SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q/A

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2008

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ________________

Commission File Number 0-17325

(Exact name of registrant as specified in its charter)

| Colorado | 88-0218499 |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

5444 Westheimer Road

Suite1440

Houston, Texas 77056

(Address of principal executive offices, including zip code)

(713) 626-4700

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Large Accelerated Filer o | Accelerated Filer x | Non-Accelerated Filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

The number of shares of common stock, par value $0.0001 per share, outstanding as of July 31, 2008 was 722,238,550

ERHC ENERGY INC.

| Part I. Financial Information | Page |

| | | |

| | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

Part II. Other Information | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | | |

Forward-Looking Statements

ERHC Energy Inc. (the “Company”) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements that are “forward-looking statements”. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain or be identified by the words “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “believe,” “should,” “could,” “may,” “might,” “will,” “will be,” “will continue,” “will likely result,” “project,” “forecast,” “budget” and similar expressions. Statements made by the Company in this report that contain forward-looking statements include, but are not limited to, information concerning the Company’s possible or assumed future business activities and results of operations and statements about the following subjects:

| | — | future development of concessions, exploitation of assets and other business operations; |

| | — | future market conditions and the effect of such conditions on the Company’s future activities or results of operations; |

| | — | future uses of and requirements for financial resources; |

| | — | interest rate and foreign exchange risk; |

| | — | future contractual obligations; |

| | — | outcomes of legal proceedings including, without limitation, the ongoing investigations of the Company; |

| | — | future operations outside the United States; |

| | — | expected financial position; |

| | — | future liquidity and sufficiency of capital resources; |

| | — | budgets for capital and other expenditures; |

| | — | plans and objectives of management; |

| | — | compliance with applicable laws; and |

| | — | adequacy of insurance or indemnification. |

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

| | — | general economic and business conditions; |

| | — | worldwide demand for oil and natural gas; |

| | — | changes in foreign and domestic oil and gas exploration, development and production activity; |

| | — | oil and natural gas price fluctuations and related market expectations; |

| | — | termination, renegotiation or modification of existing contracts; |

| | — | the ability of the Organization of Petroleum Exporting Countries, commonly called OPEC, to set and maintain production levels and pricing, and the level of production in non-OPEC countries; |

| | — | policies of the various governments regarding exploration and development of oil and gas reserves; |

| | — | advances in exploration and development technology; |

| | — | the political environment of oil-producing regions; |

| | — | political instability in the Democratic Republic of Sao Tome and Principe and the Federal Republic of Nigeria; |

| | — | changes in foreign, political, social and economic conditions; |

| | — | risks of international operations, compliance with foreign laws and taxation policies and expropriation or nationalization of equipment and assets; |

| | — | risks of potential contractual liabilities; |

| | — | foreign exchange and currency fluctuations and regulations, and the inability to repatriate income or capital; |

| | — | risks of war, military operations, other armed hostilities, terrorist acts and embargoes; |

| | — | regulatory initiatives and compliance with governmental regulations; |

| | — | compliance with environmental laws and regulations; |

| | — | compliance with tax laws and regulations; |

| | — | effects of litigation and governmental proceedings; |

| | — | cost, availability and adequacy of insurance; |

| | — | adequacy of the Company’s sources of liquidity; |

| | — | labor conditions and the availability of qualified personnel; and |

| | — | various other matters, many of which are beyond the Company’s control. |

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”) include additional factors that could adversely affect the Company’s business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements. Forward-looking statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations with regard to the statement or any change in events, conditions or circumstances on which any forward-looking statement is based.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

(A CORPORATION IN THE DEVELOPMENT STAGE)

UNAUDITED CONSOLIDATED BALANCE SHEETS

June 30, 2008 and September 30, 2007

| | | June 30, | | | September 30, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

Cash and cash equivalents | | | | | | | | |

Prepaid expenses and other current assets | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

Furniture and equipment, net | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | |

Accounts payable and accrued liabilities | | | | | | | | |

Accounts payable and accrued liabilities, related parties | | | | | | | | |

| | | | | | | | |

Asset retirement obligation | | | | | | | | |

Current portion of convertible debt | | | | | | | | |

| | | | | | | | | |

Total current liabilities | | | | | | | | |

| | | | | | | | | |

Commitments and contingencies: | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

Preferred stock, par value $0.0001; authorized 10,000,000; none issued and outstanding | | | | | | | | |

Common stock, par value $0.0001; authorized 950,000,000 shares; issued and outstanding 722,238,550 and 721,938,550 at June 30, 2008 and September 30, 2007, respectively | | | | | | | | |

Additional paid-in capital | | | | | | | | |

Deficit accumulated in the development stage | | | | | | | | |

| | | | | | | | | |

Total shareholders’ equity | | | | | | | | |

| | | | | | | | | |

Total liabilities and shareholders' equity | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements

(A CORPORATION IN THE DEVELOPMENT STAGE)

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three Months and Nine Months Ended June 30, 2008 and 2007 and for the Period from Inception,

September 5, 1995, to June 30, 2008

| | | | | | | | | | | | | | | Inception to | |

| | | Three Months Ended June 30, | | | Nine Months Ended June 30, | | | June 30, | |

| | | 2007 | | | 2008 | | | 2007 | | | 2008 | | | 2008 | |

| | | | | | | | | | | | | | | | |

| Operating costs and expenses: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

General and administrative expenses | | | | | | | | | | | | | | | | | | | | |

Depreciation, depletion and amortization | | | | | | | | | | | | | | | | | | | | |

Write-offs and abandonments | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Other income and (expenses): | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Gain (loss) from settlement | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Gain from sale of partial interest in DRSTP concession | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Loss on extinguishment of debt | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Total other income and expenses, net | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Loss before benefit for income | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Total benefit for income taxes | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net loss per common share - basic and diluted | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding - basic and dilute diluted | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the consolidated financial statements

(A CORPORATION IN THE DEVELOPMENT STAGE)

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Nine Months Ended June 30, 2008 and 2007 and for the Period from Inception,

September 5, 1995, to June 30, 2008

| | | | | | | | | Inception to | |

| | | | | | | | | June 30, | |

| | | 2007 | | | 2008 | | | 2008 | |

| | | | | | | | | | |

| Cash Flows from Operating Activities | | | | | | | | | |

| | | | | | | | | | | | |

Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | | | | | |

Depreciation, depletion and amortization expenses | | | | | | | | | | | | |

Write-offs and abandonments | | | | | | | | | | | | |

| | | | | | | | | | | | |

Compensatory stock options | | | | | | | | | | | | |

| | | | | | | | | | | | |

Gain on sale of partial interest in DRSTP concession | | | | | | | | | | | | |

Amortization of beneficial conversion feature associated with convertible debt | | | | | | | | | | | | |

Amortization of deferred compensation | | | | | | | | | | | | |

Common stock issued for services | | | | | | | | | | | | |

Common stock issued for settlements | | | | | | | | | | | | |

Common stock issued for officer bonuses | | | | | | | | | | | | |

Common stock issued for interest and penalties on convertible debt | | | | | | | | | | | | |

Common stock issued for board compensation | | | | | | | | | | | | |

Loss on extinguishment of debt | | | | | | | | | | | | |

Changes in operating assets and liabilities: | | | | | | | | | | | | |

Prepaid expenses and other current assets | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Accounts payable and other accrued liabilities | | | | | | | | | | | | |

Accrued federal income taxes | | | | | | | | | | | | |

Accounts payable, and accrued liabilities, related party | | | | | | | | | | | | |

Accrued interest - related party | | | | | | | | | | | | |

Accrued retirement obligation | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net cash used by operating activities | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | | | | | |

Purchase of DRSTP concession | | | | | | | | | | | | |

Proceeds from sale of partial interest in DRSTP concession | | | | | | | | | | | | |

Purchase of furniture and equipment | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net cash provided (used) by investing activities | | | | | | | | | | | | |

The accompanying notes are an integral part of the consolidated financial statements

ERHC ENERGY INC.

(A CORPORATION IN THE DEVELOPMENT STAGE)

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Nine Months Ended June 30, 2008 and 2007 and for the Period from Inception,

September 5, 1995, to June 30, 2008

| | | | | | | | | Inception to | |

| | | | | | | | | June 30, | |

| | | 2007 | | | 2008 | | | 2008 | |

| | | | | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | | |

Proceeds from warrants exercised | | | | | | | | | | | | |

Proceeds from common stock, net of expenses | | | | | | | | | | | | |

Proceeds from related party line of credit | | | | | | | | | | | | |

Proceeds from related party debt | | | | | | | | | | | | |

Proceeds from related party convertible debt | | | | | | | | | | | | |

Proceeds from convertible debt | | | | | | | | | | | | |

Proceeds from note payable to bank | | | | | | | | | | | | |

Proceeds from shareholder loans | | | | | | | | | | | | |

Collection of stock subscription receivable | | | | | | | | | | | | |

Repayment of shareholder loans | | | | | | | | | | | | |

Repayment of long-term debt | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net cash provided by financing activities | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Cash and cash equivalents, beginning of period | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Cash and cash equivalents, end of period | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Supplemental Disclosure of Cash Flow Information | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Cash paid for interest expense | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Cash paid for income taxes | | | | | | | | | | | | |

The accompanying notes are an integral part of the consolidated financial statements

(A CORPORATION IN THE DEVELOPMENT STAGE)

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation and Business Organization

The consolidated financial statements included herein, which have not been audited pursuant to the rules and regulations of the Securities and Exchange Commission, reflect all adjustments which, in the opinion of management, are necessary to present a fair statement of the results for the interim periods on a basis consistent with the annual audited financial statements. All such adjustments are of a normal recurring nature. The results of operations for the interim periods are not necessarily indicative of the results to be expected for an entire year. Certain information, accounting policies and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such rules and regulations, although ERHC Energy Inc. (“ERHC” or the “Company”) believes that the disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2007.

Note 2 – Sao Tome Concession

In April 2003, the Company and the Democratic Republic of Sao Tome and Principe (“DRSTP”) entered into an Option Agreement (the “2003 Option Agreement”) in which the Company relinquished certain financial interests in the JDZ in exchange for exploration rights in the JDZ. The Company additionally entered into an administration agreement with the Nigeria-Sao Tome and Principe Joint Development Authority (“JDA”). The administration agreement is the formal agreement by the JDA that it will fully implement ERHC’s preferential rights to working interests in the JDZ acreage as set forth in the 2003 Option Agreement and describes certain procedures regarding the exercising of these rights. ERHC retained under a previous agreement the following rights to participate in exploration and production activities in the EEZ subject to certain restrictions: (a) the right to receive up to two blocks of ERHC’s choice and (b) the option to acquire up to a 15% paid working interest in up to two blocks of ERHC’s choice in the EEZ. The Company would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The following represents ERHC’s current rights in the JDZ blocks.

| JDZ Block # | | ERHC Original Participating Interest(1) | | ERHC Joint Bid Participating Interest | | Participating Interest(s) Sold | | Current ERHC Retained Participating Interest |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (1) | Original Participating Interest granted pursuant to the Option Agreement, dated April 2, 2003, between DRSTP and ERHC (the “2003 Option Agreement”). |

| (2) | In March 2006, ERHC sold an aggregate 28.67% participating interest to Sinopec and an aggregate 14.33% participating interest to Addax Ltd. |

| (3) | In February 2006, ERHC sold a 15% participating interest to Addax Sub. |

| (4) | By a Participation Agreement made in November 2005 and subsequently amended, ERHC sold 33.3% participating interest to Addax. In July 2008, Addax received a further 7.2% participating interest without any futher consideration due from Addax to ERHC. The additional 7.2% arose from the recovery of 9% from Godsonic due to Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. Pursuant to the Amendment to the Participation Agreement made on April 11, 2006 |

| (5) | No contracts have been entered into as of the date hereof. ERHC’s goal is to enter into agreements to exploit its interests in Blocks 5, 6 and 9. Additionally, the Company intends to exploit its rights in the EEZ. |

| (6) | Includes the 1.8%, out of 9% reclaimed by ERHC from Godsonic by ERHC on behalf of the ERHC/Addax consortium following Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. Pursuant to the Amendment to the Participation Agreement made on April 11, 2006, the 9% was distributed between Addax (7.2%) and ERHC (1.8%). In July 2008, the London Court of International Arbitration (LCIA) confirmed that under the Participation Agreement between the parties no further consideration is payable by Addax Petroleum to ERHC for Addax Petroleum’s 7.2 percent share of the 9 percent. |

Particulars of Participating Agreements:

| Date of Participation Agreement | Parties | Key Terms |

| JDZ Block 2 Participation Agreement |

| March 2, 2006 | 1a. Sinopec International Petroleum Exploration and Production Co. Nigeria Ltd 1b. Sinopec International Petroleum and Production Corporation 2a. Addax Energy Nigeria Limited 2b. Addax Petroleum Corporation 3. ERHC Energy Inc | ERHC assigns 28.67% of participating interest to Sinopec International Petroleum Exploration and Production Co Nigeria Ltd (“Sinopec”) and a 14.33% participating interest to Addax Energy Nigeria Limited (“Addax”) leaving ERHC with a 22% participating interest. .1 Consideration from Sinopec to ERHC for the 28.67% interest (the “SINOPEC assigned interest”) is $13.6 million. Consideration from Addax to ERHC for the 14.33% interest (the “Addax assigned interest”) is $6.8 million In addition, Sinopec and Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 22% interest retained by ERHC (the “retained interest”) in Block 2. Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interest on Block 2 until Sinopec and Addax Sub recover 100% of the carried costs. |

| JDZ Block 3 Participation Agreement |

| February 15, 2006 | 1. ERHC Energy Inc 2a. Addax Petroleum Resources Nigeria Limited 2b. Addax Petroleum Corporation | ERHC assigns 15% of participating interest to Addax Petroleum Resources Nigeria Limited (“Addax Sub”) leaving ERHC with a 10% participating interest. Consideration from Addax Sub to ERHC for the 15% interest (the “acquired interest”) is $7.5 million. In addition, Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 10% interest retained by ERHC (the “retained interest”) in Block 3. Addax is entitled to 100% of ERHC’s future costs in respect of petroleum operations. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax Sub recovers 100% of the carried costs. |

| JDZ Block 4 Participation Agreement |

| November 17, 2005 | 1. ERHC Energy Inc 2a.Addax Petroleum Nigeria (Offshore 2) Limited 2b. Addax Petroleum NV | ERHC sold 33.3% and assigned additional 7.2% of participating interest to Addax Petroleum Nigeria (Offshore 2) Limited (“Addax”) (leaving ERHC with a 19.5% participating interest). (1) Consideration from Addax Sub to ERHC for the interest acquired by Addax (the “acquired interest”) is fixed at $18 million. In addition, Addax will pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC’s retained interest in Block 4. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax recovers 100% of the carried costs. |

| (1) | By an Amendment to the Participation Agreement dated February 23, 2006, ERHC and Addax amended the Participation Agreement so that the assigned interest to Addax would be changed to 33.3%. By the second Amendment to the Participation Agreement, entered into on March 14, 2006, ERHC and Addax amended the Participation Agreement so that the assigned interest to Addax would be 33.3% and ERHC’s participating interest would be 26.7%. By the third Amendment to the Participation Agreement dated April 11, 2006, ERHC and Addax agreed that if Godsonic, a third party, did not meet financial and other obligations for the transfer of 9% of ERHC’s participating interest to Godsonic (and was foreclosed from all claims to the 9%), ERHC would transfer 7.2% out of the 9% interest to Addax so that Addax’s participating interest would be 40.5% in aggregate and ERHC’s participating interest would be 19.5% in aggregate. The amount of fresh consideration to accrue from Addax to ERHC for the transfer of the 7.2% is not stated in the third Amendment to the Participation Agreement. In July 2008, the London Court of International Arbitration (LCIA) confirmed that under the Participation Agreement between the parties no further consideration is payable by Addax Petroleum to ERHC for Addax Petroleum’s 7.2 percent share of the nine percent. |

Note 3 – Income Taxes

At June 30, 2008, the Company had a consolidated net operating loss carry-forward (“NOL”) of approximately $3.3 million expiring through 2027. The NOLs are subject to certain limitations under the Internal Revenue Code of 1986, as amended, including Section 382 of the Tax Reform Act of 1986. During the fiscal year ended September 30, 2006, the Company recognized a significant gain on the sale of various participation interests. This gain utilized a substantial portion of the Company’s NOLs and such NOLs were adjusted to remove losses limited under Section 382.

The composition of deferred tax assets and the related tax effects at June 30, 2008 and September 30, 2007 are as follows:

| | | June 30, 2008 | | | September 30, 2007 | |

| | | | | | | |

| | | | | | | | |

Accrual for asset retirement | | | | | | | | |

| | | | | | | | | |

Total deferred tax assets | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

The $480,000 deferred tax asset at September 30, 2007 represents the minimum NOL carry back claim from losses in future years against the fiscal year ended September 30, 2006 taxable income. At June 30, 2008, the $480,000 balance was reclassified to current income tax receivable.

The difference between the income tax benefit (provision) in the accompanying consolidated statements of operations and the amount that would result if the U.S. federal statutory rate of 34% were applied to pre-tax income (loss) for the three and nine months ended June 30, 2008 and 2007, is as follows:

| | | Three Months Ended June 30, | | | Nine Months Ended June 30, | |

| | | 2007 | | | 2008 | | | 2007 | | | 2008 | |

| | | | | | | | | | | | | |

Benefit at federal statutory rate | | | | | | | | | | | | | | | | |

Non-deductible stock based compensation | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Change in valuation allowance | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Provision for income taxes | | | | | | | | | | | | | | | | |

Note 4 – Commitments and Contingencies

Subpoenas:

On May 4, 2006, a Federal court search warrant initiated by DOJ was executed on the Company. The DOJ sought various records including, among other matters, documents, if any, related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria. Related SEC subpoenas issued on May 9, 2006 and August 29, 2006 also requested a range of documents. ERHC continues to interface with both the DOJ and SEC investigators to respond to the SEC subpoenas and any additional requests for information from the DOJ or SEC.

On July 5, 2007, the U.S. Senate Committee on Homeland Security and Governmental Affairs’ Permanent Subcommittee on Investigations served ERHC with a subpoena in connection with its review of matters relating to the potential abuse of payments made to foreign governments. The subpoena, as amended on July 18, 2007, seeks documents and information regarding ERHC’s activities, particularly those related to the acquisition of ERHC’s interests in the Gulf of Guinea.

ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, are assisting ERHC in responding to the subpoenas.

ERHC/Addax Arbitration:

In July 2008, the London Court of International Arbitration (LCIA) confirmed that under the Participation Agreement between the parties in respect of JDZ Block 4, no further consideration is payable by Addax Petroleum to ERHC for Addax Petroleum’s 7.2 percent share of the 9 percent recovered by the ERHC/Addax consortium from Godsonic upon the failure of Godsonic to meet certain financial obligations under which the 9 percent was to have been transferred to Godsonic.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the Company’s unaudited consolidated financial statements (including the notes thereto) and Item 1A of Part II, “Risk Factors,” included elsewhere in this report and the Company’s audited consolidated financial statements and the notes thereto, Item 7, “Management’s Discussion and Analysis of Financial Condition and Plan of Operations” and Item 1A, “Risk Factors” included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2007, Item 1A of Part II, “Risk Factors,” included in the Company’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2006 and Item 1A of Part II, “Risk Factors,” included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2006. The Company’s historical results are not necessarily an indication of trends in operating results for any future period. References to “ERHC” or the “Company” mean ERHC Energy Inc., a Coloradocorporation, and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

Overview

ERHC reports as a development stage enterprise as there are currently no significant operations and no revenue has been generated from business activities. The Company was formed in 1986, as a Colorado corporation, and was engaged in a variety of businesses until 1996, when it began its current operations as an independent oil and gas company. The Company’s goal is to maximize its value through exploration and exploitation of oil and gas reserves in the Gulf of Guinea offshore of central West Africa. The Company’s current focus is to exploit its assets, which are rights to working interests in exploration acreage in the Joint Development Zone (“JDZ”) between the Democratic Republic of Sao Tome and Principe (“DRSTP or “Tome”) and the Federal Republic of Nigeria (“FRN or “Nigeria”) and in the exclusive territorial waters of Sao Tome (the “Exclusive Economic Zone” or “EEZ”). ERHC will not directly carry out the exploration and production operations in the Joint Development Zone, but will rely on reputable technical operators, with whom the Company has entered into partnership relationships, such as Addax Petroleum Inc. and Sinopec Corp to carry out those operations. The Company has formed relationships with these upstream oil and gas companies to assist the Company in exploiting its assets in the JDZ. The Company currently has no other operations but is exploring opportunities in other areas of the energy industry, including supply and trading.

Current Business Operations

ERHC’s operations are currently focused on the Gulf of Guinea, off the coast of central West Africa. ERHC believes this region has the possibility of significant oil reserves and has worked to realize the value of the assets it has acquired in this region. The Company’s current operations include those below, details of which can be found at the link:http://www.erhc.com/en/cms/?169

JDZ - ERHC has interests in six of the nine Blocks in the JDZ, a 34,548 square kilometer area approximately 200 kilometers off the coastline of Nigeria and Săo Tomй & Principe that is adjacent to several large petroleum discovery areas.

EEZ - The government of Săo Tomé & Principe has awarded ERHC rights to participate in exploration and production activities in the EEZ, which encompasses an area of approximately 160,000 square kilometers.

Operations in the JDZ

ERHC has interests in six of the nine Blocks in the JDZ, as follows

| | — | JDZ Block 2: 22.0% Working interest percentage |

| | — | JDZ Block 3: 10.0% Working interest percentage |

| | — | JDZ Block 4: 19.5% Working interest percentage |

| | — | JDZ Block 5: 15.0% Working interest percentage |

| | — | JDZ Block 6: 15.0% Working interest percentage |

| | — | JDZ Block 9: 20.0% Working interest percentage |

The working interest represents ERHC’s share of all the hydrocarbons production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks.. These costs in blocks 2, 3 and 4 are currently being carried by the operators until production, whereupon the operators will recover their costs from the production revenues.

In early 2008, Addax Petroleum, an experienced exploration and production company that has participation agreements with ERHC in JDZ Blocks 2, 3 and 4, and is the operator of JDZ Block 4 publicly disclosed seismic images and maps showcasing the prospectivity of its JDZ interests. This seismic was compiled by Geco-Prakla (now WesternGeco) in 1999 when WesternGeco shot a 2D seismic survey of approximately 5,900km covering the major part of the JDZ. Interpretation carried out by WesternGeco has led to the identification of 56 prospective structures within Blocks 1 to 9 in the JDZ, of which 17 were defined as prospects and 39 as leads. WesternGeco used reservoir parameters similar to those known from nearby fields in Nigeria and Equatorial Guinea. Combined recoverable reserves potential of the 17 prospects was estimated by WesternGeco ( Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts) The scope of the WesternGeco report was to interpret and map seismic data, highlight prospectivity, and calculate volumetrics.

The estimate of "recoverable reserves potential" based on WesternGeco's report, which interpreted and mapped seismic data, highlighted prospectivity and calculated volumetrics, was not based on any attempt to comply with the SEC definition of reserves and, accordingly the estimate of recoverable reserves potential is not presented. ERHC Energy has access to the data compiled by WesternGeco under the terms of a data use license with WesternGeco (Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).

Operations in JDZ Block 4

ERHC's consortium partner Addax Petroleum is the operator of JDZ Block 4. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 4. (Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts). Addax has secured Joint Development Authority approval to explore the Kina Prospect. Drilling equipment has been ordered. Earlier in 2007, Addax and Sinopec jointly entered into an agreement with a subsidiary of Aban Offshore Limited for the provision of the Aban Abraham, which continues being refurbished and upgraded in Singapore. At the end of its contractual obligations to another partnership, the Aban Abraham will be transferred to Addax and Sinopec.

Operations in JDZ Block 3

Anadarko Petroleum is the operator of JDZ Block 3. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 3(Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).. On August 8, 2007, Anadarko presented the initial proposals for exploration well locations for the Block. The Joint Development Authority has approved drilling at the Lemba Prospect and Anadarko has ordered drilling equipment.

Operations in JDZ Block 2

ERHC's consortium partner Sinopec Corp. is the operator in JDZ Block 2. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 2(Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).. The Joint Development Authority has approved drilling at the Tome Prospect . In 2007, Sinopec and Addax jointly entered into an agreement with a subsidiary of Aban Offshore Limited for the provision of the Aban Abraham deepwater drillship, which continues being refurbished and upgraded in Singapore. At the end of its contractual obligations to another partnership, the Aban Abraham will be transferred to Addax and Sinopec.

Background of the JDZ

In the spring of 2001, the governments of Săo Tomé & Principe and Nigeria reached an agreement over a long-standing maritime border dispute. Under the terms of the agreement, the two established the Joint Development Zone to govern commercial activities within the disputed boundaries. The JDZ is administered by a Joint Development Authority (JDA) which oversees all future exploration and development activities in the JDZ. The remaining claimed territorial waters of Săo Tomé & Principe are known as the Exclusive Economic Zone (EEZ). Revenues derived from the JDZ will be shared 60/40 between the governments of Nigeria and Săo Tomé & Principe, respectively.

Background of the EEZ

The government of Săo Tomй & Principe has awarded ERHC rights to participate in exploration and production activities in Săo Tomй & Principe’s Exclusive Economic Zone (EEZ). ERHC’s rights include the following:

| | — | The right to receive up to two blocks of ERHC’s choice; and |

| | — | The option to acquire up to a 15 percent paid working interest in another two blocks of ERHC’s choice. |

ERHC would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The EEZ describes territorial waters of Săo Tomй that encompasses an area of approximately 160,000 square km. It is measured from claimed archipelagic baselines — territorial sea: 12 nautical miles, exclusive economic zone: 200 nautical miles. It is the largest in the Gulf of Guinea. Ocean water depths around the two islands exceed 5,000 feet, depths that have only become feasible for oil production over the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo. The African coast is less than 400 nautical miles offshore, which means the exclusive economic zones of the concerned countries overlap.

Sale of Participation Interests

The following represents ERHC’s current rights in the JDZ blocks.

| JDZ Block # | | ERHC Original Participating Interest(1) | | ERHC Joint Bid Participating Interest | | Participating Interest(s) Sold | | Current ERHC Retained Participating Interest |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (1) | Original Participating Interest granted pursuant to the Option Agreement, dated April 2, 2003, between DRSTP and ERHC (the “2003 Option Agreement”). |

| (2) | In March 2006, ERHC sold an aggregate 28.67% participating interest to Sinopec and an aggregate 14.33% participating interest to Addax Ltd. |

| (3) | In February 2006, ERHC sold a 15% participating interest to Addax Sub. |

| (4) | By a Participation Agreement made in November 2005 and subsequently amended, ERHC sold 33.3% participating interest to Addax. In July 2008, Addax received a further 7.2% participating interest without any futher consideration due from Addax to ERHC. The additional 7.2% arose from the recovery of 9% from Godsonic due to Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. |

| (5) | No contracts have been entered into as of the date hereof. ERHC’s goal is to enter into agreements to exploit its interests in Blocks 5, 6 and 9 also. Additionally, the Company intends to exploit its rights in the EEZ. |

| (6) | Includes the 1.8%, out of 9% reclaimed by ERHC from Godsonic by ERHC on behalf of the ERHC/Addax consortium following Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. Pursuant to the Amendment to the Participation Agreement made on April 11, 2006, the 9% was distributed between Addax (7.2%) and ERHC (1.8%). In July 2008, the London Court of International Arbitration (LCIA) confirmed that under the Participation Agreement between the parties no further consideration is payable by Addax Petroleum to ERHC for Addax Petroleum’s 7.2 percent share of the 9 percent. |

With regard to drilling in the JDZ, the Joint Development Authority (JDA), which was set up by the governments of Nigeria and Sao Tome & Prнncipe to administer the JDZ, has approved the budgets for JDZ Blocks 2, 3 and 4 in which ERHC has interests. The JDA also has approved well locations in two of those Blocks. The Aban Abraham deepwater drill ship, which has already been jointly contracted by the operators in JDZ Blocks 2 and 4, Sinopec and Addax Petroleum, remains under refurbishment in Singapore. ERHC continues to support Addax’s efforts to secure a drilling rig of opportunity to avert delay or at least mitigate its impact with respect to drilling schedules.

ERHC is continuing to assess the feasibility of acquisition prospects to diversify its asset portfolio.

Annual Shareholders’ Meeting:

On April 22, 2008 in Houston, Texas, the Company held an annual shareholders’ meeting. The Company announced the resignation of Nicolae Luca as Director and Acting Chief Executive Officer/President. Nicole Luca resigned to pursue other interest.

The Company also announced the re-election, by a majority of all the shareholders of the Company, of Directors Howard Jeter, Dr. Andrew Uzoigwe and Clement Nwizubo, for another term of office which will run through the Company’s next annual shareholders meeting or until their successors are elected.

New Leadership:

The Company announced the appointment of Peter Ntephe to the newly created position of Chief Operating Officer (COO) on April 22, 2008. Mr. Ntephe who has been the Corporate Secretary since 2001 will oversee the administration and corporate governance of the Company and its subsidiaries. Mr. Ntephe will also replace Mr. Luca as acting CEO/President pending the appointment of a permanent CEO/President.

The Company also created the position of Vice President Corporate Development for ERHC and its subsidiaries. This position will oversee planning and implementation of strategies for corporate growth by ERHC and its subsidiaries, including:

| | — | identification of opportunities for corporate mergers and acquisitions |

Mr. David Bovell has been appointed to the position effective May 1st, 2008.

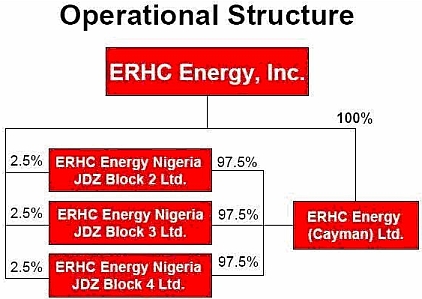

Corporate Operational Structure

ERHC Energy Inc, has a wholly owned subsidiary - ERHC Energy (Cayman) Limited which will serve as holding company for the working subsidiaries through which its activities in the Gulf of Guinea will be operated. There are three working subsidiary companies, namely ERHC Energy Nigeria JDZ Block 2 Limited, ERHC Energy Nigeria JDZ Block 3 Limited and ERHC Energy Nigeria JDZ Block 4 Limited, each of which is jointly owned by both ERHC Energy Inc and ERHC Energy (Cayman) Ltd. Each of these companies was created to manage the operations in the Joint Development Zone Block for which each is respectively named. The ownership structure of the companies is given below.

Other subsidiaries of ERHC might be created as necessary, including for seeking stock-exchange listings, joint-ventures, etc. the Company has made

Results of Operations

Three Months Ended June 30, 2008 Compared with Three Months Ended June 30, 2007

During the three months ended June 30, 2008, the Company had a net loss of $604,174 compared with a net loss of $587,219 for the three months ended June 30, 2007. Interest income decreased from $457,540 in the three months ended June 30, 2007 to $225,079 in the three months ended June 30, 2008, due to a decline in the significant cash balance maintained by the Company following the sale of the participation interests in 2006. General and administrative expenses decreased from $1,076,864 in the three months ended June 30, 2007 to $820,462 in the three months ended June 30, 2008 due to normal changes in operating expenses. See “Legal Proceedings” in Item 1 of Part II of this report.

Nine Months Ended June 30, 2008 Compared with Nine Months Ended June 30, 2007

During the nine months ended June 30, 2008, the Company had a net loss of $2,038,029 compared with a net loss of $1,553,868 for the nine months ended June 30, 2007. Interest income decreased from $1,541,666 in the nine months ended June 30, 2007 to $979,904 in the nine months ended June 30, 2008, due to a decline in the significant cash balance maintained by the Company following the sale of the participation interests in 2006 and due a significant decline in interest rates on deposits. General and administrative expenses decreased from $3,584,127 in the nine months ended June 30, 2007 to $2,994,433 in the nine months ended June 30, 2008 primarily due to a decrease of $1,233,314 in legal fees, from $2,138,905 in the nine months ended June 30, 2007, to $905,591 in the nine months ended June 30, 2008. The decrease in legal fees was due to reduction in required assistance in connection with the Justice Department investigation of the Company, and the decrease was partially offset by an increase in public relations expense of $177,807 from $22,490 in the nine months ended June 30, 2007 to $200,297 in the nine months ended June 30, 2008. See “Legal Proceedings” in Item 1 of Part II of this report.

Liquidity and Capital Resources

As of June 30, 2008, the Company had $32,401,450 in cash and cash equivalents and short-term investments and positive working capital of $29,091,666. Management believes that this cash position should be sufficient to support the Company’s working capital requirements for more than 12 months.

Off-Balance Sheet Arrangements

At June 30, 2008, the Company had no off-balance sheet arrangements that have or are reasonably likely to have a material current or future effect on its financial condition or results of operations.

Debt Financing Arrangements

At June 30, 2008, the Company had short-term debt of $33,513 bearing interest at 5.5% per year payable to an individual. The Company had other current liabilities of $5,573,001 including related party liabilities of $8,275.00 due to the Company’s board of directors for directors’ fees. Included in current liabilities is also a $4,803,750 liability to Feltang International Inc. that will be satisfied upon issuance of 5,250,000 shares of common stock.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

The Company’s current focus is to exploit its primary assets, which are rights to working interest in the JDZ and EEZ under agreements with the JDA and DRSTP. The Company intends to continue to form relationships with other oil and gas companies with technical and financial capabilities to assist the Company in leveraging its interests in the EEZ and the JDZ. The Company currently has no other operations.

At June 30, 2008, all of the Company's operations were located outside the United States. The Company’s primary asset are agreements with DRSTP and the JDA, which provide ERHC with rights to participate in exploration and production activities in the Gulf of Guinea off the coast of central West Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility, which is out of management’s control. The Company’s ability to exploit its interests in the agreements in this area may be impacted by this circumstance.

The future success of the Company’s international operations may also be adversely affected by risks associated with international activities, including economic and labor conditions, political instability, risk of war, expropriation, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar versus the local currencies in which future oil and gas producing activities may be denominated. As well, changes in exchange rates may adversely affect the Company's future results of operations and financial condition.

Market risks relating to the Company’s operations result primarily from changes in interest rates as well as credit risk concentrations. The Company’s interest expense is generally not sensitive to changes in the general level of interest rates in the United States, particularly because a substantial majority of its indebtedness is at fixed rates.

The Company holds no derivative financial or commodity instruments, nor does it engage in any foreign currency denominated transactions.

The Company’s Chief Executive Officer and Principal Accounting Officer participated in an evaluation by management of the effectiveness of the Company’s disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of June 30, 2008. Based on their participation in that evaluation, the Company’s Chief Executive Officer and Principal Accounting Officer concluded that as of June 30, 2008, our disclosure controls and procedures are effective to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, to allow timely decisions regarding required disclosure under the Exchange Act. Our officers also concluded at June 30, 2008 that our disclosure controls and procedures are effective to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms.

There was no change in the Company’s internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) that occurred during the fiscal quarter ended June 30, 2008 that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II. OTHER INFORMATION

DOJ, SEC and U.S. Senate Committee Subpoenas. On May 4, 2006, a search warrant issued by the U.S. District Court of the Southern District of Texas, Houston Division, was executed on ERHC seeking various records including, among others, documents, if any, related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria. The search warrant cited, among other things, possible violations of the FCPA, Section 10(b) of the Exchange Act, Rule 10b-5 under the Exchange Act and criminal conspiracy and wire fraud statutes. ERHC filed suit in federal district court in Texas in June 2006 seeking to protect the Company’s attorney-client privileged documents and to allow its counsel to determine the factual basis for the DOJ’s search warrant affidavit, which is currently under seal.

A related SEC subpoena was issued on May 9, 2006, and a second related subpoena issued on August 29, 2006. The subpoenas request from ERHC a range of documents including all documents related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria, personnel records (specifically, those regarding the Company’s former Chief Financial Officer, Franklin Ihekwoaba) and other corporate records. The Company has been actively responding to both subpoenas.

On July 5, 2007, U.S. Senate Committee on Homeland Security and Governmental Affairs’ Permanent Subcommittee on Investigations served ERHC with a subpoena, in connection with its review of matters relating to the potential abuse of payments made to foreign governments. The subpoena, as amended on July 18, 2007, seeks documents and information regarding ERHC’s activities, particularly those related to the acquisition of ERHC’s interests in the Gulf of Guinea. ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, are assisting ERHC in responding to all subpoenas.

The investigations by the DOJ, SEC and Senate Subcommittee are continuing. The Company anticipates that these investigations will be lengthy and do not expect these investigations to be concluded in the immediate future. If violations are found, the Company may be subject to criminal, civil and/or administrative sanctions, including substantial fines, and the resolution or disposition of these matters could have a material adverse effect on its business, prospects, operations, financial condition and cash flows.

In July 2008, the London Court of International Arbitration (LCIA) confirmed that under the Participation Agreement between the parties in respect of JDZ Block 4, no further consideration is payable by Addax Petroleum to ERHC for Addax Petroleum’s 7.2 percent share of the 9 percent recovered by the ERHC/Addax consortium from Godsonic upon the failure of Godsonic to meet certain financial obligations under which the 9 percent was to have been transferred to Godsonic..

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. In the opinion of management, no pending or known threatened claims, actions or proceedings against the Company are expected to have a material adverse effect on ERHC’s consolidated financial position, results of operations or cash flows. ERHC intends to defend these matters vigorously; the Company cannot predict with certainty, however, the outcome or effect of any of the litigation or investigatory matters specifically described above or any other pending litigation or claims. There can be no assurance as to the ultimate outcome of these lawsuits and investigations.

The Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2007 (“2007 Annual Report”), as modified by its Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2007 (“First Quarterly Report”), its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2008 (“Second Quarterly Report”) and this Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2008 (“Second Quarterly Report”), includes a detailed discussion of certain material risk factors facing the Company. The information presented below describes updates and additions to such risk factors and should be read in conjunction with the risk factors and information disclosed in ERHC’s 2007 Annual Report, First Quarterly Report, Second Quarterly Report and Third Quarterly Report. References to “ERHC,” “we,” “us” or “our” mean ERHC Energy Inc., a Colorado corporation and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

The risk factor in the First Quarterly Report captioned “Our Operations Are Located Outside of the United States Which Subjects Us to Risks Associated with International Activities.” is amended and restated in its entirety as follows:

Our Operations Are Located Outside of the United States Which Subjects Us to Risks Associated with International Activities.

At December 31, 2007, all of our operations were located outside the United States. Our only assets are agreements with DRSTP and the JDA, which provide ERHC with rights to participate in exploration and production activities in the Gulf of Guinea off the coast of central West Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility, which is out of management’s control. Our ability to exploit our interests in this area pursuant to such agreements may be adversely impacted by this circumstance.

The future success of our international operations may also be adversely affected by risks associated with international activities, including economic and labor conditions, political instability, risk of war, expropriation, termination, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar versus the local currencies in which future oil and gas producing activities may be denominated. Changes in exchange rates may also adversely affect our future results of operations and financial condition.

In addition, to the extent we engage in operations and activities outside the United States, we are subject to the Foreign Corrupt Practices Act, or FCPA, which generally prohibits U.S. companies and their intermediaries from making corrupt payments to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment, and requires companies to maintain adequate record-keeping and internal accounting practices to accurately reflect the transactions of the company. The FCPA applies to companies, individual directors, officers, employees and agents. The FCPA also applies to foreign companies and persons taking any act in furtherance of such corrupt payments while in the United States. Under the FCPA, U.S. companies may be held liable for actions taken by strategic or local partners or representatives.

The FCPA imposes civil and criminal penalties for violations of the Act. Civil penalties may include fines of up to $500,000 per violation, and equitable remedies such as disgorgement of profits causally connected to the violation (including prejudgment interest on such profits) and injunctive relief. Criminal penalties for violations of the corrupt payments provisions could range up to the greater of $2 million per violation or twice the gross pecuniary gain sought by making the payment, and/or incarceration for up to 5 years per violation. Moreover, if a director, officer or employee of a company is found to have willfully violated the FCPA books and records provisions, the maximum penalty would be imprisonment for 20 years per violation. Maximum fines of up to $25 million also may be imposed for willful violations of the books and records provisions by a company.

The SEC and/or the Department of Justice, or DOJ, could assert that there have been multiple violations of the FCPA, which could lead to multiple fines. The amount of any fines or monetary penalties which could be assessed would depend on, among other factors, findings regarding the amount, timing, nature and scope of any improper payments, whether any such payments were authorized by or made with knowledge of ERHC or its affiliates, the amount of gross pecuniary gain or loss involved, and the level of cooperation provided to the government authorities during the investigations. Negotiated dispositions of these types of violations also frequently result in an acknowledgement of wrongdoing by the entity and the appointment of a monitor on terms agreed upon with the SEC and DOJ to review and monitor current and future business practices, including the retention of agents, with the goal of assuring future FCPA compliance. Other potential consequences could be significant and include suspension or debarment of ERHC’s ability to contract with governmental agencies of the United States and of foreign countries. Any determination that ERHC has violated the FCPA could result in sanctions that could have a material adverse effect on our business, prospects, operations, financial condition and cash flow.

The risk factor in the Second Quarterly Report captioned “We are under investigation by the SEC and the DOJ, and the results of these investigations could have a material adverse effect on our business, prospects, operations, financial condition and cash flow.” is amended and restated in its entirety as follows:

We are under investigation by the SEC, the DOJ and a U.S. Senate Subcommittee, and the results of these investigations could have a material adverse effect on our business, prospects, operations, financial condition and cash flow.

On May 4, 2006, a search warrant issued by the U.S. District Court of the Southern District of Texas, Houston Division, was executed on ERHC seeking various records including, among others, documents, if any, related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria. The search warrant cited, among other things, possible violations of the FCPA, Section 10(b) of the Exchange Act, Rule 10b-5 under the Exchange Act and criminal conspiracy and wire fraud statutes. ERHC filed suit in federal district court in Texas in June 2006 seeking to protect our attorney-client privileged documents and to allow our counsel to determine the factual basis for the DOJ’s search warrant affidavit, which is currently under seal.

A related SEC subpoena was issued on May 9, 2006, and a second related subpoena issued on August 29, 2006. The subpoenas request from ERHC a range of documents including all documents related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria, personnel records (specifically, those regarding our former Chief Financial Officer, Franklin Ihekwoaba) and other corporate records. We have been actively responding to both subpoenas.

On July 5, 2007, the U.S. Senate Committee on Homeland Security and Governmental Affairs’ Permanent Subcommittee on Investigations served ERHC with a subpoena, in connection with its review of matters relating to the potential abuse of payments made to foreign governments. The subpoena, as amended on July 18, 2007, seeks documents and information regarding ERHC’s activities, particularly those related to the acquisition of ERHC’s interests in the Gulf of Guinea. ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, will assist ERHC in responding to the subpoena. Please see “Legal Proceedings” for more information.

The investigations by the DOJ, SEC and Senate Subcommittee are continuing. We anticipate that these investigations will be lengthy and do not expect these investigations to be concluded in the immediate future. If violations are found, we may be subject to criminal, civil and/or administrative sanctions, including substantial fines, and the resolution or disposition of these matters could have a material adverse effect on our business, prospects, operations, financial condition and cash flow.

These investigations could also result in:

| | — | third party claims against us, which may include claims for special, indirect, derivative or consequential damages; |

| | — | damage to our business, operations and reputation; |

| | — | loss of, or adverse effect on, cash flow, assets, goodwill, operations and financial condition, business, prospects, profits or business value; |

| | — | adverse consequences on our ability to obtain or continue financing for current or future projects; and/or |

| | — | claims by directors, officers, employees, affiliates, advisors, attorneys, agents, debt holders or other interest holders or constituents of ERHC. |

Continuing negative publicity arising out of these investigations could also adversely affect our business and prospects in the commercial marketplace. In addition, these investigations have resulted in increased expenses to ERHC, including substantial legal fees and the diversion of management’s attention from our operations and other activities. If we incur costs or losses as a result of these matters, we may not have the liquidity or funds to address those costs or losses, in which case such costs or losses could have a material adverse effect on our business, prospects, operations, financial condition and cash flow.

| 31.1* | Rule 13a-14(a) Certification of the Chief Executive Officer |

| 31.2* | Rule 13a-14(a) Certification of the Principal Accounting Officer |

| 32.1* | Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Chief Executive Officer |

| 32.2* | Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Principal Accounting Officer |

* Filed or furnished herewith.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ERHC Energy Inc.

| Name | Title | Date |

| | | |

| /s/ Peter Ntephe | Chief Operating Officer and Acting President and | July 8, 2009 |

| Peter Ntephe | Acting Chief Executive Officer | |

| | | |

| /s/ Sylvan Odobulu | Controller (Principal Accounting Officer) | July 8, 2009 |

| Sylvan Odobulu | | |

EXHIBIT INDEX

| Rule 13a-14(a) Certification of the Chief Executive Officer |

| Rule 13a-14(a) Certification of the Principal Accounting Officer |

| Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Chief Executive Officer |

| Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Principal Accounting Officer |

* Filed or furnished herewith.

27