UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

ALMOST FAMILY, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

April 30, 2004

To Our Stockholders:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of Almost Family, Inc. on Monday, May 24, 2004. The meeting will be held at the Company’s headquarters at 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky, at 9:00 a.m. local time.

Two matters will be voted on at this meeting. Please take the time to read carefully each of the proposals for stockholder action described in the accompanying proxy materials.

Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly completing, signing and dating your proxy form and returning it in the enclosed envelope. If you attend the meeting, you may revoke your proxy and vote your shares in person.

Thank you for your continued support of our company.

Sincerely,

William B. Yarmuth

Chairman of the Board,

President & CEO

ALMOST FAMILY, INC.

9510 Ormsby Station Road, Suite 300

Louisville, Kentucky 40223

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 24, 2004

To the Stockholders:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Almost Family, Inc. (the “Company”), will be held at the Company’s headquarters, 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky, on Monday, May 24, 2004, at 9:00 a.m. local time for the following purposes:

(1) To elect a Board of seven directors to serve until the next annual meeting of stockholders;

(2) To ratify the appointment of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending December 31, 2004; and

(3) To transact such other business as may properly come before the meeting or any adjournments thereof.

A Proxy Statement describing matters to be considered at the Annual Meeting is attached to this Notice. Only stockholders of record at the close of business on April 1, 2004, are entitled to receive notice of and to vote at the meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection for a period of ten days before the meeting at the Company’s offices located at 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky.

By Order of the Board of Directors

C. Steven Guenthner

Secretary

Louisville, Kentucky

April 30, 2004

IMPORTANT

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE WHICH HAS BEEN PROVIDED. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

ALMOST FAMILY, INC.

9510 Ormsby Station Road, Suite 300

Louisville, Kentucky 40223

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 24, 2004

GENERAL INFORMATION

This Proxy Statement and accompanying proxy are being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Almost Family, Inc., a Delaware corporation (the “Company”), to be voted on at the Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments thereof. The Annual Meeting will be held at the Company’s headquarters, at 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky, on Monday, May 24, 2004, at 9:00 a.m., local time, for the purposes set forth in this Proxy Statement and the accompanying Notice of Annual Meeting. This Proxy Statement and accompanying proxy are first being mailed to stockholders on or about April 30, 2004.

The original solicitation of proxies by mail may be supplemented by telephone and other means of communication and through personal solicitation by officers, directors and other employees of the Company, at no compensation. Proxy materials will also be distributed through brokers, custodians and other like parties to the beneficial owners of the Company’s common stock, par value $.10 per share (the “Common Stock”), and the Company will reimburse such parties for their reasonable out-of-pocket and clerical expenses incurred in connection therewith.

RECORD DATE AND VOTING SECURITIES

The Board has fixed the record date (the “Record Date”) for the Annual Meeting as the close of business on April 1, 2004. At the Record Date, there were outstanding 2,296,527 shares of Common Stock (each of which is entitled to one vote per share on all matters to be considered at the Annual Meeting). A majority of the total number of shares of outstanding Common Stock present in person or by proxy is required to constitute a quorum to transact business at the Annual Meeting. Shares of Common Stock represented by properly executed proxies received before the close of voting at the Annual Meeting will be voted as directed by the stockholders, unless revoked as described below. Under Delaware law, proxies marked as abstentions are not counted as votes cast, but will be considered present and entitled to vote to determine if a quorum exists. In addition, shares held in street name that have been designated by brokers on proxy cards as not voted will not be counted as votes cast, but will be considered present and entitled to vote to determine if a quorum exists. If no instructions are given, shares represented by executed but unmarked proxies will be voted FOR election of the individuals nominated as directors and FOR ratification of the selection of Ernst & Young LLP as the Company’s

1

independent auditors for the current fiscal year. If any other matter is brought before the annual meeting, shares represented by proxies will be voted by the proxy holders as directed by a majority of the board of directors.

A stockholder who completes and returns the proxy that accompanies this proxy statement may revoke that proxy at any time before the closing of the polls at the Annual Meeting. A stockholder may revoke a proxy by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to, the Secretary of the Company at the Company’s main office address at any time before the annual meeting. Stockholders may also revoke proxies by delivering a duly executed proxy bearing a later date to the inspector of election at the Annual Meeting before the close of voting, or by attending the Annual Meeting and voting in person. The presence of a stockholder at the Annual Meeting will not automatically revoke the stockholder’s proxy.

SECURITY OWNERSHIP OF PRINCIPAL HOLDERS AND MANAGEMENT

The following table sets forth as of the Record Date certain information with respect to the beneficial ownership of the Company’s Common Stock of (i) each executive officer of the Company named in the Summary Compensation Table set forth herein under “Executive Compensation,” (ii) each director or nominee for director of the Company, (iii) all directors and executive officers as a group and (iv) each person known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock. The Company has no shares of Preferred Stock outstanding.

| | Shares of Common Stock Beneficially Owned (1) | |

Directors and Executive Officers | | Amount and Nature of

Beneficial Ownership | | Percent

of Class | |

| | | | | |

William B. Yarmuth

100 Mallard Creek Road, Suite 400

Louisville, KY 40207 | | 638,048 | (2) | 24.3 | % |

| | | | | |

Mary A. Yarmuth

100 Mallard Creek Road, Suite 400

Louisville, KY 40207 | | 638,048 | (3) | 24.3 | % |

| | | | | |

C. Steven Guenthner | | 105,841 | (4) | 4.5 | % |

| | | | | |

Steven B. Bing | | 8,340 | (5) | | * |

| | | | | |

Donald G. McClinton | | 45,007 | (6) | 1.9 | % |

| | | | | |

Tyree G. Wilburn | | 28,000 | (7) | 1.2 | % |

2

Jonathan D. Goldberg | | 38,617 | (8) | 1.7 | % |

| | | | | |

Wayne T. Smith

155 Franklin Road, Suite 400

Franklin, TN 37027-4600 | | 128,227 | (9) | 5.5 | % |

| | | | | |

W. Earl Reed, III | | 72,278 | (10) | 3.1 | % |

| | | | | |

Patrick T. Lyles | | 55,300 | (11) | 2.4 | % |

| | | | | |

Anne T. Liechty | | 23,806 | (12) | 1.0 | % |

| | | | | |

Directors and Executive Officers as a Group (11 persons) | | 1,139,120 | (13) | 39.9 | % |

| | | | | |

Other Five Percent Beneficial Owners | | | | | |

| | | | | |

Heartland Advisors, Inc.

William J. Nasgovitz

789 North Water Street

Milwaukee, WI 53202 | | 250,000 | (14) | 11.0 | % |

| | | | | |

Yarmuth Family Limited Partnership

100 Mallard Creek Road, Suite 400

Louisville, KY 40207 | | 157,723 | (15) | 6.9 | % |

| | | | | |

David T. Russell

1414 Greenfield Avenue, Apt. 302

Los Angeles, CA 90025 | | 159,932 | | 7.0 | % |

* Represents less than 1% of class.

(1) Based upon information furnished to the Company by the named persons, and information contained in filings with the Securities and Exchange Commission (the “Commission”). Under the rules of the Commission, a person is deemed to beneficially own shares over which the person has or shares voting or investment power or has the right to acquire beneficial ownership within 60 days, and such shares are deemed to be outstanding for the purpose of computing the percentage beneficially owned by such person or group. Unless otherwise indicated, the named person has the sole voting and investment power with respect to the number of shares of Common Stock set forth opposite such person’s name.

(2) Includes 2,962 shares as to which Mr. Yarmuth shares voting and investment power pursuant to a family trust and an option for 250,000 shares vested and exercisable, and 55,000 exercisable options owned by Mrs. Yarmuth in addition to 44,427 shares owned directly by Mrs. Yarmuth.

3

(3) Includes the same ownership components as stated for Mr. Yarmuth.

(4) Includes 55,000 shares subject to currently exercisable options.

(5) Includes 8,000 shares subject to currently exercisable options.

(6) Includes 18,000 shares subject to currently exercisable options and 12,507 phantom shares within the Non-Employee Directors Deferred Compensation Plan.

(7) Includes 18,000 shares subject to currently exercisable options.

(8) Includes 18,000 shares subject to currently exercisable options and 16,617 phantom shares within the Non-Employee Directors Deferred Compensation Plan.

(9) Includes 5,500 shares subject to currently exercisable options and 12,102 phantom shares within the Non-Employee Directors Deferred Compensation Plan.

(10) Includes 16,000 shares subject to currently exercisable options and 6,278 phantom shares within the Non-Employee Directors Deferred Compensation Plan.

(11) Includes 45,000 shares subject to currently exercisable options.

(12) Includes 20,500 shares subject to currently exercisable options.

(13) Includes currently exercisable options held by all directors and executive officers as a group to purchase 509,000 shares of Common Stock and 47,504 phantom shares held by Non-Employee Directors within the Non-Employee Directors Deferred Compensation Plan.

(14) Based upon a Schedule 13G/A filed with the Commission for the year ended December 31, 2003, Heartland Advisors, Inc., and William J. Nasgovitz, President and principal shareholder of Heartland Advisors, Inc., have shared voting and/or dispositive power with respect to 250,000 shares of Common Stock.

(15) Robert N. Yarmuth is the general partner and is the brother of William B. Yarmuth.

4

ITEM 1

ELECTION OF DIRECTORS

At the Annual Meeting, seven directors will be elected to serve until the next annual meeting of stockholders. To be elected, a nominee must receive a plurality of the votes cast in the election at the Annual Meeting. Proxies cannot be voted for a greater number of persons than are named. Although it is not anticipated that any of the nominees listed below will decline or be unable to serve, if that should occur, the proxy holders may, in their discretion, vote for substitute nominees.

Nominees for Election as Directors

Set forth below is a list of Board members who will stand for re-election at the Annual Meeting, together with their ages, all Company positions and offices each person currently holds and the year in which each person joined the Board of Directors.

Name | | Age | | Position

or Office | | Director

Since | |

| | | | | | | |

William B. Yarmuth | | 52 | | Chairman of the Board, President and Chief Executive Officer | | 1991 | |

| | | | | | | |

Steven B. Bing | | 58 | | Director | | 1992 | |

| | | | | | | |

Donald G. McClinton | | 70 | | Director | | 1994 | |

| | | | | | | |

Tyree G. Wilburn | | 51 | | Director | | 1996 | |

| | | | | | | |

Jonathan D. Goldberg | | 53 | | Director | | 1997 | |

| | | | | | | |

Wayne T. Smith | | 58 | | Director | | 1997 | |

| | | | | | | |

W. Earl Reed, III | | 52 | | Director | | 2000 | |

William B. Yarmuth. Mr. Yarmuth has been a director of the Company since 1991, when the Company acquired National Health Industries (“National”), where Mr. Yarmuth was Chairman, President and Chief Executive Officer. After the acquisition, Mr. Yarmuth became the President and Chief Operating Officer of the Company. Mr. Yarmuth became Chairman and CEO in 1992. He was Chairman of the Board, President and Chief Executive Officer of National from 1981 to 1991.

Steven B. Bing. Mr. Bing was elected a director in January 1992. Mr. Bing is a principal and Chief Operating Officer of Prosperitas Investment Partners, L.P., a private investment company located in Louisville, Kentucky. From 1989 to March 1992, Mr. Bing was President of

5

ICH Corporation, an insurance holding company. From 1984 to 1989, he served as Senior Vice President of ICH Corporation. He is also a director of various closely-held business entities.

Donald G. McClinton. Mr. McClinton was elected a director in October 1994. Mr. McClinton was President and part owner of Skylight Thoroughbred Training Center, Inc., a thoroughbred training center, until July 2002, when it was sold. From 1986 to 1994, Mr. McClinton was co-chairman of Interlock Industries, a privately held conglomerate in the metals and transportation industries.

Tyree G. Wilburn. Mr. Wilburn was elected a director in January 1996. Mr. Wilburn is Chairman of the Board, President and Chief Executive Officer of Merit Health Systems, LLC, a private hospital management company. He was a private investor from 1996 to 2002. From 1992 to 1996, Mr. Wilburn was Chief Development Officer of Community Health Systems, Inc., and, most recently, Executive Vice President and Chief Financial and Development Officer. From 1974 to 1992, Mr. Wilburn was with Humana Inc. where he held senior and executive positions in mergers and acquisitions, finance, planning, hospital operations, audit and investor relations. He is also a director of several private companies.

Jonathan D. Goldberg. Mr. Goldberg was elected a director in February 1997. Mr. Goldberg is the managing partner of the law firm of Goldberg and Simpson in Louisville, Kentucky and has served in that capacity since 1991.

Wayne T. Smith. Mr. Smith was elected a director in March 1997. Mr. Smith is Chairman of the Board, President and Chief Executive Officer of Community Health Systems, Inc., having been elected President and then Chief Executive Officer and a director in 1997. Mr. Smith also serves as a director of Praxair, Inc. Mr. Smith was President, Chief Operating Officer and a member of the Board of Directors of Humana Inc. from 1993 to 1996 and served with Humana Inc. from 1973 to 1993 in various capacities, including numerous positions as vice president and divisional president.

W. Earl Reed, III. Mr. Reed was elected a director in November 2000. Mr. Reed has been a partner with The Allegro Group, a healthcare financial advisory firm that advises public and private healthcare organizations, since September 1998. From May 2000 to December 2001, Mr. Reed served as Chairman, President and Chief Executive Officer of Rehab Designs of America Corporation, a private venture capital backed orthotics and prosthetics healthcare company, as part of a turnaround project. Rehab Designs of America Corporation filed a voluntary petition for protection under Chapter 11 of the federal bankruptcy code in February 2001 and emerged in December 2001 after successfully completing its financial restructuring. From 1987 to 1998, Mr. Reed was Chief Financial Officer and member of the board of directors of Vencor, Inc. Vencor filed voluntary petitions for protection under Chapter 11 of the federal bankruptcy code in September 1999 and emerged in April 2001 after successfully completing its financial restructuring.

6

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE SEVEN NOMINEES FOR DIRECTOR OF THE COMPANY.

Meetings of the Board of Directors

The Board met on four occasions during the fiscal year ended December 31, 2003. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board and its committees on which such director served during his period of service. In addition, all members of the Board of Directors are expected to attend the Annual Meeting and did so in 2003.

Committees of the Board of Directors

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee. The Board does not have an executive committee; executive committee functions are performed by the entire Board.

The Board has adopted a written charter for the Audit Committee, which charter sets forth the functions and responsibilities of the Audit Committee. The principal duties of the Audit Committee include appointing the Company’s independent auditors, reviewing the scope of the audit, reviewing the corporate accounting practices and policies with the independent auditors, reviewing with the independent auditors their final report, reviewing with independent auditors overall accounting and financial controls and consulting with the independent auditors. The Audit Committee is currently comprised of three independent directors, as independent is defined in the Nasdaq rules and Rule 10A-3 under the Securities Exchange Act. The members of the Audit Committee are Messrs. Goldberg, Reed (Chair), and Wilburn. The Board has designated Reed as the “audit committee financial expert” within the meaning of the SEC rules. The Audit Committee held eight meetings during the fiscal year ended December 31, 2003.

The principal duties of the Compensation Committee are to review the compensation of directors and officers of the Company and to prepare recommendations and periodic reports to the Board concerning such matters. The Compensation Committee also administers the Company’s employee stock option plans. The members of the Compensation Committee are Messrs. Bing, Goldberg, McClinton (Chair), Reed, Smith and Wilburn. The Compensation Committee held one meeting during the fiscal year ended December 31, 2003.

The Nominating and Corporate Governance Committee was initially formed in March 2004. The Nominating and Corporate Governance Committee exercises general oversight with respect to the governance of the Board of Directors, including with respect to the identification and recommendation to the Board of Directors of proposed nominees for election to the Board. The Board has adopted a written charter for the Nominating and Corporate Governance Committee, which charter sets forth the functions and responsibilities of the Nominating and

7

Corporate Governance Committee. A copy of the Nominating and Corporate Governance Committee charter is an appendix to this proxy statement. This newly formed committee will consider the establishment of a process for shareholders to send communications to the Board of Directors. The Nominating and Corporate Governance Committee is currently comprised of three independent directors, as independent is defined in the Nasdaq rules: Bing, Goldberg (Chair) and Wilburn. The Nominating and Corporate Governance Committee will submit nominees to be considered for election to the Board of Directors, beginning with the annual meeting of shareholders scheduled for 2005. In 2004, the entire Board of Directors approved the nominees to be considered for election. All nominees served as directors during 2003.

The Nominating and Corporate Governance Committee will consider shareholder recommendations for director nominees at the 2005 Annual Meeting if shareholders comply with the requirements of the Company’s by-laws. Shareholders should submit nominations, if any, not less than 30 days before the 2005 Annual Meeting, to the Company’s Corporate Secretary, at 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky, 40223. The Company does not pay a third party fee to assist in identifying and evaluating nominees, but the Company does not preclude the potential for using such services if needed as may be determined at the discretion of the Nominating and Corporate Governance Committee.

Compensation of Directors

Directors who are not also employees of the Company are entitled to compensation at a rate of $2,000 for each Board of Directors meeting attended, $500 for each independently scheduled committee meeting attended, other than the Audit Committee, and $2,000 for each independently scheduled Audit Committee meeting attended. In addition, non-employee directors are eligible to receive stock options under the Almost Family, Inc. 1993 Stock Option Plan for Non-Employee Directors (the “Directors’ Plan”) adopted by the Board on February 17, 1993, and subsequently approved by stockholders. There were no grants under the Directors’ Plan in the fiscal year ended December 31, 2003.

William Yarmuth Employment Agreement

The Company has a year-to-year employment agreement with William B. Yarmuth, its Chairman of the Board, President and Chief Executive Officer. Under the terms of the agreement, Mr. Yarmuth earned an annual base salary of $250,000 in fiscal 2003. In addition, Mr. Yarmuth is eligible for a performance based cash incentive of 50% of his annual base salary. The agreement includes a covenant not to compete for a period of two years following Mr. Yarmuth’s termination as an employee of the Company and potential termination payments to Mr. Yarmuth of two times his then current annual salary.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of stock ownership and reports of changes in stock ownership and to provide the Company with

8

copies of all such filed forms. Based solely on its review of such copies or written representations from reporting persons, the Company believes that all reports were filed on a timely basis during fiscal 2003.

EXECUTIVE COMPENSATION

On September 14, 2001, the Company changed its fiscal year end from March 31 to December 31. The following table sets forth information concerning compensation paid by the Company for services rendered in all capacities during the years ended December 31, 2003 and 2002, the nine months ended December 31, 2001, and the fiscal year ended March 31, 2001, to the Chief Executive Officer and the four other most highly compensated executive officers earning over $100,000 in salary and bonus. For purposes of the presentation, the 2001-9M amounts reflect the nine months ended December 31, 2001. Bonus amounts for 2003 reflect the executive officers’ portion of a discretionary holiday bonus.

Summary Compensation Table

| | | | | | | | Long-Term

Compensation | |

Name and Principal Position | | Year | | | | | | Securities

Underlying

Options

(No. of Shares) | |

| | |

Annual Compensation |

Salary | | Bonus |

| | | | | | | | | |

William B. Yarmuth | | 2003 | | $ | 250,000 | | $ | 0 | | 0 | |

Chairman of the Board, | | 2002 | | 250,000 | | 0 | | 0 | |

President and Chief | | 2001-9M | | 172,022 | | 0 | | 0 | |

Executive Officer | | 2001 | | 190,000 | | 99,750 | | 100,000 | |

| | | | | | | | | |

C. Steven Guenthner | | 2003 | | $ | 169,950 | | $ | 1,148 | | 0 | |

Senior Vice President | | 2002 | | 167,285 | | 0 | | 0 | |

Secretary/Treasurer and | | 2001-9M | | 118,551 | | 0 | | 0 | |

Chief Financial Officer | | 2001 | | 136,638 | | 51,736 | | 20,000 | |

| | | | | | | | | |

Mary A. Yarmuth | | 2003 | | $ | 154,500 | | $ | 1,148 | | 0 | |

Senior Vice President - | | 2002 | | 152,077 | | 0 | | 0 | |

Service Development | | 2001-9M | | 110,185 | | 0 | | 0 | |

| | 2001 | | 136,638 | | 51,736 | | 20,000 | |

9

Patrick T. Lyles | | 2003 | | $ | 139,050 | | $ | 1,148 | | 0 | |

Senior Vice President | | 2002 | | 136,869 | | 0 | | 0 | |

| | 2001-9M | | 99,770 | | 0 | | 0 | |

| | 2001 | | 126,079 | | 31,826 | | 10,000 | |

| | | | | | | | | |

Anne T. Liechty | | 2003 | | $ | 139,050 | | $ | 1,148 | | 0 | |

Senior Vice President – | | 2002 | | 136,869 | | 20,000 | | 0 | |

Visiting Nurse Operations | | 2001-9M | | 95,481 | | 0 | | 0 | |

OPTION GRANTS IN FISCAL YEAR 2003

There were no grants of stock options to the executive officers named in the Summary Compensation Table in the fiscal year ended December 31, 2003.

EXECUTIVE COMPENSATION PLAN TABLE

The Company maintains plans under which options to purchase our common stock are granted to officers, directors, and key employees. The exercise price for options is generally the fair market value of the Company’s Common Stock on the date of grant. Exercise provisions vary, but most options vest in whole or in part from one to three years from date of grant and expire ten years after date of grant.

Information concerning stock options awards, and number of securities remaining available for future issuance under our equity compensation plans in effect as of December 31, 2003 follows:

Plan category | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average exercise

price of outstanding

options, warrants and

rights | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)) | |

| | (a) | | (b) | | (c) | |

| | | | | | | | |

Equity compensation plans approved by security holders | | 563,500 | | $ | 3.40 | | 428,493 | (1) |

| | | | | | | |

Equity compensation plans not approved by security holders | | 0 | | $ | 0 | | 0 | |

| | | | | | | |

Total | | 563,500 | | $ | 3.40 | | 428,493 | |

(1) No stock options have been granted since December 31, 2003.

10

OPTION EXERCISES IN FISCAL 2003 AND DECEMBER 31, 2003 VALUES

Executive officers exercised stock options during the year ended December 31, 2003 as set forth below. In addition, set forth below is information with respect to the number and value of unexercised stock options held by the executive officers named in the summary Compensation Table at December 31, 2003.

Name | | Shares

Acquired on

Exercise | | Value

Realized | | Number of

Securities

Underlying

Unexercised

Options At

December 31,

2003 Exercisable/

Unexercisable | | Value of

Unexercised In-

The-Money At

December 31, 2003

Exercisable/

Unexercisable(1) | |

| | | | | | | | | | | | | |

William B. Yarmuth | | 0 | | $ | 0 | | 225,000 | | 25,000 | | $ | 1,345,000 | | $ | 117,500 | |

| | | | | | | | | | | | | |

C. Steven Guenthner | | 0 | | 0 | | 50,000 | | 5,000 | | 300,625 | | 23,500 | |

| | | | | | | | | | | | | |

Mary A. Yarmuth | | 12,000 | | 26,580 | | 50,000 | | 5,000 | | 300,625 | | 23,500 | |

| | | | | | | | | | | | | |

Patrick T. Lyles | | 0 | | 0 | | 42,500 | | 2,500 | | 263,188 | | 11,750 | |

| | | | | | | | | | | | | |

Anne T. Liechty | | 0 | | 0 | | 18,000 | | 2,500 | | 104,944 | | 11,750 | |

| | | | | | | | | | | | | | | | |

(1) These amounts represent the market value less the exercise price. The market value of the Common Stock was $8.95 based on the closing bid price per share at December 31, 2003, on the Nasdaq Small Cap System.

11

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Compensation Policies

The Compensation Committee of the Board of Directors is comprised of Messrs. Bing, Goldberg, McClinton, Reed, Smith and Wilburn, each a non-employee director of the Company. The Compensation Committee is responsible for advising the Board of Directors on matters relating to the compensation of the Company’s executive officers and administering the Company’s stock option plans. Set forth below is a report submitted by the Compensation Committee describing its compensation policies and the committee’s decisions relating to compensation of executive officers during the 2003 fiscal year.

The Compensation Committee’s policies concerning the compensation of the Company’s executive officers are summarized as follows:

• Compensation awarded by the Company should be effective in attracting, motivating and retaining key executives;

• Executive officers of the Company should be compensated at a level which is comparable to other executives with similar skills and qualifications; and

• The Company’s compensation programs should give executive officers a financial interest in the Company similar to the interests of the Company’s stockholders.

The Company’s executive officers are compensated through a combination of salary, annual bonuses (when appropriate) and grants of stock options under the Company’s option plans. The annual salaries of the Company’s executives are reviewed from time to time by the Compensation Committee. The Compensation Committee recommends to the Board of Directors that adjustments be made where necessary in order for the annual salaries of the Company’s executives to be competitive with the salaries of other executives with similar skills and qualifications. Officers of the Company are eligible for performance based cash incentives based on the Compensation Committee’s subjective determination of performance in conjunction with a review of the Company’s achievement of annual goals and objectives established by the Compensation Committee. For fiscal 2003 the goals and objectives related to meeting earnings targets. Based on these goals and objectives, with respect to the 2003 fiscal year, no performance based cash incentives were paid to the Company’s executive officers.

The Compensation Committee periodically grants stock options under the Company’s option plans in order to provide executive officers and other employees with an additional incentive to strive for the success of the Company’s business so as to increase the price of the Company’s Common Stock. The Compensation Committee believes that stock options are a valuable tool in encouraging executive officers to align their interests with the interests of the stockholders and to manage the Company for the long term. With respect to the 2003 fiscal year, the Compensation Committee granted options for no shares of Common Stock to the executive officers named in the Summary Compensation Table. The Compensation Committee determined

12

the number of options granted to the executive officers based upon its subjective evaluation of the performance and responsibilities of each of the officers.

Compensation of the Chief Executive Officer

William B. Yarmuth, the Chairman, President and Chief Executive Officer of the Company, is eligible to participate in the same executive compensation plans available to the Company’s other executive officers. Mr. Yarmuth’s salary of $250,000 for the 2003 fiscal year was determined pursuant to his employment agreement. Mr. Yarmuth received no bonus during 2003. See discussion regarding incentive compensation under “Compensation Policies” above.

OBRA Deductibility Limitation

Under the Omnibus Budget Reconciliation Act of 1993 (“OBRA”), subject to certain exceptions and transition provisions, the allowable deduction for compensation paid or accrued with respect to the chief executive officer and each of the four most highly compensated executive officers of a publicly held corporation, is limited to $1 million per year, per executive officer. The Company has determined not to take any actions at this time with respect to its compensation plans that might be necessary to exempt compensation under such plans from the OBRA deductibility limitation.

Compensation Committee: | | Steven B. Bing |

| | Jonathan D. Goldberg |

| | Donald G. McClinton |

| | W. Earl Reed, III |

| | Wayne T. Smith |

| | Tyree G. Wilburn |

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed of three directors, all of whom meet the current Nasdaq Marketplace Rules test for independence. The Committee acts under a written charter adopted by the Board of Directors. The Audit Committee has prepared the following report on its activities with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2003 (the “audited financial statements”).

• The Audit Committee reviewed and discussed the Company’s audited financial statements with management;

• The Audit Committee discussed with Ernst & Young LLP, the Company’s independent auditors for the fiscal year ended December 31, 2003, the matters required to be discussed by Statements on Auditing Standards No. 61 (Communication with Audit Committees);

• The Audit Committee received the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), discussed with Ernst & Young LLP its independence from the

13

Company and its management, and considered whether Ernst & Young LLP’s provision of non-audit services to the Company was compatible with the auditor’s independence; and

• Based on the review and discussion referred to above, and in reliance thereon, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, for filing with the U.S. Securities and Exchange Commission.

Audit Committee: | | Jonathan D. Goldberg |

| | W. Earl Reed, III |

| | Tyree G. Wilburn |

Fees Paid to the Independent Auditors

Audit Fees

Ernst & Young LLP charged to the Company an aggregate amount of $160,000 and $153,700 for professional services rendered for fiscal year 2003 and fiscal year 2002, respectively, for the audit of the Company’s annual financial statements, the reviews of the Company’s financial statements included in the Company’s reports on Form 10-Q, and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees

Ernst & Young LLP charged to the Company an aggregate amount of $9,000 and $27,145 for assurance and related services rendered for fiscal year 2003 and fiscal year 2002, respectively, that are reasonably related to the performance of the audit or review of the Company’s financial statements other than the fees disclosed in the foregoing paragraph.

Tax Fees

Ernst & Young LLP charged to the Company an aggregate amount of $81,105 and $49,950 for professional services rendered for fiscal year 2003 and fiscal year 2002, respectively, for tax compliance, tax advice, and tax planning.

All Other Fees

Ernst & Young LLP did not bill the Company for any fees for products and services rendered in 2003 and 2002, other than those reported in the foregoing paragraphs.

Pre-Approval Policies and Procedures

During fiscal year 2003, the Audit Committee approved all audit, audit related and non-audit services provided to the Company by Ernst & Young LLP before management engaged the

14

auditor for those purposes. The Audit Committee’s current practice is to consider for pre-approval all audit, audit related and non-audit services proposed to be provided by our independent auditors for the fiscal year.

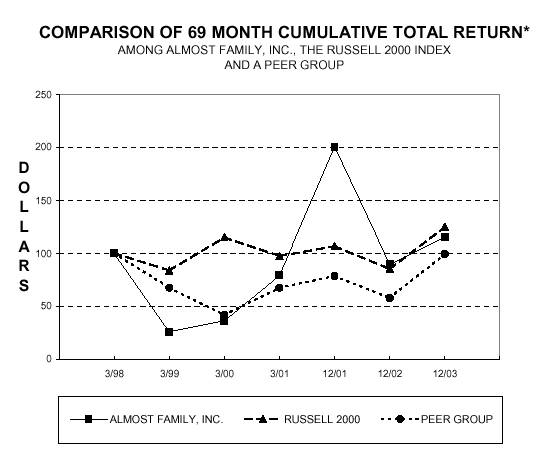

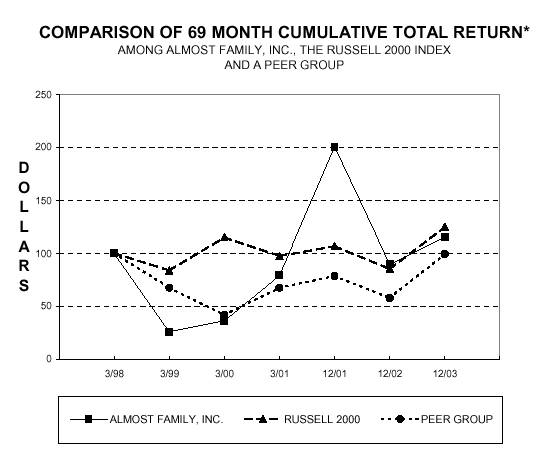

COMPARISON OF FIVE-YEAR CUMULATIVE STOCKHOLDER RETURN

The graph that follows compares the cumulative return experienced by holders of the Company’s Common Stock during the last five fiscal years and the nine months ended December 31, 2001 to the returns of the Russell 2000 Index and the returns of a peer group index comprised of other publicly-traded companies within the healthcare industry. The graph assumes the investment of $100 on March 31, 1998 in the Company’s Common Stock and each of the indices, and the reinvestment of all dividends paid during the period of the securities comprising the indices.

In addition to the Company, the peer group includes the following companies: Amedisys Inc.; Apria Healthcare Group Inc.; Beverly Enterprises Inc.; Gentiva Health Services Inc.; ManorCare Inc.; National Home Health Care Corporation; New York Health Care Inc.; Res-Care, Inc.; and Sunrise Assisted Living Inc.

15

ALMOST FAMILY INC

| | Cumulative Total Return | |

| | 3/98 | | 3/99 | | 3/00 | | 3/01 | | 12/01 | | 12/02 | | 12/03 | |

| | | | | | | | | | | | | | | |

ALMOST FAMILY, INC. | | 100.00 | | 25.81 | | 36.30 | | 79.03 | | 200.00 | | 89.55 | | 115.48 | |

RUSSELL 2000 | | 100.00 | | 83.74 | | 114.98 | | 97.35 | | 106.71 | | 84.86 | | 124.95 | |

PEER GROUP | | 100.00 | | 67.45 | | 41.68 | | 67.38 | | 78.47 | | 57.73 | | 99.26 | |

16

ITEM 2

RATIFICATION OF INDEPENDENT AUDITOR

Pursuant to prior authorization of the Company’s Board of Directors, the Audit Committee has appointed the firm of Ernst & Young LLP to serve as the independent public accountants to audit the financial statements of the Company for the year ended December 31, 2004. Accordingly, a resolution will be presented at the Annual Meeting to ratify the appointment of Ernst & Young LLP. If the stockholders fail to ratify the appointment of Ernst & Young LLP, the Audit Committee will reconsider such appointment. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its stockholders. One or more representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Pursuant to prior authorization of the Company’s Board of Directors, the Audit Committee dismissed Arthur Andersen LLP as the Company’s independent certifying accountants on May 30, 2002. The reports of Arthur Andersen LLP on the Company’s financial statements for the nine-months ended December 31, 2001, and the fiscal years ended March 31, 2001 and March 31, 2000 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. In connection with the audit of the Company’s financial statements for the nine-months ended December 31, 2001, and the fiscal years ended March 31, 2001 and March 31, 2000 and through May 30, 2002, there were no disagreements with Arthur Andersen LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedures which, if not resolved to the satisfaction of Arthur Andersen LLP, would have caused the firm to make reference to the matter in their report. During the period ended December 31, 2001, and the fiscal years ended March 31, 2001 and March 31, 2000, and the subsequent interim period preceding the dismissal of Arthur Andersen LLP on May 30, 2002, no reportable events (as defined in the SEC’s Regulation S-K Item 304(a)(1)(v)) occurred in connection with the relationship between Arthur Andersen LLP and the Company, except as referred to in the next sentence. The Company’s consolidated balance sheet as of March 31, 2001 and the related consolidated statement of operations, stockholders’ equity and cash flows for the two years in the period ended March 31, 2001 were restated as indicated in Arthur Andersen LLP’s report included in the Company’s Form 10-K for the period ending December 31, 2001. Representatives of Arthur Andersen LLP are not expected to be present at the Annual Meeting, and therefore will not have the opportunity to make a statement if they desire to do so, and will not be available to respond to appropriate questions.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITOR FOR THE FISCAL YEAR ENDING DECEMBER 31, 2004.

17

STOCKHOLDER PROPOSALS

Under Rule 14a-8 promulgated under the Exchange Act, stockholders may present proposals to be included in the Company proxy statement for consideration at the next annual meeting of its stockholders by submitting their proposals to the Company in a timely manner. Any such proposal must comply with Rule 14a-8.

The Company’s by-laws, copies of which are available from the Company’s Secretary, require stockholders who intend to propose business for consideration by stockholders at an annual meeting, other than stockholder proposals that are included in the proxy statement, to give written notice to the President or Secretary of the Company not less than thirty days before the annual meeting. This notice must include a brief description of the business desired to be brought before the annual meeting, any material interest the stockholder has in such business, the name and address of the stockholder as they appear on the Company’s books and the class and number of shares of Common Stock the stockholder beneficially owns. This notice must also include the name, address and share holdings of any other stockholders known by the proposing stockholder to support such proposal. Similar requirements are set forth in the Company’s by-laws with respect to stockholders desiring to nominate candidates for election as director. If a stockholder submitting a matter to be raised at the Company’s next annual meeting or a candidate for election as director desires that such matter or candidate be included in the Company’s proxy statement, such matter or candidate must be submitted to the Company no later than December 23, 2004.

SEC rules set forth standards for what stockholder proposals the Company is required to include in a proxy statement for an annual meeting.

18

FORM 10-K

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, accompanies this Proxy Statement. Stockholders may obtain copies of exhibits at $0.25 per page to cover the Company’s costs in furnishing such copies by sending a written request to C. Steven Guenthner, Almost Family, Inc., 9510 Ormsby Station Road, Suite 300, Louisville, Kentucky 40223.

OTHER BUSINESS

The Board of Directors is not aware of any other matters to be presented at the Annual Meeting other than those set forth in the Notice of Annual Meeting and routine matters incident to the conduct of the meeting. If any other matters should properly come before the Annual Meeting or any adjournment or postponement thereof, the persons named in the proxy, or their substitutes, intend to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors

C. Steven Guenthner

Secretary

Louisville, Kentucky

April 30, 2004

19

Appendix

Almost Family, Inc.

Charter of the Nominating and Corporate Governance Committee

I. Mission

The Nominating and Corporate Governance Committee exercises general oversight with respect to the governance of the Board of Directors, including with respect to the identification and recommendation to the Board of Directors of proposed nominees for election to the Board.

II. Organization

The Nominating and Corporate Governance Committee shall be composed of at least three directors, each of whom shall be an “independent director” as defined by the rules of the Nasdaq Stock Market. At least one member of the Committee shall be a member of the Board’s Audit Committee. The Committee shall meet at least one time per year.

III. Authority and Responsibilities

The Nominating and Corporate Governance Committee exercises general oversight with respect to the Board of Directors as set forth herein. It reviews the qualifications of and recommends to the Board of Directors proposed nominees for election to the Board. It is also responsible for leading the Board in its annual review of the Board’s performance.

The Committee, to the extent it deems necessary or appropriate, will:

• make recommendations to the full Board regarding its size and composition and the tenure of directors.

• evaluate the skills and expertise needed by the Board in light of the skills and expertise of the current directors.

• identify individuals qualified to become directors of the Corporation; recommend to the Board nominees to fill vacancies on the Board and the nominees to stand for election (or re-election) as directors at the next annual meeting of shareholders (or, if applicable, a special meeting of shareholders); and have sole authority to engage any search firm retained to identify director candidates, including sole authority to approve the search firm’s fees and other engagement terms.

• periodically assess and make recommendations to the Board regarding both the independence of directors under applicable law and the rules of the Nasdaq Stock Market, and service by the Corporation’s directors and executive officers on the boards of other companies and organizations.

20

• review the duties and composition of the committees of the Board, and identify and make recommendations to the Board regarding directors qualified to serve on and chair those committees, taking into account the following criteria, as applicable:

• Nasdaq Stock Market criteria for composition of the Audit Committee;

• criteria for composition of the Compensation Committee under Nasdaq Stock Market rules, Section 162(m) of the Internal Revenue Code and Section 16 of the Securities Exchange Act of 1934; and

• such other criteria and factors as the Nominating and Corporate Governance Committee deems appropriate.

• review and make recommendations to the Board regarding the appointment of officers.

• review proposals and nominations by shareholders and proposed responses.

• periodically appraise Board performance and lead Board self-evaluation discussion.

• annually review and assess its performance and charter and recommends to the Board any proposed changes to the Nominating and Corporate Governance Committee charter.

21