U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

| T | Annual Report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended September 30, 2007

OR

| £ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period ended: __________________

Commission file number: 000-17325

(Exact name of registrant as specified in its charter)

| Colorado | 88-0218499 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

5444 Westheimer Road, Suite 1440, Houston, Texas | 77056 |

| (Address of Principal Executive Office) | (Zip Code) |

713-626-4700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: common stock

Check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No T

Check if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes £ No T

Check if the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Check if the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

Large Accelerated Filer £ Accelerated Filer T Non-Accelerated Filer £

Check if the registrant is a shell company. Yes £ No T

The aggregate market value of the voting stock held by non-affiliates of the registrant on March 31, 2007 was $144,547,630.

On November 30, 2007, the registrant had 721,938,550 shares of common stock issued and outstanding.

We filed our Annual Report on Form 10-K for the year ended September 30, 2007 on December 14, 2007 (the “Original Report”). We filed this Amendment No. 1 on Form 10-K/A (“Amendment 1”) on July 7,2008 solely to disclose additional information or revise disclosures based on comments from the Securities and Exchange Commission regarding the Original Report. No other changes to the Original Report were included in this Amendment No.1 other than to disclose additional information or revise disclosures in the Original report based on comments from the Securities and Exchange Commission. We are filing this Amendment No. 2 on Form 10-K/A solely to include Exhibits 10.9 through 10.19 that should have been included in Amendment No. 1.

We have made no attempt in this Amendment to modify or update the disclosures presented in the Original Report other than as noted in the previous paragraph. Also, this Amendment does not reflect events occurring after the filing of the Original Report. Accordingly, this Amendment should be read in conjunction with the Original Report and our other filings with the SEC subsequent to the filing of the Original Report.

Forward-Looking Statements

ERHC Energy Inc. (the “Company”) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain or be identified by the words “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “believe,” “should,” “could,” “may,” “might,” “will,” “will be,” “will continue,” “will likely result,” “project,” “forecast,” “budget” and similar expressions. Statements made by the Company in this report that contain forward-looking statements include, but are not limited to, information concerning the Company’s possible or assumed future business activities and results of operations and statements about the following subjects:

| | · | future development of concessions, exploitation of assets and other business operations; |

| | · | future market conditions and the effect of such conditions on the Company’s future activities or results of operations; |

| | · | future uses of and requirements for financial resources; |

| | · | interest rate and foreign exchange risk; |

| | · | future contractual obligations; |

| | · | outcomes of legal proceedings including, without limitation, the ongoing investigations of the Company; |

| | · | future operations outside the United States; |

| | · | expected financial position; |

| | · | future liquidity and sufficiency of capital resources; |

| | · | budgets for capital and other expenditures; |

| | · | plans and objectives of management; |

| | · | compliance with applicable laws; and |

| | · | adequacy of insurance or indemnification. |

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

| | · | general economic and business conditions; |

| | · | worldwide demand for oil and natural gas; |

| | · | changes in foreign and domestic oil and gas exploration, development and production activity; |

| | · | oil and natural gas price fluctuations and related market expectations; |

| | · | termination, renegotiation or modification of existing contracts; |

| | · | the ability of the Organization of Petroleum Exporting Countries, commonly called OPEC, to set and maintain production levels and pricing, and the level of production in non-OPEC countries; |

| | · | policies of the various governments regarding exploration and development of oil and gas reserves; |

| | · | advances in exploration and development technology; |

| | · | the political environment of oil-producing regions; |

| | · | political instability in the Democratic Republic of Sao Tome and Principe and the Federal Republic of Nigeria; |

casualty losses;

| | · | changes in foreign, political, social and economic conditions; |

| | · | risks of international operations, compliance with foreign laws and taxation policies and expropriation or nationalization of equipment and assets; |

| | · | risks of potential contractual liabilities; |

| | · | foreign exchange and currency fluctuations and regulations, and the inability to repatriate income or capital; |

| | · | risks of war, military operations, other armed hostilities, terrorist acts and embargoes; |

| | · | regulatory initiatives and compliance with governmental regulations; |

| | · | compliance with environmental laws and regulations; |

| | · | compliance with tax laws and regulations; |

| | · | effects of litigation and governmental proceedings; |

| | · | cost, availability and adequacy of insurance; |

| | · | adequacy of the Company’s sources of liquidity; |

| | · | labor conditions and the availability of qualified personnel; and |

| | · | various other matters, many of which are beyond the Company’s control. |

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”) include additional factors that could adversely affect the Company’s business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements. Forward-looking statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations with regard to the statement or any change in events, conditions or circumstances on which any forward-looking statement is based.

PART I

Overview

ERHC Energy Inc., a Colorado corporation, (“ERHC” or the “Company”) is an independent oil and gas company formed in 1986. The Company was engaged in a variety of businesses until 1996, when it began its current operations. The Company’s goal is to maximize its value through exploration and exploitation of oil and gas reserves in the Gulf of Guinea offshore of central West Africa. The Company’s current focus is to exploit its assets, which are rights to working interests in exploration acreage in the Joint Development Zone (“JDZ”) between the Democratic Republic of Sao Tome and Principe (“DRSTP or “Tome”) and the Federal Republic of Nigeria (“FRN or “Nigeria”) and in the exclusive territorial waters of Sao Tome (the “Exclusive Economic Zone” or “EEZ”). ERHC will not directly carry out the exploration and production operations in the Joint Development Zone, but will rely on reputable technical operators, with whom the Company has entered into partnership relationships, such as Addax Petroleum Inc. and Sinopec Corp to carry out those operations. The Company has formed relationships with these upstream oil and gas companies to assist the Company in exploiting its assets in the JDZ. The Company currently has no other operations but is exploring opportunities in other areas of the energy industry, including supply and trading.

General Development of the Business

In April 2003, the Company and the DRSTP entered into an Option Agreement (the “2003 Option Agreement”) in which the Company relinquished certain financial interests in the JDZ in exchange for exploration rights in the JDZ. The Company additionally entered into an administration agreement with the Nigeria-Sao Tome and Principe Joint Development Authority (“JDA”). The administration agreement is the formal agreement by the JDA that it will fully implement ERHC’s preferential rights to working interests in the JDZ acreage as set forth in the 2003 Option Agreement and describes certain procedures regarding the exercising of these rights. However, ERHC retained under a previous agreement the following rights to participate in exploration and production activities in the EEZ subject to certain restrictions: (a) the right to receive up to two blocks of ERHC’s choice and (b) the option to acquire up to a 15% paid working interest in up to two blocks of ERHC’s choice in the EEZ. The Company would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

This exercise of the Company’s rights was subject to the condition that if no license is awarded or a license is awarded and subsequently withdrawn by the JDA prior to the commencement of operations, ERHC will be entitled to receive its working interest in that block in a future license awarded for that block.

On April 28, 2005, ERHC and its then consortium partner Noble Energy International, Ltd. (“Noble”) entered into a Memorandum of Understanding with Godsonic Oil Company Limited (“Godsonic”), an independent bidder for interest in Block 4. The Memorandum of Understanding stated that if ERHC and Noble (“ERHC/Noble”) received less than a 26% bid-interest award in Block 4 in the Nigeria and Sao Tome and Principe JDZ from the JDA established pursuant to the Treaty between FRN and the DRSTP, Godsonic would transfer whatever Godsonic received in Block 4 to ERHC/Noble; on the other hand, if ERHC/Noble received more than a 26% bid-interest award in Block 4 from the JDA, ERHC/Noble would transfer the excess over 26% to Godsonic. In June 2005, the JDA awarded ERHC and its then consortium partner Noble a 35% bid interest in Block 4 of the JDZ, in addition to the option interest of 25% which ERHC had exercised in the Block. In October 2005, Noble withdrew from participation in Block 4 and Addax Petroleum (Nigeria Offshore 2) Limited (“Addax”) replaced Noble as ERHC’s consortium partner. By a Letter Agreement dated October 24, 2005 (the “Letter Agreement”), ERHC and Addax undertook to transfer a 9% interest of the 35% bid interest to Godsonic subject to Godsonic meeting financial and other conditions.

In November 2005, ERHC and Addax entered into a Participation Agreement dated November 17, 2005 (the “Participation Agreement”) whereby ERHC undertook to assign a 42.3% interest (the “Assigned Interest”) in Block 4 to Addax. Under the Participation Agreement, ERHC’s “Retained Interest” would be 17.7% in Block 4. The Participation Agreement stated Addax’s cash payment obligations to ERHC would be $18 million, which was paid in February and March 2006. Pursuant to the Participation Agreement between ERHC and Addax, as amended, Addax will serve as operator and pay all of ERHC’s future costs in respect of all petroleum operations in Block 4. Addax is entitled to 100% of ERHC’s share of cost oil and 50% of ERHC’s share of profit oil from the oil production until Addax recovers all ERHC’s costs.

Pursuant to an Amendment to the Participation Agreement dated February 23, 2006, ERHC and Addax amended the Participation Agreement so that the Assigned Interest to Addax would be changed to 33.3% while ERHC’s Retained Interest would remain at 17.7%. By a second Amendment to the Participation Agreement, entered into on March 14, 2006, ERHC and Addax further amended the Participation Agreement so that the “Assigned Interest” would be 33.3% and ERHC’s “participating interest” would be 26.7%.

On March 15, 2006, an agreement to assign 9% in Block 4 from ERHC to Godsonic was entered into by ERHC (on behalf of the ERHC/Addax consortium) and Godsonic subject to Godsonic meeting stipulated financial and other conditions. Pursuant to another Amendment to the Participation Agreement entered into on April 11, 2006, ERHC and Addax provisionally agreed that if Godsonic did not meet the financial and other conditions as stipulated in the Letter Agreement on the 9% interest to be transferred to Godsonic and was foreclosed from all claims to the 9% interest, ERHC would transfer 7.2% out of the 9% interest to Addax so that Addax’s participating interest would be 40.5% in aggregate and ERHC’s participating interest would be 19.5% in aggregate.

In July 2007, ERHC acted on behalf of the ERHC/Addax consortium in JDZ Block 4 to reclaim Godsonic’s 9% share because Godsonic failed to meet certain obligations. Addax claims entitlement under the existing agreements to 7.2% out of the recovered 9%, leaving 1.8% remaining with ERHC. If finalized, this would increase ERHC’s share of JDZ Block 4 from 17.7% to 19.5%. ERHC and Addax are currently in arbitration, under amicable conditions, to resolve whether or not additional consideration is due to ERHC from Addax for the 7.2% claim by Addax under the terms of the existing agreements. The parties are also exploring mediation as an alternative to seeing arbitration to conclusion.

In February 2006, ERHC sold a 15% participating interest in Block 3 of the JDZ to Addax Petroleum Resources Nigeria Limited ("Addax Sub") leaving a 10% participating interest in Block 3 to ERHC. In exchange, Addax Sub paid ERHC $7.5 million in the second quarter of fiscal 2006. Under the participation agreement between ERHC and Addax Sub, Addax Sub agreed to pay all of ERHC's future costs in respect of petroleum operations in Block 3. Addax Sub is entitled to 100% of ERHC’s allocation of cost plus up to 50% of ERHC’s allocation of profit until Addax Sub recovers 100% of ERHC's costs.

In March 2006, ERHC sold a 28.67% participating interest in Block 2 of the JDZ to Sinopec International Petroleum Exploration and Production Corporation Nigeria ("Sinopec"), and a 14.33% participating interest in Block 2 of the JDZ to Addax Energy Nigeria Limited ("Addax Ltd.") leaving a 22% participating interest in Block 2 to the Company. In exchange, Sinopec paid ERHC $13.6 million and Addax Ltd. paid ERHC $6.8 million in the second quarter of fiscal 2006. Under the participation agreement among ERHC, Sinopec and Addax Ltd., Sinopec will serve as operator, and Sinopec and Addax Ltd. will pay all of ERHC's future costs in respect of petroleum operations in Block 2. Sinopec and Addax Ltd. are entitled to 100% of ERHC's allocation of cost plus up to 50% of ERHC’s allocation of profit until they recover 100% of ERHC's costs and Sinopec is to receive 6% interest on its future costs, up to $35 million, but only to the extent that those interest costs are covered by production.

Related to the sale of the participating interest in Block 2 to Sinopec, ERHC agreed to pay a $3 million cash success fee ($1.5 million was paid in March 2006 and the remaining $1.5 million was paid in March 2007) to Feltang International Inc., a British Virgin Island company (“Feltang”) that was responsible to ERHC for obtaining Sinopec’s participation in Block 2. ERHC also will issue to Feltang 5,250,000 shares of common stock and warrants to purchase 6,500,000 shares at a fixed exercise price of $0.355 per share. The common stock was valued at $4,803,750 based on the quoted market value of the common stock on the date Sinopec signed the production sharing agreement.

Our business strategy is to enter into agreements to exploit the Company’s interests in Blocks 5, 6 and 9 also. Additionally, the Company intends to exploit its rights in the EEZ.

Current Business Operations

ERHC’s operations are currently focused on the Gulf of Guinea, off the coast of central West Africa. ERHC believes this region has the possibility of significant oil reserves and has worked to realize the value of the assets it has acquired in this region. The Company’s current operations include those below, details of which can be found at the link:http://www.erhc.com/en/cms/?169

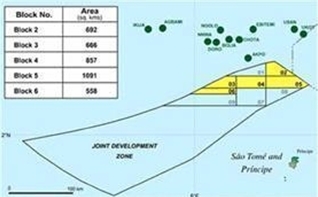

JDZ - ERHC has interests in six of the nine Blocks in the JDZ, a 34,548 square kilometer area approximately 200 kilometers off the coastline of Nigeria and São Tomé & Principe that is adjacent to several large petroleum discovery areas. EEZ - The government of São Tomé & Principe has awarded ERHC rights to participate in exploration and production activities in the EEZ, which encompasses an area of approximately 160,000 square kilometers. These rights were granted in a May 21, 2001 Memorandum of Agreement made between the Democratic Republic of Sao Tome and Principe (DRSTP) and the Company. The Company’s rights in the EEZ expire on October 1, 2024 or, or if the company has a producing working interest in any Block(s) at October 1, 2024, the Company’s rights extend in such Block(s), as long as the Block(s) remains in production. | |

Operations in the JDZ

ERHC has interests in six of the nine Blocks in the JDZ, as follow

| | · | JDZ Block 2: 22.0% Working interest percentage |

| | · | JDZ Block 3: 10.0% Working interest percentage |

| | · | JDZ Block 4: 26.7% Working interest percentage (subject to transfer of 7.2% to Addax ) |

| | · | JDZ Block 5: 15.0% Working interest percentage |

| | · | JDZ Block 6: 15.0% Working interest percentage |

| | · | JDZ Block 9: 20.0% Working interest percentage |

The working interest represents ERHC’s share of all the hydrocarbons production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks.. These costs in blocks 2, 3 and 4 are currently being carried by the operators until production, whereupon the operators will recover their costs from the production revenues.

In early 2008, Addax Petroleum, an experienced exploration and production company that has participation agreements with ERHC in JDZ Blocks 2, 3 and 4, and is the operator of JDZ Block 4 publicly disclosed seismic images and maps showcasing the prospectivity of its JDZ interests. This seismic was compiled by Geco-Prakla (now WesternGeco) in 1999 when WesternGeco shot a 2D seismic survey of approximately 5,900km covering the major part of the JDZ. Interpretation carried out by WesternGeco has led to the identification of 56 prospective structures within Blocks 1 to 9 in the JDZ, of which 17 were defined as prospects and 39 as leads. WesternGeco used reservoir parameters similar to those known from nearby fields in Nigeria and Equatorial Guinea. Combined reserves potential of the 17 prospects was estimated by WesternGeco. The scope of the WesternGeco report was to interpret and map seismic data, highlight prospectivity, and calculate volumetrics. (Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).

The estimate of "recoverable reserves potential" based on WesternGeco's report, which interpreted and mapped seismic data, highlighted prospectivity and calculated volumetrics, was not based on any attempt to comply with the SEC definition of reserves and, accordingly the estimate of recoverable reserves potential is not presented. ERHC Energy has access to the data compiled by WesternGeco under the terms of a data use license with WesternGeco. (Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).

Operations in JDZ Block 4

ERHC's consortium partner Addax Petroleum is the operator of JDZ Block 4. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 4. (Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts). Addax has secured Joint Development Authority approval to explore the Kina Prospect. Drilling equipment has been ordered. Earlier in 2007, Addax and Sinopec jointly entered into an agreement with a subsidiary of Aban Offshore Limited for the provision of the Aban Abraham, which continues being refurbished and upgraded in Singapore. At the end of its contractual obligations to another partnership, the Aban Abraham will be transferred to Addax and Sinopec.

Operations in JDZ Block 3

Anadarko Petroleum is the operator of JDZ Block 3. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 3(Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).. On August 8, 2007, Anadarko presented the initial proposals for exploration well locations for the Block. The Joint Development Authority has approved drilling at the Lemba Prospect and Anadarko has ordered drilling equipment.

Operations in JDZ Block 2

ERHC's consortium partner Sinopec Corp. is the operator in JDZ Block 2. WesternGeco’s interpretation of seismic data indicates significant recoverable reserves in JDZ Block 2(Note that even when properly interpreted, seismic data and visualization techniques are not conclusive in determining if hydrocarbons are present ill economically producible amounts).. The Joint Development Authority has approved drilling at the Tome Prospect. In 2007, Sinopec and Addax jointly entered into an agreement with a subsidiary of Aban Offshore Limited for the provision of the Aban Abraham deepwater drillship, which continues being refurbished and upgraded in Singapore. At the end of its contractual obligations to another partnership, the Aban Abraham will be transferred to Addax and Sinopec.

Background of the JDZ

In the spring of 2001, the governments of Sгo Tomй & Principe and Nigeria reached an agreement over a long-standing maritime border dispute. Under the terms of the agreement, the two established the Joint Development Zone to govern commercial activities within the disputed boundaries. The JDZ is administered by a Joint Development Authority (JDA) which oversees all future exploration and development activities in the JDZ. The remaining claimed territorial waters of Sгo Tomй & Principe are known as the Exclusive Economic Zone (EEZ). Revenues derived from the JDZ will be shared 60/40 between the governments of Nigeria and Sгo Tomй & Principe, respectively.

Background of the EEZ

The government of Sгo Tomй & Principe has awarded ERHC rights to participate in exploration and production activities in Sгo Tomй & Principe’s Exclusive Economic Zone (EEZ). ERHC’s rights include the following:

| | · | The right to receive up to two blocks of ERHC’s choice; and |

| | · | The option to acquire up to a 15 percent paid working interest in another two blocks of ERHC’s choice. |

ERHC would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The EEZ describes territorial waters of Sгo Tomй that encompasses an area of approximately 160,000 square km. It is measured from claimed archipelagic baselines — territorial sea: 12 nautical miles, exclusive economic zone: 200 nautical miles. It is the largest in the Gulf of Guinea. Ocean water depths around the two islands exceed 5,000 feet, depths that have only become feasible for oil production over the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo. The African coast is less than 400 nautical miles offshore, which means the exclusive economic zones of the concerned countries overlap.

The following chart represents ERHC’s current rights in the JDZ blocks.

| JDZ Block # | | ERHC Original Participating Interest (1) | | ERHC Joint Bid Participating Interest | | Participating Interest(s) Sold | | Current ERHC Retained Participating Interest |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (1) | Original Participating Interest granted pursuant to the Option Agreement, dated April 2, 2003, between DRSTP and ERHC (the “2003 Option Agreement”). |

| (2) | In March 2006, ERHC sold an aggregate 28.67% participating interest to Sinopec and an aggregate 14.33% participating interest to Addax Ltd. |

| (3) | In February 2006, ERHC sold a 15% participating interest to Addax Sub. |

| (4) | By a Participation Agreement made in November 2005 and subsequently amended, ERHC sold 33.3% participating interest to Addax. |

| (5) | No contracts have been entered into as of the date hereof. |

| (6) | Includes the 9% reclaimed from Godsonic by ERHC on behalf of the ERHC/Addax consortium following Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. Pursuant to the Amendment to the Participation Agreement made on April 11, 2006, the 9% is subject to distribution between Addax (7.2%) and ERHC (1.8%), if agreement is reached between the parties on the amount payable by Addax to ERHC for said interest. |

Particulars of Participating Agreements

JDZ Block 2 Participation Agreement

| Date of Participation Agreement | | Parties | | Key Terms |

| | 1. Sinopec International Petroleum Exploration and Production Co. Nigeria Ltd 1b. Sinopec International Petroleum and Production Corporation 2a. Addax Energy Nigeria Limited 2b. Addax Petroleum Corporation | | ERHC assigns 28.6% of participating interest to Sinopec International Petroleum Exploration and Production Co Nigeria Ltd (“Sinopec”) and a 14.3% participating interest to Addax Energy Nigeria Limited (“Addax”) leaving ERHC with a 22% participating interest. Consideration from Sinopec to to ERHC for the 28.67% interest (the “SINOPEC assigned interest”) is $13.6 million. Consideration from Addax to ERHC for the 14.33% interest (the “Addax assigned interest”) is $6.8 million In addition, Sinopec and Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 22% interest retained by ERHC (the “retained interest”) in Block 2. Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interest on Block 2 until Sinopec and Addax Sub recover 100% of the carried costs |

JDZ Block 3 Participation Agreement

| Date of Participation Agreement | | Parties | | Key Terms |

| | 2a. Addax Petroleum Resources Nigeria Limited 2b. Addax Petroleum Corporation | | ERHC assigns 15% of participating interest to Addax Petroleum Resources Nigeria Limited (“Addax Sub”) leaving ERHC with a 10% participating interest. Consideration from Addax Sub to ERHC for the 15% interest (the “acquired interest”) is $7.5 million. In addition, Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 10% interest retained by ERHC (the “retained interest”) in Block 3. Addax is entitled to 100% of ERHC’s future costs in respect of petroleum operations. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax Sub recovers 100% of the carried costs |

JDZ Block 4 Participation Agreement

| Date | | Parties | | Key Terms |

| | 2a. Addax Petroleum Nigeria (Offshore 2) Limited | | ERHC shall assign 33.3%2 of participating interest to Addax Petroleum Nigeria (Offshore 2) Limited (“Addax”) (leaving ERHC with a 26.7% participating interest). Consideration from Addax Sub to ERHC for the interest to be acquired by Addax (the “acquired interest”) is fixed at $18 million. In addition, Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC’s retained interest in Block 4. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax recovers 100% of the carried costs |

1 By an Amendment to the Participation Agreement dated February 23 2006, ERHC and Addax amended the Participation Agreement so that the assigned interest to Addax would be changed to 33.3% . By a second Amendment to the Participation Agreement, entered into on March 14 2006, ERHC and Addax amended the Participation Agreement so that the assigned interest to Addax would be 33.3% and ERHC’s participating interest would be 26.7%. By a third Amendment to the Participation Agreement dated April 11 2006, ERHC and Addax agreed that if Godsonic, a third party, did not meet financial and other obligations for the transfer of 9% of ERHC’s participating interest to Godsonic (and was foreclosed from all claims to the 9%), ERHC would transfer 7.2% out of the 9% interest to Addax so that Addax’s participating interest would be 40.5% in aggregate and ERHC’s participating interest would be 19.5% in aggregate. The amount of fresh consideration to accrue from Addax to ERHC for the transfer of the 7.2% is not stated in the third Amendment to the Participation Agreement.

2 See the immediately preceding footnote.

Current Plans for Income Generation

The Company is currently focused on exploiting its interests in Blocks 5, 6 and 9 but no current sources of income other than interest income from cash investments that it purchased with funds generated from sale of participation interests in Blocks 2, 3 and 4 to Sinopec and Addax Ltd. The Company hopes to enter into participation agreements in Blocks 5, 6 and 9, but the timing or likelihood of such transactions cannot currently be predicted. The Company believes that the participation agreements that it has entered into will be its primary source of future revenue; however, the Company has no formal plans to derive income from sources other than the sale of participation interests in additional Blocks or through income generated from successful development of its interests under existing participation

Government Regulation

In the event the Company begins activities relating to the exploration and exploitation of hydrocarbons, it will be required to make the necessary expenditures to comply with the applicable health and safety, environmental and other regulations.

The oil and gas industry is subject to various types of regulation throughout the world. Legislation affecting the oil and gas industry has been pervasive and is under constant review for amendment or expansion. Pursuant to such legislation, numerous government agencies have issued extensive laws and regulations binding on the oil and gas industry and companies engaged in this industry, some of which carry substantial penalties for failure to comply. Such laws and regulations have a significant impact on oil and gas exploration, production and marketing and midstream activities. These laws and regulations increase the cost of doing business and, consequently, will affect results of operations. Inasmuch as new legislation affecting the oil and gas industry is commonplace and existing laws and regulations are frequently amended or reinterpreted, the Company is unable to predict the future cost or impact of complying with such laws and regulations. However, the Company does not expect that any of these laws and regulations will affect its operations in a manner materially different than they would affect other oil and gas companies of similar size.

Competition

Strong competition exists in all sectors of the oil and gas industry. ERHC competes with other independent oil and gas companies for equipment and personnel required to explore, develop and operate properties. Competition is also prevalent in the marketing of oil, gas and natural gas liquids. Higher recent commodity prices have increased the costs of properties available for acquisition, and there are a greater number of companies with the financial resources to pursue acquisition opportunities. Certain of the Company’s competitors have financial and other resources substantially larger than ours, and they have also established strategic long-term positions and maintain strong governmental relationships in countries in which the Company may seek new entry. As a consequence, ERHC may be at a competitive disadvantage in bidding for drilling rights. In addition, many of the Company’s larger competitors may have a competitive advantage when responding to factors that affect demand for oil and natural gas production, such as changing worldwide prices and levels of production, the cost and availability of alternative fuels and the application of government regulations.

Employees

As of September 30, 2007, the Company had five (5) full-time employees and a consultant who serves as the Corporate Secretary.

Availability of Information

We file annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (“SEC”) under the Securities Act of 1934. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov .

We also make available, free of charge on or through our Internet website (http://www.erhc.com), our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

You should carefully consider the risks described below before making any investment decision related to the Company’s securities. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known or that the Company currently deems immaterial also may impair its business operations. If any of the following risks actually occur, the Company’s business could be harmed.

The Company has no sources of revenue and a history of losses from operations

The Company’s business is in an early stage of development. The Company has not generated any operating revenue since its entry into the oil and gas business and has incurred significant operating losses. The Company has incurred net operating losses of $4,976,765 in fiscal 2007 and $43,118,918 since inception. The Company had net losses of $1,756,904 in fiscal 2007. The Company had net income of $23,171,536 in fiscal 2006, primarily as a result of entering into production sharing agreements under which it sold various participatory interests. The Company had net losses of $11,270,478 in fiscal 2005, and $57,993,079 since inception. The Company expects to incur additional operating losses for the foreseeable future.

The Company has a limited operating history in the oil and gas business

The Company’s operations to date have consisted solely of acquiring rights to working interests in the JDZ and EEZ and entering into production sharing contracts. The Company will not be the operator with respect to these contracts. The Company’s future financial results depend primarily on (1) the ability of the Company’s venture partners to provide or obtain sufficient financing to meet their financial commitments in the production sharing contracts, (2) the ability to discover commercial quantities of oil and gas, and (3) the market price for oil and gas. Management cannot predict that the production sharing contracts will result in wells being drilled or if drilled, whether oil and/or gas will be discovered in commercial quantities.

Financing will be needed to fund the financial commitments of the production sharing contracts

While the Company is not required to fund any financial commitments pursuant to the production sharing contracts, project financing will be required to fund exploration activities. Failure of our venture partners to provide or obtain the necessary financing will preclude the commencement of exploration activities.

The Company may not discover commercially productive reserves in the JDZ or EEZ

The Company’s future success depends on its ability to economically locate oil and gas reserves in commercial quantities in the JDZ and EEZ. There can be no assurance that the Company’s planned projects in the JDZ or EEZ will result in significant, if any, reserves or that the Company will have future success in drilling productive wells.

The Company’s non-operator status limits its control over its oil and gas projects in the JDZ or EEZ

The Company will focus primarily on creating exploration opportunities and forming relationships with oil and gas companies to develop those opportunities in the JDZ or EEZ. As a result, the Company will have only a limited ability to exercise control over a significant portion of a project’s operations or the associated costs of those operations in the JDZ or EEZ. The success of a future project is dependent upon a number of factors that are outside the Company’s areas of control. These factors include:

| | • | the availability of future capital resources to the Company and the other participants to be used for drilling wells; |

| | • | the approval of other participants for the drilling of wells on the projects; |

| | • | the economic conditions at the time of drilling, including the prevailing and anticipated prices for oil and gas; and |

| | • | the availability of deep water drilling rigs. |

The Company’s reliance on other project participants and its limited ability to directly control future project costs could have a material adverse effect on its future expected rates of return.

The Company’s success depends on its ability to exploit its limited assets

The Company’s primary assets are rights to working interests in exploration acreage in the JDZ and EEZ under agreements with the JDA and DRSTP. The Company’s operations have been limited to sustaining and managing its rights under these agreements. The Company’s success depends on its ability to exploit these assets, of which there is no assurance that it will be successful.

The Company has limited sources of working capital

The Company is currently focused on exploiting its rights to working interests in exploration acreage in the JDZ and EEZ under agreements with the JDA and DRSTP, but no current sources of income or working capital other than interest income from cash investments that it purchased with funds generated from sale of participation interests in Blocks 2, 3 and 4 to Sinopec and Addax Ltd. The Company hopes to enter into participation agreements in Blocks 5, 6 and 9, but the timing or likelihood of such transactions cannot currently be predicted. The Company believes that the participation agreements that it has entered into will be its primary source of future revenue; however, the Company has no formal plans to derive income from sources other than the sale of participation interests in additional Blocks or through income generated from successful development of its interests under existing participation agreements. If the Company is unsuccessful in its efforts in to exploit its existing working interests in exploration acreage in the JDZ and EEZ, the Company could face significant working capital issued that could cause the curtailment of operations and could ultimately bring the Company’s continued existence into question.

The Company’s competition includes oil and gas conglomerates that have significant advantages over it

The oil and gas industry is highly competitive. Many companies and individuals are engaged in exploring for crude oil and natural gas and acquiring crude oil and natural gas properties, resulting in a high degree of competition for desirable exploratory and producing properties. The companies with which the Company competes are much larger and have greater financial resources than the Company.

Various factors beyond the Company’s control will affect prices of oil and gas

The availability of a ready market for the Company’s future crude oil and natural gas production depends on numerous factors beyond its control, including the level of consumer demand, the extent of worldwide crude oil and natural gas production, the costs and availability of alternative fuels, the costs and proximity of transportation facilities, regulation by authorities and the costs of complying with applicable environmental regulations.

The Company is Subject to the Volatility of Foreign Governments

The Company’s primary assets are located in “emerging markets” controlled by governments that are historically more volatile than the US government. Because of less developed economies and less mature governments in the countries where our primary assets are located, we are exposed us to significant foreign government volatility. We face the risk that national policies may restrict our ability to fully exploit our primary asset. We also face greater risks of expropriation, confiscatory taxation and nationalization. These risks relate to over-dependence on exports in emerging markets, especially with respect to primary commodities, making these economies vulnerable to changes in commodities prices. Foreign governments face challenges with overburdened infrastructure, obsolete or unseasoned financial systems, environmental problems, less developed legal systems, andin some instances, war.

The Company’s Business Interests Are Located Outside of the United States Which Subjects It to Risks Associated with International Activities.

At September 30, 2007, the Company’s major assets were located outside the United States. Apart from cash maintained in United States’ financial institutions, the Company’s primary assets are agreements with DRSTP and the JDA, which provide the Company with rights to participate in exploration and production activities in the Gulf of Guinea off the coast of central West Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility, which is out of management’s control. The Company’s ability to exploit its interests in this area pursuant to such agreements may be adversely impacted by this circumstance.

The future success of the Company’s international operations may also be adversely affected by risks associated with international activities, including economic and labor conditions, political instability, risk of war, expropriation, termination, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar versus the local currencies in which future oil and gas producing activities may be denominated. Changes in exchange rates may also adversely affect the Company’s future results of operations and financial condition.

In addition, to the extent the Company engages in operations and activities outside the United States, it is subject to the Foreign Corrupt Practices Act (the “FCPA”) which, among other restrictions, prohibits U.S. companies and their intermediaries from making corrupt payments to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment, and requires companies to maintain adequate record-keeping and internal accounting practices to accurately reflect their financial and other transactions with foreign officials. The FCPA applies to companies, individual directors, officers, employees and agents. The FCPA also applies to foreign companies and persons taking any act in furtherance of such corrupt payments while in the United States. Under the FCPA, U.S. companies may also be held liable for actions taken by strategic or local partners or representatives.

The FCPA imposes civil and criminal penalties for violations of its provisions. Civil penalties may include fines of up to $500,000 per violation, and equitable remedies such as disgorgement of profits causally connected to the violation (including prejudgment interest on such profits) and injunctive relief. Criminal penalties for violations of the corrupt payments provisions could range up to the greater of $2 million per violation or twice the gross pecuniary gain sought by making the payment, and/or incarceration for up to 5 years per violation. Moreover, if a director, officer or employee of a company is found to have willfully violated the FCPA books and records provisions, the maximum penalty would be imprisonment for 20 years per violation. Maximum fines of up to $25 million also may be imposed for willful violations of the books and records provisions by a company.

The SEC and/or the Department of Justice (“DOJ”) could assert that there have been multiple violations of the FCPA, which could lead to multiple fines. The amount of any fines or monetary penalties which could be assessed would depend on, among other factors, findings regarding the amount, timing, nature and scope of any improper payments, whether any such payments were authorized by or made with knowledge of ERHC or its affiliates, the amount of gross pecuniary gain or loss involved, and the level of cooperation provided to the government authorities during the investigations. Negotiated dispositions of these types of violations also frequently result in an acknowledgement of wrongdoing by the entity and the appointment of a monitor on terms agreed upon with the SEC and DOJ to review and monitor current and future business practices, including the retention of agents, with the goal of assuring future FCPA compliance. Other potential consequences could be significant and include suspension or debarment of ERHC’s ability to contract with governmental agencies of the United States and of foreign countries. Any determination that ERHC has violated the FCPA could result in sanctions that could have a material adverse effect on the Company’s business, prospects, operations, financial condition and cash flow.

The Company’s business interests are located in the Gulf of Guinea offshore of central West Africa and are subject to the Volatility of Foreign Governments

All of our primary assets are located the in the Gulf of Guinea offshore of central West Africa. The governments of Nigeria and the island nation of Sao Tome and Principe granted our participation interests in various concessions in their offshore waters. The governments of Nigeria and Sao Tome and Principe exist in extremely volatile political and economic circumstances and the Company is subject to all the risks associated with those governments. These risks include, but are not limited to:

| · | Loss of future revenue and our concessions as a result of hazards such as war, acts of terrorism, insurrection and other political risks |

| · | Increases in taxes and governmental interests |

| · | Unilateral renegotiation of contracts by government entities |

| · | Difficulties in enforcing our rights against a governmental agency because of the doctrine of sovereign immunity and foreign sovereignty over international operations |

| · | Changes in laws and policies governing operations of foreign-based companies, and |

| · | Currency restrictions and exchange rate fluctuations |

Our foreign operations may also be adversely affected by laws and policies of the United States affecting foreign trade and taxation. Realization of any of these factors could materially and adversely affect our financial position, results of operations and cash flows.

The Company is under investigation by the SEC, the DOJ and a U.S. Senate Subcommittee, and the results of these investigations could have a material adverse effect on its business, prospects, operations, financial condition and cash flow.

On May 4, 2006, a search warrant issued by the U.S. District Court of the Southern District of Texas, Houston Division, was executed on ERHC seeking various records including, among others, documents, if any, related to correspondence with foreign governmental officials or entities in Săo Tomé and Nigeria. The search warrant cited, among other things, possible violations of the FCPA, Section 10(b) of the Exchange Act, Rule 10b-5 under the Exchange Act and criminal conspiracy and wire fraud statutes. ERHC filed suit in federal district court in Texas in June 2006 seeking to protect the Company’s attorney-client privileged documents and to allow its counsel to determine the factual basis for the DOJ’s search warrant affidavit, which is currently under seal.

A related SEC subpoena was issued on May 9, 2006, and a second related subpoena issued on August 29, 2006. The subpoenas request from ERHC a range of documents including all documents related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria, personnel records (specifically, those regarding the Company’s former Chief Financial Officer, Franklin Ihekwoaba) and other corporate records. The Company has been actively responding to both subpoenas.

On July 5, 2007, the U.S. Senate Committee on Homeland Security and Governmental Affairs’ Permanent Subcommittee on Investigations served ERHC with a subpoena, in connection with its review of matters relating to the potential abuse of payments made to foreign governments. The subpoena, as amended on July 18, 2007, seeks documents and information regarding ERHC’s activities, particularly those related to the acquisition of ERHC’s interests in the Gulf of Guinea. ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, are assisting ERHC in responding to the subpoena. Please see “Legal Proceedings” for more information.

The investigations by the DOJ, SEC and Senate Subcommittee are continuing. The Company anticipates that these investigations will be lengthy and do not expect these investigations to be concluded in the immediate future. If violations are found, the Company may be subject to criminal, civil and/or administrative sanctions, including substantial fines, and the resolution or disposition of these matters could have a material adverse effect on its business, prospects, operations, financial condition and cash flow.

These investigations could also result in:

| | · | third party claims against us, which may include claims for special, indirect, derivative or consequential damages; |

| | · | damage to our business, operations and reputation; |

| | · | loss of, or adverse effect on, cash flow, assets, goodwill, operations and financial condition, business, prospects, profits or business value; |

| | · | adverse consequences on our ability to obtain or continue financing for current or future projects; and/or |

| | · | claims by directors, officers, employees, affiliates, advisors, attorneys, agents, debt holders or other interest holders or constituents of ERHC. |

Continuing negative publicity arising out of these investigations could also adversely affect our business and prospects in the commercial marketplace. In addition, these investigations have resulted in increased expenses to ERHC, including substantial legal fees and the diversion of management’s attention from its operations and other activities. If the Company incurs costs or losses as a result of these matters, it may not have the liquidity or funds to address those costs or losses, in which case such costs or losses could have a material adverse effect on its business, prospects, operations, financial condition and cash flow.

Through September 30, 2007, ERHC has incurred substantial costs in responding to the investigations by the DOJ, SEC and Senate Subcommittee. Those costs consist primarily of legal fees paid to the Company’s legal counsel, Akin Gump Strauss Hauer & Feld LLP and documents production costs. These costs have had a significant negative impact on the Company’s cash flows from operations and ERHC expects the use of cash to address these investigations, if continued at current levels could have a serious negative impact on the Company’s liquidity. Neither management nor and its legal counsel can currently assess the magnitude of future cash requirement that could result from prolonged investigations or any negative findings that arise from the investigations. In a worst case scenario, the Company’s cash resources could be exhausted and the Company’s status as a going concern could be brought into substantial doubt.

The Company’s results of operations are susceptible to general economic conditions

The Company’s revenues and results of operations will be subject to fluctuations based upon the general economic conditions both in the United States and internationally. If there were to be a general economic downturn or a recession in the oil and gas industry, the Company’s future revenues, the value of its oil and natural gas exploration concession, as well as its ability to exploit its assets could be materially adversely affected.

The Company has limited sources of working capital

The Company believes that its working capital requirements for 2008 will be approximately $2,000,000 based on maintaining operations at their current level and the generation of interest income at levels similar to 2007. Our consortium partners will pay all of ERHC’s future costs in respect of all petroleum operations subject to total reimbursement upon production. Accordingly, the commencement of drilling operations is not expected to have a significant impact on our working capital requirements. Management believes that our current cash resources will be adequate to maintain our planned operations throughout the drilling and exploration phase of existing participation agreements.

The Company is currently focused on exploiting its interests in Blocks 2, 3, 4, 5, 6 and 9 but has no current source of income other than interest income from cash investments generated from the sale of participation interests in Blocks 2, 3 and 4 to Sinopec and Addax Ltd. The Company hopes to enter into participation agreements in Blocks 5, 6 and 9, but the timing or likelihood of such transactions cannot be predicted.

One shareholder controls approximately 43% of the Company’s outstanding common stock

Chrome Oil Services (“Chrome”) beneficially owns approximately 43% of the outstanding common stock. As a result, Chrome has the ability to substantially influence, and may effectively control the outcome of corporate actions that require stockholder approval, including the election of directors. This concentration of ownership may have the effect of delaying or preventing a future change in control of the Company or a liquidity event.

The Company’s stock price is highly volatile

The Company’s common stock is currently traded on the Over-the-Counter Bulletin Board. The market price of the Company’s common stock has experienced fluctuations that are unrelated to its operating performance. The market price of the common stock has been highly volatile over the last several years. The Company can provide no assurance that its current price will be maintained.

The Company does not currently pay dividends on its common stock and do not anticipate doing so in the future

The Company has paid no cash dividends on its common stock, and there is no assurance that the Company will achieve sufficient earnings to pay cash dividends on its common stock in the future. The Company intends to retain any earnings to fund its operations. Therefore, the Company does not anticipate paying any cash dividends on the common stock in the foreseeable future.

The Company’s stock is considered a “penny stock”

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are equity securities with a share price of less than $5.00. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. These disclosure requirements may have the effect of reducing the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules. The Company’s common stock may be subject to the penny stock rules, and accordingly, investors in the common stock may find it difficult to sell their shares in the future, if at all.

The Company is currently under examination by the Internal Revenue Service

The Internal Revenue Service is currently examining the tax returns for the Company’s 2005 and 2006 tax years. The Company anticipates that this examination should conclude in the next few months. If adjustments are found, the Company may be subject to taxes, penalties and interest and these could have a material adverse effect on its operations, financial condition and cash flow.

Item 1B. Unresolved Staff Comments

None.

Substantially all of the Company’s properties are in the form of working interest. The working interest represents ERHC’s share of all the hydrocarbons production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks.. These costs in blocks 2, 3 and 4 are currently being carried by the operators until production, whereupon the operators will recover their costs from the production revenues. Today, ERHC has interests in Blocks 2, 3, 4, 5, 6, and 9 in the offshore Joint Development Zone (JDZ) of Nigeria and the island nation of Sao Tome and Principe. ERHC has additional interests in the territorial waters of Sao Tome and Principe, known as the Exclusive Economic Zone (EEZ). The Company’s rights in the JDZ and in the EEZ expire on October 1, 2024, or if the company has a producing working interests in any Block(s) at October 1, 2024, the Company’s rights extend in such Block(s), as long as the Block(s) remains in production.

Joint Development Zone

| ERHC has interests in six of the nine Blocks in the Joint Development Zone (JDZ), a 34,548 sq km area approximately 200 km off the coastline of Nigeria and Sao Tome and Principe that is adjacent to several large petroleum discovery areas. ERHC's rights in the JDZ include: | |

| | · | JDZ Block 2: 22.0% Working interest |

| | · | JDZ Block 3: 10.0% Working interest |

| | · | JDZ Block 4: 26.7% Working interest* (subject to transfer of 7.2% to Addax Petroleum) |

| | · | JDZ Block 5: 15.0% Working interest |

| | · | JDZ Block 6: 15.0% Working interest |

| | · | JDZ Block 9: 20.0% Working interest |

Sao Tome and Exclusive Economic Zone

The government of Sгo Tomй & Principe has awarded ERHC rights to participate in exploration and production activities in the EEZ, which encompasses an area of approximately 160,000 square kilometers. These rights were granted in a May 21, 2001 Memorandum of Agreement made between the Democratic Republic of Sao Tome and Principe (DRSTP) and the Company. The Company’s rights in the EEZ expire on October 1, 2024 or, or if the company has a producing working interest in any Block(s) at October 1, 2024, the Company’s rights extend in such Block(s), as long as the Block(s) remains in production.

ERHC’s rights include the following:

| | · | The right to receive up to two blocks of ERHC’s choice; and |

| | · | The option to acquire up to a 15% paid working interest in another two blocks of ERHC’s choice. |

ERHC would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The EEZ describes territorial waters of Sao Tome that encompasses an area of approximately 160,000 square km. It is measured from claimed archipelagic baselines — territorial sea: 12 nautical miles, exclusive economic zone: 200 nautical miles. It is the largest in the Gulf of Guinea.

The Company’s corporate office is located at 5444 Westheimer Road, Suite 1440, Houston, Texas 77056 pursuant to a lease that expires in December 2011.

Item 3. Legal Proceedings

Subpoenas. On May 4, 2006, a Federal court search warrant initiated by DOJ was executed on the Company. The DOJ sought various records including, among other matters, documents, if any, related to correspondence with foreign governmental officials or entities in Sao Tome and Nigeria. Related SEC subpoenas issued on May 9, 2006 and August 29, 2006 also requested a range of documents. ERHC continues to interface with both the DOJ and SEC investigators to respond to the SEC subpoenas and any additional requests for information from the DOJ or SEC. ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, are assisting ERHC in responding to the subpoena

On July 5, 2007, the U.S. Senate Committee on Homeland Security and Governmental Affairs’ Permanent Subcommittee on Investigations served ERHC with a subpoena in connection with its review of matters relating to the potential abuse of payments made to foreign governments. The subpoena, as amended on July 18, 2007, seeks documents and information regarding ERHC’s activities, particularly those related to the acquisition of ERHC’s interests in the Gulf of Guinea. ERHC’s attorneys, Akin Gump Strauss Hauer & Feld LLP, are assisting ERHC in responding to the subpoena.

Godsonic Negotiations. In July 2007, ERHC and Godsonic commenced negotiations to have Godsonic relinquish all of its claims to a 9% interest in Block 4. The parties reached a settlement in August 2007 which resulted in Godsonic’s relinquishment of all claims to the 9% interest in Block 4.

ERHC/Addax Arbitration. Addax, our consortium partner in JDZ Block 4, claims entitlement under our existing agreements to 7.2% out of the recovered 9% interest in Block 4, leaving 1.8% remaining with ERHC. ERHC disputes the consideration that Addax should pay to ERHC for the 7.2%. If Addax’s claims are successful, ERHC’s share of JDZ Block 4 will increase from 17.7% to 19.5% and Addax’s share of the JDZ Block 4 will increase from 33.3% to 40.5% for no additional consideration paid to ERHC. ERHC and Addax are currently in arbitration to resolve the issue. The parties are also exploring mediation as a potential alternative.

Lakeshore Arbitration. In October 2006, Lakeshore Capital Limited (“Lakeshore”) filed an arbitration claim against ERHC seeking $4,400,000 for the alleged value of 4,500,000 shares of ERHC common stock and for a warrant to purchase an additional 1,500,000 shares of common stock at an exercise price of $.20 per share, including interest and costs, as compensation for financial consultancy and related services rendered under a contract with ERHC dated May 20, 2002. The claim was resolved in mediation conducted by the American Arbitration Association by the payment by ERHC of $250,000 to Lakeshore. Pursuant to the Settlement Agreement dated May 16, 2007, the arbitration was discontinued with prejudice.

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. In the opinion of management, no pending or known threatened claims, actions or proceedings against the Company are expected to have a material adverse effect on ERHC’s consolidated financial position, results of operations or cash flows. ERHC intends to defend these matters vigorously; the Company cannot predict with certainty, however, the outcome or effect of any of the litigation or investigatory matters specifically described above or any other pending litigation or claims. There can be no assurance as to the ultimate outcome of these lawsuits and investigations.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market and Related Information

ERHC’s common stock is currently traded on the OTC Bulletin Board under the symbol “ERHE.” The market for the Company’s common stock is sporadic and highly volatile. The following table sets forth the closing sales price per share of the common stock for the past two fiscal years. These prices reflect inter-dealer prices, without retail mark-ups, markdowns or commissions, and may not necessarily represent actual transactions.

Stock Price Highs & Lows

| | | High | | | Low | |

| | | (per share) | |

| Fiscal Year 2006 | | | | | | |

| | $ | 0.41 | | | $ | 0.30 | |

| | $ | 0.95 | | | $ | 0.30 | |

| | $ | 0.92 | | | $ | 0.40 | |

| | $ | 0.54 | | | $ | 0.37 | |

| | | | | | | | | |

| | | | | | | | |

| | $ | 0.51 | | | $ | 0.31 | |

| | $ | 0.48 | | | $ | 0.33 | |

| | $ | 0.42 | | | $ | 0.24 | |

| | $ | 0.34 | | | $ | 0.20 | |

As of November 30, 2007, there were approximately 2,243 stockholders of record. The closing price of the common stock as reported on the OTC Bulletin Board on November 30, 2007 was $0.23. The Company has not paid any dividends during the last two fiscal years and does not anticipate paying any cash dividends in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

In November 2004, the Board of Directors adopted a 2004 Compensatory Stock Option Plan pursuant to which it reserved 20,000,000 shares for issuance. This plan was approved at a special meeting of the stockholders of the Company in February 2005. Under this plan, 7,576,756 shares have been issued.

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | | (a) | | (b) | | | (c) | |

Equity compensation plans approved by security holders | | | 1,000,000 | | | $ | 0.43 | | | | 11,423,244 | |

Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

Recent Sales of Unregistered Securities

The Company has sold the following unregistered securities:

| | · | During the second fiscal quarter of 2007, warrants issued in 2003, with an exercise price of $0.20, were exercised on a cashless basis, which exercise resulted in the issuance of an aggregate of 2,949,587 shares of common stock. |

| | · | During the fourth fiscal quarter of 2007, there were an aggregate of 300,000 shares of common stock due to the Company’s directors for services rendered as more fully disclosed in Item 10, Directors and Executive Officers of the Registrant. |

With respect to the sale of the unregistered securities referenced above, all transactions were exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended. No sales commissions were paid in connection with these transactions.

Issuer Purchases of Equity Securities

The Company has not repurchased any of its Common Stock.

Item 6. Selected Financial Data

The selected financial data of the Company presented below as of and for each of the five years in the period ended September 30, 2007, has been derived from the audited financial statements of the Company. The financial statements as of and for the years ended September 30, 2007, 2006 and 2005 have been audited by Malone & Bailey, PC, an independent registered public accounting firm. The financial statements as of and for the years ended September 30, 2003 and 2004 were audited by another independent registered public accounting firms. The data set forth below should be read in conjunction with the Company’s financial statements, related notes thereto and Management’s Discussion and Analysis of Financial Condition and Plan of Operations, contained elsewhere herein.

| | | For the Years Ended September 30, | |

| Statements of Operations Data | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| | $ | 4,976,765 | | | $ | (24,113,494 | ) | | $ | 4,652,459 | | | $ | 2,085,426 | | | $ | 1,944,655 | |

| | | (1,843 | ) | | | (2,099 | ) | | | (1,147,248 | ) | | | (1,671,759 | ) | | | (1,209227 | ) |

| | | 1,498,704 | | | | 1,123,141 | | | | 278,804 | | | | 163,797 | | | | - | |

Loss on extinguishment of debt | | | - | | | | - | | | | (5,749,575 | ) | | | - | | | | - | |

| | | (1,723,000 | ) | | | 2,063,000 | | | | - | | | | - | | | | - | |

| | | (1,756,904 | ) | | | 23,171,536 | | | | (11,270,478 | ) | | | (3,593,388 | ) | | | (3153882 | ) |

Net income (loss) per share – basic and diluted | | | 0.00 | | | | 0.03 | | | | (0.02 | ) | | | (0.01 | ) | | | (0.01 | ) |

Weighted average shares of common stock outstanding | | | 720,966,165 | | | | 712,063,980 | | | | 671,164,058 | | | | 592,603,441 | | | | 567,788,483 | |

| | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | $ | 2,839,500 | | | $ | 2,839,500 | | | $ | 5,679,000 | | | $ | 5,679,000 | | | $ | 5,679,000 | |

| | | 39,854,641 | | | | 45,878,249 | | | | 6,720,210 | | | | 5,728,556 | | | | 5,735,744 | |

| | | 5,947,982 | | | | 10,390,126 | | | | 2,799,011 | | | | 14,757,208 | | | | 16,283,506 | |

Shareholders' equity (deficit) | | | 33,906,659 | | | | 35,488,123 | | | | 3,941,199 | | | | (9,028,652 | ) | | | (10,547,762 | ) |

Item 7. Management’s Discussion and Analysis of Financial Condition and Plan of Operations

Introduction

The following discussion and analysis presents management’s perspective of our business, financial condition and overall performance. This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future. You must read the following discussion of the results of the operations and financial condition of the Company in conjunction with its financial statements, including the notes thereto included in this Form 10-K filing. The Company’s historical results are not necessarily an indication of trends in operating results for any future period.

Reference is made to “Item 6. Selected Financial Data” and “Item 8. Financial Statements and Supplementary Data.”

Overview of Business

ERHC reports as a development stage enterprise as there are currently no significant operations and no revenue has been generated from business activities. The Company was incorporated in 1986 as a Colorado corporation, and was engaged in a variety of businesses until 1996, when it began its current operations as an independent oil and gas Company. The Company’s goal is to maximize its value through exploration and exploitation of oil and gas reserves in the Gulf of Guinea offshore of central West Africa. The Company’s current focus is to exploit its primary assets, which are rights to working interests in exploration acreage in the JDZ and the EEZ. The Company has entered into production sharing agreements with upstream oil and gas companies in these JDZ Blocks to assist the Company in exploring its assets in the JDZ. The technical and operation expertise in conducting exploration operations will be provided by participating in the Company’s interest oil and gas companies. The Company is also exploring opportunities in other areas of the energy industry

State of Participation Interests

The following represents ERHC’s current rights in the JDZ blocks.

| JDZ Block # | | ERHC Original Participating Interest (1) | | ERHC Joint Bid Participating Interest | | Participating Interest(s) Sold | | Current ERHC Retained Participating Interest |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (1) | Original Participating Interest granted pursuant to the Option Agreement, dated April 2, 2003, between DRSTP and ERHC (the “2003 Option Agreement”). |

| (2) | In March 2006, ERHC sold an aggregate 28.67% participating interest to Sinopec and an aggregate 14.33% participating interest to Addax Ltd. |

| (3) | In February 2006, ERHC sold a 15% participating interest to Addax Sub. |

| (4) | By a Participation Agreement made in November 2005 and subsequently amended, ERHC sold 33.3% participating interest to Addax. |

| (5) | No contracts have been entered into as of the date hereof. |

| (6) | Includes the 9% reclaimed from Godsonic by ERHC on behalf of the ERHC/Addax consortium following Godsonic's inability to fulfill financial and other conditions upon which the 9% was to have been assigned to Godsonic. Pursuant to the Amendment to the Participation Agreement made on April 11, 2006, the 9% is subject to distribution between Addax (7.2%) and ERHC (1.8%), if agreement is reached between the parties on the amount payable by Addax to ERHC for said interest. |

Particulars of Participating Agreements

JDZ Block 2 Participation Agreement

| Date of Participation Agreement | | Parties | | Key Terms |

| | 1. Sinopec International Petroleum Exploration and Production Co. Nigeria Ltd 1b. Sinopec International Petroleum and Production Corporation 2a. Addax Energy Nigeria Limited 2b. Addax Petroleum Corporation | | ERHC assigns 28.6% of participating interest to Sinopec International Petroleum Exploration and Production Co Nigeria Ltd (“Sinopec”) and a 14.3% participating interest to Addax Energy Nigeria Limited (“Addax”) leaving ERHC with a 22% participating interest. Consideration from Sinopec to to ERHC for the 28.67% interest (the “SINOPEC assigned interest”) is $13.6 million. Consideration from Addax to ERHC for the 14.33% interest (the “Addax assigned interest”) is $6.8 million In addition, Sinopec and Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 22% interest retained by ERHC (the “retained interest”) in Block 2. Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interest on Block 2 until Sinopec and Addax Sub recover 100% of the carried costs |

JDZ Block 3 Participation Agreement

| Date of Participation Agreement | | Parties | | Key Terms |

| | 2a. Addax Petroleum Resources Nigeria Limited 2b. Addax Petroleum Corporation | | ERHC assigns 15% of participating interest to Addax Petroleum Resources Nigeria Limited (“Addax Sub”) leaving ERHC with a 10% participating interest. Consideration from Addax Sub to ERHC for the 15% interest (the “acquired interest”) is $7.5 million. In addition, Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of the 10% interest retained by ERHC (the “retained interest”) in Block 3. Addax is entitled to 100% of ERHC’s future costs in respect of petroleum operations. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax Sub recovers 100% of the carried costs |

JDZ Block 4 Participation Agreement

| Date | | Parties | | Key Terms |

| | 2a. Addax Petroleum Nigeria (Offshore 2) Limited | | ERHC shall assign 33.3%2 of participating interest to Addax Petroleum Nigeria Offshore Limited (“Addax”) (leaving ERHC with a 26.7% participating interest). (2) Consideration from Addax Sub to ERHC for the interest to be acquired by Addax (the “acquired interest”) is fixed at $18 million. In addition, Addax to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC’s retained interest in Block 4. Addax is entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil until Addax recovers 100% of the carried costs |