UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04526

| Name of Registrant: | Vanguard Quantitative Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | John E. Schadl, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2023—September 30, 2024

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

Vanguard Growth and Income Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Vanguard Growth and Income Fund (the "Fund") for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447. The report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Admiral Shares | $30 | 0.25% |

How did the Fund perform during the reporting period?

For the 12 months ended September 30, 2024, the Fund performed roughly in line with its benchmark, the S&P 500 Index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve began cutting interest rates for the first time since early 2020, and the year-over-year rate of consumer price inflation eased to around 2.5%. Even with some negative monthly returns, U.S. stocks finished the period up sharply.

Stock selection among industrial companies contributed most to relative performance. The Fund’s underweight stake in consumer staples and its specific holdings in that sector also helped. In an environment where money market yields in excess of 5% paled in comparison to substantial stock gains, the Fund’s modest allocation to cash proved the greatest drag on performance. Stock selection in health care and utilities also detracted somewhat.

For the 10 years ended September 30, 2024, the Fund’s average annual return was roughly in line with its benchmark.

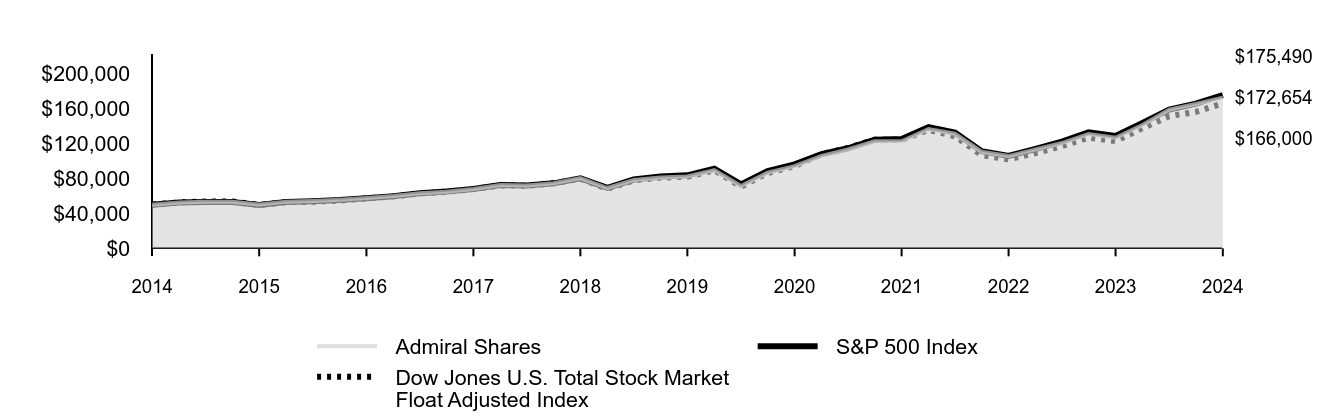

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 30, 2014, Through September 30, 2024

Initial investment of $50,000

| Admiral Shares | S&P 500 Index | Dow Jones U.S. Total Stock Market Float Adjusted Index |

|---|

| 2014 | $50,000 | $50,000 | $50,000 |

| 2014 | $52,429 | $52,466 | $52,614 |

| 2015 | $53,230 | $52,965 | $53,561 |

| 2015 | $53,225 | $53,112 | $53,625 |

| 2015 | $50,157 | $49,693 | $49,727 |

| 2015 | $53,493 | $53,192 | $52,846 |

| 2016 | $54,230 | $53,909 | $53,329 |

| 2016 | $55,551 | $55,233 | $54,723 |

| 2016 | $57,636 | $57,361 | $57,150 |

| 2016 | $59,975 | $59,554 | $59,514 |

| 2017 | $63,141 | $63,167 | $62,962 |

| 2017 | $64,735 | $65,117 | $64,856 |

| 2017 | $67,900 | $68,035 | $67,818 |

| 2017 | $72,450 | $72,556 | $72,109 |

| 2018 | $71,952 | $72,005 | $71,673 |

| 2018 | $74,540 | $74,478 | $74,449 |

| 2018 | $80,566 | $80,220 | $79,740 |

| 2018 | $69,107 | $69,375 | $68,290 |

| 2019 | $78,309 | $78,843 | $77,878 |

| 2019 | $81,199 | $82,236 | $81,062 |

| 2019 | $82,434 | $83,633 | $81,983 |

| 2019 | $89,680 | $91,218 | $89,391 |

| 2020 | $71,412 | $73,341 | $70,654 |

| 2020 | $86,711 | $88,408 | $86,261 |

| 2020 | $94,134 | $96,302 | $94,089 |

| 2020 | $105,893 | $108,001 | $107,976 |

| 2021 | $113,226 | $114,670 | $114,939 |

| 2021 | $122,718 | $124,473 | $124,465 |

| 2021 | $122,695 | $125,198 | $124,318 |

| 2021 | $136,721 | $139,004 | $135,680 |

| 2022 | $131,386 | $132,611 | $128,354 |

| 2022 | $110,657 | $111,260 | $106,744 |

| 2022 | $105,703 | $105,827 | $101,873 |

| 2022 | $113,329 | $113,829 | $109,183 |

| 2023 | $120,662 | $122,363 | $117,093 |

| 2023 | $130,918 | $133,060 | $126,920 |

| 2023 | $126,770 | $128,704 | $122,744 |

| 2023 | $141,392 | $143,752 | $137,635 |

| 2024 | $158,976 | $158,926 | $151,462 |

| 2024 | $165,504 | $165,734 | $156,368 |

| 2024 | $172,654 | $175,490 | $166,000 |

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Admiral Shares | 36.19% | 15.93% | 13.19% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 35.24% | 15.15% | 12.75% |

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of September 30, 2024)

| Communication Services | 8.9% | |

| Consumer Discretionary | 12.3% | |

| Consumer Staples | 4.5% | |

| Energy | 2.4% | |

| Financials | 12.4% | |

| Health Care | 11.6% | |

| Industrials | 7.9% | |

| Information Technology | 30.8% | |

| Materials | 2.1% | |

| Other | 0.5% | |

| Real Estate | 2.3% | |

| Utilities | 2.6% | |

| Other Assets and Liabilities—Net | 1.7% | |

Fund Statistics

(as of September 30, 2024)

| Fund Net Assets (in millions) | $15,666 |

| Number of Portfolio Holdings | 758 |

| Portfolio Turnover Rate | 84% |

| Total Investment Advisory Fees (in thousands) | $16,421 |

How has the Fund changed?

Effective August 28, 2024, the contractual fee waiver in place with Wellington Management Company LLP to waive 0.03% of the management fee on its portion of the Fund's assets expired.

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 31, 2025 at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature or upon request at 800-662-7447.

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR593

Vanguard Growth and Income Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Vanguard Growth and Income Fund (the "Fund") for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447. The report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $41 | 0.35% |

How did the Fund perform during the reporting period?

For the 12 months ended September 30, 2024, the Fund performed roughly in line with its benchmark, the S&P 500 Index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve began cutting interest rates for the first time since early 2020, and the year-over-year rate of consumer price inflation eased to around 2.5%. Even with some negative monthly returns, U.S. stocks finished the period up sharply.

Stock selection among industrial companies contributed most to relative performance. The Fund’s underweight stake in consumer staples and its specific holdings in that sector also helped. In an environment where money market yields in excess of 5% paled in comparison to substantial stock gains, the Fund’s modest allocation to cash proved the greatest drag on performance. Stock selection in health care and utilities also detracted somewhat.

For the 10 years ended September 30, 2024, the Fund’s average annual return was roughly in line with its benchmark.

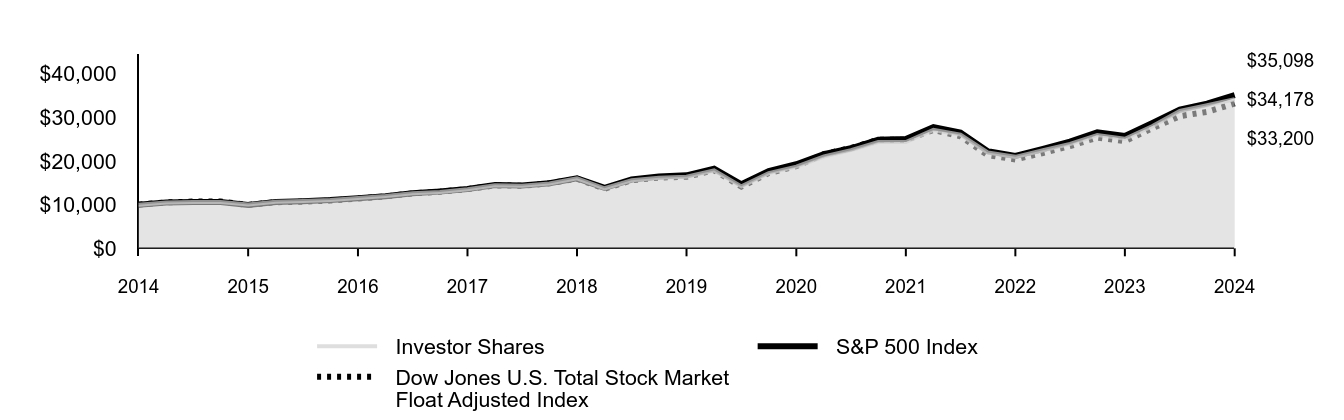

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 30, 2014, Through September 30, 2024

Initial investment of $10,000

| Investor Shares | S&P 500 Index | Dow Jones U.S. Total Stock Market Float Adjusted Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,483 | $10,493 | $10,523 |

| 2015 | $10,641 | $10,593 | $10,712 |

| 2015 | $10,637 | $10,622 | $10,725 |

| 2015 | $10,022 | $9,939 | $9,945 |

| 2015 | $10,685 | $10,638 | $10,569 |

| 2016 | $10,830 | $10,782 | $10,666 |

| 2016 | $11,089 | $11,047 | $10,945 |

| 2016 | $11,504 | $11,472 | $11,430 |

| 2016 | $11,964 | $11,911 | $11,903 |

| 2017 | $12,594 | $12,633 | $12,592 |

| 2017 | $12,909 | $13,023 | $12,971 |

| 2017 | $13,535 | $13,607 | $13,564 |

| 2017 | $14,438 | $14,511 | $14,422 |

| 2018 | $14,334 | $14,401 | $14,335 |

| 2018 | $14,847 | $14,896 | $14,890 |

| 2018 | $16,046 | $16,044 | $15,948 |

| 2018 | $13,758 | $13,875 | $13,658 |

| 2019 | $15,586 | $15,769 | $15,576 |

| 2019 | $16,159 | $16,447 | $16,212 |

| 2019 | $16,401 | $16,727 | $16,397 |

| 2019 | $17,839 | $18,244 | $17,878 |

| 2020 | $14,201 | $14,668 | $14,131 |

| 2020 | $17,241 | $17,682 | $17,252 |

| 2020 | $18,709 | $19,260 | $18,818 |

| 2020 | $21,040 | $21,600 | $21,595 |

| 2021 | $22,491 | $22,934 | $22,988 |

| 2021 | $24,373 | $24,895 | $24,893 |

| 2021 | $24,362 | $25,040 | $24,864 |

| 2021 | $27,138 | $27,801 | $27,136 |

| 2022 | $26,072 | $26,522 | $25,671 |

| 2022 | $21,955 | $22,252 | $21,349 |

| 2022 | $20,967 | $21,165 | $20,375 |

| 2022 | $22,471 | $22,766 | $21,837 |

| 2023 | $23,921 | $24,473 | $23,419 |

| 2023 | $25,951 | $26,612 | $25,384 |

| 2023 | $25,121 | $25,741 | $24,549 |

| 2023 | $28,011 | $28,750 | $27,527 |

| 2024 | $31,487 | $31,785 | $30,292 |

| 2024 | $32,774 | $33,147 | $31,274 |

| 2024 | $34,178 | $35,098 | $33,200 |

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Investor Shares | 36.05% | 15.82% | 13.08% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 35.24% | 15.15% | 12.75% |

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of September 30, 2024)

| Communication Services | 8.9% | |

| Consumer Discretionary | 12.3% | |

| Consumer Staples | 4.5% | |

| Energy | 2.4% | |

| Financials | 12.4% | |

| Health Care | 11.6% | |

| Industrials | 7.9% | |

| Information Technology | 30.8% | |

| Materials | 2.1% | |

| Other | 0.5% | |

| Real Estate | 2.3% | |

| Utilities | 2.6% | |

| Other Assets and Liabilities—Net | 1.7% | |

Fund Statistics

(as of September 30, 2024)

| Fund Net Assets (in millions) | $15,666 |

| Number of Portfolio Holdings | 758 |

| Portfolio Turnover Rate | 84% |

| Total Investment Advisory Fees (in thousands) | $16,421 |

How has the Fund changed?

Effective August 28, 2024, the contractual fee waiver in place with Wellington Management Company LLP to waive 0.03% of the management fee on its portion of the Fund's assets expired.

This is a summary of certain changes to the Fund since September 30, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 31, 2025 at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature or upon request at 800-662-7447.

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR93

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant only.

| | | Fiscal Year Ended

September 30,

2024 | | | Fiscal Year Ended

September 30,

2023 | |

| (a) Audit Fees. | | $ | 38,000 | | | $ | 36,000 | |

| (b) Audit-Related Fees. | | | 0 | | | | 0 | |

| (c) Tax Fees. | | | 0 | | | | 0 | |

| (d) All Other Fees. | | | 0 | | | | 0 | |

| Total. | | $ | 38,000 | | | $ | 36,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any preapproval is brought to the attention of the full audit committee at the next scheduled meeting. |

| | | |

(2) No percentage of the principal accountant’s fees or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| (f) | For the most recent fiscal year, over 50% of the hours worked under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees of the principal accountant. |

| | | |

| (g) | Aggregate Non-Audit Fees. |

Includes fees billed for non-audit services provided to the Registrant, other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | | Fiscal Year Ended

September 30,

2024 | | | Fiscal Year Ended

September 30,

2023 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | | | | | | | | |

| Audit-Related Fees. | | $ | 3,508,505 | | | $ | 3,295,934 | |

| Tax Fees. | | $ | 2,017,364 | | | $ | 1,678,928 | |

| All Other Fees. | | $ | 268,000 | | | $ | 25,000 | |

| Total. | | $ | 5,793,869 | | | $ | 4,999,862 | |

| (h) | For the most recent fiscal year, the Audit Committee has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements

For the year ended September 30, 2024

Vanguard Growth and Income Fund

Contents

Financial Statements

| 1 |

Report of Independent Registered Public Accounting Firm

| 22 |

Tax information

| 23 |

| | |

Schedule of Investments

As of September 30, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | Shares | Market

Value•

($000) |

| Common Stocks (98.3%) |

| Communication Services (8.9%) |

| | Alphabet Inc. Class A | 2,422,319 | 401,742 |

| | Meta Platforms Inc. Class A | 485,427 | 277,878 |

| * | Netflix Inc. | 249,906 | 177,251 |

| | Alphabet Inc. Class C | 816,422 | 136,498 |

| | T-Mobile US Inc. | 479,421 | 98,933 |

| | AT&T Inc. | 2,437,900 | 53,634 |

| * | Pinterest Inc. Class A | 1,502,593 | 48,639 |

| | Electronic Arts Inc. | 337,000 | 48,339 |

| | Omnicom Group Inc. | 419,098 | 43,331 |

| | Walt Disney Co. | 255,100 | 24,538 |

| | Comcast Corp. Class A | 527,600 | 22,038 |

| * | Live Nation Entertainment Inc. | 127,700 | 13,982 |

| * | Spotify Technology SA | 37,700 | 13,894 |

| * | Charter Communications Inc. Class A | 22,200 | 7,195 |

| | Verizon Communications Inc. | 106,330 | 4,775 |

| | Iridium Communications Inc. | 91,200 | 2,777 |

| | New York Times Co. Class A | 39,200 | 2,182 |

| * | Gannett Co. Inc. | 249,900 | 1,404 |

| * | Lions Gate Entertainment Corp. Class B | 157,600 | 1,091 |

| | ATN International Inc. | 32,900 | 1,064 |

| | News Corp. Class A | 36,300 | 967 |

| * | Eventbrite Inc. Class A | 319,500 | 872 |

| * | Globalstar Inc. | 529,500 | 657 |

| | Telephone and Data Systems Inc. | 26,100 | 607 |

| * | Yelp Inc. | 13,000 | 456 |

| | Fox Corp. Class A | 10,507 | 445 |

| * | Snap Inc. Class A | 34,700 | 371 |

| | Scholastic Corp. | 9,420 | 301 |

| * | Perion Network Ltd. | 35,700 | 281 |

| * | Altice USA Inc. Class A | 112,000 | 275 |

| * | EW Scripps Co. Class A | 117,200 | 263 |

| | Warner Music Group Corp. Class A | 7,000 | 219 |

| * | AMC Networks Inc. Class A | 22,500 | 195 |

| * | United States Cellular Corp. | 2,700 | 148 |

| * | Liberty Global Ltd. Class A | 6,400 | 135 |

| | John Wiley & Sons Inc. Class A | 1,900 | 92 |

| * | Lions Gate Entertainment Corp. Class A | 4,200 | 33 |

| * | Gogo Inc. | 4,400 | 32 |

| * | WideOpenWest Inc. | 5,204 | 27 |

| | Entravision Communications Corp. Class A | 12,800 | 26 |

| | IDT Corp. Class B | 245 | 9 |

| * | DHI Group Inc. | 3,200 | 6 |

| *,1 | Nebius Group NV | 23,500 | — |

| | | | 1,387,602 |

| Consumer Discretionary (12.3%) |

| * | Amazon.com Inc. | 3,898,699 | 726,445 |

| | Ross Stores Inc. | 1,338,852 | 201,511 |

| * | Tesla Inc. | 533,420 | 139,559 |

| * | Chipotle Mexican Grill Inc. | 2,150,984 | 123,940 |

| | Marriott International Inc. Class A | 427,859 | 106,366 |

| | TJX Cos. Inc. | 644,610 | 75,767 |

| * | Airbnb Inc. Class A | 536,556 | 68,041 |

| | Booking Holdings Inc. | 12,836 | 54,067 |

| | DR Horton Inc. | 235,080 | 44,846 |

| | PulteGroup Inc. | 265,590 | 38,120 |

| | Lennar Corp. Class A | 197,062 | 36,945 |

| | Pool Corp. | 97,315 | 36,668 |

| | McDonald's Corp. | 83,600 | 25,457 |

| | Ralph Lauren Corp. | 117,612 | 22,801 |

| | | Shares | Market

Value•

($000) |

| | Starbucks Corp. | 199,620 | 19,461 |

| * | AutoZone Inc. | 5,876 | 18,510 |

| | Genuine Parts Co. | 110,700 | 15,463 |

| | Hilton Worldwide Holdings Inc. | 65,400 | 15,075 |

| | Best Buy Co. Inc. | 130,800 | 13,512 |

| | Royal Caribbean Cruises Ltd. | 71,700 | 12,717 |

| * | Carvana Co. | 65,300 | 11,369 |

| * | O'Reilly Automotive Inc. | 8,720 | 10,042 |

| * | Skechers USA Inc. Class A | 146,500 | 9,804 |

| | Home Depot Inc. | 23,022 | 9,329 |

| | Lowe's Cos. Inc. | 24,400 | 6,609 |

| | Yum! Brands Inc. | 45,083 | 6,299 |

| * | DraftKings Inc. Class A | 153,600 | 6,021 |

| | Williams-Sonoma Inc. | 38,000 | 5,887 |

| * | DoorDash Inc. Class A | 39,000 | 5,566 |

| * | Lululemon Athletica Inc. | 15,000 | 4,070 |

| | Wynn Resorts Ltd. | 40,203 | 3,855 |

| | Leggett & Platt Inc. | 281,200 | 3,830 |

| * | Adient plc | 166,400 | 3,756 |

| * | NVR Inc. | 371 | 3,640 |

| * | Expedia Group Inc. | 23,500 | 3,478 |

| * | Dutch Bros Inc. Class A | 98,100 | 3,142 |

| | H&R Block Inc. | 43,900 | 2,790 |

| * | Deckers Outdoor Corp. | 15,600 | 2,487 |

| | General Motors Co. | 55,210 | 2,476 |

| * | Chuy's Holdings Inc. | 57,800 | 2,162 |

| * | Ulta Beauty Inc. | 4,856 | 1,890 |

| | Macy's Inc. | 112,000 | 1,757 |

| | Las Vegas Sands Corp. | 27,500 | 1,384 |

| | VF Corp. | 63,100 | 1,259 |

| | International Game Technology plc | 51,700 | 1,101 |

| | Advance Auto Parts Inc. | 24,800 | 967 |

| * | Sleep Number Corp. | 50,000 | 916 |

| | Penske Automotive Group Inc. | 4,600 | 747 |

| * | Coupang Inc. | 29,500 | 724 |

| | Foot Locker Inc. | 26,900 | 695 |

| * | Coursera Inc. | 78,000 | 619 |

| * | Visteon Corp. | 5,100 | 486 |

| * | Genesco Inc. | 17,814 | 484 |

| * | GoPro Inc. Class A | 329,695 | 448 |

| | OneSpaWorld Holdings Ltd. | 25,961 | 429 |

| | Dine Brands Global Inc. | 13,200 | 412 |

| * | National Vision Holdings Inc. | 37,500 | 409 |

| * | Rush Street Interactive Inc. | 36,200 | 393 |

| * | Chegg Inc. | 221,100 | 391 |

| * | Adtalem Global Education Inc. | 5,000 | 377 |

| | Laureate Education Inc. | 17,290 | 287 |

| | Phinia Inc. | 4,436 | 204 |

| * | Qurate Retail Inc. Series A | 333,000 | 203 |

| * | JAKKS Pacific Inc. | 7,092 | 181 |

| * | Playa Hotels & Resorts NV | 22,017 | 171 |

| * | CarParts.com Inc. | 185,800 | 168 |

| * | Birkenstock Holding plc | 3,127 | 154 |

| | Domino's Pizza Inc. | 300 | 129 |

| | Marriott Vacations Worldwide Corp. | 1,500 | 110 |

| | Bath & Body Works Inc. | 3,400 | 109 |

| | J Jill Inc. | 4,316 | 106 |

| * | Cooper-Standard Holdings Inc. | 7,311 | 101 |

| * | Zumiez Inc. | 4,300 | 92 |

| | Texas Roadhouse Inc. | 500 | 88 |

| | Monarch Casino & Resort Inc. | 1,100 | 87 |

| * | Victoria's Secret & Co. | 3,200 | 82 |

| * | Universal Electronics Inc. | 6,292 | 58 |

| * | Noodles & Co. | 36,200 | 43 |

| | Cato Corp. Class A | 6,786 | 34 |

| | Acushnet Holdings Corp. | 400 | 26 |

| * | Stoneridge Inc. | 2,300 | 26 |

| * | ODP Corp. | 847 | 25 |

| * | Latham Group Inc. | 1,900 | 13 |

| * | Container Store Group Inc. | 400 | 4 |

| | | Shares | Market

Value•

($000) |

| * | LL Flooring Holdings Inc. | 17,700 | — |

| | | | 1,920,272 |

| Consumer Staples (4.5%) |

| | Altria Group Inc. | 1,595,230 | 81,421 |

| | Philip Morris International Inc. | 626,870 | 76,102 |

| | Walmart Inc. | 900,644 | 72,727 |

| | Costco Wholesale Corp. | 72,451 | 64,229 |

| | Procter & Gamble Co. | 363,973 | 63,040 |

| | Colgate-Palmolive Co. | 596,860 | 61,960 |

| | Kimberly-Clark Corp. | 334,450 | 47,586 |

| | Target Corp. | 295,670 | 46,083 |

| | PepsiCo Inc. | 201,167 | 34,208 |

| | Kroger Co. | 489,500 | 28,048 |

| | Clorox Co. | 165,940 | 27,033 |

| | Sysco Corp. | 338,354 | 26,412 |

| | Kraft Heinz Co. | 379,790 | 13,334 |

| | WK Kellogg Co. | 428,100 | 7,325 |

| | Molson Coors Beverage Co. Class B | 99,162 | 5,704 |

| * | Performance Food Group Co. | 71,358 | 5,592 |

| | Hormel Foods Corp. | 167,400 | 5,307 |

| * | Vita Coco Co. Inc. | 168,673 | 4,775 |

| | Coca-Cola Consolidated Inc. | 3,488 | 4,592 |

| * | Boston Beer Co. Inc. Class A | 15,700 | 4,540 |

| * | United Natural Foods Inc. | 252,900 | 4,254 |

| | Coca-Cola Europacific Partners plc | 50,400 | 3,969 |

| | Coca-Cola Co. | 52,800 | 3,794 |

| | Estee Lauder Cos. Inc. Class A | 29,400 | 2,931 |

| | Vector Group Ltd. | 181,600 | 2,709 |

| | Archer-Daniels-Midland Co. | 25,900 | 1,547 |

| | Adecoagro SA | 90,700 | 1,004 |

| | Nu Skin Enterprises Inc. Class A | 113,900 | 839 |

| | Reynolds Consumer Products Inc. | 23,100 | 718 |

| | SpartanNash Co. | 22,800 | 511 |

| | Albertsons Cos. Inc. Class A | 25,600 | 473 |

| | Fresh Del Monte Produce Inc. | 15,498 | 458 |

| | Flowers Foods Inc. | 17,200 | 397 |

| * | Medifast Inc. | 20,700 | 396 |

| * | Lifeway Foods Inc. | 9,800 | 254 |

| * | US Foods Holding Corp. | 3,700 | 228 |

| | National Beverage Corp. | 4,788 | 225 |

| | General Mills Inc. | 2,600 | 192 |

| * | Hain Celestial Group Inc. | 17,519 | 151 |

| | Campbell Soup Co. | 2,300 | 113 |

| | Walgreens Boots Alliance Inc. | 12,200 | 109 |

| * | Mama's Creations Inc. | 14,590 | 107 |

| | Nomad Foods Ltd. | 3,870 | 74 |

| | | | 705,471 |

| Energy (2.4%) |

| | Exxon Mobil Corp. | 1,369,050 | 160,480 |

| | Shell plc ADR | 1,109,817 | 73,192 |

| | Cheniere Energy Inc. | 182,600 | 32,839 |

| | Kinder Morgan Inc. | 926,020 | 20,456 |

| | Targa Resources Corp. | 131,460 | 19,457 |

| | Devon Energy Corp. | 411,240 | 16,088 |

| | ConocoPhillips | 148,100 | 15,592 |

| | Coterra Energy Inc. | 478,500 | 11,460 |

| | Baker Hughes Co. | 294,530 | 10,647 |

| * | CNX Resources Corp. | 167,400 | 5,452 |

| | Marathon Oil Corp. | 183,600 | 4,889 |

| * | Gulfport Energy Corp. | 20,500 | 3,103 |

| | Hess Corp. | 17,700 | 2,404 |

| | Ovintiv Inc. (XNYS) | 46,700 | 1,789 |

| * | REX American Resources Corp. | 35,500 | 1,643 |

| * | Antero Resources Corp. | 46,400 | 1,329 |

| * | Oil States International Inc. | 198,105 | 911 |

| * | Par Pacific Holdings Inc. | 28,700 | 505 |

| | Williams Cos. Inc. | 9,100 | 415 |

| | PBF Energy Inc. Class A | 11,000 | 341 |

| | Delek US Holdings Inc. | 18,100 | 339 |

| | | Shares | Market

Value•

($000) |

| * | Teekay Corp. | 25,600 | 236 |

| | EOG Resources Inc. | 1,800 | 221 |

| * | Green Plains Inc. | 13,343 | 181 |

| * | TETRA Technologies Inc. | 51,800 | 161 |

| | FutureFuel Corp. | 16,296 | 94 |

| | Schlumberger NV | 400 | 17 |

| | Range Resources Corp. | 13 | — |

| | | | 384,241 |

| Financials (12.4%) |

| | Mastercard Inc. Class A | 417,341 | 206,083 |

| | American Express Co. | 531,312 | 144,092 |

| | JPMorgan Chase & Co. | 575,151 | 121,276 |

| | Progressive Corp. | 399,231 | 101,309 |

| | Wells Fargo & Co. | 1,701,279 | 96,105 |

| * | Berkshire Hathaway Inc. Class B | 204,797 | 94,260 |

| | Ares Management Corp. Class A | 602,581 | 93,906 |

| | KKR & Co. Inc. | 707,721 | 92,414 |

| | Visa Inc. Class A | 255,400 | 70,222 |

| | Bank of America Corp. | 1,367,110 | 54,247 |

| | Bank of New York Mellon Corp. | 738,956 | 53,101 |

| | Citizens Financial Group Inc. | 1,254,941 | 51,540 |

| | M&T Bank Corp. | 284,652 | 50,702 |

| | CME Group Inc. | 229,250 | 50,584 |

| | Nasdaq Inc. | 662,296 | 48,354 |

| | Cboe Global Markets Inc. | 230,497 | 47,222 |

| | US Bancorp | 941,310 | 43,046 |

| | Apollo Global Management Inc. | 296,000 | 36,973 |

| | Marsh & McLennan Cos. Inc. | 150,364 | 33,545 |

| | Synchrony Financial | 642,350 | 32,040 |

| | MSCI Inc. | 51,580 | 30,068 |

| * | NU Holdings Ltd. Class A | 2,085,400 | 28,466 |

| | Capital One Financial Corp. | 187,800 | 28,119 |

| | Allstate Corp. | 147,050 | 27,888 |

| | PNC Financial Services Group Inc. | 121,320 | 22,426 |

| | Fifth Third Bancorp | 440,170 | 18,857 |

| | Brown & Brown Inc. | 180,520 | 18,702 |

| | Morgan Stanley | 168,900 | 17,606 |

| | Travelers Cos. Inc. | 71,100 | 16,646 |

| | Cincinnati Financial Corp. | 117,140 | 15,945 |

| | Moody's Corp. | 33,321 | 15,814 |

| | Zions Bancorp NA | 296,450 | 13,998 |

| | Discover Financial Services | 92,140 | 12,926 |

| | KeyCorp. | 607,581 | 10,177 |

| | Affiliated Managers Group Inc. | 50,110 | 8,910 |

| | Virtu Financial Inc. Class A | 264,000 | 8,041 |

| | Globe Life Inc. | 75,700 | 8,017 |

| * | Fiserv Inc. | 44,230 | 7,946 |

| | MetLife Inc. | 95,100 | 7,844 |

| | W R Berkley Corp. | 136,684 | 7,754 |

| | Charles Schwab Corp. | 107,900 | 6,993 |

| | T Rowe Price Group Inc. | 63,900 | 6,961 |

| | Huntington Bancshares Inc. | 458,260 | 6,736 |

| | Hartford Financial Services Group Inc. | 50,510 | 5,940 |

| | Chubb Ltd. | 20,120 | 5,802 |

| | Ameriprise Financial Inc. | 10,930 | 5,135 |

| | Intercontinental Exchange Inc. | 27,200 | 4,369 |

| | Aflac Inc. | 30,370 | 3,395 |

| | FS KKR Capital Corp. | 148,600 | 2,932 |

| | Unum Group | 42,700 | 2,538 |

| | Principal Financial Group Inc. | 27,700 | 2,379 |

| | Truist Financial Corp. | 55,423 | 2,370 |

| | State Street Corp. | 23,800 | 2,106 |

| | Blue Owl Capital Corp. | 141,400 | 2,060 |

| | Federated Hermes Inc. | 49,300 | 1,813 |

| | Enact Holdings Inc. | 49,800 | 1,809 |

| | Everest Group Ltd. | 4,399 | 1,724 |

| | Bank OZK | 36,300 | 1,561 |

| | Franklin Resources Inc. | 66,300 | 1,336 |

| * | Enova International Inc. | 15,900 | 1,332 |

| | | Shares | Market

Value•

($000) |

| | Regions Financial Corp. | 54,600 | 1,274 |

| | Blackstone Inc. | 7,900 | 1,210 |

| | First American Financial Corp. | 17,000 | 1,122 |

| * | EZCorp. Inc. Class A | 93,300 | 1,046 |

| | UBS Group AG (Registered) | 33,100 | 1,023 |

| | OneMain Holdings Inc. | 18,600 | 876 |

| | Jefferies Financial Group Inc. | 13,400 | 825 |

| | Golub Capital BDC Inc. | 52,600 | 795 |

| | FNB Corp. | 53,500 | 755 |

| | S&P Global Inc. | 1,452 | 750 |

| * | Oscar Health Inc. Class A | 30,800 | 653 |

| | KKR Real Estate Finance Trust Inc. | 52,100 | 643 |

| | BOK Financial Corp. | 5,700 | 596 |

| | Nelnet Inc. Class A | 4,500 | 510 |

| | Stifel Financial Corp. | 5,200 | 488 |

| | James River Group Holdings Ltd. | 71,800 | 450 |

| | Ladder Capital Corp. | 38,300 | 444 |

| | MGIC Investment Corp. | 16,000 | 410 |

| | Burford Capital Ltd. | 30,072 | 399 |

| | Moelis & Co. Class A | 5,300 | 363 |

| | Federal Agricultural Mortgage Corp. Class C | 1,934 | 362 |

| * | Lemonade Inc. | 21,865 | 361 |

| | UWM Holdings Corp. | 41,700 | 355 |

| | Invesco Ltd. | 19,700 | 346 |

| | Chimera Investment Corp. | 21,394 | 339 |

| | AFC Gamma Inc. | 31,503 | 322 |

| | Global Payments Inc. | 3,100 | 318 |

| * | Brighthouse Financial Inc. | 6,900 | 311 |

| * | Customers Bancorp Inc. | 6,600 | 307 |

| | First Internet Bancorp | 8,100 | 278 |

| | Selective Insurance Group Inc. | 2,900 | 271 |

| | Granite Point Mortgage Trust Inc. | 83,700 | 265 |

| | Live Oak Bancshares Inc. | 5,400 | 256 |

| | XP Inc. Class A | 12,472 | 224 |

| | Bank of NT Butterfield & Son Ltd. | 4,300 | 159 |

| | Loews Corp. | 2,000 | 158 |

| | Berkshire Hills Bancorp Inc. | 5,700 | 153 |

| | Home BancShares Inc. | 5,281 | 143 |

| * | Green Dot Corp. Class A | 11,600 | 136 |

| | First Horizon Corp. | 7,700 | 120 |

| | PROG Holdings Inc. | 2,300 | 112 |

| | First Foundation Inc. | 16,758 | 105 |

| * | LendingClub Corp. | 9,035 | 103 |

| | LPL Financial Holdings Inc. | 400 | 93 |

| | Navient Corp. | 4,700 | 73 |

| | Eagle Bancorp Inc. | 2,639 | 60 |

| * | MBIA Inc. | 16,700 | 60 |

| * | NerdWallet Inc. Class A | 4,382 | 56 |

| | Sandy Spring Bancorp Inc. | 1,600 | 50 |

| * | Encore Capital Group Inc. | 1,000 | 47 |

| | HomeTrust Bancshares Inc. | 1,162 | 40 |

| | Hanmi Financial Corp. | 1,749 | 33 |

| * | PRA Group Inc. | 500 | 11 |

| | Brightspire Capital Inc. | 1,700 | 10 |

| * | Open Lending Corp. | 500 | 3 |

| | Western Union Co. | 41 | — |

| | | | 1,937,134 |

| Health Care (11.6%) |

| | Eli Lilly & Co. | 299,054 | 264,944 |

| | Merck & Co. Inc. | 2,071,146 | 235,199 |

| | AbbVie Inc. | 721,708 | 142,523 |

| * | Boston Scientific Corp. | 1,304,145 | 109,287 |

| * | Vertex Pharmaceuticals Inc. | 202,321 | 94,095 |

| | Bristol-Myers Squibb Co. | 1,628,138 | 84,240 |

| | UnitedHealth Group Inc. | 142,326 | 83,215 |

| | Humana Inc. | 237,874 | 75,344 |

| | Pfizer Inc. | 2,367,120 | 68,504 |

| * | Edwards Lifesciences Corp. | 850,877 | 56,149 |

| * | Centene Corp. | 721,008 | 54,278 |

| | | Shares | Market

Value•

($000) |

| | Johnson & Johnson | 321,759 | 52,144 |

| | Stryker Corp. | 142,030 | 51,310 |

| * | ICON plc | 157,602 | 45,281 |

| | HCA Healthcare Inc. | 100,153 | 40,705 |

| | Gilead Sciences Inc. | 392,030 | 32,868 |

| | Medtronic plc | 343,710 | 30,944 |

| | ResMed Inc. | 103,180 | 25,188 |

| | Thermo Fisher Scientific Inc. | 37,400 | 23,135 |

| | Amgen Inc. | 68,600 | 22,104 |

| | Zoetis Inc. | 103,430 | 20,208 |

| | Cigna Group | 47,980 | 16,622 |

| | Universal Health Services Inc. Class B | 72,400 | 16,580 |

| * | Molina Healthcare Inc. | 46,252 | 15,937 |

| | Cardinal Health Inc. | 126,300 | 13,959 |

| * | DexCom Inc. | 207,400 | 13,904 |

| | Becton Dickinson & Co. | 57,300 | 13,815 |

| * | Alnylam Pharmaceuticals Inc. | 44,128 | 12,137 |

| | Alcon Inc. | 120,900 | 12,098 |

| | Elevance Health Inc. | 20,500 | 10,660 |

| * | IQVIA Holdings Inc. | 39,350 | 9,325 |

| * | Medpace Holdings Inc. | 24,800 | 8,278 |

| * | Regeneron Pharmaceuticals Inc. | 6,700 | 7,043 |

| | McKesson Corp. | 9,100 | 4,499 |

| * | ACADIA Pharmaceuticals Inc. | 289,200 | 4,448 |

| * | QuidelOrtho Corp. | 82,600 | 3,767 |

| * | Viking Therapeutics Inc. | 50,700 | 3,210 |

| * | Biohaven Ltd. | 59,500 | 2,973 |

| | Abbott Laboratories | 25,400 | 2,896 |

| * | Corcept Therapeutics Inc. | 47,896 | 2,217 |

| * | Neurocrine Biosciences Inc. | 18,700 | 2,155 |

| | Embecta Corp. | 141,348 | 1,993 |

| * | Incyte Corp. | 27,600 | 1,824 |

| * | Natera Inc. | 13,500 | 1,714 |

| | Cencora Inc. | 7,600 | 1,711 |

| * | Celldex Therapeutics Inc. | 33,800 | 1,149 |

| * | Nuvalent Inc. Class A | 10,900 | 1,115 |

| * | Merus NV | 21,900 | 1,094 |

| * | LivaNova plc | 20,700 | 1,088 |

| * | TG Therapeutics Inc. | 44,700 | 1,046 |

| * | Nevro Corp. | 166,300 | 930 |

| | Patterson Cos. Inc. | 40,100 | 876 |

| * | Owens & Minor Inc. | 54,800 | 860 |

| * | Cooper Cos. Inc. | 6,100 | 673 |

| * | Exelixis Inc. | 25,300 | 657 |

| | West Pharmaceutical Services Inc. | 1,900 | 570 |

| * | Ionis Pharmaceuticals Inc. | 12,000 | 481 |

| * | Enanta Pharmaceuticals Inc. | 45,395 | 470 |

| * | IDEXX Laboratories Inc. | 900 | 455 |

| * | Avidity Biosciences Inc. | 9,500 | 436 |

| * | Sage Therapeutics Inc. | 57,300 | 414 |

| * | Fulcrum Therapeutics Inc. | 107,000 | 382 |

| * | Surmodics Inc. | 8,979 | 348 |

| * | Myriad Genetics Inc. | 12,600 | 345 |

| * | Blueprint Medicines Corp. | 3,300 | 305 |

| * | Dynavax Technologies Corp. | 26,700 | 297 |

| * | Varex Imaging Corp. | 24,800 | 296 |

| * | Vir Biotechnology Inc. | 38,700 | 290 |

| * | Travere Therapeutics Inc. | 18,400 | 257 |

| * | Align Technology Inc. | 1,000 | 254 |

| * | Intuitive Surgical Inc. | 500 | 246 |

| * | Avadel Pharmaceuticals plc | 17,300 | 227 |

| * | Protagonist Therapeutics Inc. | 4,700 | 212 |

| * | Pacira BioSciences Inc. | 12,500 | 188 |

| * | Hologic Inc. | 2,200 | 179 |

| * | Supernus Pharmaceuticals Inc. | 5,204 | 162 |

| * | Syndax Pharmaceuticals Inc. | 7,400 | 142 |

| * | Sarepta Therapeutics Inc. | 1,000 | 125 |

| * | Edgewise Therapeutics Inc. | 4,700 | 125 |

| * | CorMedix Inc. | 14,140 | 114 |

| * | Rapt Therapeutics Inc. | 50,400 | 101 |

| | | Shares | Market

Value•

($000) |

| * | Ideaya Biosciences Inc. | 3,200 | 101 |

| * | Praxis Precision Medicines Inc. | 1,742 | 100 |

| * | Crinetics Pharmaceuticals Inc. | 1,900 | 97 |

| * | Pediatrix Medical Group Inc. | 7,400 | 86 |

| * | Zimvie Inc. | 5,402 | 86 |

| | CVS Health Corp. | 1,354 | 85 |

| * | Mersana Therapeutics Inc. | 44,335 | 84 |

| * | AngioDynamics Inc. | 10,600 | 82 |

| | Revvity Inc. | 600 | 77 |

| * | Kodiak Sciences Inc. | 27,766 | 72 |

| * | Amylyx Pharmaceuticals Inc. | 18,342 | 59 |

| * | Fate Therapeutics Inc. | 15,765 | 55 |

| * | Inotiv Inc. | 22,700 | 39 |

| * | Replimune Group Inc. | 3,300 | 36 |

| * | ModivCare Inc. | 2,506 | 36 |

| * | Scholar Rock Holding Corp. | 4,100 | 33 |

| * | OptimizeRx Corp. | 3,776 | 29 |

| * | Ironwood Pharmaceuticals Inc. | 6,100 | 25 |

| * | ADMA Biologics Inc. | 1,100 | 22 |

| * | Accuray Inc. | 8,076 | 15 |

| * | PTC Therapeutics Inc. | 400 | 15 |

| * | CVRx Inc. | 1,650 | 15 |

| * | Bridgebio Pharma Inc. | 500 | 13 |

| * | Joint Corp. | 1,154 | 13 |

| * | OmniAb Inc. | 2,564 | 11 |

| * | ALX Oncology Holdings Inc. | 5,448 | 10 |

| | GE HealthCare Technologies Inc. | 100 | 9 |

| * | OraSure Technologies Inc. | 400 | 2 |

| *,1 | Radius Health Inc. CVR | 17,800 | 1 |

| * | Xeris Biopharma Holdings Inc. | 33 | — |

| *,2 | Scilex Holding Co. (Acquired 1/6/23, Cost $681) | 65 | — |

| | | | 1,813,647 |

| Industrials (7.9%) |

| | General Dynamics Corp. | 493,771 | 149,218 |

| | Lockheed Martin Corp. | 220,070 | 128,644 |

| * | Uber Technologies Inc. | 1,694,795 | 127,381 |

| | Caterpillar Inc. | 163,938 | 64,119 |

| | Westinghouse Air Brake Technologies Corp. | 341,119 | 62,005 |

| | Cintas Corp. | 252,844 | 52,056 |

| | RTX Corp. | 413,108 | 50,052 |

| | Northrop Grumman Corp. | 82,790 | 43,719 |

| | Howmet Aerospace Inc. | 425,546 | 42,661 |

| | General Electric Co. | 218,350 | 41,176 |

| | Trane Technologies plc | 99,630 | 38,729 |

| | Delta Air Lines Inc. | 718,630 | 36,499 |

| | Waste Connections Inc. (XTSE) | 203,424 | 36,376 |

| | Parker-Hannifin Corp. | 50,367 | 31,823 |

| | Vertiv Holdings Co. Class A | 294,227 | 29,273 |

| | WW Grainger Inc. | 26,717 | 27,754 |

| | Eaton Corp. plc | 74,890 | 24,822 |

| * | Builders FirstSource Inc. | 121,425 | 23,539 |

| | Waste Management Inc. | 112,943 | 23,447 |

| | Textron Inc. | 236,067 | 20,911 |

| | TransDigm Group Inc. | 12,460 | 17,782 |

| | Automatic Data Processing Inc. | 63,900 | 17,683 |

| | AerCap Holdings NV | 140,900 | 13,346 |

| | Snap-on Inc. | 38,500 | 11,154 |

| | Illinois Tool Works Inc. | 28,060 | 7,354 |

| | A O Smith Corp. | 76,600 | 6,881 |

| * | Parsons Corp. | 62,400 | 6,470 |

| | CH Robinson Worldwide Inc. | 58,308 | 6,435 |

| | Leidos Holdings Inc. | 38,592 | 6,290 |

| | Expeditors International of Washington Inc. | 36,690 | 4,821 |

| | Union Pacific Corp. | 18,200 | 4,486 |

| | PACCAR Inc. | 44,672 | 4,408 |

| | Broadridge Financial Solutions Inc. | 19,590 | 4,212 |

| | 3M Co. | 30,710 | 4,198 |

| | Emerson Electric Co. | 37,000 | 4,047 |

| * | Fluor Corp. | 75,100 | 3,583 |

| | | Shares | Market

Value•

($000) |

| | KBR Inc. | 54,100 | 3,524 |

| | Johnson Controls International plc | 40,768 | 3,164 |

| | Hexcel Corp. | 49,600 | 3,067 |

| | Quanta Services Inc. | 9,880 | 2,946 |

| | United Rentals Inc. | 3,600 | 2,915 |

| | Allegion plc | 18,690 | 2,724 |

| * | Lyft Inc. Class A | 205,087 | 2,615 |

| | Honeywell International Inc. | 12,400 | 2,563 |

| * | NEXTracker Inc. Class A | 63,460 | 2,378 |

| | Wabash National Corp. | 119,472 | 2,293 |

| * | Boeing Co. | 14,480 | 2,202 |

| | Fortive Corp. | 24,800 | 1,957 |

| | Huntington Ingalls Industries Inc. | 6,700 | 1,771 |

| * | Masterbrand Inc. | 89,500 | 1,659 |

| * | United Airlines Holdings Inc. | 26,800 | 1,529 |

| | WESCO International Inc. | 9,100 | 1,529 |

| * | Copart Inc. | 28,801 | 1,509 |

| * | Blue Bird Corp. | 30,700 | 1,472 |

| | Otis Worldwide Corp. | 12,606 | 1,310 |

| | United Parcel Service Inc. Class B (XNYS) | 9,031 | 1,231 |

| | FedEx Corp. | 4,200 | 1,149 |

| | Advanced Drainage Systems Inc. | 7,300 | 1,147 |

| * | AZEK Co. Inc. | 20,300 | 950 |

| | AECOM | 8,910 | 920 |

| | Shyft Group Inc. | 68,500 | 860 |

| | Acuity Brands Inc. | 2,800 | 771 |

| | Copa Holdings SA Class A | 8,000 | 751 |

| | Brady Corp. Class A | 9,600 | 736 |

| * | Legalzoom.com Inc. | 109,600 | 696 |

| | CSX Corp. | 19,500 | 673 |

| * | API Group Corp. | 20,100 | 664 |

| | Republic Services Inc. | 3,170 | 637 |

| | Xylem Inc. | 4,500 | 608 |

| | Atmus Filtration Technologies Inc. | 15,100 | 567 |

| * | Air Transport Services Group Inc. | 33,705 | 546 |

| * | Enviri Corp. | 52,400 | 542 |

| | Enerpac Tool Group Corp. | 12,239 | 513 |

| * | CACI International Inc. Class A | 1,000 | 505 |

| | Ingersoll Rand Inc. (XYNS) | 5,000 | 491 |

| * | TrueBlue Inc. | 60,200 | 475 |

| | L3Harris Technologies Inc. | 1,900 | 452 |

| * | Hudson Technologies Inc. | 53,585 | 447 |

| | AMETEK Inc. | 2,000 | 343 |

| | Paycom Software Inc. | 1,700 | 283 |

| * | Core & Main Inc. Class A | 5,000 | 222 |

| * | Triumph Group Inc. | 16,700 | 215 |

| | JB Hunt Transport Services Inc. | 1,200 | 207 |

| | Donaldson Co. Inc. | 2,500 | 184 |

| | Flowserve Corp. | 2,500 | 129 |

| | Carrier Global Corp. | 1,600 | 129 |

| * | Planet Labs PBC | 54,700 | 122 |

| | Marten Transport Ltd. | 6,846 | 121 |

| | Rollins Inc. | 2,400 | 121 |

| | Valmont Industries Inc. | 400 | 116 |

| | Tennant Co. | 1,005 | 96 |

| | TTEC Holdings Inc. | 10,600 | 62 |

| | Woodward Inc. | 300 | 51 |

| * | IBEX Holdings Ltd. | 2,400 | 48 |

| | Powell Industries Inc. | 200 | 44 |

| * | Babcock & Wilcox Enterprises Inc. | 17,000 | 35 |

| * | Resideo Technologies Inc. | 1,271 | 26 |

| | Quad/Graphics Inc. | 4,798 | 22 |

| * | Northwest Pipe Co. | 300 | 14 |

| * | Conduent Inc. | 2,708 | 11 |

| * | TELUS International CDA Inc. | 22 | — |

| | | | 1,239,413 |

| Information Technology (30.8%) |

| | Microsoft Corp. | 2,314,934 | 996,116 |

| | NVIDIA Corp. | 8,121,334 | 986,255 |

| | | Shares | Market

Value•

($000) |

| | Apple Inc. | 4,037,199 | 940,667 |

| | Broadcom Inc. | 1,896,559 | 327,156 |

| | QUALCOMM Inc. | 767,203 | 130,463 |

| * | Arista Networks Inc. | 306,467 | 117,628 |

| * | Adobe Inc. | 222,176 | 115,038 |

| * | ServiceNow Inc. | 116,998 | 104,642 |

| | Cisco Systems Inc. | 1,712,538 | 91,141 |

| | NXP Semiconductors NV | 324,737 | 77,940 |

| | Oracle Corp. | 398,480 | 67,901 |

| | NetApp Inc. | 538,396 | 66,497 |

| | Motorola Solutions Inc. | 132,480 | 59,567 |

| * | Fortinet Inc. | 686,992 | 53,276 |

| * | Synopsys Inc. | 90,880 | 46,021 |

| * | MongoDB Inc. | 166,426 | 44,993 |

| | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 247,078 | 42,910 |

| | Salesforce Inc. | 146,710 | 40,156 |

| * | HubSpot Inc. | 75,072 | 39,908 |

| * | VeriSign Inc. | 184,305 | 35,011 |

| | Micron Technology Inc. | 334,453 | 34,686 |

| | TE Connectivity plc | 228,960 | 34,571 |

| | KLA Corp. | 44,620 | 34,554 |

| | Applied Materials Inc. | 154,410 | 31,199 |

| * | Palantir Technologies Inc. Class A | 783,700 | 29,154 |

| | Analog Devices Inc. | 117,830 | 27,121 |

| | Texas Instruments Inc. | 127,500 | 26,338 |

| * | Autodesk Inc. | 81,770 | 22,526 |

| * | Advanced Micro Devices Inc. | 129,700 | 21,281 |

| | Accenture plc Class A | 57,100 | 20,184 |

| | Corning Inc. | 373,290 | 16,854 |

| | Seagate Technology Holdings plc | 125,210 | 13,714 |

| | Lam Research Corp. | 14,699 | 11,996 |

| | Vontier Corp. | 316,690 | 10,685 |

| * | ON Semiconductor Corp. | 125,000 | 9,076 |

| * | Crowdstrike Holdings Inc. Class A | 30,200 | 8,470 |

| | Intel Corp. | 349,300 | 8,195 |

| * | Keysight Technologies Inc. | 44,880 | 7,133 |

| * | Fair Isaac Corp. | 3,500 | 6,802 |

| * | F5 Inc. | 30,090 | 6,626 |

| * | Sanmina Corp. | 96,000 | 6,571 |

| | International Business Machines Corp. | 28,483 | 6,297 |

| * | DocuSign Inc. | 84,900 | 5,271 |

| | Amdocs Ltd. | 59,224 | 5,181 |

| * | UiPath Inc. Class A | 380,200 | 4,867 |

| | Dell Technologies Inc. Class C | 34,200 | 4,054 |

| * | EPAM Systems Inc. | 19,900 | 3,961 |

| | Logitech International SA (Registered) | 29,700 | 2,665 |

| | Jabil Inc. | 17,600 | 2,109 |

| | Pegasystems Inc. | 24,600 | 1,798 |

| | Microchip Technology Inc. | 21,700 | 1,742 |

| * | Yext Inc. | 225,900 | 1,563 |

| * | Okta Inc. | 19,400 | 1,442 |

| | Amphenol Corp. Class A | 19,200 | 1,251 |

| * | Rambus Inc. | 29,200 | 1,233 |

| * | MaxLinear Inc. | 84,564 | 1,225 |

| * | Trimble Inc. | 19,000 | 1,180 |

| | Gen Digital Inc. (XNGS) | 38,500 | 1,056 |

| * | Consensus Cloud Solutions Inc. | 42,600 | 1,003 |

| * | NetScout Systems Inc. | 42,100 | 916 |

| | Methode Electronics Inc. | 70,221 | 840 |

| * | Xperi Inc. | 71,205 | 658 |

| * | Wolfspeed Inc. | 61,500 | 597 |

| * | Photronics Inc. | 22,700 | 562 |

| * | Kyndryl Holdings Inc. | 23,400 | 538 |

| * | Teradata Corp. | 17,400 | 528 |

| * | Extreme Networks Inc. | 32,240 | 485 |

| * | Weave Communications Inc. | 36,900 | 472 |

| * | CommScope Holding Co. Inc. | 77,000 | 471 |

| * | Credo Technology Group Holding Ltd. | 15,200 | 468 |

| * | Daktronics Inc. | 35,900 | 463 |

| * | Nutanix Inc. Class A | 6,800 | 403 |

| | | Shares | Market

Value•

($000) |

| * | Ouster Inc. | 53,300 | 336 |

| | Hewlett Packard Enterprise Co. | 15,400 | 315 |

| | Roper Technologies Inc. | 564 | 314 |

| | Cognizant Technology Solutions Corp. Class A | 3,500 | 270 |

| * | Workday Inc. Class A | 1,000 | 244 |

| * | Western Digital Corp. | 3,400 | 232 |

| * | Domo Inc. Class B | 28,800 | 216 |

| * | Everspin Technologies Inc. | 35,900 | 212 |

| * | DoubleVerify Holdings Inc. | 12,300 | 207 |

| * | Veeco Instruments Inc. | 6,100 | 202 |

| * | Plexus Corp. | 1,470 | 201 |

| * | Manhattan Associates Inc. | 712 | 200 |

| * | PDF Solutions Inc. | 5,600 | 177 |

| * | Zoom Video Communications Inc. Class A | 2,532 | 177 |

| * | Ultra Clean Holdings Inc. | 4,419 | 176 |

| * | Unisys Corp. | 30,206 | 172 |

| * | Upland Software Inc. | 44,800 | 112 |

| | Amkor Technology Inc. | 3,575 | 109 |

| * | Aurora Innovation Inc. | 18,400 | 109 |

| * | N-able Inc. | 8,009 | 105 |

| | Badger Meter Inc. | 463 | 101 |

| * | Rimini Street Inc. | 54,200 | 100 |

| | Kulicke & Soffa Industries Inc. | 2,200 | 99 |

| * | Digital Turbine Inc. | 27,400 | 84 |

| | AudioCodes Ltd. | 8,565 | 83 |

| * | PROS Holdings Inc. | 4,000 | 74 |

| * | Expensify Inc. Class A | 26,300 | 52 |

| * | Brightcove Inc. | 11,374 | 25 |

| * | 8x8 Inc. | 10,800 | 22 |

| | | | 4,831,047 |

| Materials (2.1%) |

| | Linde plc | 140,621 | 67,057 |

| | Freeport-McMoRan Inc. | 987,090 | 49,276 |

| | Celanese Corp. | 356,724 | 48,500 |

| | Sherwin-Williams Co. | 125,900 | 48,052 |

| | FMC Corp. | 467,395 | 30,820 |

| | Ecolab Inc. | 74,200 | 18,946 |

| | PPG Industries Inc. | 142,600 | 18,889 |

| | Mosaic Co. | 662,400 | 17,739 |

| | Vulcan Materials Co. | 19,700 | 4,933 |

| | Southern Copper Corp. | 35,500 | 4,106 |

| | DuPont de Nemours Inc. | 45,760 | 4,078 |

| | Dow Inc. | 51,000 | 2,786 |

| | Nucor Corp. | 17,900 | 2,691 |

| | Huntsman Corp. | 102,100 | 2,471 |

| * | Constellium SE | 140,200 | 2,280 |

| 3 | Nutrien Ltd. | 41,500 | 1,995 |

| | Packaging Corp. of America | 7,100 | 1,529 |

| | Corteva Inc. | 23,249 | 1,367 |

| | Orion SA | 49,100 | 874 |

| | First Majestic Silver Corp. | 143,100 | 859 |

| * | Fortuna Mining Corp. | 137,300 | 636 |

| * | SilverCrest Metals Inc. | 65,700 | 608 |

| | LyondellBasell Industries NV Class A | 4,990 | 479 |

| | SSR Mining Inc. (XTSE) | 64,300 | 365 |

| * | Axalta Coating Systems Ltd. | 8,800 | 318 |

| | American Vanguard Corp. | 43,052 | 228 |

| * | Intrepid Potash Inc. | 9,100 | 218 |

| * | Eldorado Gold Corp. | 10,300 | 179 |

| | SunCoke Energy Inc. | 17,701 | 154 |

| | Olympic Steel Inc. | 3,103 | 121 |

| * | Clearwater Paper Corp. | 4,200 | 120 |

| * | Alto Ingredients Inc. | 73,400 | 118 |

| * | LSB Industries Inc. | 14,541 | 117 |

| | Mativ Holdings Inc. | 6,899 | 117 |

| * | Summit Materials Inc. Class A | 2,697 | 105 |

| * | ATI Inc. | 1,500 | 100 |

| * | Glatfelter Corp. | 47,900 | 86 |

| | Trinseo plc | 14,100 | 72 |

| | | Shares | Market

Value•

($000) |

| * | Gatos Silver Inc. | 3,500 | 53 |

| | Kaiser Aluminum Corp. | 500 | 36 |

| * | Metallus Inc. | 1,300 | 19 |

| | Mercer International Inc. | 2,500 | 17 |

| | International Paper Co. | 1 | — |

| | | | 333,514 |

| Other (0.5%) |

| | SPDR S&P 500 ETF Trust | 137,932 | 79,140 |

| *,1 | Paratek Pharmaceuticals Inc. CVR | 15,782 | 1 |

| *,1 | Aduro Biotech Inc. CVR | 67 | — |

| *,1 | Strongbridge Biopharm CVR | 335 | — |

| *,1 | GCI Liberty Inc. | 100 | — |

| | | | 79,141 |

| Real Estate (2.3%) |

| | Welltower Inc. | 934,940 | 119,700 |

| | Simon Property Group Inc. | 351,610 | 59,429 |

| | Equity Residential | 465,096 | 34,631 |

| | American Tower Corp. | 125,260 | 29,130 |

| | Digital Realty Trust Inc. | 115,571 | 18,703 |

| | Equinix Inc. | 20,990 | 18,631 |

| | SBA Communications Corp. | 58,460 | 14,071 |

| | UDR Inc. | 253,880 | 11,511 |

| | Camden Property Trust | 62,160 | 7,679 |

| | BXP Inc. | 69,477 | 5,590 |

| | Federal Realty Investment Trust | 44,670 | 5,136 |

| * | CBRE Group Inc. Class A | 39,290 | 4,891 |

| | First Industrial Realty Trust Inc. | 83,700 | 4,686 |

| | Mid-America Apartment Communities Inc. | 28,700 | 4,560 |

| | VICI Properties Inc. | 130,860 | 4,359 |

| | AvalonBay Communities Inc. | 18,920 | 4,262 |

| | Kimco Realty Corp. | 101,700 | 2,362 |

| * | Anywhere Real Estate Inc. | 306,107 | 1,555 |

| | Public Storage | 4,247 | 1,545 |

| | CareTrust REIT Inc. | 34,800 | 1,074 |

| | Omega Healthcare Investors Inc. | 25,200 | 1,026 |

| | Innovative Industrial Properties Inc. | 7,100 | 956 |

| | Regency Centers Corp. | 12,854 | 928 |

| | COPT Defense Properties | 28,700 | 870 |

| | InvenTrust Properties Corp. | 28,900 | 820 |

| | Kite Realty Group Trust | 29,100 | 773 |

| * | Equity Commonwealth | 23,200 | 462 |

| | Ventas Inc. | 7,100 | 455 |

| | Weyerhaeuser Co. | 12,599 | 427 |

| * | RE/MAX Holdings Inc. Class A | 31,000 | 386 |

| | Community Healthcare Trust Inc. | 16,400 | 298 |

| | Ryman Hospitality Properties Inc. | 2,600 | 279 |

| | Cousins Properties Inc. | 9,400 | 277 |

| | Industrial Logistics Properties Trust | 58,000 | 276 |

| * | Seritage Growth Properties Class A | 47,581 | 221 |

| | Retail Opportunity Investments Corp. | 14,000 | 220 |

| * | Douglas Elliman Inc. | 108,400 | 198 |

| | Healthpeak Properties Inc. | 8,400 | 192 |

| | LTC Properties Inc. | 5,100 | 187 |

| | Vornado Realty Trust | 4,700 | 185 |

| | Veris Residential Inc. | 8,800 | 157 |

| * | Forestar Group Inc. | 4,518 | 146 |

| | Orion Office REIT Inc. | 34,961 | 140 |

| | City Office REIT Inc. | 23,106 | 135 |

| | Office Properties Income Trust | 60,600 | 132 |

| | LXP Industrial Trust | 11,800 | 119 |

| | Hudson Pacific Properties Inc. | 22,100 | 106 |

| * | Apartment Investment and Management Co. Class A | 10,300 | 93 |

| | Gaming and Leisure Properties Inc. | 1,500 | 77 |

| | Franklin Street Properties Corp. | 24,873 | 44 |

| | Armada Hoffler Properties Inc. | 2,500 | 27 |

| | Alexander & Baldwin Inc. | 1,100 | 21 |

| | Phillips Edison & Co. Inc. | 400 | 15 |

| | Host Hotels & Resorts Inc. | 200 | 4 |

| | | | 364,157 |

| | | Shares | Market

Value•

($000) |

| Utilities (2.6%) |

| | Sempra | 2,078,821 | 173,852 |

| | Consolidated Edison Inc. | 315,100 | 32,811 |

| | Public Service Enterprise Group Inc. | 319,818 | 28,531 |

| | Exelon Corp. | 578,439 | 23,456 |

| | Constellation Energy Corp. | 81,600 | 21,218 |

| | NRG Energy Inc. | 227,250 | 20,702 |

| | Evergy Inc. | 330,780 | 20,512 |

| | Dominion Energy Inc. | 295,380 | 17,070 |

| | Vistra Corp. | 107,326 | 12,722 |

| | Edison International | 144,000 | 12,541 |

| | Atmos Energy Corp. | 60,016 | 8,325 |

| | Southern Co. | 75,800 | 6,836 |

| | FirstEnergy Corp. | 125,971 | 5,587 |

| | Eversource Energy | 74,450 | 5,066 |

| | CMS Energy Corp. | 68,100 | 4,810 |

| | CenterPoint Energy Inc. | 105,200 | 3,095 |

| | Entergy Corp. | 22,734 | 2,992 |

| | Duke Energy Corp. | 25,650 | 2,957 |

| | PG&E Corp. | 146,300 | 2,892 |

| | Pinnacle West Capital Corp. | 5,000 | 443 |

| | American Electric Power Co. Inc. | 4,100 | 421 |

| | MGE Energy Inc. | 2,100 | 192 |

| | American States Water Co. | 1,300 | 108 |

| * | Montauk Renewables Inc. | 18,372 | 96 |

| | AES Corp. | 4,000 | 80 |

| | | | 407,315 |

| Total Common Stocks (Cost $10,165,373) | 15,402,954 |

| Temporary Cash Investments (1.6%) |

| Money Market Fund (1.6%) |

| 4,5 | Vanguard Market Liquidity Fund, 5.014% (Cost $255,295) | 2,553,115 | 255,312 |

| Total Investments (99.9%) (Cost $10,420,668) | 15,658,266 |

| Other Assets and Liabilities—Net (0.1%) | 7,875 |

| Net Assets (100%) | 15,666,141 |

| Cost is in $000. |

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Security value determined using significant unobservable inputs. |

| 2 | Restricted securities totaling $0, representing 0.0% of net assets. |

| 3 | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $2,172,000. |

| 4 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 5 | Collateral of $2,260,000 was received for securities on loan, of which $2,254,000 is held in Vanguard Market Liquidity Fund and $6,000 is held in cash. |

| | ADR—American Depositary Receipt. |

| | CVR—Contingent Value Rights. |

| | REIT—Real Estate Investment Trust. |

Derivative Financial Instruments Outstanding as of Period End

| Futures Contracts |

| | | | ($000) |

| | Expiration | Number of

Long (Short)

Contracts | Notional

Amount | Value and

Unrealized

Appreciation

(Depreciation) |

| Long Futures Contracts | | | | |

| E-mini S&P 500 Index | December 2024 | 714 | 207,569 | 1,302 |

See accompanying Notes, which are an integral part of the Financial Statements.

Statement of Assets and Liabilities

|

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value1 | |

| Unaffiliated Issuers (Cost $10,165,373) | 15,402,954 |

| Affiliated Issuers (Cost $255,295) | 255,312 |

| Total Investments in Securities | 15,658,266 |

| Investment in Vanguard | 435 |

| Cash | 6 |

| Cash Collateral Pledged—Futures Contracts | 10,432 |

| Receivables for Investment Securities Sold | 12,514 |

| Receivables for Accrued Income | 11,748 |

| Receivables for Capital Shares Issued | 3,971 |

| Variation Margin Receivable—Futures Contracts | 821 |

| Total Assets | 15,698,193 |

| Liabilities | |

| Due to Custodian | 113 |

| Payables for Investment Securities Purchased | 14,261 |

| Collateral for Securities on Loan | 2,260 |

| Payables to Investment Advisor | 4,804 |

| Payables for Capital Shares Redeemed | 9,574 |

| Payables to Vanguard | 1,040 |

| Total Liabilities | 32,052 |

| Net Assets | 15,666,141 |

| 1 Includes $2,172,000 of securities on loan. | |

| At September 30, 2024, net assets consisted of: | |

| | |

| Paid-in Capital | 9,068,029 |

| Total Distributable Earnings (Loss) | 6,598,112 |

| Net Assets | 15,666,141 |

| |

| Investor Shares—Net Assets | |

Applicable to 53,853,768 outstanding $.001 par value shares of

beneficial interest (unlimited authorization) | 3,617,519 |

| Net Asset Value Per Share—Investor Shares | $67.17 |

| |

| Admiral™ Shares—Net Assets | |

Applicable to 109,900,969 outstanding $.001 par value shares of

beneficial interest (unlimited authorization) | 12,048,622 |

| Net Asset Value Per Share—Admiral Shares | $109.63 |

See accompanying Notes, which are an integral part of the Financial Statements.

|

| | Year Ended

September 30, 2024 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 172,078 |

| Interest2 | 19,036 |

| Securities Lending—Net | 70 |

| Total Income | 191,184 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 18,410 |

| Performance Adjustment | (1,989) |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 7,795 |

| Management and Administrative—Admiral Shares | 14,417 |

| Marketing and Distribution—Investor Shares | 156 |

| Marketing and Distribution—Admiral Shares | 384 |

| Custodian Fees | 176 |

| Auditing Fees | 38 |

| Shareholders’ Reports and Proxy Fees—Investor Shares | 109 |

| Shareholders’ Reports and Proxy Fees—Admiral Shares | 87 |

| Trustees’ Fees and Expenses | 9 |

| Other Expenses | 23 |

| Total Expenses | 39,615 |

| Expenses Paid Indirectly | (15) |

| Fees Waived/Expenses Reimbursed—Note B | (1,232) |

| Net Expenses | 38,368 |

| Net Investment Income | 152,816 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | 1,395,367 |

| Futures Contracts | 54,100 |

| Realized Net Gain (Loss) | 1,449,467 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 2,644,798 |

| Futures Contracts | 12,600 |

| Change in Unrealized Appreciation (Depreciation) | 2,657,398 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 4,259,681 |

| 1 | Dividends are net of foreign withholding taxes of $211,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $18,250,000, $120,000, $2,000, and ($83,000), respectively. Purchases and sales are for temporary cash investment purposes. |

See accompanying Notes, which are an integral part of the Financial Statements.

Statement of Changes in Net Assets

|

| | Year Ended September 30, |

| | 2024

($000) | 2023

($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 152,816 | 162,966 |

| Realized Net Gain (Loss) | 1,449,467 | 1,038,095 |

| Change in Unrealized Appreciation (Depreciation) | 2,657,398 | 813,431 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 4,259,681 | 2,014,492 |

| Distributions | | |

| Investor Shares | (258,116) | (243,419) |

| Admiral Shares | (799,053) | (740,469) |

| Total Distributions | (1,057,169) | (983,888) |

| Capital Share Transactions | | |

| Investor Shares | (107,058) | 127,575 |

| Admiral Shares | 673,035 | 492,457 |

| Net Increase (Decrease) from Capital Share Transactions | 565,977 | 620,032 |

| Total Increase (Decrease) | 3,768,489 | 1,650,636 |

| Net Assets | | |

| Beginning of Period | 11,897,652 | 10,247,016 |

| End of Period | 15,666,141 | 11,897,652 |

See accompanying Notes, which are an integral part of the Financial Statements.

| Investor Shares | | | | | |

For a Share Outstanding

Throughout Each Period | Year Ended September 30, |

| 2024 | 2023 | 2022 | 2021 | 2020 |

| Net Asset Value, Beginning of Period | $53.55 | $49.02 | $66.16 | $54.15 | $49.46 |

| Investment Operations | | | | | |

| Net Investment Income1 | .603 | .701 | .746 | .761 | .787 |

| Net Realized and Unrealized Gain (Loss) on Investments | 17.713 | 8.483 | (8.155) | 14.991 | 6.024 |

| Total from Investment Operations | 18.316 | 9.184 | (7.409) | 15.752 | 6.811 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.604) | (.775) | (.777) | (.770) | (.815) |

| Distributions from Realized Capital Gains | (4.092) | (3.879) | (8.954) | (2.972) | (1.306) |

| Total Distributions | (4.696) | (4.654) | (9.731) | (3.742) | (2.121) |

| Net Asset Value, End of Period | $67.17 | $53.55 | $49.02 | $66.16 | $54.15 |

| Total Return2 | 36.05% | 19.81% | -13.94% | 30.22% | 14.07% |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $3,618 | $2,955 | $2,570 | $3,205 | $2,779 |

| Ratio of Total Expenses to Average Net Assets3 | 0.35%4,5 | 0.32%5 | 0.32% | 0.32% | 0.32% |

| Ratio of Net Investment Income to Average Net Assets | 1.00% | 1.34% | 1.25% | 1.22% | 1.57% |

| Portfolio Turnover Rate | 84% | 94% | 62% | 62% | 58% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | Includes performance-based investment advisory fee increases (decreases) of (0.01%), (0.01%), (0.01%), (0.00%), and 0.00%. |

| 4 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.35%. |

| 5 | The ratio of total expenses to average net assets before basic fees waived was 0.36% for 2024 and 0.32% for 2023. See Note B in the Notes to Financial Statements. |

See accompanying Notes, which are an integral part of the Financial Statements.

| Admiral Shares | | | | | |

For a Share Outstanding

Throughout Each Period | Year Ended September 30, |

| 2024 | 2023 | 2022 | 2021 | 2020 |

| Net Asset Value, Beginning of Period | $87.40 | $80.01 | $108.01 | $88.40 | $80.74 |

| Investment Operations | | | | | |

| Net Investment Income1 | 1.089 | 1.230 | 1.315 | 1.344 | 1.364 |

| Net Realized and Unrealized Gain (Loss) on Investments | 28.909 | 13.845 | (13.315) | 24.466 | 9.842 |

| Total from Investment Operations | 29.998 | 15.075 | (12.000) | 25.810 | 11.206 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.087) | (1.353) | (1.380) | (1.347) | (1.414) |

| Distributions from Realized Capital Gains | (6.681) | (6.332) | (14.620) | (4.853) | (2.132) |

| Total Distributions | (7.768) | (7.685) | (16.000) | (6.200) | (3.546) |

| Net Asset Value, End of Period | $109.63 | $87.40 | $80.01 | $108.01 | $88.40 |

| Total Return2 | 36.19% | 19.93% | -13.85% | 30.34% | 14.19% |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $12,049 | $8,942 | $7,677 | $9,821 | $9,086 |

| Ratio of Total Expenses to Average Net Assets3 | 0.25%4,5 | 0.22%5 | 0.22% | 0.22% | 0.22% |

| Ratio of Net Investment Income to Average Net Assets | 1.10% | 1.44% | 1.34% | 1.33% | 1.66% |

| Portfolio Turnover Rate | 84% | 94% | 62% | 62% | 58% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | Includes performance-based investment advisory fee increases (decreases) of (0.01%), (0.01%), (0.01%), (0.00%), and 0.00%. |

| 4 | The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.25%. |

| 5 | The ratio of total expenses to average net assets before basic fees waived was 0.26% for 2024 and 0.22% for 2023. See Note B in the Notes to Financial Statements. |

See accompanying Notes, which are an integral part of the Financial Statements.

Notes to Financial Statements

Vanguard Growth and Income Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Admiral Shares. Each of the share classes has different eligibility and minimum purchase requirements, and is designed for different types of investors.

| A. | The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements. |

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any securities pledged as initial margin for open contracts are noted in the Schedule of Investments.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Assets and Liabilities. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on futures contracts.

During the year ended September 30, 2024, the fund’s average investments in long and short futures contracts represented 2% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Assets and Liabilities for the return of the collateral, during the period the securities are on loan. Collateral investments in Vanguard Market Liquidity Fund are subject to market appreciation or depreciation. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facilities and Interfund Lending Program: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement and an uncommitted credit facility provided by Vanguard. Both facilities may be renewed annually. Each fund is individually liable for its borrowings, if any, under the credit facilities. Borrowings may be utilized for temporary or emergency purposes and are subject to the fund’s regulatory and contractual borrowing restrictions. With respect to the committed credit facility, the participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn committed amount of the facility, which are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under either facility bear interest at an agreed-upon spread plus the higher of the federal funds effective rate, the overnight bank funding rate, or the Daily Simple Secured Overnight Financing Rate inclusive of an additional agreed-upon spread. However, borrowings under the uncommitted credit facility may bear interest based upon an alternate rate agreed to by the fund and Vanguard.

In accordance with an exemptive order (the “Order”) from the SEC, the fund may participate in a joint lending and borrowing program that allows registered open-end Vanguard funds to borrow money from and lend money to each other for temporary or emergency purposes (the “Interfund Lending Program”), subject to compliance with the terms and conditions of the Order, and to the extent permitted by the fund’s investment objective

and investment policies. Interfund loans and borrowings normally extend overnight but can have a maximum duration of seven days. Loans may be called on one business day’s notice. The interest rate to be charged is governed by the conditions of the Order and internal procedures adopted by the board of trustees. The board of trustees is responsible for overseeing the Interfund Lending Program.

For the year ended September 30, 2024, the fund did not utilize the credit facilities or the Interfund Lending Program.

7. Other: Dividend income is recorded on the ex-dividend date. Non-cash dividends included in income, if any, are recorded at the fair value of the securities received. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and proxy fees. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.