24 4Q23 3Q24 4Q23 Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Loans and leases (1) $ 138,186 $ 2,322 6.69 % $ 137,602 $ 2,430 7.03 % $ 131,594 $ 2,391 7.21 % $ 584 $ (108) (0.34) % $ 6,592 $ (69) (0.52) % Investment securities 40,779 374 3.66 38,189 354 3.70 28,722 239 3.30 2,590 20 (0.04) 12,057 135 0.36 Securities purchased under agreements to resell 266 3 4.67 241 4 5.34 225 2 5.36 25 (1) (0.67) 41 1 (0.69) Interest-earning deposits at banks 25,548 302 4.70 26,167 350 5.33 35,712 485 5.39 (619) (48) (0.63) (10,164) (183) (0.69) Total interest-earning assets (1) $ 204,779 $ 3,001 5.83 % $ 202,199 $ 3,138 6.18 % $ 196,253 $ 3,117 6.30 % $ 2,580 $ (137) -0.35 % $ 8,526 $ (116) -0.47 % Interest-bearing deposits $ 114,565 $ 957 3.32 % $ 112,446 $ 1,004 3.55 % $ 104,717 $ 865 3.28 % $ 2,119 $ (47) (0.23) % $ 9,848 $ 92 0.04 % Securities sold under customer repurchase agreements 370 1 0.57 384 — 0.55 455 1 0.44 (14) 1 0.02 (85) — 0.13 Long-term borrowings 36,722 334 3.64 37,064 338 3.64 37,260 340 3.65 (342) (4) — (538) (6) (0.01) Total borrowings $ 37,092 $ 335 3.61 % $ 37,448 $ 338 3.61 % $ 37,715 $ 341 3.61 % $ (356) $ (3) — % $ (623) $ (6) — % Total interest-bearing liabilities $ 151,657 $ 1,292 3.39 % $ 149,894 $ 1,342 3.57 % $ 142,432 $ 1,206 3.37 % $ 1,763 $ (50) -0.18 % $ 9,225 $ 86 0.02 % Net interest income $ 1,709 $ 1,796 $ 1,911 $ (87) $ (202) Net interest spread (1) 2.44 % 2.61 % 2.93 % (0.17) % (0.49) % Net interest margin (1) 3.32 % 3.53 % 3.86 % (0.21) % (0.54) % Change vs. YTD23 YTD22 YTD22 Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Avg. Balance Income / Expense Yield / Rate Loans and leases (1) $ 66,634 $ 2,953 4.41 % $ 65,639 $ 2,697 4.09 % $ 995 $ 256 0.32 % Investment securities 19,166 354 1.85 16,110 216 1.32 3,056 138 0.53 Interest-earning deposits at banks 7,726 106 1.38 13,246 17 0.13 (5,520) 89 1.25 Total interest-earning assets (1) $ 93,526 $ 3,413 3.63 % $ 94,995 $ 2,930 3.07 % $ (1,469) $ 483 0.56 % Interest-bearing deposits $ 63,598 $ 335 0.53 % $ 65,295 $ 239 0.37 % $ (1,697) $ 96 0.16 % Securities sold under customer repurchase agreements 590 1 0.19 660 1 0.20 (70) — (0.01) Other short-term borrowings 824 28 3.30 — — — 824 28 3.30 Long-term borrowings 3,882 103 2.64 5,915 249 4.15 (2,033) (146) (1.51) Total borrowings $ 5,296 $ 132 2.47 % $ 6,575 $ 250 3.75 % $ (1,279) $ (118) (1.28) % Total interest-bearing liabilities $ 68,894 $ 467 0.68 % $ 71,870 $ 489 0.68 % $ (2,976) $ (22) — % Net interest income $ 2,946 $ 2,441 $ 505 Net interest spread (1) 2.95 % 2.39 % 0.56 % Net interest margin (1) 3.14 % 2.55 % 0.59 % Average Balances and Yields ($ in millions) YTD not disclosed Q1 (1) The balance and rate presented is calculated net of average credit balances and deposits of factoring clients. Note: Certain items above do not precisely recalculate as presented due to rounding.

41 Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Income Statement 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 277 $ 274 $ 271 $ 3 0.9 % $ 6 1.9 % Rental income on operating lease equipment 55 57 57 (2) (2.3) (2) (3.1) Less: depreciation on operating lease equipment 44 47 47 (3) (3.3) (3) (3.1) Adjusted rental income on operating lease equipment (1) 11 10 10 1 2.4 1 (3.0) All other noninterest income 87 76 83 11 15.8 4 8.4 Total noninterest income 98 86 93 12 14.2 5 7.0 Net revenue 375 360 364 15 4.1 11 3.2 Noninterest expense 191 180 162 11 6.1 29 18.3 Pre-provision net revenue (1) 184 180 202 4 2.0 (18) (9.0) Provision for credit losses 79 29 164 50 174.9 (85) (51.5) Income before income taxes 105 151 38 (46) (31.0) 67 172.0 Income tax expense 20 41 14 (21) (52.6) 6 37.9 Net income $ 85 $ 110 $ 24 $ (25) (22.9) % $ 61 250.5 % Period end Balances (2) Loans and leases $ 33,197 $ 32,689 $ 30,936 $ 508 6.2 % $ 2,261 7.3 % Deposits 3,283 2,754 3,228 529 76.5 55 1.7 Other Key Metrics Factoring volume $ 6,124 $ 6,094 $ 6,169 $ 30 0.5 % $ (45) (0.7) % Highlights • The Commercial Bank segment achieved strong loan growth during the quarter, 6.2% annualized over the linked quarter, largely driven by strong origination volume in our industry verticals. • Factoring volume totaled $6.1 billion, relatively in line with the linked quarter and the prior year quarter. • Segment revenue increased $15 million compared to the linked quarter, primarily driven by higher noninterest income. Commercial Bank Segment ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Linked quarter loan and deposit growth percentages are annualized using end of period balances. Please do not review - data is update based on latest rounded financials but has not yet been validated and data and commentary will be updated in subsequent draft Please do not review commentary. To be provided in subsequent draft. Please do not review - data is not available. To be provided in subsequent draft.

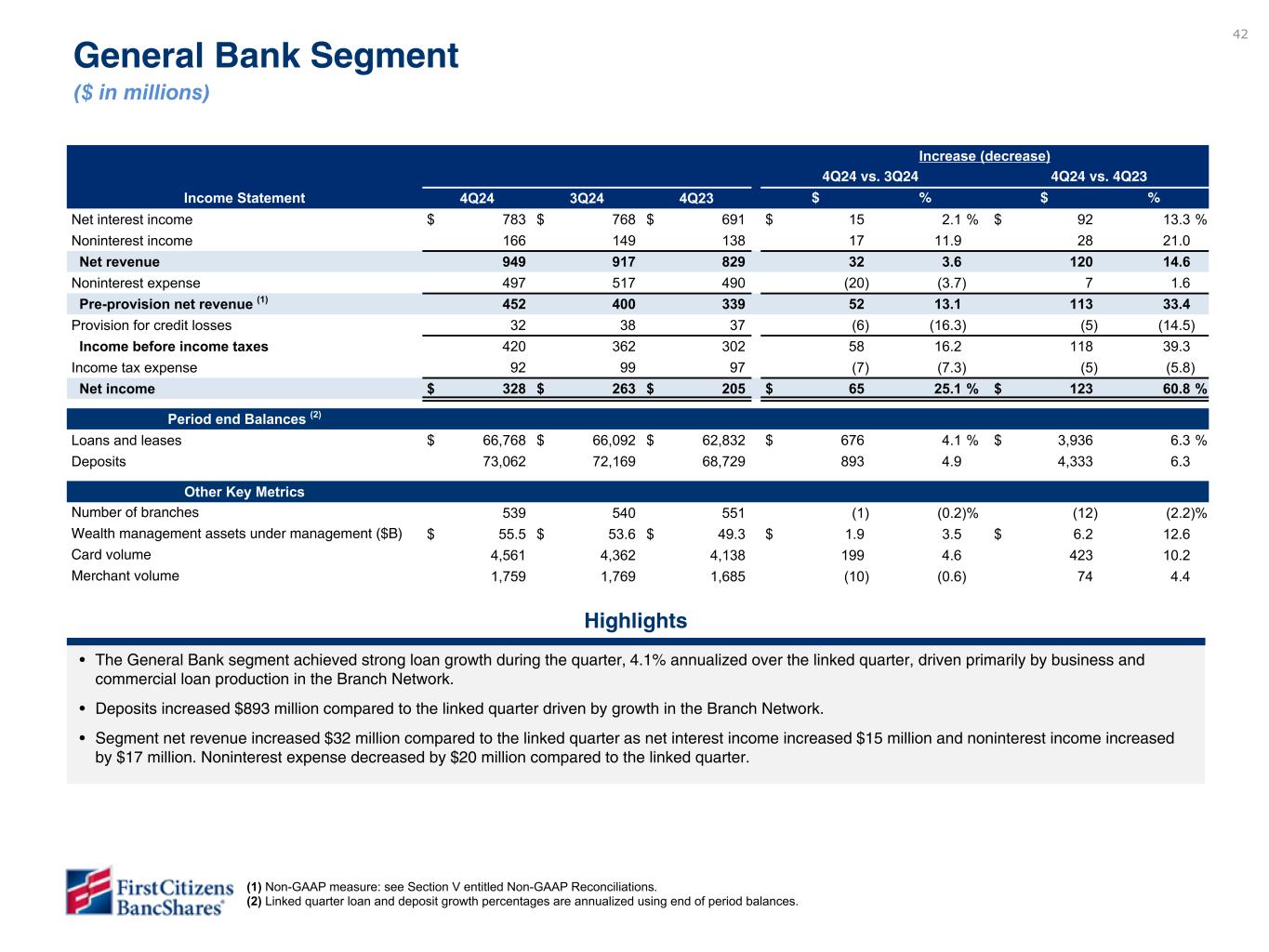

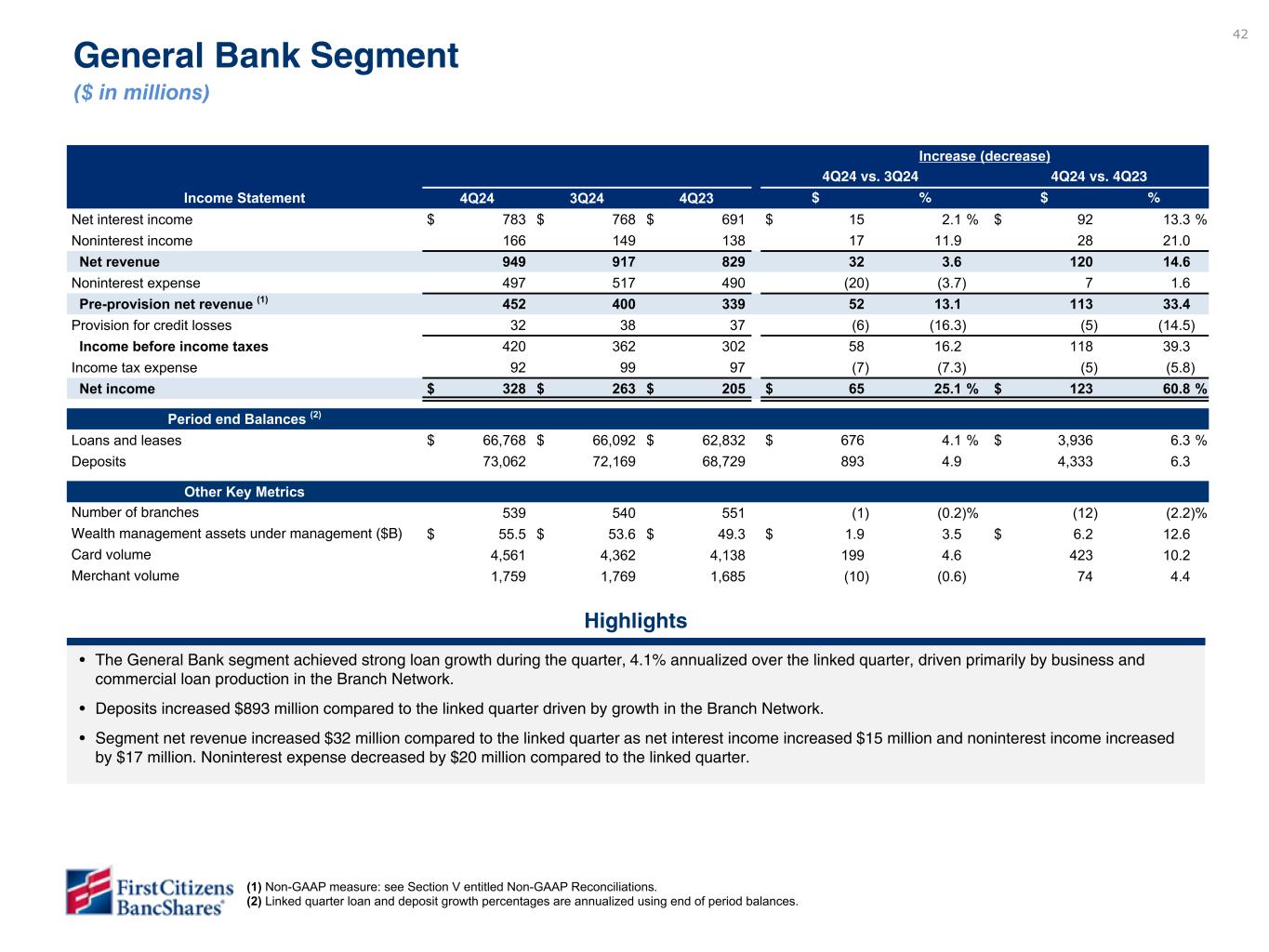

42 General Bank Segment ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Linked quarter loan and deposit growth percentages are annualized using end of period balances. Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Income Statement 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 783 $ 768 $ 691 $ 15 2.1 % $ 92 13.3 % Noninterest income 166 149 138 17 11.9 28 21.0 Net revenue 949 917 829 32 3.6 120 14.6 Noninterest expense 497 517 490 (20) (3.7) 7 1.6 Pre-provision net revenue (1) 452 400 339 52 13.1 113 33.4 Provision for credit losses 32 38 37 (6) (16.3) (5) (14.5) Income before income taxes 420 362 302 58 16.2 118 39.3 Income tax expense 92 99 97 (7) (7.3) (5) (5.8) Net income $ 328 $ 263 $ 205 $ 65 25.1 % $ 123 60.8 % Period end Balances (2) Loans and leases $ 66,768 $ 66,092 $ 62,832 $ 676 4.1 % $ 3,936 6.3 % Deposits 73,062 72,169 68,729 893 4.9 4,333 6.3 Other Key Metrics Number of branches 539 540 551 (1) (0.2) % (12) (2.2) % Wealth management assets under management ($B) $ 55.5 $ 53.6 $ 49.3 $ 1.9 3.5 $ 6.2 12.6 Card volume 4,561 4,362 4,138 199 4.6 423 10.2 Merchant volume 1,759 1,769 1,685 (10) (0.6) 74 4.4 Highlights • The General Bank segment achieved strong loan growth during the quarter, 4.1% annualized over the linked quarter, driven primarily by business and commercial loan production in the Branch Network. • Deposits increased $893 million compared to the linked quarter driven by growth in the Branch Network. • Segment net revenue increased $32 million compared to the linked quarter as net interest income increased $15 million and noninterest income increased by $17 million. Noninterest expense decreased by $20 million compared to the linked quarter. Please do not review - data is update based on latest rounded financials but has not yet been validated and data and commentary will be updated in subsequent draft Please do not review commentary. To be provided in subsequent draft. Please do not review - data is not available. To be provided in subsequent draft.

43 Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Income Statement 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 568 $ 583 $ 519 $ (15) (2.6) % $ 49 9.4 % Noninterest income 150 139 135 11 7.6 15 11.5 Net revenue 718 722 654 (4) (0.7) 64 9.9 Noninterest expense 389 393 384 (4) (1.1) 5 1.4 Pre-provision net revenue (1) 329 329 270 — (0.2) 59 21.9 Provision for credit losses 44 50 48 (6) (14.2) (4) (9.0) Income before income taxes 285 279 222 6 2.3 63 28.6 Income tax expense 60 75 48 (15) (20.3) 12 25.3 Net income $ 225 $ 204 $ 174 $ 21 10.7 % $ 51 29.5 % Period end Balances (2) Loans and leases $ 40,194 $ 39,852 $ 39,511 $ 342 3.4 % $ 683 1.7 % Total client funds 98,954 93,702 92,778 5,252 22.2 6,176 6.7 Off balance sheet client funds 62,317 57,757 58,048 4,560 31.3 4,269 7.4 Deposits 36,637 35,945 34,730 692 7.7 1,907 5.5 SVB Commercial Segment ($ in millions) Note – SVB Commercial segment results do not include the accretion impact of SVB loans or the impact of overnight investments and debt that was added at the acquisition date (the aforementioned items are contained within Corporate). (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Linked quarter loan, total client funds, off balance sheet client funds and deposit growth percentages are annualized using end of period balances. Highlights • SVB Commercial segment loans increased $342 million from the linked quarter driven by Global Fund Banking production and improved utilization. • Total client funds increased $5.3 billion compared to the linked quarter including growth of $4.6 billion in off balance sheet client funds and on balance sheet deposit growth of $692 million. The increase in total client funds reflects higher VC investment activity and slowing client cash burn. • Segment net revenue decreased $4 million compared to the linked quarter due to lower net interest income partially offset by higher noninterest income. Noninterest expense decreased $4 million compared to the linked quarter.

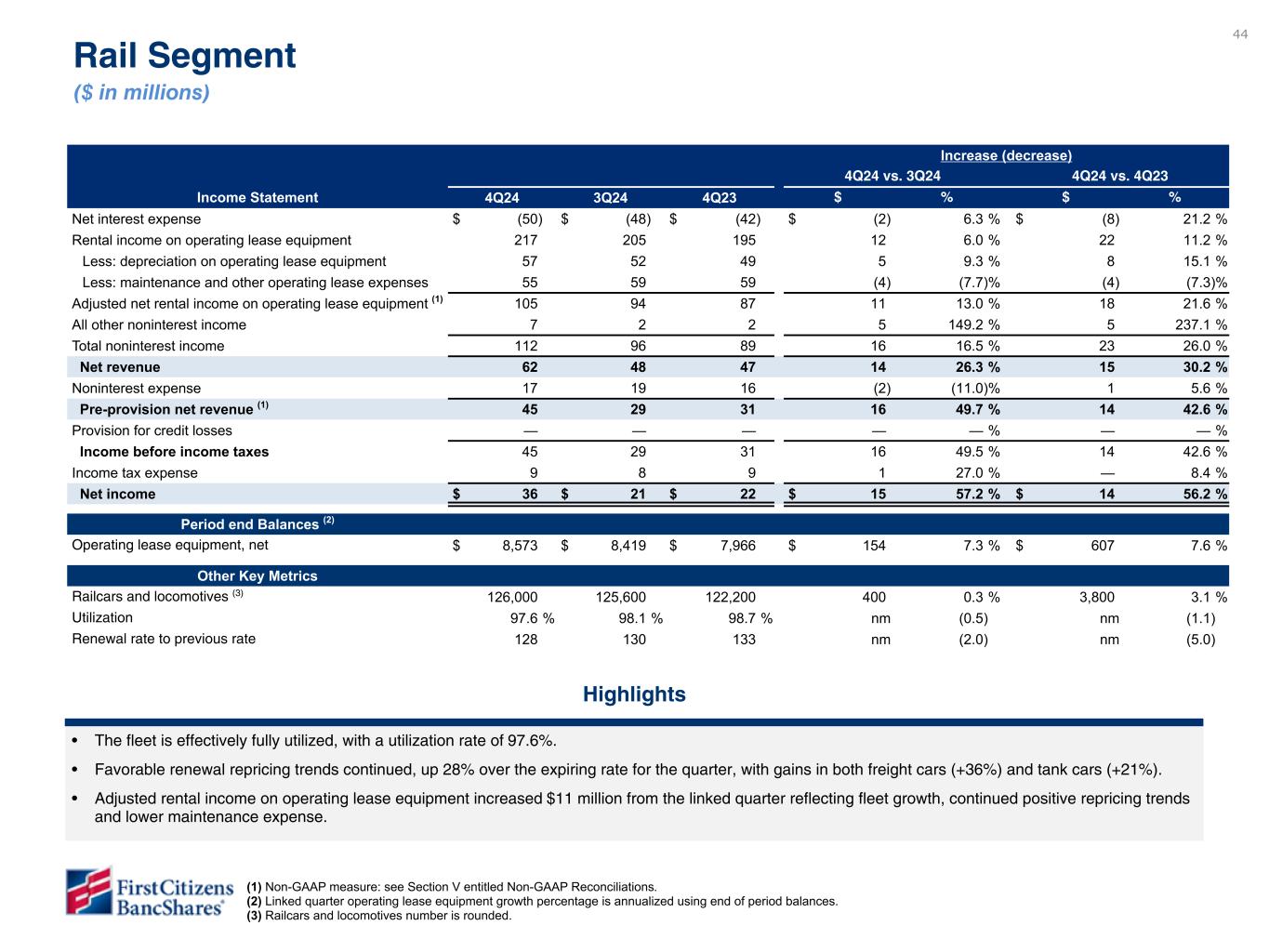

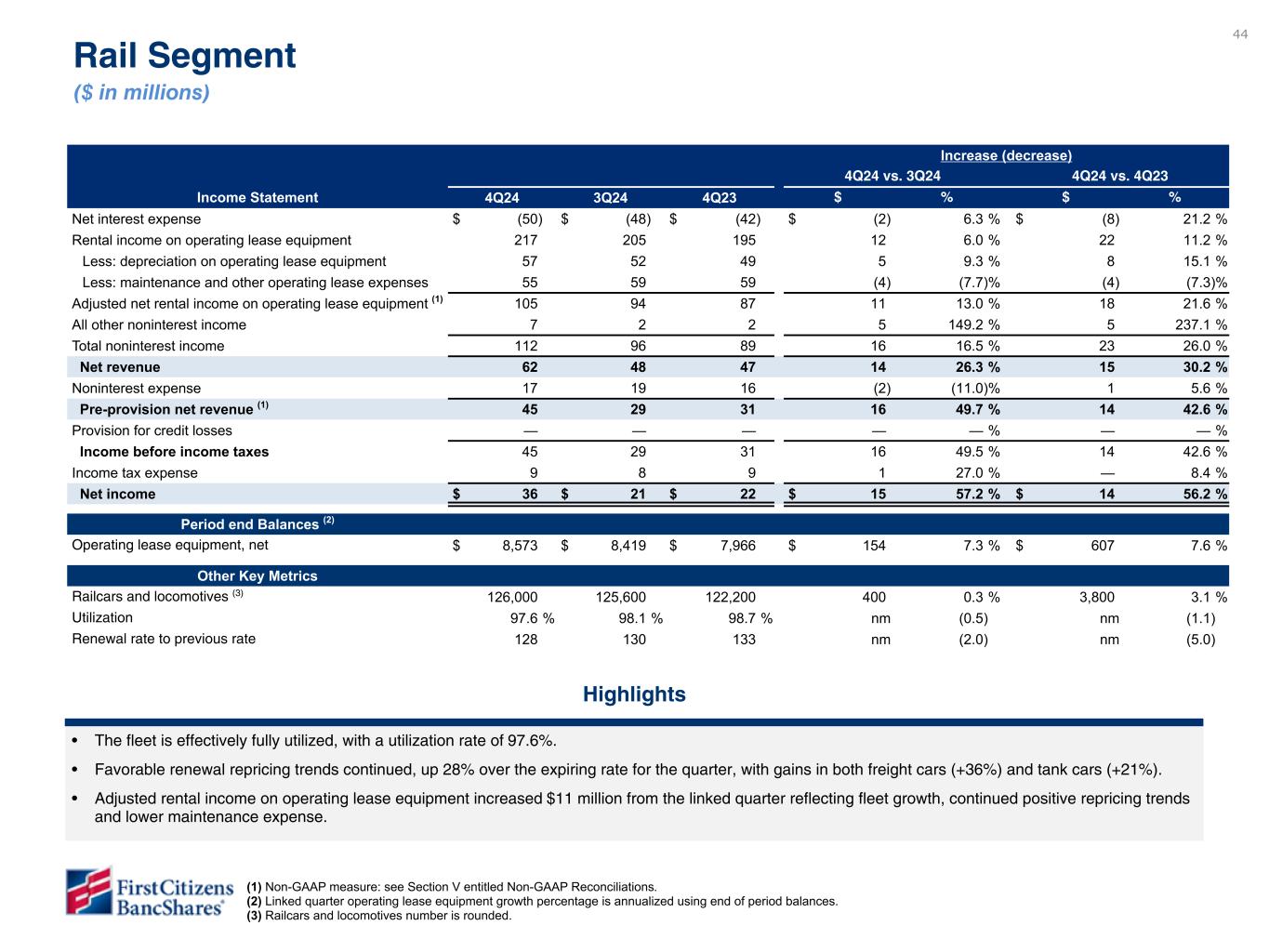

44 Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Income Statement 4Q24 3Q24 4Q23 $ % $ % Net interest expense $ (50) $ (48) $ (42) $ (2) 6.3 % $ (8) 21.2 % Rental income on operating lease equipment 217 205 195 12 6.0 % 22 11.2 % Less: depreciation on operating lease equipment 57 52 49 5 9.3 % 8 15.1 % Less: maintenance and other operating lease expenses 55 59 59 (4) (7.7) % (4) (7.3) % Adjusted net rental income on operating lease equipment (1) 105 94 87 11 13.0 % 18 21.6 % All other noninterest income 7 2 2 5 149.2 % 5 237.1 % Total noninterest income 112 96 89 16 16.5 % 23 26.0 % Net revenue 62 48 47 14 26.3 % 15 30.2 % Noninterest expense 17 19 16 (2) (11.0) % 1 5.6 % Pre-provision net revenue (1) 45 29 31 16 49.7 % 14 42.6 % Provision for credit losses — — — — — % — — % Income before income taxes 45 29 31 16 49.5 % 14 42.6 % Income tax expense 9 8 9 1 27.0 % — 8.4 % Net income $ 36 $ 21 $ 22 $ 15 57.2 % $ 14 56.2 % Period end Balances (2) Operating lease equipment, net $ 8,573 $ 8,419 $ 7,966 $ 154 7.3 % $ 607 7.6 % Other Key Metrics Railcars and locomotives (3) 126,000 125,600 122,200 400 0.3 % 3,800 3.1 % Utilization 97.6 % 98.1 % 98.7 % nm (0.5) nm (1.1) Renewal rate to previous rate 128 130 133 nm (2.0) nm (5.0) Rail Segment ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Linked quarter operating lease equipment growth percentage is annualized using end of period balances. (3) Railcars and locomotives number is rounded. Highlights • The fleet is effectively fully utilized, with a utilization rate of 97.6%. • Favorable renewal repricing trends continued, up 28% over the expiring rate for the quarter, with gains in both freight cars (+36%) and tank cars (+21%). • Adjusted rental income on operating lease equipment increased $11 million from the linked quarter reflecting fleet growth, continued positive repricing trends and lower maintenance expense. Please do not review - data is not available. To be provided in subsequent draft.

45 Highlights • Net interest income decreased $88 million compared to the linked quarter driven primarily by lower interest income from overnight investments and higher interest expense from growth in Direct Bank deposits, partially offset by increased interest income from higher investment securities. • Noninterest expense increased $78 million driven primarily by similar items as noted on slide 16. • Direct Bank deposits reflect continued growth in the channel even with declining rates paid. Corporate ($ in millions) (1) Non-GAAP measure: see Section V entitled Non-GAAP Reconciliations. (2) Linked quarter investment securities and Direct Bank deposit growth percentages are annualized using end of period balances. Increase (decrease) 4Q24 vs. 3Q24 4Q24 vs. 4Q23 Income Statement 4Q24 3Q24 4Q23 $ % $ % Net interest income $ 131 $ 219 $ 472 $ (88) (40.1) % $ (341) (72.2) % Noninterest income 17 22 (67) (5) (21.1) 84 (126.8) Net revenue 148 241 405 (93) (38.4) (257) (63.6) Noninterest expense 267 189 285 78 41.2 (18) (7.0) Pre-provision net (loss) revenue (1) (119) 52 120 (171) (328.5) (239) (198.1) Provision for credit losses — — — — — — — (Loss) income before income taxes (119) 52 120 (171) (328.3) (239) (198.0) Income tax (benefit) expense (145) 11 31 (156) NM (176) (561.9) Net income $ 26 $ 41 $ 89 $ (15) (35.0) % $ (63) (70.3) % Period end Balance Sheet (2) Investment securities $ 44,090 $ 38,663 $ 29,999 $ 5,427 55.8 % $ 14,091 47.0 % Direct Bank deposits 41,093 39,504 37,666 1,589 16.0 3,427 9.1 Highlighted commentary subject to change Please do not review - data is not available. To be provided in subsequent draft.

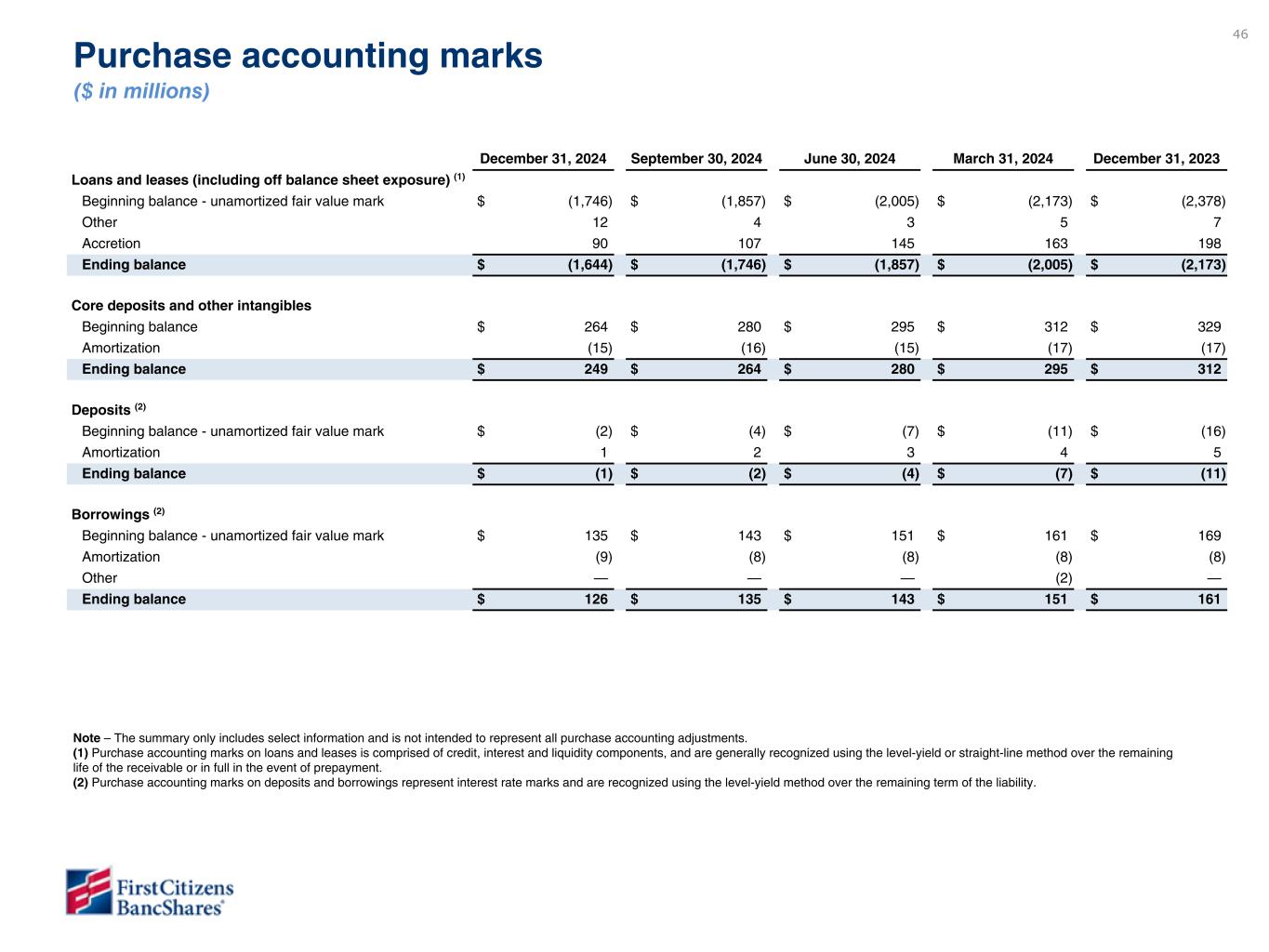

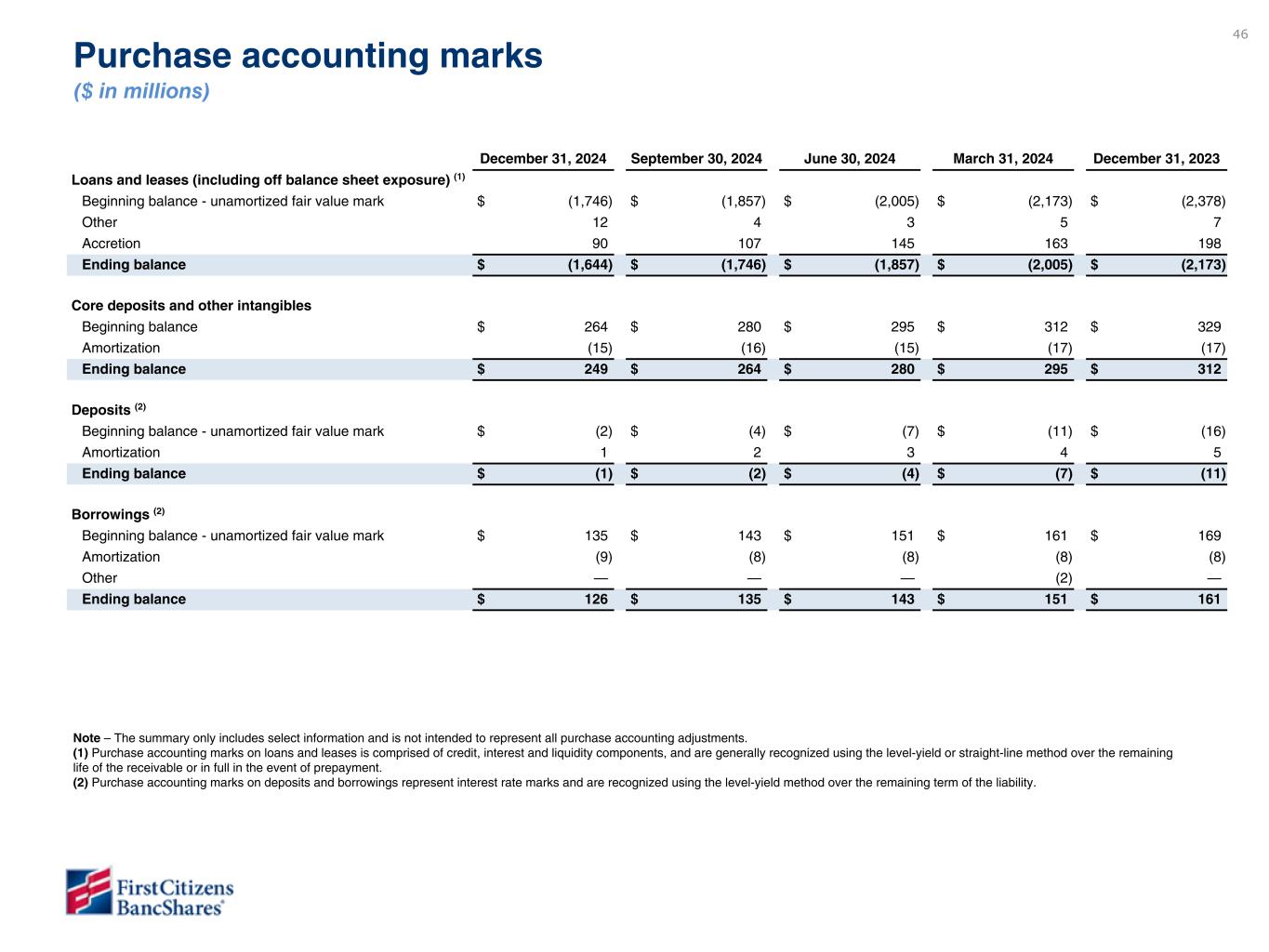

46 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Loans and leases (including off balance sheet exposure) (1) Beginning balance - unamortized fair value mark $ (1,746) $ (1,857) $ (2,005) $ (2,173) $ (2,378) Other 12 4 3 5 7 Accretion 90 107 145 163 198 Ending balance $ (1,644) $ (1,746) $ (1,857) $ (2,005) $ (2,173) Core deposits and other intangibles Beginning balance $ 264 $ 280 $ 295 $ 312 $ 329 Amortization (15) (16) (15) (17) (17) Ending balance $ 249 $ 264 $ 280 $ 295 $ 312 Deposits (2) Beginning balance - unamortized fair value mark $ (2) $ (4) $ (7) $ (11) $ (16) Amortization 1 2 3 4 5 Ending balance $ (1) $ (2) $ (4) $ (7) $ (11) Borrowings (2) Beginning balance - unamortized fair value mark $ 135 $ 143 $ 151 $ 161 $ 169 Amortization (9) (8) (8) (8) (8) Other — — — (2) — Ending balance $ 126 $ 135 $ 143 $ 151 $ 161 Purchase accounting marks ($ in millions) Note – The summary only includes select information and is not intended to represent all purchase accounting adjustments. (1) Purchase accounting marks on loans and leases is comprised of credit, interest and liquidity components, and are generally recognized using the level-yield or straight-line method over the remaining life of the receivable or in full in the event of prepayment. (2) Purchase accounting marks on deposits and borrowings represent interest rate marks and are recognized using the level-yield method over the remaining term of the liability.

Non-GAAP Reconciliations Section V

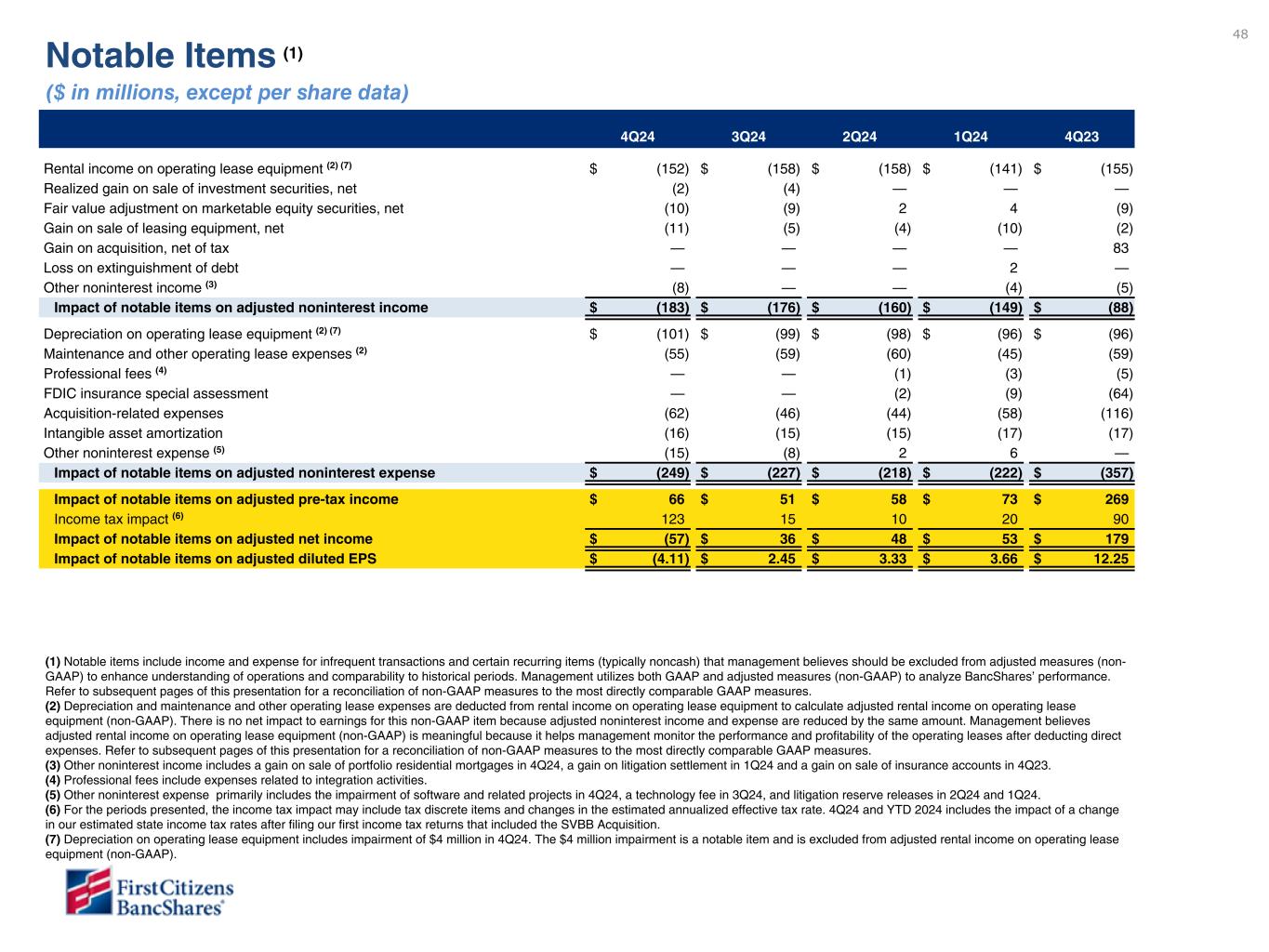

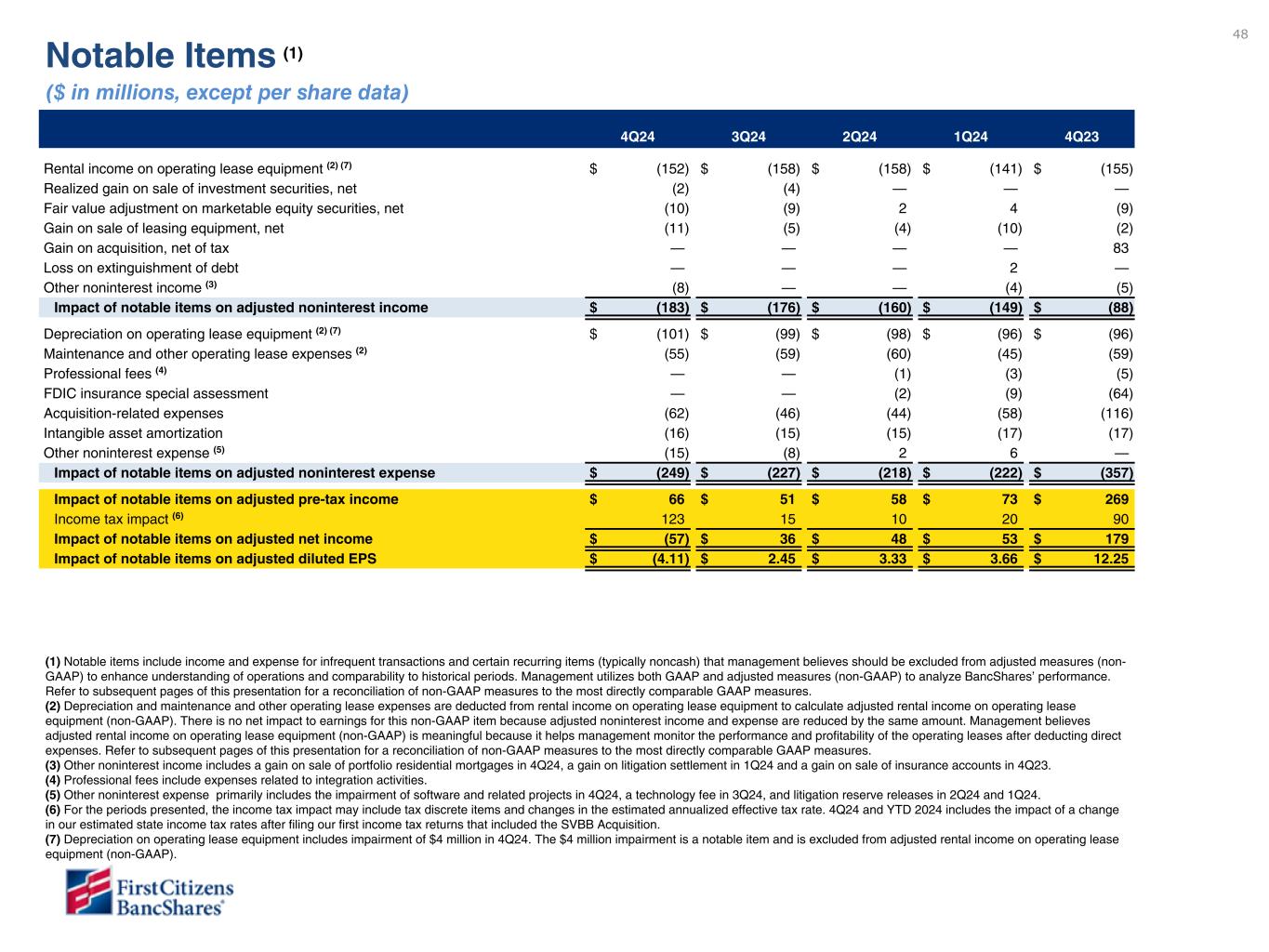

48 1Q23 4Q22 1Q22 Rental income on operating lease equipment (2) $ (152) $ (158) $ (155) Realized gain on sale of investment securities available for sale, net (2) (4) — Fair value adjustment on marketable equity securities, net (10) (9) (9) Gain on sale of leasing equipment, net (11) (5) (2) Gain on acquisition — — 83 Gain on extinguishment of debt — — — Other noninterest income(3) (8) — (5) Impact on adjusted noninterest income $ (183) $ (176) $ (88) Depreciation on operating lease equipment (2) $ (101) $ (99) $ (96) Maintenance and other operating lease expenses (2) (55) (59) (59) Salaries and benefits — — — Acquisition-related expenses (62) (46) (116) Intangible asset amortization (16) (15) (17) Other noninterest expense (4) (15) (8) — Impact on adjusted noninterest expense $ (249) $ (227) $ (357) CECL Day 2 provision and reserve for unfunded commitments — (716) — Provision for credit losses- investment securities available for sale — (4) — Provision for credit losses - total adjustments $ — $ — $ — Impact on adjusted pre-tax income $ 134 $ 173 $ 38 Income tax impact (5) (6) 123 15 90 Impact on adjusted net income $ (57) $ 36 $ 179 Impact on adjusted diluted EPS $ (4.11) $ 2.45 12.25 Notable Items (1) ($ in millions, except per share data) 4Q24 3Q24 2Q24 1Q24 4Q23 Rental income on operating lease equipment (2) (7) $ (152) $ (158) $ (158) $ (141) $ (155) Realized gain on sale of investment securities, net (2) (4) — — — Fair value adjustment on marketable equity securities, net (10) (9) 2 4 (9) Gain on sale of leasing equipment, net (11) (5) (4) (10) (2) Gain on acquisition, net of tax — — — — 83 Loss on extinguishment of debt — — — 2 — Other noninterest income (3) (8) — — (4) (5) Impact of notable items on adjusted noninterest income $ (183) $ (176) $ (160) $ (149) $ (88) Depreciation on operating lease equipment (2) (7) $ (101) $ (99) $ (98) $ (96) $ (96) Maintenance and other operating lease expenses (2) (55) (59) (60) (45) (59) Professional fees (4) — — (1) (3) (5) FDIC insurance special assessment — — (2) (9) (64) Acquisition-related expenses (62) (46) (44) (58) (116) Intangible asset amortization (16) (15) (15) (17) (17) Other noninterest expense (5) (15) (8) 2 6 — Impact of notable items on adjusted noninterest expense $ (249) $ (227) $ (218) $ (222) $ (357) Impact of notable items on adjusted pre-tax income $ 66 $ 51 $ 58 $ 73 $ 269 Income tax impact (6) 123 15 10 20 90 Impact of notable items on adjusted net income $ (57) $ 36 $ 48 $ 53 $ 179 Impact of notable items on adjusted diluted EPS $ (4.11) $ 2.45 $ 3.33 $ 3.66 $ 12.25 (1) Notable items include income and expense for infrequent transactions and certain recurring items (typically noncash) that management believes should be excluded from adjusted measures (non- GAAP) to enhance understanding of operations and comparability to historical periods. Management utilizes both GAAP and adjusted measures (non-GAAP) to analyze BancShares’ performance. Refer to subsequent pages of this presentation for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures. (2) Depreciation and maintenance and other operating lease expenses are deducted from rental income on operating lease equipment to calculate adjusted rental income on operating lease equipment (non-GAAP). There is no net impact to earnings for this non-GAAP item because adjusted noninterest income and expense are reduced by the same amount. Management believes adjusted rental income on operating lease equipment (non-GAAP) is meaningful because it helps management monitor the performance and profitability of the operating leases after deducting direct expenses. Refer to subsequent pages of this presentation for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures. (3) Other noninterest income includes a gain on sale of portfolio residential mortgages in 4Q24, a gain on litigation settlement in 1Q24 and a gain on sale of insurance accounts in 4Q23. (4) Professional fees include expenses related to integration activities. (5) Other noninterest expense primarily includes the impairment of software and related projects in 4Q24, a technology fee in 3Q24, and litigation reserve releases in 2Q24 and 1Q24. (6) For the periods presented, the income tax impact may include tax discrete items and changes in the estimated annualized effective tax rate. 4Q24 and YTD 2024 includes the impact of a change in our estimated state income tax rates after filing our first income tax returns that included the SVBB Acquisition. (7) Depreciation on operating lease equipment includes impairment of $4 million in 4Q24. The $4 million impairment is a notable item and is excluded from adjusted rental income on operating lease equipment (non-GAAP).

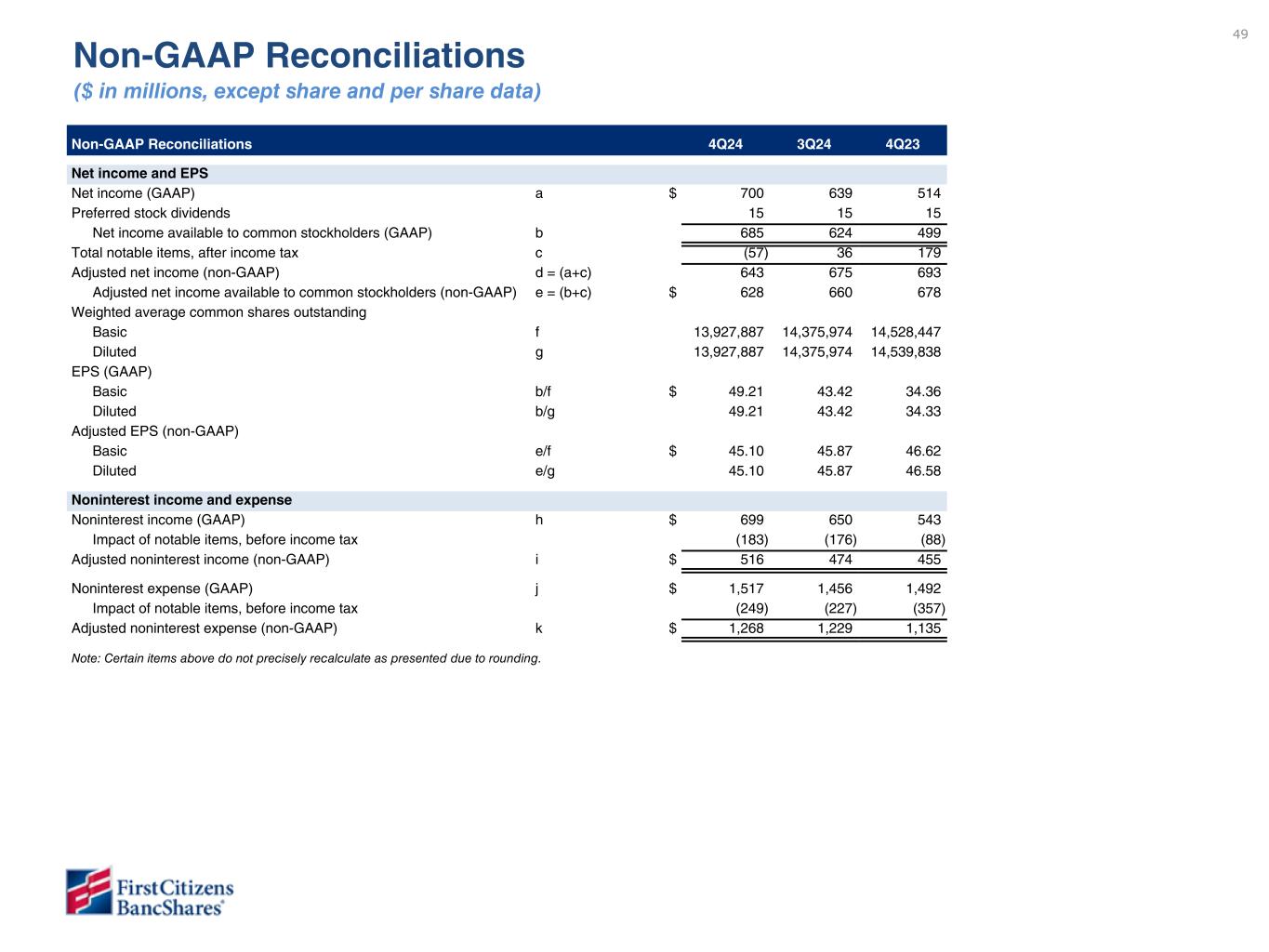

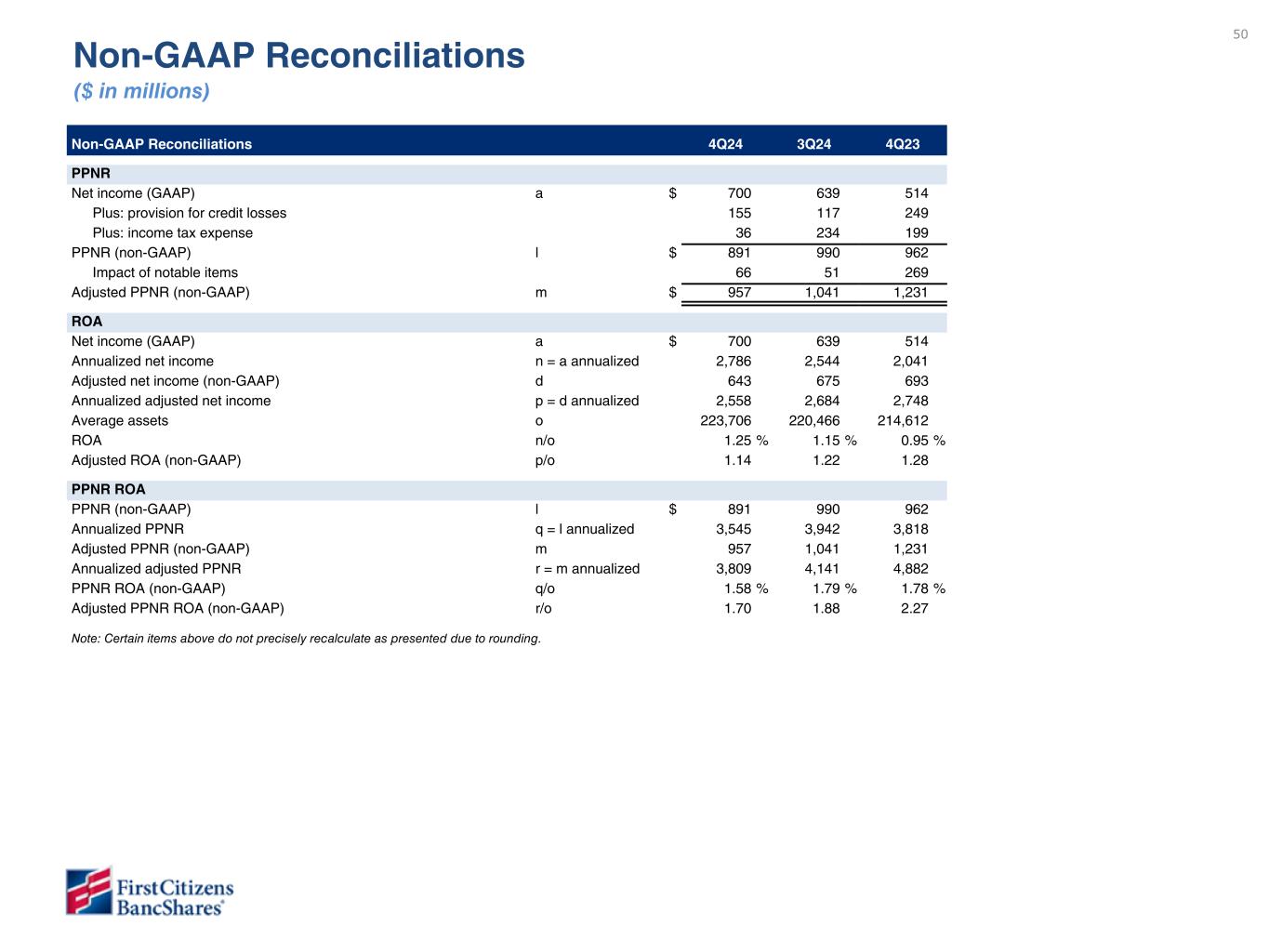

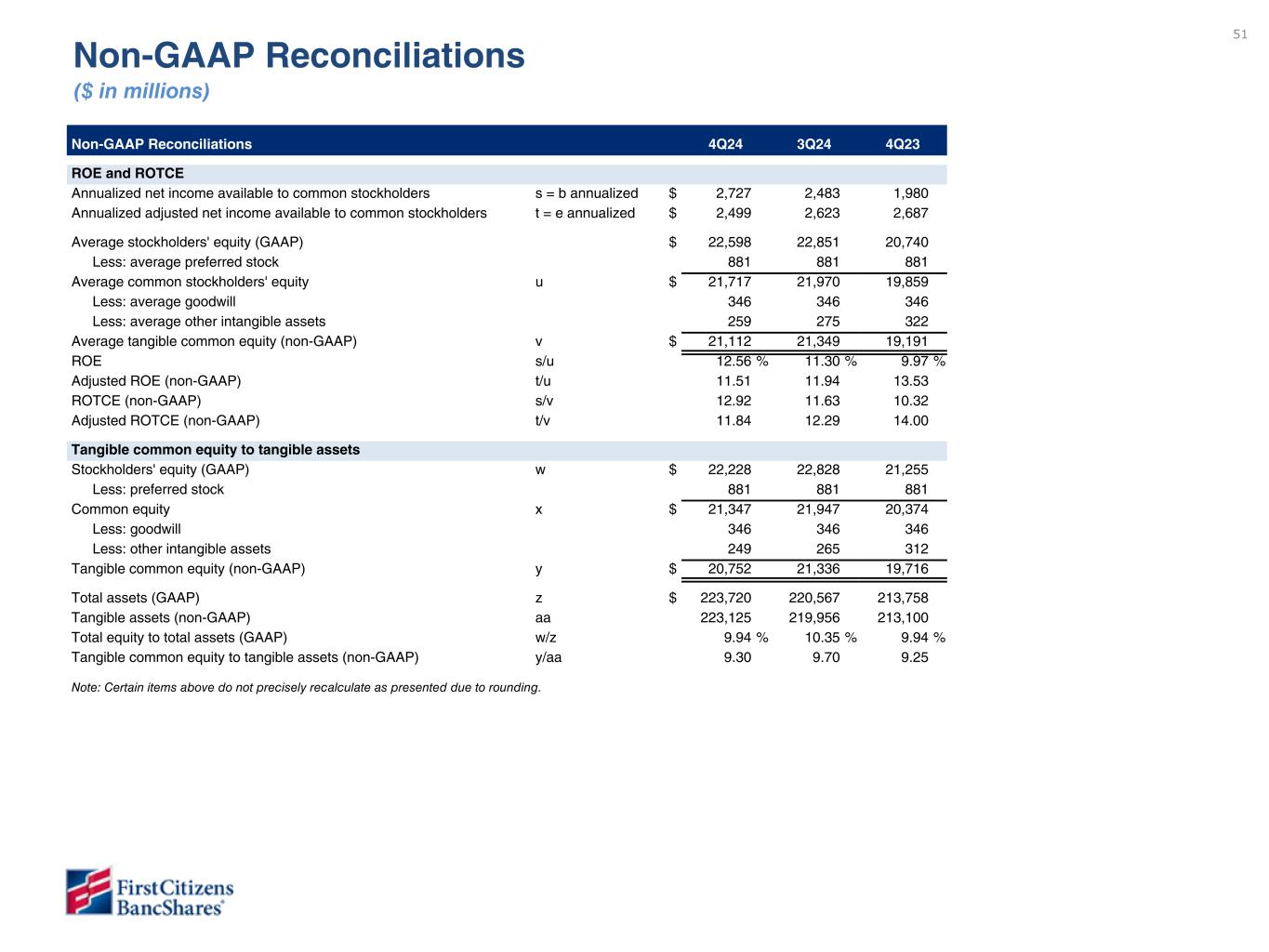

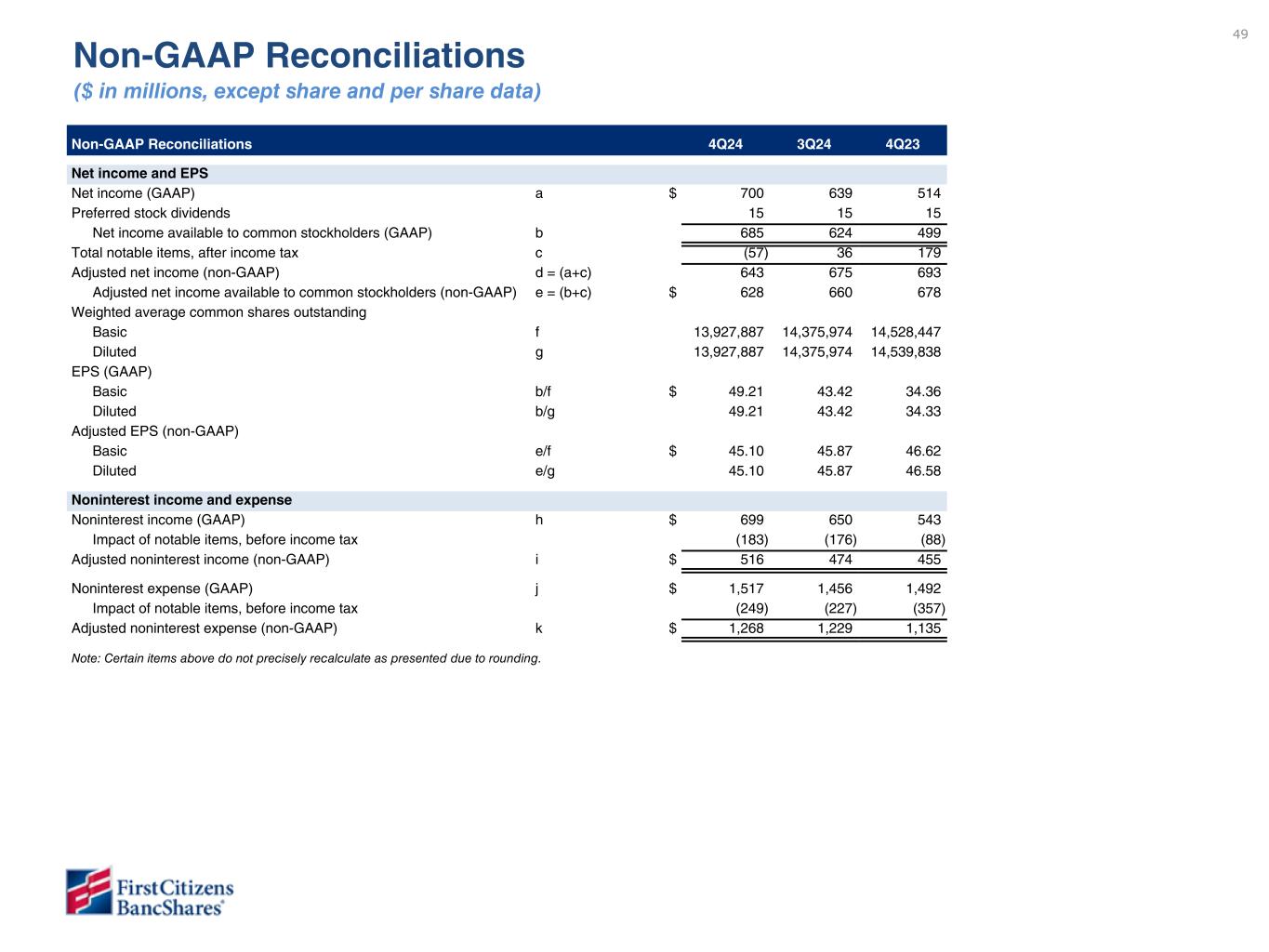

49 Non-GAAP Reconciliations 4Q24 3Q24 4Q23 Net income and EPS Net income (GAAP) a $ 700 639 514 Preferred stock dividends 15 15 15 Net income available to common stockholders (GAAP) b 685 624 499 Total notable items, after income tax c (57) 36 179 Adjusted net income (non-GAAP) d = (a+c) 643 675 693 Adjusted net income available to common stockholders (non-GAAP) e = (b+c) $ 628 660 678 Weighted average common shares outstanding Basic f 13,927,887 14,375,974 14,528,447 Diluted g 13,927,887 14,375,974 14,539,838 EPS (GAAP) Basic b/f $ 49.21 43.42 34.36 Diluted b/g 49.21 43.42 34.33 Adjusted EPS (non-GAAP) Basic e/f $ 45.10 45.87 46.62 Diluted e/g 45.10 45.87 46.58 Noninterest income and expense Noninterest income (GAAP) h $ 699 650 543 Impact of notable items, before income tax (183) (176) (88) Adjusted noninterest income (non-GAAP) i $ 516 474 455 Noninterest expense (GAAP) j $ 1,517 1,456 1,492 Impact of notable items, before income tax (249) (227) (357) Adjusted noninterest expense (non-GAAP) k $ 1,268 1,229 1,135 Note: Certain items above do not precisely recalculate as presented due to rounding. Non-GAAP Reconciliations ($ in millions, except share and per share data)