- UNTC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

-

Shorts

-

DEF 14A Filing

Unit (UNTC) DEF 14ADefinitive proxy

Filed: 14 Mar 08, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Unit Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

UNIT CORPORATION

NOTICE OF THE ANNUAL MEETING OF OUR STOCKHOLDERS

AND

PROXY STATEMENT

| Meeting Date | Wednesday, May 7, 2008 | |

| Meeting Time | 11:00 a.m., Central Time | |

| Meeting Place | Tulsa Room - Ninth Floor | |

| Bank of Oklahoma Tower | ||

| One Williams Center | ||

| Tulsa, Oklahoma 74172 | ||

Dear Stockholder:

On behalf of the board of directors and management, it is my pleasure to invite you to our Annual Meeting of Stockholders to be held on Wednesday, May 7, 2008 at 11:00 a.m., Central Time. This year’s meeting will be held in the Tulsa Room on the ninth floor of the Bank of Oklahoma Tower, One Williams Center, Tulsa, Oklahoma.

By attending the meeting you will have an opportunity to hear a report on our operations and to meet our directors and officers. There will also be time for questions.

Information about the meeting, including the various matters on which you will act, may be found in the attached Notice of Annual Meeting of Stockholders and proxy statement.

We hope that you will be able to attend the Annual Meeting. However, whether or not you plan to attend the meeting in person, it is important that your shares be represented. Please vote your shares using one of the methods available to you.

If you have any further questions concerning the annual meeting or any of the proposals, please contact our investor relations department at (918) 493-7700. For questions regarding your stock ownership, you may contact our transfer agent, American Stock Transfer & Trust Company at:

Toll Free Number: (800) 710-0929

Foreign Stockholders: (718) 921-8283

Web Site Address:www.amstock.com

AST Customer Service Representatives are also available to help you through AST’s “Live Help” Internet service weekdays from 9:00 a.m. - 5:00 p.m., Eastern Time.

I look forward to your participation and thank you for your continued support.

Dated this 14thday of March, 2008.

Sincerely,

John G. Nikkel

Chairman of the Board

7130 S. Lewis, Suite 1000, Tulsa, OK 74136 · PO Box 702500, Tulsa, OK 74170

Phone: (918) 493-7700 ** Fax: (918) 493-7711

UNIT CORPORATION

7130 South Lewis, Suite 1000

Tulsa, Oklahoma 74136

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Time and Date | 11:00 a.m., Central Time, on Wednesday, May 7, 2008 | |

Place | Tulsa Room on the ninth floor of the Bank of Oklahoma Tower, One Williams Center, Tulsa, Oklahoma | |

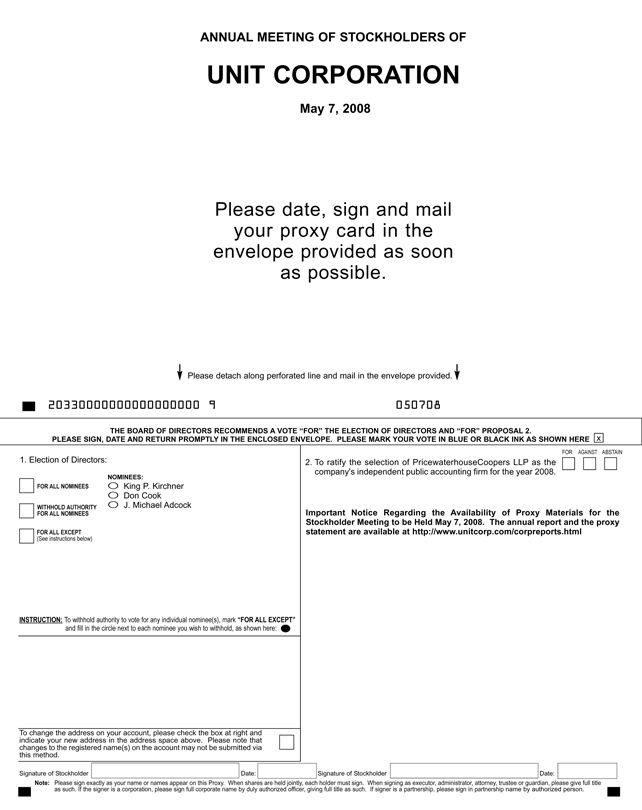

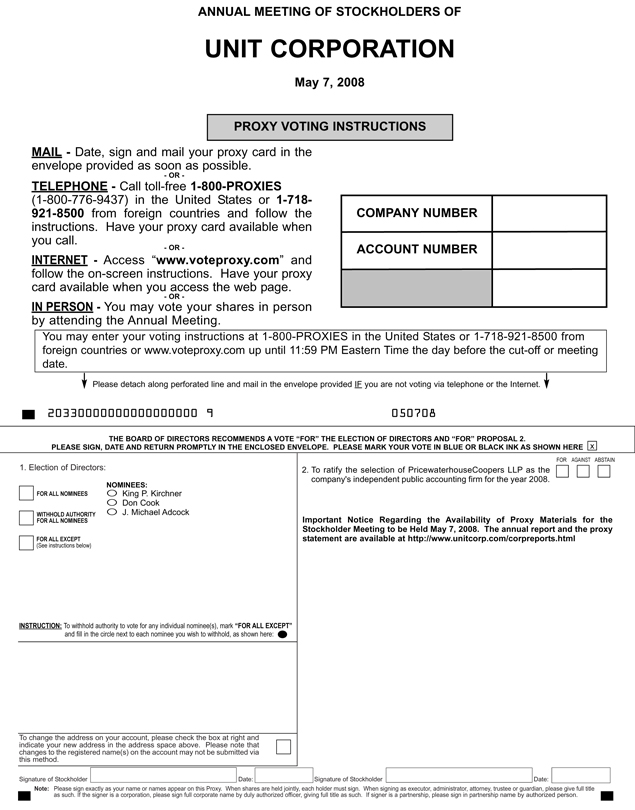

Items of Business | • elect three directors for a three-year term expiring in 2011(Item No. 1 on the proxy card); | |

• ratify the selection of PricewaterhouseCoopers LLP, Tulsa, Oklahoma, as our independent registered public accounting firm for our fiscal year 2008(Item No. 2 on the proxy card); | ||

• transact any other business that properly comes before the meeting or any adjournment(s) of the meeting. | ||

Record Date | March 10, 2008 | |

Voting Options | Most stockholders have four options for submitting their vote:

• via the Internet athttp://www.voteproxy.com,

• by phone (please see your proxy card for instructions),

• by mail, using the paper proxy card, and

• in person at the meeting. | |

Date of this Notice | March 14, 2008 | |

By Order of the Board of Directors,

/s/ Mark E. Schell

Mark E. Schell

Senior Vice President,

Secretary and General Counsel

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, we urge you to vote.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

MAY 7, 2008

This proxy statement and the accompanying proxy card are being mailed to our stockholders in connection with the solicitation of proxies by the board of directors for the 2008 Annual Meeting of Stockholders. Mailing of this proxy statement will commence on or about March 15, 2008.

| Page | ||

| 1 | ||

| 5 | ||

| 5 | ||

| 5 | ||

| 7 | ||

| 7 | ||

| 9 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 13 | ||

Ownership of our Common Stock by Beneficial Owners and Management | 14 | |

| 16 | ||

| 16 | ||

| 16 | ||

| 29 | ||

| 32 | ||

| 34 | ||

| 36 | ||

| 36 | ||

| 38 | ||

| 38 | ||

| 39 | ||

| 39 | ||

(i)

| 39 | ||

| 42 | ||

| 44 | ||

| 44 | ||

| 44 | ||

| 45 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 47 | ||

| 48 | ||

| 48 | ||

| 48 | ||

ITEM 2: Ratification of appointment of independent registered public accounting firm | 51 | |

| 51 | ||

| 51 | ||

| 52 | ||

| 52 | ||

| 53 | ||

Availability of our form 10-K, annual report and proxy statement | 53 | |

| 53 | ||

(ii)

| Q: | Why am I receiving these materials? |

| A: | The board of directors of Unit Corporation, a Delaware corporation, is providing these proxy materials to you in connection with our annual meeting of stockholders, which will take place on May 7, 2008. As a stockholder, you are invited to attend the annual meeting and are entitled to and requested to vote on the items of business described in this proxy statement. |

| Q: | Who can vote? |

| A: | You can vote if you were a stockholder at the close of business on the record date, March 10, 2008. On that date, there were 47,152,184 shares outstanding and entitled to vote at the annual meeting. |

| Q: | What information is contained in this proxy statement? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and certain executive officers and certain other required information. |

| Q: | Who does the phrase “named executive officers” refer to in this proxy statement? |

| A: | For purposes of this proxy statement, our named executive officers are: |

| • | Larry D. Pinkston our Chief Executive Officer and President; |

| • | Mark E. Schell our Senior Vice President, General Counsel and Secretary; |

| • | David T. Merrill our Chief Financial Officer and Treasurer; |

| • | John Cromling the Executive Vice President of Unit Drilling Company; and |

| • | Bradford J. Guidry the Senior Vice President of Unit Petroleum Company. |

| Q: | Can I access the proxy material on the Internet? |

| A: | The proxy material is located on our web sitewww.unitcorp.com. |

| Q: | How may I obtain the company’s 10-K? |

| A: | A copy of our 2007 Form 10-K can be obtained at no charge from: |

Unit Corporation

Attn: Investor Relations

7130 South Lewis, Suite 1000

Tulsa, Oklahoma 74136

(918) 493-7700

http://www.unitcorp.com

We will also furnish any exhibit to the 2007 Form 10-K if specifically requested.

| Q: | Who can attend the meeting? |

| A: | All stockholders can attend. |

| Q: | What am I voting on? |

| A: | You are voting on: |

| • | The election of three nominees as directors for terms that expire in 2011. The board’s nominees are King P. Kirchner, Don Cook, and J. Michael Adcock. |

| • | The ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2008. |

| Q: | What are the voting requirements to elect the directors and to approve the other proposal discussed in this proxy statement? |

| A: | Proposal | Vote requirement | Discretionary | |||

Election of Directors | plurality | yes | ||||

Ratification of Independent Accountants | majority | yes | ||||

1

| Q: | How do I cast my vote? |

| A: | If you hold your shares as a stockholder of record, you can vote in person at the annual meeting or you can vote by mail, telephone or the Internet. If you are a street-name stockholder, you will receive instructions from your bank, broker or other nominee describing how to vote your shares. |

The enclosed proxy card contains instructions for mail voting or for voting by way of telephone or the Internet. The proxies identified on the proxy card will vote the shares of which you are the stockholder of record in accordance with your instructions. If you submit a proxy card without giving specific voting instructions, the proxies will vote those shares as recommended by the board.

| Q: | How does the board recommend I vote on the proposals? |

| A: | The board recommends you vote“for”each of the proposals. |

| Q: | Can I revoke my proxy? |

| A: | Yes. You can revoke your proxy by: |

| • | Submitting a new proxy; |

| • | Giving written notice before the meeting to our corporate secretary stating that you are revoking your proxy; or |

| • | Attending the meeting and voting your shares in person. |

| Q: | Who will count the vote? |

| A: | American Stock Transfer & Trust Company, our transfer agent, will count the vote. A representative of American Stock Transfer & Trust Company will also act as the inspector of election. |

| Q: | What is a “quorum”? |

| A: | A quorum is the number of shares that must be present to hold the annual meeting. The quorum requirement for the annual meeting is a majority of the outstanding shares as of the record date, present in person or represented by proxy. If you submit a valid proxy or attend the annual meeting, your |

shares will be counted to determine whether there is a quorum. |

Abstentions and broker non-votes count toward the quorum. “Broker non-votes” occur when nominees (such as banks and brokers) that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners by 15 days before the meeting and do not have discretionary voting authority to vote those shares.

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most of our stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholder of Record.If your shares are registered directly in your name with the transfer agent, you are considered, with respect to those shares, thestockholder of record, and these proxy materials are being sent directly to you. As thestockholder of record, you have the right to grant your voting proxy directly to the company or to vote in person at the meeting. We have enclosed or sent a proxy card for you to use.

Beneficial Owner. If your shares are held in a brokerage account or by another nominee, you are considered thebeneficial ownerof shares heldin street name, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and are also invited to attend the annual meeting.

Since a beneficial owner is not thestockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee

2

has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

| Q: | Will broker non-votes or abstentions affect the voting results? |

| A: | In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained. |

| Q: | What shares are included on my proxy card? |

| A: | Your proxy card represents all shares registered to your account in the same social security number and address. However, the proxy card does not include shares held for participants in the Unit Corporation Employee Thrift Plan. Instead, those participants will receive from the plan trustee separate voting instruction cards covering these shares. If voting instructions are not received from participants in that plan, the plan trustee will vote the shares. |

| Q: | What does it mean if I get more than one proxy card? |

| A: | Your shares are probably registered in more than one account. You should vote each proxy card you receive. We encourage you to consolidate all your accounts by registering them in the same name, social security number and address. |

| Q: | How many votes can I cast? |

| A: | On each matter, including each director position, you are entitled to one vote per share. |

| Q: | What happens if additional matters are presented at the annual meeting? |

| A: | Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted on at the annual meeting. If you grant a proxy, the persons named as proxy holders, |

Larry D. Pinkston and Mark E. Schell, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If, for any unforeseen reason, any of our nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for that candidate or candidates as may be nominated by the board on the recommendation of the nominating and governance committee. |

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

| A: | Stockholder Proposals.For a stockholder proposal to be considered for inclusion in our proxy statement for next year’s annual meeting, the written proposal must be received by our corporate secretary at our principal executive offices no later than November 13, 2008. If the date of next year’s annual meeting is moved more than 30 days before or after the anniversary date of this year’s annual meeting, the deadline for inclusion of proposals in our proxy statement is instead a reasonable time before the company begins to print and mail its proxy materials. Proposals also will need to comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to: |

Corporate Secretary

Unit Corporation

7130 South Lewis, Suite 1000

Tulsa, Oklahoma 74136

Fax: (918) 493-7711

For a stockholder proposal that is not intended to be included in our proxy statement under Rule 14a-8, the stockholder must deliver a proxy statement and form of proxy to holders of a sufficient number of shares of our common stock to approve that proposal, provide the information required by our bylaws and give timely notice to our corporate

3

secretary in accordance with our bylaws, which, in general, require that the notice be received by the corporate secretary:

| • | Not earlier than the close of business on January 3, 2009; and |

| • | Not later than the close of business on February 2, 2009. |

If the date of the stockholder meeting is moved more than 30 days before or 70 days after the anniversary of our annual meeting for the previous year, then notice of a stockholder proposal that is not intended to be included in the company’s proxy statement under Rule 14a-8 must be received no earlier than the close of business 120 days before the meeting and no later than the close of business on the later of the following two dates:

| • | 90 days before the meeting; and |

| • | 10 days after public announcement of the meeting date. |

Nomination of director candidates.You may propose director candidates for consideration by the board’s nominating and governance committee. Any recommendations should include the nominee’s name and qualifications for board membership and should be directed to our corporate secretary at the address of our principal executive offices set forth above. In addition, our bylaws permit a stockholder to nominate directors for election at an annual stockholder meeting. To nominate a director, a stockholder must deliver a proxy statement and form of proxy to holders of a sufficient number of shares of our common stock to elect the nominee and provide the information required by our bylaws, including a statement by the stockholder identifying (i) the name and address of the stockholder, as they appear on the company’s books, and of the beneficial owner, if any, on behalf of who the nomination or proposal is made, (ii) the class and number of shares of our capital stock which are owned beneficially and of record by the

stockholder (and such beneficial owner, if any), (iii) a representation that the stockholder is a holder of record of our stock entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to propose the nomination, and (iv) a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (A) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of our outstanding capital stock required to elect the nominee and/or (B) otherwise to solicit proxies from stockholders in support of the nomination. In addition, the stockholder must give timely notice to our corporate secretary in accordance with our bylaws, which, in general, require that the notice be received by the corporate secretary within the January 3, 2009 through February 2, 2009 time period described above.

Copy of Bylaw Provisions. You may contact our corporate secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. Our bylaws are also available on our website athttp://www.unitcorp.com.

| Q: | How is this proxy solicitation being conducted? |

| A: | We hired Regan & Associates, New York, New York, to assist in the distribution of proxy materials and solicitation of votes for a fee of $8,500.00 with all of their out-of-pocket expenses included. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. Some of our employees may also solicit proxies. Regan & Associates and our employees may solicit proxies in person, by telephone and by mail. None of our employees will receive special compensation for these services, which the employees will perform as part of their regular duties. |

4

| Q: | How can I obtain the company’s corporate governance information? |

| A: | Our Internet website is located atwww.unitcorp.com. You may also enterwww.unitcorp.com/corpgov.html for a direct link to the following information: |

| • | Our bylaws; |

| • | Audit Committee Charter; |

| • | Compensation Committee Charter; |

| • | Nominating and Governance Committee Charter; |

| • | Corporate Governance Guidelines; |

| • | Code of Business Conduct and Ethics; |

| • | Accounting and Auditing Complaint Procedures; and |

| • | Policy and Procedures with respect to Related Person Transactions. |

Our corporate governance webpage also has a link for reporting on any accounting, internal controls, or auditing matters that pertain to us.

CORPORATE GOVERNANCE AND BOARD MATTERS

General governance information

We are committed to having sound corporate governance principles. Our Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on our website athttp://www.unitcorp.com/corpgov.html and copies of these documents may also be obtained from our corporate secretary. These provisions apply to our employees, including our principal executive officer, principal financial officer and principal accounting officer. We will post any amendments or waivers to our Code of Business Conduct and Ethics (to the extent applicable to our chief executive officer, principal financial officer or principal accounting officer) on our website.

Each year, our directors and executive officers are obligated to complete a director and officer questionnaire which requires disclosure of any transactions with us in which the director or executive officer, or any member of his or her immediate family, have a direct or indirect material interest. Our chief executive officer and general counsel are charged with resolving any conflict of interests not otherwise resolved under one of our other policies.

Director independence criteria

Attached as Appendix “A” to this proxy statement is a copy of our board’s independence standards. The board has defined an independent director as a director who the board has determined has no material relationship with the

company, either directly, or as a partner, shareholder, or executive officer of an organization that has a relationship with the company. A relationship is “material” if, in the judgment of the board, the relationship would interfere with the director’s independent judgment. Based on the materiality guidelines adopted by the board, a director is not deemed to be independent if:

| • | the director, or the director’s “immediate family member” received any payment from the company in excess of $100,000 during any twelve-month period within the last three years, other than compensation for board service and pension or other forms of deferred compensation for prior service with the company, except that compensation received by an immediate family member for service as an employee of the company (other than as an executive officer) need not be considered in determining independence; |

| • | the director is an executive officer or employee of, or his or her immediate family member, is an executive officer of, a company, or other for profit entity, to which the company made, or from which the company received for property or services (other than those arising solely from investments in the company’s securities), payments in |

5

excess of the greater of $1 million or 2% of such company’s consolidated gross revenues in any of the last three fiscal years; |

| • | the director serves as an executive officer of any tax exempt organization which received contributions from the company in any of the preceding three fiscal years in an aggregate amount that exceeded the greater of $1 million or 2% of such tax exempt organization’s consolidated gross revenues. |

Any person who, or whose immediate family member(s), has within the prior three years had any of the following relationships with the company does not qualify as an independent director.

| • | Former employees. No director will be independent if he or she is currently, or was at any time within the last three years, an employee of the company. |

| • | Interlocking directorships. No director, and no immediate family member of a director, may currently be, or have been within the last three years, employed as an executive officer of another company where any of our present executive officers at the same time serves or served on that company’s compensation committee. |

| • | Former executive officers of company. No director will be independent if he or she has any immediate family member that is currently, or was at any time within the last three years, an executive officer of the company. |

| • | Former auditor. No director will be independent if (i) he or she or an immediate family member is a current partner of a firm that is the company’s internal or external auditor; (ii) the director is a current employee of such a firm; (iii) the director has an immediate family member who is a current employee of such a firm; and who participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice; or (iv) the director or |

an immediate family member was at any time within the last three years but is no longer a partner or employee of such a firm and personally worked on the company’s audit within that time. |

Additional requirements for audit committee members.In addition to the guidelines set forth above, a director is not considered independent for purposes of serving on the audit committee, and may not serve on the audit committee, if the director:

| • | receives directly or indirectly any consulting, advisory, or compensatory fee from the company, other than fees for service as a director or fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with the company (provided that such compensation is not contingent in any way on continued service); or |

| • | is an affiliated person of the company or it subsidiaries, as determined in accordance with SEC regulations. In this regard, audit committee members are prohibited from owning or controlling more than 10% of any class of the company’s voting securities or such lower amount as may be established by the SEC. |

Additional requirements for compensation committee members.In addition to the guidelines set forth above, a director is not considered independent for purposes of serving on the compensation committee, and may not serve on the compensation committee, if the director:

| • | receives directly or indirectly any remuneration as specified for purposes of Section 162(m) of the Internal Revenue Code; |

| • | has ever been an officer of the company; or |

| • | has a direct or indirect material interest in any transaction, arrangement or relationship or any series of similar transactions, arrangements or relationships required to be disclosed |

6

under SEC Regulation S-K Item 404(a) and involving, generally, amounts in excess of $120,000. |

Director independence determinations

The board has determined that Don Cook, William B. Morgan, John H. Williams, J. Michael Adcock, Gary R. Christopher and Robert J. Sullivan Jr. have no material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the company) and is independent within the meaning of our director independence standards, which reflect the NYSE director independence standards, as currently in effect. The board has also determined that each of the members of its standing committees has no material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the company) and is “independent” within the meaning of our director independence standards.

Board structure and committees

As of the date of this proxy statement, our board has nine directors and the following three standing committees:

| • | audit; |

| • | compensation; and |

| • | nominating and governance. |

Our board is divided into three classes with each class consisting of three directors. Directors serve for a three year term.

Each of the board’s three standing committees operate under a committee’s adopted written charter. The charter of each committee is available at our website athttp://www.unitcorp.com/corpgov.html. In addition, copies of these charters may also be obtained from our corporate secretary.

During 2007, the board and its committees held a total of 16 meetings. Our board met seven times, all regularly scheduled meetings. There were 9 committee meetings held in 2007. All directors attended 100% of the board meetings with the exception that one director missed one of the meetings. Each committee member attended 100% of his respective committee meetings. All directors are encouraged to attend our annual meeting of stockholders. All directors attended our last annual meeting of stockholders. In addition to its meetings, the board and its various committees act, from time to time, by unanimous consent.

The following table identifies the membership of each of the three standing committees and the number of meetings each committee held during 2007. A summary of each committee’s responsibilities follows the table.

| DIRECTOR | COMMITTEE MEMBERSHIP | ||||||||

| Audit | Compensation | Nominating and Governance | |||||||

Don Cook | x | * | x | ||||||

William B. Morgan | x | x | x | * | |||||

John H. Williams | x | x | |||||||

J. Michael Adcock | x | * | x | ||||||

Gary R. Christopher | x | ||||||||

Robert J. Sullivan Jr.** | x | ||||||||

Number of meetings in 2007 | 4 | 4 | 1 | ||||||

| * | Designates the chairman of the committee. |

| ** | Mr. Sullivan was elected to our Nominating and Governance Committee on May 2, 2007. |

7

Audit Committee

The responsibilities of our audit committee include:

| • | Selects our independent registered public accounting firm; |

| • | Approves all audit engagement fees and terms; |

| • | Pre-approves all audit and non-audit services to be rendered by our independent registered public accounting firm; |

| • | Reviews our annual and quarterly financial statements; |

| • | Consults with our personnel and the independent registered public accounting firm to determine the adequacy of our internal accounting controls; |

| • | Oversees our relationship with our independent registered public accounting firm; |

| • | Oversees our internal audit functions; |

| • | Reviews with our independent registered public accounting firm and our internal audit department and management: |

| - | the adequacy and effectiveness of our systems of internal controls over financial reporting and any significant changes in those controls; |

| - | our accounting practices, and disclosure controls and procedures; and |

| - | current accounting trends and developments; |

and takes any action with respect to these matters that it deems appropriate;

| • | Recommends to our board whether the financial statements should be included in our annual report on Form 10-K; and |

| • | Reviews our earnings press releases, as well as our policies with respect to earnings press releases and financial information. |

The committee has the authority to form and delegate authority to one or more of its members.

The audit committee has the authority to obtain advice and assistance from, and receive appropriate funding from the company for, outside legal, accounting or other advisors as the committee deems necessary to carry out its duties.

In addition, the audit committee has established procedures for the receipt, retention and treatment (on a confidential basis) of complaints received by the company, the board or the audit committee, regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters. These procedures are described in the Accounting and Auditing Complaint Procedures posted on our website.

The report of the audit committee is included on page 45.

Compensation Committee

Our compensation committee has overall responsibility for approving and evaluating director and executive officer compensation plans, policies and programs. In carrying out these responsibilities the committee:

| • | Annually reviews and approves any corporate goals and objectives relevant to our chief executive officer’s compensation, and makes recommendations to the board as to our chief executive officer’s compensation; |

| • | Recommends to our board the compensation of our other executive officers and certain key employees; |

| • | Annually reviews the compensation available to our chief executive officer and other executive officers, including the annual base salary level, annual incentive opportunity level, long-term incentive opportunity level, employment agreements (if any), severance arrangements, change-in-control agreements and any special or supplemental benefits or plans; |

| • | Annually approves and evaluates director and officer compensation plans, |

8

policies and programs, and discharges its duties under any of those plans; |

| • | Determines director compensation; |

| • | Reviews and approves the “compensation discussion and analysis” for inclusion in our proxy statement; and |

| • | Has the authority to retain compensation consultants or other advisors to assist the committee in its evaluation of director, chief executive officer, or executive officer compensation. |

The committee has the authority to form and delegate authority to subcommittees and to delegate authority to one or more of its members. For additional information on the operations of the committee, including the role of our executive officers in determining executive and director compensation, see “Compensation discussion and analysis – Administration of executive compensation program,” page 19.

The report of the compensation committee is included at page 16.

Nominating and Governance Committee

The responsibilities of this committee include:

| • | Advises the board as a whole on corporate governance matters; |

| • | Advises the board on the size and composition of the board; |

| • | Recommends a slate of nominees for election to the board; |

| • | Identifies individuals qualified to become board members, consistent with criteria approved by the board; |

| • | Identifies best practices and recommends corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance; |

| • | Recommends membership to each board committee; and |

| • | Defines specific criteria for director independence. |

Consideration of nominees for director

Stockholder nominees.The policy of the nominating and governance committee is to consider properly-submitted stockholder nominations for candidates for membership on the board as described below under “Identifying and evaluating nominees for directors.” In evaluating nominations, the committee seeks to achieve a balance of knowledge, experience and diversity on the board. Any stockholder nominations proposed for consideration by the committee should include the nominee’s name and qualifications for board membership and should be addressed to:

Corporate Secretary

Unit Corporation

7130 South Lewis, Suite 1000

Tulsa, Oklahoma 74136

In addition, our bylaws permit stockholders to nominate directors for consideration at an annual stockholders meeting. For a description of the process for nominating directors in accordance with our bylaws, see “Questions and Answers- What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?” on page 3.

Director qualifications.Our Corporate Governance Guidelines contain board membership criteria that apply to nominating and governance committee-recommended nominees for a position on the board. Under these criteria, members of the board should meet the board’s qualifications as independent (as applicable) and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of the company and its stockholders.

Identifying and evaluating nominees for directors.The nominating and governance committee uses a variety of methods for identifying and evaluating nominees for director.

9

The committee assesses the appropriate size of the board, and whether any vacancies on the board are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise, the committee considers various potential candidates for director. Candidates may come to the attention of the committee through current board members, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the committee and may be considered at any point during the year. As described above, the committee considers properly-submitted stockholder nominations for candidates for the board. Following verification of the stockholder status of persons proposing candidates, recommendations are considered by the committee. If any materials are provided by a stockholder in connection with the nomination of a director candidate, those materials are forwarded to the nominating and governance committee. The committee may also review materials provided by a professional search firm or other party in connection with a nominee who is not proposed by a stockholder.

Executive sessions of non-management directors are held periodically during the year. The sessions are scheduled and presided over by Mr. J. Michael Adcock who was elected by the board to chair each executive session. Meetings are also held from time to time with the board chairman and our chief executive officer for a general discussion of relevant subjects. Any non-management director can request that an executive session be scheduled. Executive sessions of the independent directors only are held at least once a year.

Any interested party may communicate directly with the presiding director by writing to the following:

Mr. J. Michael Adcock

c/o Corporate Secretary

Unit Corporation

7130 South Lewis, Suite 1000

Tulsa, Oklahoma 74136

Individuals may communicate with the board by submitting an e-mail to the board in care of the company’s corporate secretary atmark.schell@unitcorp.com or sending a letter to: Board of Directors, c/o Corporate Secretary, Unit Corporation, 7130 S. Lewis, Suite 1000, Tulsa, Oklahoma 74136.

The chair of the nominating and governance committee has been designated as the person to receive communications directed to non-management directors. Our stockholders may write to the chairman of this or any other board committee or to the outside directors as a group c/o Mark E. Schell, Senior Vice President and General Counsel, Unit Corporation, 7130 South Lewis, Suite 1000, Tulsa, Oklahoma 74136.

Stockholder communications are distributed to the board, or to the appropriate individual director or directors, depending on the facts and circumstances of the communication. However, at the request of the board, certain items that are not related to the duty and responsibilities of the board are excluded, such as advertisements, junk mail, mass mailings, spam and surveys.

Board and committee evaluations

Each year the board evaluates its performance and effectiveness. Each director completes a board evaluation form to solicit feedback on specific aspects of the board’s role, organization and meetings. The collective ratings and comments are compiled by or for the chairman of the nominating and governance committee and presented by him to the full board. Additionally, each of the three standing board committees conducts an annual self-evaluation of its performance through a committee evaluation form.

10

DIRECTORS’ COMPENSATION AND BENEFITS

Only non-employee directors receive compensation for serving as a director. The various components of the cash compensation paid to our non-employee directors during 2007 is as follows:

| Annual retainer (payable quarterly) | $30,000* | |

| Annual retainer for each committee a board member serves on (payable quarterly) | $2,000 | |

| Each board meeting attended | $1,500 | |

| Each committee meeting attended | $1,500 | |

| Additional compensation for service as chairman of the audit committee | $7,500 | |

| Additional compensation for service as chairman for each of the compensation committee and nominating and governance committee | $3,500 | |

| Reimbursement for expenses incurred attending stockholder, board and committee meetings | Yes | |

| Range of total cash compensation (excluding expense reimbursement and retirement/consulting fees) earned by directors (for the year 2007) | $39,000 - 68,000 | |

| * | At its December 19, 2007, meeting, the board of directors increased the annual retainer to $60,000 effective January 1, 2008. |

Under a plan approved by our stockholders, each non-employee director automatically receives an option to purchase 3,500 shares of our common stock on the first business day following each annual meeting of our stockholders. The option exercise price is the fair market value of our common stock on that date. Payment of the exercise price may be made in cash or in shares

of common stock that have been held by the director for at least one year. No stock option may be exercised during the first six months of its term except in the case of death. Each option has a ten-year term. In 2007, stock options were granted for a total of 28,000 shares at $57.63 per share. As of March 10, 2008, 139,000 shares were subject to outstanding options held by directors.

11

The following table shows the outstanding options held by our current directors as of March 10, 2008:

| OUTSTANDING OPTIONS HELD BY NON-EMPLOYEE DIRECTORS AS OF MARCH 10, 2008 | ||||||

| Director | Date of Option | Shares Subject to Option(#) | Exercise Price($) | |||

J. Michael Adcock | 5/6/04 | 3,500 | 28.23 | |||

| 5/5/05 | 3,500 | 39.50 | ||||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

Don Cook | 5/4/00 | 3,500 | 12.1875 | |||

| 5/3/01 | 3,500 | 17.54 | ||||

| 5/2/02 | 3,500 | 20.10 | ||||

| 5/8/03 | 3,500 | 20.46 | ||||

| 5/6/04 | 3,500 | 28.23 | ||||

| 5/5/05 | 3,500 | 39.50 | ||||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

John H. Williams | 5/3/01 | 3,500 | 17.54 | |||

| 5/2/02 | 3,500 | 20.10 | ||||

| 5/8/03 | 3,500 | 20.46 | ||||

| 5/6/04 | 3,500 | 28.23 | ||||

| 5/5/05 | 3,500 | 39.50 | ||||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

William B. Morgan | 5/6/99 | 2,500 | 6.90 | |||

| 5/3/01 | 3,500 | 17.54 | ||||

| 5/2/02 | 3,500 | 20.10 | ||||

| 5/8/03 | 3,500 | 20.46 | ||||

| 5/6/04 | 3,500 | 28.23 | ||||

| 5/5/05 | 3,500 | 39.50 | ||||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

King P. Kirchner | 5/2/02 | 3,500 | 20.10 | |||

| 5/8/03 | 3,500 | 20.46 | ||||

| 5/6/04 | 3,500 | 28.23 | ||||

| 5/5/05 | 3,500 | 39.50 | ||||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

John G. Nikkel | 5/5/05 | 3,500 | 39.50 | |||

| 5/4/06 | 3,500 | 62.40 | ||||

| 5/3/07 | 3,500 | 57.63 | ||||

Gary R. Christopher | 5/4/06 | 3,500 | 62.40 | |||

| 5/3/07 | 3,500 | 57.63 | ||||

Robert J. Sullivan Jr. | 5/4/06 | 3,500 | 62.40 | |||

| 5/3/07 | 3,500 | 57.63 | ||||

12

The following table shows the total compensation received by each of our non-employee directors in 2007:

| DIRECTOR COMPENSATION FOR 2007 | ||||||||||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in ($) | All Other Compensation ($) | Total ($) | |||||||

| (a) | (b)(1) | (c) | (d)(2) | (e) | (f) | (g)(3) | (h) | |||||||

J. Michael Adcock | 58,500 | n/a | 76,510 | n/a | n/a | 200 | 135,210 | |||||||

John H. Williams | 55,000 | n/a | 76,510 | n/a | n/a | - | 131,510 | |||||||

Don Cook | 65,500 | n/a | 76,510 | n/a | n/a | - | 142,010 | |||||||

William B. Morgan | 68,000 | n/a | 76,510 | n/a | n/a | 3,396 | 147,906 | |||||||

King P. Kirchner | 40,500 | n/a | 76,510 | n/a | n/a | 300,000(4) | 417,010 | |||||||

John G. Nikkel | 39,000 | n/a | 76,510 | n/a | n/a | 515,000(4) | 641,510 | |||||||

Gary R. Christopher | 50,000 | n/a | 76,510 | n/a | n/a | - | 115,510 | |||||||

Robert J. Sullivan Jr. | 42,000 | n/a | 76,510 | n/a | n/a | - | 118,510 | |||||||

Notes to table:

| (1) | Represents cash compensation for board and committee meeting attendance, retainers and service as a committee chairman. |

| (2) | The amounts included in the “Option Awards” column are the amounts of compensation costs recognized by the company in fiscal 2007 related to the stock options granted on May 3, 2007 as described in FAS 123(R), but does not include any impact of estimated forfeitures. This value is calculated using the closing price of our common stock on the date of grant. For a discussion of the valuation assumptions used in calculating these values, see Notes 2 and 11 to our 2007 Consolidated Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2007. The directors have the following aggregate number of stock options outstanding at 2007 year end: |

| Name | Number of Options | |

| J. Michael Adcock | 14,000 | |

| John H. Williams | 24,500 | |

| Don Cook | 28,000 | |

| William B. Morgan | 24,500 | |

| King P. Kirchner | 21,000 | |

| John G. Nikkel | 10,500 | |

| Gary R. Christopher | 7,000 | |

| Robert J. Sullivan Jr. | 7,000 |

| (3) | Represents reimbursement for expenses. |

| (4) | Represents amounts paid under our plans or retirement or consulting agreements as more fully discussed under, “Potential Payments on Termination or Change-in-Control—Retirement or consulting agreements.” |

13

OWNERSHIP OF OUR COMMON STOCK BY BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the number of shares of our common stock beneficially owned as of March 10, 2008 by each director, each named executive officer and by all directors and executive officers as a group. Except as otherwise noted, all shares are directly owned.

| STOCK OWNED BY OUR DIRECTORS AND EXECUTIVE OFFICERS AS OF MARCH 10, 2008 | ||||||||

| Name of Beneficial Owner* | Common Stock(1)(2) | Options Exercisable within 60 days | Shares of Restricted Stock(3) | Shares of Stock Appreciation Rights(4) | ||||

King P. Kirchner | 134,720 | 21,000 | - | - | ||||

Don Cook | 10,118 | 28,000 | - | - | ||||

William B. Morgan | 5,000 | 27,000 | - | - | ||||

John G. Nikkel | 244,127 | 10,500 | - | - | ||||

John H. Williams | 1,000 | 24,500 | - | - | ||||

J. Michael Adcock | 17,891 | 14,000 | - | - | ||||

Larry D. Pinkston | 54,508 | 41,000 | 32,122 | 71,245 | ||||

Mark E. Schell | 48,184 | 38,100 | 14,715 | 23,949 | ||||

David T. Merrill | 5,016 | 9,400 | 13,378 | 21,772 | ||||

Gary R. Christopher | 3,000 | 7,000 | - | - | ||||

Robert J. Sullivan Jr. | - | 7,000 | - | - | ||||

John Cromling | 12,316 | 6,800 | 10,555 | 14,804 | ||||

Bradford J. Guidry | 19,755 | 12,900 | 10,789 | 14,131 | ||||

All directors and executive officers as a group* | 555,635 | 247,200 | 81,559 | 145,901 | ||||

| * | Each named director and officer individually owns less than one percent of our outstanding shares of common stock and collectively the directors and officers own 1.88%. For purposes of calculating this percentage ownership, the total number of shares outstanding includes the shares previously issued and outstanding plus the number of shares that any named owner has the right to acquire within 60 days. |

Notes to table:

| (1) | Includes the following shares of common stock held under our 401(k) thrift plan as of March 10, 2008: Mr. Pinkston, 5,152 shares; Mr. Schell, 33,047 shares; Mr. Merrill, 1,851 shares; Mr. Cromling, 727 shares; Mr. Guidry, 2,024 shares; and directors and officers as a group, 42,801 shares. |

| (2) | Of the shares listed as being beneficially owned, the following individuals disclaim any beneficial interest in shares held by spouses, trusts or for the benefit of family members: Mr. Adcock, 17,891 shares; and Mr. Nikkel, 63,000 shares. |

| (3) | These shares of restricted stock were awarded as follows: |

| (a) On December 12, 2006, the following restricted stock awards were granted. The total amount of the awards and the vesting schedule is shown below. The unvested part of these awards is subject to the recipient’s then continued employment by the company. |

Name | Vesting schedule (#) | |||||||||

| Total shares subject to award | 1/1/07 | 1/1/08 | 1/1/09 | 1/1/10 | ||||||

| Larry Pinkston | 8,990 | 2,248 | 2,247 | 2,248 | 2,247 | |||||

| Mark Schell | 2,472 | 618 | 618 | 618 | 618 | |||||

| David Merrill | 2,248 | 562 | 562 | 562 | 562 | |||||

| Brad Guidry | 1,573 | 394 | 393 | 393 | 393 | |||||

| John Cromling | 1,648 | 412 | 412 | 412 | 412 | |||||

14

| (b) On December 19, 2007, the following Long-term retention restricted stock awards were granted. The total amount of the awards is shown below. All of these shares vest on August 23, 2010 subject to the recipient’s continued employment by the company. |

| Name | Shares subject to award | |

| Larry Pinkston | 18,267 | |

| Mark Schell | 10,047 | |

| David Merrill | 9,134 | |

| Brad Guidry | 8,038 | |

| John Cromling | 7,672 |

| (c) On December 19, 2007, the following restricted stock awards were granted. The total amount of the awards and the vesting schedule is shown below. The unvested part of these awards is subject to the recipient’s continued employment by the company. |

| Vesting schedule (#) | ||||||||||

| Name | Shares subject to award | 1/1/08 | 1/5/09 | 1/4/10 | 1/3/11 | |||||

| Larry Pinkston | 12,481 | 3,121 | 3,120 | 3,120 | 3,120 | |||||

| Mark Schell | 4,576 | 1,144 | 1,144 | 1,144 | 1,144 | |||||

| David Merrill | 4,160 | 1,040 | 1,040 | 1,040 | 1,040 | |||||

| Brad Guidry | 2,621 | 656 | 655 | 655 | 655 | |||||

| John Cromling | 2,746 | 687 | 687 | 686 | 686 | |||||

| (4) | The stock appreciation rights (all settled in stock) were awarded as follows: |

| Vesting schedule (#) | ||||||||||

| Name | Award date | Total SARs | 1/1/08 | 1/1/09 | 1/1/10 | |||||

| Larry Pinkston | 12/12/06 | 23,716 | 7,906 | 7,905 | 7,905 | |||||

| Mark Schell | 12/12/06 | 6,522 | 2,174 | 2,174 | 2,174 | |||||

| David Merrill | 12/12/06 | 5,929 | 1,977 | 1,976 | 1,976 | |||||

| Brad Guidry | 12/12/06 | 4,150 | 1,384 | 1,383 | 1,383 | |||||

| John Cromling | 12/12/06 | 4,348 | 1,450 | 1,449 | 1,449 | |||||

| Vesting schedule (#) | ||||||||||

| Name | Award date | Total SARs | 1/5/09 | 1/4/10 | 1/3/11 | |||||

| Larry Pinkston | 12/19/07 | 47,529 | 15,843 | 15,843 | 15,843 | |||||

| Mark Schell | 12/19/07 | 17,427 | 5,809 | 5,809 | 5,809 | |||||

| David Merrill | 12/19/07 | 15,843 | 5,281 | 5,281 | 5,281 | |||||

| Brad Guidry | 12/19/07 | 9,981 | 3,327 | 3,327 | 3,327 | |||||

| John Cromling | 12/19/07 | 10,456 | 3,486 | 3,485 | 3,485 | |||||

15

The following table sets forth information concerning the beneficial ownership of our common stock by stockholders who own at least five percent of our common stock.

| STOCKHOLDERS WHO OWN AT LEAST 5% OF OUR COMMON STOCK | ||||

| Name and Address | Amount and Nature of Beneficial Ownership(1) | Percent of Class | ||

| Royce & Associates, LLC 1414 Avenue of the Americas New York, New York 10019 | 6,594,765 | 14.22% | ||

| Barclays Global Investors, N.A. (and other reporting persons) 45 Fremont Street San Francisco, California 94105 | 4,111,058 | 8.86% | ||

| George Kaiser Family Foundation 124 East Fourth Street, Suite 100 Tulsa, Oklahoma 74103 | 2,448,932 | 5.28% | ||

Note to table:

| (1) | Beneficial ownership is based on the Schedule 13G or 13G/A most recently filed by the stockholder or other information provided to us. Beneficial ownership may under certain circumstances include both voting power and investment power. Information is provided for reporting purposes only and should not be construed as an admission of actual beneficial ownership. |

The compensation committee of the board has reviewed and discussed with our management the following compensation discussion and analysis. Based on that review and discussion, the compensation committee recommended to the board that the compensation discussion and analysis be included in this proxy statement.

Members of the Compensation Committee:

J. Michael Adcock - chairman

William B. Morgan

John H. Williams

Don Cook

Compensation discussion and analysis

General compensation objectives

The primary goals of our compensation program, both for executives and non-executives, is to attract, motivate, reward and retain competent employees. We try to apply our program in a way that joins our employees’ interests with that of our business and financial objectives as well as the interests of our stockholders. To accomplish this we:

| • | offer a competitive compensation mix consisting of reasonable salaries, |

short-term and long-term cash and equity incentives, as well as additional benefits such as perquisites and general health and retirement benefits; |

| • | reward performance that achieves our business objectives and enhances the performance of our common stock; and |

| • | link executive compensation incentives to stockholders’ interests by offering equity incentives primarily related to appreciation in the value of our stock. |

Elements of our compensation program

Our executives’ compensation consists of base salary, cash bonus, equity awards, health, disability and life insurance, indemnification protection, retirement and separation benefits, and certain perquisites. We use each of these elements because we believe they provide the compensation mix required to attract and retain talented executives, reward them for quality performance, and motivate them to focus on both the short-term and long-term performance of the company. Specifically, we believe an adequate base salary is required to attract and retain qualified executives based on competitive

16

salaries. Annual salary increases and cash bonuses provide executives with potential earnings that can be based on annual financial and operating results and reward them for short-term successes. Equity awards are used to motivate our executives to achieve both long-term and short-term results and aid long-term retention of our executives. Compensating our executives for positive company performance in

both the short term and the long term serves our goal of aligning our executives’ compensation with the interests of our stockholders. Indemnification protections, retirement and separation benefits and general perquisites are commonly included in executive compensation packages offered by our competitors, and we believe that providing them helps achieve our compensation goals.

The following chart provides further details about what we pay (or offer) our executives and why we do so:

Form of compensation or benefit | Description | Purpose and what it rewards | Interaction with other elements of compensation or benefits | |||

| Base Salary | Regular cash income, paid semi-monthly. | Provides adequate and predictable regular compensation and rewards core competence and experience. | Serves as a short-term feature to balance long-term incentives; is a fundamental component of our overall competitive pay mix. | |||

| Cash Bonus | Discretionary cash awards. | Provides annual incentive in form of cash based compensation and rewards short-term corporate and individual performance. | Serves as a short-term incentive to balance long- term incentives; rewards short-term performance, aligning executives’ interests with those of the stockholders in the short term. | |||

| Long-term Incentives | Before 2005 we used stock options as our long-term equity incentive. Starting in 2005, we awarded shares of restricted stock and in 2006 and 2007 we awarded a combination of shares of restricted stock and stock appreciation rights. Pay-out is generally staggered over a vesting period. See “Long-term Incentive Compensation,” page 26, for additional information. | Provides long-term incentive to contribute to company performance and rewards positive corporate performance as well as employee’s continuity of service with company. | This balances the short-term features of our mix and motivates our executives to enhance corporate performance, further aligning the executives’ interest with stockholder interests by creating value. | |||

| Indemnification | We indemnify our officers and directors to the fullest extent permitted by law. This is required by our charter, bylaws, and we have agreements with certain of those individuals, contractually binding us to provide this indemnification for them. | We include this as a compensation element because it is commonly provided by peer organizations and it is a value to our executives. We believe that it allows our executives to be free from undue concern about personal liability in connection with their service to us and it rewards willingness to serve in positions that carry exposure to liability and significant responsibility. | We feel this is a significant component of a competitive executive compensation package. | |||

17

Form of compensation or benefit | Description | Purpose and what it rewards | Interaction with other elements of compensation or benefits | |||

| Medical, Dental, Life and Disability | Employee benefits, available to most full-time company employees through our benefit plans. The value of these is not included in the Summary Compensation Table, since they are available on a company-wide basis. | We include this as a compensation element as it is commonly provided by most of our competitors and it encourages health of our employees, and adds to employee productivity and loyalty. | We feel this is a significant component of a competitive executive compensation package. | |||

| Other Paid Time-off Benefits | We provide vacation and other paid holidays to most of our full time employees, including the named executive officers. | This rewards continuity of service, and is a standard benefit comparable to the vacation benefits provided at similar-sized competitors. | We feel this is a minimal requirement and works together with other elements to create a competitive compensation package. | |||

| Unit Corporation Employees’ Thrift Plan [(401(k) plan)] | Tax-qualified retirement savings plan under which participating employees can contribute up to 99% of their pre-tax compensation, a portion of which the company can match. Our match for 2007 was 117% of the first 6% of the participant’s salary deferral contribution paid in stock. | We provide this plan (and our match to the participants) as an element of compensation as we believe it is a standard benefit, and is a component of our program that contributes to our competitiveness. This benefits continuity of service. | We feel this element works in combination with our other executive pay components to create a competitive overall executive compensation package. | |||

| Unit Corporation Salary Deferral Plan [Non-qualified plan] | Our non-qualified plan allows designated participants to defer recognition of salary and cash bonus for tax purposes until actual distribution at termination, death, or under defined hardship. We do not make a matching contribution to this plan. | We provide this element of compensation as we believe it is a standard benefit at executive levels, and is a component of our program that contributes to our competitiveness. This benefits continuity of service. | We feel this element works in combination with our other executive pay components to create a competitive overall executive compensation package. | |||

| Separation Benefits | We provide potential payments to most of our salaried full time employees on involuntary termination, change-in-control, or on retirement after 20 years of service with the company.

This benefit is generally offered on a company-wide basis to most all of our salaried full time employees. For specifics, see the narrative discussion at “Potential Payments On Termination or Change-in-Control,” page 38. | We pay this element of compensation as we believe it is a standard benefit at executive levels, is a component of our program that contributes to our competitiveness, and helps retain our employees. This benefit rewards length and continuity of service. | We feel this element works in combination with our other executive pay components to create a competitive overall executive compensation package. | |||

| Perquisites | We provide a car allowance to our named executive officers as well as paying for certain club memberships. | We believe that compensating for certain perquisites adds to the general attractiveness and competitiveness of our compensation mix, and helps us to attract and retain the quality executives we value. | Again, we feel that this element works in combination with our other executive pay components to create a competitive executive compensation program. | |||

18

Administration of our executive compensation program

Our executive compensation program is administered by our compensation committee. Additional details about that committee are located in the corporate governance provisions of this proxy statement, under “Compensation Committee,” on page 8.

The committee meets each year in December to review, approve and recommend (where appropriate or required) to the board the compensation for our named executive officers. The committee’s chairman meets with management before the December meeting and reviews the recommendations to be presented at that meeting. The committee’s salary and bonus determinations, once approved by the board, are generally implemented as of January 1st of the following year. Equity awards are effective as of the date of the committee’s decision to award them.

By holding its meeting in December the committee can take into account the full annual performance of the company, both financially and operationally. If, during the year, circumstances warrant that the committee make adjustments to its previously-approved compensation decisions, the committee will evaluate those needs at one or more meetings scheduled throughout the year. An example of a situation when the committee might make an adjustment to salary before the December meeting would be in the event of a pre-December promotion or material increase in responsibility, or perhaps in the event of a severe downturn in the oil and natural gas industry. The decision to make any salary adjustments would be made on an ad hoc basis, and any or all elements of compensation could be adjusted based on the actual circumstances involved.

In making its determinations, the committee considers the financial and operational results of the company for the year, generally taking into account:

| • | the growth of its oil and natural gas reserves; |

| • | its oil and natural gas production volumes; |

| • | net income, cash flow, and asset base growth; |

| • | long-term debt levels; |

| • | results of acquisitions made during the year; |

| • | the attainment of any designated business objectives; |

| • | conditions within our industry; and |

| • | the relationship of our compensation program to those being offered by other companies. |

The committee’s review of these results is a retrospective review, and there are no pre-established performance targets or goals.

Individual performances are also taken into account, as are the individual’s responsibilities, experience, potential and length of service. The process by which individual performance is taken into account is a very informal one, not subject to a specific policy, and this applies to all our named executive officers without regard to their position. Individual contributions are noted in the context of reviewing the overall operational and financial results of the company. For our chief executive officer, those results are the committee’s primary measure of performance; as to the other named executive officers, the chief executive officer’s recommendations to the committee (as described more under “Role of chief executive officer,” page 20), within the context of the overall operating and financial results, are the primary basis on which the committee addresses their individual performance. The committee’s evaluation has always been subjective. There are no specific written criteria or formulas under which an executive officer’s annual compensation is determined or calculated. The factors considered in compensation decisions are not weighted, but are viewed collectively, and, with few exceptions, there are no material differences in how we approach these decisions with respect to individual named executive officers. Because there is no written policy or compensation formula, there have been no formulaic decisions on how to allocate the various types of compensation or forms of

19

awards, how to specifically tie company or individual achievement to the awards, whether prior compensation should be considered in making compensation decisions or whether or how to incorporate other such criteria-based measures into the compensation-setting process.

Role of compensation consultant and chief executive officer

Role of compensation consultant.In both 2006 and 2007, the committee used the services of Longnecker & Associates, a Houston, Texas-based independent outside compensation consultant. The committee’s charter grants it the authority to retain consultants to assist it. Longnecker had no prior relationship with the company, its executive officers, or the compensation committee, and it has never advised management of the company. Longnecker received no compensation from the company other than its fee for consulting with the committee on executive compensation matters. Longnecker assisted the committee in:

| • | obtaining better information regarding the competitiveness of our named executive officers’ compensation; |

| • | providing recommendations on how the committee might further align the named executive officers’ compensation with the long-term and short-term performance of the company; |

| • | designing and implementing future awards under the company’s new incentive plan; and |

| • | if needed, determining the financial impact on the company of the various forms of awards that might be made under the plan. |

Each year, Longnecker performed a study of our senior management executive compensation structure compared to a group of peer companies in the oil and gas exploration and drilling industry. The Longnecker data provided a background for the committee to use in benchmarking, or comparing, our programs with other independent exploration and production companies as well as certain drilling contractors.

Role of chief executive officer. At the annual

December committee meeting, committee members review the information and recommendations made by our chief executive officer regarding the other named executive officers. Additionally, our chief executive officer meets with the committee and discusses his recommendations. The recommendation of the chief executive officer generally consists of his recommended changes, if any, to the recommendations made by the committee’s compensation consultant. The chief executive officer does not make a recommendation regarding his compensation. The executives subject to the chief executive officer’s recommendations are not present at the time of these deliberations. Following the chief executive officer’s review and departure from the meeting, the committee members then discuss the recommendations, review the financial and operational results of the company for the year and also discuss their opinions regarding the compensation for the chief executive officer. The compensation committee has the authority to accept, reject or adjust the recommendations made to it by the chief executive officer. The committee then sets the compensation for the executive officers (which may or may not involve the grant of an equity award). The committee’s determinations are then submitted to the full board at its meeting held immediately following the committee’s December meeting. The full board then ratifies (and approves, if required) the committee’s determination regarding the compensation for the named executive officers.

Salaries for the named executive officers was determined by the compensation committee at its December, 2006 meeting while annual incentives and long term incentive awards for 2007 were made in December, 2007. Accordingly, information relevant to both those decisions is separately provided below.

Establishment of salaries for 2007

In 2006, Longnecker performed a study of our executive compensation structure compared to 14 companies in the oil and gas exploration and drilling industry. The Longnecker data provided a background for the committee to use in benchmarking, or comparing, our programs with

20

other independent exploration and production companies as well as certain drilling contractors. The 14 companies that served as our peer group in the study are:

Cabot Oil & Gas Corporation (COG)

Cimarex Energy Co. (XEC)

Denbury Resources Inc. (DNR)

Forest Oil Corporation (FST)

Grey Wolf, Inc. (GW)

Helmerich & Payne, Inc. (HP)

Newfield Exploration Co. (NFX)

Parker Drilling Company (PKD)

Patterson-UTI Energy, Inc (PTEN)

Pioneer Drilling Company (PDC)

Pogo Producing Company (PPP)

St. Mary Land & Exploration Co. (SM)

Stone Energy Corporation (SGY)

W&T Offshore, Inc. (WTI).

Longnecker selected these companies for comparison because they were publicly traded companies similar to us in industry, projected revenues, assets, and market capitalization.

Additionally, information from the following published salary surveys was incorporated into Longnecker’s study:

| • | Effective Compensation Incorporated, Oil and Gas E&P Compensation Survey; |

| • | Economic Research Institute, ERI Executive Compensation Assessor 2006; |

| • | Mercer Human Resources Consulting, 2006 Mercer Benchmark Database Executive; |

| • | Watson Wyatt, 2006 Top Management Compensation – Industry Report; |

| • | Mercer Human Resources Consulting, 2006 Energy Compensation Survey; and |

| • | WordatWork, 2006/2007 Total Salary Increase Budget Survey. |

Studies like Longnecker’s only include information on individuals for whom compensation information is publicly disclosed. As a result, these studies typically include only the five most highly-compensated individuals at each company. Generally, this information correlates to our following employees:

Larry D. Pinkston – President and Chief Executive Officer, Unit Corporation;

Mark E. Schell – Senior Vice President, General Counsel and Secretary, Unit Corporation;

David T. Merrill – Chief Financial Officer and Treasurer, Unit Corporation;

John Cromling – Executive Vice President, Unit Drilling Company; and

Bradford J. Guidry – Senior Vice President, Unit Petroleum Company.

We refer to these persons in this proxy statement as the “named executive officers.”

Results of Longnecker 2006 Study.Longnecker’s study revealed that our named executive officers’ salary, as compared to the peer group’s 50th and 75th percentiles, were below market.

The tables below show certain results of their study. The first table shows the salary of our named executive officers for 2006 (as used in the study) while the second table shows the ratio of the named executive officers’ salary within the 50th and 75th percentiles of the market as reflected in the study.

Table No. 1

| Name | Salary ($) | |

| Larry D. Pinkston | 450,000 | |

| Mark E. Schell | 220,000 | |

| David T. Merrill | 200,000 | |

| John Cromling | 210,000 | |

| Bradford J. Guidry | 200,000 |

21

Table No. 2

| Elements of current compensation | As a ratio to Market | Range of individuals’ compensation within the Market | ||||||

50th percentile | 75th percentile | 50th percentile | 75th percentile | |||||

| Base Salary | .83 | .70 | .72 - .97 | .62 - .88 | ||||

In addition, the study provided the following information regarding the comparison of our named executive officers’ salary as a percentage of total compensation.

Table No. 3

| Company | 50th Percentile | 75th Percentile | |||||||

| Base Salary | 54 | % | 28 | % | 21 | % |

The following table presents a summary of the comparison of the individual named executive officer’s salary, as compared to that of the 50th percentile contained in the study:

Table No. 4

| Salary($) | ||||

| Name | Current | 50th percentile | ||

| Larry D. Pinkston | 450,000 | 532,052 | ||

| Mark E. Schell | 220,000 | 302,627 | ||

| David T. Merrill | 200,000 | 279,023 | ||

| John Cromling | 210,000 | 228,484 | ||

| Bradford J. Guidry | 200,000 | 206,803 | ||

In view of the Longnecker data and individual and corporate performance, the committee determined that for the company to be competitive and to better align the named executive officers’ salary with the company’s performance, it needed to increase our executives’ salary to at least the 50th percentile range, with the 75th percentile range as a long-term goal.

At its December 12, 2006 meeting the committee, in addition to the results of the Longnecker study, reviewed the company’s performance over the course of 2006, taking the following into account:

| • | earnings for each of the first three quarters were up over the same periods in 2005; |

| • | the company had acquired additional significant new proven oil and gas reserves; |

| • | the company had increased production for the first nine months of 2006 by 35% on a year-over-year basis; |

| • | the success ratio for wells drilled by its exploration segment was 89% as of December 8, 2006; |

| • | the company had developed through its own exploration drilling 80 Bcfe and acquired another 41 Bcfe of oil and gas reserves as of December 8, 2006; |

| • | as of December 8, 2006 oil and gas reserves had grown by 252% of production, exceeding the company’s goal of growing reserves by at least 150% of production; |

| • | the company’s stock price was $51.83 per share on December 6, 2006, compared to $57.34 per share on January 3, 2006; |

22

| • | the rig fleet increased from 112 rigs to 117 rigs during the period from January 1, 2006 to December 8, 2006; and |

| • | the company’s mid-stream segment had closed an acquisition of a natural gas processing plant, gathering system with 15 miles of pipeline, three field compressors and two plant compressors, and had increased gas gathering and processing operations from 199,363 MMBtu per day in December 2005 to 294,962 MMBtu per day in November 2006. |

As a result of its review, the committee approved the following salaries for our named executive officers for 2007:

For our chief executive officer and president, the Longnecker study showed that the 50th percentile pay rate was $532,052 for base salary. The committee elected to raise Mr. Pinkston’s salary from $450,000 to $500,000. Similarly, for Mr. Schell, the committee determined that $302,627 would be the 50th percentile pay rate, but that raising his salary from $220,000 to $275,000 was a reasonable increase. For similar reasons, Mr. Merrill received a raise from $200,000 to $250,000 ($279,023 was the 50th percentile), Mr. Cromling received a raise from $210,000 to $220,000 ($228,484 was the 50th percentile), and Mr. Guidry received a raise from

$200,000 to $210,000 ($206,803 was the 50th percentile).

2007 annual cash bonuses and long term compensation

For 2007, the peer group contained in Longnecker’s study contained the same companies used in 2006, with the exception of Whiting Petroleum. Whiting Petroleum was substituted for Pogo Producing Company which was acquired by another company.