June 2008

Jefferies Annual

Healthcare Conference

Forward Looking Statements

This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking statements

that are subject to a number of risks and uncertainties, many of which are outside our control. All statements regarding our

strategy, future operations, financial position, estimated revenues or losses, projected costs, prospects, plans and objectives,

other than statements of historical fact included in our prospectus, are forward-looking statements. When used in this

presentation or in answers given to questions asked today, the words “may,” “will,” “could,” “would,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar expressions are intended to identify forward-

looking statements, although not all forward-looking statements contain these identifying words. You should not place undue

reliance on forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement

that we make, we caution you that these statements are based on a combination of facts and factors currently known by us and

projections of future events or conditions, about which we cannot be certain. For a more complete discussion regarding these

and other factors which could affect the Company's financial performance, refer to the Company's various filings with the

Securities and Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2007, in particular

information under the headings "Special Caution Regarding Forward-Looking Statements" and “Risk Factors.” These cautionary

statements qualify all of the forward-looking statements. In addition, market and industry statistics contained in this presentation

are based on information available to us that we believe is accurate. This information is generally based on publications that are

not produced for purposes of securities offerings or economic analysis.

All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume no

obligation to update these forward-looking statements publicly or to update the factors that could cause actual results to differ

materially, even if new information becomes available in the future.

Investment Highlights

Leading regional home health provider

40+% three year revenue CAGR

Decentralized operating model

Strong capital position

Raised $42 million in equity in 2008

Disciplined approach to acquisitions driven by seasoned

management

Growing force in consolidating home health care market

12 acquisitions in three years

Three geographic clusters: Northeast, Southeast and Midwest

Patient Care acquisition brings annual revenue run rate

to $200 million

Acquiring Patient Care for

$46.5 million

8 branch locations, $47 million in

revenue

Strong local brand

Tremendous growth opportunity

Major expansion of Northeast

operations

Enter New Jersey with 3 branches

Densify Connecticut adding 4

branches for 10 total branches with

~$30 million in revenue

Initial presence in Pennsylvania

Patient Care Acquisition

Locations

Founded Louisville, KY -- 1976

Two home health segments:

Visiting Nurse Medicare-certified

(~80% of revenue)

Personal Care primarily Medicaid-

Waiver (~20% of revenue) Non-

skilled

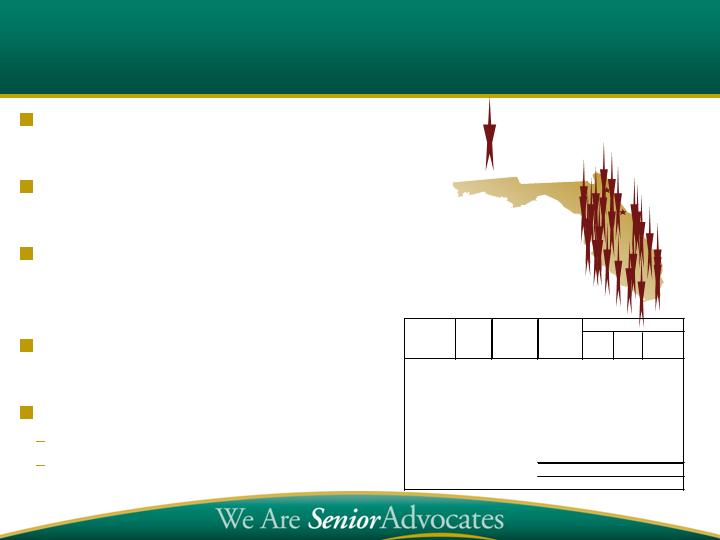

89 locations in three geographic

clusters, spanning 11 states

Revenue run rate over $200 million

with Patient Care

Almost Family Overview

Almost Family Locations

Geographic

Focus:

Northeast

Midwest

Southeast

6

10 years at AFAM

VP Operations Personal Care

–

David Pruitt

at AFAM as senior operator

18 years

SVP VN Operations North

–

Anne Liechty

ital management

osp

h

ears

13 y

SVP

AFAM

10 years as

SVP Administration

–

Todd Lyles

ccounting

9 years Big Six public a

CFO

AFAM

15 years as

CFO

SVP and

–

ve Guenthner

Ste

hareholder

Founding s

CEO

AFAM

26 years as

CEO

–

William Yarmuth

Core Team Together for Over a Decade

Experienced Management Team

Recently Added Talent to Manage Growth

Phyllis

Montville

–

SVP VN Operations South

Florida

2+ years

at AFAM

, 20+ years as senior operator of home health

b

usinesses

Cathy Newhouse

–

SVP Clinical Programs, Sales

and

Marketing

22 years with Gentiva

Michael

Moses

–

VP Group Living Programs

Founder Quality of Life Home Care

Nancy Ralston and James Spriggs

–

VPs

Operations North Florida

Founders Apex Home Health Care

Ray Rasa

–

VP Operations Northeast

20+ years home health, Gentiva and Patient Care

Compelling Market Opportunity

U.S. Population age 65 and over

(Millions)

Source: CMS

Aging U.S. population with higher incidence of chronic illness

Patient preference for home care and payor preference for cost-

effective care settings

Spending: $19.8B Medicare, $17.7B Medicaid in 2006

Home Health Expenditures

($Billions)

$32.2

$34.2

$38.0

$42.7

$47.9

$52.7

$57.6

$62.0

$66.7

$71.8

5

Fragmented Home Health Market -

Calls for Consolidation

Source: CMS, MedPAC, National Association for Home Care and Hospice

~8,800 Medicare-certified

home health agencies in U.S.

~7,000 agencies are

independently-owned

operations

Almost Family’s acquisition

criteria

Geographically

complementary markets

Multi-site, free-standing

agencies or hospital-based

agencies

Track Record of Strong Performance

($Millions)

$65.3

$75.1

$91.8

Revenues

$132.1

$39.0

$31.7

$20.5

45% revenue CAGR

61% EPS CAGR

Last 18 months:

30% organic

growth

Acquired $98M

revenue

Balanced geography

$218.1

Local emphasis leads to increased market share

Local brands, local managers and sales maintain referral relationships

Senior Advocacy philosophy is Common Bond

Singular focus on home-bound, geriatric population

Individualized approach advocates for patients and their needs

Curative and Restorative Care

Frail Elderly Management and Disease State Management

Increase referrals by improving outcomes

Specialty programs in response to local needs

Consistent delivery of highest quality patient care

Same store revenue growth is best quality measure

Local Emphasis Drives Growth

“Densification” – Increase density of

geographic clusters

Enter non-contiguous states/markets

through acquisition

Build on Local Brand

Use start-ups as extenders of existing

service area

Plan to open 5 to 10 start-ups in 2008

Optimize span of control

Disciplined Development Strategy

Branch Development

Last 4 Years

32

5

18

Continuing Local Brand Identity – Loyalty of employees,

patients and referral sources to the local brand

Managing Successfully:

Placing senior management closer to the local market

Local “course knowledge”, hometown business

Standard local office operating model, with local office

flexibility in marketing and clinical programs

Information system allows effective control through study and

analysis of local activities

Proven model for consolidation of fragmented industry

Bringing it All Together –

Rapid Growth with Local Emphasis

Proven, replicable model for

targeted states

Largest Medicare U.S home

care market

Completed 10 acquisitions and

400+% revenue growth over

four years

~$80 million provider in Florida,

32 locations

Seek continued densification

Cover 80% of population

Plan 3-5 startups in 2008

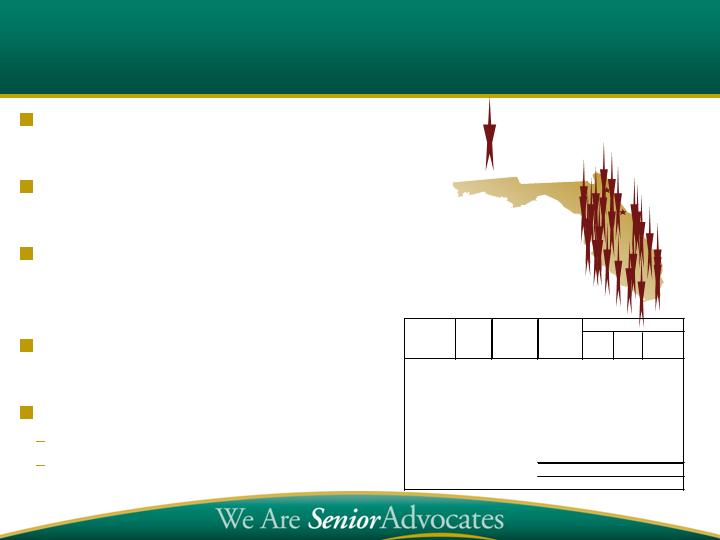

Strong Florida Market Track Record

VN Location

%

Branches

Year

# Brchs

Rev $ in

(000's)

Rev

Growth

Start

Acq

Comb

2001

8

11,038

$

3

5

2002

8

12,203

$

10.6%

2003

8

13,583

$

11.3%

2004

12

16,272

$

19.8%

4

2005

14

20,362

$

25.1%

1

2

(1)

2006

25

29,089

$

42.9%

1

18

(8)

2007

26

55,301

$

90.1%

1

2007PF*

32

78,547

$

170.0%

6

2004-2008

478.3%

6

27

-

* Proforma Full Year Quality of Life & Apex

Strong Florida Market Track Record

32 branches

30 branches

25 branches

14 branches

12 branches

8 branches

8 branches

8 branches

*Pro forma full year Apex acquisition

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

2001

2002

2003

2004

2005

2006

2007

2007PF*

Replicating Florida Success

In Northeast and Midwest

Shifting development emphasis to Northeast and Midwest

Patient Care quadruples Northeast presence

Annual revenue increases from $16 million to $63 million pro

forma

Service quality and specialties drive organic growth

Geographic clusters leverage:

Span of control

Referral relationships

Significant acquisition focus in Midwest

Financial Highlights

Long term EPS growth driven by organic volumes

Prudent management of capital structure with

appropriate leverage

Proven ability to access debt and equity

Scalable infrastructure keeps tight rein on

operating costs

Strong track record of investing capital in

accretive acquisitions

66

48

39

35

# of Locations

58

21

45

21

27

20

19

15

20

Track Record of Increasing Locations

51

22

73

23

81

65

24

89

21,415

16,707

14,100

13,065

Admissions

Growing Patient Admissions

32,025

19%

81%

18%

82%

15%

85%

88%

12%

8%

92%

8,467

89%

11%

9,287

91%

9%

Proven Revenue Performance

Continuing Operations

($Millions)

Proven EPS Growth

Continuing Operations EPS

($Millions)

Based on diluted shares.

Recent Patient Care Acquisition

Balances geography – Northeast represents ~30% of revenue

Strong local brand with tremendous opportunities for branch expansion

New Jersey

Only for-profit provider in four Northeast counties

Easily support more branches

Connecticut

Regulations allow unlimited branches anywhere in state

Pennsylvania

Just getting started

Earnings accretion:

Limited in 2008, due to timing and transition costs

2009, similar margins to rest of VN business

Pro forma leverage below 2X EBITDA

Same store sales growth (including post-acquisition)

10%-15% same store volume growth

Incremental 30%-40% same store revenue margin

Favorable acquisition economics

Agency contribution 20%-25% of revenue, paying 4x-5x

Incremental overhead 2%-3% of revenue

Strong ROI, accretive investments

Follow-on startups enhance returns

Margin implications

Volume-based incremental margin largely offsets rate cuts (case-mix creep adj)

EPS implications

Conditions right for long-term EPS growth as a consolidator

Investment Thesis: Long-Term EPS Growth