SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant [X] |

| Filed by a party other than the Registrant ¨ |

| Check the appropriate box: |

| ¨ Preliminary Proxy Statement | ¨ Confidential, For Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| |

| [X] Definitive Proxy Statement |

| ¨ Definitive Additional Materials |

| ¨ Soliciting Material Pursuant to (S)240.14a-11(c) or (S)240.14a-12(c) |

| |

| |

| COST PLUS, INC. |

|

| (Name of Registrant as Specified in its Charter) |

| |

|

| (Name of Person(s) Filing Proxy Statement) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [X] No fee required. |

| ¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: | |

| | |

|

| |

| (2) | Aggregate number of securities to which transaction applies: | |

| | |

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | |

|

|

| (4) | Proposed maximum aggregate value of transaction: | |

| | |

|

|

| (5) | Total fee paid: | |

| | | |

| |

|

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. | |

| | | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| (1) | Amount Previously Paid: | |

| | |

|

|

| (2) | Form, Schedule or Registration Statement No.: | |

| | |

|

|

| (3) | Filing Party: | |

| | |

|

|

| (4) | Date Filed: | |

| | | |

| |

|

| | | |

COST PLUS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 27, 2002

To The Shareholders:

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Shareholders (the “Annual Meeting”) of Cost Plus, Inc. (the “Company”), a California corporation, will be held on June 27, 2002 at 2:00 p.m., local time, at the Company’s corporate headquarters located at 200 4th Street, Oakland, California 94607, for the following purposes:

| | (1) | | To elect the following directors to serve for the ensuing year and until their successors are elected: Murray H. Dashe, Joseph H. Coulombe, Barry J. Feld, Danny W. Gurr, Kim D. Robbins, Fredric M. Roberts and Thomas D. Willardson. |

| | (2) | | To approve an amendment to the Company’s 1995 Stock Option Plan to increase the shares reserved for issuance thereunder by 900,000 shares. |

| | (3) | | To approve an amendment to the Company’s 1996 Director Option Plan to increase the shares reserved for issuance thereunder by 150,000 shares. |

| | (4) | | To ratify and approve the appointment of Deloitte & Touche LLP as independent auditors of the Company for the fiscal year ending February 1, 2003. |

| | (5) | | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on May 1, 2002 are entitled to notice of and to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to mark, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder attending the Annual Meeting may vote in person even if he or she returned a proxy.

By Order of the Board of Directors

Murray H. Dashe

Chairman of the Board, Chief Executive Officer

and President

Oakland, California

May 21, 2002

YOUR VOTE IS IMPORTANT

To assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope, which requires no postage if mailed in the United States.

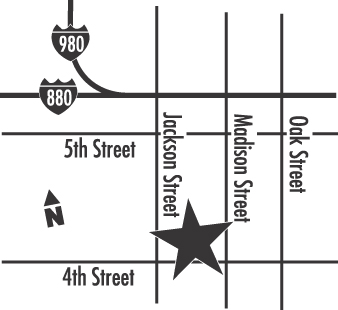

DIRECTIONS TO COST PLUS, INC.’S

CORPORATE HEADQUARTERS

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

(510) 893-7300

Directions from San Francisco

Take the Bay Bridge to Interstate 580 East, to Interstate 980 (Downtown Oakland), which turns into Interstate 880, to Jackson Street. Exit Jackson Street and take a right onto Jackson Street and a left on Fourth Street. The corporate headquarters are located right on the corner.

Directions from Oakland Airport (and from the south)

Take Interstate 880 North to Oak Street Exit. Exit Oak Street and go straight ahead for two blocks and turn left on Jackson Street. Go two blocks and turn left on Fourth Street. The corporate headquarters are located right on the corner.

COST PLUS, INC.

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

General

The enclosed Proxy is solicited on behalf of the Board of Directors of Cost Plus, Inc. (the “Company”) for use at the 2002 Annual Meeting of Shareholders (the “Annual Meeting”) to be held June 27, 2002 at 2:00 p.m., local time, or at any adjournment or postponement thereof, for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at the Company’s corporate headquarters located at 200 4th Street, Oakland, California 94607. The telephone number of the Company’s corporate headquarters is (510) 893-7300.

These proxy solicitation materials were mailed on or about May 21, 2002 to all shareholders entitled to vote at the Annual Meeting.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company, Attention: Jane L. Baughman, Inspector of Elections, a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. The mere presence at the Annual Meeting of the shareholder who has appointed a proxy will not revoke the prior appointment. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the instructions indicated on the proxy card, or if no instructions are indicated, will be voted “FOR” the slate of directors described herein, “FOR” Proposals Two, Three and Four and, as to any other matter that may be properly brought before the Annual Meeting, in accordance with the judgment of the proxy holders.

Voting and Solicitation

Each stockholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

The seven nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to vote shall be elected as directors. On each other matter, the affirmative vote of a majority of the votes cast is required under California law for approval. For this purpose, the “votes cast” are defined under California law to be the shares of the Company’s Common Stock represented and voting in person or by proxy at the Annual Meeting. In addition, the affirmative votes must constitute at least a majority of the required quorum, which quorum is a majority of the shares outstanding on the record date for the meeting. Votes that are cast against a proposal will be counted for purposes of determining: (i) the presence or absence of a quorum; and (ii) the total number of votes cast with respect to the proposal. While there is no definitive statutory or case law authority in California as to the proper treatment of abstentions in the counting of votes with respect to a proposal, the Company believes that abstentions should be counted for purposes of determining both: (i) the presence or absence of a quorum for the transaction of business; and (ii) the total number of votes cast with respect to the proposal. In the absence of controlling precedent to the contrary, the Company intends to treat abstentions in this manner. Accordingly, abstentions will have the same effect as a vote against the proposal. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the

1

transaction of business, but will not be counted for purposes of determining the number of votes cast with respect to a proposal. An automated system administered by the Company’s transfer agent tabulates the votes. Each proposal is tabulated separately.

This solicitation of proxies is made by the Company and all related costs will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation, without payment of additional compensation, by directors, officers, or regular employees of the Company. In addition, the Company has retained Georgeson Shareholder to assist in the solicitation of proxies at an estimated fee of $6,500, plus reimbursement of reasonable out-of-pocket expenses.

Only shareholders of record at the close of business on May 1, 2002 are entitled to notice of and to vote at the Annual Meeting. As of May 1, 2002, 21,641,598 shares of the Company’s Common Stock were issued and outstanding.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Board of Directors of the Company currently consists of seven directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s seven nominees named below, all of whom are presently directors of the Company. If any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board of Directors to fill the vacancy. Management has no reason to believe that any of the nominees will be unable or unwilling to serve if elected. The term of office of each person elected as a director will continue until the next Annual Meeting of Shareholders or until such person’s successor has been elected and qualified.

Required Vote

The seven nominees receiving the highest number of affirmative votes of the holders of the shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal shall be elected to the Board of Directors. See “Voting and Solicitation” above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED BELOW.

The names of the nominees, their ages as of the date of this proxy statement and certain information about them are set forth below:

Name of Nominee

| | Age

| | Principal Occupation

| | Director Since

|

| Joseph H. Coulombe | | 71 | | Independent Management Consultant | | 1995 |

| Murray H. Dashe | | 59 | | Chairman, Chief Executive Officer and President, Cost Plus, Inc. | | 1997 |

| Barry J. Feld | | 44 | | Chairman, Chief Executive Officer and President, PCA International, Inc. | | 2001 |

| Danny W. Gurr | | 44 | | President, Quarto Holdings, Inc. | | 1995 |

| Kim D. Robbins | | 56 | | Director of Product Development, Jack Nadel, Inc. | | 1999 |

| Fredric M. Roberts | | 59 | | President, F. M. Roberts and Company, Inc. | | 1999 |

| Thomas D. Willardson | | 51 | | Independent Financial Consultant | | 1991 |

Except as set forth below, each of the nominees has been engaged in his principal occupation described above during the past five years. There is no family relationship between any director or executive officer of the Company.

Mr. Coulombe has served as a director of the Company since November 1995. From February 1995 to April 1995, Mr. Coulombe served as President and Chief Executive Officer of Sport Chalet, Inc., a sporting goods retailer. From February 1994 to January 1995, Mr. Coulombe served as Chief Executive Officer of Provigo Corp., a wholesale and retail grocer. From November 1992 to February 1994, Mr. Coulombe was an independent business consultant. From March 1992 to October 1992, Mr. Coulombe served as Executive Vice President of Pacific Enterprises, with principal responsibility for Thrifty Corporation, an operator of drug and sporting goods chain stores and also served as Co-Chairman of Thrifty Corporation. From June 1989 through March 1992, Mr. Coulombe served as an independent business consultant. Mr. Coulombe is the founder of Trader Joe’s, a specialty food grocery chain and served as its Chief Executive Officer from 1957 to 1989. Mr. Coulombe also serves as a director of PIA Merchandising.

3

Mr. Dashe joined the Company in June 1997 as Vice Chairman of the Board of Directors and was named President in September 1997 and Chairman of the Board of Directors and Chief Executive Officer in February 1998. From August 1992 to June 1997, he was Chief Operating Officer of Leslie’s Poolmart, Inc., a swimming pool supply retail chain and was a director of that company from August 1989 to November 1996. From May 1990 through August 1992, he was President and Chief Executive Officer of RogerSound Labs, a Southern California retailer of audio/video consumer electronics. From September 1985 through April 1990, Mr. Dashe held several positions with SILO, a consumer electronics and appliance retailer, including Regional President, Regional Vice President and Director of Stores. Previously, he was employed in an executive capacity by other retailers, including Allied Stores Corp. (now Federated Department Stores), where he served in a variety of positions of increasing responsibility, including Vice President/Director of Stores. Mr. Dashe is a member of the Board of Trustees for Albright College in Reading, PA.

Mr. Feld has served as a director of the Company since February 2001. Mr. Feld is currently the President, Chief Executive Officer and Chairman of the Board of Directors of PCA International, Inc., the largest North American operator of portrait studios focused on serving the discount retail market. Prior to joining PCA International, Inc., in August 1999, Mr. Feld was President and Chief Operating Officer and a member of the Board of Directors of Vista Eyecare, Inc., a retail chain of nine hundred plus vision centers operating throughout the continental United States and Mexico. Mr. Feld joined Vista Eyecare, Inc. as a result of an acquisition of New West Eyeworks, Inc. where he had been serving as President, Chief Executive Officer and a member of the Board of Directors. Vista Eyecare, Inc. filed for protection under Chapter 11 of the Federal Bankruptcy Act in April 2000. Prior to joining New West Eyeworks in May 1991, Mr. Feld was President of Frame-n-Lens Optical, Inc., which was the largest chain of retail optical stores in California.

Mr. Gurr has served as a director of the Company since November 1995. Since January 2002, Mr. Gurr has served as President of Quarto Holdings, Inc., a leading international co-edition publisher. From April 1998 through July 2001, Mr. Gurr was President of Dorling Kindersley Publishing, Inc., a publisher of illustrated books, videos and multi-media products. From September 1991 to February 1998, Mr. Gurr served as President and Chief Executive Officer of Lauriat’s Books, Inc., an operator of various bookstore chains (“Lauriat’s Books”). In March 1998, Lauriat’s Books filed for protection under Chapter 11 of the Federal Bankruptcy Act. From November 1995 until June 1997, Mr. Gurr served as President and Chief Executive Officer of Chadwick Miller, Inc., an importer and wholesaler of housewares and gifts. From September 1990 to September 1991, Mr. Gurr was Vice President of Publishing and Acquisition for the Outlet Book Company Division of Random House, Inc.

Ms. Robbins has served as a director of the Company since November 1999. Ms. Robbins is the Director of Product Development for Jack Nadel, Inc., a direct response promotion agency specializing in creative marketing and merchandise solutions. From 1996 to 1997, she was the Executive Vice President and General Merchandise Manager of House of Fabrics, Inc., which operates sewing and craft stores throughout the United States. From 1995 to 1996, she was the Vice President of Merchandising for Sport Chalet, Inc., a sporting goods retailer. From 1976 to 1993, Ms. Robbins served in capacities of ever increasing responsibility at Carter Hawley Hale, culminating in her appointment as Senior Vice President and General Merchandising Manager.

Mr. Roberts has served as a director of the Company since November 1999. Mr. Roberts is President of F. M. Roberts & Company, Inc., an investment-banking firm he established in 1980. Mr. Roberts has over 30 years of investment banking experience including executive corporate finance positions with Lehman Brothers, Loeb, Rhoades & Co., E.F. Hutton & Co. and Cantor, Fitzgerald & Co., Inc. Mr. Roberts served as 1993 Chairman of the Board of Governors of the National Association of Securities Dealers (“NASD”), which owns and operates the Nasdaq Stock Market. From 1994 to 1996, he was a member of the Nasdaq Board of Directors and its Executive Committee. Mr. Roberts also serves as a director of ARTISTdirect, Inc.

4

Mr. Willardson was re-elected as a director of the Company in April 1996. He also served as a director of the Company from March 1991 to February 1996. From June 1998 to March 2002, Mr. Willardson was the Senior Vice President, Finance and Treasurer of Leap Wireless International, Inc., a wireless communications carrier. From August 1997 to June 1998, he served as a Vice President and Associate Managing Director of Bechtel Enterprises, Inc., a wholly owned investment and development subsidiary of Bechtel Group, Inc. He served as a manager of that company from July 1995 until August 1997. From January 1986 to July 1995, Mr. Willardson served as a principal at The Fremont Group, an investment company.

Board Meetings and Committees

The Board of Directors of the Company held a total of six meetings during the fiscal year ended February 2, 2002. The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee of the Board of Directors consists of Messrs. Willardson, Coulombe and Gurr and held five meetings during the last fiscal year. The Audit Committee recommends engagement of the Company’s independent auditors and is primarily responsible for approving the services performed by the Company’s independent auditors and assisting the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and reporting practices of the Company.

The Compensation Committee of the Board of Directors consists of Ms. Robbins and Messrs. Roberts and Feld and held two meetings during the last fiscal year. The Compensation Committee establishes the Company’s executive compensation policy, determines the salary and bonuses of the Company’s executive officers and approves stock option grants for executive officers.

The Nominating Committee of the Board of Directors consists of Messrs. Gurr, Feld and Willardson. The Nominating Committee did not hold any meetings during the last fiscal year. The Nominating Committee has responsibility for identifying, screening and recommending to the board any candidates for addition to the Company’s Board of Directors. The Nominating Committee will consider nominees recommended by management and stockholders. Such recommendations may be delivered in writing to the attention of the Nominating Committee in care of the Secretary at the Company’s principal executive offices.

No director attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings of all committees of the Board of Directors on which that director served.

Audit Committee Report

The Audit Committee of the Board of Directors is responsible for monitoring the integrity of the Company’s consolidated financial statements, its system of internal controls and the independence and performance of its independent auditors. The Committee is composed of three non-employee directors and operates under a written charter adopted and approved by the Board of Directors. Each Committee member is independent as defined by NASD listing standards.

Management is responsible for the financial reporting process, including the system of internal controls and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The Company’s independent auditors are responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. However, we are not professionally engaged in the practice of accounting or auditing and are not experts in the fields of accounting or auditing, including with respect to auditor independence. We rely, without independent verification, on the information provided to us and on the representations made by management and the independent auditors.

In this context, we held five meetings during fiscal year 2001. The meetings were designed, among other things, to facilitate and encourage communication among the Committee, management and the Company’s

5

independent auditors, Deloitte & Touche LLP. We discussed with the Company’s independent auditors the overall scope and plans for their audit. We met with the independent auditors, with and without management present, to discuss the results of their examination and their evaluations of the Company’s internal controls.

We have reviewed and discussed the audited consolidated financial statements for the fiscal year ending February 2, 2002 with management and Deloitte & Touche LLP.

We also discussed with the independent auditors matters required to be discussed with audit committees under auditing standards generally accepted in the United States of America, including, among other things, matters related to the conduct of the audit of the Company’s consolidated financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

The Company’s independent auditors also provided to us the written disclosures and the letter required by Independence Standards Board Standards No. 1 (Independence Discussions with Audit Committees) and we discussed with the independent auditors their independence from the Company. When considering Deloitte & Touche’s independence, we considered whether their provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s consolidated financial statements was compatible with maintaining their independence. We also reviewed, among other things, the amount of fees paid to Deloitte & Touche for audit and non-audit services.

Based on our review and these meetings, discussions and reports and subject to the limitations on our role and responsibilities referred to above and in the Audit Committee Charter, we recommended to the Board of Directors that the Company’s audited consolidated financial statements for the fiscal year ended February 2, 2002 be included in the Company’s Annual Report on Form 10-K. We have also recommended the selection of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ended February 1, 2003, subject to shareholder ratification.

The Audit Committee

Thomas D. Willardson, Chairman

Joseph H. Coulombe

Danny W. Gurr

Director Compensation

Cash Compensation

In fiscal year 2001, each of the Company’s non-employee directors was compensated at the rate of $12,000 per annum for service on the Board of Directors and committees thereof, with adjustments for service for a portion of the year. In addition, each non-employee director received a fee of $750 for each in-person board meeting attended. Directors are also reimbursed for reasonable expenses incurred in connection with attendance at meetings of the Board of Directors and its committees. The Chairmen of the Compensation and Audit Committees receive additional annual compensation of $4,000 and $2,500, respectively, for their services as chairs of those committees.

1996 Director Option Plan

The Company’s 1996 Director Option Plan (the “Director Plan”) was adopted by the Board of Directors and approved by the Company’s shareholders in March 1996. Under the Director Plan, the Company has reserved 253,675 shares of Common Stock for issuance to the non-employee directors of the Company not including the proposed increase to the Director Plan in Proposal Three. The Director Plan will be in effect for a term of ten years unless sooner terminated. Under the Plan each Director is awarded stock options at the sole discretion of the Company’s Board of Directors.

6

On March 1, 2001, Messrs. Coulombe, Gurr, Roberts, Willardson and Ms. Robbins each received grants under the Director Plan of options to purchase 6,000 shares of Common Stock at an exercise price of $24.00 per share. In addition, on March 1, 2001, Mr. Feld received a grant under the Director Plan of an option to purchase 16,000 shares of Common Stock at an exercise price of $24.00 per share, which was issued upon his commencement of service on the Board of Directors. These option grants are subject to four-year vesting and will be fully vested in March 2005. On November 5, 2001, Messrs. Coulombe, Feld, Gurr, Roberts, Willardson and Ms. Robbins each received grants under the Director Plan of options to purchase 10,000 shares of Common Stock at an exercise price of $20.00 per share. These option grants are subject to four-year vesting and will be fully vested in November 2005.

See Proposal Three for additional information on the Director Plan.

7

PROPOSAL TWO

AMENDMENT OF THE 1995 STOCK OPTION PLAN

The Company’s 1995 Stock Option Plan (the “1995 Option Plan”) was approved by the Board of Directors and by the shareholders in November 1995. An aggregate of 5,068,006 shares of Common Stock have been reserved for issuance under the 1995 Option Plan which does not include the proposed increase to the 1995 Option Plan. However, under the terms of the 1995 Option Plan, that number must be reduced by 821,120 shares, the aggregate number of shares of Common Stock subject to options outstanding under the Company’s 1994 Stock Option Plan (the “1994 Option Plan”) and issued upon exercise of options granted under the 1994 Option Plan. Accordingly, an effective total of 4,246,886 shares of Common Stock are available for issuance under the 1995 Option Plan, which number will automatically increase to the extent that any of the 21,871 options outstanding as of February 2, 2002 under the 1994 Option Plan lapse or are canceled without being exercised. As of February 2, 2002, options to purchase 1,736,127 shares of Common Stock were outstanding under the 1995 Option Plan, 2,042,702 shares had been issued by the Company upon exercise of options under the 1995 Option Plan and 468,057 shares remained available for future option grants under the 1995 Option Plan. In February 2002 as part of the Company’s annual grant program, options to purchase an additional 465,500 shares of Common Stock were granted under the 1995 Option Plan leaving 2,557 shares available for future option grants.

In February 2002, the Board of Directors approved a proposal to amend the 1995 Option Plan to increase the shares reserved for issuance thereunder by 900,000 shares. The Company is seeking shareholder approval of the proposed amendment to the 1995 Option Plan. A summary of the 1995 Option Plan, as amended, is included as Appendix A to this Proxy Statement. Under the terms of the 1995 Option Plan option exercise prices must be at least 100% of the fair market value of the common stock on the grant date.

The Board of Directors believes that the proposed increase is in the best interests of the Company for several reasons. First, the increase will provide an adequate reserve of shares for issuance under the 1995 Option Plan, which is an integral part of the Company’s overall compensation program. Second, the Board of Directors believes the proposed increase is essential for the Company to compete successfully against other companies in attracting and retaining key employees, thereby facilitating the future potential growth of the Company. Finally, the Board of Directors believes the 1995 Option Plan is an important contributor to the alignment of employee and shareholder interests.

Amended 1995 Option Plan Benefits

The following table sets forth information with respect to stock option grants under the 1995 Option Plan for the fiscal year ended February 2, 2002 to: (i) the Chief Executive Officer and the four most highly compensated executive officers of the Company in the fiscal year ended February 2, 2002; (ii) all current executive officers as a group; and (iii) all other employees, including all current officers who are not executive officers, as a group:

Amended Plan Benefits Table

Name of Individual or Identity of Group

| | Dollar Value ($)(1)

| | Number of Shares Subject to Options Granted

|

| Murray H. Dashe | | $ | 727,631 | | 168,031 |

| Stephen L. Higgins | | | 147,000 | | 30,000 |

| John J. Luttrell | | | 226,250 | | 42,500 |

| Judith A. Soares | | | 132,500 | | 25,000 |

| Gary D. Weatherford | | | 220,392 | | 49,125 |

| All current executive officers as a group (13 total) | | | 2,403,749 | | 500,407 |

| All other current employees as a group | | | 1,136,224 | | 320,125 |

| (1) | | Calculated by determining the difference between the fair market value of the Company’s Common Stock on February 1, 2002 ($26.90) and the exercise price of such options, multiplied by the number of shares. |

8

Required Vote

The proposed amendment of the 1995 Option Plan requires the affirmative vote of the holders of a majority of the shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal, which shares voting affirmatively must also constitute a majority of the required quorum. See “Voting and Solicitation” above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE 1995 STOCK OPTION PLAN.

9

PROPOSAL THREE

AMENDMENT OF THE 1996 DIRECTOR OPTION PLAN

The 1996 Director Option Plan (the “Director Plan”) was adopted by the Board of Directors and approved by the shareholders in March 1996. Under the terms of the Director Plan, the exercise price of each option is the market value of the Common Stock on the date of grant. Additionally, such options have terms of 10 years, but terminate earlier if the individual ceases to serve as a director. A cumulative total of 253,675 shares of Common Stock have been reserved for issuance under the Director Plan which does not include the proposed increase to the Director Plan. As of February 2, 2002 options to purchase 212,105 shares were issued and outstanding under the Director Plan, options to purchase 26,280 shares of Common Stock were exercised and options to purchase 15,290 shares remained available for future grants.

In February 2002, the Board of Directors approved a proposal to amend the Director Plan to increase the shares reserved for issuance thereunder by 150,000 shares. The Company is seeking shareholder approval of the proposed amendment to the Director Plan. A summary of the Director Plan, as amended, is included as Appendix B to this Proxy Statement. The Board of Directors believes that the proposed amendment is in the best interest of the Company and its shareholders for a number of reasons. The Board of Directors believes that the Company’s Director Plan serves as an incentive to current Directors and helps align their interests with those of the Company’s shareholders. Second, the Board of Directors believes that the Director Plan is an important element of the Company’s strategy to attract and retain qualified persons willing to serve on the Company’s Board of Directors.

Amended Director Plan Benefits

The following table sets forth information with respect to stock option grants expected to be made in the fiscal year ended February 1, 2003 under the Director Plan to the Company’s non-employee directors or their assignees:

Amended Plan Benefits Table

Name of Individual or Identity of Group

| | Dollar Value ($)(1)

| | Expected Number of Shares Subject to Options Granted (#)

|

| Joseph H. Coulombe | | $ | 17,400 | | 6,000 |

| Barry J. Feld | | | 17,400 | | 6,000 |

| Danny W. Gurr | | | 17,400 | | 6,000 |

| Kim D. Robbins | | | 17,400 | | 6,000 |

| Fredric M. Roberts | | | 17,400 | | 6,000 |

| Thomas D. Willardson | | | 17,400 | | 6,000 |

| All current non-employee directors (6 persons) | | | 104,400 | | 36,000 |

| (1) | | It is not practical to assign a dollar value to stock option grants expected to be made in the current year as grants are made at the fair market value of the Company’s common stock on date of grant. However, for the purposes of this table prior year data was used. The dollar value is calculated based on the exercise price of options granted in March last year ($24.00) less the fair market value of the Company’s stock on February 1, 2002 ($26.90), multiplied by the number of shares. |

Required Vote

The proposed amendment to the 1996 Director Option Plan requires the affirmative vote of the holders of a majority of the shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal, which shares voting affirmatively must also constitute a majority of the required quorum. See “Voting and Solicitation” above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE 1996 DIRECTOR OPTION PLAN.

10

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information with respect to the Company’s equity compensation plans as of the end of the most recently completed fiscal year.

| | | (a)

| | (b)

| | (c)

|

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|

| 1994 Stock Option Plan | | 21,871 | | $2.563 – $2.638 | | None |

|

| 1995 Stock Option Plan | | 1,736,127 | | $5.025 – $33.813 | | 468,057 |

|

| 1996 Director Option Plan | | 212,105 | | $6.667 – $33.438 | | 15,290 |

| | |

| | | |

|

|

| Total | | 1,970,103 | | $2.563 – $33.813 | | 483,347 |

11

PROPOSAL FOUR

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP, independent auditors, to audit the financial statements of the Company for the current fiscal year ending February 1, 2003 and recommends that the shareholders ratify this selection. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. Representatives of Deloitte & Touche LLP are expected to be available at the meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Required Vote

The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditors requires the affirmative vote of the holders of a majority of the shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal, which shares voting affirmatively must also constitute a majority of the required quorum. See “Voting and Solicitation” above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT AUDITORS.

INDEPENDENT ACCOUNTANT FEES

The aggregate professional fees billed for Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu and their respective affiliates (collectively “Deloitte”) for the fiscal year ended February 2, 2002 were as follows:

| Audit Fees | | $200,000 |

| Financial Information Systems Design and Implementation Fees | | — |

| All Other Fees | | $231,000 |

The Audit Committee has considered whether the fiscal 2001 non-audit services provided by Deloitte are compatible with maintaining auditor independence.

12

EXECUTIVE COMPENSATION AND OTHER MATTERS

The table below sets forth information for the three most recently completed fiscal years concerning the compensation of the Chief Executive Officer of the Company and the four other most highly compensated executive officers of the Company in the fiscal year ended February 2, 2002:

Summary Compensation Table

Name and Principal Position

| | Fiscal Year

| | Annual Compensation

| | Long-Term Compensation

| | All Other Compensation ($)

| |

| | | Salary

($)

| | | Bonus

($)

| | Restricted Stock Award ($)

| | Securities Underlying Options (#)

| |

| Murray H. Dashe | | 2001 | | $ | 464,989 | | | $ | 113,295 | | $ | — | | 168,031 | | $ | — | |

| Chairman, Chief Executive Officer | | 2000 | | | 465,004 | (1) | | | 247,824 | | | — | | 72,213 | | | — | |

| and President | | 1999 | | | 360,577 | | | | 314,184 | | | — | | 109,500 | | | — | |

|

| Stephen L. Higgins (2) | | 2001 | | | 239,799 | | | | 25,515 | | | — | | 30,000 | | | 80,274 | (4) |

| Senior Vice President, | | 2000 | | | 208,654 | | | | 57,150 | | | — | | 8,000 | | | 72,685 | (4) |

| Merchandising | | 1999 | | | 15,385 | | | | 20,000 | | | — | | 25,000 | | | — | |

|

| John J. Luttrell (3) | | 2001 | | | 189,195 | | | | 45,805 | | | — | | 42,500 | | | — | |

| Senior Vice President and | | 2000 | | | 102,909 | | | | 22,677 | | | — | | 15,000 | | | 10,217 | (4) |

| Chief Financial Officer | | 1999 | | | — | | | | — | | | — | | — | | | — | |

|

| Judith A. Soares | | 2001 | | | 177,118 | | | | 57,500 | | | — | | 25,000 | | | — | |

| Senior Vice President, | | 2000 | | | 173,373 | | | | 35,373 | | | — | | 8,000 | | | — | |

| Cost Plus Management Services, Inc. | | 1999 | | | 136,352 | | | | 35,502 | | | — | | 11,250 | | | — | |

|

| Gary D. Weatherford | | 2001 | | | 209,435 | | | | 31,666 | | | — | | 49,125 | | | — | |

| Senior Vice President, Stores | | 2000 | | | 192,731 | | | | 59,429 | | | — | | 19,650 | | | — | |

| | | 1999 | | | 155,923 | | | | 78,312 | | | — | | 21,000 | | | — | |

| (1) | | Includes $23,654 of salary earned in fiscal 1999 but paid in fiscal 2000. |

| (2) | | Mr. Higgins became Senior Vice President, Merchandising in September 2000. Mr. Higgins joined the Company in December 1999 as Vice President, Merchandising. |

| (3) | | Mr. Luttrell joined the Company in May 2000 as Vice President, Controller and was promoted to Chief Financial Officer in August 2001. |

| (4) | | Amount reimbursed for relocation expenses. |

13

The table below provides the specified information concerning grants of options to purchase the Company’s Common Stock made during the fiscal year ended February 2, 2002 to the persons named in the Summary Compensation Table.

Option Grants in Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at Assumed Rates of Stock Price Appreciation for Option Term (3)

|

Name

| | Number of Securities Underlying Option Granted (#)

| | Percent of Total Options Granted to Employees in Fiscal Year(1)

| | | Exercise Price ($/Share) (2)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

| Murray H. Dashe | | 75,000 | | 7.50 | % | | $ | 24.00 | | 2/27/2011 | | $ | 1,132,010 | | $ | 2,868,736 |

| | | 43,031 | | 4.30 | | | | 23.06 | | 3/31/2011 | | | 624,117 | | | 1,581,634 |

| | | 50,000 | | 5.00 | | | | 20.00 | | 11/01/2011 | | | 628,894 | | | 1,593,742 |

|

| Stephen L. Higgins | | 15,000 | | 1.50 | | | | 24.00 | | 2/27/2011 | | | 226,402 | | | 573,748 |

| | | 15,000 | | 1.50 | | | | 20.00 | | 11/01/2011 | | | 188,668 | | | 478,123 |

|

| John J. Luttrell | | 7,500 | | 0.76 | | | | 24.00 | | 2/27/2011 | | | 113,201 | | | 286,874 |

| | | 20,000 | | 2.00 | | | | 21.85 | | 8/21/2011 | | | 302,518 | | | 740,559 |

| | | 15,000 | | 1.50 | | | | 20.00 | | 11/01/2011 | | | 188,668 | | | 478,123 |

|

| Judith A. Soares | | 10,000 | | 1.00 | | | | 24.00 | | 2/27/2011 | | | 150,935 | | | 382,498 |

| | | 15,000 | | 1.50 | | | | 20.00 | | 11/01/2011 | | | 188,668 | | | 478,123 |

|

| Gary D. Weatherford | | 15,000 | | 1.50 | | | | 24.00 | | 2/27/2011 | | | 226,402 | | | 573,748 |

| | | 19,125 | | 1.91 | | | | 23.06 | | 3/31/2011 | | | 277,387 | | | 702,952 |

| | | 15,000 | | 1.50 | | | | 20.00 | | 11/01/2011 | | | 188,668 | | | 478,123 |

| (1) | | The Company granted options to employees and directors to purchase a total of 1,000,532 of Common Stock during the fiscal year ended February 2, 2002. |

| (2) | | All options were granted at the fair market value of the Common Stock on the date of grant, as determined by the Board of Directors. The exercise price may be paid in cash, check, shares of the Company’s Common Stock or through a cashless exercise procedure involving same-day sale of the purchased shares, or by any combination of such methods. |

| (3) | | Potential realizable value is net of exercise price, but before taxes associated with exercise. The amounts represent certain assumed rates of appreciation only, based on the Securities and Exchange Commission rules. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock, overall market conditions and the option holders’ continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved and do not reflect the Company’s estimate of future stock price growth. |

14

The table below provides the specified information concerning the exercise of options to purchase the Company’s Common Stock in the fiscal year ended February 2, 2002 and the unexercised options held as of February 2, 2002 by the persons named in the Summary Compensation Table.

Aggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option Values

Name

| | Shares Acquired on Exercise(#)

| | Value Realized ($) (1)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End(#)

| | Value of Unexercised

in the Money Options

at Fiscal Year-End($)(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Murray H. Dashe | | 87,675 | | $ | 961,733 | | 94,410 | | 195,334 | | $ | 259,312 | | $ | 1,170,911 |

| Stephen L. Higgins | | — | | | — | | 17,999 | | 45,001 | | | 13,697 | | | 215,503 |

| John J. Luttrell | | 3,750 | | | 17,813 | | — | | 53,750 | | | — | | | 244,812 |

| Judith A. Soares | | 14,459 | | | 217,906 | | 1,332 | | 43,461 | | | 13,686 | | | 363,935 |

| Gary D. Weatherford | | — | | | — | | 64,829 | | 44,750 | | | 529,321 | | | 275,525 |

| (1) | | Calculated by determining the difference between the fair market value of the Company’s Common Stock on the date of exercise or at February 1, 2002 ($26.90), as applicable and the exercise price of such options, multiplied by the number of shares. |

Employment and Related Agreements; Change in Control Arrangements

The Company has entered into retention agreements with the following executive officers: Murray Dashe, Michael Allen, Joan Fujii, Stephen Higgins, John Luttrell, Judith Soares and Gary Weatherford. These agreements provide for payments to them in certain circumstances upon their involuntary termination of employment, including termination following a change of control (as such terms are defined below). Mr. Dashe’s agreement provides for 24 months of severance pay in the event he is involuntarily terminated prior to June 15, 2004 and 24 months of severance pay if he is involuntarily terminated after a change of control prior to June 15, 2004. Mr. Weatherford’s agreement provides for 12 months of severance pay if he is involuntarily terminated prior to June 15, 2003 and 18 months of severance pay in the event he is involuntarily terminated after a change in control prior to June 15, 2003. Both Ms. Fujii’s and Mr. Luttrell’s agreements provide for nine months of severance pay in the event either such employee is involuntarily terminated prior to June 15, 2003 and 12 months of severance pay if either such employee is involuntarily terminated after a change of control prior to June 15, 2003. Each of Ms. Soares’s and Messrs. Allen’s and Higgins’s agreements provide for six months of severance pay in the event any such employee is involuntarily terminated prior to June 15, 2003 and nine months of severance pay if any such employee is involuntarily terminated after a change of control prior to June 15, 2003. In addition, the agreement for Mr. Dashe provides for a minimum base salary.

The agreements discussed in the preceding paragraph define an “involuntary termination” as either the termination by the Company of the executive’s employment with the Company, other than for cause, or a material reduction in either the executive’s salary and bonus or the executive’s employee benefits. A “change of control” is defined as: (i) the acquisition by any person of securities representing 50% or more of the voting power of the Company’s outstanding securities; (ii) a change in the composition of the Board of Directors within a two-year period resulting in a minority of incumbent directors; (iii) a merger or consolidation in which the Company’s shareholders immediately prior to the transaction hold less than 50% of the voting power of the surviving entity immediately after the transaction; (iv) the sale or disposition of all or substantially all of the Company’s assets; or (vi) the complete liquidation or dissolution of the Company.

The Company’s 1995 Stock Option Plan provides that in the event of a change of control of the Company, as that term is defined in the 1995 Stock Option Plan, outstanding stock options will become fully vested and will either be exchanged for the same per share consideration other shareholders receive in the sale, less the option exercise price, or become exercisable thereafter for such consideration.

15

Certain Relationships and Related Transactions

To provide housing relocation assistance for Murray Dashe, Chairman, Chief Executive Officer and President, the Company loaned Mr. Dashe $992,244.11 on April 2, 2002. The loan is due and payable on the earlier to occur of (i) March 25, 2005, or (ii) the third business day after the sale by Mr. Dashe of each of his prior residences. The loan bears interest at the applicable federal rate under Internal Revenue Code Section 1274 for short-term debts compounded annually in effect as of the date of the agreement. As of May 1, 2002, $744,229 remained outstanding.

To provide housing relocation assistance for Stephen Higgins, Senior Vice President, Merchandising, the Company loaned Mr. Higgins $175,000 on April 28, 2000. The loan is due and payable on the earlier to occur of (i) the third anniversary of the Agreement or, (ii) the third business day after the sale by Mr. Higgins of his prior residence. The loan bears interest at 6.75% per annum. As of May 1, 2002, $107,582 remained outstanding.

16

REPORT OF THE COMPENSATION COMMITTEE

The Company’s Executive Compensation program is administered by the Compensation Committee comprised of three non-employee directors: Fredric M. Roberts, Barry J. Feld and Kim D. Robbins. Mr. Roberts serves as Chairman of the Compensation Committee.

Compensation Philosophy

The objectives of the executive compensation program are:

| | · | | to align compensation with Company performance in meeting both short-term and long-term business objectives and with the interests of the Company’s shareholders; |

| | · | | to enable the Company to attract, retain and reward leaders who are key to the continued successful growth of the Company; |

| | · | | to reward high levels of performance, with pay-at-risk increasing at higher levels of the organization. |

Compensation Program

The Committee annually reviews the compensation of its executive officers on the basis of each executive’s responsibility, position and level of experience in conjunction with a competitive peer company salary survey. The Company’s total direct compensation program consists of base salary, annual cash incentive opportunity (the “Cash Plus Incentive Plan”) and long-term equity-based incentive opportunity. The base salary structure is targeted at median competitive levels.

| | · | | The Cash Plus Incentive Plan rewards the achievement of short-term operational goals based on the Company’s achievement of targets established prior to the fiscal year for earnings before interest, taxes, depreciation and amortization (EBITDA) and other financial goals. The Committee believes that target bonus awards, in combination with base salaries, provide total cash compensation opportunity at median competitive levels. If actual performance exceeds target levels, total cash compensation would be above median competitive levels. If actual performance does not meet target levels, total cash compensation would fall below median competitive levels. |

| | · | | Long-term incentive opportunity is delivered through annual basic grants under the Company’s 1995 Option Plan at what the Committee believes are median competitive levels. |

Compensation of Chief Executive Officer

The Committee generally uses the factors and criteria described above in establishing the compensation of the Chief Executive Officer. Mr. Dashe’s base salary was raised to $465,000 per annum effective April 1, 2001. Mr. Dashe is also provided an incentive bonus, which was satisfied through his participation in the Company’s Cash Plus Incentive Plan. Mr. Dashe’s incentive award payment of $113,295 for fiscal year ended February 2, 2002 was based on the EBITDA target and other financial goals established prior to the fiscal year.

Mr. Dashe was also awarded stock option grants for the purchase of an aggregate of 168,031 shares of Common Stock during the last fiscal year. Of these, options to purchase 37,500 shares were considered “performance options” that would become exercisable at an earlier date if the Company met a specified earnings per share target for the fiscal year, which target was not achieved.

It is the opinion of the Committee that the aforementioned compensation policies and structures provide the necessary discipline to properly align the Company’s corporate economic performance and the interest of the

17

Company’s shareholders with progressive, balanced and competitive executive total compensation practices in an equitable manner.

| | Th | e Compensation Committee |

| | Fre | dric M. Roberts, Chairman |

Compensation Committee Interlocks and Insider Participation

Neither Fredric M. Roberts, Barry J. Feld, nor Kim D. Robbins, the members of the Company’s Compensation Committee, is an executive officer of any entity for which any executive officer of the Company serves as a director or a member of the Compensation Committee.

18

PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total return for the Company’s Common Stock, the Nasdaq National Market—U.S. Index and the Nasdaq CRSP Retail Group Index from January 31, 1997 through the fiscal year ended February 2, 2002. In preparing the graph it was assumed that: (i) $100 was invested on January 31, 1997 in the Company’s Common Stock at $7.667 per share, the Nasdaq National Market—U.S. Index and the Nasdaq CRSP Retail Group Index and (ii) all dividends were reinvested.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the preceding Report of the Compensation Committee and the following Performance Graph shall not be incorporated by reference into any such filings; nor shall such Compensation Committee Report or Performance Graph be incorporated by reference into any future filings.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN*

AMONG COST PLUS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ RETAIL TRADE INDEX

| | * | | $100 invested on 1/31/97 in stock or index—including reinvestment of dividends. |

| | | | Fiscal year ending February 2, 2002. |

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth as of April 6, 2002 (except as otherwise indicated) certain information with respect to the beneficial ownership of the Company’s Common Stock by: (i) each person known by the Company to own beneficially more than five percent (5%) of the outstanding shares of Common Stock; (ii) each director of the Company; (iii) each executive officer named in the Summary Compensation Table; and (iv) all directors and executive officers as a group.

Name and Address(1)

| | Shares Beneficially Owned

| | Percentage(2)

| |

| Franklin Resources, Inc. (3) | | 2,279,155 | | 10.6 | % |

| One Franklin Parkway | | | | | |

| San Mateo, CA 94403 | | | | | |

| The TCW Group, Inc. (4) | | 1,994,066 | | 9.2 | % |

| 865 South Figueroa Street | | | | | |

| Los Angeles, CA 90017 | | | | | |

| Delaware Management Holdings, Inc. (5) | | 1,515,613 | | 7.0 | % |

| One Commerce Square | | | | | |

| 2005 Market Street | | | | | |

| Philadelphia, PA 19103 | | | | | |

| Westfield Capital Management Co., LLC (6) | | 1,227,914 | | 5.7 | % |

| One Financial Center | | | | | |

| Boston, MA 02111 | | | | | |

| Murray H. Dashe (7) | | 116,077 | | * | |

| Stephen L. Higgins (7) | | 22,021 | | * | |

| John J. Luttrell (7) | | 5,000 | | * | |

| Judith A. Soares (7) | | 17,455 | | * | |

| Gary D. Weatherford (7) | | 72,572 | | * | |

| Joseph H. Coulombe (8) | | 19,511 | | * | |

| Barry J. Feld (7) | | 4,000 | | * | |

| Danny W. Gurr (9) | | 31,239 | | * | |

| Kim D. Robbins (7) | | 10,584 | | * | |

| Fredric M. Roberts (7) | | 10,584 | | * | |

| Thomas D. Willardson (7) | | 5,825 | | * | |

| All current directors and executive officers as a group (19 persons) (7) | | 576,294 | | 2.7 | % |

| (1) | | Except as otherwise indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown. |

| (2) | | Percentage ownership is based on 21,593,139 shares of Common Stock outstanding as of April 6, 2002 plus any shares issuable pursuant to the options held by the person or group in question which may be exercised within 60 days of April 6, 2002. |

| (3) | | Information is as of February 14, 2002 and is based solely on a Schedule 13G filed with the Securities and Exchange Commission by Franklin Resources, Inc. The shares are beneficially owned by one or more open or closed-end investment companies or other managed accounts, which are advised by direct and indirect investment advisory subsidiaries of Franklin Resources, Inc. (“FRI”). Charles B. Johnson and Rupert H. Johnson, Jr. (the “Principal Shareholders”) each own in excess of 10% of the outstanding Common Stock of FRI and are the principal shareholders of FRI. FRI and the Principal Shareholders may be deemed to be, for purposes of Rule 13d-3 under the 1934 Act, the beneficial owner of securities held by persons and entities advised by FRI subsidiaries. |

| (4) | | Information is as of February 13, 2002 and is based solely on a Schedule 13G/A filed with the Securities and Exchange Commission by The TCW Group, Inc. Mr. Robert Day is the majority shareholder of The TCW Group, Inc. and is deemed also to have beneficial ownership of the shares held by The TCW Group, Inc. |

20

| (5) | | Information is as of February 7, 2002 and is based solely on a Schedule 13G/A filed with the Securities and Exchange Commission by Delaware Management Holdings, Inc. and Delaware Management Business Trust, both of which report to have beneficial ownership of the shares. |

| (6) | | Information is as of January 16, 2002 and is based solely on a Schedule 13G filed with the Securities and Exchange Commission by Westfield Capital Management Co., LLC. |

| (7) | | Includes shares issuable upon exercise of stock options exercisable within 60 days of April 6, 2002, as follows: Mr. Dashe, 116,077; Mr. Feld, 4,000; Mr. Higgins, 21,832; Mr. Luttrell, 5,000; Ms. Robbins, 10,584; Mr. Roberts, 10,584; Ms. Soares 17,455; Mr. Weatherford, 71,579; Mr. Willardson, 5,825 and all directors and executive officers as a group (19 persons), 560,722. |

| (8) | | Includes 2,300 shares held by the Coulombe Family Trust. Also includes 17,211 shares issuable upon exercise of stock options exercisable within 60 days of April 6, 2002. |

| (9) | | Includes 4,200 shares registered in the name of Mr. Gurr’s spouse. Also includes 25,639 shares issuable upon exercise of stock options exercisable within 60 days of April 6, 2002. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission (the “SEC”) initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended February 2, 2002, all officers, directors and greater than ten percent shareholders complied with all Section 16(a) filing requirements except the Form 3’s required to be filed by Barry Feld and Lisa Griffin were filed late.

DEADLINE FOR RECEIPT OF SHAREHOLDER PROPOSALS—2003 ANNUAL MEETING

Shareholders of the Company are entitled to present proposals for consideration at forthcoming shareholder meetings provided that they comply with the proxy rules promulgated by the Securities and Exchange Commission and the Bylaws of the Company. Shareholders wishing to present a proposal at the Company’s 2003 Annual Shareholder Meeting must submit such proposal to the Company by January 22, 2003 if they wish to include it in the proxy statement and form of proxy relating to that meeting. In addition, under the Company’s Bylaws, a shareholder wishing to make a proposal at the 2003 Annual Shareholder Meeting must submit such proposal to the Company prior to April 7, 2003.

OTHER MATTERS

The Company knows of no other matters to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed Proxy to vote the shares they represent as the Board of Directors may recommend.

BY ORDER OF THE BOARD OF DIRECTORS

Murray H. Dashe

Chairman of the Board,

Chief Executive Officer

and President

Dated: May 21, 2002

21

APPENDIX A

SUMMARY OF 1995 STOCK OPTION PLAN

(INCLUDING PROPOSED AMENDMENT)

The essential features of the 1995 Stock Option Plan (the “1995 Option Plan”) are summarized below. This summary does not purport to be complete and is subject to and qualified in its entirety by, the provisions of the 1995 Option Plan. Capitalized terms used herein and not defined shall have the meanings set forth in the 1995 Option Plan.

Purpose. The purpose of the 1995 Option Plan is to strengthen the Company by providing an incentive to selected officers and other key employees and thereby encouraging them to devote their abilities and industry to the success of the Company’s business enterprise. It is intended that this purpose be achieved by extending to selected officers and other key employees of the Company and its subsidiaries an added long-term incentive for high levels of performance and unusual efforts through the grant of stock options to purchase Common Stock of the Company.

Administration. The 1995 Option Plan is administered by the Board or a committee appointed by the Board (as applicable, the “Administrator”). Such committee may consist of (i) two or more “non-employee” directors in order to grant options to officers and directors in compliance with Rule 16b-3 promulgated under the Exchange Act or (ii) two or more “outside” directors in order to grant options intended to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Administrator may make any determinations deemed necessary or advisable for the 1995 Option Plan.

Eligibility. The 1995 Option Plan provides that options may be granted to employees, including officers, directors and consultants of the Company, its parent or subsidiaries. Incentive stock options may be granted only to employees, including employee directors and officers. The Administrator has full authority to select those employees who will receive options, the time or times at which options are granted and the number of shares subject to each grant.

Limits on Grants. Section 162(m) of the Code places limits on the deductibility for federal income tax purposes of compensation paid to certain executive officers of the Company. In order to preserve the Company’s ability to deduct the compensation income associated with options granted to such persons, the 1995 Option Plan provides that no employee, director or consultant may be granted, in any fiscal year of the Company, options to purchase more than 397,983 shares of Common Stock.

Reserved Shares. The maximum number of shares that may be subject to option grants under the 1995 Option Plan is 5,968,006 shares, less the aggregate number of shares (i) subject to options outstanding under the Company’s 1994 Stock Option Plan and (ii) issued upon exercise of options granted under the 1994 Stock Option Plan.

Terms of Options. The specific terms of each option granted under the 1995 Option Plan are determined by the Administrator. Each option is evidenced by a written agreement between the Company and the optionee to whom such option is granted and is subject to the following additional terms and conditions:

(a) Exercise of Option. The Administrator determines when options may be exercisable. The Administrator may accelerate the vesting of any outstanding option. The purchase price of the exercise of any option may be paid, at the discretion of the Administrator, in cash, check, cashless exercise, or other shares of Common Stock (with some restrictions).

(b) Exercise Price. The exercise price under the 1995 Option Plan is determined by the Administrator, provided that the exercise price may not be less than 100% of the fair market value of the

A-1

Common Stock on the date the option is granted and, provided further, that, in the case of an incentive stock option granted to an employee who, at the time of such grant, owns stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company or any parent or subsidiary of the Company, the exercise price may be no less than 110% of the fair market value of the Common Stock on the date the option is granted.

(c) Disability or Retirement of Optionee. If optionee’s employment with or service as a consultant to or director of the Company ends because of optionee’s disability or voluntary retirement (at or after age 65 or at or after age 55 with the Company’s consent), optionee may exercise his or her options for one year after the date of termination (but in no event later than the expiration date of the options) to the extent the options were vested as of the date of termination unless otherwise provided for in the stock option agreement. The Administrator may provide in the stock option agreement for the options to become fully vested and exercisable on the date of such termination.

(d) Death of Optionee. If an optionee should die while employed by or serving as a consultant to or director of the Company, or within thirty days after termination of optionee’s employment, consultancy or directorship, the options may be exercised at any time within one year after the date of death (but in no event later than the date of expiration of the term of the option). If an optionee’s employment with the Company is terminated because of his or her death, all options held by the optionee shall be exercisable, including those not vested or exercisable on the date of such optionee’s death.

(e) Termination for Cause. If an optionee’s employment with or service as a consultant to the Company is terminated for cause, all options held by the optionee will terminate on the date of optionee’s termination. Cause includes (i) the intentional failure to perform reasonably assigned duties, (ii) dishonesty or willful misconduct in the performance of duties, (iii) engaging in actions in connection with the performance of duties which are adverse to the Company’s interests or for personal profit or (iv) the willful violation of any law, rule or regulation (other than traffic violations or similar offenses) in connection with the performance of duties.

(f) Termination of Employment. If the optionee’s status as an employee, consultant or director terminates for any reason other than death, disability, retirement, or cause, an option may be exercised for thirty days after such termination (but in no event later than the date of expiration of the term of the option) and may be exercised only to the extent such option was exercisable and vested on the date of termination.

(g) Termination of Options. Stock options granted under the 1995 Option Plan expire as determined by the Administrator, but in no event later than ten (10) years from the date of grant. However, in the case of an incentive stock option granted to an employee who, at the time of such grant, owns stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company or any parent or subsidiary of the Company, the term of the option may not be greater than five (5) years. Under the form of option agreement currently used by the Company, options generally expire ten (10) years from the date of grant.

(h) Non-transferability of Options. Unless otherwise specified by the Administrator, options are non-transferable by the optionee other than by will or by the laws of descent or distribution and are exercisable during the optionee’s lifetime only by the optionee.

(i) Vesting. Unless otherwise determined by the Administrator, one-fourth of the shares subject to option will vest and become exercisable each year on the anniversary of the options grant date.

(j) Other Provisions. The option agreement may contain such other terms, provisions and conditions not inconsistent with the 1995 Option Plan as may be determined by the Administrator.

Adjustments Upon Changes in Capitalization. In the event a change in the Company’s capitalization as a result of a merger, consolidation, reorganization, spin-off, stock dividend, stock split, reclassification or recapitalization, the Administrator will determine the appropriate adjustment to be made in the number of shares reserved for issuance under the 1995 Option Plan, the maximum number of shares which may be granted

A-2

annually to each employee under the 1995 Option Plan and the number of shares subject to outstanding options under the 1995 Option Plan, as well as in the price per share of Common Stock covered by such options. Such adjustment will be made so as not to cause a modification (as defined in the Code) of any incentive stock options.

Change of Control. In connection with a change of control of the Company, each outstanding option shall become fully vested and exercisable and, at the election of the Company:

(a) (i) each option shall be deemed to have been exercised to the extent it had not been exercised prior to that date; (ii) the shares issuable in connection with the deemed exercise of each option shall be issued to the acquiror of the Company, if any; and (iii) the optionee shall receive a per share payment equal to the number (or amount) and kind of consideration that each holder of a share was entitled to receive in connection with the transaction, reduced by the per share option price, or

(b) shall be terminated in exchange for a per share payment for each share then subject to such option equal to the number (or amount) and kind of consideration that each holder of a share was entitled to receive in connection with the transaction, reduced by the per share option price, or

(c) in the event of a change of control of the Company that is consummated pursuant to a merger, consolidation or reorganization (a “Transaction”), each outstanding option shall become fully (100%) vested and exercisable and the 1995 Option Plan and the outstanding options shall continue in effect and each optionee shall be entitled to receive in respect of each share subject to any outstanding option, upon exercise of such option, the same number (or amount) and kind of consideration that each holder of a share was entitled to receive in connection with the Transaction.

A change of control means (i) a merger or consolidation of the Company where the Company’s stockholders prior to the merger or consolidation do not own at least fifty percent of the Company after the merger or consolidation, (ii) the sale of all or substantially all of the assets of the Company, (iii) the complete liquidation or dissolution of the Company, (iv) an acquisition by any person directly or indirectly of fifty percent or more of the total voting power of the Company and (v) certain changes in the composition of the Board of Directors occurring within a two year period.

Sale of the Company. In the event of a sale of the Company, each optionee shall sell all incentive stock options, vested and unvested, granted prior to February 12, 1998, and receive the same consideration entitled to each shareholder in connection with the sale of the Company and, if certain conditions are met, may be required to vote in favor of the sale of the Company. The consideration received by an optionee with an incentive stock option granted prior to February 12, 1998 will be reduced by an amount equal to the optionee’s proportionate share of the expenses of the sale incurred by certain controlling shareholders of the Company. A sale of the Company includes a sale of all or substantially all of the assets of the Company, a complete liquidation or dissolution of the Company and a merger consolidation or reorganization involving the Company if certain conditions are met.

Amendment and Termination of Plan. The Board of Directors may amend the 1995 Option Plan at any time, or may terminate the 1995 Option Plan, without approval of the shareholders; provided, however, that shareholder approval is required for any amendment to the 1995 Option Plan for which shareholder approval would be required under the Code or other applicable rules and no action by the Board of Directors or shareholders may unilaterally impair any option previously granted under the 1995 Option Plan. In any event, the 1995 Option Plan will terminate in November, 2005. Any options outstanding under the 1995 Option Plan at the time of its termination will remain outstanding until they expire by their terms.

Tax Information

The following is a summary of the effect of federal income taxation with respect to the grant and exercise of options under the 1995 Option Plan. It does not purport to be complete and does not discuss the tax consequences

A-3

of the optionee’s death or the income tax laws of any municipality, state or foreign country in which a participant may reside.

Incentive Stock Options. An optionee who is granted an incentive stock option does not recognize taxable income at the time the option is granted or upon its exercise, although the exercise is an adjustment item for alternative minimum tax purposes and may subject the optionee to the alternative minimum tax. Upon a disposition of the shares more than two years after grant of the option and one year after exercise of the option, any gain or loss is treated as long-term capital gain or loss. Capital losses are allowed in full against capital gains and up to $3,000 against other income. If these holding periods are not satisfied, the optionee recognizes ordinary income at the time of disposition equal to the difference between the exercise price and the lower of (i) the fair market value of the shares at the date of the option exercise or (ii) the sale price of the shares. Any gain or loss recognized on such a premature disposition of the shares in excess of the amount treated as ordinary income is treated as long-term or short-term capital gain or loss, depending on the holding period. A different rule for measuring ordinary income upon such a premature disposition may apply if the optionee is also an officer, director, or 10% shareholder of the Company. Unless limited by Section 162(m) of the Code, the Company is entitled to a deduction in the same amount as the ordinary income recognized by the optionee.

Nonqualified Stock Options. An optionee does not recognize any taxable income at the time he or she is granted a nonqualified stock option. Upon exercise, the optionee recognizes taxable income generally measured by the excess of the then fair market value of the shares over the exercise price. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. Unless limited by Section 162(m) of the Code, the Company is entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Upon a disposition of such shares by the optionee, any difference between the sale price and the optionee’s exercise price, to the extent not recognized as taxable income as provided above, is treated as long-term or short-term capital gain or loss, depending on the holding period. Capital losses are allowed in full against capital gains and up to $3,000 against other income.

A-4

APPENDIX B

SUMMARY OF 1996 DIRECTOR OPTION PLAN

(INCLUDING PROPOSED AMENDMENT)

The essential features of the 1996 Director Option Plan (the “Director Plan”) are summarized below. This summary does not purport to be complete and is subject to, and qualified in its entirety by, the provisions of the Director Plan. Capitalized terms used herein and not defined shall have the meanings set forth in the Director Plan.

Purpose. The purposes of the Director Plan are to attract and retain the best available individuals for service as non-employee directors of the Company (“Outside Directors”), to provide additional incentive to the Outside Directors and to encourage their continued service on the Board of Directors.

Administration. The Director Plan is administered by the Board of Directors (the “Board”) or a committee appointed by the Board (the “Committee”), whose members receive no additional compensation for such service. All grants of options under the Director Plan are subject to the discretion of the Committee pursuant to the terms of the Director Plan. All questions of interpretation or application of the Director Plan are determined by the Board, whose decisions are final and binding upon all participants.

Reserved Shares. The maximum number of shares that may be subject to option grants under the Director Plan is 403,675 shares.

Eligibility. Options under the Director Plan may be granted only to Outside Directors of the Company or the director’s assignee. As of the Record Date, there were six Outside Directors of the Company, all of whom have been nominated to serve as directors for the 2002 fiscal year. The Committee has power to determine those individuals to whom options shall be granted, the number of shares subject to each option granted and to proscribe the terms and conditions of each such option, consistent with the terms of the Director Plan.

Terms of Options. The specific terms of each option granted under the Director Plan are determined by the Committee. Each option granted under the Director Plan is evidenced by a written stock option agreement between the Company and the optionee. Options are generally subject to the terms and conditions listed below.