continuation of the relevant Fund or class is not in the best interests of its shareholders as a result of factors or events adversely affecting its ability to conduct its business in an economically viable manner. Generally, these are Funds that were formed more recently under a more modern form of certificate of designation, the instrument that creates a “Fund” or a “class” of a Fund. As noted, there are currently no plans to liquidate any of the Funds affected by this proposal.

Your vote is extremely important, even if you only own a few Fund shares. Voting promptly is also important. If we do not receive enough votes, we will have to resolicit shareholders, which can be time consuming and may delay the meeting. You may receive a reminder call to return your Proxy Card from Broadridge Financial Solutions, Inc., a proxy solicitation firm.

J. David Officer, President,

Chief Executive Officer and Chairman of the Board of Trustees

MELLON INSTITUTIONAL FUNDS INVESTMENT TRUST

(the “Trust”)

The Boston Company Large Cap Core Fund

The Boston Company Small/Mid Cap Growth Fund

The Boston Company Small Cap Growth Fund

The Boston Company Small Cap Value Fund

The Boston Company Small Cap Value Fund II

The Boston Company Small Cap Tax-Sensitive Equity Fund

The Boston Company International Core Equity Fund

The Boston Company International Small Cap Fund

The Boston Company Emerging Markets Core Equity Fund

Newton International Equity Fund

Mellon Capital Large Cap Growth Fund

Mellon Capital Micro Cap Fund

Standish Mellon Intermediate Tax Exempt Bond Fund

Standish Mellon Fixed Income Fund

Standish Mellon Global Fixed Income Fund

Standish Mellon International Fixed Income Fund

(each, a “Fund” and collectively, the “Funds”)

One Boston Place

Boston, Massachusetts 02108

1-800-221-4795

NOTICE OF SPECIAL MEETINGS OF SHAREHOLDERS OF THE TRUST

To be held on November 17, 2008

A Special Meeting of Shareholders of the Trust will be held on November 17, 2008 at 10 AM (Eastern Time) at the offices of The Bank of New York Mellon Corporation, One Boston Place, 24th Floor, Boston, Massachusetts 02108, to consider and act upon the following proposal, and to transact such other business as may properly come before the meeting:

Proposal 1. All Funds: To elect six Trustees of the Trust, and to consider any other business that may properly come before the Special Meeting of Shareholders of the Trust.

A separate Special Meeting of Shareholders of the Trust will be held on November 17, 2008 at 11 AM (Eastern time) at the offices of The Bank of New York Mellon Corporation, One Boston Place, 24th Floor, Boston, Massachusetts 02108, to consider and act upon the following proposals, and to transact such other business as may properly come before the meeting:

- 1 -

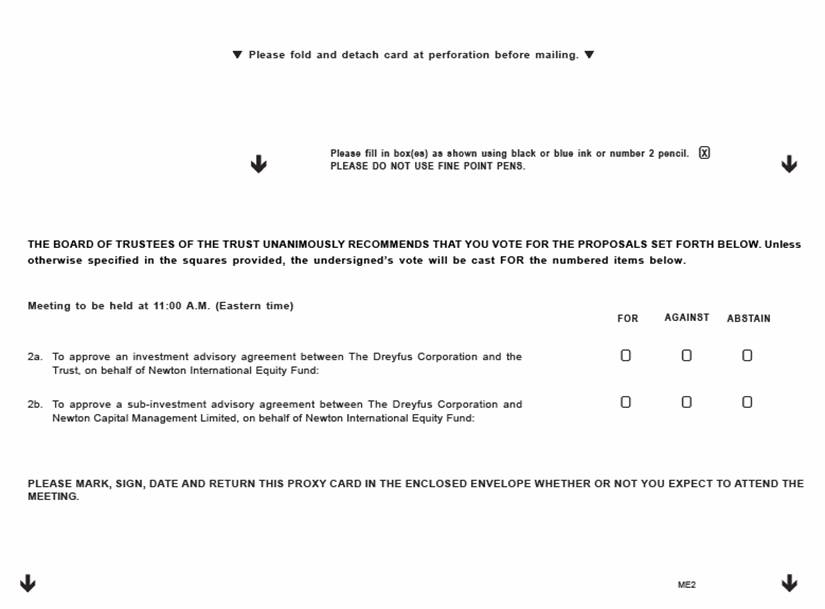

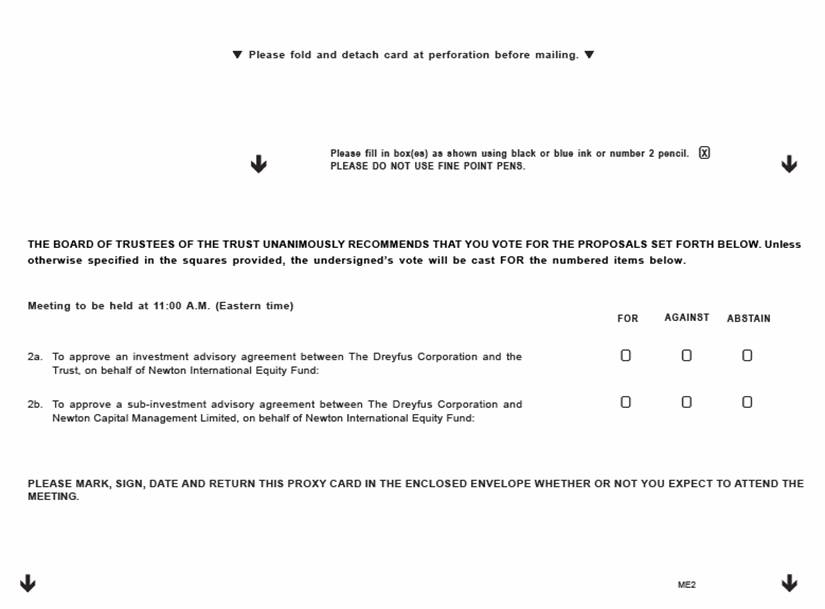

Proposal 2. Newton International Equity Fund only:

(a)

To approve a new investment advisory agreement between the Trust, on behalf of the Fund, and The Dreyfus Corporation (“Dreyfus”); and

(b)

To approve a new sub-investment advisory agreement between Dreyfus and Newton Capital Management Limited, on behalf of the Fund.

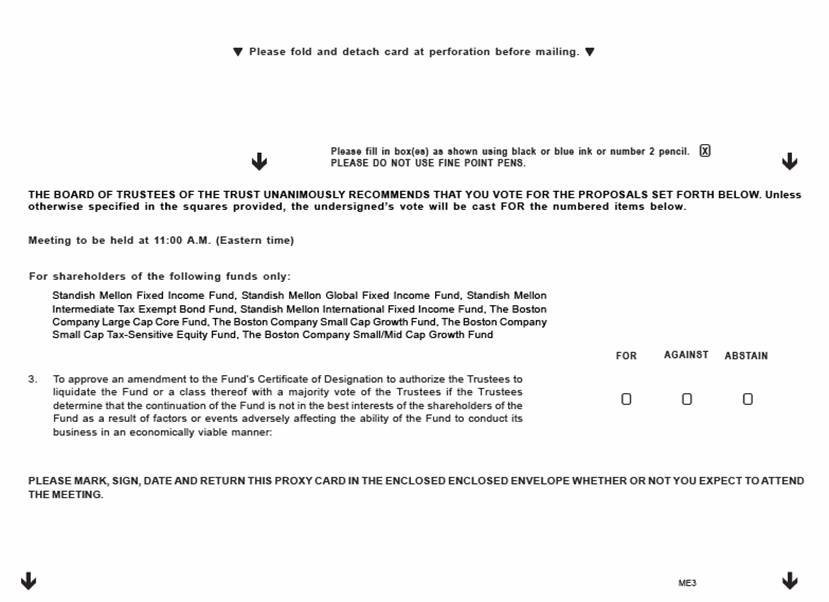

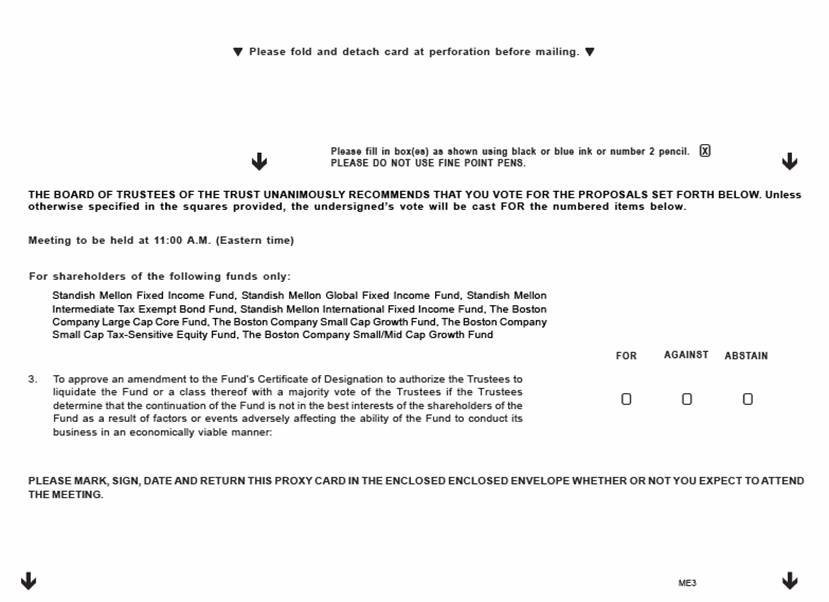

Proposal 3. The Boston Company Large Cap Core Fund, The Boston Company Small/Mid Cap Growth Fund, The Boston Company Small Cap Growth Fund, The Boston Company Small Cap Tax-Sensitive Equity Fund, Standish Mellon Intermediate Tax Exempt Bond Fund, Standish Mellon Fixed Income Fund, Standish Mellon Global Fixed Income Fund and Standish Mellon International Fixed Income Fund only: To amend the Certificate of Designation with respect to the applicable Fund to authorize the Trustees to liquidate the Fund (or any applicable class of shares of the Fund) without shareholder vote.

Proposal 4. To consider any other business that may properly come before the meetings.

Unless otherwise indicated, the first Special Meeting of Shareholders of the Trust and the second Special Meeting of Shareholders of the Trust are each referred to herein as the “Meeting” and collectively as the “Meetings.”

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF EACH PROPOSAL.

Each Fund’s shareholders of record at the close of business on September 3, 2008 will be entitled to vote at the Meetings and at any adjournment(s) thereof. The Proxy Statement and the Proxy Card will be mailed to Fund shareholders of record on or about October 3, 2008.

By Order of the Board of Trustees,

J. David Officer, President,

Chief Executive Officer and Chairman of the Board of Trustees

Boston, Massachusetts

October 3, 2008

PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD(S) FOR EACH FUND THAT YOU ARE A SHAREHOLDER OF, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETINGS.

- 2 -

MELLON INSTITUTIONAL FUNDS INVESTMENT TRUST

The Boston Company Large Cap Core Fund

The Boston Company Small/Mid Cap Growth Fund

The Boston Company Small Cap Growth Fund

The Boston Company Small Cap Value Fund

The Boston Company Small Cap Value Fund II

The Boston Company Small Cap Tax-Sensitive Equity Fund

The Boston Company International Core Equity Fund

The Boston Company International Small Cap Fund

The Boston Company Emerging Markets Core Equity Fund

Newton International Equity Fund

Mellon Capital Large Cap Growth Fund

Mellon Capital Micro Cap Fund

Standish Mellon Intermediate Tax Exempt Bond Fund

Standish Mellon Fixed Income Fund

Standish Mellon Global Fixed Income Fund

Standish Mellon International Fixed Income Fund

One Boston Place

Boston, Massachusetts 02108

1-800-221-4795

PROXY STATEMENT

This Proxy Statement contains information you should know before voting on the proposals summarized below.

TABLE OF CONTENTS

INTRODUCTION | 1 |

PROPOSAL 1 ELECTION OF TRUSTEES | 5 |

Introduction | 5 |

Reasons for Proposal to Elect a New Slate of Trustees | 5 |

Nominees and Current Trustees | 9 |

The Nominating Committee’s Actions | 13 |

Current Trustees, Nominees and Their Compensation | 14 |

Shares Owned by the Trustees and Nominees | 14 |

Other Interests of Trustees and Nominees | 14 |

Other Information | 15 |

Indemnification and Insurance | 16 |

Officers of the Trust | 17 |

Required Vote | 19 |

Recommendation of the Board | 19 |

PROPOSALS 2(a) and 2(b) APPROVAL OF NEW INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS | 20 |

Introduction | 20 |

Reasons for Proposals to Approve New Investment Advisory and Sub-Investment Advisory Agreements | 20 |

Information Concerning Dreyfus | 21 |

Information Concerning Newton | 21 |

Proposal 2(a) | 21 |

Approval of New Investment Advisory Agreement | 21 |

Factors Considered by the Board in Approving the New Advisory Agreement | 22 |

Effective Date and Term | 22 |

Required Vote | 23 |

Recommendation of the Board | 24 |

Proposal 2(b) | 25 |

Approval of New Sub-Investment Advisory Agreement | 25 |

Factors Considered by the Board in Approving the New Sub-Investment Advisory Agreement | 25 |

Effective Date and Term | 26 |

Required Vote | 26 |

i

Recommendation of the Board | 26 |

PROPOSAL 3 APPROVAL TO AMEND CERTIFICATE OF DESIGNATION | 27 |

Introduction | 27 |

Reasons for Proposal to Amend Certificate of Designation | 27 |

Summary of Current Provision and Proposed Amendment | 27 |

Required Vote | 29 |

Recommendation of the Board | 29 |

INFORMATION CONCERNING THE MEETINGS | 30 |

Proxies, Quorum and Voting at the Meetings | 30 |

Method of Solicitation and Expenses | 31 |

Householding | 31 |

Other Business | 32 |

Proposals by Shareholders | 32 |

Information about the Funds’ Service Providers | 32 |

SCHEDULE 1 COMPENSATION OF TRUSTEES AND NOMINEES | 2 |

SCHEDULE 2 SHARES OWNED BY TRUSTEES AND NOMINEES | 5 |

SCHEDULE 3 INFORMATION ABOUT THE INVESTMENT ADVISER AND SUB-INVESTMENT ADVISER | 9 |

SCHEDULE 4 5% SHARE OWNERSHIP AND NUMBER OF SHARES OUTSTANDING | 11 |

SCHEDULE 5 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 15 |

SCHEDULE 6 AUDIT FEES, AUDIT-RELATED FEES, TAX FEES AND ALL OTHER FEES TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 19 |

SCHEDULE 7 INTERNATIONAL FUNDS ADVISED BY DREYFUS AND NEWTON | 24 |

SCHEDULE 8 FACTORS CONSIDERED BY THE BOARD IN APPROVING THE NEW INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS | 26 |

EXHIBIT 1 FORM OF NEW INVESTMENT ADVISORY AGREEMENT | 32 |

EXHIBIT 2 FORM OF NEW SUB-INVESTMENT ADVISORY AGREEMENT | 38 |

EXHIBIT 3 NOMINATING COMMITTEE CHARTER | 44 |

EXHIBIT 4 AUDIT COMMITTEE PRE-APPROVAL POLICIES | 49 |

ii

INTRODUCTION

This Proxy Statement is being used by the Board of Trustees (the “Board” or “Trustees”) of Mellon Institutional Funds Investment Trust (the “Trust”) to solicit proxies to be voted at two Special Meetings of Shareholders of the Trust (the “Meetings”). The Trust consists of The Boston Company Large Cap Core Fund, The Boston Company Small/Mid Cap Growth Fund, The Boston Company Small Cap Growth Fund, The Boston Company Small Cap Value Fund, The Boston Company Small Cap Value Fund II, The Boston Company Small Cap Tax-Sensitive Equity Fund, The Boston Company International Core Equity Fund, The Boston Company International Small Cap Fund, The Boston Company Emerging Markets Core Equity Fund, Newton International Equity Fund, Mellon Capital Large Cap Growth Fund, Mellon Capital Micro Cap Fund, Standish Mellon Intermediate Tax Exempt Bond Fund, Standish Mellon Fixed Income Fund, Standish Mellon Global Fixed Income Fund and Standish Mellon International Fixed Income Fund (each, a “Fund” and collectively, the “Funds”). The Meetings are expected to be held at the offices of The Bank of New York Mellon Corporation (“BNY Mellon”), One Boston Place, 24th Floor, Boston, Massachusetts 02108, onNovember 17, 2008 at 10 AM (Eastern Time) and on the 24th Floor at 11 AM (Eastern Time), respectively, for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders.

The following table summarizes each proposal to be presented at the Meetings and the Funds solicited with respect to such proposal:

| | |

PROPOSAL | AFFECTED FUNDS | PAGE NUMBER |

First Meeting

1. Election of Trustees |

All Funds

|

5

|

Second Meeting 2. (a) New Investment Advisory Agreement (b) New Sub-Investment Advisory

Agreement | · Newton International Equity Fund |

20

|

3. Amendment to Certificate of

Designation

| · The Boston Company Large Cap Core Fund · The Boston Company Small/Mid Cap Growth Fund · The Boston Company Small Cap Growth Fund · The Boston Company Small Cap Tax-Sensitive Equity Fund |

27

|

1

| | |

PROPOSAL | AFFECTED FUNDS | PAGE NUMBER |

| · Standish Mellon Intermediate Tax Exempt Bond Fund · Standish Mellon Fixed Income Fund · Standish Mellon Global Fixed Income Fund · Standish Mellon International Fixed Income Fund (the “Proposal Three Funds”) |

|

This Proxy Statement and the enclosed Proxy Card will be mailed to shareholders of record on or about October 3, 2008. The annual report for each Fund for its most recently completed fiscal year was previously mailed to shareholders. Each Fund will furnish, without charge, a copy of its most recent annual report and more recent semi-annual report, if any, to a shareholder upon request. Shareholders may request a copy of these reports by writing to Mellon Institutional Funds, P.O. Box 8585, Boston, Massachusetts 02266, by calling 1-800-221-4795 or by visiting our web site at www.melloninstitutionalfunds.com.

The Trustees of the Trust know of no business other than that mentioned in the Notice that will be presented for consideration at the Meetings. Should other business properly be brought before the Meetings, proxies will be voted in accordance with the best judgment of the persons named as proxies or in the best judgment of their designees.

Who is eligible to vote

Each Fund’s shareholders of record as of the close of business on September 3, 2008 (the “Record Date”) are entitled to vote on all of that Fund’s business at the Meetings and any adjournments thereof. Each share is entitled to one vote. A fractional share is entitled to the corresponding fraction of one vote. See Schedule 4 for a list of owners of more than 5% of the outstanding shares of each class of each Fund. Shares represented by properly executed proxies will be voted according to the shareholder’s instructions unless revoked before or at the relevant Meeting. If you sign a proxy, but do not fill in a vote, your shares will be voted FOR each proposal, as applicable. If any other business comes before the Meetings, your shares will be voted at the discretion of the persons named as proxies, or in the best judgment of their designees. Shareholders of all Funds vote together in the election of Trustees. Only shareholders of the Funds affected by Proposals 2(a) and 2(b) and Proposal 3 vote with respect to these proposals, and do so separately by Fund. See “INFORMATION CONCERNING THE MEETINGS – Proxies, Quorum and Voting at the Meetings” below for more information.

2

Background

Each Fund’s current investment adviser and The Dreyfus Corporation (“Dreyfus”) is either a direct or indirect wholly-owned subsidiary of BNY Mellon. Proposals 1, 2(a) and 2(b) being submitted for shareholder approval relate to a larger process currently underway at BNY Mellon to restructure and consolidate its mutual fund business to realize cost savings for shareholders and to take advantage of the Dreyfus organization’s deep mutual fund tradition, expertise and infrastructure, including its ability to supervise and monitor the performance of sub-investment advisers. In connection therewith, a majority of the current Trustees (including a majority of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Trust, the current or proposed advisers and principal underwriter) (the “Indep endent Trustees”) voted to appoint Dreyfus to serve as each Fund’s investment adviser. This appointment does not require any shareholder vote, except with respect to Newton International Equity Fund, which is the subject of Proposals 2(a) and 2(b) submitted to shareholders hereby. Dreyfus manages over $300 billion in approximately 180 mutual fund portfolios. Dreyfus is the primary mutual fund business of BNY Mellon.

For each Fund, the current portfolio managers and research analysts for the Fund would remain the same and, except in the case of Newton International Equity Fund, the Fund’s portfolio managers are employees of the Fund’s current investment adviser and of Dreyfus. In the case of Newton International Equity Fund, if Proposals 2(a) and 2(b) are each approved, the Fund’s current portfolio managers and research analysts would remain the same, but would not become employees of Dreyfus. As discussed more fully in Proposal 2(b) below, it is being proposed that Newton Capital Management Limited (“Newton”) serve as the sub-investment adviser for Newton International Equity Fund. As a practical matter, shareholders of Newton International Equity Fund will experience no change in the overall portfolio management of Newton International Equity Fund as a result of the new contractual a rrangements, except that they are expected to have the added benefit of the oversight and supervision supplied by Dreyfus. In addition, the name of the Trust and of each Fund would change to reflect that Dreyfus is serving as the Fund’s investment adviser. No shareholder approval is required to change the name of the Trust or a Fund.

At a meeting held on August 27, 2008, a majority of the Trustees, including a majority of the Independent Trustees, voted to appoint Dreyfus to serve as each Fund’s investment adviser, effective on or about December 1, 2008, or such other date as the Board may approve (the “Effective Date”). No shareholder approval is required with respect to the appointment of Dreyfus as each Fund’s investment adviser (with the exception of Newton International Equity Fund, as discussed more fully in Proposal 2 below). The Trust has received an opinion from counsel to BNY Mellon to the effect that the appointment of Dreyfus as the investment adviser to each Fund (other than Newton International Equity Fund) will not constitute an “assignment” of that Fund’s investment advisory contract under Section 15(a)(4) of the 1940 Act, and, therefore, will not require the approval of that Fund’s shareholders pursuant to Section 15(a) of the 1940 Act. This opinion is based on, among other things, the fact that the current investment adviser of each of these Funds (i.e., other than Newton International Equity Fund) and Dreyfus are under common control, and there will be no change in the portfolio management of the Fund as a result of the new contractual arrangements. The opinion does not address Newton International Equity Fund, which is the su bject of Proposal 2.

3

In connection with the selection of Dreyfus as each Fund’s investment adviser, the Trustees have approved the nomination of new trustees. The process followed by the Trust’s Nominating Committee in recommending these Nominees to the full Board is described in “Proposal 1 – Election of Trustees” below. Proposal 1 seeks your approval of a proposal to elect to the Board independent trustees that have experience as board members of Dreyfus mutual funds and with the Dreyfus organization. The Trust’s current Trustees believe that electing to the Board independent trustees who are familiar with the Dreyfus organization will be beneficial to each Fund’s shareholders.

Based on information provided by management, the current Trustees also believe that shareholders of some or all of the Funds will benefit from certain cost savings, discussed further below, expected to be realized by consolidating Trust governance and certain other aspects of the Trust’s operations under the Dreyfus umbrella.

The third proposal is unrelated to the other proposals, but relates to the manner in which certain Funds in the Trust, the Proposal Three Funds, might be liquidated in the future. If the third proposal is approved by shareholders of any of the Proposal Three Funds, that Fund (and any class thereof) could be liquidated in the future under certain circumstances by operation of a vote of the Trustees and without a shareholder vote. This proposal is intended to spare the shareholders of a Proposal Three Fund the cost of a shareholder meeting to liquidate that Fund. Given that a meeting of all of the shareholders of the Trust was to be held for purposes of the election of Trustees, the Board of Trustees determined that it would be most efficient to use this occasion to seek approval of this change by shareholders of the Proposal Three Funds with minimal incremental cost. There are currently no pl ans to liquidate any of the Funds affected by this proposal.

4

PROPOSAL 1

ELECTION OF TRUSTEES

(All Funds)

Introduction

In connection with the restructuring and consolidation of BNY Mellon’s mutual fund business in order to take advantage of the resources of the Dreyfus organization and the other changes described above, BNY Mellon and the current Trustees are proposing that Joseph S. DiMartino, James M. Fitzgibbons, Kenneth A. Himmel, Stephen J. Lockwood, Roslyn M. Watson and Benaree Pratt Wiley be elected to serve as trustees of the Trust (the “Nominees”).

If elected, it is expected that the Nominees’ terms of office will commence on or about December 1, 2008, or such other dateas the Board may approve (the “Effective Date”). Each Trustee elected will hold office until his or her successor is duly elected or until his or her earlier death, retirement or removal.

The current Trustees have determined that the number of trustees of the Trust shall be fixed at six. The current Trustees have indicated that they are prepared to resign as of the Effective Date.

The persons named as proxies on the accompanying Proxy Card intend to vote at the Meeting (unless otherwise directed) for the election of each of the Nominees. Each Nominee has consented to being named in this Proxy Statement and has agreed to serve on the Board if elected by the shareholders. If, however, before the election, any Nominee refuses or is unable to serve, proxies may be voted for a replacement Nominee, if any, designated by members of the Board.

Reasons for Proposal to Elect a New Slate of Trustees

Shareholders of each Fund, voting together as a whole, are being asked to elect the Nominees in connection with BNY Mellon’s overall restructuring and consolidation of its mutual fund business and the selection of Dreyfus as each Fund’s investment adviser. The current Trustees believe that the election of the Nominees will be beneficial to the Funds’ shareholders in light of the Nominees’ depth of experience with mutual funds generally and the Dreyfus funds in particular and the Nominees’ familiarity with the Dreyfus organization. The current Trustees also believe that, based on information supplied by management, the Trust will realize certain cost savings as a result of the consolidation of its governance and certain other aspects of its operations under the Dreyfus umbrella.

Specifically, the Trustees observed that, based on information provided by management, it is currently anticipated that the combined effect of: (i) the consolidation of the Board of Trustees of the Trust with the Board of the Dreyfus funds on which the Nominees now serve; and (ii) the related consolidation of other Trust operations and functions under Dreyfus, would generate meaningful annual cost savings for the Trust as a whole and for a number of the Funds individually in the short term and potentially for all Funds in the longer term. These anticipated annual savings are expected to result in part from spreading fixed fees or expenses over a larger fund complex asset base, the ability to negotiate better fees from certain vendors or service

5

providers and the elimination of duplicative services and/or service providers. The Trustees observed that these estimated savings amounted to approximately $800,000 annually based on 2007 cost data, and could, therefore, be expected to represent substantial future savings over time.

The more significant estimated annual cost savings to the Trust as a whole, and separately to individual Funds, stated as a percentage of net assets as of June 30, 2008, are illustrated in Tables 1 and 2, respectively, below. In applying the Trust level costs and cost savings illustrated in Table 1 to the individual Funds in Table 2, all costs, other than those related to custody and the annual retainer portion of the Trust’s Independent Trustee compensation were allocatedpro rata based on the Funds’ net assets. The asset-based custody fees were calculated assuming the implementation of existing Dreyfus contractual fee arrangements which entail a fee schedule based upon fund type (e.g., domestic equity, international equity, etc.). Each Fund’s portion of the Independent Trustees’ annual retainer expenses was calculated according to the Trust’s existing compensation schedule which incorporates asset level breakpoints which subject larger funds to a greater retainer amount than smaller funds.

The Trustees also noted that in some cases, identified below, a Fund is subject to a voluntary expense limitation that currently has the effect of requiring the Fund’s adviser to waive a portion of its advisory fees and/or to bear, or reimburse the Fund for, at least a portion of the Fund’s expenses. Dreyfus has represented to the Trust’s Board that it will continue these voluntary expense limitations indefinitely. Thus, for these Funds, the combined effect of these limitations and the anticipated cost savings is merely to reduce or eliminate the subsidy currently provided to the relevant Fund rather than to reduce fees or expenses actually borne currently by the Fund and its shareholders in the full amount of the cost savings. As a result, in these cases, the cost savings anticipated to be generated would initially benefit Dreyfus to the extent these subsidies are correspondingly reduced. The Trustees observed, however, that with asset growth, these anticipated cost savings would eventually benefit these Funds’ shareholders. The column in Table 2, captioned “Anticipated Actual Annual Cost Savings (after giving effect to expense limitation),” reflects the anticipated net actual savings for each Fund after giving effect to any such expense limitation.

The expense data presented in the tables below is approximate and based on estimates. Not all of the anticipated cost savings will take effect on the Effective Date.

6

Table 1

Trust Level Approximate Annual Savings (by Category)

| | | |

Expense or Fee Category | 2007 Pre-

Consolidation

Costs1, 2 | Anticipated

Post-

Consolidation

Costs1 | Anticipated

Annual Cost

Savings (without

giving effect to

individual

Fund’s expense

limitations) |

Asset-based custody fees | 0.012% | 0.008% | 0.004% |

Trust legal counsel fees | 0.006% | 0.005% | 0.001% |

Independent Trustee compensation | 0.004% | 0.002% | 0.002% |

Independent Trustee counsel fees | 0.002% | 0.000% | 0.002% |

Insurance premiums3 | 0.003% | 0.001% | 0.002% |

Totals | 0.027% | 0.016% | 0.011% |

1 Costs stated as a percentage of average net assets for the year ended December 31, 2007.

2 These categories of Pre-Consolidation Costs were calculated based on actual costs paid by the Funds during the 2007 calendar year.

3 The Board has approved the liquidation of two funds, Mellon Capital Large Cap Growth Fund and Mellon Capital Micro Cap Fund (neither of which is the subject of Proposal 3). These figures presume the closing of these two funds which are proposed to be liquidated.

7

Table 2

Individual Fund Level Approximate Annual Savings

| | | | |

Fund | 2007 Pre-

Consolidation

Costs

Described in

Table 1 Above1 | Anticipated

Post-

Consolidation

Costs

Described in

Table 1 Above1 | Anticipated

Annual Cost

Savings (without

giving effect to

expense

limitation)1 | Anticipated

Actual Annual

Cost Savings

(after giving

effect to

expense

limitation)1 |

The Boston Company Large Cap Core Fund | 0.056% | 0.025% | 0.031% | 0.031% |

The Boston Company Small/Mid Cap Growth Fund | 0.176% | 0.063% | 0.113% | 0.113% |

The Boston Company Small Cap Growth Fund | 0.059% | 0.018% | 0.041% | 0.041% |

The Boston Company Small Cap Value Fund | 0.023% | 0.006% | 0.017% | 0.017% |

The Boston Company Small Cap Value Fund II* | 0.486% | 0.390% | 0.096% | 0% |

The Boston Company Small Cap Tax-Sensitive Equity Fund | 0.041% | 0.013% | 0.028% | 0.028% |

The Boston Company International Core Equity Fund | 0.017% | 0.008% | 0.009% | 0.009% |

The Boston Company International Small Cap Fund* | 0.020% | 0.008% | 0.012% | 0% |

The Boston Company Emerging Markets Core Equity Fund* | 0.244% | 0.281% | –0.037% | 0% |

Newton International Equity Fund* | 0.144% | 0.149% | –0.005% | 0% |

Mellon Capital Large Cap Growth Fund* | 0.400% | 0.372% | 0.028% | 0% |

Mellon Capital Micro Cap Fund* | 0.193% | 0.161% | 0.032% | 0% |

8

| | | | |

Fund | 2007 Pre-

Consolidation

Costs

Described in

Table 1 Above1 | Anticipated

Post-

Consolidation

Costs

Described in

Table 1 Above1 | Anticipated

Annual Cost

Savings (without

giving effect to

expense

limitation)1 | Anticipated

Actual Annual

Cost Savings

(after giving

effect to

expense

limitation)1 |

Standish Mellon Intermediate Tax Exempt Bond Fund* | 0.046% | 0.015% | 0.031% | 0% |

Standish Mellon Fixed Income Fund* | 0.028% | 0.008% | 0.020% | 0% |

Standish Mellon Global Fixed Income Fund* | 0.083% | 0.055% | 0.028% | 0% |

Standish Mellon International Fixed Income Fund* | 0.060% | 0.044% | 0.016% | 0% |

1 Costs stated as a percentage of average net assets for the year ended December 31, 2007. Anticipated Actual Annual Cost Savings (after giving effect to expense limitation) are computed by applying the amounts reflected in the column captioned “Anticipated Annual Cost Savings (without giving effect to expense limitation)” to each Fund’s net assets as of June 30, 2008, and assume the Fund’s current expense ratio and expense limitation in effect on that date.

* The Fund is currently subject to a voluntary expense limitation expected to be continued by Dreyfus. In these cases, the cost savings anticipated to be generated will benefit Dreyfus, in the form of a reduced subsidization of the Fund, to the extent the Fund’s total expenses continue in excess of the expense limitations in effect. Like the Fund’s current adviser, Dreyfus can terminate the expense limitation at any time.

Nominees and Current Trustees

The Nominees and current Trustees, their ages, their principal occupations for the past five years (their titles may have varied during that period), the total number of funds in the BNY Mellon fund complex (including the Dreyfus Funds) (the “Fund Complex”) the Nominees will oversee if elected, and other board memberships they hold are set forth in the table below. No Nominee has previously held any position with the Trust or any Fund. There are no family relationships among Nominees and current Trustees. Since the beginning of the most recently completed fiscal year end of any Fund (September 30, 2007 or December 31, 2007), no Nominee or current Trustee has had or proposes to have a material transaction with any Fund, the investment adviser of any Fund (each, an “Adviser” and collectively, the “Advisers”), Dreyfus or BNY Mellon.

The mailing address of each Nominee is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. The mailing address of each current Trustee is c/o Mellon Institutional Funds Investment Trust, One Boston Place, Boston, Massachusetts 02108. Each Nominee was recommended for nomination by the Trust’s Nominating Committee and approved by the Board.

9

If elected, Joseph S. DiMartino is expected to serve as Chairman of the Board and Trustee of the Trust.

| | | |

Name (Age) | Principal

Occupation

During Past 5

Years | Number of

Funds in

Fund

Complex

Overseen or

to be

Overseen | Directorships of Publicly Held

Entities (Other than the Trust) |

Nominees | | | |

Joseph S. DiMartino (64) | Corporate Director and Trustee | 193 (177 Dreyfus Funds; and, if elected, 16 Funds of the Trust)

| Dreyfus Funds, Chairman of the Board

CBIZ, Inc. (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director

The Newark Group, Inc., a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

Sunair Services Corporation, a provider of certain outdoor-related services to homes and businesses, Director |

James M. Fitzgibbons (74) | Corporate Director | 45 (29 Dreyfus Funds; and, if elected, 16 Funds of the Trust)

| Dreyfus Funds, Board Member

Bill Barrett Company, an oil and gas exploration company, Director |

10

| | | |

Name (Age) | Principal

Occupation

During Past 5

Years | Number of

Funds in

Fund

Complex

Overseen or

to be

Overseen | Directorships of Publicly Held

Entities (Other than the Trust) |

Kenneth A. Himmel (62) | President and CEO, Related Urban Development, a real estate development company (1996-Present) President and CEO, Himmel & Company, a real estate development company (1980-Present) CEO, American Food Management, a restaurant company (1983-Present) | 45 (29 Dreyfus Funds; and, if elected, 16 Funds of the Trust) | Dreyfus Funds, Board Member

|

Stephen J. Lockwood (61) | Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company (2000-Present) | 45 (29 Dreyfus Funds; and, if elected, 16 Funds of the Trust) | Dreyfus Funds, Board Member |

Roslyn M. Watson (58) | Principal, Watson Ventures, Inc., a real estate investment company

(1993-Present) | 45 (29 Dreyfus Funds; and, if elected, 16 Funds of the Trust) | Dreyfus Funds, Board Member

|

Benaree Pratt Wiley (62) | Principal, The Wiley Group, a firm specializing in strategy and business development (2005-Present) | 55 (39 Dreyfus Funds; and, if elected, 16 Funds of the Trust) | Dreyfus Funds, Board Member

CBIZ, Inc. (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director |

11

| | | |

Name (Age) | Principal

Occupation

During Past 5

Years | Number of

Funds in

Fund

Complex

Overseen or

to be

Overseen | Directorships of Publicly Held

Entities (Other than the Trust) |

| President and CEO, The Partnership, an organization dedicated to increasing the representation of African Americans in positions of leadership, influence and decision-making in Boston, MA

(1991- 2005) | |

|

Current Trustees | | | |

J. David Officer (60)*

| Vice-Chairman, Chief Operating Officer and Director, Dreyfus | 17** | Executive Vice President of BNY Mellon |

Samuel C. Fleming (67) | Chairman Emeritus, Decision Resources, Inc. (“DRI”) (healthcare research and consulting firm); formerly Chairman of the Board and Chief Executive Officer, DRI | 17** | None |

Benjamin M. Friedman (64) | William Joseph Maier, Professor of Political Economy, Harvard University | 17** | Pioneer Funds, Board Member |

John H. Hewitt (73) | Retired | 17** | None |

Caleb Loring III (64) | Trustee, Essex Street Associates (family investment trust office) | 17** | None |

_______________

12

* “Interested Person” of the Trust. Mr. Officer is a Director, Vice Chairman and Chief Operating Officer of Dreyfus, the prospective investment adviser of the Funds. He is also an Executive Vice President of BNY Mellon, the parent of Dreyfus and the Advisers; and a Director and President of MBSC Securities Corporation, which is a wholly-owned subsidiary of Dreyfus.

** If the Nominees are elected, this number is expected to be one as of the Effective Date. The one fund will be Mellon Optima Long/Short Strategy Fund LLC and, if, as currently proposed, a successor Board is elected as to that fund also, none of the current Trustees will then oversee any funds in the complex.

The Nominating Committee’s Actions

Following a series of meetings in July and August 2008, the Nominating Committee met on August 27, 2008 to take formal action with respect to the Nominees and unanimously recommended their election by the Trust’s shareholders. In considering the Nominees, the members of the Nominating Committee, with the assistance of their independent legal counsel, requested and reviewed information concerning each Nominee, including copies of a completed Trustee and Officer Questionnaire, biographical information concerning his or her employment and educational background, the possible qualification of any Nominee as an “audit committee financial expert,” the number, asset sizes and principal characteristics of the Dreyfus funds on whose Boards the Nominees currently serve, as well as each Nominee’s membership on Board committees, his or her tenure on such Boards and related compensation. The Nominating Committee also requested and considered information relating to each Nominee’s status as an “independent” trustee (i.e., not an “interested person” of Dreyfus or BNY Mellon), including making such inquiries as they considered appropriate as to any possible past or present business or other relationships between the Nominees or their family members and BNY Mellon affiliates.

As an important part of its deliberations, the Nominating Committee also received and considered information from management concerning certain cost savings and efficiencies expected to benefit the Trust and its shareholders from the consolidation of the governance and certain other operations of the Trust with those of the Dreyfus funds on whose boards the Nominees now serve. These savings are described above under “Introduction-Reasons for Proposal to Elect a New Slate of Trustees.”

Over the course of two meetings, various members of the Nominating Committee also met in person with the Nominees. At these meetings, the Nominating Committee members had an opportunity to discuss with the Nominees as a group and in individual conversations their background and experience and their governance practices and philosophies in connection with their current roles as trustees or directors of Dreyfus funds.

The Nominating Committee also met privately, with only their independent legal counsel present, to discuss the information provided and their individual and collective impressions of the Nominees and their qualifications. In applying these criteria, the Nominating Committee noted that one of the Nominees, Mr. Fitzgibbons, currently age 74, would normally have been ineligible to serve as a Trustee under the Trust’s previously established retirement age for “independent” trustees of 72. The Nominating Committee observed, however, that the Dreyfus funds Board on which the Nominees currently served had established a mandatory retirement age of 80 with the opportunity to elect non-voting “emeritus” status at age 72. The Nominating Committee also noted that the current Board of Trustees had previously considered it appropriate

13

to extend for one year the retirement age for one of its own members, Mr. Hewitt, in order to permit Mr. Hewitt to participate in the Board’s deliberations concerning the Board transition process which had then been contemplated and which is described herein. The Nominating Committee (and, subsequently, the Trust’s Board of Trustees), determined, that given all the circumstances it was likewise appropriate to grant a waiver from the Trust’s retirement policy for Mr. Fitzgibbons, in order to permit an orderly transition and to leave for the newly elected Board the matter of considering whether to retain the Trust’s current retirement policy or to operate under a uniform policy by adopting for the Trust the same retirement policy applicable to the other Dreyfus Boards on which they now serve.

Following their review of the information provided, the in-person meetings conducted with the Nominees, and their private deliberations, the members of the Nominating Committee concluded that each of the Nominees was well qualified to serve in the role of independent trustee of the Trust, and that the cost savings anticipated to be generated in part by the Board consolidation that would be implemented by their election supported this action. The members of the Nominating Committee voted unanimously to recommend to the Trust’s full Board that the Nominees be proposed for election by the shareholders of the Trust with the recommendation of the Board. The full Board subsequently accepted the Nominating Committee’s recommendation and recommends that the shareholders of the Trust vote for the election of each of the Nominees.

Current Trustees, Nominees and Their Compensation

The compensation paid to the current Trustees with respect to each Fund during its most recently completed fiscal year and from the fund complex is set forth inSchedule 1 of this Proxy Statement. As the Nominees held no positions with the Trust, they received no compensation from any Fund during its most recently completed fiscal year. The elements comprising the compensation paid to the Nominees in their capacities as trustees or directors of the Dreyfus Funds they oversee is also set forth in Schedule 1.

Shares Owned by the Trustees and Nominees

The dollar range of shares beneficially owned by the current Trustees and Nominees issued by the Funds that they currently oversee or, if elected, will oversee, as the case may be, is set forth inSchedule 2 of this Proxy Statement. As of the most recently completed fiscal year end of any Fund, none of the current Independent Trustees or Nominees, or any of their immediate family members, owned shares that in the aggregate exceeded 1% of the outstanding shares of the Funds.

Other Interests of Trustees and Nominees

As of June 30, 2008, none of the current Independent Trustees or Nominees, or any of their immediate family members, beneficially owned any securities issued by or otherwise had any interest in the Advisers, Dreyfus or the principal underwriter of any Fund, or any person controlling, controlled by or under common control with such persons. For these purposes, “immediate family member” includes the current Independent Trustee’s or Nominee’s spouse,

14

children residing in the current Independent Trustee’s or Nominee’s household and dependents of the current Independent Trustee or Nominee.

Other Information

Board Meetings. During the calendar year ended December 31, 2007, the Trust’s Board of Trustees held six meetings.

Standing Committees. The Trust’s Board of Trustees has a standing Committee of Independent Trustees, an Audit Committee and a Nominating Committee.

Messrs. Fleming, Friedman, Hewitt and Loring (each a current Independent Trustee) serve on the Committee of Independent Trustees, the Audit Committee and the Nominating Committee.

The functions of the Committee of Independent Trustees include requesting that the Funds’ investment adviser(s) and principal underwriter furnish such information as may reasonably be necessary to evaluate: (i) the performance of the Funds’ investment adviser(s) and principal underwriter; (ii) the terms of the investment advisory and underwriting agreements, and any advisory fees, distribution fees, service fees or sales charges to be paid by the Funds or their investors; and (iii) the resources, qualifications and profitability of the Funds’ investment adviser(s) and principal underwriter, recommending to the Board the selection, retention or termination of the Funds’ investment adviser(s) and principal underwriter and the compensation to be paid thereto, reviewing periodically the size and composition of the Board of Trustees and its governance procedures and recommending any such changes to the full Board of Trustees, reviewing periodically the compensation of independent Trustees and making such adjustments as appropriate, and reviewing the responsibilities, size and composition of committees of the Board of Trustees, whether there is a continuing need for each committee, whether there is a need for additional committees of the Board, and whether committees should be combined or reorganized, and to make such recommendations to the full Board of Trustees as the Committee shall deem appropriate.

The functions of the Audit Committee include recommending independent auditors to the Board, monitoring the independent auditors’ performance, reviewing the results of audits and responding to certain other matters deemed appropriate by the Trustees. The Nominating Committee is responsible for the selection and nomination of candidates to serve as independent Trustees. For a discussion of the Nominating Committee’s process and deliberations in nominating the Nominees, see “The Nominating Committee’s Actions” above.

During the most recently completed fiscal year for each Fund (ending either September 30, or December 31, 2007), the Committee of Independent Trustees held four meetings, the Audit Committee held four meetings and the Nominating Committee did not hold any meetings.

All of the current Trustees then serving attended at least 75% of all of the Board and committee meetings held during each Fund’s most recently completed fiscal year.

15

Indemnification and Insurance

The Trust’s Declaration of Trust provides generally that the Trustees of the Trust are indemnified by the Trust against all liabilities and expenses incurred by any of the Trustees in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or legislative body. This indemnity extends to proceedings in which such Trustees may be or may have been involved as a party or otherwise or with which such Trustees may or may have been threatened, while in office or thereafter, by reason of being or having been such a Trustee. This indemnity is not available with respect to any matter as to which it has been determined that such Trustee (i) did not act in good faith in the reasonable belief that his action was in or not opposed to the best interests of the Trust or (ii) had acted with willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office. Pursuant to these provisions, the Trustees are also entitled to advancement of legal and other indemnifiable expenses in advance of a final disposition of a matter.

The current Trustees are also currently named insureds under a combined Trustees and Officers/Professional Liability insurance policy maintained by and at the expense of the Trust. A portion of the coverage provided under this policy is reserved for the exclusive purpose of covering claims and liabilities of the Independent Trustees.

In anticipation of their leaving the Board, the Trustees approved: (i) certain amendments to the Trust’s Declaration of Trust to clarify, for the avoidance of doubt, that the indemnification provisions apply equally to former Trustees as to Trustees still in office; and (ii) a prepaid “tail” or “run off” insurance policy covering the current Independent Trustees beginning immediately upon their leaving office and for a period of six years thereafter. The premium for this policy will be paid by BNY Mellon.

The Independent Trustees also requested and obtained from Dreyfus a written indemnification undertaking. This undertaking, which is not limited in duration, provides that Dreyfus will indemnify each of the Independent Trustees to the fullest extent permitted by law for all liabilities, costs, expenses and damages relating to, incurred or resulting from their having served as Trustees of the Trust.

The undertaking also provides that, if (i) an action, suit, proceeding or investigation (whether criminal, civil or administrative) is brought or threatened against an Independent Trustee within six years following his leaving the Board for any act or omission or alleged act or omission committed or allegedly committed as a Trustee prior to leaving such Board, and (ii) both the Trust and one or more issuers of the “tail” or “run off” policies refuse or fail, regardless of the reason, to advance to, or pay for fees or expenses, incurred by the Independent Trustee, in connection with the defense of or representation in connection with, such action, suit, proceeding or investigation, then Dreyfus will promptly pay on behalf of such Independent Trustee, or reimburse such Independent Trustee for, the reasonable costs and expenses of such defense or representation.

16

Officers of the Trust

The following table shows information about the current officers of the Trust, including their ages, positions held with the Trust and principal occupations during the past five years (their titles may have varied during that period). Each officer serves at the discretion of the Board. The mailing address of each officer is One Boston Place, 24th Floor, Boston, Massachusetts 02108.

| | |

Name (Age) Position(s) Held with the Trust, Address | Length of Time Served | Principal Occupation During Past 5 Years |

J. David Officer (60)*, Trustee (Chairman), President and Chief Executive Officer

Dreyfus 200 Park Avenue, 55th Fl.,

New York, NY 10166 | Since 2007 | Director, Vice Chairman and Chief Operating Officer of Dreyfus; Executive Vice President of BNY Mellon; Director and President of MBSC Securities Corporation |

Steven M. Anderson* (43), Vice President, Treasurer and Chief Financial Officer

BNY Mellon Asset Management, One Boston Place Boston, MA 02108 | Vice President since 1999; Treasurer and Chief Financial Officer since 2002 | Vice President and Mutual Funds Controller, BNY Mellon Asset Management; formerly Assistant Vice President and Mutual Funds Controller, Standish Mellon Asset Management Company LLC |

Denise B. Kneeland* (57), Assistant Vice President and Secretary

BNY Mellon Asset Management, One Boston Place Boston, MA 02108 | Assistant Vice President since 1996; Secretary since 2007 | First Vice President and Manager, BNY Mellon Asset Management; formerly Vice President and Manager, Mutual Funds Operations, Standish Mellon Asset Management Company LLC |

Janelle E. Belcher (50)* Chief Compliance Officer

Founders Asset Management, LLC, 210 University Blvd. | Since 2008 | Chief Compliance Officer, Mellon Optima L/S Strategy Fund LLC since 2008; Chief Compliance Officer and Vice President of Compliance, Founders Asset Management, LLC (a wholly-owned indirect subsidiary of BNY Mellon) since 2000; formerly Senior Examiner and Team Leader: Investment Adviser and Investment Company Examinations, U.S. |

17

| | |

Name (Age) Position(s) Held with the Trust, Address | Length of Time Served | Principal Occupation During Past 5 Years |

Suite 800, Denver, CO 80206-4658 | | Securities and Exchange Commission 1990 to 2000 |

________________

* “Interested Person” of the Trust

None of the Trust’s current officers receives compensation from the Trust, except that a portion of the compensation of the Trust’s Chief Compliance Officer, as approved by the Independent Trustees, is paid by the Trust. The portion of the Chief Compliance Officer’s compensation paid by the Trust amounted to $88,594 in calendar year 2007.

It is expected that following the Effective Date, management will propose that the new Board of Trustees appoint certain persons as officers of the Trust who would, if appointed, succeed certain of the current officers of the Trust (other than Mr. Officer and Ms. Belcher). These persons are expected to include those listed below. Other non-executive officers may also be appointed. The individuals listed below currently serve, in the capacities indicated in the table below, as officers of certain Dreyfus funds currently overseen by the Nominees as trustees or directors of those Dreyfus funds. It is expected that they would be proposed to serve in the same capacities for the Trust.

| | |

Name (Age) Position(s) Held with Dreyfus Funds | Length of Time Served with Dreyfus | Principal Occupation During Past 5 Years |

Phillip N. Maisano (61), Executive Vice President | Since 2006 | Chief Investment Officer, Vice Chair and a Director of Dreyfus; Chairman and Chief Executive Officer of EACM Advisors 2004 to 2006; Chief Executive Officer of Evaluation Associates 1988 to 2004 |

James Windels (49), Treasurer | Since 1985 | Mutual Fund Accounting Director of Dreyfus |

Michael A. Rosenberg (48), Vice President and Secretary | Since 1991 | Assistant General Counsel of BNY Mellon |

James Bitetto (42), Vice President and Assistant Secretary | Since 1996 | Senior Counsel of BNY Mellon; Secretary of Dreyfus |

Joni Lacks Charatan (52), Vice President and Assistant Secretary | Since 1988 | Senior Counsel of BNY Mellon |

Joseph M. Chioffi (46), Vice President and Assistant Secretary | Since 2000 | Senior Counsel of BNY Mellon |

18

| | |

Name (Age) Position(s) Held with

Dreyfus Funds | Length of Time Served with Dreyfus | Principal Occupation During Past 5 Years |

Janette E. Farragher (45), Vice President and Assistant Secretary | Since 1984 | Assistant General Counsel of BNY Mellon |

John B. Hammalian (45), Vice President and Assistant Secretary | Since 1991 | Managing Counsel of BNY Mellon |

Robert R. Mullery (56), Vice President and Assistant Secretary | Since 1986 | Managing Counsel of BNY Mellon |

Jeff Prusnofsky (43), Vice President and Assistant Secretary | Since 1990 | Managing Counsel of BNY Mellon |

Each of the persons named above has consented to act as officer if so appointed. None of the officers to be proposed for election would receive any compensation from the Trust if so appointed.

The mailing address of each new officer is 200 Park Avenue, New York, NY 10166.

Required Vote

The election of each Nominee must be approved by the affirmative vote of a plurality of the shares of the Trust with all Funds and all classes voting together as a whole, cast in person or by proxy at the Meeting, at which a quorum exists. Being elected by a plurality of votes means receiving the greater number of votes cast limited by the number of Trustees to be elected. Since the number of Nominees equals the number of Trustees to be elected and no competing slate of nominees has been proposed by any person, it is expected that a Nominee receiving any votes will be elected.

Recommendation of the Board

The Board recommends that you vote “FOR” the election of each Nominee.

19

PROPOSALS 2(a) and 2(b)

APPROVAL OF NEW INVESTMENT ADVISORY AND SUB-INVESTMENT ADVISORY AGREEMENTS

(Newton International Equity Fund)

Introduction

The Fund’s current investment adviser, Newton, is an indirect wholly-owned subsidiary of BNY Mellon. Similarly, the Fund’s proposed investment adviser, Dreyfus, is a direct wholly-owned subsidiary of BNY Mellon. Shareholders of the Fund are being asked to approve:

·

a new investment advisory agreement between the Trust, on behalf of the Fund, and Dreyfus, and

·

a new sub-investment advisory agreement between Dreyfus and Newton with respect to the Fund.

As discussed in the introduction to this Proxy Statement, these changes are being proposed in connection with the larger process currently underway at BNY Mellon to restructure and consolidate BNY Mellon’s mutual fund business to realize cost savings and to take advantage of the Dreyfus organization’s deep mutual fund tradition, expertise and infrastructure.

The selection of Dreyfus as the Fund’s investment adviser and Newton as the Fund’s sub-investment adviser was approved by the Trustees at a meeting held on August 27, 2008, and, if approved by the Fund’s shareholders, would become effective on the Effective Date.

Reasons for Proposals to Approve New Investment Advisory and Sub-Investment Advisory Agreements

As discussed in the Introduction above, it is proposed that Dreyfus serve as the Fund’s investment adviser and that Newton serve as the Fund’s sub-investment adviser. Both Newton and Dreyfus are under the common control of BNY Mellon. The Fund’s current portfolio managers and research analysts would remain as employees of Newton. As a practical matter, assuming shareholders approve the proposed investment advisory agreement with Dreyfus (the “New Advisory Agreement”) and the proposed sub-investment advisory agreement between Dreyfus and Newton (the “New Sub-Investment Advisory Agreement”), Fund shareholders should experience no change in the overall portfolio management of the Fund except that Dreyfus would supervise Newton. In addition, the Fund’s name would change to Dreyfus/Newton International Equity Fund in order to reflect the fact that Dreyfus w ould be serving as the Fund’s investment adviser. No shareholder approval is required to change the Fund’s name.

20

Information Concerning Dreyfus

Dreyfus is located at 200 Park Avenue, New York, New York 10166. Founded in 1947, Dreyfus managed approximately $327 billion in approximately 180 mutual fund portfolios as of August 31, 2008. Dreyfus is the primary mutual fund business of BNY Mellon.

Information Concerning Newton

Newton, a member of the Newton Group, was established in 1992 and serves as the Fund’s investment adviser pursuant to an investment advisory agreement (“Current Advisory Agreement”). Newton is located at160 Queen Victoria Street, London, EC4V 4LA, England. The Newton Group manages money for a wide range of clients including small and large institutional investors, as well as charities, private clients and mutual fund clients. As of June 30, 2008, the Newton Group managed approximately $74 billion in assets.

For additional information about Dreyfus and Newton, seeSchedule 3.

Proposal 2(a)

Approval of New Investment Advisory Agreement

The Fund’s New Advisory Agreement was unanimously approved by the Trustees, including the Independent Trustees, voting in person at a meeting called for that purpose on August 27, 2008. The Fund’s Current Advisory Agreement, dated December 21, 2005, as amended from time to time, was initially approved by written consent of sole shareholder, dated December 20, 2005, and its most recent annual continuance was approved by the Trustees on October 30, 2007.

The terms of the New Advisory Agreement are substantially similar to the terms of the Current Advisory Agreement. The following summary of the New Advisory Agreement is qualified by reference to the form of New Advisory Agreement attached to this Proxy Statement inExhibit 1.

Both agreements provide that the investment adviser will provide investment management (in the New Advisory Agreement) or “a continuous investment program” (in the Current Advisory Agreement); however, the New Advisory Agreement provides that Dreyfus may hire and supervise at its own expense a sub-investment adviser in performing the “continuous program of investment.” In addition, Dreyfus undertakes in the New Advisory Agreement to inform the Trust of important developments materially affecting the Fund. Both agreements have comparable provisions limiting the liability of the adviser for errors in judgment or mistakes of law, but the New Advisory Agreement specifies that Dreyfus will use its “best judgment” in rendering its advisory services, while that provision is not included in the Current Advisory Agreement. Each of the New Advisory Agreement and Current Advisor y Agreement provides that the adviser will not be liable for loss suffered by the Fund in connection with any investment policy or the purchase, sale or retention of any securities on the recommendation of the adviser; except a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under the respective Agreement. The fee calculation provisions are substantially the same, as is the rate to be paid to the adviser. Both agreements provide that the Fund will pay its own expenses, and while the provisions are substantially the same, the New Advisory Agreement

21

specifies additional examples of expenses to be paid by the Fund. Both agreements contain provisions limiting recourse for satisfaction of obligations arising under the agreements to the property of the Fund, thereby protecting shareholders and Trustees from claims with respect to such obligations.

The New Advisory Agreement expressly provides that while Dreyfus or Newton may manage multiple funds and accounts with similar investment objectives to the Fund, securities that are suitable for purchase or sale by multiple accounts will be allocated fairly. There is no similar provision in the Current Advisory Agreement. It is expressly noted in the New Advisory Agreement that Dreyfus personnel may not be devoted to the Fund on a full time basis, that other entities may have Dreyfus in their name, and that the Trust agrees to cease using the name Dreyfus if Dreyfus ceases to be an adviser for the Fund or other Funds of the Trust. There is no similar express provision in the Current Advisory Agreement. The New Advisory Agreement makes Newton (in its capacity as sub-investment adviser) a third party beneficiary of the limitation of liability provisions contained in it. As noted above, N ewton currently has the benefit of a similar limitation of liabilities provision in its capacity as adviser to the Fund under the Current Advisory Agreement.

The Fund’s investment advisory fee rate will not increase as a result of the approval of this Proposal. The investment advisory fee, as a percentage of net assets payable by the Fund, will be the same under the New Advisory Agreement as under the Current Advisory Agreement (such rate is set forth below). If the New Advisory Agreement had been in effect for the Fund’s most recently completed fiscal year, the amount of advisory fees payable to Dreyfus by the Fund would have been identical to those payable to Newton under the Current Advisory Agreement. There will be no change in the scope or nature of services provided to the Fund.

As noted above, under the New Advisory Agreement, Dreyfus may delegate day-to-day management responsibilities to a sub-investment adviser. Dreyfus will, subject to shareholder approval of both this Proposal 2(a) and Proposal 2(b) below, retain Newton to be the sub-investment adviser to the Fund. See Proposal 2(b) below for a detailed explanation of Newton’s duties with respect to the management of the Fund. Under the New Advisory Agreement, Dreyfus, and not the Fund, would be responsible for Newton’s fees.

The adviser’s activities with respect to the Fund are subject to the review and supervision of the Board, to which the adviser renders periodic reports with respect to the Fund’s investment activities.

Factors Considered by the Board in Approving the New Advisory Agreement

For a description of the factors considered by the Board of Trustees in approving the New Advisory Agreement, see Schedule 8.

Effective Date and Term

If approved by the Fund’s shareholders at the Meeting, the New Advisory Agreement would become effective on the Effective Date. The New Advisory Agreement would continue in effect until April 4, 2010 and would continue in effect thereafter for successive one year periods as long as each such continuance is approved in accordance with the requirements of the 1940 Act.

22

The Current Advisory Agreement and the New Advisory Agreement each provide that they may be terminated at any time, without the payment of any penalty, by the Board or by at least a 1940 Act Majority Vote (as defined below) of the shares of the Fund upon not more than 60 days’notice. The Current Advisory Agreement provides that it may be terminated upon 60 days’ notice by Newton, while the New Advisory Agreement requires 90 days’ notice by Dreyfus.Both agreements provide that they automatically terminate in the event of their assignment.

For its investment advisory services under the New Advisory Agreement, Dreyfus would be entitled to receive an annual fee, payable monthly, which varies in accordance with the average daily net assets of the Fund. The advisory fee is accrued daily and will be pro rated if Dreyfus does not act as the Fund’s investment adviser during any entire monthly period.

The annual fee rates under the Current and New Advisory Agreements and the advisory fees paid by the Fund to Newton pursuant to the Current Advisory Agreement for the Fund’s most recent fiscal year end are as follows:

| |

ANNUAL ADVISORY FEE RATE (as a percentage of

average daily net assets) | ADVISORY FEES PAID TO NEWTON

FOR THE MOST RECENT FISCAL YEAR |

0.80% | $255,879* |

* During the fiscal year ended September 30, 2007, Newton voluntarily agreed to waive receipt of its fees and/or reimburse the Fund to the extent necessary to maintain the Fund’s annual operating expenses (excluding Rule 12b-1 fees, shareholder services fees, brokerage commissions, taxes, interest, acquired fund fees and extraordinary expenses) at 1.15% of the Fund’s average daily net assets. For the past fiscal year, Newton waived receipt of $95,995 pursuant to this undertaking. Newton’s voluntary expense waivers/reimbursements can be revoked at any time. If Proposals 2(a) and 2(b) are approved by Fund shareholders, Dreyfus has voluntarily agreed to continue indefinitely the waivers/reimbursements referred to in this paragraph on the same terms as provided by Newton. Newton may, and, if appointed, Dreyfus will be able to, revoke the voluntary expense waivers/reimb ursements at any time.

For the most recent fiscal year ended September 30, 2007, the Fund did not pay any brokerage commissions to any affiliate.

Dreyfus acts as adviser with respect to other “international” funds having substantially similar investment policies and strategies as the Fund. For information about such funds, seeSchedule 7.

Required Vote

The New Advisory Agreement must be approved by the affirmative vote of at least “a majority of the outstanding voting securities” of all of the classes of shares of the Fund voting together as a whole, which is defined under the 1940 Act as the lesser of (i) 67% or more of the shares of all of the classes of shares of the Fund voting together and entitled to vote thereon present in person

23

or by proxy at the Meeting if the holders of more than 50% of all of the shares of all classes of outstanding shares in the aggregate are present in person or represented by proxy or (ii) more than 50% of all of the shares of all classes of the Fund’s outstanding shares entitled to vote thereon (a “1940 Act Majority Vote”). If the shareholders of the Fund do not approveboth the New Advisory Agreement and the New Sub-Investment Advisory Agreement, the Current Advisory Agreement will remain in effect.

Recommendation of the Board

The Board recommends that you vote “FOR” the New Advisory Agreement.

24

Proposal 2(b)

Approval of New Sub-Investment Advisory Agreement

The Fund’s New Sub-Investment Advisory Agreement was unanimously approved by the Trustees, including the Independent Trustees, voting in person at a meeting called for that purpose on August 27, 2008.

The following summary of the New Sub-Investment Advisory Agreement is qualified by reference to the form of New Sub-Investment Advisory Agreement attached to this Proxy Statement inExhibit 2.

Pursuant to the New Sub-Investment Advisory Agreement, Dreyfus would pay Newton a monthly sub-investment advisory fee, equal on an annual basis to 0.38% of the average daily net assets of the Fund. The Fund has no responsibility for any fee payable to Newton and would pay advisory fees only to Dreyfus. The sub-investment advisory fee payable by Dreyfus to Newton may be reduced if Dreyfus’ fees are reduced or if Dreyfus reimburses Fund expenses.

Under the New Sub-Investment Advisory Agreement, Newton would provide the Fund, among other services, with suitable investment management services. As sub-investment adviser, Newton would supervise and conduct a continuous program of investment, evaluation, and, if appropriate, sale and reinvestment of the Fund’s assets, consistent with the investment policies, objective and restrictions of the Fund. Newton would bear its own costs of maintaining the staff and personnel necessary for it to perform its obligations under the New Sub-Investment Advisory Agreement, and any other expenses incurred by it in connection with the performance of its duties under the New Sub-Investment Advisory Agreement.

Pursuant to the New Advisory Agreement and New Sub-Investment Advisory Agreement, and under the supervision of Dreyfus and the Board, Newton would be responsible for decisions to buy and sell securities for the Fund as the Fund’s sub-investment adviser. Newton also would be responsible for placement of the Fund’s portfolio securities and negotiation of commissions, if any, paid on these transactions.

The New Sub-Investment Advisory Agreement provides that Newton will not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund or Dreyfus in connection with the matters to which the agreement relates, except a loss resulting from willful misfeasance, bad faith or gross negligence on Newton’s part in the performance of its duties or from reckless disregard by it of its obligations and duties under the New Sub-Investment Advisory Agreement.

Newton acts as adviser or sub-investment adviser with respect to other “international” funds having substantially similar investment policies and strategies as the Fund. For information about such funds, seeSchedule 7.

Factors Considered by the Board in Approving the New Sub-Investment Advisory Agreement

25

For a description of the factors considered by the Board of Trustees in approving the New Sub-Investment Advisory Agreement, see Schedule 8.

Effective Date and Term

If approved by the Fund’s shareholders at the Meeting, the New Sub-Investment Advisory Agreement would become effective on the Effective Date. The New Sub-Investment Advisory Agreement would continue in effect until April 4, 2010 and would continue in effect thereafter for successive one year periods as long as each such continuance is approved in accordance with the requirements of the 1940 Act. The New Sub-Investment Advisory Agreement may be terminated at any time without penalty (i) by Dreyfus upon 60 days’ notice to Newton, (ii) by the Trust’s Board or by a 1940 Act Majority Vote upon 60 days’ notice to Newton, or (iii) by Newton upon not less than 90 days’ notice to the Trust and Dreyfus. In addition, the New Sub-Investment Advisory Agreement automatically terminates in the event of its assignment.

Required Vote

The New Sub-Investment Advisory Agreement must be approved by at least a 1940 Act Majority Vote (as defined above). If the shareholders of the Fund do not approveboth the New Advisory Agreement and the New Sub-Investment Advisory Agreement, the Current Advisory Agreement will remain in effect.

Recommendation of the Board

The Board recommends that you vote “FOR” the New Sub-Investment Advisory Agreement.

26

PROPOSAL 3

APPROVAL TO AMEND CERTIFICATE OF DESIGNATION

The Boston Company Large Cap Core Fund

The Boston Company Small/Mid Cap Growth Fund

The Boston Company Small Cap Growth Fund

The Boston Company Small Cap Tax-Sensitive Equity Fund

Standish Mellon Intermediate Tax Exempt Bond Fund

Standish Mellon Fixed Income Fund

Standish Mellon Global Fixed Income Fund

Standish Mellon International Fixed Income Fund

Introduction

Shareholders of the Proposal Three Funds are being asked to approve an amendment to the Certificate of Designation with respect to the Proposal Three Funds. The proposed amendment to the Certificate of Designation would authorize the Trustees to liquidate any of the Proposal Three Funds or a class thereof with a majority vote of the Trustees without shareholder approval if the Trustees determine that the continuation of such a Fund or a class thereof is not in the best interests of the shareholders of the Fund as a result of factors or events adversely affecting the ability of the Fund or a class thereof to conduct its business in an economically viable manner. If approved, this would cause the liquidation provisions of the Proposal Three Funds to be identical to the liquidation provisions of the other Funds.

Reasons for Proposal to Amend Certificate of Designation

The Board recommends that you vote in favor of this proposal for the following reasons:

·

The amendment will avoid the time and expense of a shareholder meeting and permit the Board to act quickly if the Board were to determine it is in the best interests of the shareholders to liquidate a Proposal Three Fund.

·

The amendment will make the Certificates of Designation for the Proposal Three Funds consistent with other more recent Certificates of Designation for other Funds, which authorize the Trustees to liquidate those Funds by a majority vote.

Summary of Current Provision and Proposed Amendment

·

The current provision and the proposed amendment to each Certificate of Designation for the Proposal Three Funds are set forth below. Capitalized terms used herein and not otherwise defined shall have their respective meanings set forth in the Certificate of Designation, as applicable.

27

| |

Current Provision | Proposed Amendment |

Liquidation. In the event of the liquidation or dissolution of the Trust or the liquidation of the Fund, the Shareholders of the Fund shall be entitled to receive, when and as declared by the Trustees, the excess of Fund Assets over the liabilities of the Fund. The assets so distributable to the Shareholders of the Fund shall be distributed among such Shareholders in proportion to the number of Shares of the Fund held by them and recorded on the books of the Trust. The liquidation of the Fund may be authorized by vote of a Majority of the Trustees, subject to the affirmative vote of “a majority of the outstanding voting securities” of the Fund, as the quoted phrase is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), determined in accordance with clause (iii) of the definition of “Majority Shareholder Vote” in Section 1.4 of the Declaration of Trust.

| Liquidation. In the event of the liquidation or dissolution of the Trust or the liquidation of the Fund, the Shareholders of the Fund shall be entitled to receive, when and as declared by the Trustees, the excess of the Fund Assets over the liabilities of the Fund. The assets so distributable to the Shareholders of the Fund shall be distributed among such Shareholders in proportion to the number of Shares of the Fund held by them and recorded on the books of the Trust. The Fund or any class thereof may be terminated by the affirmative vote of the holders of not less than two-thirds of the Shares outstanding and entitled to vote at any meeting or action of Shareholders of the Fund or class thereof; provided, however, that if such termination is recommended by the Trustees, either (i) a Majority Shareholder Vote shall be sufficient to authorize such liquidation, or (ii) the affirmative vote of a majority of the Trustees having determined that the continuation of the Fund or class thereof is not in the best interests of the Shareholders of the Fund or class as a result of factors or events adversely affecting the ability of the Fund or class to conduct its business in an economically viable manner shall be sufficient to authorize such liquidation. Such factors and events may include (but are not limited to) the inability of the Fund or class to maintain its assets at an appropriate size, changes in laws or regulations governing the Fund or class or affecting assets of the type in which the Fund invests or economic developments or trends having a significant adverse impact on the business or operation of the Fund or class. |

Currently, there is no intention to liquidate any of the Proposal Three Funds.

28

Required Vote

Proposal 3 must be approved by at least a 1940 Act Majority Vote (as defined above) of the outstanding voting securities for each Proposal Three Fund, voting separately. If any particular Proposal Three Fund does not obtain the necessary shareholder votes, the Trustees will consider what further action to take consistent with their fiduciary duties to such Fund; however, obtaining or the failure to obtain the approval of shareholders of any one Fund will not affect any other Fund.

Recommendation of the Board

The Board recommends that you vote “FOR” approval of the amendment to the Certificate of Designation.

29

INFORMATION CONCERNING THE MEETINGS

Proxies, Quorum and Voting at the Meetings

Only shareholders of record as of the Record Date are entitled to notice of and to vote at the Meetings with respect to their Fund. A majority of the outstanding shares of the Trust that are entitled to vote will be considered a quorum for the transaction of business at the Meetings, except that (i) a majority of the outstanding shares of Newton International Equity Fund that are entitled to vote will be considered a quorum for the transaction of business at the Meeting with respect to Proposals 2 (a) and 2(b) and (ii) a majority of the outstanding shares of each of the Proposal Three Funds will be considered a quorum for the transaction of business at the Meeting of those Funds with respect to Proposal 3. Each Proposal Three Fund will vote separately with respect to Proposal 3.

Shareholders may use the enclosed Proxy Card if they are unable to attend the applicable Meeting in person or wish to have their shares voted by a proxy even if they do attend the Meeting. Any shareholder that has given his or her Proxy has the power to revoke that Proxy at any time prior to its exercise by executing a superseding Proxy or by submitting a notice of revocation to the secretary of the Trust. In addition, although mere attendance at a Meeting will not revoke a Proxy, a shareholder present at a Meeting may withdraw his or her Proxy and vote in person on a proposal to be voted on at that Meeting. All properly executed and unrevoked Proxies received in time for a Meeting will be voted in accordance with the instructions contained in the Proxies. If no instruction is given, the persons named as proxies or their designees will vote the shares represented thereby in favor of Proposal s 1, 2(a), 2(b) and 3 as described above and will use their best judgment in connection with the transaction to vote on such other business as may properly come before such Meeting or any adjournment thereof. There will be no cumulative voting in the election of Trustees.