UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2011

Commission File Number: 000-52387

American Telstar, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 84-1052279 | |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification Number) |

Fengshou Road West, Jiefang District, Jiaozuo, Henan Province, PRC 454000

(Address of principal executive offices)

011- 86-0391-3582676

(Registrant’s telephone number, including area code)

36 Mclean Street, Red Bank, New Jersey 07701

(Former name or former address if changed since the last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed by American Telstar, Inc. We are reporting the acquisition of a new business and providing a description of this business and its audited financials below.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

| · | "Telstar," "the Company," "we," "us," or "our," are references to the combined business of American Telstar, Inc, and its subsidiary, China Agricorp, Inc., and China Agricorp, Inc.’s direct and indirect subsidiaries. |

| · | "Agricorp" refers to China Agricorp, Inc., a Nevada corporation and our direct, wholly owned subsidiary, and/or its direct and indirect subsidiaries, as the case may be; |

| · | "China," "Chinese" and "PRC," refer to the People’s Republic of China; |

| · | "RMB" refers to Renminbi, the legal currency of China; |

| · | "U.S. dollar," "$" and "US$" refer to the legal currency of the United States; |

| · | "Securities Act" refers to the Securities Act of 1933, as amended; and |

| · | "Exchange Act" refers to the Securities Exchange Act of 1934, as amended. |

Certain references to ownership and other rights of the Company in this Current Report include the rights of Jiaozuo Yida Vegetable Oil Co., Ltd. (“Yida”) which we are attributing to the Company by virtue of the Contractual Agreements described below.

All of the financial information for Agricorp as of September 30, 2010 and for the nine months ended September 30, 2010 in this Current Report is unaudited.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Share Exchange Agreement

On February 11, 2011, we entered into a Share Exchange Agreement with China Agricorp and the stockholders of China Agricorp (the “Agricorp Stockholders”) (the “Share Exchange Agreement”). Pursuant to the Share Exchange Agreement, on February 11, 2011, 335 Agricorp Stockholders transferred 100% of the outstanding shares of common stock of Agricorp held by them, in exchange for an aggregate of 9,001,903 newly issued shares of our Common Stock. The shares of our Common Stock acquired by the Agricorp Stockholders in such transactions constitute approximately 99.97% of our issued and outstanding Common Stock on a fully-diluted basis giving effect to the share exchange.

The Share Exchange Agreement contains representations and warranties by us, Agricorp and the Agricorp Stockholders which are customary for transactions of this type such as, with respect to Telstar: organization, good standing and qualification to do business; capitalization; subsidiaries, authorization and enforceability of the transaction and transaction documents; financial condition; valid issuance of stock, consents being obtained or not required to consummate the transaction; litigation; compliance with securities laws; the filing of required tax returns; and no brokers used, and with respect to Agricorp: authorization, capitalization, and title to Agricorp common stock being exchanged.

The foregoing description of the terms of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the Share Exchange Agreement which is included as Exhibit 2.1 of this Current Report and is incorporated by reference herein.

2

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On February 11, 2011, we completed the acquisition of Agricorp pursuant to the Share Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange. Agricorp is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

As a result of this transaction, the Company ceased being a “shell company” as that term is defined in Rule 12b-2 under the Securities and Exchange Act of 1934 (the “Exchange Act”).

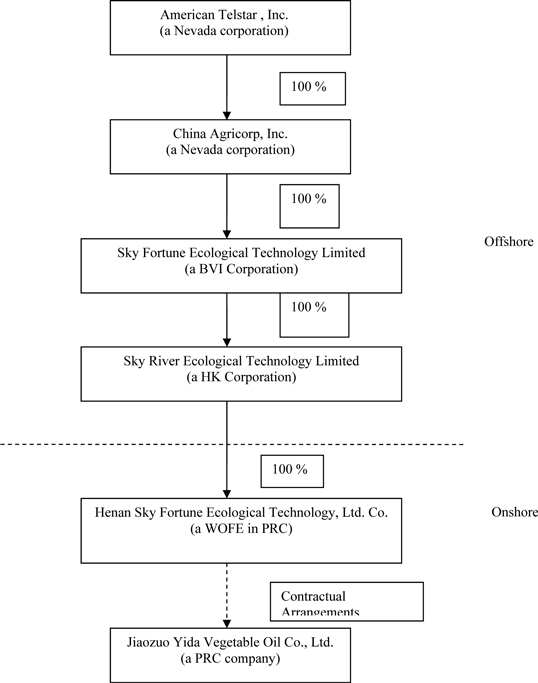

Our Corporate Structure

As set forth in the following diagram, following our acquisition of Agricorp, Agricorp became and currently is our direct, wholly-owned subsidiary.

3

4

Organizational History of China Agricorp, Inc. and Subsidiaries

China Agricorp, Inc. was incorporated in Nevada on June 16, 2010. In June 2010 Agricorp sold 100 shares for $.001 per share to each of 326 investors located in the PRC in transactions that were not subject to registration under the U.S. securities laws.

Pursuant to a Share Exchange Agreement, dated as of August 26, 2010, Sky Harmony Ecological Technology Limited (“Sky Harmony”) which owned one ordinary share of Sky Fortune Ecological Technology Limited (“Sky Fortune”) and was the sole shareholder of Sky Fortune, exchanged such ordinary share of Sky Fortune for 7,473,808 shares of Common Stock of China Agricorp.

Sky Fortune was incorporated in the British Virgin Islands on April 30, 2010. On May 5, 2010, Sky Harmony subscribed to one common share of Sky Fortune, which constitutes 100% of the equity interests of Sky Fortune. On May 10, 2010, Sky Fortune incorporated and established Sky River under the laws of Hong Kong, and simultaneously, Sky Fortune subscribed to one share of Sky River, which constitutes 100% of the equity interests of Sky River. Sky River incorporated and established Henan Sky Fortune on July 12, 2010 or “WFOE,” under the laws of the PRC by virtue of its status as a wholly-owned subsidiary of a non-PRC company, Sky River. In July 2010, the WOFE entered into and consummated a series of agreements (the “Contractual Agreements”), with Jiaozuo Yida Vegetable Oil Co., Ltd. (“Yida”) described below.

Yida was incorporated in the PRC on August 29, 2000 as a limited liability company (a company solely owned by a natural person).

The following is a summary of the material terms of each of the Contractual Agreements. All references to the Contractual Agreements and other agreements in this prospectus are qualified, in their entirety, by the text of those agreements. Certain references to ownership and other rights of the Company in this prospectus include the rights of Yida, which we are attributing to the Company by virtue of the Contractual Agreements.

Exclusive Business Cooperation Agreement. Pursuant to the Exclusive Business Cooperation Agreement and a Supplemental Agreement thereto, the WOFE will provide Yida with its complete business support and technical and consulting services on an exclusive basis, and the WOFE shall be entitled to all of Yida‘s net income as compensation for such services. Yida shall not dispose (including but not limited to transfer, sell, donate, abandon, mortgage, pledge, etc.) any of its material assets without the written consent of the WOFE, and the WOFE shall have the right to control and instruct Yida’s disposal of its assets and the use of any proceeds thus gained. The Exclusive Business Cooperation Agreement will remain in effect for a term of 10 years, and the term is renewable by the WOFE without the consent of Yida.

Power of Attorney. Shareholders of Yida have granted the WOFE an irrevocable Power of Attorney, under which the WOFE is appointed as proxy to vote on all matters that require approval by the shareholders of Yida, including the election of Yida’s officers and directors, and the WOFE shall be entitled to other shareholder’s rights including the sale or transfer or pledge or disposition of the shares owned by the shareholders of Yida.

Exclusive Option Agreement. Under the Exclusive Option Agreement, the WOFE has been granted an irrevocable and exclusive purchase option (the “Option”) to acquire Yida’s equity, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. The consideration for the exercise of the Option shall equal the actual capital contributions paid in the registered capital of Yida by shareholders of Yida.

Equity Interest Pledge Agreement. Under the Equity Interest Pledge Agreement, equity interests in Yida have been pledged to the WOFE to guarantee all of Yida‘s rights and benefits under the other Contractual Agreements. Prior to termination of the Equity Interest Pledge Agreement, the pledged equity interests cannot be transferred without the WOFE’s prior written consent.

5

DESCRIPTION OF BUSINESS

Overview

Through its subsidiaries and the Contractual Agreements described above, Agricorp (through Yida) is one of the largest edible vegetable oil producers and dealers in Henan Province, People’s Republic of China (“PRC”). Its main products currently include edible vegetable oils such as soybean oil and peanut oil. It benefits from a reliable water supply, rich soil and ideal climate. It cultivates farm land covering an area of 9,060 acres which provides a reliable supply of soybeans for its edible oil production. Currently, Yida sells the byproducts of its soybean oil processing operation as livestock feed. It is in the process of adding equipment to produce value-added soy protein, isoflavone and saponin products using the byproducts of its existing soybean oil processing operation, which it believes will help generate much higher margins per soybean processed. Soy protein, isoflavones and saponins are used extensively in natural medicine and healthcare products. We believe that Yida is well-positioned to capture a substantial portion of the soy protein, isoflavone and saponin market in China. Potential markets in which such byproducts can be further processed and sold as a raw material include the nutraceutical, personal health care, health food and bio based industrial markets. We believe that Yida’s future farm base expansion can enhance its ability to cultivate the most favorable agriculture products according to environmental and market conditions.

During the fiscal year ended December 31, 2009 (“fiscal 2009”) Agricorp had total revenues of approximately $22,353,000 and a net income of approximately $5,033,000. Based on unaudited information for the nine months ended September 30, 2010 Agricorp had total revenues of approximately $22,083,000 and a net income of approximately $1,208,972.

Industry Overview

China’s Agriculture Industry

According to the United Nations World Food Program, in 2008 China fed 20% of the world's population with only 7 percent of the world's arable land. Of the approximately 540,500 square miles of such arable land, only about 1.2% permanently supports crops and 203,000 square miles are irrigated. The land is divided into approximately 200 million households, with an average land allocation of just 1.6 acres. China ranks first worldwide in farm output, while, as a result of topographic and climatic factors, only about 10–15 percent of the total land area is suitable for cultivation. Of this, slightly more than half is not irrigated, and the remainder is divided roughly equally between paddy fields and irrigated areas. These factors emphasize the value of Yida’s location in Henan Province, with rich soil, abundant water supply, favorable climate and lack of competition.

International Soybean Industry

According to the Food and Agricultural Policy Research Institute (“FAPRI”), annual worldwide consumption of soybeans is 10,256 million bushels, soybean meal consumption is 167 million tons, and soy oil consumption is 39 million tons. Based on the world population, this equals approximately 12 pounds of soy consumption per capita. Global soybean consumption is expected to grow substantially. China’s expanding demand leads the escalation with over 100% growth this decade. With substantial growth in China’s GDP and per capita income, its soybean demand is expected to continue to rise. China became the largest soybean oil consumer in 2006/07 and is expected to account for 33% of global consumption by 2018/19.

Brazil is expected to surpass the U.S. global production of soybeans and likely double its exports to the U.S. by 2016. Increased U.S. consumption is expected to result in substantially less US soybean exports. According to the United States Food and Drug Administration (the “USDA”), China leads in soybean imports, with a projected growth that will account for over 75% of the projected gain in world trade by 2016/17.

6

India’s per capita GDP, population levels and growth rates have followed a similar path to those of China. India is currently at population and per capita GDP levels China was at 10-15 years ago. As a result, it is expected that India will emerge as a future importer in soy protein products instead of raw soybeans.

Soy protein is an inexpensive source of non-animal protein. The Biological Value (“BV”) score, on a scale of 0-100, is a common measure of protein quality for human consumption. Although products such as eggs have a larger BV, cost makes soy protein the least expensive source of digestible protein on a per gram basis. The Indian population currently consumes predominantly poor quality protein; approximately 75% of Indian protein consumption is from cereals.

Table 1. Protein Products and Biological Value

| Product | BV |

| White Flour | 41 |

| Corn | 60 |

| Full-fat Soy Flour | 64 |

| Soybean Curd (Tofu) | 64 |

| Whole Wheat | 64 |

| Beef | 74 |

| Soy Protein Isolate | 74 |

| Fish | 76 |

| Defatted Soy Flour | 81 |

| Rice | 83 |

| Cheese | 84 |

| Cow Milk | 90 |

Soybean Milk | 91 |

| Chicken Egg | 94 |

Note: The Biological Value (BV) score is on a scale of 0-100 with zero being the lowest quality protein to the human body and 100 being the highest.

Raw soybeans yield approximately 35% protein. The standard USDA measure for one bushel of soybeans is 60 pounds. This results in 21 pounds of protein per bushel, or one pound of protein from 2.857 pounds of raw soybeans.

Further processing soybeans into more concentrated protein products adds value. Products such as Soy Protein Isolates/Isoflavones, Soy Protein Concentrate and Saponins are often referred to as Value Added Products in the natural medicine industry. Soybeans are valued at $5.50-$8.50 per bushel. Table 2 summarizes the average price of selected soybean products noting value per bushel, but does not account for additional market value realized for sideline products produced simultaneously.

Table 2. Average price per pound and per bushel of selected soy products

| Product | $/lb | $/bu | ||||||

| Soybeans | $ | 0.12 | $ | 7.00 | ||||

| Soy Flour | $ | 0.21 | $ | 8.51 | ||||

| Soybean Meal | $ | 0.13 | $ | 6.12 | ||||

| Soy Oil | $ | 0.28 | $ | 3.03 | ||||

| Soy Protein Concentrates | $ | 1.45 | $ | 47.13 | ||||

| Soy Protein Isolates | $ | 1.92 | $ | 42.53 | ||||

7

The United States, Brazil, and Argentina collectively account for more than 90 percent of world exports of soybeans, soybean meal, and soybean oil. Most of the projected growth in global soybean exports is expected to be satisfied from Brazil alone. According to the USDA, Argentina dominates world exports of soybean meal and soybean oil, as the country's modest domestic use and differential export taxes make it the most competitive place to process soybeans. Argentina taxes soybean exports at a higher rate than the exports of soybean meal and soybean oil, which favors demand by domestic processors.

China Soybean Industry

China is the world’s fourth largest soybean producer, after the US, Brazil and Argentina. Being the second largest consumer of soybeans, China is currently the world’s largest soybean importer. China’s edible oil industry can be volatile primarily due to its dependence on foreign soybean imports. To address the volatility, the Chinese government is supporting expansion of “key enterprises in soybean planting” to help stabilize the market. The ADB Project (discussed below) in which Yida participates, is an example of China’s commitment to this industry.

Dollar cost per metric ton

8

Industry Proportions

As a primary industry, agriculture is very important to the Chinese economy. However the development of the industrial, manufacturing and the service industries over the past thirty years has influenced the role of agriculture by decreasing its proportional weight in China’s total economy. In 2008, GDP was RMB 30,067 billion (USD 4,421.6 billion), a year on year increase of 9.0%, among which the primary industrial sector value was RMB 3,400 billion (USD 500 billion), a growth of 5.5% accounting for 11.3% of total GDP. In the late 1970’s, agriculture accounted for about 27.94% of total GDP, and in 1983 this proportion hit a record high at 32.88%. After 1983, the proportion decreased, and in 2008 it was 11.3%. China's soybean consumption outpaced increases in domestic production during the last 25 years, mainly because of increases in consumption of soybean oil and meal induced by income and population growth, particularly in large urban areas.

Planting Area Proportion

In recent years, with the support of various national policies influencing agriculture, the total planting area of major farm products, has increased (See chart 1.3). In 2008, the grain planting area in China reached 263.5 million acres, 2.62 million acres more than the previous year. Of this amount, the planting area of cotton was 14.2 million acres, a decrease of 420,000 acres, planting area of oil plants was 31.4 million acres, an increase of 4.77 million acres, and planting area of sugar plants was 4.76 million acres, an increase of 321,000 acres (see chart 1.3).

Chart 1.3: Planting area and proportion of major farm products, 1999~2008

| Year | Farm products | Grain crops | Proportion | Cotton | Proportion | Oil plants | Proportion | Sugar plants | Proportion | |||||||||||||||||||||||||||

| 1999 | 386.3 | 279.6 | 72.37 | 9.1 | 2.38 | 34.3 | 8.89 | 3.9 | 1.05 | |||||||||||||||||||||||||||

| 2000 | 386.0 | 267.9 | 69.39 | 9.8 | 2.59 | 38.0 | 9.85 | 3.7 | 0.97 | |||||||||||||||||||||||||||

| 2001 | 384.5 | 262.1 | 68.13 | 11.8 | 3.09 | 36.0 | 9.40 | 4.1 | 1.06 | |||||||||||||||||||||||||||

| 2002 | 381.9 | 256.6 | 67.18 | 10.3 | 2.71 | 36.5 | 9.55 | 4.6 | 1.18 | |||||||||||||||||||||||||||

| 2003 | 376.4 | 245.5 | 65.22 | 12.5 | 3.35 | 37.5 | 9.83 | 4.1 | 1.09 | |||||||||||||||||||||||||||

| 2004 | 379.3 | 250.9 | 66.17 | 14.0 | 3.71 | 35.5 | 9.40 | 3.9 | 1.02 | |||||||||||||||||||||||||||

| 2005 | 384.0 | 257.6 | 67.07 | 12.5 | 3.26 | 35.3 | 9.21 | 3.9 | 1.01 | |||||||||||||||||||||||||||

| 2006 | 375.6 | 259.3 | 68.98 | 14.3 | 3.82 | 28.8 | 7.72 | 3.9 | 1.03 | |||||||||||||||||||||||||||

| 2007 | 379.1 | 260.8 | 68.84 | 14.5 | 3.86 | 27.9 | 7.37 | 4.4 | 1.17 | |||||||||||||||||||||||||||

| 2008 | 386.0 | 263.5 | 68.28 | 14.3 | 3.69 | 31.3 | 8.13 | 4.6 | 1.24 | |||||||||||||||||||||||||||

Data source: NSB, China Economic Information Network Unit: million acres, %

9

10

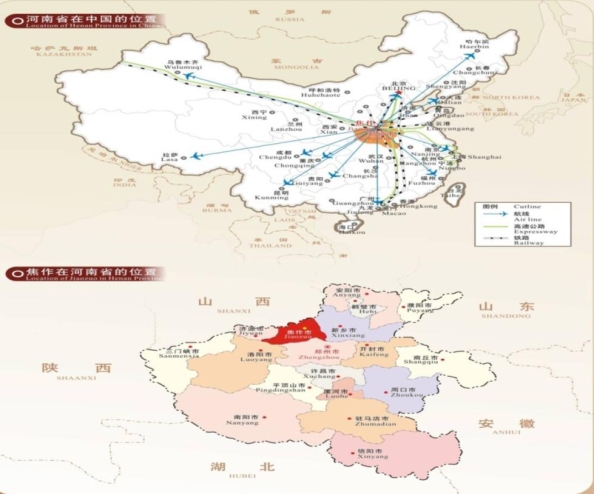

Stategic Location

Yida is located in Henan Province near the Yellow River in an historically significant agricultural area of China. An abundant and reliable water supply supports the company’s agriculture activities while an extensive railway and highway network facilitate efficient distribution.

Yida is located in modern Jiaozuo City, population 3.6 million with local revenues of USD $858 million (RMB 5.86 billion). Net urban and rural income is USD $1,932 (RMB 13,200) and $900 (RMB 6,130) per annum, respectively. Savings deposits in Jiaozuo are $8.122 billion (RMB 55.47 billion). Jioazhi, Jiaotai, Jiaoxin and Yuehou railways all pass through Jiaozuo and a network of five expressways facilitate transportation throughout China. A rich surface and underground water supply of 1.6 billion and 12 billion cubic meters, respectively, together with 23 rivers provide a unique and valuable asset to Jiaozuo.

Henan Province agriculture overview

Henan Province is located in Middle Eastern China, the middle and lower reaches of the Yellow River. Henan covers an area of 64,479 square miles, accounting for 1.73% of total national territory. Among the total area, 17.7 million acres are arable lands, of which Yida would control 13,400 after its proposed expansion. Henan is a warm temperate zone – semi-tropical with a moist to semi-moist monsoon climate. Winters are cold with little precipitation, spring is dry, summers are hot with abundant precipitation, and autumn is mostly sunny and dry. The average annual temperature is 54 F (12°C) to 61F (16°C). The annual frost free period from north to south is 180-240 days/yr. The average annual precipitation is 19.7 inches to 34.5 inches, with 50% of annual rainfall in the summer.

11

Henan Province is extremely rich with water resources, a fundamental factor for agriculture production. Studies have determined the area to be close to 100% resilient to the effects of drought or flood, two serious risk factors that do not favor the majority of China’s agriculture. Henan is home to 4 large river systems, the Yellow, Huaihe, Haihe, and Yangtze Rivers. In Henan Province there are over 1,500 rivers forming an extensive water network. The Yellow River runs through the center of Henan with 440 miles of main stream and 13,977 square miles of water-collection area accounting for about 1/5 of the province. Huaihe runs through the middle and southern area of the province with various tributaries, 211 miles of main stream and 34,090 square miles of water-collection area, accounting for 1/2 of the total province. The Weihe and Zhanghe Rivers located in the Northern Province enter the Haihe River. The Danjian, Tuanhe and Tangbai Rivers run through the southeastern portion of the province entering the Hanshui River. Total provincial water resources are 41.3B cubic meters. Henan water power resource reserves are 4.9 million KW. Currently there are 2,347 reservoirs in Henan with a capacity of 27B cubic meters. The effective agricultural irrigated area is 11.8M acres.

Jiaozuo agriculture overview

Jiaozuo is one of the major agricultural production areas of Henan Province. Jiaozuo has a warm temperature zone with a continental monsoon climate. There is sufficient sunshine year-round and rainfall is centralized during hot seasons. The annual average temperature is about 57.5F (14.2°C). The average annual precipitation is about 25.5 inches with the majority of rainfall in July, August and September. The average frost free period is 230 days. There are over 20 rivers including the Yellow River, Qinhe River, Yuehe River, Dasha River and Manghe River in Jiaozuo as well as 25 small to medium sized reservoirs such as Qingtian River and Qunying River. There are rich underground water resources in Jiaozuo with water reserves of about 3.5 billion cubic meters. In Jiaozuo, 94% of the arable lands are being effectively irrigated and 84% of arable lands can be harvested despite drought or excessive rains. With rich soils and ample irrigation, Jiaozuo is a high yielding grain area and produces various agriculture products such as wheat, corns, rice, cotton, oil plants and other economic crops.

Natural Medicine

Natural medicine is any form of health care such as diet, exercise, herbs or hydrotherapy which seeks to enhance the body’s natural healing powers. Segments of the natural medicine market include:

| · | TCM - Ancient and holistic system of health and healing, based on the notion of harmony and balance, employing the ideas of moderation and prevention. |

| · | Dietary Supplements - a product that contains vitamins, minerals, foods, botanicals, amino acids and is intended to supplement the usual intake of these substances. |

| · | Nutraceuticals - Food, or parts of food, that provide medical or health benefits, including the prevention and treatment of disease. |

| · | Health Food - A food believed to be highly beneficial to health, especially a food grown organically and free of chemical additives. |

More than 300 million people sought TCM at Chinese hospitals in 2008. China’s production in this sector was valued at US $29.25 billion (RMB 200 billion) in 2008, and is expected to double to US $58.5 billion (RMB 400 billion) within ten years. Experts at the 2009 International Conference for Bio-economy (BioEco 2009) predict China as the fifth largest TCM market worldwide in 2010 after the U.S., Japan, Germany and France.

The Chinese government seems to be dedicated to fully integrating TCM into its existing health care system and provides 85% of China’s rural population the benefit of TCM health services. In May 2009, the China State Council issued a set of policies, including more government investment, to support the sector's development.

12

China’s exports of TCM products reached US $1.3 billion in 2008, compared with US $720 million in 2003. In 2008, China experienced substantial growth in TCM imports and exports, exporting TCM products to 154 countries and regions worldwide. These 2008 levels were all time highs for the TCM market, according to the Chinese Medicines and Health Products Import and Export Chamber of Commerce. The export earnings in 2008 represented a 10.94% increase from 2007.

Tremendous worldwide growth in the organic soy foods industry has occurred over the last two decades as consumers seek healthy dietary alternative sources of protein. From 1992 to 2008, U.S. soyfood sales increased from $300M to $4B, with 32% of Americans consuming soyfoods. From 2000 to 2007, U.S. food manufacturers introduced over 2,700 new foods with soy as an ingredient. The demand for dietary supplements is escalating, with Asia Pacific accounting for $22.6B, or 44% of the world market, followed by North America’s $16B, or 32% of the world market. China is unquestionably the Asia Pacific leader with a $746M protein powder and $1B calcium market. The dietary supplement market in India is currently growing 12 to 15% per year, with soy protein playing a dominant role in this growth spurt. The nutraceutical industry in the U.S. is $86B, and this figure is slightly higher in Europe’s market. Japan’s nutraceutical industry represents approximately 25% of their $6B total annual food sales, with 47% of the Japanese population consuming nutraceuticals.

Business

Yida is a substantial player in China’s agricultural industry in Henan Province with its farming and raw material processing enterprise. Mr. Feng Hexi purchased Yida in 2000 and restructured it into a private enterprise. Currently, Yida has over 150 employees, including 50 engineers and technical staff. Yida’s 9,060 acres of farm land - under expansion to 11,943 acres - supports its 269,000 square foot processing facility. The processing facility consists of four existing edible oil production lines with two additional deep processing lines expected to become operational in May 2011 and September 2011. The deep processing lines are expected to be utilized to further process byproducts resulting from the initial processing of Yida’s crops, allowing these byproducts to be marketed as a raw material for a variety of consumer products. The two deep processing lines are expected to produce isoflavones, saponins and soy proteins for sale to the natural medicine industry, significantly increasing our sales volume and profits.

Farming Expansion

Yida’s proposed expansion includes the addition of 2,883 acres of farm land situated in Jiaozuo with a rich surface and underground water supply of 1.6 billion and 12 billion cubic meters, respectively. This expansion will allow Yida to control 11,943 acres of farm land. This expansion will add 450 new water wells to complement the existing 1,480 wells, resulting in approximately 6 acres per well. Additionally, 443 pieces of new farm equipment will be added to its inventory of farm machinery. The farm land expansion is scheduled for completion in March 2011, and is expected to help increase the existing internal supply of soybeans for deep processing of isoflavones, saponins and soy proteins.

13

Processing Facility Expansion

The first deep processing line is under construction and is scheduled to be operational in May 2011. This new line will have an annual capacity of 5,500 tons of soy proteins, 13 tons of isoflavones and 13 tons of saponins. The second line will have the same capacity and is scheduled for operation by September 2011. Yida’s four existing production lines are compatible with the new deep processing lines. It is anticipated that the new lines will process soybean pulp into soy protein and soybean molasses, which will be deep processed into soy protein, isoflavones and saponins. Yida intends to sell these raw materials to pharmaceutical companies that specialize in the natural medicine market. Agricorp expects this expansion to help to improve its financial performance. Yida has already received non-binding letters of intent from three pharmaceutical companies to purchase the soy proteins, isoflavones and saponins from the new lines.

|  | |

| Soybeans | Isoflavone Extract |

|  | |

The new deep processing line provides a seamless extension of existing oil refining lines and will extract Soy Protein, Isoflavone and Saponin to be sold to the medical and health food industry. | ||

Production

As one of the largest agricultural and processing enterprises in Henan Province, Yida cultivates farm land covering an area of 9,060 acres which provides a reliable supply of soybeans for our edible oil production. Over the years, Yida has selectively acquired soybean and peanut seeds to develop a self supply of planting seeds. The seeds are reproduced to incorporate a variety of beneficial traits to maximize production in the Jiaozuo environment. Currently, Yida’s inventory of these hybrid peanut and soybean seeds provide 100% self supply for its planting needs.

Once Yida’s farm base is expanded, we expect it to grow all of its raw materials needed for deep processing soy proteins, isoflavones and saponins. In addition to price protection against fluctuating markets, supplying all of its own raw materials should give Yida the ability to control soybean protein content, which in turn should give it a competitive edge in marketing our products to the to the pharmaceutical companies. Yida’s anticipated 32% expansion to 11,943 acres is expected to sharpen this current advantage and strengthen its position as a leading agricultural company. Its 1,480 existing wells provide approximately one well per 6 acres of farm land. The substantial underground water source helps to protect Yida from many of the adverse affects of drought. Indeed, recent landmark drought conditions had no impact on Yida’s production.

14

Yida’s vast planting area protects the purity of seed breeds by preventing unwanted cross-contamination from adjacent inferior species that commonly migrate between farm operations throughout Henan Province. Yida has secured long term leases of large land parcels to buffer its seed cultivation. As a result, its crops such as wheat, soybean, peanut and sweet potato maintain superior characteristics over crops grown in surrounding farmlands. Several technically advanced seed companies have capitalized on Yida’s unique position. The Henan Kaide Seed Technology Co., Ltd., Wenxian Keyuan Seed Co., Ltd. and Wuzhi Nongke Seed Companies have established cooperative relations with Yida to cultivate high quality planting grade wheat seeds. This is a high margin business for Yida. The gross margin for wheat seed cultivation is 39%. The cooperative team is dedicated to developing advanced seed breeds and monitors all applicable farming methods to improve Yida’s competitive edge.

Edible Oil Processing

With a planting base of 9,060 acres, Yida is one of the largest edible vegetable oil producers and dealers in Henan Province. Yida’s main products currently include edible vegetable oils such as soybean oil and peanut oil. The edible oil industry in China is volatile at times. Yida has the ability to efficiently switch from soybean cultivation to a variety of economic crops. From 2007 to 2009, edible oil prices varied greatly and Yida was able to avoid losses with emphasis on its economic crops. We believe that Yida’sexpansion into the natural medicine sector will diversify its income, increase profitability and provide the opportunity to capture profits when oil prices are high

Yida has four existing production lines:

| 1. | The soybean line can treat 500 tons per day with an average oiling rate (efficiency rate) of 16% -17% for 83 tons/day output; |

| 2. | The peanut line capacity is 600 tons/day with an average oiling rate of 40% and output of 240 tons; |

| 3. | The refining line capacity is 300 tons of oil per day; |

| 4. | The bottling line capacity is 60,000 bottles per day. |

The production equipment and technical system is designed with advanced equipment and automated control systems. Utilizing American, Japanese and German technology, Yida’s advanced processing capability and automated control equipment provide highly efficient product processing.

Yida is properly licensed to produce Grade I (highest quality) to Grade IV (lowest quality) edible refining oils. Many industry peers can only produce Grade III and Grade IV oils. In the area, Yida is the only company licensed for producing this full-range of refining oils. Yida is compliant with ISO 9001 standards to ensure consistent production quality.

15

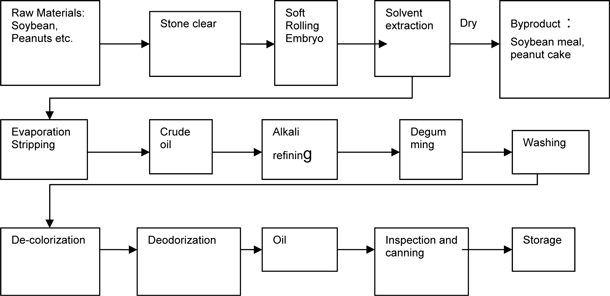

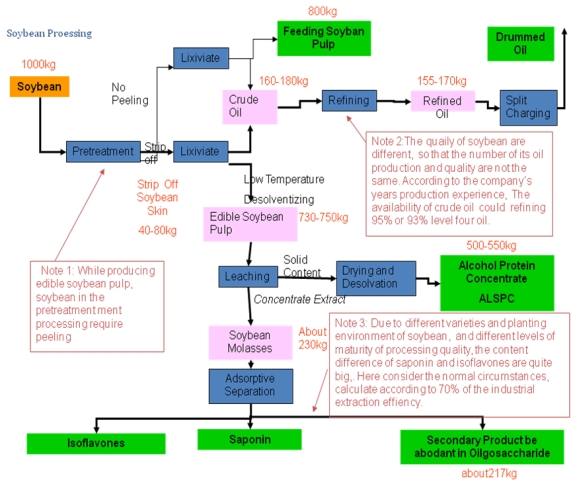

Flow Chart for Current Edible Oil Products

Deep Processing

Yida is constructing a deep processing line which is expected to be operational in May 2011 and a second deep processing line is expected to be operational September 2011. The lines are expected to produce high-value added products such as soy proteins, isoflavones and saponins. The annual production capacity for the line is 5,500 tons of soy proteins and 13 tons of isoflavones and 13 tons of saponins. The production process is as follows:

16

(1) Preprocessing

Sieve raw soybeans into the steel silo drums then upgrade into the quenching tower with warehouse scraper and bucket and dry to approximately 10% water content to facilitate separation of kernel and peel. Remove stones and iron. Soybean crusher will breakdown to 4-6 petal and separate kernel and peel. Soybean peel enters the embryo rolling machine for softening. Control of soybean embryos film to be approximately 0.3mm, (destruct cell walls as much as possible, in order to facilitate oil extraction). Embryo water film will be adjusted to 9% -10% by drying machines. Separate the oil meals with extractor.

(2) Leaching Refining

Soaking of bean embryos with #6 solvent oil extraction for obtained mixed oil. Separate the solvent from the mixture oil by the pre-evaporator the second evaporator and the stripper tower. After condensation, participate in the next cycle; crude oil (control the volatile matter < 0.3%) is measured into the refining plant, after hydration degumming, alkali refining de-acidification and de-colorate by de-colorizer. Separate the bleaching agent through filter process. Deodorize oil at deodorization tower for finished edible oil. Remove fat and oil with steam process and separate the solvent from the bean pulp. After the solvent is congealed and the soybean pulp has cooled it is crushed into 40-80 objective soybean flour through the hammer mill to prepare for further processing.

17

(3) Preparation of Protein Concentrate (deep processing begins with this step):

After grinding soybean, flour enters the extractor. Product is filtered for 30-40 minutes at 122F, 7-10 times to achieve 60-70% water ethanol extraction with continuous stirring. After filtering, the bean dregs and whey liquid are separated, dried, de-solvatized and packaged after dehydration. Concentration of ethanol solution will enable protein denaturation and decrease solubility, while the oligosaccharides, saponins, isoflavones and other substances become very soluble in ethanol solution. Separation of the protein from the alcohol solution occurs; it is then washed two times with 70% -80% of the water ethanol. Washing temperature is 158F and each immersion is 10-15 minutes. Product is vacuum dried to obtain protein concentrate. Ethanol is dried and removed after distillation to be recycled in the next circulation.

(4) Main process of preparation of saponins:

Extraction liquid is obtained by separating out the whey proteins. The remaining product is rich in oligosaccharides, saponins and isoflavones. Decompress and concentrate with the concentrator, recycle ethanol and place concentrated liquid into extractor. Add equal amounts of alcohol and water solvents (butanol: water = 1:1) to soak, with full mixing and let stand for 2-3 hours. Soybean saponin is easily soluble in alcohol and free sugars are soluble in water. To evaporate and concentrate the butanol alcohol layer under conditions of decompression, solvent is recycled; the remaining substances penetrate the freeze-dried extracts of soybean saponin.

Environmental Impact

Yida is dedicated to developing technical improvements that save energy and reduce waste. Water and steam are recycled at the oil processing plant resulting in minimal environmental impact. Yida uses bio-pesticides on the farm and it is anticipated that the two new deep processing lines will use an alcohol leaching method that meets pollution free standards. Additionally, the new processing line construction includes a waste water treatment system to treat living waste water generated by workers.

Sales and Marketing

Deep Processing (Value-Added) Products

With the success of its current soybean oil products, Yida is seeking to extend its business line into high-value added deep processing products to sell to pharmaceutical companies. The company is constructing a deep processing line which is expected to be operational in May 2011 and a seconf deep processing line is expected to be operational September 2011. The new lines are designed to work congruently with Yida’s existing four lines and are expected to produce soy proteins, isoflavones and saponins using Yida’s own supply of raw materials.

Deep processing products such as soy proteins, isoflavones and saponins have much higher profit margins than the related edible oil business. Isoflavones and saponins are purchased by pharmaceutical companies for the well-established and fast growing TCM industry.

Yida has obtained non-binding letters of intent with the following three companies for orders of soy protein, isoflavones and saponins.

| · | Henan Huaiqing Pharmaceutical Co., Ltd. (formerly Jiaozuo Chinese Medicine Factory) has signed a non-binding letter of intent with Yida for the purchase of isoflavones and saponins for its natural medicine products. The company is a key pharmaceutical company in Henan and an advanced enterprise at the provincial level. Located in Jiaozuo, the company’s factory covers an area of 904,000 square feet with a total investment of US $43M (RMB 292M). |

18

| · | Pingguang Pharmaceutical Group has signed a non-binding letter of intent for the purchase of isoflavones and saponins for its natural medicine products. The company is a specialized pharmaceutical group incorporating medicine manufacturing, import and export, research and development and trading. Jiangsu Pingguang Xinyi (Jiaozuo) Chinese Medicine Co., Ltd. is a member of Pingguang Pharmaceutical Group. With total assets of US $5.1M (RMB 35M) and over 180 employees, the company manufactures 39 types of medicines among which the “Wujin Oral Liquid” is a national protected Chinese medicine. The company currently is undergoing a substantial expansion to be able to process our products. |

| · | Heilongjiang Shuanghe Songnen Soybean Bioengineering Co., Ltd. has also signed a non-binding letter of intent for purchase of isoflavones and saponins for its natural medicine products. It is a national technological enterprise with soybean deep processing as a major business application and a leading agricultural industrialization enterprise in Heilongjiang Province. Its market sales capacity exceeds its own deep processing production so it will purchase raw materials from Yida. |

|  |

| Soy Protein | Isoflavone |

Each of the new production lines can produce up to 5,500 tons of soy protein and 13 tons of isoflavones and 13 tons of saponins annually. This raw material supply for natural medicine is expected to be a new growth area for Yida.

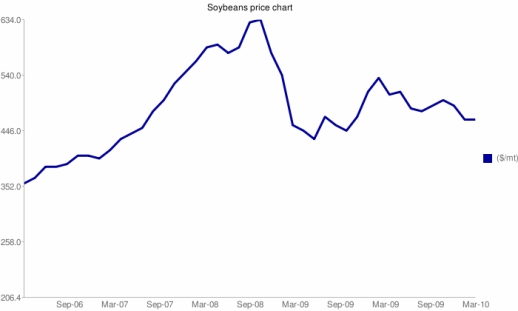

Soybean raw material is a major production cost for soybean oil and healthcare product processing companies. The large fluctuation of soybean prices in international markets gives the processing companies great difficulties in controlling production costs. (See the following chart)

Chart Soybean Futures Quotes

19

Source: CME - Yida’s autumn soybean harvest will provide 100% self supply for deep processing production, a substantial advantage over its competitors.

Chinese cultivated soybeans are Non-GMO soybeans which are thought to be healthier than GMO soybeans (Japan requires imports to be Non-GMO). Currently in China only 5% of edible soybean oil raw materials are domestically cultivated non-GMO soybeans while 95% of raw materials are imported soybeans. Therefore, we believe our raw materials have an advantage over foreign competitors.

Edible Oils

Currently in China, there is excess production capacity in the edible oil market. Most of the processing companies are located in coastal areas. The Chinese government enforces a sales radius restriction of approximate 500 kilometers to ensure fresh product and protect markets. The production and supply of edible oil in Central China is moderate.

As of the end of 2009, the population in Henan was 99.67 million. The large population in the local area ensures strong demand for edible oil. As a living necessity, edible oil is anti-cyclical. The industry is stable and it provides Yida with a reliable cash flow for its daily operations.

Yida’s current main edible oil competitor is Zhengzhou Yangguang Group, a joint venture of US investors, HK investors and the Henan Import and Export Company. Zhengzhou Yangguang has larger financial resources than Yida; however its location in Zhengzhou for the sales to Shanxi, North-West of Yu is poor.

Yida sells its oils primarily through agents without contract. Its top 5 agents account for 43% of its total sales, with an average commission of US $22 (RMB 150) per ton. The agents are responsible for pick-up and delivery, paying 100% cash in advance for all products. Prior to the Mid-Autumn Festival and the Spring Festival, many local residents pool their purchasing power to make group purchases accounting for 15% to 20% of Yida’s annual oil sales.

Currently, oils are sold primarily under the brand name of Xilinmen, targeted at the middle to high end market. Yida has other brands, Fumanchu and Jinsifu, targeted at the lower end market. Its sales staff is responsible for distributing product to agents and determining daily oil pricing. The sales staff is paid “salary + bonus” with no written contract and the bonus schedule is determined by Mr. Feng Hexi, Yida’s CEO.

|  | |

| Grade 2 vegetable oil is sold primarily to upper income consumers in luxury packaging and 5-star hotels and restaurants in bulk packaging. Grade 4 oil is marketed to lower income consumers and wholesale customers. | ||

20

Wheat

Yida’s wheat seed cultivation yields a 39% gross margin. Its wheat planting is conducted as cooperative business between Yida and three seed companies: Henan Kaide Seed Technology Co., Ltd., Wenxian Keyuan Seed Co., Ltd. and Wuzhi Nongke Seed Co., Ltd. Seed companies provide Yida with wheat seeds free of charge. Seed companies then instruct, guide and train Yida on how to grow the wheat for optimal results. When the wheat is harvested, the seed companies will confirm that product quality requirements have been met. The seed companies then purchase the entire harvest. The wheat grown by Yida to be purchased back by the seed companies is sold to surrounding local farmers as seeds. The seed companies pay Yida 10% over market value for their seeds because the Yida seeds are of planting quality which is superior to ordinary wheat sold for food.

There are two kinds of wheat planted in China: Spring Wheat and Winter Wheat. Spring Wheat is planted in Northeast China. Due to its low quality, Spring Wheat is not welcomed by most consumers and only the local people of Northeast China consume Spring Wheat. Winter Wheat is planted in several provinces such as Henan, Shandong and Anhui. Approximately 50% of all wheat consumed by non-wheat producing provinces is grown in Henan province. Seed companies have advanced R&D teams to cultivate new breeds of seeds with superior characteristics such as high yield and disease and pest resistance. These top quality seeds are highly valued by local farmers for planting. Competition in the wheat seed business is low due to the difficulty in acquiring large farm lands and modern farming equipment.

Economic Crops

Yida also cultivates economic crops and usually can sell all crops produced, providing a good cash flow. There is little competition for these economic crops. These crops are typically purchased by local dealers at the farm, avoiding any transportation costs. Yida determines the types of crops to grow according to temperature, climate and market demand. Currently Yida is growing new sweet potato.

New sweet potatoes are a high-production, high-value economic crop providing good cash flow

21

The Company plants soybean providing a reliable product source to process edible oil and deep processing of soy protein, saponins and isoflavones.

Peanut cultivation, a good economic crop with strong market demand.

Medical Benefits of Soybeans

Research indicates that soy protein, soy isoflavone and soy saponin may provide significant medical benefits.

22

| · | Soy protein - it is very low in fat, contains no cholesterol and contains phytochemicals. The main phytochemicals in soy protein are isoflavones, saponins and phytc acid. These phytochemicals are strong antioxidants and have many other properties. It is believed that soy protein and its associated phytochemicals reduce heart disease, osteoporosis, cholesterol levels and the risk of cancer. |

| · | Isoflavone (ī′sō flā′vōn′) - Phytoestrogen compounds that are extracted from soy, such as daidzein, genistein, and glycitein, are known as soy isoflavones. They are commonly used to alleviate the effects of menopause, PMS, and other female hormone-related conditions. They have been shown to help improve bone density, protect against bone loss, reduce cholesterol levels, and benefit people with prostate problems. |

| · | Saponin (sap´o-nin) - any of a group of glycosides widely distributed in plants. Saponins are plant-based anti-inflammatory compounds that may lower cholesterol and prevent heart disease as well as some cancers. |

The benefits of soy products are supported with volumes of favorable medical research. There are well established growing markets for natural medicine, health food, dietary supplements and various personal care products in China and worldwide. In the past two decades, most research has centered on one particular group of naturally-present chemicals, the isoflavones. Isoflavones are essentially unique to the soybean. Isoflavones are a class of phytoestrogens—plant-derived compounds with estrogenic activity. Soybeans and soy products are the richest sources of isoflavones in the human diet. Below is a summary of some of the most important medicinal benefits that may be derived from soybeans:

Cancer

The number of global cancer deaths is projected to increase 45% from 2007 to 2030 (from 7.9 million to 11.5 million deaths annually), influenced in part by an increasing and aging global population. The U.S. National Cancer Institute first began seriously investigating the potential for soy to reduce cancer risk nearly 20 years ago. Interest in this area was stimulated in part by the observation that soyfood consuming countries have relatively low breast and prostate cancer rates. Researchers also recognized that soybeans contain several compounds that may have cancer-protective qualities.

| · | High-soy consumers were found to be about 30% less likely to report having breast cancer than Asian women who consumed relatively little soy. |

| · | Breast cancer risk reduction from 28 to 60% when soy intake occurs at younger ages. |

| · | Rates of prostate cancer are relatively low in soyfood-consuming countries. |

| · | Studies involving Asian men who consumed the most soy were almost 50% less likely to have prostate cancer than those who consumed relatively little soy. |

| · | A recent National Cancer Institute study reported that Isoflavone Genisten markedly reduced the ability of a malignant cell to invade tissue in prostate cancer patients. |

| · | Men with unsuccessful prostate cancer treatment benefit from soy isoflavones. |

| · | Many animal studies show that isoflavones and isoflavone-rich soy protein inhibit prostate tumors. |

Diabetes

With obesity reaching epidemic proportions, the U.S. Centers for Disease Control (“CDC”) estimates that 18 million Americans have diabetes. Increased rates of diabetes have resulted in a dramatic rise in the incidence of kidney or renal disease, which is often a complication of diabetes.

| · | Soy appears to positively impact cardiovascular health and kidney health, organs known to be particularly vulnerable to diabetes. |

| · | A recent prospective study found that, among Chinese postmenopausal women with a body mass index of <25 kg/m2, the risk of glycosuria was reduced by about two-thirds in high- versus low-soy consumers. |

23

| · | A study of 173 postmenopausal women from Hong Kong found habitual soy protein intake was inversely related to fasting serum glucose levels in women with baseline fasting glucose levels above the median. |

| · | The low glycemic index of soy foods suggests they can help control diabetes and obesity. |

| · | Studies show soy protein can play a beneficial role in renal function. |

| · | When healthy subjects were given an equivalent 80g dose of either soy protein or meat protein, the soy protein produced favorable effects on kidney function relative to the meat protein. |

Cholesterol and Heart Health

Coronary heart disease (“CHD”) is substantial in the United States, with almost 17 million Americans diagnosed. Approximately 1/2 of men and 2/3 of women in America will develop CHD after age 40. Soyfoods may favorably affect several CHD factors, including elevated blood pressure8 and damaged arteries.

| · | In 1995, a comprehensive statistical analysis that included 34 studies showed conclusively that soy protein lowered LDLC. |

| · | In 1999, the Food and Drug Administration asserted that 25 grams of soy protein per day, as part of a diet low in saturated fat and cholesterol, may reduce the risk of heart disease. |

| · | Estimates suggest soy protein lowers LDLC 3 to 5%, lowering CHD risk 10 to 15%. |

| · | The American Heart Association (“AHA”) has stated that soy protein as a replacement for animal protein products may provide cholesterol-lowering benefits. |

| · | Soy diets have been shown to lower cholesterol by as much as 30 percent. |

| · | Studies suggest that soy protein may lower blood pressure, make LDL less atherogenic and that isoflavones in soybeans directly improve the health of coronary arteries by improving systemic arterial compliance and vascular reactivity. For example a Southern China study found that higher soyfood intake was associated with 44 to 82% reduction in the risk of stroke among men and women. |

Soy and Osteoporosis

A worldwide problem, osteoporosis is the most prevalent metabolic bone disease in developed countries including the United States. Since overall diet is known to influence bone health, there is considerable interest in the possible skeletal benefits of soyfoods, particularly isoflavones.

| · | Studies show that higher Asian soy intake is positively associated with higher bone mineral density. |

| · | A three-year Italian study found spinal bone loss decreased by approximately 12% in the placebo group whereas in the group given the isoflavone Genisten, BMD increased by 9%. |

| · | Two prospective Asian epidemiologic studies concluded that relative risk among high-soy consuming postmenopausal women was lower by approximately one-third in comparison to women who consumed relatively little soy. |

Menopause and Hot Flashes

Soyfoods are a rich, and essentially unique, dietary source of isoflavones. Isoflavones are often referred to as phytoestrogens because they have a similar chemical structure to the hormone estrogen and exert estrogen-like effects under certain conditions. For many women, hot flashes are a classic sign of menopause, and the most common reason for seeking treatment. A hot flash produces a sudden sensation of warmth or even intense heat that spreads over various parts of the body, especially the chest, face and head. In about 10 to 15% of women with hot flashes, the symptoms are frequent and severe. Hot flashes can greatly impact quality of life for many women. Although the hormone estrogen is known to alleviate hot flashes, for many reasons a large portion of menopausal women prefer to seek relief with a more natural, non-pharmaceutical approach. Clinical evidence suggests that soyfoods may offer one such approach.

24

| · | Japanese women report having fewer hot flashes than European and North American women. And among Japanese women, those who consume the most soy have fewer hot flashes. |

| · | More than 50 hot flash trials evaluating the efficacy of isoflavone-containing products have been conducted. There is clinical evidence indicating that isoflavone supplements may offer an effective treatment for hot flashes. |

| · | In a comprehensive analysis evaluating the effects of isoflavone supplements, not whole soyfoods, isoflavone supplements were found to reduce the frequency and severity of hot flashes by approximately 50%. |

Competition

The Chinese edible oil industry is highly competitive, yet we believe Yida has significant competitive advantages over its peers:

| · | Yida will be the only supplier of isoflavones and saponins in Henan Province. |

| · | Its existing 9,060 acres of Yida farm land is substantial. |

| · | Yida’s substantial underground water source helps to protect it from many of the adverse affects of drought. |

| · | 1,480 developed water wells with underground piping in place and farm expansion includes 450 additional wells. |

| · | Self-supplied soybeans following its farm expansion is expected to shelter Yida from price fluctuation risks and ensure the quality of its raw materials. |

| · | Low cost factors including the common family farming background in China, large-scale mechanized cultivation, location within China's largest grain and oil-producing areas, low acquisition cost of raw materials, low transportation cost, strategic location near densely populated areas with low-cost human resources. |

| · | Fully integrated soybean processing chain designed for unified adaption to new deep processing line extension. |

| · | The only Henan company with an energy efficient and pollution free deep processing line using an alcohol leaching method, as compared to the competing acid method which generates highly polluted waste water. |

| · | Adaptable sell-or-use strategy to control cultivation, edible oil and deep processing production. |

| · | Modern mechanized farm equipment provides superior efficiency compared to the majority of small farm operations. |

Employees

As of February 7, 2011 Agricorp and its subsidiaries had 84 full-time employees, including 9 management and supervisory personnel, 52 production workers, 4 sales and marketing personnel, 14 administration personnel, 6 accounting personnel and 5 employees engaged in research and development.

Seasonality

Wheat is harvested in June of each year and peanuts and soybeans are harvested in September and October of each year. External sales of wheat are made in June and external sales of peanuts and soybean are made in the fourth quarter and first quarter of each year. Yida uses its own grown peanuts and soybeans in its vegetable oil processing operations during the fourth and first quarter. As a result, cost of sales of vegetable oils is relatively lower in those quarters.

25

Intellectual Property

The Company does not own any patents.

Set forth below is a list of the trademark applications that we have submitted for trademark registration:

| Jurisdiction | Trademark Description | Application No. | Trademark Status | Application Date | ||||

| China | Jiachuxilinmen | 5286095 | Pending Approval | April 14, 2006 | ||||

| China | Jinsinfu | 5002743 | Pending Approval | November 15, 2005 | ||||

| China | Fumanchu | 5002721 | Pending Approval | November 15, 2005 | ||||

| China | Cancanxilinmen | 5286096 | Pending Approval | April 14, 2006 |

Private Placement of Convertible Notes and Warrants of China Agricorp, Inc.

On August 26, 2010 and September 30, 2010 Agricorp entered into Subscription Agreements with investors pursuant to which the investors agreed to and purchased, for an aggregate purchase price of $2,930,000, 10% convertible promissory notes (the “Notes”) in the aggregate principal amount of $2,930,000 and warrants to purchase common stock of Agricorp (the “Warrants”). All outstanding principal and accrued interest on the Notes are due on August 26, 2010. The outstanding principal amount of the Notes bear interest at the rate of 10% per annum. Interest is payable quarterly on the last business day of each fiscal quarter of Agricorp. The Notes are secured by a Non-Recourse Guaranty by certain management principals of Agricorp and Sky Harmony Ecological Technology Limited, a British Virgin Islands company, which has pledged 7,473,800 shares of Agricorp’s Common Stock to a collateral agent for the investors in order to secure such guaranty.

A portion of the proceeds of the sale of the Notes and Warrants is being held in escrow by Interwest Transfer Company (“Interwest”) pursuant to an Escrow Agreement dated as of July 22, 2010 between the Company and Interwest. Such funds have been used to fund the first two payments of interest on the Notes and will be used to fund the third payment of interest on the Notes when due.

The Notes shall automatically convert into the Company’s securities at a 50% discount to the price at which such securities are sold in a “Qualified Financing, which term is defined as the sale by the Company of its capital stock in a capital raising transaction, for aggregate gross proceeds to the Company of at least $15 million.

The Warrants issued to the investors are exerciseable at any time during the five-year period commencing on the first anniversary of their date of issuance, except that the warrants shall be null and void and unexerciseable if, prior to such one year anniversary, the Notes are automatically converted into Common Stock. The number of shares for which a Warrant issued to each investor is exerciseable equals the principal amount of the Note issued to the investor divided by the exercise price of the Warrant. The exercise price per share of the Warrant equals the lesser of $2.50 and 50% of the price per share of the Common Stock (or common stock equivalent) issued by the Company in a Financing (as defined in the warrant).

In connection with the issuance of the Notes and Warrants, the Company entered into a Registration Rights Agreements with the investors covering the resale of shares of the Company’s Common Stock issuable upon conversion of the Notes and exercise of the Warrants

26

DESCRIPTION OF PROPERTY

Facilities

Yida is located in Henan Province, one of the largest agricultural provinces in China. Its oil processing factory is situated on a 342,000 square feet lot with a building area of over 269,000 square feet.

Set forth below is a table containing certain information concerning the location and area of each of Yida’s farm lands and the terms under which such properties are leased.

| Name of Farm | Area (Mu)/(Square Meters) | Location | Lessor | Lessee | Lease Commencement Date | Lease Expiration Date | Rent per Year ($) | |||||||||

| Huanghetan Farmland | 25,000.00/ 16,666,666.67 | Wanbo Chen | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2006 | 6/1/2016 | $ | 1,346,153.85 | i | ||||||||

| Dongzhou Village, Beileng Town, Wen County Farmland | 3,000.00/ 2,000,000.00 | Dongzhou Village, Beileng Town, Wen County, Jiaozuo, Henan | Dongzhou Village, Beileng Town, Wen County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2006 | 6/1/2016 | $ | 161,538.46 | ii | |||||||

Xinanleng Village, Beileng Town, Wen County Farmland | 2,000.00/1,333,333.33 | Xinanleng Village, Beileng Town, Wen County, Jiaozuo, Henan | Xinanleng Village, Beileng Town, Wen County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2006 | 6/1/2016 | $ | 107,692.31 | iii | |||||||

| South Village Farmland | 1,703.69/ 1,135,793.33 | South of Mazhuang Village, Zhouzhuang Town, Xiuwu County, Jiaozuo, Henan | Villagers Committee of Mazhuang Village of Zhouzhuang Town of Xiuwu County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 10/1/2007 | 9/30/2017 | $ | 157,263.69 | iv | |||||||

Mazhuang Village, Zhouzhuang Town, Xiuwu County Huanghetan Farmland | 1,700/ 1,133,333.33 | Mazhuang Village, Zhouzhuang Town, Xiuwu County, Jiaozuo, Henan | Mazhuang Village, Zhouzhuang Town, Xiuwu County, | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2009 | 5/31/2024 | $ | 156,923.08 | v | |||||||

Tanlu Zhuang, Wenquan Town, Wen County Huanghetan Farmland | 17,000/11,333,333.33 | Tanlu Zhuang, Wenquan Town, Wen County, Jiaozuo, Henan | Tanlu Zhuang, Wenquan Town, Wen County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2009 | 5/31/2024 | $ | 915,384.62 | vi | |||||||

27

| Zhujia Zhuang, Nanzhangqiang Town, Wen County Farmland | 7,000/ 4,666,666.67 | Zhujia Zhuang, Nanzhangqiang Town, Wen County, Jiaozuo, Henan | Zhujia Zhuang, Nanzhangqiang Town, Wen County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2009 | 5/31/2024 | $ | 376,923.08 | vii | |||||||

| Zhujia Zhuang, Nanzhangqiang Town, Wen County Farmland | 9,000/ 6,000,000.00 | Zhujia Zhuang, Nanzhangqiang Town, Wen County, Jiaozuo, Henan | Zhujia Zhuang, Nanzhangqiang Town, Wen County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 9/1/2008 | 8/31/2023 | $ | 484,615.38 | viii | |||||||

| Liaoyu Village, Sishui Town, Xingyang City, Huanghetan Farmland | 10,000/6,666,666.67 | Liaoyu Village, Sishui Town, Xingyang City, Henan | Liaoyu Village, Sishui Town, Xingyang City | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2009 | 5/31/2024 | $ | 538,461.54 | ix | |||||||

Qingjinggou Village, Sishui Town, Xingyang City, Huanghetan Farmland | 13,000/ 8,666,666.67 | Qingjinggou Village, Sishui Town, Xingyang City, Henan | Qingjinggou Village, Sishui Town, Xingyang City | Jiaozuo Yida Vegetable Oil Co., Ltd. | 6/1/2009 | 5/31/2024 | $ | 700,000 | x | |||||||

| South Village Farmland | 1,670.75/1,113,833.33 | South of Yanglou Village, Zhouzhuang Town, Xiuwu County, Jiaozuo, Henan | Villagers Committee of Yanglou Village of Zhouzhuang Town of Xiuwu County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 10/1/2007 | 9/30/2017 | $ | 154,223.08 | xi | |||||||

| South Village Farmland | 1,015.00/676,666.67 | South of Dongchangwei Village, Zhouzhuang Town,Xiuwu County,Jiaozuo,Henan | Villagers Committee of Dongchangwei Village of Zhouzhuang Town of Xiuwu County | Jiaozuo Yida Vegetable Oil Co., Ltd. | 10/1/2007 | 9/30/2017 | $ | 93,692.31 | xii | |||||||

| Total | 92,089.44/61,392,960.00 |

i This is the first year rent. The rent will be adjusted according to market condition after the first year.

ii This is the first year rent. The rent will be adjusted according to market condition after the first year.

iii This is the first year rent. The rent will be adjusted according to market condition after the first year.

ivThis is the first year rent. Starting from the second year, the annual rent should be calculated as follows: before September 20 of each year, the Lessee should pay the September market price of 0.60 kilogram wheat per square meter multiplied by the total area leased, if the market price is below $0.14/square meter, $0.14/square meter shall be adopted.

28

v This is the first year rent. The rent may be adjusted according to market conditions after the first year.

vi This is the first year rent. The rent may be adjusted according to market conditions after the first year.

vii This is the first year rent. The rent may be adjusted according to market conditions after the first year.

viii This is the first year rent. The rent may be adjusted according to market conditions after the first year.

ix This is the first year rent. The rent may be adjusted according to market conditions after the first year.

x This is the first year rent. The rent may be adjusted according to market conditions after the first year.

x1 This is the first year rent. Starting from the second year, the annual rent should be calculated as follows: before September 20 of each year, the Lessee should pay the September market price of 0.60 kilogram wheat per square meter multiplied by the total area leased, if the market price is below $0.14/square meter, $0.14/square meter shall be adopted.

xii This is the first year rent. Starting from the second year, the annual rent should be calculated as follows: before September 20 of each year, the Lessee should pay the September market price of 0.60 kilogram wheat per square meter multiplied by the total area leased, if the market price is below $0.14/square meter, $0.14/square meter shall be adopted.

Yida has been granted a state-owned land use right by Jiaozuo City People’s Government. The land for which the land use right is granted has a total area of 31,770.21 square meters. The land is located at the Fengshou Road West, Jiaozuo City, Henan Province. The State-Owned land use right with a title certificate No. Jiaoguoyong (2003) No. 113 shall expire on March 6, 2053.

Set forth below is a table containing certain information concerning the building property title certificate of Yida.

Building Property Title Certificate No. | License-Issuing Authority | Owner | Location of the Building | Area (square meters) | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100869 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 327.65 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100870 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 688.19 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100871 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 675.13 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100872 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 30.94 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100873 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 76.53 |

29

| Jiao Fangquanzheng Jie Zi No. 0190100874 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 43.56 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100875 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 14.85 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100876 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 557.01 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100877 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 206.25 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100878 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 778.05 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100879 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 43.56 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100880 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 256.13 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100881 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 33.79 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100882 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 33.79 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100883 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 74.36 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100884 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 873.80 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100885 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 377.30 |

30

| Jiao Fangquanzheng Jie Zi No. 0190100886 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 33.12 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100887 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 219.18 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100888 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 41.29 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100889 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 634.20 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100890 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 26.88 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100891 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 1,049.44 | ||||

| Jiao Fangquanzheng Jie Zi No. 0190100892 | Jiaozuo City Housing Administrative Bureau | Jiaozuo Yida Vegetable Oil Co., Ltd. | South of Fengshou Road, Jiefang District | 24.40 | ||||

| Total Area (square meters) | 7,119.4 |

Huge Storage Capacity

Yida has 3 steel silos, in which raw materials of 90,000 tons can be stored. Yida has 3 warehouses in which raw materials of 12,000 tons can be stored and has 2 containers outside in which parts of raw materials can be stored.

31

Pre-treatment Automated Equipment

500 tons of soybeans and 600 tons of peanuts can be pre-treated daily in the pre-treatment production line.

The capacity of refining is 100 tons hourly in the high burning-point cooking oil production line.

Two Clean Production Lines (filling and refined packaging).

32

Testing equipment and strict quality control measures provide stable product quality.

Environmental Controls & Energy Conservation

Yida’s R&D center is based in the laboratory with a focus on quality and stability improvements by utilizing Yida department heads as cooperative researchers. The R&D center also cooperates with a number of research institutions.

The Company believes that the foregoing properties are adequate for its present needs.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors and Executive Officers

The following table sets forth the name and position of each of our current executive officers and directors.

| Name | Age | Position | ||

| Hexi Feng | 48 | Chairman of the Board, Chief Executive Officer and Director | ||

| Chao He | 29 | Financial controller | ||

| Ming Liu | 36 | Director | ||

| Joseph Levinson | 34 | Director |

Hexi Feng, became our Chairman of the Board, Chief Executive Officer and a director on August 24, 2010. Mr. Feng has been the Chairman of the Board of Yida since 2003 Mr. Feng is responsible for the formulation and deployment of the overall company strategy. He has an undergraduate degree and over 16 years of related business experience and served in the army as the monitor of the radio headquarters. In 1984, he was appointed as the Deputy Secretary of the Food Bureau, Jiaozuo City. In 1998, he became the Director of the Oil Reserve Department of Jiaozuo City.

33

Chao He became our Financial Controller in December 2010. For approximately one year prior to his employment with Agricorp, Mr. He was working as an analyst for the Shanghai office of Primary Capital, LLC, an investment and consulting firm in the U.S. During the period between April 2008 and January 2010, Mr. He was a financial analyst at Hella Shanghai General Electronic Co., Ltd. Prior to that, he served as a financial consultant at Marzars Group (Shanghai), an international financial consulting and advisory company, during July 2007 through April 2008. Mr. He graduated from Shanghai Maritime University in 2006 with a Bachelor degree in Accounting and Management. Mr. He is a certified member of the Association of International Accountants.

Ming Liu became a director of the Company on September 27, 2010. Since 2006, Mr. Liu has been a director of Sino-American Capital Group, LLC, an advisory firm based in the People’s Republic of China which is engaged in developing business and financial relationships between the U.S. and the People's Republic of China. From October 2006 to February 2007, Mr. Liu was the CEO of Ubrandit.com, a public company listed on the OTC BB. In February 2007, Ubrandit merged with Advanced Green Materials, a company based in Harbin in the People’s Republic of China. From 2004 to 2005, Mr. Liu was a member of the Board and Corporate Secretary to Advanced Battery Technologies, Inc., a Delaware holding Company listed on NASDAQ under the symbol ABAT whose Chinese subsidiary, ZQ Power-Tech, is engaged in the development and manufacture of lithium-ion batteries. From 2003 to 2004, Mr. Liu was Secretary to the Board of ZQ Power-Tech. From 1999 until 2003, Mr. Liu was Vice President of Harbin Ridaxing Science and Technology Co., Ltd., a technology provider located in Harbin, China.

Joseph Levinson became a director of the Company on October 4, 2010. He has been a United States Certified Public Accountant for more than 14 years. He speaks, reads and writes Chinese fluently and has vast experience in China working with Chinese companies. He was previously a Manager in the banking practice of the New York office of Deloitte and Touche and was involved in numerous transactions involving complex financial structures. He also previously worked at KPMG in New York and Hong Kong. In the 1990s, Mr. Levinson served as an executive of Hong Kong Stock Exchange-listed China Strategic Holdings, where his major responsibilities included its subsidiary China Tire, one of the first Mainland Chinese companies to list on the NYSE. He is also the editor of Wall Street Guanxi: How Chinese Companies Can Maximize Their Value in the U.S. Capital Markets, a trade paperback published in Chinese by Beijing University Press in 2007. Mr. Levinson graduated summa cum laude from the University at Buffalo in 1994 with a double major in accounting and finance.

Employment Agreements

Agricorp has not entered into employment agreements with any of its officers or other key employees.

Compensation of Officers and Directors

The following table sets forth information concerning cash and non cash compensation paid by Agricorp and its subsidiaries. to its chief Executive Officer in 2009 and 2010. No executive officer received compensation in excess of $100,000 for either fiscal 2010 or fiscal 2009.

Name and Principal Position | Year Ended | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non- Equity Incentive Plan Compen- sation ($) | Non- Qualified Deferred Compensation Earnings ($) | All Other Compen- sation ($) | Total ($) | ||||||||||||||||||

| Feng Hexi, CEO | 12/31/2010 | $ | 40,000 | - | — | — | — | — | — | $ | 40,000 | ||||||||||||||||

| Feng Hexi, CEO | 12/31/2009 | $ | 0 | $ | 46,153 | — | — | — | — | — | $ | 46,153 | |||||||||||||||

34