UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 | |

SUNAMERICA EQUITY FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

(2) | Aggregate number of securities to which transaction applies:

| |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4) | Proposed maximum aggregate value of transaction:

| |||

(5) | Total fee paid:

| |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

(2) | Form, Schedule or Registration Statement No.:

| |||

(3) | Filing Party:

| |||

(4) | Date Filed:

| |||

SUNAMERICA EQUITY FUNDS

AIG Japan Fund

Harborside 5

185 Hudson Street, Suite 3300

Jersey City, NJ 07311

(800) 858-8850

April 9, 2021

Dear Shareholder:

The Board of Trustees (the “Board”) of SunAmerica Equity Funds, a Massachusetts business trust (the “Trust”), has called a special meeting of shareholders of the AIG Japan Fund (the “Fund”), a series of the Trust, to be held on Wednesday, June 9, 2021, at 4:00 p.m. Eastern Time (the “Special Meeting”). In light of public health concerns regarding the COVID-19 pandemic, the Special Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Special Meeting in person.

AIG Life & Retirement, a division of American International Group, Inc. (“AIG”), determined that the retail mutual fund asset management business of SunAmerica Asset Management, LLC, an indirect wholly-owned subsidiary of AIG and the Fund’s investment adviser, was no longer core to AIG Life & Retirement’s strategic priorities. As a result of this decision, the funds within AIG’s retail mutual fund complex were proposed to be reorganized or liquidated.

The Board determined that it is advisable and in the best interests of the Fund and its shareholders to liquidate the Fund and has unanimously approved a Plan of Liquidation with respect to the Fund (the “Plan”), which provides for the complete liquidation of all of the assets of the Fund. The Board has directed that a proposal to liquidate the Fund pursuant to the Plan be submitted to a vote of the Fund’s shareholders for their approval at the Special Meeting (the “Proposal”). If the shareholders approve the Plan, the Fund will promptly cease its investment operations and will not engage in any investment activities, except as necessary to effect the Fund’s liquidation, including winding up its business, converting its portfolio securities to cash, discharging or making reasonable provision for the payment of all of its liabilities and making one or more liquidating distributions to shareholders on a pro rata basis in accordance with the Plan. Subject to approval by the Fund’s shareholders, the date of liquidation for the Fund is anticipated to be on or about July 12, 2021.

After careful consideration, the Board unanimously recommends that the Fund’s shareholders vote “FOR” the Proposal.

Enclosed are the following materials:

| • | A Notice of Special Meeting of Shareholders, which summarizes the Proposal on which you are being asked to vote; and |

| • | A proxy statement, which provides detailed information on the Proposal and why the Proposal is being made. |

We encourage you to review the enclosed materials carefully. As a shareholder of the Fund, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the Special Meeting. You may vote in one of the following ways:

| • | By calling the toll-free telephone number listed on the enclosed proxy card; |

| • | By Internet at the website address listed on the enclosed proxy card; |

| • | By returning the enclosed proxy card in the postage-paid envelope; or |

| • | By participating virtually at the Special Meeting. |

As always, we appreciate your support.

Sincerely, |

|

John T. Genoy |

President |

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation, we urge you to promptly indicate your vote on the enclosed proxy card, date and sign it, and return it in the envelope provided, or record your voting instructions by telephone or via the Internet, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” the liquidation of the Fund pursuant to the provisions of the Plan. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares at the Special Meeting.

QUESTIONS & ANSWERS

We recommend that you read the enclosed proxy statement (the “Proxy Statement”) in its entirety. For your convenience, we have provided a brief overview of the proposal to be voted on.

| Q: | What is happening? |

| A: | The Board of Trustees (the “Board”) of SunAmerica Equity Funds, a Massachusetts business trust (the “Trust”), has approved a Plan of Liquidation (the “Plan”) with respect to the AIG Japan Fund, a series of the Trust (the “Fund”), which provides for the complete liquidation of all of the assets of the Fund. The Board has called a special meeting of shareholders of the Fund to be held on Wednesday, June 9, 2021 at 4:00 p.m., Eastern Time (the “Special Meeting”). At the Special Meeting, shareholders of the Fund will be asked to approve a proposal to liquidate the Fund pursuant to the Plan (the “Proposal”). Shareholder approval of the Proposal is required under the Trust’s Declaration of Trust. The Board recommends that you vote “FOR” the Proposal after you carefully study the enclosed materials. |

| Q: | Why is the Board recommending this Proposal? |

| A: | AIG Life & Retirement, a division of American International Group, Inc. (“AIG”), determined that the retail mutual fund asset management business of SunAmerica Asset Management, LLC (“SunAmerica” or the “Adviser”), an indirect wholly-owned subsidiary of AIG and the Fund’s investment adviser, was no longer core to AIG Life & Retirement’s strategic priorities. As a result of this decision, the funds within AIG’s retail mutual fund complex were proposed to be reorganized or liquidated. On February 8, 2021, the Board, upon the recommendation of SunAmerica, determined that it is advisable and in the best interests of the Fund and its shareholders to liquidate the Fund. Please refer to the section entitled “Reasons for the Proposed Liquidation of the Fund” in the Proxy Statement for a more detailed description of the factors considered by the Board. |

| Q: | Who is eligible to vote? |

| A: | Shareholders of the Fund as of the close of business on March 31, 2021 (the “Record Date”) are eligible to vote at the Special Meeting. |

| Q: | How will the liquidation work? |

| A: | If the Proposal is approved by shareholders, the Fund will promptly cease its investment operations and will not engage in any investment activities, except as necessary to effect the Fund’s liquidation, including winding up its business, |

i

converting its portfolio securities to cash, discharging or making reasonable provision for the payment of all of its liabilities and making one or more liquidating distributions to shareholders on a pro rata basis in accordance with the Plan. If the Fund’s shareholders approve the Proposal at the Special Meeting, the Fund expects to make liquidating distributions to shareholders shortly before the liquidation date of the Fund. After the distributions are made and other formalities addressed, the Fund will cease to exist. |

| Q: | Who will pay for the proxy solicitation expenses? |

| A: | The costs of the preparation, mailing and solicitation of this proxy are estimated to be approximately $6,500, and will be borne solely by the Adviser or its affiliates, not the Fund. The Fund will bear the transaction costs associated with the liquidation of its portfolio securities, which are estimated to be approximately $4,157. |

| Q: | How does the Board recommend I vote? |

| A: | After careful consideration, the Board unanimously recommends that you vote “FOR” the Proposal. |

| Q: | Whom do I contact for further information? |

| A: | You may call AST Fund Solutions, LLC (“AST”), our proxy solicitation firm, toll free at 800-341-6292. |

| Q: | How can I vote? |

| A: | You may cast your vote by mail, telephone or Internet or by participating virtually at the Special Meeting. To vote by mail, please mark your vote on the enclosed proxy card and sign, date and return the card in the postage-paid envelope provided. To vote by telephone or over the Internet, please have the proxy card in hand and call the telephone number or go to the website address listed on the enclosed form and follow the instructions. Your vote by mail, telephone or Internet will be an authorization of a proxy to cast your vote at the Special Meeting. |

In light of public health concerns regarding the COVID-19 pandemic, the Special Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Special Meeting in person.

If your shares in the Fund are held by a financial intermediary (such as a broker-dealer or a bank), and you wish to attend and vote at the Special Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. Please email your legal proxy to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After

ii

receiving this information, AST will then provide you with your credentials to attend the Special Meeting. If your shares in the Fund are held by a financial intermediary, and you wish to attend, but not vote at, the Special Meeting, please send an email to AST at attendameeting@astfinancial.com with the Fund’s name in the subject line and include your full name, address, and satisfactory proof of ownership. After receiving this information, AST will then provide you with your credentials to attend the Special Meeting.

If you are a shareholder of record of the Fund – your shares are held in your name as reflected in the Fund’s records – and you wish to attend and/or vote at the Special Meeting, please send an email with your intention to attend the Special Meeting to AST at attendameeting@astfinancial.com with the Fund name in the subject line, your name and address in the body of the email. After receiving this information, AST will then provide you with your credentials for attending the Special Meeting.

Important additional information about the Proposal is set forth in the accompanying Proxy Statement. Please read it carefully.

iii

SUNAMERICA EQUITY FUNDS

AIG Japan Fund

Harborside 5

185 Hudson Street, Suite 3300

Jersey City, NJ 07311

(800) 858-8850

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, JUNE 9, 2021

To the Shareholders of the AIG Japan Fund:

This is to notify you that a special meeting (the “Special Meeting”) of shareholders of the AIG Japan Fund (the “Fund”), a series of SunAmerica Equity Funds, a Massachusetts business trust (the “Trust”), will be held on Wednesday, June 9, 2021, at 4:00 p.m., Eastern Time.

The Special Meeting will be held for the following purposes:

| 1. | To consider and vote to approve a proposal to liquidate the Fund pursuant to the Plan of Liquidation of the Fund, attached as Appendix A to the accompanying Proxy Statement; and |

| 2. | To consider and transact such other business as may properly be presented at the Special Meeting or any adjournment or postponement thereof. |

The Board of Trustees of the Trust has fixed the close of business on March 31, 2021 as the record date (“Record Date”) for determination of shareholders of the Fund entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

In light of public health concerns regarding the COVID-19 pandemic, the Special Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Special Meeting in person.

If your shares in the Fund are held by a financial intermediary (such as a broker-dealer or a bank), and you wish to attend and vote at the Special Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. Please email your legal proxy to AST Fund Solutions, LLC (“AST”) at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then provide you with your credentials to attend the Special Meeting. If your shares in the Fund are held by a financial intermediary, and you wish to attend, but not vote at, the Special Meeting, please send an email to AST at attendameeting@astfinancial.com with the Fund’s name in the subject line and include your full name, address, and satisfactory proof of ownership. After receiving this information, AST will then provide you with your credentials to attend the Special Meeting.

i

If you are a shareholder of record of the Fund – your shares are held in your name as reflected in the Fund’s records – and you wish to attend and/or vote at the Special Meeting, please send an email with your intention to attend the Special Meeting to AST at attendameeting@astfinancial.com with the Fund name in the subject line, your name and address in the body of the email. After receiving this information, AST will then provide you with your credentials for attending the Special Meeting.

It is very important that your vote be received prior to the Special Meeting date. Voting instructions for shares held of record in the name of a nominee, such as a broker-dealer or director of an employee benefit plan, may be subject to earlier cut-off dates established by such intermediaries for receipt of such instructions.

Your vote is important regardless of the size of your holdings in the Fund. Whether or not you expect to be present at the Special Meeting, please complete and sign the enclosed proxy card and return it promptly in the enclosed envelope. Certain shareholders may also vote by telephone or over the Internet; please see page 10 of the enclosed Proxy Statement for details. If you vote by proxy and then desire to change your vote or vote virtually at the Special Meeting, you may revoke your proxy at any time prior to the votes being tallied at the Special Meeting. Please refer to the section of the enclosed Proxy Statement entitled “Voting Information and Requirements—Manner of Voting” for more information.

By Order of the Board of Trustees, |

|

Gregory N. Bressler Secretary |

April 9, 2021

ii

PROXY STATEMENT

SUNAMERICA EQUITY FUNDS

AIG Japan Fund

Harborside 5

185 Hudson Street, Suite 3300

Jersey City, NJ 07311

(800) 858-8850

This proxy statement (the “Proxy Statement”) is furnished to you as a shareholder of the AIG Japan Fund (the “Fund”), a series of SunAmerica Equity Funds (the “Trust”), an open-end management investment company registered under the Investment Company of 1940, as amended (the “1940 Act”), and organized as a Massachusetts business trust. A special meeting of shareholders of the Fund (the “Special Meeting”) will be held on Wednesday, June 9, 2021 at 4:00 p.m., Eastern Time, to consider the items that are listed below and discussed in greater detail elsewhere in this Proxy Statement.

Shareholders of record of the Fund as of the close of business on March 31, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting. The Notice of Special Meeting of Shareholders, this Proxy Statement and the enclosed proxy card are being mailed to shareholders on or about April 19, 2021.

In light of public health concerns regarding the COVID-19 pandemic, the Special Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Special Meeting in person.

If your shares in the Fund are held by a financial intermediary (such as a broker-dealer or a bank), and you wish to attend and vote at the Special Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. Please email your legal proxy to AST Fund Solutions, LLC (“AST”) at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then provide you with your credentials to attend the Special Meeting. If your shares in the Fund are held by a financial intermediary, and you wish to attend, but not vote at, the Special Meeting, please send an email to AST at attendameeting@astfinancial.com with the Fund’s name in the subject line and include your full name, address, and satisfactory proof of ownership. After receiving this information, AST will then provide you with your credentials to attend the Special Meeting.

If you are a shareholder of record of the Fund – your shares are held in your name as reflected in the Fund’s records – and you wish to attend and/or vote at the Special Meeting, please send an email with your intention to attend the Special Meeting to AST at attendameeting@astfinancial.com with the Fund name in the subject line, your

1

name and address in the body of the email. After receiving this information, AST will then provide you with your credentials for attending the Special Meeting.

Copies of the Fund’s annual and semi-annual reports have previously been mailed to shareholders. You may receive additional copies of the Fund’s most recent annual and semi-annual reports, without charge, by calling 1-800-858-8850, by writing to the Trust at Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311 or through the Internet at www-1012.aig.com. Copies of the Fund’s annual and semi-annual reports are also available on the EDGAR Database on the U.S. Securities and Exchange Commission’s website at www.sec.gov.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON WEDNESDAY, JUNE 9, 2021. The Notice of Special Meeting of Shareholders and this Proxy Statement are available on the Internet at https://vote.proxyonline.com/aig/docs/japanproxy2021.pdf.

PROPOSAL: TO APPROVE THE LIQUIDATION OF THE FUND PURSUANT TO THE PLAN OF LIQUIDATION

The only item of business that the Board of Trustees (the “Board”) of the Trust expects will come before the Special Meeting is the proposal to liquidate the Fund pursuant to the Fund’s Plan of Liquidation (the “Plan”), approved by the Board and attached hereto as Appendix A (the “Proposal”).

The Trust’s Declaration of Trust provides that the Fund cannot be liquidated unless both the Board and the Fund’s shareholders vote in favor of liquidation. For the reasons discussed below, the Board has approved, and recommends that the Fund’s shareholders vote in favor of the Proposal, which calls for the liquidation of the Fund pursuant to the Plan. The Special Meeting is being held to seek shareholder approval of the Proposal.

Any shareholder who owned shares of the Fund on the Record Date is entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. Each share is entitled to cast one vote, and fractional shares are entitled to cast a proportionate fractional vote.

The Board unanimously recommends that the Fund’s shareholders vote “FOR” the proposal to liquidate the Fund pursuant to the Plan.

Reason for the Liquidation

AIG Life & Retirement, a division of American International Group, Inc. (“AIG”), determined that the retail mutual fund asset management business of

2

SunAmerica Asset Management, LLC (“SunAmerica” or the “Adviser”), an indirect wholly-owned subsidiary of AIG and the Fund’s investment adviser, was no longer core to AIG Life & Retirement’s strategic priorities. As a result of this decision, the funds within AIG’s retail mutual fund complex were proposed to be reorganized or liquidated.

At a meeting held on February 8, 2021, the Board, upon the recommendation of SunAmerica, determined that it is advisable and in the best interests of the Fund and its shareholders to liquidate the Fund. In evaluating the liquidation and the Plan for the Fund, the Board considered a number of factors, including particularly the Fund’s small asset size. It also considered representations from management that it was not practicable to reorganize the Fund with another fund. In addition, the Board considered the fact that SunAmerica and its affiliates will voluntarily bear the expenses of the proxy statement and the expenses (other than brokerage fees and other transaction costs incurred in connection with the sale of the Fund’s holdings in connection with the liquidation and certain extraordinary expenses) incurred in implementing the Plan, including, but not limited to, all printing, legal, accounting, transfer agency and custodian fees, and the expenses of any notices to appropriate parties. Expenses incurred by the Fund in the ordinary course during the liquidation, including without limitation Fund transaction costs, will continue to be treated as Fund expenses.

Based on an evaluation of all the factors noted above, including SunAmerica’s recommendation, the Board concluded that it is advisable and in the best interests of the Fund and its shareholders to liquidate the Fund. Based on its consideration of these and other factors deemed relevant, the Board, including all of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Fund, unanimously approved the liquidation of the Fund and the Plan and directed that the proposal to liquidate the Fund as set forth in the Plan be submitted to a vote of the Fund’s shareholders. The Trust is not required to seek federal or state regulatory approval of the Plan or the liquidation of the Fund. In the event the Proposal is not approved by the requisite shareholder vote, the Board will consider what other action should be taken, which could include resoliciting shareholders.

Summary of the Plan of Liquidation of the Fund

The following discussion summarizes the important terms of the Plan, does not purport to be complete, and is subject in all respects to the provisions of, and is qualified in its entirety by reference to, the Plan, which is attached hereto as Appendix A. Shareholders are urged to read the Plan in its entirety. The Plan provides for the complete liquidation of all assets of the Fund, the payment and discharge of, or other provision for, all liabilities and obligations of the Fund, and the distribution of the remaining net assets to shareholders.

The Plan will become effective on the date the Fund’s shareholders approve the Proposal (the “Effective Date”). After the Effective Date, the Fund will promptly cease

3

its business as a series of an investment company and will not engage in any business activities except for the purposes of winding up its business and affairs, marshalling and preserving the value of its assets, and distributing it assets to shareholders in redemption of their shares in accordance with the provisions of the Plan after the payment to all creditors of the Fund and discharging or making reasonable provisions for the Fund’s liabilities. The Fund’s officers will undertake to liquidate the Fund in accordance with the terms of the Plan.

As soon as practicable after the consummation of the sale of all of the Fund’s securities and the payment and reserve for payment of all of the Fund’s known liabilities and obligations, the Fund will liquidate and distribute all of the remaining assets of the Fund pro rata to its shareholders in an amount equal to the net asset value per share in complete cancellation and redemption of all of the outstanding shares of the Fund (the “Liquidation Distribution”). Shareholders may also receive previously declared and unpaid dividends and distributions, together with the Liquidation Distribution, with respect to each of the shareholder’s shares of the Fund.

If the Fund is unable to make distributions to all of its shareholders because of an inability to locate shareholders to whom distributions are payable, these assets will be subject to applicable abandoned property laws.

The Board may authorize or ratify variations from or amendments to the provisions of the Plan as may be necessary or appropriate. If any amendment or modification appears necessary and, in the judgment of the Board, will materially and adversely affect the interests of the Fund’s shareholders, shareholders will be given prompt and timely notice of such an amendment or modification. In addition, the Board may abandon the Plan at any time if it determines that abandonment would be advisable and in the best interests of the Fund and its shareholders. SunAmerica and its affiliates will bear all expenses incurred in implementing the Plan, including the proxy solicitation, but the Fund will bear the transaction costs associated with the liquidation of its portfolio securities, which is estimated to cost the Fund approximately $4,157.

Material Federal Income Tax Consequences of the Liquidation of the Fund

The following discussion summarizes the material U.S. federal income tax consequences to shareholders on receipt of their pro rata shares of the Liquidation Distribution from the Fund pursuant to the provisions of the Plan. This discussion also summarizes the material U.S. federal income tax consequences to the Fund resulting from its liquidation. This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), temporary and proposed Treasury regulations and administrative and judicial interpretations, all as in effect on the date of this Proxy Statement and all of which are subject to change, possibly with retroactive effect. Any such changes could affect the accuracy of the statements and conclusions set forth herein.

4

As discussed above, pursuant to the Plan, the Fund will sell its investment securities and distribute the proceeds to its shareholders on the basis of their respective shareholdings. The Fund anticipates that it will retain its qualification as a regulated investment company under the Code during the liquidation period and, therefore, will not be taxed on any of its net income from the sale of its assets to the extent that such income is timely distributed to shareholders.

For federal income tax purposes, a shareholder’s receipt of his or her pro rata share of the Liquidation Distribution will be a taxable event in which the shareholder will be viewed as having sold his or her shares in exchange for an amount equal to the cash that he or she receives. Each shareholder generally will recognize gain (or loss) for federal income tax purposes equal to the amount by which such cash exceeds (or is less than) the shareholder’s adjusted tax basis in his or her Fund shares. If any gain or loss is recognized, such gain or loss generally will be treated as long-term capital gain or loss if the shareholder held the Fund shares for more than one year and otherwise generally will be treated as short-term capital gain or loss. Notwithstanding the foregoing, any loss realized by a shareholder in respect of shares with a tax holding period of six months or less will be treated as long-term capital loss to the extent of any capital gain dividends with respect to such shares. The federal income tax treatment that a Fund shareholder would receive if such shareholder’s entire interest in the Fund were redeemed prior to the liquidation generally would be identical to the federal income tax treatment described above to a shareholder in liquidation of the shareholder’s interest in the Fund. In addition, before liquidating, the Fund will continue to make its ordinary dividend distributions on a monthly basis.

The foregoing summary sets forth general information regarding the anticipated federal income tax consequences of the liquidation to the Fund and to shareholders who are United States citizens or residents. This discussion does not address all aspects of U.S. federal income taxation that may be relevant to a shareholder in light of the shareholder’s particular circumstances, nor does it discuss the special considerations applicable to those holders of shares subject to special rules, such as shareholders whose functional currency is not the United States dollar, shareholders subject to the alternative minimum tax, shareholders who are financial institutions or broker-dealers, mutual funds, partnerships or other pass-through entities for U.S. federal income tax purposes, tax-exempt organizations, insurance companies, dealers in securities or foreign currencies, traders in securities who elect mark to market method of accounting, controlled foreign corporations, passive foreign investment companies, expatriates, or shareholders who hold their shares as part of a straddle, constructive sale or conversion transaction. This discussion assumes that shareholders hold their shares as capital assets within the meaning of Section 1221 of the Code (generally property held for investment). The Fund will not seek an opinion of counsel or a ruling from the IRS with respect to the U.S. federal income tax consequences discussed herein and accordingly there can be no assurance that the IRS will agree with the positions described in this Proxy Statement. This discussion also does not address the application and effect of any foreign state or local tax laws.

5

An Individual Retirement Account (an “IRA”) is generally not taxed on investment income and gain from the Fund (assuming that the IRA did not incur debt to finance its investment in the Fund). Accordingly, the receipt by an IRA of the Liquidation Distribution should not be a taxable event for the IRA. However, if the IRA beneficiary receives a distribution from the IRA as a result of the liquidation (as opposed to the IRA reinvesting the Liquidation Distribution), then such distribution may be taxable to the IRA beneficiary. In this situation, the amount received by the beneficiary will constitute a taxable distribution, and if the beneficiary has not attained 591⁄2 years of age, such distribution will generally constitute an early distribution subject to a 10% federal penalty tax and possibly state and local penalty taxes. This federal penalty tax is in addition to the beneficiary’s regular federal income tax liability on the distribution. In order to avoid having to include such distribution in his or her taxable income for the year, the IRA beneficiary may be able to roll the distribution into another IRA. If the IRA beneficiary is eligible to do so, the rollover must occur within sixty (60) days of the date of the distribution in order to avoid having to include the distribution in the taxable income of the IRA beneficiary. However, an IRA beneficiary may make only one tax-free rollover during a 12-month period regardless of the number of IRAs owned by such beneficiary, provided such limitation with respect to tax-free rollovers does not apply to rollovers from traditional IRAs to Roth IRAs (conversions), trustee-to-trustee transfers to another IRA, and certain other rollover exceptions. IRA owners should promptly provide instructions to their IRA custodian with respect to a rollover of a distribution.

Shareholders should consult their own tax advisors to determine the particular tax consequences to them (including the application and effect of any state, local or foreign income and other tax laws) of the receipt of cash in exchange for their shares, in light of their individual circumstances.

ADDITIONAL INFORMATION

Service Providers

SunAmerica Asset Management, LLC, the Fund’s investment adviser, and AIG Capital Services, Inc., the Fund’s distributor, are located at Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311. Wellington Management Company LLP, the Fund’s subadviser, is located at 280 Congress Street, Boston, Massachusetts 02210.

Fund Annual Report

The Fund has previously sent its Annual Report to its shareholders for the period ended September 30, 2020. You can obtain a copy of this Report, or the most recent Semi-Annual Report, without charge by writing to the Trust at Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311 or by calling (800) 858-8850. You can also access Annual and Semi-Annual Reports through the Internet at www-1012.aig.com.

6

Delivery of Proxy Statements – Householding

Please note that only one copy of the Proxy Statement and other shareholder documents may be delivered to a shareholder or multiple shareholders of the Fund whose accounts are registered under the same social security number or tax identification number and the same address, unless the Fund has received instructions to the contrary. This practice is commonly called “householding” and it is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. To request a separate copy of the Proxy Statement or any other shareholder document or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Trust by telephone at (800) 858-8850 or by mail at Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311.

Outstanding Shares and Significant Shareholders

On the Record Date, the Trustees and officers of the Trust, individually and as a group, owned beneficially less than one percent of the shares of the Fund.

To the best knowledge of the Fund, as of the Record Date, no person, except as set forth in the table below, owned, of record or beneficially, 5% or more of the outstanding shares of the Fund:

Class | Holder and Address | Of Record | Percentage | |||||

A | AIG Multi-Asset Allocation Fund Attn: Greg Kingston 2929 Allen Parkway #A8-10 Houston, Texas 77019-7100 | Record | 48.35 | % | ||||

A | AIG Active Allocation Fund Attn: Greg Kingston 2929 Allen Parkway #A8-10 Houston, Texas 77019-7100 | Record | 21.16 | % | ||||

A | Morgan Stanley Smith Barney for exclusive benefit of its customer 1 New York Plaza Fl. 12 New York, New York 10004-1901 | Record | 10.42 | % | ||||

C | Morgan Stanley Smith Barney for exclusive benefit of its customer 1 New York Plaza Fl. 12 New York, New York 10004-1901 | Record | 76.72 | % | ||||

W | Pershing LLC 1 Pershing Plaza Jersey City, New Jersey 07399-0002 | Record | 13.20 | % | ||||

7

Class | Holder and Address | Of Record | Percentage | |||||

W | SunAmerica Asset Management, LLC Attn: Frank Curran Harborside 5, 185 Hudson Street Suite 3300 Jersey City, New Jersey 07311-1209 | Record | 24.06 | % | ||||

W | LPL Financial A/C 1000-0005 4701 Executive Drive San Diego, California 92121 | Record | 14.15 | % | ||||

W | UBS WM USASPEC CDY A/C BEN CUST UBSFSIOMNI ACCOUNT M/F Attn: Department Manager 1000 Harbor Boulevard, Fl. 5 Weehawken, New Jersey 07086-6761 | Record | 45.75 | % | ||||

VOTING INFORMATION AND REQUIREMENTS

Voting Eligibility and Number of Votes

Only shareholders of record of the Fund at the close of business on the Record Date are entitled to vote at the Special Meeting. The number of shares of the Fund outstanding as of the Record Date was 5,608,077.92.

Information About Proxies and the Conduct of the Special Meeting

Solicitation of Proxies. Solicitations of proxies are being made on behalf of the Fund and the Board primarily by the mailing of the Notice of Special Meeting of Shareholders and this Proxy Statement with its enclosures on or about April 19, 2021. Fund shareholders whose shares are held by nominees such as brokers can vote their proxies by contacting their respective nominee. In addition to the solicitation of proxies by mail, employees of the Fund and its affiliates as well as dealers or their representatives may, without additional compensation, solicit proxies by mail, telephone, facsimile or oral communication. The Fund has retained AST, a professional proxy solicitation firm, to assist with the distribution of proxy materials, the solicitation and tabulation of proxies and the hosting of the virtual Special Meeting. Fund shareholders may receive a telephone call from AST asking them to vote.

Brokerage firms and others will be reimbursed for their expenses in forwarding solicitation material to the beneficial owners of shares of the Fund. Representatives of SunAmerica and its affiliates and other representatives of the Fund may also solicit proxies.

Questions about the Proposal should be directed to the Trust by telephone at (800) 858-8850 or by mail at Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311.

8

Costs of Solicitation. The costs of the Special Meeting, including any costs of soliciting proxies in connection with the liquidation of the Fund, are estimated to be approximately $6,500 and will be borne solely by the Adviser and its affiliates, not by the Fund. The Fund will bear the transaction costs associated with the liquidation of its portfolio securities, which are estimated to be approximately $4,157.

Required Vote. Approval of the Proposal will require the affirmative vote of the holders of a majority of the outstanding voting securities of the Fund, as defined under the 1940 Act. The 1940 Act defines such vote as the lesser of (1) 67% of the shares of the Fund that are present or represented by proxy at the Special Meeting, if the holders of more than 50% of the shares of the Fund outstanding as of the Record Date are present or represented by proxy at the Special Meeting, or (2) more than 50% of the shares of the Fund outstanding on the Record Date. If the required vote is not obtained, the Board will consider what other actions to take in the best interests of the Fund. The Board has fixed the close of business on March 31, 2021 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting.

Proxies. If a proxy authorization (a “proxy”) is properly given in time for a vote at the Special Meeting (either by returning the paper proxy card or by submitting a proxy by telephone or over the Internet), the shares of the Fund represented thereby will be voted at the Special Meeting in accordance with the shareholder’s instructions. The proxy grants discretion to the persons named therein, as proxies, to take such further action as they may determine appropriate in connection with any other matter, which may properly come before the Special Meeting, or any adjournments or postponements thereof. All properly executed proxies received prior to the Special Meeting will be voted in accordance with the instructions marked thereon or otherwise as provided therein. Unless instructions to the contrary are marked, properly executed proxies will be voted in favor of the Proposal. See the section entitled “Manner of Voting” below.

Quorum; Adjournments. A majority of the outstanding shares of the Fund entitled to vote at the Special Meeting must be present in person (i.e., virtually) or by proxy to have a quorum to conduct business at the Special Meeting. For purposes of determining the presence of a quorum for transacting business at the Special Meeting and determining whether sufficient votes have been received for approval of any proposal to be acted upon at the Special Meeting, abstentions and broker non-votes (i.e., where a nominee such as a broker holding shares for beneficial owners votes on certain matters pursuant to discretionary authority or instructions from beneficial owners, but with respect to one or more proposals does not receive instructions from beneficial owners or does not exercise discretionary authority) will be counted as present for purposes of a quorum but would have the same effect as votes “Against” the approval of the Proposal.

Whether or not a quorum is present, the chairman of the Special Meeting may propose one or more adjournments of the Special Meeting on behalf of the Fund without further notice to permit further solicitation of proxies. Any such adjournment

9

will require the affirmative vote of the holders of a majority of the shares of the Fund present in person or by proxy and entitled to vote at the Special Meeting to be adjourned or postponed. Those proxies that are instructed to vote in favor of the Proposal will vote in favor of any such adjournment, and those proxies that are instructed to vote against the Proposal, will vote against any such adjournment, as applicable.

Future Shareholder Meetings; Shareholder Proposals. It is expected that the Plan will be implemented as soon as practicable after the Effective Date, and that no future meetings of shareholders will be held. The Fund does not hold annual or other regular meetings of shareholders unless a shareholder vote is required under the 1940 Act or the Trust’s Declaration of Trust. In the event that the Fund is not liquidated and holds a meeting of shareholders in the future, shareholders who would like to submit proposals for consideration at a shareholder meeting should send written proposals to Gregory N. Bressler, Secretary, Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, New Jersey 07311. To be considered for presentation at a shareholder meeting, rules promulgated by the U.S. Securities and Exchange Commission require that, among other things, a shareholder’s proposal must be received at the offices of the Trust within a reasonable time before a solicitation is made. Timely submission of a proposal does not necessarily mean that such proposal will be included.

Manner of Voting

Fund shareholders may vote by participating virtually at the Special Meeting, or may authorize proxies by returning the enclosed proxy card or via telephone or the Internet using the instructions provided on the enclosed proxy card. Any shareholder who has given a proxy, whether in written form, by telephone or over the Internet, may revoke it at any time prior to its exercise by submitting a subsequent written, telephonic or electronic proxy, by giving written notice of revocation to the Secretary of the Trust, or by attending the Special Meeting and voting virtually at the Special Meeting.

By Mail. To authorize your proxies by mail, you should date and sign the proxy card included with this Proxy Statement, indicate your vote on the proposal, and return the form in the envelope provided. Please mail it early enough to be delivered prior to the Special Meeting.

By Telephone. You may use the automated touch-tone voting method by calling the toll-free number provided on the proxy card. At the prompt, follow the menu. Prior to calling, you should read this Proxy Statement and have your proxy card at hand.

By Internet. To authorize your proxies over the Internet, please log on to the website listed on your proxy card and click on the proxy voting button. Prior to logging on, you should read this Proxy Statement and have your proxy card at hand. After logging on, follow the instructions on the screen.

10

Additional Information. Shareholders authorizing their proxies by telephone or over the Internet need not return their proxy card by mail.

A person submitting voting instructions by telephone or over the Internet is deemed to represent that he or she is authorized to vote on behalf of all owners of the account, including spouses or other joint owners. By using the telephone or the Internet to submit voting instructions, the shareholder is authorizing AST, a proxy solicitation firm and a tabulation agent, and its agents, to execute a proxy to vote the shareholder’s shares at the Special Meeting as the shareholder has indicated.

The Fund believes that the procedures for authorizing the execution of a proxy by telephone or over the Internet set forth above are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately recorded.

You are requested to fill in, sign and return the enclosed proxy card promptly, even if you expect to be participating virtually in the Special Meeting. No postage is necessary if mailed in the United States.

April 9, 2021

11

Appendix A

SUNAMERICA EQUITY FUNDS

AIG JAPAN FUND

PLAN OF LIQUIDATION

This Plan of Liquidation (the “Plan”) is adopted by SunAmerica Equity Funds (the “Trust”) a Massachusetts business trust, with respect to the AIG Japan Fund (the “Fund”), a series of the Trust. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and this Plan is adopted as a plan of liquidation for purposes of the Internal Revenue Code of 1986, as amended, and the regulations thereunder (collectively, the “Code”) with respect to the Fund. The Plan is intended to accomplish the complete liquidation and dissolution of the Fund and the redemption of the Fund’s outstanding shares in conformity with applicable law and the Declaration of Trust and By-Laws, as they have been amended, supplemented or restated.

WHEREAS, on February 8, 2021, the Board of Trustees (“Board”) of the Trust has determined, after careful deliberation and consideration of the alternatives, that the continuation of the Fund would not be in the best interest of the Fund or its shareholders;

WHEREAS, the Board has determined that it is advisable and in the best interests of the Fund and its shareholders to liquidate and dissolve the Fund on or about July 16, 2021, or such other date as determined by any officer of the Trust (the “Liquidation Date”);

NOW, THEREFORE, the Board unanimously approves this Plan as being advisable and in the best interests of the Fund and its shareholders, and adopts this Plan as the method of liquidating the Fund in the manner hereinafter set forth:

| 1. | Effective Date of the Plan. The Plan shall become effective on [DATE], only upon the adoption and approval of the Plan, at a meeting of shareholders called for the purpose of voting on the Plan, by the affirmative vote of a majority of the outstanding voting securities, which for purposes of the 1940 Act means the lesser of (1) 67% or more of the voting securities present at the meeting if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (2) more than 50% of the outstanding voting securities. The date of such adoption and approval of the Plan is herein called the “Effective Date.” |

| 2. | Liquidation. The Fund shall be liquidated on or before the Liquidation Date in accordance with Section 331 of the Code. |

A-1

| 3. | Dissolution. As promptly as practicable, consistent with the provisions of the Plan, the Fund shall be liquidated and terminated in accordance with the laws of the Commonwealth of Massachusetts and the Declaration of Trust and By-Laws. |

| 4. | Cessation of Business. As soon as is reasonable and practicable after the Effective Date, the Fund shall cease its business as a series of an investment company and shall not engage in any business activities except for the purposes of winding up its business and affairs, marshalling and preserving the value of its assets and distributing its assets to shareholders in redemption of their shares in accordance with the provisions of the Plan after the payment to (or reservation of assets for payment to) all creditors of the Fund and discharging or making reasonable provisions for the Fund’s liabilities. |

| 5. | Notice of Liquidation. Prior to the Effective Date, the Fund shall provide notice to the appropriate parties that this Plan has been approved by the Board and that on the Liquidation Date, the Fund will be liquidating its assets and redeeming its shares. |

| 6. | Liquidation of Assets and Payment of Debts. On or before the Liquidation Date, subject to the provisions of Section 8 hereof, the Fund shall: (i) convert all portfolio securities of the Fund to cash or cash equivalents; and (ii) pay, or make reasonable provision to pay, in full all known, existing, reasonably foreseeable and ascertainable claims, debts, liabilities and obligations, including, without limitation, all contingent, conditional, liquidated, matured, unmatured and asserted claims, debts, liabilities and obligations, known to the Fund and all claims, debts, liabilities and obligations which are known to the Fund but for which the identity of the claimant is unknown. Such amount shall include, without limitation, all charges, taxes and expenses of the Fund, whether due, accrued or anticipated, that have been incurred or are expected to be incurred by the Fund. |

| 7. | Liquidating Distribution. Any shares of the Fund outstanding on the Liquidation Date will be automatically redeemed by the Trust on that date. On the Liquidation Date, the Fund shall distribute pro rata to the Fund’s shareholders of record, as of the close of business on the Liquidation Date, all of the remaining assets of the Fund in complete cancellation and redemption of all of the outstanding shares of beneficial interest of the Fund, less an estimated amount necessary to discharge (a) any unpaid liabilities and obligations of the Fund on the Fund’s books on the date of distribution, and (b) liabilities as the Board shall reasonably deem to exist against the assets of the Fund. |

If the Trust is unable to make distributions to all of the Fund’s shareholders because of the inability to locate shareholders to whom distributions in cancellation and redemption of the Fund’s shares are payable, the Board may authorize the officers of the Trust to create, in the name and on behalf of the

A-2

Fund, a trust or account with a financial institution and, subject to applicable abandoned property laws, deposit any remaining assets of the Fund in such account or trust for the benefit of the shareholders that cannot be located. The expenses of any of the foregoing shall be charged against the assets therein.

| 8. | Satisfaction of Federal Income and Excise Tax Distribution Requirements. If necessary, the Fund shall, by the Liquidation Date, have declared and paid a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the Fund’s shareholders all of the Fund’s investment company taxable income for the taxable years ending at, or prior to, the Liquidation Date (computed without regard to any deduction for dividends paid), and all of the Fund’s net capital gain, if any, realized in the taxable years ending at or prior to the Liquidation Date (after reduction for any available capital loss carry-forward) and any additional amounts necessary to avoid any excise tax for such periods. |

| 9. | Receipt of Cash or Other Distributions After the Liquidation Date. Following the Liquidation Date, provided that no liquidating trust has been established, if the Fund holds cash or becomes entitled to any other assets that it had not recorded on its books on or before the Liquidation Date in excess of its unpaid liabilities and obligations, such assets shall be reduced to cash and will be disbursed pro rata to shareholders of record; provided, however, that the Fund shall not be required to distribute to shareholders of record any cash or other distributions that SunAmerica Asset Management, LLC (“SunAmerica”) determines to be de minimis after taking into account all expenses associated with effecting the disposition thereof. |

| 10. | Management and Expenses of the Fund. SunAmerica and its affiliates shall bear all of the expenses (other than brokerage fees and other transaction costs incurred in connection with the sale of the Fund’s holdings in connection with the liquidation and certain extraordinary expenses) incurred in implementing the Plan, including, but not limited to, all printing, legal, accounting, transfer agency and custodian fees, and the expenses of any notices to appropriate parties. Expenses incurred by the Fund in the ordinary course during the liquidation, including without limitation Fund transaction costs, will continue to be treated as Fund expenses. |

| 11. | Powers of the Board of Trustees. Without limiting the power of the Board under the law of the Commonwealth of Massachusetts and the Declaration of Trust, the Board, and subject to the direction of the Board, the officers of the Trust, shall have authority to do or authorize any or all acts and things as provided for in the Plan and any and all such further acts and things as they may consider necessary or desirable to carry out the purposes of the Plan, including the execution and filing of all certificates, documents, information returns, tax returns and other papers that may be necessary or appropriate to implement the Plan or that may be required by the provisions of the 1940 Act |

A-3

or any other applicable laws. The death, resignation or disability of any Trustee or any officer of the Trust shall not impair the authority of the surviving or remaining Trustees or officers to exercise any of the powers provided for in the Plan. |

| 12. | Amendment or Abandonment of Plan and Shareholder Approval of Plan. The Board shall have the authority to authorize or ratify such variations from or amendments to the provisions of the Plan as may be necessary or appropriate to effect the marshalling of the Fund’s assets and the dissolution, complete liquidation and termination of the existence of the Fund, and the distribution of the Fund’s net assets to shareholders in redemption of the shares in accordance with the laws of the Commonwealth of Massachusetts, the 1940 Act, the Code, the Trust’s Declaration of Trust and By-Laws and the purposes to be accomplished by the Plan. If any amendment or modification appears necessary and in the judgment of the Board will materially and adversely affect the interests of Fund shareholders, Fund shareholders will be given prompt and timely notice of such an amendment or modification. In addition, the Board may abandon this Plan at any time if it determines that abandonment would be advisable and in the best interests of the Fund and its shareholders. |

| 13. | Filings. The Fund shall, by the Liquidation Date, or as soon as practicable thereafter, have filed all necessary regulatory reports, tax reports, tax returns, or other documents with the Securities and Exchange Commission (“SEC”), any state securities commission, and any federal, state or local tax authorities or any other relevant regulatory authority. In addition, following the Liquidation Date, all necessary regulatory reports, tax returns, or other documents shall be filed with the SEC and any other necessary or applicable state, federal, or local regulatory or tax authority. |

| 14. | Changes to Dates. Each officer of the Trust may modify or extend any of the dates specified in the Plan for the taking of any action in connection with the implementation of the Plan (including, but not limited to, the Effective Date and the Liquidation Date) if such officer(s) determine, with the advice of the Trust’s counsel, that such modification or extension is necessary or appropriate in connection with the orderly liquidation of the Fund or to protect the interests of the shareholders of the Fund. |

| 15. | No Appraisal Rights. Shareholders are not entitled to appraisal rights in connection with this Plan. |

| 16. | Records. The Trust or its designee will maintain all records related to this Plan as required by the 1940 Act and the rules thereunder. |

| 17. | Trust Only. With respect to the Trust, which is organized as a Massachusetts business trust, the Declaration of Trust establishing the Trust, a copy of which is on file in the office of the Secretary of State of the Commonwealth of Massachusetts, provides that the name of the Trust refers to the trustees |

A-4

collectively as Trustees, not as individuals or personally; and that no Trustee, shareholder, officer, employee or agent of such Trust shall be held to any personal liability, nor shall resort be had to their private property for the satisfaction of any obligation or claim or otherwise in connection with the affairs of the Trust or any fund; but that the Trust estate shall be liable. Notice is hereby given that nothing contained herein shall be construed to be binding upon any of the Trustees, officers, or shareholders of such Trust individually. |

| 18. | Governing Law. This Plan shall be governed and construed in accordance with the laws of the Commonwealth of Massachusetts, without giving effect to the conflicts of law provisions therein. |

Adopted: [DATE], 2021

A-5

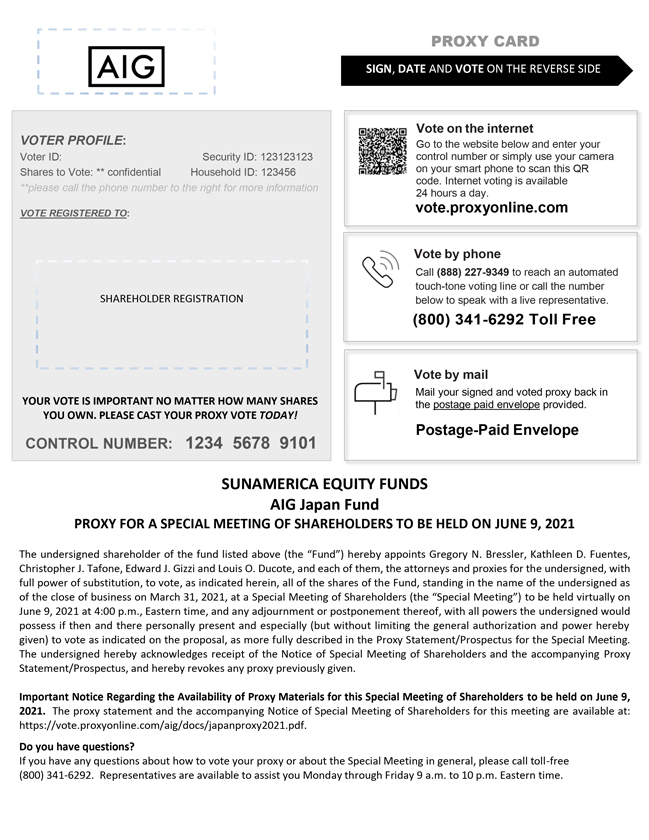

PROXY CARD SIGN, DATE AND VOTE ON THE REVERSE SIDE VOTER PROFILE: Go to the website below and enter your Voter ID: Security ID: 123123123 control number or simply use your camera Shares to Vote: ** confidential Household ID: 123456 on your smart phone to scan this QR code. Internet voting is available **please call the phone number to the right for more information 24 hours a day. vote.proxyonline.com Vote by phone SHAREHOLDER REGISTRATION (800) 341-6292 Toll Free Vote by mail Mail your signed and voted proxy back in YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES the postage paid envelope provided. YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY! Postage-Paid Envelope : 1234 5678 9101 SUNAMERICA EQUITY FUNDS AIG Japan Fund PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 9, 2021 The undersigned shareholder of the fund listed above (the “Fund”) hereby appoints Gregory N. Bressler, Kathleen D. Fuentes, Christopher J. Tafone, Edward J. Gizzi and Louis O. Ducote, and each of them, the attorneys and proxies for the undersigned, with full power of substitution, to vote, as indicated herein, all of the shares of the Fund, standing in the name of the undersigned as of the close of business on March 31, 2021, at a Special Meeting of Shareholders (the “Special Meeting”) to be held virtually on June 9, 2021 at 4:00 p.m., Eastern time, and any adjournment or postponement thereof, with all powers the undersigned would possess if then and there personally present and especially (but without limiting the general authorization and power hereby given) to vote as indicated on the proposal, as more fully described in the Proxy Statement/Prospectus for the Special Meeting. The undersigned hereby acknowledges receipt of the Notice of Special Meeting of Shareholders and the accompanying Proxy Statement/Prospectus, and hereby revokes any proxy previously given. Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to be held on June 9, 2021. The proxy statement and the accompanying Notice of Special Meeting of Shareholders for this meeting are available at: https://vote .proxyonline.com/aig/docs/japanproxy2021.pdf. Do you have questions? If you have any questions about how to vote your proxy or about the Special Meeting in general, please call toll-free (800) 341-6292. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern time.

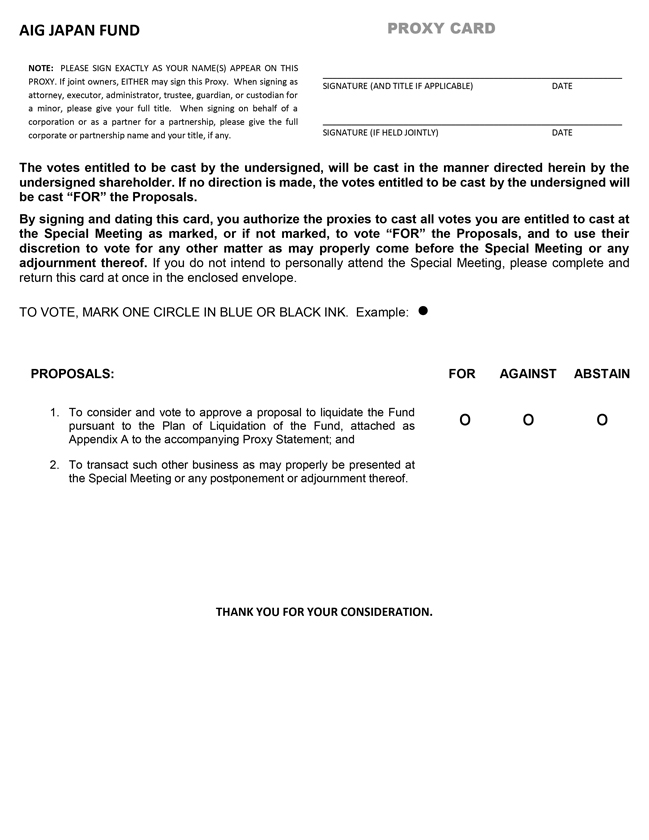

PROXY CARD AIG JAPAN FUND NOTE: PLEASE SIGN EXACTLY AS YOUR NAME(S) APPEAR ON THIS PROXY. If joint owners, EITHER may sign this Proxy. When signing as SIGNATURE (AND TITLE IF APPLICABLE) DATE attorney, executor, administrator, trustee, guardian, or custodian for a minor, please give your full title. When signing on behalf of a corporation or as a partner for a partnership, please give the full corporate or partnership name and your title, if any. SIGNATURE (IF HELD JOINTLY) DATE The votes entitled to be cast by the undersigned, will be cast in the manner directed herein by the undersigned shareholder. If no direction is made, the votes entitled to be cast by the undersigned will be cast “FOR” the Proposals. By signing and dating this card, you authorize the proxies to cast all votes you are entitled to cast at the Special Meeting as marked, or if not marked, to vote “FOR” the Proposals, and to use their discretion to vote for any other matter as may properly come before the Special Meeting or any adjournment thereof. If you do not intend to personally attend the Special Meeting, please complete and return this card at once in the enclosed envelope. TO VOTE, MARK ONE CIRCLE IN BLUE OR BLACK INK. Example: • PROPOSALS: FOR AGAINST ABSTAIN 1. To consider and vote to approve a proposal to liquidate the Fund o o o pursuant to the Plan of Liquidation of the Fund, attached as Appendix A to the accompanying Proxy Statement; and 2. To transact such other business as may properly be presented at the Special Meeting or any postponement or adjournment thereof. THANK YOU FOR YOUR CONSIDERATION.