Exhibit 99.1

May 2009

Investor Presentation

Forward Looking Statements

This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking statements

that are subject to a number of risks and uncertainties, many of which are outside our control. All statements regarding our

strategy, future operations, financial position, estimated revenues or losses, projected costs, prospects, plans and objectives,

other than statements of historical fact included in our prospectus, are forward-looking statements. When used in this

presentation or in answers given to questions asked today, the words “may,” “will,” “could,” “would,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar expressions are intended to identify forward-

looking statements, although not all forward-looking statements contain these identifying words. You should not place undue

reliance on forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement

that we make, we caution you that these statements are based on a combination of facts and factors currently known by us and

projections of future events or conditions, about which we cannot be certain. For a more complete discussion regarding these

and other factors which could affect the Company's financial performance, refer to the Company's various filings with the

Securities and Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2008, in particular

information under the headings "Special Caution Regarding Forward-Looking Statements" and “Risk Factors.” These cautionary

statements qualify all of the forward-looking statements. In addition, market and industry statistics contained in this presentation

are based on information available to us that we believe is accurate. This information is generally based on publications that are

not produced for purposes of securities offerings or economic analysis.

All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume no

obligation to update these forward-looking statements publicly or to update the factors that could cause actual results to differ

materially, even if new information becomes available in the future.

15

45

3

2

3

2

11

1

3

3

10

Founded Louisville, KY -- 1976

Two home health segments:

Visiting Nurse Medicare-certified

(~85% of revenue)

Personal Care primarily Medicaid-

Waiver (~15% of revenue) Non-

skilled

98 locations in three geographic

clusters, spanning 11 states

Revenue run rate over $275 million

Almost Family Overview

Geographic

Focus:

Northeast

Midwest

Florida

Geographic

Focus:

Northeast

Midwest

Southeast

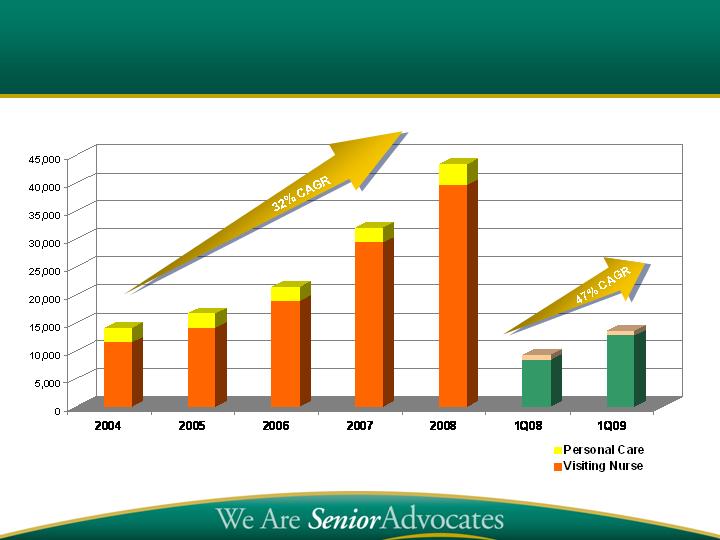

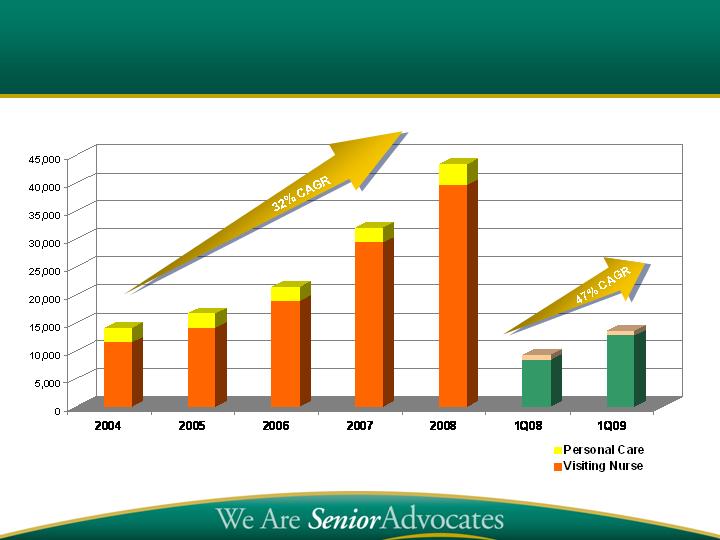

($Millions)

$65.3

$75.1

$91.8

$132.1

$69.2

$30.0

$31.9

$260.7

32% revenue CAGR

75% EPS CAGR

Last 24 months:

43% organic

growth

Acquired $98M

revenue

Track Record of Strong Performance

Revenue in Millions

ears at AFAM

y

23

SVP VN Operations North

–

Anne Liechty

ital management

13 years hosp

years as AFAM SVP

12

SVP Administration

–

Todd Lyles

9 years Big Six public accounting

years as AFAM CFO

17

SVP and CFO

–

Steve Guenthner

Founding shareholder

years as AFAM CEO

28

CEO

–

William Yarmuth

Core Team Together for Over a Decade

Experienced Management Team

Recently Added Talent to Manage Growth

Phyllis

Montville

–

SVP VN Operations South

Florida

3

+ years

at AFAM

, 20+ years as senior operator of home health

b

usinesses

Cathy Newhouse

–

SVP Clinical Programs, Sales

and

Marketing

22 years with Gentiva

Michael

Moses

–

VP Group Living Programs

Founder Quality of Life Home Care

Nancy Ralston and James Spriggs

–

VPs

Operations North Florida

Founders Apex Home Health Care

Ray Rasa

–

VP Operations Northeast

20+ years home health, Gentiva and Patient Care

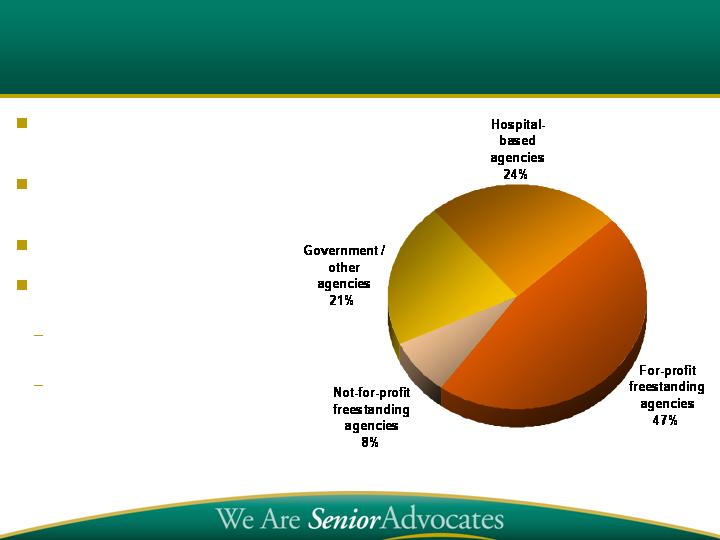

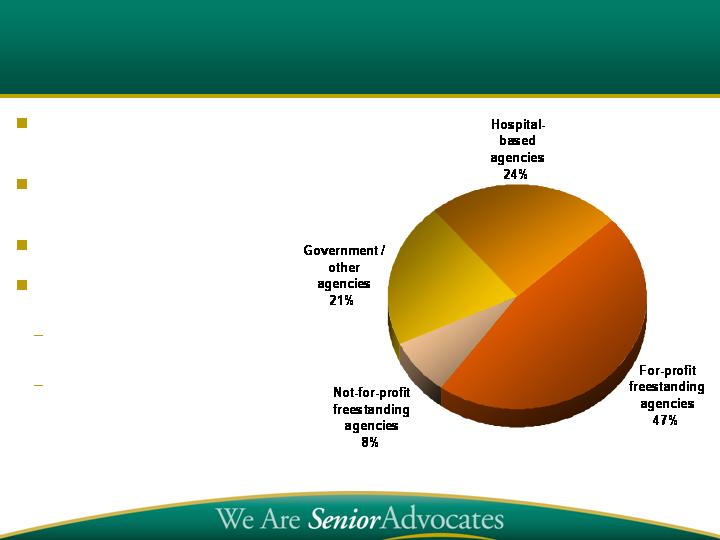

Fragmented Home Health Market -

Calls for Consolidation

Source: CMS, MedPAC, National Association for Home Care and Hospice

~9,200 Medicare-certified home

health agencies in U.S.

~7,000 agencies are

independently-owned operations

$16B Annual Medicare Spend

Almost Family’s acquisition

criteria

Geographically

complementary markets

Multi-site, free-standing

agencies or hospital-based

agencies

45 million beneficiaries

Limited Resources – 1 out of 2 have income of less than $21,000 (near poverty

level)

1 out of 3 have 3 or more chronic health conditions

1 out of 3 have cognitive or mental impairment

1 out of 3 are in poor health

1 out of 5 have significant limitations in activities of daily living

1 out of 8 is over 85 years old

1 out of 20 lives in a nursing home

The US Government is obligated to provide for their health care needs and

spends $477B per year doing it – Projected to double in 10 years

Home health is the lowest cost way to meet that obligation – we represent about

4% of the entire Medicare spend

Characteristics of the Medicare Population

Source: Kaiser Family Foundation Medicare Primer 2009

80+ year old, sick patients

Co-morbid chronic conditions, sickest of the sick, intensities increasing

Want to stay in their homes – out of the hospital – out of long term care

Want to restore their ability to care for themselves

Our Nurses and Therapists deliver:

Avoided hospital episodes by identifying skilled needs before patient

needs hospitalization

Earlier hospital discharges, fewer re-admissions, fewer ER visits

A better quality of life for the patients and their families

Lower costs to the Medicare program

Advocating the needs of seniors improves their lives and

saves significant dollars for the Medicare program

What is home health really about?

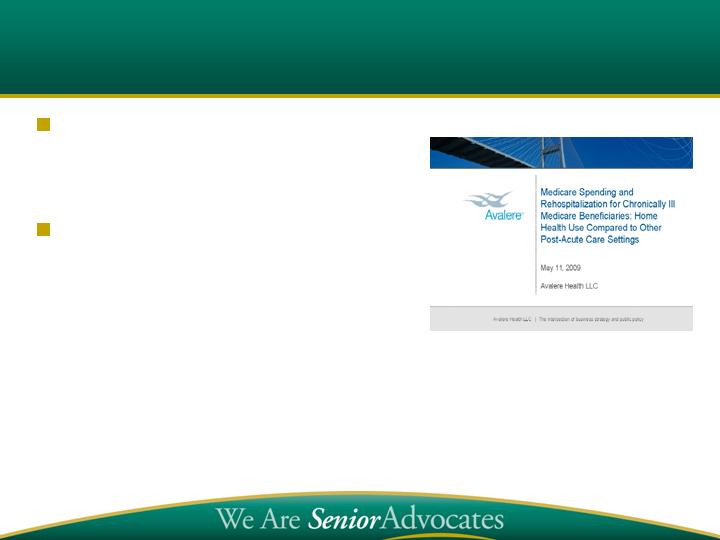

Home Health Works Post Hospital Stay --

AHHQI – Avalere Study

Studied three high cost conditions:

diabetes, COPD and CHF --

572,093 periods of care

Compared early use of home

health post-hospital to other non-

home health post-acute care

Avalere Conclusion:

“The post-hospital period of care costs and odds of

hospital readmission are statistically significantly

lower for diabetes patients, COPD patients, and CHF

patients requiring PAC who use early home health,

in every SOI category.”

Avalere: Home Health Compared to Other

Post-Acute Settings

$216 million

(Included in $1.71B

above)

Reduction in Medicare spending over 2005-2006

associated with the 24,000 fewer readmissions

24,000

Fewer hospital readmissions over 2005-2006

period associated with use of early home health

$1.77 billion

Reduction in Medicare post-hospital spending

over 2005-2006 if lower period-of-care costs

associated with early home health were applied

to periods of care for non-home health user

$1.71 billion

Reduction in Medicare post-hospital spending

over 2005-2006 associated with use of early

home health

Result

Impact Analysis

Federal Chronic Care Initiatives are

Aligned with Home Health Care Strengths

Senate Finance proposal for Chronic Care Management

Innovation Center, proposes options that :

“(1) places the patient, including family members and other

informal caregivers, at the center of the care team;

(2) focuses on in-person contact with beneficiaries;

(3) maintains a close relationship between care

coordinators and primary care physicians; and

(4) relies on a team-based approach to interventions such

as comprehensive care assessments, care planning …

and self-management coaching”.

Home

Health

Continuing Local Brand Identity – Loyalty of employees,

patients and referral sources to the local brand

Managing Successfully:

Placing senior management closer to the local market

Local “course knowledge”, hometown business

Growing locally based sales & marketing staff

Standard local office operating model, with local office

flexibility in marketing and clinical programs

Information system allows effective control through study

and analysis of local activities

AFAM’s Local Emphasis Drives Growth

Senior Advocacy philosophy is Common Bond

Singular focus on home-bound, geriatric population

Curative and Restorative Care

Individualized approach advocates for patients and their needs

Frail Elderly Care Management and Disease State Management

Increase referrals by improving outcomes

Credentialing Clinicians as Geriatric Specialists

Specialty programs in response to local needs

Consistent delivery of highest quality patient care

Same store revenue growth is best quality measure

AFAM’s Senior Advocacy Mission

“Densification” – Increase density of

existing geographic clusters

Make selected acquisitions to enter

states and markets contiguous to

existing operations

Build on Local Brand

Use start-ups as extenders of

existing service area

Opened 14 start-ups in 2008

Planning 5-10 startups in 2009

Optimize span of control

AFAM’s Disciplined Development Strategy

Branch Development

Last 4 Years

33

6

25

Proven, replicable model for

targeted states

Largest Medicare U.S home

care market

Completed 10 acquisitions and

400+% revenue growth over

four years

~$100 million provider in

Florida, 38 VN locations

Seek continued densification

Cover 80% of population

Densification Works

%

Branches

Year

# Brchs

Rev $ in

(000's)

Rev

Growth

Start

Acq

Comb

2001

8

11,038

$

3

5

2002

8

12,203

$

10.6%

2003

8

13,583

$

11.3%

2004

12

16,272

$

19.8%

4

2005

14

20,362

$

25.1%

1

2

(1)

2006

25

29,089

$

42.9%

1

18

(8)

2007*

26

55,301

$

90.1%

1

2008

37

103,219

$

86.6%

8

3

Q109LTM

38

106,045

$

91.8%

1

2004-2009

551.7%

15

24

(9)

Local Market Emphasis

Senior Advocacy Mission

Densification

Seasoned Management

History of Strong Organic

Growth

Proven model for

consolidation of fragmented

industry

Bringing it All Together

Financial Highlights

Long term EPS growth driven by organic volumes

Prudent management of capital structure with

appropriate leverage

Proven ability to access debt and equity

Scalable infrastructure keeps tight rein on

operating costs

Strong track record of investing capital in

accretive acquisitions

48

36

# of Locations

21

27

19

17

Track Record of Increasing Locations

51

22

73

75

23

98

21,415

16,707

14,100

Admissions

Growing Patient Admissions

32,025

18%

82%

15%

85%

88%

12%

8%

92%

9,290

91%

9%

13,627

93%

7%

8%

92%

43,337

Proven Revenue Performance

Continuing Operations

($Millions)

Proven EPS Growth

Continuing Operations EPS

($Millions)

Based on diluted shares.

Financial Update -- 2008 and Q1 2009

2008 Highlights

Revenues up 61%

EPS up 59%

VN organic revenue up 36%

Q1 2009

Revenues up 77%

EPS up 55%

VN organic revenue up 41%

Financial Measures:

AR DSO 47 at March 2009

LTM EBITDA $36M

Debt $29.8M

2008 Organic Medicare

Growth

Admissions 12%

Episodes 38%

Q109 Organic Medicare

Growth

Admissions 14%

Episodes 36%

Reimbursement Uncertainty–

WHAT is going on?

President’s Feb 2009 budget proposal set

everything spinning

Follows MedPac -- 5.5% cut in 2010, then “rebasing” in 2011

Proposing post-acute bundling phase-in that could begin in 2015

Obama’s “need for speed” and absence of any other voice puts all

the emphasis on MedPac’s recommendations

Senate and House resolutions do NOT reflect cuts

to home health reimbursement

Political Process at work – you count on:

Continuous annual reconsideration of rates

Long term downward pressure on margins

Ups and Downs in expectations until Federal budget cycle is done

Reimbursement Uncertainty –

How do we deal with it?

Make sure Home Health has a seat at the table

Collaborate with NAHC and AHHQI to educate and inform

Research, grassroots, CEO time in DC

Deal with long term margin shrink:

#1 Organic admissions growth

#2 Excel at the operational fundamentals

#3 Be a consolidator and densify geographic span of control

Deal with short term uncertainty:

Manage debt levels more conservatively

Value acquisitions more conservatively,

Pace ourselves until we know more

Same store sales growth (including post-acquisition)

10%-15% same store volume growth

Incremental 30%-40% same store revenue margin (subject to change with rates)

Favorable acquisition economics

Agency contribution 20%-25% of revenue, paying 4x-5x (subject to change with rates)

Incremental overhead 2%-3% of revenue

Strong ROI, accretive investments

Follow-on startups enhance returns

Margin implications

Volume-based incremental margin largely offsets rate cuts (case-mix creep adj)

Continue emphasis on efficiency of operations, improved clinical outcomes

EPS implications

Conditions remain for long-term EPS growth as a consolidator

Investment Thesis Remains:

Long-Term EPS Growth as Low Cost Provider

Investment Highlights

Annual revenue run rate now over $275 million

Leading regional home health provider

40+% three year revenue CAGR

Decentralized operating model

Strong capital position

$50 million available for future growth

Disciplined approach to acquisitions driven by seasoned

management

Growing force in consolidating home health care market

13 acquisitions in three years

Three geographic clusters: Northeast, Southeast and Midwest