- LE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lands' End (LE) DEF 14ADefinitive proxy

Filed: 1 Apr 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14c-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

LANDS’ END, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

April 1, 2016

To our Stockholders:

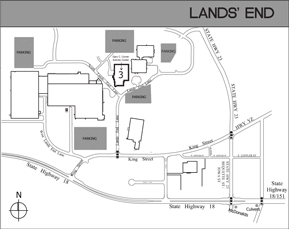

I am pleased to invite you to attend the annual meeting of stockholders of Lands’ End, Inc. (the “Company” or “Lands’ End”) on Thursday, May 12, 2016. The meeting will begin at 9:00 a.m. (Central time) in the Gary C. Comer Activity Center, 3 Lands’ End Lane, Dodgeville, Wisconsin, 53595.

We are furnishing proxy materials to our stockholders over the Internet, which we believe expedites stockholders’ receipt of proxy materials, while also lowering the costs that the Company incurs and, as part of our continued efforts to be “Lands’ Friendly,” reducing the environmental impact of our Annual Meeting.

Please read the Proxy Statement and vote your shares, whether or not you plan to attend the Annual Meeting in person. Instructions for Internet and telephone voting are included in your Notice of Internet Availability of Proxy Materials or proxy card (if you received your materials by mail).

Admission to the 2016 Annual Meeting

An Admission Ticket (or other acceptable proof of stock ownership) and a form of government-issued photo identification (such as a valid driver’s license or passport) will be required for admission to the Annual Meeting. Only stockholders who own Lands’ End common stock as of the close of business on March 14, 2016 will be entitled to attend the Annual Meeting. We strongly urge you to obtain your Admission Ticket in advance by following the instructions on page 4 of the Proxy Statement.

Registration will begin at 8:15 a.m. and seating will begin at 8:30 a.m. Cameras, recording devices, and other electronic devices will not be permitted at the Annual Meeting.

| Sincerely, |

|

Federica Marchionni President and Chief Executive Officer |

LANDS’ END, INC. 1 LANDS’ END LANE DODGEVILLE, WISCONSIN 53595

Lands’ End, Inc.

1 Lands’ End Lane

Dodgeville, Wisconsin 53595

Notice of 2016 Annual Meeting of Stockholders

| Date: | May 12, 2016 | |

| Time: | 9:00 a.m. Central Time | |

| Place: | Lands’ End, Inc. | |

| Gary C. Comer Activity Center | ||

| 3 Lands’ End Lane | ||

| Dodgeville, Wisconsin 53595 |

Please attend the 2016 Annual Meeting of Stockholders of Lands’ End, Inc. (the “Company,” “our company,” “we,” “our,” or “us”) to:

| 1. | Elect the seven director nominees named in the accompanying Proxy Statement; |

| 2. | Hold a non-binding advisory vote to approve the compensation of our named executive officers; |

| 3. | Ratify the appointment by the Audit Committee of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2016; and |

| 4. | Consider any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

The record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting is March 14, 2016. Only stockholders of record at the close of business on that date can vote at, or will be eligible to attend, the Annual Meeting.

On or about April 1, 2016 we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of March 14, 2016 and posted our proxy materials on the website referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. For those who previously requested printed proxy materials or electronic materials on an ongoing basis, you will receive those materials as you requested.

It is important that your shares are represented at the Annual Meeting. Stockholders may vote their shares (1) in person at the Annual Meeting, (2) by telephone, (3) through the Internet, or (4) by completing and mailing a proxy card if you receive your proxy materials by mail. Specific instructions for voting by telephone or through the Internet (including voting deadlines) are included in the Notice and in the proxy card. If you attend and vote at the Annual Meeting, your vote at the Annual Meeting will replace any earlier vote.

| By Order of the Board of Directors. |

Dorian R. Williams Senior Vice President, General Counsel, and Corporate Secretary |

| April 1, 2016 |

PROXY STATEMENT

The accompanying proxy is being solicited on behalf of the Board of Directors for use at the Annual Meeting of Stockholders to be held on May 12, 2016. On or about April 1, 2016 the Company began mailing to stockholders a Notice of Internet Availability of the Proxy Materials containing instructions on how to access proxy materials via the Internet and how to vote online (www.proxyvote.com). Stockholders who did not receive the Notice will continue to receive a paper or electronic copy of the proxy materials, which the Company also began sending on or about April 1, 2016.

Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Stockholders

The Company’s Proxy Statement for the 2016 Annual Meeting of Stockholders and the Annual Report on Form 10-K for the fiscal year ended January 29, 2016 are available at www.proxyvote.com.

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 14 | ||||

| 18 | ||||

Item 2. Advisory Vote to Approve the Compensation of Our Named Executive Officers | 41 | |||

Item 3. Ratification of Appointment of Independent Registered Public Accounting Firm | 41 | |||

| 43 | ||||

| 48 |

i

| Q. | Why is Lands’ End distributing this Proxy Statement? |

| A. | Our Board of Directors is soliciting proxies for use at the Lands’ End 2016 Annual Meeting (the “Annual Meeting”) to be held on Thursday, May 12, 2016, at 9:00 a.m. Central Time, in the Gary C. Comer Activity Center, 3 Lands’ End Lane, Dodgeville, Wisconsin, 53595. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information about the matters to be voted upon at the Annual Meeting. |

| Q. | How was Lands’ End, Inc. separated from Sears Holdings Corporation? |

| A. | On April 4, 2014, Sears Holdings Corporation (“Sears Holdings”) distributed 100% of the issued and outstanding shares of Lands’ End common stock to Sears Holdings stockholders as of March 24, 2014, the record date for the distribution (the “Separation”). Following the Separation, Lands’ End began operating as a separate, publicly traded company. |

| Q. | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| A. | In accordance with rules and regulations adopted by the of the Securities and Exchange Commission (“SEC”), instead of mailing a printed copy of our proxy materials to each stockholder, we are furnishing proxy materials, including this Proxy Statement and the Annual Report on Form 10-K, by providing access to such documents on the Internet. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, a Notice of Internet Availability of Proxy Materials (the “Notice”) has been sent to most of our stockholders instructing them as to how to access and review the proxy materials on the Internet. The Notice also provides instructions as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, please follow the instructions for requesting such materials in the Notice. |

| Q. | What will stockholders be asked to do at the Annual Meeting? |

| A. | At the Annual Meeting, our stockholders will be asked to: |

| • | elect the seven director nominees named in this Proxy Statement to the Board of Directors; |

| • | hold a non-binding advisory vote to approve the compensation of our named executive officers (as identified under“Executive Compensation”); |

| • | ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2016; and |

| • | consider any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

| Q. | What does it mean to vote by proxy? |

| A. | It means that you give someone else the right to vote your shares in accordance with your instructions. In this way, you ensure that your vote will be counted even if you are unable to attend the Annual Meeting. If you give your proxy but do not include specific instructions on how to vote, the individuals named as proxies will vote your shares as follows: |

| • | FORthe election of seven nominees for director; |

| • | FORthe approval, on a non-binding advisory basis, of the compensation of our named executive officers as described in this Proxy Statement; and |

1

| • | FORthe ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2016. |

| Q. | Who is entitled to vote? |

| A. | Only holders of our common stock at the close of business on March 14, 2016 (the “Record Date”) are entitled to vote at the Annual Meeting. Each outstanding share of common stock is entitled to one vote. There were 31,969,645 shares of our common stock outstanding on the Record Date. |

| Q. | How do I cast my vote? |

| A. | If you hold your shares directly in your own name, you are a “registered stockholder” and can complete and submit a proxy through the Internet, by telephone or by mail (if you received your proxy materials by mail) or vote in person at the Annual Meeting. If your shares are held in the name of a broker or other nominee, you are a “street-name stockholder” and will receive instructions from your broker or other nominee describing how to vote your shares. |

| Q. | How do I vote by telephone or through the Internet? |

| A. | If you are a registered stockholder, you may vote by telephone or through the Internet following the instructions in the Notice or in the proxy card. If you are a street-name stockholder, your broker or other nominee will provide information for you to use in directing your broker or nominee how to vote your shares. |

| Q. | Who will count the vote? |

| A. | A representative of Broadridge Financial Services, Inc., an independent tabulator, will count the vote and act as the inspector of election. |

| Q. | Can I change my vote after I have voted? |

| A. | A subsequent vote by any means will change your prior vote. For example, if you voted by telephone, a subsequent Internet vote will change your vote. If you are a registered stockholder and wish to change your vote by mail, you may do so by requesting, in writing, a proxy card from the Corporate Secretary at Lands’ End, Inc., Law Department, 1 Lands’ End Lane, Dodgeville, Wisconsin 53595, Attention: General Counsel and Corporate Secretary. The last vote timely received prior to the Annual Meeting will be the one counted. If you are a registered stockholder, you may also change your vote by voting in person at the Annual Meeting. Street-name stockholders wishing to change their votes must contact the broker or nominee directly (the holder of record). If you are a street-name stockholder, you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting, you will not be permitted to vote unless you obtain a signed proxy from your bank, broker or other nominee. |

| Q. | Can I revoke a proxy? |

| A. | Yes, registered stockholders may revoke a properly executed proxy at any time before it is exercised by submitting a letter addressed to and received by the Corporate Secretary at the address listed in the answer to the previous question, or by voting in person at the meeting. If you are a street-name stockholder, you must contact your broker or other nominee for instructions on how to revoke your voting instructions for your shares. |

| Q. | What does it mean if I receive more than one Notice, proxy or voting instruction card? |

| A. | It means your shares are registered differently or are in more than one account. For all Notices you receive, please enter your vote by Internet for each control number you have been assigned. If you received paper |

2

| copies of proxy materials, please complete, sign and mail all proxy and voting instruction cards you receive. We encourage you to register all your accounts in the same name and address. Registered stockholders may contact our transfer agent, Computershare Trust Company, N.A., at P.O. Box 30170, College Station, Texas 77842 (1-866-627-2096). Street-name stockholders holding shares through a broker or other nominee should contact their broker or nominee and request consolidation of their accounts. |

| Q. | What is a quorum? |

| A. | A majority of the outstanding shares entitled to vote, being present or represented by proxy at the Annual Meeting, constitutes a quorum. A quorum is necessary to conduct the Annual Meeting. |

| Q. | How many votes are needed to approve each of the proposals? |

| A. | Item 1:The director nominees will be elected by a plurality of the votes cast by the shares of common stock entitled to vote at the Annual Meeting and present in person or represented by proxy. This means that the seven nominees who receive the most affirmative votes will be elected as directors. |

Item 2:Approval of the compensation of our named executive officers on a non-binding advisory basis requires the affirmative vote of a majority of those shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal.

Item 3: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm requires the affirmative vote of a majority of those shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal.

| Q. | What is the effect of an abstention? |

| A. | The shares of a stockholder who abstains from voting on a matter will be counted for purposes of determining whether a quorum is present at the Annual Meeting so long as the stockholder is present in person or represented by proxy. With regard to the election of directors, votes may be cast in favor or withheld, and votes that are withheld will have no effect. On all other matters, abstentions may be specified. An abstention from voting on a proposal by a stockholder will have the same legal effect as a vote “against” such proposal. |

| Q. | How will votes be counted on shares held through brokers? |

| A. | If you are a street-name stockholder and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Brokers are not entitled to vote on the election of directors, or the advisory proposal to approve the compensation of our named executive officers unless the brokers receive voting instructions from the beneficial owner. The shares of a stockholder whose shares are not voted because of a broker non-vote on a particular matter will be counted for purposes of determining whether a quorum is present at the Annual Meeting so long as the stockholder is represented by proxy. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered present and entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Brokers will be permitted to vote without voting instructions on the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, assuming that a quorum is obtained. |

| Q. | Who may attend the Annual Meeting? |

| A. | Any stockholder as of the Record Date may attend. Seating and parking are limited. |

3

If you plan to attend the meeting, you will be required to present an Admission Ticket (or other acceptable proof of stock ownership) and a form of government-issued photo identification (such as a valid driver’s license or passport). We strongly urge you to obtain your Admission Ticket in advance by accessing www.proxyvote.com and following the instructions provided (you will need the 16 digit number included on your proxy card, voting instruction form or Notice).

Alternatively, the following documents will be accepted in lieu of an Admission Ticket for those stockholders of record who are unable to obtain an Admission Ticket in advance of the Annual Meeting:

| • | If you received a Notice and will not be requesting a printed copy of the proxy materials, you may use your Notice as your Admission Ticket. |

| • | If your Lands’ End shares are registered in your name and you received your proxy materials by mail, you may use the Admission Ticket attached to your proxy card at the Annual Meeting. |

| • | If your Lands’ End shares are held in a bank or brokerage account, you may use a recent bank or brokerage statement showing that you owned shares of Lands’ End common stock on March 14, 2016, or a proxy or signed letter from your broker or other nominee confirming ownership of Lands’ End shares as of the Record Date. |

| Q. | Can I access future annual meeting materials through the Internet rather than receiving them by mail? |

| A. | Yes. Registered stockholders can sign up for electronic delivery at www.proxyvote.com. If you vote through the Internet, you can also sign up for electronic delivery. Just follow the instructions that appear after you finish voting. You will receive an e-mail next year containing links to our Annual Report on Form 10-K and the Proxy Statement for our 2017 annual meeting. Street-name stockholders may also have the opportunity to receive copies of these documents electronically. Please check the information provided in the proxy materials mailed to you by your broker or other nominee regarding the availability of this service. This procedure reduces the printing costs and fees we incur in connection with the solicitation of proxies. |

| Q. | What is “householding”? |

| A. | Lands’ End has adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, registered stockholders who have the same address and last name and do not receive proxy materials electronically will receive a single Notice or set of proxy materials, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. Stockholders who participate in householding will continue to receive separate proxy cards. This procedure can result in savings to Lands’ End by reducing printing and postage costs. |

If you participate in householding and wish to receive a separate Notice or set of proxy materials, or if you wish to receive separate copies of future Notices or sets of proxy materials, please call 1-866-540-7095 or write to: Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717. The Company will deliver the requested documents to you promptly upon your request.

Registered stockholders who share the same address, currently receive multiple copies of proxy materials, and who wish to receive only one copy of these materials per household in the future may contact Broadridge Financial Solutions at the address or telephone number listed above. Street-name stockholders should contact their broker or other nominee to request information about householding.

4

Corporate Governance Practices

The Lands’ End Board of Directors (the “Board”) is committed to effective corporate governance. The Board has approved and adopted Corporate Governance Guidelines that provide the framework for Lands’ End’s governance. The Nominating and Corporate Governance Committee of the Board reviews and assesses the Corporate Governance Guidelines annually and recommends changes to the Board as appropriate. The Corporate Governance Guidelines, along with the charters of Board committees, our Code of Conduct and our Board of Directors Code of Conduct are available on our website at www.landsend.com, under the heading “Investor Relations” and then “Corporate Governance.”

Among other things, the Corporate Governance Guidelines provide that:

| • | Independent Directors will meet regularly in executive session in conjunction with regularly scheduled Board meetings. |

| • | Executive sessions of the independent Directors will occur at least twice a year as determined by the independent Directors. |

| • | The Board and its committees have the power to engage, at the Company’s expense, independent legal, financial, and other advisors as deemed necessary, without consulting or obtaining the approval of the Company’s officers in advance. |

| • | The Board will conduct annual self-evaluations to assess whether it and its committees are functioning effectively. |

Director Independence

Based on the review and recommendation by the Nominating and Corporate Governance Committee, the Board analyzed the independence of each Director. In making its independence determinations, the Board considers transactions, relationships and arrangements between Lands’ End and entities with which directors are associated as executive officers, directors and trustees. When these transactions, relationships and arrangements exist, they are in the ordinary course of business and are of a type customary for a retail company like Lands’ End.

As a result of this review, the Board affirmatively determined that the following directors meet the standards of independence under the applicable the Nasdaq Stock Market listing rules, including that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment:

Robert Galvin

Elizabeth Darst Leykum

Josephine Linden

John T. McClain

Jignesh Patel

In addition, Tracy Gardner, who did not stand for re-election to the Board at the Company’s 2015 annual meeting of stockholders, was determined to meet the standards of independence for a director during her tenure on the Board until the 2015 annual meeting.

In the course of the Board’s independence determination, the Board considered transactions, relationships and arrangements required to be disclosed pursuant to SEC rules. In determining that Ms. Leykum met the applicable independence standards, the Board considered her relationship with ESL Investments, Inc. and Edward S. Lampert, significant stockholders of the Company. In determining that Mr. McClain met the applicable independence standards, the Board considered his service as a trustee of Seritage Growth Properties,

5

which, as of January 29, 2016, owned or held an indirect ownership interest in 74 stores in which the Company subleased space from a subsidiary of Sears Holdings for Lands’ End Shops at Sears.

The Board also has determined that each member of the Audit Committee (1) meets additional, heightened independence criteria applicable to audit committee members under the Nasdaq Stock Market listing rules and SEC Rule 10A-3, and (2) is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC.

The Board also has determined that all members of the Compensation Committee meet independence criteria applicable to compensation committee members under the Nasdaq Stock Market listing rules.

6

Item 1 is the election of seven nominees to our Board: Robert Galvin, Elizabeth Darst Leykum, Josephine Linden, Federica Marchionni, John T. McClain, Jignesh Patel and Jonah Staw. Each of the nominees is a current member of the Board. If elected, the seven nominees will hold office until the next annual meeting or until their successors are elected and qualified. The persons named in the proxy card (the “proxies”) will vote FOR the election of all of the nominees listed below, unless otherwise instructed.

The current members of the Board are Robert Galvin, Elizabeth Darst Leykum, Josephine Linden, Federica Marchionni, John T. McClain, Jignesh Patel and Jonah Staw. You may not vote for a greater number of persons than the number of nominees named in this Proxy Statement.

The Board expects all nominees to be available for election. If any nominee should become unavailable to serve as a director for any reason prior to the Annual Meeting, the Board may substitute another person as a nominee. In that case, your shares will be voted for that other person.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR” ELECTION OF THE SEVEN NOMINEES FOR DIRECTOR.

The biographies of each of the nominees below contains information regarding the person’s service as a director, business experience, education, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Board to determine that the person should serve as a director for the Company.

Robert Galvin, 56, joined the Board in May 2014. He is the principal of Galvin Consulting, which he founded in January 2014. Mr. Galvin served as the chief executive officer of Elie Tahari, a leading global designer lifestyle brand, from January to November 2013. Prior to that, he served as the president of Camuto Group, a leading global women’s fashion footwear company from April 2007 to January 2012. Mr. Galvin previously served as the chief operating officer of Sport Brands International, a global wholesale and retail athletic branded company from 2003 until April 2007. He previously held leadership roles at Kurt Salmon Associates, York International and Nine West Group Inc. Mr. Galvin has served on the board of Big 5 Sporting Goods Corporation since July 2015, bebe stores, inc. since November 2014, and Cherokee Inc. since June 2012. Mr. Galvin has a B.S. in Accounting from Fairfield University and a M.B.A. from New York University, Stern School of Business. Mr. Galvin brings an extensive knowledge of the apparel industry and management experience, gained through his service as chief executive officer and through numerous senior executive positions at several apparel companies for more than 15 years.

Elizabeth Darst Leykum, 37, joined the Board in March 2014. Since October 2013 she has served as a founding principal of HEG Capital LLC, a Connecticut-registered investment advisory firm that provides research and advisory services to ESL Investments, Inc. Prior to joining HEG Capital, Ms. Leykum was, from June 2012 to September 2013, a Vice President at Rand Group, an investment management services firm that provided services to ESL Investments, Inc. Until June 2012, she was a Vice President of ESL Investments, Inc., which she joined in July 2004. From 2000 to 2002, Ms. Leykum worked in the Principal Investment Area at Goldman, Sachs & Co. She served as a director of Sears Hometown and Outlet Stores, Inc. from October 2012 to May 2014 and is currently a trustee of Greenwich Academy, a college preparatory school, where she is a member of its Finance and Investment committees. She graduated Phi Beta Kappa,magna cum laude from Harvard College and received an M.B.A with distinction from Harvard Business School. Through her work in investment management, she brings to the Board a strong ability to analyze, assess, and oversee corporate and financial performance.

7

Josephine Linden, 64, joined the Board in March 2014 and has served as Chair of the Board since October 2014. She founded and has been the managing member and principal of Linden Global Strategies LLC, a New York-based SEC registered investment management firm working with sophisticated U.S. and international clients, since September 2011. From September 2010 to July 2011, she held an Adjunct Professor position in the Finance department of Columbia Business School. In November 2008, Mrs. Linden retired from Goldman, Sachs & Co. as a Partner and Managing Director after having been with the firm for more than 25 years, where she held a variety of roles, including Managing Director and Regional Manager of the New York office for Private Wealth Management, head of Global Equities Compliance, and an Advisor to GSJBWere, Australia. She serves as a trustee, and is Chair of the Financing Committee, of Collegiate School in New York, New York, and also has served as its Treasurer, and chair of its Finance, Audit and Nominating Committees. She acts as financial advisor to The Prince of Wales Foundation. She served as a director of Bally Technologies, Inc. from April 2011 to November 2014 and has served as a director of Sears Hometown and Outlet Stores, Inc. since October 2012. She received an M.B.A. from the University of Chicago, with a specialization in Finance, and a B.A. from the University of Sydney. Mrs. Linden brings extensive knowledge of capital markets and other financial matters to the Board from her 25-year career with Goldman Sachs.

Federica Marchionni, 44, joined Lands’ End as President and Chief Executive Officer and as a member of the Board in February 2015. From 2001 until 2010, she was a global group director based at the headquarters of Dolce & Gabbana, a designer and retailer of apparel and accessories. She rejoined the company in October 2011 to serve as the President of Dolce & Gabbana USA. Prior to rejoining Dolce & Gabbana, she was a Senior Vice President at Ferrari, a luxury automaker and merchandising retailer. Earlier in her career Ms. Marchionni held positions of increasing responsibility in product marketing and sales at industry-leading customer technology and telecommunications companies such as Samsung, Phillips, and Ericsson. She graduatedsumma cum laude from La Sapienza University of Rome with a Master’s Degree in Business Administration. Ms. Marchionni brings to the Board significant creative, strategic and analytical skills and has proven product development, retail and international experience.

John T. McClain, 55, joined the Board in May 2014. Since November 2015, has served as chief financial officer of Lindblad Expeditions Holdings, Inc., a global provider of expedition cruises and adventure travel experiences. Mr. McClain served as the chief financial officer of The Jones Group Inc., a leading global designer, marketer and wholesaler of over 25 brands, from July 2007 until the sale of the company to Sycamore Partners in April 2014. From April 2014 to August 2014, he continued to provide Senior Advisor services related to financial operations to The Jones Group Inc. Prior to that, Mr. McClain held a number of roles at Avis Budget Group, Inc. formerly Cendant Corporation. He joined Cendant Corporation in September 1999, serving as the Senior Vice President, Finance & Corporate Controller until 2006. From July 2006 to 2007, Mr. McClain served as the chief accounting officer of Avis and chief operating officer of Cendant Finance Holdings. Mr. McClain previously held leadership roles at Sirius Satellite Radio Inc. and ITT Corporation. Mr. McClain has served as a trustee of Seritage Growth Properties, a real estate investment trust, since June 2015, and on the board of Nine West Holdings from April 2014 until October 2015. Mr. McClain holds a B.S degree in accounting from Lehigh University. Mr. McClain brings over 25 years of executive financial experience, serving at high-level capacities for the retail and consumer sectors.

Jignesh Patel, 45, joined the Board in April 2014. He is a professor in the Computer Science Department at the University of Wisconsin-Madison, where he has served on the faculty since September 2008. He has also served as the Chief Scientist of Pivotal Software, Inc. since June 2015. He co-founded Locomatix, which developed a platform to power mobile data-driven services and applications, and served as its Chief Technology Officer from May 2007 to May 2010 and Chairman of its board and Chief Executive Officer from May 2007 and June 2010, respectively, until August 2013 when the company became part of Twitter. Mr. Patel is currently the sole proprietor of JMP Consulting LLC, which provides consulting services on big data. He is also a Fellow of the Association for Computing Machinery (ACM). He obtained his B. Tech. (with honors) in Computer Science and Engineering from IT-BHU (now ITT-Varanasi) in 1991, M.S. in Computer Sciences from the University of Wisconsin-Madison in 1993, and Ph. D. in Computer Sciences from the University of Wisconsin-Madison in

8

1998. Mr. Patel brings extensive experience with emerging technologies and technology-driven companies from his academic and professional activities.

Jonah Staw, 40, joined the Board in April 2014. Mr. Staw has served as the Chief Executive Officer of Staw Entertainment Enterprises, LLC, an advisory group working with corporate clients including Sears Holdings, since August 2011. Mr. Staw is the co-founder of LittleMissMatched, a multi-channel international brand that includes retail, wholesale, licensing, catalog and internet businesses, and served as its Chief Executive Officer from 2004 to July 2011 and as Chairman from July 2011 to July 2012. Mr. Staw previously served as a Director and Strategist at Frog Design, a product strategy and design firm, from 1999 to 2004 and as a member of the real estate development team of Skanska USA from 1997 to 1999. Mr. Staw graduated Phi Beta Kappa andmagna cum laude from Brown University with a B.A. in the History of Art and Architecture. Mr. Staw brings extensive knowledge of multi-channel retail businesses including digital, branding, product development, marketing and innovation through his professional experience.

The Nominating and Corporate Governance Committee of our Board is responsible for reviewing the qualifications and independence of members of the Board and its various committees on a periodic basis, as well as the composition of the Board as a whole. This assessment includes members’ qualification as independent, as well as consideration of skills and experience in relation to the needs of the Board. New director nominees will be recommended to the Board by the Nominating and Corporate Governance Committee. The ultimate responsibility for selection of director nominees resides with the Board.

While the Company does not have a formal diversity policy, the Board considers diversity in identifying director nominees. The Board and the Nominating and Governance Committee believe that it is important that our directors represent diverse viewpoints. In addition to diversity of experience, the Nominating and Corporate Governance Committee seeks director candidates with a broad diversity of professions, skills and backgrounds. The Nominating and Corporate Governance Committee discusses the diversity of the Board annually.

The Board met six times during fiscal year 2015 (the fiscal year ended January 29, 2016). All of the directors attended over 75% of the total number of meetings of the Board and meetings of the committees on which they served. Our Corporate Governance Guidelines provide that directors are expected to attend Annual Meetings of Stockholders.

Committees of the Board

The Board has standing Audit, Compensation, Nominating and Corporate Governance and Technology Committees.

The table below reflects the current membership of each committee and the number of meetings held by each committee during fiscal year 2015.

| Audit | Compensation | Nominating and Corporate Governance | Technology | |||||||||||||

Robert Galvin | X | X | * | X | X | |||||||||||

Elizabeth Darst Leykum | X | X | * | |||||||||||||

Josephine Linden | X | X | ||||||||||||||

Federica Marchionni | ||||||||||||||||

John T. McClain | X | * | ||||||||||||||

Jignesh Patel | X | X | * | |||||||||||||

Jonah Staw | X | |||||||||||||||

2015 Meetings | 9 | 8 | 5 | 7 | ||||||||||||

| * | Committee Chair |

9

Each committee operates under a written charter. The charters are available on our corporate website, www.landsend.com, under the heading “Investor Relations” and then “Corporate Governance.” The principal functions of each Committee are summarized below.

Audit Committee

| • | Responsible for the compensation and oversight of the work of the independent registered public accounting firm in connection with the annual audit report |

| • | Hires the independent registered public accounting firm to perform the annual audit |

| • | Reviews the Company’s annual and quarterly financial statements, including disclosures made in management’s discussion and analysis of results of operations and financial condition |

| • | Reviews the reports prepared by the independent registered public accounting firm and management’s responses thereto |

| • | Pre-approves audit and permitted non-audit services performed by the independent registered public accounting firm |

| • | Responsible for oversight of risks and exposures associated with financial matters, the Company’s enterprise risk management framework and the steps management has taken to monitor and control risks and exposures |

| • | Reviews management’s plan for establishing and maintaining internal controls |

| • | Reviews the internal audit department’s responsibilities, budget and staffing |

| • | Discusses with the Company’s General Counsel matters that involve our compliance and ethics policies |

| • | Reviews and approves all related party transactions, as defined by applicable Nasdaq Stock Market listing rules |

In June 2015, the Audit Committee established a Related Party Transactions Subcommittee (the “RPT Subcommittee”), consisting of Mr. Galvin, to assist the Audit Committee by reviewing potential related party transactions; material amendments to, or modifications, terminations or extensions of agreements involving related party transactions; and the Company’s guidelines and policies with regard to related party transactions generally. The RPT Subcommittee may approve or pre-approve certain types of related party transactions (and report on them to the Audit Committee at its next scheduled meeting) or may, if it deems it advisable, refer them to the Audit Committee for review.

Compensation Committee

| • | Evaluates the Chief Executive Officer’s performance in light of corporate goals and objectives |

| • | Reviews and approves the base salaries, annual incentive opportunities and cash- and equity-based awards and opportunities for our senior executives |

| • | Reviews and approves employment agreements, severance arrangements, change-in-control agreements and change-in-control provisions affecting any elements of compensation and benefits for our senior executives |

| • | Approves compensation plans and programs for our senior executives |

| • | Approves any special or supplemental compensation and benefits for senior executives, including supplemental retirement benefits and the perquisites provided to them during and after employment |

| • | Receives periodic reports on our compensation programs as they affect all employees |

10

Nominating and Corporate Governance Committee

| • | Reports annually to the Board with an assessment of the performance of the Board |

| • | Recommends to the Board new director nominees |

| • | In concert with the Compensation Committee, reviews annually succession planning recommendations for the Company’s senior executives |

| • | Recommends to the Board director compensation and benefits |

| • | Reviews and reassesses the adequacy of our Corporate Governance Guidelines |

Technology Committee

| • | Reviews the Company’s information technology plans and strategy |

| • | Makes recommendations to the Board on significant technology investments |

| • | Reviews management reports on implementation of significant information technology initiatives |

| • | Reviews reports on existing and future trends in information technology |

| • | Evaluates significant information technology risk exposures of the Company |

| • | Reviews Company risk management and risk assessment guidelines and policies regarding information technology security and data integrity, including the quality and effectiveness of the Company’s information technology security and disaster recovery capabilities |

| • | Reports periodically to the Audit Committee on information technology systems and processes that relate to or affect the Audit Committee’s responsibility for oversight of risks and exposures associated with financial matters |

Communications with the Board

Our Board has adopted a policy and process for stockholders to communicate with the Board or an individual director. Stockholders may communicate with the Board collectively, or with any of its individual non-employee directors, by writing to Lands’ End, Inc. Board of Directors, c/o Corporate Secretary, Lands’ End, Inc., Law Department, 1 Lands’ End Lane, Dodgeville, Wisconsin 53595. The Corporate Secretary has discretion to determine whether stockholder communications are proper for submission to the intended recipient. Examples of stockholder communications that would be considered presumptively inappropriate for submission include the following: communications regarding personal grievances or solicitations; communications that do not relate, directly or indirectly, to the Company; spam and other junk mail; product and service complaints or inquiries; new product suggestions; resumes and other job inquiries; surveys; business solicitations or advertisements; communications that are unduly hostile, threatening, illegal, or similarly unsuitable; and communications that are duplicative of previously submitted communications or are frivolous in nature. We will make available to any director any excluded communication at the director’s request.

Board Leadership Structure

We separate the roles of Chief Executive Officer and Chairman of the Board. Our Chief Executive Officer is responsible for the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to our Chief Executive Officer and senior management and sets the agenda for Board meetings and presides over Board meetings. In carrying out her responsibilities, the Chairman preserves the distinction between management and oversight, maintaining the responsibility of management to develop corporate strategy and the responsibility of the Board to review and express its views on corporate strategy and management’s execution of that strategy.

11

The Board’s Role in Risk Oversight

Consistent with our leadership structure, our Chief Executive Officer and other members of senior management are responsible for the identification, assessment, and management of risks that could affect the Company and the Board provides oversight in connection with these efforts. We do not believe that the Board’s role in risk oversight has an effect on the Company’s leadership structure. The Board’s oversight is conducted primarily through committees of the Board, as disclosed in the descriptions of the responsibilities of the Audit Committee, the Compensation Committee and the Technology Committee above and in the charters of such committees.

The Audit Committee is responsible for oversight of (1) risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, and credit and liquidity matters; (2) the Company’s enterprise risk management framework; and (3) the steps management has taken to monitor and control risks and exposures, including the Company’s risk assessment and risk management policies and strategies and programs and policies relating to legal compliance.

The Technology Committee is responsible for (1) reviewing the significant information technology risk exposures of the Company; (2) reviewing the Company’s risk management and risk assessment guidelines and policies regarding information technology security and data integrity, including the quality and effectiveness of the Company’s information technology security and the Company’s disaster recovery capabilities; and (3) coordinating with the Audit Committee regarding information technology systems and processes that relate to or affect the Audit Committee’s responsibility for oversight of risks.

The Compensation Committee evaluates whether the risks arising from the Company’s compensation policies and practices for its employees would be reasonably likely to have a material adverse effect on the Company.

The Board has retained responsibility for general oversight of risks. The Board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company, including our Chief Financial Officer, our General Counsel, our Chief Information Officer and our senior internal audit executive.

Nomination of Director Candidates

Directors may be nominated by the Board or by stockholders in accordance with our Bylaws. The Nominating and Corporate Governance Committee will, when it deems appropriate, actively seek individuals qualified to become Board members, and will solicit input on director candidates from a variety of sources, including current directors. The Committee will evaluate a candidate’s qualifications and review all proposed nominees for the Board, including those proposed by stockholders, in accordance with its charter and our Corporate Governance Guidelines. This will include a review of the person’s qualifications and independence as well as consideration of diversity, age, skills, education and experience in the context of the needs of the Board. The Committee has the ability to retain a third party to assist in the nomination process.

Director nominees recommended by the Nominating and Corporate Governance Committee are expected to be committed to representing the long-term interests of our stockholders. The Committee believes that it is important to align the interests of directors with those of our stockholders. Generally, each non-employee director is required to acquire a number of shares of our common stock in an amount that, at cost, is equal to one times the amount of the director’s annual retainer in effect on the date when the director first becomes a member of the Board. Non-employee directors must meet this requirement by the third anniversary of that date unless, due to employment or legal restrictions, he or she is unable to acquire our common stock. Board members should possess a high degree of integrity and have broad knowledge, experience and mature judgment. In addition to a meaningful economic commitment to our company as expressed in share ownership, directors and nominees should have predominately business backgrounds, have experience at policy-making levels in business and/or technology, and bring a diverse set of business experiences and perspectives to the Board.

12

Under her executive severance agreement with the Company, a termination of employment by Ms. Marchionni is for “good reason” if, among other events, it results from the failure to nominate her for reelection to the Board.

A Lands’ End stockholder can nominate a candidate for election to the Board by complying with the nomination procedures in our Bylaws. For an election to be held at an annual meeting of stockholders, nomination by a stockholder must be made by notice in writing delivered to the Company not later than the 90th day, and not earlier than the 120th day, prior to the first anniversary of the preceding year’s annual meeting. If the date of the subject annual meeting is more than 30 days before or more than 70 days after the first anniversary of the preceding year’s annual meeting, notice by the stockholder must be delivered not earlier than the 120th day prior to the annual meeting and not later than the later of the 90th day prior to the annual meeting or the 10th day following the day on which public announcement of the date of such annual meeting is first made by the Company. For an election to be held at a special meeting of stockholders, the stockholder’s notice in writing must be delivered to the Company not earlier than the 120th day prior to the special meeting and not later than the later of the 90th day prior to the special meeting or the 10th day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at the special meeting.

A stockholder’s written notice to the Corporate Secretary described in the preceding two paragraphs must be delivered to Lands’ End, Inc., 1 Lands’ End Lane, Dodgeville, Wisconsin 53595, Attn: Corporate Secretary, and must include each of the following:

| • | the name and address of the stockholder; |

| • | the number of shares of capital stock of the Company owned beneficially and of record by the stockholder; |

| • | a description of any agreement, arrangement or understanding with respect to the nomination between or among the stockholder, any of its affiliates or associates, each nominee and any others acting in concert with any of the foregoing; |

| • | a description of any agreement, arrangement or understanding that has been entered into as of the date of the stockholder’s notice by, or on behalf of, the stockholder, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, the stockholder with respect to securities of the Company; |

| • | a representation that the stockholder is a holder of record of stock of the Company entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to propose each nomination; |

| • | a representation whether the stockholder intends or is part of a group that intends (a) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Company’s outstanding capital stock required to elect each nominee and/or (b) otherwise to solicit proxies or votes from stockholders in support of each nomination; |

| • | the name, age and business address of each nominee proposed in the notice; |

| • | all information concerning the stockholder and each nominee required to be disclosed in proxy solicitations for director elections under the proxy rules of the SEC; and |

| • | the written consent of each nominee to serve as a director if so elected. |

The Company may require any proposed nominee to furnish such other information as the Company may reasonably require to determine the eligibility of the nominee to serve as a director. The chairman of any annual meeting or special meeting of stockholders may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedures. A stockholder’s compliance with these procedures will not require the Company to include information regarding a proposed nominee in the Company’s proxy solicitation materials.

13

Our Director Compensation Policy provides for an annual cash retainer for serving as a non-employee director of the Company as follows:

| Cash Compensation(1) | ||||

Board Member | $ | 100,000 | ||

Board Chair (additional) | $ | 30,000 | ||

Audit Committee Chair (additional) | $ | 20,000 | ||

All Other Committee Chairs (additional) | $ | 10,000 | ||

| (1) | Assumes service for a full year; directors who serve for less than the full year are entitled to receive a pro-rated portion of the applicable payment. Each “year,” for purposes of the Director Compensation Policy, begins on the date of our annual meeting of stockholders. |

In addition, the Director Compensation Policy provides that our non-employee directors may elect annually in advance to receive all or a portion of their retainer in the form of shares of Lands’ End common stock issued under the Stock Plan or a successor plan. Beginning in calendar year 2016, upon the approval on a case-by-case basis of the Nominating and Corporate Governance Committee, a non-employee director may participate in health care programs of the Company on a basis no less favorable than senior executives of the Company.

The following table shows information concerning the compensation paid in fiscal year 2015 to non-employee directors who served on the Board during fiscal year 2015.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(a) | Total(b) | |||||||||

Josephine Linden, Chairman | $ | 120,000 | — | $ | 120,000 | |||||||

Robert Galvin | $ | 87,788 | $ | 13,750 | $ | 101,538 | ||||||

Tracy Gardner(c) | $ | 42,308 | — | $ | 42,308 | |||||||

Elizabeth Darst Leykum | $ | 101,538 | — | $ | 101,538 | |||||||

John T. McClain | $ | 110,769 | — | $ | 110,769 | |||||||

Jignesh Patel | $ | 101,538 | — | $ | 101,538 | |||||||

Jonah Staw | $ | 92,308 | — | $ | 92,308 | |||||||

| (a) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. |

| (b) | The amounts in this column do not include amounts attributable to the discount on Lands’ End merchandise and the incremental cost to the Company of health care coverage, in each case, that are available generally to all Lands’ End salaried employees and non-employee directors. |

| (c) | Tracy Gardner served as a director until the Company’s annual meeting of stockholders held on June 5, 2015. |

During fiscal year 2015, Ms. Marchionni and Mr. Huber were employees of the Company and, as such, did not receive separate or additional compensation for their service as a director. See “Executive Compensation” for information relating to the compensation paid to Ms. Marchionni and Mr. Huber during fiscal year 2015.

14

Amount and Nature of Beneficial Ownership

Security Ownership of Directors and Management

The following table sets forth information with respect to the beneficial ownership of our common stock by each of our directors, each named executive officer, and all of our directors and executive officers as a group. Beneficial ownership is shown as of March 25, 2016, except as otherwise noted.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | |||

Robert Galvin | 832 | |||

Edgar O. Huber | — | |||

Scott D. Hyatt | — | |||

Elizabeth Darst Leykum | — | |||

Josephine Linden | 8,000 | |||

Federica Marchionni | 18,673 | |||

John T. McClain | 1,850 | |||

Jignesh Patel | 7,500 | |||

Steven G. Rado | 3,741 | (2) | ||

Kelly Ritchie | 3,355 | (3) | ||

Michael P. Rosera | — | |||

Jonah Staw | 2,350 | |||

|

| |||

Directors and executive officers as a group (15 persons) | 48,920 | (4) | ||

| (1) | Beneficial ownership includes shares in which the director or executive officer may be deemed to have a beneficial interest, including shares in which such director or executive officer has the right to acquire within 60 days of March 25, 2016. Unless otherwise indicated, the directors and executive officers listed in the table have sole voting and investment power with respect to the common stock listed next to their respective names. Information is provided for reporting purposes only and should not be construed as an admission of actual beneficial ownership. |

| (2) | Includes 3,741 shares that are subject to Restricted Stock Units but vest within 60 days of March 25, 2016. |

| (3) | Includes 3,355 shares that are subject to Restricted Stock Units but vest within 60 days of March 25, 2016. |

| (4) | Includes 9,375 shares that are subject to Restricted Stock Units but vest within 60 days of March 25, 2016. |

To the knowledge of the Company, as of March 25, 2016, no director or executive officer beneficially owned 1% or more of our outstanding common stock, and all directors and executive officers together beneficially owned an aggregate of less than 1% of our outstanding common stock.

Under the Company’s Insider Trading Policy, our employees and directors are prohibited from engaging in, among other things, short sale transactions and hedging transactions with respect to Company securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and private exchange funds. Our employees and directors also are prohibited from holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan.

15

Security Ownership of 5% Beneficial Owners

The following table sets forth information with respect to beneficial ownership of our common stock by persons known by us to beneficially own 5% or more of our outstanding common stock.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(a) | Percent of Class(b) | ||||||

Capital Research Global Investors(c) | 3,404,000 | 10.6 | % | |||||

ESL Investments, Inc. and related entities, as a group(d) | 17,185,502 | (e) | 53.8 | % | ||||

Fairholme Capital Management, L.L.C. and related entities(f) | 3,041,727 | 9.5 | % | |||||

Janus Capital Management LLC and | 3,787,618 | (h) | 11.8 | % | ||||

| (a) | Information is provided for reporting purposes only and should not be construed as an admission of actual beneficial ownership. |

| (b) | There were 31,969,645 shares of our common stock outstanding as of March 25, 2016. The “Percent of Class” was calculated by using the disclosed number of beneficially owned shares as the numerator and 31,969,645 shares of the Company’s common stock outstanding as of March 25, 2016 as the denominator. |

| (c) | Beneficial ownership is based on the Capital Research Global Investors Amendment No. 2 to Schedule 13G reporting ownership as of December 31, 2015. Capital Research Global Investors disclosed sole voting power and sole dispositive power as to 3,404,000 shares. Capital Research Global Investors disclaims beneficial ownership. |

| (d) | Beneficial ownership is based on the ESL Investments, Inc. Amendment No. 8 to Schedule 13D reporting ownership as of January 21, 2016, as updated by a subsequent Form 4 report filed on February 10, 2016. ESL Investments, Inc. and related entities, as a group, consists of the following: ESL Investments, Inc. (“Investments”); Edward S. Lampert; ESL Partners, L.P. (“Partners”); RBS Partners, L.P. (“RBS”); SPE Master I, LP (“SPE Master I”); and SPE I Partners, LP (“SPE I”). RBS is the general partner of, and may be deemed to indirectly beneficially own securities beneficially owned by, Partners, SPE I and SPE Master I. ESL is the general partner of, and may be deemed to indirectly beneficially own securities beneficially owned by, RBS. Mr. Lampert is the Chairman, Chief Executive Officer and Director of, and may be deemed to indirectly beneficially own securities beneficially owned by, ESL Investments, Inc. and related entities. |

| (e) | Investments disclosed sole voting power and sole dispositive power as to 6,718,592 shares and shared dispositive power as to 10,458,111 shares; Edward S. Lampert disclosed sole voting power as to 17,176,703 shares, sole dispositive power as to 6,718,592 shares and shared dispositive power as to 10,458,111 shares; Partners disclosed sole voting power and sole dispositive power as to 6,615,280 shares and shared dispositive power as to 10,458,111 shares; RBS disclosed sole voting power and sole dispositive power as to 6,718,592 shares and shared dispositive power as to 10,458,111 shares; SPE Master I disclosed sole voting power and sole dispositive power as to 58,156 shares; and SPE I disclosed sole voting power and sole dispositive power as to 45,156 shares. |

| (f) | Beneficial ownership is based on a Schedule 13G filed by Fairholme Capital Management, L.L.C. (“FCM”), Bruce R. Berkowitz, and Fairholme Funds, Inc. reporting beneficial ownership as of December 31, 2015. The shares of common stock are reported beneficially owned, in the aggregate, by Bruce R. Berkowitz and various investment vehicles managed by FCM. FCM disclosed shared voting power as to 2,681,127 shares and shared dispositive power as to 3,041,727 shares, Mr. Berkowitz disclosed shared voting power as to 2,681,127 shares and shared dispositive power as to 3,041,727 shares, and Fairholme Funds, Inc. disclosed |

16

| shared voting and dispositive power as to 2,55,527 shares. Of the 3,041,727 shares, 2,415,527 are owned by The Fairholme Fund and 140,000 are owned by The Fairholme Allocation Fund, each a series of Fairholme Funds, Inc. Because Mr. Berkowitz, in his capacity as the controlling person of the sole member of FCM or as President of Fairholme Funds, Inc., has voting or dispositive power over all shares beneficially owned by FCM, he is deemed to have beneficial ownership of all of the shares. Mr. Berkowitz, Fairholme Funds, Inc. and FCM disclaim ownership of these shares except to the extent of their pecuniary interest. |

| (g) | Beneficial ownership is based on the Amendment No. 2 to Schedule 13G filed by Janus Capital Management LLC (“Janus Capital”) reporting ownership as of December 31, 2015 (the “Janus 13-G/A”). Janus Capital is an investment adviser and Janus Contrarian Fund is one of the managed portfolios to which Janus Capital provides investment advice. Janus Capital disclosed sole voting and sole dispositive power as to 3,787,618 shares and Janus Contrarian Fund disclosed sole voting and sole dispositive power as to 3,686,652 shares. |

| (h) | According to the Janus 13G/A, Janus Capital has sole voting and sole dispositive power as to 3,787,618 shares and Janus Contrarian Fund has sole voting and sole dispositive power as to 3,686,652 shares. |

17

Compensation Discussion and Analysis

Summary

This Compensation Discussion and Analysis provides information to assist you in understanding the fiscal year 2015 compensation of the executive officers identified in the Summary Compensation Table, whom we refer to as our “named executive officers.” Our named executive officers are:

| • | Federica Marchionni, President and Chief Executive Officer |

| • | Scott Hyatt, Executive Vice President, Chief Supply Chain Officer |

| • | Steven G. Rado, Senior Vice President, Chief Marketing Officer |

| • | Kelly Ritchie, Senior Vice President, Employee and Customer Services |

| • | Edgar O. Huber, Former President and Chief Executive Officer |

| • | Michael P. Rosera, Former Executive Vice President, Chief Operating Officer, Chief Financial Officer and Treasurer |

Mr. Huber resigned as our President and Chief Executive Officer effective February 16, 2015. Mr. Rosera’s employment with the Company ended effective January 29, 2016.

During fiscal year 2015, the Compensation Committee of the Board determined the appropriate executive compensation practices and policies for the senior executives of Lands’ End, including our named executive officers. Overall compensation philosophy and structure for Lands’ End has been determined or otherwise approved by the Compensation Committee. The compensation philosophies and practices used in setting compensation for our named executive officers during fiscal year 2015 are described below.

Executive Compensation Philosophy and Objectives

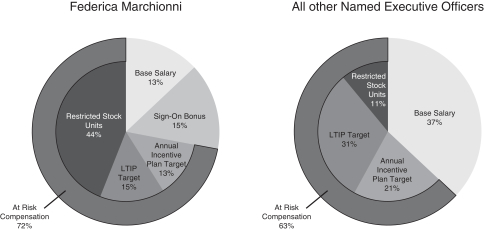

The Compensation Committee believes that the Company’s long-term success is directly related to its ability to attract, motivate and retain highly talented executives who are committed to our mission, results and cultural beliefs. The Compensation Committee has developed a compensation philosophy for our senior executives designed to pay for performance. Accordingly, the total compensation packages provided to our named executive officers generally include both annual and long-term incentive opportunities that are linked to performance measures or are otherwise “at risk” due to market fluctuations and potential for forfeiture. For fiscal year 2015, 72% of our CEO’s target compensation and 63%, on average, of our other named executive officers’ target compensation was considered at-risk based on financial performance measures or the possibility of forfeiture. The charts below present the mix of base salary, cash sign-on bonus, and target annual and long term

18

incentive compensation for fiscal year 2015 for Ms. Marchionni and our other named executive officers (other than Mr. Huber), on average:

Our compensation packages are designed in large measure to motivate and encourage executives to drive performance and achieve superior results for the Company and its stockholders. They also reflect other important considerations, such as the value of the position in the marketplace, levels of job responsibility, individual performance and the need to attract and retain top executive talent. The Compensation Committee placed emphasis on equity-based incentives to better align their interests with those of the Company’s stockholders. While the Compensation Committee seeks to approve compensation and benefit arrangements that reflect the pay-for-performance compensation philosophy, it recognizes that from time to time it may be appropriate for the Company to provide additional inducements, such as sign-on bonuses and other provisions, in order to recruit, retain, and motivate highly qualified executives. Such considerations were a primary factor in the fiscal year 2015 compensation decisions with respect to Ms. Marchionni and Mr. Hyatt.

Competitive Pay Practices

The Committee believes that, in order to attract qualified external candidates and retain valuable executives, the Company must offer executive compensation arrangements that include elements and are set at a level that candidates would view favorably when considering alternative employment opportunities. In making compensation decisions, the Company takes many factors into account, including competitive considerations; the responsibilities, impact and importance of the individual’s position within the Company; individual performance; the individual’s expected future contributions to Lands’ End; the individual’s historical compensation; the performance of the Company overall; retention risk; tenure in position; internal pay equity (meaning the relative pay differences for different positions within the Company); and the effect on our general and administrative expenses. The Committee also takes into account compensation and market data, which data, where appropriate, primarily focuses on apparel retail companies and other related industries.

In connection with the actions taken by the Compensation Committee in fiscal year 2015 for the named executive officers, the Compensation Committee reviewed publicly available compensation data of a peer group of companies that was determined with assistance from Frederic W. Cook & Co., Inc. (“F.W. Cook”), the Compensation Committee’s independent compensation consultant, supplemented by survey data, where necessary, when relevant public data were not available. The Compensation Committee used available information and monitored actions taken by the peer group companies to evaluate market trends and to assess the long-term incentive plan design aspects and overall competitiveness of our executive compensation programs. While the Compensation Committee did not seek to establish any specific element of compensation or total compensation at or within a prescribed range relative to the peer group of companies, it generally considers compensation arrangements to be competitive if they fall within a range around a market median.

19

During fiscal year 2015, the Compensation Committee considered compensation data from the following 20 peer companies, comprised primarily of apparel retail companies and those in related industries:

| Aeropostale, Inc. | American Eagle Outfitters, Inc. | |

| ANN INC. (Ann Taylor) | The Buckle, Inc. | |

| Cabela’s Incorporated | Carter’s, Inc. | |

| Chico’s FAS, Inc. | The Children’s Place Retail Stores, Inc. | |

| Coldwater Creek Inc. | Columbia Sportswear Company | |

| Express, Inc. | Fifth & Pacific Companies, Inc. (Kate Spade) | |

| The Finish Line, Inc. | HSN, Inc. | |

| Jos. A. Bank Clothiers, Inc. | lululemon athletica inc. | |

| New York & Company, Inc. | Pier 1 Imports, Inc. | |

| Urban Outfitters, Inc. | zulily, inc. |

In comparing the relative size of the Company to the peer group median, the Company fell into the 30th percentile in revenue, the primary size consideration when conducting executive compensation comparisons. Following a review of the peer group in September 2015, at the recommendation of F.W. Cook, ANN INC., Cabela’s Incorporated and zulily, inc., were removed from the peer group and were replaced by Francesca’s Holdings Corp., Tilly’s, Inc. and Zumiez Inc. at that time. ANN INC. and zulily, inc. were removed from the peer group because each was acquired by another company in 2015. Cabela’s Incorporated was removed from the peer group because it has significantly higher annual revenues and market capitalization relative to Lands’ End.

At our 2015 annual meeting of stockholders, over 99% of the votes cast supported our advisory resolution on the compensation of our executive officers named in the proxy statement for the meeting. The results of this vote were not a determining factor in the Company’s 2015 executive compensation decisions and policies.

Executive Compensation Program: Key Elements

The key elements of Lands’ End’s compensation program for its executives include base salary, annual cash incentive opportunities, long-term performance-based cash and equity incentive opportunities and time-based cash and/or time-based equity awards (i.e., equity that vests with the passage of time and thus is at risk).

Annual Compensation

| • | Base Salary—Base salary is the fixed element of each executive’s cash compensation, and provides executives with an appropriate level of financial certainty. |

| • | Annual Incentive Plan—Lands’ End’s annual incentive program provides opportunities to earn annual cash awards based on the achievement of financial performance goals relating to a specific fiscal year. The annual incentive program seeks to motivate participants, including its participating executives, to achieve financial performance goals by making their cash incentive award variable and dependent upon certain Lands’ End financial performance measures. |

Long-Term Compensation

| • | Long-Term Performance-Based Programs—Lands’ End’s long-term incentive programs are designed to motivate executives to focus on long-term company performance through awards generally based on three-year performance periods that reinforce accountability by linking executive compensation to performance goals. These programs are an important instrument in aligning the goals of Lands’ End executives with Lands’ End’s strategic direction and initiatives, which Lands’ End believes will result in increased returns to its stockholders. |

20

| • | Long-Term Time-Based Programs—Lands’ End’s long-term incentive programs also include time-based awards of cash and equity that are at risk. The multi-year vesting requirements of time-based awards are designed to promote retention and encourage executive officers to adopt longer-term approaches to Lands’ End’s business. Time-based equity compensation also provides alignment with Lands’ End’s stockholders, as value received will be consistent with return to Lands’ End’s stockholders. |

There is no pre-established policy or target for the allocation between annual and long-term incentive compensation. Instead, we take a holistic approach to executive compensation and balance the compensation elements for each executive individually.

How Elements Are Used to Achieve Our Compensation Objectives

The Compensation Committee believes that the most fair and effective way to motivate executives to produce the best results for stockholders is to increase the proportion of an executive’s total compensation that is performance-based or otherwise at risk, including time-based cash and equity compensation, as the executive’s ability to affect those results increases. Additionally, the Compensation Committee believes that the value of incentive compensation should depend upon the performance of the Company in a given performance period or over the applicable vesting period. Under Lands’ End’s incentive compensation structure, the highest amount of compensation can be achieved through consistent superior performance over sustained periods of time. This approach is designed to provide an incentive to manage Lands’ End for the long term, while minimizing excessive risk taking in the short term.

During fiscal year 2015, the Compensation Committee sought to achieve the objectives of our compensation program for our named executive officers through the grant of annual and long-term incentive awards. The fiscal year 2015 annual incentive awards offered an opportunity to earn cash compensation based solely upon the achievement by Lands’ End of an adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) goal for fiscal year 2015. The Compensation Committee also granted long-term cash and equity awards to its named executive officers, as well as the broader group of senior executives, that will become payable following the completion of specified employment service periods.

The targets established for our named executive officers each year under the Lands’ End, Inc. Annual Incentive Plan (“AIP”) are calculated based on a percentage of base salary. Opportunities under the AIP for the participating executives are generally established when the Compensation Committee approves a new annual incentive plan or at the time a compensation package for a participating executive is otherwise approved. The performance-based long-term awards and time-based long-term awards granted to Lands’ End’s participating executives under the long-term incentive programs have also been calculated based on a percentage of base salary. As the participating executive’s base salary is determined, in part, on his or her past performance, an award that is based on a multiple of that base salary also reflects, in part, his or her past performance.

Following the end of a performance period, the Compensation Committee certifies the level of achievement against the applicable financial performance goals established under its annual and long-term performance-based incentive programs if the applicable threshold level of performance is achieved. In doing so, the Compensation Committee retains the ability to exercise discretion in relation to the annual and long-term performance-based incentive awards granted to Lands’ End executives; however, any exercise of discretion may not result in an increase in the payments under existing awards intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”). With respect to its fiscal year 2015 compensation decisions, the Compensation Committee did not exercise its discretion to adjust performance targets or payout amounts for any of the named executive officers.

21

Fiscal Year 2015 Compensation Decisions

Our Compensation Committee approved all elements of compensation for all of our named executive officers. Ms. Marchionni, other members of the Company’s management and F.W. Cook presented recommendations to the Compensation Committee regarding certain compensation elements for review and approval.

Fiscal Year 2015 Base Salaries